UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 4, 2011

THERAPEUTICSMD, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-16731

|

87-0233535

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

951 Broken Sound Parkway NW, Suite 320, Boca Raton, FL 33487

(Address of principal executive offices and Zip Code)

(516) 961-1911

(Registrant’s telephone number, including area code)

AMHN, INC.

10611 N. Hayden Rd., Suite D106, Scottsdale, AZ 85260

(Former Name and Address of Registrant)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

TABLE OF CONTENTS

|

Cautionary Statement Concerning Forward-Looking Information

|

3

|

|

Explanatory Note

|

3

|

|

4

|

|

|

4

|

|

|

Agreement and Plan of Merger with VitaMedMD, LLC

|

4

|

|

Form 10 Information

|

6

|

|

The Business

|

6

|

|

Reports to Security Holders

|

23

|

|

Risk Factors

|

24

|

|

Risks Related to VitaMed's Business and Industry

|

24

|

|

Risks Related to VitaMed's Dependence on Third Parties

|

35

|

|

Risks Related to the Company's Common Stock

|

36

|

|

Trends, Risks and Uncertainties

|

41

|

|

Selected Financial Information

|

42

|

|

Management's Discussion and Analysis or Plan of Operations

|

43

|

|

Summary of Key Results

|

43

|

|

Properties

|

47

|

|

Security Ownership of Certain Beneficial Owners and Management

|

48

|

|

Directors and Executive Officers

|

49

|

|

Executive Compensation

|

53

|

|

Certain Relationships and Related Transactions and Director Independence

|

57

|

|

Legal Proceedings

|

59

|

|

Market Price of and Dividends on Common Equity and Related Stockholder Matters

|

59

|

|

Indemnification of Directors and Officers

|

60

|

|

Financial Statements

|

62

|

|

62

|

|

|

63

|

|

|

63

|

|

|

64

|

|

2

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This report contains certain forward-looking statements (as such term is defined in Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and information relating to the Company that are based on the current beliefs of the Company’s management as well as assumptions made by and information currently available to management, including statements related to the markets for the Company’s products, general trends and trends in the Company’s operations or financial results, plans, expectations, estimates and beliefs. When used in this report, the words "anticipate," "believe," "estimate,"

"expect," "intend," "plan," "predict," "opinion," "will" and similar expressions and their variants, as they relate to the Company or the Company’s management, may identify forward-looking statements. Such statements reflect the Company’s judgment as of the date of this report with respect to future events, the outcome of which is subject to certain risks, including the risk factors described herein, which may have a significant impact on the Company’s business, operating results or financial condition. You are cautioned that these forward-looking statements are inherently uncertain. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described herein. See Item 2.01, Form 10

Information, Risk Factors for examples of factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected or assumed in our forward-looking statements. The Company undertakes no obligation to update forward-looking statements.

EXPLANATORY NOTE

Upon the closing of the Agreement and Plan of Merger as more fully described below (the "Merger"), TherapeuticsMD, Inc., a Nevada corporation formerly known as AMHN, Inc. ("Therapeutics," "AMHN," or the "Company"), became the parent company of VitaMedMD, LLC, a Delaware limited liability company ("VitaMed"). Unless otherwise provided in this Current Report on Form 8-K (the "Report"), all references in this Report to "we," "us," "our Company," "our," "Therapeutics," the "Company," or the "Registrant" refers to Therapeutics. Unless otherwise indicated in this Report, all references in this Report to the Company’s Board of Directors shall refer to the Board of Directors of Therapeutics which was reconstituted

upon the closing of the Merger. The business of Therapeutics following the Merger primarily consists of those of its subsidiary, VitaMed. This Report contains summaries of the material terms of various agreements executed in connection with the Merger and related transactions.

3

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On July 18, 2011, AMHN, Inc., a Nevada corporation ("AMHN" or the "Company") entered into an Agreement and Plan of Merger ("Merger Agreement") by and among VitaMedMD, LLC, a Delaware limited liability company ("VitaMed") and VitaMed Acquisition, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company ("Merger Sub"), pursuant to which the Company would acquire 100% of VitaMed. The proposed acquisition was to be accomplished by the merger of Merger Sub with and into VitaMed with VitaMed being the surviving limited liability company (the "Merger") in accordance with the Limited Liability Company Act of the State of Delaware. The

Merger became effective upon the filing of the Certificate of Merger with the Secretary of State of the State of Delaware on October 4, 2011 (the "Effective Time").

In preparation of and prior to the closing of the Merger Agreement, the Company completed the following required corporate actions with an effective date of October 3, 2011:

|

·

|

a reverse split of its outstanding shares of Common Stock on a ratio of 1 for 100 (the "Reverse Split"),

|

|

·

|

an increase of its authorized shares of Common Stock to 250,000,000,

|

|

·

|

a change in the name of the Company to TherapeuticsMD, Inc., and

|

|

·

|

an amendment to the Company's Long Term Incentive Compensation Plan ("LTIP") to increase the authorized shares for issuance thereunder to 25,000,000.

|

The Merger Agreement was filed as an exhibit to the Current Report on Form 8-K filed with the Securities and Exchange Commission (the "Commission") on July 21, 2011. The closing of the Merger Agreement is further discussed in Item 201, Completion of Acquisition or Disposition of Assets, Agreement and Plan of Merger with VitaMedMD, LLC below.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

AGREEMENT AND PLAN OF MERGER WITH VITAMEDMD, LLC

On October 4, 2011, the Closing Date of the Merger Agreement, the Company acquired 100% of VitaMed in exchange for the issuance of shares of the Company's Common Stock, as more fully described below (the "Merger"). In accordance with the provisions of this triangulated merger, Merger Sub was merged with and into VitaMed as of the Effective Date. Upon consummation of the Merger Agreement and all transactions contemplated therein, the separate existence of Merger Sub ceased and VitaMed became a wholly owned subsidiary of the Company. .

Corporate Actions Prior to Closing of Agreement

On July 18, 2011, prior to and in anticipation of the Merger, the sole member of the Company's Board of Directors (the "Sole Director") and the Company's majority shareholder owning 53.7% of the Company's then-outstanding shares of Common Stock ("Consenting Shareholder") consented to and approved the following corporate actions:

|

·

|

A Reverse Split of the Company's 16,575,209 issued and outstanding shares of Common Stock. As a result of the Reverse Split, each share of Common Stock outstanding on the July 28, 2011 (the "Record Date"), without any action on the part of the holder thereof, became one one-hundredth of a share of Common Stock. The Reverse Split decreased the number of outstanding shares of the Company's Common Stock by approximately 99% resulting in 165,856 shares outstanding after the Reverse Split. The effectuation of the Reverse Split did not result in a change in the relative equity position or voting power of the shareholders of the Company.

|

4

|

·

|

An increase in the Company's number of shares of Common Stock authorized for issuance to 250,000,000.

|

|

·

|

A change in the name of the Company to TherapeuticsMD, Inc.

|

|

·

|

An amendment to the Company's LTIP to increase the shares authorized for issuance thereunder to 25,000,000.

|

The effective date for the above-mentioned corporate actions was October 3, 2011.

