UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For

the fiscal year ended

OR | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission

file number:

(Exact Name of registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of Principal Executive Offices) | (Zip Code) |

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934

(“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller

reporting company | ||

| Emerging

Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act,

indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

As

of October 31, 2022, the aggregate market value of the voting and non-voting shares of common stock of the registrant issued and outstanding

on such date, excluding shares held by affiliates of the registrant as a group, was $

Number of shares of Common Stock outstanding as of July 28, 2023:

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III of this Form 10-K is incorporated herein by reference from the registrant’s Definitive Proxy Statement for its 2023 annual meeting of stockholders which the registrant intends to file pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this report.

U.S. GOLD CORP

INDEX

| 2 |

FORWARD-LOOKING STATEMENTS

Some information contained in or incorporated by reference into this Annual Report on Form 10-K may contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

| ● | The timing of preparation and filing of our mine construction and operating permits for the CK Gold Project; | |

| ● | The timing and process of our mine operating permit and closure plan for the CK Gold Project; | |

| ● | The assumptions and projections contained in the CK Gold Project Prefeasibility Study, including estimated mineral resources and mineral reserves, mine life, projected operating and capital costs, projected production, internal rate of return (“IRR”) and Net Present Value (“NPV”) calculations, and the possibility of upside potential at the project; | |

| ● | The planned extensions of our leases; | |

| ● | Our planned expenditures during our fiscal year ended April 30, 2024; | |

| ● | Whether we will make a buy down payment of the NSR associated with the Keystone Project; | |

| ● | Future exploration plans and expectations related to our properties; | |

| ● | Our ability to fund our business through April 30, 2024 with our current cash reserves based on our currently planned activities; | |

| ● | Our anticipation of future environmental and regulatory impacts; and | |

| ● | Our business and operating strategies. |

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions (including negative and grammatical variations) to identify forward-looking statements. Statements that contain these words discuss our future expectations and plans, or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Our actual results could differ materially from those expressed or implied in these forward-looking statements as a result of various factors described in this annual report on Form 10-K, including:

| ● | Unfavorable results from our exploration activities; | |

| ● | Decreases in gold, copper or silver prices; | |

| ● | Whether we are able to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely negative effect of volatility in metals prices or unfavorable exploration results; | |

| ● | Whether we will be able to begin to mine and sell minerals successfully or profitably at any of our current properties at current or future metals prices; | |

| ● | Potential delays in our exploration activities or other activities to advance properties towards mining resulting from environmental consents or permitting delays or problems, accidents, problems with contractors, disputes under agreements related to exploration properties, unanticipated costs and other unexpected events; | |

| ● | Our ability to retain key management and mining personnel necessary to successfully operate and grow our business; | |

| ● | Economic and political events affecting the market prices for gold, copper, silver, and other minerals that may be found on our exploration properties; | |

| ● | Volatility in the market price of our common stock; and | |

| ● | The factors set forth under “Risk Factors” in Item 1A of this annual report on Form 10-K. |

Many of these factors are beyond our ability to control or predict. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such statements can only be based on facts and factors currently known to us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. These statements speak only as of the date of this Annual Report on Form 10-K. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this Annual Report on Form 10-K.

ADDITIONAL INFORMATION

Descriptions of agreements or other documents contained in this Annual Report on Form 10-K are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the exhibit index at the end of this report for a complete list of those exhibits.

| 3 |

PART I

Items 1 and 2. BUSINESS AND PROPERTIES

Overview

U.S. Gold Corp., formerly known as Dataram Corporation (the “Company”), was re-incorporated under the laws of the State of Nevada in 2016 and was originally incorporated in the State of New Jersey in 1967. Effective June 26, 2017, the Company changed its legal name to U.S. Gold Corp. from Dataram Corporation. On May 23, 2017, the Company merged with Gold King Corp. (“Gold King”), in a transaction treated as a reverse acquisition and recapitalization, and the business of Gold King became the business of the Company. We are a gold, copper and precious metals exploration company pursuing exploration opportunities primarily in Wyoming, Nevada and Idaho.

We are an exploration and development company that owns certain mining leases and other mineral rights comprising the CK Gold Project in Wyoming, the Keystone Project in Nevada and the Challis Gold Project in Idaho. The Company’s CK Gold Project’s property contains proven and probable mineral reserves and accordingly is classified as a development stage property, as defined in subpart 1300 of Regulation S-K promulgated by the Securities and Exchange Commission (“S-K 1300”). None of the Company’s other properties contain proven and probable mineral reserves and all activities are exploratory in nature. We do not currently have any revenue-producing activities.

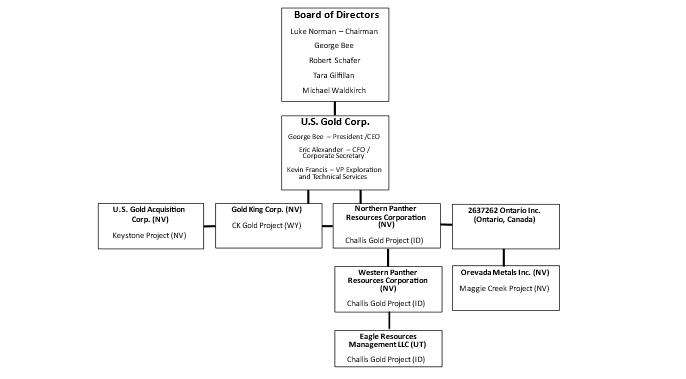

Corporate Organization Chart

The name, place of incorporation, continuance or organization and percent of equity securities that we own or control as of July 31, 2023 for each of our subsidiaries is set out below.

Corporate Address

The current address, telephone number of our offices are:

U.S. Gold Corp.

1910 E. Idaho Street, Suite 102-Box 604

Elko, NV 89801

(800) 557-4550

| 4 |

We make available, free of charge, on or through our website, at https://www.usgoldcorp.gold, our annual report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as amended, and other information. Our website and the information contained therein or connected thereto are not intended to be, and are not, incorporated into this annual report on Form 10-K. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Employees

As of April 30, 2023, we had 4 full-time employees and no part-time employees. In addition, we use consultants with specific skills to assist with various aspects of our project evaluation, due diligence, corporate governance and property management.

