10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended: December 31, 2015

Commission File Number: 1-1063

Dana Holding Corporation

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 26-1531856 |

(State of incorporation) | | (IRS Employer Identification Number) |

3939 Technology Drive, Maumee, OH | | 43537 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (419) 887-3000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the common stock held by non-affiliates of the registrant computed by reference to the closing price of the common stock on June 30, 2015 was $3,289,900,525.

APPLICABLE ONLY TO CORPORATE ISSUERS:

There were 149,370,259 shares of the registrant's common stock outstanding at February 5, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to stockholders in connection with the Annual Meeting of Stockholders to be held on April 28, 2016 are incorporated by reference into Part III.

DANA HOLDING CORPORATION

FORM 10-K

YEAR ENDED DECEMBER 31, 2015

Table of Contents

|

| | |

| | Pages |

PART I | | |

Item 1 | Business | |

Item 1A | Risk Factors | |

Item 1B | Unresolved Staff Comments | |

Item 2 | Properties | |

Item 3 | Legal Proceedings | |

| | |

PART II | | |

Item 5 | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6 | Selected Financial Data | |

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A | Quantitative and Qualitative Disclosures about Market Risk | |

Item 8 | Financial Statements and Supplementary Data | |

Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |

Item 9A | Controls and Procedures | |

Item 9B | Other Information | |

| | |

PART III | | |

Item 10 | Directors, Executive Officers and Corporate Governance | |

Item 11 | Executive Compensation | |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13 | Certain Relationships and Related Transactions, and Director Independence | |

Item 14 | Principal Accountant Fees and Services | |

| | |

PART IV | | |

Item 15 | Exhibits and Financial Statement Schedules | |

| | |

Signatures | | |

Exhibit Index | | |

Exhibits | | |

Forward-Looking Information

Statements in this report (or otherwise made by us or on our behalf) that are not entirely historical constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can often be identified by words such as “anticipates,” “expects,” “believes,” “intends,” “plans,” "predicts," "seeks," “estimates,” “projects,” “outlook,” "may," "will," "should," "would," "could," "potential," "continue," "ongoing" and similar expressions, variations or negatives of these words. These statements represent the present expectations of Dana Holding Corporation and its consolidated subsidiaries (Dana) based on our current information and assumptions. Forward-looking statements are inherently subject to risks and uncertainties. Our plans, actions and actual results could differ materially from our present expectations due to a number of factors, including those discussed below and elsewhere in this report and in our other filings with the Securities and Exchange Commission (SEC). All forward-looking statements speak only as of the date made and we undertake no obligation to publicly update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of this report.

PART I

(Dollars in millions, except per share amounts)

Item 1. Business

General

Dana Holding Corporation (Dana) is headquartered in Maumee, Ohio and was incorporated in Delaware in 2007. As a global provider of high technology driveline (axles, driveshafts and transmissions), sealing and thermal-management products our customer base includes virtually every major vehicle manufacturer in the global light vehicle, medium/heavy vehicle and off-highway markets. We employ approximately 23,100 people, operate in 25 countries and have 90 major facilities around the world.

The terms “Dana,” “we,” “our” and “us,” when used in this report are references to Dana. These references include the subsidiaries of Dana unless otherwise indicated or the context requires otherwise.

Overview of our Business

We have aligned our organization around four operating segments: Light Vehicle Driveline Technologies (Light Vehicle), Commercial Vehicle Driveline Technologies (Commercial Vehicle), Off-Highway Driveline Technologies (Off-Highway) and Power Technologies. These operating segments have global responsibility and accountability for business commercial activities and financial performance.

External sales by operating segment for the years ended December 31, 2015, 2014 and 2013 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2015 | | 2014 | | 2013 |

| | Dollars | | % of Total | | Dollars | | % of Total | | Dollars | | % of Total |

Light Vehicle | | $ | 2,482 |

| | 40.9 | % | | $ | 2,496 |

| | 37.7 | % | | $ | 2,549 |

| | 37.7 | % |

Commercial Vehicle | | 1,533 |

| | 25.3 | % | | 1,838 |

| | 27.8 | % | | 1,860 |

| | 27.5 | % |

Off-Highway | | 1,040 |

| | 17.2 | % | | 1,231 |

| | 18.6 | % | | 1,330 |

| | 19.6 | % |

Power Technologies | | 1,005 |

| | 16.6 | % | | 1,052 |

| | 15.9 | % | | 1,030 |

| | 15.2 | % |

Total | | $ | 6,060 |

| | | | $ | 6,617 |

| | | | $ | 6,769 |

| | |

Refer to Segment Results of Operations in Item 7 and Note 18 to our consolidated financial statements in Item 8 for further financial information about our operating segments.

Our business is diversified across end-markets, products and customers. The following table summarizes the markets, products and largest customers of each of our operating segments.

|

| | | |

Segment | Markets | Products | Largest

Customers |

Light Vehicle | Light vehicle market: | Front axles | Ford Motor Company |

| Light trucks (full frame) | Rear axles | Hyundai Mobis |

| Sport utility vehicles | Driveshafts | Tata Motors |

| Crossover utility vehicles | Differentials | Nissan Motor Company |

| Vans | Torque couplings | General Motors Company |

| Passenger cars | Modular assemblies | Toyota Motor Company |

Commercial Vehicle | Medium/heavy vehicle market: | Steer axles | PACCAR |

| Medium duty trucks | Drive axles | Ford Motor Company |

| Heavy duty trucks | Driveshafts | AB Volvo |

| Buses | Tire inflation systems | Daimler AG |

| Specialty vehicles |

| Navistar International Corporation |

Off-Highway | Off-Highway market: | Front axles | Deere & Company |

| Construction | Rear axles | AGCO Corporation |

| Earth moving | Driveshafts | Manitou Group |

| Agricultural | Transmissions | Oshkosh Corporation |

| Mining | Torque converters | Terex Corporation |

| Forestry | Tire inflation systems | |

| Rail | Electronic controls | |

| Material handling | | |

Power Technologies | Light vehicle market | Gaskets | Ford Motor Company |

| Medium/heavy vehicle market | Cover modules | General Motors Company |

| Off-Highway market | Heat shields | Volkswagen AG |

| | Engine sealing systems | Caterpillar Inc. |

| | Cooling | Cummins Inc. |

| | Heat transfer products | |

Geographic Operations

We maintain administrative and operational organizations in North America, Europe, South America and Asia Pacific to support our operating segments, assist with the management of affiliate relations and facilitate financial and statutory reporting and tax compliance on a worldwide basis. Our operations are located in the following countries:

|

| | | | |

North America | Europe | South America | Asia Pacific |

Canada | Belgium | South Africa | Argentina | Australia |

Mexico | France | Spain | Brazil | China |

United States | Germany | Sweden | Colombia | India |

| Hungary | Switzerland | Ecuador | Japan |

| Italy | United Kingdom | | South Korea |

| Russia | | | Taiwan |

| | | | Thailand |

Our non-U.S. subsidiaries and affiliates manufacture and sell products similar to those we produce in the United States. Operations outside the U.S. may be subject to a greater risk of changing political, economic and social environments, changing governmental laws and regulations, currency revaluations and market fluctuations than our domestic operations. See the discussion of risk factors in Item 1A.

Sales reported by our non-U.S. subsidiaries comprised $3,255 of our 2015 consolidated sales of $6,060. A summary of sales and long-lived assets by geographic region can be found in Note 18 to our consolidated financial statements in Item 8.

