UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-2183

Babson Capital Corporate Investors

(Exact name of registrant as specified in charter)

1500 Main Street, P.O. Box 15189, Springfield, MA 01115-5189

(Address of principal executive offices) (Zip code)

Christopher A. DeFrancis, Vice President and Secretary

1500 Main Street, Suite 2800, P.O. Box 15189, Springfield, MA 01115-5189

(Name and address of agent for service)

Registrant's telephone number, including area code: 413-226-1000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/13

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Attached hereto is the semi-annual shareholder report transmitted to shareholders pursuant to Rule 30e-1 of the Investment Company Act of 1940, as amended.

| Adviser

Babson Capital Management LLC

1500 Main Street, P.O. Box 15189

Springfield, Massachusetts 01115-5189

Independent Registered Public Accounting Firm

KPMG LLP

Boston, Massachusetts 02110

|

Transfer Agent & Registrar DST Systems, Inc.

P.O. Box 219086

Kansas City, MO 64121-9086

1-800-647-7374

Internet Website

www.babsoncapital.com/mci

|

||

| Counsel to the Trust Ropes & Gray LLP

Boston, Massachusetts 02110

Custodian

State Street Bank and Trust Company

Boston, Massachusetts 02116

|

|

Babson Capital Corporate Investors

c/o Babson Capital Management LLC

1500 Main Street, Suite 2200

Springfield, Massachusetts 01115

(413) 226-1516

|

|

| Investment Objective and Policy

Babson Capital Corporate Investors (the “Trust”) is a closed-end management investment company, first offered to the public in 1971, whose shares are traded on the New York Stock Exchange under the trading symbol “MCI”. The Trust’s share price can be found in the financial section of most newspapers under either the New York Stock Exchange listings or Closed-End Fund Listings.

The Trust’s investment objective is to maintain a portfolio of securities providing a fixed yield and at the same time offering an opportunity for capital gains. The Trust’s principal investments are privately placed, below-investment grade, long-term debt obligations with equity features such as common stock, warrants, conversion rights, or other equity features and, occasionally, preferred stocks. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically mezzanine debt instruments with accompanying private equity securities made to small or middle market companies. In addition, the Trust may temporarily invest, subject to certain limitations, in marketable investment grade debt securities, other marketable debt securities (including high yield securities) and marketable common stocks. Below-investment grade or high yield securities have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay principal.

Babson Capital Management LLC (“Babson Capital”) manages the Trust on a total return basis. The Trust distributes substantially all of its net income to shareholders each year. Accordingly, the Trust pays dividends to shareholders in January, May, August, and November. The Trust pays dividends to its shareholders in cash, unless the shareholder elects to participate in the Dividend Reinvestment and Share Purchase Plan.

|

Form N-Q The Trust files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. This information is available (i) on the SEC’s website at http:// www.sec.gov; and (ii) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available upon request by calling, toll-free, 866-399-1516.

Proxy Voting Policies & Procedures; Proxy Voting Record

The Trustees of the Trust have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Babson Capital. A description of Babson Capital’s proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 866-399-1516; (2) on the Trust’s website: http://www.babsoncapital.com/mci; and (3) on the SEC’s website at http://www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (1) on the Trust’s website: http://www.babsoncapital. com/mci; and (2) on the SEC’s website at http://www.sec.gov.

|

||

|

|||

Babson Capital Corporate Investors

TO OUR SHAREHOLDERS

July 31, 2013

We are pleased to present the June 30, 2013 Quarterly Report of Babson Capital Corporate Investors (the “Trust”).

The Board of Trustees declared a quarterly dividend of 30 cents per share, payable on August 16, 2013 to shareholders of record on August 5, 2013. The Trust paid a 30 cent per share dividend for the preceding quarter. The Trust earned 31 cents per share of net investment income for the second quarter of 2013, compared to 31 cents per share in the previous quarter.

During the second quarter, the net assets of the Trust decreased to $267,509,124 or $13.85 per share compared to $268,758,554 or $13.94 per share on March 31, 2013. This translates into a 1.5% total return for the quarter, based on the change in the Trust’s net assets assuming the reinvestment of all dividends. Longer term, the Trust returned 17.4%, 15.6%, 11.0%, 13.5%, and 13.4% for the 1-, 3-, 5-, 10-, and 25-year time periods, respectively, based on the change in the Trust’s net assets assuming the reinvestment of all dividends.

The Trust’s share price decreased 3.0% during the quarter, from $16.34 per share as of March 31, 2013 to $15.85 per share as of June 30, 2013. The Trust’s market price of $15.85 per share equates to a 14.4% premium over the June 30, 2013 net asset value per share of $13.85. The Trust’s average quarter-end premium for the 3, 5 and 10-year periods was 21.6%, 13.6% and 12.6%, respectively. U.S. equity markets, as approximated by the Russell 2000 Index, increased 3.1% for the quarter. U.S. fixed income markets, as approximated by the Barclays Capital U.S. Corporate High Yield Index, decreased 1.4% for the quarter.

The Trust closed three new private placement investments and three “follow-on” investments in existing portfolio companies during the second quarter. The three new investments were in ARI Holding Corporation, CG Holdings Manufacturing Company and Hi-Rel Group LLC, while the three follow-on investments were in F G I Equity LLC, K & N Parent, Inc. and Safety Infrastructure Solutions. A brief description of these investments can be found in the Consolidated Schedule of Investments. The total amount invested by the Trust in these six transactions was $12,417,763.

U.S. middle market buyout activity continued at a sluggish pace during the second quarter of 2013. In fact, the level of private equity backed deals completed in the first half of 2013 was at its lowest level since 2009. While there is a shortage of quality deal flow, there is plenty of equity capital and senior and mezzanine debt looking to be invested. The result is that attractive companies are being aggressively pursued by buyers and lenders alike, pushing both purchase price multiples and leverage levels up. As we head into the third quarter of 2013, most market participants expect deal flow to improve over the remainder of the year. We currently have a number of deals under review and hope that our new investment activity in the second half of the year will exceed that of the first half of the year. We continue to be cautious, though, in light of the more aggressive leverage multiples and mezzanine pricing we are seeing in the market. We intend to maintain the same discipline and investment philosophy, based on taking prudent levels of risk and getting paid appropriately for the risks taken, that has served us well for so many years.

The quality of the Trust’s existing portfolio remained solid through the second quarter. We are pleased that sales and earnings for the Trust’s portfolio as a whole continued their upward momentum. We had no exits from the portfolio in the second quarter, but we have a healthy backlog of companies in the process of being sold and expect the second half of the year to be active for realizations. On the negative side of the ledger, however, we saw refinancing activity in the portfolio continue at a high level in the second quarter. These transactions, in which the debt instruments held by the Trust were fully or partially prepaid, are being driven by companies seeking to take advantage of low interest rates and plentiful credit. We had six portfolio companies fully or partially prepay the Trust’s debt holdings in the second quarter, on top of eight in the first quarter. As mentioned in prior reports, the loss of these income-producing investments, unless replaced by new investments, could adversely affect the Trust’s ability to sustain its dividend level in the quarters ahead.

(Continued)

1

Thank you for your continued interest in and support of Babson Capital Corporate Investors.

Sincerely,

Michael L. Klofas

President

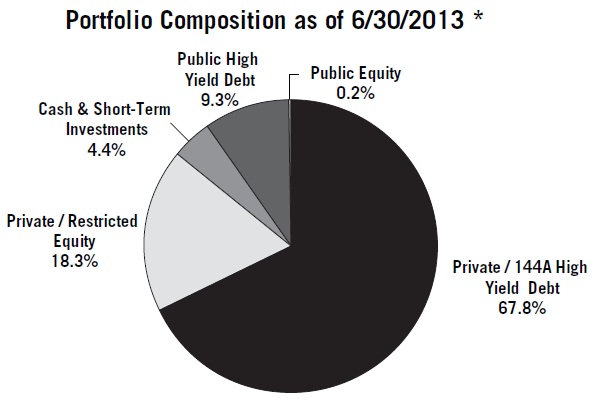

* Based on market value of total investments (including cash)

Cautionary Notice: Certain statements contained in this report may be “forward looking” statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of the Trust’s trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Trust’s current or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information, future events, or otherwise.