OUR MINERAL PROPERTIES AND PROJECTS

Property Map

For a map showing the more precise location of each property, see the individual property descriptions set forth below.

| 5 |

Summary of Current Mineral Properties

| Property | Stage of Property/Mine and mineralization types | Ownership,

Mineral Rights, Leases or Options |

Key permit conditions | Processing plants and other available facilities | Other | |||||

| CK Gold Project - Wyoming | Development stage, proposed open-pit mine producing a copper concentrate containing gold, copper and silver from porphyry-style mineralization. | 100% ownership - Two state of Wyoming Mineral Leases covering approximately 1,120 acres in Laramie County, Wyoming. State of Wyoming has certain royalty interests on mineral production. | Exploration permits received. Submitted applications to the Wyoming Division of Enviromental Quality for the permit to mine and industrial siting (granted), and air permit to be submitted at a later date. | No significant facilities | Working on detailed engineering studies for feasibility study | |||||

| Keystone -Nevada | Gold exploration | 100% ownership – 601 unpatented lode mining claims comprising approximately 20 square miles in Eureka County, Nevada. | Exploration permits received. Reclamation bonding in place. Additional exploration permits may be necessary for additional exploration. | No significant facilities | ||||||

| Challis - Idaho | Gold exploration | 100% ownership - 77 unpatented lode mining claims in Lemhi County, Idaho covering approximately 1,710 acres. A royalty interest has been granted on the Challis property. | Preparing a revised plan of operations for further exploration. | No significant facilities |

Summary of Previous Mineral Properties

| Property | Stage of Property/Mine and mineralization types | Ownership,

Mineral Rights, Leases or Options |

Key permit conditions | Processing plants and other available facilities | Other | |||||

| Maggie Creek - Nevada | Gold exploration | We sold our rights to acquire the property to Nevada Gold Mines (“NGM) in November 2022. Royalty potential of .5% if NGM exercises its option and acquires the Maggie Creek property. | Exploration permits received and reclamation bond in place. Additional exploration permits may be necessary for additional exploration. | No significant facilities | Drilled two exploration holes in the year ended April 30, 2022 |

Quality Assurance/Quality Control (“QA/QC”) Protocol

We employ a rigorous QA/QC protocol on all aspects of sampling and analytical procedure. Drill core is checked, logged, marked for sampling and sawn in half. One-half of each drill core is maintained for future reference and the other half of each drill core is sent to ALS, an ISO 17025 accredited laboratory in Elko, Nevada to complete all sample preparation and assaying. Samples are analyzed by employing fire assaying with atomic absorption finish for gold, and four-acid ICP-MS analysis for silver and copper. For QA/QC protocol purposes, certified standards, blank samples and sample duplicates are inserted into the sample stream. We also periodically submit sample pulps to another independent laboratory for check analysis. With respect to the CK Gold Project, and as part of the examination and preparation of a Technical Report under Reg. S-K 1300 guidelines, QA/QC protocols have been independently checked.

CK Gold Project, Wyoming

The CK Gold Project consists of certain mining leases and other mineral rights located in the historic Silver Crown Mining District of southeast Wyoming.

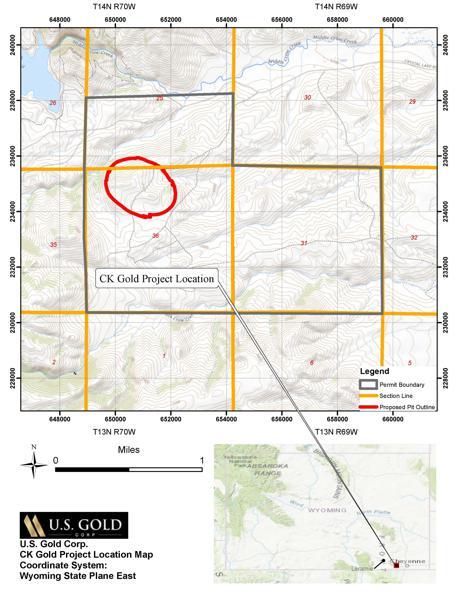

Location and Access

The CK Gold Project is located in southeastern Wyoming, approximately 20 miles west of the city of Cheyenne, on the southeastern margin of the Laramie Range (Figure 1). The property covers about two square miles that include the S½ Section 25, NE¼ Section 35, and all of Section 36, T.14N., R.70W., Sixth Principal Meridian. Access to within an approximate 0.9 miles of the property is provided by paved and maintained gravel roads. The surface of S½ Section 25, NE¼ Section 35 is privately owned. An easement agreement providing access for exploration and other minimal impact activities has been negotiated with an adjacent landowner. The fee for this easement is $10,000 per year, renewable each year prior to July 11. The surface of Section 36 is owned by the State of Wyoming and is currently leased to an adjacent landowner for grazing.

The project is entirely located on mineral rights owned and administered by the State of Wyoming. There are no federal lands within or adjoining the CK Gold Project’s land position. Curt Gowdy State Park lies northwest of the property, partially within Section 26. The state park’s southeastern boundary is approximately 1,000 feet northwest of the property and approximately 3,000 feet northwest of the mineralized area. The CK Gold Project’s property position consists of two State of Wyoming Metallic and Non- metallic Rocks and Minerals Mining Leases.

| 6 |

Figure 1 – CK Gold Project Location and Project Boundary

| 7 |

Rights to the CK Gold Project

Our rights to the CK Gold Project arise under two State of Wyoming mineral leases:

| 1) | State of Wyoming Mining Lease No. 0-40828 |

Township 14 North, Range 70 West, 6th P.M., Laramie County, Wyoming:

Section 36: All

| 2) | State of Wyoming Mining Lease No. 0-40858 |

Township 14 North, Range 70 West, 6th P.M., Laramie County, Wyoming:

Section 25: S/2

Section 35: NE/4

Ownership of the mineral rights remains in the possession of the State of Wyoming as conveyed to the State by the United States, evidenced by 1942 patents for Section 36, and 1989 Order confirming title to Section 25 and 35. The State of Wyoming issued Mineral Leases for the mineral rights to Wyoming Gold Mining Company, Inc. (“Wyoming Gold”) in 2013 and 2014. These leases were assigned to us on June 23, 2014.

Lease 0-40828 is a ten-year lease that was renewed within the past year and expires on February 1, 2033. Annual rental payments under this lease are $3.00 per acre. Lease 0-40858 is a ten-year lease that expires on February 1, 2024. This lease requires an annual rental payment of $2.00 per acre. Upon the renewal of this lease for another ten-year term the annual rental payment will increase to $3.00 per acre. Each lease is renewable for successive ten-year terms by submitting a renewal application fee and paying a nominal fee of $50. We anticipate continuing to renew each lease beyond their current expiration dates.

Effective April 6, 2023, the Board of Directors of the Office of State Lands and Investments (“OSLI”) approved the recommendation from the staff of the OSLI fixing the production royalty rate at a flat 2.1% of net receipts received by us once the project is in operation. Additionally, once the project is in operation, the Board of Directors of the OSLI has the authority to reduce the royalty payable to the State.

Infrastructure

Given the project’s proximity to Cheyenne, the state capital of Wyoming and the Front Range metropolitan area, personnel needs, delivery of consumables, and infrastructure needs are available both locally and regionally. The area has access to both BNSF and Union Pacific railroad lines, intersection of 2 major interstate highways, I-80 and I-25, and a regional airport.

High voltage powerlines are approximately 1.5 miles (2.4km) from the current project area. A connection to the local power provider and easement for transmission lines has been identified and scoped. While there is a nearby line serving the local population, we anticipate that a new line to the project site will be constructed.

In February 2023, we entered into a Water Development and Purchase Agreement (“Water Agreement”) with the Board of Public Utilities (the “BOPU”) of the City of Cheyenne. Under this Water Agreement, BOPU will provide a firm supply of up to 600 gallons per minute for the life of the project. It is anticipated that the water to be supplied under this Water Agreement will come from the Lone Tree wellfield owned by BOPU. A pipeline from the Lone Tree well field to the project will be required to be constructed. Minor water sources have been identified around the project site from monitoring well locations, and additional deeper well sites will be investigated in upcoming fields seasons with a view to securing an independent water supply.

