Table of Contents

As filed with the Securities and Exchange Commission on May 31, 2017

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CROWN HOLDINGS, INC.

(Exact name of Registrants as specified in their charter)

| Pennsylvania | 3411 | 75-3099507 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

One Crown Way

Philadelphia, Pennsylvania 19154

(215) 698-5100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CROWN AMERICAS LLC

| Pennsylvania | 3411 | 23-1526444 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

c/o Crown Holdings, Inc.

One Crown Way

Philadelphia, Pennsylvania 19154

(215) 698-4000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CROWN AMERICAS CAPITAL CORP. V

| Delaware | 3411 | 36-4845824 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

c/o Crown Holdings, Inc.

One Crown Way

Philadelphia, Pennsylvania 19154

(215) 698-4000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

William T. Gallagher, Esquire

Senior Vice President and General Counsel

Crown Holdings, Inc.

One Crown Way

Philadelphia, Pennsylvania 19154

(215) 698-5100

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Table of Contents

See Table of Additional Registrants Below

Copies to:

William G. Lawlor, Esquire

Ian A. Hartman, Esquire

Dechert LLP

Cira Centre

2929 Arch Street

Philadelphia, Pennsylvania 19104

(215) 994-4000

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per share |

Proposed maximum offering price(1) |

Amount of registration fee(2) | ||||

| 4.25% Senior Notes due 2026 |

$400,000,000 | 100% | $400,000,000 | $46,360 | ||||

| Guarantees of 4.25% Senior Notes due 2026 |

N/A | N/A | N/A | N/A(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) of the Securities Act. |

| (2) | The registration fee has been calculated pursuant to Rule 457(f) under the Securities Act. |

| (3) | No additional consideration is being received for the guarantees, and, therefore no additional fee is required. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Additional Registrants

| Exact Name of Additional Registrants |

Jurisdiction of Incorporation |

I.R.S. Employer Identification Number | ||

| CROWN Beverage Packaging Puerto Rico, Inc. |

Delaware | Not Applicable | ||

| Crown Consultants, Inc. |

Pennsylvania | 23-2846356 | ||

| Crown Cork & Seal Company (DE), LLC |

Delaware | Not Applicable | ||

| Crown Cork & Seal Company, Inc. |

Pennsylvania | 23-1526444 | ||

| Crown Financial Corporation |

Pennsylvania | 23-1603914 | ||

| Crown International Holdings, Inc. |

Delaware | 75-3099512 | ||

| CROWN Packaging Technology, Inc. |

Delaware | 52-2006645 | ||

| Foreign Manufacturers Finance Corporation |

Delaware | 51-0099971 | ||

| CROWN Cork & Seal USA, Inc. |

Delaware | 52-2006645 | ||

| CR USA, Inc. |

Delaware | 23-2162641 | ||

| Crown Beverage Packaging, LLC |

Delaware | 13-2853410 |

The address for service of each of the additional registrants is c/o Crown Holdings, Inc., One Crown Way, Philadelphia, Pennsylvania, telephone (215) 698-5100. The primary industrial classifications number for each of the additional registrants is 3411.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 31, 2017

PRELIMINARY PROSPECTUS

Crown Americas LLC

Crown Americas Capital Corp. V

OFFER TO EXCHANGE

$400,000,000 4.25% Senior Notes due 2026 and related Guarantees for all outstanding 4.25% Senior Notes due 2026

The exchange offer expires at 5:00 p.m., New York City time, on , 2017, unless extended. Crown Americas LLC (“Crown Americas”) and Crown Americas Capital Corp. V (“Crown Americas Capital V” and, together with Crown Americas, the “Issuers”) will exchange all old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. You may withdraw tenders of old notes at any time before the exchange offer expires.

The form and terms of the new notes will be identical in all material respects to the form and terms of the old notes, except that the new notes:

| • | will have been registered under the Securities Act; |

| • | will not bear restrictive legends restricting their transfer under the Securities Act; |

| • | will not be entitled to the registration rights that apply to the old notes; and |

| • | will not contain provisions relating to increased interest rates in connection with the old notes under circumstances related to the timing of the exchange offer. |

The new notes will be senior obligations of the issuers and initially will be guaranteed on a senior basis by their indirect parent, Crown Holdings, Inc. (“Crown”), and each of Crown’s U.S. subsidiaries (other than Crown Americas, Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV and Crown Americas Capital V) that guarantees obligations under Crown’s senior secured credit facilities, subject to customary release provisions. The entities providing such guarantees are referred to collectively as the guarantors. The notes will not be guaranteed by Crown’s foreign subsidiaries. The new notes and new note guarantees will be effectively junior in right of payment to all existing and future secured indebtedness of the issuers and the guarantors to the extent of the value of the assets securing such indebtedness and will be junior in right of payment to all indebtedness of Crown’s non-guarantor subsidiaries.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. Crown has agreed that, starting on the expiration date of the exchange offer and ending on the close of business one year after the expiration date, it will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

See “Risk Factors” beginning on page 12 for a discussion of risks that should be considered by holders prior to tendering their old notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017.

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 34 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 51 | ||||

| 60 | ||||

| 86 | ||||

| 91 | ||||

| 92 | ||||

| 92 | ||||

| 92 | ||||

| 92 | ||||

This prospectus incorporates important business and financial information that is not included in or delivered with this document. This information is available without charge upon written or oral request. To obtain timely delivery, note holders must request the information no later than five business days before the expiration date. The expiration date is , 2017. See “Incorporation of Documents by Reference.”

You should rely only on the information contained in this document and any supplement, including the periodic reports and other information we file with the Securities and Exchange Commission or to which we have referred you. See “Where You Can Find Additional Information.” Neither Crown Americas, Crown Americas Capital V nor Crown has authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. Neither Crown Americas, Crown Americas Capital V nor Crown is making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities.

The distribution of this prospectus and the offer or sale of the new notes may be restricted by law in certain jurisdictions. Persons who possess this prospectus must inform themselves about, and observe, any such restrictions. See “Plan of Distribution.” None of Crown Americas, Crown Americas Capital V, Crown or any of their respective representatives is making any representation to any offeree or purchaser under applicable legal investment or similar laws or regulations. Each prospective investor must comply with all applicable laws and regulations in force in any jurisdiction in which it purchases, offers or sells notes or possesses or distributes this prospectus and must obtain any consent, approval or permission required by it for the purchase, offer or sale by it of notes under the laws and regulations in force in any jurisdiction to which it is subject or in which it makes such purchases, offers or sales, and none of Crown Americas, Crown Americas Capital V, Crown or any of their respective representatives shall have any responsibility therefor.

i

Table of Contents

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities to any person in any jurisdiction where it is unlawful to make such an offer or solicitation.

