Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Fiscal Year Ended December 31, 2018 |

OR |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-4639

CTS CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | | | |

| Indiana | | | | 35-0225010 | |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification Number) |

| | | | | | |

4925 Indiana Avenue, Lisle, IL (Address of principal executive offices) | | 60532 (Zip Code) |

Registrant's telephone number, including area code: 630-577-8800

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common stock, without par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer x | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company o |

Emerging growth market o | | | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of CTS Corporation, based upon the closing sales price of CTS common stock on June 30, 2018, was approximately $1,176,000,000. There were 32,734,227 shares of common stock, without par value, outstanding on February 19, 2019.

DOCUMENTS INCORPORATED BY REFERENCE

| |

(1) | Portions of the Proxy Statement to be filed for the annual meeting of shareholders to be held on or about May 16, 2019 are incorporated by reference in Part III. |

TABLE OF CONTENTS

Safe Harbor

Forward-Looking Statements

This document contains statements that are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, any financial or other guidance, statements that reflect our current expectations concerning future results and events, and any other statements that are not based solely on historical fact. Forward-looking statements are based on management's expectations, certain assumptions and currently available information. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from those presented in the forward-looking statements. Examples of factors that may affect future operating results and financial condition include, but are not limited to: changes in the economy generally and in respect to the business in which CTS operates; unanticipated issues in integrating acquisitions; the results of actions to reposition our business; rapid technological change; general market conditions in the transportation, telecommunications, and information technology industries, as well as conditions in the industrial, aerospace and defense, and medical markets; reliance on key customers; unanticipated natural disasters or other events; environmental compliance and remediation expenses; the ability to protect our intellectual property; pricing pressures and demand for our products; and risks associated with our international operations, including trade and tariff barriers, exchange rates and political and geopolitical risks. Many of these, and other risks and uncertainties, are discussed in further detail in Item 1A. of this Annual Report on Form 10-K. We undertake no obligation to publicly update our forward-looking statements to reflect new information or events or circumstances that arise after the date hereof, including market or industry changes.

PART I

Item 1. Business

CTS Corporation ("CTS", "we", "our", "us" or the "Company") is a global manufacturer of sensors, electronic components, and actuators. CTS was established in 1896 as a provider of high-quality telephone products and was incorporated as an Indiana corporation in February 1929. Our principal executive offices are located in Lisle, Illinois.

We design, manufacture, and sell a broad line of sensors, electronic components, and actuators primarily to original equipment manufacturers ("OEMs") for the aerospace and defense, industrial, information technology, medical, telecommunications, and transportation markets. Our vision is to be a leading provider of sensing and motion devices as well as connectivity components, enabling an intelligent and seamless world. These devices are categorized by their ability to Sense, Connect or Move. Sense products provide vital inputs to electronic systems. Connect products allow systems to function in synchronization with other systems. Move products ensure required movements are effectively and accurately executed. We are committed to achieving our vision by continuing to invest in the development of products and technologies within these categories.

We operate manufacturing facilities in North America, Asia, and Europe. Sales and marketing are accomplished through our sales engineers, independent manufacturers' representatives, and distributors.

See the Consolidated Financial Statements and Notes included in Part II, Item 8 of this Annual Report on Form 10-K for financial information regarding the Company.

PRODUCTS BY MAJOR MARKETS

Our products perform specific electronic functions for a given product family and are intended for use in customer assemblies. Our major products consist principally of sensors and actuators used in passenger or commercial vehicles, electronic components used in telecommunications infrastructure, information technology and other high-speed applications, switches, and potentiometers supplied to multiple markets, and fabricated piezoelectric materials and substrates used primarily in medical, industrial, aerospace and defense, and information technology markets.

The following table provides a breakdown of net sales by industry as a percent of consolidated net sales:

|

| | | |

| 2018 | 2017 | 2016 |

Industry | | | |

Transportation | 64% | 65% | 66% |

Industrial | 18% | 18% | 17% |

Medical | 9% | 8% | 7% |

Aerospace and Defense | 5% | 4% | 4% |

Telecommunications and IT | 4% | 5% | 6% |

% of consolidated net sales | 100% | 100% | 100% |

The following table identifies major products by industry. Products are sold to several industry OEMs and through distributors.

|

| | | | | |

Product Description | Transportation | Industrial | Medical | Aerospace and Defense | Telecom and IT |

SENSE | l | l | l | l | |

(Controls, Pedals, Piezo Sensing Products, Sensors, Switches, Transducers) | | | | | |

CONNECT | | l | l | l | l |

(EMI/RFI Filters, Capacitors, Frequency Control, Resistors, RF filters) | | | | | |

MOVE | l | l | | | l |

(Piezo Microactuators, Rotary Actuators) | | | | | |

MARKETING AND DISTRIBUTION

Sales and marketing to OEMs is accomplished through our sales engineers, independent manufacturers' representatives, and distributors. We maintain sales offices in China, Czech Republic, Denmark, Germany, India, Japan, Scotland, Singapore, Taiwan, and the United States. Approximately 89% of 2018 net sales were attributable to our sales engineers.

Our sales engineers generally service our largest customers with application-specific products. The sales engineers work closely with major customers in designing and developing products to meet specific customer requirements.

We utilize the services of independent manufacturers' representatives for customers not serviced directly by our sales engineers. Independent manufacturers' representatives receive commissions from us. During 2018, approximately 5% of net sales were attributable to independent manufacturers' representatives. We also use independent distributors. Independent distributors purchase products from us for resale to customers. In 2018, independent distributors accounted for approximately 6% of net sales.

RAW MATERIALS

We utilize a wide variety of raw materials and purchased parts in our manufacturing processes. The following are the most significant raw materials and purchased components:

Conductive inks and contactors, passive electronic components, integrated circuits and semiconductors, certain rare earth elements ("REEs"), ceramic powders, plastic components, molding compounds, printed circuit boards and assemblies, quartz blanks and crystals, wire harness assemblies, copper, brass, silver, gold, platinum, lead, aluminum, and steel-based raw materials and components.

These raw materials and parts are purchased from a number of suppliers, and we generally do not believe we are dependent upon one or a limited number of suppliers. Although we purchase all of our semiconductors, REEs, conductive inks, and silver pastes from a limited number of suppliers, alternative sources are available.

We do not currently anticipate any significant raw material shortages that would limit production. However, the lead times between the placement of orders for certain raw materials and purchased parts and actual delivery to us may vary. Occasionally, we may need to order raw materials in greater quantities and at higher prices to compensate for the variability of lead times for delivery.

PATENTS, TRADEMARKS, AND LICENSES

We maintain a program of obtaining and protecting U.S. and non-U.S. patents relating to products that we have designed and manufactured, as well as processes and equipment used in our manufacturing technology. We were issued 10 new U.S. patents and 19 non-U.S. patents in 2018 and currently hold 147 U.S. patents and 159 non-U.S. patents. We have 9 registered U.S. trademarks, 20 registered foreign trademarks and 4 international trademark registrations. We have licensed the right to use several of our patents. In 2018, license and royalty income was less than 1% of net sales.

MAJOR CUSTOMERS

Sales to our 15 largest customers as a percentage of total net sales were as follows:

|

| | | |

| Years Ended December 31, |

| 2018 | 2017 | 2016 |

Total of 15 largest customers / net sales | 63.7% | 64.4% | 63.1% |

Our net sales to significant customers as a percentage of total net sales were as follows:

|

| | | |

| Years Ended December 31, |

| 2018 | 2017 | 2016 |

Cummins Inc. | 15.2% | 13.4% | 9.9% |

Honda Motor Co. | 10.5% | 11.2% | 10.7% |

Toyota Motor Corporation | 10.5% | 10.2% | 10.4% |

We sell automotive parts to these three customers for certain vehicle platforms under purchase agreements that have no volume commitments and are subject to purchase orders issued from time to time.

