UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 10-K

|

| | |

x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2019 |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number 1-10356

CRAWFORD & COMPANY

(Exact name of Registrant as specified in its charter)

|

| | |

Georgia (State or other jurisdiction of incorporation or organization) | | 58-0506554 (I.R.S. Employer Identification Number) |

5335 Triangle Parkway, Peachtree Corners, Georgia (Address of principal executive offices) | | 30092 (Zip Code) |

Registrant's telephone number, including area code

(404) 300-1000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Class A Common Stock — $1.00 Par Value | CRD-A | New York Stock Exchange |

Class B Common Stock — $1.00 Par Value | CRD-B | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes x No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | |

Large accelerated filer o | | Accelerated filer x | | Non-accelerated filer o | | Smaller reporting company o | | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the Registrant's voting and non-voting common stock held by non-affiliates of the Registrant was $273,206,852 as of June 28, 2019, based upon the closing prices of such stock as reported on the NYSE on such date. For purposes hereof, beneficial ownership is determined under rules adopted pursuant to Section 13 of the Securities Exchange Act of 1934, and excludes voting and non-voting common stock beneficially owned by the directors and executive officers of the Registrant, some of whom may not be deemed to be affiliates upon judicial determination.

The number of shares outstanding of each class of the Registrant's common stock, as of February 28, 2020, was:

Class A Common Stock — $1.00 Par Value — 30,565,518 Shares

Class B Common Stock — $1.00 Par Value — 22,580,333 Shares

Documents incorporated by reference:

Portions of the Registrant's proxy statement for its 2019 annual shareholders' meeting, which proxy statement will be filed within 120 days of the Registrant's year end, are incorporated by reference into Part III hereof.

CRAWFORD & COMPANY

FORM 10-K

For The Year Ended December 31, 2019

Table of Contents

We use the terms "Crawford", "the Company", "the Registrant", "we", "us" and "our" to refer to the business of Crawford & Company, its subsidiaries, and variable interest entities.

Cautionary Statement Concerning Forward-Looking Statements

This report contains and incorporates by reference forward-looking statements within the meaning of that term in the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Statements contained or incorporated by reference in this report that are not statements of historical fact are forward-looking statements made pursuant to the "safe harbor" provisions thereof. These statements may relate to, among other things, our expected future operating results and financial condition, our ability to grow our revenues and reduce our operating expenses, expectations regarding our anticipated contributions to our underfunded defined benefit pension plans, collectability of our billed and unbilled accounts receivable, financial results from our recent acquisitions, our continued compliance with the financial and other covenants contained in our financing agreements, and our other long-term capital resource and liquidity requirements. These statements may also relate to our business strategies, goals and expectations concerning our market position, future operations, margins, case volumes, profitability, contingencies, liquidity position, and capital resources. The words "anticipate", "believe", "could", "would", "should", "estimate", "expect", "intend", "may", "plan", "goal", "strategy", "predict", "project", "will" and similar terms and phrases, or the negatives thereof, identify forward-looking statements in this report and in the statements incorporated by reference in this report. These risks and uncertainties include, but are not limited to, those described in Part I, "Item 1A. Risk Factors" and elsewhere in this report and those described from time to time in our other reports filed with the Securities and Exchange Commission.

Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could prove to be incorrect. Our operations and the forward-looking statements related to our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially adversely affect our financial condition and results of operations, and whether the forward-looking statements ultimately prove to be correct. As a result, undue reliance should not be placed on any forward-looking statements. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements. Forward-looking statements speak only as of the date they are made and we undertake no obligation to publicly update any of these forward-looking statements in light of new information or future events.

PART I

ITEM 1. BUSINESS

Headquartered in Atlanta, Georgia, and founded in 1941, the Company is the world's largest publicly listed independent provider of claims management and outsourcing solutions to carriers, brokers and corporates with an expansive global network serving clients in more than 70 countries. For the year ended December 31, 2019, the Company reported total revenues before reimbursements of $1.006 billion.

Shares of the Company's two classes of common stock are traded on the New York Stock Exchange ("NYSE") under the symbols CRD-A and CRD-B, respectively. The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class.

DESCRIPTION OF SERVICES

The Company delivers services to its clients through a global service line reporting structure consisting of three operating segments as follows:

| |

• | Crawford Claims Solutions provides claims management services globally to insurance carriers and self-insured entities related to property, casualty, and catastrophe losses. |

| |

• | Crawford TPA Solutions, which trades under the Broadspire brand globally, provides third party administration for workers' compensation, auto and liability, disability absence management, medical management, and accident and health to corporations, brokers and insurers worldwide. |

| |

• | Crawford Specialty Solutions provides services to the global property and casualty insurance company markets through service lines known as Global Technical Services and Contractor Connection. |

A significant portion of our revenues are derived from international operations. For a discussion of certain risks attendant to international operations, see Item 1A, "Risk Factors."

CRAWFORD CLAIMS SOLUTIONS. The Crawford Claims Solutions segment accounted for 33.8% of the Company's revenues before reimbursements in 2019. The Company's Crawford Claims Solutions segment provides claims management services globally to insurance carriers and self-insured entities related to property, casualty, and catastrophe losses caused by physical damage to commercial and residential real property, certain types of personal property and marine losses. The Company's Crawford Claims Solutions segment revenues are substantially derived from the insurance carrier market. Insurance companies customarily manage their own claims administration function, but often rely upon third-parties for certain services which the Company provides, primarily with respect to field investigation, catastrophe, and the evaluation and resolution of property and casualty insurance claims.

Claims management services offered by our Crawford Claims Solutions segment are provided to clients pursuant to a variety of different referral assignments which generally are classified by the underlying insured risk categories used by insurance companies. These major risk categories are:

| |

• | Property — losses caused by physical damage to commercial or residential real property and certain types of personal property |

| |

• | Catastrophe — losses caused by all types of natural disasters, such as fires, hailstorms, hurricanes, earthquakes and floods, and man-made disasters such as oil spills, chemical releases, and explosions |

| |

• | Public Liability — a wide range of non-automobile liability claims such as product liability; owners, landlords and tenants liabilities; and comprehensive general liability |

| |

• | Automobile — all types of losses involving use of an automobile, including bodily injury, physical damage, medical payments, collision, fire, theft, and comprehensive liability |

| |

• | Marine — losses relating to hull, machinery and cargo |

In addition, the Crawford Claims Solutions segment, through the Company’s WeGoLook®, LLC subsidiary, provides a variety of on-demand inspection, verification, and other task-specific field services for businesses and consumers through a mobile platform of independent contractors.

CRAWFORD TPA SOLUTIONS. Our Crawford TPA Solutions segment, which operates under the Broadspire brand name, is a leading third party administrator that provides services to the global casualty and disability insurance and self-insured markets. This segment accounted for 39.2% of the Company's revenues before reimbursements in 2019.