Exchange of Securities

At the Effective Time, all outstanding membership units of VitaMed (the "Units") were exchanged for shares of the Company's Common Stock. In addition, all outstanding VitaMed options ("Options") and VitaMed warrants ("Warrants") were exchanged and converted into options and warrants for the purchase of the Company's Common Stock ("Company Options" and "Company Warrants"). All Units, Options and Warrants were exchanged on a pro-rata basis for shares of the Company's Common Stock which in the aggregate totaled 70,000,000 shares, resulting in a conversion ratio calculated by the sum of all outstanding Units, Options and Warrants divided by 70,000,000 (the

"Conversion Ratio"). Pursuant to the Conversion Ratio, the Company will issue 58,407,331 shares of the Company's Common Stock in exchange for the outstanding Units and will reserve for issuance an aggregate of 10,365,281 shares issuable upon the exercise of the Company's Options. The Company assumed VitaMed warrants that were originally issued in conjunction with the sale of VitaMed Promissory Notes, and pursuant to the Conversion Ratio, will issue Company Warrants for the purchase of an aggregate of 613,718 shares of the Company's Common Stock. The Company also assumed VitaMed's obligation to subsequently issue warrants to affiliates in consideration for their guarantee of a bank loan for the benefit of VitaMed (the "Reserved Warrants"). Pursuant to the Conversion Ratio, the Reserved Warrants for the purchase of 613,710 shares of the Company's Common

Stock will be issued to certain officers and directors of the Company once they are earned.

Aggregate Beneficial Ownership of Therapeutics' Common Stock After the Transaction

After giving effect to the Reverse Split, and taking into consideration the issuance of the 58,407,331 aforementioned shares in exchange for the Units, the number of shares of the Company's Common Stock issued and outstanding is 58,573,187 of which the members of VitaMed own approximately 99%.

All shares of the Company's Common Stock issued in exchange for the Units, and to be issued upon exercise of the Company Options and Warrants, are subject to a lock-up agreement for a period of eighteen (18) months from the Closing.

The aggregated beneficial ownership of the Company's shares of outstanding Common Stock on a fully diluted basis is as follows:

|

●

|

The members who exchanged their Units in connection with the Merger acquired an aggregate beneficial ownership of approximately ninety-nine percent (99%) of the issued and outstanding shares of Common Stock of the Company; and

|

|

●

|

Shareholders beneficially owning 100% of the shares of the Company's Common Stock immediately prior to the consummation of the Transaction were diluted to an aggregate beneficial ownership of approximately one percent (1%) of the issued and outstanding shares of Common Stock of the Company.

|

5

A discussion of beneficial ownership of the Company's directors, officers and principal shareholders is set forth herein at Security Ownership of Certain Beneficial Owners and Management.

FORM 10 INFORMATION

THE BUSINESS

Corporate Overview and History of Therapeutics, Inc.

The Company was incorporated in Utah in 1907 under the name Croff Mining Company. The Company changed its name to Croff Oil Company in 1952 and in 1996 changed its name to Croff Enterprises, Inc. In the twenty (20) years prior to 2008, Croff's operations consisted entirely of oil and natural gas leases. Due to a spin-off of its operations in December 2007, Croff had no business operations or revenue source and had reduced its operations to a minimal level although it continued to file reports required under the Exchange Act. As a result of the spin-off, Croff was a "shell company" under the rules of the Commission. In July 2009, the Company (i) closed a transaction to

acquire America's Minority Health Network, Inc. as a wholly owned subsidiary, (ii) ceased being a shell company, and (iii) experienced a change in control in which the former shareholders of America's Minority Health Network, Inc. acquired control of the Company.

On September 14, 2009, the Company changed its name to AMHN, Inc.

On June 11, 2010, the Company closed a transaction to acquire Spectrum Health Network, Inc. as a wholly owned subsidiary.

On July 20, 2010, the Company filed Articles of Conversion and Articles of Incorporation to redomicile in the State of Nevada and changed the par value of its shares of capital stock to $0.001 per share. On July 31, 2010, the Company transferred the assets of America's Minority Health Network, Inc. to a secured noteholder in exchange for the satisfaction of debt associated therewith.

On February 15, 2011, the Company transferred the assets of Spectrum Health Network, Inc. to a secured noteholder in exchange for the satisfaction of debt associated therewith and in exchange for an Exclusive Licensing, Distribution and Advertising Sales Agreement under which the Company sells subscription services and advertising on the Spectrum Health Network for commissions.

On August 3, 2011, in anticipation of closing the Merger, the Company filed Amended and Restated Articles of Incorporation to change its name to TherapeuticsMD, Inc. and to increase the shares of Common Stock authorized for issuance to 250,000,000.

On October 4, 2011, the Company closed the Merger. Unless otherwise stated or unless the context otherwise requires, the description of our business set forth below is provided on a combined basis, taking into account our newly-acquired wholly owned subsidiary, VitaMed.

The Company maintains a website at www.therapeuticsmd.com.

Corporate Overview and History of VitaMedMD, LLC

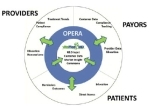

VitaMed is a specialty pharmaceutical company organized as a limited liability company in the State of Delaware on May 13, 2008. VitaMed has developed a patent-pending technology and business methodology to market both over-the-counter ("OTC") and prescription versions of nutritional supplements, drugs, medical foods and other medical products directly to consumers with the recommendation of their physician. VitaMed’s business model creates unique value propositions for patients, physician/providers and insurance payors by eliminating much of the inefficiencies associated with the traditional sales, marketing and distribution models. VitaMed offers superior-quality products for a lower overall cost to

patients and payors while increasing efficiencies for physicians.

6

VitaMed's technology allows it to collect and analyze data from various sources to improve patient compliance and education, facilitate product development and provide immediate feedback on effectiveness of therapies. The result is increased efficiency and communication between the patient, physician/provider and insurance payor, ultimately creating improved outcomes for all. This combination of efficient distribution and technology provides measurable customer benefits differentiates VitaMed from existing competitors in the market.

VitaMed was founded by Robert Finizio and Brian Bernick, M.D. to provide pregnant women with alternatives to traditionally overpriced prescription vitamins. In January of 2009, VitaMed's completed formulation of its first products, a prenatal multivitamin and a vegan docosahexaenoic acid ("DHA") supplement. VitaMed contracted with Lang Naturals, Inc. to produce its first products in March of 2009. In the first half of 2009, VitaMed began to hire management and sales

personnel, design its consumer sales website and deploy its business model. VitaMed's first product sales occurred in June 2009 with sales focused primarily in south Florida. In September 2010, VitaMed achieved a milestone of $1 million in total sales.

VitaMed's new product development continues to focus on the women’s health market place. Based on the analysis of the proprietary data collected, VitaMed has developed and released eight new products since the introduction of its first prenatal vitamin:

· January 2010 – Single pill prenatal vitamin

· February 2020 – Stretch mark cream

· September 2010 - Menopause supplement, Iron supplement and Scar Guard

· February 2011 – Vitamin D3 50,000 IU and 1,000 IU

· May 2011 – Calcium with Vitamin D

As VitaMed continues its product development efforts for both new products and refinements to existing products, it is also looking to find proprietary ingredients that can be licensed on an exclusive basis for use in women’s healthcare that can help further differentiate its products from the competition.

VitaMed has not been involved in any bankruptcy, receivership or any similar proceeding, and except for the subject Merger set forth herein, has not had or been a party to any material reclassifications, mergers or consolidations since inception.