MARKETS, RANKING AND OTHER DATA

The data included in this prospectus regarding markets and ranking, including the position of Crown and its competitors within these markets, are based on independent industry publications, reports of government agencies or other published industry sources and the estimates of Crown based on its management’s knowledge and experience in the markets in which it operates. We believe these data are accurate in all material respects as of the date of this prospectus. Crown’s estimates have been based on information obtained from customers, suppliers, trade and business organizations and other contacts in the markets in which it operates. This information may prove to be inaccurate because of the method by which Crown obtained some of the data for these estimates or because this information cannot always be independently verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other inherent limitations and uncertainties. Furthermore, facts, statistics and estimates upon which these publications and data are based and to which Crown cites in this prospectus may become outdated, obsolete or inaccurate as underlying facts or markets or industry conditions change.

ii

Table of Contents

The following summary should be read in connection with, and is qualified in its entirety by, the more detailed information and financial statements (including the accompanying notes) included elsewhere or incorporated by reference in this prospectus. See “Risk Factors” for a discussion of certain factors that should be considered in connection with this offering. Unless the context otherwise requires:

| • | “Crown” refers to Crown Holdings, Inc. and its subsidiaries on a consolidated basis; |

| • | “Crown Cork” refers to Crown Cork & Seal Company, Inc. and not its subsidiaries; |

| • | “Crown European Holdings” refers to Crown European Holdings SA and not its subsidiaries; |

| • | “Crown Americas” refers to Crown Americas LLC and not its subsidiaries; |

| • | “Crown Americas Capital V” refers to Crown Americas Capital Corp. V; |

| • | “we,” “us,” “our” and the “issuers” refer to Crown Americas and Crown Americas Capital V, collectively; |

| • | “old notes” refers to the $400 million aggregate principal amount of 4.25% Senior Notes due 2026 issued on September 8, 2016; |

| • | “new notes” refers to the $400 million aggregate principal amount of 4.25% Senior Notes due 2026 offered in exchange for the old notes pursuant to this prospectus; and |

| • | “notes” refers collectively to the old notes and the new notes. |

Crown Holdings, Inc.

Crown is a worldwide leader in the design, manufacture and sale of packaging products for consumer goods. Crown’s primary products include steel and aluminum cans for food, beverage, household and other consumer products and metal vacuum closures and caps. These products are manufactured in Crown’s plants both within and outside the U.S. and are sold through Crown’s sales organization to the soft drink, food, citrus, brewing, household products, personal care and various other industries. At December 31, 2016, Crown operated 146 plants along with sales and service facilities throughout 36 countries and had approximately 24,000 employees. Consolidated net sales for Crown in 2016 were approximately $8.3 billion with approximately 77% derived from operations outside the United States.

Table of Contents

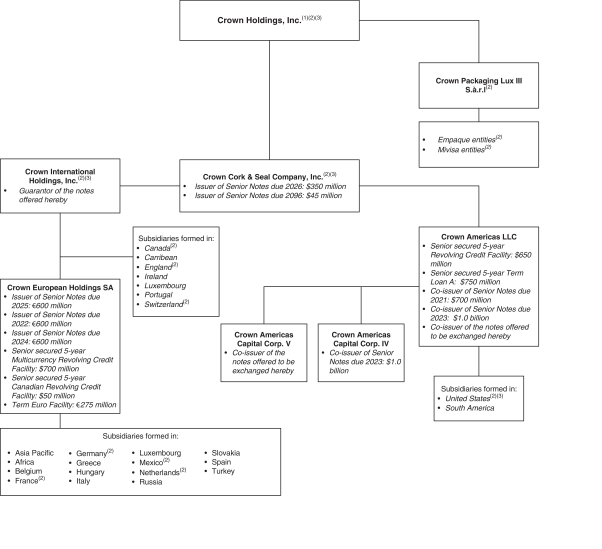

Organizational Structure

The following chart shows a summary of Crown’s current organizational structure, as well as the applicable obligors under the notes, other outstanding notes, and Crown’s senior secured credit facilities as of the date of this prospectus. Crown may modify this corporate structure in the future, subject to the covenants in the indenture governing the notes and compliance with the agreements governing Crown’s other outstanding indebtedness. The new notes offered hereby in exchange for the old notes are unsecured and guaranteed by Crown and each of Crown’s U.S. subsidiaries that guarantees obligations under Crown’s senior secured credit facilities (other than Crown Americas, Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV and Crown Americas Capital V). See “Capitalization.”

| 1) | Guarantor of outstanding debentures of Crown Cork. |

| 2) | Guarantors of outstanding senior notes and senior secured credit facilities of Crown European Holdings and its subsidiaries. |

2

Table of Contents

| 3) | Guarantors of the outstanding notes of Crown Americas LLC, Crown Americas Capital Corp. IV and the notes offered to be exchanged hereby, with the exception of the following U.S. subsidiaries: Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV, Crown Americas Capital V, Crownway Insurance Company and Crown, Cork & Seal Receivables (DE) Corporation. |

| 4) | Crown Metal Packaging Canada LP serves as the Canadian borrower. |

Crown is a Pennsylvania corporation. Crown’s principal executive offices are located at One Crown Way, Philadelphia, Pennsylvania 19154, and its telephone number is (215) 698-5100. Crown Cork is a Pennsylvania corporation. Crown Americas (formerly known as Crown Americas, Inc.) is a Pennsylvania limited liability company. Crown Americas Capital V is a Delaware corporation. Crown European Holdings (formerly known as CarnaudMetalbox SA) is a société anonyme organized under the laws of France. Each of Crown Americas, Crown Americas Capital V and Crown European Holdings is an indirect, wholly-owned subsidiary of Crown, and Crown Cork is a direct, wholly-owned subsidiary of Crown.

3

Table of Contents

The Exchange Offer

The summary below describes the principal terms of the exchange offer and is not intended to be complete. Certain of the terms and conditions described below are subject to important limitations and exceptions. The section of this prospectus entitled “The Exchange Offer” contains a more detailed description of the terms and conditions of the exchange offer.

On September 8, 2016, we issued and sold $400,000,000 4.25% Senior Notes due 2026. In connection with this sale, we entered into a separate registration rights agreement with the initial purchasers of the old notes in which we agreed to deliver this prospectus to you and to complete an exchange offer for the old notes.

| Notes Offered |

$400,000,000 4.25% Senior Notes due 2026. |

| The issuance of the new notes will be registered under the Securities Act. The terms of the new notes and old notes are identical in all material respects, except for transfer restrictions, registration rights relating to the old notes and certain provisions relating to increased interest rates in connection with the old notes under circumstances related to the timing of the exchange offer. You are urged to read the discussions under the heading “The New Notes” in this Summary for further information regarding the new notes. |

| The Exchange Offer |

We are offering to exchange the new notes for up to $400 million aggregate principal amount of the old notes. |

| Old notes may be exchanged only in denominations of $2,000 and any integral multiple of $1,000 in excess thereof. In this prospectus, the term “exchange offer” means this offer to exchange new notes for old notes in accordance with the terms set forth in this prospectus and the accompanying letter of transmittal. You are entitled to exchange your old notes for new notes. |

| Expiration Date; Withdrawal of Tender |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2017, or such later date and time to which it may be extended by us. The tender of old notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date of the exchange offer. Any old notes not accepted for exchange for any reason will be returned without expense to the tendering holder thereof promptly after the expiration or termination of the exchange offer. |

| Conditions to the Exchange Offer |

Our obligation to accept for exchange, or to issue new notes in exchange for, any old notes is subject to customary conditions relating to compliance with any applicable law or any applicable interpretation by the staff of the Securities and Exchange Commission, the receipt of any applicable governmental approvals and the absence of any actions or proceedings of any governmental agency or court which could materially impair Crown Americas’ or Crown Americas Capital V’s ability to consummate the exchange offer. See “The Exchange Offer—Conditions to the Exchange Offer.” |

