Exhibit 99.1

|

|

|

|

|

|

Crawford & Company®

5335 Triangle Parkway

Peachtree Corners, GA 30092

FOR IMMEDIATE RELEASE

CRAWFORD & COMPANY REPORTS 2021 FIRST QUARTER RESULTS

AIDED BY WEATHER CLAIMS

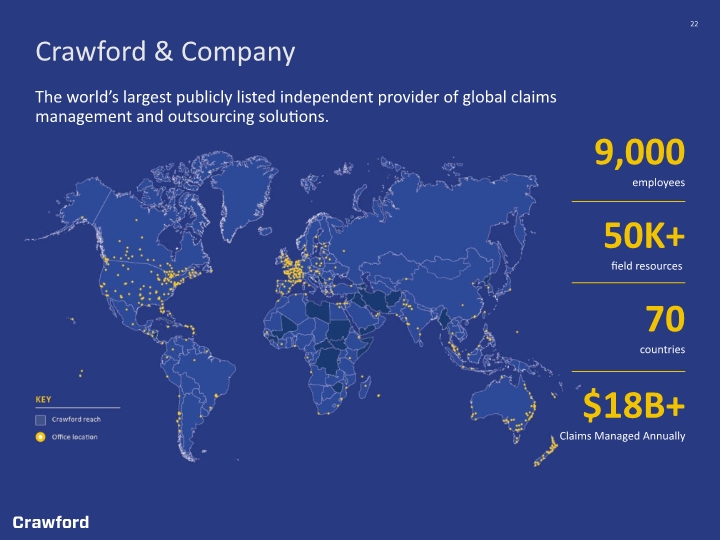

ATLANTA, (May 5, 2021) -- Crawford & Company® (NYSE: CRD-A and CRD-B), the world’s largest publicly listed independent provider of claims management and outsourcing solutions to carriers, brokers and corporations, today announced its financial results for the first quarter ended March 31, 2021.

The Company’s two classes of stock are substantially identical, except with respect to voting rights and the Company’s ability to pay greater cash dividends on the non-voting Class A Common Stock (CRD-A) than on the voting Class B Common Stock (CRD-B), subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRD-A must receive the same type and amount of consideration as holders of CRD-B, unless different consideration is approved by the holders of 75% of CRD-A, voting as a class.

GAAP Consolidated Results

First Quarter 2021

|

|

• |

Revenues before reimbursements of $253.2 million, compared with $237.5 million for the 2020 first quarter |

|

|

• |

Net income attributable to shareholders of $6.1 million, compared with a loss of ($11.4) million in the same period last year |

|

|

• |

Diluted earnings per share of $0.11 for both CRD-A and CRD-B, compared with a loss of ($0.21) for CRD-A and ($0.23) for CRD-B in the prior year first quarter |

Non-GAAP Consolidated Results

First Quarter 2021

Non-GAAP consolidated results for 2021 exclude after-tax amortization of intangible assets of $2.1 million. Non-GAAP consolidated results for 2020 exclude the non-cash after-tax adjustments of amortization of intangible assets of $2.1 million, restructuring costs of $3.3 million and goodwill impairment of $9.1 million, as explained further on pages 2 and 3.

|

|

• |

Foreign currency exchange rates increased revenues before reimbursements by $5.3 million or 2.2%. Presented on a constant dollar basis to the prior year, revenues before reimbursements totaled $247.9 million, compared with $237.5 million for the 2020 first quarter |

|

|

• |

Net income attributable to shareholders, on a non-GAAP basis, totaled $8.2 million in the 2021 first quarter, compared with $3.1 million in the same period last year |

|

|

• |

Diluted earnings per share, on a non-GAAP basis, of $0.15 for both CRD-A and CRD-B in the 2021 first quarter, compared with $0.07 for CRD-A and $0.05 for CRD-B in the prior year first quarter |

|

|

• |

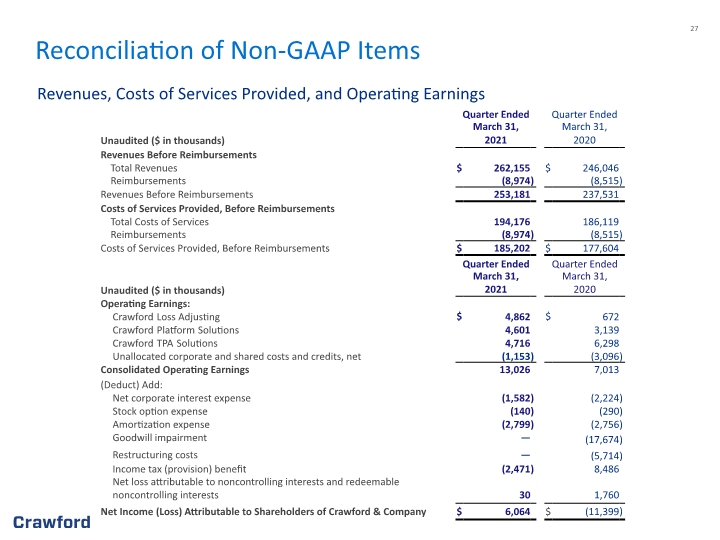

Consolidated adjusted operating earnings, on a non-GAAP basis, were $13.0 million, or 5.1% of non-GAAP revenues, in the 2021 first quarter, compared with $7.0 million, or 3.0% of revenues, in the 2020 first quarter |

|

|

• |

Consolidated adjusted EBITDA, a non-GAAP financial measure, was $22.2 million, or 8.8% of non-GAAP revenues, in the 2021 first quarter, compared with $16.7 million, or 7.0% of revenues, in the 2020 first quarter |

