|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington,

D.C. 20549

|

|

FORM

|

|

CURRENT

REPORT

|

|

|

|

|

||

|

(State or Other

Jurisdiction of

Incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

|

|

CURTISS-WRIGHT CORPORATION | |

|

|

|

|

|

|

|

|

|

|

By: /s/ K. Christopher Farkas

|

|

|

|

|

K. Christopher Farkas |

|

|

|

Vice-President and

Chief Financial Officer

|

|

Exhibit

Number |

Description

|

| 99.2 |

Presentation shown during investor and securities analyst webcast on August

4, 2022 |

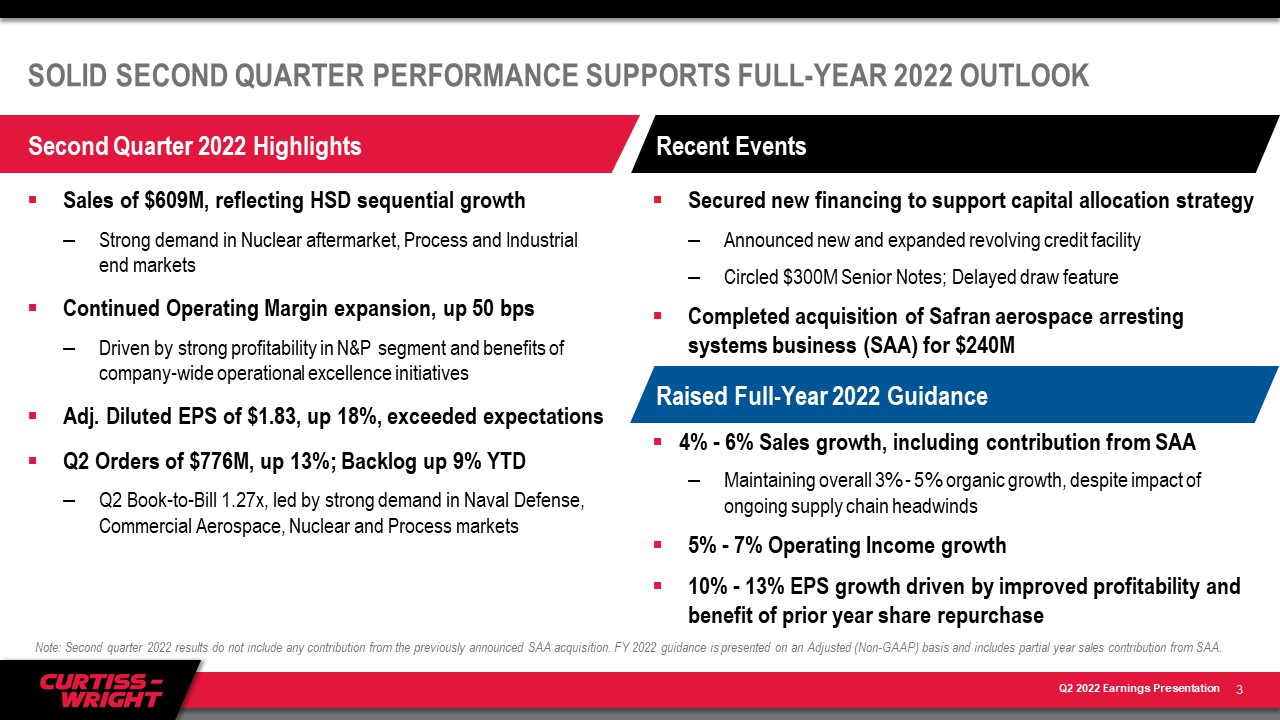

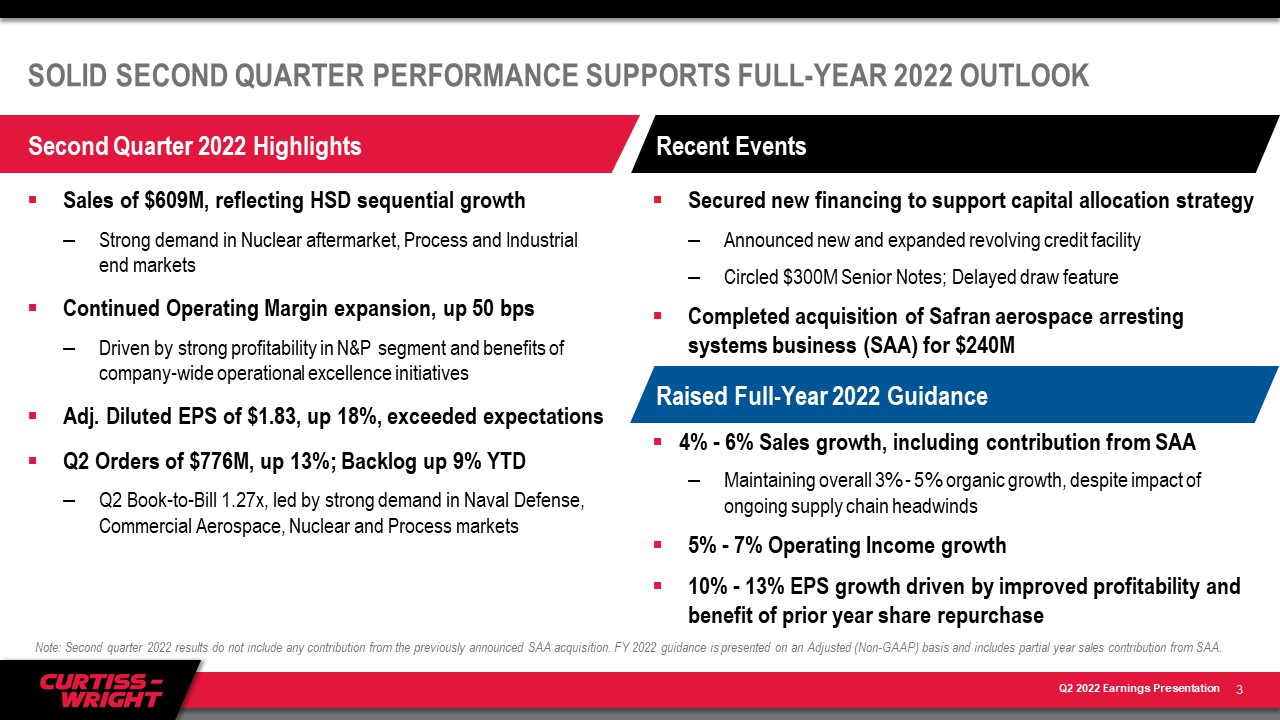

DAVIDSON, N.C.--(BUSINESS WIRE)--August 3, 2022--Curtiss-Wright Corporation (NYSE: CW) reports financial results for the second quarter ended June 30, 2022.

