1

TABLE OF CONTENTS | ||

Forward-Looking Statements | |

Earnings Release | |

Condensed Consolidated Balance Sheets | |

Condensed Consolidated Statements of Operations | |

Key Performance Metrics | |

Funds From Operations - Detail | |

Portfolio Statistics | |

Office Leasing Activity | |

Office Lease Expirations | |

Top 20 Office Tenants | |

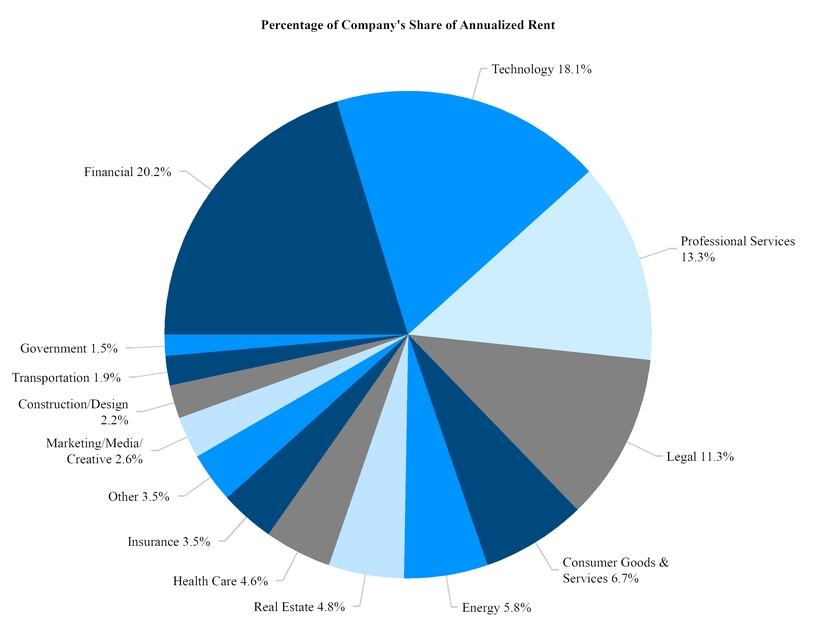

Tenant Industry Diversification | |

Investment Activity | |

Land Inventory | |

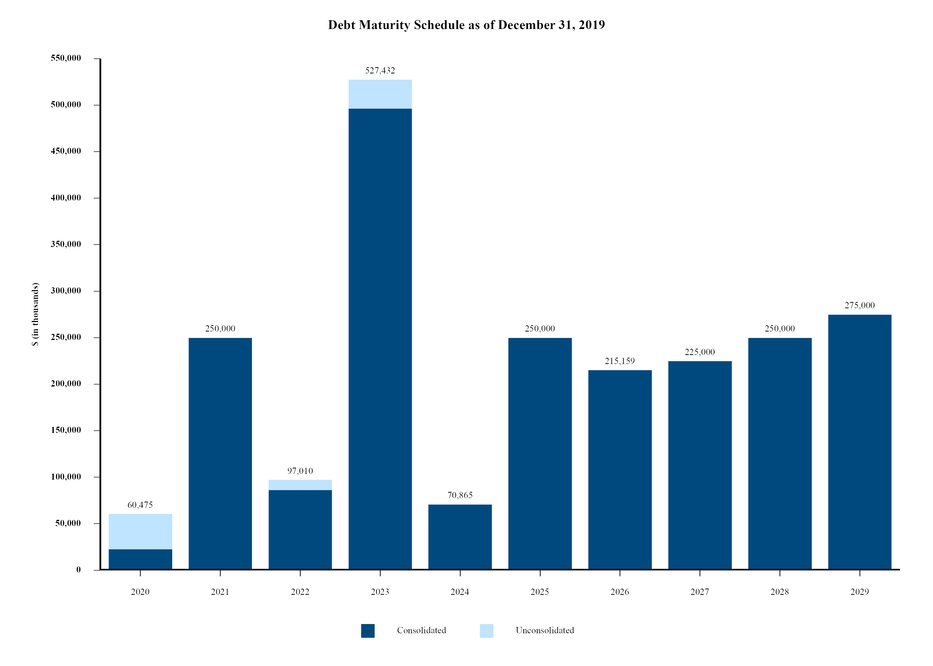

Debt Schedule | |

Joint Venture Information | |

Non-GAAP Financial Measures - Calculations and Reconciliations | |

Non-GAAP Financial Measures - Discussion | |

Cousins Properties | Q4 2019 Supplemental Information | |

FORWARD-LOOKING STATEMENTS | ||

Certain matters contained in this report are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risks, as itemized in Item 1A included in the Annual Report on Form 10-K for the year ended December 31, 2019. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as the following: 2020 guidance and underlying assumptions; business and financial strategy; future debt financings; future acquisitions and dispositions of operating assets or joint venture interests; future acquisitions and dispositions of land, including ground leases; future development and redevelopment opportunities, including fee development opportunities; future issuances and repurchases of common stock; future distributions; projected capital expenditures; market and industry trends; entry into new markets; future changes in interest rates; and all statements that address operating performance, events, or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders.

Any forward-looking statements are based upon management's beliefs, assumptions, and expectations of our future performance, taking into account information that is currently available. These beliefs, assumptions, and expectations may change as a result of possible events or factors, not all of which are known. If a change occurs, our business, financial condition, liquidity, and results of operations may vary materially from those expressed in forward-looking statements. Actual results may vary from forward-looking statements due to, but not limited to, the following: the availability and terms of capital; the ability to refinance or repay indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions, investments, or dispositions; the potential dilutive effect of common stock or operating partnership unit issuances; the availability of buyers and pricing with respect to the disposition of assets; changes in national and local economic conditions, the real estate industry, and the commercial real estate markets in which we operate (including supply and demand changes), particularly in Atlanta, Austin, Charlotte, Phoenix, Tampa, and Dallas where we have high concentrations of our lease revenues; changes to our strategy with regard to land and other non-core holdings that may require impairment losses to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, the ability to lease newly developed and/or recently acquired space, the failure of a tenant to occupy leased space, and the risk of declining leasing rates; changes in the needs of our tenants brought about by the desire for co-working arrangements, trends toward utilizing less office space per employee, and the effect of telecommuting; the adverse change in the financial condition of one or more of our major tenants; volatility in interest rates and insurance rates; competition from other developers or investors; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); cyber security breaches; changes in senior management, changes in the Board of Directors, and the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust and meet regulatory requirements; potential changes to state, local, or federal regulations applicable to our business; material changes in the rates, or the ability to pay, dividends on common shares or other securities; potential changes to the tax laws impacting REITs and real estate in general; potential changes to the tax laws impacting REITs and real estate in general; the ability to realize anticipated benefits of the merger with TIER REIT, Inc. ("TIER"); and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission ("SEC") by the Company.

The words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information, or otherwise, except as required under U.S. federal securities laws.

Cousins Properties | 3 | Q4 2019 Supplemental Information |

EARNINGS RELEASE | ||

COUSINS PROPERTIES REPORTS FOURTH QUARTER AND FULL YEAR 2019 RESULTS

Updates 2020 Earnings Guidance

Highlights

• | Net income per share was $0.80; net income per share was $0.81 before TIER transaction costs. |

• | Funds from operations per share was $0.73 before TIER transaction costs. |

• | Same property net operating income on a cash basis increased 6.0%. |

• | Second generation net rent per square foot on a cash basis increased 12.6%. |

• | Executed 561,651 square feet of office leases. |

• | Pre-leasing on $565 million development pipeline was 80%. |

• | Purchased remaining 50% interest in Terminus Office Holdings LLC from the joint venture partner in a transaction that valued the properties at $503 million. The Company recognized a gain on this transaction of $92.8 million. |

• | Received notice of Truist's intent to exercise its purchase right for Hearst Tower, a 966,000 square foot office property in Charlotte, and subsequently entered into an agreement to sell the property for a gross sales price of $455.5 million. The Company anticipates closing on this sale at the end of the first quarter of 2020. |

• | Sold remaining North Point land, a 9.2 acre parcel located in Atlanta, recognizing a gain on this transaction of $3.7 million. |

• | Entered into an agreement to sell Woodcrest, a 386,000 square foot office property in Cherry Hill, New Jersey. The Company anticipates closing this sale during the first quarter of 2020. |

• | Subsequent to quarter end: |

◦ | The Company's partner in its Gateway Village joint venture executed its right to purchase the Company's interest for $52.2 million. This sales price generates a 17% internal rate of return for the Company on its invested capital over the life of the venture, as stipulated in the partnership agreement. The Company anticipates closing this sale at the end of the first quarter of 2020. |

◦ | Sold its remaining interest in the Wildwood Associates joint venture, which owned a 6.3 acre parcel of land in Atlanta, to its venture partner, recognizing a gain of $1.4 million on this transaction. |

◦ | Commenced development of 100 Mill, a 287,000 square foot office building in Tempe, Arizona, with a total estimated project cost of $153 million. |

ATLANTA (February 5, 2020) - Cousins Properties (NYSE:CUZ) today reported its results of operations for the quarter and year ended December 31, 2019.

"Fourth quarter operating results were solid, highlighted by 6% same property NOI growth and a 12.6% increase in second generation rents," said Colin Connolly, president and chief executive officer of Cousins Properties. "Earnings exceeded our expectations aside from an increase in G&A expenses directly attributable to our strong share price performance during the quarter. Looking forward, solid fundamentals in our Sunbelt markets will continue to drive both internal and external growth. Reflecting this strength, our updated earnings guidance includes 5% same property NOI growth as well as a new development start in Phoenix."

Cousins Properties | 4 | Q4 2019 Supplemental Information |

EARNINGS RELEASE | ||

Financial Results

Net income available to common stockholders was $117.1 million, or $0.80 per share, for the fourth quarter of 2019, compared with net income available to common stockholders of $22.4 million, or $0.21 per share, for the fourth quarter of 2018. Net income available to common stockholders was $150.4 million, or $1.17 per share, for the year ended December 31, 2019, compared with $79.2 million, or $0.75 per share, for the year ended December 31, 2018.

Funds From Operations ("FFO") was $106.2 million, or $0.72 per share, for the fourth quarter of 2019, compared with $71.2 million, or $0.67 per share, for the fourth quarter of 2018. FFO was $328.8 million, or $2.53 per share, for the year ended December 31, 2019, compared with $267.9 million, or $2.51 per share, for the year ended December 31, 2018.

The Company recorded costs associated with the TIER transaction of $2.0 million for the fourth quarter of 2019 and $52.9 million for the year ended December 31, 2019. Net income available to common stockholders excluding TIER transaction costs was $119.1 million, or $0.81 per share, for the fourth quarter of 2019 and $202.2 million, or $1.58 per share, for the year ended December 31, 2019. FFO excluding TIER transaction costs was $108.2 million, or $0.73 per share, for the fourth quarter of 2019 and $381.7 million, or $2.94 per share, for the year ended December 31, 2019.

2020 Guidance

The Company has raised its 2020 FFO guidance to $2.72 to $2.86 per share from $2.71 to $2.85 per share. The Company leaves unchanged the previously provided assumptions of its 2020 guidance, except for the following updates:

• | General and administrative expenses of $32 million to $34 million, net of capitalized salaries, down from the previous range of $33 million to $35 million. |

• | Interest and other expenses, net of capitalized interest, of $68 million to $70 million, down from the previous range of $69 million to $71 million, due to an increase in capitalized interest on projects under development. |

• | Gain on land sales of $1.4 million, due to the redemption of the remainder of the Wildwood Associates joint venture land occurring in the first quarter of 2020 instead of the fourth quarter of 2019. |

• | Sale of Woodcrest in the first quarter of 2020 instead of the fourth quarter of 2019. |

• | Sale of interest in Gateway Village joint venture at the end of the first quarter of 2020. |

• | Commencement of development of 100 Mill. |

A reconciliation of projected net income per share to projected FFO per share is provided as follows:

Full Year 2020 Range | |||||||

Low | High | ||||||

Net income per common share | $ | 1.70 | $ | 1.84 | |||

Add: Real estate depreciation and amortization | 1.92 | 1.92 | |||||

Less: Gain on sale of depreciated real estate | (0.90 | ) | (0.90 | ) | |||

Funds From Operations per share | $ | 2.72 | $ | 2.86 | |||

The Company's guidance is provided for information purposes based on current plans and assumptions and is subject to change.

