| Label |

Element |

Value |

| LORD ABBETT AFFILIATED FUND INC |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

LORD ABBETT AFFILIATED FUND INC

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Fund’s investment objective is long-term growth of capital and income without excessive fluctuations in market value.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in the Lord Abbett Family of Funds. More information about these and other discounts is available from your financial professional and in “Sales Charge Reductions and Waivers” on page 36 of the prospectus, Appendix A to the prospectus, titled “Intermediary-Specific Sales Charge Reductions and Waivers,” and “Purchases, Redemptions, Pricing, and Payments to Dealers” on page 8-1 of the statement of additional information (“SAI”).

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees (Fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover.

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 73.31% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

73.31%

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in the Lord Abbett Family of Funds.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 50,000

|

|

| Other Expenses, New Fund, Based on Estimates [Text] |

rr_OtherExpensesNewFundBasedOnEstimates |

Based on estimated amounts for the current fiscal year.

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

This amount has been updated from fiscal year amounts to reflect current fees and expenses.

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

If Shares Are Redeemed

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

If Shares Are Not Redeemed

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal circumstances, the Fund invests at least 80% of its net assets in equity securities of large companies. The Fund invests primarily in equity securities of companies in the Russell 1000® Index that pay dividends and that the portfolio management team believes have the potential for capital appreciation. In selecting investments, the portfolio management team focuses on U.S. companies that pay dividends. The Fund also may invest up to 10% of its net assets in securities of foreign companies, including emerging market companies and American Depositary Receipts (“ADRs”). The Fund defines foreign companies as those whose securities are traded primarily on non-U.S. securities exchanges. Because ADRs represent exposure to foreign companies, the Fund deems them to be foreign investments even though they trade on U.S. exchanges. Foreign securities may be denominated in the U.S. dollar or other currencies. The Fund’s principal investments include the following types of securities and other financial instruments:

| | • | | Equity securities, including any security that represents equity ownership in a company. Currently, the Fund invests in equity securities consisting primarily of common stocks, preferred stocks, equity interests in trusts (including real estate investment trusts (“REITs”) and privately offered trusts), partnerships, joint ventures, limited liability companies, and vehicles with similar legal structures, and other instruments with similar characteristics. The Fund considers equity securities to include rights offerings and investments that convert into the equity securities described above. | | | • | | Large companies having a market capitalization at the time of purchase that falls within the market capitalization range of companies in the Russell 1000® Index. | | | • | | Dividend paying securities issued by companies that pay out a portion of their profits to shareholders instead of reinvesting all their profits in their businesses. Although issuers of dividend paying securities may include fast growing companies, they more commonly are “value” companies whose securities the portfolio team believes have the potential for investment return because they are underpriced or undervalued according to certain financial measurements of intrinsic worth or business prospects. |

The Fund’s portfolio management team uses fundamental research and quantitative analysis to select the Fund’s investments.

The Fund generally will sell a security when the Fund believes the security is less likely to benefit from the current market and economic environment, shows signs of deteriorating fundamentals, or has reached its valuation target, among other reasons. The Fund seeks to remain fully invested in accordance with its investment objective; however, in response to adverse economic, market or other unfavorable conditions, the Fund may invest its assets in a temporary defensive manner.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

As with any investment in a mutual fund, investing in the Fund involves risk, including the risk that you may receive little or no return on your investment. When you redeem your shares, they may be worth more or less than what you paid for them, which means that you may lose a portion or all of the money you invested in the Fund. The principal risks of investing in the Fund, which could adversely affect its performance, include:

| | • | | Investment Strategy Risk: If the Fund’s fundamental research and quantitative analysis fail to produce the intended result, the Fund may suffer losses or underperform its benchmark or other funds with the same investment objective or strategies, even in a rising market. In addition, the Fund’s strategy of focusing on dividend paying companies means the Fund will be more exposed to risks associated with that particular market segment than a fund that invests more widely. | | | | • | | Market Risk: The market values of securities will fluctuate, sometimes sharply and unpredictably, based on overall economic conditions, governmental actions or intervention, political developments and other factors. Prices of equity securities tend to rise and fall more dramatically than those of debt securities. | | | | • | | Equity Securities Risk: Equity securities, as well as equity-like securities such as convertible debt securities, may experience significant volatility. Such securities may fall sharply in response to adverse events affecting overall markets, a particular industry or sector, or an individual company’s financial condition. | | | • | | Industry and Sector Risk: Although the Fund does not employ an industry or sector focus, its exposure to specific industries or sectors will increase from time to time based on the portfolio management team’s perception of investment opportunities. If the Fund overweights a single industry or sector relative to its benchmark index, the Fund will face an increased risk that the value of its portfolio will decrease because of events disproportionately affecting that industry or sector. Furthermore, investments in particular industries or sectors may be more volatile than the broader market as a whole. | | | • | | Dividend Risk: Securities of dividend paying companies that meet the Fund’s investment criteria may not be widely available, limiting the Fund’s ability to produce current income and increasing the volatility of the Fund’s returns. At times, the performance of dividend paying companies may lag the performance of other companies or the broader market as a whole. In addition, the dividend payments of the Fund’s portfolio companies may vary over time, and there is no guarantee that a company will pay a dividend at all. | | | • | | Large Company Risk: As compared to smaller successful companies, larger, more established companies may be less able to respond quickly to certain market developments and may have slower rates of growth. Large companies also may fall out of favor relative to smaller companies in certain market cycles, causing the Fund to incur losses or underperform. | | | • | | Mid-Sized Company Risk: The equity securities of mid-sized companies typically involve greater investment risks than larger, more established companies. As compared to larger companies, mid-sized companies may have limited management experience or depth, limited ability to generate or borrow capital needed for growth, and limited products or services, or operate in markets that have not yet been established. Accordingly, mid-sized company securities tend to be more sensitive to changing economic, market and industry conditions and tend to be more volatile and less liquid than equity securities of larger companies, especially over the short term. Mid-sized companies also may fall out of favor relative to larger companies in certain market cycles, causing the Fund to incur losses or underperform. | | | | • | | Foreign and Emerging Market Company Risk: The Fund’s investments in foreign (including emerging market) companies and in U.S. companies with economic ties to foreign markets generally involve special risks that can increase the likelihood that the Fund will lose money. For example, as compared with companies organized and operated in the U.S., these companies may be more vulnerable to economic, political, and social instability and subject to less government supervision, lack of transparency, inadequate regulatory and accounting standards, and foreign taxes. In addition, the securities of foreign companies also may be subject to inadequate exchange control regulations, the imposition of economic sanctions or other government restrictions, higher transaction and other costs, reduced liquidity, and delays in settlement to the extent they are traded on non-U.S. exchanges or markets. Foreign securities also may subject the Fund’s investments to changes in currency rates. Emerging market securities generally are more volatile than other foreign securities, and are subject to greater liquidity, regulatory, and political risks. | | | • | | Foreign Currency Risk: The Fund may invest in securities denominated in foreign (including emerging markets) currencies, which are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time. | | | | • | | Real Estate Risk: An investment in a REIT generally is subject to the risks that impact the value of the underlying properties or mortgages of the REIT. These risks include loss to casualty or condemnation, and changes in supply and demand, interest rates, zoning laws, regulatory limitations on rents, property taxes, and operating expenses. Other factors that may adversely affect REITs include poor performance by management of the REIT, changes to the tax laws, or failure by the REIT to qualify for tax-free distribution of income, and changes in local, regional, or general economic conditions. | | | • | | Liquidity/Redemption Risk: The Fund may lose money when selling securities at inopportune times to fulfill shareholder redemption requests. The risk of loss may increase depending on the size and frequency of redemption requests, whether the redemption requests occur in times of overall market turmoil or declining prices, and whether the securities the Fund intends to sell have decreased in value or are illiquid. | |

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. For more information on the principal risks of the Fund, please see the “More Information About the Fund – Principal Risks” section in the prospectus.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