Management Comments

Mr. Rohit Verma, chief executive officer of Crawford & Company, stated, “Crawford delivered another strong quarter aided by weather-related activity, with revenue and operating earnings increasing nearly 7% and 86% year-over-year, respectively. We added a net total of $13 million in new and enhanced business, further building on our already sound customer and carrier client relationships, while continuing to drive innovation through the launch of Crawford Inspection Services, a digital solution that allows more claims to be handled from the desk.”

Mr. Verma concluded, “In 2021, Crawford will celebrate its 80th anniversary. As we look towards the remainder of this momentous year, we believe the strategic evolution of our business will enable us to confidently execute on our growth plans and envisioned future, supported by the right group of experts and leaders to achieve our long-term strategy. We are confident in our financial position and look forward to continuing to deliver value to our shareholders, while fulfilling our purpose of restoring and enhancing lives, businesses and communities.”

Segment Results for the First Quarter

Crawford Loss Adjusting

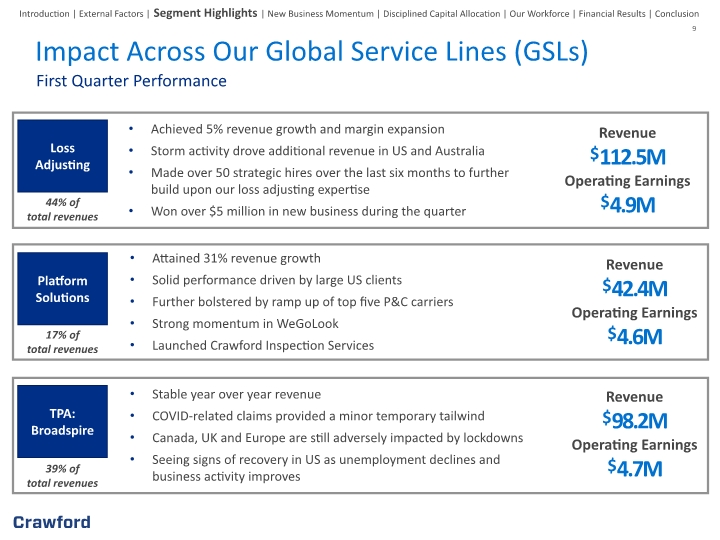

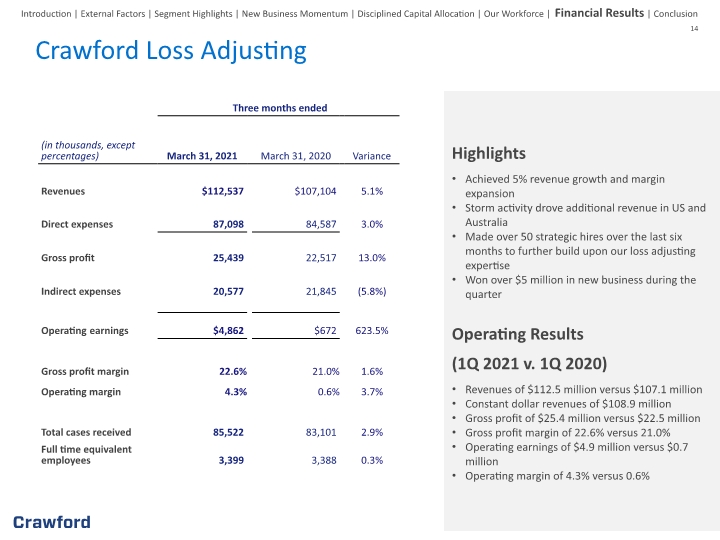

Crawford Loss Adjusting revenues before reimbursements were $112.5 million in the first quarter of 2021, increasing 5.1% from $107.1 million in the first quarter of 2020. Absent foreign currency rate fluctuations of $3.7 million, first quarter 2021 revenues would have been $108.9 million.

The segment had operating earnings of $4.9 million in the 2021 first quarter increasing from the $0.7 million in the first quarter of 2020. The operating margin was 4.3% in the 2021 quarter and 0.6% in the 2020 quarter.

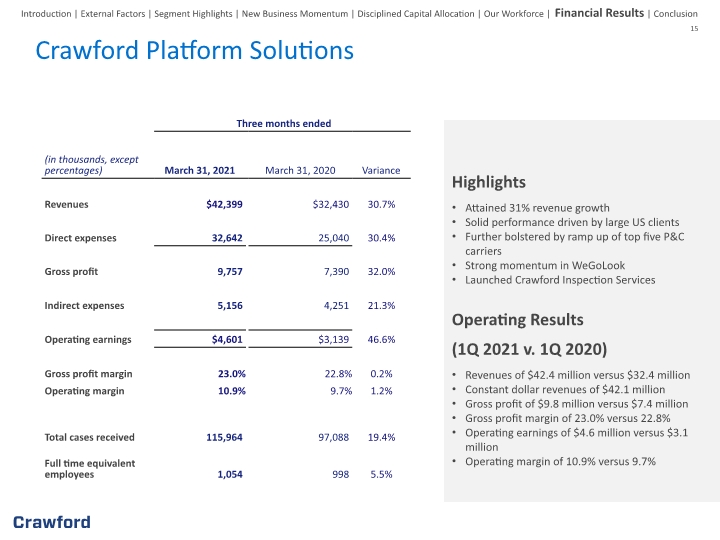

Crawford Platform Solutions

Crawford Platform Solution revenues before reimbursements were $42.4 million in the first quarter of 2021, up 30.7% from $32.4 million in the same period of 2020. Absent foreign exchange rate fluctuations of $0.3 million, revenues would have been $42.1 million for the three months ended March 31, 2021.