Second Quarter 2022 Highlights:

Full-Year 2022 Adjusted Guidance:

"Curtiss-Wright delivered solid second quarter results, as overall sales were in-line with our expectations and our ongoing focus on operational execution enabled us to generate 50 basis points in operating margin expansion. As a result, Adjusted diluted EPS of $1.83 exceeded our expectations in the second quarter," said Lynn M. Bamford, Chair and CEO of Curtiss-Wright Corporation. "We also experienced strong order activity, as bookings increased 13% year over year, yielding a book-to-bill of 1.27, driven by increased demand in our defense and commercial aerospace markets."

"Looking ahead to the remainder of 2022, although near-term headwinds from ongoing supply chain disruption continue to impact the timing of revenue within our defense markets, we are encouraged by the improving trends in our commercial markets which provides confidence in achieving our full-year outlook. We raised our full-year 2022 guidance for total sales growth to a new range of 4% to 6% to reflect the contribution of the recently completed SAA acquisition, and we continue to anticipate solid organic growth of 3% to 5% in our A&D and Commercial markets. We also expect continued operating margin expansion and double-digit Adjusted diluted EPS growth of 10% to 13%, as we successfully execute on our Pivot to Growth strategy to drive long-term shareholder value.”

Financing of $300 Million in Senior Notes:

Second Quarter 2022 Operating Results

|

(In millions) |

Q2-2022 |

Q2-2021 |

Change |

||||||||

|

Reported |

|

|

|

||||||||

|

Sales |

$ |

609 |

|

$ |

621 |

|

(2 |

%) |

|||

|

Operating income |

$ |

98 |

|

$ |

95 |

|

4 |

% |

|||

|

Operating margin |

|

16.1 |

% |

|

15.2 |

% |

90 bps |

||||

|

|

|

|

|

||||||||

|

Adjusted (1) |

|

|

|

||||||||

|

Sales |

$ |

609 |

|

$ |

609 |

|

0 |

% |

|||

|

Operating income |

$ |

98 |

|

$ |

95 |

|

3 |

% |

|||

|

Operating margin |

|

16.1 |

% |

|

15.6 |

% |

50 bps |

||||

|

(1) |

Reconciliations of Reported to Adjusted operating results are available in the Appendix. |

Second Quarter 2022 Segment Performance

Aerospace & Industrial

|

(In millions) |

Q2-2022 |

Q2-2021 |

Change |

||||||||

|

Reported |

|

|

|

||||||||

|

Sales |

$ |

209 |

|

$ |

200 |

|

4 |

% |

|||

|

Operating income |

$ |

32 |

|

$ |

32 |

|

2 |

% |

|||

|

Operating margin |

|

15.6 |

% |

|

16.0 |

% |

(40 bps) |

||||

|

|

|

|

|

||||||||

|

Adjusted (1) |

|

|

|

||||||||

|

Sales |

$ |

209 |

|

$ |

194 |

|

8 |

% |

|||

|

Operating income |

$ |

32 |

|

$ |

30 |

|

7 |

% |

|||

|

Operating margin |

|

15.6 |

% |

|

15.7 |

% |

(10 bps) |

||||

|

(1) |

Reconciliations of Reported to Adjusted operating results are available in the Appendix. |

Defense Electronics

|

(In millions) |

Q2-2022 |

Q2-2021 |

Change |

||||||||

|

Reported |

|

|

|

||||||||

|

Sales |

$ |

150 |

|

$ |

162 |

|

(8 |

%) |

|||

|

Operating income |

$ |

24 |

|

$ |

29 |

|

(16 |

%) |

|||

|

Operating margin |

|

16.4 |

% |

|

18.0 |

% |

(160 bps) |

||||

|

|

|

|

|

||||||||

|

Adjusted (1) |

|

|

|

||||||||

|

Sales |

$ |

150 |

|

$ |

163 |

|

(8 |

%) |

|||

|

Operating income |

$ |

24 |

|

$ |

31 |

|

(21 |

%) |

|||

|

Operating margin |

|

16.4 |

% |

|

18.9 |

% |

(250 bps) |

||||

|

(1) |

Reconciliations of Reported to Adjusted operating results are available in the Appendix. |

Naval & Power

|

(In millions) |

Q2-2022 |

Q2-2021 |

Change |

||||||||

|

Reported |

|

|

|

||||||||

|

Sales |

$ |

251 |

|

$ |

259 |

|

(3 |

%) |

|||

|

Operating income |

$ |

50 |

|

$ |

43 |

|

16 |

% |

|||

|

Operating margin |

|

19.9 |

% |

|

16.6 |

% |

330 bps |

||||

|

|

|

|

|

||||||||

|

Adjusted (1) |

|

|

|

||||||||

|

Sales |

$ |

251 |

|

$ |

252 |

|

0 |

% |

|||

|

Operating income |

$ |

50 |

|

$ |

43 |

|

15 |

% |

|||

|

Operating margin |

|

19.9 |

% |

|

17.2 |

% |

270 bps |

||||

|

(1) |

Reconciliations of Reported to Adjusted operating results are available in the Appendix. |

Free Cash Flow

|

(In millions) |

Q2-2022 |

Q2-2021 |

Change |

||||||||

|

Net cash provided by operating activities |

$ |

31 |

|

$ |

75 |

|

(59 |

%) |

|||

|

Capital expenditures |

|

(9 |

) |

|

(9 |

) |

(7 |

%) |

|||

|

Reported free cash flow |

$ |

22 |

|

$ |

66 |

|

(66 |

%) |

|||

|

Adjusted free cash flow (1) |

$ |

22 |

|

$ |

66 |

|

(66 |

%) |

|||

|

(1) |

A reconciliation of Reported to Adjusted free cash flow is available in the Appendix. |

New Orders and Backlog

Share Repurchase and Dividends

Full-Year 2022 Guidance

The Company is updating its full-year 2022 Adjusted financial guidance(1) as follows:

|

($ in millions, except EPS) |

2022 Adjusted |

2022 Adjusted |

% Chg vs 2021 |

|||

|

Total Sales |

$2,530 - $2,580 |

$2,570 - $2,620 |

Up 4% - 6% |

|||

|

Operating Income |

$432 - $446 |

$439 - $452 |

Up 5% - 7% |

|||

|

Operating Margin |

17.1% - 17.3% |

17.1% - 17.3% |

Up 10 - 30 bps |

|||

|

Diluted EPS |

$8.05 - $8.25 |

$8.10 - $8.30 |

Up 10% - 13% |

|||

|

Free Cash Flow |

$345 - $365 |

$345 - $365 |

Up 0% - 5% |

|

(1) |

Reconciliations of Reported to Adjusted 2021 operating results and 2022 financial guidance are available in the Appendix. Adjusted guidance includes the contribution from the SAA acquisition to the Company's second half 2022 performance. |

**********

A more detailed breakdown of the Company’s 2022 financial guidance by segment and by market, as well as all reconciliations of Reported GAAP amounts to Adjusted non-GAAP amounts, can be found in the accompanying schedules. Historical financial results are available in the Investor Relations section of Curtiss-Wright’s website.