As with any investment in a mutual fund, investing in the Fund involves risk, including the risk that you may receive little or no return on your investment. When you redeem your shares, they may be worth more or less than what you paid for them, which means that you may lose a portion or all of the money you invested in the Fund.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

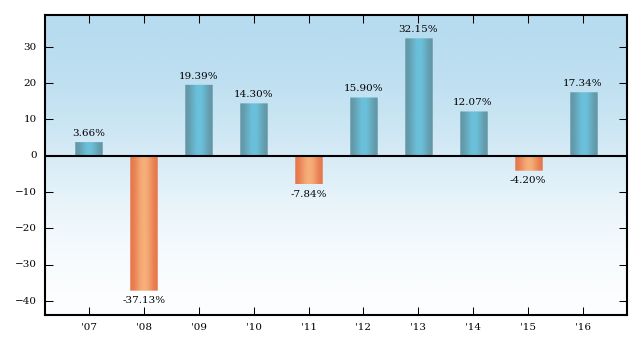

The bar chart and table below provide some indication of the risks of investing in the Fund by illustrating the variability of the Fund’s returns. Each assumes reinvestment of dividends and distributions. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. No performance is shown for Class F3 or T shares because these classes have not completed a full calendar year of operations as of the date of this prospectus.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and table below provide some indication of the risks of investing in the Fund by illustrating the variability of the Fund’s returns.

|

|

| Performance One Year or Less [Text] |

rr_PerformanceOneYearOrLess |

No performance is shown for Class F3 or T shares because these classes have not completed a full calendar year of operations as of the date of this prospectus.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

888-522-2388

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.lordabbett.com

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Bar Chart (per calendar year) — Class A Shares

|

|

| Bar Chart Narrative [Text Block] |

rr_BarChartNarrativeTextBlock |

The bar chart shows changes in the performance of the Fund’s Class A shares from calendar year to calendar year. This chart does not reflect the sales charge applicable to Class A shares. If the sales charge were reflected, returns would be lower. Performance for the Fund’s other share classes will vary due to the different expenses each class bears. Updated performance information is available at www.lordabbett.com or by calling 888-522-2388.

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

This chart does not reflect the sales charge applicable to Class A shares. If the sales charge were reflected, returns would be lower.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| | | | Best Quarter 2nd Q ’09 +18.76% | | Worst Quarter 3rd Q ’11 -20.73% |

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

18.76%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(20.73%)

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average Annual Total Returns (for the periods ended December 31, 2016)

|

|

| Performance Table Does Reflect Sales Loads |

rr_PerformanceTableDoesReflectSalesLoads |

The Fund’s average annual total returns include applicable sales charges.

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

(reflects no deduction for fees, expenses, or taxes)

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

The after-tax returns of Class A shares included in the table below are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements such as 401(k) plans or Individual Retirement Accounts (“IRAs”).

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

After-tax returns for other share classes are not shown in the table and will vary from those shown for Class A shares.

|

|

| Performance Table Explanation after Tax Higher |

rr_PerformanceTableExplanationAfterTaxHigher |

In some cases, the return after taxes on distributions and sale of Fund shares may exceed the return before taxes due to a tax benefit resulting from realized losses on a sale of Fund shares at the end of the period that is used to offset other gains.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

The table below shows how the Fund’s average annual total returns compare to the returns of a securities market index with investment characteristics similar to those of the Fund. The Fund’s average annual total returns include applicable sales charges.