2

Babson Capital Corporate Investors

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

June 30, 2013

(Unaudited)

| Assets: | ||||

| Investments | ||||

|

(See Consolidated Schedule of Investments)

|

||||

|

Corporate restricted securities at fair value

|

||||

|

(Cost - $239,754,703)

|

$ | 229,200,275 | ||

|

Corporate restricted securities at market value

|

||||

|

(Cost - $25,379,731)

|

25,429,009 | |||

|

Corporate public securities at market value

|

||||

|

(Cost - $28,119,151)

|

29,247,792 | |||

|

Short-term securities at amortized cost

|

3,500,000 | |||

|

Total investments (Cost - $296,753,585)

|

287,377,076 | |||

|

Cash

|

9,408,260 | |||

|

Interest receivable

|

3,125,104 | |||

|

Other assets

|

23,568 | |||

|

Total assets

|

299,934,008 | |||

|

Liabilities:

|

||||

|

Note payable

|

30,000,000 | |||

|

Deferred tax liability

|

1,018,282 | |||

|

Investment advisory fee payable

|

835,966 | |||

|

Tax Payable

|

252,820 | |||

|

Interest payable

|

202,400 | |||

|

Accrued expenses

|

115,416 | |||

|

Total liabilities

|

32,424,884 | |||

|

Total net assets

|

$ | 267,509,124 | ||

| Net Assets: | ||||

| Common shares, par value $1.00 per share | $ | 19,319,200 | ||

| Additional paid-in capital | 111,801,788 | |||

| Retained net realized gain on investments, prior years | 128,487,422 | |||

| Undistributed net investment income | 9,428,094 | |||

| Accumulated net realized gain on investments | 8,867,411 | |||

| Net unrealized depreciation of investments | (10,394,791 | ) | ||

| Total net assets | $ | 267,509,124 | ||

| Common shares issued and outstanding (28,054,782 authorized) | 19,319,200 | |||

| Net asset value per share | $ | 13.85 | ||

See Notes to Consolidated Financial Statements

3

CONSOLIDATED STATEMENT OF OPERATIONS

For the six months ended June 30, 2013

(Unaudited)

| Investment Income: | ||||

|

Interest

|

$ | 14,208,607 | ||

|

Dividends

|

297,071 | |||

|

Other

|

262,235 | |||

|

Total investment income

|

14,767,913 | |||

|

Expenses:

|

||||

|

Investment advisory fees

|

1,675,836 | |||

|

Interest

|

792,000 | |||

|

Trustees’ fees and expenses

|

240,000 | |||

|

Professional fees

|

125,571 | |||

|

Reports to shareholders

|

45,000 | |||

|

Custodian fees

|

16,800 | |||

|

Other

|

17,550 | |||

|

Total expenses

|

2,912,757 | |||

|

Investment income - net

|

11,855,156 | |||

|

Net realized and unrealized gain on investments:

|

||||

|

Net realized gain on investments before taxes

|

3,047,122 | |||

|

Income tax expense

|

(3,162 | ) | ||

|

Net realized gain on investments after taxes

|

3,043,960 | |||

|

Net change in unrealized depreciation of investments before taxes

|

(138,104 | ) | ||

|

Net change in deferred income tax expense

|

(116,242 | ) | ||

|

Net change in unrealized depreciation of investments after taxes

|

(254,346 | ) | ||

|

Net gain on investments

|

2,789,614 | |||

|

Net increase in net assets resulting from operations

|

$ | 14,644,770 | ||

See Notes to Consolidated Financial Statements

4

Babson Capital Corporate Investors

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended June 30, 2013

For the six months ended June 30, 2013

(Unaudited)

| Net increase in cash: | ||||

| Cash flows from operating activities: | ||||

|

Purchases/Proceeds/Maturities from short-term portfolio securities, net

|

$ | 4,508,688 | ||

|

Purchases of portfolio securities

|

(41,946,894 | ) | ||

|

Proceeds from disposition of portfolio securities

|

46,250,835 | |||

|

Interest, dividends and other income received

|

12,895,857 | |||

|

Interest expense paid

|

(792,000 | ) | ||

|

Operating expenses paid

|

(2,156,159 | ) | ||

|

Income taxes paid

|

(1,987,142 | ) | ||

| Net cash provided by operating activities | 16,773,185 | |||

| Cash flows from financing activities: | ||||

| Cash dividends paid from net investment income | (13,481,609 | ) | ||

| Receipts for shares issued on reinvestment of dividends | 1,271,702 | |||

| Net cash used for financing activities | (12,209,907 | ) | ||

| Net increase in cash | 4,563,278 | |||

| Cash - beginning of year | 4,844,982 | |||

| Cash - end of period | $ | 9,408,260 | ||

| Reconciliation of net increase in net assets to net cash provided by operating activities: | ||||

|

Net increase in net assets resulting from operations

|

$ | 14,644,770 | ||

|

Decrease in investments

|

4,914,985 | |||

|

Increase in interest receivable

|

(982,876 | ) | ||

|

Decrease in receivable for investments sold

|

122,631 | |||

|

Increase in other assets

|

(23,185 | ) | ||

|

Increase in deferred tax liability

|

116,242 | |||

|

Increase in investment advisory fee payable

|

31,659 | |||

|

Decrease in tax payable

|

(1,983,980 | ) | ||

|

Increase in accrued expenses

|

(67,061 | ) | ||

|

Total adjustments to net assets from operations

|

2,128,415 | |||

|

Net cash provided by operating activities

|

$ | 16,773,185 | ||

See Notes to Consolidated Financial Statements

5

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

|

For the six

|

||||||||

|

months ended

|

For the

|

|||||||

|

06/30/2013

|

year ended

|

|||||||

|

(Unaudited)

|

12/31/2012

|

|||||||

|

Increase in net assets:

|

||||||||

|

Operations:

|

||||||||

|

Investment income - net

|

$ | 11,855,156 | $ | 24,510,117 | ||||

|

Net realized gain on investments after taxes

|

3,043,960 | 5,288,921 | ||||||

|

Net change in unrealized depreciation of investments after taxes

|

(254,346 | ) | 7,904,425 | |||||

|

Net increase in net assets resulting from operations

|

14,644,770 | 37,703,463 | ||||||

|

Increase from common shares issued on reinvestment of dividends

|

||||||||

|

Common shares issued (2013 - 79,527; 2012 - 169,463)

|

1,271,702 | 2,676,531 | ||||||

|

Dividends to shareholders from:

|

||||||||

|

Net investment income (2013 - $0.30 per share; 2012 - $1.25 per share)

|

(5,785,740 | ) | (24,075,541 | ) | ||||

|

Net realized gains (2013 - $0.00; 2012 - $0.05 per share)

|

— | (869,595 | ) | |||||

|

Total increase in net assets

|

10,130,732 | 15,434,858 | ||||||

|

Net assets, beginning of year

|

257,378,392 | 241,943,534 | ||||||

|

Net assets, end of period/year (including undistributed net investment

|

||||||||

|

income of $9,428,094 and $3,358,678, respectively)

|

$ | 267,509,124 | $ | 257,378,392 | ||||

See Notes to Consolidated Financial Statements

6

Babson Capital Corporate Investors

CONSOLIDATED SELECTED FINANCIAL HIGHLIGHTS

Selected data for each share of beneficial interest outstanding:

|

For the six months

|

||||||||||||||||||||||||

|

ended 06/30/2013

|

For the years ended December 31, | |||||||||||||||||||||||

|

(Unaudited)

|

2012

|

2011(a)

|

2010(a)

|

2009(a)

|

2008(a)

|

|||||||||||||||||||

|

Net asset value:

|

||||||||||||||||||||||||

|

Beginning of year

|

$ | 13.38 | $ | 12.69 | $ | 12.56 | $ | 11.45 | $ | 11.17 | $ | 13.60 | ||||||||||||

|

Net investment income (b)

|

0.61 | 1.28 | 1.29 | 1.13 | 1.03 | 1.16 | ||||||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