Conference Call & Webcast Information

The Company will host a conference call to discuss second quarter 2022 financial results and updates to 2022 guidance at 10:00 a.m. ET on Thursday, August 4, 2022. A live webcast of the call and the accompanying financial presentation, as well as a replay of the call, will be made available on the internet by visiting the Investor Relations section of the Company’s website at www.curtisswright.com.

(Tables to Follow)

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED) |

||||||||||||||||

|

($'s in thousands, except per share data) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Three Months Ended |

|

Six Months Ended |

|||||||||||||

|

|

June 30, |

|

June 30, |

|||||||||||||

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|||||||||

|

Product sales |

$ |

505,416 |

|

|

$ |

515,392 |

|

|

$ |

958,837 |

|

|

$ |

1,024,367 |

|

|

|

Service sales |

|

103,941 |

|

|

|

106,103 |

|

|

|

209,981 |

|

|

|

194,187 |

|

|

|

Total net sales |

|

609,357 |

|

|

|

621,495 |

|

|

|

1,168,818 |

|

|

|

1,218,554 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Cost of product sales |

|

316,389 |

|

|

|

331,881 |

|

|

|

610,916 |

|

|

|

661,335 |

|

|

|

Cost of service sales |

|

64,454 |

|

|

|

64,895 |

|

|

|

127,986 |

|

|

|

122,743 |

|

|

|

Total cost of sales |

|

380,843 |

|

|

|

396,776 |

|

|

|

738,902 |

|

|

|

784,078 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Gross profit |

|

228,514 |

|

|

|

224,719 |

|

|

|

429,916 |

|

|

|

434,476 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Research and development expenses |

|

23,868 |

|

|

|

23,194 |

|

|

|

44,417 |

|

|

|

45,057 |

|

|

|

Selling expenses |

|

30,407 |

|

|

|

29,564 |

|

|

|

58,499 |

|

|

|

59,160 |

|

|

|

General and administrative expenses |

|

76,134 |

|

|

|

77,378 |

|

|

|

163,734 |

|

|

|

150,610 |

|

|

|

Loss on divestiture |

|

— |

|

|

|

— |

|

|

|

4,651 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Operating income |

|

98,105 |

|

|

|

94,583 |

|

|

|

158,615 |

|

|

|

179,649 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Interest expense |

|

9,788 |

|

|

|

10,180 |

|

|

|

19,318 |

|

|

|

20,139 |

|

|

|

Other income, net |

|

4,555 |

|

|

|

440 |

|

|

|

7,552 |

|

|

|

5,283 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Earnings before income taxes |

|

92,872 |

|

|

|

84,843 |

|

|

|

146,849 |

|

|

|

164,793 |

|

|

|

Provision for income taxes |

|

(22,000 |

) |

|

|

(23,435 |

) |

|

|

(35,292 |

) |

|

|

(43,916 |

) |

|

|

Net earnings |

$ |

70,872 |

|

|

$ |

61,408 |

|

|

$ |

111,557 |

|

|

$ |

120,877 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Net earnings per share: |

