UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________

FORM 10-Q

| (Mark One) | |||||

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2021

| OR | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from ______ to ______ . | |||||

Commission File Number: 1-14829

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization)

(Address of principal executive offices)

(I.R.S. Employer Identification No.)

(Zip Code)

(Registrant's telephone number, including area code)

_______________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbols | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of April 22, 2021:

Class A Common Stock — 2,561,670 shares

Class B Common Stock — 200,532,624 shares

Exchangeable shares:

As of April 22, 2021, the following number of exchangeable shares were outstanding for Molson Coors Canada, Inc.:

Class A Exchangeable shares — 2,718,267 shares

Class B Exchangeable shares — 11,104,565 shares

The Class A exchangeable shares and Class B exchangeable shares are shares of the share capital in Molson Coors Canada Inc., a wholly-owned subsidiary of the registrant. They are publicly traded on the Toronto Stock Exchange under the symbols TPX.A and TPX.B,

respectively. These shares are intended to provide substantially the same economic and voting rights as the corresponding class of Molson Coors common stock in which they may be exchanged. In addition to the registered Class A common stock and the Class B common stock, the registrant has also issued and outstanding one share each of a Special Class A voting stock and Special Class B voting stock. The Special Class A voting stock and the Special Class B voting stock provide the mechanism for holders of Class A exchangeable shares and Class B exchangeable shares to be provided instructions to vote with the holders of the Class A common stock and the Class B common stock, respectively. The holders of the Special Class A voting stock and Special Class B voting stock are entitled to one vote for each outstanding Class A exchangeable share and Class B exchangeable share, respectively, excluding shares held by the registrant or its subsidiaries, and generally vote together with the Class A common stock and Class B common stock, respectively, on all matters on which the Class A common stock and Class B common stock are entitled to vote. The Special Class A voting stock and Special Class B voting stock are subject to a voting trust arrangement. The trustee which holds the Special Class A voting stock and the Special Class B voting stock is required to cast a number of votes equal to the number of then-outstanding Class A exchangeable shares and Class B exchangeable shares, respectively, but will only cast a number of votes equal to the number of Class A exchangeable shares and Class B exchangeable shares as to which it has received voting instructions from the owners of record of those Class A exchangeable shares and Class B exchangeable shares, other than the registrant or its subsidiaries, respectively, on the record date, and will cast the votes in accordance with such instructions so received.

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

INDEX

| Page | ||||||||||||||

2

Glossary of Terms and Abbreviations

AOCI | Accumulated other comprehensive income (loss) | ||||

CAD | Canadian Dollar | ||||

| CZK | Czech Koruna | ||||

| DBRS | A global credit rating agency in Toronto | ||||

| EBITDA | Earnings before interest, tax, depreciation and amortization | ||||

EPS | Earnings per share | ||||

| EUR | Euro | ||||

FASB | Financial Accounting Standards Board | ||||

GBP | British Pound | ||||

| HRK | Croatian Kuna | ||||

JPY | Japanese Yen | ||||

Moody’s | Moody’s Investors Service Limited, a nationally recognized statistical rating organization designated by the SEC | ||||

| OCI | Other comprehensive income (loss) | ||||

| OPEB | Other postretirement benefit plans | ||||

PSUs | Performance share units | ||||

RSD | Serbian Dinar | ||||

| RSUs | Restricted stock units | ||||

| SEC | U.S. Securities and Exchange Commission | ||||

| Standard & Poor’s | Standard and Poor’s Ratings Services, a nationally recognized statistical rating organization designated by the SEC | ||||

STRs | Sales-to-retailers | ||||

STWs | Sales-to-wholesalers | ||||

| 2017 Tax Act | U.S. Tax Cuts and Jobs Act | ||||

| U.K. | United Kingdom | ||||

U.S. | United States | ||||

| U.S. GAAP | Accounting principles generally accepted in the U.S. | ||||

| USD or $ | U.S. Dollar | ||||

| VIEs | Variable interest entities | ||||

3

Cautionary Statement Pursuant to Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). From time to time, we may also provide oral or written forward-looking statements in other materials we release to the public. Such forward-looking statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995.

Statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements, and include, but are not limited to, statements in Part I - Item 2 Management's Discussion and Analysis of Financial Condition and Results of Operations in this report, and under the headings "Executive Summary" and "Outlook" therein, with respect to expectations regarding the impact of the coronavirus pandemic on our operations, liquidity, financial condition and financial results, impact of the cybersecurity incident, including on revenues and related expenses, expectations regarding future dividends, overall volume trends, consumer preferences, pricing trends, industry forces, cost reduction strategies, including our revitalization plan announced in 2019 and the estimated range of related charges and timing of cash charges, anticipated results, expectations for funding future capital expenditures and operations, debt service capabilities, timing and amounts of debt and leverage levels, shipment levels and profitability, market share, and the sufficiency of capital resources. In addition, statements that we make in this report that are not statements of historical fact may also be forward-looking statements. Words such as "expects," "intend," "goals," "plans," "believes," "continues," "may," "anticipate," "seek," "estimate," "outlook," "trends," "future benefits," "potential," "projects," "strategies," and variations of such words and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are subject to risks and uncertainties that could cause actual results to be materially different from those indicated (both favorably and unfavorably). These risks and uncertainties include, but are not limited to, those described in Part II - Item IA. Risk Factors in this report, and those described from time to time in our past and future reports filed with the SEC, including in our Annual Report on Form 10-K for the year ended December 31, 2020. Caution should be taken not to place undue reliance on any such forward-looking statements. Forward-looking statements speak only as of the date when made and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Market and Industry Data

The market and industry data used in this Quarterly Report on Form 10-Q are based on independent industry publications, customers, trade or business organizations, reports by market research firms and other published statistical information from third parties (collectively, the “Third Party Information”), as well as information based on management’s good faith estimates, which we derive from our review of internal information and independent sources. Such Third Party Information generally states that the information contained therein or provided by such sources has been obtained from sources believed to be reliable.

4

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN MILLIONS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| Sales | $ | $ | |||||||||

| Excise taxes | ( | ( | |||||||||

| Net sales | |||||||||||

| Cost of goods sold | ( | ( | |||||||||

| Gross profit | |||||||||||

| Marketing, general and administrative expenses | ( | ( | |||||||||

| Special items, net | ( | ( | |||||||||

| Operating income (loss) | ( | ||||||||||

| Interest income (expense), net | ( | ( | |||||||||

| Other pension and postretirement benefits (costs), net | |||||||||||

| Other income (expense), net | ( | ||||||||||

| Income (loss) before income taxes | ( | ||||||||||

| Income tax benefit (expense) | ( | ||||||||||

| Net income (loss) | ( | ||||||||||

| Net (income) loss attributable to noncontrolling interests | ( | ||||||||||

| Net income (loss) attributable to Molson Coors Beverage Company | $ | $ | ( | ||||||||

| Net income (loss) attributable to Molson Coors Beverage Company per share | |||||||||||

| Basic | $ | $ | ( | ||||||||

| Diluted | $ | $ | ( | ||||||||

| Weighted-average shares outstanding | |||||||||||

| Basic | |||||||||||

| Dilutive effect of share-based awards | |||||||||||

| Diluted | |||||||||||

| Anti-dilutive securities excluded from the computation of diluted EPS | |||||||||||

See notes to unaudited condensed consolidated financial statements.

5

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(IN MILLIONS)

(UNAUDITED)

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| Net income (loss) including noncontrolling interests | $ | $ | ( | ||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||

| Foreign currency translation adjustments | ( | ||||||||||

| Reclassification of cumulative translation adjustment to income (loss) | |||||||||||

| Unrealized gain (loss) on derivative instruments | ( | ||||||||||

| Reclassification of derivative (gain) loss to income (loss) | |||||||||||

| Amortization of net prior service (benefit) cost and net actuarial (gain) loss to income (loss) | ( | ||||||||||

| Ownership share of unconsolidated subsidiaries' other comprehensive income (loss) | |||||||||||

| Total other comprehensive income (loss), net of tax | ( | ||||||||||

| Comprehensive income (loss) | ( | ||||||||||

| Comprehensive (income) loss attributable to noncontrolling interests | |||||||||||

| Comprehensive income (loss) attributable to Molson Coors Beverage Company | $ | $ | ( | ||||||||

See notes to unaudited condensed consolidated financial statements.

6

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN MILLIONS, EXCEPT PAR VALUE)

(UNAUDITED)

| As of | |||||||||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Accounts receivable, net | |||||||||||

| Other receivables, net | |||||||||||

| Inventories, net | |||||||||||

| Other current assets, net | |||||||||||

| Total current assets | |||||||||||

| Properties, net | |||||||||||

| Goodwill | |||||||||||

| Other intangibles, net | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable and other current liabilities | $ | $ | |||||||||

| Current portion of long-term debt and short-term borrowings | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt | |||||||||||

| Pension and postretirement benefits | |||||||||||

| Deferred tax liabilities | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

| Molson Coors Beverage Company stockholders' equity | |||||||||||

| Capital stock | |||||||||||

Preferred stock, $ | |||||||||||

Class A common stock, $ | |||||||||||

Class B common stock, $ | |||||||||||

Class A exchangeable shares, | |||||||||||

Class B exchangeable shares, | |||||||||||

| Paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

Class B common stock held in treasury at cost ( | ( | ( | |||||||||

| Total Molson Coors Beverage Company stockholders' equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

See notes to unaudited condensed consolidated financial statements.