VitaMed's primary SIC code is 2833 – Medicinal Chemicals and Botanical Products. VitaMed maintains a website at www.vitamedmd.com.

Overview of Industry and Market

Healthcare and Pharmaceutical Market

According to statistics compiled by Kaiser Family Foundation, a non-profit foundation focusing on the major healthcare issues facing the United States, healthcare expenditures were approximately $2.5 trillion in 2009 (or 17.6% of our nation's economy or Gross Domestic Product (GDP)), up from 7.2% of GDP in 1970 and 12.5% of GDP in 1990. In 2009, healthcare spending in the U.S. averaged $8,086 per person.

Recently, healthcare reimbursements by Medicare and Medicaid have been reduced to accommodate federal and state budget deficits. This change in physician reimbursement has had an adverse financial impact on physicians in that the costs associated with administration of a medical practice have exceeded the revenues received from providing services to patients. Moreover, as healthcare becomes increasingly consumer driven, patients are seeking more information, control and convenience which place additional time and financial pressures on physicians. These changes have prompted many physicians in the United States to search for tools and solutions to improve practice

efficiency and increase revenue.

7

Pharmaceuticals are a major cost driver in U.S. healthcare. In a report issued by Centers for Medicare and Medicaid Services ("CMS"), the total national spending on prescription drugs, both private and public, from retail outlets reached $250 billion last year, or real per capita spending of $806. In 2009, prescription drugs accounted for approximately ten percent of all national healthcare spending. Total national spending on prescription drugs, both private and public, from retail outlets "increased on average by about 10 percent a year from 1998 through 2009 — faster than the average 6.7 percent a year increase in total U.S. health expenditures

for the same period."

Women’s Health Market

The U. S. Census Bureau projects that there were approximately 150 million women and 146 million men living in the U.S. in 2010. Women are major consumers of health care services, negotiating not only their own complex health care but often managing care for their family members as well. Their reproductive health needs, greater rates of health problems and longer life spans as compared with men make women's' relationships with the health care system complex. According to a 2004 study by the Department of U.S. Health and Human Services, women's health care spending was 57% of the total health care expenditures. According to US Department of Health Services the number of infant births in the U.S. in 2009

was 4,131,019. Women are also more likely to be low-income and often face the added challenge of balancing work with family health and care giving responsibilities. For the one in five women who are uninsured, access to high quality, comprehensive care is even more difficult.

U.S. Dietary Supplement Market

According to a survey conducted by Ipsos-Public Affairs for the Council for Responsible Nutrition, 65% of U.S. adults used dietary supplements in 2010. According to the 2009 U.S. Nutrition Industry Overview by the Nutrition Business Journal (NBJ), a division of Penton Media, Inc. that provides strategic market and competitive analysis of the global nutrition industry, U.S. sales of dietary supplements (including vitamins, herbs, meal supplements, sports nutrition and specialty supplements) grew 6.0% to $26.9 billion in 2009. NBJ is forecasting U.S. sales of dietary supplements to grow at a rate of 6.0% per

year for the next four years reaching $34 billion by 2013. Steady growth reflects customers’ purchases of these natural products to protect their health and ward off more expensive medical visits and prescription drugs. The dietary supplement industry is highly fragmented with products sold through multiple channels including retailers such as mass merchants, grocery stores, drug stores and specialty retailers, direct mail, catalogs, multi-level marketers and the Internet. U.S. sales of dietary supplements through the Internet grew significantly faster than the overall category increasing approximately 18% in 2009 to $1.2 billion and accounted for an estimated 4.3% of the total U.S. dietary supplement category. According to the NBJ 2010 Direct-to-Consumer Selling Report, Internet sales of dietary supplements are expected to grow at an 18% compound annual growth rate (CAGR) over

the next four years, reaching $2.3 billion by 2013.

8

|

The market for supplements in the women's health market is estimated at $2 billion annually (see illustration to left). A common misperception by healthcare providers is that prescription Nutrition and Medical Foods (i.e., prenatal vitamins) are drugs that require approval of and fall under the drug manufacturing standards of the U.S. Food and Drug Administration ("FDA"). The fact is that prescription nutritional products are dietary supplements, NOT drugs, even though they may be dispensed through a pharmacy to fulfill a doctor's prescription. Our business model is designed to transform this large market currently burdened by unnecessary costs and inefficiencies. |

Our Business Model

VitaMed is a specialty pharmaceutical company that has developed a patent-pending technology and business methodology to market both OTC and prescription versions of nutritional supplements, medical foods, drugs and other medical products directly to consumers or via retail pharmacies under the direct supervision of a physician. VitaMed’s business model creates a unique value proposition for patients, physicians/providers and payors by eliminating much of the inefficiencies associated with the traditional sales, marketing and distribution models. VitaMed offers superior-quality products for a lower overall cost to patients and payors while increasing efficiencies for physicians.

At the core of our business model is our patent-pending information technology platform, OPERA™. This technology allows us to collect critical data from various sources that is continuously evaluated and analyzed by VitaMed. This transformation of data is what allows VitaMed to provide significant value to patients, providers and payors by focusing on the areas of customer satisfaction and service, product strategy and development, market intelligence and Phase IV drug studies.1

|

As healthcare becomes increasingly consumer driven, patients are seeking more information, control and convenience which place additional time and financial pressures on physicians. Physicians are looking for improved ways to provide better service to their patients. A recent study by IMS Health Incorporated, the leading provider of information servcies for the healthcare industry, concludes that physicians desire fewer but more encompassing relationships with companies that can provide more valuable information, deliver more relevant services, and better respond to specific needs of their practice and patients. VitaMed meets this

challenge by focusing on the opportunities in women’s health, specifically the OB/GYN market, to provide a better customer experience for physician and patient.

|

|

1Phase IV trial is also known as postmarketing surveillance trial. Phase IV trials involve the safety surveillance and ongoing technical support of a drug after it receives permission to be sold. Phase IV studies may be required by regulatory authorities or may be undertaken by the sponsoring company for competitive or other reasons.

9

Our business model is designed to achieve better outcomes for patient, physician and payor.

|

·

|

VitaMed offers the highest quality products incorporating patented ingredients like chelated iron and life’s DHA™ into its formulations while maintaining value pricing. This results in greater patient acceptance and satisfaction of our products versus the competition.

|

|

·

|

VitaMed is able to show physician practices that by recommending VitaMed products, the practice is able to realize office efficiencies and cost savings over prescribing competing prescription products.

|

|

·

|

Through the use of our data collection, VitaMed is able to provide to physician practices with statistics and data that show they have helped reduced the cost of patient care and improved patient compliance.

|

|

·

|

Physician practices that choose to dispense products directly to their patients from their offices earn revenue from the sale of the products. Additionally, selected physicians that participate in our studies can receive compensation for their time and services.

|

|

·

|

Our statistical data indicates that a high level of patient compliance is achieved as a result of VitaMed’s direct interaction with patients which supplements patient education.

|

|

·

|

Improved patient education, a high level of patient compliance and reduced cost of products all result in lower cost of care for payors.

|

Sales Strategy

Although our national sales force is similar to that of a traditional pharmaceutical company in that the sales representatives are calling on OB/GYN practices to provide education and sampling, our sales representatives are more customer centric in their sales approach. Our sales representatives offer more than just differences in our products from the competition; they are able to offer an array of partnering opportunities to promote efficiency and cost savings. Our OPERA™ technology allows us to collect and analyze critical data from various inputs allowing VitaMed to provide significant value to patients, providers and payors.