No other customer accounted for 10% or more of total net sales during these periods.

We continue to broaden our customer base. Changes in the level of our customers' orders have, in the past, had a significant impact on our operating results. If a major customer reduces the amount of business it does with us, or substantially changes the terms of that business, there could be an adverse impact on our operating results.

We expect to continue to depend on sales to our major customers. Because our customers are under no obligation to continue to do business with us on a long-term basis, it is possible that one or more customers may choose to work with a competitor and reduce its business with us. Customers may also reduce or delay their business with us because of economic or other conditions or decisions that reduce their need for our products or services. Since it is difficult to replace lost business on a timely basis, it is likely that our operating results would be adversely affected if one or more of our major customers were to cancel, delay, or reduce a large amount of business with us in the future. If one or more of our customers were to become insolvent or otherwise unable to pay for our products and/or services, our operating results, financial condition, and cash flows could be adversely affected.

ORDER BACKLOG

Order backlog is comprised of firm open purchase orders we have received from our customers and generally represents 1 to 2 months of sales for certain products. Our business is a mix of purchase order based business, shorter-term contracts, and multi-year awards, such as with customers who serve the automotive end market. As such, order backlog does not provide a meaningful indication of future sales.

COMPETITION

We compete with many domestic and foreign manufacturers principally on the basis of product features, technology, price, quality, reliability, delivery, and service. Most of our product lines encounter significant global competition. The number of competitors varies from product line to product line. No one competitor competes with us in every product line, but many competitors are larger and more diversified than we are.

Some customers have reduced or plan to reduce their number of suppliers, while increasing their volume of purchases. Customers demand lower cost and higher quality, reliability, and delivery standards from us as well as from our competitors. These trends create opportunities for us, but also increase the risk of loss of business to competitors. We are subject to competitive risks that are typical within the electronics industry, including in some cases short product life cycles and technical obsolescence.

We believe we compete most successfully in custom engineered products manufactured to meet specific applications of major OEMs.

NON-U.S. REVENUES AND ASSETS

Our net sales to customers originating from our non-U.S. operations as a percentage of total net sales were as follows:

|

| | | |

| Years Ended December 31, |

| 2018 | 2017 | 2016 |

Net sales from non-U.S. operations | 33% | 32% | 30% |

Our percentages of total assets at non-U.S. locations were as follows:

|

| | | |

| Years Ended December 31, |

| 2018 | 2017 | 2016 |

Total assets at non-U.S. operations | 46% | 49% | 48% |

A substantial portion of these assets, other than cash and cash equivalents, cannot readily be liquidated. We believe the business risks to our non-U.S. operations, though substantial, are normal risks for global businesses. These risks include currency controls and changes in currency exchange rates, longer collection cycles, political and transportation risks, economic downturns and inflation, government regulations, and expropriation. Our non-U.S. manufacturing facilities are located in China, Czech Republic, Denmark, India, Mexico, and Taiwan.

EMPLOYEES

We employed 3,230 people at December 31, 2018, with 81% of these employees located outside the U.S. We employed 3,222 people at December 31, 2017. Approximately 11 employees at one location in the United States were covered by two collective bargaining agreements as of December 31, 2018. Both agreements are scheduled to expire upon completion of our 2016 Restructuring Plan activities.

ADDITIONAL INFORMATION

We are incorporated in the State of Indiana. Our principal corporate office is located at 4925 Indiana Avenue Lisle, IL 60532.

Our internet address is www.ctscorp.com. We make available free of charge through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission ("SEC"). Other than the documents that we file with the SEC that are incorporated by reference herein, the information contained on or accessible through our website is not part of this or any other report we file or furnish to the SEC.

The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov.

EXECUTIVE OFFICERS OF THE COMPANY

Executive Officers. The following serve as executive officers of CTS as of February 22, 2019. The executive officers are expected to serve until the next annual shareholders meeting, scheduled to be held on or about May 16, 2019, at which time the election of officers will be considered again by the Board of Directors.

|

| | | | |

Name | | Age | | Positions and Offices |

Kieran O'Sullivan | | 56 | | President, Chief Executive Officer and Chairman of the Board |

Ashish Agrawal | | 48 | | Vice President and Chief Financial Officer |

Luis Francisco Machado | | 56 | | Vice President, General Counsel and Secretary |

Kieran O'Sullivan - 56 - President, Chief Executive Officer and Chairman of the Board. Mr. O'Sullivan joined CTS on January 7, 2013. Before joining CTS, Mr. O'Sullivan served as Executive Vice President of Continental AG's Global Infotainment and Connectivity Business and led the NAFTA Interior Division, having joined Continental AG, a global automotive supplier, in 2006. Mr. O'Sullivan is a member of the board of directors, is chairman of the compensation committee, and is a member of the audit committee of LCI Industries, a supplier of components for manufacturers of recreational vehicles, manufactured homes, marine applications, and for the related aftermarkets of those industries.

Ashish Agrawal - 48 - Vice President and Chief Financial Officer. On November 11, 2013, Mr. Agrawal was elected Vice President and Chief Financial Officer for CTS. Mr. Agrawal joined CTS in June 2011 as Vice President, Treasury and Corporate Development, and was elected as Treasurer on September 1, 2011. Before joining CTS, Mr. Agrawal was with Dometic Corporation, a manufacturer of refrigerators, awnings and air conditioners, as Senior Vice President and Chief Financial Officer since 2007. Prior to that, Mr. Agrawal was with General Electric Co. in various positions since December 1994.

Luis Francisco Machado - 56 - Vice President, General Counsel and Secretary. Mr. Machado joined CTS in August 2015. Before joining CTS, Mr. Machado was at L Brands, Inc., a retailer of intimate apparel, home fragrance and beauty products under the Victoria's Secret, Pink, and Bath and Body Works Brands, as Senior Vice President, Legal and Assistant Secretary since August 2010, and Associate General Counsel, Corporate and Assistant Secretary of Wm. Wrigley Jr. Company since February 2006.

Information with respect to Directors and Corporate Governance may be found in our definitive proxy statement to be delivered to shareholders in connection with our 2019 Annual Meeting of Shareholders. Such information is incorporated herein by reference.

Item 1A. Risk Factors

The following are certain risk factors that could affect our business, financial condition and operating results. These risk factors should be considered in connection with evaluating forward-looking statements contained in this Annual Report on Form 10-K or in any other reports filed or furnished by us, because these factors could cause our actual results and financial condition to differ materially from those projected in any such forward-looking statements. Before you invest in us, you should know that making such an investment involves risks, including the risks described below. The risks that are highlighted below are not the only ones that we face. If any of the following risks occur, our business, financial condition or operating results could be negatively affected.

Because we currently derive a significant portion of our revenues from a small number of customers, any decrease in orders from these customers could have an adverse effect on our business, financial condition and operating results.

We depend on a small number of customers for a large portion of our business, and changes in the level of our customers' orders have, in the past, had a significant impact on our results of operations. If a major customer significantly delays, reduces, or cancels the level of business it does with us, there could be an adverse effect on our business, financial condition and operating results. Significant pricing and margin pressures exerted by a major customer could also materially adversely affect our operating results. In addition, we generate significant accounts receivable from sales to our major customers. If one or more of our major customers were to become insolvent or otherwise unable to pay or were to delay payment for our products, our business, financial condition and operating results could be materially adversely affected.

Negative or unexpected tax consequences could adversely affect our results of operations.