7

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN MILLIONS)

(UNAUDITED)

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) including noncontrolling interests | $ | $ | ( | ||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Amortization of debt issuance costs and discounts | |||||||||||

| Share-based compensation | |||||||||||

| (Gain) loss on sale or impairment of properties and other assets, net | ( | ||||||||||

| Unrealized (gain) loss on foreign currency fluctuations and derivative instruments, net | ( | ||||||||||

| Income tax (benefit) expense | ( | ||||||||||

| Income tax (paid) received | ( | ( | |||||||||

| Interest expense, excluding interest amortization | |||||||||||

| Interest paid | ( | ( | |||||||||

| Change in current assets and liabilities and other | ( | ( | |||||||||

| Net cash provided by (used in) operating activities | ( | ( | |||||||||

| Cash flows from investing activities: | |||||||||||

| Additions to properties | ( | ( | |||||||||

| Proceeds from sales of properties and other assets | |||||||||||

| Other | |||||||||||

| Net cash provided by (used in) investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Exercise of stock options under equity compensation plans | |||||||||||

| Dividends paid | ( | ||||||||||

| Payments on debt and borrowings | ( | ( | |||||||||

| Proceeds on debt and borrowings | |||||||||||

| Net proceeds from (payments on) revolving credit facilities and commercial paper | |||||||||||

| Change in overdraft balances and other | ( | ||||||||||

| Net cash provided by (used in) financing activities | |||||||||||

| Cash and cash equivalents: | |||||||||||

| Net increase (decrease) in cash and cash equivalents | ( | ||||||||||

| Effect of foreign exchange rate changes on cash and cash equivalents | ( | ( | |||||||||

| Balance at beginning of year | |||||||||||

| Balance at end of period | $ | $ | |||||||||

See notes to unaudited condensed consolidated financial statements.

8

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

AND NONCONTROLLING INTERESTS

(IN MILLIONS)

(UNAUDITED)

| Molson Coors Beverage Company Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | Common stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | Exchangeable | other | held in | Non | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| issued | shares issued | Paid-in- | Retained | comprehensive | treasury | controlling | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | Class A | Class B | Class A | Class B | capital | earnings | income (loss) | Class B | interests | ||||||||||||||||||||||||||||||||||||||||||||||||||

| As of December 31, 2019 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of share-based compensation | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase of noncontrolling interest | ( | — | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) including noncontrolling interests | ( | — | — | — | — | — | ( | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of tax | ( | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions from noncontrolling interests | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions and dividends to noncontrolling interests | ( | — | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

Dividends declared - $ | ( | — | — | — | — | — | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| As of March 31, 2020 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Molson Coors Beverage Company Stockholders' Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | Common stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock | Exchangeable | other | held in | Non | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| issued | shares issued | Paid-in- | Retained | comprehensive | treasury | controlling | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | Class A | Class B | Class A | Class B | capital | earnings | income (loss) | Class B | interests | ||||||||||||||||||||||||||||||||||||||||||||||||||

| As of December 31, 2020 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of share-based compensation | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase of noncontrolling interest | ( | — | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) including noncontrolling interests | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of tax | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions and dividends to noncontrolling interests | ( | — | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| As of March 31, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||||||||||||||||

See notes to unaudited condensed consolidated financial statements.

9

MOLSON COORS BEVERAGE COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies

Unless otherwise indicated, information in this report is presented in USD and comparisons are to comparable prior periods. Our primary operating currencies, other than the USD, include the CAD, the GBP, and our Central European operating currencies such as the EUR, CZK, HRK and RSD.

The accompanying unaudited condensed consolidated interim financial statements reflect all adjustments which are necessary for a fair statement of the financial position, results of operations and cash flows for the periods presented in accordance with U.S. GAAP. Such unaudited interim condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q pursuant to the rules and regulations of the SEC. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations.