Through the Crawford TPA Solutions segment, we provide a complete range of claims and risk management services to corporations in the self-insured or commercially-insured marketplace inclusive of brokers and insurance companies. In addition to desktop claim adjusting and evaluation of claims, Crawford TPA Solutions also offers initial loss reporting services for claimants; loss mitigation services, such as medical bill review, medical case management and vocational rehabilitation; risk management information services; and administration of trust funds established to pay claims. Crawford TPA Solutions services are provided through two major service lines:

| |

• | The Claims Management service line includes workers' compensation, liability, property, accident & health, and disability claims management. Accident & health claims programs include accidental death and dismemberment, business travel, life, disability, critical illness and credit protection claims programs. Disability and leave management services include the handling of short and long term disability, FMLA (Federal Medical Leave Act), ADA (Americans with Disabilities Act) and state leave claims designed to increase employee productivity and contain costs. Claims management services includes risk management information and consultative analytical services. |

| |

• | The Medical Management service line integrates evidence-based criteria, clinical expertise, and advanced technology into the claims process to achieve optimal outcomes for employees in a cost-effective manner. Case managers provide administration services by proactively managing medical treatment for employees while facilitating an understanding of and participation in their rehabilitation process. These programs assist our client employees' recovery in a quick, cost-effective method. Medical bill review services provide analysis of medical charges for clients' claims to identify opportunities for savings. Physician review services include a diverse panel of specialized physician reviewers that evaluate the medical necessity of medical services as well as causal relation determination while also supporting timely return to work for employees. |

CRAWFORD SPECIALTY SOLUTIONS. The Crawford Specialty Solutions segment accounted for 27.0% of the Company's revenues before reimbursements in 2019. The Crawford Specialty Solutions segment provides services to the global property and casualty insurance company markets.

| |

• | Global Technical Services provides claims management services to insurance companies and self-insured entities related to large, complex losses with technical adjusting and industry experts servicing a broad range of industries, including commercial property, aviation, forensic accounting, marine and transportation, retail, building and construction, cyber and energy. Crawford Global Technical Services is a group of skilled adjusters with technical training and specialized expertise, such as in forensics, engineering, accounting, or chemistry, with relationships spanning the insurance industry and Fortune 1000 corporations. |

| |

• | Contractor Connection provides a managed repair service using the largest independently managed contractor network in the industry, with approximately 6,000 credentialed residential and commercial contractors. This innovative service provides a customer-centric solution for a wide range of loss types from high-frequency, low-complexity claims to large complex repairs, optimizing the time and work process needed to resolve property claims. Contractor Connection supports our business process outsourcing strategy by providing high-quality outsourced contractor management to national and regional personal and commercial insurance carriers as well as directly to consumer markets. |

MATERIAL CUSTOMERS

No single customer accounted for 10% or more of our consolidated revenues in 2019, 2018 or 2017. However, for each of the years ended December 31, 2019, 2018 and 2017, our Crawford Specialty Solutions segment derived in excess of 10% of its revenue from one customer.

In the event we are not able to retain this significant relationship, or replace any lost revenues from such relationship, revenues and operating earnings within this segment, could be materially adversely affected.

INTELLECTUAL PROPERTY AND TRADEMARKS

Our intellectual property portfolio is an important asset which we seek to expand and protect globally through a combination of trademarks, trade names, copyrights and trade secrets. We own a number of active trademark applications and registrations which expire at various times. As the laws of many countries do not protect intellectual property to the same extent as the laws of the U.S., we cannot ensure that we will be able to adequately protect our intellectual property assets outside of the U.S. The failure to protect our intellectual property assets could have a material adverse affect on our business; however, the loss of any single patent, trademark or service mark, taken alone, would not have a material adverse effect on any of our segments or on the Company as a whole.

SERVICE DELIVERY

Our claims management services are offered primarily through a global network serving clients in more than 70 countries. Contractor Connection services are offered by providing high-quality outsourced contractor management to national and regional insurance carriers. WeGoLook services are offered through a mobile platform of independent contractors.

COMPETITION

The global claims management services market is highly competitive and comprised of a large number of companies that vary in size and that offer a varied scope of services. The demand from insurance companies and self-insured entities for services provided by independent claims service firms like us is largely dependent on industry-wide claims volumes, which are affected by, among other things, the insurance underwriting cycle, weather-related events, general economic activity, overall employment levels and workplace injury rates. Demand is also impacted by decisions insurance companies and self-insured entities make with respect to the level of claims outsourced to independent claim service firms as opposed to those handled by their own in-house claims adjusters. In addition, our ability to retain clients and maintain or increase case referrals is also dependent in part on our ability to continue to provide high-quality, competitively priced services and effective sales efforts.

We typically earn our revenues on an individual fee-per-claim basis for claims management services we provide to insurance companies and self-insured entities. Accordingly, the volume of claim referrals to us is a key driver of our revenues. Generally, fees are earned over time on cases as services are provided, which generally occurs in the period the case is assigned to us, although sometimes a portion or substantially all of the revenues generated by a specific case assignment will be earned in subsequent periods. We cannot predict the future trend of case volumes for a number of reasons, including the frequency and severity of weather-related cases and the occurrence of natural and man-made disasters, which are a significant source of cases for us and are not subject to accurate forecasting.

The Company competes with a substantial number of smaller local and regional claims management services firms. Many of these smaller firms have rate structures that are lower than the Company's or may, in certain markets, have local knowledge which provides a competitive advantage. We do not believe these smaller firms offer the broad spectrum of claims management services in the range of locations the Company provides and, although such firms may secure business which has a local or regional source, the Company believes its quality product offerings, broader scope of services, and geographically dispersed offices provide us with an overall competitive advantage in securing business from both U.S. and international clients. There are also national and global independent companies that provide a similar broad spectrum of claims management services and who directly compete with the Company.

EMPLOYEES

At December 31, 2019, our total number of full-time equivalent employees ("FTEs") was approximately 9,000. In addition, the Company from time to time, uses the resources of a pool of temporary employees and a network of independent contractors, as and when the demand for services requires. These temporary employees primarily provide catastrophe adjuster services. The Company provides many of its employees with formal classroom training in basic and advanced skills relating to claims administration and healthcare management services. In many cases, employees are required to complete these or other professional courses in order to qualify for promotions. The Company generally considers its relations with its employees to be good.

AVAILABLE INFORMATION

The Company, a Georgia corporation, is required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission ("SEC").

The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website, www.crawco.com through the "Investor Relations" link located under the "About Us" tab, as soon as reasonably practicable after these reports are electronically filed or furnished to the SEC. The information contained on, or hyperlinked from, our website is not a part of, nor is it incorporated by reference into, this Annual Report on Form 10-K. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. Copies of the Company's Annual Report will also be made available, free of charge, upon written request to Corporate Secretary, Legal Department, Crawford & Company, 5335 Triangle Parkway, Peachtree Corners, Georgia, 30092.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below, together with the other information contained or incorporated by reference in this Annual Report on Form 10-K and in our other filings with the SEC from time to time when evaluating our business and prospects. Any of the events discussed in the risk factors below may occur, and our business, results of operations or financial condition could be materially adversely affected. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also materially adversely affect our financial condition or results of operations.

MARKET CONDITIONS

We depend on claim volumes for a significant portion of our revenues. Claim volumes are not subject to accurate forecasting, and a decline in claim volumes may materially adversely affect our financial condition and results of operations.

