UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form

For the Fiscal Year Ended:

OR

For the Transition Period From to

Commission File Number:

Dana Incorporated

(Exact name of registrant as specified in its charter)

| | |

| (State of incorporation) | (IRS Employer Identification Number) |

| | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.:

| | ☑ |

|

| Accelerated filer | ☐ |

| Non-accelerated filer | ☐ |

| Smaller reporting company | | |

|

|

|

|

| Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the common stock held by non-affiliates of the registrant computed by reference to the closing price of the common stock on June 30, 2020 was $

There were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to stockholders in connection with the Annual Meeting of Shareholders to be held on April 21, 2021 are incorporated by reference into Part III.

FORM 10-K

YEAR ENDED December 31, 2020

Table of Contents

|

|

|

Pages |

| PART I |

|

|

| Item 1 |

||

| Item 1A |

||

| Item 1B |

||

| Item 2 |

||

| Item 3 |

||

|

|

|

|

| PART II |

|

|

| Item 5 |

||

| Item 6 |

||

| Item 7 |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

| Item 7A |

||

| Item 8 |

||

| Item 9 |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

| Item 9A |

||

| Item 9B |

||

|

|

|

|

| PART III |

|

|

| Item 10 |

||

| Item 11 |

||

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

| Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

|

| Item 14 |

||

|

|

|

|

| PART IV |

|

|

| Item 15 |

||

|

|

|

|

|

|

||

Forward-Looking Information

Statements in this report (or otherwise made by us or on our behalf) that are not entirely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often be identified by words such as “anticipates,” “expects,” “believes,” “intends,” “plans,” “predicts,” “seeks,” “estimates,” “projects,” “outlook,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing” and similar expressions, variations or negatives of these words. These statements represent the present expectations of Dana Incorporated and its consolidated subsidiaries based on our current information and assumptions. Forward-looking statements are inherently subject to risks and uncertainties. Our plans, actions and actual results could differ materially from our present expectations due to a number of factors, including those discussed below and elsewhere in this report and in our other filings with the Securities and Exchange Commission (SEC). All forward-looking statements speak only as of the date made and we undertake no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of this report.

PART I

(Dollars in millions, except per share amounts)

General

Dana Incorporated (Dana) is headquartered in Maumee, Ohio and was incorporated in Delaware in 2007. We are a world leader in providing power-conveyance and energy-management solutions for vehicles and machinery. The company's portfolio improves the efficiency, performance, and sustainability of light vehicles, commercial vehicles, and off-highway equipment. From axles, driveshafts, and transmissions to electrodynamic, thermal, sealing and digital solutions, the company enables the propulsion of conventional, hybrid, and electric-powered vehicles by supplying nearly every major vehicle and engine manufacturer in the world. We also serve the stationary industrial market. As of December 31, 2020 we employed approximately 38,200 people, operated in 33 countries and had 141 major facilities around the world.

The terms “Dana,” “we,” “our” and “us” are references to Dana. These references include the subsidiaries of Dana unless otherwise indicated or the context requires otherwise.

Overview of our Business

We have aligned our organization around four operating segments: Light Vehicle Drive Systems (Light Vehicle), Commercial Vehicle Drive and Motion Systems (Commercial Vehicle), Off-Highway Drive and Motion Systems (Off-Highway) and Power Technologies. These operating segments have global responsibility and accountability for business commercial activities and financial performance.

External sales by operating segment for the years ended December 31, 2020, 2019 and 2018 are as follows:

| 2020 |

2019 |

2018 |

||||||||||||||||||||||

| Dollars |

% of Total |

Dollars |

% of Total |

Dollars |

% of Total |

|||||||||||||||||||

| Light Vehicle |

$ | 3,038 | 42.8 | % | $ | 3,609 | 41.9 | % | $ | 3,575 | 43.9 | % | ||||||||||||

| Commercial Vehicle |

1,181 | 16.6 | % | 1,611 | 18.7 | % | 1,612 | 19.8 | % | |||||||||||||||

| Off-Highway |

1,970 | 27.7 | % | 2,360 | 27.4 | % | 1,844 | 22.6 | % | |||||||||||||||

| Power Technologies |

917 | 12.9 | % | 1,040 | 12.0 | % | 1,112 | 13.7 | % | |||||||||||||||

| Total |

$ | 7,106 | $ | 8,620 | $ | 8,143 | ||||||||||||||||||

Refer to Segment Results of Operations in Item 7 and Note 21 to our consolidated financial statements in Item 8 for further financial information about our operating segments.

Our business is diversified across end-markets, products and customers. The following table summarizes the markets, products and largest customers of each of our operating segments as of December 31, 2020:

| Segment |

Markets |

Products |

Largest |

|

|

|

|

|

| Light Vehicle |

Light vehicle market: |

Axles |

Ford Motor Company |

|

|

Light trucks (full frame) |

Driveshafts |

Fiat Chrysler Automobiles* |

|

|

Sport utility vehicles |

Transmissions |

Toyota Motor Company |

|

|

Crossover utility vehicles |

e-Axles |

Renault-Nissan-Mitsubishi |

|

|

Vans |

Electrodynamic and |

Alliance |

|

|

Passenger cars |

drivetrain components |

General Motors Company |

|

|

|

|

Tata Motors / Jaguar Land |

|

|

|

|

Rover |

|

|

|

|

|

|

|

|

|

|

| Commercial Vehicle |

Medium/heavy vehicle market: |

Axles |

PACCAR Inc |

|

|

Medium duty trucks |

Driveshafts |

Traton Group |

|

|

Heavy duty trucks |

e-Axles |

AB Volvo |

|

|

Buses |

e-Transmissions |

Navistar International Corp. |

|

|

Specialty vehicles |

Electrodynamic and |

Daimler AG |

|

|

|

drivetrain components |

Ford Motor Company |

| Electric vehicle integration | |||

| services | |||

|

|

|

Software as a service |

|

|

|

|

|

|

|

|

|

|

|

| Off-Highway |

Off-Highway market: |

Axles |

Deere & Company |

|

|

Construction |

Driveshafts |

CNH Industrial N.V. |

|

|

Earth moving |

Transmissions |

AGCO Corporation |

|

|

Agricultural |

Planetary hub drives |

Oshkosh Corporation |

|

|

Mining |

e-Axles |

Manitou Group |

|

|

Forestry |

e-Drives |

Sany Group |

|

|

Material handling |

Electrodynamic, hydraulic |

|

|

|

Industrial stationary |

and drivetrain components |

|

|

|

|

|

|

|

|

|

|

|

| Power Technologies |

Light vehicle market |

Gaskets |

Ford Motor Company |

|

|

Medium/heavy vehicle market |

Cover modules |

General Motors Company |

|

|

Off-Highway market |

Heat shields |

Volkswagen AG |

|

|

|

Engine sealing systems |

(including Traton Group) |

|

|

|

Cooling |

Cummins Inc. |

| Heat transfer products | Fiat Chrysler Automobiles | ||

|

|

|

|

Caterpillar Inc. |

|

|

|

|

|

* Via a directed supply relationship

Geographic Operations

We maintain administrative and operational organizations in North America, Europe, South America and Asia Pacific to support our operating segments, assist with the management of affiliate relations and facilitate financial and statutory reporting and tax compliance on a worldwide basis. Our operations are located in the following countries:

| North America |

Europe |

South America |

Asia Pacific |

|

| Canada |

Belgium |

Netherlands |

Argentina |

Australia |

| Mexico |

Denmark |

Norway |

Brazil |

China |

| United States |

Finland |

Russia |

Colombia |

India |

|

|

France |

South Africa |

Ecuador |

Japan |

|

|

Germany |

Spain |

|

New Zealand |

|

|

Hungary |

Sweden |

|

Singapore |

|

|

Ireland |

Switzerland |

|

South Korea |

|

|

Italy |

Turkey |

|

Thailand |

|

|

Lithuania |

United Kingdom |

|

|

Our non-U.S. subsidiaries and affiliates manufacture and sell products similar to those we produce in the United States. Operations outside the U.S. may be subject to a greater risk of changing political, economic and social environments, changing governmental laws and regulations, currency revaluations and market fluctuations than our domestic operations. See the discussion of risk factors in Item 1A.

