UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form

For the Fiscal Year Ended:

OR

For the Transition Period From to

Commission File Number:

Dana Incorporated

(Exact name of registrant as specified in its charter)

| | |

| (State of incorporation) | (IRS Employer Identification Number) |

| | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | ☑ |

|

| Accelerated filer | ☐ |

| Non-accelerated filer | ☐ |

| Smaller reporting company | | |

|

|

|

|

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the common stock held by non-affiliates of the registrant computed by reference to the closing price of the common stock on June 30, 2023 was $

There were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to stockholders in connection with the Annual Meeting of Shareholders to be held on April 24, 2024 are incorporated by reference into Part III.

FORM 10-K

YEAR ENDED December 31, 2023

Table of Contents

|

|

|

Pages |

| PART I |

|

|

| Item 1 |

||

| Item 1A |

||

| Item 1B |

||

| Item 1C | Cybersecurity | 12 |

| Item 2 |

||

| Item 3 |

||

|

|

|

|

| PART II |

|

|

| Item 5 |

||

| Item 6 |

||

| Item 7 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 7A |

||

| Item 8 |

||

| Item 9 |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

| Item 9A |

||

| Item 9B |

||

| Item 9C | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 71 |

|

|

|

|

| PART III |

|

|

| Item 10 |

||

| Item 11 |

||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

|

| Item 14 |

||

|

|

|

|

| PART IV |

|

|

| Item 15 |

||

|

|

|

|

|

|

||

Forward-Looking Information

Statements in this report (or otherwise made by us or on our behalf) that are not entirely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often be identified by words such as “anticipates,” “expects,” “believes,” “intends,” “plans,” “predicts,” “seeks,” “estimates,” “projects,” “outlook,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing” and similar expressions, variations or negatives of these words. These statements represent the present expectations of Dana Incorporated and its consolidated subsidiaries based on our current information and assumptions. Forward-looking statements are inherently subject to risks and uncertainties. Our plans, actions and actual results could differ materially from our present expectations due to a number of factors, including those discussed below and elsewhere in this report and in our other filings with the Securities and Exchange Commission (SEC). All forward-looking statements speak only as of the date made and we undertake no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of this report.

PART I

(Dollars in millions, except per share amounts)

General

Dana Incorporated (Dana), with history dating back to 1904, is headquartered in Maumee, Ohio. We are a world leader in providing power-conveyance and energy-management solutions for vehicles and machinery. The company's portfolio improves the efficiency, performance, and sustainability of light vehicles, commercial vehicles, and off-highway equipment. From axles, driveshafts, transmissions, sealing and thermal products to electrification products including motors, inverters, controllers, e-sealing, e-thermal and digital solutions, we enable the propulsion of internal combustion engine (ICE), hybrid and electric powered vehicles by supplying nearly every major vehicle manufacturer in the world. We also serve the stationary industrial market. As of December 31, 2023 we employed approximately 41,800 people and operated in 31 countries.

The terms “Dana,” “we,” “our” and “us” are references to Dana. These references include the subsidiaries of Dana unless otherwise indicated or the context requires otherwise.

Overview of our Business

We have aligned our organization around four operating segments: Light Vehicle Drive Systems (Light Vehicle), Commercial Vehicle Drive and Motion Systems (Commercial Vehicle), Off-Highway Drive and Motion Systems (Off-Highway) and Power Technologies. These operating segments have global responsibility and accountability for business commercial activities and financial performance.

External sales by operating segment for the years ended December 31, 2023, 2022 and 2021 are as follows:

| 2023 |

2022 |

2021 |

||||||||||||||||||||||

| Dollars |

% of Total |

Dollars |

% of Total |

Dollars |

% of Total |

|||||||||||||||||||

| Light Vehicle |

$ | 4,035 | 38.2 | % | $ | 4,090 | 40.3 | % | $ | 3,773 | 42.2 | % | ||||||||||||

| Off-Highway |

3,185 | 30.2 | % | 2,946 | 29.0 | % | 2,593 | 29.0 | % | |||||||||||||||

| Commercial Vehicle |

2,092 | 19.8 | % | 1,979 | 19.5 | % | 1,532 | 17.1 | % | |||||||||||||||

| Power Technologies |

1,243 | 11.8 | % | 1,141 | 11.2 | % | 1,047 | 11.7 | % | |||||||||||||||

| Total |

$ | 10,555 | $ | 10,156 | $ | 8,945 | ||||||||||||||||||

Refer to Segment Results of Operations in Item 7 and Note 20 to our consolidated financial statements in Item 8 for further financial information about our operating segments.

Our business is diversified across end-markets, products and customers. The following table summarizes the markets, products and largest customers of each of our operating segments as of December 31, 2023:

| Segment |

Markets |

Products |

Largest |

|

|

|

|

|

| Light Vehicle |

Light vehicle market: |

Axles |

Ford Motor Company |

|

|

Light trucks (full frame) |

Driveshafts |

Stellantis N.V.* |

|

|

Sport utility vehicles |

ICE, hybrid and e-transmissions |

Toyota Motor Corporation |

|

|

Crossover utility vehicles |

e-Axle systems |

Renault-Nissan-Mitsubishi |

|

|

Utility vans |

e-Transmission systems |

Alliance |

|

|

Sports cars |

Inverters |

Tata Motors Ltd (including |

|

|

Super sports cars |

Electric motors |

Jaguar Land Rover) |

|

|

|

Controllers |

Volkswagen AG |

|

|

|

|

|

|

|

|

|

|

| Commercial Vehicle |

Commercial vehicle market: |

Axles |

PACCAR Inc |

|

|

Medium duty trucks |

Driveshafts |

Traton SE |

|

|

Heavy duty trucks |

Hybrid and e-transmissions |

AB Volvo |

|

|

Buses |

e-Axle systems |

Daimler Truck AB |

|

|

Specialty vehicles |

e-Transmission systems |

Ford Motor Company |

|

|

|

Inverters |

CNH Industrial N.V. |

| Electric motors | |||

| Controllers | |||

|

|

|

|

|

|

|

|

|

|

| Off-Highway |

Off-Highway market: |

Axles, hub drives and driveshafts |

Deere & Company |

|

|

Construction |

ICE, hybrid and e-transmissions |

CNH Industrial N.V. |

|

|

Agricultural |

e-Axle systems |

AGCO Corporation |

|

|

Mining |

e-Transmission systems |

Oshkosh Corporation |

|

|

Forestry |

e-Hub drive systems |

Manitou Group |

|

|

Material handling |

Inverters |

JCB Inc. |

| Industrial stationary | Electric motors | ||

|

|

Lawn care and recreational |

Controllers |

|

|

|

|

|

|

|

|

|

|

|

| Power Technologies |

Light vehicle market |

ICE sealing and thermal |

Ford Motor Company |

|

|

Commercial vehicle market |

e-Sealing |

General Motors Company |

|

|

Off-Highway market |

e-Thermal cooling systems | Stellantis N.V. |

|

|

Industrial stationary market |

Battery cooling | Volkswagen AG |

|

|

|

Electronics cooling |

(including Traton SE) |

| Hydrogen fuel cell cooling | Cummins Inc. | ||

|

|

|

New power industrial cooling |

Mercedes-Benz Group |

|

|

|

|

|

* Via a directed supply relationship

Geographic Operations

We maintain administrative and operational organizations in North America, Europe, South America and Asia Pacific to support our operating segments, assist with the management of affiliate relations and facilitate financial and statutory reporting and tax compliance on a worldwide basis. Our operations are located in the following countries:

| North America |

Europe |

South America |

Asia Pacific |

|

| Canada |

Belgium |

Netherlands |

Argentina |

Australia |

| México |

Finland |

Norway |

Brazil |

China |

| United States |

France |

South Africa |

Colombia |

India |

|

|

Germany |

Spain |

Ecuador |

Japan |

|

|

Hungary |

Sweden |

|

New Zealand |

|

|

Ireland |

Switzerland |

|

Singapore |

|

|

Italy |

Turkey |

|

South Korea |

|

|

Lithuania |

United Kingdom |

|

Thailand |

Our non-U.S. subsidiaries and affiliates manufacture and sell products similar to those we produce in the United States. Operations outside the U.S. may be subject to a greater risk of changing political, economic and social environments, changing governmental laws and regulations, currency revaluations and market fluctuations than our domestic operations. See the discussion of risk factors in Item 1A.

Sales reported by our non-U.S. subsidiaries comprised $6,063, or 57%, of our 2023 consolidated sales of $10,555. A summary of sales and long-lived assets by geographic region can be found in Note 20 to our consolidated financial statements in Item 8.

Customer Dependence

We are largely dependent on light vehicle, medium- and heavy-duty vehicle and off-highway original equipment manufacturer (OEM) customers. Ford Motor Company (Ford) and Stellantis N.V. (Stellantis) were the only individual customers accounting for 10% or more of our consolidated sales in one or more of the past three years. As a percentage of total sales from operations, our sales to Ford were approximately 20% in 2023, 19% in 2022 and 19% in 2021. Our sales to Stellantis (via a directed supply relationship) were approximately 9% in 2023, 11% in 2022 and 12% in 2021. Volkswagen AG (including Traton SE), PACCAR, Inc and Toyota Motor Corporation were our third, fourth and fifth largest customers in 2023. Our 10 largest customers collectively accounted for approximately 55% of our sales in 2023.

Loss of all or a substantial portion of our sales to Ford, Stellantis or other large volume customers would have a significant adverse effect on our financial results until such lost sales volume could be replaced and there is no assurance that any such lost volume would be replaced.

Sources and Availability of Raw Materials

We use a variety of raw materials in the production of our products, including steel and products containing steel, stainless steel, forgings, castings, bearings, semiconductors, and magnets and related rare earth materials. Other commodity purchases include aluminum, brass, copper and plastics. These materials are typically available from multiple qualified sources in quantities sufficient for our needs. However, some of our operations remain dependent on single sources for certain raw materials.

While our suppliers have generally been able to support our needs, our operations may experience shortages and delays in the supply of raw material from time to time due to strong market demand, capacity limitations, supply chain disruptions, short lead times, production schedule increases from our customers and other problems experienced by the suppliers. A significant or prolonged shortage of critical components from any of our suppliers could adversely impact our ability to meet our production schedules and to deliver our products to our customers in a timely manner.

Seasonality

Our businesses are generally not seasonal. However, in the light vehicle market, our sales are closely related to the production schedules of our OEM customers and those schedules have historically been weakest in the third quarter of the year due to a large number of model year changeovers that occur during this period. Additionally, third-quarter production schedules in Europe are typically impacted by summer vacation schedules and fourth-quarter production is affected globally by year-end holidays.

Backlog

A substantial amount of the new business we are awarded by OEMs is granted well in advance of a program launch. These awards typically extend through the life of the given program. This backlog of new business does not represent firm orders. We estimate future sales from new business using the projected volume under these programs.

Competition

Within each of our markets, we compete with a variety of independent suppliers and distributors, as well as with the in-house operations of certain OEMs. With a focus on product innovation, we differentiate ourselves through efficiency and performance, reliability, materials and processes, sustainability and product extension.

The following table summarizes our principal competitors by operating segment as of December 31, 2023:

| Segment |

Principal Competitors |

|

|

|

|

|

| Light Vehicle |

American Axle & Manufacturing Holdings, Inc. |

Magna International Inc. |

|

|

BorgWarner Inc. |

Schaeffler AG |

|

|

Hofer Powertrain GmbH |

Valeo SE |

|

|

Jing-Jin Electric Technologies Co. Ltd. |

ZF Friedrichshafen AG |

| Linamar Corporation | Vertically integrated OEM operations | |

|

|

|

|

|

|

|

|

| Commercial Vehicle |

Allison Transmission Holdings, Inc. |

Eugen Klein GmbH |

|

|

BorgWarner Inc. |

Hendrickson Holdings, LLC |

|

|

Cummins Inc. |

Tirsan Kardan A.Ş. |

|

|

Danfoss A/S |

ZF Friedrichshafen AG |

| Eaton Corporation plc | Vertically integrated OEM operations | |

|

|

|

|

|

|

|

|

| Off-Highway |

Bonfiglioli Riduttori S.p.A. |

Kohler Co. |

|

|

Carraro S.p.A. |

SEW-Eurodrive GmbH |

|

|

Comer Industries S.p.A. |

Zapi S.p.A. |

| Danfoss A/S | ZF Friedrichshafen AG | |

|

|

Kessler+Co |

Vertically integrated OEM operations |

|

|

|

|

|

|

|

|

| Power Technologies |

Denso Corporation |

Mahle GmbH |

|

|

ElringKlinger AG |

Tenneco Inc. |

|

|

Freudenberg Group |

Valeo SE |

|

|

Hanon Systems |

YinLun Co., LTD |

|

|

|

|

Intellectual Property

Our proprietary driveline and power technologies product lines have strong identities in the markets we serve. Throughout these product lines, we manufacture and sell our products under a number of patents that have been obtained over a period of years and expire at various times. We consider each of these patents to be of value and aggressively protect our rights in key markets. We are involved with many product lines and the loss or expiration of any particular patent would not materially affect our sales and profits.

We own or have licensed numerous trademarks that are registered or subject to pending applications in many jurisdictions. For example, our Spicer®, Spicer ElectrifiedTM, Victor Reinz®, Long®, GrazianoTM and Dana TM4TM trademarks are widely recognized in their market segments. We regard our trademarks as valuable assets and strategically pursue available protection of these rights.

