Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number 1-134

CURTISS-WRIGHT CORPORATION

(Exact name of Registrant as specified in its charter)

|

| | |

Delaware | | 13-0612970 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

| | |

13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina | | 28277 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant's telephone number, including area code: (704) 869-4600 |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| | Name of each exchange |

Title of each class | | on which registered |

Common stock, par value $1 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

| | |

Large accelerated filer x | | Accelerated filer o |

Non-accelerated filer o | (Do not check if a smaller reporting company) | Smaller reporting company o |

| | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No

The aggregate market value of the voting and non-voting Common stock held by non-affiliates of the Registrant as of June 30, 2016 was approximately $3.3 billion.

The number of shares outstanding of the Registrant’s Common stock as of January 31, 2017:

|

| | |

| | |

Class | | Number of shares |

| | |

Common stock, par value $1 per share | | 44,528,398 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement of the Registrant with respect to the 2017 Annual Meeting of Stockholders to be held on May 11, 2017 are incorporated by reference into Part III of this Form 10-K.

INDEX TO FORM 10-K

|

| | | |

| | | |

| PART I | | |

Item 1. | | | |

Item 1A. | | | |

Item 1B. | | | |

Item 2. | | | |

Item 3. | | | |

Item 4. | | | |

| | | |

| PART II | | |

Item 5. | | | |

Item 6. | | | |

Item 7. | | | |

Item 7A. | | | |

Item 8. | | | |

Item 9. | | | |

Item 9A. | | | |

Item 9B. | | | |

| | | |

| PART III | | |

Item 10. | | | |

Item 11. | | | |

Item 12. | | | |

Item 13. | | | |

Item 14. | | | |

| | | |

| PART IV | | |

Item 15. | | | |

| | | |

| | | |

PART I

FORWARD-LOOKING STATEMENTS

Except for historical information, this Annual Report on Form 10-K may be deemed to contain “forward-looking statements” within the meaning of the Private Litigation Reform Act of 1995. Examples of forward-looking statements include, but are not limited to: (a) projections of or statements regarding return on investment, future earnings, interest income, sales, volume, other income, earnings or loss per share, growth prospects, capital structure, and other financial terms, (b) statements of plans and objectives of management, (c) statements of future economic performance, and (d) statements of assumptions, such as economic conditions underlying other statements. Such forward-looking statements can be identified by the use of forward-looking terminology such as “anticipates,” “believes,” “continue,” “could,” “estimate,” “expects,” “intend,” “may,” “might,” “outlook,” “potential,” “predict,” “should,” “will,” as well as the negative of any of the foregoing or variations of such terms or comparable terminology, or by discussion of strategy. No assurance may be given that the future results described by the forward-looking statements will be achieved. While we believe these forward-looking statements are reasonable, they are only predictions and are subject to known and unknown risks, uncertainties, and other factors, many of which are beyond our control, which could cause actual results, performance or achievement to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements. In addition, other risks, uncertainties, assumptions, and factors that could affect our results and prospects are described in this report, including under the heading “Item 1A. Risk Factors” and elsewhere, and may further be described in our prior and future filings with the Securities and Exchange Commission and other written and oral statements made or released by us. Such forward-looking statements in this Annual Report on Form 10-K include, without limitation, those contained in Item 1. Business, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 8. Financial Statements and Supplementary Data, including, without limitation, the Notes to Consolidated Financial Statements, and Item 11. Executive Compensation.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date they were made, and we assume no obligation to update forward-looking statements to reflect actual results or changes in or additions to the factors affecting such forward-looking statements.

Item 1. Business.

BUSINESS DESCRIPTION

Curtiss-Wright Corporation is a diversified multinational manufacturing and service company that designs, manufactures, and overhauls precision components and provides highly engineered products and services to the aerospace, defense, power generation, and general industrial markets. We were formed in 1929 by the merger of companies founded by the Wright brothers and Glenn Curtiss, both aviation pioneers. We are incorporated under the laws of the State of Delaware and headquartered in Charlotte, North Carolina. We list our common stock on the New York Stock Exchange (NYSE) and trade under the symbol CW.

We are an integrated, global diversified industrial company and expect that the diversification of our portfolio should mitigate the impact of business cycle volatility and allow us to realize growth in new products and markets. We strive for consistent organic sales growth, operating margin expansion, and free cash flow generation, while maintaining a disciplined and balanced capital deployment strategy.

We are positioned on high-performance platforms and critical applications that require technical sophistication. Our technologies are relied upon to improve safety, operating efficiency and reliability, while meeting demanding performance requirements. Our ability to provide high-performance, advanced technologies on a cost-effective basis is fundamental to our strategy to drive increased value to our customers. We compete globally, primarily based on technology and pricing. Our business challenges include price pressure, technological and economic developments, and geopolitical events, such as diplomatic accords.

Business Segments

We manage and evaluate our operations based on the products and services we offer and the different markets we serve. Based on this approach we operate through three segments: Commercial/Industrial, Defense, and Power.

Our principal manufacturing facilities are located in the United States in New York, Ohio, and Pennsylvania, and internationally in Canada and the United Kingdom.

Commercial / Industrial

Sales in the Commercial/Industrial segment are primarily to the general industrial and commercial aerospace markets and, to a lesser extent, the defense and power generation markets. The businesses in this segment provide a diversified offering of highly engineered products and services including: industrial vehicle products such as electronic throttle control devices and transmission shifters; sensors, controls and electro-mechanical actuation components and utility systems used on commercial aircraft; valves primarily to both the industrial and naval defense markets; and surface technology services such as shot peening, laser peening, coatings and advanced testing. The businesses within our Commercial/Industrial segment are impacted primarily by general economic conditions which may include consumer consumption or commercial construction rates, as the nature of their products and customers primarily support global industrial, commercial aerospace, oil and gas industries, commercial vehicles, and transportation industries. As commercial industrial businesses, production and service processes rest primarily within material modification, machining, assembly, and testing and inspection at commercial grade specifications. The businesses distribute products through commercial sales and marketing channels and may be impacted by changes in the regulatory environment.

Defense

Sales in the Defense segment are primarily to the defense markets and, to a lesser extent, to the commercial aerospace market. The businesses in this segment provide a diversified offering of products including: Commercial Off-the-Shelf (COTS) embedded computing board level modules, integrated subsystems, flight test equipment, instrumentation and control systems, turret aiming and stabilization products, and weapons handling systems. The businesses within our Defense segment are impacted primarily by government funding and spending, driven primarily by the U.S. Government. Our products typically support government entities in the aerospace defense, ground defense and naval defense industries. Additionally, we provide avionics and electronics, flight test equipment, and aircraft data management solutions to the commercial aerospace market. Our defense businesses supporting government contractors typically utilize more advanced production and service processes than our commercial businesses and have more stringent specifications and performance requirements. The businesses in this segment typically market and distribute products through regulated government contracting channels.