We operate globally and changes in tax laws could adversely affect our results. The international tax environment continues to change as a result of both coordinated actions by governments and unilateral measures enacted by individual countries, such as the comprehensive tax reform enacted in the U.S. in 2017, which could significantly impact our effective tax rate, tax liabilities, and ability to utilize deferred tax assets.

Adverse changes in the underlying profitability and financial outlook of our operations in several jurisdictions could lead to changes in our valuation allowances against deferred tax assets and other tax accruals that could materially and adversely affect our results of operations. In addition, acquisitions or divestitures may cause our effective tax rate to change.

We base our tax accounting positions upon the anticipated nature and conduct of our business and upon our understanding of the tax laws of the various countries in which we have assets or conduct activities. However, our tax accounting positions are subject to review and possible challenge by taxing authorities and to possible changes in law, which may have a retroactive effect.

We may be unable to compete effectively against competitors.

The industries in which we operate are highly competitive and characterized by price erosion and rapid technological change. We compete against many domestic and foreign companies, some of which have substantially greater manufacturing, financial, research and development, and marketing resources than we do. If any customer becomes dissatisfied with our prices, quality, or timeliness of delivery, among other things, it could award business to our competitors. Moreover, some of our customers could choose to manufacture and develop particular products themselves rather than purchase them from us. Increased competition could result in price reductions, reduced profit margins and loss of market share, each of which could materially adversely affect our business, financial condition and operating results. These developments also may materially adversely affect our ability to compete successfully going forward. We cannot assure you that our products will continue to compete successfully with our competitors' products, including OEMs.

We may be unable to keep pace with rapid technological changes that could make some of our products or processes obsolete before we realize a return on our investment.

The technologies relating to some of our products have undergone, and are continuing to undergo, rapid and significant changes. End markets for our products are characterized by technological change, frequent new product introductions and enhancements, changes in customer requirements, and emerging industry standards. The introduction of products embodying new technologies and the emergence of new industry standards could render our existing products obsolete and unmarketable before we can recover any or all of our research, development and commercialization expenses, or our capital investments. Furthermore, the life cycles of our products and the products we manufacture for others vary, may change, and are difficult to estimate.

We may experience difficulties that could delay or prevent the successful development, introduction and marketing of new products or product enhancements and our new products or product enhancements may not adequately meet the requirements of the

marketplace or achieve market acceptance. If we are unable, for technological or other reasons, to develop and market new products or product enhancements in a timely and cost-effective manner, our business, financial condition and operating results could be materially adversely affected.

Our customers may cancel their orders, change production quantities or locations or delay production.

We generally do not obtain firm, long-term purchase commitments from our customers, and regularly experience reduced or extended lead times in customer orders. Customers cancel orders, change production quantities and delay production for a number of reasons. Uncertain economic and geopolitical conditions may result in some of our customers delaying the delivery of some of the products we manufacture for them and placing purchase orders for lower volumes of products than previously anticipated. Cancellations, reductions or delays by a significant customer or by a number of customers may harm our results of operations by reducing the volumes of products we manufacture and sell, as well as by causing a delay in the recovery of our expenditures for inventory in preparation for customer orders, or by reducing our asset utilization, resulting in lower profitability.

In addition, customers may require that manufacturing of their products be transitioned from one of our facilities to another to achieve cost reductions and other objectives. Such transfers may result in inefficiencies and costs due to resulting excess capacity and overhead at one facility and capacity constraints and the inability to fulfill all orders at another. In addition, we make key decisions based on our estimates of customer requirements, including determining the levels of orders that we will seek and accept, production schedules, component procurement commitments, personnel needs and other resource requirements. The short-term nature of our customers' commitments and the changes in demand for their products may reduce our ability to estimate future customer requirements accurately. This may make it difficult to schedule production and maximize utilization of our manufacturing capacity. Anticipated orders may not materialize and delivery schedules may be deferred as a result of changes in demand for our products or our customers' products. We often increase staffing and capacity, and incur other expenses to meet the anticipated demand of our customers, which causes reductions in our gross margins if customer orders are delayed or canceled. On occasion, customers require rapid increases in production, which may stress our resources and reduce margins. We may not have sufficient capacity at any given time to meet our customers' demands. In addition, because many of our costs and operating expenses are relatively fixed over the short-term, a reduction in customer demand could harm our gross margin and operating income until such time as adjustments can be made to activity and operating levels or to structural costs.

We sell products to customers in cyclical industries that are subject to significant downturns that could materially adversely affect our business, financial condition and operating results.

We sell products to customers in cyclical industries that have experienced economic and industry downturns. The markets for our products have softened in the past and may again soften in the future. We may face reduced end-customer demand, underutilization of our manufacturing capacity, changes in our revenue mix and other factors that could adversely affect our results of operations in the near-term. We cannot predict whether we will achieve profitability in future periods.

We derive a substantial portion of our revenues from customers in the transportation, information technology and telecommunications industries and are susceptible to trends and factors affecting those industries.

Sales to the transportation, information technology and telecommunications industries represent a substantial portion of our revenues. Factors negatively affecting these industries and the demand for their products also negatively affect our business, financial condition and operating results. Any adverse occurrence, including among others, industry slowdown, recession, political instability, costly or constraining regulations, increased tariffs, reduced government budgets and spending, armed hostilities, terrorism, excessive inflation, prolonged disruptions in one or more of our customers' production schedules or labor disturbances, that results in a decline in the volume of sales in these industries, or in an overall downturn in the business and operations of our customers in these industries, could materially adversely affect our business, financial condition and operating results. These industries are generally unionized and some of our customers have experienced labor disruptions in the past. Furthermore, these industries are highly cyclical in nature and sensitive to changes in general economic conditions, consumer preferences and interest rates. The failure of manufacturers that we serve may result in the failure to receive payment in full for products sold in the past and an abrupt cancellation in demand for certain products. Weakness in demand, the insolvency of manufacturers that we serve or their suppliers, and constriction of credit markets may negatively and materially affect our facility utilization, cost structure, financial condition, and operating results.

Products we manufacture may contain design or manufacturing defects that could result in reduced demand for our products or services and liability claims against us.

Despite our quality control and quality assurance efforts, defects may occur in the products we manufacture due to design or manufacturing errors or component failure. Product defects could result in delayed shipments and reduced demand for our products. We may be subject to increased costs due to warranty claims on defective products. Product defects could result in product liability claims against us where defects cause, or are alleged to cause, property damage, bodily injury or death. As we grow our business in the transportation and medical device markets, the risk of exposure to product liability litigation increases. We may be required to participate in a recall involving products which are, or are alleged to be, defective. We carry insurance for certain legal matters involving product liability; however, we do not have coverage for all costs related to product defects and the costs of such claims, including costs of defense and settlement, may exceed our available coverage. Accordingly, our results of operations, cash flow and financial position could be adversely affected.

We are exposed to fluctuations in foreign currency exchange rates that may adversely affect our business, financial condition and operating results.

We transact business in various foreign countries. We present our consolidated financial statements in U.S. dollars, but a portion of our revenues and expenditures are transacted in other currencies. As a result, we are exposed to fluctuations in foreign currencies. Additionally, we have currency exposure arising from funds held in local currencies in foreign countries. Volatility in the exchange rates between the foreign currencies and the U.S. dollar could harm our business, financial condition and operating results. Furthermore, to the extent we sell our products in foreign markets, currency fluctuations may result in our products becoming too expensive for foreign customers.

Our operating results vary significantly from period to period.

We experience fluctuations in our operating results. Some of the principal factors that contribute to these fluctuations are: changes in demand for our products; our effectiveness in managing manufacturing processes, costs and timing of our component purchases so that components are available when needed for production, while mitigating the risks of purchasing inventory in excess of immediate production needs; the degree to which we are able to utilize our available manufacturing capacity; changes in the cost and availability of components, which often occur in the electronics manufacturing industry and which affect our margins and our ability to meet delivery schedules; general economic and served industry conditions; and local conditions and events that may affect our production volumes, such as labor conditions or political instability.

