1933 Act File No. 002-10638

1940 Act File No. 811-00005

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

x | ||

| Pre-Effective Amendment No. |

¨ | ||

| Post-Effective Amendment No. 99 |

x | ||

| and/or |

|||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

x | ||

| Amendment No. 99 |

x | ||

LORD ABBETT AFFILIATED FUND, INC.

(Exact Name of Registrant as Specified in Charter)

| 90 Hudson Street, Jersey City, New Jersey | 07302-3973 | |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, including Area Code: (800) 201-6984

Thomas R. Phillips, Esq., Vice President and Assistant Secretary

90 Hudson Street, Jersey City, New Jersey 07302-3973

(Name and Address of Agent for Service)

It is proposed that this filing will become effective (check appropriate box)

| ¨ | immediately upon filing pursuant to paragraph (b) |

| ¨ | on pursuant to paragraph (b) |

| ¨ | 60 days after filing pursuant to paragraph (a) (1) |

| x | on February 27, 2010 pursuant to paragraph (a) (1) |

| ¨ | 75 days after filing pursuant to paragraph (a) (2) |

| ¨ | on (date) pursuant to paragraph (a) (2) of Rule 485 |

If appropriate, check the following box:

| ¨ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Lord Abbett

Affiliated Fund

PROSPECTUS

February 27, 2010

| CLASS |

TICKER |

CLASS |

TICKER | |||

| A |

LAFFX | I | LAFYX | |||

| B |

LAFBX | P | LAFPX | |||

| C |

LAFCX | R2 | LAFQX | |||

| F |

LAAFX | R3 | LAFRX |

**The Securities and Exchange Commission has not approved or disapproved of these securities or determined whether this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| INVESTMENT PRODUCTS: NOT FDIC INSURED - NO BANK GUARANTEE - MAY LOSE VALUE |

| WHAT YOU SHOULD KNOW ABOUT |

Investment Objective | 2 | ||||

| Fees and Expenses | 2 | |||||

| Principal Investment Strategies | 3 | |||||

| Principal Risks | 3 | |||||

| Performance | 4 | |||||

| Investment Adviser | 5 | |||||

| Purchase and Sale of Fund Shares | 5 | |||||

| Tax Information | 5 | |||||

| Payments to Broker-Dealers and Other Financial Intermediaries | 6 | |||||

| MORE INFORMATION ABOUT |

Investment Objective | 6 | ||||

| Principal Investment Strategies | 6 | |||||

| Principal Risks | 7 | |||||

| Disclosure of Portfolio Holdings | 8 | |||||

| Management and Organization of the Fund | 8 | |||||

| INFORMATION FOR MANAGING YOUR FUND ACCOUNT |

Choosing a Share Class | 9 | ||||

| Sales Charges | 12 | |||||

| Sales Charge Reductions and Waivers | 13 | |||||

| Financial Intermediary Compensation | 16 | |||||

| Purchases | 19 | |||||

| Exchanges | 20 | |||||

| Redemptions | 20 | |||||

| Account Services and Policies | 22 | |||||

| Distributions and Taxes | 25 | |||||

| Financial Highlights | 26 | |||||

The Fund’s investment objective is long-term growth of capital and income without excessive fluctuations in market value.

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in the Lord Abbett Family of Funds. More information about these and other discounts is available from your financial professional and in “Sales Charges – Class A Share Front-End Sales Charge” of the prospectus and “Purchases, Redemptions, Pricing and Payments to Dealers” of the statement of additional information (“SAI”).

Shareholder Fees (Fees paid directly from your investment)

| Class | A | B | C | F, I, P, R2 and R3 | ||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

5.75% | None | None | None | ||||

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price) |

None | 5.00% | 1.00% | None |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Class | A | B | C | F | I | P | R2 | R3 | ||||||||||||||||

| Management Fees |

0.31% | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% | ||||||||||||||||

| Distribution and Service (12b-1) Fees |

0.35% | 1.00% | 1.00% | 0.10% | None | 0.45% | 0.60% | 0.50% | ||||||||||||||||

| Other Expenses |

[0.16% | ] | [0.16% | ] | [0.16% | ] | [0.16% | ] | [0.16% | ] | [0.16% | ] | [0.16% | ] | [0.16% | ] | ||||||||

| Total Annual Fund Operating Expenses |

[0.82% | ] | [1.47% | ] | [1.47% | ] | [0.57% | ] | 0.47% | ] | [0.92% | ] | [1.07% | ] | [0.97% | ] |

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund at the maximum sales charge, if any, for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, that dividends and distributions are reinvested, and that the Fund’s operating expenses remain the same. The example assumes a deduction of the applicable contingent deferred sales charge (“CDSC”), for the one-year, three-year, and five-year periods for Class B shares. Class B shares automatically convert to Class A shares after approximately eight years. The expense example for Class B shares for the ten-year period reflects the conversion to Class A shares. The first example assumes that you redeem all of your shares at the end of the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs (including any applicable CDSC) would be as shown below. The second example assumes that you do not redeem and instead keep your shares.

| Class | If Shares Are Redeemed | If Shares Are Not Redeemed | ||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

| Class A Shares |

$ | [654 | ] | $ | [822 | ] | $ | [1,004 | ] | $ | [1,530 | ] | $ | [654 | ] | $ | [822 | ] | $ | [1,004 | ] | $ | [1,530 | ] | ||||||||

| Class B Shares |

$ | [550 | ] | $ | [765 | ] | $ | [903 | ] | $ | [1,581 | ] | $ | [150 | ] | $ | [465 | ] | $ | [803 | ] | $ | [1,581 | ] | ||||||||

| Class C Shares |

$ | [150 | ] | $ | [465 | ] | $ | [803 | ] | $ | [1,757 | ] | $ | [150 | ] | $ | [465 | ] | $ | [803 | ] | $ | [1,757 | ] | ||||||||

| Class F Shares |

$ | [58 | ] | $ | [183 | ] | $ | [318 | ] | $ | [714 | ] | $ | [58 | ] | $ | [183 | ] | $ | [318 | ] | $ | [714 | ] | ||||||||

| Class I Shares |

$ | [48 | ] | $ | [151 | ] | $ | [263 | ] | $ | [591 | ] | $ | [48 | ] | $ | [151 | ] | $ | [263 | ] | $ | [591 | ] | ||||||||

| Class P Shares |

$ | [94 | ] | $ | [293 | ] | $ | [509 | ] | $ | [1,131 | ] | $ | [94 | ] | $ | [293 | ] | $ | [509 | ] | $ | [1,131 | ] | ||||||||

| Class R2 Shares |

$ | [109 | ] | $ | [340 | ] | $ | [590 | ] | $ | [1,306 | ] | $ | [109 | ] | $ | [340 | ] | $ | [590 | ] | $ | [1,306 | ] | ||||||||

| Class R3 Shares |

$ | [99 | ] | $ | [309 | ] | $ | [536 | ] | $ | [1,190 | ] | $ | [99 | ] | $ | [309 | ] | $ | [536 | ] | $ | [1,190 | ] | ||||||||

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the recent fiscal year, the Fund’s portfolio turnover rate was [105.60%] of the average value of its portfolio.

2

PRINCIPAL INVESTMENT STRATEGIES

To pursue this objective under normal market conditions, the Fund will invest at least 80% of its net assets in equity securities of large companies. The Fund primarily invests in large, established U.S. and multinational companies that the portfolio manager believes are undervalued.

The Fund’s investments primarily include the following types of securities and other financial instruments:

• Equity securities, such as common stocks, preferred stocks, convertible securities and equity interests in trusts, partnerships and limited liability companies. The Fund may also invest in securities that are tied to the price of stock, such as warrants, rights, and convertible debt securities.