Power

Sales in the Power segment are primarily to the nuclear power generation market and, to a lesser extent, to the naval defense market. The businesses in this segment provide a diversified offering of products, including a wide range of hardware, pumps, valves, fastening systems, specialized containment doors, airlock hatches, spent fuel management products, and fluid sealing technologies for nuclear power plants and nuclear equipment manufacturers. We also have been able to leverage existing technology and engineering expertise to provide Reactor Coolant Pump (RCP) technology, pump seals, and control rod drive mechanisms for commercial nuclear power plants, most notably to support the Westinghouse AP1000 reactor design. The power generation businesses within our Power segment are impacted by pricing and demand for various forms of energy (e.g. coal, natural gas, oil, and nuclear). The businesses are typically dependent upon the need for new construction, maintenance, and overhaul and repair by nuclear energy providers. The businesses are subject to changes in regulation which may impact demand, consumption, and underlying supply. The production processes are primarily material modifications, machining, assembly, and testing and inspection that are typical of commercial grade or regulated specifications. The businesses distribute products through commercial sales and marketing channels and may be impacted by changes in the regulatory environment. Additional products within our Power segment include main coolant pumps, power-dense compact motors, generators, and secondary propulsion systems, primarily to the U.S. Navy. The defense businesses in this segment are impacted by government funding and spending, primarily driven by the U.S. Government.

OTHER INFORMATION

Certain Financial Information

For information regarding sales by geographic region, see Note 17 to the Consolidated Financial Statements contained in Part II, Item 8, of this Annual Report on Form 10-K.

In 2016, 2015, and 2014, our foreign operations as a percentage of pre-tax earnings were 42%, 51%, and 51%, respectively.

Government Sales

Our sales to the U.S. Government and foreign government end use represented 38%, 36%, and 34% of consolidated sales during 2016, 2015, and 2014, respectively.

In accordance with normal U.S. Government business practices, contracts and orders are subject to partial or complete termination at any time at the option of the customer. In the event of a termination for convenience by the government, there generally are provisions for recovery of our allowable incurred costs and a proportionate share of the profit or fee on the work completed, consistent with regulations of the U.S. Government. Fixed-price redeterminable contracts usually provide that we absorb the majority of any cost overrun. In the event that there is a cost underrun, the customer recoups a portion of the underrun based upon a formula in which the customer’s portion increases as the underrun exceeds certain established levels.

Generally, long-term contracts with the U.S. Government require us to invest in and carry significant levels of inventory. However, where allowable, we utilize progress payments and other interim billing practices on nearly all of these contracts, thus reducing the overall working capital requirements. It is our policy to seek customary progress payments on certain of our contracts. Where we obtain such payments under U.S. Government prime contracts or subcontracts, the U.S. Government has either title to or a secured interest in the materials and work in process allocable or chargeable to the respective contracts. (See Notes 1, 4, and 5 to the Consolidated Financial Statements, contained in Part II, Item 8, of this Annual Report on Form 10-K).

Customers

We have hundreds of customers in the various industries we serve. No commercial customer accounted for more than 10% of our total sales during 2016, 2015, or 2014.

Approximately 32% of our total sales for 2016, 30% for 2015, and 28% for 2014 were derived from contracts with agencies of, and prime contractors to, the U.S. Government. Information on the Company’s sales to the U.S. Government, including direct sales as a prime contractor and indirect sales as a subcontractor, is as follows:

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

(In thousands) | | 2016 | | 2015 | | 2014 |

Commercial/Industrial | | $ | 187,498 |

| | $ | 177,827 |

| | $ | 150,388 |

|

Defense | | 305,459 |

| | 300,462 |

| | 290,413 |

|

Power | | 181,851 |

| | 176,737 |

| | 179,399 |

|

Total Government sales | | $ | 674,808 |

| | $ | 655,026 |

| | $ | 620,200 |

|

Patents

We own and license a number of United States and foreign patents and patent applications, which have been obtained or filed over a period of years. We also license intellectual property to and from third parties. Specifically, the U.S. Government receives licenses in our patents that are developed in performance of government contracts, and it may use or authorize others to use the technology covered by such patents for government purposes. Additionally, trade secrets, unpatented research and development, and engineering, some of which have been acquired by the company through business acquisitions, make an important contribution to our business. While our intellectual property rights in the aggregate are important to the operation of our business, we do not consider the success of our business or business segments to be materially dependent upon the timing of expiration or protection of any one or group of patents, patent applications, or patent license agreements under which we now operate.

Research and Development

We primarily conduct our own research and development activities. Company-sponsored research and development costs are charged to expense when incurred. Total research and development expenses amounted to $59 million, $61 million, and $68 million in 2016, 2015, and 2014, respectively.

Executive Officers

|

| | | | | | | | |

Name | | Current Position | | Business Experience | | Age | | Executive Officer Since |

David C. Adams | | Chairman and Chief Executive Officer

| | Chairman and Chief Executive Officer of the Corporation since January 2015. Prior to this, he served as President and Chief Executive Officer of the Corporation from August 2013. He also served as President and Chief Operating Officer of the Corporation from October 2012 and as Co-Chief Operating Officer of the Corporation from November 2008. He has been a Director of the Corporation since August 2013. | | 63 | | 2005 |

Thomas P. Quinly | | Vice President and Chief Operating Officer | | Vice President of the Corporation since November 2010 and Chief Operating Officer of the Corporation since October 2013. He also served as President of Curtiss-Wright Controls, Inc. from November 2008.

| | 58 | | 2010 |

Glenn E. Tynan | | Vice President of Finance and Chief Financial Officer | | Vice President of Finance and Chief Financial Officer of the Corporation since June 2002. | | 58 | | 2000 |

Paul J. Ferdenzi | | Vice President, General Counsel, and Corporate Secretary

| | Vice President, General Counsel, and Corporate Secretary of the Corporation since March 2014. Prior to this, he served as Vice President-Human Resources of the Corporation from November 2011 and also served as Associate General Counsel and Assistant Secretary of the Corporation from June 1999 and May 2001, respectively. | | 49 | | 2011 |

K. Christopher Farkas | | Vice President and Corporate Controller | | Vice President and Corporate Controller of the Corporation since September 2014. Prior to this, he served as Assistant Corporate Controller of the Corporation from May 2009.

| | 48 | | 2014 |

Harry S. Jakubowitz | | Vice President and Treasurer | | Vice President of the Corporation since May 2007 and Treasurer of the Corporation since September 2005. | | 64 | | 2007 |

Employees

At the end of 2016, we had approximately 8,000 employees, 8% of which are represented by labor unions and covered by collective bargaining agreements.

Available information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and proxy statements for our annual stockholders’ meetings, as well as any amendments to those reports, with the Securities and Exchange Commission (SEC). The public may read and copy any of our materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including our filings. These reports are also available free of charge through the Investor Relations section of our web site at www.curtisswright.com as soon as reasonably practicable after we electronically file.

Item 1A. Risk Factors.

We have summarized below the significant, known material risks to our business. Our business, financial condition, and results of operations and cash flows could be materially and adversely impacted if any of these risks materialize. Additional risk factors not currently known to us or that we believe are immaterial may also impair our business, financial condition, and results of operations. The risk factors below should be considered together with information included elsewhere in this Annual Report on Form 10-K as well as other required filings by us to the Securities Exchange Commission, such as our Form 10-Q’s, Form 8-K’s, proxy statements for our annual shareholder meetings, and subsequent amendments, if any.