We face risks relating to our international operations.

Because we have significant international operations, our operating results and financial condition could be materially adversely affected by economic, political, health, regulatory and other factors existing in foreign countries in which we operate. Our international operations are subject to inherent risks, which may materially adversely affect us, including: political and economic instability in countries in which our products are manufactured; expropriation or the imposition of government controls; changes in government regulations; export license requirements; trade restrictions; earnings repatriation and expatriation restrictions; exposure to different legal standards, including related to intellectual property; health conditions and standards; currency controls; fluctuations in exchange rates; increases in the duties and taxes we pay; inflation or deflation; greater difficulty in collecting accounts receivable and longer payment cycles; changes in labor conditions and difficulties in staffing and managing our international operations; limitations on insurance coverage against geopolitical risks, natural disasters, and business operations; and communication among and management of international operations. In addition, these same factors may also place us at a competitive disadvantage compared to some of our foreign competitors.

We may face risks associated with violations of the Foreign Corrupt Practices Act ("FCPA") and similar anti-bribery laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business. Our Code of Ethics mandates compliance with these anti-bribery laws. We operate in many parts of the world where strict compliance with anti-bribery laws may conflict with local customs and practices. We cannot assure you that our internal controls and procedures always will protect us from the detrimental actions by our employees or agents. If we are found to be liable for FCPA violations (either due to our own acts or inadvertence or due to the acts or inadvertence of others), we could suffer from criminal or civil penalties or other sanctions, which could have a material adverse effect on our business.

Public health or safety concerns, conditions, or restrictions that impact the availability of labor or the movement of goods in some of the countries in which we operate could have a material adverse effect on our business, financial condition and operating results.

We may restructure our operations or fail to execute capital projects as planned, which may materially adversely affect our business, financial condition and operating results.

We have announced and initiated restructuring plans or capital projects at various times in the recent past designed to revise and consolidate certain aspects of our operations for the purpose of improving our cost structure or manufacturing efficiency. We may incur restructuring and impairment charges in the future if circumstances warrant. Additionally, if we are unsuccessful in implementing restructuring plans or in executing capital projects, we may experience disruptions in our operations and higher ongoing costs, which may materially adversely affect our business, financial condition and operating results.

Losses in the stock market could negatively impact pension asset returns and cash flow due to possible required contributions in the future.

We make a number of assumptions relating to our pension plans in order to measure the financial position of the plans and the net periodic benefit cost. The most significant assumptions relate to the discount rate and the expected long-term return on plan assets. If these assumptions prove to be significantly different from actual rates, then we may need to record additional expense relating to the pension plans, which could require cash contributions to fund future pension obligation payments and could have a material adverse effect on our financial condition and results of operations.

We may pursue acquisition opportunities that complement or expand our business as well as divestitures that could impact our business operations. We may not be able to complete these transactions, and these transactions, if executed, may pose significant risks that could materially adversely affect our business, financial condition and operating results.

On an ongoing basis we explore opportunities to buy other businesses or technologies that could complement, enhance or expand our current business or product lines or that might otherwise offer us growth opportunities. We may have difficulty finding suitable opportunities or, if we do identify these opportunities, we may not be able to complete the transactions for any number of reasons including a failure to secure financing. In addition, we may not be able to successfully or profitably integrate, operate, maintain and manage our newly acquired operations or employees. Any transactions that we are able to identify and complete may involve a number of risks, including: the diversion of management's attention from our existing business to integrate the operations and personnel of the acquired or combined business; possible adverse effects on our operating results during the integration process; difficulties managing and integrating operations in geographically dispersed locations; increases in our expenses and working capital requirements, which could reduce our return on invested capital; exposure to unanticipated liabilities of acquired companies; and our possible inability to achieve the intended objectives of the transaction. Even if we are initially successful in integrating a new operation, we may not be able to maintain uniform standards, controls, procedures and policies, and this may lead to operational inefficiencies. In addition, future acquisitions may result in dilutive issuances of equity securities or the incurrence of additional debt. These and other factors could harm our ability to achieve anticipated levels of profitability from acquired operations or realize other anticipated benefits of an acquisition, and could adversely affect our business and operating results.

We have in the past, and may in the future, consider divesting certain business operations. Divestitures may involve a number of risks, including the diversion of management's attention, significant costs and expenses, the loss of customer relationships and cash flow, and the disruption of operations in the affected business. Failure to timely complete or consummate a divestiture may negatively affect valuation of the affected business or result in restructuring charges.

If we are unable to protect our intellectual property or we infringe, or are alleged to infringe, on others' intellectual property rights, our business, financial condition and operating results could be materially adversely affected.

The success of our business depends, in part, upon our ability to protect trade secrets, trademarks, copyrights and patents, obtain or license patents and operate without infringing on the intellectual property rights of others. We rely on a combination of trade secrets, copyrights, patents, nondisclosure agreements and technical measures to protect our proprietary rights in our products and technology. The steps we have taken to prevent misappropriation of our technology may be inadequate. In addition, the laws of some foreign countries in which we operate do not protect our proprietary rights to the same extent as do the laws of the United States. Although we continue to evaluate and implement protective measures, there can be no assurance that these efforts will be successful. Our inability to protect our intellectual property rights could diminish or eliminate the competitive advantages that we derive from our technology, cause us to lose sales or otherwise harm our business.

We believe that patents will continue to play an important role in our business. However, there can be no assurance that we will be successful in securing patents for claims in any pending patent application or that any issued patent will provide us with any

competitive advantage. We also cannot provide assurance that the patents will not be challenged by third parties or that the patents of others will not materially adversely affect our ability to do business.

We may become involved in litigation in the future to protect our intellectual property or because others may allege that we infringed on their intellectual property. These claims and any resulting lawsuit could subject us to liability for damages and invalidate our intellectual property rights. If an infringement claim is successfully asserted by a holder of intellectual property rights, we may be required to cease marketing or selling certain products, pay penalties and spend significant time and money to develop a non-infringing product or process or to obtain licenses for the technology, process or information from the holder. We may not be successful in the development of a non-infringing alternative, or licenses may not be available on commercially acceptable terms, if at all, in which case we may lose sales and profits. In addition, any litigation could be lengthy and costly and could materially adversely affect us even if we are successful in the litigation.

We may experience shortages and increased costs of raw material and required electronic components.

Unanticipated raw material or electronic component shortages may prevent us from making scheduled shipments to customers. Our inability to make scheduled shipments could cause us to experience a shortfall in revenue, increase our costs and adversely affect our relationship with affected customers and our reputation as a reliable supplier. We may be required to pay higher prices for raw materials or electronic components in short supply and order these raw materials or electronic components in greater quantities to compensate for variable delivery times. We may also be required to pay higher prices for raw materials or electronic components due to inflationary trends regardless of supply. We are also dependent on our suppliers' ability to supply and deliver raw materials on a timely basis at negotiated prices. Any delay or inability to deliver raw materials by our suppliers may require that we attempt to mitigate such failure or fail to make deliveries to our customers on a timely basis. As a result, raw material or electronic component shortages, price increases, or failure to perform by our suppliers could adversely affect our operating results for a particular period due to the resulting revenue shortfall and/or increased costs.

Loss of our key management and other personnel, or an inability to attract key management and other personnel, could materially affect our business.

We depend on our senior executive officers and other key personnel to run our business. We do not have long-term employment contracts with our key personnel. The loss of any of these officers or other key personnel could adversely affect our operations. Competition for qualified employees among companies that rely heavily on engineering and technology is at times intense, and the loss of qualified employees or an inability to attract, retain and motivate additional highly skilled employees required for the operation and expansion of our business could hinder our ability to conduct research activities and develop marketable products successfully.

