Use these links to rapidly review the document

Table of contents

Index to consolidated financial statements

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-186852

Prospectus

2,315,000 shares

Common stock

The selling shareholders named in this prospectus are offering all of the shares offered hereby and will receive all of the proceeds from this offering. We will not receive any proceeds from this offering. See "Principal and selling shareholders."

Our common stock is listed on the New York Stock Exchange under the symbol "CUB." On May 15, 2013, the last reported sale price of our common stock on the New York Stock Exchange was $45.83 per share.

|

Per share | Total | |||||

Public offering price |

$ | 45.75000 | $ | 105,911,250 | |||

Underwriting discounts and commissions(1) |

$ |

2.05875 |

$ |

4,766,006 |

|||

Proceeds to the selling shareholders, before expenses |

$ |

43.69125 |

$ |

101,145,244 |

|||

(1) We have agreed to reimburse the underwriters for certain FINRA-related expenses. See "Underwriting."

The selling shareholders have granted the underwriters an option for a period of 30 days to purchase up to 347,250 additional shares from them at the public offering price less underwriting discounts and commissions.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 16.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about May 21, 2013.

| J.P. Morgan | Credit Suisse |

| Raymond James | BB&T Capital Markets | Canaccord Genuity | Needham & Company |

| RBC Capital Markets | Imperial Capital | The Benchmark Company |

May 15, 2013

Neither we, the selling shareholders nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or any free writing prospectus filed with the Securities and Exchange Commission. Neither we, the selling shareholders nor the underwriters take responsibility for, nor provide assurance as to reliability of, any other information that others may give you. Neither we, the selling shareholders nor the underwriters are making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should not assume that the information appearing in this prospectus or incorporated by reference in this prospectus is accurate as of any date other than the date of such document, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

The Cubic logo and Nextcity™ are our trademarks. All other trademarks and service marks appearing in this prospectus are the property of their respective holders. All rights reserved.

i

This summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. This summary may not contain all of the information that you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the "Risk factors" section and "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and the accompanying notes included herein. Some of the statements in this summary constitute forward-looking statements. See "Special note regarding forward-looking statements." Except where the context otherwise requires or where otherwise indicated, the terms "we," "us," "our" and "Cubic" refer to Cubic Corporation and its consolidated subsidiaries. Our fiscal year ends on September 30 and our fiscal quarters end on December 31, March 31 and June 30.

Cubic Corporation is a leading international provider of cost-effective systems and solutions that address the mass transit and global defense markets' most pressing and demanding requirements. We believe that we have significant transportation and defense industry expertise which, along with our innovative technology capabilities, contributes to our leading customer positions and allows us to deepen and further expand each of our business segments in key markets. We operate in three reportable business segments across the global transportation and defense markets.

Our Cubic Transportation Systems (CTS) business accounted for approximately 37% of our net sales and 60% of operating income in fiscal year 2012. CTS specializes in the design, development, production, installation, maintenance and operation of automated fare payment and revenue management infrastructure and technologies for transit operators. As part of our turnkey solutions, CTS also provides these customers with a comprehensive suite of business process outsourcing (BPO) services and expertise, such as card and payment media management, central systems and application support, retail network management, passenger call centers and financial clearing and settlement support. As transit authorities seek to optimize their operations by outsourcing bundled systems and services, CTS has transformed itself from a provider of automated fare collection (AFC) systems into a systems integrator and services company focused on the intelligent transportation market. As a result, CTS' performance has significantly improved with segment net sales increasing 34% from $383.0 million in fiscal year 2010 to $513.6 million in fiscal year 2012, reflecting our large contract wins for turnkey solutions. Furthermore, due to the growth of our large installed base in key geographic areas and our expanding services platform, service offerings accounted for approximately 44% of segment net sales in fiscal year 2012.

Our complementary defense businesses, Mission Support Services (MSS) and Cubic Defense Systems (CDS), provided approximately 63% of our net sales and 44% of operating income in fiscal year 2012. MSS is a provider of live, virtual and constructive training services to all four branches of the U.S. military, including the special operations communities, as well as to allied nations. In addition, MSS offers a broad range of highly specialized national security solutions to the intelligence community. CDS is a leading provider of realistic, high-fidelity air and ground combat training systems for the U.S. and allied nations and a key supplier of secure communications solutions, including asset tracking and cyber products and Intelligence Surveillance and Reconnaissance (ISR) data links.

1

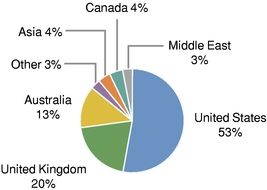

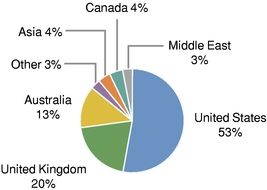

We have a broad customer base across our businesses, with approximately 56% of our fiscal year 2012 net sales generated from the U.S. federal, state and local governments. Approximately 3% of these domestic net sales were attributable to Foreign Military Sales, which are sales to allied foreign governments funded by the U.S. government. The remainder of the fiscal year 2012 net sales was attributable to sales to foreign governmental agencies. In fiscal year 2012, 52% of our total net sales were derived from services, with product net sales accounting for the remaining 48%. Headquartered in San Diego, California, we had approximately 8,100 employees working on 5 continents and in 27 countries as of March 31, 2013.

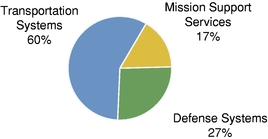

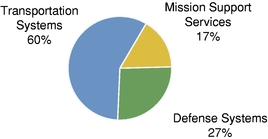

As of March 31, 2013, our funded backlog was $2,195.2 million. On a segment basis, approximately 74% of our funded backlog as of March 31, 2013 was attributable to CTS, with MSS and CDS accounting for 9% and 17%, respectively. Backlog is converted into sales in future periods as work is performed or deliveries are made. We expect that $904.5 million of the March 31, 2013 funded backlog will be converted into sales by March 31, 2014. The difference between total backlog and funded backlog represents options under multi-year service contracts in our MSS business. Funding for these contracts comes from annual operating budgets of the U.S. government and the options are normally exercised annually. Funded backlog includes unfilled firm orders for our products and services for which funding has been both authorized and appropriated by the customer (Congress, in the case of U.S. government agencies). Options for the purchase of additional systems or equipment are not included in backlog until exercised. For the fiscal years 2010, 2011 and 2012, we generated net sales of $1,198.2 million, $1,295.6 million and $1,381.5 million, respectively, and Adjusted EBITDA of $121.1 million, $135.8 million and $150.9 million, respectively. For the six months ended March 31, 2013 we generated net sales of $677.7 million and Adjusted EBITDA of $64.5 million. See footnote 1 in "—Summary consolidated financial and other data" for a reconciliation of net income attributable to Cubic to Adjusted EBITDA. In addition, for fiscal year 2012, CTS, MSS, CDS and Other Operations accounted for 37%, 36%, 27% and 0%, respectively, of net sales, and 60%, 17%, 27% and (4%), respectively, of operating income.

| March 31, 2013 funded backlog by segments | FY2012 net sales by segments | |

|

|

|

March 31, 2013 total funded backlog $2,195.2 million |

FY2012 net sales $1,381.5 million |

|

FY2012 operating income by segments(1) |

FY2012 net sales by customer locations(2) |

|

|

|

|

FY2012 operating income $128.0 million |

FY2012 net sales $1,381.5 million |

(1) Segment percentages are based on consolidated operating income, excluding the percentage of operating income from Other Operations and unallocated corporate expenses.