Permitting

Mine Operating Permit and Closure Plan (“MOP”)

In September 2022, we filed our MOP with the Wyoming Department of Environmental Quality – Land Division (the “WDEQ”). In November 2022, we received notification from WDEQ that our MOP was deemed complete and that it was under technical review. In April 2023, we received a first round of technical comments and are currently working with the WDEQ to fully respond to their initial review. We anticipate that we will continue to work with WDEQ through technical review for the remainder of calendar 2023 and into 2024.

Industrial Siting Permit (“ISP”)

In February 2023, we submitted our ISP with the Industrial Siting Division of the WDEQ. An ISP is required for all projects within the state of Wyoming when the projected capital costs are anticipated to exceed $253.9 million. This threshold includes costs we may incur as well as costs incurred from other parties. The ISP’s intent is to ascertain the regional impacts during construction and mine operation and release state funds to local governments to offset anticipated impacts. Subsequent to the permit submission, a hearing was held with the Industrial Siting Commission in May 2023 whereby our ISP was approved. In June 2023, we received official notification from the state of Wyoming that our ISP was granted.

History of Prior Operations and Exploration on the CK Gold Project

Limited exploration and mining were conducted on the CK Gold Project’s property in the late 1880s and early 1900s. Approximately 300 tons of material was reported to have been produced from a now inaccessible 160-foot-deep shaft with two levels of cross-cuts. A few small adits and prospect pits with no significant production are scattered throughout the property.

Since 1938, at least nine historic (pre-Strathmore Minerals Corp.) drilling campaigns by at least seven companies plus the U.S. Bureau of Mines have been conducted at CK Gold Project’s property, previously referred to as Copper King. The current project database contains 91 drill holes totaling 37,500 feet that were drilled before Wyoming Gold acquired the property. All but six of the drill holes are within the current resource area. Other work conducted at the CK Gold Project’s property by previous companies has included ground and aeromagnetic surveys as well as induced polarization surveys along with geochemical sampling, geologic mapping, and a number of metallurgical studies.

Wyoming Gold conducted an exploration drill program in 2007 and 2008. Thirty-five diamond core drill holes were completed for a total of 25,500 feet. The focus of that work was to confirm and potentially expand the mineralized body outlined in the previous drill campaigns, increase the geologic and geochemical database leading to the creation of the current geologic model and mineralization estimate, and to provide material for further metallurgical testing. The CK Gold Project’s historic assay database for some 120 holes contains 8,357 gold assays and 8,225 copper assays. At least 10 different organizations or individuals conducted metallurgical studies on the gold-copper mineralization at the request of prior operators between 1973 and 2009.

| 8 |

Geology and Mineralization

The CK Gold Project is underlain by Proterozoic rocks that make up the southern end of the Precambrian core of the Laramie Range. Metavolcanic and metasedimentary rocks of amphibolite-grade metamorphism are intruded by the 1.4-billion-year-old Sherman Granite and related felsic rocks. Within the project area, foliated granodiorite is intruded by aplitic quartz monzonite dikes, thin mafic dikes and younger pegmatite dikes. Shear zones with cataclastic foliation striking N60°E to N60°W are found in the southern part of the Silver Crown district, including at CK Gold. The granodiorite typically shows potassium enrichment, particularly near contacts with quartz monzonite. Copper and gold mineralization occur primarily in unfoliated to mylonitic granodiorite. The mineralization is associated with a N60°W-trending shear zone and disseminated and stockwork gold-copper deposits in the intrusive rocks. The mineralization style is consistent with a porphyry gold-copper deposit of Paleoproterozoic age. Hydrothermal alteration is overprinted on retrograde greenschist alteration and includes a central zone of silicification, followed outward by a narrow potassic zone, surrounded by propylitic alteration. Higher-grade mineralization occurs within a central core of thin quartz veining and stockwork mineralization that is surrounded by a ring of lower-grade disseminated mineralization. Disseminated sulfides and native copper with stockwork malachite and chrysocolla are present at the surface, and chalcopyrite, pyrite, minor bornite, primary chalcocite, pyrrhotite, and native copper are present at depth. Gold occurs as free gold and within chalcopyrite crystals.

The CK Gold Project’s property contains oxide, mixed oxide-sulfide, and sulfide rock types. At the stated cutoff grade of 0.015oz AuEq/ton, approximately 80% of the resource is sulfide material with the remaining 20% split evenly between the oxide and mixed rock types. There is consistent distribution of gold and copper, albeit generally low-grade, throughout this potential open-pit type deposit.

Mineral Reserves and Mineral Resources

Mineral reserve and mineral resource estimates were calculated by Gustavson Associates LLC (now WSP USA, Inc.) through the effective date of November 15, 2021 as shown in the Technical Report Summary attached to this annual report on Form 10-K. The mineral reserve and mineral resource tabulations shown below are based on assumed metals prices of $1,625/oz gold, $3.25/lb copper and $18.00/oz silver. These metals price assumptions are comprised of long-term metals forecasting (33%) and the two-year trailing average (67%). Based on the actual prices of these metals at the end of our fiscal year ($1,911/oz gold, $4.45/lb copper and $23.45/oz silver, based on the respective London Metal Exchange, we believe that the price assumptions used in preparing our mineral reserve and mineral resource estimates at November 15, 2021 remain reasonable and, therefore, we believe the estimates prepared by Gustavson Associates LLC remain a reasonable estimate of our mineral resources and mineral reserves at April 30, 2023.

CK Gold Project – Summary of Gold, Copper and Silver Mineral Resources at April 30, 2023 based on $1,625/oz gold, $3.25/lb copper and $18.00/oz silver

| Mass | Gold (Au) | Copper (Cu) | Silver (Ag) | Au Equivalent (AuEq) | ||||||||||||||||||||||||||||||||

| Tons (000’s) | Oz (000’s) | oz/ st | lbs (millions) | % | Oz (000’s) | oz/st | Oz (000’s) | oz/ st | ||||||||||||||||||||||||||||

| Measured (M) | 1,000 | 6 | 0.019 | 2 | 0.196 | 100 | 0.05 | 2 | 0.024 | |||||||||||||||||||||||||||

| Indicated (I) | 10,500 | 94 | 0.01 | 30 | 0.15 | 450 | 0.03 | 138 | 0.016 | |||||||||||||||||||||||||||

| M + I | 11,500 | 100 | 0.014 | 32 | 0.16 | 550 | 0.039 | 140 | 0.018 | |||||||||||||||||||||||||||

| Inferred | 22,500 | 235 | 0.01 | 68.3 | 0.152 | 323 | 0.014 | 357 | 0.016 | |||||||||||||||||||||||||||

(1) Resources tabulated at a cutoff grade of (0.0107 – 0.0088) AuEq oz/st, 0.009 AuEq oz/st average