A substantial portion of our revenues and earnings depends upon the continued willingness of the U.S. Government and our other customers in the defense industry to buy our products and services.

In 2016, approximately 32% of our domestic sales were derived from or related to defense programs. U.S. defense spending has historically been cyclical, and defense budgets tend to rise when perceived threats to national security increase the level of concern over the country’s safety. At other times, spending by the military can decrease. Competing demands for federal funds can put pressure on all areas of discretionary spending, which could ultimately impact the defense budget. A decrease in U.S. Government defense spending or changes in spending allocation could result in one or more of our programs being reduced, delayed, or terminated. Reductions in defense industry spending may or may not have an adverse effect on programs for which we provide products and services. In the event expenditures are reduced for products we manufacture or services we provide and are not offset by revenues from foreign sales, new programs, or products or services that we currently manufacture or provide, we may experience a reduction in our revenues and earnings and a material adverse effect on our business, financial condition, and results of operations.

If we fail to satisfy our contractual obligations, our contracts may be terminated and we may incur significant costs or liabilities, including liquidated damages and penalties.

In general, our contracts may be terminated for our failure to satisfy our contractual obligations. In addition, some of our contracts contain substantial liquidated damages provisions and financial penalties related to our failure to satisfy our contractual obligations. For example, the terms of the Electro-Mechanical Division's AP1000 China and AP1000 United States contracts with Westinghouse include liquidated damage penalty provisions for failure to meet contractual delivery dates if we caused the delay and the delay was not excusable. On October 10, 2013, we received a letter from Westinghouse stating entitlements to the maximum amount of liquidated damages allowable under the AP1000 China contract of approximately $25 million. To date, we have not met certain contractual delivery dates under the AP 1000 China and domestic contracts; however there are significant uncertainties as to which parties are responsible for the delays, and we believe we have adequate legal defenses. Consequently, as a result of the above matters, we may incur significant costs or liabilities, including penalties, which could have a material adverse effect on our financial position, results of operations, or cash flows. As of December 31, 2016, the range of possible loss for liquidated damages on the Westinghouse domestic and China contracts is $0 to $55.5 million.

As a U.S. Government contractor, we are subject to a number of procurement rules and regulations.

We must comply with and are affected by laws and regulations relating to the award, administration, and performance of U.S. Government contracts. Government contract laws and regulations affect how we do business with our customers and, in some instances, impose added costs on our business. A violation of specific laws and regulations could result in the imposition of fines and penalties or the termination of our contracts or debarment from bidding on contracts. These fines and penalties could be imposed for failing to follow procurement integrity and bidding rules, employing improper billing practices or otherwise failing to follow cost accounting standards, receiving or paying kickbacks, or filing false claims. We have been, and expect to continue to be, subjected to audits and investigations by government agencies. The failure to comply with the terms of our government contracts could harm our business reputation. It could also result in our progress payments being withheld. In some instances, these laws and regulations impose terms or rights that are more favorable to the government than those typically available to commercial parties in negotiated transactions. For example, the U.S. Government may terminate any of our government contracts and, in general, subcontracts, at its convenience as well as for default based on performance. Upon termination for convenience of a fixed-price type contract, we normally are entitled to receive the purchase price for delivered items, reimbursement for allowable costs for work-in-process, and an allowance for profit on work actually completed on the contract or adjustment for loss if completion of performance would have resulted in a loss. Upon termination for convenience of a cost reimbursement contract, we normally are entitled to reimbursement of allowable costs plus a portion of the fee. Such allowable costs would normally include our cost to terminate agreements with our suppliers and subcontractors. The amount of the fee recovered, if any, is related to the portion of the work accomplished prior to termination and is determined by negotiation.

A termination arising out of our default could expose us to liability and have a material adverse effect on our ability to compete for future contracts and orders. In addition, on those contracts for which we are teamed with others and are not the prime

contractor, the U.S. Government could terminate a prime contract under which we are a subcontractor, irrespective of the quality of our services as a subcontractor.

In addition, our U.S. Government contracts typically span one or more base years and multiple option years. The U.S. Government generally has the right to not exercise option periods and may not exercise an option period if the agency is not satisfied with our performance on the contract or does not receive funding to continue the program. U.S. Government procurement may adversely affect our cash flow or program profitability.

A significant reduction in the purchase of our products by the U.S. government could have a material adverse effect on our business. The risk that governmental purchases of our products may decline stems from the nature of our business with the U.S. government, where it may:

| |

• | terminate, reduce, or modify contracts or subcontracts if its requirements or budgetary constraints change; |

| |

• | cancel multi-year contracts and related orders if funds become unavailable; and |

| |

• | shift its spending priorities. |

In addition, as a defense contractor, we are subject to risks in connection with government contracts, including without limitation:

| |

• | the frequent need to bid on programs prior to completing the necessary design, which may result in unforeseen technological difficulties and/or cost overruns; |

| |

• | the difficulty in forecasting long-term costs and schedules and the potential obsolescence of products related to long-term, fixed price contracts; |

| |

• | contracts with varying fixed terms that may not be renewed or followed by follow-on contracts upon expiration; |

| |

• | cancellation of the follow-on production phase of contracts if program requirements are not met in the development phase; |

| |

• | the failure of a prime contractor customer to perform on a contract; |

| |

• | the fact that government contract wins can be contested by other contractors; and |

| |

• | the inadvertent failure to comply with any the U.S. Government rules, laws, and regulations, including the False Claims Act or the Arms Export Control Act. |

We use estimates when accounting for long-term contracts. Changes in estimates could affect our profitability and overall financial position.

Long-term contract accounting requires judgment relative to assessing risks, estimating contract revenues and costs, and making assumptions for schedule and technical issues. Due to the size and nature of many of our contracts, the estimation of total revenues and costs at completion is complicated and subject to many variables. For example, assumptions have to be made regarding the length of time to complete the contract as costs also include expected increases in wages and prices for materials. Similarly, assumptions have to be made regarding the future impact of efficiency initiatives and cost reduction efforts. Incentives, awards, price escalations, liquidated damages, or penalties related to performance on contracts are considered in estimating revenue and profit rates and are recorded when there is sufficient information to assess anticipated performance. It is possible that materially different amounts could be obtained, because of the significance of the judgments and estimation processes described above, if different assumptions were used or if the underlying circumstances were to change. Changes in underlying assumptions, circumstances, or estimates may have a material adverse effect upon future period financial reporting and performance. See “Critical Accounting Estimates and Policies” in Part II, Item 7 of this Form 10-K.

Our backlog is subject to reduction and cancellation, which could negatively impact our revenues and results of operations.

Backlog represents products or services that our customers have committed by contract to purchase from us. Total backlog includes both funded (unfilled orders for which funding is authorized, appropriated, and contractually obligated by the customer) and unfunded backlog (firm orders for which funding has not been appropriated and/or contractually obligated by the customer). The Corporation is a subcontractor to prime contractors for the vast majority of our government business; as such, substantially all amounts in backlog are funded. Backlog excludes unexercised contract options and potential orders under ordering type contracts (e.g. Indefinite Delivery / Indefinite Quantity). Backlog is adjusted for changes in foreign exchange rates and is reduced for contract cancellations and terminations in the period in which they occur. Backlog as of December 31, 2016 was $2.0 billion. Backlog is subject to fluctuations and is not necessarily indicative of future sales. The U.S. government may unilaterally modify or cancel its contracts. In addition, under certain of our commercial contracts, our customers may unilaterally modify or terminate their orders at any time for their convenience. Accordingly, certain portions of our backlog can

be cancelled or reduced at the option of the U.S. Government and commercial customers. Our failure to replace cancelled or reduced backlog could negatively impact our revenues and results of operations.