(2) Net sales by customer locations include U.S. funded Foreign Military Sales to international locations. Net sales are attributed to countries or regions based on the location of product or service delivery to customers.

2

On December 14, 2012, we restated our consolidated financial statements as of and for the years ended September 30, 2011, 2010 and 2009, and for the quarterly periods ended December 31, 2009 through March 31, 2012. The restatement of our financial statements corrected errors primarily related to the recognition of revenue including: the misapplication of the cost-to-cost percentage-of-completion method for long-term development contracts; the misapplication of the method of accounting for contracts with non-U.S. government customers; errors in the determination of units of accounting in accordance with multiple-element revenue recognition guidance; and errors regarding the capitalization of general and administrative costs on units-of-delivery type contracts with the U.S. government. The restated financials, which were released with our fiscal year 2012 financials and are included or incorporated herein by reference, resulted in an increase in revenues and net income cumulatively over the period of the restatement and an increase in retained earnings as of March 31, 2012. See Note 2 to our consolidated financial statements included in this prospectus for more information.

Cubic Transportation Systems

CTS is a systems integrator that develops and provides fare collection infrastructure, services and technology and real-time passenger information systems and services for public transport authorities and operators worldwide. We offer fare collection devices, software, systems and multiagency, multimodal integration technologies, as well as a full suite of operational services that help agencies efficiently collect fares, manage operations, reduce revenue leakage and make public transit more convenient. As an established partner with transit operators worldwide, we have installed over 90,000 devices and deployed several central systems which in total process approximately 10 billion fare-related transactions per year for approximately 7 billion transit passengers, generating more than $14 billion of revenue per year for such transit operators. Products accounted for 56% of the segment's fiscal year 2012 net sales, with services accounting for the remaining 44%.

We believe that we hold the leading market position in large-scale automated fare payment and collection systems and services for major metropolitan areas. To date, CTS has been awarded over 400 projects in 40 major markets on 5 continents. We have implemented and, in many cases, operate automated fare payment and collection systems for some of the world's largest mass transit systems, such as London (Oyster®), the San Francisco Bay Area and the Los Angeles region. In addition, the segment has numerous active projects worldwide, including in the New York (Metrocard®) / New Jersey (PATCO®, PATH Smartlink®) region, Chicago (Chicago Card®), Vancouver, Sydney, Brisbane, the Frankfurt / RMV region, Sweden, the Washington, D.C. / Maryland / Virginia region, the San Diego region, Miami, Minneapolis / St. Paul and Atlanta. In addition to helping us secure similar projects in new markets, our comprehensive suite of new technologies and capabilities enables us to benefit from a recurring stream of revenues in established markets resulting from innovative new services, technology obsolescence, equipment refurbishment and the introduction of new or adjacent applications.

Consistent with our history of creating next-generation, state-of-the-art technologies and systems, we are in the process of developing and implementing components of our Nextcity initiative, which envisions integrated revenue and information management systems across all modes of transport. Nextcity comprises a fully integrated solution offering innovative fare

3

payment technologies, such as contactless bank cards, general purpose reloadable (GPR) cards, transit branded credit cards and near field communication (NFC) phones directly at the point of travel, predictive data analytics, and intermodal compatibility across an entire transportation network. A key information technology (IT) component of Nextcity is the creation and distribution of real-time data through the integration of payment and information systems, ultimately enabling operators to manage demand and customers to manage their travel through improved data analytics.

Mission Support Services

MSS provides highly specialized services within the scope of small-to large-scale military training exercises, including live, virtual and constructive training exercises and support. Training services include full life-cycle support from planning through after action reviews as well as the associated support, such as operational, technical and logistical support. In addition, the segment provides a broad range of national security solutions, including subject matter and operational expertise, advanced tactical training and cyber security services, to the intelligence, special operations, law enforcement and homeland security communities.

Customers include all branches of the U.S. military, non-military agencies and allied nations under arrangements with the U.S. government. MSS is the prime contractor at more than 40 military training and support facilities and supports more than 200,000 exercises and training events per year. The segment supports all four of the U.S. Army's combat training centers, comprised of: the Joint Readiness Training Center (JRTC) in Fort Polk, Louisiana, which is the nation's premier training center for light infantry forces; the National Training Center (NTC) in Fort Irwin, California; the Joint Multinational Readiness Center (JMTC) in Hohenfels, Germany; and the Mission Command Training Program (MCTP) in Fort Leavenworth, Kansas, formerly known as the Battle Command Training Program (BCTP), which delivers mission command training to the Army's senior commanders and is the Army's only worldwide deployable combat training center. We also provide defense modernization support for 13 NATO entrants in Central and Eastern Europe. MSS continues its role as a long-time prime contractor for the Marine Corps air and ground forces, a customer which we have supported since 1998. Two recent acquisitions, Abraxas Corporation and NEK Special Programs Group, LLC (NEK), significantly expand MSS' presence in the intelligence and special operations communities, which are critically important for the continuing counterterrorism operations of the U.S. Department of Defense (DoD) around the globe.

Cubic Defense Systems

CDS is focused on two primary lines of business: training systems and secure communications. The segment is primarily a diversified supplier of live and virtual military training systems (comprising 86% of segment net sales for fiscal year 2012) and secure communications products (comprising 14% of segment net sales for fiscal year 2012) to the DoD and more than 35 allied nations.

We design and manufacture realistic, high-fidelity air and ground combat training systems for fighter aircraft, armored vehicles and infantry, as well as weapons effects simulations, laser-based tactical and communication systems. These systems collect and record simulated weapons engagements, tactical actions and event data to evaluate combat effectiveness and lessons learned and provide a basis to develop after action reviews. We also design and manufacture

4

secure communications products focused on intelligence, surveillance, asset tracking and search and rescue.

We define our addressable transportation market as large-scale, multi-modal AFC systems and estimate this market to be approximately $2 billion annually. We project the long-term growth for this market to be driven primarily by technological obsolescence leading to replacement and upgrades. The average lifecycle of our automated fare collection systems is approximately 10 years, providing long-term recurring sales visibility and opportunities for future replacements and upgrades. Also, there are additional opportunities that stem from program expansion into new areas, such as intelligent transportation, including mobile payment technologies and real-time passenger information, toll, and parking, which we believe increase the addressable market from $2 billion to approximately $5 billion. We believe industry experience, past performance, technological innovation and price are the key factors customers consider in awarding programs and such factors can serve as barriers to entry to potential competitors when coupled with scale and the upfront investments required for these programs.