These unaudited condensed consolidated interim financial statements should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2020 ("Annual Report"), and have been prepared on a consistent basis with the accounting policies described in Note 1 of the Notes to the Audited Consolidated Financial Statements included in our Annual Report, except as noted in Note 2, "New Accounting Pronouncements".

The results of operations for the three months ended March 31, 2021 are not necessarily indicative of the results that may be achieved for the full year.

Due to the anti-dilutive effect resulting from the reported net loss attributable to MCBC for the three months ended March 31, 2020, the impact of potentially dilutive securities has been excluded from the quarterly calculation of weighted-average shares for diluted EPS for the first quarter of 2020.

Cybersecurity Incident

During March 2021, we experienced a systems outage that was caused by a cybersecurity incident. We engaged leading forensic information technology firms and legal counsel to assist our investigation into the incident and we restored our systems after working to get the systems back up as quickly as possible. Despite these actions, we experienced some delays and disruptions to our business, including brewery operations, production and shipments. This incident caused us to not produce or ship as much as we would have in the first quarter of 2021. In addition, we incurred certain incremental one-time costs of $2.0 million in the first quarter of 2021 related to consultants, experts and data recovery efforts, net of insurance recoveries. We expect to incur additional incremental one-time costs related to the incident in the second quarter of 2021.

Coronavirus Global Pandemic

The coronavirus pandemic had a material adverse effect on our operations, liquidity, financial condition and results of operations in 2020, starting at the end of the first quarter of 2020, and we expect it will continue to have a material impact on our financial results in 2021 and possibly beyond. The extent to which our operations will continue to be impacted by the pandemic will depend largely on future developments, which are highly uncertain and cannot be accurately predicted, including new information which may emerge concerning the severity and duration of the outbreak, roll out and efficacy of the vaccines, and actions by government authorities to contain the pandemic or treat its impact, among other things. We continue to actively monitor the ongoing evolution of the pandemic and resulting impacts to our business and have taken various mitigating actions in response to the impacts of the pandemic and to position our business for the long term.

During the first quarter of 2020, we commenced a keg relief program in order to support and demonstrate our commitment to the continued viability of the many bars and restaurants which were negatively impacted by the shutdowns at the onset of the coronavirus pandemic. We provided customers with reimbursements for untapped kegs that met certain established return requirements and as a result, during the three month period ended March 31, 2020, we recognized a reduction to net sales of $31.5 million reflecting estimated sales returns and reimbursements through these programs. Further, during the three months ended March 31, 2020, we recognized charges of $18.5 million within cost of goods sold related to obsolete finished goods keg inventories that were not expected to be sold within our freshness specifications, as well as the costs to

10

facilitate the above mentioned keg returns. The actual duration of the coronavirus pandemic, including the length of government-mandated closures or ceased sit-down service limitations at bars and restaurants coupled with the subsequent recovery period relative to the assumptions utilized to derive the allowance for obsolete inventories, could result in future charges due to incremental finished goods keg inventory becoming obsolete in future periods.

As the coronavirus pandemic continues to evolve, we continue to monitor the impacts on our customers’ liquidity and capital resources and therefore our ability to collect, or the timeliness of collection of our accounts receivable. While these receivables are not concentrated in any specific customer and our allowance on these receivables factors in expected credit loss, continued disruption and declines in the global economy could result in difficulties in our ability to collect and require increases to our allowance for doubtful accounts. As of March 31, 2021 and December 31, 2020, our allowance for trade receivables was approximately $20 million and $18 million, respectively, and allowance activity was immaterial during the three months ended March 31, 2021.

In response to the onset of the coronavirus pandemic in 2020, various governmental authorities globally announced relief programs which among other items, provided temporary deferrals of non-income based tax payments, which positively impacted our operating cash flows in 2020. These temporary deferrals of approximately $130

Finally, we continue to protect and support our liquidity position in response to the global economic uncertainty created by the coronavirus pandemic. Beginning with the second quarter of 2020, our board of directors suspended our regular quarterly dividends on our Class A and Class B common and exchangeable shares.

For considerations of the effects of the coronavirus pandemic and related potential impairment risks to our goodwill and indefinite-lived intangible assets, see Note 7, "Goodwill and Intangible Assets."

Revitalization Plan

On October 28, 2019, we initiated a revitalization plan designed to allow us to invest across our portfolio to drive long-term, sustainable success. The revitalization plan established Chicago, Illinois as our North American operational headquarters. We closed our office in Denver, Colorado and consolidated certain administrative functions into our other existing office locations. As of January 1, 2020, we changed our name to Molson Coors Beverage Company and changed our management structure to two segments - North America and Europe. We began to incur charges related to these restructuring activities during the fourth quarter of 2019 and will continue to incur charges through fiscal year 2021.