4

Table of Contents

| Procedures for Tendering Old Notes |

If you wish to accept the exchange offer and tender your old notes, you must either: |

| • | complete, sign and date the Letter of Transmittal, or a facsimile of the Letter of Transmittal, in accordance with its instructions and the instructions in this prospectus, and mail or otherwise deliver such Letter of Transmittal, or the facsimile, together with the old notes and any other required documentation, to the exchange agent at the address set forth herein; or |

| • | if old notes are tendered pursuant to book-entry procedures, the tendering holder must arrange with the Depository Trust Company, or DTC, to cause an agent’s message to be transmitted through DTC’s Automated Tender Offer Program System with the required information (including a book-entry confirmation) to the exchange agent. |

| Broker-Dealers |

Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See “Plan of Distribution.” |

| Use of Proceeds |

We will not receive any proceeds from the exchange offer. See “Use of Proceeds.” |

| Exchange Agent |

U.S. Bank National Association is serving as the exchange agent in connection with the exchange offer. |

| U.S. Federal Income Tax Consequences |

The exchange of old notes for new notes pursuant to the exchange offer should not be a taxable event for U.S. federal income tax purposes. See “Certain Material U.S. Federal Income Tax Considerations.” |

5

Table of Contents

Consequences of Exchanging Old Notes Pursuant to the Exchange Offer

Based on certain interpretive letters issued by the staff of the Securities and Exchange Commission to third parties in unrelated transactions, Crown Americas and Crown Americas Capital V are of the view that holders of old notes (other than any holder who is an “affiliate” of the issuers within the meaning of Rule 405 under the Securities Act) who exchange their old notes for new notes pursuant to the exchange offer generally may offer the new notes for resale, resell such new notes and otherwise transfer the new notes without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that:

| • | the new notes are acquired in the ordinary course of the holders’ business; |

| • | the holders have no arrangement or understanding with any person to participate in a distribution of the new notes; and |

| • | neither the holder nor any other person is engaging in or intends to engage in a distribution of the new notes. |

Each broker-dealer that receives new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the new notes. See “Plan of Distribution.” If a holder of old notes does not exchange the old notes for new notes according to the terms of the exchange offer, the old notes will continue to be subject to the restrictions on transfer contained in the legend printed on the old notes. In general, the old notes may not be offered or sold, unless registered under the Securities Act, except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Holders of old notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. See “The Exchange Offer—Resales of New Notes.”

Additionally, if you do not participate in the exchange offer, you will not be able to require us to register your old notes under the Securities Act except in limited circumstances. These circumstances are:

| • | the exchange offer is not permitted by applicable law or SEC policy, |

| • | the exchange offer is not completed within 360 days of the issue date of the old notes, or |

| • | prior to the 20th day following consummation of the exchange offer: |

| • | any initial purchaser of the old notes requests that we register old notes that were not eligible to be exchanged for new notes in the exchange offer and that are held by it following consummation of the exchange offer; or |

| • | any holder of old notes notifies us that it is not eligible to participate in the exchange offer; or |

| • | any initial purchaser of the old notes notifies us that it will not receive freely tradable new notes in exchange for old notes constituting any portion of an unsold allotment. |

In these cases, the registration rights agreement requires us to file a registration statement for a continuous offering in accordance with Rule 415 under the Securities Act for the benefit of the holders of the old notes. We do not currently anticipate that we will register under the Securities Act any old notes that remain outstanding after completion of the exchange offer.

6

Table of Contents

The New Notes

The summary below describes the principal terms of the new notes and is not intended to be complete. Many of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Notes” section of this prospectus contains a more detailed description of the terms and conditions of the new notes.

| Issuers |

Crown Americas LLC, a Pennsylvania limited liability company, and Crown Americas Capital Corp. V, a Delaware corporation. |

| Notes Offered |

$400,000,000 principal amount of 4.25% Senior Notes due 2026. |

| Maturity |

September 30, 2026. |

| Interest |

Interest on the new notes will accrue from and will be payable on March 31 and September 30 of each year commencing on September 30, 2017. |

| Ranking and Guarantees |

The new notes will be senior obligations of Crown Americas and Crown Americas Capital V, ranking senior in right of payment to all subordinated indebtedness of Crown Americas and Crown Americas Capital V, and will be unconditionally guaranteed on an unsecured senior basis by Crown and each of Crown’s present and future U.S. subsidiaries (other than Crown Americas, Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV and Crown Americas Capital V) that from time to time are obligors under or guarantee Crown’s senior secured credit facilities. |

| The new notes and new note guarantees will be senior unsecured obligations of the issuers and the guarantors, |

| • | effectively subordinated to all existing and future secured indebtedness of the issuers and the guarantors to the extent of the value of the assets securing such indebtedness, including any borrowings under Crown’s senior secured credit facilities, to the extent of the value of the assets securing such indebtedness; |

| • | structurally subordinated to all indebtedness of subsidiaries of Crown that do not guarantee the notes offered hereby which include all of Crown’s foreign subsidiaries and any U.S. subsidiaries that are neither obligors nor guarantors of Crown’s senior secured credit facilities; |

| • | ranking equal in right of payment to any existing or future senior indebtedness of the issuers and the guarantors; and |

| • | ranking senior in right of payment to all existing and future subordinated indebtedness of the issuers and the guarantors. |

| Upon the release of any new note guarantor from its obligations under Crown’s senior secured credit facilities, unless there is existing a |