In the defense market, we continue to focus on expanding our domestic and international footprint in the global military simulation and training market as well as enabling the convergence and integration of live, virtual and constructive training technologies. According to industry estimates, the global military simulation and training market is expected to grow at 1.2% annually and reach $10 billion in 2020, with the U.S. market making up approximately $5.2 billion of such amount. In the U.S., we believe that force drawdowns in Iraq and Afghanistan will produce an increase in training requirements as the U.S. military integrates lessons learned from these engagements, pursues a renewed emphasis on conventional warfare training and prepares for future threats. Globally, we are focused on the emerging economies within the Asia-Pacific region and the Middle East, which are expected to be strong markets for simulation and training products and services with projected growth rates in excess of the overall market. In addition, new platforms and the significant increase in unmanned vehicles and other advanced weapon systems could generate significant demand for operator training on new defense systems.

Our secure communications products address the large and broadly defined Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance (C4ISR) market, with an estimated addressable market of approximately $1.6 billion annually. We believe that our products and technologies address mission critical requirements such as: integrated communications suites for unmanned aerial vehicles (UAV), ships and the dismounted soldier; battlefield awareness; and secure and encrypted communications and asset tracking and location services. We believe that these technologies will continue to experience strong demand as the U.S. military maintains a smaller, more agile force structure.

Leading position across multiple end markets

We believe that we hold a leading market position in large-scale automated payment and fare collection systems and services, with approximately 7 billion passengers using various Cubic systems annually. Our CTS business has been awarded over 400 projects in 40 major markets on

5

5 continents to date. We believe that our experience and past performance, coupled with technological innovations, will drive continued strong market performance and open up new expansion opportunities.

We also estimate that we have the largest installed base for air and ground combat live training systems in the world. The U.S. military's changing strategy, in combination with budgetary constraints, should further benefit training systems, despite the wind-down in Iraq and the upcoming wind-down in Afghanistan. We believe that renewed emphasis towards conventional warfare will require retraining of the current force following more than ten years of focused training on counter-insurgency and unconventional war. Such a shift will require leveraging cost-effective training technologies, including virtual, many of which Cubic provides. Furthermore, we expect that our large installed base and strong technological competencies will allow us to protect our current market positions while expanding into new opportunities in regions with growing defense budgets, such as Asia and the Middle East.

Strong brand equity

We enjoy considerable brand recognition as a solutions-driven innovator and thought leader among our customers as well as industry observers. This recognition is the result of over 40 years of commitment to and experience across the transportation and defense training markets, during which we have provided our customers differentiated solutions consistent with their cost objectives. We believe that our leadership positions in complex, project-driven environments are the result of our technological, organizational and program management expertise as well as our long-standing reputation for reliability. These factors have contributed to the strength of our brand, which has been recognized by customers, trade associations and publications and reflected in awards such as the 2011 DoD Value Engineering Award, the International Transport Forum Transport Achievement Award, the 2012 SESAMES Award at the CARTES exhibition and conference in Paris and the 2011 Excellence in Technology and Innovation Award by the London Transport Awards.

Leading transportation and training systems technology portfolio

We continue to lead the technological advancement of automated fare payment and collection systems. With CTS' heritage dating back to the early 1970s, our technology transformed New York City's fare collection system from coins and tokens to magnetic smart cards, which are still in use today. The next wave of change in the industry was triggered by our smart card technology, which we first deployed for the Washington Metropolitan Area Transportation Authority (WMATA). This technology paved the way for intermodal transport enabling public transit riders to use the same ticketing system between journeys on buses, subways, trains and other forms of mass transit. Later in the 2000s, we developed and integrated regional systems enabling transit patrons to use a single ticket to travel between two different transport providers. In Germany, we have launched our ticketing solution for use with mobile phones, and most recently, we launched our open payment solution, which is approved and supported by Europay, MasterCard and Visa (EMV), on London's expansive bus fleet.

Our defense businesses have supported the development of five generations of Air Combat Maneuvering Instrumentation (ACMI) technology since the 1970s. Such technology has developed from range-bound systems, which used antennas for connectivity, to the rangeless systems of today, which rely on GPS and are capable of tracking, monitoring and providing status for multiple types of high activity aircraft in near real time across hundreds of miles. Our

6

next generation systems will provide advanced, high security data links configured for installation onboard the F-35 Joint Strike Fighter (JSF). We also have developed and advanced the software used in display and debrief systems from the first generation of ACMI, which used electronic symbols to represent aircraft engagements on screen, to the current generation which replicates fighter aircraft and terrain in 3D. We keep this system current and relevant to aircrew training by providing upgrades that are responsive to the needs of users, both domestically and internationally.

We continue to lead the development of Multiple Integrated Laser Engagement Simulation Systems (MILES) tactical engagement simulation systems. We equip weapons, soldiers, vehicles, buildings, and fixed structures with our high fidelity instrumentation. Since the 1990s, we have reduced the size, weight and power consumption of our many devices, which now require fewer batteries and run on a wireless personal area network rather than a cable-based communications system. Collectively, these improvements have led to significant reductions in lifecycle costs for our wireless solutions. We have also incorporated many ergonomic and user-friendly features that have dramatically reduced set up time for certain systems, enabling soldiers to maximize their training time.

We specialize in high-speed data links that transmit ISR data and video. Our jam resistant and secure data link technology is designed for and currently in use by the Joint Surveillance Target Attack Radar System (Joint STARS), an air-to-ground surveillance system first used in Operation Desert Storm in 1991. Our latest technology is the Common Data Link (CDL), which is verified by the Joint Interoperability Test Command (JITC), a U.S. military organization that tests and certifies technology pertaining to branches of the armed services and government. We continue to adapt the form, fit and function of our CDL data links for UAVs including man portable systems, the U.K.'s Watchkeeper, the U.S. Navy's Fire Scout, and CDL shipboard systems in use by the U.S. Navy.

Strong international presence

In our Transportation segment, we continue to enjoy significant success in key international markets such as Europe, Canada and Australia. We believe we can continue to leverage our experience and track record to grow in other markets with attractive opportunities, including Asia, South America and the Middle East. Our international net sales comprised approximately 82% of segment net sales for fiscal year 2012.

In our Defense Systems segment, our customer base differs from those of many traditional defense companies that are heavily reliant on the DoD. For fiscal year 2012, we generated approximately 46% of this segment's net sales from foreign militaries in regions such as Asia-Pacific, the Middle East and Europe. As our international partners increase operational cooperation with the DoD, we are well positioned to experience increased international demand for our combat training systems and other products and services.

Strong track record of financial performance

We have a strong track record of growth and profitability. From fiscal year 2010 to fiscal year 2012, net sales and Adjusted EBITDA grew at a compound annual growth rate of 7.4% and 11.6%, respectively. During that period, Adjusted EBITDA margins improved from 10.1% to 10.9%. Our focus on growth markets along with our low leverage provides us with financial

7

flexibility to pursue new growth initiatives. Through solid financial discipline, we intend to maintain our profitability while targeting industry-leading earnings growth.

Our strong financial performance has been recognized by multiple independent organizations and publications. In 2011 and 2012, Aviation Week & Space Technology named us the #1 and #2, respectively, top performing Aerospace and Defense Company reporting revenues between $1 and $5 billion, based on various financial metrics including return on invested capital, earnings momentum, asset management and financial health.

Experienced management team with proven track record

Our senior management team has significant experience in and a deep understanding of the defense and transportation industries and a demonstrable long-term commitment to Cubic. The majority of our senior management has in excess of 25 years of experience in the defense and transportation industries.