• Large company securities, of a company having a market capitalization at the time of purchase that falls within the market capitalization range of companies in the Russell 1000® Index. The market capitalization range of the Russell 1000® Index as of its most recent annual reconstitution was approximately $0.6 billion to $341.1 billion. This range varies daily.

• Value stocks of companies that the portfolio manager believes to be underpriced or undervalued according to certain financial measurements of intrinsic worth or business prospects and have the potential for capital appreciation.

• Multinational and foreign company securities that are issued by multinational or foreign companies and traded primarily on a U.S. securities exchange. These types of securities include American Depositary Receipts (“ADRs”), which are typically issued by a U.S. financial institution (such as a bank) and represent a specified number of shares issued by a foreign company.

• Derivatives, such as options or futures, which the Fund may use to protect gains in the Fund’s portfolio, hedge against certain risks, or to efficiently gain investment exposure.

The Fund will generally sell a security when the Fund believes the security seems less likely to benefit from the current market and economic environment, shows signs of deteriorating fundamentals, or has reached its valuation target. The Fund seeks to remain fully invested in accordance with its investment objective; however, in response to adverse economic, market or other unfavorable conditions, the Fund may invest its assets in a temporary defensive manner.

As with any investment in a mutual fund, investing in the Fund involves risk, including the risk that you may receive little or no return on your investment. When you redeem your shares, they may be worth more or less than what you paid for them, which means that you may lose a portion or all of the money you invested in the Fund.

The Fund primarily invests in stocks and other equity securities, which may experience significant volatility at times and may fall sharply in response to adverse events. Individual securities may also experience dramatic movements in price. In addition to the risks of overall market movements and risks that are specific to an individual security, the principal risks of investing in the Fund, which could adversely affect its performance, include:

• Large Company Risk: As compared to smaller successful companies, larger companies may be less able to respond quickly to certain market developments and may have slower rates of growth.

• Value Stocks Risk: The prices of value stocks may lag the stock market for long periods of time if the market fails to recognize the company’s intrinsic worth.

• Portfolio Management Risk: If the strategies used by the Fund’s portfolio manager and the portfolio manager’s security selections fail to produce the intended result, the Fund may suffer losses or underperform other funds with the same investment objective or strategy, even in a rising market.

3

• Multinational and Foreign Company Risk: The Fund’s investments in multinational companies, foreign companies and ADRs generally are subject the risk that the securities may be adversely affected by political, economic and social volatility, currency exchange fluctuations, lack of transparency, or inadequate regulatory and accounting standards.

• Derivatives Risk: The Fund’s use of derivatives are subject to the risk that the underlying security or index (on which the derivative instrument is based) moves in the opposite direction from what the portfolio manager had anticipated or becomes illiquid. Swaps, futures and option contracts are also subject to the risk that the counterparty mail fail to perform its obligations.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. For more information on the principal risks of the Fund, please see the “Principal Risks” section in the Fund’s prospectus.

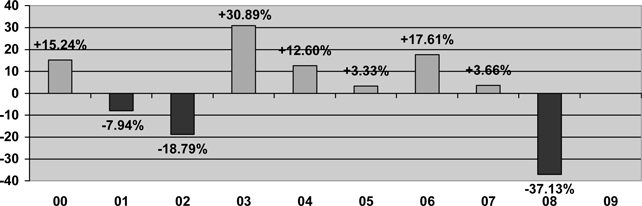

The bar chart and table below provide some indication of the risks of investing in the Fund by illustrating the variability of the Fund’s returns. Each assumes reinvestment of dividends and distributions. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The bar chart shows changes in the performance of the Fund’s Class A shares from calendar year to calendar year. This chart does not reflect the sales charge applicable to Class A shares. If the sales charge was reflected, returns would be lower. Performance for the Fund’s other share classes will vary due to the different expenses each class bears. Updated performance information is available at www.lordabbett.com or by calling 888-522-2388.

Bar Chart (per calendar year) — Class A Shares

| Best Quarter [2nd Q ’03 +18.25%] |

Worst Quarter [4th Q ’08 -22.56%] |

The table below shows how the average annual total returns of the Fund’s Class A, B, C, F, I, P, R2, and R3 shares compare to those of three broad-based securities market indices. The Fund’s average annual total returns include applicable sales charges as follows: for Class A shares, the current maximum front-end sales charge of 5.75%; for Class B shares, the current CDSC of 4.00% for the one-year period and 1.00% for the five-year period; and for Class C shares, the performance shown is at net asset value (“NAV”) because there is no CDSC for Class C shares for any period one year or greater. There are no sales charges for Class F, I, P, R2, and R3 shares. Class B shares automatically convert to Class A shares at approximately eight years after purchase. All returns for Class B shares for periods greater than eight years reflect this conversion.

The after-tax returns of Class A shares included in the table below are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some cases, after taxes on distributions and sale of Fund shares may exceed the return before taxes due to a tax benefit resulting from realized losses on a sale of Fund shares at the end of the period that is used to offset other gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or Individual Retirement Accounts (“IRAs”). After-tax returns for other share classes are not shown in the table and will vary from those shown for Class A shares.

4

| Average Annual Total Returns (for the periods ended December 31, [2009]) | ||||||||||||||

| Class | 1 Year | 5 Years | 10 Years | Life of Class | Inception Date for Performance | |||||||||

| Class A Shares |

||||||||||||||

| Before Taxes |

[-40.74% | ] | [-5.15% | ] | [-11.06% | ] | - | |||||||

| After Taxes on Distributions |

[-40.92% | ] | [-5.15% | ] | [-11.06% | ] | - | |||||||

| After Taxes on Distributions and Sale of Fund Shares |

[-26.18% | ] | [-4.30% | ] | [-8.58% | ] | - | |||||||

| Class B Shares |

[-40.06% | ] | [-4.86% | ] | [-10.98% | ] | ||||||||

| Class C Shares |

[-37.55% | ] | [-4.67% | ] | [-11.06% | ] | ||||||||

| Class F Shares |

[-37.02% | ] | - | - | [-32.67% | ] | 9/28/2007 | |||||||

| Class I Shares |

[-36.94% | ] | [-1.93% | ] | [1.97%] | - | ||||||||

| Class P Shares |

[-37.15% | ] | [-4.03% | ] | [-10.42% | ] | - | |||||||

| Class R2 Shares |

[-37.30% | ] | - | - | [-32.99% | ] | 9/28/2007 | |||||||

| Class R3 Shares |

[-37.22% | ] | - | - | [-32.90% | ] | 9/28/2007 | |||||||

| Index | ||||||||||||||

| Russell 1000® Value Index (reflects no deduction for fees, expenses, or taxes) |

[-36.85% | ] | [-0.79% | ] | [1.36%] | [-33.83% | ] | 9/28/2007 | ||||||

| S&P 500® Index |

[-37.00% | ] | [-2.19% | ] | [-1.38% | ] | [-32.59% | ] | 9/28/2007 | |||||

| S&P 500/Citigroup Value Index |

[-39.22% | ] | [-1.72% | ] | [0.10%] | [-35.59% | ] | 9/28/2007 | ||||||

The Fund’s investment adviser is Lord, Abbett & Co. LLC.

Portfolio Manager. The Portfolio Manager primarily responsible for the day-to-day management of the Fund is:

| Portfolio Manager/Title | Portfolio Manager of the Fund Since | |

| Daniel H. Frascarelli, Partner and Director and Portfolio Manager |

2009 |

PURCHASE AND SALE OF FUND SHARES

| Investment Minimums — Initial/Additional Investments(1) | ||||||

| Class | A, B, and C | F, P(2), R2, and R3 | I | |||

| General |

$250/No minimum | No minimum | $1 million minimum(3) | |||

| IRAs and Uniform Gifts or Transfers to Minor Accounts |

$250/No minimum | N/A | N/A | |||

| SIMPLE IRAs |

No minimum | N/A | N/A | |||

| Invest-A-Matic |

$250/$50 | N/A | N/A | |||

| (1) Minimum initial and additional investment amounts vary depending on the class of shares you buy and the type of account. Certain financial intermediaries may impose different restrictions than those described above. (2) Class P shares are closed to substantially all new investors. (3) Applicable requirement for certain types of institutional investors. | ||||||

You may sell (redeem) shares through your securities broker, financial professional or financial intermediary. If you have direct account access privileges, you may redeem your shares by contacting the Fund in writing at P.O. Box 219336, Kansas City, MO 64121, by calling 888-522-2388 or by accessing your account online at www.lordabbett.com.