Operating earnings were $4.6 million in the 2021 first quarter increasing 46.6% over the $3.1 million in the 2020 period. The segment’s operating margin for the 2021 quarter was 10.9% as compared with 9.7% in the 2020 quarter.

Crawford TPA Solutions

Crawford TPA Solutions segment revenues before reimbursements were $98.2 million in the 2021 first quarter, increasing 0.3% from $98.0 million in the 2020 first quarter. Absent foreign currency rate fluctuations of $1.3 million, first quarter 2021 revenues would have been $97.0 million.

Crawford TPA Solutions recorded operating earnings of $4.7 million in the first quarter of 2021, representing an operating margin of 4.8%, decreasing from $6.3 million, or 6.4% of revenues, in the 2020 first quarter.

Unallocated Corporate and Shared Costs and Credits, Net

Unallocated corporate costs were $1.2 million in the first quarter of 2021, compared with $3.1 million in the same period of 2020. The decrease for the three months ended March 31, 2021, was primarily due to a $1.4 million decrease in self-insurance costs, a $1.0 million credit from the Canada Emergency Wage Subsidy, partially offset by a $0.5 million increase in incentive compensation.

Restructuring Costs

There were no restructuring costs in 2021. The Company recognized pretax restructuring costs totaling $5.7 million in the 2020 first quarter, related primarily to severance and other termination costs in an effort to consolidate and streamline various functions of our workforce. The restructuring costs comprised of $5.1 million severance expense and $0.6 million asset impairment.

Page 2 of 11

Goodwill Impairment

There was no goodwill impairment in 2021. The Company recognized a non-cash goodwill impairment in the 2020 first quarter, totaling $17.7 million, related to its former Crawford Claims Solutions segment.

Business Acquisitions

On November 1, 2020, the Company acquired 100% of HBA Group in Australia, including 100% of the stock in each of HBA Group’s entities HBA Legal, Pillion and Paratus. HBA Legal is a legal services provider that will complement the Company’s Crawford TPA Solutions segment in Australia. The purchase price includes an initial lump-sum payment of $4.0 million, net of working capital adjustment, and a maximum of $3.2 million payable over the next four years based on achieving certain EBITDA performance goals.

COVID-19

The Company estimates that COVID-19 negatively impacted its revenues in the range of $5.0 to $10.0 million for the three months ended March 31, 2021 as compared to the prior year period. The Company expects the ongoing global economic slowdown resulting from COVID-19 could have a material impact to its results of operations, financial condition and cash flow in one or more future quarters.

Balance Sheet and Cash Flow

The Company’s consolidated cash and cash equivalents position as of March 31, 2021, totaled $42.7 million, compared with $44.7 million at December 31, 2020. The Company’s total debt outstanding as of March 31, 2021, totaled $119.2 million, compared with $113.6 million at December 31, 2020.

The Company’s operations provided $1.6 million of cash during 2021, compared with a use of $8.0 million in 2020. The increase in cash provided by operating activities was primarily due to higher net income, lower pension contributions and other working capital requirements, including a benefit from the Canada Emergency Wage Subsidy. Free cash flow increased by $12.1 million compared with the prior year period.

The Company made no contributions to its U.S. defined benefit pension plan and $0.2 million to its U.K. plans for 2021, compared with $3.0 million in contributions to the U.S. plan and $0.2 million to the U.K. plans in 2020.

During 2021, the Company repurchased 90,062 shares of CRD-A and 58,837 shares of CRD-B at an average per share cost of $8.05 and $7.90, respectively. The total cost of share repurchases during 2021 was $1.2 million.

Conference Call

As previously announced, Crawford & Company will host a conference call on May 6, 2021, at 8:30 a.m. Eastern Time to discuss its first quarter 2021 results. The conference call can be accessed live by dialing 1-833-968-1973 and using Conference ID 2219718. A presentation for tomorrow’s call can also be found on the investor relations portion of the Company’s website, https://ir.crawco.com. The call will be recorded and available for replay through June 5, 2021. You may dial 1-800-585-8367 to listen to the replay.

Non-GAAP Presentation

In the normal course of business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under U.S. generally accepted accounting principles (“GAAP”), these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In the foregoing discussion and analysis of segment results of operations, we do not include a gross up of segment expenses and revenues for these pass-through reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our results of operations with no impact to our net income or operating earnings. A reconciliation of revenues before reimbursements to consolidated revenues determined in accordance with GAAP is self-evident from the face of the accompanying unaudited condensed consolidated statements of operations.