7

Table of Contents

| default or event of default under the indenture governing the new notes, the guarantee of such new notes by such new note guarantor will also be released. |

| As of March 31, 2017, Crown and its subsidiaries had approximately $5.3 billion of indebtedness, including $1.4 billion of secured indebtedness and $2.1 billion of additional indebtedness of non-guarantor subsidiaries. |

| Additional Indebtedness |

Crown may be able to incur additional debt in the future. Although the agreements governing Crown’s outstanding indebtedness, including Crown’s senior secured credit facilities, and the indentures governing Crown’s other outstanding notes contain restrictions on Crown’s ability to incur indebtedness, those restrictions are subject to a number of exceptions. |

| Net Sales and Income from operations from Non-Guarantors |

The non-guarantor subsidiaries of Crown represented in the aggregate approximately 77% of consolidated net sales for each of the fiscal years ended December 31, 2015 and December 31, 2016 and for the three months ended March 31, 2017 (calculated using $6,749 million of net sales by non-guarantor subsidiaries for the fiscal year ended December 31, 2015, $6,366 for the fiscal year ended December 31, 2016 and $1,456 for the three months ended March 31, 2017, divided by Crown’s total consolidated net sales of $8,762 million for the fiscal year ended December 31, 2015, $8,284 for the fiscal year ended December 31, 2016 and $1,901 for the three months ended March 31, 2017). |

| For the fiscal year ended December 31, 2015, the fiscal year ended December 31, 2016 and the three months ended March 31, 2017, the non-guarantor subsidiaries of Crown represented in the aggregate approximately 81%, 85% and 84%, respectively, of consolidated income from operations (calculated using $752 million, $872 million and $199 million of income from operations from non-guarantor subsidiaries for the fiscal year ended December 31, 2015, the fiscal year ended December 31, 2016 and the three months ended March 31, 2017, respectively, divided by Crown’s total consolidated income from operations of $927 million for the fiscal year ended December 31, 2015, $1,021 million for the fiscal year ended December 31, 2016 and $237 million for the three months ended March 31, 2017). |

| Optional Redemption |

The issuers may redeem some or all of the new notes at any time prior to March 31, 2026 by paying a “make-whole” premium as set forth under “Description of the Notes—Optional Redemption,” plus accrued and unpaid interest, if any, to the redemption date. |

| Change of Control |

Upon a “change of control repurchase event” of Crown, as defined under the caption “Description of the Notes—Repurchase at the Option of Holders,” you will have the right, as a holder of new notes, |

8

Table of Contents

| to require the issuers to repurchase all or part of your new notes at a repurchase price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. Crown will comply, to the extent applicable, with requirements of Section 14(e) of the Securities Exchange Act of 1934, as amended, and any other securities laws or regulations in connection with the repurchase of notes in the event of a change of control repurchase event. |

| Restrictive Covenants |

The indenture governing the new notes limits, among other things, Crown’s ability and the ability of certain of its subsidiaries (including the issuers) to incur secured indebtedness and engage in certain sale and leaseback transactions. |

| These covenants are subject to a number of important exceptions and limitations that are described under the caption “Description of the Notes—Certain Covenants.” |

Risk Factors

Participation in the exchange offer involves risks. You should carefully consider all of the information in this prospectus. In particular, you should evaluate the specific risk factors set forth under the caption “Risk Factors” in this prospectus.

9

Table of Contents

Summary Historical Consolidated Financial Data

The following table sets forth summary historical consolidated financial data for Crown. The summary of operations data, balance sheet data and other financial data for each of the years in the three-year period ended December 31, 2016 have been derived from Crown’s audited consolidated financial statements and the notes thereto. The summary of operations data, balance sheet data and other financial data for the three-month periods ended March 31, 2016 and 2017 have been derived from Crown’s unaudited consolidated financial statements and the notes thereto. You should read the following financial information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Crown’s audited consolidated financial statements and unaudited consolidated financial statements, the related notes and the other financial information included and incorporated by reference in this prospectus.

| (dollars in millions) | ||||||||||||||||||||

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| Summary of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 9,097 | $ | 8,762 | $ | 8,284 | $ | 1,893 | $ | 1,901 | ||||||||||

| Cost of products sold, excluding depreciation and amortization |

7,525 | 7,116 | 6,583 | 1,521 | 1,519 | |||||||||||||||

| Depreciation and amortization |

190 | 237 | 247 | 60 | 59 | |||||||||||||||

| Selling and administrative expense |

398 | 390 | 368 | 91 | 90 | |||||||||||||||

| Provision for asbestos |

40 | 26 | 21 | — | — | |||||||||||||||

| Restructuring and other |

129 | 66 | 44 | 2 | (4 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

815 | 927 | 1,021 | 219 | 237 | |||||||||||||||

| Loss from early extinguishments of debt |

34 | 9 | 37 | 27 | — | |||||||||||||||

| Interest expense |

253 | 270 | 243 | 64 | 62 | |||||||||||||||

| Interest income |

(7 | ) | (11 | ) | (12 | ) | (3 | ) | (3 | ) | ||||||||||

| Foreign exchange |

14 | 20 | (16 | ) | (6 | ) | (1 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

521 | 639 | 769 | 137 | 179 | |||||||||||||||

| Provision for income taxes |

43 | 178 | 186 | 38 | 46 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income |

478 | 461 | 583 | 99 | 133 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to noncontrolling interests |

(88 | ) | (68 | ) | (87 | ) | (20 | ) | (26 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to Crown Holdings |

$ | 390 | $ | 393 | $ | 496 | $ | 79 | $ | 107 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (dollars in millions) | ||||||||||||||||||||

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Net cash flows provided by/(used for): |

||||||||||||||||||||

| Operating activities |

$ | 912 | $ | 956 | $ | 930 | $ | (408 | ) | $ | (320 | ) | ||||||||

| Investing activities |

(1,021 | ) | (1,548 | ) | (442 | ) | (48 | ) | (104 | ) | ||||||||||

| Financing activities |

445 | 406 | (616 | ) | (4 | ) | 199 | |||||||||||||

| Capital expenditures |

(328 | ) | (354 | ) | (473 | ) | (51 | ) | (107 | ) | ||||||||||

| Ratio of earnings to fixed charges(1) |

2.9 | 3.2 | 3.8 | 3.0 | 3.7 | |||||||||||||||

10

Table of Contents

| (dollars in millions) | ||||||||||||||||||||

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 965 | $ | 717 | $ | 559 | $ | 257 | $ | 338 | ||||||||||

| Working capital(2) |

695 | 141 | (55 | ) | 186 | 392 | ||||||||||||||

| Total assets |

9,673 | 10,050 | 9,599 | 9,970 | 9,870 | |||||||||||||||

| Total debt |

5,194 | 5,518 | 4,911 | 5,599 | 5,300 | |||||||||||||||

| Total equity |

337 | 385 | 668 | 503 | 859 | |||||||||||||||

| (1) | For purposes of computing the ratio of earnings to fixed charges, earnings consist of income before income taxes and equity earnings plus fixed charges (exclusive of interest capitalized during the period), amortization of interest previously capitalized and distributed income from less-than-50%-owned companies. Fixed charges include interest incurred, expensed and capitalized, amortization of debt issue costs and the portion of rental expense that is deemed representative of an interest factor. For purposes of the covenants in the indenture governing Crown’s outstanding notes, the ratio of earnings to fixed charges is defined differently. |

| (2) | Working capital consists of current assets less current liabilities. |

11

Table of Contents

You should carefully consider the risks described below, as well as the other information contained in this prospectus, before deciding whether to participate in the exchange offer. The risks described below are not the only ones that we face. Additional risks not presently known to us may also impair our business operations. The actual occurrence of any of these risks could materially adversely affect our business, financial condition and results of operations. In that case, the value of the new notes could decline substantially, and you may lose part or all of your investment.