Sales reported by our non-U.S. subsidiaries comprised $3,702, or 52%, of our 2020 consolidated sales of $7,106. A summary of sales and long-lived assets by geographic region can be found in Note 21 to our consolidated financial statements in Item 8.

Customer Dependence

We are largely dependent on light vehicle, medium- and heavy-duty vehicle and off-highway original equipment manufacturer (OEM) customers. Ford Motor Company (Ford) and Fiat Chrysler Automobiles (FCA) were the only individual customers accounting for 10% or more of our consolidated sales in 2020. As a percentage of total sales from operations, our sales to Ford were approximately 20% in 2020, 20% in 2019 and 20% in 2018, and our sales to FCA (via a directed supply relationship), our second largest customer, were approximately 12% in 2020, 11% in 2019 and 11% in 2018. PACCAR Inc, Deere & Company and Volkswagen AG (including Traton Group) were our third, fourth and fifth largest customers in 2020. Our 10 largest customers collectively accounted for approximately 54% of our sales in 2020.

Loss of all or a substantial portion of our sales to Ford, FCA or other large volume customers would have a significant adverse effect on our financial results until such lost sales volume could be replaced and there is no assurance that any such lost volume would be replaced.

Sources and Availability of Raw Materials

We use a variety of raw materials in the production of our products, including steel and products containing steel, stainless steel, forgings, castings, bearings, and batteries and related rare earth materials. Other commodity purchases include aluminum, brass, copper and plastics. These materials are typically available from multiple qualified sources in quantities sufficient for our needs. However, some of our operations remain dependent on single sources for certain raw materials.

While our suppliers have generally been able to support our needs, our operations may experience shortages and delays in the supply of raw material from time to time due to strong demand, capacity limitations, short lead times, production schedule increases from our customers and other problems experienced by the suppliers. A significant or prolonged shortage of critical components from any of our suppliers could adversely impact our ability to meet our production schedules and to deliver our products to our customers in a timely manner.

Seasonality

Our businesses are generally not seasonal. However, in the light vehicle market, our sales are closely related to the production schedules of our OEM customers and those schedules have historically been weakest in the third quarter of the year due to a large number of model year change-overs that occur during this period. Additionally, third-quarter production schedules in Europe are typically impacted by the summer vacation schedules and fourth-quarter production is affected globally by year-end holidays.

Backlog

A substantial amount of the new business we are awarded by OEMs is granted well in advance of a program launch. These awards typically extend through the life of the given program. This backlog of new business does not represent firm orders. We estimate future sales from new business using the projected volume under these programs.

Competition

Within each of our markets, we compete with a variety of independent suppliers and distributors, as well as with the in-house operations of certain OEMs. With a focus on product innovation, we differentiate ourselves through efficiency and performance, reliability, materials and processes, sustainability and product extension.

The following table summarizes our principal competitors by operating segment as of December 31, 2020:

| Segment |

Principal Competitors |

|

|

|

|

|

| Light Vehicle |

American Axle & Manufacturing Holdings, Inc. |

Schaeffler Group |

|

|

BorgWarner Inc. |

Wanxiang Group Corporation |

|

|

Hofer Powertrain GmbH |

ZF Friedrichshafen AG |

|

|

IFA ROTARION Holding GmbH |

Vertically integration OEM operations |

|

|

|

|

|

|

|

|

| Commercial Vehicle |

Allison Transmission |

Meritor, Inc. |

|

|

American Axle & Manufacturing Holdings, Inc. |

Tirsan Kardan |

|

|

Borg Warner Inc. |

ZF Friedrichshafen AG |

|

|

Klein Products Inc. |

Vertically integrated OEM operations |

|

|

|

|

|

|

|

|

| Off-Highway |

Bonfiglioli |

Danfoss |

|

|

Bosch Rexroth AG |

Kessler & Co. |

|

|

Carraro Group |

ZF Friedrichshafen AG |

|

|

Comer Industries |

Vertically integrated OEM operations |

|

|

|

|

|

|

|

|

| Power Technologies |

Denso Corporation |

MAHLE GmbH |

|

|

ElringKlinger AG |

Tenneco Inc. |

|

|

Freudenberg NOK Group |

Valeo Group |

|

|

Hanon Systems |

YinLun Co., LTD |

|

|

|

|

Intellectual Property

Our proprietary driveline and power technologies product lines have strong identities in the markets we serve. Throughout these product lines, we manufacture and sell our products under a number of patents that have been obtained over a period of years and expire at various times. We consider each of these patents to be of value and aggressively protect our rights throughout the world against infringement. We are involved with many product lines and the loss or expiration of any particular patent would not materially affect our sales and profits.

We own or have licensed numerous trademarks that are registered in many countries, enabling us to market our products worldwide. For example, our Spicer®, Victor Reinz® , Long® and TM4® trademarks are widely recognized in their market segments.

Engineering and Research and Development

Since our introduction of the automotive universal joint in 1904, we have been focused on technological innovation. Our objective is to be an essential partner to our customers and we remain highly focused on offering superior product quality, technologically advanced products, world-class service and competitive prices. To enhance quality and reduce costs, we use statistical process control, cellular manufacturing, flexible regional production and assembly, global sourcing and extensive employee training.

We engage in ongoing engineering and research and development activities to improve the reliability, performance and cost-effectiveness of our existing products and to design and develop innovative products that meet customer requirements for new applications. We are integrating related operations to create a more innovative environment, speed product development, maximize efficiency and improve communication and information sharing among our research and development operations. At December 31, 2020, we had seven stand-alone technical and engineering centers and nineteen additional sites at which we conduct research and development activities. Our research and development costs were $146 in 2020, $112 in 2019 and $103 in 2018. Total engineering expenses including research and development were $246 in 2020, $271 in 2019 and $252 in 2018. During 2020, we reduced our total engineering spend in response to the global COVID-19 pandemic, taking advantage of various government programs and subsidies in the countries in which we operate. We also made the strategic decision to focus our engineering spend more heavily on research and development activities, continuing to progress key electrification initiatives despite the global pandemic.

Our research and development is targeted to create unique value for our customers. Our technologies are enabling the electrification of vehicles and accessories to improve efficiency and reduce the impact of carbon emissions. Our advanced drivelines are more efficient than ever before and include mechatronic systems to enhance performance. The power technologies group is developing new ways to keep batteries and power electronics at optimum temperatures to improve their efficiency and operation. We have developed innovative fuel cell products to help keep vehicles running in near continuous operation.