Our national rollout strategy is to focus first on the largest metropolitan areas. In order accelerate the sales ramp in a new territory, VitaMed employs a national sales/large practice sales effort to identify key practices in a new or expanding market. Concurrently with our provider sales effort, VitaMed is working with both commercial insurance and Medicaid insurance payors for partnerships in which the payor can support the recommendation of VitaMed’s products for the benefit of patient, physician and payor with the end result of providing better outcomes for all three constituents.

In general, a better outcome is to provide patients with the best products and care at the best value. Having an assortment of high quality product options that can be recommended by both the physician and payor is the foundation of providing options to the patient.

At the forefront of our sales approach is the philosophy that the physician should recommend products based only on what is best for the patient. The physician and patient also have the option to ask for an alternative recommendation of a similar product.

10

Our Products

Our vitaMedMD® brand includes a full range of products targeted for women’s health and associated with pregnancy, child birth, nursing, post birth and menopause. The specific products include: prenatal vitamins, DHA, iron supplements, calcium supplements, Vitamin D supplements, women's multivitamins, natural (non-hormonal) menopause relief, and scar reduction creams. Our products are detailed below.

Prenatal Plus (Combo Pack)

Prenatal Plus is a two pill combo pack that contains a complete multivitamin with 18 essential vitamins and minerals and 300 mg. of life’s DHA™ (a trademarked product of Martek Bioscience Corporation). Uniquely, it is a 100% Vegetarian and Vegan and Kosher Certified. Based on the latest medical and scientific research, we have optimized many of the forms and nutrients found in our latest version. All minerals, including Iron, Zinc, Selenium, Copper, Manganese and Molybdenum are chelated to improve absorption and tolerability. The citrus-flavored tablet is small and easy to swallow. The fact that the

DHA is plant based (most DHA comes from fish-based sources) is important to many pregnant women due to concerns over contamination and taste of fish-based DHA.

Prenatal 1

Prenatal 1 is a single dose daily multivitamin that provides 14 vitamins, minerals and 200 mg. of vegetarian DHA. Prenatal 1 uses only vegetarian life’s DHA™ and is 100% fish- and animal-free. Each convenient, easy-to-swallow softgel also features .975 mcg. of Folic Acid with Vitamin C, Iron and Zinc.

Iron Complete

Iron Complete is a doctor-recommended iron replacement supplement with a unique 3-weeks-on/1-week-off dosing schedule that helps maximize absorption and enhances tolerability. It is formulated with 150 mg. of chelated Iron to help improve tolerability and limit typical side effects associated with iron replacements. Each easy-to-swallow single tablet serving also includes 800 mcg. of Folic Acid, plus Vitamins C and E, and Succinic Acid to aid in absorption.

Transitions Menopause Relief

Transitions Menopause Relief offers a natural solution for hot flashes, night sweats and mood disturbances. Each single tablet dosage delivers 120 mg. of Lifenol®, a patented, well-studied female hops extract recognized for its potency and support in alleviating hot flashes, plus Black Cohosh and plant phytoestrogens. It also includes Calcium (as Calcium Citrate) and Vitamin D3 for added bone support. Transitions Menopause Relief offers women relief from their symptoms without the risk of Hormone Replacement Therapy (HRT).

Calcium + Vitamin D

VitaMed's Calcium + Vitamin D is a doctor-formulated, dietary supplement that helps preserve beneficial levels of Calcium and Vitamin D in the body. Each convenient two tablet serving delivers the recommended dietary allowance of Calcium for most adults. This product provides 1,200 mg. of Calcium as Calcium Carbonate and Calcium Citrate blend, readily absorbable and digestible, and can be taken on an empty stomach. It also includes 1,000 IU of Vitamin D3 to enhance absorption and support bone health.

11

Vitamin D3 50,000 IU and Vitamin D3 1,000 IU

Vitamin D3 50,000 IU and 1,000 IU are doctor-formulated dietary supplements that help replenish and maintain beneficial levels of Vitamin D in the body. Sustaining adequate levels of Vitamin D in the body is essential to bone health, enhancing the absorption of Calcium and Phosphorus. Vitamin D3, also known as Cholecalciferol, is considered the most preferred form of Vitamin D as it is the most active form of the nutrient. Vitamin D3 50,000 IU and 1,000 IU are used in the dietary management of Vitamin D deficiency and should be used under medical supervision. Vitamin D3 50,000 IU and 1,000 IU are ideal for pregnant, breastfeeding and menopausal women needing

to sustain adequate levels of Vitamin D.

Stretch Mark Body Cream

VitaMed's Stretch Mark Body Cream contains naturally-derived ingredients, including Peptides, Shea Butter, Sweet Almond Oil and Fruit Extracts, that hydrate, soothe and pamper skin to make it softer, smoother and younger-looking. It helps reduce the appearance of stretch marks, scars, and other skin irregularities; intensely hydrates and replenishes skin’s moisture; diminishes the look of fine lines and wrinkles and encourages the fading of age spots and sun spots. Backed by clinical and scientific testing, Stretch Mark Body Cream is hypoallergenic, paraben-free and non-comedogenic.

Scar Reduction Body Cream

VitaMed's Scar Reduction Body Cream is rich in vitamins and naturally-derived extracts. Backed by independent clinical and scientific testing, it helps minimize the size and appearance of old and new scars; helps reduce scar tissue; diminish the appearance of fine line and wrinkles; and encourages the fading of age spots. It is paraben-free, non-comedogenic and hypoallergenic.

Products in Development

VitaMed's market objective is to develop an entire suite of products that are condition specific and geared to the women’s health sector. Our sales force has developed strong relationships and partnerships in the OB/GYN market segment to sell our current products. We have also established relationships with some of the largest OB/GYN practices in the country. By delivering additional products through the same sales channel we can leverage our already deployed assets to increase our sales and improve profitability.

In the next 12 months, VitaMed intends to introduce its first medical food prescription products. Our focus is to introduce products in which we use propriety or patented molecules or ingredients that will differentiate our products from the competition. We currently have five new products in development and plan to introduce our first new product by the third quarter of 2012. VitaMed is also planning to introduce prenatal vitamins with a folic acid that is better tolerated by some women. Folic acid is a key ingredient in prenatal vitamins and certain types of folic acid significantly enhance the bio-availability of folic

acid. We intend to enhance our current line of OTC prenatal vitamins by adding this more-efficiently absorbed folic acid.

Raw Materials for Our Products

All raw materials and ingredients for our proprietary products are purchased from a group of third-party suppliers specializing in raw material manufacturing, processing and specialty distribution. Our manufacturers maintain multiple supply and purchasing relationships throughout the raw materials marketplace to provide an uninterrupted supply of product to meet our manufacturing requirements.

12

Manufacturing of Our Products

Our products are manufactured and regulated by the same FDA quality standards (Controls Used for Manufacturing, Processing, Packing, or Holding Dietary Supplements for FDA 21 CFR Part 110/111 CGMP Regulations ("CFR 111")) and current good manufacturing practices ("cGMP") as prescription nutritional therapies. In addition, we use some of the same manufacturing facilities as our prescription competition, we conduct two additional un-required certificates of analysis on every lot to ensure quality, and we employ an outside third party to enforce rigorous quality audits.