Cousins Properties | 5 | Q4 2019 Supplemental Information |

EARNINGS RELEASE | ||

Investor Conference Call and Webcast

The Company will conduct a conference call at 11:00 a.m. (Eastern Time) on Thursday, February 6, 2020, to discuss the results of the quarter and year ended December 31, 2019. The number to call for this interactive teleconference is (877) 247-1056. The live webcast of this call can be accessed on the Company's website, www.cousins.com, through the “Cousins Properties Fourth Quarter Conference Call” link on the Investor Relations page. A replay of the conference call will be available for seven days by dialing (877) 344-7529 and entering the passcode 10138069. The playback can also be accessed on the Company's website.

Acting through its operating partnership Cousins Properties, LP, Cousins Properties is a leading fully-integrated real estate investment trust (REIT) with extensive experience in development, acquisition, financing, management, and leasing. Based in Atlanta, the Company actively invests in top-tier urban office assets and opportunistic mixed-use properties in Sunbelt markets.

Cousins Properties | 6 | Q4 2019 Supplemental Information |

CONDENSED CONSOLIDATED BALANCE SHEETS | ||

(in thousands, except share and per share amounts)

December 31, 2019 | December 31, 2018 | ||||||

Assets: | |||||||

Real estate assets: | |||||||

Operating properties, net of accumulated depreciation of $577,139 and $421,495 in 2019 and 2018, respectively | $ | 5,669,324 | $ | 3,603,011 | |||

Projects under development | 410,097 | 24,217 | |||||

Land | 116,860 | 72,563 | |||||

6,196,281 | 3,699,791 | ||||||

Real estate assets and other assets held for sale, net of accumulated depreciation and amortization of $61,093 in 2019 | 360,582 | — | |||||

Cash and cash equivalents | 15,603 | 2,547 | |||||

Restricted cash | 2,005 | 148 | |||||

Notes and accounts receivable | 23,680 | 13,821 | |||||

Deferred rents receivable | 102,314 | 83,116 | |||||

Investment in unconsolidated joint ventures | 133,884 | 161,907 | |||||

Intangible assets, net | 257,649 | 145,883 | |||||

Other assets | 59,449 | 39,083 | |||||

Total assets | $ | 7,151,447 | $ | 4,146,296 | |||

Liabilities: | |||||||

Notes payable | $ | 2,222,975 | $ | 1,062,570 | |||

Accounts payable and accrued expenses | 209,904 | 110,159 | |||||

Deferred income | 52,269 | 41,266 | |||||

Intangible liabilities, net of accumulated amortization of $55,798 and $42,473 in 2019 and 2018, respectively | 83,105 | 56,941 | |||||

Other liabilities | 134,128 | 54,204 | |||||

Liabilities of real estate assets held for sale, net of accumulated amortization of $7,771 in 2019 | 21,231 | — | |||||

Total liabilities | 2,723,612 | 1,325,140 | |||||

Commitments and contingencies | |||||||

Equity: | |||||||

Stockholders' investment: | |||||||

Preferred stock, $1 par value, 20,000,000 shares authorized, 1,716,837 shares issued and outstanding in 2019 and 2018 | 1,717 | 1,717 | |||||

Common stock, $1 par value, 300,000,000 and 175,000,000 shares authorized in 2019 and 2018, respectively, and 149,347,382 and 107,681,130 shares issued in 2019 and 2018, respectively | 149,347 | 107,681 | |||||

Additional paid-in capital | 5,493,883 | 3,934,385 | |||||

Treasury stock at cost, 2,584,933 shares in 2019 and 2018 | (148,473 | ) | (148,473 | ) | |||

Distributions in excess of cumulative net income | (1,137,200 | ) | (1,129,445 | ) | |||

Total stockholders' investment | 4,359,274 | 2,765,865 | |||||

Nonredeemable noncontrolling interests | 68,561 | 55,291 | |||||

Total equity | 4,427,835 | 2,821,156 | |||||

Total liabilities and equity | $ | 7,151,447 | $ | 4,146,296 | |||

Cousins Properties | 7 | Q4 2019 Supplemental Information |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||

(unaudited; in thousands, except per share amounts)

Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Revenues: | |||||||||||||||

Rental property revenues | $ | 189,127 | $ | 119,640 | $ | 628,751 | $ | 463,401 | |||||||

Fee income | 5,220 | 2,878 | 28,518 | 10,089 | |||||||||||

Other | 92 | 158 | 246 | 1,722 | |||||||||||

194,439 | 122,676 | 657,515 | 475,212 | ||||||||||||

Expenses: | |||||||||||||||

Rental property operating expenses | 66,308 | 42,177 | 222,146 | 164,678 | |||||||||||

Reimbursed expenses | 735 | 1,025 | 4,004 | 3,782 | |||||||||||

General and administrative expenses | 11,321 | 3,247 | 37,007 | 22,040 | |||||||||||

Interest expense | 16,384 | 10,387 | 53,963 | 39,430 | |||||||||||

Depreciation and amortization | 78,372 | 45,546 | 257,149 | 181,382 | |||||||||||

Transaction costs | 2,003 | 20 | 52,881 | 248 | |||||||||||

Other | 8 | 99 | 1,109 | 556 | |||||||||||

175,131 | 102,501 | 628,259 | 412,116 | ||||||||||||

Income from unconsolidated joint ventures | 2,887 | 2,051 | 12,666 | 12,224 | |||||||||||

Gain on investment property transactions | 96,373 | 525 | 110,761 | 5,437 | |||||||||||

Gain on extinguishment of debt | — | — | — | 8 | |||||||||||

Net income | 118,568 | 22,751 | 152,683 | 80,765 | |||||||||||

Net income attributable to noncontrolling interests | (1,456 | ) | (391 | ) | (2,265 | ) | (1,601 | ) | |||||||

Net income available to common stockholders | $ | 117,112 | $ | 22,360 | $ | 150,418 | $ | 79,164 | |||||||

Net income per common share - basic and diluted | $ | 0.80 | $ | 0.21 | $ | 1.17 | $ | 0.75 | |||||||

Weighted average shares — basic | 146,762 | 105,096 | 128,060 | 105,076 | |||||||||||

Weighted average shares — diluted | 148,534 | 106,871 | 129,831 | 106,868 | |||||||||||

Cousins Properties | 8 | Q4 2019 Supplemental Information |

KEY PERFORMANCE METRICS | ||

2017 | 2018 1st | 2018 2nd | 2018 3rd | 2018 4th | 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | ||||||||||||

Property Statistics | ||||||||||||||||||||||

Consolidated Operating Properties | 22 | 23 | 23 | 23 | 23 | 23 | 24 | 33 | 33 | 34 | 34 | |||||||||||

Consolidated Rentable Square Feet (in thousands) | 11,428 | 11,936 | 11,944 | 11,944 | 12,203 | 12,203 | 12,573 | 18,372 | 18,372 | 19,599 | 19,599 | |||||||||||

Unconsolidated Operating Properties | 4 | 4 | 4 | 4 | 4 | 4 | 5 | 5 | 5 | 4 | 4 | |||||||||||

Unconsolidated Rentable Square Feet (in thousands) | 3,113 | 3,113 | 3,113 | 3,113 | 3,113 | 3,113 | 3,394 | 3,394 | 3,394 | 2,168 | 2,168 | |||||||||||

Total Operating Properties | 26 | 27 | 27 | 27 | 27 | 27 | 29 | 38 | 38 | 38 | 38 | |||||||||||

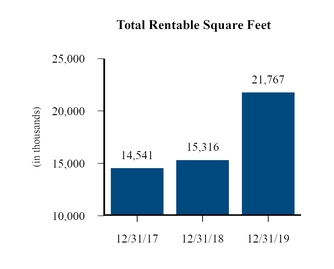

Total Rentable Square Feet (in thousands) | 14,541 | 15,049 | 15,057 | 15,057 | 15,316 | 15,316 | 15,967 | 21,766 | 21,766 | 21,767 | 21,767 | |||||||||||

Office Leasing Activity (1) | ||||||||||||||||||||||

Net Leased during the Period (square feet in thousands) | 2,190 | 330 | 328 | 486 | 455 | 1,597 | 682 | 1,089 | 741 | 562 | 3,074 | |||||||||||

Net Effective Rent Calculation (per square foot) | ||||||||||||||||||||||

Net Rent | $29.41 | $33.35 | $32.40 | $28.46 | $31.02 | $31.01 | $27.86 | $29.34 | $33.66 | $31.38 | $30.43 | |||||||||||

Net Free Rent | (0.75) | (0.55) | (1.00) | (0.94) | (0.86) | (0.85) | (0.49) | (0.52) | (0.64) | (1.01) | (0.63) | |||||||||||

Leasing Commissions | (2.32) | (2.67) | (2.49) | (2.40) | (2.17) | (2.41) | (1.13) | (2.34) | (2.86) | (2.84) | (2.29) | |||||||||||

Tenant Improvements | (4.43) | (3.07) | (4.50) | (4.29) | (5.43) | (4.40) | (1.74) | (4.69) | (3.13) | (4.89) | (3.69) | |||||||||||

Leasing Costs | (7.50) | (6.29) | (7.99) | (7.63) | (8.46) | (7.66) | (3.36) | (7.55) | (6.63) | (8.74) | (6.61) | |||||||||||

Net Effective Rent | $21.91 | $27.06 | $24.41 | $20.83 | $22.56 | $23.35 | $24.50 | $21.79 | $27.03 | $22.64 | $23.82 | |||||||||||

Change in Second Generation Net Rent | 19.6 | % | 35.2 | % | 34.2 | % | 25.8 | % | 36.0 | % | 32.5 | % | 22.8 | % | 21.5 | % | 17.2 | % | 25.5 | % | 21.3 | % |

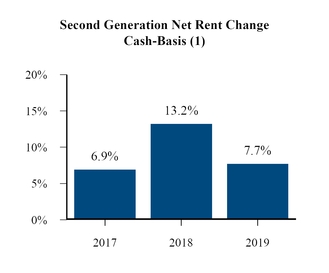

Change in Cash-Basis Second Generation Net Rent | 6.9 | % | 19.3 | % | 13.1 | % | 7.6 | % | 13.1 | % | 13.2 | % | 7.1 | % | 4.9 | % | 8.1 | % | 12.6 | % | 7.7 | % |

Same Property Information (2) | ||||||||||||||||||||||

Percent Leased (period end) | 92.6 | % | 93.6 | % | 93.5 | % | 94.2 | % | 94.5 | % | 94.5 | % | 94.4 | % | 93.9 | % | 93.7 | % | 94.6 | % | 94.6 | % |

Weighted Average Occupancy | 89.4 | % | 92.0 | % | 91.9 | % | 91.8 | % | 92.0 | % | 91.9 | % | 92.0 | % | 91.8 | % | 90.9 | % | 91.1 | % | 91.8 | % |

Change in Net Operating Income (over prior year period) | 4.4 | % | 2.6 | % | 1.3 | % | 2.7 | % | 1.8 | % | 2.1 | % | 4.3 | % | 4.5 | % | 0.3 | % | 1.4 | % | 2.6 | % |

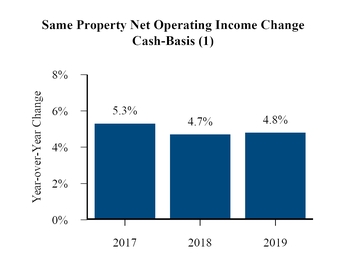

Change in Cash-Basis Net Operating Income (over prior year period) | 5.3 | % | 9.4 | % | 4.1 | % | 4.4 | % | 1.2 | % | 4.7 | % | 4.0 | % | 5.5 | % | 2.9 | % | 6.0 | % | 4.8 | % |

Development Pipeline | ||||||||||||||||||||||

Estimated Project Costs (in thousands) (3) | $490,500 | $271,500 | $358,800 | $362,900 | $245,900 | $245,900 | $199,900 | $427,900 | $427,900 | $565,600 | $565,600 | |||||||||||

Estimated Project Costs (3) / Total Undepreciated Assets | 9.9 | % | 5.5 | % | 7.2 | % | 7.2 | % | 4.7 | % | 4.7 | % | 3.8 | % | 5.5 | % | 5.4 | % | 6.9 | % | 6.9 | % |

Market Capitalization (4) | ||||||||||||||||||||||

Common Stock Price (period end) | $37.00 | $34.72 | $38.76 | $35.56 | $31.60 | $31.60 | $38.64 | $36.17 | $37.59 | $41.20 | $41.20 | |||||||||||