Human Capital

Our talented people power a customer-centric organization that is continuously improving the performance and efficiency of vehicles and machines around the globe. The following table summarizes our employees by operating segment and geographical region as of December 31, 2020:

| Segment |

Employees | Region | Employees | ||||||

| Light Vehicle |

13,800 | North America | 14,800 | ||||||

| Commercial Vehicle |

6,200 | Europe | 10,000 | ||||||

| Off-Highway |

11,100 | South America | 3,800 | ||||||

| Power Technologies |

5,400 | Asia Pacific | 9,600 | ||||||

| Technical and administrative |

1,700 | Total | 38,200 | ||||||

| Total |

38,200 | ||||||||

Safety – The health and safety of employees remain our highest priority and we believe our company has an essential responsibility to safeguard life, health, property, and the environment for the well-being of all involved. Through effective feedback and positive recognition, we actively promote and pursue safety in all that we do. This is achieved through a consistent commitment to excellence in, health, safety, security management, and risk elimination. Dana’s health, safety and security programs ensure that all employees receive training, guidance, and assistance in safety awareness and risk prevention. An implemented, verified, audited, and communicated occupational health and safety management system reflects Dana’s internal and external commitment to all our stakeholders in identifying and reducing the health and safety risk of our employees around the world. Dana has developed robust safety systems, including detailed work instructions and processes for standard and non-standard work, as well as regular layer process audits to ensure that we carefully consider safety in each of our work functions.

COVID-19 Response – The company’s response to the global COVID-19 pandemic was comprehensive, swift, and decisive with an emphasis on health and safety. Our top priorities were to protect our employees, communities, customers, and our future. For our employees, we implemented protocols throughout our global footprint to ensure their health and safety including, but not limited to: temporarily closing a significant number of our facilities; restricting access to all facilities; increasing cleaning and disinfecting protocols of those facilities that continued to operate; use of personal protection equipment; adhering to social distancing guidelines; instituting remote work; and restricting travel. In our communities, we provided support to initiatives across the globe, including light manufacturing and assembly for personal protection equipment and ventilator-related components. As our customers focused on managing through the challenges of the pandemic, we carefully managed our supply chain and inventory, while preparing our facilities for a safe restart.

Inclusion and Diversity – Our vision is to maintain an inclusive and diverse, global organization that develops, fosters, and attracts great people whose perspectives are heard, valued, and supported. We embrace our team members, suppliers, and customers. Their unique backgrounds, experiences, thoughts, views, and talents shape the ever-changing world. We are continuously building upon our diverse strengths to further grow a strong, inclusive work environment. Dana remains focused on embracing inclusion and diversity while enhancing the cultural competence of the global workforce. To achieve this, we have emphasized three core areas: retention and employee development, resources for employees, and recruiting of new team members.

Retention and Employee Development – Dana believes the development of its people is critical to the company’s success. The company empowers individuals to lead their development by articulating their professional, personal, and career growth aspirations to their manager. Development of all Dana people is strongly encouraged and should be considered each year as a part of their goals. Dana as an organization has the responsibility to set the tone, culture, and organizational expectations. The company also provides regular training opportunities for our associates across the globe to ensure they have the skills and information to keep pace with technological change. This development is supported and measured with robust performance management and development plans that encourages employees to continuously improve upon their past performance and build on critical skills the company requires to remain competitive. The company has a mentorship program for diverse employees to help guide and coach employees to positions of leadership and ensure the company is developing a diverse talent pool.

Resources – Dana has established an expanding network of Business Resource Groups (BRGs) to enhance Dana’s ability to develop, retain, and attract employees of varied backgrounds. By embracing inclusion and diversity, we create an environment that inspires the best from everyone and maximizes the value of our most important asset – Dana people. These BRGs are executive leadership-supported, employee-led initiatives with the mission to inspire growth and innovation and foster diversity for all employees. Our BRGs currently include:

| ● |

Dana Women’s Network (DAWN) – The company’s DAWN group is focused on providing professional networking and career development for women at Dana. They also promote activities that engage Dana’s senior leaders to better understand how the company can support women at work. |

| ● |

African American Resource Group (AARG) – Dana’s AARG group is committed to supporting the career development of African American talent through thought-leadership workshops and community events. The group provides insight to Dana into the best practices for sourcing and retaining top talent. |

| ● |

LGBT+A – The LGBT+A group focuses on maintaining an inclusive working environment that enables the company to leverage a diverse leadership pipeline. It has assisted in providing educational resources and community activities to engage the Dana team on best ways to support our LGBT+A colleagues. |

| ● |

Live Green – Dana’s Live Green resource group helps to advance Dana’s mission to be sustainably responsible in our business practices. The group helps to inform and drive grassroots employee initiatives on reducing our impact on the environment. |

| ● |

New to Dana (NTD) – The NTD group is open to all new Dana employees to help acclimate them to the Dana business culture and understand the company’s rich history. It provides resources, support, and professional development opportunities to new employees as they transition into their job responsibilities at Dana. |

| ● |

Dana Alumni – With more than a century of rich history, Dana leverages its vast network of Alumni, including retires and former long-time employees to help them remain informed about the company’s latest initiatives and to gather ideas on how to best continue to engage our workforce. |

| ● |

Military and Veterans – The military and veterans group supports active-duty and veteran military personnel by understanding their unique needs and finding the best ways to support them. This group’s understanding of the needs of those who have served also allows the company to consider the best way to engage candidates and recruit them to Dana. |

Recruiting – As a company, we are always collaborating with internationally recognized organizations to reach out to diverse talent and implement best practices for recruiting individuals who work within our core business functions.

Health and Wellness – Dana understands the importance of advocating for the health and well-being of our employees. Health initiatives can have a long-lasting, sustainable impact on employee well-being, but healthy habits do not develop overnight. The company is continuously evaluating new opportunities for programs that help address factors that influence health-related behaviors, which can have a long-lasting impact on an employee’s well-being. Dana understands the needs of individuals are unique and continues to offer initiatives spanning the spectrum of health and wellness to help provide a supportive work environment where employees strive for balance in their lives.

We encourage you to review the “Empowering People” section of our annual Sustainability and Social Responsibility Report (located on our website) for more detailed information regarding our Human Capital programs and initiatives. Nothing on our website, including our annual Sustainability and Social Responsibility Report or sections thereof, shall be deemed incorporated by reference into this Annual Report.

Environmental Compliance

We make capital expenditures in the normal course of business as necessary to ensure that our facilities are in compliance with applicable environmental laws and regulations. The cost of environmental compliance has not been a material part of capital expenditures and did not have a material adverse effect on our earnings or competitive position in 2020.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 as amended (Exchange Act) are available, free of charge, on or through our Internet website at http://www.dana.com/investors as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC. Copies of any materials we file with the SEC can also be obtained free of charge through the SEC’s website at http://www.sec.gov. We also post our Corporate Governance Guidelines, Standards of Business Conduct for Members of the Board of Directors, Board Committee membership lists and charters, Standards of Business Conduct and other corporate governance materials on our Internet website. Copies of these posted materials are also available in print, free of charge, to any stockholder upon request from: Dana Incorporated, Investor Relations, P.O. Box 1000, Maumee, Ohio 43537, or via telephone in the U.S. at 800-537-8823 or e-mail at InvestorRelations@dana.com. The inclusion of our website address in this report is an inactive textual reference only and is not intended to include or incorporate by reference the information on our website into this report.