The Fund’s distributions, if any, generally are taxable to you as ordinary income, capital gains or a combination of the two, and may also be subject to state and local taxes. Certain taxes on distributions may not apply to tax exempt investors or tax deferred accounts, such as a 401(k) plan or an IRA.

5

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and the Fund’s distributor or its affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your individual financial professional to recommend the Fund over another investment. Ask your individual financial professional or visit your financial intermediary’s website for more information.

The Fund’s investment objective is long-term growth of capital and income without excessive fluctuations in market value.

PRINCIPAL INVESTMENT STRATEGIES

To pursue this objective, the Fund primarily invests in equity securities of large, established, U.S. and multinational companies that the portfolio manager believes are undervalued. Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities of large companies. A large company is defined as a company having a market capitalization at the time of purchase that falls within the market capitalization range of companies in the Russell 1000® Index, a widely-used benchmark for large-cap stock performance. The market capitalization range of the Russell 1000® Index as of June 30, 2009, following its most recent annual reconstitution, was approximately $[0.6 billion] to $[341.1 billion]. This range varies daily.

Equity securities in which the Fund may invest may include common stocks, preferred stocks, convertible securities, and equity interests in real estate investment trusts, other types of trusts, partnerships, joint ventures, limited liability companies and similar enterprises. The Fund may also invest in other securities or instruments that are tied to the price of stocks, such as warrants, stock purchase rights and convertible debt securities.

In selecting investments, the Fund attempts to invest in companies the portfolio manager believes have been undervalued by the market and are selling at reasonable prices in relation to our assessment of their potential or intrinsic value. A security may be undervalued by the market because of a lack of awareness of the company’s intrinsic value or a lack of recognition of the company’s future potential. In addition, a company may be undervalued because it may be temporarily out of favor by the market. The Fund seeks to achieve gains by holding securities the prices of which the portfolio manager believes will increase when other investors recognize the securities real or potential worth or when the company returns to its historical rates of growth and profitability.

The Fund primarily invests in U.S. and multinational companies. The Fund may invest up to 10% of its net assets in securities issued by foreign companies that are primarily traded outside of the U.S. The Fund may invest without limitation in securities of companies that are incorporated or organized under the laws outside of the U.S., but are primarily traded on a U.S. securities exchange, including ADRs and similar depositary receipts. ADRs are traded on U.S. exchanges and typically are issued by a financial institution (such as a U.S. bank) acting as a depositary and represent the depositary’s holdings of a specified number of shares of a foreign company. An ADR entitles the holder to all dividends and capital gains earned by the underlying foreign securities.

The Fund may use derivatives to hedge against risk or to gain investment exposure. Derivatives are financial instruments that derive their value from the value of an underlying asset, reference rate, or index. Some examples of the types of derivatives in which the Fund may invest are options, futures, forward contracts, and swap agreements. The Fund may use derivatives for hedging purposes, including protecting the Fund’s unrealized gains by hedging against possible adverse fluctuations in the securities markets or changes in interest rates or currency exchange rates that may reduce the market value of the Fund’s investment portfolio. The Fund may also use derivatives for speculative purposes, including using derivative instruments in an effort to enhance the Fund’s returns, spreads or gains, or to efficiently invest excess cash or quickly gain market exposure. The Fund is not registered or subject to regulation as a commodity pool operator under the Commodity Exchange Act.

The Fund may purchase and write national securities exchange-listed put and call options on securities or securities indices. The Fund may use options for hedging or cross-hedging purposes, or to seek to increase total return (which is considered a speculative activity). A “call option” is a contract sold for a price giving its holder the right to buy a specific number of securities at a specific price prior to a specified date. A “covered call option” is a call option issued on securities already owned by the writer of the call option for delivery to the holder upon the exercise of the option. The Fund may write covered call options with respect to securities in its portfolio in an attempt to increase income and to provide greater flexibility in the disposition of portfolio securities. A “put option” gives the purchaser of the option the right to sell, and obligates the writer to buy, the underlying securities at the exercise price at any time during the option period. A put option sold by the Fund is covered when, among other things, the Fund segregates permissible liquid assets having a value equal to or greater than the exercise price of the option to fulfill the obligation undertaken. The Fund will not

6

purchase an option if, as a result of such purchase, more than 10% of its net assets would be invested in premiums for such options. The Fund may only sell (write) covered put options to the extent that the cover for such options does not exceed 15% of its net assets. The Fund may only sell (write) covered call options with respect to securities having an aggregate market value of less than 25% of its net assets at the time the option is written.

The Fund may sell a security if it no longer meets the Fund’s investment criteria or for a variety of other reasons, such as to secure gains, limit losses, redeploy assets into opportunities believed to be more promising, or satisfy redemption requests, among others. In considering whether to sell a security, the Fund may evaluate factors including, but not limited to, the condition of the economy, changes in the issuer’s competitive position or financial condition, changes in the outlook for the issuer’s industry, and the Fund’s valuation target for the security.

As with any investment in a mutual fund, investing in the Fund involves risk, including the risk that you may receive little or no return on your investment. When you redeem your shares, they may be worth more or less than what you paid for them, which means that you may lose a portion or all of the money you invested in the Fund. Before you invest in the Fund, you should carefully evaluate the risks in light of your investment goals. An investment in the Fund held for longer periods over full market cycles typically provides the most favorable results.

The Fund primarily invests in stocks and other equity securities. Stock markets may experience significant volatility at times and may fall sharply in response to adverse events. Different segments of the stock market may react differently than other segments and U.S. markets may react differently than foreign markets. Individual stock prices may also experience dramatic movements in price. Factors that may affect the markets in general or individual stocks include periods of slower growth or recessionary economic conditions, future expectations of poor economic conditions or lack of investor confidence. In addition, individual stocks may be adversely affected by factors such as reduced sales, increased costs or a negative outlook for the future performance of the company.

Although the Fund maintains a diversified portfolio, from time to time the Fund may favor investments in one or more particular industries or sectors. To the extent that the Fund holds emphasizes a particular industry or sector, the value of that portion of the Fund’s investments may fluctuate in response to events affecting the industry or sector (such as government regulations, resource availability or economic developments) to a greater degree than securities within other industries or sectors.