Common Stock/Units Outstanding (period end in thousands) | 106,749 | 106,805 | 106,842 | 106,840 | 106,840 | 106,840 | 106,890 | 148,507 | 148,506 | 148,506 | 148,506 | |||||||||||

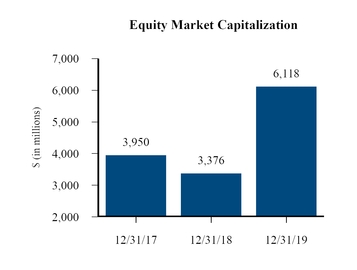

Equity Market Capitalization (in thousands) | $3,949,713 | $3,708,270 | $4,141,196 | $3,799,230 | $3,376,144 | $3,376,144 | $4,130,230 | $5,371,498 | $5,582,341 | $6,118,447 | $6,118,447 | |||||||||||

Debt (in thousands) | 1,262,523 | 1,262,833 | 1,261,459 | 1,236,891 | 1,234,016 | 1,234,016 | 1,287,164 | 2,007,663 | 2,023,136 | 2,305,494 | 2,305,494 | |||||||||||

Total Market Capitalization (in thousands) | $5,212,227 | $4,971,085 | $5,402,655 | $5,036,113 | $4,610,152 | $4,610,152 | $5,417,403 | $7,379,161 | $7,605,477 | $8,423,941 | $8,423,941 | |||||||||||

Cousins Properties | 9 | Q4 2019 Supplemental Information |

KEY PERFORMANCE METRICS | ||

2017 | 2018 1st | 2018 2nd | 2018 3rd | 2018 4th | 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | ||||||||||||

Credit Ratios (4) | ||||||||||||||||||||||

Net Debt/Total Market Capitalization | 21.4 | % | 23.2 | % | 21.3 | % | 22.9 | % | 26.7 | % | 26.7 | % | 23.7 | % | 27.0 | % | 26.4 | % | 27.2 | % | 27.2 | % |

Net Debt/Total Undepreciated Assets | 22.5 | % | 23.5 | % | 23.1 | % | 22.9 | % | 24.2 | % | 24.2 | % | 24.3 | % | 25.7 | % | 25.5 | % | 27.9 | % | 27.9 | % |

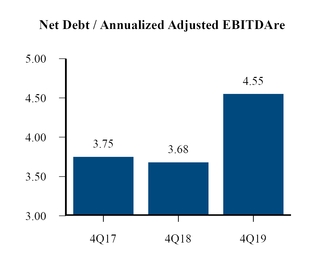

Net Debt/Annualized Adjusted EBITDAre (5) | 3.75 | 3.77 | 3.76 | 3.65 | 3.68 | 3.68 | 3.29 | 5.21 | 4.05 | 4.55 | 4.55 | |||||||||||

Fixed Charges Coverage (Adjusted EBITDAre) | 5.58 | 5.39 | 5.37 | 5.67 | 5.39 | 5.46 | 6.08 | 5.57 | 6.23 | 5.92 | 5.95 | |||||||||||

Dividend Information (4) | ||||||||||||||||||||||

Common Dividend per Share (6) | $0.96 | $0.26 | $0.26 | $0.26 | $0.26 | $1.04 | $0.29 | $0.29 | $0.29 | $0.29 | $1.16 | |||||||||||

Funds From Operations (FFO) Payout Ratio before Transaction Costs | 38.5 | % | 42.2 | % | 42.2 | % | 40.5 | % | 38.3 | % | 40.8 | % | 36.1 | % | 52.1 | % | 39.7 | % | 39.3 | % | 41.4 | % |

Funds Available for Distribution (FAD) Payout Ratio | 60.2 | % | 61.9 | % | 61.2 | % | 59.1 | % | 62.7 | % | 61.2 | % | 56.4 | % | 131.6 | % | 53.9 | % | 60.8 | % | 67.2 | % |

Operations Ratio (4) | ||||||||||||||||||||||

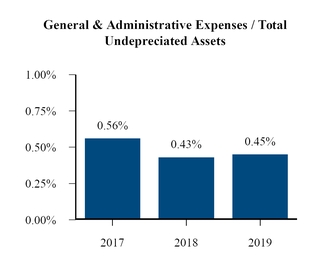

Annualized General and Administrative Expenses/Total Undepreciated Assets | 0.56 | % | 0.55 | % | 0.65 | % | 0.31 | % | 0.26 | % | 0.43 | % | 0.87 | % | 0.43 | % | 0.30 | % | 0.55 | % | 0.45 | % |

Additional Information (4) (in thousands, except per square foot amounts) | ||||||||||||||||||||||

In-Place Gross Rent (per square foot) (7) | $34.19 | $34.98 | $35.08 | $35.23 | $36.41 | $36.41 | $36.95 | $36.98 | $37.26 | $37.44 | $37.44 | |||||||||||

Straight Line Rental Revenue | $30,973 | $8,136 | $5,690 | $5,148 | $7,043 | $26,017 | $8,732 | $6,068 | $6,522 | $8,123 | $29,445 | |||||||||||

Above and Below Market Rents Amortization | $7,221 | $1,793 | $1,714 | $1,730 | $1,640 | $6,877 | $1,670 | $1,981 | $3,042 | $2,846 | $9,539 | |||||||||||

Second Generation Capital Expenditures | $53,485 | $11,256 | $11,077 | $15,152 | $19,182 | $56,667 | $8,074 | $40,604 | $18,946 | $23,085 | $90,709 | |||||||||||

(1) See Office Leasing Activity on page 20 for additional detail and explanations.

(2) Same Property Information is derived from the pool of office properties, as defined, in the period originally reported. See Same Property Performance on page 19 and Non-GAAP Financial Measures - Calculations and Reconciliations on page 36 for additional information.

(3) Cousins' share of estimated project costs. See Development Pipeline on page 26 for additional detail.

(4) See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 32.

(5) Given the timing of the closing of the TIER transaction, the actual calculation of this ratio was temporarily high for the second quarter of 2019 and decreased when a full quarter of TIER operations were included in EBITDAre. Second quarter EBITDAre, annualized for the calculation, included 17 days of Legacy TIER operations while the total impact of the TIER transaction was included in net debt as of June 30, 2019.

(6) The fourth quarter 2016 dividend was declared and paid in the first quarter of 2017.

(7) In-place gross rent equals the annualized cash basis base rent including tenant's share of estimated operating expenses, if applicable, as of the end of the period divided by occupied square feet.

Cousins Properties | 10 | Q4 2019 Supplemental Information |

KEY PERFORMANCE METRICS | ||

(1) Office properties only.

Note: See additional information included herein for calculations, definitions, and reconciliations to GAAP financial measures.

Cousins Properties | 11 | Q4 2019 Supplemental Information |

FUNDS FROM OPERATIONS - SUMMARY (1) | ||

(amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||||||

2017 | 2018 1st | 2018 2nd | 2018 3rd | 2018 4th | 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | |||||||||||||||||||||||

Net Operating Income | $ | 313,206 | $ | 80,578 | $ | 80,195 | $ | 80,858 | $ | 84,432 | $ | 326,063 | $ | 87,731 | $ | 97,417 | $ | 120,642 | $ | 126,000 | $ | 431,790 | |||||||||||

Gain on Sales of Undepreciated Investment Properties | 67 | 330 | 2,449 | — | 512 | 3,291 | 13,132 | 1,337 | 21 | 3,692 | 18,182 | ||||||||||||||||||||||

Fee Income | 8,632 | 2,894 | 1,798 | 2,519 | 2,878 | 10,089 | 8,728 | 7,075 | 7,495 | 5,220 | 28,518 | ||||||||||||||||||||||

Other Income | 15,991 | 1,034 | 1,212 | 915 | 517 | 3,678 | 748 | 306 | 3,671 | 3,136 | 7,861 | ||||||||||||||||||||||

Reimbursed Expenses | (3,527 | ) | (942 | ) | (860 | ) | (955 | ) | (1,025 | ) | (3,782 | ) | (932 | ) | (1,047 | ) | (1,290 | ) | (735 | ) | (4,004 | ) | |||||||||||

General and Administrative Expenses | (27,523 | ) | (6,809 | ) | (8,071 | ) | (3,913 | ) | (3,247 | ) | (22,040 | ) | (11,460 | ) | (8,374 | ) | (5,852 | ) | (11,321 | ) | (37,007 | ) | |||||||||||

Interest Expense | (41,382 | ) | (11,293 | ) | (11,305 | ) | (11,208 | ) | (12,080 | ) | (45,886 | ) | (12,574 | ) | (13,692 | ) | (16,377 | ) | (17,058 | ) | (59,701 | ) | |||||||||||

Other Expenses | (3,690 | ) | (695 | ) | (365 | ) | (257 | ) | (325 | ) | (1,642 | ) | (404 | ) | (50,699 | ) | (1,658 | ) | (2,286 | ) | (55,047 | ) | |||||||||||

Depreciation and Amortization of Non-Real Estate Assets | (1,874 | ) | (473 | ) | (468 | ) | (469 | ) | (462 | ) | (1,872 | ) | (456 | ) | (454 | ) | (443 | ) | (446 | ) | (1,799 | ) | |||||||||||

FFO (1) | $ | 259,900 | $ | 64,624 | $ | 64,585 | $ | 67,490 | $ | 71,200 | $ | 267,899 | $ | 84,513 | $ | 31,869 | $ | 106,209 | $ | 106,202 | $ | 328,793 | |||||||||||

TIER transaction costs | — | — | — | — | — | — | 3 | 49,827 | 1,048 | 1,999 | 52,877 | ||||||||||||||||||||||

FFO before TIER transaction costs | $ | 259,900 | $ | 64,624 | $ | 64,585 | $ | 67,490 | $ | 71,200 | $ | 267,899 | $ | 84,516 | $ | 81,696 | $ | 107,257 | $ | 108,201 | $ | 381,670 | |||||||||||

Weighted Average Shares - Diluted | 105,824 | 106,845 | 106,875 | 106,880 | 106,871 | 106,868 | 106,901 | 114,670 | 148,530 | 148,534 | 129,831 | ||||||||||||||||||||||

FFO per Share (1) | $ | 2.46 | $ | 0.60 | $ | 0.60 | $ | 0.63 | $ | 0.67 | $ | 2.51 | $ | 0.79 | $ | 0.28 | $ | 0.72 | $ | 0.72 | $ | 2.53 | |||||||||||

FFO per Share before TIER transaction costs | $ | 2.46 | $ | 0.60 | $ | 0.60 | $ | 0.63 | $ | 0.67 | $ | 2.51 | $ | 0.79 | $ | 0.71 | $ | 0.72 | $ | 0.73 | $ | 2.94 | |||||||||||

(1) See pages 32 and 35 for reconciliations of Funds From Operations to net income available to common shareholders.