We operate in highly competitive markets.

We compete against companies that often have greater sales volumes and financial, research, human, and marketing resources than we have. In addition, some of our largest customers could develop the capability to manufacture products or provide services similar to products that we manufacture or services that we provide. This would result in these customers supplying their own products or services and competing directly with us for sales of these products or services, all of which could significantly reduce our revenues. Furthermore, we are facing increased international competition and cross-border consolidation of competition. Our management believes that the principal points of competition in our markets are technology, product quality, performance, price, technical expertise, and timeliness of delivery. If we are unable to compete successfully with existing or new competitors in these areas, our business, financial position, results of operations, or cash flows could be materially and adversely impacted.

A downturn in the aircraft market could adversely affect our business.

The aerospace industry is cyclical in nature and can be adversely affected by periodic downturns by a number of factors, including a recession, increasing fuel and labor costs, intense price competition, outbreak of infectious disease, and terrorist attacks, as well as economic cycles, all of which can be unpredictable and are outside our control. Any decrease in demand resulting from a downturn in the aerospace market could adversely affect our business, financial condition, and results of operations.

Our future growth and continued success is dependent upon our key personnel.

Our success is dependent upon the efforts of our senior management personnel and our ability to attract and retain other highly qualified management and technical personnel. We face competition for management and qualified technical personnel from other companies and organizations. Therefore, we may not be able to retain our existing management and technical personnel or fill new management or technical positions or vacancies created by expansion or turnover at our existing compensation levels. Although we have entered into change of control agreements with some members of senior management, we do not have employment contracts with our key executives. We have made a concerted effort to reduce the effect of the loss of our senior management personnel through management succession planning. The loss of members of our senior management and qualified technical personnel could have a material and adverse effect on our business.

Our international operations are subject to risks and volatility.

During 2016, approximately 30% of our consolidated revenue was from customers outside of the United States, and we have operating facilities in foreign countries. Doing business in foreign countries is subject to numerous risks, including without limitation: political and economic instability; the uncertainty of the ability of non-U.S. customers to finance purchases; restrictive trade policies; changes in the local labor-relations climate; economic conditions in local markets; health concerns; and complying with foreign regulatory and tax requirements that are subject to change. While these factors or the impact of these factors are difficult to predict, any one or more of these factors could adversely affect our operations. To the extent that foreign sales are transacted in foreign currencies and we do not enter into currency hedge transactions, we are exposed to risk of losses due to fluctuations in foreign currency exchange rates, particularly for the Canadian dollar, the Euro, Swiss franc, and the British Pound. Significant fluctuations in the value of the currencies of the countries in which we do business could have an adverse effect on our results of operations.

Intrusion on our systems could damage our business.

We store sensitive data, including intellectual property, proprietary business information, and confidential employee information on our servers and databases. Despite our implementation of firewalls, switchgear, and other network security measures, our servers, databases, and other systems may be vulnerable to computer hackers, physical or electronic break-ins, sabotage, computer viruses, worms, and similar disruptions from unauthorized tampering with our computer systems. We continue to review and enhance our computer systems to try to prevent unauthorized and unlawful intrusions, but in the future it is possible that we may not be able to prevent all intrusions. Such intrusions could result in our network security or computer systems being compromised and possibly result in the misappropriation or corruption of sensitive information or cause disruptions in our services. We might be required to expend significant capital and resources to protect against, remediate, or

alleviate problems caused by such intrusions. Any such intrusion could cause us to be non-compliant with applicable laws or regulations, subject us to legal claims or proceedings, disrupt our operations, damage our reputation, and cause a loss of confidence in our products and services, any of which could have a material adverse effect on our business, financial condition, and results of operations.

We may be unable to protect the value of our intellectual property.

Obtaining, maintaining, and enforcing our intellectual property rights and avoiding infringing on the intellectual property rights of others are important factors to the operation of our business. While we take precautionary steps to protect our technological advantages and intellectual property and rely in part on patent, trademark, trade secret, and copyright laws, we cannot assure that the precautionary steps we have taken will completely protect our intellectual property rights. Because patent applications in the United States are maintained in secrecy until either the patent application is published or a patent is issued, we may not be aware of third-party patents, patent applications, and other intellectual property relevant to our products that may block our use of our intellectual property or may be used in third-party products that compete with our products and processes. When others infringe on our intellectual property rights, the value of our products is diminished, and we may incur substantial litigation costs to enforce our rights. Similarly, we may incur substantial litigation costs and the obligation to pay royalties if others claim we infringed on their intellectual property rights. When we develop intellectual property and technologies with funding from U.S. Government contracts, the government has the royalty-free right to use that property.

In addition to our patent rights, we also rely on unpatented technology, trade secrets, and confidential information. Others may independently develop substantially equivalent information and techniques or otherwise gain access to or disclose our technology. We may not be able to protect our rights in unpatented technology, trade secrets, and confidential information effectively. We require each of our employees and consultants to execute a confidentiality agreement at the commencement of an employment or consulting relationship with us. There is no guarantee that we will succeed in obtaining and retaining executed agreements from all employees or consultants. Moreover, these agreements may not provide effective protection of our information or, in the event of unauthorized use or disclosure, they may not provide adequate remedies.

Our future financial results could be adversely impacted by asset impairment charges.

At December 31, 2016, we had goodwill and other intangible assets, net of accumulated amortization, of approximately $1,223 million, which represented approximately 40% of our total assets. Our goodwill is subject to an impairment test on an annual basis and is also tested whenever events and circumstances indicate that goodwill may be impaired. Any excess goodwill resulting from the impairment test must be written off in the period of determination. Intangible assets (other than goodwill) are generally amortized over the useful life of such assets. In addition, from time to time, we may acquire or make an investment in a business that will require us to record goodwill based on the purchase price and the value of the acquired assets. We may subsequently experience unforeseen issues with such business that adversely affect the anticipated returns of the business or value of the intangible assets and trigger an evaluation of the recoverability of the recorded goodwill and intangible assets for such business. Future determinations of significant write-offs of goodwill or intangible assets as a result of an impairment test or any accelerated amortization of other intangible assets could have a material adverse impact on our results of operations and financial condition.

Our operations are subject to numerous domestic and international laws, regulations, and restrictions, and noncompliance with these laws, regulations, and restrictions could expose us to fines, penalties, suspension, or debarment, which could have a material adverse effect on our profitability and overall financial condition.