Risks Related to the Exchange Offer

If you fail to exchange your old notes for new notes your old notes will continue to be subject to restrictions on transfer and may become less liquid.

We did not register the old notes under the Securities Act or any state securities laws, nor do we intend to after the exchange offer. In general, you may only offer or sell the old notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. If you do not exchange your old notes in the exchange offer, you will lose your right to have the old notes registered under the Securities Act, subject to certain limitations. If you continue to hold old notes after the exchange offer, you may be unable to sell the old notes.

Because we anticipate that most holders of old notes will elect to exchange their old notes, we expect that the liquidity of the market for any old notes remaining after the completion of the exchange offer will be substantially limited. Any old notes tendered and exchanged in the exchange offer will reduce the aggregate principal amount of the old notes outstanding. Following the exchange offer, if you do not tender your old notes you generally will not have any further registration rights, and your old notes will continue to be subject to certain transfer restrictions. Accordingly, the liquidity of the market for the old notes could be adversely affected.

If an active trading market for the new notes does not develop, the liquidity and value of the new notes could be harmed.

There is no existing market for the new notes. An active public market for the new notes may not develop or, if developed, may not continue. If an active public market does not develop or is not maintained, you may not be able to sell your new notes at their fair market value or at all.

Even if a public market for the new notes develops, trading prices will depend on many factors, including prevailing interest rates, Crown’s operating results and the market for similar securities. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the new notes. Declines in the market for debt securities generally may also materially and adversely affect the liquidity of the new notes, independent of Crown’s financial performance.

You must comply with the exchange offer procedures in order to receive new notes.

The new notes will be issued in exchange for the old notes only after timely receipt by the exchange agent of the old notes or a book-entry confirmation related thereto, a properly completed and executed letter of transmittal or an agent’s message and all other required documentation. If you want to tender your old notes in exchange for new notes, you should allow sufficient time to ensure timely delivery. None of us, Crown nor the exchange agent are under any duty to give you notification of defects or irregularities with respect to tenders of old notes for exchange. Old notes that are not tendered or are tendered but not accepted will, following the exchange offer, continue to be subject to the existing transfer restrictions. In addition, if you tender the old notes in the exchange offer to participate in a distribution of the new notes, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For additional information, please refer to the sections entitled “The Exchange Offer” and “Plan of Distribution” later in this prospectus.

12

Table of Contents

Some persons who participate in the exchange offer must deliver a prospectus in connection with resales of the new notes.

Based on interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1983), we believe that you may offer for resale, resell or otherwise transfer the new notes without compliance with the registration and prospectus delivery requirements of the Securities Act. However, in some instances described in this prospectus under “Plan of Distribution,” you will remain obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer your new notes. In these cases, if you transfer any new note without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange under the Securities Act, you may incur liability under the Securities Act. We do not and will not assume, or indemnify you against, this liability.

Risks Related to the New Notes

The substantial indebtedness of Crown could prevent it from fulfilling its obligations under its indebtedness, including the new notes and the new note guarantees.

Crown has substantial outstanding indebtedness. As a result of Crown’s substantial indebtedness, a significant portion of Crown’s cash flow will be required to pay interest and principal on its outstanding indebtedness, and Crown may not generate sufficient cash flow from operations, or have future borrowings available under its senior secured credit facilities, to enable it to repay its indebtedness, including the new notes, or to fund other liquidity needs. As of March 31, 2017, Crown and its subsidiaries had approximately $5.3 billion of indebtedness, including approximately $1.4 billion of secured indebtedness and $2.1 billion of additional indebtedness of non-guarantor subsidiaries and the ability to borrow $804 million under Crown’s senior secured revolving credit facilities. Crown’s ratio of earnings to fixed charges, was 3.2 times for the fiscal year ended December 31, 2015, 3.8 times for the fiscal year ended December 31, 2016 and 3.7 times for the three months ended March 31, 2017.

Crown’s sources of liquidity include securitization facilities with program limits that expire as follows: $200 million in December 2018 and $160 million in December 2019. Additional sources of liquidity include borrowings that mature as follows: its $1.4 billion revolving credit facilities in April 2022; its €650 million ($694 million at March 31, 2017) 4.0% senior notes in July 2022; its $1 billion 4.50% senior notes in January 2023; its €600 million ($641 million at March 31, 2017) 2.625% senior notes in September 2024; its €600 million ($641 million at March 31, 2017) 3.375% senior notes in May 2025; its $400 million 4.25% senior notes in September 2026; its $350 million 7.375% senior notes in December 2026; its $45 million 7.5% senior notes in December 2096; and its $124 million of other indebtedness in various currencies at various dates through 2036. In addition, Crown’s term loan facilities mature as follows: $750 million in April 2022 and €275 million in April 2022. See “Description of Certain Indebtedness.”

The substantial indebtedness of Crown could:

| • | make it more difficult for Crown and its subsidiaries to satisfy their obligations with respect to the new notes, such as the issuer’s obligation to purchase new notes tendered as a result of a change in control of Crown; |

| • | increase Crown’s vulnerability to general adverse economic and industry conditions, including rising interest rates; |

| • | restrict Crown from making strategic acquisitions or exploiting business opportunities, including any planned expansion in emerging markets; |

| • | limit Crown’s ability to make capital expenditures both domestically and internationally in order to grow Crown’s business or maintain manufacturing plants in good working order and repair; |

13

Table of Contents

| • | limit, along with the financial and other restrictive covenants under Crown’s indebtedness, Crown’s ability to obtain additional financing, dispose of assets or pay cash dividends; |

| • | require Crown to dedicate a substantial portion of its cash flow from operations to service its indebtedness, thereby reducing the availability of its cash flow to fund future working capital, capital expenditures, research and development expenditures and other general corporate requirements; |

| • | require Crown to sell assets used in its business; |

| • | limit Crown’s ability to refinance its existing indebtedness, particularly during periods of adverse credit market conditions when refinancing indebtedness may not be available under interest rates and other terms acceptable to Crown or at all; |

| • | increase Crown’s cost of borrowing; |

| • | limit Crown’s flexibility in planning for, or reacting to, changes in its business and the industry in which it operates; and |

| • | place Crown at a competitive disadvantage compared to its competitors that have less debt. |

If its financial condition, operating results and liquidity deteriorate, Crown’s creditors may restrict its ability to obtain future financing and its suppliers could require prepayment or cash on delivery rather than extend credit which could further diminish Crown’s ability to generate cash flows from operations sufficient to service its debt obligations. In addition, Crown’s ability to make payments on and refinance its debt and to fund its operations will depend on Crown’s ability to generate cash in the future.

Crown and Crown Americas are holding companies with no direct operations and the new notes will be structurally subordinated to all indebtedness of Crown’s subsidiaries that are not guarantors of the new notes.