Cousins Properties | 12 | Q4 2019 Supplemental Information |

FUNDS FROM OPERATIONS - DETAIL (1) | ||

(amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||||||

2017 | 2018 1st | 2018 2nd | 2018 3rd | 2018 4th | 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | |||||||||||||||||||||||

Net Operating Income | |||||||||||||||||||||||||||||||||

Consolidated Properties | |||||||||||||||||||||||||||||||||

Spring & 8th (2) | $ | 50 | $ | 4,726 | $ | 4,608 | $ | 4,704 | $ | 7,412 | $ | 21,450 | $ | 7,218 | $ | 7,385 | $ | 7,392 | $ | 7,374 | $ | 29,369 | |||||||||||

Corporate Center (2) | 20,889 | 5,780 | 5,956 | 5,947 | 6,263 | 23,946 | 6,386 | 6,785 | 6,619 | 6,694 | 26,484 | ||||||||||||||||||||||

Northpark (2) | 20,506 | 5,731 | 5,814 | 6,204 | 6,669 | 24,418 | 6,463 | 6,039 | 6,521 | 6,249 | 25,272 | ||||||||||||||||||||||

Hearst Tower | 26,186 | 6,493 | 6,426 | 6,456 | 6,544 | 25,919 | 6,492 | 6,512 | 5,875 | 6,099 | 24,978 | ||||||||||||||||||||||

Hayden Ferry (2) | 21,950 | 5,766 | 5,433 | 5,894 | 6,372 | 23,465 | 5,945 | 6,154 | 5,721 | 6,118 | 23,938 | ||||||||||||||||||||||

The Domain (2) | — | — | — | — | — | — | — | 1,881 | 8,926 | 9,138 | 19,945 | ||||||||||||||||||||||

Promenade | 16,755 | 4,240 | 4,242 | 4,125 | 3,895 | 16,502 | 4,788 | 4,708 | 4,353 | 4,510 | 18,359 | ||||||||||||||||||||||

Fifth Third Center | 19,284 | 4,729 | 4,647 | 4,912 | 4,842 | 19,130 | 4,735 | 4,503 | 4,408 | 4,347 | 17,993 | ||||||||||||||||||||||

One Eleven Congress | 15,146 | 4,036 | 4,039 | 4,034 | 4,109 | 16,218 | 4,446 | 4,515 | 4,203 | 4,215 | 17,379 | ||||||||||||||||||||||

Buckhead Plaza (2) | 17,516 | 4,330 | 4,382 | 4,367 | 3,772 | 16,851 | 4,047 | 3,968 | 3,765 | 3,299 | 15,079 | ||||||||||||||||||||||

San Jacinto Center | 16,069 | 3,635 | 3,632 | 3,596 | 3,789 | 14,652 | 3,665 | 3,679 | 3,637 | 3,612 | 14,593 | ||||||||||||||||||||||

Colorado Tower | 13,557 | 3,429 | 3,453 | 3,511 | 3,380 | 13,773 | 3,480 | 3,483 | 3,502 | 3,526 | 13,991 | ||||||||||||||||||||||

3344 Peachtree | 10,909 | 2,994 | 3,069 | 2,970 | 3,149 | 12,182 | 3,142 | 3,328 | 3,345 | 3,488 | 13,303 | ||||||||||||||||||||||

816 Congress | 10,898 | 2,780 | 2,911 | 3,016 | 2,949 | 11,656 | 3,290 | 2,879 | 2,969 | 2,709 | 11,847 | ||||||||||||||||||||||

Bank of America Plaza | — | — | — | — | — | — | — | 933 | 5,103 | 4,569 | 10,605 | ||||||||||||||||||||||

NASCAR Plaza | 10,189 | 2,652 | 2,590 | 2,683 | 2,409 | 10,334 | 2,538 | 2,494 | 2,586 | 2,682 | 10,300 | ||||||||||||||||||||||

BriarLake Plaza (2) | — | — | — | — | — | — | — | 852 | 4,623 | 4,742 | 10,217 | ||||||||||||||||||||||

3350 Peachtree | 8,673 | 1,987 | 1,899 | 1,888 | 1,859 | 7,633 | 2,011 | 2,345 | 2,329 | 2,272 | 8,957 | ||||||||||||||||||||||

The Terrace (2) | — | — | — | — | — | — | — | 749 | 3,617 | 3,945 | 8,311 | ||||||||||||||||||||||

Burnett Plaza | — | — | — | — | — | — | — | 710 | 3,556 | 3,963 | 8,229 | ||||||||||||||||||||||

Tempe Gateway | 8,079 | 1,893 | 2,029 | 1,997 | 2,015 | 7,934 | 2,165 | 1,757 | 1,785 | 2,043 | 7,750 | ||||||||||||||||||||||

1200 Peachtree | — | — | — | — | — | — | 775 | 2,318 | 2,332 | 2,266 | 7,691 | ||||||||||||||||||||||

8000 Avalon | 433 | 1,357 | 1,350 | 1,144 | 1,581 | 5,432 | 1,714 | 1,916 | 1,899 | 1,879 | 7,408 | ||||||||||||||||||||||

Terminus (2) (3) | — | — | — | — | — | — | — | — | — | 7,330 | 7,330 | ||||||||||||||||||||||

3348 Peachtree | 6,146 | 1,405 | 1,360 | 1,472 | 1,483 | 5,720 | 1,527 | 1,499 | 1,598 | 1,543 | 6,167 | ||||||||||||||||||||||

111 West Rio | 4,044 | 1,314 | 1,419 | 1,374 | 1,370 | 5,477 | 1,381 | 1,380 | 1,407 | 1,391 | 5,559 | ||||||||||||||||||||||

Legacy Union One | — | — | — | — | — | — | — | 450 | 2,360 | 2,347 | 5,157 | ||||||||||||||||||||||

The Pointe | 4,568 | 1,236 | 1,170 | 1,179 | 1,230 | 4,815 | 1,255 | 1,235 | 1,260 | 1,339 | 5,089 | ||||||||||||||||||||||

Meridian Mark Plaza | 4,081 | 920 | 1,006 | 1,049 | 874 | 3,849 | 1,018 | 1,163 | 1,104 | 1,085 | 4,370 | ||||||||||||||||||||||

Research Park V | 2,976 | 1,012 | 1,016 | 1,023 | 1,015 | 4,066 | 1,031 | 1,023 | 1,006 | 1,027 | 4,087 | ||||||||||||||||||||||

Domain Point (2) | — | — | — | — | — | — | — | 348 | 1,571 | 1,139 | 3,058 | ||||||||||||||||||||||

5950 Sherry Lane | — | — | — | — | — | — | — | 220 | 1,056 | 1,040 | 2,316 | ||||||||||||||||||||||

Woodcrest (2) | — | — | — | — | — | — | — | 274 | 746 | 1,213 | 2,233 | ||||||||||||||||||||||

Harborview Plaza | 3,970 | 712 | 516 | 319 | 206 | 1,753 | 346 | 553 | 431 | 683 | 2,013 | ||||||||||||||||||||||

Subtotal - Consolidated | 282,153 | 73,157 | 72,967 | 73,864 | 77,187 | 297,175 | 79,858 | 88,038 | 111,605 | 119,876 | 399,377 | ||||||||||||||||||||||

Cousins Properties | 13 | Q4 2019 Supplemental Information |

FUNDS FROM OPERATIONS - DETAIL (1) | ||

(amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||||||

2017 | 2018 1st | 2018 2nd | 2018 3rd | 2018 4th | 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | |||||||||||||||||||||||

Unconsolidated Properties (4) | |||||||||||||||||||||||||||||||||

Terminus (2) (3) | 14,477 | 3,486 | 3,415 | 3,345 | 3,255 | 13,501 | 3,670 | 3,662 | 3,216 | — | 10,548 | ||||||||||||||||||||||

Gateway Village (2) | 7,047 | 1,968 | 1,770 | 1,873 | 1,819 | 7,430 | 1,837 | 1,839 | 1,807 | 1,964 | 7,447 | ||||||||||||||||||||||

Dimensional Place | — | — | — | — | — | — | 206 | 1,770 | 1,912 | 1,873 | 5,761 | ||||||||||||||||||||||

Carolina Square (2) | 705 | 928 | 975 | 747 | 1,173 | 3,823 | 1,097 | 1,053 | 1,009 | 1,208 | 4,367 | ||||||||||||||||||||||

Emory University Hospital Midtown | 3,913 | 990 | 1,031 | 1,028 | 975 | 4,024 | 1,027 | 1,036 | 1,072 | 1,104 | 4,239 | ||||||||||||||||||||||

Other (5) | 4,911 | 49 | 37 | 1 | 23 | 110 | 36 | 19 | 21 | (25 | ) | 51 | |||||||||||||||||||||

Subtotal - Unconsolidated | 31,053 | 7,421 | 7,228 | 6,994 | 7,245 | 28,888 | 7,873 | 9,379 | 9,037 | 6,124 | 32,413 | ||||||||||||||||||||||

Total Net Operating Income (1) | 313,206 | 80,578 | 80,195 | 80,858 | 84,432 | 326,063 | 87,731 | 97,417 | 120,642 | 126,000 | 431,790 | ||||||||||||||||||||||

Gain on Sales of Undepreciated Investment Properties | |||||||||||||||||||||||||||||||||

Sales Less Cost of Sales - Consolidated | 67 | — | — | — | 512 | 512 | 13,132 | 1,337 | 21 | 3,692 | 18,182 | ||||||||||||||||||||||

Sales Less Cost of Sales - Unconsolidated (4) | — | 330 | 2,449 | — | — | 2,779 | — | — | — | — | — | ||||||||||||||||||||||

Total Gain on Sales of Undepreciated Investment Properties | 67 | 330 | 2,449 | — | 512 | 3,291 | 13,132 | 1,337 | 21 | 3,692 | 18,182 | ||||||||||||||||||||||

Fee Income | |||||||||||||||||||||||||||||||||

Development Fees | 2,140 | 291 | 271 | 951 | 1,422 | 2,935 | 7,022 | 5,112 | 5,670 | 4,254 | 22,058 | ||||||||||||||||||||||

Management Fees (6) | 5,794 | 1,524 | 1,401 | 1,537 | 1,449 | 5,911 | 1,379 | 1,548 | 1,824 | 966 | 5,717 | ||||||||||||||||||||||

Leasing & Other Fees | 698 | 1,079 | 126 | 31 | 7 | 1,243 | 327 | 415 | 1 | — | 743 | ||||||||||||||||||||||

Total Fee Income | 8,632 | 2,894 | 1,798 | 2,519 | 2,878 | 10,089 | 8,728 | 7,075 | 7,495 | 5,220 | 28,518 | ||||||||||||||||||||||

Other Income | |||||||||||||||||||||||||||||||||

Termination Fees | 9,270 | 360 | 639 | 276 | 273 | 1,548 | 520 | 190 | 3,575 | 2,942 | 7,227 | ||||||||||||||||||||||

Termination Fees - Unconsolidated (4) | 1,294 | — | — | — | — | — | 3 | 4 | 9 | — | 16 | ||||||||||||||||||||||

Interest and Other Income | 2,248 | 600 | 493 | 468 | 161 | 1,722 | 140 | 11 | 3 | 92 | 246 | ||||||||||||||||||||||

Interest and Other Income - Unconsolidated (4) | 921 | 74 | 80 | 78 | 83 | 315 | 85 | 101 | 84 | 102 | 372 | ||||||||||||||||||||||

Gain on Extinguishment of Debt | 2,258 | — | — | 93 | — | 93 | — | — | — | — | — | ||||||||||||||||||||||

Total Other Income | 15,991 | 1,034 | 1,212 | 915 | 517 | 3,678 | 748 | 306 | 3,671 | 3,136 | 7,861 | ||||||||||||||||||||||

Total Fee and Other Income | 24,623 | 3,928 | 3,010 | 3,434 | 3,395 | 13,767 | 9,476 | 7,381 | 11,166 | 8,356 | 36,379 | ||||||||||||||||||||||

Reimbursed Expenses | (3,527 | ) | (942 | ) | (860 | ) | (955 | ) | (1,025 | ) | (3,782 | ) | (932 | ) | (1,047 | ) | (1,290 | ) | (735 | ) | (4,004 | ) | |||||||||||

General and Administrative Expenses | (27,523 | ) | (6,809 | ) | (8,071 | ) | (3,913 | ) | (3,247 | ) | (22,040 | ) | (11,460 | ) | (8,374 | ) | (5,852 | ) | (11,321 | ) | (37,007 | ) | |||||||||||

Interest Expense | |||||||||||||||||||||||||||||||||

Consolidated Debt | |||||||||||||||||||||||||||||||||

2017 Senior Notes, Unsecured ($250M) | (4,842 | ) | (2,489 | ) | (2,490 | ) | (2,488 | ) | (2,491 | ) | (9,958 | ) | (2,490 | ) | (2,489 | ) | (2,490 | ) | (2,489 | ) | (9,958 | ) | |||||||||||

Term Loan, Unsecured | (6,198 | ) | (1,858 | ) | (2,088 | ) | (2,205 | ) | (2,344 | ) | (8,495 | ) | (2,422 | ) | (2,421 | ) | (2,302 | ) | (2,049 | ) | (9,194 | ) | |||||||||||

Credit Facility, Unsecured | (3,050 | ) | (742 | ) | (754 | ) | (754 | ) | (773 | ) | (3,023 | ) | (1,289 | ) | (1,705 | ) | (1,628 | ) | (2,703 | ) | (7,325 | ) | |||||||||||

2019 Senior Notes, Unsecured ($275M) | — | — | — | — | — | — | — | (366 | ) | (2,744 | ) | (2,743 | ) | (5,853 | ) | ||||||||||||||||||

2019 Senior Notes, Unsecured ($250M) | — | — | — | — | — | — | — | (326 | ) | (2,440 | ) | (2,441 | ) | (5,207 | ) | ||||||||||||||||||

Fifth Third Center | (5,052 | ) | (1,247 | ) | (1,241 | ) | (1,235 | ) | (1,228 | ) | (4,951 | ) | (1,221 | ) | (1,215 | ) | (1,208 | ) | (1,202 | ) | (4,846 | ) | |||||||||||