In addition to the risks of overall market movements and risks that are specific to an individual security, the principal risks you assume when investing in the Fund are described below. The Fund attempts to manage these risks through careful security selection, portfolio diversification, and continual portfolio review and analysis, but there can be no assurance or guarantee that these strategies will be successful in reducing risk. Please see the SAI for a further discussion of strategies employed by the Fund and the risks associated with an investment in the Fund.

| • | Large Company Risk: Larger, more established companies may be unable to respond quickly to certain market developments. In addition, larger companies may have slower rates of growth as compared to successful, but less well-established, smaller companies, especially during market cycles corresponding to periods of economic expansion. |

| • | Value Stocks Risk: The prices of value stocks may lag the stock market for long periods of time if the market fails to recognize the company’s intrinsic worth. |

| • | Portfolio Management Risk: The strategies used by the Fund’s portfolio managers and their security selections may fail to produce the intended result and the Fund may not achieve its objective. The securities selected for the Fund may not perform as well as other securities that were not selected for the Fund. As a result, the Fund may suffer losses or underperform other funds with the same investment objective or strategies, and may generate losses even in a rising market. |

| • | Multinational and Foreign Company Risk: The Fund’s investments in multinational, foreign companies and ADRs generally are subject to more risks than investing in U.S. companies, which may increase the potential for losses in the Fund and may adversely affect its share price. Investing in multinational, foreign companies and ADRs include the risk that the securities may be adversely affected by political, economic and social volatility, currency exchange fluctuations, lack of transparency, or inadequate regulatory and accounting standards. |

| • | Derivatives Risk: To the extent that the Fund uses derivatives, the Fund will be exposed to the risk that the value of a derivative instrument does not move in correlation with the value of the underlying security, market index or interest rate, or moves in an |

7

| opposite direction than anticipated by the Fund. Derivatives also include the risk that the derivatives will become illiquid and that the counterparty to the options, futures, forwards or swap agreement or contract may fail to perform its obligations. Because derivatives may involve a small amount of cash relative to the total amount of the transaction, the magnitude of losses from derivatives may be greater than the amount originally invested by the Fund in the derivative instrument. In addition, the Fund may be required to segregate permissible liquid assets to cover its obligations under these transactions and may have to liquidate positions before it is desirable to do so to fulfill its requirements to segregate. There is no assurance that a Fund will be able to employ its derivatives strategy successfully. Whether the Fund’s use of derivatives is successful will depend on, among other things, the Fund’s ability to correctly forecast market movements, company and industry valuation levels and trends, changes in foreign exchange rates, and other factors. If the Fund incorrectly forecasts these and other factors, the Fund’s performance could suffer. |

Temporary or Defensive Investments. The Fund seeks to remain fully invested in accordance with its investment objective. In an attempt to respond to adverse economic, market, political or other conditions that are unfavorable for investors, however, the Fund may invest its assets in a temporary defensive manner by holding all or a substantial portion of its assets in cash, cash equivalents or other high quality short-term investments, money market fund shares, and other money market instruments. The Fund also may invest in these types of securities or hold cash while looking for suitable investment opportunities or to maintain liquidity. When investing in this manner, the Fund may be unable to achieve its investment objective.

DISCLOSURE OF PORTFOLIO HOLDINGS

A description of the Fund’s policies and procedures regarding the disclosure of the Fund’s portfolio holdings is available in the Fund’s SAI and further information is available at www.lordabbett.com.

MANAGEMENT AND ORGANIZATION OF THE FUND

Board of Trustees. The Board oversees the management of the business and affairs of the Fund. The Board meets regularly to review the Fund’s portfolio investments, performance, expenses, and operations. The Board appoints officers who are responsible for the day-to-day operations of the Fund and who execute policies authorized by the Board. At least 75 percent of the Board members are independent of Lord Abbett.

Each year in December the Board considers whether to approve the continuation of the existing management and administrative services agreements between the Fund and Lord Abbett. A discussion regarding the basis for the Board’s approval is available in the Fund’s semiannual report to shareholders for the six-month period ended April 30.

Investment Adviser. The Fund’s investment adviser is Lord, Abbett & Co. LLC (“Lord Abbett”), which is located at 90 Hudson Street, Jersey City, NJ 07302-3973. Founded in 1929, Lord Abbett manages one of the nation’s oldest mutual fund complexes, with assets under management of approximately [$84.8] billion in 53 mutual funds and other advisory accounts as of [December 31, 2009].

Portfolio Managers. The Fund is managed by a team of experienced portfolio managers responsible for investment decisions together with a team of research analysts who provide company, industry, sector and macroeconomic research and analysis. The SAI contains additional information about portfolio manager compensation, other accounts managed, and ownership of Fund shares.

Daniel H. Frascarelli, Partner and Director, heads the team and is primarily responsible for the day-to-day management of the Fund. Mr. Frascarelli joined Lord Abbett in 1990 and has served as a portfolio manager for one or more investment strategies since 1993. Mr. Frascarelli has been the portfolio manager for the Fund since 2009.

Management Fee. Lord Abbett is entitled to a management fee based on the Fund’s average daily net assets. The management fee is accrued daily and payable monthly at the following annual rate:

0.50% on the first $200 million of average daily net assets;

0.40% on the next $300 million of average daily net assets;

0.375% on the next $200 million of average daily net assets;

0.35% on the next $200 million of average daily net assets; and

0.30% on the Fund’s average daily net assets over $900 million.

For the fiscal year ended October 31, 2009, the fee paid to Lord Abbett was at an effective annual rate of [0.31%] of the Fund’s average daily net assets. In addition, Lord Abbett provides certain administrative services to the Fund pursuant to an Administrative Services Agreement in return for a fee at an annual rate of 0.04% of the Fund’s average daily net assets. The Fund pays all of its expenses not expressly assumed by Lord Abbett.

8

Each class of shares represents an investment in the same portfolio of securities, but each has different eligibility criteria, sales charges, expenses, and dividends, allowing you to choose the class that best meets your needs. You should read this section carefully to determine which class of shares is best for you and discuss your selection with your financial intermediary. Factors you should consider in choosing a class of shares include:

| • | the amount you plan to invest; |

| • | the length of time you expect to hold your investment; |

| • | the total costs associated with your investment, including any sales charges that you pay when you buy or sell your Fund shares and expenses that are paid out of Fund assets over time; |

| • | whether you qualify for any reduction or waiver of sales charges; |

| • | whether you plan to take any distributions in the near future; |

| • | the availability of the share class; |

| • | the services that will be available to you depending on the share class you choose; and |

| • | the amount of compensation that your financial intermediary will receive depending on the share class you choose. |

If you are considering investing a certain amount in Class B shares and if you were to invest the same amount in Class A shares and would qualify for a reduced sales charge, it may be more economical for you to choose Class A shares because of the reduced sales charge and lower ongoing annual expenses of Class A shares.

If your investment horizon is limited, an investment in Class C shares may be more appropriate than Class B shares. Class C shares are sold without a front-end sales charge and the CDSC does not apply to shares redeemed after the first anniversary of the purchase.

If you plan to invest a large amount and your investment horizon is five years or more, Class A shares may be more advantageous than Class C shares. The higher ongoing annual expenses of Class C shares may cost you more over the longer term than the front-end sales charge you would pay on larger purchases of Class A shares.

Key Features of Share Classes. The following table compares key features of each share class. You should review the Fee Table and Example at the front of this prospectus carefully before choosing your share class. As a general matter, share classes with relatively lower expenses generally have relatively higher dividends. Your financial intermediary can help you decide which class meets your goals. Not all share classes may be available through your financial intermediary. Your financial intermediary may receive different compensation depending upon which class you choose.

| Class A Shares |

||||

| Availability | Available through financial intermediaries to individual investors, certain retirement and benefit plans, and fee-based advisory programs | |||

| Front-End Sales Charge | Up to 5.75%; reduced or waived for large purchases and certain investors. Eliminated for purchases of $1 million or more | |||

| CDSC | 1.00% on redemptions made within one year following purchases of $1 million or more; waived under certain circumstances | |||

| Distribution and Service (12b-1) Fee(1) | 0.35% of the Fund’s average daily net assets | |||

| Conversion | None | |||

| Exchange Privilege(2) | Class A shares of most Lord Abbett Funds | |||

| Class B Shares |

||||

| Availability | Available through financial intermediaries to individual investors and certain retirement and benefit plans | |||

| Front-End Sales Charge | None | |||

| CDSC | Up to 5.00% on redemptions; reduced over time and eliminated after sixth anniversary of purchase; waived under certain circumstances | |||