Because we depend on claim volume for revenue streams, a reduction in claim referrals for any reason may materially adversely impact our results of operations and financial condition. We are unable to predict claim volumes for a number of reasons, including the following:

| |

• | changes in the degree to which property and casualty insurance carriers or self-insured entities outsource, or intend to outsource, their claims handling functions are generally not disclosed in advance; |

| |

• | we cannot predict the length or timing of any insurance cycle; |

| |

• | changes in the overall employment levels and associated workplace injury rates could impact the number of total claims and our claim volumes and are not subject to accurate forecasting; |

| |

• | the frequency and severity of weather-related, natural, and man-made disasters, which are a significant source of claims for us, are also generally not subject to accurate forecasting; |

| |

• | potential consolidation of clients in the markets we operate could impact the volume of claims referred to us; |

| |

• | major insurance carriers, underwriters, and brokers could elect to expand their activities as administrators and adjusters, which would directly compete with our business; and |

| |

• | we may not desire to or be able to renew existing major contracts with clients. |

If our claim volume referrals decline for any of the foregoing, or any other reason, our revenues may decline, which could materially adversely affect our financial condition and results of operations.

In recent periods, we have derived a material amount of our revenues from a limited number of clients. If we are not able to retain these clients or replace these revenues, our financial condition and results of operations could be materially adversely affected.

From time to time, we derive a material portion of our revenues from a limited number of clients. No single customer accounts for 10% or more of our consolidated revenues for the years ended December 31, 2019, 2018, or 2017. However, for each of the years ended December 31, 2019, 2018 and 2017, our Crawford Specialty Solutions segment derived in excess of 10% of its revenue from one customer.

In the event we are not able to retain this significant relationship, or replace any lost revenues from such relationship, revenues and operating earnings within this segment, could be materially adversely affected.

TECHNOLOGY AND DATA SECURITY

We manage a large amount of highly sensitive and confidential consumer information including personally identifiable information, protected health information and financial information. Unauthorized access to, alteration or disclosure of this data, whether as a result of criminal conduct, advances in computer hacking or otherwise, could result in a material loss of business, substantial legal liability or significant harm to our reputation.

We manage a large amount of highly sensitive and confidential consumer information including personally identifiable information, protected health information and financial information. A security incident impacting our own data centers or data maintained, processed or stored by our service providers may compromise the confidentiality, integrity or availability of this confidential information. Unauthorized access to or disclosure of sensitive and confidential information stored by us or our service providers may occur through break-ins, breaches of a secure network by an unauthorized party, employee theft or misuse or other misconduct. It is also possible that unauthorized access to or disclosure of such sensitive and confidential information may be obtained through accidental or malicious failure to follow security policies or controls by us or our employees. If there were an inadvertent disclosure of confidential consumer information, or if a third party were to gain unauthorized access to the confidential information, our operations could be disrupted, our reputation could be damaged and we could be subject to claims or other liabilities, regulatory investigations, or fines. In addition, such perceived or actual unauthorized disclosure of the information we collect or breach of our security could damage our reputation, result in the loss of customers and harm our business.

We are subject to increased frequency and complexity of cybersecurity attacks. Our failure to effectively identify such attacks or quickly recover from such attacks could materially adversely affect our business, results of operations, and financial condition.

We have implemented procedures and controls to reduce our exposure to cybersecurity attacks, and assess our incident response and notification protocols. Additionally, we have existing procedures to determine the potential materiality of a cybersecurity incident. These procedures include reporting protocols to and oversight from our Board of Directors. We also have disclosure controls and insider trading restrictions that would apply in the event of a material cybersecurity incident. We have made investments in software and internal training to prevent cybersecurity incidents such as phishing and business email compromise. However, we may not be able to prevent a cybersecurity attack due to the increasing sophistication and frequency of such attacks. Unauthorized access to, or breaches of a secure network by an unauthorized party could occur due to inadequate use of security controls by us or our employees. Any failure to effectively identify such attack, or quickly recover from such attack in a timely manner, could materially adversely affect our business, results of operations, and financial condition.

Increasing regulatory focus on privacy issues and expanding laws could impact our business models and expose us to increased liability.

U.S. privacy and data security laws apply to our various businesses. We also do business globally in countries that have stringent data protection laws that may be inconsistent across jurisdictions and are subject to evolving and differing interpretations. Governments, privacy advocates and class action attorneys are increasingly scrutinizing how companies collect, process, use, store, share and transmit personal data. Globally, new laws, such as the General Data Protection Regulation (“GDPR”) in Europe, the California Consumer Privacy Act ("CCPA") in California, and industry self-regulatory codes have been enacted and more are being considered that may affect our ability to respond to customer requests under the laws, and to implement our business models effectively. These requirements, among others, may force us to bear the burden of more onerous obligations in our contracts. Any perception of our practices, products or services as a violation of individual privacy rights may subject us to public criticism, class action lawsuits, reputational harm, or investigations or claims by regulators, industry groups or other third parties, all of which could disrupt our business and expose us to increased liability. Additionally, we store information on behalf of our customers and if our customers fail to comply with contractual obligations or applicable laws, it could result in litigation or reputational harm to us.

Transferring personal information across international borders is becoming increasingly complex. The mechanisms that we and many other companies rely upon for European data transfers are being contested in the European court system. We are closely monitoring developments related to requirements for transferring personal data outside the European Union ("EU"). These requirements may result in an increase in the obligations required to provide our services in the EU or in sanctions and fines for non-compliance. Several other countries, including Canada and Australia, have also established specific legal

requirements for cross-border transfers of personal information. These developments in Europe and elsewhere could harm our business, results of operations, and financial condition.

We may not be able to develop or acquire necessary IT resources to support and grow our business, and disruptive technologies could impact the volume and pricing of our products. Our failure to address these risks could materially adversely affect our business, results of operations, and financial condition.

We have made substantial investments in software and related technologies that are critical to the core operations of our business. These IT resources will require future maintenance and enhancements, potentially at substantial costs. Additionally, these IT resources may become obsolete in the future and require replacement, potentially at substantial costs. We may not be able to develop, acquire replacement resources or identify new technology resources necessary to support and grow our business.

In addition, we could face changes in our markets due to disruptive technologies that could impact the volume and pricing of our products, or introduce changes to the insurance claims management processes which could negatively impact our volume of case referrals. Our failure to address these risks, or to do so in a timely manner or at a cost considered reasonable by us, could materially adversely affect our business, results of operations, and financial condition.

If we do not protect our proprietary information and technology resources and prevent third parties from making unauthorized use of our proprietary information, intellectual property, and technology, our financial results could be harmed.