Promenade | (4,492 | ) | (1,102 | ) | (1,095 | ) | (1,085 | ) | (1,078 | ) | (4,360 | ) | (1,069 | ) | (1,060 | ) | (1,052 | ) | (1,043 | ) | (4,224 | ) | |||||||||||

Colorado Tower | (4,236 | ) | (1,059 | ) | (1,059 | ) | (1,059 | ) | (1,056 | ) | (4,233 | ) | (1,051 | ) | (1,046 | ) | (1,040 | ) | (1,036 | ) | (4,173 | ) | |||||||||||

2017 Senior Notes, Unsecured ($100M) | (2,937 | ) | (1,036 | ) | (1,037 | ) | (1,036 | ) | (1,036 | ) | (4,145 | ) | (1,036 | ) | (1,037 | ) | (1,036 | ) | (1,036 | ) | (4,145 | ) | |||||||||||

816 Congress | (3,233 | ) | (799 | ) | (795 | ) | (792 | ) | (787 | ) | (3,173 | ) | (784 | ) | (779 | ) | (776 | ) | (772 | ) | (3,111 | ) | |||||||||||

Cousins Properties | 14 | Q4 2019 Supplemental Information |

FUNDS FROM OPERATIONS - DETAIL (1) | ||

(amounts in thousands, except per share amounts) | |||||||||||||||||||||||||||||||||

2017 | 2018 1st | 2018 2nd | 2018 3rd | 2018 4th | 2018 | 2019 1st | 2019 2nd | 2019 3rd | 2019 4th | 2019 | |||||||||||||||||||||||

2019 Senior Notes, Unsecured ($125M) | — | — | — | — | — | — | — | (160 | ) | (1,197 | ) | (1,197 | ) | (2,554 | ) | ||||||||||||||||||

Terminus (2) (3) | — | — | — | — | — | — | — | — | — | (1,540 | ) | (1,540 | ) | ||||||||||||||||||||

Meridian Mark Plaza | (1,483 | ) | (366 | ) | (368 | ) | (359 | ) | (360 | ) | (1,453 | ) | (358 | ) | (357 | ) | (354 | ) | (352 | ) | (1,421 | ) | |||||||||||

Legacy Union One | — | — | — | — | — | — | — | (98 | ) | (536 | ) | (535 | ) | (1,169 | ) | ||||||||||||||||||

Other | (7,243 | ) | (175 | ) | (177 | ) | (74 | ) | (115 | ) | (541 | ) | (115 | ) | (116 | ) | (115 | ) | (116 | ) | (462 | ) | |||||||||||

Capitalized (7) | 9,242 | 1,095 | 1,390 | 1,536 | 881 | 4,902 | 1,015 | 1,116 | 4,218 | 4,870 | 11,219 | ||||||||||||||||||||||

Subtotal - Consolidated | (33,524 | ) | (9,778 | ) | (9,714 | ) | (9,551 | ) | (10,387 | ) | (39,430 | ) | (10,820 | ) | (12,059 | ) | (14,700 | ) | (16,384 | ) | (53,963 | ) | |||||||||||

Unconsolidated Debt (4) | |||||||||||||||||||||||||||||||||

Terminus (2) (3) | (4,823 | ) | (1,001 | ) | (995 | ) | (988 | ) | (992 | ) | (3,976 | ) | (1,038 | ) | (905 | ) | (961 | ) | — | (2,904 | ) | ||||||||||||

Carolina Square (2) | (184 | ) | (197 | ) | (281 | ) | (355 | ) | (390 | ) | (1,223 | ) | (406 | ) | (420 | ) | (409 | ) | (370 | ) | (1,605 | ) | |||||||||||

Emory University Hospital Midtown | (1,285 | ) | (317 | ) | (315 | ) | (314 | ) | (311 | ) | (1,257 | ) | (310 | ) | (308 | ) | (307 | ) | (304 | ) | (1,229 | ) | |||||||||||

Other | (1,566 | ) | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||

Subtotal - Unconsolidated | (7,858 | ) | (1,515 | ) | (1,591 | ) | (1,657 | ) | (1,693 | ) | (6,456 | ) | (1,754 | ) | (1,633 | ) | (1,677 | ) | (674 | ) | (5,738 | ) | |||||||||||

Total Interest Expense | (41,382 | ) | (11,293 | ) | (11,305 | ) | (11,208 | ) | (12,080 | ) | (45,886 | ) | (12,574 | ) | (13,692 | ) | (16,377 | ) | (17,058 | ) | (59,701 | ) | |||||||||||

Other Expenses | |||||||||||||||||||||||||||||||||

Severance | (446 | ) | (195 | ) | 128 | 4 | 3 | (60 | ) | (23 | ) | (23 | ) | (84 | ) | (24 | ) | (154 | ) | ||||||||||||||

Partners' share of FFO in consolidated joint ventures | (16 | ) | (144 | ) | (134 | ) | (121 | ) | (159 | ) | (558 | ) | (171 | ) | (192 | ) | (249 | ) | (221 | ) | (833 | ) | |||||||||||

Property Taxes and Other Holding Costs | (764 | ) | (130 | ) | (152 | ) | (148 | ) | (153 | ) | (583 | ) | (184 | ) | (209 | ) | (392 | ) | (290 | ) | (1,075 | ) | |||||||||||

Loss on Extinguishment of Debt | — | (85 | ) | — | — | — | (85 | ) | — | — | — | — | — | ||||||||||||||||||||

Income Tax Expense | — | — | — | — | — | — | — | (242 | ) | 242 | 298 | 298 | |||||||||||||||||||||

Predevelopment & Other Costs | (803 | ) | (50 | ) | (70 | ) | 8 | 4 | (108 | ) | (23 | ) | (206 | ) | (127 | ) | (46 | ) | (402 | ) | |||||||||||||

Transaction Costs - TIER | — | — | — | — | — | — | (3 | ) | (49,827 | ) | (1,048 | ) | (1,999 | ) | (52,877 | ) | |||||||||||||||||

Transaction/Acquisition Costs - Other (8) | (1,661 | ) | (91 | ) | (137 | ) | — | (20 | ) | (248 | ) | — | — | — | (4 | ) | (4 | ) | |||||||||||||||

Total Other Expenses | (3,690 | ) | (695 | ) | (365 | ) | (257 | ) | (325 | ) | (1,642 | ) | (404 | ) | (50,699 | ) | (1,658 | ) | (2,286 | ) | (55,047 | ) | |||||||||||

Depreciation and Amortization of Non-Real Estate Assets | (1,874 | ) | (473 | ) | (468 | ) | (469 | ) | (462 | ) | (1,872 | ) | (456 | ) | (454 | ) | (443 | ) | (446 | ) | (1,799 | ) | |||||||||||

FFO (1) | $ | 259,900 | $ | 64,624 | $ | 64,585 | $ | 67,490 | $ | 71,200 | $ | 267,899 | $ | 84,513 | $ | 31,869 | $ | 106,209 | $ | 106,202 | $ | 328,793 | |||||||||||

TIER transaction costs | — | — | — | — | — | — | 3 | 49,827 | 1,048 | 1,999 | 52,877 | ||||||||||||||||||||||

FFO before TIER transaction costs | 259,900 | 64,624 | 64,585 | 67,490 | 71,200 | 267,899 | 84,516 | 81,696 | 107,257 | 108,201 | 381,670 | ||||||||||||||||||||||

Weighted Average Shares - Diluted | 105,824 | 106,845 | 106,875 | 106,880 | 106,871 | 106,868 | 106,901 | 114,670 | 148,530 | 148,534 | 129,831 | ||||||||||||||||||||||

FFO per Share (1) | $ | 2.46 | $ | 0.60 | $ | 0.60 | $ | 0.63 | $ | 0.67 | $ | 2.51 | $ | 0.79 | $ | 0.28 | $ | 0.72 | $ | 0.72 | $ | 2.53 | |||||||||||

FFO per Share before TIER transaction costs | $ | 2.46 | $ | 0.60 | $ | 0.60 | $ | 0.63 | $ | 0.67 | $ | 2.51 | $ | 0.79 | $ | 0.71 | $ | 0.72 | $ | 0.73 | $ | 2.94 | |||||||||||

Note: Amounts may differ slightly from other schedules contained herein due to rounding. | |||||||||||||||||

(1) See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 32. | |||||||||||||||||

(2) Contains multiple buildings that are grouped together for reporting purposes. | |||||||||||||||||

(3) On October 1, 2019, the Company purchased its partner's 50% interest in Terminus Office Holdings LLC. | |||||||||||||||||

(4) Unconsolidated amounts include amounts recorded in unconsolidated joint ventures for the respective category multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures, but believes including these amounts in the categories indicated is meaningful to investors and analysts. | |||||||||||||||||

(5) In 2018 and 2019, other unconsolidated NOI related primarily to 300 Colorado and 120 West Trinity. In 2017, other unconsolidated NOI related primarily to Emory Point, which was sold in 2017. | |||||||||||||||||

(6) Management Fees include reimbursement of expenses that are included in the "Reimbursed Expenses" line item. | |||||||||||||||||

(7) Amounts of interest expense related to consolidated debt that is capitalized to consolidated development projects and equity in unconsolidated development projects. | |||||||||||||||||

(8) In 2017 and 2018, transaction costs related primarily to the transactions with Parkway Properties, Inc. | |||||||||||||||||

Cousins Properties | 15 | Q4 2019 Supplemental Information |

PORTFOLIO STATISTICS | ||

Office Properties | Rentable Square Feet | Financial Statement Presentation | Company's Ownership Interest | End of Period Leased | Weighted Average Occupancy (1) | % of Total Net Operating Income (2) | Property Level Debt ($000) (3) | ||||||||||||||

4Q19 | 3Q19 | 4Q19 | 3Q19 | ||||||||||||||||||

Spring & 8th (4) (5) | 765,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 5.9% | $ | — | |||||||||||

Terminus (4) (5) | 1,226,000 | Consolidated | 100% | 83.3% | 83.1% | 78.8% | 77.1% | 5.8% | 203,309 | ||||||||||||

Northpark (4) | 1,539,000 | Consolidated | 100% | 92.8% | 93.1% | 85.7% | 86.1% | 5.0% | — | ||||||||||||

Promenade | 777,000 | Consolidated | 100% | 90.5% | 90.5% | 89.6% | 89.5% | 3.6% | 95,824 | ||||||||||||

3344 Peachtree | 484,000 | Consolidated | 100% | 94.2% | 94.1% | 89.3% | 94.1% | 2.8% | — | ||||||||||||

Buckhead Plaza (4) | 671,000 | Consolidated | 100% | 75.6% | 76.9% | 73.9% | 77.9% | 2.6% | — | ||||||||||||

1200 Peachtree (5) | 370,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 1.8% | — | ||||||||||||

3350 Peachtree | 413,000 | Consolidated | 100% | 95.2% | 95.2% | 95.0% | 94.7% | 1.8% | — | ||||||||||||

8000 Avalon (5) | 229,000 | Consolidated | 90% | 100.0% | 100.0% | 100.0% | 100.0% | 1.5% | — | ||||||||||||

3348 Peachtree | 258,000 | Consolidated | 100% | 92.3% | 92.2% | 92.1% | 92.1% | 1.2% | — | ||||||||||||

Emory University Hospital Midtown | 358,000 | Unconsolidated | 50% | 99.1% | 99.6% | 98.5% | 99.1% | 0.9% | 33,973 | ||||||||||||

Meridian Mark Plaza | 160,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 0.9% | 22,964 | ||||||||||||

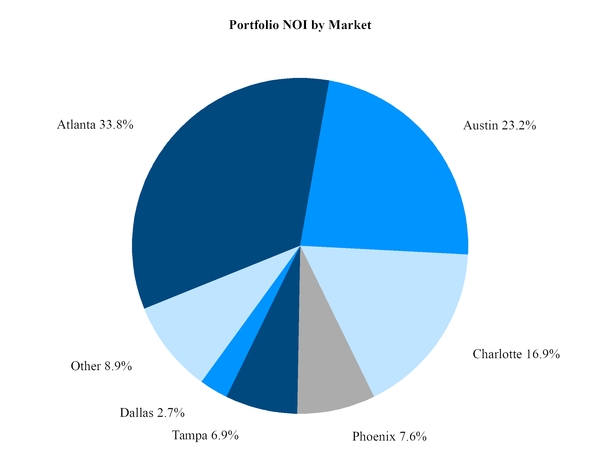

ATLANTA (6) | 7,250,000 | 91.2% | 91.3% | 88.2% | 88.7% | 33.8% | 356,070 | ||||||||||||||

The Domain (4) (5) | 1,287,000 | Consolidated | 100% | 99.7% | 99.7% | 89.2% | 88.6% | 7.3% | — | ||||||||||||