Non-Cash Activity

Non-cash activity includes non-cash issuances of share-based awards, as well as non-cash investing activities related to movements in our guarantee of indebtedness of certain equity method investments. See Note 4, "Investments" for further discussion. We also had non-cash activities related to capital expenditures incurred but not yet paid of $116.2 million and $153.5 million during the three months ended March 31, 2021 and March 31, 2020, respectively.

Other than the activity mentioned above and the supplemental non-cash activity related to the recognition of leases further discussed in Note 13, "Leases," there was no other significant non-cash activity during the three months ended March 31, 2021 and March 31, 2020.

Share-Based Compensation

2. New Accounting Pronouncements

New Accounting Pronouncements Recently Adopted

In December 2019, the FASB issued authoritative guidance intended to simplify the accounting for income taxes. This guidance eliminated certain exceptions to the general approach to the income tax accounting model and added new guidance to reduce the complexity in accounting for income taxes. We adopted this guidance in the first quarter of 2021, which did not have a material impact on our financial statements.

11

New Accounting Pronouncements Not Yet Adopted

In March 2020, the FASB issued authoritative guidance which provides optional expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. The amendments apply only to contracts, hedging relationships and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform and are effective for all entities upon issuance, March 12, 2020 through December 31, 2022, which is a full year after the current expected discontinuation date of LIBOR. We are currently evaluating the potential impact of this guidance on our financial statements.

Other than the items noted above, there have been no new accounting pronouncements not yet effective or adopted in the current year that we believe have a significant impact, or potential significant impact, to our unaudited condensed consolidated interim financial statements.

3. Segment Reporting

Our reporting segments are based on the key geographic regions in which we operate, and include the North America and Europe segments. Our North America segment operates in the U.S., Canada and various countries in Latin and South America and our Europe segment operates in Bulgaria, Croatia, Czech Republic, Hungary, Montenegro, the Republic of Ireland, Romania, Serbia, the U.K., various other European countries, and certain countries within the Middle East, Africa and Asia Pacific.

We also have certain activity that is not allocated to our segments, which has been reflected as “Unallocated” below. Specifically, "Unallocated" activity primarily includes financing-related costs such as interest expense and income, foreign exchange gains and losses on intercompany balances related to financing and other treasury-related activities, and the unrealized changes in fair value on our commodity swaps not designated in hedging relationships recorded within cost of goods sold, which are later reclassified when realized to the segment in which the underlying exposure resides. Additionally, only the service cost component of net periodic pension and OPEB cost is reported within each operating segment, and all other components remain unallocated.

Summarized Financial Information

No single customer accounted for more than 10% of our consolidated sales for the three months ended March 31, 2021 and March 31, 2020. Consolidated net sales represent sales to third-party external customers less excise taxes. Inter-segment transactions impacting net sales revenues and income (loss) before income taxes eliminate upon consolidation and are primarily related to North America segment sales to the Europe segment.

The following tables present net sales and income (loss) before income taxes by segment:

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| North America | $ | $ | |||||||||

| Europe | |||||||||||

| Inter-segment net sales eliminations | ( | ( | |||||||||

| Consolidated net sales | $ | $ | |||||||||

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| (In millions) | |||||||||||

North America(1) | $ | $ | |||||||||

Europe(2) | ( | ( | |||||||||

Unallocated(3) | ( | ||||||||||

| Consolidated income (loss) before income taxes | $ | $ | ( | ||||||||

(1) The increase in income before income taxes for the North America segment for the three months ended March 31, 2021 when compared to the three months ended March 31, 2020 was primarily due to lower specials charges and lower marketing, general and administrative ("MG&A") expenses, partially offset by lower net sales. Lower net sales was primarily due to continued on-premise restrictions from the coronavirus pandemic, as well as the March 2021 cybersecurity incident and the February 2021 Fort Worth, TX brewery shutdown due to a winter storm, partially offset by the cycling of brewery downtime associated with the Milwaukee brewery tragedy in the prior year.

12

(2) The increase in the loss before income taxes for the Europe segment for the three months ended March 31, 2021 when compared to the three months ended March 31, 2020, was primarily due to lower net sales. Lower net sales was primarily due to the impacts of the coronavirus pandemic, specifically related to the closures across Europe, especially in the U.K. where the on-premise channel remained closed for the entire first quarter of 2021.