|

|

|

|

|

|

|

|||||||||

|

Basic earnings per share |

$ |

1.84 |

|

|

$ |

1.50 |

|

|

$ |

2.90 |

|

|

$ |

2.95 |

|

|

|

Diluted earnings per share |

$ |

1.83 |

|

|

$ |

1.49 |

|

|

$ |

2.89 |

|

|

$ |

2.94 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Dividends per share |

$ |

0.19 |

|

|

$ |

0.18 |

|

|

$ |

0.37 |

|

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|||||||||

|

Basic |

|

38,429 |

|

|

|

40,915 |

|

|

|

38,438 |

|

|

|

40,921 |

|

|

|

Diluted |

38,654 |

41,088 |

38,657 |

41,092 |

||||||||||||

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

||||||||

|

($'s in thousands, except par value) |

||||||||

|

|

|

|

|

|||||

|

|

June 30, |

|

December 31, |

|||||

|

|

2022 |

|

2021 |

|||||

|

Assets |

|

|

|

|||||

|

Current assets: |

|

|

|

|||||

|

Cash and cash equivalents |

$ |

171,414 |

|

|

$ |

171,004 |

|

|

|

Receivables, net |

|

699,632 |

|

|

|

647,148 |

|

|

|

Inventories, net |

|

482,790 |

|

|

|

411,567 |

|

|

|

Assets held for sale |

|

— |

|

|

|

10,988 |

|

|

|

Other current assets |

|

84,584 |

|

|

|

67,101 |

|

|

|

Total current assets |

|

1,438,420 |

|

|

|

1,307,808 |

|

|

|

Property, plant, and equipment, net |

|

348,062 |

|

|

|

360,031 |

|

|

|

Goodwill |

|

1,531,999 |

|

|

|

1,463,026 |

|

|

|

Other intangible assets, net |

|

638,873 |

|

|

|

538,077 |

|

|

|

Operating lease right-of-use assets, net |

|

145,325 |

|

|

|

143,613 |

|

|

|

Prepaid pension asset |

|

263,719 |

|

|

|

256,422 |

|

|

|

Other assets |

|

36,130 |

|

|

|

34,568 |

|

|

|

Total assets |

$ |

4,402,528 |

|

|

$ |

4,103,545 |

|

|

|

|

|

|

|

|||||

|

Liabilities |

|

|

|

|||||

|

Current liabilities: |

|

|

|

|||||

|

Current portion of long-term debt |

$ |

202,500 |

|

|

$ |

— |

|

|

|

Accounts payable |

|

171,589 |

|

|

|

211,640 |

|

|

|

Accrued expenses |

|

133,706 |

|

|

|

147,701 |

|

|

|

Deferred revenue |

|

215,188 |

|

|

|

260,157 |

|

|

|

Liabilities held for sale |

|

— |

|

|

|

12,655 |

|

|

|

Due to seller |

|

247,215 |

|

|

|

— |

|

|

|

Other current liabilities |

|

89,009 |

|

|

|

102,714 |

|

|

|

Total current liabilities |

|

1,059,207 |

|

|

|

734,867 |

|

|

|

Long-term debt |

|

1,006,577 |

|

|

|

1,050,610 |

|

|

|

Deferred tax liabilities, net |

|

149,213 |

|

|

|

147,349 |

|

|

|

Accrued pension and other postretirement benefit costs |

|

84,404 |

|

|

|

91,329 |

|

|

|

Long-term operating lease liability |

|

126,006 |

|

|

|

127,152 |

|

|

|

Long-term portion of environmental reserves |

|

13,100 |

|

|

|

13,656 |

|

|

|

Other liabilities |

|

96,382 |

|

|

|

112,092 |

|

|

|

Total liabilities |

|

2,534,889 |

|

|

2,277,055 |

|

||

|

|

|

|

|

|||||

|

Stockholders' equity |

|

|

|

|||||

|

Common stock, $1 par value |

$ |

49,187 |

|

|

$ |

49,187 |

|

|

|

Additional paid in capital |

|

126,316 |

|

|

|

127,104 |

|

|

|

Retained earnings |

|

3,006,164 |

|

|

|

2,908,827 |

|

|

|

Accumulated other comprehensive loss |

|

(227,872 |

) |

|

|

(190,465 |

) |

|

|

Less: cost of treasury stock |

|

(1,086,156 |

) |

|

|

(1,068,163 |

) |

|

|

Total stockholders' equity |

|

1,867,639 |

|

|

|

1,826,490 |

|

|

|

|

|

|

|

|||||

|

Total liabilities and stockholders' equity |

$ |

4,402,528 |

|

|

$ |

4,103,545 |

|

|

Use and Definitions of Non-GAAP Financial Information (Unaudited)

The Corporation supplements its financial information determined under U.S. generally accepted accounting principles (GAAP) with certain non-GAAP financial information. Curtiss-Wright believes that these Adjusted (non-GAAP) measures provide investors with improved transparency in order to better measure Curtiss-Wright’s ongoing operating and financial performance and better comparisons of our key financial metrics to our peers. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. Curtiss-Wright encourages investors to review its financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Reconciliations of “Reported” GAAP amounts to “Adjusted” non-GAAP amounts are furnished within this release.

The following definitions are provided:

Adjusted Sales, Operating Income, Operating Margin, Net Earnings and Diluted EPS

These Adjusted financials are defined as Reported Sales, Operating Income, Operating Margin, Net Earnings and Diluted Earnings per Share under GAAP excluding: (i) the impact of first year purchase accounting costs associated with acquisitions, specifically one-time inventory step-up, backlog amortization, deferred revenue adjustments and transaction costs; (ii) the sale or divestiture of a business or product line; (iii) pension settlement charges; and (iv) significant legal settlements, impairment costs, and costs associated with shareholder activism, as applicable.

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||||||||||||||||||||||

|

RECONCILIATION OF AS REPORTED TO ADJUSTED (UNAUDITED) |

||||||||||||||||||||||||||||

|

($'s in thousands) |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Three Months Ended |

|

Three Months Ended |

|

|

|

|

|||||||||||||||||||||

|

|

June 30, 2022 |

|

June 30, 2021 |

|

% Change |

|||||||||||||||||||||||

|

|

As Reported |

|

Adjustments |

|

Adjusted |

|

As Reported |

|

Adjustments |

|

Adjusted |

|

As Reported |

|

Adjusted |

|||||||||||||

|

Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Aerospace & Industrial (1) |

$ |

208,572 |

|

|

$ |

— |

|

$ |

208,572 |

|

|

$ |

199,713 |

|

|

$ |

(5,784 |

) |

|

$ |

193,929 |

|

|

4 |

% |

|

8 |

% |

|

Defense Electronics (2) |

|

149,549 |

|

|

|

— |

|

|

149,549 |

|

|

|

162,351 |

|

|

|

1,080 |

|

|

|

163,431 |

|

|

(8 |

)% |

|

(8 |

)% |

|

Naval & Power (3) |

|

251,236 |

|

|

|

— |

|

|

251,236 |

|

|

|

259,431 |

|

|

|

(7,413 |

) |

|

|

252,018 |

|

|

(3 |

)% |

|

— |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total sales |

$ |

609,357 |

|

|

$ |

— |

|

$ |

609,357 |

|

|

$ |

621,495 |

|

|

$ |

(12,117 |

) |

|

$ |

609,378 |

|

|

(2 |

)% |

|

— |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Operating income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Aerospace & Industrial (1) |

$ |

32,464 |

|

|

$ |

— |

|

$ |

32,464 |

|

|

$ |

31,977 |

|

|

$ |

(1,506 |

) |

|

$ |

30,471 |

|

|

2 |

% |

|

7 |

% |

|

Defense Electronics (2) |

|

24,460 |

|

|

|

— |

|

|

24,460 |

|

|

|

29,271 |

|

|

|

1,592 |

|

|

|

30,863 |

|

|

(16 |

)% |

|

(21 |

)% |

|

Naval & Power (3) |

|

50,001 |

|

|

|

— |

|

|

50,001 |

|

|

|

43,095 |

|

|

|

366 |

|

|

|

43,461 |

|

|

16 |

% |

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total segments |

$ |

106,925 |

|

|

$ |

— |

|

$ |

106,925 |

|

|

$ |

104,343 |

|

|

$ |

452 |

|

|

$ |

104,795 |

|

|

2 |

% |

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Corporate and other |

|

(8,820 |

) |

|

|

— |

|

|

(8,820 |

) |

|

|

(9,760 |

) |

|

|

— |

|

|

|

(9,760 |

) |

|

10 |

% |

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total operating income |

$ |

98,105 |

|

|

$ |

— |

|

$ |

98,105 |

|

|

$ |

94,583 |

|

|

$ |

452 |

|

|

$ |

95,035 |

|

|

4 |

% |

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Operating margins: |

As Reported |

|

|

|

Adjusted |

|

As Reported |

|

|

|

Adjusted |

|

As Reported |

|

Adjusted |

|||||||||||||

|

Aerospace & Industrial |

|

15.6 |

% |

|

|

|

|

15.6 |

% |

|

|

16.0 |

% |

|

|

|

|

15.7 |

% |

|

(40 bps) |

|

(10 bps) |

|||||

|

Defense Electronics |

|

16.4 |

% |

|

|

|

|

16.4 |

% |

|

|

18.0 |

% |

|

|

|

|

18.9 |

% |

|

(160 bps) |

|

(250 bps) |

|||||

|

Naval & Power |

|

19.9 |

% |

|

|

|

|

19.9 |

% |

|

|

16.6 |

% |

|

|

|

|

17.2 |

% |

|

330 bps |

|

270 bps |

|||||

|

Total Curtiss-Wright |

|

16.1 |

% |

|

|

|

|

16.1 |

% |

|

|

15.2 |

% |

|

|

|

|

15.6 |

% |

|

90 bps |

|

50 bps |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Segment margins |

|

17.5 |

% |

|

|

|

|

17.5 |

% |

|

|

16.8 |

% |

|

|

|

|

17.2 |

% |

|

70 bps |

|

30 bps |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

(1) Excludes our build-to-print actuation product line supporting the Boeing 737 Max program, which we substantially exited in the fourth quarter of 2020. |

|

(2) Excludes first year purchase accounting adjustments in the prior period. |

|

(3) Excludes the results of operations from our German valves business, which was sold in January 2022. |