We rely on a combination of trademark, trade name, copyright and trade secret laws to protect our proprietary information, intellectual property, and technology. However, all of these measures afford only limited protection and may be challenged, invalidated or circumvented by third parties. Third parties may copy aspects of our processes, products or materials, or otherwise obtain and use our proprietary information without authorization. Unauthorized copying or use of our intellectual property or proprietary information could materially adversely affect our financial condition and results of operations. Third parties may also develop similar or superior technology independently, including by designing around any of our proprietary technology. Furthermore, the laws of some foreign countries do not offer the same level of protection of our proprietary rights as the laws of the U.S., and we may be subject to unauthorized use of our intellectual property in those countries. Any legal action that we may bring to protect intellectual property and proprietary information could be unsuccessful, expensive and may distract management from day-to-day operations.

We currently operate on multiple proprietary software platforms to support our service offerings and internal corporate systems. The failure or obsolescence of any of these platforms, if not remediated or replaced, could materially adversely affect our business, results of operations, and financial condition

We currently utilize multiple software platforms to support our service offerings. We believe certain of these software platforms distinguish our service offerings from our competitors. The failure of one or more of our software platforms to function properly, or the failure of these platforms to remain competitive, could materially adversely affect our business, results of operations, and financial condition.

BUSINESS AND OPERATIONS

A significant portion of our operations are international. These international operations subject us to political, legal, operational, exchange rate and other risks not generally present in U.S. operations, which could materially negatively affect those operations or our business as a whole.

Our international operations subject us to political, legal, operational, exchange rate and other risks that we do not face in our domestic operations. We face, among other risks, the risk of discriminatory regulation; nationalization or expropriation of assets; changes in both domestic and foreign laws regarding taxation, trade and investment abroad; pandemics such as coronavirus; potential loss of proprietary information due to piracy, misappropriation or laws that may be less protective of our intellectual property rights; or price controls and exchange controls or other restrictions that could prevent us from transferring funds from these operations out of the countries in which they were earned or converting local currencies we hold into U.S. dollars or other currencies.

International operations also subject us to numerous additional laws and regulations that are in addition to, or may be different from, those affecting U.S. businesses, such as those related to labor, employment, worker health and safety, antitrust and competition, trade restriction, environmental protection, consumer protection, import/export and anti-corruption, including but not limited to the Foreign Corrupt Practices Act ("FCPA"). Although we have put into place policies and procedures aimed at ensuring legal and regulatory compliance, our employees, subcontractors, and agents could inadvertently or intentionally take actions that violate any of these requirements. Violations of these regulations could impact our ability to conduct business, or subject us to criminal or civil enforcement actions, any of which could have a material adverse effect on our business, financial condition or results of operations.

We have operations in the United Kingdom ("U.K.") and the European Union that may be impacted by the U.K.'s departure from the EU, known as "Brexit". The uncertainty as to the outcome of Brexit after the transition period expires may negatively impact operations in this region or our business as a whole.

The U.K. and EU insurance markets in which we operate may be impacted by the various potential outcomes of Brexit. There are multiple regulatory, contractual, and supply chain issues that need to be considered, and also the potential impact to transactions and assets denominated in foreign currencies. The majority of our relationships in these countries are within our country of operations, however, to the extent we provide services cross-border, there may be increased risks regarding employee mobility, cross-border payments, data transfer and potential regulatory impacts. Failure to secure a pan-European agreement could lead to various country-by-country approaches being implemented, resulting in a lack of consistency between countries. Changes to these regulations could impact our ability to conduct business in these countries, which could have a material adverse effect on our business, results of operations, and financial condition.

We currently, and from time to time in the future may, outsource a portion of our internal business functions to third-party providers. Outsourcing these functions has significant risks, and our failure to manage these risks successfully could materially adversely affect our business, results of operations, and financial condition.

We currently, and from time to time in the future may, outsource significant portions of our internal business functions to third-party providers. Third-party providers may not comply on a timely basis with all of our requirements, or may not provide us with an acceptable level of service. In addition, our reliance on third-party providers could have significant negative consequences, including significant disruptions in our operations and significantly increased costs to undertake our operations, either of which could damage our relationships with our customers. As a result of our outsourcing activities, it may also be more difficult for us to recruit and retain qualified employees for our business needs at any time. Our failure to successfully outsource any material portion of our business functions could materially adversely affect our business, results of operations, and financial condition.

We are, and may become, party to lawsuits or other claims or investigations that could adversely impact our business.

In the normal course of the claims administration services business, we are from time to time named as a defendant in suits by insureds or claimants contesting decisions by us or our clients with respect to the settlement of claims. Additionally, our clients have in the past brought, and may, in the future bring, claims for indemnification on the basis of alleged actions on our part or on the part of our agents or our employees in rendering services to clients. There can be no assurance that additional lawsuits will not be filed against us. There also can be no assurance that any such lawsuits will not have a disruptive impact upon the operation of our business, that the defense of the lawsuits will not consume the time and attention of our senior management and financial resources or that the resolution of any such litigation will not have a material adverse effect on our business, financial condition and results of operations.

We are also subject to numerous federal, state, and foreign labor, employment, worker health and safety, antitrust and competition, environmental and consumer protection, import/export, anti-corruption, and other laws. From time to time we face claims and investigations by employees, former employees, and governmental entities under such laws or employment contracts with such employees or former employees. Such claims, investigations, and any litigation involving the Company could divert management's time and attention from business operations and could potentially result in substantial costs of defense, settlement or other disposition, which could have a material adverse effect on our results of operations, financial position, and cash flows.

LIQUIDITY AND CAPITAL

Our U.S. qualified defined benefit pension plan (the "U.S. Qualified Plan") is underfunded. Future funding requirements, including those imposed by any further regulatory changes, could restrict cash available for our operating, financing, and investing requirements.

At the end of the most recent measurement periods for our U.S. Qualified Plan, the projected benefit obligations was underfunded by $63.5 million. In recent years we have been required to make significant contributions to this plan and will have to make significant future contributions. Crawford expects to make discretionary contributions of $9.0 million per annum to the U.S. Qualified Plan for the next five fiscal years to improve the funded status of the plan and minimize future required contributions. Volatility in the capital markets, mortality changes and future legislation may have a negative impact on our pension plans, which may further increase the underfunded portion and our attendant funding obligations. Expected and required contributions to our underfunded defined benefit pension plans will reduce our liquidity, restrict available cash for our operating, financing, and investing needs and may materially adversely affect our financial condition and our ability to deploy capital to other opportunities.

While we intend to comply with our future funding requirements through the use of cash from operations, there can be no assurance that we will generate enough cash to do so. Our inability to fund these obligations through cash from operations could require us to seek funding from other sources, including through additional borrowings under our Credit Facility (defined below), if available, proceeds from debt or equity financings, or asset sales. There can be no assurance that we would be able to obtain any such external funding in amounts, at times and on terms that we deem commercially reasonable, in order for us to meet these obligations. Furthermore, any of the foregoing could materially increase our outstanding debt or debt service requirements, or dilute the value of the holdings of our current shareholders, as the case may be. Our inability to comply with any funding obligations in a timely manner could materially adversely affect our financial condition.

We have debt covenants in our credit facility that require us to maintain compliance with certain financial ratios and other requirements. If we are not able to maintain compliance with these requirements, all of our outstanding debt could become immediately due and payable.