Since our introduction of the automotive universal joint in 1904, we have been focused on technological innovation. Our objective is to be an essential partner to our customers and we remain highly focused on offering superior product quality, technologically advanced products, world-class service and competitive prices. To enhance quality and reduce costs, we use statistical process control, cellular manufacturing, flexible regional production and assembly, global sourcing and extensive employee training.

We engage in ongoing engineering and research and development activities to improve the reliability, performance and cost-effectiveness of our existing products and to design and develop innovative products that meet customer requirements for new applications. We integrate related operations to create a more innovative environment, speed product development, maximize efficiency and improve communication and information sharing among our research and development operations. At December 31, 2023, we had eleven stand-alone technical and engineering centers and fourteen additional sites at which we conduct research and development activities. Our research and development costs were $237 in 2023, $201 in 2022 and $178 in 2021. Total engineering expenses including research and development were $369 in 2023, $321 in 2022 and $297 in 2021. Over the past several years our engineering spend has been more heavily focused on research and development activities, progressing key electrification initiatives.

Our research and development is targeted to create unique value for our customers. Our technologies are enabling the electrification of vehicles and accessories to improve efficiency and reduce the impact of carbon emissions. Our advanced drivelines are more efficient than ever before and include mechatronic systems to enhance performance. Our power technologies group is also developing new ways to keep batteries and power electronics at optimum temperatures to improve their efficiency and operation. Together the collaborative teamwork between our four business units enable Dana to differentiate by developing complete in-house 4-in-1 electrified propulsion systems, including motors, inverters, axles/transmissions and thermal management solutions. We have developed innovative fuel cell products to support the new-energy hydrogen vehicles and industrial stationary markets.

Human Capital

Our talented people power a customer-centric organization that is continuously improving the performance and efficiency of vehicles and machines around the globe. The following table summarizes our employees by operating segment and geographical region as of December 31, 2023:

| Segment |

Employees | Region | Employees | |||||||

| Light Vehicle |

13,900 | North America | 15,900 | |||||||

| Off-Highway |

11,800 | Europe | 11,500 | |||||||

| Commercial Vehicle |

7,800 | Asia Pacific | 10,100 | |||||||

| Power Technologies |

6,100 | South America | 4,300 | |||||||

| Technical and administrative |

2,200 | Total | 41,800 | |||||||

| Total |

41,800 | |||||||||

Safety – The health and safety of employees remain our highest priority and we believe our company has an essential responsibility to safeguard life, health, property, and the environment for the well-being of all involved. Through a commitment to proactive processes, we actively promote and pursue safety in all that we do. This is achieved through a consistent commitment to excellence in, health, safety, security management, and risk elimination. Dana’s health, safety and security programs ensure that all employees receive training, guidance, and assistance in safety awareness and risk prevention. An implemented, verified, audited, and communicated occupational health and safety management system reflects Dana’s internal and external commitment to all our stakeholders in identifying and reducing the health and safety risk of our employees around the world. Dana has developed robust safety systems, including detailed work instructions and processes for standard and non-standard work, as well as regular layer process audits to ensure that we carefully consider safety in each of our work functions.

Diversity, Equity and Inclusion – Our vision is to maintain a diverse and inclusive, global organization that develops, fosters, and attracts great people whose perspectives are encouraged, heard, valued, and supported. We are committed to advancing and reflecting the communities we serve. At Dana, we are proud to have an employee-centric organization that challenges the status quo by ensuring our business policies, processes and culture allow us to continuously build upon our diverse strengths to further grow a strong, inclusive work environment. Dana remains focused on cultivating an inclusive culture that embraces diversity and equity to enable Dana people to contribute to their full potential and have a sense of belonging. To achieve this, our diversity, equity, and inclusion strategy is guided by five pillars: leadership commitment; diversity representation; awareness, education and development; employee and community growth; and cross-functional collaboration.

Retention and Employee Development – Dana believes the development of its people is critical to the company’s success. The company empowers individuals to lead their development by articulating their professional, personal, and career growth aspirations to their manager. Development of all Dana people is strongly encouraged and should be considered each year as a part of their goals. Fair access to development opportunities to maintain a sustainable, diverse, and high-performance pipeline of talent is supported by Dana leaders at all levels of the organization. The company also provides regular training for our associates across the globe, providing the opportunity to enhance their skills and keep pace with technological change and offers a mentorship program to help guide and coach employees to ensure the company is developing a diverse leadership talent pool. This development is supported and measured with robust performance management and development plans that encourages employees to continuously improve upon their past performance and build on critical skills the company requires to remain competitive.

Business Resource Groups – Dana has a network of Business Resource Groups (BRGs) to empower employees and enhance Dana’s ability to develop, retain, and attract top talent. These BRGs are executive leadership-supported, employee-led initiatives with the mission to inspire growth and innovation and foster belonging for all employees. BRGs provide employees opportunities for development, mentoring, networking, and utilizing their talents in ways that positively impact the business. Our BRGs currently include:

| ● | African American Resource Group (AARG) – Dana's AARG group is committed to supporting the career development of African American talent through thought-leadership workshops and community events. The group provides Dana insight to the best practices for sourcing and retaining top talent. | |

| ● | Connected Cultures – Dana's Connected Cultures group aims to recognize and celebrate the cultural fluency and diversity of Dana people. The group focuses on increasing cultural awareness by promoting understanding and respects of different beliefs, values and customs across diverse groups. | |

| ● | Dana Alumni – With more than a century of rich history, Dana leverages its vast network of Alumni, including retirees and former long-time employees to help them remain informed about the company's latest initiatives and to gather ideas on how to best continue to engage our workforce. | |

| ● | Dana Women’s Network (DAWN) – The company’s DAWN group is focused on providing professional networking and career development for women at Dana. They also promote activities that engage Dana’s senior leaders to better understand how the company can support women at work. | |

| ● | Green Team – Dana's Green Team resource group helps to advance Dana's mission to be sustainably responsible in our business practices. The group helps to inform and drive grassroots employee initiatives on reducing our impact on the environment. | |

| ● | LGBTQ+A – The LGBTQ+A group focuses on maintaining an inclusive working environment that enables the company to leverage a diverse leadership pipeline. It has assisted in providing educational resources and community activities to engage the Dana team on best ways to support our LGBTQ+A colleagues. | |

| ● | Military and Veterans – The military and veterans group supports active-duty and veteran military personnel by understanding their unique needs and finding the best ways to support them. This group's understanding of the needs of those who have served also allows the company to consider the best way to engage candidates and recruit them to Dana. |

|

| ● | New to Dana (NTD) – The NTD group is open to all new Dana employees to help acclimate them to the Dana business culture and understand the company’s rich history. It provides resources, support, and professional development opportunities to new employees as they transition into their job responsibilities at Dana. |

Recruiting – As a company, we collaborate with internationally recognized organizations to reach out to diverse talent and implement best practices for recruiting individuals who work within our core business functions. Dana’s talent acquisition group focuses on recruitment of talented people to the company while continuing to maintain best-in-class processes to address the unique market conditions we face across our global facilities.