All of our manufacturing is performed by third party manufacturers. Over 90% of our manufacturing is done by Lang Naturals, Inc. ("Lang"), a full-service, private label and corporate brand manufacturer specializing in premium health benefit driven™ products, including medical foods, nutritional supplements, beverages, bars, and functional foods in the dietary supplement category. Lang provides VitaMed a variety of additional services including development processes, prototype development, raw materials sourcing, regulatory review and packaging production. At present, our relationship with Lang

is excellent and we intend to continue to use them as our third party manufacturer for most of our products. In the event our relationship with Lang terminates for any reason, there are a number of other manufacturers available to VitaMed; accordingly, management is of the opinion that such termination would not have a material adverse effect on VitaMed's business.

Quality Control for Our Products

A quality assurance team establishes process controls and documents and tests every stage of the manufacturing process to ensure we meet product specifications and that our finished dietary supplements contain the correct ingredients, purity, strength, and composition in compliance with FDA regulations. We test incoming raw materials and finished goods to ensure they meet or exceed FDA and U.S. Pharmacopeia standards including quantitative and qualitative assay and microbial and heavy metal contamination.

Our manufacturers' quality and production standards are designed to meet or exceed the latest FDA regulations. To ensure the highest quality, our manufacturing operations are audited by AIB International, Inc. ("AIB") for independent cGMP certification. AIB is an independent, not-for-profit organization that offers programs and services to augment and support the work of regulatory officials around the country, including standards development, product testing and certification, and onsite audits and inspections. The manufacturing facilities we use are also ISO 9001 certified which is a

family of standards related to quality management systems and are designed to help organizations ensure they meet the needs of customers. In addition, our manufacturers are hazard analysis critical control point ("HACCP") certified which is a systematic preventive approach for food and pharmaceutical safety that addresses physical, chemical and biological hazards as a means of prevention rather than finished product inspection.

Customer Service

Our goal is 100% customer satisfaction by consistently delivering superior customer experiences; before, during and after the sale. To achieve this goal, we maintain a fully staffed customer care center for both inbound and outbound customer service using the most current technologies to respond to customer's via incoming and outgoing calls, e-mails and live-chat. We believe our customer service initiatives allow us to establish and maintain long-term customer relationships and facilitate repeat visits and purchases.

Our fully staffed customer care center has representatives available to answer customer questions and to accept customer orders. Our staff has access to real time inventory data to determine if a product is in stock so as to properly manage customer expectations. Our customer care center systems provide a seamless customer experience through our toll-free telephone number, e-mail and live-chat features. Our representatives receive regular training so that they can effectively and efficiently field questions from current and prospective customers and are also trained not to answer questions that

should be directed to a customer’s physician. Having a quality customer care center allows our representatives to provide an array of valuable data in the areas of sales, market research, quality assurance, lead generation and customer retention.

13

Our Return Policy

Customers may return or exchange products for any reason by returning the product within thirty (30) days of receipt. We will refund the entire purchase price, less shipping. The customer is responsible for the cost of returning the products to us except cases where the product is being returned because of a defect or an error made in our order fulfillment. If the purchased product exceeded a thirty-day supply, the unused product must be returned to receive the full refund. All unopened products may be exchanged for different products; the customer will be responsible for the difference in price if the replacement product is more

expensive or we will refund the difference if the replacement product is less expensive.

Our Quality Guarantee

We proudly stand behind the quality of our products. Our guarantee makes it easy, convenient and safe for customers to purchase our products. Under our quality guarantee we:

|

·

|

ensure the potency and quality of our vitamin products,

|

|

·

|

help physicians/providers and payors deliver the best possible outcomes to patients by deliveringbetter information on patient compliance and satisfaction,

|

|

·

|

provide a 30-day money back guarantee for all of our products, and

|

|

·

|

ensure a safe, secure online shopping experience through our encrypted website.

|

We value frequent communication with and feedback from our customers in order to continue to improve our offerings and services.

Intellectual Property

We rely on a combination of patent, copyright, trademark and trade secret laws, confidentiality procedures and contractual provisions to protect our proprietary rights with respect to our technology and proprietary information. We have registered the name, vitaMedMD® as a trademark with the USPTO for use in connection with dietary and nutritional supplements and have trademark applications pending for TherapeuticsMD™, and OPERA™. We believe our trademarks to be valuable and identified strongly with our brand.

Issuance of a federally registered trademark creates a rebuttable presumption of ownership of the mark; however, it is subject to challenge by others claiming first use in the mark in some or all of the areas in which it is used.

Federally registered trademarks have a perpetual life, as long as they are maintained and renewed on a timely basis and used properly as trademarks, subject to the rights of third parties to seek cancellation of the trademarks if they claim priority or confusion of usage. We believe our patents and trademarks are valuable and provide us certain benefits in marketing our products. We intend to actively protect our patents, trademarks, trade secrets and other intellectual property.

14

The Company has the following U.S. trademark registrations and pending trademark applications:

| vitaMedMD® [word] |

U.S. Reg. No. 3842265

|

|

| vitaMedMD® [design] |

U.S. Reg. No. 3835805

|

|

| OPERA™ |

U.S. Application No. 85118845

|

|

| TherapeuticsMD™ |

U.S. Application No. 85371566

|

|

| VITAMEDMD™ |

U.S. Application No. 85371567

|

On September 17, 2009, we filed for patent protection on a System and Method of Ongoing Evaluation Reporting and Analysis (U.S. patent application Ser. No.: 12561515). The patent application is currently pending in the USPTO.

OPERA™ is our patent-pending information technology platform used in our business. The deployment of OPERA™ and the further development and deployment of related technology creates a sustainable competitive advantage that has led to our market share growth. We are currently developing additional intellectual property in the following areas:

|

·

|

OPERA™ business process patents

|

|

·

|

Physician/provider portal; a key way to gather and share physician data

|

|

·

|

Mobile applications linked to the OPERA™ system

|

|

·

|

New product technologies and formulations

|

As we continue to develop proprietary intellectual property, we will expand our protection by applying for additional patents around the business process for OPERA™ and patents on future technologies, including developing mobile applications to more effectively communicate with patients. As we examine our current product offerings and new product pipeline, we are in the process of modifying and developing new formulations that will enable us to gain patent protection for these products.

Generally our nutritional product formulations are proprietary in that in designing them, we attempt to blend an optimal combination of nutrients that appear to have beneficial impact based upon scientific literature and input from physicians; however, as formal clinical studies have in most instances not been conducted by us to validate the intended health benefits of our products, we are generally prohibited by the FDA from making disease treatment and prevention claims in the promotion of our products that use these formulations.

While we seek broad coverage under our patent applications, there is always a risk that an alteration to the process may provide sufficient basis for a competitor to avoid infringement claims. In addition, patents expire and we cannot provide any assurance that any patents will be issued from our pending application or that any potentially issued patents will adequately protect our intellectual property.