Crown and Crown Americas are holding companies with no direct operations and for the fiscal years ended December 31, 2015 and December 31, 2016 and the three months ended March 31, 2017, the subsidiaries of Crown that do not guarantee the notes represented in the aggregate approximately 77%, 77% and 77% of consolidated net sales, and 81%, 85% and 84% of consolidated income from operations, respectively. The principal assets of Crown and Crown Americas are the equity interests and investments they hold in their subsidiaries. As a result, they depend on dividends and other payments from their subsidiaries to generate the funds necessary to meet their financial obligations, including the payment of principal of and interest on their outstanding debt. Their subsidiaries are legally distinct from them and have no obligation to pay amounts due on their debt or to make funds available to them for such payment except as provided in the note guarantees or pursuant to intercompany notes. Not all of Crown’s or Crown Americas’ subsidiaries will guarantee the new notes. Specifically, none of Crown’s or Crown Americas’ foreign subsidiaries are expected to guarantee the new notes. A holder of new notes will not have any claim as a creditor against subsidiaries of Crown or Crown Americas that are not guarantors of the new notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those non-guarantor subsidiaries will be effectively senior to your claims. The new notes are the joint and several obligations of Crown Americas and Crown Americas Capital V. Crown Americas Capital V has no assets or operations and is prohibited from engaging in any business activities except in connection with the issuance of the new notes.

The new notes do not impose any limitations on Crown’s ability to incur additional debt, guarantees or other obligations or make restricted payments.

The indenture that governs the new notes does not restrict the future incurrence of unsecured indebtedness, guarantees or other obligations. Except for the limitations on granting liens on the capital stock and indebtedness of its subsidiaries and on certain limited assets Crown and certain of its subsidiaries own (or on entering into sale and leaseback transactions with respect to those assets), the indenture does not restrict Crown’s ability to incur

14

Table of Contents

secured indebtedness, grant liens on its assets or engage in sale and leaseback transactions. See “Description of the Notes—Limitation on Liens” and “Description of the Notes—Limitation on Sale and Leaseback Transactions.” In addition, the indenture governing the new notes does not contain many other restrictions contained in the indentures governing certain of Crown’s existing senior notes, including limitations on asset sales or on paying dividends or making other restricted payments or investments.

Your right to receive payments on the new notes is effectively subordinated to Crown’s existing secured indebtedness, including Crown’s existing senior secured credit facilities, and possible future secured borrowings.

The new notes and the new note guarantees will be effectively subordinated to the prior payment in full of Crown’s, Crown Americas’ and the guarantors’ current and future secured indebtedness to the extent of the value of the assets securing such indebtedness. As of March 31, 2017, Crown and its subsidiaries had approximately $5.3 billion of indebtedness, including approximately $1.4 billion of secured indebtedness. Such secured indebtedness may increase if Crown incurs secured indebtedness, including under Crown’s senior secured revolving credit facilities, to finance an acquisition or otherwise. Because of the liens on the assets securing the senior secured credit facilities, in the event of the bankruptcy, wind-up, reorganization, liquidation or dissolution of the borrowers or any guarantor of such indebtedness, the assets of the borrowers or guarantors would be available to pay obligations under the new notes offered to be exchanged hereby and other unsecured obligations only after payments had been made on the borrowers’ or the guarantors’ secured indebtedness. Sufficient assets may not remain after these payments have been made to make any payments on the new notes offered to be exchanged hereby and Crown’s other unsecured obligations, including payments of interest when due. Holders of the new notes offered to be exchanged hereby will participate ratably with all holders of other unsecured obligations that are deemed to be of the same class as the new notes offered to be exchanged hereby, and potentially with all of Crown’s other general creditors, based upon the respective amounts owed to each holder or creditor, in Crown’s remaining assets. As a result, holders of the new notes offered to be exchanged hereby may receive less ratably than holders of secured indebtedness. In addition, all payments on the notes and the note guarantees will be prohibited in the event of a payment default on Crown’s secured indebtedness (including borrowings under the senior secured credit facilities) and, for limited periods, upon the occurrence of other defaults under the existing senior secured credit facilities. See “Description of Certain Indebtedness.”

Crown may not be able to generate sufficient cash to service all of its indebtedness, including the new notes offered to be exchanged hereby, and may be forced to take other actions to satisfy its obligations under its indebtedness, which may not be successful.

Crown’s ability to make scheduled payments on and to refinance its indebtedness, including the new notes offered to be exchanged hereby, and to fund planned capital expenditures and research and development efforts, will depend on Crown’s ability to generate cash in the future. This is subject to general economic, financial, competitive, legislative, regulatory and other factors that may be beyond Crown’s control.

We cannot assure you, however, that Crown’s business will generate sufficient cash flow from operations or that future borrowings will be available in an amount sufficient to enable Crown to pay its indebtedness, including the new notes offered to be exchanged hereby, or to fund its other liquidity needs. If Crown’s cash flows and capital resources are insufficient to fund its debt service obligations, Crown may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance its indebtedness, including the new notes offered to be exchanged hereby. We cannot assure you that Crown would be able to take any of these actions, that these actions would be successful and permitted under the terms of Crown’s existing or future debt agreements or that Crown could release from these actions sufficient proceeds to meet any debt service obligations then due.

15

Table of Contents

Some of Crown’s indebtedness is subject to floating interest rates, which would result in Crown’s interest expense increasing if interest rates rise.

As of March 31, 2017, approximately $1.5 billion of Crown’s $5.3 billion of total indebtedness and other outstanding obligations were subject to floating interest rates. Changes in economic conditions could result in higher interest rates, thereby increasing Crown’s interest expense and reducing funds available for operations or other purposes. Crown’s annual interest expense was $243 million, $270 million and $253 million for 2016, 2015 and 2014, respectively. Based on the amount of variable rate debt outstanding at March 31, 2017, a 1% increase in variable interest rates would increase its annual interest expense by $15 million. Accordingly, Crown may experience economic losses and a negative impact on earnings as a result of interest rate fluctuation. The actual effect of a 1% increase could be more than $15 million as Crown’s average borrowings on its variable rate debt may be higher during the year than the amount at March 31, 2017. In addition, the cost of Crown’s securitization and factoring facilities would also increase with an increase in floating interest rates. Although Crown may use interest rate protection agreements from time to time to reduce its exposure to interest rate fluctuations in some cases, it may not elect or have the ability to implement hedges or, if it does implement them, there can be no assurance that such agreements will achieve the desired effect. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Market Risk” and “Quantitative and Qualitative Disclosures About Market Risk” in Crown’s Annual Report on Form 10-K for the year ended December 31, 2016, and “Quantitative and Qualitative Disclosures About Market Risk” in Crown’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, which are incorporated by reference in this prospectus.

Notwithstanding Crown’s current indebtedness levels and restrictive covenants, Crown may still be able to incur substantial additional debt or make certain restricted payments, which could exacerbate the risks described above.

