Goal 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the Fiscal Year Ended

OR

For the transition period from ____ to ____

Commission File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of exchange on which registered |

Preferred Stock Purchase Rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ◻ Yes ⌧

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ | ||

Non-accelerated filer ◻ | Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ⌧

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act)

The aggregate market value of 19,096,397 shares of common stock held by non-affiliates of the registrant was: $

Number of shares of common stock outstanding as of November 2, 2020 including shares held by affiliates is:

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with its 2021 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the Securities and Exchange Commission subsequent to the date hereof but not later than 120 days after registrant’s fiscal year ended September 30, 2020.

CUBIC CORPORATION

ANNUAL REPORT ON FORM 10-K

For the Year Ended September 30, 2020

TABLE OF CONTENTS

2

PART I

Item 1. BUSINESS.

OVERVIEW

CUBIC CORPORATION (“we,” “us,” the “Company” and “Cubic”) efficiently provides our global customers with innovative, mission-critical solutions to reduce congestion and increase operational readiness and effectiveness through superior situational understanding. Cubic serves transportation, defense command, control, communication, computers, intelligence, surveillance and reconnaissance (C4ISR), and defense training customers globally. We offer integrated payment and information systems, expeditionary communications, cloud-based computing and intelligence delivery, as well as state-of-the-art training and readiness solutions.

Our recently launched NextCUBIC strategy focuses on growth, operational excellence and culture, and is founded on our winning proposition – we solve our customers’ most critical challenges through innovative, mission-critical solutions, services and platforms. NextCUBIC, which is underpinned by a thorough outside-in assessment, launches a full-scale program to drive a step change in value creation and deliver sustainable financial improvement through both functional and cultural transformation in the way we work.

We believe that we have significant transportation and defense industry expertise which, combined with our innovative technology capabilities, contributes to our leading market positions and allows us to deepen and further expand each of our business segments in key markets. All of our businesses share a common mission with supporting technologies to increase our customers’ situational awareness so they can make better decisions. Our transportation customers benefit from enhanced efficiency and reduced congestion, while our defense customers benefit from increased readiness and mission effectiveness. Headquartered in San Diego, California, we do business on five continents and we had approximately 6,100 employees working in 17 countries as of September 30, 2020.

In recent history we’ve managed our business in three separate business segments: Cubic Transportation Systems (CTS), Cubic Mission Solutions (CMS), and Cubic Global Defense Systems (CGD). In the fourth quarter of fiscal 2020 we combined our CMS and CGD segments to form a new Cubic Mission and Performance Solutions (CMPS) segment. This new segment will continue to deliver solutions to C4ISR and training customers worldwide. This streamlined organizational structure is designed to:

| ● | Leverage our world class talent and common technologies across the combined defense business |

| ● | Enhance collaboration and customer intimacy globally |

| ● | Reduce complexity and cost, and |

| ● | Increase organizational efficiency to support customer and shareholder value creation. |

Notwithstanding our recent realignment of our defense business, we are still required to report our segment financial results based upon our legacy reportable business segments in fiscal year 2020. However, in fiscal 2021 the defense businesses will be combined into CMPS, a single reportable segment.

We have a broad customer base across our businesses, with approximately 61% of our fiscal year 2020 sales generated from U.S. federal, state and local governments. Approximately 3% of these sales were attributable to Foreign Military Sales, which are sales to allied foreign governments facilitated by the U.S. government. The remainder of our fiscal year 2020 sales were attributable to sales to foreign government and foreign municipal agencies. In fiscal year 2020, 64% of our total sales were derived from products, with services sales accounting for the remaining 36%.

BUSINESS SEGMENTS

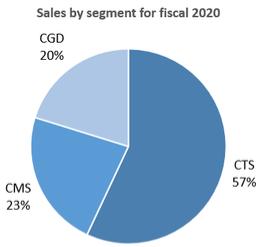

For the year ended September 30, 2020, the distribution of our sales across our three legacy business segments was as follows:

3

See Note 16 to our Consolidated Financial Statements for additional information related to disaggregation of revenues by customer location, contract type, deliverable type and revenue recognition method for each of our reportable business segments.

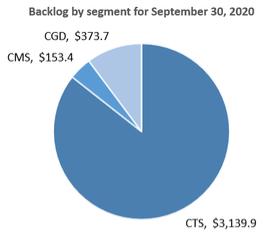

As of September 30, 2020, the distribution of backlog across our three legacy business segments was as follows (in millions):

We estimate that approximately $771.8 million, $134.3 million, and $171.6 million of the September 30, 2020 backlog for CTS, CMS, and CGD, respectively, will be converted into sales by September 30, 2021.

Sales type for each of our legacy business segments was as follows in fiscal year 2020:

Cubic Transportation Systems

CTS is a leading integrator of payment, information technology and services for intelligent travel solutions. We specialize in the design, development, production, installation, maintenance and operation of automated fare payment, traffic management and enforcement solutions, real-time information systems, and revenue management infrastructure and technologies for transportation agencies. As part of our turnkey solutions, CTS also provides these customers with a

4

comprehensive suite of business process outsourcing (BPO) services and expertise, such as card and payment media management, central systems and application support, retail network management, customer call centers and financial clearing and settlement support.

CTS is comprised of approximately 3,100 employees working in major transportation markets worldwide. As an established partner with transportation authorities and operators, we have installed systems in over 40 markets on four continents. While the COVID-19 pandemic has reduced transit ridership, our systems were serving over 41 million users a day, processing approximately 14 billion revenue-related transactions per year, which were generating more than $16 billion of revenue per year for such transportation authorities and operators at pre-pandemic activity levels.

We hold the leading market position in large-scale automated fare payment and revenue management systems and services for major metropolitan areas such as London (Oyster/Contactless Payment), the New York region (Metrocard/OMNY), the Chicago region (Ventra), the San Francisco Bay Area (Clipper), the Vancouver region (Compass), the Sydney region (Opal Card) and the Brisbane region (Go Card). We are currently designing and building major new systems in New York, Boston, Brisbane, and the San Francisco Bay Area.

Through our NextBus, ITMS, Trafficware and GRIDSMART businesses, we provide advanced transportation operational management capabilities and related services to hundreds of customers including organizations such as Transport for London, Transport Scotland, Highways England, Transport for Greater Manchester, Los Angeles Metro, San Francisco Muni and the Toronto Transit Commission. We also provide a modern tolling and road user charging alternative that uses state-of-the-art tools that are flexible and modular compared to the proprietary, legacy systems that the industry views as their only option.

Transportation Industry Overview

We define our addressable transportation market as multi-modal transportation revenue management systems (e.g. public transit fare collection, toll revenue collection, congestion charging), Real-Time Passenger Information and Intelligent Transportation Systems and services. We project the long-term growth for this market to be driven primarily by customer infrastructure expansion as well as technological refreshment and advancement which will lead to system replacements and upgrades. Together with additional opportunities that stem from our other businesses as well as entry into new geographies, we believe our overall addressable market to be in excess of $16 billion. We believe industry experience, past performance, technological innovation and price are the key factors customers consider in awarding programs and such factors can serve as barriers to entry to potential competitors when coupled with scale and the upfront investments required for these programs.