Our objective is to consistently grow sales, improve profitability and deliver attractive returns on capital. We intend to expand our position as a leading provider of automated payment and fare collection systems and services to transit authorities worldwide and build on our position with U.S. and foreign governments as a leading full spectrum supplier of training systems and mission support services. We also plan to grow our niche position as a supplier of data links and secure communications products. Our strategies to achieve these objectives include:

Leverage long-term relationships

We seek to maintain long-term relationships with our customers through repeat business by continuing to achieve high levels of performance on our existing contracts. By achieving this goal, we can leverage our returns through repeat business with existing customers and expand our presence in the market through sales of similar systems at competitive prices to new customers. The length of relationship with many of our customers exceeds 30 years and further supports our industry-wide leadership and technological capabilities. In addition, a result of maintaining a high level of performance, we continue to provide a combination of support services for our long-term customers.

Expand reach in high barrier markets

We target markets that have the potential for above-average growth where domain expertise, innovation, technical competency and contracting dynamics can help to create meaningful barriers to entry. We continue to invest in organically expanding our presence within high growth markets by finding innovative ways to address our customer needs that position us as long-term partners. In addition, we have sought out strategic acquisitions that help us overcome existing barriers in these target markets with the goal of accelerating growth. For example, through the acquisitions of Abraxas and NEK, we have expanded our reach within the military and national intelligence communities through the addition of intelligence, special operations, law enforcement and homeland security expertise.

Maintain a diversified business mix

We have a diverse mix of business across our three segments. The largest single contract in the CTS segment is with Transport for London (TfL), which represented approximately 13% of our

8

total consolidated net sales in fiscal year 2012. No other single non-U.S. government customer represented 10% or more of our total consolidated net sales in fiscal year 2012. Approximately 79% of the net sales in fiscal year 2012 of our MSS and CDS segments combined were made directly or indirectly to the U.S. government; however, this represents a wide variety of product and service sales to many different government agencies, including all four branches of the U.S. military and the special operations and intelligence communities. As of March 31, 2013, our defense segments had an immaterial amount of exposure to the overseas contingency operations (OCO) budget.

Enhance services business

We view services as a core element of our business and we are working to expand our service offerings and customer base. In aggregate, approximately 52% of our net sales in fiscal year 2012 were from service-related work.

In our CTS business, due to the technical complexities of operating electronic fare collection and payment systems, transit agencies are turning to their system suppliers for IT services and other operational and maintenance services, such as regional settlement, card management and customer support services that would otherwise be performed by the transit agency. As a result, we have transitioned from an AFC supplier to a systems integrator and services provider with a suite of turnkey services for more than 20 transit authorities worldwide.

At MSS, we provide a combination of services to our many customers. Multiple-award indefinite delivery/indefinite quantity (ID/IQ) contracts are now the primary contract vehicle in the U.S. government services marketplace. We have increased our participation on ID/IQ contracts, giving us more opportunities to bid for work and increasing our chances to develop new customers, programs and capabilities. We expand our scope of opportunities by offering additional services to current customers and transferring our skill sets to support similar programs for new customers. The broad spectrum of services we offer reinforces this strategy, and includes planning and support for theater and worldwide exercises, computer-based simulations, training and preparation of foreign military advisor and transition teams, mobilization and demobilization of deploying forces, range support and operations, logistics and maintenance operations, curriculum and leadership development, intelligence support, force modernization, open source data collection, as well as engineering and other technical support.

For CDS, increased services and operations and maintenance opportunities can reduce the volatility and timing uncertainties associated with large equipment contracts and add depth to the revenue base. Compared to the U.S. market where small business requirements, omnibus contracts and local preferences create acquisition challenges, we believe the international market offers greater opportunities to bundle and negotiate multi-year, turnkey contracts. We believe these long-term contracts reinforce CDS' competitive posture and enable the company to provide enhanced services through regular customer contact and increased visibility of product performance and reliability.

Expand international footprint

We have developed a large global presence in our three business segments. CTS has delivered over 400 projects in 40 major markets on 5 continents to date. Approximately 82% of CTS' fiscal year 2012 net sales were attributable to international customers. CTS has recently

9

expanded in Australia with the recent award of a $341.0 million contract to design and build an Electronic Ticketing System for Sydney and to operate and maintain the system until 2024. The Australian operation is now one of three primary operating regions of CTS alongside North America and Europe, and will be the base for us to pursue opportunities in the Asia-Pacific region. In Germany, we have successfully implemented a new electronic ticketing system for the Transit Authority Rhein-Main-Verkehrsverbund, and are working on providing new ticketing applications using cell phone technologies.

CDS has delivered systems in more than 35 allied nations. In fiscal year 2012, approximately 49% of CDS' net sales were to allied foreign governments, including projects funded by the U.S. government pursuant to Foreign Military Sales and Foreign Military Financing arrangements. During fiscal year 2012, we opened offices in Rome, Italy and Abu Dhabi, United Arab Emirates to better serve our customers and expand sales opportunities.

Innovation

We continue to invest in research and development to maintain a leadership role in the technological evolution within our core focus areas of the global transportation and defense markets. We are committed to using innovation and technology to address our customers' most pressing problems and demanding requirements. We have made meaningful and recognized contributions to technological advancements within our industries.

Pursue strategic acquisitions

We are focused on finding attractive acquisitions that enhance our market positions, provide expansion into complementary growth markets and lead to long-term profitability. We have developed an acquisition strategy that focuses on specific consolidation and growth opportunities in the defense and transportation markets. Over the last several years, we have completed multiple acquisitions as a means to diversify our customer base and expand our systems and services offerings.

On January 31, 2013, our board of directors named William W. Boyle as Chief Executive Officer. Mr. Boyle, formerly the Executive Vice President and Chief Financial Officer, had been serving as Interim President and Chief Executive Officer since the passing of the company's founder and former Chief Executive Officer, Walter J. Zable, in June 2012. Our board of directors also appointed Bradley H. Feldmann to the newly created position of President and Chief Operating Officer, promoted John D. Thomas to the position of Executive Vice President and Chief Financial Officer and appointed Stephen O. Shewmaker, President of CTS, to the additional role of Executive Vice President of Cubic. On March 8, 2013, our board of directors appointed Jimmie L. Balentine, President of MSS, to the additional role of Executive Vice President of Cubic. On March 25, 2013, David R. Schmitz was appointed President of CDS, a position formerly held by Mr. Feldmann and on April 16, 2013, Mr. Schmitz was appointed to the additional role of Senior Vice President of Cubic.

On March 12, 2013, we entered into a note purchase and private shelf agreement, pursuant to which we agreed to issue and sell $100.0 million in aggregate principal amount of senior unsecured notes, bearing interest at a rate of 3.35% and maturing on March 12, 2025. Notes with an aggregate principal amount of $50.0 million were purchased on March 12, 2013 and

10

notes with the remaining aggregate principal amount of $50.0 million were purchased on April 23, 2013. In addition, pursuant to the agreement, we may from time to time issue and sell, and the purchasers may in their sole discretion purchase, within the next three years, additional senior notes in aggregate principal amount of up to $25.0 million that will have terms, including interest rate, as we and the purchasers may agree upon at the time of issuance. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources."