Customer Dependence

We are largely dependent on light vehicle, medium- and heavy-duty vehicle and off-highway original equipment manufacturer (OEM) customers. Ford Motor Company (Ford) was the only individual customer accounting for 10% or more of our consolidated sales in 2015. As a percentage of total sales from operations, our sales to Ford were approximately 20% in 2015, 18% in 2014 and 18% in 2013 and our sales to PACCAR, our second largest customer, were approximately 8% in 2015, 9% in 2014 and 8% in 2013. Hyundai Mobis, Nissan Motor Corporation and Tata Motors were our third, fourth and fifth largest customers in 2015. Our 10 largest customers collectively accounted for approximately 58% of our sales in 2015.

Loss of all or a substantial portion of our sales to Ford or other large volume customers would have a significant adverse effect on our financial results until such lost sales volume could be replaced and there is no assurance that any such lost volume would be replaced.

Sources and Availability of Raw Materials

We use a variety of raw materials in the production of our products, including steel and products containing steel, stainless steel, forgings, castings and bearings. Other commodity purchases include aluminum, brass, copper and plastics. These materials are typically available from multiple qualified sources in quantities sufficient for our needs. However, some of our operations remain dependent on single sources for certain raw materials.

While our suppliers have generally been able to support our needs, our operations may experience shortages and delays in the supply of raw material from time to time, due to strong demand, capacity limitations, short lead times, production schedule increases from our customers and other problems experienced by the suppliers. A significant or prolonged shortage of critical components from any of our suppliers could adversely impact our ability to meet our production schedules and to deliver our products to our customers in a timely manner.

Seasonality

Our businesses are generally not seasonal. However, in the light vehicle market, our sales are closely related to the production schedules of our OEM customers and those schedules have historically been weakest in the third quarter of the year due to a large number of model year change-overs that occur during this period. Additionally, third-quarter production schedules in Europe are typically impacted by the summer vacation schedules and fourth-quarter production is affected globally by year-end holidays.

Backlog

A substantial amount of the new business we are awarded by OEMs is granted well in advance of a program launch. These awards typically extend through the life of the given program. This backlog of new business does not represent firm orders. We estimate future sales from new business using the projected volume under these programs.

Competition

Within each of our markets, we compete with a variety of independent suppliers and distributors, as well as with the in-house operations of certain OEMs. With a renewed focus on product innovation, we differentiate ourselves through efficiency and performance, reliability, materials and processes, sustainability and product extension.

The following table summarizes our principal competitors by operating segment.

|

| |

Segment | Principal Competitors |

Light Vehicle | ZF Friedrichshafen AG |

| GKN plc |

| American Axle & Manufacturing Holdings, Inc. |

| Magna International Inc. |

| Wanxiang Group Corporation |

| Hitachi Automotive Systems, Ltd. |

| IFA ROTORION Holding GmbH |

| Neapco, LLC |

| Vertically integrated OEM operations |

Commercial Vehicle | Meritor, Inc. |

| American Axle & Manufacturing Holdings, Inc. |

| Hendrickson (a subsidiary of the Boler Company) |

| Klein Products Inc. |

| Tirsan Kardan |

| Vertically integrated OEM operations |

Off-Highway | Carraro Group |

| ZF Friedrichshafen AG |

| GKN plc |

| Kessler + Co. |

| Meritor, Inc. |

| YTO Group |

| Comer Industries |

| Hema Endustri A.S. |

| Vertically integrated OEM operations |

Power Technologies | ElringKlinger AG |

| Federal-Mogul Corporation |

| Freudenberg NOK Group |

| MAHLE GmbH |

| Modine Manufacturing Company |

| Valeo Group |

| YinLun Co., LTD |

| Denso Corporation |

Intellectual Property

Our proprietary driveline and power technologies product lines have strong identities in the markets we serve. Throughout these product lines, we manufacture and sell our products under a number of patents that have been obtained over a period of years and expire at various times. We consider each of these patents to be of value and aggressively protect our rights throughout the world against infringement. We are involved with many product lines and the loss or expiration of any particular patent would not materially affect our sales and profits.

We own or have licensed numerous trademarks that are registered in many countries, enabling us to market our products worldwide. For example, our Spicer®, Victor Reinz® and Long® trademarks are widely recognized in their market segments.

Engineering and Research and Development

Since our introduction of the automotive universal joint in 1904, we have been focused on technological innovation. Our objective is to be an essential partner to our customers and we remain highly focused on offering superior product quality, technologically advanced products, world-class service and competitive prices. To enhance quality and reduce costs, we use statistical process control, cellular manufacturing, flexible regional production and assembly, global sourcing and extensive employee training.

We engage in ongoing engineering and research and development activities to improve the reliability, performance and cost-effectiveness of our existing products and to design and develop innovative products that meet customer requirements for new applications. We are integrating related operations to create a more innovative environment, speed product development, maximize efficiency and improve communication and information sharing among our research and development operations. At December 31, 2015, we had eight stand-alone technical and engineering centers with additional research and development activities carried out at eight additional sites. Our research and development costs were $75 in 2015, $72 in 2014 and $64 in 2013. Total engineering expenses including research and development were $183 in 2015, $176 in 2014 and $165 in 2013.

Our research and development activities continue to improve customer value. For all of our markets, this means drivelines with higher torque capacity, reduced weight and improved efficiency. End-use customers benefit by having vehicles with better fuel economy and reduced cost of ownership. We are also developing a number of power technologies products for vehicular and other applications that will assist fuel cell, battery and hybrid vehicle manufacturers in making their technologies commercially viable in mass production.

Employees

The following table summarizes our employees by operating segment.

|

| | | |

Segment | | Employees |

Light Vehicle | | 9,500 |

|

Commercial Vehicle | | 4,800 |

|

Off-Highway | | 2,700 |

|

Power Technologies | | 4,900 |

|

Technical and administrative | | 1,200 |

|

Total | | 23,100 |

|

Environmental Compliance

We make capital expenditures in the normal course of business as necessary to ensure that our facilities are in compliance with applicable environmental laws and regulations. The cost of environmental compliance has not been a material part of capital expenditures and did not have a material adverse effect on our earnings or competitive position in 2015.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 as amended (Exchange Act) are available, free of charge, on or through our Internet website at http://www.dana.com/investors as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC. We also post our Corporate Governance Guidelines, Standards of Business Conduct for Members of the Board of Directors, Board Committee membership lists and charters, Standards of Business Conduct and other corporate governance materials on our Internet website. Copies of these posted materials are also available in print, free of charge, to any stockholder upon request from: Dana Holding Corporation, Investor Relations, P.O. Box 1000, Maumee, Ohio 43537, or via telephone in the U.S. at 800-537-8823 or e-mail at InvestorRelations@dana.com. The inclusion of our website address in this report is an inactive textual reference only and is not intended to include or incorporate by reference the information on our website into this report.

Item 1A. Risk Factors

We are impacted by events and conditions that affect the light vehicle, medium/heavy vehicle and off-highway markets that we serve, as well as by factors specific to Dana. Among the risks that could materially adversely affect our business, financial condition or results of operations are the following, many of which are interrelated.

Risk Factors Related to the Markets We Serve

Failure to sustain a continuing economic recovery in the United States and elsewhere could have a substantial adverse effect on our business.

Our business is tied to general economic and industry conditions as demand for vehicles depends largely on the strength of the economy, employment levels, consumer confidence levels, the availability and cost of credit and the cost of fuel. These factors have had and could continue to have a substantial impact on our business.