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||||||||||||||||||||||

|

RECONCILIATION OF AS REPORTED TO ADJUSTED (UNAUDITED) |

||||||||||||||||||||||||||||

|

($'s in thousands) |

||||||||||||||||||||||||||||

|

Six Months Ended |

|

Six Months Ended |

|

|

|

|

||||||||||||||||||||||

|

|

June 30, 2022 |

|

June 30, 2021 |

|

% Change |

|||||||||||||||||||||||

|

|

As Reported |

|

Adjustments |

|

Adjusted |

|

As Reported |

|

Adjustments |

|

Adjusted |

|

As Reported |

|

Adjusted |

|||||||||||||

|

Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Aerospace & Industrial (1) |

$ |

399,684 |

|

|

$ |

— |

|

$ |

399,684 |

|

|

$ |

380,044 |

|

|

$ |

(8,383 |

) |

|

$ |

371,661 |

|

|

5 |

% |

|

8 |

% |

|

Defense Electronics (2) |

|

292,618 |

|

|

|

— |

|

|

292,618 |

|

|

|

343,563 |

|

|

|

2,160 |

|

|

|

345,723 |

|

|

(15 |

)% |

|

(15 |

)% |

|

Naval & Power (3) |

|

476,516 |

|

|

|

— |

|

|

476,516 |

|

|

|

494,947 |

|

|

|

(12,996 |

) |

|

|

481,951 |

|

|

(4 |

)% |

|

(1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total sales |

$ |

1,168,818 |

|

|

$ |

— |

|

$ |

1,168,818 |

|

|

$ |

1,218,554 |

|

|

$ |

(19,219 |

) |

|

$ |

1,199,335 |

|

|

(4 |

)% |

|

(3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Operating income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Aerospace & Industrial (1) |

$ |

57,317 |

|

|

$ |

— |

|

$ |

57,317 |

|

|

$ |

51,002 |

|

|

$ |

(1,982 |

) |

|

$ |

49,020 |

|

|

12 |

% |

|

17 |

% |

|

Defense Electronics (2) |

|

47,750 |

|

|

|

— |

|

|

47,750 |

|

|

|

65,894 |

|

|

|

3,197 |

|

|

|

69,091 |

|

|

(28 |

)% |

|

(31 |

)% |

|

Naval & Power (3) |

|

77,289 |

|

|

|

5,427 |

|

|

82,716 |

|

|

|

81,152 |

|

|

|

2,955 |

|

|

|

84,107 |

|

|

(5 |

)% |

|

(2 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total segments |

$ |

182,356 |

|

|

$ |

5,427 |

|

$ |

187,783 |

|

|

$ |

198,048 |

|

|

$ |

4,170 |

|

|

$ |

202,218 |

|

|

(8 |

)% |

|

(7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Corporate and other (4) |

|

(23,741 |

) |

|

|

4,876 |

|

|

(18,865 |

) |

|

|

(18,399 |

) |

|

|

— |

|

|

|

(18,399 |

) |

|

(29 |

)% |

|

(3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total operating income |

$ |

158,615 |

|

|

$ |

10,303 |

|

$ |

168,918 |

|

|

$ |

179,649 |

|

|

$ |

4,170 |

|

|

$ |

183,819 |

|

|

(12 |

)% |

|

(8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Operating margins: |

As Reported |

|

|

|

Adjusted |

|

As Reported |

|

|

|

Adjusted |

|

As Reported |

|

Adjusted |

|||||||||||||

|

Aerospace & Industrial |

|

14.3 |

% |

|

|

|

|

14.3 |

% |

|

|

13.4 |

% |

|

|

|

|

13.2 |

% |

|

90 bps |

|

110 bps |

|||||

|

Defense Electronics |

|

16.3 |

% |

|

|

|

|

16.3 |

% |

|

|

19.2 |

% |

|

|

|

|

20.0 |

% |

|

(290 bps) |

|

(370 bps) |

|||||

|

Naval & Power |

|

16.2 |

% |

|

|

|

|

17.4 |

% |

|

|

16.4 |

% |

|

|

|

|

17.5 |

% |

|

(20 bps) |

|

(10 bps) |

|||||

|

Total Curtiss-Wright |

|

13.6 |

% |

|

|

|

|

14.5 |

% |

|

|

14.7 |

% |

|

|

|

|

15.3 |

% |

|

(110 bps) |

|

(80 bps) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Segment margins |

|

15.6 |

% |

|

|

|

|

16.1 |

% |

|

|

16.3 |

% |

|

|

|

|

16.9 |

% |

|

(70 bps) |

|

(80 bps) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

(1) Excludes our build-to-print actuation product line supporting the Boeing 737 Max program, which we substantially exited in the fourth quarter of 2020. |

|

(2) Excludes first year purchase accounting adjustments in the prior period. |

|

(3) Excludes the results of operations from our German valves business, which was sold in January 2022, and the loss on divestiture in the current period. |

|

(4) Excludes costs associated with shareholder activism in the current period. |

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||||||||||||||||||||||

|

RECONCILIATION OF AS REPORTED SALES TO ADJUSTED SALES BY END MARKET (UNAUDITED) |

||||||||||||||||||||||||||||

|

($'s in thousands) |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Three Months Ended |

|

Three Months Ended |

|

|

|

|||||||||||||||||||||

|

|

|

June 30, 2022 |

|

June 30, 2021 |

|

% Change |

||||||||||||||||||||||

|

|

|

As Reported |

|

Adjustments |

|

Adjusted Sales |

|

As Reported |

|

Adjustments |

|

Adjusted Sales |

|

Change in As |

Change in |

|||||||||||||

|

Aerospace & Defense markets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Aerospace Defense |

|

$ |

94,545 |

|

$ |

— |

|

$ |

94,545 |

|

$ |

99,977 |

|

$ |

— |

|

|

$ |

99,977 |

|

(5 |

%) |

(5 |

%) |

||||

|

Ground Defense (1) |

|

|

44,393 |

|

|

— |

|

|

44,393 |

|

|

48,221 |

|

|

1,080 |

|

|

|

49,301 |

|

(8 |

%) |

(10 |

%) |

||||

|

Naval Defense |

|

|

172,786 |

|

|

— |

|

|

172,786 |

|

|

177,724 |

|

|

— |

|

|

|

177,724 |

|

(3 |

%) |

(3 |

%) |

||||

|

Commercial Aerospace (2) |

|

|

68,192 |

|

|

— |

|

|

68,192 |

|

|

71,555 |

|

|

(5,784 |

) |

|

|

65,771 |

|

(5 |

%) |

4 |

% |

||||

|

Total Aerospace & Defense |

|

$ |

379,916 |

|

$ |

— |

|

$ |

379,916 |

|

$ |

397,477 |

|

$ |

(4,704 |

) |

|

$ |

392,773 |

|

(4 |

%) |

(3 |

%) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Commercial markets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Power & Process (3) |