Advances in communications, networking and security technologies are enabling interoperability of multiple modes of transportation within a single networked system, as well as interoperability of multiple transportation operators within a single networked system. As such, there is a growing trend for regional payment systems. Recent procurements for open payment systems will further extend the acceptance of payment media from smart cards, to contactless bank cards and Near Field Communication (NFC) enabled smartphones.

Cubic Mission and Performance Solutions

CMPS serves defense C4ISR and training customers globally. We offer expeditionary communications, cloud-based computing and intelligence delivery, as well as state-of-the-art training, readiness and performance solutions. We provide our global customers with innovative, mission-critical solutions to increase operational readiness, effectiveness and performance.

Cubic Mission Solutions

CMS provides C4ISR capabilities for defense, intelligence, security and commercial missions.

5

Our rugged IoT solutions provide a wide range of deployable and tactical communications products to meet the diverse mission requirements of our military, government, first-responder and civilian customers. Our protected communications products also include RF data links, search and rescue avionics and customized radio products. We offer a wide range of Command and Control, Intelligence, Surveillance and Reconnaissance (C2ISR) products and solutions to support expeditionary and tactical needs of our military and allied forces. We support the collection, processing, analysis and dissemination of information across the full spectrum of the Department of Defense and Intelligence Community’s mission. Additionally, we have developed UAV systems which will provide affordable ISR-as-a-service, and our airborne collection solutions will be complemented by complete flight services and ongoing sustainment and logistics support.

CMS customers include the military services, principally the U.S. Army and U.S. Special Operations Command, various other government agencies of the U.S. and other countries, and commercial customers. In fiscal 2020, U.S. government customers accounted for 95% of CMS sales, international customers accounted for 1% of sales, and U.S. commercial and other customers accounted for 4% of CMS sales. CMS is comprised of approximately 800 employees working primarily in the United States.

Our major CMS programs include:

| ● | US Army Contracting Command NJ SBIR IDIQ with a contract ceiling value of $963 million. |

| ● | In fiscal 2020, we received the following significant awards: |

| o | A follow-on, single-award, IDIQ contract with a ceiling of $172 million from United States Special Operations Command (USSOCOM) to deliver GATR inflatable satellite communications terminals and baseband communications equipment in support of SOF communications requirements. |

| o | A contract worth $38 million to deliver a Joint Aerial Layer Network (JALN) High Capacity Backbone (HCB) prototype for the U.S. Air Force (USAF). The HCB is a critical element of the JALN, designed to maintain network connectivity among joint forces across the aerial layer and a critical enabler for Joint All-Domain Command and Control (JADC2) capability. Our offering for the USAF will consist of integrated capabilities across our C2ISR portfolios. |

Cubic Global Defense

CGD is a market leader in live, virtual, constructive (LVC) and game-based training solutions to the U.S. Department of Defense (DoD), other U.S. government agencies and allied nations. We design and manufacture realistic, high-fidelity air, ground, and surface instrumentation, visualization and data analytic systems that support LVC training in high fidelity environments. Our customized systems and services accelerate combat readiness in the air, on the ground and at sea while meeting the demands of evolving operations globally.

Our products and systems help our customers to retain operational, tactical, and technological superiority with cost-effective solutions. We also provide ongoing support services for systems we have built for several of our international customers. Our training business portfolio is currently organized into air training, ground training, and synthetic/digital solutions. CGD does business on five continents and is comprised of approximately 1,200 employees working in 12 nations providing training systems to the DoD and allied nations.

Our established international footprint in 34 allied nations is a key element of our strategy. Our global footprint helps to mitigate possible shifts or downturns in DoD spending. Sales to international customers accounted for 60% of CGD sales in 2020. In addition, new innovative technologies such as LVC training systems and potential expansion into adjacent markets provides us the means to add scale to our business. Strategically, we believe we are very well positioned to lead the increasing trend to fully integrated solutions that connect LVC and game-based training in multi-domain environments.

Air Training Solutions

In air training, Cubic was the initial developer and supplier of Air Combat Maneuvering Instrumentation (ACMI) capability during the Vietnam War. The latest ACMI generation, the P5 Combat Training System, provides advanced air combat training capability to the USAF, Navy and Marine Corps, as well as allied nations which has solidified Cubic’s

6

global market leading position. In addition to procuring the ACMI training system, many nations also rely on Cubic for on-site operations and maintenance support. We are constantly evolving our air combat training solutions to achieve full-spectrum LVC training systems.

Ground Training Solutions

We are a leading provider of realistic, easy-to-use, high-fidelity, reliable, and cost-effective tactical engagement simulation systems that minimize user set-up time and increase training effectiveness. Our leadership role in instrumented training was established during the 1990s when Cubic provided turnkey systems for U.S. Army training centers including the Joint Readiness Training Center (JRTC) at Fort Polk, Louisiana, and the Combat Maneuver Training Center (CMTC) at Hohenfels, Germany, now known as the Joint Multinational Readiness Center. Since the completion of these original contracts, we have significantly expanded our market footprint with the sale of fixed, mobile and urban operation training centers to uniformed military and security forces in the United States and allied nations around the world. Our ground combat training systems operate at over 90 combat training centers (CTCs) worldwide. Our laser-based tactical engagement simulation systems, widely known as Multiple Integrated Laser Engagement Systems (MILES), are used to enable realistic training without live ammunition.

Synthetic/Digital Solutions

Our synthetic/digital solutions integrate instructional material into a gaming environment, thus dramatically reducing instructor costs and providing a platform that is ideal for embedded training. These technologies are easily transferrable to different training domains and subject matters. The experiential learning environment can be augmented with intelligent tutoring and assessment tools increasing the value of this approach.

As the blend of LVC training creates broader higher fidelity training environments, the data generated creates a significant opportunity to capitalize on our advanced synthetic and digital capabilities to deliver greater insight into customer training effectiveness.

Defense Industry Overview

Our CMS markets, including protected communications, ruggedized IoT and C2ISR have a total addressable market of approximately $5 billion annually. We believe that our CMS products and technologies address mission critical requirements such as integrated communications suites for UAVs, ships and the dismounted soldier, battlefield awareness, and secure and encrypted communications.

Our training market is relatively large and stable. According to the 2018 Global Military Simulation and Virtual Training Market report, the value of the global military simulation and virtual training programs market was $10.2 billion in 2018.

The U.S. national debt now exceeds $27 trillion, and now surpasses the U.S.’s Gross Domestic Product, with recent growth in large part due to the response to the current coronavirus pandemic. In this era of deficit spending, the U.S. government has momentarily paused its focus on discretionary spending, tax, and other initiatives to control spending, debt and the deficit. As the economic effects of the pandemic recede, it is likely pressure will mount on controlling discretionary spending but there are presently no indications of reductions to current, near-term defense budgets as the defense industry is identified as essential, nor is there an indication of rising interest rates as Federal Reserve officials expect to leave interest rates near zero for years — through at least 2023 — as they try to coax the economy back to full strength after the coronavirus pandemic-induced recession.