We expect global market conditions to result in overall comparable sales in 2016. We expect the North America economic climate will continue to be modestly strong to stable with light vehicle demand levels continuing to be strong, while the medium/heavy truck market is expected to be weaker and the off-highway market remains relatively stable at already weak levels. Although the rate of growth in the Asia Pacific region has slowed, we expect overall economic improvement in the on-highway markets in 2016, with off-highway segment demand continuing to be weak. The economy in Europe is expected to improve modestly, with on-highway markets being slightly stronger while the off-highway market remains weak but stable. The South America countries where we do business are expected to remain relatively weak across all our markets in 2016. Adverse developments in the economic conditions of these markets could reduce demand for new vehicles, causing our customers to reduce their vehicle production and, as a result, demand for our products would be adversely affected.

Adverse global economic conditions could also cause our customers and suppliers to experience severe economic constraints in the future, including bankruptcy, which could have a material adverse impact on our financial position and results of operations.

We could be adversely impacted by the loss of any of our significant customers, changes in their requirements for our products or changes in their financial condition.

We are reliant upon sales to several significant customers. Sales to our ten largest customers accounted for 58% of our overall sales in 2015. Changes in our business relationships with any of our large customers or in the timing, size and continuation of their various programs could have a material adverse impact on us.

The loss of any of these customers, the loss of business with respect to one or more of their vehicle models on which we have high component content, or a significant decline in the production levels of such vehicles would negatively impact our business, results of operations and financial condition. Pricing pressure from our customers also poses certain risks. Inability on our part to offset pricing concessions with cost reductions would adversely affect our profitability. We are continually bidding on new business with these customers, as well as seeking to diversify our customer base, but there is no assurance that our efforts will be successful. Further, to the extent that the financial condition of our largest customers deteriorates, including possible bankruptcies, mergers or liquidations, or their sales otherwise decline, our financial position and results of operations could be adversely affected.

We may be adversely impacted by changes in international legislative and political conditions.

We operate in 25 countries around the world and we depend on significant foreign suppliers and customers. Further, we have several growth initiatives that are targeting emerging markets like China and India. Legislative and political activities within the countries where we conduct business, particularly in emerging markets and less developed countries, could adversely impact our ability to operate in those countries. The political situation in a number of countries in which we operate could create instability in our contractual relationships with no effective legal safeguards for resolution of these issues, or potentially result in the seizure of our assets. Through January 23, 2015, we operated in Venezuela where government exchange controls and policies placed restrictions on our ability to operate effectively and repatriate funds. Our risk associated with operating in this country was eliminated with the divestiture of our operations in Venezuela on January 23, 2015. However, we expect to continue exporting product to Venezuela, and our ability to do so effectively could be adversely impacted by Venezuela government policies. We operate in Argentina, where trade-related initiatives and other government restrictions limit our ability to optimize operating effectiveness. At December 31, 2015, our net asset exposure related to Argentina was approximately $21, including $11 of net fixed assets.

We may be adversely impacted by the strength of the U.S. dollar relative to the currencies in the other countries in which we do business.

Approximately 54% of our sales in 2015 were from operations located in countries other than the U.S. Currency variations can have an impact on our results (expressed in U.S. dollars). Currency variations can also adversely affect margins on sales of our products in countries outside of the U.S. and margins on sales of products that include components obtained from affiliates or other suppliers located outside of the U.S. Strengthening of the U.S. dollar against the euro and currencies of other countries in which we have operations has had and could continue to have an adverse affect our results reported in U.S. dollars. We use a combination of natural hedging techniques and financial derivatives to mitigate foreign currency exchange rate risks. Such

hedging activities may be ineffective or may not offset more than a portion of the adverse financial impact resulting from currency variations.

We may be adversely impacted by new laws, regulations or policies of governmental organizations related to increased fuel economy standards and reduced greenhouse gas emissions, or changes in existing ones.

The markets and customers we serve are subject to substantial government regulation, which often differs by state, region and country. These regulations, and proposals for additional regulation, are advanced primarily out of concern for the environment (including concerns about global climate change and its impact) and energy independence. We anticipate that the number and extent of these regulations, and the costs to comply with them, will increase significantly in the future.

In the U.S., vehicle fuel economy and greenhouse gas emissions are regulated under a harmonized national program administered by the National Highway Traffic Safety Administration and the Environmental Protection Agency. Other governments in the markets we serve are also creating new policies to address these same issues, including the European Union, Brazil, China and India. These government regulatory requirements could significantly affect our customers by altering their global product development plans and substantially increasing their costs, which could result in limitations on the types of vehicles they sell and the geographical markets they serve. Any of these outcomes could adversely affect our financial position and results of operations.

Company-Specific Risk Factors

We have taken, and continue to take, cost-reduction actions. Although our process includes planning for potential negative consequences, the cost-reduction actions may expose us to additional production risk and could adversely affect our sales, profitability and ability to attract and retain employees.

We have been reducing costs in all of our businesses and have discontinued product lines, exited businesses, consolidated manufacturing operations and positioned operations in lower cost locations. The impact of these cost-reduction actions on our sales and profitability may be influenced by many factors including our ability to successfully complete these ongoing efforts, our ability to generate the level of cost savings we expect or that are necessary to enable us to effectively compete, delays in implementation of anticipated workforce reductions, decline in employee morale and the potential inability to meet operational targets due to our inability to retain or recruit key employees.

We operate as a holding company and depend on our subsidiaries for cash to satisfy the obligations of the holding company.

Dana Holding Corporation is a holding company. Our subsidiaries conduct all of our operations and own substantially all of our assets. Our cash flow and our ability to meet our obligations depend on the cash flow of our subsidiaries. In addition, the payment of funds in the form of dividends, intercompany payments, tax sharing payments and otherwise may be subject to restrictions under the laws of the countries of incorporation of our subsidiaries or the by-laws of the subsidiary.

Labor stoppages or work slowdowns at Dana, key suppliers or our customers could result in a disruption in our operations and have a material adverse effect on our businesses.

We and our customers rely on our respective suppliers to provide parts needed to maintain production levels. We all rely on workforces represented by labor unions. Workforce disputes that result in work stoppages or slowdowns could disrupt operations of all of these businesses, which in turn could have a material adverse effect on the supply of, or demand for, the products we supply our customers.

We could be adversely affected if we are unable to recover portions of commodity costs (including costs of steel, other raw materials and energy) from our customers.

We continue to work with our customers to recover a portion of our material cost increases. While we have been successful in the past recovering a significant portion of such cost increases, there is no assurance that increases in commodity costs will not adversely impact our profitability in the future.

We could be adversely affected if we experience shortages of components from our suppliers or if disruptions in the supply chain lead to parts shortages for our customers.

A substantial portion of our annual cost of sales is driven by the purchase of goods and services. To manage and minimize these costs, we have been consolidating our supplier base. As a result, we are dependent on single sources of supply for some

components of our products. We select our suppliers based on total value (including price, delivery and quality), taking into consideration their production capacities and financial condition, and we expect that they will be able to support our needs. However, there is no assurance that adverse financial conditions, including bankruptcies of our suppliers, reduced levels of production, natural disasters or other problems experienced by our suppliers will not result in shortages or delays in their supply of components to us or even in the financial collapse of one or more such suppliers. If we were to experience a significant or prolonged shortage of critical components from any of our suppliers, particularly those who are sole sources, and were unable to procure the components from other sources, we would be unable to meet our production schedules for some of our key products and to ship such products to our customers in a timely fashion, which would adversely affect our sales, profitability and customer relations.

Adverse economic conditions, natural disasters and other factors can similarly lead to financial distress or production problems for other suppliers to our customers which can create disruptions to our production levels. Any such supply-chain induced disruptions to our production are likely to create operating inefficiencies that will adversely affect our sales, profitability and customer relations.