(3) Unallocated income (loss) before taxes included the unrealized mark-to-market valuation of our commodity hedge positions. We recorded unrealized gains of $121.5 million during the three months ended March 31, 2021 and unrealized losses of $99.1 million during the three months ended March 31, 2020.

Income (loss) before income taxes includes the impact of special items. Refer to Note 5, "Special Items" for further discussion.

The following table presents total assets by segment:

| As of | |||||||||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| North America | $ | $ | |||||||||

| Europe | |||||||||||

| Consolidated total assets | $ | $ | |||||||||

4. Investments

Our investments include both equity method and consolidated investments. Those entities identified as VIEs have been evaluated to determine whether we are the primary beneficiary. The VIEs included under "Consolidated VIEs" below are those for which we have concluded that we are the primary beneficiary and accordingly, we have consolidated these entities. None of our consolidated VIEs held debt as of March 31, 2021 or December 31, 2020. We have not provided any financial support to any of our VIEs during the year that we were not previously contractually obligated to provide. Amounts due to and due from our equity method investments are recorded as affiliate accounts payable and affiliate accounts receivable.

Authoritative guidance related to the consolidation of VIEs requires that we continually reassess whether we are the primary beneficiary of VIEs in which we have an interest. As such, the conclusion regarding the primary beneficiary status is subject to change and we continually evaluate circumstances that could require consolidation or deconsolidation. Our consolidated VIEs are Cobra Beer Partnership, Ltd. ("Cobra U.K."), Rocky Mountain Metal Container ("RMMC"), Rocky Mountain Bottle Company ("RMBC") and Truss LP ("Truss"), as well as other immaterial entities. Our unconsolidated VIEs are Brewers Retail Inc. ("BRI") and Brewers' Distributor Ltd. ("BDL"), as well as other immaterial investments.

Both BRI and BDL have outstanding third party debt which is guaranteed by their respective shareholders. As a result, we have a guarantee liability of $45.4 million and $38.2 million recorded as of March 31, 2021 and December 31, 2020, respectively, which is presented within accounts payable and other current liabilities on the unaudited condensed consolidated balance sheets and represents our proportionate share of the outstanding balance of these debt instruments. The carrying value of the guarantee liability equals fair value, which considers an adjustment for our own non-performance risk and is considered a Level 2 measurement. The offset to the guarantee liability was recorded as an adjustment to our respective equity method investment within the unaudited condensed consolidated balance sheets. The resulting change in our equity method investments during the year due to movements in the guarantee represents a non-cash investing activity.

Consolidated VIEs

The following summarizes the assets and liabilities of our consolidated VIEs (including noncontrolling interests):

| As of | |||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | ||||||||||||||||||||||

| Total Assets | Total Liabilities | Total Assets | Total Liabilities | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| RMMC/RMBC | $ | $ | $ | $ | |||||||||||||||||||

| Other | $ | $ | $ | $ | |||||||||||||||||||

13

5. Special Items

We incurred charges or realized benefits that either we do not believe to be indicative of our core operations, or we believe are significant to our current operating results warranting separate classification. As such, we separately classified these charges (benefits) as special items.

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Employee-related charges | |||||||||||

| Restructuring | $ | $ | |||||||||

| Impairments or asset abandonment charges | |||||||||||

North America - Asset abandonment(1) | |||||||||||

Europe - Asset abandonment | |||||||||||

| Termination fees and other (gains) losses | |||||||||||

| North America | |||||||||||

Europe(2) | |||||||||||

| Total Special items, net | $ | $ | |||||||||

(1) In January 2020, we announced plans to cease production at our Irwindale, California brewery and entered into an option agreement with Pabst Brewing Company, LLC ("Pabst"), granting Pabst an option to purchase our Irwindale, California brewery, including plant equipment and machinery and the underlying land for $150 million, subject to adjustment as further specified in the option agreement. Pursuant to the option agreement, on May 4, 2020, Pabst exercised its option to purchase the Irwindale brewery and the purchase was completed in the fourth quarter of 2020. Production at the Irwindale brewery ceased during the third quarter of 2020. Charges incurred in the three months ended March 31, 2021 were immaterial. Charges associated with the brewery closure for the three months ended March 31, 2020 totaled $58 million and primarily consisted of accelerated depreciation in excess of normal depreciation, as well as other closure costs including employee related costs.

In addition, during the three months ended March 31, 2021 and March 31, 2020 we incurred asset abandonment charges, primarily related to the accelerated depreciation in excess of normal depreciation as a result of the Montreal brewery closure, which is expected to occur in 2021.