The after-tax returns of Class A shares included in the table below are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some cases, the return after taxes on distributions and sale of Fund shares may exceed the return before taxes due to a tax benefit resulting from realized losses on a sale of Fund shares at the end of the period that is used to offset other gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements such as 401(k) plans or Individual Retirement Accounts (“IRAs”). After-tax returns for other share classes are not shown in the table and will vary from those shown for Class A shares.

|

|

| LORD ABBETT AFFILIATED FUND INC | Russell 1000® Value Index (reflects no deduction for fees, expenses, or taxes) 9/28/2007 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.34%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

14.80%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.72%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

5.53%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Sep. 28, 2007

|

|

| LORD ABBETT AFFILIATED FUND INC | Russell 1000® Value Index (reflects no deduction for fees, expenses, or taxes) 6/30/2015 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.34%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

14.80%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.72%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

8.81%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Jun. 30, 2015

|

|

| LORD ABBETT AFFILIATED FUND INC | Lipper Equity Income Funds Average (reflects no deduction for sales charges or taxes) 9/28/2007 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.86%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

11.53%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.95%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

5.48%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Sep. 28, 2007

|

|

| LORD ABBETT AFFILIATED FUND INC | Lipper Equity Income Funds Average (reflects no deduction for sales charges or taxes) 6/30/2015 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.86%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

11.53%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.95%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

6.96%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Jun. 30, 2015

|

|

| LORD ABBETT AFFILIATED FUND INC | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

5.75%

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.74%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 646

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

798

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

963

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,441

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

646

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

798

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

963

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,441

|

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

3.66%

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(37.13%)

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

19.39%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

14.30%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

(7.84%)

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

15.90%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

32.15%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

12.07%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(4.20%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

17.34%

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

10.60%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

12.71%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.07%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class A | After Taxes on Distributions |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

8.60%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

11.22%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.13%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class A | After Taxes on Distributions and Sale of Fund Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

7.53%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

10.01%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.17%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class B |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

5.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.49%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 652

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

771

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,013

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,576

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

152

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

471

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

813

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,576

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

11.52%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

12.99%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.13%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[2] |

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.49%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 252

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

471

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

813

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,779

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

152

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

471

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

813

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,779

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

15.56%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

13.25%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.99%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class F |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.10%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.59%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 60

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

189

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

329

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

738

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

60

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

189

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

329

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 738

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.52%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

14.26%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

4.48%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Sep. 28, 2007

|

|

| LORD ABBETT AFFILIATED FUND INC | Class F3 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.07%

|

[3] |

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.39%

|

[3] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 40

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

125

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

219

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

493

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

40

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

125

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

219

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 493

|

|

| LORD ABBETT AFFILIATED FUND INC | Class I |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.49%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 50

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

157

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

274

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

616

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

50

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

157

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

274

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 616

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.72%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

14.37%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.02%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class P |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.45%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.94%

|

[4] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 96

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

300

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

520

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,155

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

96

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

300

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

520

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,155

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.36%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

14.05%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.65%

|

|

| LORD ABBETT AFFILIATED FUND INC | Class R2 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.60%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.09%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 111

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

347

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

601

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,329

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

111

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

347

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

601

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,329

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

16.93%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

13.71%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

3.96%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Sep. 28, 2007

|

|

| LORD ABBETT AFFILIATED FUND INC | Class R3 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.99%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 101

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

315

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

547

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,213

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

101

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

315

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

547

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,213

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

13.83%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

4.08%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Sep. 28, 2007

|

|

| LORD ABBETT AFFILIATED FUND INC | Class R4 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.74%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 76

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

237

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

411

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

918

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

76

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

237

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

411

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 918

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.40%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

8.76%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Jun. 30, 2015

|

|

| LORD ABBETT AFFILIATED FUND INC | Class R5 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.49%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 50

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

157

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

274

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

616

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

50

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

157

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

274

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 616

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.64%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

9.01%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Jun. 30, 2015

|

|

| LORD ABBETT AFFILIATED FUND INC | Class R6 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.07%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.39%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 40

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

125

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

219

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

493

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

40

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

125

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

219

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 493

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.83%

|

|

| Life of Class |

rr_AverageAnnualReturnSinceInception |

9.13%

|

|

| Inception Date for Performance |

rr_AverageAnnualReturnInceptionDate |

Jun. 30, 2015

|

|

| LORD ABBETT AFFILIATED FUND INC | Class T |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

2.50%

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.32%

|

|

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.17%

|

[3] |

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.74%

|

[3] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 324

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

481

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

651

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,145

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

324

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

481

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

651

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,145

|

|

|

|