gain (loss) on investments

|

0.14 | 0.69 | 0.17 | 1.06 | 0.33 | (2.51 | ) | |||||||||||||||||

|

Total from investment operations

|

0.75 | 1.97 | 1.46 | 2.19 | 1.36 | (1.35 | ) | |||||||||||||||||

|

Dividends from net investment

|

||||||||||||||||||||||||

|

income to common shareholders

|

(0.30 | ) | (1.25 | ) | (1.34 | ) | (1.08 | ) | (1.08 | ) | (1.08 | ) | ||||||||||||

|

Dividends from realized gain

|

||||||||||||||||||||||||

|

on investments to common shareholders

|

— | (0.05 | ) | (0.01 | ) | — | — | — | ||||||||||||||||

|

Increase from dividends reinvested

|

0.02 | 0.02 | 0.02 | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | |||||||||||||||

|

Total dividends

|

(0.28 | ) | (1.28 | ) | (1.33 | ) | (1.08 | ) | (1.08 | ) | (1.08 | ) | ||||||||||||

|

Net asset value: End of period/year

|

$ | 13.85 | $ | 13.38 | $ | 12.69 | $ | 12.56 | $ | 11.45 | $ | 11.17 | ||||||||||||

|

Per share market value:

|

||||||||||||||||||||||||

|

End of period/year

|

$ | 15.85 | $ | 15.28 | $ | 17.99 | $ | 15.28 | $ | 12.55 | $ | 9.63 | ||||||||||||

| Total investment return | ||||||||||||||||||||||||

|

Net asset value (d)

|

5.75 | % | 17.07 | % | 12.00 | % | 19.81 | % | 12.64 | % | (10.34 | %) | ||||||||||||

|

Market value (d)

|

5.66 | % | (7.11 | %) | 27.92 | % | 31.73 | % | 39.89 | % | (30.44 | %) | ||||||||||||

|

Net assets (in millions):

|

||||||||||||||||||||||||

|

End of period/year

|

$ | 267.51 | $ | 257.38 | $ | 241.94 | $ | 237.58 | $ | 214.44 | $ | 208.14 | ||||||||||||

|

Ratio of operating expenses

|

||||||||||||||||||||||||

|

to average net assets

|

1.62 | %(f) | 1.66 | % | 1.62 | % | 1.60 | % | 1.58 | % | 1.49 | % | ||||||||||||

|

Ratio of interest expense

|

||||||||||||||||||||||||

|

to average net assets

|

0.60 | %(f) | 0.63 | % | 0.64 | % | 0.70 | % | 0.75 | % | 0.67 | % | ||||||||||||

|

Ratio of income tax expense

|

||||||||||||||||||||||||

|

to average net assets (e)

|

0.00 | %(f) | 0.88 | % | 0.16 | % | 0.27 | % | 0.00 | % | 0.00 | % | ||||||||||||

|

Ratio of total expenses

|

||||||||||||||||||||||||

|

to average net assets

|

2.22 | %(f) | 3.17 | % | 2.42 | % | 2.57 | % | 2.33 | % | 2.16 | % | ||||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||||||

|

to average net assets

|

9.04 | %(f) | 9.78 | % | 9.91 | % | 9.46 | % | 9.06 | % | 9.01 | % | ||||||||||||

|

Portfolio turnover

|

15 | % | 34 | % | 21 | % | 39 | % | 23 | % | 32 | % | ||||||||||||

|

(a)

|

Per share amounts were adjusted to reflect a 2:1 stock split effective February 18, 2011.

|

|

(b)

|

Calculated using average shares.

|

|

(c)

|

Rounds to less than $0.01 per share.

|

|

(d)

|

Net asset value return represents portfolio returns based on change in the Trust’s net asset value assuming the reinvestment of all dividends and distributions which differs from the total investment return based on the Trust’s market value due to the difference between the Trust’s net asset value and the market value of its shares outstanding; past performance is no guarantee of future results.

|

|

(e)

|

As additional information, this ratio is included to reflect the taxes paid on retained long-term gains. These taxes paid are netted against realized capital gains in the Statement of Operations. The taxes paid are treated as deemed distributions and a credit for the taxes paid is passed on to the shareholders.

|

|

(f)

|

Annualized

|

|

Senior borrowings:

|

||||||||||||||||||||||||

|

Total principal amount (in millions)

|

$ | 30 | $ | 30 | $ | 30 | $ | 30 | $ | 30 | $ | 30 | ||||||||||||

|

Asset coverage per $1,000

|

||||||||||||||||||||||||

|

of indebtedness

|

$ | 9,917 | $ | 9,579 | $ | 9,065 | $ | 8,919 | $ | 8,148 | $ | 7,938 | ||||||||||||

See Notes to Consolidated Financial Statements

7

CONSOLIDATED SCHEDULE OF INVESTMENTS

June 30, 2013

(Unaudited)

| Corporate Restricted Securities - 95.19%: (A) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

|

Private Placement Investments - 85.68%

|

|||||||||||||||

|

1492 Acquisition LLC

|

|||||||||||||||

|

A leading producer of premium Italian cured meats and deli meats in the U.S.

|

|||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,765,785 |

10/17/12

|

$ | 2,714,632 | $ | 2,667,346 | ||||||||

|

Limited Liability Company Unit Class A Common (B)

|

27,273 uts.

|

10/17/12

|

27,273 | 42,158 | |||||||||||

|

Limited Liability Company Unit Class A Preferred (B)

|

245 uts.

|

10/17/12

|

245,450 | 254,532 | |||||||||||

| 2,987,355 | 2,964,036 | ||||||||||||||

|

A E Company, Inc.

|

|||||||||||||||

|

A designer and manufacturer of machined parts and assembly structures for the commercial and military aerospace industries.

|

|||||||||||||||

|

Common Stock (B)

|

323,077 shs.

|

11/10/09

|

323,077 | 782,421 | |||||||||||

|

Warrant, exercisable until 2019, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

161,538 shs.

|

11/10/09

|

119,991 | 391,209 | |||||||||||

| 443,068 | 1,173,630 | ||||||||||||||

|

A H C Holding Company, Inc.

|

|||||||||||||||

|

A designer and manufacturer of boilers and water heaters for the commercial sector.

|

|||||||||||||||

|

Limited Partnership Interest (B)

|

23.16% int.

|

11/21/07

|

224,795 | 321,289 | |||||||||||

A S C Group, Inc.

A designer and manufacturer of high reliability encryption equipment, communications products, computing systems and electronic components primarily for the military and aerospace sectors.

|

Limited Liability Company Unit Class A (B)

|

4,128 uts.

|

* | 147,972 | 223,350 | ||||||||||||

|

Limited Liability Company Unit Class B (B)

|

2,793 uts.

|

10/09/09

|

100,114 | 151,119 | ||||||||||||

|

* 10/09/09 and 10/27/10.

|

248,086 | 374,469 | ||||||||||||||

A W X Holdings Corporation

A provider of aerial equipment rental, sales and repair services to non-residential construction and maintenance contractors operating in the State of Indiana.

|

10.5% Senior Secured Term Note due 2014 (D)

|

$ | 735,000 |

05/15/08

|

724,402 | 367,500 | ||||||||||

|

13% Senior Subordinated Note due 2015 (D)

|

$ | 735,000 |

05/15/08

|

673,096 | — | ||||||||||

|

Common Stock (B)

|

105,000 shs.

|

05/15/08

|

105,000 | — | |||||||||||

|

Warrant, exercisable until 2015, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

36,923 shs.

|

05/15/08

|

62,395 | — | |||||||||||

| 1,564,893 | 367,500 | ||||||||||||||

|

ABC Industries, Inc.

|

|||||||||||||||

|

A manufacturer of mine and tunneling ventilation products in the U.S.

|

|||||||||||||||

|

13% Senior Subordinated Note due 2019

|

$ | 1,200,000 |

08/01/12

|

1,084,082 | 1,167,119 | ||||||||||

|

Preferred Stock Series A (B)

|

300,000 shs.

|

08/01/12

|

300,000 | 278,149 | |||||||||||

|

Warrant, exercisable until 2022, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

53,794 shs.