Our defense portfolio is well aligned to support the U.S. national defense strategy. Because of the re-emergence of long-term, strategic competition with China and Russia, the National Defense Strategy priorities are likely to remain in place regardless if there is a change in presidential administrations, and will drive relatively stable defense budgets. We’ve seen strong bipartisan support for national security funding as indicated by the $740 billion FY 2021 defense appropriation. There is also bipartisan support for transportation infrastructure spending, including support for intelligent transportation and congestion management systems, in the next surface authorization act. Beyond FY21 legislation we expect, given the likely prospect of a “divided” government, that Congress will keep the current tax structure in place,

7

expand infrastructure spending and maintain defense spending at the record highs. Nonetheless, beyond 2021, the President’s administration and Congress will likely continue to debate the size and expected growth of the U.S. federal budget as well as the defense budget and balance decisions regarding defense, homeland security, and other federal spending priorities.

AVAILABLE INFORMATION

Our internet address is www.Cubic.com. The content on our website is available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports can be found on our internet website under the heading “Investor Relations”. We make these reports readily available free of charge in a reasonably practicable time after we electronically file these materials with the Securities and Exchange Commission (SEC).

COMPETITIVE ENVIRONMENT

Our businesses operate in highly competitive markets. CTS is one of several companies specializing in the transportation systems and services market. Our competitors in various market segments include among others Accenture, Conduent, Econolite, IBM, Indra, Init, Intelight, Kapsch, Kimley-Horn, McCain, Flowbird, Roper Technologies, Scheidt & Bachmann, Siemens, Thales, Trapeze and Vix. For large tenders, our competitors may form consortiums that could include telecommunications companies, financial institutions and consulting companies in addition to the companies noted above. These procurement activities are very competitive and require that we have highly skilled and experienced technical personnel to compete. We believe that our competitive advantages include intermodal and interagency regional integration expertise, technical skills, innovation, past contract performance, systems quality and reliability, experience in the industry and long-term customer relationships.

CMPS competes with large companies, including Boeing, General Dynamics, L3Harris, Lockheed Martin, Northrop Grumman, and Saab Training Systems, as well as numerous smaller companies. In many cases, we have also teamed with several of these companies, in both prime and subcontractor roles, on specific bid opportunities.

While we are generally smaller than our principal competitors, we believe our competitive advantages include an outstanding record of past performance, strong incumbent relationships, the ability to control operating costs and rapidly focus technology and innovation to solve our customer’s toughest problems.

BUSINESS STRATEGY

To improve the economics of the company, we’ve launched NextCUBIC, a Cubic-led transformation founded on a thorough independent diligence outside-in assessment. NextCUBIC resets our trajectory, redefines the full potential of our business, develops the transformation plan (initiatives and financials), and launches a full-scale effort to drive value to the bottom-line and sustain the impact of these improvements. Our NextCUBIC Strategy for fiscal years 2021 through 2025 is focused on efficiently building technology-driven, market-leading businesses guided by our five Key Priorities of Winning the Customer Obsession, Building NextCity Globally, Building NextMission & NextPerformance Globally, Improving Financial Performance and Living One Cubic.

In this strategy, we accelerate our winning proposition by solving our customer’s most critical challenges through innovative, mission-critical solutions, services and platforms. For cities, we increase the quality of urban life by reducing congestion through intelligent transportation. For our national defenders and first responders, we ensure operational readiness and effectiveness through superior, secure situational understanding. For our military and operators of the world’s most advanced machines, we enable optimal performance, safety and productivity through intelligent training systems that maximize readiness.

Implementing this strategy will improve Cubic’s competitive advantage to deliver exceptional value to our customers as well as superior returns to our shareholders. We create customer value by serving as a trusted partner, maximizing reusability, reliability and the user experience while minimizing size, weight, power and cost, executing customer-

8

aligned technology roadmaps and designing modern digital, information-rich platforms with scalability, reliability and security.

We leverage our market leadership position, provide value-based solutions and develop subscription-based revenue models, and improve our financial performance by leveraging our One Cubic scale, driving continuous improvement and leveraging a real-time, data-driven, digital performance management system. We are driving efficiency and reducing costs by optimizing facilities, manufacturing and engineering and aligning human capital and talent with our specific businesses and markets.

Our NextCUBIC strategy and digital pivot set the stage for greater differentiation, market expansion, profitability and value creation. Implementing this strategy will improve Cubic’s competitive advantage to deliver exceptional value to our customers as well as superior returns to our shareholders.

Our strategy remains guided by our Winning the Customer Obsession to create market-leading positions, delivering superior operational performance, developing customer-centric innovations and investing our capital and talent to enhance our market-leading businesses. We will accelerate our growth by being innovative, responsive, connected and, ultimately, indispensable to our customers.

In CTS, we have developed our NextCity vision for the future of transportation. We are repositioning ourselves from being a leading provider of mass transit fare collection systems to be a leading provider of integrated payment and information systems across all modes of transportation. In Building NextCity Globally, we will create transportation payment and information solutions in cities to help our customers increase efficiency and reduce congestion. We will focus on integrating transportation payments more efficiently and leveraging transportation data more effectively than anyone else. We will endeavor to increase our product reusability, innovate faster, use our superior global footprint to our advantage, and have a competitive cost structure. We will continue to grow our portfolio beyond fare collection to include industries such as tolling/road user charging, analytics and traffic management and design our solutions to scale to all cities, large and small.

Our NextMission and NextPerformance strategy is focused on solving our customer’s most critical challenges through innovative, mission-critical solutions, services and platforms. For our national defenders and first responders, we ensure operational readiness and effectiveness through superior, secure situational understanding. For our military and operators of the world’s most advanced machines, we enable optimal performance, safety and productivity through intelligent training systems. Our digital initiatives harness data, cloud and mobile platforms to create new business models, accelerate innovation cycles, improve operational efficiency, and equip our employees, customers, and partners with real-time insight and knowledge.

In providing networked C4ISR capabilities for defense, intelligence, security and commercial missions, we are committed to continuous innovation to ensure our customers are prepared for their Next Mission. Today, as a leading C4ISR innovator, we provide integrated mission capabilities in protected communications, ruggedized tactical cloud computing, secure networking, autonomous systems and C2ISR. Our resilient, scalable and secure solutions enable our customers to conduct operations in the most challenging and degraded environments. Our solutions provide rapid and continuous situational understanding that provides the knowledge needed to make timely decisions to achieve desired effects.

In providing advanced training systems and readiness solutions for the U.S. and allied forces in more than 35 nations, we are committed to building upon the core strategic training business and continue to lead the market in LVC Air and Ground Combat Training. Our approach pivots from instrumenting aircraft, vehicles and individuals to instrumenting human performance. This transforms our customer experience by providing actionable knowledge, after action feedback into individual and collective performance, and deep insights across multiple data sources.

Digital operating excellence and the creation of new digital offerings and platforms is an essential underpinning of our strategy, key priorities and investment choices. We established Cubic digital platforms to accelerate innovation cycles and place us on a path to higher profit margins. Our digital pivot initiative harnesses data, cloud and mobile platforms to create new business models, accelerate innovation cycles, improve operational efficiency and equip our employees,

9

customers and partners with real-time insight and knowledge. Our Digital Pivot will grow Cubic revenue and margins by creatively designing, building and delivering technology and new offerings to solve our customers’ most difficult challenges.