|

|

125,355 |

|

|

— |

|

|

125,355 |

|

|

125,333 |

|

|

(7,414 |

) |

|

|

117,919 |

|

0 |

% |

6 |

% |

||||

|

General Industrial |

|

|

104,086 |

|

|

— |

|

|

104,086 |

|

|

98,685 |

|

|

— |

|

|

|

98,685 |

|

5 |

% |

5 |

% |

||||

|

Total Commercial |

|

$ |

229,441 |

|

$ |

— |

|

$ |

229,441 |

|

$ |

224,018 |

|

$ |

(7,414 |

) |

|

$ |

216,604 |

|

2 |

% |

6 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total Curtiss-Wright |

|

$ |

609,357 |

|

$ |

— |

|

$ |

609,357 |

|

$ |

621,495 |

|

$ |

(12,118 |

) |

|

$ |

609,377 |

|

(2 |

%) |

0 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Six Months Ended |

|

Six Months Ended |

|

|

|

|||||||||||||||||||||

|

|

|

June 30, 2022 |

|

June 30, 2021 |

|

% Change |

||||||||||||||||||||||

|

|

|

As Reported |

|

Adjustments |

|

Adjusted Sales |

|

As Reported |

|

Adjustments |

|

Adjusted Sales |

|

Change in As Reported Sales |

Change in Adjusted Sales |

|||||||||||||

|

Aerospace & Defense markets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Aerospace Defense |

|

$ |

192,549 |

|

$ |

— |

|

$ |

192,549 |

|

$ |

210,993 |

|

$ |

— |

|

|

$ |

210,993 |

|

(9 |

%) |

(9 |

%) |

||||

|

Ground Defense (1) |

|

|

83,501 |

|

|

— |

|

|

83,501 |

|

|

103,967 |

|

|

2,160 |

|

|

|

106,127 |

|

(20 |

%) |

(21 |

%) |

||||

|

Naval Defense |

|

|

335,753 |

|

|

— |

|

|

335,753 |

|

|

355,629 |

|

|

— |

|

|

|

355,629 |

|

(6 |

%) |

(6 |

%) |

||||

|

Commercial Aerospace (2) |

|

|

129,084 |

|

|

— |

|

|

129,084 |

|

|

128,824 |

|

|

(8,383 |

) |

|

|

120,441 |

|

0 |

% |

7 |

% |

||||

|

Total Aerospace & Defense |

|

$ |

740,887 |

|

$ |

— |

|

$ |

740,887 |

|

$ |

799,413 |

|

$ |

(6,223 |

) |

|

$ |

793,190 |

|

(7 |

%) |

(7 |

%) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Commercial markets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Power & Process (3) |

|

|

230,143 |

|

|

— |

|

|

230,143 |

|

|

230,837 |

|

|

(12,996 |

) |

|

|

217,841 |

|

0 |

% |

6 |

% |

||||

|

General Industrial |

|

|

197,788 |

|

|

— |

|

|

197,788 |

|

|

188,304 |

|

|

— |

|

|

|

188,304 |

|

5 |

% |

5 |

% |

||||

|

Total Commercial |

|

$ |

427,931 |

|

$ |

— |

|

$ |

427,931 |

|

$ |

419,141 |

|

$ |

(12,996 |

) |

|

$ |

406,145 |

|

2 |

% |

5 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total Curtiss-Wright |

|

$ |

1,168,818 |

|

$ |

— |

|

$ |

1,168,818 |

|

$ |

1,218,554 |

|

$ |

(19,219 |

) |

|

$ |

1,199,335 |

|

(4 |

%) |

(3 |

%) |

||||

|

(1) Excludes first year purchase accounting adjustments in the prior period. |

|

(2) Excludes our build-to-print actuation product line supporting the Boeing 737 MAX program, which we substantially exited in the fourth quarter of 2020. |

|

(3) Excludes the prior period results of our German valves business, which was sold in January 2022. |

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||||||||

|

RECONCILIATION OF AS REPORTED TO ADJUSTED DILUTED EARNINGS PER SHARE (UNAUDITED) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

Three Months Ended |

|

Six Months Ended |

|||||||||||

|

|

June 30, |

|

June 30, |

|||||||||||

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|||||||

|

Diluted earnings per share - As Reported |

$ |

1.83 |

|

$ |

1.49 |

|

|

$ |

2.89 |

|

$ |

2.94 |

|

|

|

Divested German valves business |

|

— |

|

|

— |

|

|

|

0.11 |

|

|

0.04 |

|

|

|

Costs associated with shareholder activism |

|

— |

|

|

— |

|

|

|

0.10 |

|

|

— |

|

|

|

Former executive pension settlement expense |

|

— |

|

|

0.06 |

|

|

|

0.04 |

|

|

0.06 |

|

|

|

First year purchase accounting adjustments |

|

— |

|

|

0.03 |

|

|

|

— |

|

|

0.06 |

|

|

|

Exit of build-to-print actuation product line |

|

— |

|

|

(0.02 |

) |

|

|

— |

|

|

(0.03 |

) |

|

|

Diluted earnings per share - Adjusted (1) |

$ |

1.83 |

|

$ |

1.56 |

|

|

$ |

3.14 |

|

$ |

3.07 |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

(1) All adjustments are presented net of income taxes. |

||||||||||||||

Organic Sales and Organic Operating Income

The Corporation discloses organic sales and organic operating income because the Corporation believes it provides investors with insight as to the Company’s ongoing business performance. Organic sales and organic operating income are defined as sales and operating income, excluding contributions from acquisitions made during the last twelve months, loss on divestiture of the German valves business, and foreign currency fluctuations.