Health and Wellness – Dana understands the importance of advocating for the health and well-being of our employees. Health initiatives can have a long-lasting, sustainable impact on employee well-being, but healthy habits do not develop overnight. The company is continuously evaluating new opportunities for programs that help address factors that influence health-related behaviors, which can have a long-lasting impact on an employee’s well-being. We support vaccination programs to encourage employees to maintain their health and the health of their coworkers and communities. Dana understands the needs of individuals are unique and continues to offer initiatives spanning the spectrum of health and wellness to help provide a supportive work environment where employees strive for balance in their lives. We have enhanced our employee assistance programs around the world to support the emotional, physical and financial needs of our employees. Our program includes the traditional employee assistance services, but also gives employees access to legal services, dependent care support, financial advice, and mindfulness programs, such as meditation, positivity training tools, and inspirational videos to help manage anxiety, depression, stress, sleep and more.

We encourage you to review the “Empowering People” section of our annual Sustainability and Social Responsibility Report (located on our website) for more detailed information regarding our Human Capital programs and initiatives. Nothing on our website, including our annual Sustainability and Social Responsibility Report or sections thereof, shall be deemed incorporated by reference into this Annual Report.

Environmental Compliance

We make capital expenditures in the normal course of business as necessary to ensure that our facilities are in compliance with applicable environmental laws and regulations. The cost of environmental compliance has not been a material part of capital expenditures and did not have a material adverse effect on our earnings or competitive position in 2023.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 as amended (Exchange Act) are available, free of charge, on or through our Internet website at http://www.dana.com/investors as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC. Copies of any materials we file with the SEC can also be obtained free of charge through the SEC’s website at http://www.sec.gov. We also post our Corporate Governance Guidelines, Standards of Business Conduct for Members of the Board of Directors, Board Committee membership lists and charters, Standards of Business Conduct and other corporate governance materials on our Internet website. Copies of these posted materials are also available in print, free of charge, to any stockholder upon request from: Dana Incorporated, Investor Relations, P.O. Box 1000, Maumee, Ohio 43537, or via telephone in the U.S. at 800-537-8823 or e-mail at InvestorRelations@dana.com. The inclusion of our website address in this report is an inactive textual reference only and is not intended to include or incorporate by reference the information on our website into this report.

We are impacted by events and conditions that affect the light vehicle, commercial vehicle and off-highway markets that we serve, as well as by factors specific to Dana. Among the risks that could materially adversely affect our business, financial condition or results of operations are the following, many of which are interrelated.

Risk Factors Related to the Markets We Serve

A downturn in the global economy could have a substantial adverse effect on our business.

Our business is tied to general economic and industry conditions as demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit and the cost of fuel. These factors have had and could continue to have a substantial impact on our business. Adverse global economic conditions could also cause our customers and suppliers to experience severe economic constraints in the future, including bankruptcy, which could have a material adverse impact on our financial position and results of operations.

Our results of operations could be adversely affected by climate change, natural catastrophes or public health crises, in the locations in which we, our customers or our suppliers operate.

There is global scientific consensus that emissions of greenhouse gases (GHG) continue to alter the composition of Earth’s atmosphere in ways that are affecting and are expected to continue to affect the global climate. These considerations may lead to new international, national, regional, or local legislative or regulatory responses. Various stakeholders, including legislators and regulators, shareholders, and non-governmental organizations, as well as companies in many business sectors, including Dana, are continuing to look for ways to reduce GHG emissions. The regulation of GHG emissions from certain stationary or mobile sources or the imposition of carbon pricing mechanisms could result in additional costs to Dana in the form of taxes or emission allowances, facilities improvements, and energy costs, which would increase Dana’s operating costs through higher utility, transportation, and materials costs. Because the impact of any future climate change-related legislative, regulatory, or product standard requirements on Dana’s global businesses and products is dependent on the timing and design of mandates or standards, Dana is unable to predict their potential impact at this time. The potential physical impacts of climate change on Dana’s facilities, suppliers, and customers and therefore on Dana’s operations are highly uncertain and will be particular to the circumstances developing in various geographic regions. These may include extreme weather events and long-term changes in temperature levels and water availability. These potential physical effects may adversely affect the demand for Dana’s products and the cost, production, sales, and financial performance of Dana’s operations.

A natural disaster could disrupt our operations, or our customers’ or suppliers’ operations and could adversely affect our results of operations and financial condition. Although we have continuity plans designed to mitigate the impact of natural disasters on our operations, those plans may be insufficient, and any catastrophe may disrupt our ability to manufacture and deliver products to our customers, resulting in an adverse impact on our business and results of operations.

In addition, our global operations expose us to risks associated with public health crises, such as epidemics and pandemics, which could harm our business and cause our operating results to suffer. Pandemics, such as the novel coronavirus disease (COVID) pandemic, may have an adverse effect on our business, results of operations, cash flows and financial condition. Efforts to combat a pandemic can be complicated by viral variants and uneven access to, and acceptance and effectiveness of, vaccines globally. Pandemics may negatively impact the global economy, disrupt our operations as well as those of our customers, suppliers, and the global supply chains in which we participate, and create significant volatility and disruption of financial markets. The extent of the impact of a pandemic on our business and financial performance, including our ability to execute our near-term and long-term operational, strategic, and capital structure initiatives, will depend on the duration and severity of the pandemic, which are uncertain and cannot be predicted.

We may face facility closure requirements and other operational restrictions with respect to some or all of our locations for prolonged periods of time due to, among other factors, evolving and increasingly stringent governmental restrictions including public health directives, quarantine policies or social distancing measures. We operate as part of the complex integrated global supply chains of our largest customers. As a pandemic dissipates at varying times and rates in different regions around the world, there could be a prolonged negative impact on these global supply chains. Our ability to continue operations at specific facilities will be impacted by the interdependencies of the various participants of these global supply chains, which are largely beyond our direct control. A prolonged shut down of these global supply chains would have a material adverse effect on our business, results of operations, cash flows and financial condition.

Rising interest rates could have a substantial adverse effect on our business

Rising interest rates could have a dampening effect on overall economic activity, the financial condition of our customers and the financial condition of the end customers who ultimately create demand for the products we supply, all of which could negatively affect demand for our products. An increase in interest rates could make it difficult for us to obtain financing at attractive rates, impacting our ability to execute on our growth strategies or future acquisitions.

We could be adversely impacted by the loss of any of our significant customers, changes in their requirements for our products or changes in their financial condition.

We are reliant upon sales to several significant customers. Sales to our ten largest customers accounted for 55% of our overall sales in 2023. Changes in our business relationships with any of our large customers or in the timing, size and continuation of their various programs could have a material adverse impact on us.