During 2013, we advised one of our largest suppliers that we did not intend to extend our existing contractual relationship beyond the contract expiration date of December 31, 2014. As a consequence, we established relationships with alternative suppliers. During the first half of 2015 as we transitioned to new suppliers, we were challenged with relatively high levels of demand in the market segment supported by these suppliers. This resulted in increased costs in the first half of 2015. Additionally, our inability to fully satisfy customer demands led to some lost business with a significant customer. There is a risk that our operating results and customer relationships could be adversely impacted if other supplier transitions are not completed effectively.

In 2014, the financial condition of a major supplier to our South America operations led to them pursuing legal reorganization. As more fully described in Note 2 of the consolidated financial statements in Item 8, in 2015, legal actions were required to maintain the supply of product from this supplier that was necessary to satisfy our customer commitments. Although we are currently operating under an arrangement with this supplier that is providing us with the required supply, we have incurred additional costs and there is continued uncertainty whether we will be able to maintain cost effective, uninterrupted supply. Our future operating results and customer relationships could be adversely impacted depending on the actions required to maintain existing product supply and the outcome of this supplier's legal reorganization. Our Commercial Vehicle operating segment had sales $98 and $225 in 2015 and 2014 attributable to axles and parts sourced from this supplier.

We use important intellectual property in our business. If we are unable to protect our intellectual property or if a third party makes assertions against us or our customers relating to intellectual property rights, our business could be adversely affected.

We own important intellectual property, including patents, trademarks, copyrights and trade secrets, and are involved in numerous licensing arrangements. Our intellectual property plays an important role in maintaining our competitive position in a number of the markets that we serve. Our competitors may develop technologies that are similar or superior to our proprietary technologies or design around the patents we own or license. Further, as we expand our operations in jurisdictions where the protection of intellectual property rights is less robust, the risk of others duplicating our proprietary technologies increases, despite efforts we undertake to protect them. Developments or assertions by or against us relating to intellectual property rights, and any inability to protect these rights, could materially adversely impact our business and our competitive position.

We could encounter unexpected difficulties integrating acquisitions and joint ventures.

We acquired businesses and invested in joint ventures in 2012 and 2011, and we expect to complete additional investments in the future that complement or expand our businesses. The success of this strategy will depend on our ability to successfully complete these transactions or arrangements, to integrate the businesses acquired in these transactions and to develop satisfactory working arrangements with our strategic partners in the joint ventures. We could encounter unexpected difficulties in completing these transactions and integrating the acquisitions with our existing operations. We also may not realize the degree or timing of benefits anticipated when we entered into a transaction.

Several of our joint ventures operate pursuant to established agreements and, as such, we do not unilaterally control the joint venture. There is a risk that the partners’ objectives for the joint venture may not be aligned, leading to potential differences over management of the joint venture that could adversely impact its financial performance and consequent contribution to our earnings. Additionally, inability on the part of our partners to satisfy their contractual obligations under the agreements could adversely impact our results of operations and financial position.

We could be adversely impacted by the costs of environmental, health, safety and product liability compliance.

Our operations are subject to environmental laws and regulations in the U.S. and other countries that govern emissions to the air; discharges to water; the generation, handling, storage, transportation, treatment and disposal of waste materials; and the cleanup of contaminated properties. Historically, other than an U.S. Environmental Protection Agency settlement as part of our bankruptcy proceedings, environmental costs related to our former and existing operations have not been material. However, there is no assurance that the costs of complying with current environmental laws and regulations, or those that may be adopted in the future, will not increase and adversely impact us.

There is also no assurance that the costs of complying with current laws and regulations, or those that may be adopted in the future, that relate to health, safety and product liability matters will not adversely impact us. There is also a risk of warranty and product liability claims, as well as product recalls, if our products fail to perform to specifications or cause property damage, injury or death, and a risk that asbestos-related product liability claims could result in increased liabilities at Dana Companies, LLC, a wholly owned subsidiary. (See Notes 14 and 15 to our consolidated financial statements in Item 8 for additional information on product liabilities and warranties.)

A failure of our information technology infrastructure could adversely impact our business and operations.

We recognize the increasing volume of cyber attacks and employ commercially practical efforts to provide reasonable assurance that the risks of such attacks are appropriately mitigated. Each year, we evaluate the threat profile of our industry to stay abreast of trends and to provide reasonable assurance our existing countermeasures will address any new threats identified. Despite our implementation of security measures, our IT systems and those of our service providers are vulnerable to circumstances beyond our reasonable control including acts of terror, acts of government, natural disasters, civil unrest and denial of service attacks which may lead to the theft of our intellectual property, trade secrets or business disruption. To the extent that any disruption or security breach results in a loss or damage to our data or an inappropriate disclosure of confidential information, it could cause significant damage to our reputation, affect our relationships with our customers, suppliers and employees, lead to claims against the company and ultimately harm our business. Additionally, we may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

We participate in certain multi-employer pension plans which are not fully funded.

We contribute to certain multi-employer defined benefit pension plans for our union-represented employees in the U.S. in accordance with our collective bargaining agreements. Contributions are based on hours worked except in cases of layoff or leave where we generally contribute based on 40 hours per week for a maximum of one year. The plans are not fully funded as of December 31, 2015. We could be held liable to the plans for our obligation, as well as those of other employers, due to our participation in the plans. Contribution rates could increase if the plans are required to adopt a funding improvement plan, if the performance of plan assets does not meet expectations or as a result of future collectively bargained wage and benefit agreements. (See Note 10 to our consolidated financial statements in Item 8 for additional information on multi-employer pension plans.)

Changes in interest rates and asset returns could increase our pension funding obligations and reduce our profitability.

We have unfunded obligations under certain of our defined benefit pension and other postretirement benefit plans. The valuation of our future payment obligations under the plans and the related plan assets are subject to significant adverse changes if the credit and capital markets cause interest rates and projected rates of return to decline. Such declines could also require us to make significant additional contributions to our pension plans in the future. A material increase in the unfunded obligations of these plans could also result in a significant increase in our pension expense in the future.

We may incur additional tax expense or become subject to additional tax exposure.

Our provision for income taxes and the cash outlays required to satisfy our income tax obligations in the future could be adversely affected by numerous factors. These factors include changes in the level of earnings in the tax jurisdictions in which we operate, changes in the valuation of deferred tax assets, changes in our plans to repatriate the earnings of our non-U.S. operations to the U.S. and changes in tax laws and regulations. Our income tax returns are subject to examination by federal, state and local tax authorities in the U.S. and tax authorities outside the U.S. The results of these examinations and the ongoing assessments of our tax exposures could also have an adverse effect on our provision for income taxes and the cash outlays required to satisfy our income tax obligations.

Our ability to utilize our net operating loss carryforwards may be limited.

Net operating loss carryforwards (NOLs) approximating $729 were available at December 31, 2015 to reduce future U.S. income tax liabilities. Our ability to utilize these NOLs may be limited as a result of certain change of control provisions of the U.S. Internal Revenue Code of 1986, as amended (Code). Of this amount, NOLs of approximately $594 are treated as losses incurred before the change of control upon emergence from Chapter 11 and are limited to annual utilization of $84. The balance of our NOLs, treated as incurred subsequent to the change in control, is not subject to limitation as of December 31, 2015. However, there can be no assurance that trading in our shares will not effect another change in control under the Code, which would further limit our ability to utilize our available NOLs. Such limitations may cause us to pay income taxes earlier and in greater amounts than would be the case if the NOLs were not subject to limitation.

Risk Factors Related to our Securities

Provisions in our Restated Certificate of Incorporation and Bylaws may discourage a takeover attempt.