(2) Note only 3 significant figures shown, may not sum due to rounding

(3) Estimates of mineral resources are exclusive of mineral reserves

CK Gold Project – Summary of Gold, Copper and Silver Mineral Reserves at April 30, 2023 based on $1,625/oz gold, $3.25/lb copper and $18.00/oz silver

| Mass | Gold (Au) | Copper (Cu) | Silver (Ag) | Au Equivalent (AuEq) | ||||||||||||||||||||||||||||||||

| Tons (000’s) | Oz (000’s) | oz/ st | lbs (millions) | % | Oz (000’s) | oz/ st | Oz (000’s) | oz/ st | ||||||||||||||||||||||||||||

| Proven (P1) | 29,600 | 574 | 0.019 | 118 | 0.198 | 1,440 | 0.049 | 757 | 0.026 | |||||||||||||||||||||||||||

| Probable (P2) | 40,700 | 440 | 0.011 | 130 | 0.16 | 1,220 | 0.03 | 679 | 0.017 | |||||||||||||||||||||||||||

| P1 + P2 | 70,400 | 1,010 | 0.014 | 248 | 0.176 | 2,660 | 0.038 | 1,440 | 0.02 | |||||||||||||||||||||||||||

(1) Reserves tabulated at a cutoff grade of (0.0107 – 0.0088) AuEq oz./st, 0.009 AuEq Oz/st average

(2) Note only 3 significant figures shown, may not sum due to rounding

Mineral resources are reported at a gold equivalent grade (AuEq) cutoff grade, which considers metal recovery and pricing Cutoff grade varies with expected recovery for delineated material types, but averages 0.009 short ton (oz/st) AuEq, equivalent to 0.31 grams per metric tonne (g/t) AuEq. Gold equivalent grade (Au/Eq) is used to simplify cutoff grade to a single equivalent metal (gold). The mineral resource is constrained inside an optimization shell which, combined with the cutoff grade, represents reasonable prospects for economic extraction. The mineral reserve estimate lies inside of a designed mine open pit. See Section 12.1 in the Technical Report Summary incorporated by reference in this Form 10-K for a discussion of pit optimization, cutoff grade and dilution.

| 9 |

Prefeasibility Study (“PFS”)

On December 1, 2021, we released the results of our PFS. The PFS was prepared by Gustavson Associates LLC with an effective date of November 15, 2021.

The following are highlights from the PFS:

| ● | 10-year Mine Life at 20,000 short tons per day process rate | ||

| ○ | Average AuEq production: 108,500 ounces per year | ||

| ○ | First three years: 135,300 AuEq ounces per year | ||

| ● | Initial Capital: $221 million | ||

| ○ | Potential attractive financing terms from equipment suppliers and development capital sources | ||

| ○ | 2-year payback | ||

| ● | Economics – 39.4% IRR before tax and 33.7% IRR after tax | ||

| ○ | NPV (5%): $323 million and $266 million, before and after tax, respectively | ||

| ○ | All in Sustaining Cost (“AISC”) at $800 per AuEq ounce | ||

| ○ | Assumes $1,625/ounce gold price and $3.25/lb copper price | ||

| ○ | Highly leveraged to increasing metals prices | ||

| ● | Upside Potential | ||

| ○ | Aggregate sales from mine waste rock, proven to be excellent quality | ||

| ○ | Feasibility study level value engineering and plant optimization | ||

| ○ | Ongoing metallurgical testing to enhance recovery of gold and copper | ||

| ○ | Resource expansion potential at depth and to the south-east | ||

| ● | Permitting and Development | ||

| ○ | Project footprint under the jurisdiction of Wyoming agencies | ||

The economic projections in the PFS are subject to a variety of assumptions and qualifications that are described in more detail in the Technical Report Summary incorporated by reference into this Form 10-K. In summary, the low-grade copper, silver and gold deposit located on Wyoming State Land and under lease to US Gold Corp, is proposed as an open pit mine. The rate of extraction will be sufficient to feed minerals to the process plant at a rate of 20,000 tons per day, involving the removal of surrounding waste material at a similar rate. The process plant serves to crush and grind the ore into a fine particle form in a slurry, whereupon the copper, silver and gold values can be separated from non-mineralized rock into a concentrate using froth flotation. The concentrate will be dried and shipped off site and sold to a smelter for final metal extraction. The waste material will be filtered to recoup and recycle water back to the process plant, and the filtered tailings will be trucked and mechanically stacked onto a tailings pile. The process facility is also on the same Wyoming State section less than a mile away from the mineralized orebody, with the entire operation some 20-miles west of Cheyenne. The metallurgical test work supporting the extraction methodology was initially performed by a previous owner between 2009 and 2012, but the company has gathered additional representative sample and conducted further extensive test work between 2020 and 2023. The results of the test work were incorporated into the prefeasibility study published on December 1, 2021, and have continued to confirm results and inform the feasibility study due for publication in the second half of 2023.

We expense all mineral exploration costs as incurred. Although we have identified proven and probable mineral reserves on our CK Gold Project, development costs will be capitalized when all the following criteria have been met, (a) we receive the requisite operating permits, (b) completion of a favorable Feasibility Study and (c) approval from our board of director’s authorizing the development of the ore body. Until such time all these criteria have been met, we record pre-development costs to expense as incurred. The current book value of our property is approximately $3.1 million, which is recorded in mineral properties and reflects the value that was attributed to the purchase of the CK Gold Project. We do not have any costs on our balance sheet related to plant or equipment as we have not incurred any such costs.

Recent Activities

We submitted both of our major permit applications during the year-ended April 30, 2023, the MOP and ISP. We are in technical review with regards to the MOP with an expected completion date in 2024. We were granted our ISP in June 2023 providing local governments the ability to receive state funds to mitigate impacts from the anticipated construction and operation of our CK Gold Project.

We secured the necessary water needed to operate the project with the execution of the Water Agreement with the Cheyenne Board of Public Utilities (BOPU), post approval from the Cheyenne City Council to allow BOPU to enter into an “Outside Water Users Agreement”, which provides us a firm supply of water of 600 gallons per minute over the life of the project.

Primarily in support of the feasibility study presently underway, during the 2021 field season, 47 core, rotary and conventional holes were drilled at the CK Gold Project. The primary purpose of the drilling program is to supplement the geotechnical and hydrological information.

Additional work centered around the capture and interpretation of environmental base line data encompassing sub-surface and surface water, fauna, flora, cultural, air quality, meteorological conditions, wetlands and socio-economic factors in the project area. Starting in September 2020, over 2 1/2 years of monitoring data have been gathered and ongoing monitoring in critical areas continues.

Additionally, a great deal of social outreach has been conducted to familiarize the immediate population and the Wyoming, Cheyenne and Laramie governmental and regulatory agencies.

Geological Potential of the CK Gold Project

Potential to expand the existing resource exists primarily at depth beyond current drilling depths and to the south of the proposed pit. Numerous drill holes end in significant mineralization. We are developing a program to evaluate a magnetic anomaly, similar to that found centered on the CK Gold Project mineralization, ½ mile to the southeast of the project.