The loss of any of these customers, the loss of business with respect to one or more of their vehicle models on which we have high component content, or a significant decline in the production levels of such vehicles would negatively impact our business, results of operations and financial condition. Pricing pressure from our customers also poses certain risks. Inability on our part to offset pricing concessions with cost reductions would adversely affect our profitability. We are continually bidding on new business with these customers, as well as seeking to diversify our customer base, but there is no assurance that our efforts will be successful. Further, to the extent that the financial condition of our largest customers deteriorates, including possible bankruptcies, mergers or liquidations, or their sales otherwise decline, our financial position and results of operations could be adversely affected.

We may be adversely impacted by changes in international legislative and political conditions.

We operate in 31 countries around the world and we depend on significant foreign suppliers and customers. Further, we have several growth initiatives that are targeting emerging markets like China and India. Legislative and political activities within the countries where we conduct business, particularly in emerging markets and less developed countries, could adversely impact our ability to operate in those countries. The political situation in a number of countries in which we operate could create instability in our contractual relationships with no effective legal safeguards for resolution of these issues, or potentially result in the seizure of our assets. We operate in Argentina, where trade-related initiatives and other government restrictions limit our ability to optimize operating effectiveness. At December 31, 2023, our net asset exposure related to Argentina was approximately $50, including $20 of net fixed assets.

We may be adversely impacted by changes in trade policies and proposed or imposed tariffs, including but not limited to, the imposition of new tariffs by the U.S. government on imports to the U.S. and/or the imposition of retaliatory tariffs by foreign countries.

Section 232 of the Trade Expansion Act of 1962, as amended (the Trade Act), gives the executive branch of the U.S. government broad authority to restrict imports in the interest of national security by imposing tariffs. Tariffs imposed on imported steel and aluminum could raise the costs associated with manufacturing our products. We work with our customers to recover a portion of any increased costs, and with our suppliers to defray costs, associated with tariffs. While we have been successful in the past recovering a significant portion of costs increases, there is no assurance that cost increases resulting from trade policies and tariffs will not adversely impact our profitability. Our sales may also be adversely impacted if tariffs are assessed directly on the products we produce or on our customers’ products containing content sourced from us.

We may be adversely impacted by the strength of the U.S. dollar relative to the currencies in the other countries in which we do business.

Approximately 57% of our sales in 2023 were from operations located in countries other than the U.S. Currency variations can have an impact on our results (expressed in U.S. dollars). Currency variations can also adversely affect margins on sales of our products in countries outside of the U.S. and margins on sales of products that include components obtained from affiliates or other suppliers located outside of the U.S. Strengthening of the U.S. dollar against the euro and currencies of other countries in which we have operations could have an adverse effect on our results reported in U.S. dollars. We use a combination of natural hedging techniques and financial derivatives to mitigate foreign currency exchange rate risks. Such hedging activities may be ineffective or may not offset more than a portion of the adverse financial impact resulting from currency variations.

We may be adversely impacted by new laws, regulations or policies of governmental organizations related to increased fuel economy standards and reduced greenhouse gas emissions, or changes in existing ones.

The markets and customers we serve are subject to substantial government regulation, which often differs by state, region and country. These regulations, and proposals for additional regulation, are advanced primarily out of concern for the environment (including concerns about global climate change and its impact) and energy independence. We anticipate that the number and extent of these regulations, and the costs to comply with them, will increase significantly in the future.

In the U.S., vehicle fuel economy and greenhouse gas emissions are regulated under a harmonized national program administered by the National Highway Traffic Safety Administration and the Environmental Protection Agency (EPA). Other governments in the markets we serve are also creating new policies to address these same issues, including the European Union, Brazil, China and India. These government regulatory requirements could significantly affect our customers by altering their global product development plans and substantially increasing their costs, which could result in limitations on the types of vehicles they sell and the geographical markets they serve. Any of these outcomes could adversely affect our financial position and results of operations.

Company-Specific Risk Factors

We have taken, and continue to take, cost-reduction actions. Although our process includes planning for potential negative consequences, the cost-reduction actions may expose us to additional production risk and could adversely affect our sales, profitability and ability to retain and attract employees.

We have been reducing costs in all of our businesses and have discontinued product lines, exited businesses, consolidated manufacturing operations and positioned operations in lower cost locations. The impact of these cost-reduction actions on our sales and profitability may be influenced by many factors including our ability to successfully complete these ongoing efforts, our ability to generate the level of cost savings we expect or that are necessary to enable us to effectively compete, delays in implementation of anticipated workforce reductions, decline in employee morale and the potential inability to meet operational targets due to our inability to retain or recruit key employees.

We depend on our subsidiaries for cash to satisfy the obligations of the company.

Our subsidiaries conduct all of our operations and own substantially all of our assets. Our cash flow and our ability to meet our obligations depend on the cash flow of our subsidiaries. In addition, the payment of funds in the form of dividends, intercompany payments, tax sharing payments and otherwise may be subject to restrictions under the laws of the countries of incorporation of our subsidiaries or the by-laws of the subsidiary.

Labor stoppages or work slowdowns at Dana, key suppliers or our customers could result in a disruption in our operations and have a material adverse effect on our businesses.

We and our customers rely on our respective suppliers to provide parts needed to maintain production levels. We all rely on workforces represented by labor unions. Workforce disputes that result in work stoppages or slowdowns could disrupt operations of all of these businesses, which in turn could have a material adverse effect on the supply of, or demand for, the products we supply our customers.

We could be adversely affected if we are unable to recover portions of commodity (including costs of steel and other raw materials), labor, transportation and energy costs from our customers.

Commodity, labor, transportation and energy costs have been volatile over the past several of years creating pressure on our profit margins. We continue to work with our customers to recover a portion of our material cost increases. While we have been successful in the past recovering a significant portion of such cost increases, there is no assurance that increases in commodity costs, which can be impacted by a variety of factors, including changes in trade laws and tariffs, will not adversely impact our profitability in the future. We may also experience labor shortages in certain geographies and increased competition for qualified candidates. These shortages could adversely affect our ability to meet customer demand and increase labor costs, which would reduce our profitability. Standard freight may increase due to shipping container and truck driver shortages and port congestion attributable to global supply chain disruptions resulting from regional and global pandemics and conflicts. We may also incur significant premium freight, resulting from frequent changes in customer order patterns. If we are unable to pass labor, transportation and energy cost increases on to our customer base or otherwise mitigate the costs, our profit margin could be adversely affected.

We could be adversely affected if we experience shortages of components from our suppliers or if disruptions in the supply chain lead to parts shortages for our customers.

A substantial portion of our annual cost of sales is driven by the purchase of goods and services. To manage and minimize these costs, we have been consolidating our supplier base. As a result, we are dependent on single sources of supply for some components of our products. We select our suppliers based on total value (including price, delivery and quality), taking into consideration their production capacities and financial condition, and we expect that they will be able to support our needs. However, there is no assurance that adverse financial conditions, including bankruptcies of our suppliers, reduced levels of production, natural disasters or other problems experienced by our suppliers will not result in shortages or delays in their supply of components to us or even in the financial collapse of one or more such suppliers. If we were to experience a significant or prolonged shortage of critical components from any of our suppliers, particularly those who are sole sources, and were unable to procure the components from other sources, we would be unable to meet our production schedules for some of our key products and to ship such products to our customers in a timely fashion, which would adversely affect our sales, profitability and customer relations.