Crown may be able to incur additional debt in the future, including in connection with acquisitions or joint ventures. Although Crown’s senior secured credit facilities and indentures governing its outstanding notes contain restrictions on Crown’s ability to incur indebtedness, those restrictions are subject to a number of exceptions, and, under certain circumstances, indebtedness incurred in compliance with these restrictions could be substantial. Crown may also consider investments in joint ventures or acquisitions or increased capital expenditures, which may increase Crown’s indebtedness. Moreover, although Crown’s senior secured credit facilities and indentures governing certain of its outstanding notes contain restrictions on Crown’s ability to make restricted payments, including the declaration and payment of dividends and the repurchase of Crown’s common stock, Crown is able to make such restricted payments under certain circumstances which may increase indebtedness, and Crown may in the future establish a regular dividend on Crown common stock. Adding new debt to current debt levels or making otherwise restricted payments could intensify the related risks that Crown and its subsidiaries now face. See “Capitalization” and “Description of Certain Indebtedness.”

Restrictive covenants in the debt agreements governing Crown’s other current or future indebtedness could restrict Crown’s operating flexibility.

The indentures and the agreements governing Crown’s senior secured credit facilities and certain of its outstanding notes contain affirmative and negative covenants that limit the ability of Crown and its subsidiaries to take certain actions. These restrictions may limit Crown’s ability to operate its businesses and may prohibit or limit its ability to enhance its operations or take advantage of potential business opportunities as they arise. Crown’s senior secured credit facilities require Crown to maintain specified financial ratios and satisfy other financial conditions. The agreements or indentures governing Crown’s senior secured credit facilities and certain of its outstanding notes restrict, among other things, the ability of Crown and the ability of all or substantially all of its subsidiaries to:

| • | incur additional debt; |

| • | pay dividends or make other distributions, repurchase capital stock, repurchase subordinated debt and make certain investments or loans; |

16

Table of Contents

| • | create liens and engage in sale and leaseback transactions; |

| • | create restrictions on the payment of dividends and other amounts to Crown from subsidiaries; |

| • | make loans, investments and capital expenditures; |

| • | change accounting treatment and reporting practices; |

| • | enter into agreements restricting the ability of a subsidiary to pay dividends to, make or repay loans to, transfer property to, or guarantee indebtedness of, Crown or any of its subsidiaries; |

| • | sell or acquire assets, enter into leaseback transactions and merge or consolidate with or into other companies; and |

| • | engage in transactions with affiliates. |

In addition, the indentures and the agreements governing Crown’s senior secured credit facilities and certain of its outstanding notes limit, among other things, the ability of Crown to enter into certain transactions, such as mergers, consolidations, joint ventures, asset sales, sale and leaseback transactions and the pledging of assets. Furthermore, if Crown or certain of its subsidiaries experience specific kinds of changes of control, Crown’s senior secured credit facilities will be due and payable and Crown will be required to offer to repurchase outstanding notes.

The breach of any of these covenants by Crown or the failure by Crown to meet any of these ratios or conditions could result in a default under any or all of such indebtedness. If a default occurs under any such indebtedness, all of the outstanding obligations thereunder could become immediately due and payable, which could result in a default under Crown’s other outstanding debt and could lead to an acceleration of obligations related to the notes and other outstanding debt. The ability of Crown to comply with these covenants or indentures governing other indebtedness it may incur in the future and its outstanding notes can be affected by events beyond its control and, therefore, it may be unable to meet these ratios and conditions.

The indenture governing the new notes and Crown’s senior secured credit facilities and indentures governing other existing notes permit Crown to repurchase Crown’s existing notes, thereby reducing the amounts available to satisfy Crown’s obligations under the new notes.

The indenture governing the new notes and Crown’s senior secured credit facilities and the indentures governing its existing notes permit the repurchase by Crown of outstanding indebtedness and any such repurchases would reduce the amounts available to satisfy Crown’s obligations under the new notes. Crown’s outstanding notes will not be expressly subordinated to the new notes. Crown may from time to time consider repurchasing existing notes, including outstanding notes that are scheduled to mature after the maturity date of the new notes.

Crown is subject to certain restrictions that may limit its ability to make payments on its debt, including on the new notes and the new note guarantees, out of the cash reserves shown on Crown’s consolidated financial statements.

The ability of Crown’s subsidiaries and joint ventures to pay dividends, make distributions, provide loans or make other payments to Crown may be restricted by applicable state and foreign laws, potentially adverse tax consequences and their agreements, including agreements governing their debt.

In addition, the equity interests of Crown’s joint venture partners or other shareholders in Crown’s non-wholly owned subsidiaries in any dividend or other distribution made by these entities would need to be satisfied on a proportionate basis with Crown. As a result, Crown may not be able to access the cash flow of these entities to service its debt, including the new notes, and Crown cannot assure you that the amount of cash and cash flow reflected on Crown’s financial statements will be fully available to Crown.

17

Table of Contents

The new note guarantee of a subsidiary guarantor will be released if such subsidiary guarantor no longer guarantees or is otherwise an obligor of indebtedness under any Crown credit facility.

Any subsidiary guarantee of the new notes may be released without action by, or consent of, any holder of the new notes or the trustee under the indenture if the subsidiary guarantor is no longer a guarantor or an obligor of any Crown credit facility or other indebtedness as described under “Description of the Notes—Ranking and Guarantees.” The lenders under Crown’s senior secured credit facilities will have the discretion to release the subsidiary guarantees under the senior secured credit facilities in a variety of circumstances. You will not have a claim as a creditor against any subsidiary that is no longer a subsidiary guarantor of the new notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will effectively be senior to your claims.

The new notes and the new note guarantees may be voidable, subordinated or limited in scope under insolvency, fraudulent transfer, corporate or other laws.

Fraudulent transfer and insolvency laws may void, subordinate or limit the new notes and the new note guarantees. See “Description of the Notes—Certain Bankruptcy and Fraudulent Transfer Limitations.”

Under U.S. federal bankruptcy laws or comparable provisions of state fraudulent transfer laws, the issuance of the new note guarantees by Crown and the subsidiary guarantors could be voided, or claims in respect of such obligations could be subordinated to all of their other debts and other liabilities, if, among other things, at the time Crown and/or the subsidiary guarantors issued the related new note guarantees, or, potentially, the old note guarantees, Crown or the applicable subsidiary guarantor intended to hinder, delay or defraud any present or future creditor, or received less than reasonably equivalent value or fair consideration for the incurrence of such indebtedness and either:

| • | was insolvent or rendered insolvent by reason of such incurrence; |

| • | was engaged in a business or transaction for which Crown’s or such subsidiary guarantor’s remaining assets constituted unreasonably small capital; or |

| • | intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

By its terms, the new note guarantee of each guarantor will limit the liability of each such guarantor to the maximum amount it can pay without the new note guarantee being deemed a fraudulent transfer.

Crown’s senior secured credit facilities provide that certain change of control events constitute an event of default. In the event of a change of control, Crown, Crown Americas and the guarantors may not be able to satisfy all of their obligations under the senior secured credit facilities, the new notes or other indebtedness.