Page 3 of 11

Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker (“CODM”) to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Unlike net income, segment operating earnings is not a standard performance measure found in GAAP. We believe this measure is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria used by our senior management and CODM. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill impairment, restructuring costs, income taxes and net income or loss attributable to noncontrolling interests and redeemable noncontrolling interests.

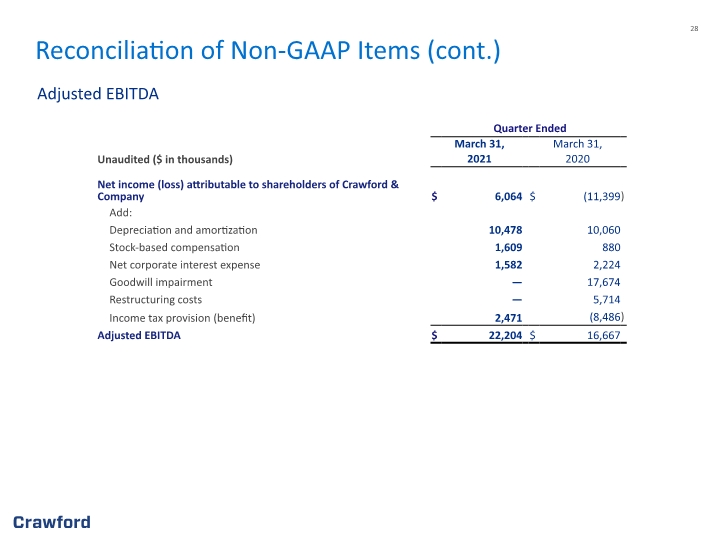

Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. However, adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results. The Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income attributable to shareholders of the Company with recurring adjustments for depreciation and amortization, net corporate interest expense, income taxes and stock-based compensation expense. Additionally, adjustments for non-recurring expenses for goodwill impairment and restructuring costs have been included in the calculation of adjusted EBITDA.

Unallocated corporate and shared costs and credits include expenses and credits related to our chief executive officer and Board of Directors, certain provisions for bad debt allowances or subsequent recoveries such as those related to bankrupt clients, defined benefit pension costs or credits for our frozen U.S. pension plan, certain unallocated professional fees and certain self-insurance costs and recoveries that are not allocated to our individual operating segments.

Income taxes, net corporate interest expense, stock option expense and amortization of customer-relationship intangible assets are recurring components of our net income, but they are not considered part of our segment operating earnings because they are managed on a corporate-wide basis. Income taxes are calculated for the Company on a consolidated basis based on statutory rates in effect in the various jurisdictions in which we provide services and vary significantly by jurisdiction. Net corporate interest expense results from capital structure decisions made by senior management and the Board of Directors, affecting the Company as a whole. Stock option expense represents the non-cash costs generally related to stock options and employee stock purchase plan expenses which are not allocated to our operating segments. Amortization expense is a non-cash expense for finite-lived customer-relationship and trade name intangible assets acquired in business combinations. None of these costs relate directly to the performance of our services or operating activities and, therefore, are excluded from segment operating earnings to better assess the results of each segment's operating activities on a consistent basis.

A significant portion of our operations are international. These international operations subject us to foreign exchange fluctuations. The following table illustrates revenue as a percentage of total revenue for the major currencies of the geographic areas that Crawford does business:

|

|

|

Three Months Ended |

|

|||||||||||

|

(in thousands) |

|

March 31, 2021 |

|

|

March 31, 2020 |

|

||||||||

|

Geographic Area |

Currency |

USD equivalent |

|

% of total |

|

|

USD equivalent |

|

% of total |

|

||||

|

U.S. |

USD |

$ |

145,402 |

|

|

57.4 |

% |

|

$ |

134,446 |

|

|

56.6 |

% |

|

U.K. |

GBP |

|

32,223 |

|

|

12.7 |

% |

|

|

32,383 |

|

|

13.6 |

% |

|

Canada |

CAD |

|

21,234 |

|

|

8.4 |

% |

|

|

25,220 |

|

|

10.6 |

% |

|

Australia |

AUD |

|

24,210 |

|

|

9.6 |

% |

|

|

16,906 |

|

|

7.1 |

% |

|

Europe |

EUR |

|

13,264 |

|

|

5.2 |

% |

|

|

13,389 |

|

|

5.6 |

% |

|

Rest of World |

Various |

|

16,848 |

|

|

6.7 |

% |

|

|

15,187 |

|

|

6.5 |

% |

|

Total Revenues, before reimbursements |

$ |

253,181 |

|

|

100.0 |

% |

|

$ |

237,531 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 of 11

Following is a reconciliation of segment and consolidated operating earnings to net income (loss) attributable to shareholders of Crawford & Company on a GAAP basis:

|

|

Three Months Ended |

|

||||

|

(in thousands) |

March 31, 2021 |

|

March 31, 2020 |

|

||

|

Operating earnings: |

|

|

|

|

|

|

|

Crawford Loss Adjusting |

$ |

4,862 |

|

$ |

672 |

|

|

Crawford Platform Solutions |

|

4,601 |

|

|

3,139 |

|

|

Crawford TPA Solutions |

|

4,716 |

|

|

6,298 |

|

|

Unallocated corporate and shared costs, net |

|

(1,153 |

) |

|

(3,096 |

) |

|

Consolidated operating earnings |

|

13,026 |

|

|

7,013 |

|

|

(Deduct) add: |

|

|

|

|

|

|

|

Net corporate interest expense |

|

(1,582 |

) |

|

(2,224 |

) |

|

Stock option expense |

|

(140 |

) |

|

(290 |

) |

|

Amortization expense |

|

(2,799 |

) |

|

(2,756 |

) |

|

Goodwill impairment |

|

— |

|

|

(17,674 |

) |

|

Restructuring costs |

|

— |

|

|

(5,714 |

) |

|

Income tax (provision) benefit |

|

(2,471 |

) |

|

8,486 |

|

|

Net loss attributable to noncontrolling interests and redeemable noncontrolling interests |

|

30 |

|

|

1,760 |

|

|

Net income (loss) attributable to shareholders of Crawford & Company |

$ |

6,064 |

|

$ |

(11,399 |

) |

|

|

|

|

|

|

|

|

Following is a reconciliation of net income (loss) attributable to shareholders of Crawford & Company on a GAAP basis to non-GAAP adjusted EBITDA:

|

|

Three Months Ended |

|

||||

|

(in thousands) |

March 31, 2021 |

|

March 31, 2020 |

|

||

|

Net income (loss) attributable to shareholders of Crawford & Company |

$ |

6,064 |

|

$ |

(11,399 |

) |

|

Add (Deduct): |

|

|

|

|

|

|

|

Depreciation and amortization |

|

10,478 |

|

|

10,060 |

|

|

Stock-based compensation |

|

1,609 |

|

|

880 |

|

|

Net corporate interest expense |

|

1,582 |

|

|

2,224 |

|

|

Goodwill impairment |

|

— |

|

|

17,674 |

|

|

Restructuring costs |

|

— |

|

|

5,714 |

|

|

Income tax provision (benefit) |

|

2,471 |

|

|

(8,486 |

) |

|

Non-GAAP adjusted EBITDA |

$ |

22,204 |

|

$ |

16,667 |

|

|

|

|

|

|

|

|

|

Following is a reconciliation of operating cash flow to free cash flow for the three months ended March 31, 2021 and 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

||||||||||

|

(in thousands) |

March 31, 2021 |

|

|

March 31, 2020 |

|

|

Change |

|

|||

|

Net Cash Provided by (Used in) Operating Activities |

$ |

1,577 |

|

|

$ |

(7,978 |

) |

|

$ |

9,555 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

Property & Equipment Purchases, net |

|

(618 |

) |

|

|

(2,708 |

) |

|

|

2,090 |

|

|

Capitalized Software (internal and external costs) |

|

(4,354 |

) |

|

|

(4,803 |

) |

|

|

449 |

|

|

Free Cash Flow |

$ |

(3,395 |

) |

|

$ |

(15,489 |

) |

|

$ |

12,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 5 of 11

Following are the reconciliations of GAAP Revenue, Operating Earnings, Pretax Earnings (Loss), Net Income (Loss) and Earnings (Loss) Per Share to related non-GAAP Adjusted figures, which reflect 2021 before amortization of intangible assets, and for 2020 exclude the results of amortization of intangible assets, goodwill impairment and restructuring costs:

|

Three Months Ended March 31, 2021 |

|

|||||||||||||||||

|

(in thousands) |

Revenues |

|

Non-GAAP Operating earnings |

|

Pretax earnings |

|

Net income attributable to Crawford & Company |

|

Diluted earnings per CRD-A share |

|

Diluted earnings per CRD-B share |

|

||||||

|

GAAP |

$ |

253,181 |

|

$ |

13,026 |

|

$ |

8,505 |

|

$ |

6,064 |

|

$ |

0.11 |

|

$ |

0.11 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

— |

|

|

— |

|

|

2,799 |

|

|

2,099 |

|

|

0.04 |

|

|

0.04 |

|

|

Non-GAAP Adjusted |

$ |

253,181 |

|

$ |

13,026 |

|

$ |

11,304 |

|

$ |

8,163 |

|

$ |

0.15 |

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2020 |

|

|||||||||||||||||

|

(in thousands) |

Revenues |

|

Non-GAAP Operating earnings |

|

Pretax (loss) earnings |

|

Net (loss) income attributable to Crawford & Company(1) |

|

Diluted (loss) earnings per CRD-A share(1) |

|

Diluted (loss) earnings per CRD-B share(1) |

|

||||||

|

GAAP |

$ |

237,531 |

|

$ |

7,013 |

|

$ |

(21,645 |

) |

$ |

(11,399 |

) |

$ |

(0.21 |

) |

$ |

(0.23 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

— |

|

|

— |

|

|

2,756 |

|

|

2,067 |

|

|

0.04 |

|

|

0.04 |

|

|

Goodwill impairment |

|

— |

|

|

— |

|

|

17,674 |

|

|

9,133 |

|

|

0.18 |

|

|

0.18 |

|

|

Restructuring costs |

|

— |

|

|

— |

|

|

5,714 |

|

|

3,263 |

|

|

0.06 |

|

|

0.06 |

|

|

Non-GAAP Adjusted |

$ |

237,531 |

|

$ |

7,013 |

|

$ |

4,499 |

|

$ |

3,064 |

|

$ |

0.07 |

|

$ |

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The income tax impact of goodwill impairment was based on the estimated annual effective income tax rate. Due to the non-discrete income tax treatment of the first quarter goodwill impairment, the income tax benefit normalized as income was earned during the remainder of the year, resulting in a lower full year income tax benefit.