We are subject to a variety of environmental, health, and safety laws and regulations that expose us to potential financial liability.

Our operations are regulated by a number of federal, state, local and foreign environmental, health, and safety (“EHS”) laws and regulations that govern, among other things, air and water emissions, worker protection, and the handling, storage and disposal of hazardous materials. Compliance with EHS laws and regulations is a major consideration for us because we use hazardous materials in our manufacturing processes. If we violate EHS laws and regulations, we could be liable for substantial fines, penalties, and costs of mandated remedial actions. Our environmental permits could also be revoked or modified, which could require us to cease or limit production at one or more of our facilities, thereby materially adversely affecting our business, financial condition and operating results. EHS laws and regulations have generally become more stringent over time and could continue to do so, imposing greater compliance costs and increasing risks and penalties associated with any violation, which also could materially affect our business, financial condition and operating results.

We have been notified by the U.S. Environmental Protection Agency, state environmental agencies and, in some cases, groups of potentially responsible parties, that we are potentially liable for environmental contamination at several sites currently and formerly owned or operated by us, including sites designated as National Priorities List sites under the U.S. Environmental Protection Agency’s Superfund program. Superfund liability is joint and several and we may be held responsible for more than our share of contamination at a site. Although we estimate our potential environmental liability and reserve for such matters, we cannot assure you that our reserves will be sufficient to cover the actual costs that we incur as a result of these matters.

Future events, such as the notification of potential liability at new sites, the discovery of additional contamination or changes to an approved remedy at existing sites, changes to existing EHS environmental laws and regulations or their interpretation, and more

rigorous regulatory action by government authorities, may require additional expenditures by us, which could have a negative impact on our operations.

In addition, we could be affected by future laws or regulations imposed in response to climate change concerns. Such laws or regulations could have a material adverse effect on our business, financial condition, and results of operations.

Our indebtedness may adversely affect our financial health.

Our debt consists of borrowings under our revolving credit facility. Our indebtedness could, among other things: increase our vulnerability to general economic and industry conditions, including recessions; require us to use cash flow from operations to service our indebtedness, thereby reducing our ability to fund working capital, capital expenditures, research and development efforts and other expenses; limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate; place us at a competitive disadvantage compared to competitors that have less indebtedness; or limit our ability to borrow additional funds that may be needed to operate and expand our business. Moreover, an increase in interest rates could increase our interest expense.

Our credit facility contains provisions that could materially restrict our business.

Our revolving credit facility contains restrictions limiting our ability to: dispose of assets; incur certain additional debt; repay other debt or amend subordinated debt instruments; create liens on assets; make investments, loans or advances; make acquisitions or engage in mergers or consolidations; engage in certain transactions with our subsidiaries and affiliates; repurchase stock; or make dividend payments above a certain amount.

The restrictions contained in our credit facility could limit our ability to plan for or react to changes in market conditions or meet capital needs or could otherwise restrict our activities or business plans. These restrictions could adversely affect our ability to finance our operations, make strategic acquisitions, fund investments or other capital needs or engage in other business activities that could be in our interest.

Further, our ability to comply with our loan covenants may be affected by events beyond our control that could result in an event of default under our credit facility, or documents governing any other existing or future indebtedness. A default, if not cured or waived, may permit acceleration of our indebtedness. In addition, our lenders could terminate their commitments to make further extensions of credit under our credit facility. If our indebtedness is accelerated, we cannot be certain that we will have sufficient funds to pay the accelerated indebtedness or that we will have the ability to refinance accelerated indebtedness on terms favorable to us, or at all.

Regulations related to conflict minerals could adversely impact our business.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as conflict minerals, originating from the Democratic Republic of Congo ("DRC") and adjoining countries. As a result, the SEC adopted annual disclosure and reporting requirements for those companies who may use conflict minerals mined from the DRC and adjoining countries in their products. There have been and will continue to be costs associated with complying with these disclosure requirements, including diligence costs to determine the sources of minerals used in our products and other potential changes to products, processes or sources of supply to the extent necessary as a consequence of such verification activities. These rules could adversely affect the sourcing, supply and pricing of materials used in our products. As there may be only a limited number of suppliers offering conflict-free minerals, we cannot be sure that we will be able to obtain necessary conflict-free minerals from such suppliers in sufficient quantities or at competitive prices. Also, we may face reputational challenges if we determine that certain of our products contain conflict minerals or if we are unable to sufficiently verify the origins for all minerals used in our products through the procedures we may implement.

Ineffective internal control over our financial reporting may harm our business.

We are subject to the ongoing internal control provisions of Section 404 of the Sarbanes-Oxley Act of 2002 ("Sarbanes-Oxley"). Our controls necessary for continued compliance with Sarbanes-Oxley may not operate effectively or at all times and may result in a material weakness. The identification of material weaknesses in internal control over financial reporting could indicate a lack of proper controls to generate accurate financial statements. Further, the effectiveness of our internal controls may be impacted if we are unable to retain sufficient skilled finance and accounting personnel, especially in light of the increased demand for such personnel among publicly traded companies.

Natural disasters may adversely impact our capability to supply product to our customers.

Natural disasters, such as storms, flooding and associated power outages, occurring at any of our locations or supplier locations may lead to disruption of our manufacturing operations and supply chain, adversely impacting our capability to supply product to our customers. In the event of a natural disaster, it may not be possible for us to find an alternate manufacturing location for certain product lines, further impacting our capability to recover from such a disruption.

We could face risks to our systems, networks and production including increased IT security threats and more sophisticated and targeted computer crime.

Increased global information technology security threats and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data and communications. While we attempt to mitigate these risks by employing a number of measures - including employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems - our systems, networks and products remain potentially vulnerable to advanced persistent threats. Depending on their nature and scope, such threats could potentially lead to the compromising of confidential information and communications, improper use of our systems and networks, manipulation and destruction of data, defective products, production downtimes and operational disruptions, which in turn could adversely affect our reputation, competitiveness and results of operations. Additionally, any updates to or implementation of systems, including the selection and implementation of an ERP system, may cause delays or disruptions in our processes or production which could adversely affect our results.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

As of February 22, 2019, we had manufacturing facilities, administrative, research and development and sales offices in the following locations:

|

| | | | |

Manufacturing Facilities | Square Footage | Owned/Leased | |

Albuquerque, New Mexico | 114,525 |

| Leased | |

Bolingbrook, Illinois | 30,600 |

| Leased | |

Elkhart, Indiana | 319,000 |

| Owned | |

Haryana, India | 19,400 |

| Leased | |

Hopkinton, Massachusetts | 32,000 |

| Owned | |

Hradec Kralove, Czech Republic | 30,680 |

| Leased | |

Juarez, Mexico | 114,600 |

| Leased | |

Kaohsiung, Taiwan | 75,900 |

| Owned | (1) |

Kvistgaard, Denmark | 30,680 |

| Leased | |

Lisle, Illinois | 31,000 |

| Leased | |

Matamoros, Mexico | 51,000 |

| Owned | |

Nogales, Mexico | 64,000 |

| Leased | |

Ostrava, Czech Republic | 67,600 |

| Leased | |

Prague, Czech Republic | 13,660 |

| Leased | |

Tianjin, China | 225,000 |

| Owned | (2) |

Zhongshan, China | 112,600 |

| Leased | |

Total manufacturing | 1,332,245 |

| | |

(1) Ground lease through 2026; restrictions on use and transfer apply.