Keystone Project, Cortez Trend, Nevada

Location

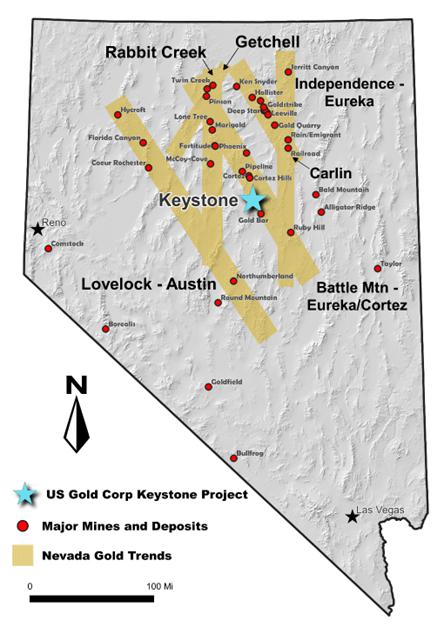

The Keystone Project consists of 601 unpatented lode mining claims situated in Eureka County, Nevada. The claims making up the Keystone Project are situated in Eureka County, Nevada in Sections 2-4 and 9-11, Township 23 North, Range 48 East, and Sections 22- 28, and 33-36 Township 24 North, all Range 48 East of the Mount Diablo Meridian (Figures 2 and 3).

| 10 |

Figure 2 – Location of Keystone Project and Major Gold Trends in Nevada

| 11 |

Figure 3 – Keystone Project Claim Boundaries

| 12 |

The Keystone Project is accessible via unpaved roads. Navigation through the interior of the project is by off-road vehicle on exploration tracks.

Title and Ownership for Keystone Project

The Keystone Project consists of unpatented mining claims located on federal land administered by the U.S. Bureau of Land Management (“BLM”). An annual maintenance fee of $165 per claim per year must be paid to the Nevada BLM by September 1 of each year, and failure to make the payment on time renders the claims void. In addition to the annual maintenance fee paid to the Nevada BLM, a $12 per claim fee is due to the Eureka County (NV) Clerk’s office as a record fee.

We acquired the mining claims comprising the Keystone Project on May 27, 2016 from Nevada Gold Ventures, LLC and Americas Gold Exploration, Inc. (“Americas Gold”). Some of the Keystone claims are subject to pre-existing net smelter royalty (“NSR”) obligations. In addition, Nevada Gold Ventures, LLC retained additional NSR rights of 0.5% with regard to certain claims and 3.5% with regard to certain other claims. The unpatented mining claims comprising the Keystone Project, with applicable NSR obligations, are as follows:

| 1. | Acquired 100% from Americas Gold; subject to a one percent (1%) NSR held by Wolfpack Gold Nevada Corp.; a two percent (2.0%) NSR with respect to precious metals and one percent (1.0%) NSR with respect to all other metals and minerals held by Orion Royalty Company, LLC; and a one-half percent (0.5%) NSR to Nevada Gold Ventures, LLC. |

27 unpatented lode mining claims situated in Eureka County, Nevada, in Sections 33 and 34, Township 24 North, Range 48 East, and Sections 3, 4, 9, and 10, Township 23 North, Range 48 East, Mount Diablo Base Line and Meridian.

| 2. | Acquired 100% from Americas Gold; subject to a three and one-half percent (3.5%) NSR to Nevada Gold Ventures, LLC |

13 unpatented lode mining claims situated in Eureka County, Nevada, in Sections 27, 28 and 35, Township 24 North, Range 48 East, and Sections 2 and 3, Township 23 North, Range 48 East, Mount Diablo Base Line and Meridian.

| 3. | Acquired 100% from Nevada Gold Ventures, LLC; subject to a three and one-half percent (3.5%) NSR to Nevada Gold Ventures, LLC |

28 unpatented lode mining claims situated in Eureka County, Nevada, in Sections 2 & 11, Township 23 North, Range 48 East, Mount Diablo Base Line and Meridian.

| 4. | Acquired 50% from Nevada Gold Ventures, LLC, 50% from Americas Gold, subject to a three and one-half percent (3.5%) NSR to Nevada Gold Ventures, LLC |

216 unpatented lode mining claims, alphabetically ordered, situated in Eureka County, Nevada, in Sections 22, 23, 24, 25, 26, 27, 28, 33, 34, 35 & 36, Township 24 North, Range 48 East, Mount Diablo Base Line and Meridian.

| 13 |

Under the terms of the Purchase and Sale Agreement, dated May 25, 2016, under which we acquired the claims, we had the right to buy down 1% of the NSR owed to Nevada Gold Ventures LLC at any time through the fifth anniversary of the closing date, May 25, 2021, for $2,000,000. In addition, we may buy down an additional 1% of the NSR owed to Nevada Gold Ventures, LLC anytime through the eighth anniversary of the closing date, May 25, 2024, for $5,000,000. At April 30, 2023, we have not bought down any portion of the NSR. The decision to make a buy down payment would be driven by our progress in identifying an economic mineral resource, coupled with financial factors, such as available cash or an expressed interest by larger producing companies to enter into joint ventures or development arrangements. We do not currently anticipate making such a buy down payment at this time.

History of Prior Operations and Exploration on the Keystone Project

No comprehensive, modern-era, model-driven exploration has ever been conducted on the Keystone Project. Newmont drilled 6 holes in the old base metal and silver Keystone mine area in 1967 and encountered low-grade (+/- 0.02 opt) gold intercepts. Chevron staked the property in 1981-1983 and drilled 27 shallow drill holes, continued by an agreement with USMX that drilled an additional 19 shallow holes; significant amounts of low grade and anomalous gold were intersected, but results were considered uneconomic, and the project was dropped. In 1988 and 1989, Phelps Dodge acquired a southern portion of the district and drilled 6 holes, one of which contained gold mineralization in its total depth and was subsequently deepened in 1990 resulting in over 200’ of low-grade gold mineralization. About this time Coral Resources acquired a northern portion of the property and drilled 21 shallow holes to follow-up previous drill intercepts. 1995-1997, Golden Glacier, a junior company, acquired the north end of the district, and Uranerz a portion of the southern area; 6 holes were drilled in the north and only 2 holes in the south, respectively. The entire district was dropped by all parties.

In 2004, with the discovery of Cortez Hills and escalating gold prices, Nevada Pacific Gold, Great American Minerals (Don McDowell), and Tone Resources (Dave Mathewson) competed in claim staking the entire district. Subsequently, Don McDowell, founder of Great American Minerals approached Placer Dome (prior to Barrick acquisition) who discovered Pipeline and Cortez Hills, and who correctly recognized the Keystone district potential. Placer Dome entered into separate joint venture agreements with Nevada Pacific and Great American. The following year Barrick Gold bought Placer Dome and dropped all Placer Dome’s Nevada exploration projects and joint ventures, including Keystone. In 2006, Nevada Pacific and Tone were purchased by McEwen Mining. McEwen Mining, drilled 35 holes mostly near the north end of the district; targeting the range front pediment and the historic Keystone Mine. McEwen Mining dropped their Keystone claims and quit claimed them to Dave Mathewson and NV Gold Ventures. NV Gold Ventures and American Gold staked their own additional claims in the district. This expanded group of claims was acquired in the original Keystone Purchase Agreement. We have staked additional claims in the district, such as Potato Canyon, since acquiring the project.

Geology and Mineralization

To date, a technical report has not been prepared on the Keystone Project. Keystone is positioned on the prolific Cortez gold trend. The Keystone Project is centered on a granitic intrusion that warped the local Paleozoic stratigraphy into a dome, allowing for exposure of highly favorable Devonian, Carboniferous (Mississippian-Pennsylvania) and Permo- Triassic rocks including key likely host rocks for mineralization, the silty carbonate strata of the Horse Creek Formation and the Wenban limestone, as well as possible sandy clastic units of the Diamond Peak Formation. The Horse Canyon and Wenban rocks are the primary host rocks at the nearby Cortez Hills Mine and Gold Rush deposit currently operated by Barrick Gold.