Certain provisions of our Restated Certificate of Incorporation and Bylaws, as well as the General Corporation Law of the State of Delaware, may have the effect of delaying, deferring or preventing a change in control of Dana. Such provisions, including those governing the nomination of directors, limiting who may call special stockholders’ meetings and eliminating stockholder action by written consent, may make it more difficult for other persons, without the approval of our board of directors, to make a tender offer or otherwise acquire substantial amounts of common stock or to launch other takeover attempts that a stockholder might consider to be in such stockholder’s best interest.

Item 1B. Unresolved Staff Comments

-None-

Item 2. Properties

|

| | | | | | | | | | |

Type of Facility | | North

America | | Europe | | South

America | | Asia

Pacific | | Total |

Light Vehicle | | | | | | | | | | |

Manufacturing/Distribution | | 13 | | 3 | | 5 | | 9 | | 30 |

Commercial Vehicle | | | | | | | | | | |

Manufacturing/Distribution | | 8 | | 4 | | 3 | | 4 | | 19 |

Off-Highway | | | | | | | | | | |

Manufacturing/Distribution | | 2 | | 8 | |

| | 2 | | 12 |

Power Technologies | | | | | | | | | | |

Manufacturing/Distribution | | 12 | | 4 | |

| | 2 | | 18 |

Technical and Engineering Centers | | 3 | |

| |

| |

| | 3 |

Corporate and other | | | | | | | | | | |

Administrative Offices | | 2 | |

| |

| | 1 | | 3 |

Technical and Engineering Centers - Multiple Segments | | 2 | |

| |

| | 3 | | 5 |

| | 42 | | 19 | | 8 | | 21 | | 90 |

We operate in 25 countries and have 90 major facilities housing manufacturing and distribution operations, technical and engineering centers and administrative offices. In addition to the eight stand-alone technical and engineering centers in the table above, we have eight technical and engineering centers housed within manufacturing sites. We lease 32 of these facilities and a portion of four others and own the remainder. We believe that all of our property and equipment is properly maintained.

Our corporate headquarters facilities are located in Maumee, Ohio. This facility and other facilities in the greater Detroit, Michigan and Maumee, Ohio areas house functions that have global or North American regional responsibility for finance and accounting, treasury, risk management, legal, human resources, procurement and supply chain management, communications and information technology.

Item 3. Legal Proceedings

We are a party to various pending judicial and administrative proceedings that arose in the ordinary course of business. After reviewing the currently pending lawsuits and proceedings (including the probable outcomes, reasonably anticipated costs and expenses and our established reserves for uninsured liabilities), we do not believe that any liabilities that may result from these proceedings are reasonably likely to have a material adverse effect on our liquidity, financial condition or results of operations. Legal proceedings are also discussed in Notes 2 and 14 to our consolidated financial statements in Item 8.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market information — Our common stock trades on the New York Stock Exchange (NYSE) under the symbol "DAN." The following table shows the high and low prices of our common stock as reported by the NYSE for each of our fiscal quarters during 2015 and 2014.

|

| | | | | | | | | | | | | | | |

| 2015 | | 2014 |

| High | | Low | | High | | Low |

Fourth quarter | $ | 18.12 |

| | $ | 13.01 |

| | $ | 22.36 |

| | $ | 16.81 |

|

Third quarter | 20.81 |

| | 15.33 |

| | 24.82 |

| | 18.93 |

|

Second quarter | 22.73 |

| | 20.35 |

| | 24.48 |

| | 20.60 |

|

First quarter | 23.48 |

| | 20.04 |

| | 23.28 |

| | 18.06 |

|

Holders of common stock — Based on reports by our transfer agent, there were approximately 3,720 registered holders of our common stock on February 5, 2016.

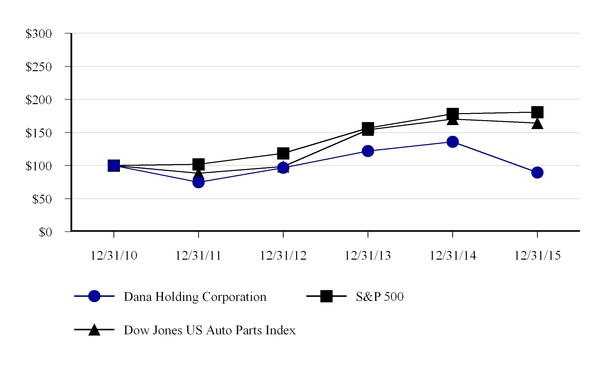

Stockholder return — The following graph shows the cumulative total shareholder return for our common stock since December 31, 2010. The graph compares our performance to that of the Standard & Poor’s 500 Stock Index (S&P 500) and the Dow Jones US Auto Parts Index. The comparison assumes $100 was invested at the closing price on December 31, 2010. Each of the returns shown assumes that all dividends paid were reinvested.

Performance chart

Index

|

| | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2010 | | 12/31/2011 | | 12/31/2012 | | 12/31/2013 | | 12/31/2014 | | 12/31/2015 |

Dana Holding Corporation | $ | 100.00 |

| | $ | 74.70 |

| | $ | 96.66 |

| | $ | 121.92 |

| | $ | 135.84 |

| | $ | 89.58 |

|

S&P 500 | 100.00 |

| | 102.11 |

| | 118.45 |

| | 156.82 |

| | 178.29 |

| | 180.75 |

|

Dow Jones US Auto Parts Index | 100.00 |

| | 88.21 |

| | 98.71 |

| | 154.04 |

| | 170.42 |

| | 164.10 |

|

Dividends — We declared and paid quarterly common stock dividends in 2015 and 2014, raising the dividend from five cents to six cents per share in the second quarter of 2015.

Issuer's purchases of equity securities — On July 30, 2014, our Board of Directors approved an expansion of our existing share repurchase program from $1,000 to $1,400. We repurchased shares utilizing available excess cash either in the open market or through privately negotiated transactions. The stock repurchases were subject to prevailing market conditions and other considerations. Under the program, we used cash of $66 to repurchase shares of our common stock during the fourth quarter of 2015.

The following table shows repurchases of our common stock for each calendar month in the quarter ended December 31, 2015.

|

| | | | | | | | | | | | | | | | |

Calendar Month | | Class or Series of Securities | | Number

of Shares Purchased | | Average

Price Paid

per Share | | Number of

Shares Purchased as

Part of Publicly

Announced Plans

or Programs | | Approximate

Dollar Value of

Shares that May Yet

be Purchased Under

the Plans or Programs |

October | | Common | | 2,948,254 |

| | $ | 16.75 |

| | 2,948,254 |

| | $ | 17 |

|

November | | Common | | 981,954 |

| | $ | 16.80 |

| | 981,954 |

| | $ | — |

|

December | | | | | | | | | | $ | — |

|

Our Board of Directors approved an expansion of our existing common stock share repurchase program from $1,400 to $1,700 on January 11, 2016. The share repurchase program expires on December 31, 2017.

Annual meeting — We will hold an annual meeting of stockholders on April 28, 2016.