We are impacted by events and conditions that affect the light vehicle, medium/heavy vehicle and off-highway markets that we serve, as well as by factors specific to Dana. Among the risks that could materially adversely affect our business, financial condition or results of operations are the following, many of which are interrelated.

Risk Factors Related to the Markets We Serve

A downturn in the global economy could have a substantial adverse effect on our business.

Our business is tied to general economic and industry conditions as demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit and the cost of fuel. These factors have had and could continue to have a substantial impact on our business.

Certain political developments occurring the past several years have provided increased economic uncertainty. The United Kingdom’s (UK) 2016 decision to exit the European Union (EU) has not had significant economic ramifications on our operations to date. The UK and the EU have announced the UK-EU Trade and Cooperation Agreement (TCA) which covers the future UK – EU relationship. The TCA is being provisionally applied beginning January 1, 2021 pending approval in the Council of the EU and European Parliament. The longer term economic, legal, political, and social implications of the TCA are unclear at this stage. Political climate changes in the U.S., including tax reform legislation, regulatory requirements and potential trade policy actions, are likely to impact economic conditions in the U.S. and various countries, the cost of importing into the U.S. and the competitive landscape of our customers, suppliers and competitors.

Adverse global economic conditions could also cause our customers and suppliers to experience severe economic constraints in the future, including bankruptcy, which could have a material adverse impact on our financial position and results of operations.

Our results of operations could be adversely affected by climate change, natural catastrophes or public health crises, in the locations in which we, our customers or our suppliers operate.

A natural disaster could disrupt our operations, or our customers’ or suppliers’ operations and could adversely affect our results of operations and financial condition. Although we have continuity plans designed to mitigate the impact of natural disasters on our operations, those plans may be insufficient, and any catastrophe may disrupt our ability to manufacture and deliver products to our customers, resulting in an adverse impact on our business and results of operations. Also, climate change poses both regulatory and physical risks that could harm our results of operations or affect the way we conduct our businesses. For example, new or modified regulations could require us to spend substantial funds to enhance our environmental compliance efforts. In addition, our global operations expose us to risks associated with public health crises, such as pandemics and epidemics, which could harm our business and cause our operating results to suffer.

The novel coronavirus disease (COVID-19) pandemic has had an adverse effect on our business, results of operations, cash flows and financial condition. The COVID-19 pandemic has negatively impacted the global economy, disrupted our operations as well as those of our customers, suppliers and the global supply chains in which we participate, and created significant volatility and disruption of financial markets. The extent of the impact of the COVID-19 pandemic on our business and financial performance, including our ability to execute our near-term and long-term operational, strategic and capital structure initiatives, will depend on future developments, including the duration and severity of the pandemic, which are uncertain and cannot be predicted.

As a result of the COVID-19 pandemic, and in response to government mandates or recommendations, rapid dissipation of customer demand, as well as decisions we have made to protect the health and safety of our employees and communities, we temporarily closed a significant number of our facilities globally during 2020. We may face facility closure requirements and other operational restrictions with respect to some or all of our locations for prolonged periods of time due to, among other factors, evolving and increasingly stringent governmental restrictions including public health directives, quarantine policies or social distancing measures. We operate as part of the complex integrated global supply chains of our largest customers. As the COVID-19 pandemic dissipates at varying times and rates in different regions around the world, there could be a prolonged negative impact on these global supply chains. Our ability to continue operations at specific facilities will be impacted by the interdependencies of the various participants of these global supply chains, which are largely beyond our direct control. A prolonged shut down of these global supply chains will have a material adverse effect on our business, results of operations, cash flows and financial condition.

Consumer spending may also be negatively impacted by general macroeconomic conditions and consumer confidence, including the impacts of any recession, resulting from the COVID-19 pandemic. This may negatively impact the markets we serve and may cause our customers to purchase fewer products from us. Any significant reduction in demand caused by decreased consumer confidence and spending following the pandemic, would result in a loss of sales and profits and other material adverse effects.

Rising interest rates could have a substantial adverse effect on our business

Rising interest rates could have a dampening effect on overall economic activity, the financial condition of our customers and the financial condition of the end customers who ultimately create demand for the products we supply, all of which could negatively affect demand for our products. An increase in interest rates could make it difficult for us to obtain financing at attractive rates, impacting our ability to execute on our growth strategies or future acquisitions.

We could be adversely impacted by the loss of any of our significant customers, changes in their requirements for our products or changes in their financial condition.

We are reliant upon sales to several significant customers. Sales to our ten largest customers accounted for 54% of our overall sales in 2020. Changes in our business relationships with any of our large customers or in the timing, size and continuation of their various programs could have a material adverse impact on us.

The loss of any of these customers, the loss of business with respect to one or more of their vehicle models on which we have high component content, or a significant decline in the production levels of such vehicles would negatively impact our business, results of operations and financial condition. Pricing pressure from our customers also poses certain risks. Inability on our part to offset pricing concessions with cost reductions would adversely affect our profitability. We are continually bidding on new business with these customers, as well as seeking to diversify our customer base, but there is no assurance that our efforts will be successful. Further, to the extent that the financial condition of our largest customers deteriorates, including possible bankruptcies, mergers or liquidations, or their sales otherwise decline, our financial position and results of operations could be adversely affected.

We may be adversely impacted by changes in international legislative and political conditions.

We operate in 33 countries around the world and we depend on significant foreign suppliers and customers. Further, we have several growth initiatives that are targeting emerging markets like China and India. Legislative and political activities within the countries where we conduct business, particularly in emerging markets and less developed countries, could adversely impact our ability to operate in those countries. The political situation in a number of countries in which we operate could create instability in our contractual relationships with no effective legal safeguards for resolution of these issues, or potentially result in the seizure of our assets. We operate in Argentina, where trade-related initiatives and other government restrictions limit our ability to optimize operating effectiveness. At December 31, 2020, our net asset exposure related to Argentina was approximately $21, including $5 of net fixed assets.

We may be adversely impacted by changes in trade policies and proposed or imposed tariffs, including but not limited to, the imposition of new tariffs by the U.S. government on imports to the U.S. and/or the imposition of retaliatory tariffs by foreign countries.

Section 232 of the Trade Expansion Act of 1962, as amended (the Trade Act), gives the executive branch of the U.S. government broad authority to restrict imports in the interest of national security by imposing tariffs. Tariffs imposed on imported steel and aluminum could raise the costs associated with manufacturing our products. We work with our customers to recover a portion of any increased costs, and with our suppliers to defray costs, associated with tariffs. While we have been successful in the past recovering a significant portion of costs increases, there is no assurance that cost increases resulting from trade policies and tariffs will not adversely impact our profitability. Our sales may also be adversely impacted if tariffs are assessed directly on the products we produce or on our customers’ products containing content sourced from us.

We may be adversely impacted by the strength of the U.S. dollar relative to the currencies in the other countries in which we do business.