Adverse economic conditions, natural disasters and other factors can similarly lead to financial distress or production problems for other suppliers to our customers which can create disruptions to our production levels. Any such supply-chain induced disruptions to our production are likely to create operating inefficiencies that will adversely affect our sales, profitability and customer relations.

Our profitability and results of operations may be adversely affected by program launch difficulties.

The launch of new business is a complex process, the success of which depends on a wide range of factors, including the production readiness of our manufacturing facilities and manufacturing processes and those of our suppliers, as well as factors related to tooling, equipment, employees, initial product quality and other factors. Our failure to successfully launch material new or takeover business could have an adverse effect on our profitability and results of operations.

We use important intellectual property in our business. If we are unable to protect our intellectual property or if a third party makes assertions against us or our customers relating to intellectual property rights, our business could be adversely affected.

We own important intellectual property, including patents, trademarks, copyrights and trade secrets, and are involved in numerous licensing arrangements. Our intellectual property plays an important role in maintaining our competitive position in a number of the markets that we serve. Our competitors may develop technologies that are similar or superior to our proprietary technologies or design around the patents we own or license. Further, as we expand our operations in jurisdictions where the protection of intellectual property rights is less robust, the risk of others duplicating our proprietary technologies increases, despite efforts we undertake to protect them. Developments or assertions by or against us relating to intellectual property rights, and any inability to protect these rights, could have a material adverse impact on our business and our competitive position.

We could encounter unexpected difficulties integrating acquisitions and operating joint ventures.

We acquired businesses in recent years, and we may complete additional acquisitions and investments in the future that complement or expand our businesses. The success of this strategy will depend on our ability to successfully complete these transactions or arrangements, to integrate the businesses acquired in these transactions and to develop satisfactory working arrangements with our strategic partners in the joint ventures. We could encounter unexpected difficulties in completing these transactions and integrating the acquisitions with our existing operations. We also may not realize the degree or timing of benefits anticipated when we entered into a transaction.

Several of our joint ventures operate pursuant to established agreements and, as such, we do not unilaterally control the joint venture. There is a risk that the partners’ objectives for the joint venture may not be aligned with ours, leading to potential differences over management of the joint venture that could adversely impact its financial performance and consequent contribution to our earnings. Additionally, inability on the part of our partners to satisfy their contractual obligations under the agreements could adversely impact our results of operations and financial position. Certain of our joint venture partners have the ability to put their ownership interests to Dana at fair value. If a joint venture partner were to put its ownership interest to Dana, it could cause Dana to outlay significant amounts of cash to purchase the joint venture partner's ownership interest in addition to increased future cash outlays required to fund 100% of the operations on a go-forward basis, reducing available funds for other strategic initiatives and capital investments.

We could be adversely impacted by the costs of environmental, health, safety and product liability compliance.

Our operations are subject to environmental laws and regulations in the U.S. and other countries that govern emissions to the air; discharges to water; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties. Historically, environmental costs related to our former and existing operations have not been material. However, there is no assurance that the costs of complying with current environmental laws and regulations, or those that may be adopted in the future, will not increase and adversely impact us.

There is also no assurance that the costs of complying with current laws and regulations, or those that may be adopted in the future, that relate to health, safety and product liability matters will not adversely impact us. There is also a risk of warranty and product liability claims, as well as product recalls, if our products fail to perform to specifications or cause property damage, injury or death. (See Notes 15 and 16 to our consolidated financial statements in Item 8 for additional information on product liabilities and warranties.)

A failure of our information technology infrastructure could adversely impact our business and operations.

We recognize the increasing volume of cyber attacks and employ commercially practical efforts to provide reasonable assurance that the risks of such attacks are appropriately mitigated. Each year, we evaluate the threat profile of our industry to stay abreast of trends and to provide reasonable assurance our existing countermeasures will address any new threats identified. Despite our implementation of security measures, our IT systems and those of our service providers are vulnerable to circumstances beyond our reasonable control including acts of terror, acts of government, natural disasters, civil unrest and denial of service attacks which may lead to the theft of our intellectual property, trade secrets or business disruption. To the extent that any disruption or security breach results in a loss or damage to our data or an inappropriate disclosure of confidential information, it could cause significant damage to our reputation, affect our relationships with our customers, suppliers and employees, lead to claims against the company and ultimately harm our business. Additionally, we may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

We participate in certain multi-employer pension plans which are not fully funded.

We contribute to certain multi-employer defined benefit pension plans for certain of our union-represented employees in the U.S. in accordance with our collective bargaining agreements. Contributions are based on hours worked except in cases of layoff or leave where we generally contribute based on 40 hours per week for a maximum of one year. The plans are not fully funded as of December 31, 2023. We could be held liable to the plans for our obligation, as well as those of other employers, due to our participation in the plans. Contribution rates could increase if the plans are required to adopt a funding improvement plan, if the performance of plan assets does not meet expectations or as a result of future collectively bargained wage and benefit agreements. (See Note 12 to our consolidated financial statements in Item 8 for additional information on multi-employer pension plans.)

Changes in interest rates and asset returns could increase our pension funding obligations and reduce our profitability.

We have unfunded obligations under certain of our defined benefit pension and other postretirement benefit plans. The valuation of our future payment obligations under the plans and the related plan assets are subject to significant adverse changes if the credit and capital markets cause interest rates and projected rates of return to decline. Such declines could also require us to make significant additional contributions to our pension plans in the future. A material increase in the unfunded obligations of these plans could also result in a significant increase in our pension expense in the future.

We may incur additional tax expense or become subject to additional tax exposure.

Our provision for income taxes and the cash outlays required to satisfy our income tax obligations in the future could be adversely affected by numerous factors. These factors include changes in the level of earnings in the tax jurisdictions in which we operate, changes in the valuation of deferred tax assets and liabilities, changes in our plans to repatriate the earnings of our non-U.S. operations to the U.S. and changes in tax laws and regulations.

Our income tax returns are subject to examination by federal, state and local tax authorities in the U.S. and tax authorities outside the U.S. The results of these examinations and the ongoing assessments of our tax exposures could also have an adverse effect on our provision for income taxes and the cash outlays required to satisfy our income tax obligations.

An inability to provide products with the technology required to satisfy customer requirements would adversely impact our ability to successfully compete in our markets.

The vehicular markets in which we operate are undergoing significant technological change, with increasing focus on electrified and autonomous vehicles. These and other technological advances could render certain of our products obsolete. Maintaining our competitive position is dependent on our ability to develop commercially-viable products and services that support the future technologies embraced by our customers.