We have contracts and operations in many parts of the world subject to United States and foreign laws and regulations, including the False Claims Act, regulations relating to import-export control (including the International Traffic in Arms Regulation promulgated under the Arms Export Control Act), technology transfer restrictions, repatriation of earnings, exchange controls, the Foreign Corrupt Practices Act, the U.K. Anti-Bribery Act, and the anti-boycott provisions of the U.S. Export Administration Act. Although we have implemented policies and procedures and provided training that we believe are sufficient to address these risks, we cannot guarantee that our operations will always comply with these laws and regulations. Failure by us, our sales representatives, or consultants to comply with these laws and regulations could result in administrative, civil, or criminal liabilities and could, in the extreme case, result in suspension or debarment from government contracts or suspension of our export privileges, which could have a material adverse effect on our business.

We are subject to liability under environmental laws.

Our business and facilities are subject to numerous federal, state, local, and foreign laws and regulations relating to the use, manufacture, storage, handling, and disposal of hazardous materials and other waste products. Environmental laws generally

impose liability for investigation, remediation, and removal of hazardous materials and other waste products on property owners and those who dispose of materials at waste sites, whether or not the waste was disposed of legally at the time in question. We are currently addressing environmental remediation at certain current and former facilities, and we have been named as a potentially responsible party along with other organizations in a number of environmental clean-up sites and may be named in connection with future sites. We are required to contribute to the costs of the investigation and remediation and to establish reserves in our financial statements for future costs deemed probable and estimable. Although we have estimated and reserved for future environmental remediation costs, the final resolution of these liabilities may significantly vary from our estimates and could potentially have an adverse effect on our results of operations and financial position.

Unanticipated changes in our tax provisions or exposure to additional income tax liabilities could affect our profitability.

Our business operates in many locations under government jurisdictions that impose income taxes. Changes in domestic or foreign income tax laws and regulations, or their interpretation, could result in higher or lower income tax rates assessed or changes in the taxability of certain revenues or the deductibility of certain expenses, thereby affecting our income tax expense and profitability. Corporate tax reform continues to be a priority in the U.S. and other jurisdictions. Changes to the tax system in the U.S. could have significant effects, positive or negative, on our effective tax rate and on our deferred tax assets and liabilities. In addition, audits by income tax authorities could result in unanticipated increases in our income tax expense.

Our business, financial condition, and results of operations could be materially adversely affected if the United States were to withdraw from or materially modify NAFTA or certain other international trade agreements, or if tariffs or other restrictions on the foreign-sourced goods that we sell were to increase.

A significant portion of our business activities are conducted in foreign countries, including Mexico and China. Our business benefits from free trade agreements such as the North American Free Trade Agreement (NAFTA) and we also rely on various U.S. corporate tax provisions related to international commerce as we build, market and sell our products globally. President Trump has made comments suggesting that he is not supportive of certain existing international trade agreements, including NAFTA, and made comments suggesting that he supports significantly increasing tariffs on goods imported into the United States from certain countries such as China and Mexico. At this time, it remains unclear what actions, if any, President Trump will take with respect to NAFTA, other international trade agreements, U.S. tax provisions related to international commerce, and tariffs on goods imported into the United States. If the United States were to withdraw from or materially modify NAFTA, or other international trade agreements to which it is a party, or change corporate tax policy related to international commerce, or if tariffs were raised on the foreign-sourced goods that we sell, such goods may no longer be available at a commercially attractive price or at all, which in turn could have a material adverse effect on our business, financial condition and results of operations.

Our current debt, and debt we may incur in the future, could adversely affect our business and financial position.

As of December 31, 2016, we had $951 million of debt outstanding, of which $816 million is long-term debt. Our level of debt could have significant consequences for our business including: requiring us to use our cash flow to pay the principal and interest on our debt, reducing funds available for acquisitions and other investments in our business; making us vulnerable to economic downturns and increases in interest rates; limiting us from obtaining additional debt; and impacting our ability to pay dividends.

A percentage of our workforce is employed under collective bargaining agreements.

Approximately 8% of our workforce is employed under collective bargaining agreements, which from time to time are subject to renewal and negotiation. We cannot ensure that we will be successful in negotiating new collective bargaining agreements, that such negotiations will not result in significant increases in the cost of labor, or that a breakdown in such negotiations will not result in the disruption of our operations. Although we have generally enjoyed good relations with both our unionized and non-unionized employees, if we are subject to labor actions, we may experience an adverse impact on our operating results.

Our earnings and margins depend in part on subcontractor performance, as well as raw material and component availability and pricing.

Our businesses depend on suppliers and subcontractors for raw materials and components. At times subcontractors perform services that we provide to our customers. We depend on these subcontractors and vendors to meet their contractual obligations in full compliance with customer requirements. Generally, raw materials and purchased components are available from a number of different suppliers, though several suppliers are our sole source of certain components. If a sole-source supplier should cease or otherwise be unable to deliver such components, our operating results could be adversely impacted. In addition,

our supply networks can sometimes experience price fluctuations. Our ability to perform our obligations as a prime contractor may be adversely affected if one or more of these suppliers are unable to provide the agreed-upon supplies or perform the agreed-upon services in a timely and cost-effective manner. While we have attempted to mitigate the effects of increased costs through price increases, there are no assurances that higher prices can effectively be passed through to our customers or that we will be able to offset fully or on a timely basis the effects of higher raw materials costs through price increases.

Our business involves risks associated with complex manufacturing processes.

Our manufacturing processes depend on certain sophisticated and high-value equipment. Unexpected failures of this equipment may result in production delays, revenue loss, and significant repair costs. In addition, equipment failures could result in injuries to our employees. Moreover, the competitive nature of our businesses requires us to continuously implement process changes intended to achieve product improvements and manufacturing efficiencies. These process changes may at times result in production delays, quality concerns, and increased costs. Any disruption of operations at our facilities due to equipment failures or process interruptions could have a material adverse effect on our business.

The airline industry is heavily regulated, and if we fail to comply with applicable requirements, our results of operations could suffer.

Governmental agencies throughout the world, including the U.S. Federal Aviation Administration (FAA) and the European Aviation Safety Agency, prescribe standards and qualification requirements for aircraft components, including virtually all commercial airline and general aviation products. Specific regulations vary from country to country, although compliance with FAA requirements generally satisfies regulatory requirements in other countries. We include, with the products that we sell to our aircraft manufacturing customers, documentation certifying that each part complies with applicable regulatory requirements and meets applicable standards of airworthiness established by the FAA or the equivalent regulatory agencies in other countries. In order to sell our products, we and the products we manufacture must also be certified by our individual original equipment manufacturers (OEM) customers. If any of the material authorizations or approvals qualifying us to supply our products is revoked or suspended, then the sale of the subject product would be prohibited by law, which would have an adverse effect on our business, financial condition, and results of operations.

From time to time, the FAA or equivalent regulatory agencies in other countries propose new regulations or changes to existing regulations, which are usually more stringent than existing regulations. If these proposed regulations are adopted and enacted, we may incur significant additional costs to achieve compliance, which could have a material adverse effect on our business, financial condition, and results of operations.

Our future success will depend, in part, on our ability to develop new technologies.

Virtually all of the products produced and sold by us are highly engineered and require sophisticated manufacturing and system-integration techniques and capabilities. The commercial and government markets in which we operate are characterized by rapidly changing technologies. The product and program needs of our government and commercial customers change and evolve regularly. Accordingly, our future performance depends in part on our ability to identify emerging technological trends, develop and manufacture competitive products, and bring those products to market quickly at cost-effective prices.