One Eleven Congress | 519,000 | Consolidated | 100% | 97.1% | 95.1% | 88.3% | 92.4% | 3.3% | — | ||||||||||||

The Terrace (4) (5) | 619,000 | Consolidated | 100% | 89.9% | 90.8% | 88.5% | 87.3% | 3.1% | — | ||||||||||||

San Jacinto Center | 395,000 | Consolidated | 100% | 97.9% | 98.4% | 89.9% | 92.7% | 2.9% | — | ||||||||||||

Colorado Tower | 373,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 2.8% | 116,443 | ||||||||||||

816 Congress | 435,000 | Consolidated | 100% | 88.8% | 88.7% | 88.8% | 89.1% | 2.1% | 79,590 | ||||||||||||

Domain Point (4) (5) | 242,000 | Consolidated | 96.5% | 88.1% | 95.8% | 79.6% | 95.8% | 0.9% | — | ||||||||||||

Research Park V | 173,000 | Consolidated | 100% | 97.1% | 97.1% | 97.1% | 97.1% | 0.8% | — | ||||||||||||

AUSTIN | 4,043,000 | 95.8% | 96.1% | 89.8% | 91.2% | 23.2% | 196,033 | ||||||||||||||

Hearst Tower | 966,000 | Consolidated | 100% | 98.5% | 98.4% | 93.1% | 92.0% | 4.8% | — | ||||||||||||

Bank of America Plaza (5) | 891,000 | Consolidated | 100% | 90.4% | 89.8% | 88.4% | 87.3% | 3.6% | — | ||||||||||||

Fifth Third Center | 692,000 | Consolidated | 100% | 96.2% | 96.2% | 92.6% | 92.6% | 3.4% | 139,884 | ||||||||||||

NASCAR Plaza | 395,000 | Consolidated | 100% | 100.0% | 98.2% | 98.4% | 98.2% | 2.1% | — | ||||||||||||

Dimensional Place (5) | 281,000 | Unconsolidated | 50% | 95.6% | 95.6% | 94.7% | 94.3% | 1.5% | — | ||||||||||||

Gateway Village (4) | 1,061,000 | Unconsolidated | 50% | 99.4% | 99.4% | 99.4% | 99.4% | 1.5% | — | ||||||||||||

CHARLOTTE | 4,286,000 | 96.2% | 95.9% | 93.4% | 92.8% | 16.9% | 139,884 | ||||||||||||||

Hayden Ferry (4) | 789,000 | Consolidated | 100% | 97.8% | 92.4% | 92.8% | 91.5% | 4.9% | — | ||||||||||||

Tempe Gateway | 264,000 | Consolidated | 100% | 94.8% | 94.8% | 94.8% | 86.7% | 1.6% | — | ||||||||||||

111 West Rio | 225,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 1.1% | — | ||||||||||||

PHOENIX | 1,278,000 | 97.6% | 94.2% | 94.5% | 92.0% | 7.6% | — | ||||||||||||||

Corporate Center (4) | 1,224,000 | Consolidated | 100% | 98.6% | 98.3% | 96.3% | 97.1% | 5.3% | — | ||||||||||||

The Pointe | 253,000 | Consolidated | 100% | 94.9% | 97.3% | 96.1% | 97.1% | 1.1% | — | ||||||||||||

Harborview Plaza | 205,000 | Consolidated | 100% | 80.0% | 80.0% | 62.8% | 63.5% | 0.5% | — | ||||||||||||

TAMPA | 1,682,000 | 95.7% | 95.9% | 92.2% | 93.0% | 6.9% | — | ||||||||||||||

Cousins Properties | 16 | Q4 2019 Supplemental Information |

PORTFOLIO STATISTICS | ||

Office Properties | Rentable Square Feet | Financial Statement Presentation | Company's Ownership Interest | End of Period Leased | Weighted Average Occupancy (1) | % of Total Net Operating Income (2) | Property Level Debt ($000) (3) | ||||||||||||||

4Q19 | 3Q19 | 4Q19 | 3Q19 | ||||||||||||||||||

Legacy Union One (5) | 319,000 | Consolidated | 100% | 100.0% | 100.0% | 100.0% | 100.0% | 1.9% | 68,155 | ||||||||||||

5950 Sherry Lane (5) | 197,000 | Consolidated | 100% | 90.3% | 93.3% | 83.5% | 91.1% | 0.8% | — | ||||||||||||

DALLAS | 516,000 | 96.3% | 97.4% | 93.7% | 96.6% | 2.7% | 68,155 | ||||||||||||||

BriarLake Plaza - Houston (4) (5) | 835,000 | Consolidated | 100% | 89.2% | 88.9% | 88.0% | 85.0% | 3.8% | — | ||||||||||||

Burnett Plaza - Fort Worth (5) | 1,023,000 | Consolidated | 100% | 86.4% | 86.7% | 86.4% | 85.6% | 3.1% | — | ||||||||||||

Woodcrest - Cherry Hill (4) (5) | 386,000 | Consolidated | 100% | 92.0% | 92.0% | 82.4% | 70.7% | 1.0% | — | ||||||||||||

Carolina Square - Chapel Hill (5) | 158,000 | Unconsolidated | 50% | 93.4% | 93.4% | 79.5% | 79.5% | 0.3% | 12,772 | ||||||||||||

OTHER OFFICE | 2,402,000 | 88.6% | 88.6% | 86.1% | 82.7% | 8.2% | 12,772 | ||||||||||||||

TOTAL OFFICE | 21,457,000 | 93.6% | 93.5% | 90.1% | 90.0% | 99.3% | $ | 772,914 | |||||||||||||

Other Properties | |||||||||||||||||||||

Carolina Square Apartment - Chapel Hill (246 units) (5) | 266,000 | Unconsolidated | 50% | 99.6% | 100.0% | 99.6% | 96.7% | 0.6% | 21,502 | ||||||||||||

Carolina Square Retail - Chapel Hill (5) | 44,000 | Unconsolidated | 50% | 89.3% | 89.3% | 89.3% | 81.5% | 0.1% | 3,557 | ||||||||||||

TOTAL OTHER | 310,000 | 98.1% | 98.5% | 98.1% | 94.6% | 0.7% | $ | 25,059 | |||||||||||||

TOTAL | 21,767,000 | 93.6% | 93.5% | 90.1% | 90.0% | 100.0% | $ | 797,973 | |||||||||||||

See next page for footnotes | |||||||||||||||||||||

Cousins Properties | 17 | Q4 2019 Supplemental Information |

PORTFOLIO STATISTICS | ||

(1 | ) | Represents the weighted average occupancy of the property over the period for which the property was available for occupancy. |

(2 | ) | The Company's share of net operating income for the three months ended December 31, 2019. |

(3 | ) | The Company's share of property specific mortgage debt, including premiums and net of unamortized loan costs, as of December 31, 2019. |

(4 | ) | Contains two or more buildings that are grouped together for reporting purposes. |

(5 | ) | Not included in Same Property as of December 31, 2019. |

(6 | ) | Weighted average percentages for Atlanta for the third quarter of 2019 have been restated to reflect Terminus at the Company's current 100% ownership percentage. |

Cousins Properties | 18 | Q4 2019 Supplemental Information |

SAME PROPERTY PERFORMANCE (1) | ||

Net Operating Income ($ in thousands) | ||||||||||

Three Months Ended December 31, | ||||||||||

2019 | 2018 | % Change | ||||||||

Rental Property Revenues (2) | $ | 115,004 | $ | 112,425 | 2.3 | % | ||||

Rental Property Operating Expenses (2) | 43,005 | 41,441 | 3.8 | % | ||||||

Same Property Net Operating Income | $ | 71,999 | $ | 70,984 | 1.4 | % | ||||

Cash-Basis Rental Property Revenues (3) | $ | 109,834 | $ | 104,512 | 5.1 | % | ||||

Cash-Basis Rental Property Operating Expenses (4) | 42,839 | 41,302 | 3.7 | % | ||||||

Cash-Basis Same Property Net Operating Income | $ | 66,995 | $ | 63,210 | 6.0 | % | ||||

End of Period Leased | 94.6 | % | 94.7 | % | ||||||

Weighted Average Occupancy | 91.1 | % | 92.5 | % | ||||||

Year Ended December 31, | ||||||||||

2019 | 2018 | % Change | ||||||||

Rental Property Revenues (2) | $ | 460,257 | $ | 446,122 | 3.2 | % | ||||

Rental Property Operating Expenses (2) | 171,063 | 164,377 | 4.1 | % | ||||||

Same Property Net Operating Income | $ | 289,194 | $ | 281,745 | 2.6 | % | ||||

Cash-Basis Rental Property Revenues (3) | $ | 433,684 | $ | 414,767 | 4.6 | % | ||||

Cash-Basis Rental Property Operating Expenses (4) | 170,404 | 163,632 | 4.1 | % | ||||||

Cash-Basis Same Property Net Operating Income | $ | 263,280 | $ | 251,135 | 4.8 | % | ||||

Weighted Average Occupancy | 91.8 | % | 92.3 | % | ||||||

(1) | Same Properties include those office properties that were fully operational in each of the comparable reporting periods. See Portfolio Statistics beginning on page 16 for footnotes indicating which properties are not included in Same Property. On October 1, 2019, the Company purchased its partner's interest in Terminus Office Holdings LLC and, therefore, has excluded the Terminus properties from Same Property as of December 31, 2019. See Non-GAAP Financial Measures - Calculations and Reconciliations. | ||

(2) | Rental Property Revenues and Expenses include results for the Company and its share of unconsolidated joint ventures and exclude termination fee income. Net operating income for unconsolidated joint ventures is calculated as rental property revenues less termination fee income and rental property expenses at the joint ventures multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures, but believes that including these amounts with consolidated net operating income is meaningful to investors and analysts. | ||

(3) | Cash-Basis Rental Property Revenues include that of the Company and its share of unconsolidated joint ventures. It represents Rental Property Revenues, excluding termination fee income, straight-line rents, amortization of lease inducements, and amortization of acquired above and below market rents. | ||

(4) | Cash-Basis Rental Property Operating Expenses include that of the Company and its share of unconsolidated joint ventures. It represents Rental Property Operating Expenses, excluding straight-line ground rent expense and amortization of above and below market ground rent expense. | ||

Cousins Properties | 19 | Q4 2019 Supplemental Information |

OFFICE LEASING ACTIVITY(1) | ||

Three Months Ended December 31, 2019 | Year Ended December 31, 2019 | ||||||||||||||||||||||||||||||

New | Renewal | Expansion | Total | New | Renewal | Expansion | Total | ||||||||||||||||||||||||

Gross leased (square feet) | 687,885 | 3,584,798 | |||||||||||||||||||||||||||||

Less: Leases one year or less, amenity leases, percentage rent leases, storage leases, intercompany leases, and license agreements | (126,234 | ) | (510,333 | ) | |||||||||||||||||||||||||||

Net leased (square feet) | 153,195 | 322,036 | 86,420 | 561,651 | 1,558,196 | 1,060,293 | 455,976 | 3,074,465 | |||||||||||||||||||||||

Number of transactions | 16 | 22 | 9 | 47 | 57 | 72 | 34 | 163 | |||||||||||||||||||||||

Lease term (years) (2) | 8.1 | 5.3 | 6.2 | 6.2 | 9.4 | 5.7 | 8.1 | 7.9 | |||||||||||||||||||||||

Net Effective Rent Calculation (per square foot per year) (2) | |||||||||||||||||||||||||||||||

Net annualized rent (3) | $ | 33.59 | $ | 29.49 | $ | 34.50 | $ | 31.38 | $ | 28.58 | $ | 30.30 | $ | 37.02 | $ | 30.43 | |||||||||||||||

Net free rent | (1.43 | ) | (0.72 | ) | (1.34 | ) | (1.01 | ) | (0.60 | ) | (0.60 | ) | (0.81 | ) | (0.63 | ) | |||||||||||||||

Leasing commissions | (3.08 | ) | (2.72 | ) | (2.91 | ) | (2.84 | ) | (1.84 | ) | (2.62 | ) | (3.10 | ) | (2.29 | ) | |||||||||||||||