In 2022, a hyperspectral survey was conducted on the property identifying evidence of potential mineralization. Numerous anomalies often associated with mineralization were identified. Field investigation of the anomalies will commence during the 2023 field season.

Infrastructure and Facilities

The Keystone Project does not currently include any significant facilities. The Keystone Project sits some 10 miles to the southwest of Nevada Gold mines Cortez Complex. The Cortez Complex, consisting of surface and underground mines, is served by roads and power, while water in the area is extracted from sub-surface water resources. The Keystone Project is served by paved and unpaved roads, which extend down trend from the Cortez Complex to the north and additional road and infrastructure to the north-east. The whole area is some 30 miles to the south of the I-80 interstate corridor between the towns of Battle Mountain and Winnemucca, with Elko, Nevada being the dormitory town for the majority of the workforce and support services.

| 14 |

The Challis Gold Project, Idaho

Location

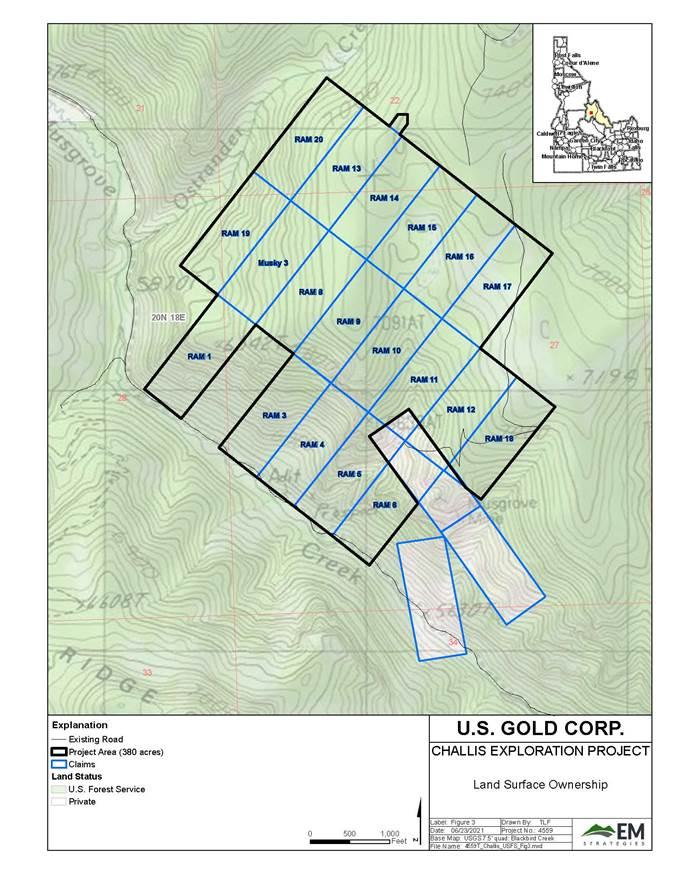

The Challis Gold property is situated in the Salmon River Mountains, approximately 40 km (25 mi) southwest of the town of Salmon, Idaho, and 69 km (43 mi) north of the smaller town of Challis (Figure 7). The project area is considered to be within the Cobalt Mining District, as the past-producing Blackbird Cobalt Mine is located 9.3 km (5.75 mi) north-northwest of the property. The nearly-abandoned town of Cobalt, a previous company town for the Blackbird Mine, is along Panther Creek 9.7 km (6 mi) northeast of the property. Meridian Gold’s Beartrack Mine, the closest of the larger gold mines in the region, is 24 km (15 mi) northeast of the Challis Gold Project. The central portion of the property is located at approximately 45º 2’ North Latitude and 114º 20’ West Longitude. The claims are situated in the south-central portion of unsurveyed Township T20N, R18E.

| - | Figure 7: The Challis Gold Project Location in Idaho |

Title and Ownership for Challis Gold Project

All of the mining claims comprising the Musgrove property are unpatented lode mining claims that have been recorded in the Lemhi County Court House in Salmon, Idaho and filed with the US Bureau of Land Management office in Boise.

History of Prior Operations and Exploration

Early mining dates to the late 1880’s when gold was discovered at the nearby Yellow Jacket Mine and copper and cobalt was discovered north of the project area at the Blackbird Mine. Small scale intermittent mining was conducted in the project area from 1908 through the 1930’s at the Musgrove Mine and at the Smith-Gahan Mine.

| 15 |

In the mid-1980’s, alteration and quartz veining was identified located along the ridge north of Musgrove CreekA large block of claims covering the area was staked by an independent geologist and then leased to Atlas Minerals. Atlas completed an extensive sampling program and, in 1991, drilled nine reverse circulation holes resulting in the discovery of significant mineralization at the Johny’s Point deposit.

The project was acquired by Newmont in 1992 as part of the Grassy Mountain Deposit acquisition. Newmont conducted an extensive exploration program between 1992 and the fall of 1995 consisting of mapping and rock chip sampling. Twenty-seven core holes were completed consisting of nine holes in the Johny’s Point area and 18 holes testing targets along strike from Johny’s Point. Newmont concluded that the project did not meet the potential for their size criteria and the project was dropped.

In 1996, Meridian Gold acquired the property and drilled an additional 20 core holes and three reverse circulation drill holes. The property was subsequently returned to the owner due to declining gold prices.

In 2003, Wave Exploration leased the property and completed a GIS compilation of the surface and drill hole data. Wave subsequently commissioned a technical report. In 2004, Wave drilled two confirmation drill holes and two step out holes and completed a soil geochemical program northwest of Johny’s Point.

In 2005, Wave optioned the property to Journey Resources. In 2006 and 2007, Journey drilled nine reverse circulation drill holes and five core holes northwest of Johny’s Point.

There is no documented exploration activity from 2008 until 2018. On September 1, 2018, Journey Resources failed to pay the required claim payments to the Bureau of Land Management and the claims were forfeited. Subsequently, Northern Panther Resources Corporation located or acquired new claims covering the project. In 2020, we acquired Northern Panther Resources. In 2020, we contracted with Wright Geophysics to conduct a ground magnetic geophysical over the current claim block. This survey identified a prominent low magnetic linear feature that trends from the Musgrove Mine north-northwest for over two miles.

Geology and Mineralization

The project is located within the Trans-Challis Fault System, a prominent NE-trending fault zone which crosscuts central Idaho and hosts numerous gold deposits. Host rocks consist of quartzites and phyllites of the Precambrian Apple Creek Fm with minor mineralization within the Eocene Challis Volcanics. The Musgrove Mine – Johny’s Point mineral trend is within and adjacent to the Musgrove Fault, a northwest-trending fault that brings the Challis Volcanics into contact with the Precambrian rocks. This is a major structural zone that forms the northern edge of the Panther Creek Graben.