Lastly, our strategy is supported by our Living One Cubic key priority of sharing resources across the company to help achieve superior talent management, absolute customer focus, innovation, collaboration, cost-effective enterprise systems and impeccable ethics.

Long-Term Customer Relationships

We seek to build leadership positions in our core markets by building and maintaining long-term relationships with our customers. The length of relationship with many of our customers exceeds 30 years and further supports our industry-wide leadership and technological capabilities. As a result of maintaining a high level of performance, we continue to provide a combination of services and upgrades for our long-term customers. Such long-term relationships include the following:

Segment & Business Area |

| Customer Relationships |

CTS - Automated Fare Collection | ● Since 1972, provided ticket encoding and vending technology to the San Francisco Bay Area’s MTC, which includes Bay Area Rapid Transit (BART). We are in process of delivering next-generation fare payment technology and operational services to the Clipper smart card system | |

● Since 1985, provided the London Underground (the Tube) with new fare gates and standardized ticketing machines. | ||

CGD - Air Training | ● In 1973, supplied first “Top Gun” Air Combat Maneuvering Instrumentation system for the Marine Corps Air Station at Yuma, AZ. | |

CGD - Ground Training | ● In 1990, pioneered the world’s first turnkey ground combat-instrumentation system at Hohenfels, Germany for the U.S. Army. | |

CMS - Expeditionary Satellite Communication Terminals | ● In 2008, GATR’s technology was made an evolutionary component of the U.S. Special Operations Command Deployable Node family of SATCOM terminals. |

Strategic Innovation-focused Investment of Capital

We target markets that have the potential for above-average growth and profit margins where domain expertise, innovation, technical competency and contracting dynamics can help to create meaningful barriers to entry. We will strategically reinvest in key program captures, internal research and development (R&D), and acquisitions to target priority markets and help ensure market leading positions to drive long-term shareholder return.

We are committed to using innovation and technology to address our customers’ most pressing problems and demanding requirements. We have made meaningful and recognized contributions to technological advancements within our industries. During fiscal 2020 we prudently reduced lower-priority company-sponsored R&D due to the environment caused by the COVID-19 pandemic, but we plan to increase investment in R&D going forward.

In addition to internally funded R&D, a significant portion of our new product development occurs in conjunction with the performance of work on our contracts. These costs are included in cost of sales in our Consolidated Statements of Operations as they are directly related to contract performance.

10

The cost of company-sponsored R&D activities included in our Consolidated Statements of Operations and the cost of contract R&D activities included in our cost of sales are as follows (in thousands):

Years Ended September 30, | ||||||||||

| 2020 |

| 2019 |

| 2018 |

| ||||

Company-Sponsored Research and Development Expense: | ||||||||||

Cubic Transportation Systems | $ | 8,669 | $ | 10,948 | $ | 13,394 | ||||

Cubic Mission Solutions | 30,060 |

| 27,111 |

| 22,745 | |||||

Cubic Global Defense Systems |

| 5,845 |

| 10,573 |

| 16,259 | ||||

Unallocated corporate expenses |

| — |

| 1,500 |

| — | ||||

Total company-sponsored research and development expense | 44,574 | 50,132 | 52,398 | |||||||

Cost of Contract Research and Development Activities: | ||||||||||

Cubic Transportation Systems | 59,395 | 59,589 | 44,222 | |||||||

Cubic Mission Solutions | 41,930 | 30,416 | 18,077 | |||||||

Cubic Global Defense Systems | 34,749 | 34,698 | 32,695 | |||||||

Total cost of contract research and development activities | 136,074 | 124,703 | 94,994 | |||||||

Total Company-Sponsored Research and Development Expense and Contract Research and Development Activities | $ | 170,823 | $ | 159,401 | $ | 127,689 | ||||

Enhance Services Business

We view services tied to our technologies as a core element of our business and we are working to expand our service offerings and customer base. In aggregate, approximately 36% of our sales in fiscal year 2020, were from service-related work. We believe that a strong base of service work helps to consistently generate profits and smooth the sales fluctuations inherent in systems work.

At CTS, we deliver a number of customer services for multiple transportation authorities worldwide. Due to the technical complexities of operating payment systems, transportation agencies are turning to their system suppliers for IT services and other operational and maintenance services, such as regional settlement, card management and customer support services that would otherwise be performed by the agencies. As a result, we have transitioned from a supplier to a systems integration and services company providing a suite of turnkey outsourced services for more than 20 transit authorities and cities worldwide. Today, CTS delivers a wide range of services from customer support to financial management and technical support at operation centers across the United States, Canada, United Kingdom and Australia.

At CGD, we primarily provide services for products for which we are the Original Equipment Manufacturer (OEM). Our services on OEM equipment drive value for our customers and allow us to earn higher margins. Compared to the U.S. market where small business requirements, omnibus contracts and local preferences create acquisition challenges, we believe the international market offers greater opportunities to bundle and negotiate multi-year, turnkey contracts. We believe these long-term contracts reinforce CGD’s competitive posture and enable us to provide enhanced services through regular customer contact and increased visibility of product performance and reliability.

Expand International Footprint

We have developed a large global presence in our business segments. CTS has delivered over 500 projects in 40 major markets on 4 continents to date. Approximately 41% of the CTS segment’s fiscal year 2020 sales were attributable to international customers. In fiscal 2018, CTS was selected by the Queensland Department of Transport & Main Roads (DTMR) in Australia to design, build and operate a new ticketing system for the state and signed a contract with Transport for New South Wales in Australia to build an Intelligent Congestion Management Platform. In 2017, CTS signed a contract with Transport for London (TfL) for a three-year extension of services to London’s Oyster and contactless ticketing system to extend the contract for these services from 2022 to 2025.

11

CGD has delivered systems in more than 34 allied nations. In fiscal year 2020, approximately 56% of CGD sales were to allied foreign governments and an additional 10% of CGD sales were to projects funded by the U.S. government pursuant to Foreign Military Sales and Foreign Military Financing arrangements. We have expanded our presence in the United Kingdom, Canada, and the Middle-East in response to growing opportunities. These complement a well-established and sound presence in Singapore, Australia, New Zealand, and Italy.

Our CMS products are designed to address the needs of numerous international defense and civil applications. Our ISR data links are used by a number of international allied forces. In early fiscal 2018, CMS was awarded an order to provide satellite communication solutions for the New Zealand Defence Force (NZDF) under which we are supplying inflatable satellite antennas with supporting hardware and equipment training for the NZDF Network Enabled Army program. In addition, in late fiscal 2018 Australia’s Ministry of Defense procured CMS Atlas Strike kits that provide communications capability and situational awareness for Australia’s Joint Tactical Air Controllers. In fiscal 2019, CMS was awarded a contract from the New Zealand Ministry of Defence to deliver Command and Control (C2) capabilities to support the Network Enabled Army (NEA) program's Tactical Network (TNet) project. The NEA program is a transformational program to be delivered in four tranches over 12 years and will benefit the New Zealand Army's Land Forces and Special Operations Forces. The TNet contract is a framework agreement allowing multiple awards over the life of the contract to address current, emerging and future requirements through support of the four tranches.