Following is information regarding the weighted average shares used in the computation of basic and diluted earnings per share:

|

|

Three months ended |

|

||||

|

(in thousands) |

March 31, 2021 |

|

March 31, 2020 |

|

||

|

Weighted-Average Shares Used to Compute Basic Earnings (Loss) Per Share: |

|

|

|

|

|

|

|

Class A Common Stock |

|

30,824 |

|

|

30,562 |

|

|

Class B Common Stock |

|

22,464 |

|

|

22,578 |

|

|

Weighted-Average Shares Used to Compute Diluted Earnings (Loss) Per Share: |

|

|

|

|

|

|

|

Class A Common Stock |

|

31,106 |

|

|

30,562 |

|

|

Class B Common Stock |

|

22,464 |

|

|

22,578 |

|

|

|

|

|

|

|

|

|

Further information regarding the Company’s operating results for the quarter ended March 31, 2021, financial position as of March 31, 2021, and cash flows for the quarter ended March 31, 2021 is shown on the attached unaudited condensed consolidated financial statements.

Page 6 of 11

About Crawford & Company

Based in Atlanta, Crawford & Company (NYSE: CRD-A and CRD-B) is the world's largest publicly listed independent provider of claims management and outsourcing solutions to carriers, brokers and corporations with an expansive global network serving clients in more than 70 countries. The Company’s shares are traded on the NYSE under the symbols CRD-A and CRD-B. The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class. More information is available at www.crawco.com.

Earnings per share may be different between CRD-A and CRD-B due to the payment of a higher per share dividend on CRD-A than CRD-B, and the impact that has on the earnings per share calculation according to generally accepted accounting principles.

TAG: Crawford-Financial, Crawford-Investor-News-and-Events

FOR FURTHER INFORMATION REGARDING THIS PRESS RELEASE, PLEASE CALL BRUCE SWAIN AT (404) 300-1051.

|

This press release contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not historical facts may be “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company’s present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. For further information regarding Crawford & Company, including factors that could cause our actual financial condition, results or earnings to differ from those described in any forward-looking statements, please read Crawford & Company’s reports filed with the SEC and available at www.sec.gov and in the Investor Relations section of Crawford & Company’s website at www.crawco.com. |

Page 7 of 11

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

(In Thousands, Except Per Share Amounts and Percentages)

|

Three Months Ended March 31, |

|

2021 |

|

|

2020 |

|

|

% Change |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues Before Reimbursements |

|

$ |

253,181 |

|

|

$ |

237,531 |

|

|

|

7 |

% |

|

Reimbursements |

|

|

8,974 |

|

|

|

8,515 |

|

|

|

5 |

% |

|

Total Revenues |

|

|

262,155 |

|

|

|

246,046 |

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of Services Provided, Before Reimbursements |

|

|

185,202 |

|

|

|

177,604 |

|

|

|

4 |

% |

|

Reimbursements |

|

|

8,974 |

|

|

|

8,515 |

|

|

|

5 |

% |

|

Total Costs of Services |

|

|

194,176 |

|

|

|

186,119 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General, and Administrative Expenses |

|

|

58,702 |

|

|

|

55,754 |

|

|

|

5 |

% |

|

Corporate Interest Expense, Net |

|

|

1,582 |

|

|

|

2,224 |

|

|

|

(29 |

)% |

|

Goodwill Impairment |

|

|

- |

|

|

|

17,674 |

|

|

|

(100 |

)% |

|

Restructuring Costs |

|

|

- |

|

|

|

5,714 |

|

|

|

(100 |

)% |

|

Total Costs and Expenses |

|

|

254,460 |

|

|

|

267,485 |

|

|

|

(5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense), Net |

|

|

810 |

|

|

|

(206 |

) |

|

|

493 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) Before Income Taxes |

|

|

8,505 |

|

|

|

(21,645 |

) |

|

|

139 |

% |

|

Provision (benefit) for Income Taxes |

|

|

2,471 |

|

|

|

(8,486 |

) |

|

|

129 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

|

|

6,034 |

|

|

|

(13,159 |

) |

|

|

146 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Attributable to Noncontrolling Interests and Redeemable Noncontrolling Interests |

|

|

30 |

|

|

|

1,760 |

|

|

|

(98 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Shareholders of Crawford & Company |

|

$ |

6,064 |

|

|

$ |

(11,399 |

) |

|

|

153 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share - Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.11 |

|

|

$ |

(0.21 |

) |

|

|

152 |

% |

|

Class B Common Stock |

|

$ |

0.11 |

|

|

$ |

(0.23 |

) |

|

|

148 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share - Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.11 |

|

|

$ |

(0.21 |

) |

|

|

152 |

% |

|

Class B Common Stock |

|

$ |

0.11 |

|

|

$ |

(0.23 |

) |

|

|

148 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Dividends Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Stock |

|

$ |

0.06 |

|

|

$ |

0.07 |

|

|

|

(14 |

)% |

|

Class B Common Stock |

|

$ |

0.06 |

|

|

$ |

0.05 |

|

|

|

20 |

% |

Page 8 of 11

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

As of March 31, 2021 and December 31, 2020

Unaudited

(In Thousands, Except Par Values)