Approximately 52% of our sales in 2020 were from operations located in countries other than the U.S. Currency variations can have an impact on our results (expressed in U.S. dollars). Currency variations can also adversely affect margins on sales of our products in countries outside of the U.S. and margins on sales of products that include components obtained from affiliates or other suppliers located outside of the U.S. Strengthening of the U.S. dollar against the euro and currencies of other countries in which we have operations could have an adverse effect on our results reported in U.S. dollars. We use a combination of natural hedging techniques and financial derivatives to mitigate foreign currency exchange rate risks. Such hedging activities may be ineffective or may not offset more than a portion of the adverse financial impact resulting from currency variations.

We may be adversely impacted by new laws, regulations or policies of governmental organizations related to increased fuel economy standards and reduced greenhouse gas emissions, or changes in existing ones.

The markets and customers we serve are subject to substantial government regulation, which often differs by state, region and country. These regulations, and proposals for additional regulation, are advanced primarily out of concern for the environment (including concerns about global climate change and its impact) and energy independence. We anticipate that the number and extent of these regulations, and the costs to comply with them, will increase significantly in the future.

In the U.S., vehicle fuel economy and greenhouse gas emissions are regulated under a harmonized national program administered by the National Highway Traffic Safety Administration and the Environmental Protection Agency (EPA). Other governments in the markets we serve are also creating new policies to address these same issues, including the European Union, Brazil, China and India. These government regulatory requirements could significantly affect our customers by altering their global product development plans and substantially increasing their costs, which could result in limitations on the types of vehicles they sell and the geographical markets they serve. Any of these outcomes could adversely affect our financial position and results of operations.

The proposed phase out of the London Interbank Offer Rate (LIBOR) could have an adverse effect on our business

Our revolving credit facility (the "Revolving Facility") and term loan B facility (the "Term B Facility") utilize Libor to set the interest rate on any outstanding borrowings. In July 2017, the head of the United Kingdom Financial Conduct Authority announced the desire to phase out the use of Libor by the end of 2021. On November 30, 2020 the ICE Benchmark Administration Limited (IBA) announced that it will consult on its intention to cease publication of the one week and two-month USD Libor settings at the end of 2021 and the remaining USD Libor settings at the end of June 2023. The potential effect on our cost of borrowing utilizing a replacement rate cannot yet be determined. In addition, any further changes or reforms to the determination of Libor or its successor rate may result in a sudden or prolonged increase or decrease on our borrowing rate, which could have an adverse impact on extension of credit held by us and could have a material adverse effect on our business, financial condition and results of operations.

Company-Specific Risk Factors

We have taken, and continue to take, cost-reduction actions. Although our process includes planning for potential negative consequences, the cost-reduction actions may expose us to additional production risk and could adversely affect our sales, profitability and ability to retain and attract employees.

We have been reducing costs in all of our businesses and have discontinued product lines, exited businesses, consolidated manufacturing operations and positioned operations in lower cost locations. The impact of these cost-reduction actions on our sales and profitability may be influenced by many factors including our ability to successfully complete these ongoing efforts, our ability to generate the level of cost savings we expect or that are necessary to enable us to effectively compete, delays in implementation of anticipated workforce reductions, decline in employee morale and the potential inability to meet operational targets due to our inability to retain or recruit key employees.

We depend on our subsidiaries for cash to satisfy the obligations of the company.

Our subsidiaries conduct all of our operations and own substantially all of our assets. Our cash flow and our ability to meet our obligations depend on the cash flow of our subsidiaries. In addition, the payment of funds in the form of dividends, intercompany payments, tax sharing payments and otherwise may be subject to restrictions under the laws of the countries of incorporation of our subsidiaries or the by-laws of the subsidiary.

Labor stoppages or work slowdowns at Dana, key suppliers or our customers could result in a disruption in our operations and have a material adverse effect on our businesses.

We and our customers rely on our respective suppliers to provide parts needed to maintain production levels. We all rely on workforces represented by labor unions. Workforce disputes that result in work stoppages or slowdowns could disrupt operations of all of these businesses, which in turn could have a material adverse effect on the supply of, or demand for, the products we supply our customers.

We could be adversely affected if we are unable to recover portions of commodity costs (including costs of steel, other raw materials and energy) from our customers.

We continue to work with our customers to recover a portion of our material cost increases. While we have been successful in the past recovering a significant portion of such cost increases, there is no assurance that increases in commodity costs, which can be impacted by a variety of factors, including changes in trade laws and tariffs, will not adversely impact our profitability in the future.

We could be adversely affected if we experience shortages of components from our suppliers or if disruptions in the supply chain lead to parts shortages for our customers.

A substantial portion of our annual cost of sales is driven by the purchase of goods and services. To manage and minimize these costs, we have been consolidating our supplier base. As a result, we are dependent on single sources of supply for some components of our products. We select our suppliers based on total value (including price, delivery and quality), taking into consideration their production capacities and financial condition, and we expect that they will be able to support our needs. However, there is no assurance that adverse financial conditions, including bankruptcies of our suppliers, reduced levels of production, natural disasters or other problems experienced by our suppliers will not result in shortages or delays in their supply of components to us or even in the financial collapse of one or more such suppliers. If we were to experience a significant or prolonged shortage of critical components from any of our suppliers, particularly those who are sole sources, and were unable to procure the components from other sources, we would be unable to meet our production schedules for some of our key products and to ship such products to our customers in a timely fashion, which would adversely affect our sales, profitability and customer relations.

Adverse economic conditions, natural disasters and other factors can similarly lead to financial distress or production problems for other suppliers to our customers which can create disruptions to our production levels. Any such supply-chain induced disruptions to our production are likely to create operating inefficiencies that will adversely affect our sales, profitability and customer relations.

Our profitability and results of operations may be adversely affected by program launch difficulties.

The launch of new business is a complex process, the success of which depends on a wide range of factors, including the production readiness of our manufacturing facilities and manufacturing processes and those of our suppliers, as well as factors related to tooling, equipment, employees, initial product quality and other factors. Our failure to successfully launch material new or takeover business could have an adverse effect on our profitability and results of operations.

We use important intellectual property in our business. If we are unable to protect our intellectual property or if a third party makes assertions against us or our customers relating to intellectual property rights, our business could be adversely affected.

We own important intellectual property, including patents, trademarks, copyrights and trade secrets, and are involved in numerous licensing arrangements. Our intellectual property plays an important role in maintaining our competitive position in a number of the markets that we serve. Our competitors may develop technologies that are similar or superior to our proprietary technologies or design around the patents we own or license. Further, as we expand our operations in jurisdictions where the protection of intellectual property rights is less robust, the risk of others duplicating our proprietary technologies increases, despite efforts we undertake to protect them. Developments or assertions by or against us relating to intellectual property rights, and any inability to protect these rights, could have a material adverse impact on our business and our competitive position.

We could encounter unexpected difficulties integrating acquisitions and joint ventures.

We acquired businesses in recent years, and we expect to complete additional acquisitions and investments in the future that complement or expand our businesses. The success of this strategy will depend on our ability to successfully complete these transactions or arrangements, to integrate the businesses acquired in these transactions and to develop satisfactory working arrangements with our strategic partners in the joint ventures. We could encounter unexpected difficulties in completing these transactions and integrating the acquisitions with our existing operations. We also may not realize the degree or timing of benefits anticipated when we entered into a transaction.