EXECUTIVE OFFICERS

The executive officers of Cubic as of November 1, 2020 are as follows:

Bradley H. Feldmann, 59. Mr. Feldmann is Chairman of the Board of Directors (Board), Chief Executive Officer (CEO), and President of Cubic. He was appointed to the Board in May 2014 and was elected as Chairman of the Board in February 2018. He has served as CEO of Cubic since July 2014, and as President since January 2013. He also served as Chief Operating Officer of Cubic from January 2013 to July 2014. Prior to that, he was President of the companies comprising the Cubic Defense Systems segment, a role he assumed in 2008. He previously worked at Cubic Defense Systems from 1989 to 1999. Prior to rejoining Cubic in 2008, Mr. Feldmann held senior leadership positions at OMNIPLEX World Services Corporation, a security services provider, and ManTech International, a defense contracting firm (Nasdaq: MANT). He is a Board Leadership Fellow of the National Association of Corporate Directors, a member of the Aerospace Industries Association Board of Governors and is a member of the Board of the National Defense Industrial Association (NDIA), serving on NDIA’s Executive Committee and as Chair of the Finance Committee. He also serves on the board of directors of UrbanLife, a non-profit organization, as Chair of the Finance Committee.

Anshooman Aga, 45. Mr. Aga is Executive Vice President and Chief Financial Officer (CFO) of Cubic. He joined Cubic in July 2017 as Executive Vice President and assumed the role of CFO in October 2017. In this role, Mr. Aga is responsible for all aspects of the Company's financial strategies, processes and operations, including corporate development, risk management, investor relations, real estate, and global manufacturing, procurement and IT. Prior to joining Cubic, Mr. Aga served at AECOM, a multinational engineering firm (NYSE: ACM) from June 2015 to July 2017, where he was senior vice president and chief financial officer of their multi-billion-dollar Design and Consulting Services business in the Americas. He also held a series of financial leadership positions at Siemens, a multinational industrial manufacturing company, from July 2006 to May 2015, including chief financial officer of the Energy Automation business based in Nuremburg, Germany, in addition to similar financial roles for Siemen's Rail Electrification and TurboCare business units.

Hilary L. Hageman, 52. Ms. Hageman is Senior Vice President, General Counsel and Corporate Secretary of Cubic, a position she has held since October 2019. She is responsible for managing Cubic’s legal department as well as overseeing ethics, contracts, global trade compliance, security and environmental, social and governance (ESG). Ms. Hageman is a business leader with extensive legal experience. Prior to joining Cubic, she was the senior vice president and deputy general counsel for Science Applications International Corporation, a government services and information technology provider (NYSE: SAIC), from August 2016 to September 2019. She also held senior legal counsel roles at CACI International Inc., a multinational professional services and information technology company (NYSE: CACI), from 2007 to 2016, and the U.S. Department of Defense from 1995 to 2007.

12

Mark A. Harrison, 63. Mr. Harrison is Senior Vice President and Chief Accounting Officer of Cubic. He was appointed to the position in June 2019. His prior roles at Cubic include Senior Vice President and Corporate Controller from 2012 to June 2019, Vice President and Corporate Controller from 2004 to 2012, Vice President – Financial Planning and Accounting from 2000 to 2004, and Assistant Corporate Controller and Director of Financial Planning from 1991 to 2000. Since 1983, Mr. Harrison has held a variety of financial positions with Cubic. From 1980 to 1983 he was a senior auditor with Ernst & Young LLP, a multinational accounting and professional services provider.

Michael Knowles, 53. Mr. Knowles has served as Senior Vice President of Cubic and President of Cubic’s CMPS business segment since August 2020. Previously, Mr. Knowles served as President of Cubic’s former CGD business segment from October 2018 to August 2020, and Vice President and General Manager of CGD’s Air Ranges business unit from July 2014 to October 2018. Before joining Cubic, Mr. Knowles served as the senior director of Air Transport and Mission Solutions at Rockwell Collins, a former avionics and information technology systems and services provider, where he was employed from 2004 until 2014. Mr. Knowles served as a Naval Flight Officer, flight test engineer and aerospace engineering duty officer in the United States Navy, where he retired as a Commander.

Grace G. Lee, 52. Ms. Lee is Senior Vice President, Chief Human Resources and Diversity Officer of Cubic, a position she has held since October 2018. Ms. Lee is responsible for the strategic leadership of global human resources for Cubic, as well as overseeing the development and advancement of Cubic’s diversity strategy. Ms. Lee’s diversity and inclusion strategy has earned her recognition as one of the top chief diversity officers from the National Diversity Council and Cubic as a top employer for diversity from Forbes. Prior to joining Cubic, Ms. Lee was senior vice president of global human resources for Charles River Laboratories, a biotechnology company (NYSE: CRL), from June 2016 to October 2018. Ms. Lee was senior vice president of human resources and communications for Beckman Coulter, a biomedical operating company of Danaher Corporation (NYSE: DHR), from December 2014 to June 2016. She also previously held the head human resources position at TTM Technologies, a global printed circuit board manufacturer (Nasdaq: TTMI) from November 2010 to December 2014 and IMI Severe Service (now IMI Critical Engineering), a leading provider of critical flow control technologies, from June 2007 to November 2010. Since August 2020, Ms. Lee has served as a member of the board of directors of Asure Software, a human capital management software and services company (Nasdaq: ASUR).

Jeffrey Lowinger, 59. Mr. Lowinger joined Cubic in April 2020 as Senior Vice President of Cubic and President of CTS. Prior to joining Cubic, Mr. Lowinger was president of the eMobility segment for Eaton Corporation, a multinational power management company (NYSE: ETN), from March 2018 to April 2020. Prior to leading eMobility, Mr. Lowinger served as senior vice president of engineering and chief technology officer for Eaton Corporation’s industrial sector from September 2013 to February 2018. Mr. Lowinger had a 25-year career at The Boeing Company, a multinational aerospace company (NYSE: BA), where he held several engineering leadership roles managing complex hardware/software development programs for all key rotorcraft programs. He was also the executive vice president of engineering at Bell Helicopter, an aerospace manufacturer and a division of Textron (NYSE: TXT), where he oversaw the $1.5 billion global commercial business in addition to leading innovation and technology for Bell’s Xworx organization.

Rhys V. Williams, 51. Mr. Williams is Vice President and Treasurer of Cubic, a position he has held since March 2018. Prior to joining Cubic, Mr. Williams led the treasury function at Ancestry, the largest online resource for family history and consumer genomics, as its treasurer from October 2013 to March 2018. Prior to that, Mr. Williams was the director of treasury from April 2009 to October 2013, at Life Technologies, a biotechnology company which was later acquired by Thermo Fisher Scientific, responsible for overseeing all facets of the capital markets function. He also held treasury and business development roles at Callaway Golf Company, a global sporting goods company, and Gateway, Inc., a computer hardware company.