|

08/01/12

|

101,870 | — | |||||||||||

| 1,485,952 | 1,445,268 | ||||||||||||||

8

Babson Capital Corporate Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

(Unaudited)

|

Corporate Restricted Securities: (A) (Continued)

|

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

||||||||||||

| ACP Cascade Holdings LLC | ||||||||||||||||

| A manufacturer and distributor of vinyl windows and patio doors throughout the northwestern United States. | ||||||||||||||||

|

Limited Liability Company Unit Class B (B)

|

64 uts.

|

11/09/12

|

$ | — | $ | — | ||||||||||

|

Advanced Manufacturing Enterprises LLC

|

||||||||||||||||

|

A designer and manufacturer of large, custom gearing products for a number of critical customer applications.

|

||||||||||||||||

|

14% Senior Subordinated Note due 2018

|

$ | 2,723,077 |

12/07/12

|

2,684,764 | 2,593,951 | |||||||||||

|

Limited Liability Company Unit (B)

|

2,769 uts.

|

12/07/12

|

276,923 | 189,584 | ||||||||||||

| 2,961,687 | 2,783,535 | |||||||||||||||

|

Advanced Technologies Holdings

|

||||||||||||||||

|

A provider of factory maintenance services to industrial companies.

|

||||||||||||||||

|

Preferred Stock Series A (B)

|

796 shs.

|

12/27/07

|

393,754 | 1,509,813 | ||||||||||||

|

Convertible Preferred Stock Series B (B)

|

52 shs.

|

01/04/11

|

40,800 | 99,599 | ||||||||||||

| 434,554 | 1,609,412 | |||||||||||||||

|

All Current Holding Company

|

||||||||||||||||

|

A specialty re-seller of essential electrical parts and components primarily serving wholesale distributors.

|

||||||||||||||||

|

12% Senior Subordinated Note due 2015

|

$ | 1,140,317 |

09/26/08

|

1,095,210 | 1,140,317 | |||||||||||

|

Common Stock (B)

|

1,347 shs.

|

09/26/08

|

134,683 | 241,919 | ||||||||||||

|

Warrant, exercisable until 2018, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

958 shs.

|

09/26/08

|

87,993 | 172,055 | ||||||||||||

| 1,317,886 | 1,554,291 | |||||||||||||||

|

American Hospice Management Holding LLC

|

||||||||||||||||

|

A for-profit hospice care provider in the United States.

|

||||||||||||||||

|

12% Senior Subordinated Note due 2013

|

$ | 2,337,496 | * | 2,322,221 | 2,337,496 | |||||||||||

|

Preferred Class A Unit (B)

|

3,223 uts.

|

** | 322,300 | 456,692 | ||||||||||||

|

Preferred Class B Unit (B)

|

1,526 uts.

|

06/09/08

|

152,626 | 334,650 | ||||||||||||

|

Common Class B Unit (B)

|

30,420 uts.

|

01/22/04

|

1 | — | ||||||||||||

|

Common Class D Unit (B)

|

6,980 uts.

|

09/12/06

|

1 | — | ||||||||||||

|

* 01/22/04 and 06/09/08.

|

2,797,149 | 3,128,838 | ||||||||||||||

|

** 01/22/04 and 09/12/06.

|

||||||||||||||||

|

AMS Holding LLC

|

||||||||||||||||

|

A leading multi-channel direct marketer of high-value collectible coins and proprietary-branded jewelry and watches.

|

||||||||||||||||

|

14.25% Senior Subordinated Note due 2019

|

$ | 2,772,866 |

10/04/12

|

2,721,858 | 2,743,517 | |||||||||||

|

Limited Liability Company Unit Class A Preferred (B)

|

273 uts.

|

10/04/12

|

272,727 | 272,730 | ||||||||||||

| 2,994,585 | 3,016,247 | |||||||||||||||

9

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

| Apex Analytix Holding Corporation | |||||||||||||||

| A provider of audit recovery and fraud detection services and software to commercial and retail businesses in the U.S. and Europe. | |||||||||||||||

|

12.5% Senior Subordinated Note due 2017

|

$ | 1,912,500 |

04/28/09

|

$ | 1,753,557 | $ | 1,912,500 | ||||||||

|

Preferred Stock Series B (B)

|

3,065 shs.

|

04/28/09

|

306,507 | 408,754 | |||||||||||

|

Common Stock (B)

|

1,366 shs.

|

04/28/09

|

1,366 | 151,867 | |||||||||||

| 2,061,430 | 2,473,121 | ||||||||||||||

|

Arch Global Precision LLC

|

|||||||||||||||

|

A leading manufacturer of high tolerance precision components and consumable tools.

|

|||||||||||||||

|

14.75% Senior Subordinated Note due 2018

|

$ | 2,346,023 |

12/21/11

|

2,295,501 | 2,344,275 | ||||||||||

|

Limited Liability Company Unit Class B (B)

|

85 uts.

|

12/21/11

|

85,250 | 111,082 | |||||||||||

|

Limited Liability Company Unit Class C (B)

|

665 uts.

|

12/21/11

|

664,750 | 866,179 | |||||||||||

| 3,045,501 | 3,321,536 | ||||||||||||||

|

ARI Holding Corporation

|

|||||||||||||||

|

A leading national supplier of products used primarily by specialty contractors.

|

|||||||||||||||

|

13.5% Senior Subordinated Note due 2020

|

$ | 2,610,671 |

05/21/13

|

2,559,050 | 2,534,477 | ||||||||||

|

Preferred Stock (B)

|

58 shs.

|

05/21/13

|

579,208 | 550,271 | |||||||||||

|

Common Stock (B)

|

58 shs.

|

05/21/13

|

64,356 | 61,141 | |||||||||||

| 3,202,614 | 3,145,889 | ||||||||||||||

|

Arrow Tru-Line Holdings, Inc.

|

|||||||||||||||

|

A manufacturer of hardware for residential and commercial overhead garage doors in North America.

|

|||||||||||||||

|

12% Senior Subordinated Note due 2016 (D)

|

$ | 1,473,588 |

05/18/05

|

1,357,040 | 1,473,588 | ||||||||||

|

Preferred Stock (B)

|

63 shs.

|

10/16/09

|

62,756 | 130,638 | |||||||||||

|

Common Stock (B)

|

497 shs.

|

05/18/05

|

497,340 | — | |||||||||||

|

Warrant, exercisable until 2014, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

130 shs.

|

05/18/05

|

112,128 | — | |||||||||||

| 2,029,264 | 1,604,226 | ||||||||||||||

|

Baby Jogger Holdings LLC

|

|||||||||||||||

|

A designer and marketer of premium baby strollers and stroller accessories.

|

|||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,826,634 |

04/20/12

|

2,777,472 | 2,883,167 | ||||||||||

|

Common Stock (B)

|

2,261 shs.

|

04/20/12

|

226,132 | 358,799 | |||||||||||

| 3,003,604 | 3,241,966 | ||||||||||||||

|

Blue Wave Products, Inc.

|

|||||||||||||||

|

A distributor of pool supplies.

|

|||||||||||||||

|

10% Senior Secured Term Note due 2018

|

$ | 714,893 |

10/12/12

|

701,900 | 696,699 | ||||||||||

|

13% Senior Subordinated Note due 2019

|

$ | 720,069 |

10/12/12

|

670,536 | 694,955 | ||||||||||

|

Common Stock (B)

|

114,894 shs.

|

10/12/12

|

114,894 | 76,257 | |||||||||||

|

Warrant, exercisable until 2022, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

45,486 shs.

|

10/12/12

|

45,486 | 30,190 | |||||||||||

| 1,532,816 | 1,498,101 | ||||||||||||||

10

Babson Capital Corporate Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

(Unaudited)

|

Corporate Restricted Securities: (A) (Continued)

|

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

| BP SCI LLC | |||||||||||||||

| A leading value-added distributor of branded pipes, valves, and fittings (PVF) to diversified end markets. | |||||||||||||||

|

14% Senior Subordinated Note due 2018

|

$ | 2,535,724 |

10/17/12

|

$ | 2,489,656 | $ | 2,454,866 | ||||||||

|

Limited Liability Company Unit Class A (B)

|

1,000 uts.