We are party to a credit facility, amended and restated as of October 11, 2017, with Wells Fargo Bank, N.A., Bank of America, N.A., Citizens Bank, N.A., and the other lenders a party thereto, (as amended, the "Credit Facility"). The Credit Facility contains various representations, warranties and covenants, including covenants limiting liens, indebtedness, guarantees, mergers and consolidations, substantial asset sales, investments and loans, sale and leasebacks, restrictions on dividends and distributions, and other fundamental changes in our business. Additionally, the Credit Facility contains covenants requiring us to remain in compliance with a maximum leverage ratio and a minimum fixed charge coverage ratio. If we do not maintain compliance with the covenant requirements, we may be in default under the Credit Facility. In such an event, the lenders under the Credit Facility would generally have the right to declare all then-outstanding amounts thereunder immediately due and payable. If we could not obtain a required waiver on satisfactory terms, we could be required to renegotiate the terms of the Credit Facility or immediately repay this indebtedness. Any such renegotiation could result in less favorable terms, including additional fees, higher interest rates and accelerated payments, and would necessitate significant time and attention of management, which could divert their focus from business operations. Any required payment may necessitate the sale of assets or other uses of resources that we do not believe would be in our best interests. While we do not presently expect to be in violation of any of these requirements, no assurances can be given that we will be able to continue to comply with them in the future. Any failure to continue to comply with such requirements could materially adversely affect our borrowing ability and access to liquidity, and thus our overall financial condition, as well as our ability to operate our business. We do not believe there is significant risk to our debt covenants if LIBOR were to be replaced with an alternative reference rate in the future. We have no current hedged transactions, and our Credit Facility allows for the use of a suitable replacement rate if an alternative was required.

In recent periods we have incurred impairment charges that reduced the carrying value of our intangible assets and goodwill; in the future we may be required to incur additional impairment charges on a portion or all of the carrying value of our intangible assets and goodwill, which may adversely affect our financial condition and results of operations.

Each year, and more frequently on an interim basis if appropriate, we are required by ASC Topic 350, "Intangibles--Goodwill and Other," to assess the carrying value of our indefinite lived intangible assets and goodwill to determine whether the carrying value of those assets is impaired. Such assessment and determination involves significant judgments to estimate the fair value of our reporting units, including estimating future cash flows, near term and long term revenue growth, and determining appropriate discount rates, among other assumptions. We intend to continue to monitor the performance of our reporting units and, should actual operating earnings consistently fall below forecasted operating earnings, we will perform an interim goodwill impairment analysis. Any such charges could materially adversely affect our financial results in the periods in which they are recorded.

Control by a principal shareholder could adversely affect the Company and our other shareholders.

As of December 31, 2019, Jesse C. Crawford, a member of our Board of Directors, and the father of Jesse C. Crawford, Jr., who is also a member of the Board of Directors, beneficially owned approximately 57% of our outstanding voting Class B Common Stock. As a result, he has the ability to control substantially all matters submitted to our shareholders for approval, including the election and removal of directors. He also has the ability to control our management and affairs. As of December 31, 2019, Mr. Crawford also beneficially owned approximately 36% of our outstanding non-voting Class A Common Stock. This concentration of ownership of our stock may delay or prevent a change in control; impede a merger, consolidation, takeover, or other business combination involving us; discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us; reduce the liquidity, and thus the trading price, of our stock; or result in other actions that may be opposed by, or not be in the best interests of, the Company and our other shareholders.

COMPETITION AND EMPLOYEES

We operate in highly competitive markets and face intense competition from both established entities and new entrants into those markets. Potential consolidation in our industry can also create stronger competition. Our failure to compete effectively may adversely affect us.

Our ability to retain clients and maintain and increase case referrals is also dependent in part on our ability to continue to provide high-quality, competitively priced services and effective sales efforts.

The global claims management services market is highly competitive and comprised of a large number of companies that vary in size and that offer a varied scope of services. The demand from insurance companies and self-insured entities for services provided by independent claims service firms like us is largely dependent on industry-wide claims volumes, which are affected by, among other things, the insurance underwriting cycle, weather-related events, general economic activity, overall employment levels, and workplace injury rates. We are also impacted by decisions insurance companies and self-insured entities make with respect to the level of claims outsourced to independent claim service firms as opposed to those handled by their own in-house claims adjusters.

We also face competition from potential new entrants into the global claims management services market, in addition to traditional competitors. Potential consolidation in our industry can also create stronger competition. Our inability to react to such competition or improved technology could negatively impact our volume of case referrals and results of operations.

We may not be able to recruit, train, and retain qualified personnel, including retaining a sufficient number of qualified and experienced on-call claims adjusters, to respond to catastrophic events that may, singularly or in combination, significantly increase our clients' needs for adjusters.

Our catastrophe related work and revenues can fluctuate dramatically based on the frequency and severity of natural and man-made disasters. When such events happen, our clients usually require a sudden and substantial increase in the need for catastrophic claims services, which can strain our capacity. Our internal resources are sometimes not sufficient to meet these sudden and substantial increases in demand. When these situations occur, we must retain outside adjusters (temporary employees and contractors) to increase our capacity. There can be no assurance that we will be able to retain such outside adjusters with the requisite qualifications, at the times needed or on terms that we believe are economically reasonable. Insurance companies and other loss adjusting firms also aggressively compete for the same pool of independent adjusters, who often command high prices for their services at such times of peak demand. Such competition could reduce availability, increase our costs and reduce our revenues. Our failure to timely, efficiently, and competently provide these services to our clients could result in reduced revenues, loss of customer goodwill and a materially negative impact on our results of operations.

We compete for nurses and other case management professionals in the healthcare industry, which may increase our labor costs and reduce profitability.

Our Crawford TPA Solutions business competes with the general healthcare industry in recruiting qualified nurses, other case management professionals and other talent. In some markets, the scarcity of nurses and other medical support personnel has become a significant operating issue to healthcare providers. Such competition could reduce availability, increase our costs and reduce our revenues. This shortage may require us to increase wages and benefits to recruit and retain qualified nurses and other healthcare professionals. Our failure to recruit and retain qualified management, nurses, and other healthcare professionals, or to control labor costs could result in reduced revenues, loss of customer goodwill and a materially negative impact on our results of operations.

We face challenges caused by our aging workforce and we may not be able to recruit, train, and retain adequate replacements for our qualified and skilled employees.

Many of the nurses and adjusters in our industry, including those that we employ directly, are approaching retirement age. As these experienced employees retire, we may have difficulty recruiting new employees with comparable qualifications and experience, and we may be unable to transfer our employees’ institutional knowledge successfully to new qualified employees. Any such failures would be exacerbated at times of peak demand and could cause us to rely more heavily on outside nurses and adjusters. Our failure to recruit and train new employees and to ensure they obtain the adequate qualifications and experience could result in reduced revenues, loss of customer goodwill and a materially negative impact on our results of operations.