Item 6. Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Operating Results | | | | | | | | | | |

Net sales | | $ | 6,060 |

| | $ | 6,617 |

| | $ | 6,769 |

| | $ | 7,224 |

| | $ | 7,544 |

|

Income from continuing operations before income taxes | | 292 |

| | 260 |

| | 368 |

| | 364 |

| | 306 |

|

Income from continuing operations | | 176 |

| | 343 |

| | 261 |

| | 315 |

| | 240 |

|

Income (loss) from discontinued operations | | 4 |

| | (15 | ) | | (1 | ) | | — |

| | (8 | ) |

Net income | | 180 |

| | 328 |

| | 260 |

| | 315 |

| | 232 |

|

| | | | | | | | | | |

Net income attributable to the parent company | | $ | 159 |

| | $ | 319 |

| | $ | 244 |

| | $ | 300 |

| | $ | 219 |

|

Preferred stock dividend requirements | | — |

| | 7 |

| | 25 |

| | 31 |

| | 31 |

|

Preferred stock redemption premium | | — |

| | — |

| | 232 |

| | — |

| | — |

|

Net income (loss) available to common stockholders | | $ | 159 |

| | $ | 312 |

| | $ | (13 | ) | | $ | 269 |

| | $ | 188 |

|

| | | | | | | | | | |

Net income (loss) per share available to common stockholders | | | | | | | | | | |

Basic | | | | | | | | | | |

Income (loss) from continuing operations | | $ | 0.98 |

| | $ | 2.07 |

| | $ | (0.08 | ) | | $ | 1.82 |

| | $ | 1.34 |

|

Income (loss) from discontinued operations | | 0.02 |

| | (0.10 | ) | | (0.01 | ) | | — |

| | (0.06 | ) |

Net income (loss) | | 1.00 |

| | 1.97 |

| | (0.09 | ) | | 1.82 |

| | 1.28 |

|

Diluted | | | | | | | | | | |

Income (loss) from continuing operations | | $ | 0.97 |

| | $ | 1.93 |

| | $ | (0.08 | ) | | $ | 1.40 |

| | $ | 1.05 |

|

Income (loss) from discontinued operations | | 0.02 |

| | (0.09 | ) | | (0.01 | ) | | — |

| | (0.03 | ) |

Net income (loss) | | 0.99 |

| | 1.84 |

| | (0.09 | ) | | 1.40 |

| | 1.02 |

|

| | | | | | | | | | |

Depreciation and amortization of intangibles | | $ | 174 |

| | $ | 213 |

| | $ | 262 |

| | $ | 277 |

| | $ | 307 |

|

Net cash provided by operating activities | | 406 |

| | 510 |

| | 577 |

| | 339 |

| | 370 |

|

Purchases of property, plant and equipment | | 260 |

| | 234 |

| | 209 |

| | 164 |

| | 196 |

|

| | | | | | | | | | |

Financial Position | | | | | | | | | | |

Cash and cash equivalents and marketable securities | | $ | 953 |

| | $ | 1,290 |

| | $ | 1,366 |

| | $ | 1,119 |

| | $ | 987 |

|

Total assets | | 4,326 |

| | 4,905 |

| | 5,103 |

| | 5,131 |

| | 5,262 |

|

Long-term debt, less debt issuance costs | | 1,553 |

| | 1,588 |

| | 1,541 |

| | 790 |

| | 816 |

|

Total debt | | 1,575 |

| | 1,653 |

| | 1,598 |

| | 891 |

| | 887 |

|

Preferred stock | | — |

| | — |

| | 372 |

| | 753 |

| | 753 |

|

Common stock and additional paid-in capital | | 2,313 |

| | 2,642 |

| | 2,842 |

| | 2,670 |

| | 2,644 |

|

Treasury stock | | (1 | ) | | (33 | ) | | (366 | ) | | (25 | ) | | (9 | ) |

Total parent company stockholders' equity | | 728 |

| | 1,080 |

| | 1,309 |

| | 1,836 |

| | 1,730 |

|

Book value per share | | $ | 4.58 |

| | $ | 6.83 |

| | $ | 8.94 |

| | $ | 12.41 |

| | $ | 11.81 |

|

| | | | | | | | | | |

Common Share Information | | | | | | | | | | |

Dividends declared per common share | | $ | 0.23 |

| | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.20 |

| | $ | — |

|

Weighted-average common shares outstanding | | | | | | | | | | |

Basic | | 159.0 |

| | 158.0 |

| | 146.4 |

| | 148.0 |

| | 146.6 |

|

Diluted | | 160.0 |

| | 173.5 |

| | 146.4 |

| | 214.7 |

| | 215.3 |

|

Market prices | | | | | | | | | | |

High | | $ | 23.48 |

| | $ | 24.82 |

| | $ | 23.46 |

| | $ | 16.76 |

| | $ | 19.35 |

|

Low | | 13.01 |

| | 16.81 |

| | 15.17 |

| | 11.13 |

| | 9.45 |

|

| |

Note: | In April 2015, the Financial Accounting Standards Board issued guidance which changes the presentation of debt issuance costs. Debt issuance costs related to term debt will be presented on the balance sheet as a direct deduction from the related debt liability rather than recorded as a separate asset. The guidance requires retrospective application to all prior periods presented. We have presented $21, $25, $26, $13 and $15 of debt issuance costs as a direct deduction from long-term debt as of December 31, 2015, 2014, 2013, 2012 and 2011. See Note 1 to our consolidated financial statements in Item 8 for additional information. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (Dollars in millions)

Management's discussion and analysis of financial condition and results of operations should be read in conjunction with the financial statements and accompanying notes in Item 8.

Management Overview

We are a global provider of high technology driveline, sealing and thermal-management products for virtually every major vehicle manufacturer in the on-highway and off-highway markets. Our driveline products – axles, driveshafts and transmissions – are delivered through our Light Vehicle Driveline Technologies (Light Vehicle), Commercial Vehicle Driveline Technologies (Commercial Vehicle) and Off-Highway Driveline Technologies (Off-Highway) operating segments. Our fourth global operating segment – Power Technologies – is the center of excellence for the sealing and thermal technologies that span all customers in our on-highway and off-highway markets. We have a diverse customer base and geographic footprint which minimizes our exposure to individual market and segment declines. In 2015, 53% of our sales came from North American operations and 47% from operations throughout the rest of the world. Our sales by operating segment were Light Vehicle – 41%, Commercial Vehicle – 25%, Off-Highway – 17% and Power Technologies – 17%.

Operational and Strategic Initiatives

Over the past several years, we have significantly improved our overall financial position — improving the overall profitability of our business, simplifying our capital structure, maintaining strong cash flows and addressing structural costs. We have also strengthened our leadership team and streamlined our operating segments to focus on our core competencies of driveline technologies, sealing systems and thermal management. As a result, we believe that we are well-positioned to place increasing focus on profitable growth and shareholder returns.

Shareholder returns and capital structure actions — When evaluating capital structure initiatives, we balance our growth opportunities and shareholder value initiatives with maintaining a strong balance sheet and access to capital. Our strong financial position in recent years enabled us to simplify our capital structure while providing returns to our common shareholders in the form of cash dividends and reduction in the number of common share equivalents outstanding. During 2013, we redeemed our Series A preferred stock, the equivalent of 21 million common shares on an as converted basis, for $474. In 2014, we exercised our option to convert all remaining outstanding preferred shares to common shares. In 2014, our Board of Directors approved the expansion of our share repurchase program from $1,000 to $1,400. In 2015, we used $311 under this program to repurchase common shares, bringing the total shares repurchased since program inception to 67 million, inclusive of the common share equivalent reduction resulting from redemption of preferred shares. In January 2016, our Board of Directors approved the expansion of our share repurchase program from $1,400 to $1,700. Additionally, we declared and paid quarterly common stock dividends over the past four years, raising the dividend from five cents to six cents per share in the second quarter of 2015.

In December 2014 and the first quarter of 2015, we completed the redemption of our senior notes maturing in 2019, replacing them with senior notes having lower interest rates and maturing in 2024. Additionally, in the fourth quarter of 2014, we completed a voluntary program offered to deferred vested salaried participants in our U.S. pension plans. With this program, we reduced plan benefit obligations by $171 with lump sum payments of $133 from plan assets.