Gold mineralization occurs within epithermal quartz veins, quartz vein stockworks, and silicified breccia. The mineralization displays the characteristics of a low sulfidation epithermal gold system. The Musgrove Mine – Johny’s Point mineral trend has been defined by a broad soil and rock chip gold and arsenic anomaly that extends a distance 3000 feet and is up to 800 feet wide. Approximately 600 feet of this zone has been drilled with the remainder tested by wide spaced drilling.

Infrastructure and Facilities

The Challis Gold project does not currently include any significant facilities. The Challis property is located in the Salmon-Challis National Forest and served by paved and unpaved roads. There are historic workings in the area and there has been recent mining activity in the area. The site is somewhat remote from grid power and power lines would have to be extended into the area, or onsite power generation used to support an eventual operation. There is water in the area from both surface and sub-surface sources. The Bear Track operation, now closed but under renewed exploration, is some 16 miles as the crow flies to the northeast of the property. Historic mining was conducted; however the facilities have been abandoned decades ago and the nearest habited area is a forest ranger station near Forney some 5-miles from site.

Competition

We do not compete directly with anyone for the exploration or removal of minerals from our property as we hold all interest and rights to the claims. Readily available commodities markets exist in the U.S. and around the world for the sale of minerals. Therefore, we will likely be able to sell minerals that we are able to recover. We will be subject to competition and unforeseen limited sources of supplies in the industry in the event spot shortages arise for supplies such as explosives or large equipment tires, and certain equipment such as bulldozers and excavators and services, such as contract drilling that we will need to conduct exploration. If we are unsuccessful in securing the products, equipment and services we need, we may have to suspend our exploration plans until we are able to secure them.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the United States generally. We will also be subject to the regulations of the BLM and the US Forest Service (“Forest Service”) with respect to mining claims on federal lands.

| 16 |

Future exploration drilling on any of our properties that consist of BLM or Forest Service land will require us to either file a Notice of Intent (NOI) or a Plan of Operations, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is required for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period.

Environmental Permitting Requirements

Various levels of governmental controls and regulations address, among other things, the environmental impact of mineral mining and exploration operations and establish requirements for reclamation of mineral mining and exploration properties after exploration operations have ceased. With respect to the regulation of mineral mining and exploration, legislation and regulations in various jurisdictions establish performance standards, air and water quality emission limits and other design or operational requirements for various aspects of the operations, including health and safety standards. Legislation and regulations also establish requirements for reclamation and rehabilitation of mining properties following the cessation of operations and may require that some former mining properties be managed for long periods of time after mining activities have ceased.

Our activities are subject to various levels of federal and state laws and regulations relating to protection of the environment, including requirements for closure and reclamation of mineral exploration properties. Some of the laws and regulations include the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), the Emergency Planning and Community Right-to-Know Act, the Endangered Species Act, the Federal Land Policy and Management Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, and related state laws in Nevada. Additionally, much of our property is subject to the federal General Mining Law of 1872, which regulates how mining claims on federal lands are located and maintained.

The State of Nevada, where we focus mineral exploration efforts, requires mining projects to obtain a Nevada State Reclamation Permit pursuant to the Mined Land Reclamation Act (the “Nevada MLR Act”), which establishes reclamation and financial assurance requirements for all mining operations in the state. New and expanding facilities are required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of operations. The Nevada MLR Act also requires reclamation plans and permits for exploration projects that will result in more than five acres of surface disturbance on private lands.

The State of Wyoming, where we focus mineral exploration and development efforts at the CK Gold Project, requires exploration and mining projects to obtain permits from the Wyoming Department of Environmental Quality (WDEQ), and various other state agencies. New and expanding facilities are required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of operations. WDEQ in granting permits requires that reclamation plans and permits are in place and that bonds have been secured covering the cost of remediation of disturbances on both state and private land.

Executive Officers of U.S. Gold Corp.

Name |

Age |

Principal Occupation |

Officer/ Director Since | |||

| Eric Alexander | 56 | Chief Financial Officer - Principal Financial and Accounting Officer | 2020 | |||

| of U.S. Gold Corp. | ||||||

| George M. Bee | 65 | Chief Executive Officer, President and Director of U.S. Gold Corp. | 2020 | |||

| Kevin Francis | 63 | Vice President – Exploration and Technical Services | 2021 |

Eric Alexander is our Chief Financial Officer and Secretary and has been with us since September 2020. He has over 30 years of corporate, operational and business experience, and over 15 years of mining industry experience. Previously he served as Corporate Controller of Helix Technologies, Inc., a publicly traded software and technology company from April 2019 to September 2020. Prior to that, he served as the Vice President Finance and Controller of Pershing Gold Corporation, a mining company (formerly NASDAQ: PGLC), from September 2012 until April 2019. Prior to that, Mr. Alexander was the Corporate Controller for Sunshine Silver Mines Corporation, a privately held mining company with exploration and pre-development properties in Idaho and Mexico, from March 2011 to August 2012. He was a consultant to Hein & Associates LLP from August 2012 to September 2012 and a Manager with Hein & Associates LLP from July 2010 to March 2011. He served from July 2007 to May 2010 as the Corporate Controller for Golden Minerals Company (and its predecessor, Apex Silver Mines Limited), a publicly traded mining company with operations and exploration activities in South America and Mexico. In addition to his direct experience in the mining industry, he has also held the position of Senior Manager with the public accounting firm KPMG LLP, focusing on mining and energy clients. Mr. Alexander has a B.S. in Business Administration (concentrations in Accounting and Finance) from the State University of New York at Buffalo and is also a licensed CPA.

George M. Bee has been serving as a member of our Board since November 2020 and our Executive Chairman from March 2021 to May 2022. He was appointed as our President in August 2020 and become Chief Executive Officer in November 2020. Mr. Bee is a senior mining industry executive, with deep mine development and operational experience. He has an extensive career advancing world-class gold mining projects in eight countries on three continents for both major and junior mining companies. In 2018, Mr. Bee concluded a third term with Barrick Gold Corporation (“Barrick Gold”) (NYSE: GOLD) as Senior VP Frontera District in Chile and Argentina working to advance Pascua Lama feasibility as an underground mine. This capped a 16-year tenure at Barrick Gold, where he served in multiple senior-level positions, including Mine Manager at Goldstrike during early development and operations, Operations Manager at Pierina Mine taking Pierina from construction to operations, and General Manager of Veladero developing the project from advanced exploration through permitting, feasibility and into production. Previously, Mr. Bee held positions as CEO and Director of Jaguar Mining Inc. between March 2014 and December 2015, President and CEO of Andina Minerals Inc. from February 2009 until January 2013 and Chief Operating Officer for Aurelian Resources, Inc. from 2007 to 2009. As Chief Operating Officer of Aurelian Resources in 2007, he was in charge of project development for Fruta del Norte in Ecuador until Aurelian was acquired by Kinross Gold in 2008. Mr. Bee has served on the board of directors of Stillwater Mining Company, Sandspring Resources Ltd., Jaguar Mining, Peregrine Metals Ltd. and Minera IRL. He received a Bachelor of Science degree from the Camborne School of Mines in Cornwall, United Kingdom. He also holds ICD.D designation from the Institute of Corporate Directors.