Several of our joint ventures operate pursuant to established agreements and, as such, we do not unilaterally control the joint venture. There is a risk that the partners’ objectives for the joint venture may not be aligned with ours, leading to potential differences over management of the joint venture that could adversely impact its financial performance and consequent contribution to our earnings. Additionally, inability on the part of our partners to satisfy their contractual obligations under the agreements could adversely impact our results of operations and financial position.

We could be adversely impacted by the costs of environmental, health, safety and product liability compliance.

Our operations are subject to environmental laws and regulations in the U.S. and other countries that govern emissions to the air; discharges to water; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties. Historically, environmental costs related to our former and existing operations have not been material. However, there is no assurance that the costs of complying with current environmental laws and regulations, or those that may be adopted in the future, will not increase and adversely impact us.

There is also no assurance that the costs of complying with current laws and regulations, or those that may be adopted in the future, that relate to health, safety and product liability matters will not adversely impact us. There is also a risk of warranty and product liability claims, as well as product recalls, if our products fail to perform to specifications or cause property damage, injury or death. (See Notes 16 and 17 to our consolidated financial statements in Item 8 for additional information on product liabilities and warranties.)

A failure of our information technology infrastructure could adversely impact our business and operations.

We recognize the increasing volume of cyber attacks and employ commercially practical efforts to provide reasonable assurance that the risks of such attacks are appropriately mitigated. Each year, we evaluate the threat profile of our industry to stay abreast of trends and to provide reasonable assurance our existing countermeasures will address any new threats identified. Despite our implementation of security measures, our IT systems and those of our service providers are vulnerable to circumstances beyond our reasonable control including acts of terror, acts of government, natural disasters, civil unrest and denial of service attacks which may lead to the theft of our intellectual property, trade secrets or business disruption. To the extent that any disruption or security breach results in a loss or damage to our data or an inappropriate disclosure of confidential information, it could cause significant damage to our reputation, affect our relationships with our customers, suppliers and employees, lead to claims against the company and ultimately harm our business. Additionally, we may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

We participate in certain multi-employer pension plans which are not fully funded.

We contribute to certain multi-employer defined benefit pension plans for certain of our union-represented employees in the U.S. in accordance with our collective bargaining agreements. Contributions are based on hours worked except in cases of layoff or leave where we generally contribute based on 40 hours per week for a maximum of one year. The plans are not fully funded as of December 31, 2020. We could be held liable to the plans for our obligation, as well as those of other employers, due to our participation in the plans. Contribution rates could increase if the plans are required to adopt a funding improvement plan, if the performance of plan assets does not meet expectations or as a result of future collectively bargained wage and benefit agreements. (See Note 12 to our consolidated financial statements in Item 8 for additional information on multi-employer pension plans.)

Changes in interest rates and asset returns could increase our pension funding obligations and reduce our profitability.

We have unfunded obligations under certain of our defined benefit pension and other postretirement benefit plans. The valuation of our future payment obligations under the plans and the related plan assets are subject to significant adverse changes if the credit and capital markets cause interest rates and projected rates of return to decline. Such declines could also require us to make significant additional contributions to our pension plans in the future. A material increase in the unfunded obligations of these plans could also result in a significant increase in our pension expense in the future.

We may incur additional tax expense or become subject to additional tax exposure.

Our provision for income taxes and the cash outlays required to satisfy our income tax obligations in the future could be adversely affected by numerous factors. These factors include changes in the level of earnings in the tax jurisdictions in which we operate, changes in the valuation of deferred tax assets and liabilities, changes in our plans to repatriate the earnings of our non-U.S. operations to the U.S. and changes in tax laws and regulations.

Our income tax returns are subject to examination by federal, state and local tax authorities in the U.S. and tax authorities outside the U.S. The results of these examinations and the ongoing assessments of our tax exposures could also have an adverse effect on our provision for income taxes and the cash outlays required to satisfy our income tax obligations.

Our ability to utilize our net operating loss carryforwards may be limited.

Net operating loss carryforwards (NOLs) approximating $190 were available at December 31, 2020 to reduce future U.S. income tax liabilities. Our ability to utilize these NOLs may be limited as a result of certain change of control provisions of the U.S. Internal Revenue Code of 1986, as amended (Code). The NOLs are treated as losses incurred before the change of control in January 2008 and are limited to annual utilization of $84. There can be no assurance that trading in our shares will not effect another change in control under the Code, which could further limit our ability to utilize our available NOLs. Such limitations may cause us to pay income taxes earlier and in greater amounts than would be the case if the NOLs were not subject to limitation.

An inability to provide products with the technology required to satisfy customer requirements would adversely impact our ability to successfully compete in our markets.

The vehicular markets in which we operate are undergoing significant technological change, with increasing focus on electrified and autonomous vehicles. These and other technological advances could render certain of our products obsolete. Maintaining our competitive position is dependent on our ability to develop commercially-viable products and services that support the future technologies embraced by our customers.

Failure to appropriately anticipate and react to the cyclical and volatile nature of production rates and customer demands in our business can adversely impact our results of operations.

Our financial performance is directly related to production levels of our customers. In several of our markets, customer production levels are prone to significant cyclicality, influenced by general economic conditions, changing consumer preferences, regulatory changes, and other factors. Oftentimes the rapidity of the downcycles and upcycles can be severe. Successfully executing operationally during periods of extreme downward and upward demand pressures can be challenging. Our inability to recognize and react appropriately to the production cycles inherent in our markets can adversely impact our operating results.

Our continued success is dependent on being able to retain and attract requisite talent.

Sustaining and growing our business requires that we continue to retain, develop and attract people with the requisite skills. With the vehicles of the future expected to undergo significant technological change, having qualified people savvy in the right technologies will be a key factor in our ability to develop the products necessary to successfully compete in the future. As a global organization, we are also dependent on our ability to attract and maintain a diverse work force that is fully engaged supporting our company’s objectives and initiatives.

Failure to maintain effective internal controls could adversely impact our business, financial condition and results of operations.

Regulatory provisions governing the financial reporting of U.S. public companies require that we maintain effective disclosure controls and internal controls over financial reporting across our operations in 33 countries. Effective internal controls are designed to provide reasonable assurance of compliance, and, as such, they can be susceptible to human error, circumvention or override, and fraud. Failure to maintain adequate, effective internal controls could result in potential financial misstatements or other forms of noncompliance that have an adverse impact on our results of operations, financial condition or organizational reputation.

Developments in the financial markets or downgrades to Dana's credit rating could restrict our access to capital and increase financing costs.

At December 31, 2020, Dana had consolidated debt obligations of $2,481, with cash and marketable securities of $580 and unused revolving credit capacity of $979. Our ability to grow the business and satisfy debt service obligations is dependent, in part, on our ability to gain access to capital at competitive costs. External factors beyond our control can adversely affect capital markets – either tightening availability of capital or increasing the cost of available capital. Failure on our part to maintain adequate financial performance and appropriate credit metrics can also affect our ability to access capital at competitive prices.

Risk Factors Related to our Securities

Provisions in our Restated Certificate of Incorporation and Bylaws may discourage a takeover attempt.