Technology leadership — With a clear focus on market-based value drivers, global-mega trends and customer sustainability objectives and requirements, we are driving innovation to create differentiated value for our customers, enabling a “market pull” product pipeline. Our sealing and thermal engine expertise provides us with early insight into some of the critical design factors important to our customers. When combined with our drivetrain expertise, we are able to collaborate with our customers on complete power conveyance solutions, from the engine through the vehicle driveline. We are committed to making investments and diversifying our product offerings to strengthen our competitive position in our core driveline, sealing and thermal technologies businesses, creating value for our customers through improved fuel efficiency, emission control, electric and hybrid electric solutions, durability and cost of ownership, software integration and systems solutions. Our industry leading electronically actuated disconnecting all wheel drive technology, which we believe is the most fuel efficient rapidly disconnecting system in the market, was recently selected by one of our major customers for a significant new global vehicle platform - opening up new commercial channels for us in the passenger car, crossover and sport utility vehicle markets. A strategic alliance with Fallbrook Technologies Inc. (Fallbrook) provides us the opportunity to leverage leading edge continuously variable planetary (CVP) technology into the development of advanced drivetrain and transmission solutions for customers in our end markets.

Additional engineering and operational investment is being channeled into reinvigorating our product portfolio and capitalizing on technology advancement opportunities. Combined engineering centers of our Light Vehicle and Commercial Vehicle segments allow us the opportunity to better share technologies among these businesses. New engineering facilities in India and China were opened in the past few years and are now on line, more than doubling our engineering presence in the Asia Pacific region with state-of-the-art development and test capabilities that globally support each of our businesses. Additionally, in 2014, we opened a new technology center in Cedar Park, Texas to support our CVP technology development initiatives.

Geographic expansion — Our manufacturing and technology center footprint positions us to support customers globally - an important factor as many of our customers are increasingly focused on common powertrain solutions for global platforms. While growth opportunities are present in each region of the world, we have a primary focus on building our presence and local capability in the Asia Pacific region, especially India and China. In addition to new engineering facilities in those countries, new gear manufacturing facilities were recently established in India and Thailand. We have expanded our China off-highway activities and we believe there is considerable opportunity for growth in this market.

Aftermarket opportunities — We have a global group dedicated to identifying and developing aftermarket growth opportunities that leverage the capabilities within our existing businesses – targeting increased future aftermarket sales.

Selective acquisitions — Our current acquisition focus is to identify “bolt-on” or adjacent acquisition opportunities that have a strategic fit with our existing core businesses, particularly opportunities that support our growth initiatives and enhance the value proposition of our customer product offerings. Any potential acquisition will be evaluated in the same manner we currently consider customer program opportunities – with a disciplined financial approach designed to ensure profitable growth.

New commercial channels — In each of our operating segments, we have customer, geographic and product growth opportunities. By leveraging our relentless pursuit of customer satisfaction, innovative technology and differentiated products, we believe there are opportunities to open new, as well as further penetrate existing, commercial channels.

Manufacturing excellence/cost management — Although we have taken significant strides to improve our profitability and margins, particularly through streamlining and rationalizing our manufacturing activities and administrative support processes, we believe additional opportunities remain to further improve our financial performance. We have ramped up our material cost efforts to ensure that we are rationalizing our supply base and obtaining appropriate competitive pricing. We have embarked on information technology initiatives to reduce and streamline systems and supporting costs. With a continued emphasis on process improvements and productivity throughout the organization, we expect cost reductions to continue contributing to future margin improvement.

Divestitures

Disposal of operations in Venezuela — The operating, political and economic environment in Venezuela in recent years was very challenging. Foreign exchange controls restricted our ability to import required parts and material and satisfy the related U.S. dollar obligations. Production activities were curtailed for most of 2014 as our major original equipment customers suspended production, with a limited amount of activity coming back on line later in the year. Our sales in Venezuela during 2014 approximated $110 as compared to $170 in 2013. Results of operations were adversely impacted by the reduced production levels making break-even operating performance a significant challenge. Further, devaluations of the bolivar along with other foreign exchange developments provided added volatility to results of operations and increased uncertainty around future performance.

In December 2014, we entered into an agreement to divest our operations in Venezuela (the disposal group) to an unaffiliated company for no consideration. We completed the divestiture in January 2015. In connection with the divestiture, we entered into a supply and technology agreement whereby Dana will supply product and technology to the operations at competitive market prices. Dana has no obligations to otherwise provide support to the operations. The disposal group was classified as held for sale at December 31, 2014, and we recognized a net charge of $77 – an $80 loss to adjust the carrying value of the net assets to fair value less cost to sell, with a reduction of $3 for the noncontrolling interest share of the loss. These assets and liabilities were presented as held for sale on our December 31, 2014 balance sheet. Upon completion of the divestiture of the disposal group in January 2015, we recognized a gain of $5 on the derecognition of the noncontrolling interest in a former Venezuelan subsidiary in other income, net. We also credited other comprehensive loss attributable to the parent for $10 and other comprehensive loss attributable to noncontrolling interests for $1 to eliminate the unrecognized pension expense recorded in accumulated other comprehensive loss. See Note 2 to our consolidated financial statements in Item 8 for additional information. With the completion of the sale in January 2015, Dana has no remaining investment in Venezuela.

Divestiture of Structural Products Business — In 2010, we completed the sale of substantially all of the assets of our Structural Products business to Metalsa S.A. de C.V. (Metalsa). We had received cash proceeds of $134 by the end of 2011, excluding amounts related to working capital adjustments and tooling. The parties reached a final agreement on disputed issues in May 2014, resulting in the receipt of additional cash proceeds of $9 and a charge of $1 to other expense. Prior to the third quarter of 2012, Structural Products was reported as an operating segment of continuing operations. With the cessation of the retained operations in the third quarter of 2012, we began reporting the activities relating to the Structural Products business as discontinued operations.

Segments

We manage our operations globally through four operating segments. Our Light Vehicle and Power Technologies segments primarily support light vehicle original equipment manufacturers (OEMs) with products for light trucks, SUVs, CUVs, vans and passenger cars. The Commercial Vehicle segment supports the OEMs of on-highway commercial vehicles (primarily trucks and buses), while our Off-Highway segment supports OEMs of off-highway vehicles (primarily wheeled vehicles used in construction, mining and agricultural applications).