The risks described above are not the only ones we face, but are the ones currently deemed the most material by us based on available information. New risks may emerge from time to time, and it is not possible for management to predict all such risks, nor can we assess the impact of known risks on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statement.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

As of December 31, 2019, the Company owned an office in Kitchener, Ontario. As of December 31, 2019, the Company leased approximately 250 other office locations under various leases with varying terms. For additional information on the Company's significant operating leases and subleases, see Note 6 "Lease Commitments" of our accompanying audited consolidated financial statements included in Item 8 of this Annual Report on Form 10-K. Other office locations are occupied under various short-term rental arrangements. The Company generally believes that its office locations are sufficient for its operations and that, if it were necessary to obtain different or additional office locations, such locations would be available at times, and on commercially reasonable terms, as would be necessary for the conduct of its business. No assurances can be given, however, that the Company would be able to obtain such office locations as and when needed, or on terms it considered to be reasonable, if at all.

ITEM 3. LEGAL PROCEEDINGS

In the normal course of the claims administration services business, the Company is from time to time named as a defendant in suits by insureds or claimants contesting decisions by the Company or its clients with respect to the settlement of claims. Additionally, clients of the Company have, in the past, brought and may, in the future bring, claims for indemnification on the basis of alleged actions on the part of the Company, its agents or its employees in rendering service to clients. The majority of these claims are of the type covered by insurance maintained by the Company; however, the Company is responsible for the deductibles and self-insured retentions under its various insurance coverages. In the opinion of the Company, adequate reserves have been provided for such known risks. No assurances can be provided, however, that the result of any such action, claim or proceeding, now known or occurring in the future, will not result in a material adverse effect on our business, financial condition or results of operations.

The Company is also subject to numerous federal, state, and foreign labor, employment, worker health and safety, antitrust and competition, environmental and consumer protection, import/export, anti-corruption, and other laws. From time to time the Company faces claims and investigations by employees, former employees, and governmental entities under such laws or employment contracts with such employees or former employees.

The Company recognized arbitration and claim settlement charges in 2019 of $12.6 million related to an arbitration panel awarding three of four former executives of our former Garden City Group business unit additional payments associated with their departure from the Garden City Group on December 31, 2015, and a claim settlement with the fourth former executive. There are no other potential claimants related to this matter.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS,

AND ISSUER PURCHASES OF EQUITY SECURITIES

Shares of the Company's two classes of common stock are traded on the NYSE under the symbols CRD-A and CRD-B, respectively. The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class.

The number of record holders of each class of the Company's common stock as of December 31, 2019 was as follows: CRD-A — 2,923 and CRD-B — 390.

The Company's share repurchase authorization, approved in July 2017 (the "2017 Repurchase Authorization"), provided the Company with the ability to repurchase up to 2,000,000 shares of CRD-A or CRD-B (or both). The 2017 Repurchase Authorization was terminated on May 8, 2019.

Effective May 9, 2019, the Company's Board of Directors authorized the repurchase of up to 2,000,000 shares of CRD-A or CRD-B (or a combination of the two) through December 31, 2020 (the "2019 Repurchase Authorization"). Under the 2019 Repurchase Authorization, repurchases may be made for cash, in the open market or privately negotiated transactions at such times and for such prices as management deems appropriate, subject to applicable contractual and regulatory restrictions.

Through December 31, 2019, the Company had repurchased 1,103,398 shares of CRD-A and 1,736,011 shares of CRD-B at an average cost of $9.33 and $9.17, respectively, of which 421,427 shares of CRD-A and 1,376,889 shares of CRD-B were purchased pursuant to a stock purchase agreement authorized by the Board of Directors separate from the 2017 Repurchase Authorization and the 2019 Repurchase Authorization. At December 31, 2019, the Company had remaining authorization to repurchase 958,907 shares under the 2019 Repurchase Authorization.

Through December 31, 2018, the Company had repurchased 1,144,410 shares of CRD-A and 94,378 shares of CRD-B under the 2017 Repurchase Authorizations at an average cost of $8.36 and $8.96, respectively. At December 31, 2018, the Company had remaining authorization to repurchase 427,883 shares under the 2017 Repurchase Authorization.

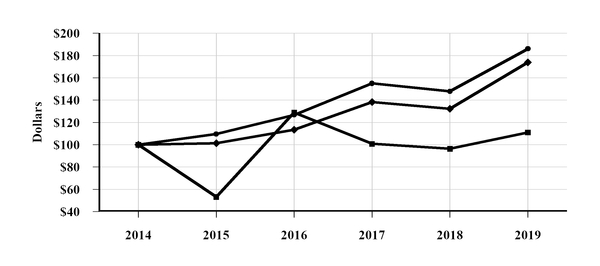

The following graph and table show the value as of December 31, 2019 of a $100 investment in the Company's Class B common stock as of December 31, 2014 as compared to a similar investment in each of (i) the S&P 500 Index, and (ii) the S&P 500 Property-Casualty Insurance Index, in each case on a total return basis assuming the reinvestment of all dividends. We caution you not to draw any conclusions from the data in this performance graph, as past results do not necessarily indicate future performance.

Comparison of Cumulative Five Year Total Return

nCrawford & Company (Class B) tS&P 500 Index lS&P Property-Casualty Insurance Index

|

| | | | | | | | | | | | |

TOTAL RETURN TO SHAREHOLDERS | | | | | |

(Includes reinvestment of dividends) | | | | | | |

| Base | INDEXED RETURNS |

| Period | YEARS ENDED DECEMBER 31, |

Company / Index | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

Crawford & Company (Class B) | 100.00 |

| 53.18 |

| 128.94 |

| 100.79 |

| 96.45 |

| 111.06 |

|

S&P 500 Index | 100.00 |

| 101.38 |

| 113.51 |

| 138.29 |

| 132.23 |

| 173.86 |

|

S&P Property-Casualty Insurance Index | 100.00 |

| 109.53 |

| 126.73 |

| 155.10 |

| 147.83 |

| 186.07 |

|

The foregoing graph and table are not, and shall not be deemed to be, filed as part of the Company's Annual Report on Form 10-K. Such graph and table do not constitute soliciting material and should not be deemed filed or incorporated by reference into any filing of the Company under the Securities Act of 1933, or the Securities Exchange Act of 1934, except to the extent specifically incorporated by reference therein by the Company.