Investing in securities involves substantial risk, and our business is subject to numerous risks and uncertainties. See the "Risk factors" section of this prospectus for a description of certain of the risks you should consider before investing in our common stock. Some of these risks include:

- •

- We have restated our prior consolidated financial statements, which may lead to additional risks and uncertainties,

including shareholder litigation.

- •

- We have identified material weaknesses in our internal control over financial reporting which could, if not remediated,

result in additional material misstatements in our financial statements.

- •

- We depend on government contracts for substantially all of our revenues and the loss of government contracts or a delay or

decline in funding of existing or future government contracts could decrease our backlog or adversely affect our sales and cash flows and our ability to fund our growth.

- •

- Government spending priorities and terms may change in a manner adverse to our businesses.

- •

- Sequestration may adversely affect our businesses which are dependent on federal government funding.

- •

- Failure to retain existing contracts or win new contracts under competitive bidding processes may adversely affect our

revenue.

- •

- The U.S. government's increased emphasis on awarding contracts to small businesses could preclude us from acting as a

prime contractor and increase the number of contracts we receive as a subcontractor to small businesses, which could decrease the amount of our revenues from such contracts. Some of these small

businesses may not be financially sound, which could adversely affect our business.

- •

- Our future success will depend on our ability to develop new products, systems and services that achieve market acceptance in our current and future markets.

We were incorporated in the State of California in 1949 and began operations in 1951. In 1984, we moved our corporate domicile to the State of Delaware. Our principal executive offices are located at 9333 Balboa Avenue, San Diego, California 92123 and our telephone number at that address is (858) 277-6780. Our internet address is www.cubic.com. The content on our website is available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this prospectus.

11

| Common stock offered by the selling shareholders | 2,315,000 shares (or 2,662,250 shares if the underwriters exercise their over-allotment option in full) | |

Common stock to be outstanding immediately after this offering |

26,736,307 shares |

|

Over-allotment option |

The selling shareholders have granted the underwriters a 30-day option to purchase up to 347,250 additional shares of our common stock to cover over-allotments, if any. |

|

Use of proceeds |

The selling shareholders will receive all of the proceeds from this offering, and we will not receive any proceeds from the sale of shares in this offering. See "Use of proceeds." For more information on the selling shareholders, see "Principal and selling shareholders." |

|

Risk factors |

See "Risk factors" beginning on page 16 and the other information included and incorporated by reference in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

New York Stock Exchange symbol |

"CUB" |

The number of shares of our common stock to be outstanding immediately after this offering set forth above is based on 26,736,307 shares of our common stock outstanding as of March 31, 2013, and excludes as of such date:

- •

- 18,000 shares of common stock issuable upon the exercise of outstanding options with a weighted average exercise price of

$28.85 per share;

- •

- 426,511 shares of common stock issuable upon the vesting of restricted stock units;

- •

- 4,038,614 shares of common stock reserved for future issuance under our 2005 Equity Incentive Plan; and

- •

- 8,945,300 shares of common stock held as treasury stock.

Except as otherwise indicated, information in this prospectus assumes:

- •

- no exercise of the underwriters' over-allotment option to purchase up

to additional shares of

our common stock from selling shareholders; and

- •

- no exercise of outstanding options and no vesting of restricted stock units.

12

Summary consolidated financial and other data

The following tables present our summary consolidated financial and other data as of and for the periods indicated. You should read this information together with the more detailed information contained in "Selected consolidated financial and other data," "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and the accompanying notes included in this prospectus. The summary consolidated results of operations data for the years ended September 30, 2012, 2011 (as restated) and 2010 (as restated), and the summary consolidated balance sheet data as of September 30, 2012, 2011 (as restated) and 2010 (as restated), have been derived from our audited consolidated financial statements included in this prospectus. The summary consolidated results of operations data for the three and six months ended March 31, 2013 and 2012 (as restated), and the summary consolidated balance sheet data as of March 31, 2013 and 2012 (as restated), have been derived from our unaudited consolidated financial statements included in this prospectus. The unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of our management, reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the financial information for the periods presented. Historical results are not necessarily indicative of the results to be expected for future periods, and the results for any interim period are not necessarily indicative of the results that may be expected for a full year.

| |

Six months ended March 31, |

Three months ended March 31, |

|

|

|

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (amounts in thousands, except percentages and per share data) |

Years ended September 30, | |||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

2012 |

2011 |

2010 |

||||||||||||||||

| |

|

(As restated) |

|

(As restated) |

|

(As restated) |

(As restated) |

|||||||||||||||

| |

(Unaudited) |

|

|

|

||||||||||||||||||

Results of Operations Data: |

||||||||||||||||||||||

Net sales: |

||||||||||||||||||||||

Products |

$ | 300,669 | $ | 309,086 | $ | 164,968 | $ | 155,776 | $ | 663,287 | $ | 600,933 | $ | 607,756 | ||||||||

Services |

377,007 | 347,325 | 199,337 | 183,869 | 718,208 | 694,648 | 590,436 | |||||||||||||||

Costs and expenses: |

||||||||||||||||||||||

Products |

218,018 | 220,133 | 117,123 | 106,684 | 451,573 | 418,279 | 430,417 | |||||||||||||||

Services |

297,617 | 277,050 | 153,766 | 145,642 | 594,662 | 564,062 | 511,014 | |||||||||||||||

Selling, general and administrative expenses |

82,317 | 78,259 | 41,320 | 43,039 | 163,688 | 159,791 | 124,306 | |||||||||||||||

Restructuring costs |

6,084 | — | 6,084 | — | — | — | — | |||||||||||||||

Research and development |

12,920 | 12,968 | 7,098 | 8,072 | 28,722 | 25,260 | 18,976 | |||||||||||||||

Amortization of purchased intangibles |

7,830 | 7,707 | 4,266 | 3,668 | 14,828 | 14,681 | 6,846 | |||||||||||||||

Interest expense |

1,516 | 678 | 654 | 331 | 1,550 | 1,461 | 1,755 | |||||||||||||||

Income taxes |

12,443 | 18,200 | 7,043 | 9,847 | 38,183 | 32,373 | 38,011 | |||||||||||||||

Net income attributable to Cubic |

39,604 | 44,091 | 27,158 | 23,397 | 91,900 | 83,594 | 72,094 | |||||||||||||||

Weighted average number of shares outstanding, basic and diluted |

26,736 | 26,736 | 26,736 | 26,736 | 26,736 | 26,736 | 26,735 | |||||||||||||||

Other Financial Data: |

||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 64,487 | $ | 71,591 | $ | 41,527 | $ | 38,005 | $ | 150,879 | $ | 135,849 | $ | 121,102 | ||||||||

Adjusted EBITDA Margin(2) |

9.5% | 10.9% | 11.4% | 11.2% | 10.9% | 10.5% | 10.1% | |||||||||||||||

Funded Backlog |

2,195,159 | 2,459,396 | 2,195,159 | 2,459,396 | 2,342,664 | 2,107,917 | 1,827,371 | |||||||||||||||

Total Backlog |

2,803,959 | 3,052,896 | 2,803,959 | 3,052,896 | 2,831,564 | 2,781,317 | 2,441,371 | |||||||||||||||