Online Commerce

A vast majority of VitaMed's sales are completed online. The Internet has continued to increase its influence over communication, content and commerce. According to Forrester Research, an independent research company providing advice to global leaders in business and technology, U.S. online retail sales increased 12.6% from 2009. Forrester projects online retail sales to grow at a 10% CAGR to $278.9 billion by 2015. We believe several factors will contribute to this increase including convenience, expanded range of available products and services, improved security and electronic payment technology, increased access to broadband Internet connections and widespread consumer confidence and acceptance

of the Internet as a means of commerce.

15

Growth Strategy

VitaMed has exceptional opportunities to expand its business. There are five key pillars to our growth strategy:

1. Geographic Expansion - We have experienced rapid growth in our initial sales territories (principally Florida, Texas, Southern California and Georgia). We are now expanding to additional markets and increased our sales team to 27 people as of September 30, 2011. In the next 12 months, we intend to expand to 60 territories with a focus on major markets.

2. Introduction of New Products through Existing Sales Channel - Through our unique offerings like e-commerce, wholesale opportunities and OPERA, we are able to develop a much stronger partnership with OB/GYN practices than in traditional pharma. This gives us the ability to bring significant new products and services to these practices. We have an aggressive pipeline of new products and are also able to offer our sales channel capability to other companies that are looking to penetrate the OB/GYN market.

3. Large Group Practices – Due to our unique partnership offerings, we have developed strong relationships with many of the largest OB/GYN practices. Because of the savings and the data that come with our model, we are particularly attractive to large practices that can use this data in negotiating their contracts. Once the leaders of a large practice accept our model there is rapid adoption by the other practitioners in that group.

4. Direct to Consumer - In addition to our physician channel, we have a unique direct-to-consumer channel to drive customer retention, acquisition and revenue growth. Consumers that go to our website are usually sent there by a healthcare provider, so they arrive with a bias that the site is credible and believable. After their initial order, over 60% of our customers sign up for "auto-refill" so they can continue to receive the product without placing an order each month. In addition, to the initial product sales, a satisfied customer provides us with continued sales

opportunities throughout the customer's life cycle which increases the overall value of each customer. The loyalty of our customer base helps build traffic revenue through social media.

5. VitaMed is working with both commercial insurance and Medicaid insurance payors to create relationships in which the payor can support the recommendation of our products for the benefit of patient, provider and payor with the end result of providing better outcomes for all.

6. Software Services and Licensing - OPERA is a powerful tool for reducing costs and improving efficiencies. As such, other companies are interested in licensing this technology for use in enhancing their own marketing strategies. Additionally, OPERA is very well suited to facilitate data gathering for Phase 4 drug studies, which will provide another source of future revenue.

The key elements of our growth strategy include (i) the hiring of additional in-field sales representatives, including national sales and local sales personnel, (ii) additions to our product line and (iii) opening new distribution channels. Over time, we believe our growth strategy will increase net sales while maintaining or increasing our gross margins,

Competition and Our Competitive Advantage

The specialty pharmaceutical industry, including the Women’s Health market in which we primarily participate, is defined by rapidly advancing technologies, extreme competition and a focus on proprietary products. We face competition from numerous sources, including commercial pharmaceutical companies, pharmacy retailers, specialty retailers, on-line retailers, biotechnology organizations, academic institutions, government agencies and private and public research institutions. Our current products compete with existing and new therapies that may become available in the future.

16

Our competition may have larger pools of financial resources and more sophisticated expertise in research and development, manufacturing, clinical trials, regulatory pathways and marketing approved products than we do. These competitors are also recruiting and retaining exceptional sales and management personnel. Usually, competition to our currently marketed products have distinguished brand names, are distributed by large pharmaceutical companies with sizable amounts of resources and have achieved widespread acknowledgement in the healthcare market. Small or early stage companies may also prove to be serious competition, predominantly through collaborative

agreements with large and established companies. While we have experience in OTC products, we have never developed a medical food or FDA-approved drug. With respect to FDA-approval process, we are at a competitive disadvantage to many companies with significantly more experience than we have in developing these drugs.

We believe our business model creates a unique value proposition for patients, providers and payors by eliminating much of the inefficiencies associated with the traditional sales, marketing and distribution models. We believe we compete favorably; however, the nature and extent to which our competitors implement various pricing and promotional activities in response to increasing competition and our response to these competitive actions, could adversely affect our profitability.

User friendly shopping experience

Our website is designed to attract natural search traffic while providing a convenient, educational, secure and efficient shopping experience. Our website and sales collateral includes specific and detailed information about our products which helps our customers make informed purchases. Our website uses secure encryption technology designed to protect our customers’ personal and credit card information and to prevent its unauthorized use. Our customer service representatives take orders and answer product and technical questions through our toll-free telephone number. Customers are also able to reach our customer service representatives via email or the

live-chat feature on our website. We seek to respond within 24 hours to all email requests received between Monday and Friday. We also facilitate repeat customer orders through our Autoship feature.

Technology Infrastructure and Operations

Our website is supported by a technology infrastructure designed to provide a superior customer experience, including simplicity, speed and security. We are able to monitor our website and services in real time. We also track and manage our inventory, order fulfillment, customer service and marketing through state-of-the-art technologies that allow us to integrate this data as part of our OPERA™ system. In summary, our technology allows us to collect critical data from various sources that we continuously evaluate and analyze. This transformation of data is what allows us to provide significant value to patients, providers and payors by

focusing on the areas of customer satisfaction and service, product strategy and development, market intelligence and post marketing surveillance.

We follow rigorous industry standards to protect our internal operations and the personal information we collect from our customers. We do not sell or disclose the personal information of our customers. We continue to maintain and upgrade our technology framework to assure compliance with the high levels of security defined by the Payment Card Industry Data Security Standard, the standard created to increase controls around cardholder data to reduce credit card fraud.

17

Government Regulation

Although our current products do not specifically require approval, we are subject to federal and state consumer protection laws, including laws protecting the privacy of consumer non-public information and regulations prohibiting unfair and deceptive acts and trade practices. In particular, under federal and state financial privacy laws and regulations, we must provide:

· notice to consumers of our policies on sharing non-public information with third parties;

· advance notice of any changes to our policies, and

· with limited exceptions, provide consumers the right to prevent sharing of their non-public personal information with unaffiliated third parties.

The growth and demand for eCommerce could result in more stringent consumer protection laws that impose additional compliance burdens on online retailers. These consumer protection laws could result in substantial compliance costs and could interfere with the conduct of our business.

There is currently great uncertainty in many states whether or how existing laws governing issues such as property ownership, sales and other taxes, and libel and personal privacy apply to the Internet and commercial online retailers. These issues may take years to resolve. For example, tax authorities in a number of states, as well as a Congressional advisory commission, are currently reviewing the appropriate tax treatment of companies engaged in online commerce and new state tax regulations may subject us to additional state sales and income taxes. New legislation or regulation, the application of laws and regulations from jurisdictions whose laws do not

currently apply to our business, or a change in application of existing laws and regulations to the Internet and commercial online services could result in significant additional taxes on our business. These taxes could have an adverse effect on our results of operations.

Our products are subject to extensive regulation in the U.S. The FDA enforces the Federal Food, Drug and Cosmetic Act (FDCA) and related regulations which govern the identity, purity, quality, strength, and composition of dietary supplements and regulate the formulation, manufacture, packaging, labeling, holding, sale, and distribution of dietary supplements, foods and over-the-counter (OTC) drugs, and prohibit the sale of misbranded and adulterated dietary supplements and dietary supplements that by the intention of the manufacturer or distributor or label or labeling claims are unapproved new drugs.