Potential product liability risks exist from the products that we sell.

We manufacture highly engineered products, which may result in product liability claims against us. For example, in December 2013, we, along with other unaffiliated parties, received a claim from Canadian Natural Resources Limited (CNRL) pertaining to a fire and explosion at a delayed coker unit at CNRL’s Fort McMurray refinery which resulted in the injury of five CNRL employees, damage to property and equipment, and various forms of consequential loss such as loss of profit, lost opportunities, and business interruption. The fire and explosion occurred when a CNRL employee bypassed certain safety controls and opened an operating coker unit. The total quantum of alleged damages arising from the incident has not been finalized, but is estimated to meet or exceed $1 billion. We currently maintain what we believe to be suitable and adequate commercial, property and casualty, product liability, and other forms of insurance to cover this matter and other potential claims. The Corporation is currently unable to estimate an amount, or range of potential losses, if any, from this matter. The Corporation believes it has adequate legal defenses and intends to defend this matter vigorously. There can be no assurance, however, that we will be able to maintain our insurance on acceptable terms or that such insurance will provide adequate protection against these potential liabilities. In the event of a judgment against us on this matter or other claims against us, a lack of sufficient insurance coverage could have a material adverse effect on our business, financial condition, and results of operations. Moreover, even if we maintain adequate insurance, any successful claim could have a material adverse effect on our business, financial condition, results of operations, or cash flows, and on the ability to obtain suitable or adequate insurance.

We self-insure health benefits and may be adversely impacted by unfavorable claims experience.

We are self-insured for our health benefits. If the number or severity of claims increases, or we are required to accrue or pay additional amounts because the claims prove to be more severe than our original assessment, our operating results would be adversely affected. Our future claims expense might exceed historical levels, which could reduce our earnings. We expect to periodically assess our self-insurance strategy. We are required to periodically evaluate and adjust our claims reserves to reflect our experience. However, ultimate results may differ from our estimates, which could result in losses over our reserved amounts. In addition, because we do not carry “stop loss” insurance, a significant increase in the number of claims that we must cover under our self-insurance retainage could adversely affect our profitability.

Increasing costs of certain employee and retiree benefits could adversely affect our financial position, results of operations, or cash flows.

Our earnings may be positively or negatively impacted by the amount of income or expense we record for our pension and other postretirement benefit plans. U.S. GAAP requires that we calculate income or expense for the plans using actuarial valuations. These valuations reflect assumptions relating to financial markets and other economic conditions. Changes in key economic indicators can change the assumptions. The most significant year-end assumptions used to estimate pension or other postretirement benefit expense for the following year are the discount rate, the expected long-term rate of return on plan assets, expected future medical cost inflation, and expected compensation increases. In addition, we are required to make an annual measurement of plan assets and liabilities, which may result in a significant change to equity through a reduction or increase to other comprehensive income. For a discussion regarding how our financial statements can be affected by pension and other postretirement benefit plans accounting policies, see “Management’s Discussion and Analysis—Critical Accounting Estimates and Policies—Pension and Other Postretirement Benefits” in Part II, Item 7 of this Form 10-K. Although U.S. GAAP expense and pension or other postretirement contributions are not directly related, the key economic factors that affect U.S. GAAP expense would also likely affect the amount of cash the company would contribute to the pension or other postretirement plans. Potential pension contributions include both mandatory amounts required under federal law, Employee Retirement Income Security Act, and discretionary contributions to improve the plans’ funded status. An obligation to make contributions to pension plans could reduce the cash available for working capital and other corporate uses.

Our operating results and financial condition may be adversely impacted by the current worldwide economic conditions.

We currently generate significant operating cash flows, which combined with access to the credit markets provides us with significant discretionary funding capacity. However, financial markets in the United States, Europe, and Asia had experienced extreme disruption in previous years, that included, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations of others. While previously these conditions had not impaired our ability to operate our business, there can be no assurance that there will not be a further deterioration in financial markets and confidence in major economies, which could impact customer demand for our products as well as our ability to manage normal commercial relationships with our customers, suppliers, and creditors. We are unable to predict the likely duration and severity of a disruption in financial markets and adverse economic conditions and the effects they will have on our business and financial condition.

Implementing our acquisition strategy involves risks, and our failure to successfully implement this strategy could have a material adverse effect on our business.

As part of our capital allocation strategy, we aim to grow our business by selectively pursuing acquisitions to supplement our organic growth. We are continuing to actively pursue additional acquisition opportunities, some of which may be material to our business and financial performance. Although we have been successful with this strategy in the past, we may not be able to grow our business in the future through acquisitions for a number of reasons, including:

| |

• | Encountering difficulties identifying and executing acquisitions; |

| |

• | Increased competition for targets, which may increase acquisition costs; |

| |

• | Consolidation in our industry reducing the number of acquisition targets; |

| |

• | Competition laws and regulations preventing us from making certain acquisitions; and |

| |

• | Acquisition financing not being available on acceptable terms or at all. |

In addition, there are potential risks associated with growing our business through acquisitions, including the failure to successfully integrate and realize the expected benefits of an acquisition. For example, with any past or future acquisition, there is the possibility that:

| |

• | The business culture of the acquired business may not match well with our culture; |

| |

• | Technological and product synergies, economies of scale and cost reductions may not occur as expected; |

| |

• | Management may be distracted from overseeing existing operations by the need to integrate acquired businesses; |

| |

• | We may acquire or assume unexpected liabilities; |

| |

• | Unforeseen difficulties may arise in integrating operations and systems; |

| |

• | We may fail to retain and assimilate employees of the acquired business; |

| |

• | We may experience problems in retaining customers and integrating customer bases; and |

| |

• | Problems may arise in entering new markets in which we may have little or no experience. |

Failure to successfully implement our acquisition strategy, including successfully integrating acquired businesses, could have a material adverse effect on our business, financial condition and results of operations.

War, natural disasters, or other events beyond our control could adversely impact our businesses.

Despite our concerted effort to minimize risk to our production capabilities and corporate information systems and to reduce the effect of unforeseen interruptions to us through business continuity planning and disaster recovery plans, war, natural disasters, such as hurricanes, floods, tornadoes, pandemic diseases, or other events, such as strikes by a significant customer’s or supplier’s workforce, could adversely impact demand for or supply of our products and could also cause disruption to our facilities or systems, which could also interrupt operational processes and adversely impact our ability to manufacture our products and provide services and support to our customers. We operate facilities in areas of the world that are exposed to natural disasters, such as but not limited to hurricanes, floods, tornados, and pandemic diseases. Financial difficulties of our customers, delays by our customers in production of their products, high fuel prices, the concern of another major terrorist attack, and the overall decreased demand for our products could adversely affect our operating results and financial position.

A resurgence of terrorist activity around the world could cause economic conditions to deteriorate and adversely impact our businesses.