13

| |

Six months ended March 31, |

Three months ended March 31, |

|

|

|

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (amounts in thousands, except percentages and per share data) |

Years ended September 30, | |||||||||||||||||||||

| 2013 |

2012 |

2013 |

2012 |

2012 |

2011 |

2010 |

||||||||||||||||

| |

|

(As restated) |

|

(As restated) |

|

(As restated) |

(As restated) |

|||||||||||||||

| |

(Unaudited) |

|

|

|

||||||||||||||||||

Segment Data: |

||||||||||||||||||||||

Net sales: |

||||||||||||||||||||||

Cubic Transportation Systems (CTS) |

$ | 257,372 | $ | 257,520 | $ | 138,762 | $ | 131,750 | $ | 513,642 | $ | 427,091 | $ | 382,938 | ||||||||

Mission Support Services (MSS) |

235,643 | 234,370 | 122,264 | 126,895 | 491,383 | 476,476 | 444,922 | |||||||||||||||

Cubic Defense Systems (CDS) |

184,415 | 163,967 | 103,152 | 80,688 | 375,364 | 390,689 | 368,201 | |||||||||||||||

Other Operations(3) |

246 | 554 | 127 | 312 | 1,106 | 1,325 | 2,131 | |||||||||||||||

Operating Income: |

||||||||||||||||||||||

CTS |

$ | 45,440 | $ | 41,344 | $ | 32,210 | $ | 23,407 | $ | 76,337 | $ | 66,852 | $ | 51,813 | ||||||||

MSS |

7,804 | 9,107 | 3,561 | 4,596 | 21,893 | 23,910 | 27,933 | |||||||||||||||

CDS |

1,497 | 12,138 | 310 | 6,144 | 34,601 | 29,827 | 31,604 | |||||||||||||||

Other Operations(3)(4) |

(1,851 | ) | (2,295 | ) | (1,433 | ) | (1,607 | ) | (4,809 | ) | (7,081 | ) | (4,717 | ) | ||||||||

Funded Backlog: |

||||||||||||||||||||||

CTS |

$ | 1,616,283 | $ | 1,725,958 | $ | 1,616,283 | $ | 1,725,958 | $ | 1,663,687 | $ | 1,321,413 | $ | 1,077,156 | ||||||||

MSS |

197,771 | 251,569 | 197,771 | 251,569 | 248,057 | 258,146 | 236,312 | |||||||||||||||

CDS |

381,105 | 481,869 | 381,105 | 481,869 | 430,920 | 528,358 | 513,903 | |||||||||||||||

Per Share Data: |

||||||||||||||||||||||

Net income attributable to Cubic, basic and diluted |

$ | 1.48 | $ | 1.65 | $ | 1.02 | $ | 0.88 | $ | 3.44 | $ | 3.13 | $ | 2.70 | ||||||||

Cash dividends |

0.12 | 0.12 | 0.12 | 0.12 | 0.24 | 0.28 | 0.18 | |||||||||||||||

Balance Sheet Data: |

||||||||||||||||||||||

Shareholders' equity related to Cubic |

$ | 693,530 | $ | 630,767 | $ | 693,530 | $ | 630,767 | $ | 670,391 | $ | 579,563 | $ | 513,612 | ||||||||

Equity per share |

25.94 | 23.59 | 25.94 | 23.59 | 25.07 | 21.68 | 19.21 | |||||||||||||||

Total assets |

1,100,243 | 979,987 | 1,100,243 | 979,987 | 1,026,317 | 966,524 | 871,519 | |||||||||||||||

Long-term debt(5) |

53,029 | 11,747 | 53,029 | 11,747 | 11,503 | 15,918 | 20,494 | |||||||||||||||

(1) Adjusted EBITDA represents net income attributable to Cubic before interest, taxes, non-operating income and depreciation and amortization. We believe that the presentation of Adjusted EBITDA included in this prospectus provides useful information to investors with which to analyze our operating trends and performance and ability to service and incur debt. Also, Adjusted EBITDA is a factor we use in measuring our performance and compensating certain of our executives. Further, we believe Adjusted EBITDA facilitates company-to-company operating performance comparisons by backing out potential differences caused by variations in capital structures (affecting net interest expense), taxation and the age and book depreciation of property, plant and equipment (affecting relative depreciation expense), and non-operating expenses which may vary for different companies for reasons unrelated to operating performance. In addition, we believe that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. Adjusted EBITDA is not a measurement of financial performance under U.S. Generally Accepted Accounting Principles (GAAP) and should not be considered as an alternative to net income as a measure of performance. In addition, other companies may define Adjusted EBITDA differently and, as a result, our measure of Adjusted EBITDA may not be directly comparable to Adjusted EBITDA of other companies. Furthermore, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

- •

- Adjusted EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures or

contractual commitments;

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- Adjusted EBITDA does not reflect the interest expense, or the cash requirements necessary to service

interest or principal payments, on our debt;

- •

- Adjusted EBITDA does not reflect our provision for income taxes, which may vary significantly from period to

period; and

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements.

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally. You are cautioned not to place undue reliance on Adjusted EBITDA.

14

The following table reconciles Adjusted EBITDA to net income attributable to Cubic, which we consider to be the most directly comparable GAAP financial measure to Adjusted EBITDA:

| |

Six months ended March 31, |

Three months ended March 31, |

Years ended September 30, | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (amounts in thousands) |

2013 |

2012 |

2013 |

2012 |

2012 |

2011 |

2010 |

|||||||||||||||

| |

|

(As restated) |

|

(As restated) |

|

(As restated) |

(As restated) |

|||||||||||||||

Reconciliation: |

||||||||||||||||||||||

Net income attributable to Cubic |

$ | 39,604 | $ | 44,091 | $ | 27,158 | $ | 23,397 | $ | 91,900 | $ | 83,594 | $ | 72,094 | ||||||||

Add: |

||||||||||||||||||||||

Provision for income taxes |

12,443 | 18,200 | 7,043 | 9,847 | 38,183 | 32,373 | 38,011 | |||||||||||||||

Interest expense (income), net |

767 | (1,048 | ) | 342 | (633 | ) | (1,444 | ) | (1,107 | ) | 165 | |||||||||||

Other income, net |

(49 | ) | (1,045 | ) | 53 | (122 | ) | (821 | ) | (1,662 | ) | (3,637 | ) | |||||||||

Noncontrolling interest in income of VIE |

125 | 96 | 52 | 51 | 204 | 310 | — | |||||||||||||||

Depreciation and amortization |

11,597 | 11,297 | 6,879 | 5,465 | 22,857 | 22,341 | 14,469 | |||||||||||||||

Adjusted EBITDA |

$ | 64,487 | $ | 71,591 | $ | 41,527 | $ | 38,005 | $ | 150,879 | $ | 135,849 | $ | 121,102 | ||||||||

(2) Represents Adjusted EBITDA as a percentage of net sales.

(3) Represents operations of certain of our subsidiaries that are not incorporated into any of our three business segments.

(4) Includes unallocated corporate expenses.

(5) Long-term debt for the three and six months ended March 31, 2013 excludes $50.0 million in aggregate principal amount of notes purchased on April 23, 2013 pursuant to our note purchase and private shelf agreement.