9

| Distribution and Service (12b-1) Fee(1) | 1.00% of the Fund’s average daily net assets | |||

| Conversion | Automatic conversion to Class A shares after approximately the eighth anniversary of purchase (3) | |||

| Exchange Privilege(2) | Class B shares of most Lord Abbett Funds | |||

| Class C Shares |

||||

| Availability | Available through financial intermediaries to individual investors and certain retirement and benefit plans | |||

| Front-End Sales Charge | None | |||

| CDSC | 1.00% on redemptions made before the first anniversary of purchase; waived under certain circumstances | |||

| Distribution and Service (12b-1) Fee(1) | 1.00% of the Fund’s average daily net assets | |||

| Conversion | None | |||

| Exchange Privilege(2) | Class C shares of most Lord Abbett Funds | |||

| Class F Shares |

||||

| Availability | Available only to eligible fee-based advisory programs and certain registered investment advisors | |||

| Front-End Sales Charge | None | |||

| CDSC | None | |||

| Distribution and Service (12b-1) Fee(1) | 0.10% of the Fund’s average daily net assets | |||

| Conversion | None | |||

| Exchange Privilege(2) | Class F shares of most Lord Abbett Funds | |||

| Class I Shares |

||||

| Availability | Available only to eligible investors | |||

| Front-End Sales Charge | None | |||

| CDSC | None | |||

| Distribution and Service (12b-1) Fee(1) | None | |||

| Conversion | None | |||

| Exchange Privilege(2) | Class I shares of most Lord Abbett Funds | |||

| Class P Shares |

||||

| Availability | Available on a limited basis through certain financial intermediaries and retirement and benefit plans(4) | |||

| Front-End Sales Charge | None | |||

| CDSC | None | |||

| Distribution and Service (12b-1) Fee(1) | 0.45% of the Fund’s average daily net assets | |||

| Conversion | None | |||

| Exchange Privilege(2) | Class P shares of most Lord Abbett Funds | |||

| Class R2 Shares |

||||

| Availability | Available only to eligible retirement and benefit plans | |||

| Front-End Sales Charge | None | |||

| CDSC | None | |||

| Distribution and Service (12b-1) Fee(1) | 0.60% of the Fund’s average daily net assets | |||

| Conversion | None | |||

| Exchange Privilege(2) | Class R2 shares of most Lord Abbett Funds | |||

| Class R3 Shares |

||||

| Availability | Available only to eligible retirement and benefit plans | |||

| Front-End Sales Charge | None | |||

| CDSC | None | |||

| Distribution and Service (12b-1) Fee(1) | 0.50% of the Fund’s average daily net assets | |||

10

| Conversion | None | |

| Exchange Privilege(2) | Class R3 shares of most Lord Abbett Funds |

| (1) | The 12b-1 plan provides that the maximum payments that may be authorized by the Board for Class A shares are 0.50%; for Class P shares, 0.75%; and for Class B, C, F, R2, and R3 shares, 1.00%. The 12b-1 plan does not permit any payments for Class I shares. |

| (2) | Ask your financial intermediary about the Lord Abbett Funds available for exchange. |

| (3) | Class B shares will automatically convert to Class A shares on the 25th day of the month (or, if the 25th is not a business day, the next business day thereafter) following the eighth anniversary of the day on which the purchase order was accepted. |

| (4) | Class P shares are closed to substantially all new investors. |

Investment Minimums.

Investment Minimums – Initial /Additional Investments (1)

| Class | A, B, and C | F, P(2), R2, and R3 | I | |||

| General |

$250/No minimum | No minimum | $1 million minimum(3) | |||

| IRAs and Uniform Gifts or Transfers to Minor Accounts |

$250/No minimum | N/A | N/A | |||

| SIMPLE IRAs |

No minimum | N/A | N/A | |||

| Invest-A- Matic |

$250/$50 | N/A | N/A |

| (1) | Consult your financial intermediary for more information. |

| (2) | Class P shares are closed to substantially all new investors. |

| (3) | There is no minimum initial investment for (1) certain purchases through or by a financial intermediary (otherwise eligible to purchase Class I shares) that charge a fee for services that include investment advisory or management services or (2) purchases by retirement and benefit plans meeting the Class I eligibility requirements described below. These investment minimums may be suspended, changed, or withdrawn by Lord Abbett Distributor. |

Additional Information about Availability of Class F, I, P, R2, and R3 Shares.

Class F shares. Class F shares generally are available to investors participating in fee-based advisory programs that have (or whose trading agents have) an agreement with Lord Abbett Distributor and to investors that are clients of certain registered investment advisors that have an agreement with Lord Abbett Distributor, if it so deems appropriate.

Class I Shares. Class I shares currently are available for purchase by the following entities:

| — | Registered investment advisors investing on behalf of clients, provided that the registered investment advisor: |

| (i) | is not affiliated or associated with a broker or dealer primarily engaged in the retail securities business; |

| (ii) | derives its compensation for its services exclusively from its clients for such advisory services; and |

| (iii) | has entered into an appropriate agreement with the Fund and/or Lord Abbett Distributor for such purchases. |

| — | Institutional investors, such as retirement and benefit plans, companies, foundations, trusts, endowments, and other entities that were not introduced to Lord Abbett by persons associated with a securities broker or dealer, where the total amount of potential investable assets exceeds $10 million. |

| — | Each registered investment company within the Lord Abbett Family of Funds that operates as a fund of funds and, at the discretion of Lord Abbett Distributor, other registered investment companies that are not affiliated with Lord Abbett and operate as a fund of funds. |

In addition, Class I shares may be available for purchases by or on behalf of financial intermediaries for clients that pay the financial intermediary for services that include investment advisory or management services, provided that the financial intermediary (or its trading agent) has entered into a special arrangement with and agreeable to the Fund and/or Lord Abbett Distributor specifically for such purchases. Financial intermediaries should contact Lord Abbett Distributor to determine whether the financial intermediary may be eligible for such purchases.

11

Class P Shares. Class P shares are closed to substantially all new investors. Existing shareholders holding Class P shares may continue to hold their Class P shares and make additional purchases, redemptions, and exchanges. Class P shares are also available for orders made by or on behalf of a financial intermediary for clients participating in an IRA rollover program sponsored by the financial intermediary that operates the program in an omnibus recordkeeping environment and has entered into special arrangements with the Fund and/or Lord Abbett Distributor specifically for such orders.

Class R2 and R3 (collectively referred to as “Class R”) Shares. Class R shares generally are available through:

| • | certain employer-sponsored retirement and benefit plans offering funds from multiple fund families as investment options where the employer, administrator, recordkeeper, sponsor, related person, financial intermediary, or other appropriate party has entered into an agreement to make Class R shares available to plan participants; or |

| • | dealers that have entered into certain approved agreements with Lord Abbett Distributor. |

Class R shares also are available for orders made by or on behalf of a financial intermediary for clients participating in an IRA rollover program sponsored by the financial intermediary that operates the program in an omnibus recordkeeping environment and has entered into special arrangements with the Fund and/or Lord Abbett Distributor specifically for such orders.

Class R shares generally are not available to retail non-retirement accounts, traditional and Roth IRAs, Coverdell Education Savings Accounts, SEPs, SARSEPs, SIMPLE IRAs, individual 403(b) plans, or 529 college savings plans.

As an investor in the Fund, you may pay one of two types of sales charges: a front-end sales charge that is deducted from your investment when you buy Fund shares or a CDSC that applies when you sell Fund shares.