Trends in Our Markets

Global Vehicle Production

|

| | | | | | | | | | | | | |

| | | | | Actual |

(Units in thousands) | Dana 2016 Outlook | | 2015 | | 2014 | | 2013 |

North America | |

| | | | |

| | |

| | |

|

Light Truck (Full Frame) | 4,250 |

| to | 4,300 | | 4,123 |

| | 3,834 |

| | 3,632 |

|

Light Vehicle Engines | 15,500 |

| to | 16,000 | | 15,355 |

| | 15,119 |

| | 14,233 |

|

Medium Truck (Classes 5-7) | 230 |

| to | 240 | | 235 |

| | 226 |

| | 201 |

|

Heavy Truck (Class 8) | 240 |

| to | 260 | | 322 |

| | 297 |

| | 245 |

|

Agricultural Equipment | 55 |

| to | 60 | | 58 |

| | 64 |

| | 75 |

|

Construction/Mining Equipment | 155 |

| to | 165 | | 158 |

| | 158 |

| | 157 |

|

Europe (including Eastern Europe) | |

| | | | |

| | |

| | |

|

Light Truck | 8,800 |

| to | 8,900 | | 8,525 |

| | 7,790 |

| | 7,276 |

|

Light Vehicle Engines | 22,500 |

| to | 23,000 | | 22,617 |

| | 21,510 |

| | 20,836 |

|

Medium/Heavy Truck | 440 |

| to | 445 | | 438 |

| | 397 |

| | 400 |

|

Agricultural Equipment | 200 |

| to | 205 | | 202 |

| | 220 |

| | 244 |

|

Construction/Mining Equipment | 300 |

| to | 305 | | 299 |

| | 301 |

| | 298 |

|

South America | |

| | | | |

| | |

| | |

|

Light Truck | 950 |

| to | 1,000 | | 948 |

| | 1,146 |

| | 1,302 |

|

Light Vehicle Engines | 2,500 |

| to | 2,550 | | 2,486 |

| | 3,176 |

| | 3,775 |

|

Medium/Heavy Truck | 80 |

| to | 90 | | 86 |

| | 167 |

| | 218 |

|

Agricultural Equipment | 30 |

| to | 35 | | 32 |

| | 43 |

| | 54 |

|

Construction/Mining Equipment | 10 |

| to | 15 | | 13 |

| | 17 |

| | 20 |

|

Asia-Pacific | |

| | | | |

| | |

| | |

|

Light Truck | 24,000 |

| to | 25,000 | | 24,031 |

| | 22,337 |

| | 20,515 |

|

Light Vehicle Engines | 48,500 |

| to | 49,500 | | 47,060 |

| | 46,497 |

| | 45,213 |

|

Medium/Heavy Truck | 1,400 |

| to | 1,450 | | 1,378 |

| | 1,573 |

| | 1,522 |

|

Agricultural Equipment | 655 |

| to | 690 | | 676 |

| | 710 |

| | 788 |

|

Construction/Mining Equipment | 400 |

| to | 420 | | 405 |

| | 509 |

| | 555 |

|

North America

Light vehicle markets — Improving economic conditions during the past three years have contributed to increased light vehicle sales and production levels in North America. Release of built-up demand to replace older vehicles, greater availability of credit, stronger consumer confidence and other factors have combined to stimulate new vehicle sales. Light vehicle sales in 2015 increased about 6% from 2014, with sales that year being up 6% from 2013. Many of our programs are focused in the full frame light truck segment. Sales in this segment were especially strong the past two years, being up about 9% in 2015 and 8% in 2014. Light vehicle production levels were reflective of the stronger vehicle sales. Production of approximately 17.5 million

light vehicles in 2015 was 3% higher than in 2014, after increased production of about 5% the preceding year. Light vehicle engine production was similarly higher, up 2% in 2015 and 6% in 2014. In the key full frame light truck segment, production levels increased about 8% in 2015 compared with an increase of 6% in 2014. Days’ supply of total light vehicles in the U.S. at the end of December 2015 was around 61 days, comparable with the number of days at the end of 2014 and down slightly from 64 days at the end of 2013. In the full frame light truck segment, an inventory level of 62 days at the end of 2015 compares favorably with 63 days at the end of 2014 and 67 days at the end of 2013.

Looking ahead to 2016, we believe the North American markets will continue to be relatively strong. Reduced unemployment levels, low fuel prices and stable consumer confidence are expected to provide a favorable economic climate. Our current outlook for 2016 light vehicle engine production is 15.5 to 16.0 million units, a 1 to 4% increase over 2015, with full frame light truck production expected to be in the range of 4.25 to 4.3 million units, an increase of about 3 to 4% from 2015.

Medium/heavy vehicle markets — Similar to the light vehicle market, the commercial vehicle segment benefited from an improving North America economy in recent years, leading to increased medium duty Classes 5-7 truck production the past three years. After increasing 12% in 2014, medium duty production increased another 4% in 2015. In the Class 8 segment, after declining 12% in 2013, production levels increased about 21% in 2014 as confidence in a sustained stronger economy took hold. That continued in 2015, as production climbed about 8% to around 322,000 units.

Orders for Class 8 trucks weakened some in the fourth quarter of 2015, which led to customers pulling back some on production near the end of the quarter and into the first month of 2016. Combined with the strong production level in 2015, inventory levels are higher and customers are being somewhat cautious about 2016 production levels. At present, we expect Class 8 production in the region to be in the range of 240,000 to 260,000 units, a decrease of around 19 to 25% from 2015. Medium duty production is expected to be relatively comparable with 2015.

Markets Outside of North America

Light vehicle markets — Signs of an improved overall European economy have been evident, albeit mixed at times, during the past few years. Reflective of a modestly improved economy, light vehicle production levels have increased with light vehicle engine production being up about 5% in 2015 after increasing 3% in 2014 and light truck production being higher by 9% in 2015 after being up about 7% in 2014. We expect the current economic stability to persist in 2016 with light vehicle engine and light truck production being comparable to up slightly from 2015. The economic climate in most South America markets the past three years has been weak, volatile and challenging. After rebounding some in 2013 from a relatively weak 2012, light truck production declined 12% in 2014 and was down another 17% in 2015. Light vehicle engine production was similarly down 16% in 2014 and another 22% in 2015. Our current 2016 outlook for light trucks and light vehicle engines has production being relatively flat with 2015. The Asia Pacific markets have been relatively strong the past few years, principally fueled by growth in China. Light truck production increased 9% in 2014 and was up another 8% in 2015, while light vehicle engine production increased 3% in 2014 and another 1% in 2015. We expect to see continued growth in 2016, with year-over-year light truck production being flat to up 4% and light vehicle engine production being higher by about 3 to 5%.

Medium/heavy vehicle markets — Some of the same factors referenced above that affected light vehicle markets outside of North America similarly affected the medium/heavy markets. Whereas some modest improvement was reflected in light vehicle production levels in 2013 and 2014, production levels in the medium/heavy truck market were relatively comparable as improvement was a little slower to manifest in this market. Signs of a strengthening European market emerged in 2015 with medium/heavy truck production in 2015 being up about 10% from the preceding year. For 2016, we expect Europe medium/heavy truck production to be comparable with 2015. South America medium/heavy truck production rebounded some in 2013 from low production levels in 2012, due in part to engine emission changes in Brazil that year. A weakening economic climate in 2014 in the region, however, led to medium/heavy truck production declining about 23% in 2014. Further weakening in 2015 resulted in a further decline in production, with vehicle build being down about 49% from 2014. Our outlook in South America for 2016 anticipates persistent economic weakness in the region, with medium/heavy truck production likely to be relatively flat with 2015. Asia Pacific medium/heavy truck production levels in 2012 and early 2013 were still restrained from the effects of natural disasters that significantly impacted the region in 2011, along with a sluggish 2012 commercial vehicle market in China. After strengthening about 2% in 2013, the medium/truck market in Asia Pacific has been sluggish the past two years, being up a modest 3% in 2014 and declining about 12% in 2015 as a slow down in the China market materialized. While the China market is expected to be comparable to up modestly in 2016, an improving India market is expected to help improve production in the region by about 2 to 5% in 2016.

Off-Highway Markets — Our off-highway business has a large presence outside of North America, with more than 75% of its sales coming from Europe and approximately 12% from South America and Asia Pacific combined. We serve several segments

of the diverse off-highway market, including construction, agriculture, mining and material handling. Our largest markets are the construction/mining and agricultural equipment segments. After experiencing increased global demand in 2011 and 2012, these markets have been relatively weak the past three years. Global demand in the agriculture market was up about 3% in 2013, but down 11% in 2014 and 7% in 2015. The construction/mining segment weakened about 8% in 2013 and was down about 4% in 2014 and 11% in 2015. Both markets are expected to remain weak in 2016, with demand levels in the agriculture segment expected to range from down 3% to up 2% from 2015 and construction/mining segment demand expected to be flat to up 3% compared to 2015.

Foreign Currency Effects