The Federal Trade Commission (FTC) enforces the Federal Trade Commission Act (FTCA) and related regulations which govern the advertising and advertising acts and practices associated with the promotion and sale of these products. The U.S. Postal Inspection Service enforces federal laws governing fraudulent use of the mail. Regulation of certain aspects of the dietary supplement business at the federal level is also governed by the Consumer Product Safety Commission (CPSC) (e.g., concerning the presence of adulterated substances, such as toxic levels of lead or iron, that render products unsafe for consumption and require an ordered recall), the Department of

Agriculture (e.g., for products that are intended for ingestion as dietary supplements for animals) and the Environmental Protection Agency (e.g., in the methods of disposal used for certain dietary ingredients, such as colloidal silver). Federal and state anti-kick back statutes, the Ethics in Patient Referrals Act, false claims statutes and HIPPA also apply to our business.

The FDCA has been amended several times affecting provisions that concern dietary ingredients and dietary supplements, including by the Dietary Supplement Health and Education Act of 1994 (DSHEA). DSHEA formally defined what may be sold as a dietary supplement, defined statements of nutritional support and the conditions under which they may lawfully be used, and included provisions that permit the FDA to regulate manufacturing practices and labeling claims peculiar to dietary supplements. "Dietary supplements" are defined as vitamins, minerals, herbs, other botanicals, amino acids and other dietary substances that are used to supplement the diet,

as well as concentrates, constituents, extracts, metabolites, or combinations of such dietary ingredients. Generally, under DSHEA, dietary ingredients that were on the market before October 15, 1994 may be used in dietary supplements without notifying the FDA. However, a "new" dietary ingredient (i.e., a dietary ingredient that was not marketed in the U.S. before October 15, 1994) must be the subject of a new dietary ingredient notification submitted to the FDA unless the ingredient has been "present in the food supply as an article used for food" without having been "chemically altered." A new dietary ingredient notification must provide the FDA with evidence of a "history of use or other evidence of safety" which establishes that use of the dietary ingredient "will reasonably be expected to be safe." A new dietary ingredient notification must be submitted to the FDA at

least 75 days before the new dietary ingredient can be marketed. There can be no assurance that the FDA will accept evidence purporting to establish the safety of any new dietary ingredients that we may want to market and the FDA’s refusal to accept such evidence could prevent the marketing of such dietary ingredients.

18

Increased FDA enforcement could lead the FDA to challenge dietary ingredients already on the market as "illegal" under the FDCA because of the failure to file a new dietary ingredient notification or because the substance may be one found to be the subject of an investigational new drug application for which clinical trials have commenced and been publicized.

The FDA generally prohibits labeling a dietary supplement with any "health claim" (i.e., any statement associating a nutrient with prevention, but not treatment, of a disease or health-related condition), unless the claim is pre-approved by the FDA. The FDA prohibits disease treatment claims entirely when made for a dietary supplement; however, "statements of nutritional support," including so-called "structure/function claims" are permitted to be included in labeling for dietary supplements without FDA pre-approval. Such statements may describe how a particular dietary ingredient affects the structure, function or general well-being of the body, or the mechanism of

action by which a dietary ingredient may affect the structure, function or well-being of the body, but such statements may not state that a dietary supplement will reduce the risk or incidence of a disease unless such claim has been reviewed and approved by the FDA. A company that uses a statement of nutritional support in labeling must possess evidence substantiating that the statement is truthful and not misleading. Such statements must be submitted to the FDA no later than thirty days after first marketing the product with the statement and must be accompanied by the following FDA mandated label disclaimer: "This statement has not been evaluated by the Food and Drug Administration. This product is not intended to diagnose, treat, cure or prevent any disease." There can be no assurance that the FDA will not determine that a particular statement of nutritional support that

we want to use is an unacceptable disease claim or an unauthorized nutrient-disease relationship claim otherwise permitted with FDA approval as a "health claim." Such a determination might prevent the use of such a claim.

Medical foods are specially formulated and intended for the dietary management of a disease that has distinctive nutritional needs that cannot be met by normal diet alone. They were defined in the Food and Drug Administration’s 1988 Orphan Drug Act Amendments and are subject to the general food and safety labeling requirements of the Federal Food, Drug, and Cosmetic Act. Medical foods are distinct from the broader category of foods for special dietary use and from traditional foods that bear a health claim. In order to be considered a medical food the product must, at a minimum:

|

·

|

be a food for oral ingestion or tube feeding (nasogastric tube);

|

|

·

|

be labeled for the dietary management of a specific medical disorder, disease or condition for which there are distinctive nutritional requirements; and

|

|

·

|

be intended to be used under medical supervision. Medical foods require a prescription from a physician.

|

In addition, DSHEA provides that certain "third-party literature," such as a reprint of a peer-reviewed scientific publication linking a particular dietary ingredient with health benefits, may "in connection with the sale of a dietary supplement to consumers" be exempt from labeling regulation. However, the FDA has adopted an "intent to use" doctrine whereby such literature, even if exempt from labeling, may nonetheless form the basis for an agency determination that the literature in context reveals a company's intent to sell a dietary ingredient or dietary supplement as a drug, thereby rendering the supplement an unlawful, unapproved new

drug. Because the "intent to use" doctrine is predicated on a subjective assessment of all facts and circumstances associated with the promotion and sale of a dietary supplement, we cannot know whether any particular piece of literature otherwise exempt from labeling will be deemed by the FDA unlawful for use in association with the sale of the dietary ingredient or dietary supplement.

19

As authorized by the FDCA, the FDA has adopted and is implementing Good Manufacturing Practices (GMPs) specifically for dietary supplements. These GMPs impose extensive process controls on the manufacture, holding, labeling, packaging, and distribution of dietary supplements. They require that every dietary supplement be made in accordance with a master manufacturing record, that each step in the manufacture, holding, labeling, packaging, and distribution be defined with written standard operating procedures, monitored, and documented, and that any deviation in manufacture, holding, labeling, packaging, or distribution be contemporaneously documented, assessed by a

quality control expert, and corrected through documented corrective action steps (whether through an intervention that restores the product to the specifications in the master manufacturing record or to document destruction of the non-conforming product). The GMPs are designed to ensure documentation, including testing results that confirm the identity, purity, quality, strength, and composition of dietary supplements. In addition, GMPs require a company to make and keep written records of every product complaint that is related to GMPs. The written record of the product complaint must include the following: the name and description of the dietary supplement; the batch, lot, or control number of the dietary supplement, if available; the date the complaint was received and the name, address, or telephone number of the person making the complaint, if available; the nature of the

complaint, including, if known, how the product was used; the reply to the complainant, if any; and findings of the investigation and follow-up action taken when an investigation is performed. The regulations directly affect all who manufacture the dietary supplements we sell. The FDA may deem any dietary supplement adulterated, whether presenting a risk of illness or injury or not, based on a failure to comply with any one or more process controls in the GMP regulations. If deemed adulterated, a dietary supplement may not be lawfully sold and may have to be recalled from the market. It is possible that the FDA will find one or more of the process controls implemented by us, by our contract manufacturers, or by those whose dietary supplements we sell to be inadequate and, thus, requiring corrective action, requiring any one or more of the dietary supplements we sell to be unlawful for

sale, or resulting in a judicial order that may impair our ability to manufacture, market, and sell dietary supplements.