|

|

|

March 31, |

|

|

December 31, |

|

||

|

|

|

2021 |

|

|

2020 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents |

|

$ |

42,723 |

|

|

$ |

44,656 |

|

|

Accounts Receivable, Net |

|

|

126,214 |

|

|

|

123,060 |

|

|

Unbilled Revenues, at Estimated Billable Amounts |

|

|

114,383 |

|

|

|

103,528 |

|

|

Income Taxes Receivable |

|

|

1,269 |

|

|

|

1,269 |

|

|

Prepaid Expenses and Other Current Assets |

|

|

30,531 |

|

|

|

29,490 |

|

|

Total Current Assets |

|

|

315,120 |

|

|

|

302,003 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Property and Equipment |

|

|

35,201 |

|

|

|

36,402 |

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets: |

|

|

|

|

|

|

|

|

|

Operating Lease Right-of-Use Asset, Net |

|

|

109,537 |

|

|

|

109,315 |

|

|

Goodwill |

|

|

74,242 |

|

|

|

66,537 |

|

|

Intangible Assets Arising from Business Acquisitions, Net |

|

|

71,501 |

|

|

|

71,176 |

|

|

Capitalized Software Costs, Net |

|

|

70,980 |

|

|

|

71,021 |

|

|

Deferred Income Tax Assets |

|

|

25,208 |

|

|

|

25,595 |

|

|

Other Noncurrent Assets |

|

|

70,945 |

|

|

|

70,935 |

|

|

Total Other Assets |

|

|

422,413 |

|

|

|

414,579 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

772,734 |

|

|

$ |

752,984 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ INVESTMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Short-Term Borrowings |

|

$ |

3,795 |

|

|

$ |

1,837 |

|

|

Accounts Payable |

|

|

39,724 |

|

|

|

41,544 |

|

|

Accrued Compensation and Related Costs |

|

|

74,721 |

|

|

|

81,848 |

|

|

Self-Insured Risks |

|

|

10,112 |

|

|

|

11,390 |

|

|

Income Taxes Payable |

|

|

6,533 |

|

|

|

5,822 |

|

|

Operating Lease Liability |

|

|

32,257 |

|

|

|

32,745 |

|

|

Other Accrued Liabilities |

|

|

38,259 |

|

|

|

40,375 |

|

|

Deferred Revenues |

|

|

29,796 |

|

|

|

27,233 |

|

|

Total Current Liabilities |

|

|

235,197 |

|

|

|

242,794 |

|

|

|

|

|

|

|

|

|

|

|

|

Noncurrent Liabilities: |

|

|

|

|

|

|

|

|

|

Long-Term Debt and Finance Leases, Less Current Installments |

|

|

115,433 |

|

|

|

111,758 |

|

|

Operating Lease Liability |

|

|

93,785 |

|

|

|

93,228 |

|

|

Deferred Revenues |

|

|

24,381 |

|

|

|

24,136 |

|

|

Accrued Pension Liabilities |

|

|

51,366 |

|

|

|

53,886 |

|

|

Other Noncurrent Liabilities |

|

|

50,014 |

|

|

|

40,254 |

|

|

Total Noncurrent Liabilities |

|

|

334,979 |

|

|

|

323,262 |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Investment: |

|

|

|

|

|

|

|

|

|

Class A Common Stock, $1.00 Par Value |

|

|

30,850 |

|

|

|

30,847 |

|

|

Class B Common Stock, $1.00 Par Value |

|

|

22,451 |

|

|

|

22,510 |

|

|

Additional Paid-in Capital |

|

|

68,715 |

|

|

|

67,193 |

|

|

Retained Earnings |

|

|

267,070 |

|

|

|

265,245 |

|

|

Accumulated Other Comprehensive Loss |

|

|

(186,266 |

) |

|

|

(198,856 |

) |

|

Shareholders’ Investment Attributable to Shareholders of Crawford & Company |

|

|

202,820 |

|

|

|

186,939 |

|

|

Noncontrolling Interests |

|

|

(262 |

) |

|

|

(11 |

) |

|

Total Shareholders’ Investment |

|

|

202,558 |

|

|

|

186,928 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Investment |

|

$ |

772,734 |

|

|

$ |

752,984 |

|

Page 9 of 11

CRAWFORD & COMPANY

SUMMARY RESULTS BY OPERATING SEGMENT WITH DIRECT COMPENSATION AND OTHER EXPENSES

Unaudited

(In Thousands, Except Percentages)

Three Months Ended March 31

|

|

|

Crawford Loss Adjusting |

|

|

% |

|

|

Crawford Platform Solutions |

|

|

% |

|

|

Crawford TPA Solutions |

|

|

% |

|

||||||||||||||||||||

|

|

|

2021 |

|

|

2020 |

|

|

Change |

|

|

2021 |

|

|

|

|

2020 |

|

|

Change |

|

|

2021 |

|

|

2020 |

|

|

Change |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues Before Reimbursements |

|

$ |

112,537 |

|

|

$ |

107,104 |

|

|

|

5.1 |

% |

|

$ |

42,399 |

|

|

|

|

$ |

32,430 |

|

|

|

30.7 |

% |

|

$ |

98,245 |

|

|

$ |

97,997 |

|

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Compensation, Fringe Benefits & Non-Employee Labor |