RAW MATERIALS

The principal raw materials used in our products include sheet aluminum and steel, copper electrical wire and castings, fabrics, purchased electronic subcomponents, cabling to include electrical wiring, connectors and harnesses, injection molded plastics, and composite products. A significant portion of our end products are composed of purchased electronic components and subcontracted parts and supplies that we procure from third-party suppliers. In general, supplies of raw materials and purchased parts are adequate to meet our requirements.

13

INTELLECTUAL PROPERTY

We seek to protect our proprietary technology and inventions through patents and other proprietary-right protection, and also rely on trademark laws to protect our brand. However, we do not regard ourselves as materially dependent on patents for the maintenance of our competitive position. We also rely on trade secrets, proprietary know-how and continuing technological innovation to remain competitive.

REGULATION

Our businesses must comply with and are affected by various government regulations that impact our operating costs, profit margins and our internal organization and operation of our businesses. We deal with numerous U.S. government agencies and entities, including all branches of the U.S. military and the DoD. Therefore, we must comply with and are affected by laws and regulations relating to the formation, administration, and performance of U.S. government and other contracts. These laws and regulations, among other things, include the Federal Acquisition Regulations and all department and agency supplements, which comprehensively regulate the formation, administration and performance of U.S. government contracts. These and other federal regulations require certification and disclosure of cost or pricing data in connection with contract negotiations for certain types of contracts, define allowable and unallowable costs, govern reimbursement rights under cost-based contracts, and restrict the use, dissemination and exportation of products and information classified for national security purposes. For additional discussion of government contracting laws and regulations and related matters, see “Risk Factors” and “Business—Industry Considerations” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies, Estimates and Judgments—Revenue Recognition” with respect to pricing and revenue under government contracts.

Our business is subject to a range of foreign, federal, state and local laws and regulations regarding environmental protection and employee health and safety, including those that govern the emission and discharge of hazardous or toxic materials into the environment and the generation, storage, treatment, handling, use, transportation and disposal of such materials. From time to time, we have been named as a potentially responsible party at third-party waste disposal sites. We do not currently expect compliance with such laws and regulations to have a material effect upon our capital expenditures, earnings or competitive position. However, such laws and regulations are complex, change frequently and have tended to become increasingly stringent over time. Accordingly, we cannot assure that such laws and regulations will not have a material effect on our business in the future.

OTHER MATTERS

We do not generally engage in any business that is seasonal in nature. Since our revenues are generated primarily from work on contracts performed by our employees and subcontractors, first quarter revenues tend to be lower than the other three quarters due to our policy of providing many of our employees more holidays in the first quarter, compared to other quarters of the year. The U.S. government’s fiscal year ends on September 30 of each year. It is not uncommon for U.S. government agencies to award extra tasks or complete other contract actions in the weeks before the end of a fiscal year in order to avoid the loss of unexpended funds. These are not necessarily consistent patterns and depend upon actual activities in any given year.

We employed approximately 6,100 persons at September 30, 2020.

Our domestic products and services are sold almost entirely by our employees. Overseas sales are made either directly or through representatives or agents.

14

Item 1A. RISK FACTORS.

Risks relating to our business, operations and industry

The COVID-19 pandemic may adversely affect our business, operating results and financial condition, has negatively affected our stock price, and may do so in the future.

In March 2020, COVID-19 was categorized as a pandemic by the World Health Organization. The outbreak and preventative or protective actions that governments, corporations, individuals or we may take to contain the virus may result in a period of reduced operations and business disruption for us and our suppliers, subcontractors, customers and other third parties with which we do business. The effects of the outbreak and related actions, including if significant portions of our or our suppliers’ workforce are unable to work effectively due to facilities closures, illnesses, quarantines, government actions or other restrictions, may therefore hinder or delay our production capabilities and otherwise impede our ability to perform on our obligations to our customers, and may also result in increased costs to us. Any costs associated with the COVID-19 outbreak may not be fully recoverable or adequately covered by insurance. The outbreak and related actions may also result in reduced customer demand or limit the ability of customers to perform, including making timely payments to us. Our transportation agency customers are experiencing reduced revenue and funding from multiple sources which could disrupt or delay future orders. The vast majority of revenue from our CTS businesses is earned under fixed-price contracts. However, a portion of our CTS revenue is earned based upon transit ridership. As such, reductions in ridership caused by COVID-19 have negatively impacted our operating results and will continue to do so until ridership levels return to those prevalent prior to the outbreak. Any of these factors, depending on the severity and duration of the outbreak and its effects, could have a material adverse effect on our business, results of operations and financial condition.

In addition, the COVID-19 outbreak and resulting actions have negatively affected, and may continue to negatively affect, our stock price and the U.S. and global financial markets generally.

The total financial impact of these factors cannot be reasonably estimated at this time but may materially affect our financial condition and results of operations.

We depend on government contracts for substantially all of our revenues and the loss of government contracts or a delay or decline in funding of existing or future government contracts could decrease our backlog or adversely affect our sales and cash flows and our ability to fund our growth.

Our revenues from contracts, directly or indirectly, with foreign and U.S. state, regional and local governmental agencies represented substantially all of our total revenues in fiscal year 2020. As a result of the concentration of business with governmental agencies, we are vulnerable to adverse changes in our revenues, income and cash flows if a significant number of our government contracts, subcontracts or prospects are delayed or canceled for budgetary or other reasons.

The factors that could cause us to lose these contracts and could decrease our backlog or otherwise materially harm our business, prospects, financial condition or results of operations include:

| ● | budget constraints affecting government spending generally, or specific departments or agencies such as U.S. or foreign defense and transportation agencies and regional transportation agencies, and changes in fiscal policies or a reduction of available funding or government appropriations delays; |

| ● | re-allocation of government resources as the result of actual or threatened terrorism or hostile activities or for other reasons; |

| ● | Congress and the executive branch of the U.S. government may reach an impasse on increasing the national debt limit or passing the fiscal year budget, which could result in a full or partial shutdown of the U.S. government, restrict the U.S. government’s ability to pay contractors for prior work, cause the termination or suspension of our contracts with the U.S. government, provide for automatic cuts to the U.S. defense budget, require us to furlough affected employees for an indefinite time, terminate or suspend subcontracts, or incur contract wind-down costs; |

15

| ● | Congress and such foreign governments do not always enact spending bills by the beginning of the new fiscal year. Such delays leave the affected agencies under-funded delaying their ability to contract. Future delays and uncertainties in funding could impose additional business risks on us; |

| ● | curtailment of governments’ use of outsourced service providers and governments’ in-sourcing of certain services; |

| ● | In addition, the DoD has an increased emphasis on awarding contracts to small businesses and awarding shorter duration contracts, each of which has the potential to reduce the amount of revenue we could otherwise earn from such contracts; |

| ● | the adoption of new laws or regulations pertaining to government procurement; |

| ● | suspension or prohibition from contracting with or impairment of our reputation or relationships with the government or any significant agency with which we conduct business; |

| ● | increased aggressiveness by the government in seeking rights in technical data, computer software, and computer software documentation that we deliver under a contract, which may result in “leveling the playing field” for competitors on follow-on procurements; |

In addition, some of our international work is done at the request and at the expense of the U.S. government and its agencies. Therefore, risks associated with performing work for the U.S. government and its agencies may also apply to our international contracts.