The FDA also requires adverse event notices on labels and serious adverse event reporting for all supplements and OTC drugs. An "adverse event" is defined by statute to include "any health-related event associated with the use of a dietary supplement that is adverse." Only serious adverse events must be reported to the FDA. A "serious adverse event" is an adverse event that: results in death, a life-threatening experience, inpatient hospitalization, a persistent or significant disability or incapacity, or a congenital anomaly or birth defect; or requires, based on reasonable medical judgment, a medical or surgical intervention to prevent an

outcome described above.

The regulation of medical foods and dietary supplements may increase or become more restrictive in the future. There can be no assurance that, if more stringent statutes are enacted for dietary supplements, or if more stringent regulations are promulgated, we will be able to comply with such statutes or regulations without incurring substantial expense.

The FDA regulates the formulation, manufacturing, packaging, labeling and distribution of OTC drug products pursuant to a "monograph" system that specifies active drug ingredients that are generally recognized as safe and effective for particular uses. If an OTC drug is not in compliance with the applicable FDA monograph, the product generally cannot be sold without first obtaining FDA approval of a new drug application, which can be a long and expensive procedure. The homeopathic drugs that we sell are regulated as non-prescription, OTC drugs. These products must generally meet the standards set forth in the Homeopathic Pharmacopeia of the United States and claims

made for them must not deviate from those contained in specific homeopathic treatises recognized by the FDA as appropriate for use. If these requirements are not met, the FDA can consider the products unapproved new drugs and prohibit their sale.

20

The FDA has broad authority to enforce the provisions of the FDCA concerning medical foods, dietary supplements and OTC drugs, including powers to issue a public "warning letter" to a company to quarantine and prohibit the sale of products deemed adulterated or misbranded, to publicize information about illegal products, to request a voluntary recall of illegal products from the market, to request that the Department of Justice initiate a seizure action, an injunction action or a criminal prosecution in U.S. courts, and to seek disgorgement from a federal court of all proceeds received from the sale of products deemed misbranded or adulterated. For instance, the FDA

recently announced that any unapproved new drug introduced after September 19, 2011 will be subject to immediate enforcement action, without prior notice and without regard to the enforcement priorities set out in CPG 440.100. The FDA will continue to apply the enforcement priorities established in 2006. These give a higher priority to enforcement actions involving drugs in certain high-risk categories, such as drugs that pose a potential safety risk or lack evidence of effectiveness.

The FTC exercises jurisdiction over the advertising of medical foods, dietary supplements and OTC drugs. In recent years, the FTC has instituted numerous enforcement actions against dietary supplement companies for making false or misleading advertising claims and for failing to adequately substantiate claims made in advertising. These enforcement actions have often resulted in consent decrees and the payment of civil penalties and/or restitution by the companies involved. The FTC also regulates other aspects of consumer purchases including, but not limited to, promotional offers of savings compared policies, telemarketing, continuity plans, and "free"

offers.

We are also subject to regulation under various state, local and international laws that include provisions governing, among other things, the formulation, manufacturing, packaging, labeling, advertising and distribution of dietary supplements and OTC drugs. For example, Proposition 65 in the State of California is a list of substances deemed to pose a risk of carcinogenicity or birth defects at or above certain levels. If any such ingredient exceeds the permissible levels in a dietary supplement, cosmetic, or drug, the product may be lawfully sold in California only if accompanied by a prominent warning label alerting consumers that the product contains an

ingredient linked to cancer or birth defect risk. Private attorney general actions as well as California attorney general actions may be brought against non-compliant parties and can result in substantial costs and fines.

Applicable federal and state healthcare laws and regulations, include, but are not limited to, the following:

|

·

|

The federal healthcare anti-kickback statute prohibits, among other things, persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under federal healthcare programs such as Medicare and Medicaid.

|

|

·

|

The Ethics in Patient Referrals Act, commonly referred to as the Stark Law, and its corresponding regulations, prohibit physicians from referring patients for designated health services reimbursed under the Medicare and Medicaid programs to entities with which the physicians or their immediate family members have a financial relationship or an ownership interest, subject to narrow regulatory exceptions.

|

|

·

|

The federal False Claims Act imposes criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the federal government claims for payment that are false or fraudulent or making a false statement to avoid, decrease, or conceal an obligation to pay money to the federal government.

|

21

|

·

|

HIPAA imposes criminal and civil liability for executing a scheme to defraud any healthcare benefit program and also imposes obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information.

|

|

·

|

The federal false statements statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false statement in connection with the delivery of or payment for healthcare benefits, items or services.

|

|

·

|

Analogous state laws and regulations, such as state anti-kickback and false claims laws, may apply to sales or marketing arrangements and claims involving healthcare items or services reimbursed by non-governmental third party payors, including private insurers, and some state laws require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government.

|

Efforts to ensure that our business arrangements with third parties comply with applicable healthcare laws and regulations could be costly. Although VitaMed's regulatory counsel has assisted VitaMed in establishing business practices compliant with applicable laws, it is possible that governmental authorities will conclude that our business practices may not comply with current or future statutes, regulations or case law involving applicable fraud and abuse or other healthcare laws and regulations. If our past or present operations, including activities conducted by our sales team or agents, are found to be in violation of any of these laws or any other

governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, exclusion from third party payor programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations. If any of the physicians, providers or entities with whom we do business is found to be not in compliance with applicable laws, they may be subject to criminal, civil or administrative sanctions, including exclusions from government funded healthcare programs.

Many aspects of these laws have not been definitively interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of subjective interpretations which increases the risk of potential violations. In addition, these laws and their interpretations are subject to change. Any action against us for violation of these laws, even if we successfully defend against it, could cause us to incur significant legal expenses, divert our management’s attention from the operation of our business and damage our reputation.

In addition, from time to time in the future, we may become subject to additional laws or regulations administered by the FDA, the FTC, or by other federal, state, local or foreign regulatory authorities, to the repeal of laws or regulations that we generally consider favorable, such as DSHEA, or to more stringent interpretations of current laws or regulations. We are not able to predict the nature of such future laws, regulations, repeals or interpretations, and we cannot predict what effect additional governmental regulation, if and when it occurs, would have on our business in the future. Such developments could, however, require reformulation of certain products

to meet new standards, recalls or discontinuance of certain products not able to be reformulated, additional record-keeping requirements, increased documentation of the properties of certain products, additional or different labeling, additional scientific substantiation, additional personnel or other new requirements. Any such developments could have a material adverse effect on our business.

Research and Development Activities

For the years ended December 31, 2010 and 2009, we estimate we spent $65,402 and $23,343, respectively, on research and development activities. For the period ended June 30, 2011, we estimate we spent $42,741 on research and development activities. None of these research and development costs will be borne directly by our customers.

22

Environmental Laws

We depend on third parties to support us in manufacturing and developing all of our products and do not directly handle, store or transport hazardous materials or waste products. We depend on these third parties to abide by all applicable federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous materials and waste products. We do not anticipate the cost of complying with these laws and regulations to be material.