Class A Share Front-End Sales Charge. Front-end sales charges are only applied to Class A shares. You buy Class A shares at the offering price, which is the NAV plus a sales charge. You pay a lower rate as the size of your investment increases to certain levels called breakpoints. You do not pay a sales charge on the Fund’s distributions or dividends you reinvest in additional Class A shares. The table below shows the rate of sales charge you pay (expressed as a percentage of the offering price and the net amount you invest), depending on the amount you purchase.

| Front-End Sales Charge – Class A Shares | ||||||||

| Your Investment |

Front-End Sales Charge as a % of Offering Price |

Front-End Sales Charge as a % of Your Investment |

To Compute Offering Price Divide NAV by |

Maximum Dealer’s Concession (% of Offering Price) | ||||

| Less than $50,000 |

5.75% | 6.10% | .9425 | 5.00% | ||||

| $50,000 to $99,999 |

4.75% | 4.99% | .9525 | 4.00% | ||||

| $100,000 to $249,999 |

3.95% | 4.11% | .9605 | 3.25% | ||||

| $250,000 to $499,999 |

2.75% | 2.83% | .9725 | 2.25% | ||||

| $500,000 to $999,999 |

1.95% | 1.99% | .9805 | 1.75% | ||||

| $1,000,000 and over |

No Sales Charge | 1.0000 | † | |||||

| † See “Dealer Concessions on Class A Share Purchases Without a Front-End Sales Charge.” Note: The above percentages may vary for particular investors due to rounding. | ||||||||

CDSC. Regardless of share class, the CDSC is not charged on shares acquired through reinvestment of dividends or capital gains distributions and is charged on the original purchase cost or the current market value of the shares at the time they are redeemed, whichever is lower. In addition, repayment of loans under certain retirement and benefit plans will constitute new sales for purposes of assessing the CDSC. To minimize the amount of any CDSC, the Fund redeems shares in the following order:

1. shares acquired by reinvestment of dividends and capital gains (always free of a CDSC);

2. shares held for six years or more (Class B), or one year or more (Class A and Class C); and

3. shares held the longest before the sixth anniversary of their purchase (Class B), or before the first anniversary of their purchase (Class A and Class C).

If you buy Class A shares of the Fund under certain purchases with a front-end sales charge waiver or if you acquire Class A shares of the Fund in exchange for Class A shares of another Lord Abbett-sponsored fund subject to a CDSC, and you redeem any of the Class

12

A shares before the first day of the month in which the one-year anniversary of your purchase falls, a CDSC of 1% normally will be collected.

Class B, C, F, I, P, R2, and R3 shares are not subject to a front-end sales charge. Class F, I, P, R2, and R3 shares are not subject to a CDSC. The specific types and amounts of sales charges that may apply to Class A, B, and C shares are discussed below.

If you acquire Fund shares through an exchange from another Lord Abbett-sponsored fund that originally were purchased subject to a CDSC and you redeem before the applicable CDSC period has expired, you will be charged the CDSC. The CDSC will be remitted to the appropriate party.

Class B Share CDSC. The CDSC for Class B shares normally applies if you redeem your shares before the sixth anniversary of the day on which the purchase order was accepted. The CDSC will be remitted to Lord Abbett Distributor. The CDSC declines the longer you own your shares, according to the following schedule:

| CDSC – Class B Shares |

||

| Anniversary of the Day on Which the Purchase Order was Accepted(1) |

CDSC on Redemptions (As % of Amount Subject to Charge) | |

| Before the 1st |

5.0% | |

| On the 1st, before the 2nd |

4.0% | |

| On the 2nd, before the 3rd |

3.0% | |

| On the 3rd, before the 4th |

3.0% | |

| On the 4th, before the 5th |

2.0% | |

| On the 5th, before the 6th |

1.0% | |

| On or after the 6th anniversary(2) |

None |

| (1) | The anniversary is the same calendar day in each respective year after the date of purchase. For example, the anniversary for shares purchased on May 1 will be May 1 of each succeeding year. |

| (2) | Class B shares will automatically convert to Class A shares on the 25th day of the month (or, if the 25th is not a business day, the next business day thereafter) following the eighth anniversary of the day on which the purchase order was accepted. |

Class C Share CDSC. The 1% CDSC for Class C shares normally applies if you redeem your shares before the first anniversary of your purchase. The CDSC will be remitted to Lord Abbett Distributor.

SALES CHARGE REDUCTIONS AND WAIVERS

Please inform the Fund or your financial intermediary at the time of your purchase of Fund shares if you believe you qualify for a reduced front-end sales charge. More information about sales charges and reductions and waivers is also available free of charge at www.lordabbett.com/saleschargeinfo. This information may also be reached at www.lordabbett.com by clicking on the “Performance and Pricing” tab under the mutual fund detail section, and clicking on the “more info” link next to the breakpoint table.

Reducing Your Class A Share Front-End Sales Charge. You may purchase Class A shares at a discount if you qualify under the circumstances outlined below. To receive a reduced front-end sales charge, you must let the Fund or your financial intermediary know at the time of your purchase of Fund shares that you believe you qualify for a discount. If you or a related party have holdings of Eligible Funds (as defined below) in other accounts with your financial intermediary or with other financial intermediaries that may be combined with your current purchases in determining the sales charge as described below, you must let the Fund or your financial intermediary know. You may be asked to provide supporting account statements or other information to allow us or your financial intermediary to verify your eligibility for a discount. If you or your financial intermediary do not notify the Fund or provide the requested information, you may not receive the reduced sales charge for which you otherwise qualify. Class A shares may be purchased at a discount if you qualify under either of the following conditions:

| • | Rights of Accumulation - A Purchaser may combine the value of Class A, B, C, F, and P shares of any Eligible Fund currently owned with a new purchase of Class A shares of any Eligible Fund in order to reduce the sales charge on the new purchase. Class I, R2, and R3 share holdings may not be combined for these purposes. |

13

To the extent that your financial intermediary is able to do so, the value of Class A, B, C, F, and P shares of Eligible Funds determined for the purpose of reducing the sales charge of a new purchase under the Rights of Accumulation will be calculated at the higher of: (1) the aggregate current maximum offering price of your existing Class A, B, C, F, and P shares of Eligible Funds; or (2) the aggregate amount you invested in such shares (including dividend reinvestments but excluding capital appreciation) less any withdrawals. You should retain any information and account records necessary to substantiate the historical amounts you and any related Purchasers have invested in Eligible Funds. You must inform the Fund and/or your financial intermediary at the time of purchase if you believe your purchase qualifies for a reduced sales charge and you may be requested to provide documentation of your holdings in order to verify your eligibility. If you do not do so, you may not receive all sales charge reductions for which you are eligible.

| • | Letter of Intention - In order to reduce your Class A front-end sales charge, a Purchaser may combine purchases of Class A, B, C, F, and P shares of any Eligible Fund the Purchaser intends to make over the next 13 months in determining the applicable sales charge. The 13-month Letter of Intention period commences on the day that the Letter of Intention is received by the Fund, and the Purchaser must tell the Fund that later purchases are subject to the Letter of Intention. Purchases submitted prior to the date the Letter of Intention is received by the Fund are not counted toward the sales charge reduction. Current holdings under Rights of Accumulation may be included in a Letter of Intention in order to reduce the sales charge for purchases during the 13-month period covered by the Letter of Intention. Shares purchased through reinvestment of dividends or distributions are not included. Class I, R2, and R3 share holdings may not be combined for these purposes. Class A shares valued at 5% of the amount of intended purchases are escrowed and may be redeemed to cover the additional sales charges payable if the intended purchases under the Letter of Intention is not completed. The Letter of Intention is neither a binding obligation on you to buy, nor on the Fund to sell, any or all of the intended purchase amount. |

| Purchaser |

| A Purchaser includes: (1) an individual; (2) an individual, his or her spouse, and children under the age of 21; (3) retirement and benefit plans including a 401(k) plan, profit-sharing plan, money purchase plan, defined benefit plan, and 457(b) plan sponsored by a governmental entity, non-profit organization, school district or church to which employer contributions are made, as well as SIMPLE IRA plans and SEP-IRA plans; or (4) a trustee or other fiduciary purchasing shares for a single trust, estate or single fiduciary account. An individual may include under item (1) his or her holdings in Eligible Funds as described above in IRAs, as a sole participant of a retirement and benefit plan sponsored by the individual’s business, and as a participant in a 403(b) plan to which only pre-tax salary deferrals are made. An individual and his or her spouse may include under item (2) their holdings in IRAs, and as the sole participants in retirement and benefit plans sponsored by a business owned by either or both of them. A retirement and benefit plan under item (3) includes all qualified retirement and benefit plans of a single employer and its consolidated subsidiaries, and all qualified retirement and benefit plans of multiple employers registered in the name of a single bank trustee. |