|

|

Three Months Ended |

|||||||||||||||

|

|

June 30, |

|||||||||||||||

|

|

2022 vs. 2021 |

|||||||||||||||

|

|

|

Aerospace & Industrial |

|

Defense Electronics |

|

Naval & Power |

|

Total Curtiss-Wright |

||||||||

|

|

|

Sales |

|

Operating |

|

Sales |

|

Operating |

|

Sales |

|

Operating |

|

Sales |

|

Operating |

|

As Reported |

|

4% |

|

2% |

|

(8%) |

|

(16%) |

|

(3%) |

|

16% |

|

(2%) |

|

4% |

|

Less: Acquisitions |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

Foreign Currency |

|

3% |

|

0% |

|

1% |

|

(5%) |

|

0% |

|

(1%) |

|

1% |

|

(2%) |

|

Organic |

|

7% |

|

2% |

|

(7%) |

|

(21%) |

|

(3%) |

|

15% |

|

(1%) |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

||||||||||||||

|

|

|

June 30, |

||||||||||||||

|

|

|

2022 vs. 2021 |

||||||||||||||

|

|

|

Aerospace & Industrial |

|

Defense Electronics |

|

Naval & Power |

|

Total Curtiss-Wright |

||||||||

|

|

|

Sales |

|

Operating |

|

Sales |

|

Operating |

|

Sales |

|

Operating |

|

Sales |

|

Operating |

|

As Reported |

|

5% |

|

12% |

|

(15%) |

|

(28%) |

|

(4%) |

|

(5%) |

|

(4%) |

|

(12%) |

|

Less: Acquisitions |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

Loss on divestiture |

|

0% |

|

0% |

|

0% |

|

0% |

|

0% |

|

7% |

|

0% |

|

4% |

|

Foreign Currency |

|

2% |

|

2% |

|

1% |

|

(1%) |

|

0% |

|

0% |

|

1% |

|

(1%) |

|

Organic |

|

7% |

|

14% |

|

(14%) |

|

(29%) |

|

(4%) |

|

2% |

|

(3%) |

|

(9%) |

Free Cash Flow and Free Cash Flow Conversion

The Corporation discloses free cash flow because it measures cash flow available for investing and financing activities. Free cash flow represents cash available to repay outstanding debt, invest in the business, acquire businesses, return capital to shareholders and make other strategic investments. Free cash flow is defined as net cash provided by operating activities less capital expenditures. Adjusted free cash flow for 2022 excludes: (i) payments associated with the Westinghouse legal settlement and (ii) executive pension payments. The Corporation discloses adjusted free cash flow conversion because it measures the proportion of net earnings converted into free cash flow and is defined as adjusted free cash flow divided by adjusted net earnings.

|

CURTISS-WRIGHT CORPORATION and SUBSIDIARIES |

||||||||||||||||

|

NON-GAAP FINANCIAL DATA (UNAUDITED) |

||||||||||||||||

|

($'s in thousands) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Three Months Ended |

|

Six Months Ended |

|||||||||||||

|

|

June 30, |

|

June 30, |

|||||||||||||

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|||||||||

|

Net cash provided by (used for) operating activities |

$ |

31,044 |

|

|

$ |

75,079 |

|

|

$ |

(93,271 |

) |

|

$ |

48,476 |

|

|

|

Capital expenditures |

|

(8,596 |

) |

|

|

(9,234 |

) |

|

|

(19,492 |

) |

|

|

(17,771 |

) |

|

|

Free cash flow |

$ |

22,448 |

|

|

$ |

65,845 |

|

|

$ |

(112,763 |

) |

|

$ |

30,705 |

|

|

|

Westinghouse legal settlement |

|

— |

|

|

|

— |

|

|

|

15,000 |

|

|

|

— |

|

|

|

Pension payment to former executive |

|

— |

|

|

|

— |

|

|

|

8,214 |

|

|

|

— |

|

|

|

Adjusted free cash flow |

$ |

22,448 |

|

|

$ |

65,845 |

|

|

$ |

(89,549 |

) |

|

$ |

30,705 |

|

|

|

Adjusted free cash flow conversion |

|

32 |

% |

|

|

101 |

% |

|

|

(74 |

%) |

|

|

24 |

% |

|

|

CURTISS-WRIGHT CORPORATION |

|||||||||||||||||||||||||||||||

|

2022 Guidance |

|||||||||||||||||||||||||||||||

|

As of August 3, 2022 |

|||||||||||||||||||||||||||||||

|

($'s in millions, except per share data) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

2021 |

|

2021 |

|

2021 |

|

2022 |

|

2022 |

|

2022 |

||||||||||||||||||||

|

|

|

|

|

|

|

|

Low |

High |

|

|

|

Low |

High |

|

2022 Chg |

||||||||||||||||

|

Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Aerospace & Industrial |

$ |

786 |

|

|

$ |

(11 |

) |

|

$ |

775 |

|

|

$ |

820 |

|

$ |

840 |

|

|

$ |

— |

|

|

$ |

820 |

|

$ |

840 |

|

|

6 - 8% |

|

Defense Electronics |

|

724 |

|

|

|

4 |

|

|

|

728 |

|

|

|

720 |

|

|

735 |

|

|

|

— |

|

|

|

720 |

|

|

735 |

|

|

(1) - 1% |

|

Naval & Power |

|

995 |

|

|

|

(30 |

) |

|

|

965 |

|

|

|

1,030 |

|

|

1,045 |

|

|

|

— |

|

|

|

1,030 |

|

|

1,045 |

|

|

7 - 8% |

|

Total sales |

$ |

2,506 |

|

|

$ |

(37 |

) |

|

$ |

2,468 |

|

|

$ |

2,570 |

|

$ |

2,620 |

|

|

$ |

— |

|

|

$ |

2,570 |

|

$ |

2,620 |

|

|

4 to 6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Aerospace & Industrial |

$ |

122 |

|

|

$ |

(2 |

) |

|

$ |

120 |

|

|

$ |

133 |

|

$ |

137 |

|

|

$ |

— |

|

|

$ |

133 |

|

$ |

137 |

|

|

11 - 14% |

|

Defense Electronics |

|

159 |

|

|

|

5 |

|

|

|

164 |

|

|

|

160 |

|

|

165 |

|

|

|

— |

|

|

|

160 |

|

|

165 |

|

|

(3) - 0% |

|

Naval & Power |

|

142 |

|

|

|

34 |

|

|

|

176 |

|

|

|

171 |

|

|

175 |

|

|

|

15 |

|

|

|

186 |

|

|

190 |

|

|

6 - 8% |

|

Total segments |

|

423 |

|

|

|

38 |

|

|

|

460 |

|

|

|

464 |

|

|

477 |

|

|

|

15 |

|

|

|

479 |

|

|

492 |

|

|

|

|

Corporate and other |

|

(40 |

) |

|

|

— |

|

|

|

(40 |

) |

|

|

(44 |

) |

|

(45 |

) |

|

|

5 |

|

|

|

(39 |

) |

|

(40 |

) |

|

|

|

Total operating income |

$ |

383 |

|

|

$ |

38 |

|

|

$ |

420 |

|

|

$ |

420 |

|

$ |

432 |

|

|

$ |

20 |

|

|

$ |

439 |

|

$ |

452 |

|

|

5 to 7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Interest expense |

$ |

(40 |

) |

|

$ |

— |

|

|

$ |

(40 |

) |

|

$ |

(44 |

) |

$ |

(45 |

) |

|

$ |

— |

|

|

$ |

(44 |

) |

$ |

(45 |

) |

|

|

|

Other income, net |

|

12 |

|

|

|

3 |

|

|

|

15 |

|

|

|

8 |

|

|

9 |

|

|

|

9 |

|

|

|

17 |

|

|

18 |

|

|

|

|

Earnings before income taxes |

|

355 |

|

|

|

41 |

|

|

|

395 |

|

|

|

384 |

|

|

396 |

|

|

|

29 |

|

|

|

412 |

|

|

424 |

|

|

|

|

Provision for income taxes |

|

(87 |

) |

|

|

(10 |

) |

|

|

(97 |

) |

|

|

(92 |

) |

|

(95 |

) |

|

|

(7 |

) |

|

|

(99 |

) |

|

(102 |

) |

|

|

|

Net earnings |

$ |

267 |

|

|

$ |

31 |

|

|

$ |

298 |

|

|

$ |

291 |

|

$ |

301 |

|

|

$ |

22 |

|

|

$ |

313 |

|

$ |

323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Diluted earnings per share |