In the past, terrorist attacks have negatively impacted general economic, market, and political conditions. In particular, the 2001 terrorist attacks, compounded with changes in the national economy, resulted in reduced revenues in the aerospace and general industrial markets in 2002 and 2003. Although economic conditions have improved considerably, additional terrorist acts such as the 2015 Paris terrorist attacks could cause damage or disruption to our business, our facilities, or our employees, which could significantly impact our business, financial condition, or results of operations. The potential for additional future terrorist attacks and the national and international responses to terrorist attacks, have created many economic and political uncertainties, which could adversely affect our business and results of operations in ways that cannot presently be predicted. In addition, with manufacturing facilities located worldwide, including facilities located in the United States, Western Europe, and the People’s Republic of China, we may be impacted by terrorist actions not only against the United States but in other parts of the world as well. In some cases, we are not insured for losses and interruptions caused by terrorist acts.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Our corporate headquarters is located at a leased facility in Charlotte, North Carolina. As of December 31, 2016, we had 173 facilities worldwide, including four corporate and shared-services facilities. Approximately 87% of our facilities operate as manufacturing and engineering, metal treatment, or aerospace overhaul plants, while the remaining 13% operate as selling and administrative office facilities. The number and type of facilities utilized by each of our reportable segments are summarized below:

|

| | | | | | | | |

Owned Facilities Location | | Commercial/ Industrial | | Defense | | Power | | Total |

North America | | 16 | | 1 | | 3 | | 20 |

Europe | | 14 | | 1 | | — | | 15 |

Total | | 30 | | 2 | | 3 | | 35 |

|

| | | | | | | | |

Leased Facilities Location | | Commercial/ Industrial | | Defense | | Power | | Total |

North America | | 52 | | 11 | | 23 | | 86 |

Europe | | 28 | | 4 | | — | | 32 |

Asia | | 16 | | — | | — | | 16 |

Total | | 96 | | 15 | | 23 | | 134 |

The buildings on the properties referred to in this Item are well maintained, in good condition, and are suitable and adequate for the uses presently being made of them. Management believes the productive capacity of our properties is adequate to meet our anticipated volume for the foreseeable future.

Item 3. Legal Proceedings.

In the ordinary course of business, we and our subsidiaries are subject to various pending claims, lawsuits, and contingent liabilities. We do not believe that the disposition of any of these matters, individually or in the aggregate, will have a material adverse effect on our consolidated financial position, results of operations, and cash flows.

In December 2013, the Corporation, along with other unaffiliated parties, received a claim from Canadian Natural Resources Limited (CNRL) filed in the Court of Queen's Bench of Alberta, Judicial District of Calgary. The claim pertains to a January 2011 fire and explosion at a delayed coker unit at its Fort McMurray refinery that resulted in the injury of five CNRL employees, damage to property and equipment, and various forms of consequential loss such as loss of profit, lost opportunities, and business interruption. The fire and explosion occurred when a CNRL employee bypassed certain safety controls and opened an operating coker unit. The total quantum of alleged damages arising from the incident has not been finalized, but is estimated to meet or exceed $1 billion. Although the parties tentatively agreed to mediate the claim, no progress has been made to further pursue the claim. The Corporation maintains various forms of commercial, property and casualty, product liability, and other forms of insurance; however, such insurance may not be adequate to cover the costs associated with a judgment against us. The Corporation is currently unable to estimate an amount or range of potential losses, if any, from this matter. The Corporation believes it has adequate legal defenses and intends to defend this matter vigorously. The Corporation's financial condition, results of operations, and cash flows could be materially affected during a future fiscal quarter or fiscal year by unfavorable developments or outcome regarding this claim.

We have been named in pending lawsuits that allege injury from exposure to asbestos. To date, we have not been found liable or paid any material sum of money in settlement in any case. We believe that the minimal use of asbestos in our past operations and the relatively non-friable condition of asbestos in our products makes it unlikely that we will face material liability in any asbestos litigation, whether individually or in the aggregate. We maintain insurance coverage for these potential liabilities and we believe adequate coverage exists to cover any unanticipated asbestos liability.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

MARKET INFORMATION

Our common stock is listed and traded on the New York Stock Exchange (NYSE) under the symbol CW.

|

| | | | | | | | | | | | | | | | |

Stock Price Range | | 2016 | | 2015 |

| | High | | Low | | High | | Low |

Common Stock | | | | | | | | |

First Quarter | | $ | 75.93 |

| | $ | 62.57 |

| | $ | 74.63 |

| | $ | 64.40 |

|

Second Quarter | | 87.76 |

| | 73.95 |

| | 77.57 |

| | 70.13 |

|

Third Quarter | | 91.65 |

| | 81.52 |

| | 73.90 |

| | 61.59 |

|

Fourth Quarter | | 107.61 |

| | 83.48 |

| | 71.86 |

| | 60.73 |

|

As of January 1, 2017, we had approximately 3,770 registered shareholders of our common stock, $1.00 par value.

DIVIDENDS

During 2016 and 2015, the Company paid quarterly dividends of thirteen cents ($0.13) a share.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth information regarding our equity compensation plans as of December 31, 2016, the end of our most recently completed fiscal year:

|

| | | | | | | | |

Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | | | Weighted average exercise price of outstanding options, warrants, and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column) | |

Equity compensation plans approved by security holders | | 968,891 | (a) | | $52.95 | | 2,474,816 | (b) |

Equity compensation plans not approved by security holders | | None | | | Not applicable | | Not applicable | |

| |

(a) | Consists of 922,306 shares issuable upon exercise of outstanding options and vesting of performance share units, restricted shares, restricted stock units, and shares to non-employee directors under the 2005 and 2014 Omnibus Incentive Plan, 46,585 shares issuable under the Employee Stock Purchase Plans. |

| |

(b) | Consists of 2,076,115 shares available for future option grants under the 2014 Omnibus Incentive Plan, 398,701 shares remaining available for issuance under the Employee Stock Purchase Plan. |

Issuer Purchases of Equity Securities

The following table provides information about our repurchases of equity securities that are registered by us pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, during the quarter ended December 31, 2016.

|

| | | | | | | | |

| | Total Number of shares purchased | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of a Publicly Announced Program | | Maximum Dollar amount of shares that may yet be Purchased Under the Program |

October 1 – October 31 | | 95,100 | | $87.70 | | 1,129,747 | | $111,364,432 |

November 1 – November 30 | | 89,100 | | 93.41 | | 1,218,847 | | 103,041,289 |

December 1 – December 31 | | 80,700 | | 102.73 | | 1,299,547 | | 94,751,213 |

For the quarter ended December 31 | | 264,900 | | $94.20 | | 1,299,547 | | $94,751,213 |

On December 9, 2015, the Corporation announced the authorization of a $200 million share repurchase program. The Company initiated the program in January 2016 and repurchased over $100 million of shares in 2016. On December 7, 2016, the Corporation authorized an additional $100 million for future share repurchases. The Company plans to repurchase at least $50 million in shares in 2017. Under the current program, shares may be purchased on the open market, in privately negotiated transactions, and under plans complying with Rules 10b5-1 and 10b-18 under the Securities Exchange Act of 1934, as amended.