|

|

73,585 |

|

|

|

70,573 |

|

|

|

4.3 |

% |

|

|

27,369 |

|

|

|

|

|

20,409 |

|

|

|

34.1 |

% |

|

|

62,955 |

|

|

|

61,400 |

|

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

|

65.4 |

% |

|

|

65.9 |

% |

|

|

|

|

|

|

64.6 |

% |

|

|

|

|

62.9 |

% |

|

|

|

|

|

|

64.1 |

% |

|

|

62.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses Other than Reimbursements, Direct Compensation, Fringe Benefits & Non-Employee Labor |

|

|

34,090 |

|

|

|

35,859 |

|

|

|

(4.9 |

)% |

|

|

10,429 |

|

|

|

|

|

8,882 |

|

|

|

17.4 |

% |

|

|

30,574 |

|

|

|

30,299 |

|

|

|

0.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

|

30.3 |

% |

|

|

33.5 |

% |

|

|

|

|

|

|

24.6 |

% |

|

|

|

|

27.4 |

% |

|

|

|

|

|

|

31.1 |

% |

|

|

30.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

|

107,675 |

|

|

|

106,432 |

|

|

|

1.2 |

% |

|

|

37,798 |

|

|

|

|

|

29,291 |

|

|

|

29.0 |

% |

|

|

93,529 |

|

|

|

91,699 |

|

|

|

2.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Earnings (1) |

|

$ |

4,862 |

|

|

$ |

672 |

|

|

|

623.5 |

% |

|

$ |

4,601 |

|

|

|

|

$ |

3,139 |

|

|

|

46.6 |

% |

|

$ |

4,716 |

|

|

$ |

6,298 |

|

|

|

(25.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Revenues Before Reimbursements |

|

|

4.3 |

% |

|

|

0.6 |

% |

|

|

|

|

|

|

10.9 |

% |

|

|

|

|

9.7 |

% |

|

|

|

|

|

|

4.8 |

% |

|

|

6.4 |

% |

|

|

|

|

(1) A non-GAAP financial measurement which represents net income attributable to the applicable reporting segment excluding income taxes, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill impairment, restructuring costs, and certain unallocated corporate and shared costs and credits. See pages 3 and 4 for additional information about segment operating earnings.

Page 10 of 11

CRAWFORD & COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Year to Date Period Ended March 31, 2021 and March 31, 2020

Unaudited

(In Thousands)

|

|

|

2021 |

|

|

2020 |

|

||

|

Cash Flows From Operating Activities: |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

6,034 |

|

|

$ |

(13,159 |

) |

|

Reconciliation of net income (loss) to net cash provided (used in) by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

10,478 |

|

|

|

10,060 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

17,674 |

|

|

Stock-based compensation |

|

|

1,609 |

|

|

|

880 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

888 |

|

|

|

6,084 |

|

|

Unbilled revenues, net |

|

|

(6,632 |

) |

|

|

(7,240 |

) |

|

Accrued or prepaid income taxes |

|

|

511 |

|

|

|

(10,355 |

) |

|

Accounts payable and accrued liabilities |

|

|

(8,032 |

) |

|

|

(4,617 |

) |

|

Deferred revenues |

|

|

1,783 |

|

|

|

2,898 |

|

|

Accrued retirement costs |

|

|

(5,457 |

) |

|

|

(8,638 |

) |

|

Prepaid expenses and other operating activities |

|

|

395 |

|

|

|

(1,565 |

) |

|

Net cash provided by (used in) operating activities |

|

|

1,577 |

|

|

|

(7,978 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities: |

|

|

|

|

|

|

|

|

|

Acquisitions of property and equipment |

|

|

(618 |

) |

|

|

(2,708 |

) |

|

Capitalization of computer software costs |

|

|

(4,354 |

) |

|

|

(4,803 |

) |

|

Proceeds from settlement of life insurance policies |

|

|

3,054 |

|

|

|

— |

|

|

Payments for business acquisitions, net of cash acquired |

|

|

(3,786 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

|

(5,704 |

) |

|

|

(7,511 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities: |

|

|

|

|

|

|

|

|

|

Cash dividends paid |

|

|

(3,198 |

) |

|

|

(3,268 |

) |

|

Repurchases of common stock |

|

|

(1,190 |

) |

|

|

(2,666 |

) |

|

Increases in short-term and revolving credit facility borrowings |

|

|

17,126 |

|

|

|

65,179 |

|

|

Payments on short-term and revolving credit facility borrowings |

|

|

(11,729 |

) |

|

|

(11,910 |

) |

|

Other financing activities |

|

|

(399 |

) |

|

|

(146 |

) |

|

Net cash provided by financing activities |

|

|

610 |

|

|

|

47,189 |

|

|

|

|

|

|

|

|

|

|

|

|

Effects of exchange rate changes on cash and cash equivalents |

|

|

1,584 |

|

|

|

(392 |

) |

|

(Decrease) increase in cash and cash equivalents |

|

|

(1,933 |

) |

|

|

31,308 |

|

|

Cash and cash equivalents at beginning of year |

|

|

44,656 |

|

|

|

51,802 |

|

|

Cash and cash equivalents at end of period |

|

$ |

42,723 |

|

|

$ |

83,110 |

|

Page 11 of 11