$ |

6.58 |

|

|

$ |

0.76 |

|

|

$ |

7.34 |

|

|

$ |

7.54 |

|

$ |

7.74 |

|

|

$ |

0.56 |

|

|

$ |

8.10 |

|

$ |

8.30 |

|

|

10 to 13% |

|

Diluted shares outstanding |

|

40.6 |

|

|

|

|

|

40.6 |

|

|

|

38.6 |

|

|

38.8 |

|

|

|

|

|

38.6 |

|

|

38.8 |

|

|

|

||||

|

Effective tax rate |

|

24.6 |

% |

|

|

|

|

24.6 |

% |

|

|

24.0 |

% |

|

24.0 |

% |

|

|

|

|

24.0 |

% |

|

24.0 |

% |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Operating margins: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Aerospace & Industrial |

|

15.5 |

% |

|

|

|

|

15.5 |

% |

|

|

16.2 |

% |

|

16.4 |

% |

|

|

|

|

16.2 |

% |

|

16.4 |

% |

|

70 to 90 bps |

||||

|

Defense Electronics |

|

22.0 |

% |

|

|

|

|

22.6 |

% |

|

|

22.2 |

% |

|

22.4 |

% |

|

|

|

|

22.2 |

% |

|

22.4 |

% |

|

(20 to 40 bps) |

||||

|

Naval & Power |

|

14.2 |

% |

|

|

|

|

18.2 |

% |

|

|

16.6 |

% |

|

16.7 |

% |

|

|

|

|

18.0 |

% |

|

18.2 |

% |

|

(20) to 0 bps |

||||

|

Total operating margin |

|

15.3 |

% |

|

|

|

|

17.0 |

% |

|

|

16.3 |

% |

|

16.5 |

% |

|

|

|

|

17.1 |

% |

|

17.3 |

% |

|

10 to 30 bps |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Free cash flow |

$ |

347 |

|

|

|

|

$ |

347 |

|

|

$ |

306 |

|

$ |

326 |

|

|

$ |

39 |

|

|

$ |

345 |

|

$ |

365 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Notes: Full year amounts may not add due to rounding. |

|||||||||||||||||||||||||||||||

|

(1) 2021 Adjusted financials excludes the impact of first year purchase accounting adjustments; our build-to-print actuation product line supporting the Boeing 737 Max program; the results of operations and related impairments from our German valves business; pension settlement charges related to the retirement of two former executives (within non-operating income); and one-time legal settlement costs. |

|||||||||||||||||||||||||||||||

|

(2) 2022 Adjusted financials exclude the impact of first year purchase accounting adjustments, the loss on sale of our German valves business, costs associated with shareholder activism and pension settlement charges related to the retirement of two former executives. |

|||||||||||||||||||||||||||||||

|

(3) Free Cash Flow is defined as cash flow from operations less capital expenditures. 2022 Adjusted Free Cash Flow guidance excludes executive pension settlement payments of $24 million and a legal settlement payment of $15 million. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

CURTISS-WRIGHT CORPORATION |

|||||

|

2022 Sales Growth Guidance by End Market |

|||||

|

As of August 3, 2022 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

2022 % Change vs. 2021 Adjusted(1)(2) |

|

|

||

|

|

|

|

|

|

|

|

|

Prior |

|

Current |

|

% Total Sales |

|

Aerospace & Defense Markets |

|

|

|

|

|

|

Aerospace Defense |

0 - 2% |

|

9 - 11% |

|

19% |

|

Ground Defense |

2 - 4% |

|

(1 - 3%) |

|

8% |

|

Naval Defense |

1 - 3% |

|

1 - 3% |

|

28% |

|

Commercial Aerospace |

9 - 11% |

|

9 - 11% |

|

11% |

|

Total Aerospace & Defense |

2 - 4% |

|

4 - 6% |

|

66% |

|

|

|

|

|

|

|

|

Commercial Markets |

|

|

|

|

|

|

Power & Process |

1 - 3% |

|

4 - 6% |

|

18% |

|

General Industrial |

6 - 8% |

|

6 - 8% |

|

16% |

|

Total Commercial |

4 - 6% |

|

5 - 7% |

|

34% |

|

|

|

|

|

|

|

|

Total Curtiss-Wright Sales |

3 - 5% |

|

4 - 6% |

|

100% |

|

|

|

|

|

|

|

|

(1) 2021 Adjusted Sales exclude the impact of first year purchase accounting adjustments; our build-to-print actuation product line supporting the Boeing 737 Max programs; and the results of operations from our German valves business. |

|||||

|

(2) 2022 Sales include the contribution from the SAA acquisition to the Company's second half 2022 performance. |

|||||

|

|

|||||

About Curtiss-Wright Corporation

Curtiss-Wright Corporation (NYSE:CW) is a global integrated business that provides highly engineered products, solutions and services mainly to Aerospace & Defense markets, as well as critical technologies in demanding Commercial Power, Process and Industrial markets. We leverage a workforce of approximately 8,000 highly skilled employees who develop, design and build what we believe are the best engineered solutions to the markets we serve. Building on the heritage of Glenn Curtiss and the Wright brothers, Curtiss-Wright has a long tradition of providing innovative solutions through trusted customer relationships. For more information, visit www.curtisswright.com.

###

Certain statements made in this press release, including statements about future revenue, financial performance guidance, quarterly and annual revenue, net income, operating income growth, future business opportunities, cost saving initiatives, the successful integration of the Company’s acquisitions, and future cash flow from operations, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements present management's expectations, beliefs, plans and objectives regarding future financial performance, and assumptions or judgments concerning such performance. Any discussions contained in this press release, except to the extent that they contain historical facts, are forward-looking and accordingly involve estimates, assumptions, judgments and uncertainties. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Such risks and uncertainties include, but are not limited to: a reduction in anticipated orders; an economic downturn; changes in the competitive marketplace and/or customer requirements; a change in government spending; an inability to perform customer contracts at anticipated cost levels; and other factors that generally affect the business of aerospace, defense contracting, electronics, marine, and industrial companies. Such factors are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and subsequent reports filed with the Securities and Exchange Commission.

This press release and additional information are available at www.curtisswright.com.

Jim Ryan

(704) 869-4621

Jim.Ryan@curtisswright.com