(2) During the three months ended March 31, 2021, we recognized termination fees and other losses of $1.9 million related to the sale of a disposal group within our India business which represented an insignificant part of our Europe segment. The loss includes the reclassification of the associated cumulative foreign currency translation adjustment losses from AOCI into specials at the time of sale. See Note 10, "Accumulated Other Comprehensive Income (Loss)" for further details.

Restructuring Activities

On October 28, 2019, as part of our revitalization plan, we established Chicago, Illinois as our North American operational headquarters, closed our office in Denver, Colorado and consolidated certain administrative functions into our other existing office locations. In connection with these consolidation activities, certain impacted employees were extended an opportunity to continue their employment with MCBC in the new organization and locations and, for those not continuing with MCBC, certain of such employees were asked to provide transition assistance and offered severance and retention packages in connection with their termination of service. We expect the costs associated with the restructuring to be substantially recognized by the end of fiscal year 2021. After taking into account all changes in each of the business units, including Europe, the revitalization plan reduced employment levels, in aggregate, by approximately 600 employees globally.

In connection with the revitalization plan, we incurred and expect we may continue to incur cash and non-cash restructuring charges related to severance, retention and transition costs, employee relocation, non-cash asset related costs, lease impairment and exit costs in connection with our office lease in Denver, Colorado, and other transition activities related to the consolidation activities and related organizational and personnel changes of the revitalization plan through 2021 which is expected to aggregate in the range of approximately $100 million to $120 million. During the three months ended March 31, 2021 and March 31, 2020, we recognized severance and retention charges of $1.5 million and $22.7 million, respectively, and our remaining accrued restructuring balance related to the revitalization plan as of March 31, 2021 was approximately $13 million. Actual severance and retention costs related to this restructuring, which are primarily being recognized ratably over the

14

employees' required future service period, may differ from original estimates based on actual employee turnover levels prior to achieving severance and retention eligibility requirements.

Other than those noted above, there were no material changes to our restructuring activities since December 31, 2020, as reported in Part II - Item 8. Financial Statements and Supplementary Data, Note 7, "Special Items" in our Annual Report. We continually evaluate our cost structure and seek opportunities for further efficiencies and cost savings as part of ongoing and new initiatives. As such, we may incur additional restructuring related charges or adjustments to previously recorded charges in the future, however, we are unable to estimate the amount of charges at this time.

The accrued restructuring balances as of March 31, 2021 represent expected future cash payments required to satisfy our remaining obligations to terminated employees, the majority of which we expect to be paid in the next 12 months.

| North America | Europe | Total | |||||||||||||||

| (In millions) | |||||||||||||||||

| As of December 31, 2020 | $ | $ | $ | ||||||||||||||

| Charges incurred | |||||||||||||||||

| Payments made | ( | ( | ( | ||||||||||||||

| Changes in estimates | ( | ||||||||||||||||

| Foreign currency and other adjustments | |||||||||||||||||

| As of March 31, 2021 | $ | $ | $ | ||||||||||||||

| North America | Europe | Total | |||||||||||||||

| (In millions) | |||||||||||||||||

| As of December 31, 2019 | $ | $ | $ | ||||||||||||||

| Charges incurred | |||||||||||||||||

| Payments made | ( | ( | ( | ||||||||||||||

| Changes in estimates | ( | ( | |||||||||||||||

| Foreign currency and other adjustments | ( | ( | ( | ||||||||||||||

| As of March 31, 2020 | $ | $ | $ | ||||||||||||||

6. Income Tax

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| Effective tax rate | % | % | |||||||||

The increase in the effective tax rate during the first quarter of 2021 was primarily driven by an increase in net discrete tax expense. We recognized $18.1 million net discrete tax expense in the first quarter of 2021 versus $13.9 million net discrete tax benefit in the first quarter of 2020. In addition, jurisdictions with a higher income tax rate had proportionally higher pretax income in 2021 compared to prior year driving the effective tax rate higher.

Our tax rate is volatile and may increase or decrease with changes in, among other things, the amount and source of income or loss, our ability to utilize foreign tax credits, excess tax benefits or deficiencies from share-based compensation, changes in tax laws, and the movement of liabilities established pursuant to accounting guidance for uncertain tax positions as statutes of limitations expire, positions are effectively settled, or when additional information becomes available. There are proposed or pending tax law changes in various jurisdictions and other changes to regulatory environments in countries in which we do business that, if enacted, may have an impact on our effective tax rate.