Certain provisions of our Restated Certificate of Incorporation and Bylaws, as well as the General Corporation Law of the State of Delaware, may have the effect of delaying, deferring or preventing a change in control of Dana. Such provisions, including those governing the nomination of directors, limiting who may call special stockholders’ meetings and eliminating stockholder action by written consent, may make it more difficult for other persons, without the approval of our board of directors, to make a tender offer or otherwise acquire substantial amounts of common stock or to launch other takeover attempts that a stockholder might consider to be in such stockholder’s best interest.

Item 1B. Unresolved Staff Comments

None.

|

Type of Facility |

North |

Europe |

South |

Asia |

Total |

|||||||||||||||

| Light Vehicle |

||||||||||||||||||||

| Manufacturing/Distribution |

14 | 4 | 4 | 9 | 31 | |||||||||||||||

| Service/Assembly |

1 | 1 | 2 | |||||||||||||||||

| Technical and Engineering Centers |

1 | 1 | ||||||||||||||||||

| Commercial Vehicle |

||||||||||||||||||||

| Manufacturing/Distribution |

6 | 5 | 3 | 7 | 21 | |||||||||||||||

| Service/Assembly |

1 | 1 | ||||||||||||||||||

| Administrative Offices | 1 | 1 | ||||||||||||||||||

| Technical and Engineering Centers |

1 | 1 | 2 | |||||||||||||||||

| Off-Highway |

||||||||||||||||||||

| Manufacturing/Distribution |

3 | 20 | 7 | 30 | ||||||||||||||||

| Service/Assembly |

3 | 13 | 1 | 4 | 21 | |||||||||||||||

| Administrative Offices |

3 | 1 | 4 | |||||||||||||||||

| Technical and Engineering Centers |

1 | 1 | ||||||||||||||||||

| Power Technologies |

||||||||||||||||||||

| Manufacturing/Distribution |

9 | 4 | 2 | 15 | ||||||||||||||||

| Administrative Offices |

1 | 1 | ||||||||||||||||||

| Technical and Engineering Centers |

1 | 1 | ||||||||||||||||||

| Corporate and other |

||||||||||||||||||||

| Administrative Offices |

3 | 1 | 1 | 2 | 7 | |||||||||||||||

| Technical and Engineering Centers - Multiple Segments |

2 | 2 | ||||||||||||||||||

| 43 | 52 | 9 | 37 | 141 | ||||||||||||||||

As of December 31, 2020, we operated in 33 countries and had 141 major facilities housing manufacturing and distribution operations, service and assembly operations, technical and engineering centers and administrative offices. In addition to the seven stand-alone technical and engineering centers in the table above, we have nineteen technical and engineering centers housed within manufacturing sites. We lease 68 of these facilities and own the remainder. We believe that all of our property and equipment is properly maintained.

Our world headquarters is located in Maumee, Ohio. This facility and other facilities in the greater Detroit, Michigan and Maumee, Ohio areas house functions that have global or North American regional responsibility for finance and accounting, tax, treasury, risk management, legal, human resources, procurement and supply chain management, communications and information technology.

We are a party to various pending judicial and administrative proceedings that arose in the ordinary course of business. After reviewing the currently pending lawsuits and proceedings (including the probable outcomes, reasonably anticipated costs and expenses and our established reserves for uninsured liabilities), we do not believe that any liabilities that may result from these proceedings are reasonably likely to have a material adverse effect on our liquidity, financial condition or results of operations. Legal proceedings are also discussed in Note 16 to our consolidated financial statements in Item 8.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market information — Our common stock trades on the New York Stock Exchange (NYSE) under the symbol "DAN."

Holders of common stock — Based on reports by our transfer agent, there were approximately 2,629 registered holders of our common stock on January 29, 2021.

Reference is made to the Equity Compensation Plan Information section of Item 12 for certain information regarding our equity compensation plans.

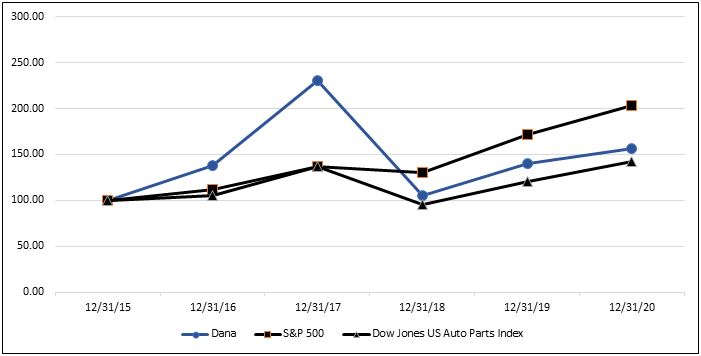

Stockholder return — The following graph shows the cumulative total shareholder return for our common stock since December 31, 2015. The graph compares our performance to that of the Standard & Poor’s 500 Stock Index (S&P 500) and the Dow Jones US Auto Parts Index. The comparison assumes $100 was invested at the closing price on December 31, 2015. Each of the returns shown assumes that all dividends paid were reinvested.

Performance chart

Index

| 12/31/2015 |

12/31/2016 |

12/31/2017 |

12/31/2018 |

12/31/2019 |

12/31/20 |

|||||||||||||||||||

| Dana Incorporated |

$ | 100.00 | $ | 137.94 | $ | 230.83 | $ | 104.97 | $ | 139.76 | $ | 156.84 | ||||||||||||

| S&P 500 |

100.00 | 111.96 | 136.40 | 130.42 | 171.49 | 203.04 | ||||||||||||||||||

| Dow Jones US Auto Parts Index |

100.00 | 105.41 | 136.81 | 94.91 | 120.95 | 142.12 | ||||||||||||||||||

Issuer's purchases of equity securities — On February 16, 2021, our Board of Directors approved an extension of our existing common stock share repurchase program through December 31, 2023. Approximately $150 remained available under the program for future share repurchases as of December 31, 2020. We repurchase shares utilizing available excess cash either in the open market or through privately negotiated transactions. Stock repurchases are subject to prevailing market conditions and other considerations. No shares of our common stock were repurchased under the program during the fourth quarter of 2020.

Annual meeting — We will hold an annual meeting of shareholders on April 21, 2021.