Our contracts with government agencies may be unilaterally terminated or modified prior to completion, which could adversely affect our business.

Government contracts typically contain provisions and are subject to laws and regulations that give the government agencies rights and remedies not typically found in commercial contracts, including providing the government agency with the ability to unilaterally:

| ● | terminate or reduce the value of our existing contracts; |

| ● | modify the terms and conditions in our existing contracts; |

| ● | control and potentially prohibit the export of our products; |

| ● | cancel, delay or decline to exercise an option to extend existing multi-year contracts and related orders if the necessary funds for contract performance for any subsequent year are not appropriated; and |

| ● | claim rights in technologies and systems invented, developed or produced by us. |

Many agencies with which we contract can terminate their contracts with us for convenience, and in that event, we generally may recover only our incurred or committed costs, settlement expenses and profit on the work completed prior to termination. If an agency terminates a contract with us for default, we may be denied any recovery and may be liable for excess costs incurred by the agency in procuring undelivered items from an alternative source. We may receive show-cause or cure notices under contracts that, if not addressed to the agency’s satisfaction, could give the agency the right to terminate those contracts for default or to cease procuring our services under those contracts.

In the event that any of our contracts were to be terminated or adversely modified, there may be significant adverse effects on our revenues, operating costs and income that would not be recoverable.

16

We have made assumptions concerning behavior by transportation authorities which may not hold true over time.

In our transportation business we have made certain assumptions that support the growth of the business. For example, we have assumed that governments will continue to charge passengers for using public transit. We have also assumed that transportation agencies will continue to outsource operations and services. Should these assumptions not hold true, our transportation business could experience a material loss of business.

Failure to retain existing contracts or obtain new contracts under competitive bidding processes may adversely affect our revenue.

We obtain most of our contracts through a competitive bidding process, and substantially all of the business that we expect to seek in the foreseeable future likely will be subject to a competitive bidding process. Competitive bidding presents a number of risks, including:

| ● | the need to compete against companies or teams of companies with more financial and marketing resources and more experience in bidding on and performing major contracts than we have; |

| ● | the need to compete against companies or teams of companies that may be long-term, entrenched incumbents for a particular contract for which we are competing and that have, as a result, greater domain expertise and better customer relations; |

| ● | the need to compete to retain existing contracts that have in the past been awarded to us on a sole-source basis or as to which we have been incumbent for a substantial period of time; |

| ● | the reduction of margins achievable under any contracts awarded to us; |

| ● | the expense and delay that may arise if our competitors protest or otherwise challenge new contract awards; |

| ● | the need to bid on some programs in advance of the completion of their design, which may result in higher R&D expenditures, unforeseen technological difficulties, or increased costs which lower our profitability; |

| ● | the substantial cost and managerial time and effort, including design, development and marketing activities, necessary to prepare bids and proposals for contracts that may not be awarded to us; |

| ● | the need to develop, introduce and implement new and enhanced solutions to our customers’ needs; and |

| ● | the need to accurately estimate the resources and cost structure that will be required to perform any fixed-price contract that we are awarded. |

If we are unable to win particular contracts that are awarded through the competitive bidding process, we may not be able to operate in the market for services that are provided under those contracts for a number of years. If we win a contract, and upon expiration the customer requires further services of the type provided by the contract, there is frequently a competitive rebidding process and there can be no assurance that we will win any particular bid, or that we will be able to replace business lost upon expiration or completion of a contract.

As a result of the complexity and scheduling of contracting with government agencies, we occasionally incur costs before receiving contractual funding by the government agency. In some circumstances, we may not be able to recover these costs in whole or in part under subsequent contractual actions.

The customers currently serviced by our CTS segment are finite in number. The loss of any one of these customers, or the failure to win replacement awards upon expiration of contracts with such customers, could adversely impact us.

If we are unable to consistently retain existing contracts or win new contract awards, our business, prospects, financial condition and results of operations could be adversely affected.

17

Government audits of our contracts could result in a material change to our earnings, have a negative effect on our cash position following an audit adjustment or adversely affect our ability to conduct future business.

U.S. government agencies, including the DoD, routinely audit and review a contractor’s performance on government contracts, contract costs, indirect rates and pricing practices, and compliance with applicable contracting and procurement laws, regulations and standards. This could lead to adjustments to our contract costs, and any costs found to be unreasonable, improperly allocated, or unallowable under government cost accounting standards or contractual provisions will not be reimbursed. The government could also potentially refuse to agree to our proposed unit prices if the auditing agency does not find them to be “fair and reasonable.” The government may also demand that we refund what the government claims are any excess proceeds we received on particular items where the government claims we did not properly disclose required information in negotiating the unit price.

The DoD, in particular, also reviews the adequacy of, and compliance with, our internal control systems and policies, including our purchasing, accounting, financial capability, pricing, labor pool, overhead rate and management information systems. Our failure to obtain an “adequate” determination of our various accounting and management internal control systems from the responsible U.S. government agency could significantly and adversely affect our business, including our ability to bid on new contracts and our competitive position in the bidding process. Failure to comply with applicable contracting and procurement laws, regulations and standards could also result in the U.S. government imposing penalties and sanctions against us, including suspension of payments and increased government scrutiny that could delay or adversely affect our ability to invoice and receive timely payment on contracts or perform contracts, or could result in suspension or debarment from competing for contracts with the U.S. government. In addition, we could suffer serious harm to our reputation if allegations of impropriety were made against us, whether or not true.

In addition, transit authorities have the right to audit our work under their respective contracts. If, as the result of an adverse audit finding, we were suspended, debarred, proposed for debarment, or otherwise prohibited from contracting with the U.S. government, any significant government agency or a transit authority terminated its contract with us, or our reputation or relationship with such agencies and authorities was impaired or they otherwise ceased doing business with us or significantly decreased the amount of business done with us, it could adversely affect our business, results of operations and financial condition.

Our business and stock price may be adversely affected if our internal control over financial reporting is not effective.

The accuracy of our financial reporting is dependent on the effectiveness of our internal controls. We are required to provide a report from management to our shareholders on our internal control over financial reporting that includes an assessment of the effectiveness of these controls. Internal control over financial reporting has inherent limitations, including human error, the possibility that controls could be circumvented or become inadequate because of changed conditions, and fraud. Because of these inherent limitations, internal control over financial reporting might not prevent or detect all misstatements or fraud. If we cannot maintain and execute adequate internal control over financial reporting or implement required new or improved controls that provide reasonable assurance of the reliability of the financial reporting and preparation of our financial statements for external use, we could suffer harm to our reputation, incur incremental compliance costs, fail to meet our public reporting requirements on a timely basis, be unable to properly report on our business and our results of operations, or be required to restate our financial statements, and our results of operations, our share price and our ability to obtain new business could be materially adversely affected.