(2) Land Use Rights Agreement through 2050 includes transfer, lease and mortgage rights.

|

| | | | |

Non-Manufacturing Facilities | Square Footage | Owned/Leased | Description |

Brownsville, Texas | N/A |

| Owned | Land |

Brownsville, Texas | 10,000 |

| Leased | Warehouse |

El Paso, Texas | 22,400 |

| Leased | Office and warehouse |

Matamoros, Mexico | 20,000 |

| Leased | Warehouse |

Elkhart, Indiana | 93,000 |

| Owned | Idle facility |

Farmington Hills, Michigan | 1,800 |

| Leased | Sales office |

Glasgow, Scotland | 18,600 |

| Leased | Administrative offices and research |

Lisle, Illinois | 74,925 |

| Leased | Administrative offices and research |

Malden, Massachusetts | 3,600 |

| Leased | Administrative offices and research |

Nagoya, Japan | 800 |

| Leased | Sales office |

Singapore | 5,600 |

| Leased | Sales office |

Yokohama, Japan | 1,400 |

| Leased | Sales office |

Total non-manufacturing | 252,125 |

| | |

We regularly assess the adequacy of our manufacturing facilities for manufacturing capacity, available labor, and proximity to our markets and major customers. Management believes our manufacturing facilities are suitable and adequate, and have sufficient capacity to meet our current needs. The extent of utilization varies from plant to plant and with general economic conditions. We

also review the operating costs of our facilities and may from time-to-time relocate a portion of our manufacturing activities in order to reduce operating costs and improve asset utilization and cash flow.

Item 3. Legal Proceedings

From time to time we are involved in litigation with respect to matters arising from the ordinary conduct of our business, and currently certain claims are pending against us. In the opinion of management, based upon presently available information, either adequate provision for anticipated costs have been accrued or the ultimate anticipated costs will not materially affect our consolidated financial position, results of operations, or cash flows.

See Note 10 "Contingencies" in the Notes to the Consolidated Financial Statements in this Annual Report on Form 10-K.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the symbol "CTS." On February 19, 2019, there were approximately 962 shareholders of record.

As shown in the following table, we repurchased stock totaling $9,440 during the twelve months ended December 31, 2018:

|

| | | | | | | | | | | |

(in thousands, except share data) | (a) Total Number of Shares Purchased | (b) Average Price Paid per Share | (c) Total Value of Shares Purchased as Part of Plans or Program | (d) Maximum Value of Shares That May Yet Be Purchased Under the Plans or Programs(1) |

Balance at December 31, 2017 | |

| |

| |

| $ | 17,554 |

|

January 1, 2018 - September 30, 2018 | — |

| $ | — |

| $ | — |

| $ | 17,554 |

|

October 1, 2018 – December 31, 2018 | 342,100 |

| $ | 27.60 |

| $ | 9,440 |

| $ | 8,114 |

|

(1) In April 2015, the Board of Directors authorized a program to repurchase up to $25 million of our common stock in the open market. The authorization has no expiration.

On February 7, 2019, the Board of Directors of CTS authorized a new stock repurchase program with a maximum dollar limit of $25 million and no set expiration date. This new program replaces the program shown in the table above.

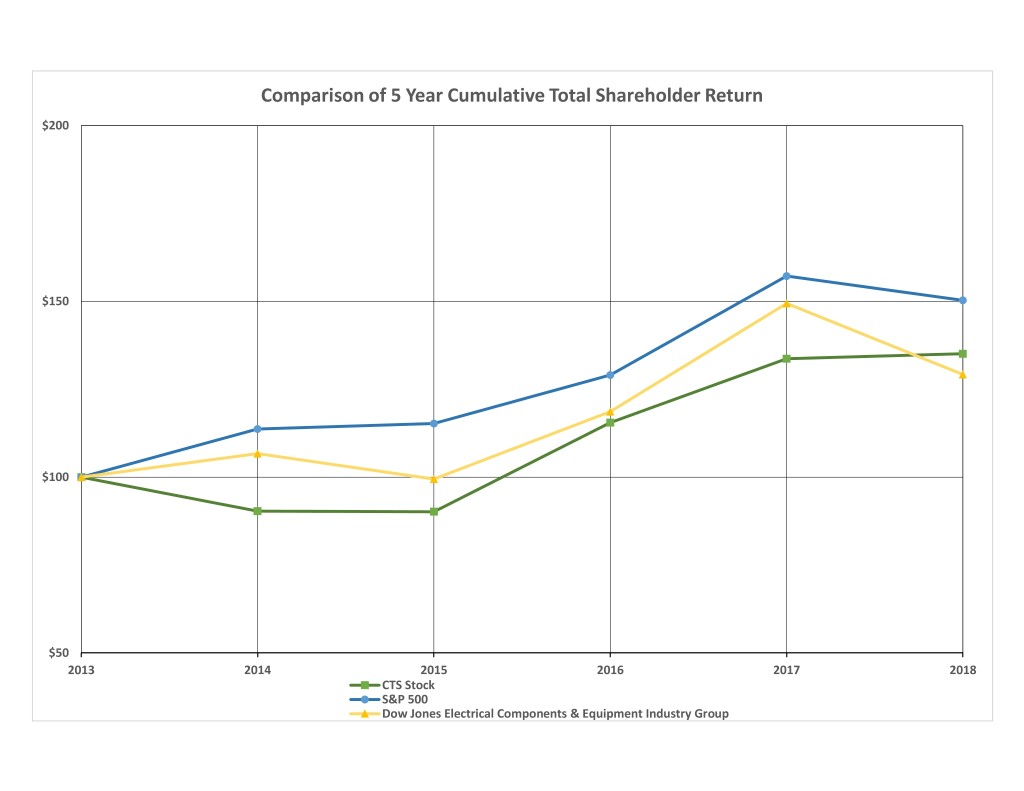

Shareholder Performance Graph

The following graph shows a five-year comparison of the cumulative total shareholder return on CTS common stock with the cumulative total returns of a general market index and a peer group index (S&P 500 and Dow Jones Electrical Components & Equipment Industry Group). The graph tracks the performance of a $100 investment in the Company's common stock and in each of the indexes (with the reinvestment of all dividends) on December 31, 2013.

Item 6. Selected Financial Data

Five-Year Summary

(Amounts in thousands, except percentages and per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 2018 | % of Sales | 2017 | % of Sales | 2016 | % of Sales | 2015 | % of Sales | 2014 | % of Sales |

Summary of Operations | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Net sales | $ | 470,483 |

| 100.0 |

| $ | 422,993 |

| 100.0 |

| $ | 396,679 |

| 100.0 |

| $ | 382,310 |

| 100.0 |

| $ | 404,021 |

| 100.0 |

|

Cost of goods sold | 305,510 |

| 64.9 |

| 282,562 |

| 66.8 |

| 256,251 |

| 64.6 |

| 255,201 |

| 66.8 |

| 274,058 |

| 67.8 |

|

Gross Margin | 164,973 |

| 35.1 |

| 140,431 |

| 33.2 |

| 140,428 |

| 35.4 |

| 127,109 |

| 33.2 |

| 129,963 |

| 32.2 |

|

Selling, general and administrative expenses | 73,569 |

| 15.6 |

| 71,943 |

| 17.0 |

| 61,624 |

| 15.5 |

| 59,586 |

| 15.6 |

| 61,051 |

| 15.1 |

|

Research and development expenses | 25,304 |

| 5.4 |

| 25,146 |

| 5.9 |

| 24,040 |

| 6.1 |

| 22,461 |

| 5.9 |

| 22,563 |

| 5.6 |

|

Non-recurring environmental expense | — |

| — |

| — |

| — |

| — |

| — |

| 14,541 |

| 3.8 |

| — |

| — |

|

Restructuring and impairment charges | 5,062 |

| 1.1 |

| 4,139 |

| 1.0 |

| 3,048 |

| 0.8 |

| 14,564 |

| 3.8 |

| 5,941 |

| 1.5 |

|

Loss (gain) on sale of assets | — |

| — |

| 708 |

| (2.9 | ) | (11,450 | ) | (2.9 | ) | (2,156 | ) | (0.6 | ) | (1,915 | ) | (0.5 | ) |