Item 6. Selected Financial Data

| Year Ended December 31, |

||||||||||||||||||||

| 2020(1) | 2019(2) | 2018(3) | 2017(4) | 2016(5) | ||||||||||||||||

| Operating Results |

||||||||||||||||||||

| Net sales |

$ | 7,106 | $ | 8,620 | $ | 8,143 | $ | 7,209 | $ | 5,826 | ||||||||||

| Earnings (loss) before income taxes |

(13 | ) | 171 | 494 | 380 | 215 | ||||||||||||||

| Net income (loss) |

(51 | ) | 233 | 440 | 116 | 653 | ||||||||||||||

| Net income (loss) attributable to the parent company |

$ | (31 | ) | $ | 226 | $ | 427 | $ | 111 | $ | 640 | |||||||||

| Redeemable noncontrolling interests adjustment to redemption value |

— | — | — | 6 | — | |||||||||||||||

| Net income (loss) available to common stockholders |

$ | (31 | ) | $ | 226 | $ | 427 | $ | 105 | $ | 640 | |||||||||

| Net income (loss) per share available to common stockholders |

||||||||||||||||||||

| Basic |

$ | (0.21 | ) | $ | 1.57 | $ | 2.94 | $ | 0.72 | $ | 4.38 | |||||||||

| Diluted |

$ | (0.21 | ) | $ | 1.56 | $ | 2.91 | $ | 0.71 | $ | 4.36 | |||||||||

| Depreciation and amortization |

$ | 365 | $ | 339 | $ | 270 | $ | 233 | $ | 182 | ||||||||||

| Net cash provided by operating activities |

386 | 637 | 568 | 554 | 384 | |||||||||||||||

| Purchases of property, plant and equipment |

326 | 426 | 325 | 393 | 322 | |||||||||||||||

| Financial Position |

||||||||||||||||||||

| Cash and cash equivalents and marketable securities |

$ | 580 | $ | 527 | $ | 531 | $ | 643 | $ | 737 | ||||||||||

| Total assets |

7,376 | 7,220 | 5,918 | 5,644 | 4,860 | |||||||||||||||

| Long-term debt, less debt issuance costs |

2,420 | 2,336 | 1,755 | 1,759 | 1,595 | |||||||||||||||

| Total debt, less debt issuance costs |

2,454 | 2,370 | 1,783 | 1,799 | 1,664 | |||||||||||||||

| Common stock and additional paid-in capital |

2,410 | 2,388 | 2,370 | 2,356 | 2,329 | |||||||||||||||

| Treasury stock |

(156 | ) | (150 | ) | (119 | ) | (87 | ) | (83 | ) | ||||||||||

| Total parent company stockholders' equity |

1,758 | 1,873 | 1,345 | 1,013 | 1,157 | |||||||||||||||

| Book value per share |

$ | 12.17 | $ | 13.01 | $ | 9.27 | $ | 6.98 | $ | 7.92 | ||||||||||

| Common Share Information |

||||||||||||||||||||

| Dividends declared per common share |

$ | 0.10 | $ | 0.40 | $ | 0.40 | $ | 0.24 | $ | 0.24 | ||||||||||

| Weighted-average common shares outstanding |

||||||||||||||||||||

| Basic |

144.5 | 144.0 | 145.0 | 145.1 | 146.0 | |||||||||||||||

| Diluted |

144.5 | 145.1 | 146.5 | 146.9 | 146.8 | |||||||||||||||

| (1) |

Operating results in 2020 were significantly impacted by the global COVID-19 pandemic. Net income in 2020 included a $51 pre-tax goodwill impairment charge, a $33 pre-tax gain on notes receivable conversion and subsequent adjustment of shares to fair value and a $8 charge attributable to net discrete tax items. |

|

|

|

| (2) |

Net income in 2019 included pension settlement charges of $259 attributable to the termination of certain U.S. and Canadian defined benefit pension plans and a $135 benefit attributable to net discrete tax items. The increase in total assets in 2019 is primarily attributable to the acquisition of the Oerlikon Drive Systems (ODS) segment of the Oerlikon Group. The increase in total debt, less debt issuance costs is primarily attributable to taking out additional debt to finance the acquisition of ODS. |

|

|

|

| (3) |

Net income in 2018 included a $20 charge attributable to the impairment of intangible assets used in research and development activities and a $67 benefit attributable to net discrete tax items. |

|

|

|

| (4) |

Net income in 2017 included a $27 charge attributable to the divestiture of our Brazil suspension components business and a $159 charge attributable to net discrete tax items, including a charge of $186 associated with a reduction of net deferred tax assets to reflect expected realization at the lower U.S corporate tax rate of 21% rather than the previous rate of 35%. |

|

|

|

| (5) |

Net income in 2016 includes a $77 loss attributable to the divestiture of Dana Companies, LLC and a $476 benefit attributable to net discrete tax items, including a benefit of $501 associated with the release of valuation allowances against U.S. deferred taxes. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (Dollars in millions)

Management's discussion and analysis of financial condition and results of operations should be read in conjunction with the financial statements and accompanying notes in Item 8.

Management Overview

We are a global provider of high-technology products to virtually every major vehicle manufacturer in the world. We also serve the stationary industrial market. Our technologies include drive systems (axles, driveshafts, transmissions, and wheel and track drives); motion systems (winches, slew drives, and hub drives); electrodynamic technologies (motors, inverters, software and control systems, battery-management systems, and fuel cell plates); sealing solutions (gaskets, seals, cam covers, and oil pan modules); thermal-management technologies (transmission and engine oil cooling, battery and electronics cooling, charge air cooling, and thermal-acoustical protective shielding); and digital solutions (active and passive system controls and descriptive and predictive analytics). We serve our global light vehicle, medium/heavy vehicle and off-highway markets through four business units – Light Vehicle Drive Systems (Light Vehicle), Commercial Vehicle Drive and Motion Systems (Commercial Vehicle), Off-Highway Drive and Motion Systems (Off-Highway) and Power Technologies, which is the center of excellence for sealing and thermal-management technologies that span all customers in our on-highway and off-highway markets. We have a diverse customer base and geographic footprint which minimizes our exposure to individual market and segment declines. In 2020, 51% of our sales came from North American operations and 49% from operations throughout the rest of the world. Our sales by operating segment were Light Vehicle – 43%, Commercial Vehicle – 16%, Off-Highway – 28% and Power Technologies – 13%.

Operational and Strategic Initiatives

Our enterprise strategy builds on our strong technology foundation and leverages our resources across the organization while driving a customer centric focus, expanding our global markets, and delivering innovative solutions as we evolve into the era of vehicle electrification.

Central to our strategy is leveraging our core operations. This foundational element enables us to infuse strong operational disciplines throughout the strategy, making it practical, actionable, and effective. It enables us to capitalize on being a major drive systems supplier across all three end-mobility markets. We are achieving improved profitability by actively seeking synergies across our engineering, purchasing, and manufacturing base. We have strengthened the portfolio by acquiring critical assets; and we are utilizing our physical and intellectual capital to amplify innovation across the enterprise. Leveraging these core elements can further expand the cost efficiencies of our common technologies and deliver a sustainable competitive advantage for Dana.

Driving customer centricity continues to be at the heart of who we are. Putting our customers at the center of our value system is firmly embedded in our culture and is driving growth by focusing customer relationships and providing value to our customers. These relationships are strengthened as we are physically where we need to be in order to provide unparalleled service and we are prioritizing our customers’ needs as we engineer solutions that differentiate their products, while making it easier to do business with Dana by digitizing their experience. Our customer centric focus has uniquely positioned us to win more than our fair share of new business and capitalize on future customer outsourcing initiatives.

We continue to enhance and expand our global footprint, optimizing it to capture growth across all of our end markets.

Expanding global markets means utilizing our global capabilities and presence to further penetrate growth markets, focusing on Asia due to its position as the largest mobility market in the world with the highest market growth rate and its lead in the adoption of new energy vehicles. We are investing across various avenues to increase our presence in Asia Pacific by forging new partnerships, expanding inorganically, and growing organically. We continue to operate in this region through wholly owned and joint ventures with local market partners. We have recently made acquisitions that have augmented our footprint in the region, specifically in India and China. All the while, we have been making meaningful organic investments to grow with existing and new customers, primarily in Thailand, India, and China. These added capabilities have enabled us to target the domestic Asia Pacific markets and utilize the capacity for export to other global markets.