Crown, Crown Americas and the guarantors may not have sufficient assets or be able to obtain sufficient third-party financing on favorable terms to satisfy all of their obligations under Crown’s senior secured credit facilities, the new notes or other indebtedness in the event of a change of control. If Crown or Crown Americas experiences a change of control repurchase event, the issuers will be required to offer to repurchase all outstanding new notes. However, Crown’s senior secured credit facilities provide that certain change of control events constitute an event of default under the senior secured credit facilities. Such an event of default entitles the lenders thereunder to, among other things, cause all outstanding debt obligations under the senior secured credit facilities to become due and payable and to proceed against the collateral securing the senior secured credit facilities. Any event of default or acceleration of the senior secured credit facilities will likely also cause a default under the terms of other indebtedness of Crown.

In addition, Crown’s senior secured credit facilities contain, and any future credit facilities or other agreements to which Crown becomes a party may contain, restrictions on its ability to offer to repurchase the

18

Table of Contents

new notes in connection with a change of control. In the event a change of control repurchase event occurs at a time when it is prohibited from offering to purchase the new notes, the issuers could seek consent to offer to purchase the new notes or attempt to refinance the borrowings that contain such a prohibition. If it does not obtain the consent or refinance the borrowings, the issuers would remain prohibited from offering to purchase the new notes. In such case, the failure by the issuers to offer to purchase the new notes would constitute a default under the indenture governing the new notes, which, in turn, could result in amounts outstanding under any future credit facility or other agreement relating to indebtedness being declared due and payable. Any such declaration could have adverse consequences to Crown, the issuers and the holders of the new notes.

You may not be able to determine when a change of control has occurred and may not be able to require the issuers to purchase the new notes as a result of a change in the composition of the directors on Crown’s board of directors.

Legal uncertainty regarding what constitutes a change of control repurchase event and the provisions of the indenture may allow Crown to enter into transactions, such as acquisitions, refinancings or recapitalizations, that would not constitute a change of control repurchase event but may increase Crown’s outstanding indebtedness or otherwise affect Crown’s ability to satisfy its obligations under the new notes. The definition of change of control includes a phrase relating to the transfer of “all or substantially all” of the assets of Crown and its subsidiaries taken as a whole. Although there is a limited body of case law interpreting the phrase “substantially all,” there is no precise established definition of the phrase under applicable law. Accordingly, your ability to require the issuers to repurchase new notes as a result of a transfer of less than all of the assets of Crown to another person may be uncertain.

In addition, in a 2009 decision, the Court of Chancery of the State of Delaware raised the possibility that a change of control put right occurring as a result of a failure to have “continuing directors” comprising a majority of a board of directors might be unenforceable on public policy grounds.

Any decline in the ratings of Crown’s corporate credit could adversely affect the trading price of the new notes.

Any decline in the ratings of our corporate credit or any indications from the rating agencies that their ratings on Crown’s corporate credit are under surveillance or review with possible negative implications could adversely affect the value of the new notes. In addition, a ratings downgrade could adversely affect our ability to access capital.

Risks Related to Crown’s Business

Crown’s international operations, which generated approximately 77% of its consolidated net sales in 2016, are subject to various risks that may lead to decreases in its financial results.

Crown is an international company, and the risks associated with operating in foreign countries may have a negative impact on Crown’s liquidity and net income. Crown’s international operations generated approximately 77% of its consolidated net sales in the years ended 2016 and 2015, 76% of its consolidated net sales in the year ended 2014 and 77% of its consolidated net sales in the three months ended March 31, 2017. In addition, Crown’s business strategy includes continued expansion of international activities, including within developing markets and areas, such as the Middle East, South America, and Asia, that may pose greater risk of political or economic instability. Approximately 38%, 37%, 32% and 39% of Crown’s consolidated net sales in the years ended 2016, 2015 and 2014, and the three months ended March 31, 2017, respectively, were generated outside of the developed markets in Western Europe, the United States and Canada. Furthermore, if economic conditions in Europe deteriorate, there will likely be a negative effect on Crown’s European business, as well as the businesses of Crown’s European customers and suppliers. If economic conditions ultimately lead to a significant devaluation of the euro, the value of Crown’s financial assets that are denominated in euros would be significantly reduced when translated to U.S. dollars for financial reporting purposes. Any of these conditions could ultimately harm Crown’s overall business, prospects, operating results, financial condition and cash flows.

19

Table of Contents

Emerging markets are a focus of Crown’s international growth strategy. The developing nature of these markets and the nature of Crown’s international operations generally are subject to various risks, including:

| • | foreign government’s restrictive trade policies; |

| • | inconsistent product regulation or policy changes by foreign agencies or governments; |

| • | duties, taxes or government royalties, including the imposition or increase of withholding and other taxes on remittances and other payments by non-U.S. subsidiaries; |

| • | customs, import/export and other trade compliance regulations; |

| • | foreign exchange rate risks; |

| • | difficulty in collecting international accounts receivable and potentially longer payment cycles; |

| • | increased costs in maintaining international manufacturing and marketing efforts; |

| • | non-tariff barriers and higher duty rates; |

| • | difficulties associated with expatriating cash generated or held abroad in a tax-efficient manner and changes in tax laws; |

| • | difficulties in enforcement of contractual obligations and intellectual property rights and difficulties in protecting intellectual property or sensitive commercial and operations data or information technology systems generally; |

| • | exchange controls; |

| • | national and regional labor strikes; |

| • | geographic, language and cultural differences between personnel in different areas of the world; |

| • | high social benefit costs for labor, including costs associated with restructurings; |

| • | civil unrest or political, social, legal and economic instability, such as recent political turmoil in the Middle East; |

| • | product boycotts, including with respect to the products of Crown’s multi-national customers; |

| • | customer, supplier, and investor concerns regarding operations in areas such as the Middle East; |

| • | taking of property by nationalization or expropriation without fair compensation; |

| • | imposition of limitations on conversions of foreign currencies into dollars or payment of dividends and other payments by non-U.S. subsidiaries; |

| • | hyperinflation and currency devaluation in certain foreign countries where such currency devaluation could affect the amount of cash generated by operations in those countries and thereby affect Crown’s ability to satisfy its obligations; |

| • | war, civil disturbance, global or regional catastrophic events, natural disasters, such as flooding in Southeast Asia, widespread outbreaks of infectious diseases, including in emerging markets, and acts of terrorism; |

| • | geographical concentration of Crown’s factories and operations and regional shifts in its customer base; |

| • | periodic health epidemic concerns; |

| • | the complexity of managing global operations; and |

| • | compliance with applicable anti-corruption or anti-bribery laws. |

There can be no guarantee that a deterioration of economic conditions in countries in which Crown operates or may seek to operate in the future would not have a material impact on Crown’s results of operations.

20

Table of Contents

As Crown seeks to expand its business globally, growth opportunities may be impacted by greater political, economic and social uncertainty and the continuing and accelerating globalization of businesses could significantly change the dynamics of Crown’s competition, customer base and product offerings.