Tenant improvements | (6.49 | ) | (3.74 | ) | (6.36 | ) | (4.89 | ) | (3.85 | ) | (3.02 | ) | (4.73 | ) | (3.69 | ) | |||||||||||||||

Leasing Costs | (11.00 | ) | (7.18 | ) | (10.61 | ) | (8.74 | ) | (6.29 | ) | (6.24 | ) | (8.64 | ) | (6.61 | ) | |||||||||||||||

Net effective rent | $ | 22.59 | $ | 22.31 | $ | 23.89 | $ | 22.64 | $ | 22.29 | $ | 24.06 | $ | 28.38 | $ | 23.82 | |||||||||||||||

Second generation leased square footage (4)(5) | 445,196 | 2,146,608 | |||||||||||||||||||||||||||||

Increase in second generation net rent per square foot (2)(3)(4)(5) | 25.5 | % | 21.3 | % | |||||||||||||||||||||||||||

Increase in cash-basis second generation net rent per square foot (2)(4)(5) | 12.6 | % | 7.7 | % | |||||||||||||||||||||||||||

(1) Office leasing activity is comprised of total square feet leased, unadjusted for ownership share, and excluding apartment and retail leasing at our mixed-use projects. | |||||||||||||||||||||||||||||||

(2) Weighted average. | |||||||||||||||||||||||||||||||

(3) Straight-line net rent per square foot (operating expenses deducted from gross leases) over the lease term. | |||||||||||||||||||||||||||||||

(4) Excludes leases executed for spaces that were vacant upon acquisition, new leases in development properties, and leases for spaces that have been vacant for one year or more. | |||||||||||||||||||||||||||||||

(5) Increase in net rent at the end of term paid by the prior tenant compared to net rent at the beginning of term paid by the current tenant. For early renewals, the increase in net rent at the end of term of the original lease is compared to net rent at the beginning of the extended term of the lease. | |||||||||||||||||||||||||||||||

Cousins Properties | 20 | Q4 2019 Supplemental Information |

OFFICE LEASE EXPIRATIONS | ||

Lease Expirations by Year (1)

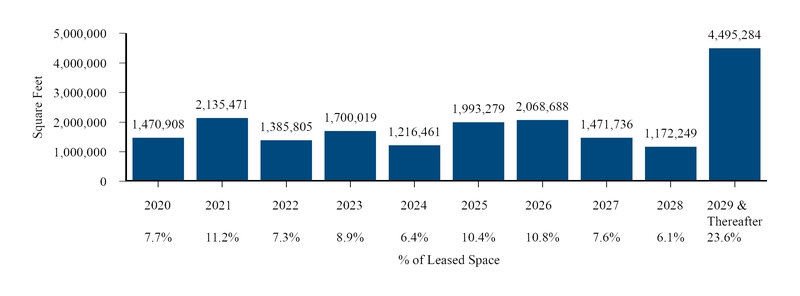

Year of Expiration | Square Feet Expiring | % of Leased Space | Annual Contractual Rent ($000's) (2) | % of Annual Contractual Rent | Annual Contractual Rent/Sq. Ft. | ||||||||||||

2020 | 1,470,908 | 7.7 | % | $ | 47,658 | 5.9 | % | $ | 32.53 | ||||||||

2021 | 2,135,471 | 11.2 | % | 77,864 | 9.6 | % | 36.46 | ||||||||||

2022 | 1,385,805 | 7.3 | % | 56,590 | 6.9 | % | 40.84 | ||||||||||

2023 | 1,700,019 | 8.9 | % | 69,947 | 8.6 | % | 41.14 | ||||||||||

2024 | 1,216,461 | 6.4 | % | 48,970 | 6.0 | % | 40.26 | ||||||||||

2025 | 1,993,279 | 10.4 | % | 87,994 | 10.9 | % | 44.15 | ||||||||||

2026 | 2,068,688 | 10.8 | % | 83,204 | 10.3 | % | 40.22 | ||||||||||

2027 | 1,471,736 | 7.6 | % | 60,873 | 7.4 | % | 41.16 | ||||||||||

2028 | 1,172,249 | 6.1 | % | 49,825 | 6.1 | % | 42.38 | ||||||||||

2029 &Thereafter | 4,495,284 | 23.6 | % | 229,494 | 28.3 | % | 51.06 | ||||||||||

Total | 19,109,900 | 100.0 | % | $ | 812,419 | 100.0 | % | $ 42.51 | |||||||||

(1) Company's share. | |||

(2) Annual Contractual Rent is the estimated rent in the year of expiration. It includes the minimum base rent and an estimate of operating expenses, if applicable, as defined in the respective leases. | |||

Cousins Properties | 21 | Q4 2019 Supplemental Information |

TOP 20 OFFICE TENANTS | ||

Tenant (1) | Number of Properties Occupied | Number of Markets Occupied | Company's Share of Square Footage | Company's Share of Annualized Rent (2) | Percentage of Company's Share of Annualized Rent | Weighted Average Remaining Lease Term (Years) | |||||||||||

1 | Bank of America | 4 | 1 | 1,393,086 | $ | 38,611,659 | 5.6% | 4 | |||||||||

2 | NCR Corporation | 1 | 1 | 762,090 | 36,166,613 | 5.3% | 14 | ||||||||||

3 | Amazon | 4 | 3 | 391,187 | 17,810,008 | 2.6% | 6 | ||||||||||

4 | Expedia, Inc. | 1 | 1 | 296,955 | 13,407,563 | 2.0% | 9 | ||||||||||

5 | Norfolk Southern Corporation | 2 | 1 | 394,621 | 11,271,065 | 1.6% | 2 | ||||||||||

6 | Apache Corporation | 1 | 1 | 210,012 | 9,232,036 | 1.3% | 5 | ||||||||||

7 | Wells Fargo Bank, NA | 4 | 3 | 212,662 | 8,961,318 | 1.3% | 3 | ||||||||||

8 | Americredit Financial Services (dba GM Financial) | 2 | 2 | 333,782 | 8,520,825 | 1.2% | 10 | ||||||||||

9 | Parsley Energy, L.P. | 1 | 1 | 135,107 | 7,944,527 | 1.2% | 5 | ||||||||||

10 | Encana Oil & Gas (USA) Inc. | 1 | 1 | 318,582 | 7,831,964 | 1.1% | 8 | ||||||||||

11 | ADP, LLC | 1 | 1 | 225,000 | 7,307,064 | 1.0% | 8 | ||||||||||

12 | McGuirewoods LLP | 3 | 3 | 197,282 | 6,742,246 | 1.0% | 7 | ||||||||||

13 | Westrock Shared Services, LLC | 1 | 1 | 205,185 | 6,701,263 | 0.9% | 10 | ||||||||||

14 | Dimensional Fund Advisors LP | 1 | 1 | 132,434 | 6,235,230 | 0.9% | 14 | ||||||||||

15 | Morgan Stanley | 2 | 2 | 130,863 | 5,925,364 | 0.9% | 8 | ||||||||||

16 | Regus Equity Business Centers, LLC | 6 | 4 | 146,852 | 5,894,747 | 0.9% | 5 | ||||||||||

17 | Samsung Engineering America | 1 | 1 | 133,860 | 5,857,544 | 0.9% | 7 | ||||||||||

18 | Anthem | 1 | 1 | 198,834 | 5,642,481 | 0.8% | 1 | ||||||||||

19 | General Services Administration | 3 | 3 | 220,600 | 5,613,079 | 0.8% | 3 | ||||||||||

20 | NASCAR Media Group, LLC | 1 | 1 | 139,861 | 5,518,368 | 0.8% | 1 | ||||||||||

Total | 6,178,855 | $ | 221,194,964 | 32.1% | 7 | ||||||||||||

(1) | In some cases, the actual tenant may be an affiliate of the entity shown. | ||||||||||||||||

(2) | Annualized Rent represents the annualized rent including tenant's share of estimated operating expenses, if applicable, paid by the tenant as of the date of this report. If the tenant is in a free rent period as of the date of this report, Annualized Rent represents the annualized contractual rent the tenant will pay in the first month it is required to pay rent. | ||||||||||||||||

Note: | This schedule includes tenants whose leases have commenced and/or who have taken occupancy. Leases that have been signed but have not commenced are excluded. | ||||||||||||||||

Cousins Properties | 22 | Q4 2019 Supplemental Information |

TENANT INDUSTRY DIVERSIFICATION | ||

Note: Management uses SIC codes when available, along with judgment, to determine tenant industry classification.

Cousins Properties | 23 | Q4 2019 Supplemental Information |

INVESTMENT ACTIVITY | ||

Completed Property Acquisitions

Property | Type | Market | Company's Ownership Interest | Timing | Square Feet | Gross Purchase Price ($ in thousands) (1) | |||||||||

2019 | |||||||||||||||

1200 Peachtree | Office | Atlanta | 100.0% | 1Q | 370,000 | $ | 82,000 | ||||||||

TIER REIT, Inc. | Office | Various | Various | 2Q | 5,799,000 | (2 | ) | ||||||||

Terminus (3) | Office | Atlanta | 100.0% | 4Q | 1,226,000 | 246,000 | |||||||||

2017 | |||||||||||||||

111 West Rio (4) | Office | Phoenix | 100.0% | 1Q | 225,000 | 19,600 | |||||||||

2016 | |||||||||||||||

Parkway Properties | Office | Various | Various | 4Q | 8,819,000 | (5 | ) | ||||||||

Cousins Fund II, L.P. (6) | Office | Various | 100.0% | 4Q | (6 | ) | 279,100 | ||||||||

2014 | |||||||||||||||

Fifth Third Center | Office | Charlotte | 100.0% | 3Q | 698,000 | 215,000 | |||||||||

Northpark | Office | Atlanta | 100.0% | 4Q | 1,528,000 | 348,000 | |||||||||

18,665,000 | $ | 1,189,700 | |||||||||||||

Completed Property Developments

Project | Type | Market | Company's Ownership Interest | Timing | Square Feet | Total Project Cost ($ in thousands) (1) | |||||||||

2019 | |||||||||||||||

Dimensional Place | Office | Charlotte | 50.0% | 1Q | 281,000 | $ | 96,000 | ||||||||

2018 | |||||||||||||||

Spring & 8th | Office | Atlanta | 100.0% | 1Q/4Q | 765,000 | 332,500 | |||||||||

2017 | |||||||||||||||

8000 Avalon | Office | Atlanta | 90.0% | 2Q | 229,000 | 73,000 | |||||||||

Carolina Square | Mixed | Chapel Hill | 50.0% | 3Q | 468,000 | 123,000 | |||||||||

2015 | |||||||||||||||

Colorado Tower | Office | Austin | 100.0% | 1Q | 373,000 | 126,100 | |||||||||

Emory Point - Phase II | Mixed | Atlanta | 75.0% | 3Q | 302,000 | 75,400 | |||||||||

Research Park V | Office | Austin | 100.0% | 4Q | 173,000 | 45,000 | |||||||||

2,591,000 | $ | 871,000 | |||||||||||||

(1) Except as otherwise noted, amounts represent total purchase prices, total project cost paid by the company, and, where applicable, its joint venture partner, including certain allocated costs required by GAAP that are not incurred in a joint venture.

(2) Properties acquired in the merger with TIER REIT, Inc.

(3) Purchased outside interest of 50% in Terminus Office Holdings for $246 million before reductionsfor existing mortgage debt.

(4) Purchased outside interest of 25.4% in 111 West Rio.

(5) Properties acquired in the merger/spin with Parkway Properties, Inc.

(6) Purchased the outside interest (approximately 70%) in a consolidated partnership for $279.1 million.