| Eligible Fund |

| For all classes of shares other than Class I shares, an Eligible Fund is any Lord Abbett-sponsored fund except for (1) certain tax-free, single state funds where the exchanging shareholder is a resident of a state in which such fund is not offered for sale; (2) Lord Abbett Series Fund, Inc.; (3) Lord Abbett U.S. Government & Government Sponsored Enterprises Money Market Fund, Inc. (“Money Market Fund”) (except for holdings in Money Market Fund which are attributable to any shares exchanged from the Lord Abbett sponsored funds); and (4) any other fund the shares of which are not available to the investor at the time of the transaction due to a limitation on the offering of the fund’s shares. For Class I shares, an Eligible Fund is any Lord Abbett-sponsored fund currently offering Class I shares. |

Front-End Sales Charge Waivers. Class A shares may be purchased without a front-end sales charge under any of the following conditions:

| • | purchases of $1 million or more (may be subject to a CDSC); |

| • | purchases by retirement and benefit plans with at least 100 eligible employees (may be subject to a CDSC); |

| • | purchases for retirement and benefit plans made through financial intermediaries that perform participant recordkeeping or other administrative services for the plans and that have entered into special arrangements with the Fund and/or Lord Abbett Distributor specifically for such purchases (may be subject to a CDSC); |

| • | purchases made by or on behalf of financial intermediaries for clients that pay the financial intermediaries fees in connection with fee-based advisory program, provided that the financial intermediaries or their trading agents have entered into special arrangements with the Fund and/or Lord Abbett Distributor specifically for such purchases; |

14

| • | purchases by insurance companies and/or their separate accounts to fund variable insurance contracts, provided that the insurance company provides recordkeeping and related administrative services to the contract owners and has entered into special arrangements with the Fund and/or Lord Abbett Distributor specifically for such purchases; |

| • | purchases made with dividends and distributions on Class A shares of another Eligible Fund; |

| • | purchases representing repayment under the loan feature of the Lord Abbett-sponsored prototype 403(b) Plan for Class A shares; |

| • | purchases by employees of any consenting securities dealer having a sales agreement with Lord Abbett Distributor; |

| • | purchases by trustees or custodians of any pension or profit sharing plan, or payroll deduction IRA for the employees of any consenting securities dealer having a sales agreement with Lord Abbett Distributor; |

| • | purchases involving the concurrent sale of Class B or C shares of the Fund related to the requirements of a settlement agreement that the broker-dealer entered into with a regulatory body relating to share class suitability. These sales transactions will be subject to the assessment of any applicable CDSCs (although the broker-dealer may pay on behalf of the investor or reimburse the investor for any such CDSC), and any investor purchases subsequent to the original concurrent transactions will be at the applicable public offering price, which may include a sales charge; |

| • | purchases by non-U.S. pension funds or insurance companies by or through local intermediaries, provided that Class A shares have been approved by and/or registered with a relevant local authority and that Lord Abbett Distributor has entered into special arrangements with a local financial intermediary in connection with the distribution or placement of such shares; and |

| • | certain other types of investors may qualify to purchase Class A share without a front-end sales charge as described in the SAI. |

CDSC Waivers. The CDSC generally will not be assessed on Class A, B, or C shares under the circumstances listed in the chart below. Certain other types of redemptions may qualify for a CDSC waiver. Documentation may be required and some limitations may apply.

| CDSC Waivers | Share Class(es) | |

| Benefit payments under retirement and benefit plans in connection with loans, hardship withdrawals, death, disability, retirement, separation from service, or any excess distribution under retirement and benefit plans | A, B, C | |

| Eligible mandatory distributions under the Internal Revenue Code of 1996 | A, B, C | |

| Redemptions by retirement and benefit plans made through financial intermediaries that have special arrangements with the Fund and/or Lord Abbett Distributor, provided the plan has not redeemed all, or substantially all, of its assets from the Lord Abbett-sponsored funds | A | |

| Redemptions by retirement and benefit plans made through financial intermediaries that have special arrangements with the Fund and/or Lord Abbett Distributor that include the waiver of CDSCs and that were initially entered into prior to December 2002 | A | |

| Class A and Class C shares that are subject to a CDSC and held by certain 401(k) plans for which the Fund’s transfer agent provides plan administration and recordkeeping services and which offer Lord Abbett Funds as the only investment options to the plan’s participants, will no longer be subject to the CDSC upon the 401(k) plan’s transition to a Financial Intermediary that: (1) provides recordkeeping services to the plan; (2) offers other mutual funds in addition to the Lord Abbett Funds as investment options for the plan’s participants; and (3) has entered into a special arrangement with Lord Abbett to facilitate the 401(k) plan’s transition to the Financial Intermediary | A, C | |

| Death of the shareholder | B, C | |

| Redemptions under Div-Move and Systematic Withdrawal Plans (up to 12% per year) | B, C | |

Concurrent Sales. A broker-dealer may pay on behalf of an investor or reimburse an investor for a CDSC otherwise applicable in the case of transactions involving purchases through such broker-dealer where the investor is concurrently selling his or her holdings in Class B or C shares of the Fund and buying Class A shares of that Fund, provided that the purchases are related to the requirements of a settlement agreement that the broker-dealer entered into with a regulatory body relating to share class suitability.

15

Reinvestment Privilege. If you redeem Class A or B shares of the Fund, you may reinvest some or all of the proceeds in the same class of any Eligible Fund on or before the 60th day after the redemption without a sales charge unless the reinvestment would be prohibited by the Fund’s frequent trading policy. Special tax rules may apply. Please see the SAI for more information. If you paid a CDSC when you redeemed your shares, you will be credited with the amount of the CDSC. All accounts involved must have the same registration. This privilege does not apply to purchases made through Invest-A-Matic or other automatic investment services.

FINANCIAL INTERMEDIARY COMPENSATION

As part of a plan for distributing shares, the Fund and Lord Abbett Distributor pay sales and service compensation to authorized institutions that sell the Fund’s shares and service its shareholder accounts. Additionally, your broker-dealer or agent may charge you a fee to effect transactions in Fund shares.

As shown in the table “Fees and Expenses” above, sales compensation originates from sales charges, which are paid directly by shareholders, and 12b-1 distribution fees, which are paid by the Fund out of share class assets. Service compensation originates from 12b-1 service fees. Because 12b-1 fees are paid on an ongoing basis, over time they will increase the cost of your investment and may cost you more than paying other types of sales charges. The fees are accrued daily at annual rates based upon average daily net assets as follows:

| Class |

| ||||||||||||||||||||||

| Fee* |

A | B | C | F | I | P | R2 | R3 | |||||||||||||||

| Service |

0.25 | % | 0.25 | % | 0.25 | % | — | — | 0.20 | % | 0.25 | % | 0.25 | % | |||||||||

| Distribution |

0.10 | % | 0.75 | % | 0.75 | % | 0.10 | % | — | 0.25 | % | 0.35 | % | 0.25 | % | ||||||||

| * | The Fund may designate a portion of the aggregate fee as attributable to service activities for purposes of calculating Financial Industry Regulatory Authority, Inc. sales charge limitations. |

Lord Abbett Distributor may pay 12b-1 fees to financial intermediaries or use the fees for other distribution purposes, including revenue sharing. The amounts paid by the Fund need not be directly related to expenses. If Lord Abbett Distributor’s actual expenses exceed the fee paid to it, the Fund will not have to pay more than that fee. If Lord Abbett Distributor’s expenses are less than the fee it receives, Lord Abbett Distributor will keep the excess amount of the fee.