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the audited consolidated financial statements and notes thereto contained in Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K.

|

| | | | | | | | | | | | | | | | | | | |

Year Ended December 31, | 2019 | | 2018 | | 2017 | | 2016 | | 2015 |

| (In thousands, except per share amounts and percentages) |

Revenues before Reimbursements | $ | 1,005,802 |

| | $ | 1,070,971 |

| | $ | 1,105,832 |

| | $ | 1,109,286 |

| | $ | 1,170,385 |

|

Reimbursements | 41,825 |

| | 52,008 |

| | 57,877 |

| | 68,302 |

| | 71,135 |

|

Total Revenues | 1,047,627 |

| | 1,122,979 |

| | 1,163,709 |

| | 1,177,588 |

| | 1,241,520 |

|

Total Costs of Services | 752,773 |

| | 808,005 |

| | 842,167 |

| | 850,112 |

| | 940,352 |

|

Crawford Claims Solutions Operating Earnings (1) | 7,630 |

| | 11,308 |

| | 18,541 |

| | 14,371 |

| | 5,708 |

|

Crawford TPA Solutions Operating Earnings (1) | 27,173 |

| | 36,909 |

| | 38,224 |

| | 36,520 |

| | 33,915 |

|

Crawford Specialty Solutions Operating Earnings (1) | 49,321 |

| | 49,564 |

| | 52,404 |

| | 65,641 |

| | 49,956 |

|

Unallocated Corporate and Shared Costs and Credits, Net | (6,515 | ) | | (9,321 | ) | | (13,463 | ) | | (24,403 | ) | | (19,159 | ) |

Net Corporate Interest Expense | (10,774 | ) | | (10,109 | ) | | (9,062 | ) | | (9,185 | ) | | (8,383 | ) |

Stock Option Expense | (1,885 | ) | | (1,742 | ) | | (1,718 | ) | | (621 | ) | | (433 | ) |

Amortization of Customer-Relationship Intangible Assets | (11,277 | ) | | (11,152 | ) | | (10,982 | ) | | (9,592 | ) | | (9,668 | ) |

Goodwill and Intangible Asset Impairment Charges | (17,484 | ) | | (1,056 | ) | | (19,598 | ) | | — |

| | (49,314 | ) |

Arbitration and Claim Settlements | (12,552 | ) | | — |

| | — |

| | — |

| | — |

|

Restructuring and Special Charges | — |

| | — |

| | (12,084 | ) | | (9,490 | ) | | (34,395 | ) |

Loss on Disposition of Business Line | — |

| | (20,270 | ) | | — |

| | — |

| | — |

|

Income Taxes | (14,111 | ) | | (18,542 | ) | | (15,039 | ) | | (25,565 | ) | | (13,832 | ) |

Net Loss (Income) Attributable to Noncontrolling Interests and Redeemable Noncontrolling Interests | 2,959 |

| | 389 |

| | 442 |

| | (1,710 | ) | | 117 |

|

Net Income (Loss) Attributable to Shareholders of Crawford & Company | $ | 12,485 |

| | $ | 25,978 |

| | $ | 27,665 |

| | $ | 35,966 |

| | $ | (45,488 | ) |

Earnings (Loss) Per Share - Basic (2): | | | | | | | | | |

CRD-A | $ | 0.27 |

| | $ | 0.51 |

| | $ | 0.53 |

| | $ | 0.68 |

| | $ | (0.79 | ) |

CRD-B | $ | 0.19 |

| | $ | 0.43 |

| | $ | 0.45 |

| | $ | 0.60 |

| | $ | (0.87 | ) |

Earnings (Loss) Per share - Diluted (2): | | | | | | | | | |

CRD-A | $ | 0.26 |

| | $ | 0.50 |

| | $ | 0.52 |

| | $ | 0.67 |

| | $ | (0.79 | ) |

CRD-B | $ | 0.19 |

| | $ | 0.42 |

| | $ | 0.45 |

| | $ | 0.60 |

| | $ | (0.87 | ) |

Current Assets | $ | 315,209 |

| | $ | 320,848 |

| | $ | 370,367 |

| | $ | 364,731 |

| | $ | 370,177 |

|

Total Assets | $ | 760,013 |

| | $ | 701,442 |

| | $ | 787,936 |

| | $ | 735,859 |

| | $ | 783,406 |

|

Current Liabilities | $ | 236,265 |

| | $ | 225,310 |

| | $ | 256,591 |

| | $ | 230,287 |

| | $ | 258,348 |

|

Long-Term Debt and Capital Leases, Less Current Installments | $ | 148,408 |

| | $ | 167,126 |

| | $ | 200,460 |

| | $ | 187,002 |

| | $ | 225,365 |

|

Total Debt | $ | 176,954 |

| | $ | 190,410 |

| | $ | 225,672 |

| | $ | 188,014 |

| | $ | 247,282 |

|

Shareholders' Investment Attributable to Shareholders of Crawford & Company | $ | 159,317 |

| | $ | 171,288 |

| | $ | 182,320 |

| | $ | 153,883 |

| | $ | 113,693 |

|

Total Capital | $ | 336,271 |

| | $ | 361,698 |

| | $ | 407,992 |

| | $ | 341,897 |

| | $ | 360,975 |

|

Current Ratio | 1.3:1 |

| | 1.4:1 |

| | 1.4:1 |

| | 1.6:1 |

| | 1.4:1 |

|

Total Debt to Total Capital Ratio | 52.6 | % | | 52.6 | % | | 55.3 | % | | 55.0 | % | | 68.5 | % |

Return on Average Shareholders' Investment | 7.6 | % | | 14.7 | % | | 16.5 | % | | 26.9 | % | | (31.7 | )% |

Cash Provided by Operating Activities | $ | 75,216 |

| | $ | 52,419 |

| | $ | 40,757 |

| | $ | 98,864 |

| | $ | 61,655 |

|

Cash (Used in) Provided by Investing Activities | $ | (23,420 | ) | | $ | 6,449 |

| | $ | (81,866 | ) | | $ | (32,966 | ) | | $ | (101,178 | ) |

Cash (Used in) Provided by Financing Activities | $ | (53,406 | ) | | $ | (58,739 | ) | | $ | 10,343 |

| | $ | (55,151 | ) | | $ | 67,889 |

|

Shareholders' Investment Attributable to Shareholders of Crawford & Company Per Diluted Share | $ | 2.95 |

| | $ | 3.07 |

| | $ | 3.21 |

| | $ | 2.74 |

| | $ | 2.06 |

|

Cash Dividends Per Share: | | | | | | | | | |

CRD-A | $ | 0.28 |

| | $ | 0.28 |

| | $ | 0.28 |

| | $ | 0.28 |

| | $ | 0.28 |

|

CRD-B | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.20 |

|

Weighted-Average Shares and Share-Equivalents: | | | | | | | | | |

Basic | 53,612 |

| | 55,254 |

| | 55,928 |

| | 55,483 |

| | 55,286 |

|

Diluted | 54,065 |

| | 55,883 |

| | 56,764 |

| | 56,220 |

| | 55,286 |

|

______________________

| |

(1) | This is a segment financial measure calculated in accordance with ASC Topic 280, "Segment Reporting," and representing segment earnings before certain unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill and intangible asset impairment charges, restructuring and special charges, loss on disposition of business line, arbitration and claim settlements, income taxes, and net income or loss attributable to noncontrolling interests and redeemable noncontrolling interests. |

| |

(2) | The Company computes earnings (loss) per share of CRD-A and CRD-B using the two-class method, which allocates the undistributed earnings (loss) for each period to each class on a proportionate basis. The Company's Board of Directors has the right, but not the obligation, to declare higher dividends on CRD-A than on CRD-B, subject to certain limitations. In periods when the dividend is the same for CRD-A and CRD-B or when no dividends are declared or paid to either class, the two-class method generally will yield the same earnings (loss) per share for CRD-A and CRD-B. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

The following Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") is intended to help the reader understand Crawford & Company, our operations, and our business environment. This MD&A is provided as a supplement to — and should be read in conjunction with — our audited consolidated financial statements and the accompanying notes thereto contained in Item 8, "Financial Statements and Supplementary Data," of this Annual Report on Form 10-K. As described in Note 1, "Significant Accounting and Reporting Policies," of those accompanying audited consolidated financial statements, financial results from our operations outside of the U.S., Canada, the Caribbean, and certain subsidiaries in the Philippines, are reported and consolidated on a two-month delayed basis in accordance with the provisions of ASC 810, "Consolidation," in order to provide sufficient time for accumulation of their results. Accordingly, the Company's December 31, 2019, 2018, and 2017 consolidated financial statements include the financial position of such operations as of October 31, 2019 and 2018, respectively, and the results of their operations and cash flows for the fiscal periods ended October 31, 2019, 2018 and 2017, respectively.