Kevin Francis is our Vice President - Exploration and Technical Services and has been with us since July 2021. Mr. Francis has held many senior roles within the mining industry, including VP of Project Development for Aurcana Corporation, VP of Technical Services for Oracle Mining Corporation, VP of Resources for NovaGold Resources and Principal Geologist for AMEC Mining and Metals. Most recently, he consulted to U.S. Gold Corp. as Principal of Mineral Resource Management LLC, a consultancy providing technical leadership to the mining industry, as well as through his association with Gustavson Associates LLC (a member of WSP Global Inc.) since September 2020. Mr. Francis is a “qualified person” as defined by SEC S-K 1300 and Canadian NI 43-101 reporting standards and holds both an M.S. degree and a B.A. in geology from the University of Colorado.

| 17 |

Item 1A. RISK FACTORS

RISKS RELATED TO OUR FINANCIAL CIRCUMSTANCES

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock and our ability to file registration statements pursuant to registration rights agreements and other commitments.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result of our small size, any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. As of April 30, 2023, management has concluded that our internal controls over financial reporting were effective.

There is substantial doubt about whether we can continue as a going concern.

To date, we have earned no revenues and have incurred accumulated net losses of $65.4 million. We have limited financial resources. As of April 30, 2023, we had cash and cash equivalents of $7.8 million and working capital of $8.1 million. Therefore, our continuation as a going concern is dependent upon our achieving a future financing or strategic transaction. However, there is no assurance that we will be successful pursuing a financing or strategic transaction. Accordingly, there is substantial doubt as to whether our existing cash resources and working capital are sufficient to enable us to continue our operations for the next 12 months as a going concern. Ultimately, in the event that we cannot obtain additional financial resources, or achieve profitable operations, we may have to liquidate our business interests and investors may lose their investment. The accompanying consolidated financial statements have been prepared assuming that our company will continue as a going concern. Continued operations are dependent on our ability to obtain additional financial resources or generate profitable operations. Such additional financial resources may not be available or may not be available on reasonable terms. Our consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty. Such adjustments could be material.

We have a limited operating history on which to base an evaluation of our business and prospects.

Since our inception, we have had no revenue from operations. We have no history of producing metals from any of our exploration properties. Our properties are exploration stage properties. Advancing properties from the exploration stage requires significant capital and time, and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction of the potential mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

| ● | completion of feasibility studies to verify potential mineral reserves and commercial viability, including the ability to find sufficient mineral reserves to support a commercial mining operation; |

| 18 |

| ● | the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities; | |

| ● | the availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required; | |

| ● | the availability and cost of appropriate smelting and/or refining arrangements, if required; | |

| ● | compliance with environmental and other governmental approval and permit requirements; | |

| ● | the availability of funds to finance exploration activities, as warranted; | |

| ● | potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent exploration activities; | |

| ● | potential increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies; | |

| ● | inability to secure fair and reasonable terms associated with mineral leases; and | |

| ● | potential shortages of mineral processing, construction and other facilities-related supplies. |

The costs, timing and complexities of exploration activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if ever commenced, development, construction and mine start-up. Accordingly, our activities may not ever result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties.

We will require significant additional capital to fund our business plan.

We will be required to expend significant funds to continue exploration and if warranted, develop our existing exploration properties and to identify and acquire additional properties to diversify our properties portfolio. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying and feasibility studies with regard to the results of our exploration. We may not benefit from some of these investments if we are unable to identify any commercially exploitable mineralized material.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold and copper. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration operations, development activities and the possible partial or total loss of our potential interest in our properties.

| 19 |

RISKS RELATED TO OUR BUSINESS

We do not know if our properties contain any gold or other minerals that can be mined at a profit.

Although the properties on which we have the right to explore for gold are known to have historic deposits of gold, there can be no assurance such deposits can be mined at a profit. Whether a gold deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of gold, which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection.

Most of our projects are in the exploration stage.

Although we have established an estimate of mineral reserves on the CK Gold Project, there are no current estimates of mineral resources or mineral reserves at the Keystone Property or Challis Gold Project. There is no assurance that we can establish the existence of any mineral reserves on those projects in commercially exploitable quantities. If we do not establish the existence of mineral reserves or mineral resources on those projects, we may lose all of the funds that we expend on exploration.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

| 20 |

We have no history of producing metals from our current mineral properties and there can be no assurance that we will successfully establish mining operations or profitably produce precious metals.

We have no history of producing metals from our properties. We do not produce gold and do not currently generate operating earnings. While we seek to advance our projects and properties through exploration, such efforts will be subject to all of the risks associated with establishing new future potential mining operations and business enterprises, including:

| ● | the timing and cost, which are considerable, of the construction of mining and processing facilities; | |

| ● | the availability and costs of skilled labor and mining equipment; | |

| ● | compliance with environmental and other governmental approval and permit requirements; | |

| ● | the availability of funds to finance exploration activities; | |

| ● | potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants that may delay or prevent exploration activities; and | |

| ● | potential increases in construction and operating costs due to changes in the cost of labor, fuel, power, materials and supplies. |

It is common in new mining operations to experience unexpected problems and delays. In addition, our management will need to be expanded. This could result in delays in the commencement of potential mineral production and increased costs of production. Accordingly, we cannot assure you that our activities will result in any profitable mining operations or that we will ever successfully establish mining operations.

We may not be able to obtain all required permits and licenses to place any of our properties into future potential production.

Our current and future operations, including additional exploration activities, require permits from governmental authorities and such operations are and will be governed by laws and regulations governing prospecting, exploration, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in mineral property exploration generally experience increased costs, and delays in exploration and other schedules as a result of the need to comply with applicable laws, regulations and permits. We cannot predict if all permits which we may require for continued exploration and development activities, will be obtainable on reasonable terms, if at all. Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay our planned exploration activities. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions.

Parties engaged in exploration operations may be required to compensate those suffering loss or damage by reason of the exploration activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on our operations and cause increases in capital expenditures or production costs or reduction in levels of exploration activities at our properties or require abandonment or delays in future activities.

We are subject to significant governmental regulations, which affect our operations and costs of conducting our business.

Our current and future operations are and will be governed by laws and regulations, including:

| ● | laws and regulations governing mineral concession acquisition, prospecting, exploration and development and operation; | |

| ● | laws and regulations related to exports, taxes and fees; | |

| ● | labor standards and regulations related to occupational health and mine safety; and | |

| ● | environmental standards and regulations related to waste disposal, toxic substances, land use and environmental protection. |

Companies engaged in exploration activities often experience increased costs and delays in exploration and other schedules as a result of the need to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in enforcement actions, including the forfeiture of mineral claims or other mineral tenures, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. We may be required to compensate those suffering loss or damage by reason of our mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation, could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in exploration.

Our business is subject to extensive environmental regulations that may make exploring, or related activities prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations that can substantially delay exploration and make exploration expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities on our properties. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploration, or other activities, and adversely affect our financial position. If we are unable to fully remedy an environmental problem, we might be required to suspend exploration operations or to enter into interim compliance measures pending the completion of the required remedy. We have not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities) and such insurance may not be available to us on reasonable terms or at a reasonable price. All of our exploration will be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under specific federal and state exploration operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws.

| 21 |

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations.

The values of our properties are subject to volatility in the price of gold and any other deposits we may seek or locate.