|

10/17/12

|

100,000 | 82,014 | |||||||||||

|

Limited Liability Company Unit Class B (B)

|

400 uts.

|

10/17/12

|

400,000 | 422,300 | |||||||||||

| 2,989,656 | 2,959,180 | ||||||||||||||

|

Bravo Sports Holding Corporation

|

|||||||||||||||

|

A designer and marketer of niche branded consumer products including canopies, trampolines, in-line skates, skateboards, and urethane wheels.

|

|||||||||||||||

|

12.5% Senior Subordinated Note due 2014

|

$ | 2,281,593 |

06/30/06

|

2,255,354 | 2,167,513 | ||||||||||

|

Preferred Stock Class A (B)

|

879 shs.

|

06/30/06

|

268,121 | 105,749 | |||||||||||

|

Common Stock (B)

|

1 sh.

|

06/30/06

|

286 | — | |||||||||||

|

Warrant, exercisable until 2014, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

309 shs.

|

06/30/06

|

92,102 | 37,165 | |||||||||||

| 2,615,863 | 2,310,427 | ||||||||||||||

|

C D N T, Inc.

|

|||||||||||||||

|

A value-added converter and distributor of specialty pressure sensitive adhesives, foams, films, and foils.

|

|||||||||||||||

|

10.5% Senior Secured Term Note due 2014

|

$ | 187,718 |

08/07/08

|

186,857 | 187,718 | ||||||||||

|

12.5% Senior Subordinated Note due 2015

|

$ | 750,872 |

08/07/08

|

721,214 | 750,872 | ||||||||||

|

Common Stock (B)

|

73,256 shs.

|

08/07/08

|

73,256 | 106,609 | |||||||||||

|

Warrant, exercisable until 2018, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

57,600 shs.

|

08/07/08

|

57,689 | 83,825 | |||||||||||

| 1,039,016 | 1,129,024 | ||||||||||||||

|

Capital Specialty Plastics, Inc.

|

|||||||||||||||

|

A producer of desiccant strips used for packaging pharmaceutical products.

|

|||||||||||||||

|

Common Stock (B)

|

109 shs.

|

*

|

503 | 1,247,181 | |||||||||||

|

* 12/30/97 and 05/29/99

|

|||||||||||||||

CG Holdings Manufacturing Company

A coating provider in the fragmented North American market, serving the automotive, agricultural, heavy truck and other end markets.

|

13% Senior Subordinated Note due 2019

|

$ | 2,727,273 |

05/09/13

|

2,568,019 | 2,642,678 | ||||||||||

|

Preferred Stock (B)

|

2,455 shs.

|

05/09/13

|

245,454 | 233,182 | |||||||||||

|

Preferred Stock-OID (B)

|

965 shs.

|

05/09/13

|

96,496 | 91,671 | |||||||||||

|

Common Stock (B)

|

253 shs.

|

05/09/13

|

27,273 | 25,943 | |||||||||||

|

Warrant, exercisable until 2023, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

114 shs.

|

05/09/13

|

10,736 | 1 | |||||||||||

| 2,947,978 | 2,993,475 | ||||||||||||||

11

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

||||||||||||

| CHG Alternative Education Holding Company | ||||||||||||||||

| A leading provider of publicly-funded, for profit pre-K-12 education services targeting special needs children at therapeutic day schools and “at risk” youth through alternative education programs. | ||||||||||||||||

|

13.5% Senior Subordinated Note due 2018

|

$ | 2,218,377 |

01/19/11

|

$ | 2,120,823 | $ | 2,239,391 | |||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 572,915 |

08/03/12

|

562,590 | 565,085 | |||||||||||

|

Common Stock (B)

|

1,125 shs.

|

01/19/11

|

112,500 | 134,262 | ||||||||||||

|

Warrant, exercisable until 2021, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

884 shs.

|

01/19/11

|

87,750 | 105,538 | ||||||||||||

| 2,883,663 | 3,044,276 | |||||||||||||||

|

Church Services Holding Company

|

||||||||||||||||

|

A provider of diversified residential services to homeowners in the Houston, Dallas, and Austin markets.

|

||||||||||||||||

|

14.5% Senior Subordinated Note due 2018

|

$ | 1,230,574 |

03/26/12

|

1,195,452 | 1,225,999 | |||||||||||

|

Common Stock (B)

|

3,981 shs.

|

* | 398,100 | 318,293 | ||||||||||||

|

Warrant, exercisable until 2022, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

172 shs.

|

03/26/12

|

17,220 | 13,752 | ||||||||||||

|

* 03/26/12, 05/25/12 and 06/19/12.

|

1,610,772 | 1,558,044 | ||||||||||||||

|

Clough, Harbour and Associates

|

||||||||||||||||

|

An engineering service firm that is located in Albany, NY.

|

||||||||||||||||

|

Preferred Stock (B)

|

277 shs.

|

12/02/08

|

276,900 | 392,015 | ||||||||||||

|

Connecticut Electric, Inc.

|

||||||||||||||||

|

A supplier and distributor of electrical products sold into the retail and wholesale markets.

|

||||||||||||||||

|

10% Senior Subordinated Note due 2014 (D)

|

$ | 1,456,429 |

01/12/07

|

1,358,675 | 1,411,537 | |||||||||||

|

Limited Liability Company Unit Class A (B)

|

156,046 uts.

|

01/12/07

|

156,046 | 60,953 | ||||||||||||

|

Limited Liability Company Unit Class C (B)

|

112,873 uts.

|

01/12/07

|

112,873 | 47,248 | ||||||||||||

|

Limited Liability Company Unit Class D (B)

|

1,268,437 uts.

|

05/03/10

|

— | 1,351,824 | ||||||||||||

|

Limited Liability Company Unit Class E (B)

|

2,081 uts.

|

05/03/10

|

— | — | ||||||||||||

| 1,627,594 | 2,871,562 | |||||||||||||||

Connor Sport Court International, Inc.

A designer and manufacturer of outdoor and indoor synthetic sports flooring and other temporary flooring products.

|

Preferred Stock Series B-2 (B)

|

17,152 shs.

|

07/05/07

|

700,392 | 1,551,381 | ||||||||||||

|

Preferred Stock Series C (B)

|

7,080 shs.

|

07/05/07

|

236,503 | 640,340 | ||||||||||||

|

Common Stock (B)

|

718 shs.

|

07/05/07

|

7 | — | ||||||||||||

|

Limited Partnership Interest (B)

|

12.64% int.

|

* | 189,586 | — | ||||||||||||

|

* 08/12/04 and 01/14/05.

|

1,126,488 | 2,191,721 | ||||||||||||||

12

Babson Capital Corporate Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

|

Corporate Restricted Securities: (A) (Continued)

|

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

|

CorePharma LLC

|

|||||||||||||||

|

A manufacturer of oral dose generic pharmaceuticals targeted at niche applications.

|

|||||||||||||||

|

Warrant, exercisable until 2013, to purchase

|

|||||||||||||||

|

common stock at $.001 per share (B)

|

20 shs.

|

08/04/05

|

$ | 137,166 | $ | 682,863 | |||||||||

|

Crane Rental Corporation

|

|||||||||||||||

|

A crane rental company since 1960, headquartered in Florida.

|

|||||||||||||||

|

13% Senior Subordinated Note due 2015

|

$ | 1,950,750 |

08/21/08

|

1,864,174 | 1,950,750 | ||||||||||

|

Common Stock (B)

|

255,000 shs.

|

08/21/08

|

255,000 | 153,840 | |||||||||||

|

Warrant, exercisable until 2016, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

136,070 shs.

|

08/21/08

|

194,826 | 82,090 | |||||||||||

| 2,314,000 | 2,186,680 | ||||||||||||||

Custom Engineered Wheels, Inc.