Business Overview

Based in Atlanta, Georgia, Crawford & Company (www.crawco.com) is the world's largest publicly listed independent provider of claims management and outsourcing solutions to carriers, brokers and corporates with an expansive global network serving clients in more than 70 countries. Shares of the Company's two classes of common stock are traded on the NYSE under the symbols CRD-A and CRD-B, respectively. The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class.

As discussed in more detail in subsequent sections of this MD&A, we have three operating segments: Crawford Claims Solutions, Crawford TPA Solutions, and Crawford Specialty Solutions. Our three operating segments represent components of the Company for which separate financial information is available, and which is evaluated regularly by our chief operating decision maker ("CODM") in deciding how to allocate resources and in assessing operating performance. Crawford Claims Solutions serves the global property and casualty insurance company markets. Crawford TPA Solutions serves the global casualty, disability and self-insurance marketplace worldwide. Crawford Specialty Solutions serves the global property and casualty insurance company markets.

Insurance companies rely on us for certain services such as field investigation and the evaluation of property and casualty insurance claims. Self-insured entities typically rely on us for a broader range of services. In addition to field investigation and claims evaluation, we may also provide initial loss reporting services for their claimants, loss mitigation services such as medical bill review, medical case management and vocational rehabilitation, risk management information services, and trust fund administration to pay their claims. Our Contractor Connection service line in our Crawford Specialty Solutions segment provides a managed contractor network to insurance carriers and consumer markets.

The global claims management services market is highly competitive and comprised of a large number of companies that vary in size and that offer a varied scope of services. The demand from insurance companies and self-insured entities for services provided by independent claims service firms like us is largely dependent on industry-wide claims volumes, which are affected by, among other things, the insurance underwriting cycle, weather-related events, general economic activity, overall employment levels and workplace injury rates. Demand is also impacted by decisions insurance companies and self-insured entities make with respect to the level of claims outsourced to independent claim service firms as opposed to those handled by their own in-house claims adjusters. In addition, our ability to retain clients and maintain or increase case referrals is also dependent in part on our ability to continue to provide high-quality, competitively priced services and effective sales efforts.

We typically earn our revenues on an individual fee-per-claim basis for claims management services we provide to insurance companies and self-insured entities. Accordingly, the volume of claim referrals to us is a key driver of our revenues. Generally, fees are earned over time on cases as services are provided, which generally occurs in the period the case is assigned to us, although sometimes a portion or substantially all of the revenues generated by a specific case assignment will be earned in subsequent periods. We cannot predict the future trend of case volumes for a number of reasons, including the frequency and severity of weather-related cases and the occurrence of natural and man-made disasters, which are a significant source of cases for us and are not subject to accurate forecasting.

We recognized arbitration and claim settlement charges in 2019 of $12.6 million related to an arbitration panel awarding three of four former executives of our former Garden City Group business unit additional payments associated with their departure from the Garden City Group on December 31, 2015, and a claim settlement with the fourth former executive. There are no other potential claimants related to this matter. This pretax expense is presented in the Consolidated Statements of Operations as a separate charge "Arbitration and claim settlements."

We recognized a non-cash goodwill impairment charge in 2019 totaling $17.5 million related to our Crawford Claims Solutions segment, due to lower forecasts in that reporting unit. This charge was partially offset by a $2.2 million reduction in income tax expense and $2.2 million credit in noncontrolling interest expense. There were no goodwill impairment charges in 2018. See the "Critical Accounting Policies" in Item 7 and Note 4, "Goodwill and Intangible Assets" of our accompanying audited consolidated financial statements included in Item 8 of this Annual Report on Form 10-K for further discussion about goodwill impairment charges.

In 2019, we recognized a $2.0 million non-recurring deferred tax asset valuation allowance related to certain state net operating loss carryforwards, foreign tax credits and capital losses.

In 2018, we recognized an impairment of $1.1 million related to an indefinite-lived trade name due to a combination of achieving less than forecasted revenue compared to previous modeled results and further reduced forecasted revenue associated with the trade name.

On June 15, 2018, we completed the sale of our Garden City Group business (the “GCG Business”) to EPIQ Class Action & Claims Solutions, Inc. ("EPIQ") for cash proceeds of $42.6 million. At the time of the disposal, the GCG Business included total assets of $70.6 million and total liabilities of $10.1 million. The total asset balance was primarily comprised of accounts receivable, unbilled revenues and capitalized software costs. After including transaction and other costs related to the sale, we recognized a pretax loss on the disposal of $20.3 million. The loss on disposal is presented in the Consolidated Statements of Operations as a separate charge "Loss on disposition of business line."

On January 4, 2017, we acquired 85% of the outstanding membership interests of WeGoLook®, LLC, an Oklahoma limited liability company, and certain non-compete agreements, for consideration of $36.1 million on a debt free valuation basis. WeGoLook provides a variety of on-demand inspection, verification, and other field services for businesses and consumers through a mobile platform of independent contractors.

On December 22, 2017, the Tax Cuts and Jobs Act (the “Tax Act”) was enacted. The Tax Act significantly changed U.S. Federal income tax law. The changes included but were not limited to: a federal corporate rate reduction from 35% to 21%, limitations on the deductibility of interest expense and executive compensation, creation of a new minimum tax on global intangible low taxed income (“GILTI”), and a one-time U.S. tax liability on those earnings which have not previously been repatriated to the U.S. (the “Transition Tax”) as a result of the transition of U.S. international taxation from a worldwide tax system to a modified territorial tax system. In connection with our initial analysis of the impact of the Tax Act, we recorded a provisional estimate in accordance with Staff Accounting Bulletin No. 118 (“SAB 118”) of net tax expense of $3.8 million in the period ended December 31, 2017. This expense consisted of provisional estimates of $7.6 million net expense for the Transition Tax, which we estimated would be fully offset by foreign tax credit carryforwards, and $3.8 million net benefit for remeasurement of our domestic deferred tax balances for the corporate rate reduction. In the period ended December 31, 2018, we completed accounting for the Tax Act in accordance with SAB 118. As a result, we recorded additional income tax expense of $3.6 million. This expense consisted of substantially all of the $7.0 million valuation allowance established against foreign tax credits and $0.1 million for the revaluation of deferred taxes, net of $3.5 million of Transition Tax release of uncertain tax positions and adjustments. We completed the accounting for the Tax Act within the one year measurement period, as allowed under SAB 118.