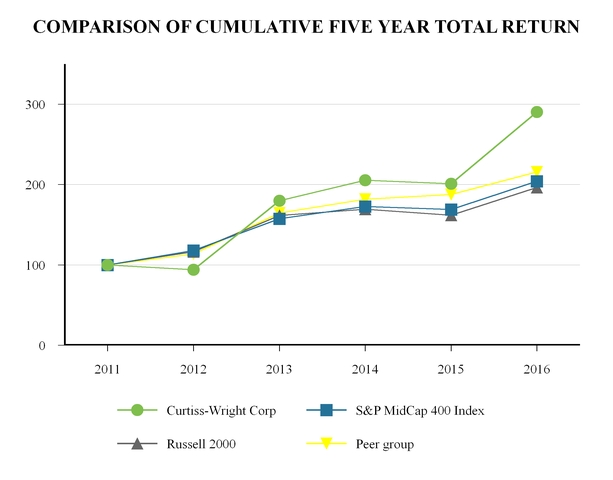

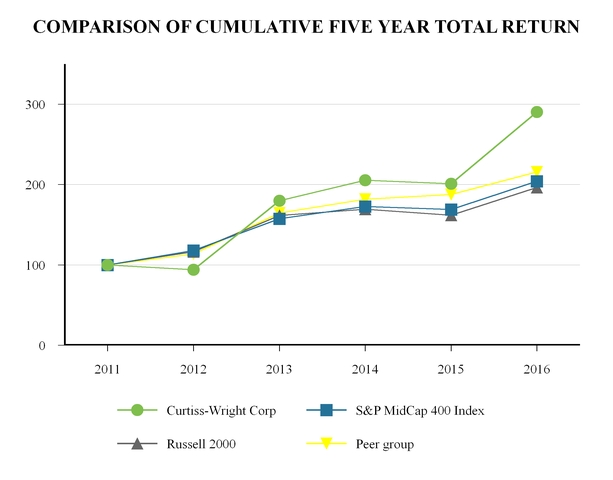

The following performance graph does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of our other filings under the Securities Act or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this information by reference therein.

PERFORMANCE GRAPH

On January 29, 2016, S&P Dow Jones Indices added Curtiss-Wright to the S&P MidCap 400 Index. The Company was previously a member of the S&P SmallCap 600 Index. The following graph compares the annual change in the cumulative total return on our Company’s Common Stock during the last five fiscal years with the annual change in the cumulative total return of the Russell 2000 Index, the S&P MidCap 400 Index, and our self-constructed proxy peer group. The proxy peer group companies are as follows:

|

| |

AAR Corp | Moog Inc. |

Crane Co. | Orbital ATK, Inc. |

Cubic Corp | Rockwell Collins Inc. |

EnPro Industries Inc. | Spirit Aerosystems Holdings Inc. |

Esterline Technologies Corp | Teledyne Technologies Inc. |

Hexcel Corp | TransDigm Group Inc. |

IDEX Corporation | Triumph Group Inc. |

Kaman Corp | Woodward Inc. |

ITT Corp | |

The graph assumes an investment of $100 on December 31, 2011 and the reinvestment of all dividends paid during the following five fiscal years.

|

| | | | | | | | | | | | | | | | | | |

Company / Index | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 |

Curtiss-Wright Corp | | 100 |

| | 93.93 |

| | 179.74 |

| | 205.49 |

| | 200.89 |

| | 290.19 |

|

S&P MidCap 400 Index | | 100 |

| | 117.88 |

| | 157.37 |

| | 172.74 |

| | 168.98 |

| | 204.03 |

|

Russell 2000 | | 100 |

| | 116.35 |

| | 161.52 |

| | 169.43 |

| | 161.95 |

| | 196.45 |

|

Peer group | | 100 |

| | 113.68 |

| | 164.65 |

| | 181.73 |

| | 187.70 |

| | 215.75 |

|

Item 6. Selected Financial Data.

The following table presents our selected financial data from continuing operations. The table should be read in conjunction with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Five-Year Financial Highlights

|

| | | | | | | | | | | | | | | | | | | | |

| | CONSOLIDATED SELECTED FINANCIAL DATA |

(In thousands, except per share data) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

| | | | | | | | | | |

Net sales | | $ | 2,108,931 |

| | $ | 2,205,683 |

| | $ | 2,243,126 |

| | $ | 2,118,081 |

| | $ | 1,823,307 |

|

Net earnings from continuing operations | | 189,382 |

| | 192,248 |

| | 169,949 |

| | 139,404 |

| | 104,081 |

|

Total assets | | 3,037,781 |

| | 2,989,611 |

| | 3,382,448 |

| | 3,458,274 |

| | 3,114,588 |

|

Total debt, net | | 966,298 |

| | 953,205 |

| | 954,348 |

| | 959,938 |

| | 880,215 |

|

Earnings per share from continuing operations: | | | | | | | | | | |

Basic | | $ | 4.27 |

| | $ | 4.12 |

| | $ | 3.54 |

| | $ | 2.97 |

| | $ | 2.23 |

|

Diluted | | $ | 4.20 |

| | $ | 4.04 |

| | $ | 3.46 |

| | $ | 2.91 |

| | $ | 2.20 |

|

Cash dividends per share | | $ | 0.52 |

| | $ | 0.52 |

| | $ | 0.52 |

| | $ | 0.39 |

| | $ | 0.35 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

COMPANY ORGANIZATION

Curtiss-Wright Corporation and its subsidiaries is a global, diversified, industrial provider of highly engineered, technologically advanced, products and services to a broad range of industries which are reported through our Commercial/Industrial, Defense, and Power segments. We are positioned as a market leader across a diversified array of niche markets through engineering and technological leadership, precision manufacturing, and strong relationships with our customers. We provide products and services to a number of global markets, including the commercial aerospace, defense, power generation, and industrial markets. Our overall strategy is to be a balanced and diversified company, less vulnerable to cycles or downturns in any one market, and to establish strong positions in profitable niche markets. Approximately 37% of our 2017 revenues are expected to be generated from defense-related markets.

As discussed in Note 2 to the Corporation's Consolidated Financial Statements, we have completed our 2014 divestiture activities. The results of operations of the divested businesses are reported as discontinued operations within our Consolidated Statements of Earnings.

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations begins with an overview of our company, followed by economic and industry-wide factors impacting our company and the markets we serve, a discussion of the overall results of continuing operations, and finally a more detailed discussion of those results within each of our reportable operating segments.

Impacts of inflation, pricing, and volume

We have not historically been and do not expect to be significantly impacted by inflation. Increases in payroll costs and any increases in raw material costs that we have encountered are generally able to be offset through lean manufacturing activities. We have consistently made annual investments in capital that deliver efficiencies and cost savings. The benefits of these efforts generally offset the margin impact of competitive pricing conditions in all of the markets we serve.

Analytical Definitions

Throughout management’s discussion and analysis of financial condition and results of operations, the terms “incremental” and “organic” are used to explain changes from period to period. The term “incremental” is used to highlight the impact acquisitions had on the current year results for which there was no comparable prior-year period. Therefore, the results of

operations for acquisitions are incremental for the first twelve months from the date of acquisition. The remaining businesses are referred to as the “organic”. The definition of “organic” excludes the effect of foreign currency translation.

Market Analysis and Economic Factors

Economic Factors Impacting Our Markets