15

Investing in our common stock involves a high degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus and the documents incorporated by reference herein, before deciding whether to invest in our common stock. The following are some of the factors we believe could cause our actual results to differ materially from expected and historical results. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any of the risks or uncertainties described below or any such additional risks and uncertainties actually occur, our business, results of operations or financial condition could be materially and adversely affected. This could cause the trading price of our stock to decline and you could lose part or all of your investment.

Risks relating to our business

We have restated our prior consolidated financial statements, which may lead to additional risks and uncertainties, including shareholder litigation.

As discussed in Note 2 to our consolidated financial statements included in this prospectus, we have restated our consolidated financial statements as of and for the years ended September 30, 2011, 2010 and 2009, and for the quarterly periods ended December 31, 2009 through March 31, 2012. The determination to restate these consolidated financial statements and the unaudited interim condensed consolidated financial statements was made by our Audit and Compliance Committee upon management's recommendation following the identification of errors related to our method of recognizing revenues on certain contracts.

As a result of these events, we have become subject to a number of additional risks and uncertainties, including substantial unanticipated costs for accounting and legal fees in connection with or related to the restatement and potential shareholder litigation. If litigation did occur, we may incur additional substantial defense costs regardless of the outcome, and such litigation could cause a diversion of our management's time and attention. If we do not prevail in any such litigation, we could be required to pay substantial damages or settlement costs. In addition, as our net income increased as a result of the restatement, we are liable to pay increased tax liabilities or penalties for prior periods, both under U.S. and foreign laws.

We have identified material weaknesses in our internal control over financial reporting which could, if not remediated, result in additional material misstatements in our financial statements.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934, as amended. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. During the fourth quarter of fiscal year 2012, management identified the following material weaknesses in our internal control over financial reporting related to accounting for revenue on certain types of contracts: (i) in our process of assessing the appropriate accounting treatment for revenue and costs for certain of our contracts with customers, we did not maintain a sufficient number of personnel with an appropriate level of knowledge and experience or ongoing training in U.S. Generally Accepted

16

Accounting Principles (GAAP) to challenge our application of GAAP commensurate with the number and complexity of our contracts to prevent or detect material misstatements in revenue or cost of sales in a timely manner; and (ii) our policies for the review and approval of revenue recognition decisions required review and analysis by personnel with an appropriate level of GAAP knowledge and experience for contracts over certain materiality thresholds, which thresholds were not designed to ensure that sufficient review was being performed for revenue recognition decisions that could have a material impact on our financial statements. As a result of these material weaknesses, our management concluded that our internal control over financial reporting was not effective based on criteria set forth by the Committee of Sponsoring Organization of the Treadway Commission in Internal Control—An Integrated Framework. We are actively engaged in developing a remediation plan designed to address these material weaknesses. If our remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results, which could lead to substantial additional costs for accounting and legal fees and shareholder litigation.

We depend on government contracts for substantially all of our revenues and the loss of government contracts or a delay or decline in funding of existing or future government contracts could decrease our backlog or adversely affect our sales and cash flows and our ability to fund our growth.

Our revenues from contracts, directly or indirectly, with foreign and U.S. state, regional and local governmental agencies represented substantially all of our total revenues in fiscal year 2012 and the six months ended March 31, 2013. Although these various government agencies are subject to common budgetary pressures and other factors, many of our various government customers exercise independent purchasing decisions. As a result of the concentration of business with governmental agencies, we are vulnerable to adverse changes in our revenues, income and cash flows if a significant number of our government contracts, subcontracts or prospects are delayed or canceled for budgetary or other reasons.

The factors that could cause us to lose these contracts and could decrease our backlog or otherwise materially harm our business, prospects, financial condition or results of operations include:

- •

- budget constraints affecting government spending generally, or specific departments or agencies such as U.S. or foreign

defense and transit agencies and regional transit agencies, and changes in fiscal policies or a reduction of available funding;

- •

- re-allocation of government resources as the result of actual or threatened terrorism or hostile activities or

for other reasons;

- •

- disruptions in our customers' ability to access funding from capital markets;

- •

- curtailment of government's use of outsourced service providers and government's in-sourcing of certain

services;

- •

- the adoption of new laws or regulations pertaining to government procurement;

- •

- government appropriations delays or blanket reductions in departmental budgets;

17

- •

- suspension or prohibition from contracting with the government or any significant agency with which we conduct business;

- •

- increased use of shorter duration awards by the federal government in the defense industry, which increases the frequency

we may need to recompete for work;

- •

- impairment of our reputation or relationships with any significant government agency with which we conduct business;

- •

- impairment of our ability to provide third-party guarantees and letters of credit; and

- •

- delays in the payment of our invoices by government payment offices.

In addition, some of our international work is done at the request and at the expense of the U.S. government and its agencies. For example, our Mission Support Services (MSS) business provides services to 13 NATO forces, with the U.S. Department of Defense (DoD) compensating us for these services. Therefore, risks associated with performing work for the U.S. government and its agencies may also apply to our international contracts.

Government spending priorities and terms may change in a manner adverse to our businesses.

In the past, our businesses have been adversely affected by significant changes in U.S. and foreign government spending during periods of declining budgets. A significant decline in overall spending, or the decision not to exercise options to renew contracts, or the loss of or substantial decline in spending on a large program in which we participate could materially adversely affect our business, prospects, financial condition or results of operations. For example, the U.S. defense and national security budgets in general, and spending in specific agencies with which we work, such as those that are a part of the DoD, have declined from time to time for extended periods, resulting in program delays, program cancellations and a slowing of new program starts. Although spending on defense-related programs by the U.S. government and certain foreign governments has increased in recent years, such spending has decreased in recent years for certain other foreign governments, and future levels of expenditures and authorizations for defense-related programs may decrease, remain constant or shift to programs in areas where we do not currently provide products or services, thereby reducing the chances that we will be awarded new contracts.

Even though our contract periods of performance for a program may exceed one year, Congress and certain foreign governments must usually approve funds for a given program each fiscal year and may significantly reduce funding of a program in a particular year. Significant reductions in these appropriations or the amount of new defense contracts awarded may affect our ability to complete contracts, obtain new work and grow our business. Congress and such foreign governments do not always enact spending bills by the beginning of the new fiscal year. Such delays leave the affected agencies under-funded which delays their ability to contract. Future delays and uncertainties in funding could impose additional business risks on us.

In addition, the DoD has recently increased its emphasis on awarding contracts to small businesses and awarding shorter duration contracts, each of which has the potential to reduce the amount of revenue we could otherwise earn from such contracts. Shorter duration contracts lower our backlog numbers and increase the risk associated with recompeting for a contract, as we would need to do so more often. In addition, as we may need to expend

18

capital resources at higher levels upon the award of a new contract, the shorter the duration of the contract, the less time we have to recoup such expenditures and turn a profit under such contract.

Sequestration may adversely affect our businesses which are dependent on federal government funding.

On March 1, 2013, pursuant to laws passed in August 2011 and January 2013, the federal government implemented sequestration, which will result in deep and automatic cuts in defense budgets and other non-defense budgets. It is currently unknown what programs will be cut, over what time period and by what amount. Some programs may be cancelled in their entirety.