A manufacturer of custom engineered, non-pneumatic plastic wheels and plastic tread cap tires used primarily for lawn and garden products and wheelchairs.

|

Preferred Stock PIK (B)

|

296 shs.

|

10/27/09

|

295,550 | 346,659 | |||||||||||

|

Preferred Stock Series A (B)

|

216 shs.

|

10/27/09

|

197,152 | 253,282 | |||||||||||

|

Common Stock (B)

|

72 shs.

|

10/27/09

|

72,238 | — | |||||||||||

|

Warrant, exercisable until 2016, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

53 shs.

|

10/27/09

|

48,608 | — | |||||||||||

| 613,548 | 599,941 | ||||||||||||||

|

DPL Holding Corporation

|

|||||||||||||||

|

A distributor and manufacturer of aftermarket undercarriage parts for medium and heavy duty trucks and trailers.

|

|||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 3,142,253 |

05/04/12

|

3,087,143 | 2,986,189 | ||||||||||

|

Preferred Stock (B)

|

61 shs.

|

05/04/12

|

605,841 | 616,766 | |||||||||||

|

Common Stock (B)

|

61 shs.

|

05/04/12

|

67,316 | — | |||||||||||

| 3,760,300 | 3,602,955 | ||||||||||||||

|

Duncan Systems, Inc.

|

|||||||||||||||

|

A distributor of windshields and side glass for the recreational vehicle market.

|

|||||||||||||||

|

10% Senior Secured Term Note due 2013

|

$ | 135,000 |

11/01/06

|

134,870 | 134,144 | ||||||||||

|

13% Senior Subordinated Note due 2014

|

$ | 855,000 |

11/01/06

|

830,280 | 842,233 | ||||||||||

|

Common Stock (B)

|

180,000 shs.

|

11/01/06

|

180,000 | 44,432 | |||||||||||

|

Warrant, exercisable until 2014, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

56,514 shs.

|

11/01/06

|

78,160 | 13,950 | |||||||||||

| 1,223,310 | 1,034,759 | ||||||||||||||

E S P Holdco, Inc.

A manufacturer of power protection technology for commercial office equipment, primarily supplying the office equipment dealer network.

|

14% Senior Subordinated Note due 2015

|

$ | 2,476,648 |

01/08/08

|

2,456,606 | 2,476,648 | ||||||||||

|

Common Stock (B)

|

660 shs.

|

01/08/08

|

329,990 | 378,963 | |||||||||||

| 2,786,596 | 2,855,611 | ||||||||||||||

13

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

| Eatem Holding Company | |||||||||||||||

| A developer and manufacturer of savory flavor systems for soups, sauces, gravies, and other products produced by food manufacturers for retail and foodservice end products. | |||||||||||||||

|

12.5% Senior Subordinated Note due 2018

|

$ | 2,850,000 |

02/01/10

|

$ | 2,580,530 | $ | 2,806,167 | ||||||||

|

Common Stock (B)

|

150 shs.

|

02/01/10

|

150,000 | 156,665 | |||||||||||

|

Warrant, exercisable until 2018, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

358 shs.

|

02/01/10

|

321,300 | 373,543 | |||||||||||

| 3,051,830 | 3,336,375 | ||||||||||||||

|

ELT Holding Company

|

|||||||||||||||

|

A provider of web-based ethics and compliance training solutions for companies in the United States.

|

|||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,801,706 |

03/01/12

|

2,754,086 | 2,796,289 | ||||||||||

|

Common Stock (B)

|

122 shs.

|

03/01/12

|

272,727 | 313,555 | |||||||||||

| 3,026,813 | 3,109,844 | ||||||||||||||

|

F F C Holding Corporation

|

|||||||||||||||

|

A leading U.S. manufacturer of private label frozen novelty and ice cream products.

|

|||||||||||||||

|

16% Senior Subordinated Note due 2017

|

$ | 2,739,068 |

09/27/10

|

2,705,220 | 2,766,458 | ||||||||||

|

Limited Liability Company Unit Preferred (B)

|

512 uts.

|

09/27/10

|

175,035 | 563,901 | |||||||||||

|

Limited Liability Company Unit (B)

|

512 uts.

|

09/27/10

|

51,220 | 64,651 | |||||||||||

| 2,931,475 | 3,395,010 | ||||||||||||||

F G I Equity LLC

A manufacturer of a broad range of filters and related products that are used in commercial, light industrial, healthcare, gas turbine, nuclear, laboratory, clean room, hotel, educational system, and food processing settings.

|

13.25% Senior Subordinated Note due 2018

|

$ | 2,610,510 |

05/02/13

|

2,585,072 | 2,617,896 | ||||||||||

|

14.25% Senior Subordinated Note due 2018

|

$ | 680,341 |

02/29/12

|

680,532 | 693,948 | ||||||||||

|

Limited Liability Company Unit Class B-1 (B)

|

394,737 uts.

|

12/15/10

|

394,737 | 872,621 | |||||||||||

|

Limited Liability Company Unit Class B-2 (B)

|

49,488 uts.

|

12/15/10

|

49,488 | 109,400 | |||||||||||

|

Limited Liability Company Unit Class B-3 (B)

|

39,130 uts.

|

08/30/12

|

90,000 | 96,168 | |||||||||||

|

Limited Liability Company Unit Class C (B)

|

9,449 uts.

|

12/20/10

|

96,056 | 139,378 | |||||||||||

| 3,895,885 | 4,529,411 | ||||||||||||||

Flutes, Inc.

An independent manufacturer of micro fluted corrugated sheet material for the food and consumer products packaging industries.

| 10% Senior Secured Term Note due 2014 (D) | $ | 1,146,937 |

04/13/06

|

908,339 | 1,089,590 | ||||||||||

| 14% Senior Subordinated Note due 2014 (D) | $ | 756,489 |

04/13/06

|

509,089 | — | ||||||||||

| 1,417,428 | 1,089,590 |

G C Holdings

A leading manufacturer of gaming tickets, industrial recording charts, security-enabled point-of sale receipts, and medical charts and supplies.

|

12.5% Senior Subordinated Note due 2017

|

$ | 3,000,000 |

10/19/10

|

2,856,173 | 3,030,000 | ||||||||||

|

Warrant, exercisable until 2018, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

594 shs.

|

10/19/10

|

140,875 | 1,636,605 | |||||||||||

| 2,997,048 | 4,666,605 | ||||||||||||||

14

Babson Capital Corporate Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

| GD Dental Services LLC | |||||||||||||||

| A provider of convenient “onestop” general, specialty, and cosmetic dental services with 21 offices located throughout South and Central Florida. | |||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,829,249 |

10/05/12

|

$ | 2,776,602 | $ | 2,747,916 | ||||||||

|

Limited Liability Company Unit Common (B)

|

1,840 uts.

|

10/05/12

|

1,841 | — | |||||||||||

|

Limited Liability Company Unit Preferred (B)

|

182 uts.

|

10/05/12

|

182,209 | 178,191 | |||||||||||

| 2,960,652 | 2,926,107 | ||||||||||||||

|

gloProfessional Holdings, Inc.

|

|||||||||||||||

|

A marketer and distributor of premium mineral-based cosmetics, cosmeceuticals and professional hair care products to the professional spa and physician’s office channels.

|

|||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,730,570 |

03/27/13

|

2,677,776 | 2,675,865 | ||||||||||

|

Common Stock (B)

|

2,835 shs.

|

03/27/13

|

283,465 | 244,705 | |||||||||||

| 2,961,241 | 2,920,570 | ||||||||||||||

|

Golden County Foods Holding, Inc.

|

|||||||||||||||

|

A manufacturer of frozen appetizers and snacks.

|

|||||||||||||||

|

16% Senior Subordinated Note due 2015 (D)

|

$ | 1,912,500 |

11/01/07

|

1,772,199 | — | ||||||||||

|

14% PIK Note due 2015 (D)

|

$ | 472,711 |

12/31/08

|

411,209 | — | ||||||||||

|

8% Series A Convertible Preferred Stock, convertible into

|

|||||||||||||||

|

common shares (B)

|

287,658 shs.

|

11/01/07

|

146,658 | — | |||||||||||

| 2,330,066 | — | ||||||||||||||

| H M Holding Company | ||||||||||||||||

|

A designer, manufacturer, and importer of promotional and wood furniture.

|

||||||||||||||||

|

7.5% Senior Subordinated Note due 2014 (D)

|

$ | 685,100 |

10/15/09

|

512,231 | — | |||||||||||

|

Preferred Stock (B)

|

40 shs.