Sales Activities. The Fund may use 12b-1 distribution fees to pay authorized institutions to finance any activity that is primarily intended to result in the sale of shares. Lord Abbett Distributor uses its portion of the distribution fees attributable to the shares of a particular class for activities that are primarily intended to result in the sale of shares of such class. These activities include, but are not limited to, printing of prospectuses and statements of additional information and reports for other than existing shareholders, preparation and distribution of advertising and sales material, expenses of organizing and conducting sales seminars, additional payments to authorized institutions, maintenance of shareholder accounts, the cost necessary to provide distribution-related services or personnel, travel, office expenses, equipment and other allocable overhead.

Service Activities. Lord Abbett Distributor may pay 12b-1 service fees to authorized institutions for any activity that is primarily intended to result in personal service and/or the maintenance of shareholder accounts or certain retirement and benefit plans. Any portion of the service fees paid to Lord Abbett Distributor will be used to service and maintain shareholder accounts.

Dealer Concessions on Class A Share Purchases With a Front-End Sales Charge. See “Sales Charges - Class A Share Front-End Sales Charge” for more information.

Dealer Concessions on Class A Share Purchases Without a Front-End Sales Charge. Except as otherwise set forth in the following paragraphs, Lord Abbett Distributor may pay Dealers distribution-related compensation (i.e., concessions) according to the schedule set forth below under the following circumstances:

| • | purchases of $1 million or more; |

| • | purchases by certain retirement and benefit plans with at least 100 eligible employees; or |

| • | purchases for certain retirement and benefit plans made through financial intermediaries that perform participant recordkeeping or other administrative services for the plans in connection with multiple fund family recordkeeping platforms and have entered into special arrangements with the Fund and/or Lord Abbett Distributor specifically for such purchases (“Alliance Arrangements”). |

Dealers receive concessions described below on purchases made within a 12-month period beginning with the first NAV purchase of Class A shares for the account. The concession rate resets on each anniversary date of the initial NAV purchase, provided that the account continues to qualify for treatment at NAV. Current holdings of Class B, C, and P shares of Eligible Funds will be included for

16

purposes of calculating the breakpoints in the schedule below and the amount of the concessions payable with respect to the Class A share investment. Concessions may not be paid with respect to Alliance Arrangements unless Lord Abbett Distributor can monitor the applicability of the CDSC. In addition, if a financial intermediary decides to waive receipt of the concession, any CDSC that might otherwise have applied to any such purchase will be waived. Any waiver must be authorized by the financial intermediary firm and the registered representative.

Financial intermediaries should contact Lord Abbett Distributor for more complete information on the commission structure.

| Dealer Concession Schedule – Class A Shares for Certain Purchases Without a Front-End Sales Charge | ||||

| The dealer concession received is based on the amount of the Class A share investment as follows: | ||||

| Class A Investments | Front-End Sales Charge* | Dealer’s Concession | ||

| $1 million to $5 million |

None | 1.00% | ||

| Next $5 million above that |

None | 0.55% | ||

| Next $40 million above that |

None | 0.50% | ||

| Over $50 million |

None | 0.25% | ||

| * | Class A shares purchased without a sales charge will be subject to a 1% CDSC if they are redeemed before the first day of the month in which the one-year anniversary of the purchase falls. For Alliance Arrangements involving financial intermediaries offering multiple fund families to retirement and benefit plans, the CDSC normally will be collected only when a plan effects a complete redemption of all or substantially all shares of all Lord Abbett-sponsored funds in which the plan is invested. |

Class B Shares. Lord Abbett Distributor may pay financial intermediaries selling Class B shares a sales concession of 4.00% of the purchase price of the Class B shares and Lord Abbett Distributor will collect any applicable CDSC. Financial intermediaries also receive an annual service fee beginning in the thirteenth month after purchase of up to 0.25% of the average daily net assets represented by the Class B shares that starts to accrue after twelve months following the purchase of Class B shares.

Class C Shares. Lord Abbett Distributor may pay financial intermediaries selling Class C shares a sales concession of up to 1.00% of the purchase price of the Class C shares and Lord Abbett Distributor will collect and retain any applicable CDSC. Financial intermediaries also receive an annual service fee beginning in the thirteenth month after purchase of up to 1.00% of the average daily net assets represented by the Class C shares that starts to accrue after twelve months following the purchase of Class C shares.

Class F, I, P, R2, and R3 Shares. Class F, I, P, R2, and R3 shares are purchased at NAV with no front-end sales charge and no CDSC when redeemed.

Revenue Sharing and Other Payments to Dealers and Financial Intermediaries. In addition to the various sales commissions, concessions and 12b-1 fees described above, Lord Abbett, Lord Abbett Distributor and the Fund may make other payments to dealers and other firms authorized to accept orders for Fund shares (collectively, “Dealers”).

Lord Abbett or Lord Abbett Distributor makes payments to Dealers in its sole discretion, at its own expense and out of its own resources (including revenues from advisory fees and 12b-1 fees) and without additional cost to the Fund or the Fund’s shareholders.

This compensation from Lord Abbett is not reflected in the fees and expenses listed above in the Fee Table section of this prospectus. The payments may be for activities including but not limited to the following:

| — | marketing and/or distribution support for Dealers; |

| — | the Dealers’ and their investment professionals’ shareholder servicing efforts; |

| — | training and education activities for the Dealers, their investment professionals and/or their clients or potential clients; |

| — | certain information regarding Dealers and their investment professionals; |

| — | sponsoring or otherwise bearing, in part or in whole, the costs for other meetings of Dealers’ investment professionals and/or their clients or potential clients; |

| — | the purchase of products or services from the Dealers, such as investment research, software tools or data for investment analysis purposes; |

| — | certain Dealers’ costs associated with orders relating to Fund shares (“ticket charges”); and/or |

17

| — | any other permissible activity that Lord Abbett or Lord Abbett Distributor, in its sole discretion, believes would facilitate sales of Fund shares. |

Some of these payments are sometimes called “revenue sharing” payments. Most of these payments are intended to reimburse Dealers directly or indirectly for the costs they or their investment professionals incur in connection with educational seminars and training efforts about the Lord Abbett Funds to enable the Dealers and their investment professionals to make recommendations and provide services that are suitable and useful in meeting shareholder needs, as well as to maintain the necessary infrastructure to make the Lord Abbett Funds available to shareholders. The costs and expenses related to these efforts may include travel, lodging, entertainment and meals, among other things. In addition, Lord Abbett Distributor may, for specified periods of time, decide to forgo the portion of front-end sales charges to which it normally is entitled and allow Dealers to retain the full sales charge for sales of Fund shares. In some instances, these temporary arrangements will be offered only to certain Dealers expected to sell significant amounts of Fund shares.

Lord Abbett or Lord Abbett Distributor may benefit from revenue sharing if the Dealer features the Fund in its sales system (such as by placing the Fund on its preferred fund list or giving access on a preferential basis to members of the financial intermediary’s sales force or management). In addition, Lord Abbett Distributor may agree to participate in the Dealer’s marketing efforts (such as by helping to facilitate or provide financial assistance for conferences, seminars or other programs at which Lord Abbett personnel may make presentations on the Fund to the intermediary’s sales force). To the extent the Dealers sell more shares of the Fund or retain shares of the Fund in their clients’ accounts, Lord Abbett receives greater management and other fees due to the increase in the Fund’s assets. Although a Dealer may request additional compensation from Lord Abbett to offset costs incurred by the Dealer servicing its clients, the Dealer may earn a profit on these payments, if the amount of the payment exceeds the Dealer’s costs.