Operating earnings | 61,038 |

| 13.0 |

| 38,495 |

| 9.1 |

| 63,166 |

| 15.9 |

| 18,113 |

| 4.7 |

| 42,323 |

| 10.5 |

|

Other (expense) income | (2,935 | ) | (0.6 | ) | 1,758 |

| 0.4 |

| (5,921 | ) | (1.5 | ) | (5,852 | ) | (1.5 | ) | (2,975 | ) | (0.7 | ) |

Earnings before income taxes | 58,103 |

| 12.3 |

| 40,253 |

| 9.5 |

| 57,245 |

| 14.4 |

| 12,261 |

| 3.2 |

| 39,348 |

| 9.8 |

|

Income tax expense | 11,571 |

| 2.5 |

| 25,805 |

| 6.1 |

| 22,865 |

| 5.8 |

| 5,307 |

| 1.4 |

| 12,826 |

| 3.2 |

|

Net earnings | $ | 46,532 |

| 9.9 |

| $ | 14,448 |

| 3.4 |

| $ | 34,380 |

| 8.7 |

| $ | 6,954 |

| 1.8 |

| $ | 26,522 |

| 6.6 |

|

Retained earnings - beginning of year | 420,160 |

| |

| 410,979 |

| |

| 381,840 |

| |

| 380,145 |

| |

| 358,997 |

| |

|

Dividends declared | (5,278 | ) | |

| (5,267 | ) | |

| (5,241 | ) | |

| (5,259 | ) | |

| (5,374 | ) | |

|

Implementation of new accounting standard | 17,433 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| |

Retained earnings - end of year | $ | 478,847 |

| |

| $ | 420,160 |

| |

| $ | 410,979 |

| |

| $ | 381,840 |

| |

| $ | 380,145 |

| |

|

| | | | | | | | | | |

Net earnings per share: | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Basic | $ | 1.41 |

| |

| $ | 0.44 |

| |

| $ | 1.05 |

| |

| $ | 0.21 |

| |

| $ | 0.79 |

| |

|

Diluted | $ | 1.39 |

| |

| $ | 0.43 |

| |

| $ | 1.03 |

| |

| $ | 0.21 |

| |

| $ | 0.78 |

| |

|

| | | | | | | | | | |

Average basic shares outstanding (000s) | 33,024 |

| |

| 32,892 |

| |

| 32,728 |

| |

| 32,959 |

| |

| 33,618 |

| |

|

Average diluted shares outstanding (000s) | 33,569 |

| |

| 33,420 |

| |

| 33,251 |

| |

| 33,484 |

| |

| 34,130 |

| |

|

Cash dividends per share (annualized) | $ | 0.160 |

| |

| $ | 0.160 |

| |

| $ | 0.160 |

| |

| $ | 0.160 |

| |

| $ | 0.160 |

| |

|

Capital expenditures | $ | 28,488 |

| |

| $ | 18,094 |

| |

| $ | 20,500 |

| |

| $ | 9,723 |

| |

| $ | 12,949 |

| |

|

Depreciation and amortization | $ | 22,514 |

| |

| $ | 20,674 |

| |

| $ | 18,992 |

| |

| $ | 16,254 |

| |

| $ | 16,971 |

| |

|

| | | | | | | | | | |

Financial Position at Year End | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Current assets | $ | 239,359 |

| |

| $ | 233,609 |

| |

| $ | 215,707 |

| |

| $ | 245,954 |

| |

| $ | 240,401 |

| |

|

Current liabilities | 103,993 |

| |

| 102,412 |

| |

| 98,129 |

| |

| 94,620 |

| |

| 79,982 |

| |

|

Current ratio | 2.3 to 1 |

| |

| 2.3 to 1 |

| |

| 2.2 to 1 |

| |

| 2.5 to 1 |

| |

| 3.0 to 1 |

| |

|

Working capital | 135,366 |

| |

| 131,197 |

| |

| 117,578 |

| |

| 151,334 |

| |

| 160,419 |

| |

|

Inventories | 43,486 |

| |

| 36,596 |

| |

| 28,652 |

| |

| 24,600 |

| |

| 27,887 |

| |

|

Net property, plant and equipment | 99,401 |

| |

| 88,247 |

| |

| 82,111 |

| |

| 69,872 |

| |

| 71,414 |

| |

|

Total assets | 548,341 |

| |

| 539,696 |

| |

| 517,697 |

| |

| 483,373 |

| |

| 456,926 |

| |

|

Long-term debt | 50,000 |

| |

| 76,300 |

| |

| 89,100 |

| |

| 90,700 |

| |

| 75,000 |

| |

|

Long-term obligations, including long-term debt | 66,419 |

| |

| 93,479 |

| |

| 101,686 |

| |

| 107,099 |

| |

| 87,155 |

| |

|

Shareholders' equity | 377,929 |

| |

| 343,805 |

| |

| 317,882 |

| |

| 281,654 |

| |

| 289,789 |

| |

|

Common shares outstanding (000s) | 32,751 |

| |

| 32,938 |

| |

| 32,762 |

| |

| 32,548 |

| |

| 33,392 |

| |

|

Equity (book value) per share | $ | 11.54 |

| |

| $ | 10.44 |

| |

| $ | 9.70 |

| |

| $ | 8.65 |

| |

| $ | 8.68 |

| |

|

Stock price range | 24.07-39.20 |

| |

| 19.30-28.35 |

| |

| 12.87-24.80 |

| |

| 15.30-20.25 |

| |

| 15.58-21.65 |

| |

|

______________________________

Certain acquisitions, divestitures, closures of operations or product lines, and certain accounting reclassifications affect the comparability of information contained in the "Five-Year Summary."

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

CTS Corporation ("CTS", "we", "our" or "us") is a leading designer and manufacturer of products that Sense, Connect and Move. Our vision is to be a leading provider of sensing and motion devices as well as connectivity components, enabling an intelligent and seamless world. These devices are categorized by their ability to Sense, Connect or Move. Sense products provide vital inputs to electronic systems. Connect products allow systems to function in synchronization with other systems. Move products ensure required movements are effectively and accurately executed. We are committed to achieving our vision by continuing to invest in the development of products and technologies within these categories.

We manufacture sensors, actuators, and electronic components in North America, Europe, and Asia. CTS provides engineered products to OEMs in the aerospace and defense, industrial, information technology, medical, telecommunications, and transportation markets.

There is an increasing proliferation of sensing and motion applications within various markets we serve. In addition, the increasing connectivity of various devices to the internet results in greater demand for communication bandwidth and data storage, increasing the need for our connectivity products. Our success is dependent on the ability to execute our strategy to support these trends. We are subject to challenges including periodic market softness, competition from other suppliers, changes in technology, and the ability to add new customers, launch new products or penetrate new markets.