Our operating margins may decline under our fixed-price contracts if we fail to accurately estimate the time and resources necessary to satisfy our obligations.

Approximately 95% of our revenues in fiscal year 2020 were from fixed-price contracts under which we bear the risk of cost overruns. Our profits are adversely affected if our costs under these contracts exceed the assumptions we used in bidding for the contract. Sometimes we are required to fix the price for a contract before the project specifications are finalized, which increases the risk that we will incorrectly price these contracts. The complexity of many of our engagements makes accurately estimating the time and resources required more difficult.

18

Our business could be negatively affected by cyber or other security threats or other disruptions.

We face cyber threats, threats to the physical security of our facilities and employees, including executives, and terrorist acts, as well as the potential for business disruptions associated with information technology or internal system failures (including network, software or hardware failures), damaging weather or other acts of nature, and pandemics or other public health crises (including the current COVID-19 outbreak), which may adversely affect our business.

We routinely experience cyber security threats, threats to our information technology infrastructure and attempts to gain access to our company’s sensitive information, as do our customers, suppliers, subcontractors and joint venture partners. We may experience similar security threats at customer sites that we operate and manage as a contractual requirement. Such events could cause loss of data and interruptions or delays in our business, cause us to incur remediation costs, subject us to claims and damage our reputation.

In addition, we could be impacted by cyber security threats or other disruptions or vulnerabilities found in products we use or in the systems of our customers, suppliers, subcontractors and joint venture partners that are used in connection with our business. Although we work cooperatively with these third parties to seek to minimize the impacts of cyber threats, other security threats or business disruptions, in addition to our internal processes, procedures and systems, we must also rely on the safeguards put in place by those entities.

The costs related to cyber or other security threats or disruptions may not be fully mitigated by insurance or other means. Occurrence of any of these events could adversely affect our internal operations, the services we provide to customers, loss of competitive advantages derived from our R&D efforts, early obsolescence of our products and services, our future financial results, our reputation or our stock price. The occurrence of any of these events could also result in civil or criminal liabilities.

Our results of operations have historically fluctuated and may continue to fluctuate significantly in the future, which could adversely affect our financial position or our stock price.

Our results of operations are affected by factors such as the unpredictability of contract awards due to the long procurement process for most of our products and services, the potential fluctuation of governmental agency budgets, any timing differences between our work performed and costs incurred under a contract and our ability to recognize revenue and generate cash flow from such contract, the time it takes for the new markets we target to develop and for us to develop and provide products and services for those markets, competition and general economic conditions. Our contract type/product mix and unit volume, our ability to keep expenses within budget and our pricing affect our operating margins. Significant growth in costs to complete our contracts may adversely affect our results of operations in future periods and cause our financial results to fluctuate significantly on a quarterly or annual basis. Consequently, we do not believe that comparison of our results of operations from period to period is necessarily meaningful or predictive of our likely future results of operations. In future financial periods our operating results or cash flows may be below the expectations of public market analysts or investors, which could cause the price of our stock to decline significantly.

The terms of our financing arrangements may restrict our financial and operational flexibility, including our ability to invest in new business opportunities.

On March 27, 2020, we executed a Fifth Amended and Restated Credit Agreement (the “Credit Facility”) with a group of financial institutions. The Credit Facility provided for a new term loan in the aggregate amount of $450.0 million (the “Term Loan”) and increased our existing revolving line of credit limit (the “Revolving Line of Credit”) from $800.0 million to $850.0 million. The commitments under the Credit Facility will mature on March 27, 2025. At September 30, 2020, we had $444.4 million of borrowings under our Term Loan and $209.0 million of borrowings under our Revolving Line of Credit. Letters of credit outstanding under the Credit Facility totaled $93.1 million at September 30, 2020, which reduced our available line of credit to $547.9 million. The $93.1 million of letters of credit includes both financial letters of credit and performance guarantees.

19

The terms of the Credit Facility contain financial covenants setting a maximum total ratio of debt to adjusted earnings before interest, taxes, depreciation and amortization and a minimum interest coverage ratio. In addition, the terms contain covenants that restrict, among other things, our ability to sell assets, incur indebtedness, make investments, grant liens, pay dividends and make other restricted payments. As of September 30, 2020, we were in compliance with all covenants under the Credit Facility.

Additionally, we may continue to use alternative financing structures in order to fund certain projects related to the redevelopment of our corporate campus. Any such financing arrangements may further restrict our financial and operational flexibility.

Our corporate campus redevelopment plan may be subject to certain unanticipated financial, environmental, regulatory, and construction risks that are beyond the scope of our typical business activities.

We are in the process of developing our corporate campus in San Diego and this redevelopment project may be subject to various risks associated with real property development including but not limited to financing, compliance with environmental laws and regulations, obtaining permits and other governmental approvals, regulatory compliance, changes in market conditions, labor and material shortages, legal claims, delays in completion, distracting management’s and employees’ attention and resources, natural disasters, cost overruns, socio-political risks, and construction defects.

Our future success will depend on our ability to develop new products, systems and services that achieve market acceptance in our current and future markets.

Both our commercial and government businesses are characterized by rapidly changing technologies and evolving industry standards. We believe that, in order to remain competitive in the future, we will need to continue to develop new products, systems and services, and in some cases transition to a product-oriented approach as opposed to our historical, project-oriented approach, all of which will require the investment of significant financial resources. The need to make these expenditures could divert our attention and resources from other projects, and we cannot be sure that these expenditures ultimately will lead to the timely development of new products, systems or services. In recent years, we have spent an amount equal to approximately 3% to 4% of our annual sales on internal R&D efforts. There can be no assurances that this percentage will not increase should we require increased innovations to successfully compete in the markets we serve. We may also experience delays in completing development and introducing certain new products, systems or services in the future due to their design complexity. Any delays could result in increased costs of development or redirect resources from other projects. In addition, we cannot provide assurances that the markets for our products, systems or services will develop as we currently anticipate, which could significantly reduce our revenue and harm our business. Furthermore, we cannot be sure that our competitors will not develop competing products, systems or services that gain market acceptance in advance of ours, or that cause our existing products, systems or services to become non-competitive or obsolete, which could adversely affect our results of operations.

If we deliver products or systems with defects, our reputation could be harmed, revenue from, and market acceptance of, our products and systems could decrease and we could expend significant capital and resources as a result of such defects.

Our products and systems are complex and frequently operate in high-performance, challenging environments. Notwithstanding our internal quality specifications, our products and systems have sometimes contained errors, defects and bugs when introduced. If we deliver products or systems with errors, defects or bugs, our reputation and the market acceptance and sales of our products and systems would be harmed. Further, if our products or systems contain errors, defects or bugs, we may be required to expend significant capital and resources to alleviate such problems and incur significant costs for product recalls and inventory write-offs. Defects could also lead to product liability lawsuits against us or against our customers, and could also damage our reputation. We have agreed to indemnify our customers in some circumstances against liability arising from defects in our products and systems. In the event of a successful product liability claim, we could be obligated to pay damages significantly in excess of our product liability insurance limits.

20

Our development contracts may be difficult for us to comply with and may expose us to third-party claims for damages.