Cousins Properties | 24 | Q4 2019 Supplemental Information |

INVESTMENT ACTIVITY | ||

Completed Property Dispositions

Property | Type | Market | Company's Ownership Interest | Timing | Square Feet | Gross Sales Price ($ in thousands) (1) | |||||||||

2017 | |||||||||||||||

Emory Point I and II | Mixed | Atlanta | 75.0% | 2Q | 786,000 | $ | 199,000 | ||||||||

American Cancer Society Center | Office | Atlanta | 100.0% | 2Q | 996,000 | 166,000 | |||||||||

Bank of America Center, One Orlando ---Centre, and Citrus Center | Office | Orlando | 100.0% | 4Q | 1,038,000 | 208,100 | |||||||||

Courvoisier Centre (2) | Office | Miami | 20.0% | 4Q | 343,000 | 33,900 | |||||||||

2016 | |||||||||||||||

100 North Point Center East | Office | Atlanta | 100.0% | 1Q | 129,000 | 22,000 | |||||||||

Post Oak Central and Greenway Plaza (3) | Office | Houston | 100.0% | 4Q | 5,628,000 | — | |||||||||

Two Liberty Place | Office | Philadelphia | 100.0% | 4Q | 941,000 | 219,000 | |||||||||

191 Peachtree | Office | Atlanta | 100.0% | 4Q | 1,225,000 | 267,500 | |||||||||

Lincoln Place | Office | Miami | 100.0% | 4Q | 140,000 | 80,000 | |||||||||

The Forum | Office | Atlanta | 100.0% | 4Q | 220,000 | 70,000 | |||||||||

2015 | |||||||||||||||

2100 Ross | Office | Dallas | 100.0% | 3Q | 844,000 | 131,000 | |||||||||

200, 333, and 555 North Point Center East | Office | Atlanta | 100.0% | 4Q | 411,000 | 70,300 | |||||||||

The Points at Waterview | Office | Dallas | 100.0% | 4Q | 203,000 | 26,800 | |||||||||

2014 | |||||||||||||||

Lakeshore and University Park Place | Office | Birmingham | 100.0% | 3Q | 320,000 | 44,700 | |||||||||

Mahan Village | Retail | Florida | 50.5% | 4Q | 147,000 | 29,500 | |||||||||

Cousins Watkins LLC | Retail | Other | 50.5% | 4Q | 339,000 | 50,000 | |||||||||

777 Main | Office | Fort Worth | 100.0% | 4Q | 980,000 | 167,000 | |||||||||

14,690,000 | $ | 1,784,800 | |||||||||||||

(1) Except as otherwise noted, amounts represent total gross sales prices received by the Company and, where applicable, its joint venture partner.

(2) The Company sold its partnership interest for $12.6 million in a transaction that valued its interest in the property at $33.9 million, prior to deduction for existing mortgage debt.

(3) These properties were spun off as part of the merger/spin with Parkway Properties, Inc.

Cousins Properties | 25 | Q4 2019 Supplemental Information |

DEVELOPMENT PIPELINE (1) | ||

Project | Type | Market | Company's Ownership Interest | Construction Start Date | Number of Square Feet /Apartment Units | Estimated Project Cost (1) (2) ($ in thousands) | Company's Share of Estimated Project Cost (2) ($ in thousands) | Project Cost Incurred to Date (2) ($ in thousands) | Company's Share of Project Cost Incurred to Date (2) ($ in thousands) | Percent Leased | Initial Occupancy (3)(5) | Estimated Stabilization (4)(5) | |||||||||||||||||||||||

120 West Trinity | Mixed | Atlanta | 20 | % | 1Q17 | $ | 85,000 | $ | 17,000 | $ | 77,449 | $ | 15,490 | ||||||||||||||||||||||

Office | 33,000 | 100 | % | 3Q20 | 3Q20 | ||||||||||||||||||||||||||||||

Retail | 19,000 | 12 | % | 3Q20 | 4Q20 | ||||||||||||||||||||||||||||||

Apartments | 330 | 12 | % | 4Q19 | 4Q20 | ||||||||||||||||||||||||||||||

10000 Avalon | Office | Atlanta | 90 | % | 3Q18 | 251,000 | 96,000 | 86,400 | 87,331 | 78,598 | 59 | % | 1Q20 | 1Q21 | |||||||||||||||||||||

300 Colorado | Office | Austin | 50 | % | 4Q18 | 358,000 | 193,000 | 96,500 | 106,022 | 53,011 | 87 | % | 1Q21 | 1Q22 | |||||||||||||||||||||

Domain 10 | Office | Austin | 100 | % | 4Q18 | 300,000 | 111,000 | 111,000 | 73,152 | 73,152 | 98 | % | 4Q20 | 3Q21 | |||||||||||||||||||||

Domain 12 | Office | Austin | 100 | % | 2Q18 | 320,000 | 117,000 | 117,000 | 87,189 | 87,189 | 100 | % | 2Q20 | 3Q20 | |||||||||||||||||||||

100 Mill | Office | Phoenix | 90 | % | 1Q20 | 287,000 | 153,000 | 137,700 | 28,441 | 25,597 | 44 | % | 1Q22 | 1Q23 | |||||||||||||||||||||

Total | $ | 755,000 | $ | 565,600 | $ | 459,584 | $ | 333,037 | |||||||||||||||||||||||||||

(1) | This schedule shows projects currently under active development through the substantial completion of construction. Amounts included in the estimated project cost column are the estimated costs of the project through stabilization. Significant estimation is required to derive these costs, and the final costs may differ from these estimates. |

(2) | Estimated and incurred project costs include financing costs only on project-specific debt, and exclude certain allocated capitalized costs required by GAAP that are not incurred in a joint venture and fair value adjustments for legacy TIER projects that were recorded as a result of the Merger. |

(3) | Initial occupancy represents the quarter within which the Company estimates the first tenant will take occupancy. |

(4) | Estimated stabilization is the quarter within which the Company estimates it will achieve 90% economic occupancy. Interest, taxes, and operating expenses are capitalized on the unoccupied portion of the building for the period beginning with initial occupancy until the earlier of the achievement of 90% economic occupancy or one year. |

(5) | Initial occupancy and estimated stabilization are based, in part, on when the space is ready for its intended use, which is dependent upon the commencement and completion of tenant improvements. Since tenants in these properties generally control the timing of tenant improvements, timing of these estimates is subject to change. |

Cousins Properties | 26 | Q4 2019 Supplemental Information |

LAND INVENTORY | ||

Market | Type | Company's Ownership Interest | Total Developable Land (Acres) | Cost Basis of Land ($ in thousands) | |||||||||

3354 Peachtree | Atlanta | Commercial | 95% | 3.0 | |||||||||

901 West Peachtree (1) (2) | Atlanta | Commercial | 100% | 1.0 | |||||||||

The Avenue Forsyth-Adjacent Land | Atlanta | Commercial | 100% | 10.4 | |||||||||

Wildwood Office Park - Joint Venture (3) | Atlanta | Commercial | 50% | 6.3 | |||||||||

Domain 9 | Austin | Commercial | 100% | 2.5 | |||||||||

Domain 14 & 15 | Austin | Commercial | 100% | 5.6 | |||||||||

Legacy Union 2 & 3 | Dallas | Commercial | 95% | 4.0 | |||||||||

Victory Center | Dallas | Commercial | 75% | 3.0 | |||||||||

Burnett Plaza-Adjacent Land | Fort Worth | Commercial | 100% | 1.4 | |||||||||

Corporate Center 5 & 6 (4) | Tampa | Commercial | 100% | 14.1 | |||||||||

Padre Island | Corpus Christi | Residential | 50% | 15.0 | |||||||||

Total | 66.3 | $ | 130,176 | ||||||||||

Company's Share | 54.5 | $ | 110,150 | ||||||||||

(1) | Includes two ground leases with future obligations to purchase. |

(2) | During the fourth quarter of 2019, the Company purchased two adjacent land parcels bringing the assemblage to approximately 1 acre. |

(3) | During January 2020, the Company sold its remaining interest in the Wildwood Associates joint venture to its venture partner and recognized a gain of $1.4 million. |

(4) | Corporate Center 5 is controlled through a long-term ground lease. |

Note: | Subsequent to quarter end, commenced development of 100 Mill. See Development Pipeline on page 26. |

Cousins Properties | 27 | Q4 2019 Supplemental Information |

DEBT SCHEDULE | ||

Company's Share of Debt Maturities and Principal Payments | |||||||||||||||||||||||||||||||||||||||||||||

($ in thousands) | |||||||||||||||||||||||||||||||||||||||||||||

Description (Interest Rate Base, if not fixed) | Company's Ownership Interest | Rate at End of Quarter | Maturity Date | 2020 | 2021 | 2022 | 2023 | 2024 | Thereafter | Total Principal | Deferred Loan Costs | Above / Below Market Value | Total | ||||||||||||||||||||||||||||||||

Consolidated Debt - Floating Rate | |||||||||||||||||||||||||||||||||||||||||||||

Credit Facility, Unsecured (LIBOR + 1.05%-1.45%) (1) | 100% | 2.81% | 1/3/23 | $ | — | $ | — | $ | — | $ | 251,500 | $ | — | $ | — | $ | 251,500 | $ | — | $ | — | $ | 251,500 | ||||||||||||||||||||||

Term Loan, Unsecured (LIBOR + 1.20%-1.70%) (2) | 100% | 2.96% | 12/2/21 | — | 250,000 | — | — | — | — | 250,000 | (774 | ) | — | 249,226 | |||||||||||||||||||||||||||||||

Total Floating Rate Debt | — | 250,000 | — | 251,500 | — | — | 501,500 | (774 | ) | — | 500,726 | ||||||||||||||||||||||||||||||||||

Consolidated Debt - Fixed Rate | |||||||||||||||||||||||||||||||||||||||||||||

2019 Senior Notes, Unsecured | 100% | 3.95% | 7/6/29 | — | — | — | — | — | 275,000 | 275,000 | (1,068 | ) | — | 273,932 | |||||||||||||||||||||||||||||||

2017 Senior Notes, Unsecured | 100% | 3.91% | 7/6/25 | — | — | — | — | — | 250,000 | 250,000 | (1,007 | ) | — | 248,993 | |||||||||||||||||||||||||||||||

2019 Senior Notes, Unsecured | 100% | 3.86% | 7/6/28 | — | — | — | — | — | 250,000 | 250,000 | (965 | ) | — | 249,035 | |||||||||||||||||||||||||||||||

Fifth Third Center | 100% | 3.37% | 10/1/26 | 3,274 | 3,386 | 3,502 | 3,622 | 3,746 | 122,802 | 140,332 | (448 | ) | — | 139,884 | |||||||||||||||||||||||||||||||

2019 Senior Notes, Unsecured | 100% | 3.78% | 7/6/27 | — | — | — | — | — | 125,000 | 125,000 | (479 | ) | — | 124,521 | |||||||||||||||||||||||||||||||

Terminus 100 | 100% | 5.25% | 1/1/23 | 3,149 | 3,319 | 3,497 | 108,181 | — | — | 118,146 | — | 7,158 | 125,304 | ||||||||||||||||||||||||||||||||

Colorado Tower | 100% | 3.45% | 9/1/26 | 2,425 | 2,510 | 2,598 | 2,689 | 2,783 | 104,080 | 117,085 | (642 | ) | — | 116,443 | |||||||||||||||||||||||||||||||

2017 Senior Notes, Unsecured | 100% | 4.09% | 7/6/27 | — | — | — | — | — | 100,000 | 100,000 | (401 | ) | — | 99,599 | |||||||||||||||||||||||||||||||

Promenade | 100% | 4.27% | 10/1/22 | 3,393 | 3,541 | 89,052 | — | — | — | 95,986 | (162 | ) | — | 95,824 | |||||||||||||||||||||||||||||||

816 Congress | 100% | 3.75% | 11/1/24 | 1,754 | 1,821 | 1,891 | 1,963 | 72,558 | — | 79,987 | (397 | ) | — | 79,590 | |||||||||||||||||||||||||||||||

Terminus 200 | 100% | 3.79% | 1/1/23 | 1,726 | 1,792 | 1,861 | 70,700 | — | — | 76,079 | — | 1,926 | 78,005 | ||||||||||||||||||||||||||||||||

Legacy Union One | 100% | 4.24% | 1/1/23 | — | — | — | 66,000 | — | — | 66,000 | — | 2,155 | 68,155 | ||||||||||||||||||||||||||||||||

Meridian Mark Plaza (6) | 100% | 6.00% | 8/1/20 | 22,978 | — | — | — | — | — | 22,978 | (14 | ) | — | 22,964 | |||||||||||||||||||||||||||||||

Total Fixed Rate Debt | 38,699 | 16,369 | 102,401 | 253,155 | 79,087 | 1,226,882 | 1,716,593 | (5,583 | ) | 11,239 | 1,722,249 | ||||||||||||||||||||||||||||||||||

Total Consolidated Debt | 38,699 | 266,369 | 102,401 | 504,655 | 79,087 | 1,226,882 | 2,218,093 | (6,357 | ) | 11,239 | 2,222,975 | ||||||||||||||||||||||||||||||||||

Unconsolidated Debt - Floating Rate | |||||||||||||||||||||||||||||||||||||||||||||