All of our U.S. defense contracts are at risk of being cut or terminated. Our domestic transportation contracts could be materially harmed if transit agencies do not receive expected federal funds and are required to curtail their plans to expand or upgrade their fare collection systems. Any cuts or cancellations of our contracts may materially harm our business, prospects, financial condition and results of operations.

Our contracts with government agencies may be terminated or modified prior to completion, which could adversely affect our business.

Government contracts typically contain provisions and are subject to laws and regulations that give the government agencies rights and remedies not typically found in commercial contracts, including providing the government agency with the ability to unilaterally:

- •

- terminate our existing contracts;

- •

- reduce the value of our existing contracts;

- •

- modify some of the terms and conditions in our existing contracts;

- •

- suspend or permanently prohibit us from doing business with the government or with any specific government agency;

- •

- control and potentially prohibit the export of our products;

- •

- cancel or delay existing multi-year contracts and related orders if the necessary funds for contract

performance for any subsequent year are not appropriated;

- •

- decline to exercise an option to extend an existing multi-year contract; and

- •

- claim rights in technologies and systems invented, developed or produced by us.

Most U.S. government agencies and some other agencies with which we contract can terminate their contracts with us for convenience, and in that event we generally may recover only our incurred or committed costs, settlement expenses and profit on the work completed prior to termination. If an agency terminates a contract with us for default, we may be denied any recovery and may be liable for excess costs incurred by the agency in procuring undelivered items from an alternative source. We may receive show-cause or cure notices under contracts that, if not addressed to the agency's satisfaction, could give the agency the right to terminate those contracts for default or to cease procuring our services under those contracts.

19

In the event that any of our contracts were to be terminated or adversely modified, there may be significant adverse effects on our revenues, operating costs and income that would not be recoverable.

Changes in future business or other market conditions could cause business investments and/or recorded goodwill or other long-term assets to become impaired, resulting in substantial losses and write-downs that would reduce our results of operations.

As part of our strategy, we will, from time to time, acquire a minority or majority interest in a business. These investments are made upon careful analysis and due diligence procedures designed to achieve a desired return or strategic objective. These procedures often involve certain assumptions and judgment in determining acquisition price. After acquisition, unforeseen issues could arise which adversely affect the anticipated returns or which are otherwise not recoverable as an adjustment to the purchase price. Even after careful integration efforts, actual operating results may vary significantly from initial estimates. We evaluate our recorded goodwill balances for potential impairment annually as of July 1, or when circumstances indicate that the carrying value may not be recoverable. The goodwill impairment test is performed by comparing the fair value of each reporting unit to its carrying value, including recorded goodwill. We have not yet had a case where the carrying value exceeded the fair value; however, if it did, impairment would be measured by comparing the implied fair value of goodwill to its carrying value, and any impairment determined would be recorded in the current period, which could result in substantial losses and write-downs that would reduce our results of operations. For more information on accounting policies we have in place for impairment of goodwill, see "Management's discussion and analysis of financial condition and results of operations—Critical accounting policies, estimates and judgments—Valuation of goodwill."

Failure to retain existing contracts or win new contracts under competitive bidding processes may adversely affect our revenue.

We obtain most of our contracts through a competitive bidding process, and substantially all of the business that we expect to seek in the foreseeable future likely will be subject to a competitive bidding process. Competitive bidding presents a number of risks, including:

- •

- the need to compete against companies or teams of companies with more financial and marketing resources and more

experience in bidding on and performing major contracts than we have;

- •

- the need to compete against companies or teams of companies that may be long-term, entrenched incumbents for a

particular contract for which we are competing and that have, as a result, greater domain expertise and better customer relations;

- •

- the need to compete to retain existing contracts that have in the past been awarded to us on a sole-source

basis or as to which we have been incumbent for a long time;

- •

- the U.S. government's increased emphasis on awarding contracts to small businesses could preclude us from bidding on certain work or reduce the scope of work we can bid as a prime contractor and limit the amount of revenue we could otherwise earn as a prime contractor for such contracts;

20

- •

- the award of contracts to providers offering solutions at the "lowest price technically acceptable" which may lower the

profit we may generate under a contract awarded using this pricing method or prevent us from submitting a bid for such work due to us deeming such work to be unprofitable;

- •

- the reduction of margins achievable under any contracts awarded to us;

- •

- the expense and delay that may arise if our competitors protest or challenge new contract awards;

- •

- the need to bid on some programs in advance of the completion of their design, which may result in higher research and

development expenditures, unforeseen technological difficulties, or increased costs which lower our profitability;

- •

- the substantial cost and managerial time and effort, including design, development and marketing activities, necessary to

prepare bids and proposals for contracts that may not be awarded to us;

- •

- the need to develop, introduce and implement new and enhanced solutions to our customers' needs;

- •

- the need to locate and contract with teaming partners and subcontractors; and

- •

- the need to accurately estimate the resources and cost structure that will be required to perform any fixed-price contract that we are awarded.

We may not be afforded the opportunity in the future to bid on contracts that are held by other companies and are scheduled to expire if the agency decides to extend the existing contract. If we are unable to win particular contracts that are awarded through the competitive bidding process, we may not be able to operate in the market for services that are provided under those contracts for a number of years. If we win a contract, and upon expiration the customer requires further services of the type provided by the contract, there is frequently a competitive rebidding process and there can be no assurance that we will win any particular bid, or that we will be able to replace business lost upon expiration or completion of a contract.

As a result of the complexity and scheduling of contracting with government agencies, we occasionally incur costs before receiving contractual funding by the government agency. In some circumstances, we may not be able to recover these costs in whole or in part under subsequent contractual actions.

In addition, the customers currently serviced by our Cubic Transportation Systems segment are finite in number. The loss of any one of these customers, or the failure to win replacement awards upon expiration of contracts with such customers, such as our contract with Transport for London, which will be required to be re-competed in 2015, could have a materially adverse impact on our results of operations.

If we are unable to consistently retain existing contracts or win new contract awards, our business, prospects, financial condition and results of operations will be adversely affected.

21

Many of our U.S. government customers spend their procurement budgets through multiple-award or indefinite delivery/indefinite quantity (ID/IQ) contracts, under which we are required to compete among the awardees for post-award orders. Failure to win post-award orders could affect our ability to increase our sales.

The U.S. government can select multiple winners under multiple-award contracts, federal supply schedules and other agency-specific ID/IQ contracts, as well as award subsequent purchase orders among such multiple winners. This means that there is no guarantee that these ID/IQ, multiple-award contracts will result in the actual orders equal to the ceiling value under the contract, or result in any actual orders. We are only eligible to compete for work (purchase orders and delivery orders) as an awardee pursuant to government-wide acquisition contracts already awarded to us. Our failure to compete effectively in this procurement environment could reduce our sales, which would adversely affect our business, results of operations and financial condition.

The U.S. government's increased emphasis on awarding contracts to small businesses could preclude us from acting as a prime contractor and increase the number of contracts we receive as a subcontractor to small businesses, which could decrease the amount of our revenues from such contracts. Some of these small businesses may not be financially sound, which could adversely affect our business.