|

* | 40,476 | — | ||||||||||||

|

Preferred Stock Series B (B)

|

2,055 shs.

|

10/15/09

|

1,536,694 | — | ||||||||||||

|

Common Stock (B)

|

340 shs.

|

02/10/06

|

340,000 | — | ||||||||||||

|

Common Stock Class C (B)

|

560 shs.

|

10/15/09

|

— | — | ||||||||||||

|

Warrant, exercisable until 2013, to purchase

|

— | |||||||||||||||

|

common stock at $.02 per share (B)

|

126 shs.

|

02/10/06

|

116,875 | |||||||||||||

|

* 09/18/07 and 06/27/08.

|

2,546,276 |

—

|

||||||||||||||

Handi Quilter Holding Company

A designer and manufacturer of long-arm quilting machines and related components for the consumer quilting market.

|

12% Senior Subordinated Note due 2017

|

$ | 1,384,615 |

11/14/11

|

1,300,719 | 1,426,153 | ||||||||||

|

Common Stock (B)

|

115 shs.

|

11/14/11

|

115,385 | 257,031 | |||||||||||

|

Warrant, exercisable until 2021, to purchase

|

|||||||||||||||

|

common stock at $.01 per share (B)

|

83 shs.

|

11/14/11

|

76,788 | 184,014 | |||||||||||

| 1,492,892 | 1,867,198 | ||||||||||||||

15

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

|||||||||||

| Healthcare Direct Holding Company | |||||||||||||||

|

A direct-to-consumer marketer of discount dental plans.

|

|||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,151,183 |

03/09/12

|

$ | 2,114,541 | $ | 2,050,806 | ||||||||

|

Common Stock (B)

|

1,552 shs.

|

03/09/12

|

155,172 | 49,524 | |||||||||||

| 2,269,713 | 2,100,330 | ||||||||||||||

|

Hi-Rel Group LLC

|

|||||||||||||||

A manufacturer and distributor of precision metal piece parts for the microelectronic packaging industry, serving the aerospace/ defense, telecommunications, and medical end markets.

|

12% Senior Subordinated Note due 2018

|

$ | 1,687,500 |

04/15/13

|

1,579,471 | 1,637,312 | |||||||||||

|

Limited Liability Company Unit (B)

|

563 uts.

|

04/15/13

|

562,500 | 534,375 | ||||||||||||

|

Warrant, exercisable until 2020, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

89,224 shs.

|

04/15/13

|

77,625 | 892 | ||||||||||||

| 2,219,596 | 2,172,579 | |||||||||||||||

|

Home Décor Holding Company

|

||||||||||||||||

|

A designer, manufacturer and marketer of framed art and wall décor products.

|

||||||||||||||||

|

Common Stock (B)

|

63 shs.

|

* | 62,742 | 159,093 | ||||||||||||

|

Warrant, exercisable until 2013, to purchase

|

||||||||||||||||

|

common stock at $.02 per share (B)

|

200 shs.

|

* | 199,501 | 505,883 | ||||||||||||

|

* 06/30/04 and 08/19/04.

|

262,243 | 664,976 | ||||||||||||||

|

HOP Entertainment LLC

|

||||||||||||||||

|

A provider of post production equipment and services to producers of television shows and motion pictures.

|

||||||||||||||||

|

Limited Liability Company Unit Class F (B)

|

89 uts.

|

10/14/11

|

— | — | ||||||||||||

|

Limited Liability Company Unit Class G (B)

|

215 uts.

|

10/14/11

|

— | — | ||||||||||||

|

Limited Liability Company Unit Class H (B)

|

89 uts.

|

10/14/11

|

— | — | ||||||||||||

|

Limited Liability Company Unit Class I (B)

|

89 uts.

|

10/14/11

|

— | — | ||||||||||||

| — | — | |||||||||||||||

|

Hospitality Mints Holding Company

|

||||||||||||||||

|

A manufacturer of individually-wrapped imprinted promotional mints.

|

||||||||||||||||

|

12% Senior Subordinated Note due 2016

|

$ | 2,075,581 |

08/19/08

|

1,993,040 | 2,002,267 | |||||||||||

|

Common Stock (B)

|

474 shs.

|

08/19/08

|

474,419 | 100,676 | ||||||||||||

|

Warrant, exercisable until 2016, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

123 shs.

|

08/19/08

|

113,773 | 26,021 | ||||||||||||

| 2,581,232 | 2,128,964 | |||||||||||||||

|

HVAC Holdings, Inc.

|

||||||||||||||||

|

A provider of integrated energy efficiency services and maintenance programs for HVAC systems.

|

||||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 2,768,999 |

09/27/12

|

2,718,107 | 2,661,217 | |||||||||||

|

Preferred Stock Series A (B)

|

2,705 shs.

|

09/27/12

|

270,542 | 287,446 | ||||||||||||

|

Common Stock (B)

|

2,185 shs.

|

09/27/12

|

2,185 | 8,156 | ||||||||||||

| 2,956,819 | ||||||||||||||||

16

Babson Capital Corporate Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

|

Corporate Restricted Securities: (A) (Continued)

|

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

||||||||||||

|

Ideal Tridon Holdings, Inc.

|

||||||||||||||||

|

A designer and manufacturer of clamps and couplings used in automotive and industrial end markets.

|

||||||||||||||||

|

Common Stock (B)

|

279 shs.

|

10/27/11

|

$ | 278,561 | $ | 380,243 | ||||||||||

|

Insurance Claims Management, Inc.

|

||||||||||||||||

|

A third party administrator providing auto and property claim administration services for insurance companies.

|

||||||||||||||||

|

Common Stock (B)

|

89 shs.

|

02/27/07

|

2,689 | 469,927 | ||||||||||||

International Offshore Services LLC

A leading provider of marine transportation services, platform decommissioning, and salvage services to oil and gas producers in the shallow waters of the Gulf of Mexico.

|

14.25% Senior Subordinated Secured Note due 2017 (D)

|

$ | 2,550,000 |

07/07/09

|

2,335,431 | — | |||||||||||

|

Limited Liability Company Unit (B)

|

3,112 uts.

|

07/07/09

|

186,684 | — | ||||||||||||

| 2,522,115 | — | |||||||||||||||

|

J A C Holding Enterprises, Inc.

|

||||||||||||||||

|

A supplier of luggage racks and accessories to the original equipment manufacturers.

|

||||||||||||||||

|

12.5% Senior Subordinated Note due 2017

|

$ | 2,500,000 |

12/20/10

|

2,223,441 | 2,525,000 | |||||||||||

|

Preferred Stock A (B)

|

495 shs.

|

12/20/10

|

495,000 | 396,913 | ||||||||||||

|

Preferred Stock B (B)

|

0.17 shs.

|

12/20/10

|

— | 134 | ||||||||||||

|

Common Stock (B)

|

100 shs.

|

12/20/10

|

5,000 | — | ||||||||||||

|

Warrant, exercisable until 2020, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

36 shs.

|

12/20/10

|

316,931 | — | ||||||||||||

| 3,040,372 | 2,922,047 | |||||||||||||||

|

Jason Partners Holdings LLC

|

||||||||||||||||

|

A diversified manufacturing company serving various industrial markets.

|

||||||||||||||||

|

Limited Liability Company Unit (B)

|

90 uts.

|

09/21/10

|

848,275 | 48,185 | ||||||||||||

|

JMH Investors LLC

|

||||||||||||||||

|

A developer and manufacturer of custom formulations for a wide variety of foods.

|

||||||||||||||||

|

14.25% Senior Subordinated Note due 2019

|

$ | 2,510,292 |

12/05/12

|

2,463,140 | 2,449,561 | |||||||||||

|

Limited Liability Company Unit (B)

|

521,739 uts.

|

12/05/12

|

521,739 | 453,010 | ||||||||||||

| 2,984,879 | 2,902,571 | |||||||||||||||

|

K & N Parent, Inc.

|

||||||||||||||||

|

A manufacturer and supplier of automotive aftermarket performance air filters and intake systems.