We could be adversely impacted by increased competition in the markets we serve.

The mobility industry is beginning to shift away from petroleum fuel vehicles ("ICE" vehicles) and migrate to alternate fuel vehicles (as a group "EV-based vehicles"). As the market transitions from ICE vehicles to EV-based vehicles, the Company anticipates its content per vehicle opportunity will increase up to three-fold on a dollar basis. The Company's primary driveline content on ICE vehicles includes axles and driveshafts. As the market transitions to EV-based vehicles we anticipate losing driveshaft content but adding additional driveline content in the form of gearboxes, e-motors, e-axles, power electronics, and software controls. We anticipate a similar three-fold opportunity in thermal and sealing products, as current ICE-vehicle content is replaced with EV-based vehicle content including metallic bipolar plates, battery cold plates and power electronic cooling modules. With the increased content opportunity presented by EV-based vehicles, we are beginning to see increased competition when it comes to bidding on new customer programs. The number of competitors bidding on EV-based vehicle programs is higher than what we historically experienced on ICE vehicle programs. In addition, our OEM customers continue to assess which EV-based components they will vertically integrate and for which programs. A significant increase in competition for EV-based vehicle programs from existing and new market entrants could negatively impact our sales and profitability. A significant increase in vertical integration of EV-based vehicle components by our OEM customers could negatively impact our sales and profitability.

We could be adversely impacted by an extended transition period away from petroleum fuel vehicles to alternate fuel vehicles.

As the market transitions from ICE vehicles to EV-based vehicles, we will continue to experience elevated levels of research and development costs, capital investment and inventory levels. During the transition period, we will need to maintain production capacity to meet both ICE and EV-related customer demand, requiring incremental capital investment and reducing our ability to operate at scale. In addition, we will need to maintain incremental levels of inventory to satisfy ICE and EV-related customer demand, as raw materials and components used in the production of ICE and EV-related products are largely unique. An extended transition period could negatively impact our profitability, cash flows and financial position.

Failure to appropriately anticipate and react to the cyclical and volatile nature of production rates and customer demands in our business can adversely impact our results of operations.

Our financial performance is directly related to production levels of our customers. In several of our markets, customer production levels are prone to significant cyclicality, influenced by general economic conditions, changing consumer preferences, regulatory changes, and other factors. Oftentimes the rapidity of the downcycles and upcycles can be severe. Successfully executing operationally during periods of extreme downward and upward demand pressures can be challenging. Our inability to recognize and react appropriately to the production cycles inherent in our markets can adversely impact our operating results.

Our continued success is dependent on being able to retain and attract requisite talent.

Sustaining and growing our business requires that we continue to retain, develop and attract people with the requisite skills. With the vehicles of the future expected to undergo significant technological change, having qualified people savvy in the right technologies will be a key factor in our ability to develop the products necessary to successfully compete in the future. As a global organization, we are also dependent on our ability to attract and maintain a diverse work force that is fully engaged supporting our company’s objectives and initiatives.

Failure to maintain effective internal controls could adversely impact our business, financial condition and results of operations.

Regulatory provisions governing the financial reporting of U.S. public companies require that we maintain effective disclosure controls and internal controls over financial reporting across our operations in 31 countries. Effective internal controls are designed to provide reasonable assurance of compliance, and, as such, they can be susceptible to human error, circumvention or override, and fraud. Failure to maintain adequate, effective internal controls could result in potential financial misstatements or other forms of noncompliance that have an adverse impact on our results of operations, financial condition or organizational reputation.

Our working capital requirements may negatively affect our liquidity.

Our working capital requirements can vary significantly, depending in part on the level, variability and timing of our customers’ orders and production schedules and availability of raw materials and components from our suppliers. As production volumes increase, our working capital requirements to support the higher volumes generally increase. If our working capital needs exceed our cash flows from operations, we look to our cash and cash equivalents balances and unused capacity of our Revolving Facility to satisfy those needs, as well as other potential sources of additional capital, which may not be available on satisfactory terms or in adequate amounts.

Developments in the financial markets or downgrades to Dana's credit rating could restrict our access to capital and increase financing costs.

At December 31, 2023, Dana had consolidated debt obligations of $2,679, with cash and cash equivalents of $529 and unused revolving credit capacity of $1,141. Our ability to grow the business and satisfy debt service obligations is dependent, in part, on our ability to gain access to capital at competitive costs. External factors beyond our control can adversely affect capital markets – either tightening availability of capital or increasing the cost of available capital. Failure on our part to maintain adequate financial performance and appropriate credit metrics can also affect our ability to access capital at competitive prices.

Increased scrutiny from the public, investors, and others regarding our environmental, social, and governance ("ESG") practices could impact our reputation.

We have a board committee and an executive officer position with responsibility for sustainability, additional dedicated employee resources, a cross-functional/business sustainability leadership team to further develop and implement an enterprise-wide sustainability strategy, and we have published a sustainability report. Our sustainability report includes our policies and practices on a variety of ESG matters, including the value creation opportunities provided by our products; diversity, equity, and inclusion; employee health and safety; community giving; and human capital management. These efforts may result in increased investor, media, employee, and other stakeholder attention to such initiatives, and such stakeholders may not be satisfied with our ESG practices or initiatives. Additionally, organizations that inform investors on ESG matters have developed rating systems for evaluating companies on their approach to ESG. Unfavorable ratings may lead to negative investor sentiment, which could negatively impact our stock price and our ability to access capital at competitive prices. Any failure, or perceived failure, to respond to ESG concerns could harm our business and reputation.

Risk Factors Related to our Securities

Provisions in our Restated Certificate of Incorporation and Bylaws may discourage a takeover attempt.

Certain provisions of our Restated Certificate of Incorporation and Bylaws, as well as the General Corporation Law of the State of Delaware, may have the effect of delaying, deferring or preventing a change in control of Dana. Such provisions, including those governing the nomination of directors, limiting who may call special stockholders’ meetings and eliminating stockholder action by written consent, may make it more difficult for other persons, without the approval of our board of directors, to make a tender offer or otherwise acquire substantial amounts of common stock or to launch other takeover attempts that a stockholder might consider to be in such stockholder’s best interest.

Item 1B. Unresolved Staff Comments

None.