Results of Operations: Fourth Quarter 2018 versus Fourth Quarter 2017

(Amounts in thousands, except percentages and per share amounts):

The following table highlights changes in significant components of the Consolidated Statements of Earnings (Loss) for the quarters ended December 31, 2018, and December 31, 2017:

|

| | | | | | | | | | | | |

| Three Months Ended December 31, | | Percent of Net Sales |

| 2018 | 2017 | Percent Change | 2018 | 2017 |

Net sales | $ | 120,073 |

| $ | 110,910 |

| 8.3 |

| 100.0 |

| 100.0 |

|

Cost of goods sold | 77,428 |

| 78,035 |

| (0.8 | ) | 64.5 |

| 70.4 |

|

Gross margin | 42,645 |

| 32,875 |

| 29.7 |

| 35.5 |

| 29.6 |

|

Selling, general and administrative expenses | 18,128 |

| 24,973 |

| (27.4 | ) | 15.1 |

| 22.5 |

|

Research and development expenses | 5,804 |

| 6,714 |

| (13.6 | ) | 4.8 |

| 6.1 |

|

Restructuring and impairment charges | 1,698 |

| 1,197 |

| 41.9 |

| 1.4 |

| 1.1 |

|

(Gain) loss on sale of assets | (2 | ) | 10 |

| (120.0 | ) | — |

| — |

|

Total operating expenses | 25,628 |

| 32,894 |

| (22.1 | ) | 21.3 |

| 29.7 |

|

Operating earnings (loss) | 17,017 |

| (19 | ) | 89,663.2 |

| 14.2 |

| — |

|

Other (expense) income, net | (144 | ) | 164 |

| (187.8 | ) | (0.1 | ) | 0.1 |

|

Earnings before income tax | 16,873 |

| 145 |

| 11,536.6 |

| 14.1 |

| 0.1 |

|

Income tax (benefit) expense | (691 | ) | 13,766 |

| (105.0 | ) | (0.6 | ) | 12.4 |

|

Net earnings (loss) | $ | 17,564 |

| $ | (13,621 | ) | 228.9 |

| 14.6 |

| (12.3 | ) |

Diluted earnings per share: | |

| | |

| |

| |

|

Diluted net earnings (loss) per share | $ | 0.52 |

| $ | (0.41 | ) | |

| |

| |

|

Sales of $120,073 in the fourth quarter of 2018 increased $9,163 or 8.3% from the fourth quarter of 2017. Sales to transportation markets increased $5,163 or 7.2%. Sales to other end markets increased $4,000 or 10.2%. Changes in foreign exchange rates decreased sales by $880 year-over-year due to the U.S. Dollar appreciating compared to the Chinese Renminbi and Euro.

In the fourth quarter of 2017, we recorded a $13,415 one-time, non-cash pension settlement charge. During 2017, CTS offered its pension participants the opportunity to receive a lump sum payment to settle their future pension benefits. A number of participants elected the lump sum option, and the total lump sum payments distributed to these participants when the offer window closed in the fourth quarter was large enough to trigger a pension settlement charge under U.S. GAAP. This charge was recorded in the amount of $4,796 to cost of goods sold, $6,557 to selling, general and administrative expenses and $2,062 to research and development expenses.

Gross margin as a percent of sales was 35.5% in the fourth quarter of 2018 compared to 29.6% in the fourth quarter of 2017. The pension settlement charge recorded in the fourth quarter of 2017 impacted gross margin unfavorably by $4,796 or 4.3%. The

increase in gross margin was primarily driven by savings related to product line transfers associated with the June 2016 Restructuring Plan described in Note 8.

Selling, general and administrative expenses were $18,128 or 15.1% of sales in the fourth quarter of 2018 versus $24,973 or 22.5% of sales in the comparable quarter of 2017. The pension settlement charge recorded in the fourth quarter of 2017 impacted selling, general and administrative expenses unfavorably by $6,557 or 5.9%.

Research and development expenses were $5,804 or 4.8% of sales in the fourth quarter of 2018 compared to $6,714, or 6.1% of sales, in the comparable quarter of 2017. The pension settlement charge recorded in the fourth quarter of 2017 impacted research and development expenses unfavorably by $2,062, or 1.9%. Research and development expenses are focused on expanded applications of existing products, new product development, and enhancements for current products and processes.

Restructuring and impairment charges were $1,698 in the fourth quarter of 2018. These charges were mainly for building and equipment relocation, severance, and travel costs related to the restructuring of certain operations as part of the June 2016 Restructuring Plan. In the fourth quarter 2017, restructuring and impairment charges consisting of severance and other costs totaled $1,197, which were also in connection with our June 2016 Restructuring Plan.

Operating earnings were $17,017, or 14.2% of sales in the fourth quarter of 2018, compared to an operating loss of $19, or 0.0% of sales, in the comparable quarter of 2017 as a result of the items discussed above.

Other income and expense items are summarized in the following table:

|

| | | | | | |

| Three Months Ended December 31, |

| 2018 | 2017 |

Interest expense | $ | (484 | ) | $ | (1,134 | ) |

Interest income | 459 |

| 370 |

|

Other (expense) income | (119 | ) | 928 |

|

Total other (expense) income, net | $ | (144 | ) | $ | 164 |

|

Interest expense decreased in the fourth quarter of 2018 versus 2017 due to lower debt balances and a reduction in interest related to interest rate swaps. Interest income increased due to higher interest rates. Other income in the fourth quarter of 2017 was driven mainly by foreign currency translation gains due to the appreciation of the Chinese Renminbi compared to the U.S. Dollar.

|

| | | | |

| Three Months Ended December 31, |

| 2018 | 2017 |

Effective tax rate | (4.1 | )% | 9,493.8 | % |

The effective income tax rate for the fourth quarter of 2018 was (4.1)% compared to 9,493.8% in the fourth quarter of 2017. The tax rate in 2018 was impacted primarily by a discrete one-time rate change benefit related to the Tax Cuts and Jobs Act (“Tax Act”) resulting from the election of tax accounting method changes. The effective income tax rate in the fourth quarter of 2017 was primarily related to the initial application of the Tax Act including the remeasurement of the net deferred tax assets from 35% to 21% and the one-time mandatory transition tax on the historical earnings of foreign affiliates, which resulted in a net non-cash charge of $18,001.

Net earnings was $17,564, or $0.52 per diluted share, in the fourth quarter of 2018, compared to a net loss of $13,621, or $0.41 per share, in the comparable quarter of 2017.

Results of Operations: Year Ended December 31, 2018, versus Year Ended December 31, 2017

(Amounts in thousands, except percentages and per share amounts):

The following table highlights changes in significant components of the Consolidated Statements of Earnings for the years ended December 31, 2018, and December 31, 2017:

|

| | | | | | | | | | | |

| Years Ended December 31, | | Percent of Net Sales |

| 2018 | 2017 | Percent Change | 2018 | 2017 |

Net sales | $ | 470,483 |

| $ | 422,993 |

| 11.2 |

| 100.0 |

| 100.0 |

Cost of goods sold | 305,510 |

| 282,562 |

| 8.1 |

| 64.9 |

| 66.8 |

Gross margin | 164,973 |

| 140,431 |

| 17.5 |

| 35.1 |

| 33.2 |

Selling, general and administrative expenses | 73,569 |

| 71,943 |

| 2.3 |

| 15.6 |

| 17.0 |

Research and development expenses | 25,304 |

| 25,146 |

| 0.6 |

| 5.4 |

| 5.9 |

Restructuring and impairment charges | 5,062 |

| 4,139 |

| 22.3 |

| 1.1 |

| 1.0 |

Loss on sale of assets | — |

| 708 |

| (100.0 | ) | — |

| 0.2 |

Total operating expenses | 103,935 |

| 101,936 |

| 2.0 |

| 22.1 |

| 24.1 |

Operating earnings | 61,038 |

| 38,495 |

| 58.6 |

| 13.0 |

| 9.1 |

Other (expense) income, net | (2,935 | ) | 1,758 |

| (267.0 | ) | (0.6 | ) | 0.4 |

Earnings before income tax | 58,103 |

| 40,253 |

| 44.3 |

| 12.4 |

| 9.5 |