|

||||||||||||||||

|

14% Senior Subordinated Note due 2019

|

$ | 3,411,263 |

12/23/11

|

3,332,965 | 3,328,534 | |||||||||||

|

Preferred Stock Series A (B)

|

305 shs.

|

12/23/11

|

119,662 | 339,544 | ||||||||||||

|

Preferred Stock Series B (B)

|

86 shs.

|

12/23/11

|

— | 96,103 | ||||||||||||

|

Common Stock (B)

|

391 shs.

|

12/23/11

|

19,565 | 112,222 | ||||||||||||

| 3,472,192 | 3,876,403 | |||||||||||||||

17

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

| Corporate Restricted Securities: (A) (Continued) |

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

||||||||||||

| K N B Holdings Corporation | ||||||||||||||||

| A designer, manufacturer and marketer of products for the custom framing market. | ||||||||||||||||

|

15% Senior Subordinated Note due 2017

|

$ | 4,582,290 | * | $ | 4,291,930 | $ | 4,582,289 | |||||||||

|

Common Stock (B)

|

134,210 shs.

|

05/25/06

|

134,210 | 73,698 | ||||||||||||

|

Warrant, exercisable until 2016, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

82,357 shs.

|

05/25/06

|

71,534 | 45,224 | ||||||||||||

|

* 05/25/06 and 04/12/11.

|

4,497,674 | 4,701,211 | ||||||||||||||

K P H I Holdings, Inc.

A manufacturer of highly engineered plastic and metal components for a diverse range of end-markets, including medical, consumer and industrial, automotive and defense.

|

Common Stock (B)

|

698,478 shs.

|

12/10/10

|

698,478 | 739,725 | ||||||||||||

|

K P I Holdings, Inc.

|

||||||||||||||||

|

The largest player in the U.S. non-automotive, non-ferrous die casting segment.

|

||||||||||||||||

|

Convertible Preferred Stock Series C (B)

|

55 shs.

|

06/30/09

|

55,435 | 110,000 | ||||||||||||

|

Convertible Preferred Stock Series D (B)

|

24 shs.

|

09/17/09

|

24,476 | 73,410 | ||||||||||||

|

Common Stock (B)

|

443 shs.

|

07/15/08

|

443,478 | 79,182 | ||||||||||||

|

Warrant, exercisable until 2018, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

96 shs.

|

07/16/08

|

96,024 | 17,144 | ||||||||||||

|

Warrant, exercisable until 2018, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

128 shs.

|

09/17/09

|

— | 22,783 | ||||||||||||

| 619,413 | 302,519 | |||||||||||||||

|

LPC Holding Company

|

||||||||||||||||

A designer and manufacturer of precision-molded silicone rubber components that are utilized in the medical and automotive end markets.

|

13.5% Senior Subordinated Note due 2018

|

$ | 3,512,926 |

08/15/11

|

3,456,645 | 3,559,594 | |||||||||||

|

Common Stock (B)

|

315 shs.

|

08/15/11

|

315,057 | 397,750 | ||||||||||||

| 3,771,702 | 3,957,344 | |||||||||||||||

M V I Holding, Inc.

A manufacturer of large precision machined metal components used in equipment which services a variety of industries, including the oil and gas, mining, and defense markets.

|

Common Stock (B)

|

61 shs.

|

09/12/08

|

60,714 | 76,521 | ||||||||||||

|

Warrant, exercisable until 2018, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

66 shs.

|

09/12/08

|

65,571 | 82,647 | ||||||||||||

| 126,285 | 159,168 | |||||||||||||||

Mail Communications Group, Inc.

A provider of mail processing and handling services, lettershop services, and commercial printing services.

|

Limited Liability Company Unit (B)

|

24,109 uts.

|

* | 314,464 | 496,357 | ||||||||||||

|

Warrant, exercisable until 2014, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

3,375 shs.

|

05/04/07

|

43,031 | 69,485 | ||||||||||||

|

* 05/04/07 and 01/02/08.

|

357,495 | 565,842 | ||||||||||||||

18

Babson Capital Corporate Investors

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2013

June 30, 2013

(Unaudited)

|

Corporate Restricted Securities: (A) (Continued)

|

Principal Amount,

Shares, Units or |

Acquisition

Date |

Cost

|

Fair Value

|

||||||||||||

|

Manhattan Beachwear Holding Company

|

||||||||||||||||

|

A designer and distributor of women’s swimwear.

|

||||||||||||||||

|

12.5% Senior Subordinated Note due 2018

|

$ | 1,259,914 |

01/15/10

|

$ | 1,146,639 | $ | 1,259,914 | |||||||||

|

15% Senior Subordinated Note due 2018

|

$ | 328,947 |

10/05/10

|

324,239 | 310,280 | |||||||||||

|

Common Stock (B)

|

106 shs.

|

10/05/10

|

106,200 | 118,176 | ||||||||||||

|

Common Stock Class B (B)

|

353 shs.

|

01/15/10

|

352,941 | 392,741 | ||||||||||||

|

Warrant, exercisable until 2019, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

312 shs.

|

01/15/10

|

283,738 | 347,574 | ||||||||||||

| 2,213,757 | 2,428,685 | |||||||||||||||

|

Marshall Physicians Services LLC

|

||||||||||||||||

A provider of emergency department and hospital medicine services to hospitals located in the state of Kentucky. The company was founded in 1999 and is owned by seven practicing physicians.

|

13% Senior Subordinated Note due 2016

|

$ | 1,343,646 |

09/20/11

|

1,322,018 | 1,350,310 | |||||||||||

|

Limited Liability Company Unit Class A (B)

|

8,700 uts.

|

09/20/11

|

180,000 | 145,662 | ||||||||||||

|

Limited Liability Company Unit Class D (B)

|

874 uts.

|

09/20/11

|

— | 14,639 | ||||||||||||

| 1,502,018 | 1,510,611 | |||||||||||||||

|

MBWS Ultimate Holdco, Inc.

|

||||||||||||||||

A provider of services throughout North Dakota that address the fluid management and related transportation needs of an oil well.

|

12% Senior Subordinated Note due 2016

|

$ | 3,352,486 | * | 3,143,309 | 3,386,011 | |||||||||||

|

Preferred Stock Series A (B)

|

4,164 shs.

|

09/07/10

|

416,392 | 1,332,776 | ||||||||||||

|

Common Stock (B)

|

487 shs.

|

03/01/11

|

48,677 | 155,875 | ||||||||||||

|

Common Stock (B)

|

458 shs.

|

09/07/10

|

45,845 | 146,592 | ||||||||||||

|

Warrant, exercisable until 2020, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

310 shs.

|

03/01/11

|

30,975 | 99,222 | ||||||||||||

|

Warrant, exercisable until 2016, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

1,158 shs.

|

09/07/10

|

115,870 | 370,642 | ||||||||||||

|

* 09/07/10 and 03/01/11.

|

3,801,068 | 5,491,118 | ||||||||||||||

|

MedSystems Holdings LLC

|

||||||||||||||||

|

A manufacturer of enteral feeding products, such as feeding tubes and other products related to assisted feeding.

|

||||||||||||||||

|

Preferred Unit (B)

|

126 uts.

|

08/29/08

|

125,519 | 161,494 | ||||||||||||

|

Common Unit Class A (B)

|

1,268 uts.

|

08/29/08

|

1,268 | 82,769 | ||||||||||||

|

Common Unit Class B (B)

|

472 uts.

|

08/29/08

|

120,064 | 30,797 | ||||||||||||

| 246,851 | 275,060 | |||||||||||||||

|

MEGTEC Holdings, Inc.

|

||||||||||||||||

|

A supplier of industrial and environmental products and services to a broad array of industries.

|

||||||||||||||||

|

Preferred Stock (B)

|

107 shs.

|

09/24/08

|

103,255 | 162,239 | ||||||||||||

|

Limited Partnership Interest (B)

|

1.40% int.

|

09/16/08

|

388,983 | 494,503 | ||||||||||||

|

Warrant, exercisable until 2018, to purchase

|

||||||||||||||||

|

common stock at $.01 per share (B)

|

35 shs.

|

09/24/08

|

33,268 | 26,731 | ||||||||||||