Dana maintains a risk management program overseen by our Executive Leadership Team. Our Senior Vice President and Chief Financial Officer and Senior Vice President, General Counsel and Secretary / Chief Compliance and Sustainability Officer (General Counsel) have responsibility for our risk management program. In addition, our Business Unit Presidents and functional leads oversee strategic and operational risks, including cybersecurity risks. Cybersecurity is a top priority, and our cybersecurity program is driven by our commitment to maintaining a strong security architecture, active governance, and robust controls. Our cybersecurity program is led by our Director of Cybersecurity and GRC (DOC) and overseen by Dana’s Enterprise Cybersecurity Steering Committee (ECSC). The ECSC is sponsored by senior leaders from disciplines such as Information Technology, Legal, Human Resources, Engineering, Product Development, and Operations, and includes the Senior Vice President and Chief Information Officer (CIO); General Counsel; Senior Vice President and Chief Human Resources Officer; Senior Vice President and Chief Technology Officer; and Senior Vice President Global Operations. The ECSC is responsible for developing and overseeing strategies related to Dana’s cybersecurity program. As set forth in its charter, our Technology & Sustainability Committee, comprised of independent directors, has oversight responsibilities for cybersecurity risk and includes members with significant cybersecurity experience. The DOC and CIO regularly provide updates on Dana’s cybersecurity program to the Board and the Technology & Sustainability Committee.

Dana’s global cybersecurity team is charged with executing enterprise, product, and manufacturing cybersecurity programs and policies with a focus on security architecture, penetration testing, cyber risk management, incident response, vulnerability management, intelligence, awareness and training, and governance. Dana’s cybersecurity programs utilize the National Institute of Standards and Technology (NIST) Cybersecurity Framework and leverage the International Organization for Standardization (ISO) 27001 standard for information security. Dana periodically contracts with external auditing firms to assess the maturity of Dana’s cybersecurity program against the NIST Cybersecurity Framework. The results of these audits are shared with the Technology & Sustainability Committee. Dana leverages independent security ratings services assessments to aid in measuring our progress along the cybersecurity continuum as well as for measurement against peer companies. Dana’s supplier risk management process incorporates cybersecurity review and assessment procedures over third-party vendors and service providers.

Dana has an established cybersecurity awareness training program. Formal training on topics relating to cybersecurity is mandatory at least annually for all employees with access to the Company’s network. Training is administered and tracked through online learning modules. Training topics include how to escalate suspicious activities including phishing, viruses, spams, insider threats, suspect human behaviors or safety issues. Training is supplemented by phishing awareness campaigns.

In the event a high-risk cybersecurity incident is identified, our Incident Response Team will coordinate the response in accordance with our Information Security Incident Response Plan and make necessary communications to the ECSC and executive leadership. The DOC and CIO will make any required communications to the Chief Executive Officer (CEO), with the CEO making any required communications to the Board and Technology & Sustainability Committee. Our CEO, Chief Financial Officer, General Counsel and CIO are responsible for assessing such incidents for materiality, ensuring that any required notification or communication occurs and determining, among other things, whether any prohibition on the trading of our common stock by insiders should be imposed prior to the disclosure of information about a material cybersecurity event.

In the last three years we have not experienced any cybersecurity incident that has been material to the results of our operations or that has caused us to incur any material expenses.

|

|

Light |

Commercial |

|

Power |

Total |

|||||||||||||||

| Manufacturing and assembly plants |

31 | 19 | 19 | 19 | 88 | |||||||||||||||

As of December 31, 2023, we had eighty-eight major manufacturing and assembly plants. In addition, we had nine aftermarket sales and services facilities supporting our mobility customers and twenty-two service and assembly facilities supporting our stationary equipment customers. We maintain eleven stand-alone technical and engineering centers in addition to fourteen technical and engineering centers housed within our manufacturing and assembly plants.

Our world headquarters is located in Maumee, Ohio. This facility and other facilities in the greater Detroit, Michigan and Maumee, Ohio areas house functions that have global or North American regional responsibility for finance and accounting, tax, treasury, risk management, legal, human resources, procurement and supply chain management, communications and information technology. We operate numerous other management, marketing and administrative facilities globally.

We are a party to various pending judicial and administrative proceedings that arose in the ordinary course of business. After reviewing the currently pending lawsuits and proceedings (including the probable outcomes, reasonably anticipated costs and expenses and our established reserves for uninsured liabilities), we do not believe that any liabilities that may result from these proceedings are reasonably likely to have a material adverse effect on our liquidity, financial condition or results of operations. Legal proceedings are also discussed in Note 15 to our consolidated financial statements in Item 8.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market information — Our common stock trades on the New York Stock Exchange (NYSE) under the symbol "DAN."

Holders of common stock — Based on reports by our transfer agent, there were approximately 2,370 registered holders of our common stock on February 2, 2024.

Reference is made to the Equity Compensation Plan Information section of Item 12 for certain information regarding our equity compensation plans.

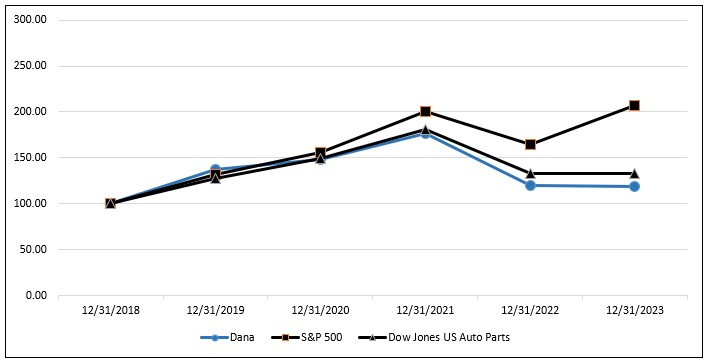

Stockholder return — The following graph shows the cumulative total shareholder return for our common stock since December 31, 2018. The graph compares our performance to that of the Standard & Poor’s 500 Stock Index (S&P 500) and the Dow Jones US Auto Parts Index. The comparison assumes $100 was invested at the closing price on December 31, 2018. Each of the returns shown assumes that all dividends paid were reinvested.

Performance chart

Index

| 12/31/2018 |

12/31/2019 |

12/31/2020 |

12/31/2021 |

12/31/2022 |

12/31/2023 |

|||||||||||||||||||

| Dana Incorporated |

$ | 100.00 | $ | 136.92 | $ | 148.28 | $ | 176.24 | $ | 119.72 | $ | 118.86 | ||||||||||||

| S&P 500 |

100.00 | 131.49 | 155.68 | 200.37 | 164.08 | 207.21 | ||||||||||||||||||

| Dow Jones US Auto Parts Index |

100.00 | 127.43 | 149.74 | 181.18 | 133.28 | 133.22 | ||||||||||||||||||

Issuer's purchases of equity securities — Our common stock share repurchase program expired on December 31, 2023. No shares of our common stock were repurchased under the program during the fourth quarter of 2023.

Trading arrangements — During the three months ended December 31, 2023, of the Company’s directors or executive officers adopted, modified or terminated any contract, instruction or written plan for the purchase or sale of Company securities that was intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) or any non-Rule 10b5-1 trading agreement.

Annual meeting — We will hold an annual meeting of shareholders on April 24, 2024.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (Dollars in millions)

Discussion and analysis of our results of operations pertaining to 2022 compared to 2021 not included in this Form 10-K can be found in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" of our Annual Report on Form 10-K for the year ended December 31, 2022. The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the financial statements and accompanying notes in Item 8.

Management Overview