15

7. Goodwill and Intangible Assets

Goodwill

The changes in the carrying amount of goodwill for the North America segment is presented in the table below.

| North America | |||||

| Changes in Goodwill: | (In millions) | ||||

| Balance as of December 31, 2020 | $ | ||||

| Foreign currency translation | |||||

| Balance as of March 31, 2021 | $ | ||||

As of December 31, 2020, due to the goodwill impairment recorded in the fourth quarter of 2020, the Europe segment had no goodwill. The North America segment had goodwill as of March 31, 2021 and December 31, 2020 as presented in the table above.

The gross amount of goodwill totaled approximately $8.4 2,250.6 million and $2,264.5 million, respectively, and are comprised of a full impairment taken on the Europe reporting unit and a partial impairment taken on the North America reporting unit as well as our historic India reporting unit, which was fully impaired in 2019.

As of the date of our annual impairment test, performed as of October 1, 2020, the North America reporting unit goodwill balance was at risk of future impairment in the event of significant unfavorable changes in assumptions including the forecasted cash flows (including company-specific risks like the performance of our above premium transformation efforts and overall market performance of new innovations like hard seltzers, along with macro-economic risks such as the continued prolonged weakening of economic conditions, or significant unfavorable changes in tax rates, environmental or other regulations, including interpretations thereof), terminal growth rates, market multiples and/or weighted-average cost of capital utilized in the discounted cash flow analyses. For testing purposes of our reporting units, management's best estimates of the expected future results are the primary driver in determining the fair value. Current projections used for our North America reporting unit testing reflect growth assumptions associated with our revitalization plan to build on the strength of our iconic core brands, aggressively grow our above premium portfolio, expand beyond the beer aisle, invest in our capabilities and support our people and our communities all of which are intended to benefit the projected cash flows of the business. The cash flow assumptions were tempered somewhat by the impacts the coronavirus has had on our overall business and specifically our more profitable on-premise business.

We determined that there was no triggering event that occurred during the first quarter of 2021 that would indicate the carrying value of our goodwill was greater than its fair value.

Intangible Assets, Other than Goodwill

The following table presents details of our intangible assets, other than goodwill, as of March 31, 2021:

| Useful life | Gross | Accumulated amortization | Net | ||||||||||||||||||||

| (Years) | (In millions) | ||||||||||||||||||||||

| Intangible assets subject to amortization: | |||||||||||||||||||||||

| Brands | $ | $ | ( | $ | |||||||||||||||||||

| License agreements and distribution rights | ( | ||||||||||||||||||||||

Other | ( | ||||||||||||||||||||||

| Intangible assets not subject to amortization: | |||||||||||||||||||||||

| Brands | Indefinite | — | |||||||||||||||||||||

| Distribution networks | Indefinite | — | |||||||||||||||||||||

| Other | Indefinite | — | |||||||||||||||||||||

| Total | $ | $ | ( | $ | |||||||||||||||||||

16

The following table presents details of our intangible assets, other than goodwill, as of December 31, 2020:

| Useful life | Gross | Accumulated amortization | Net | ||||||||||||||||||||

| (Years) | (In millions) | ||||||||||||||||||||||

| Intangible assets subject to amortization: | |||||||||||||||||||||||

| Brands | $ | $ | ( | $ | |||||||||||||||||||

| License agreements and distribution rights | ( | ||||||||||||||||||||||

Other | ( | ||||||||||||||||||||||

| Intangible assets not subject to amortization: | |||||||||||||||||||||||

| Brands | Indefinite | — | |||||||||||||||||||||

| Distribution networks | Indefinite | — | |||||||||||||||||||||

| Other | Indefinite | — | |||||||||||||||||||||

| Total | $ | $ | ( | $ | |||||||||||||||||||

The changes in the gross carrying amounts of intangible assets from December 31, 2020 to March 31, 2021 are primarily driven by the impact of foreign exchange rates, as a significant amount of intangible assets are denominated in foreign currencies.

Based on foreign exchange rates as of March 31, 2021, the estimated future amortization expense of intangible assets is as follows:

| Fiscal year | Amount | |||||||

| (In millions) | ||||||||

| 2021 - remaining | $ | |||||||

| 2022 | $ | |||||||

| 2023 | $ | |||||||

| 2024 | $ | |||||||

| 2025 | $ | |||||||

Amortization expense of intangible assets was $54.5 million and $54.9 million for the three months ended March 31, 2021 and March 31, 2020, respectively. This expense is primarily presented within marketing, general and administrative expenses on the unaudited condensed consolidated statements of operations.

As of the date of our annual impairment test of indefinite-lived intangible assets, performed as of October 1, 2020, the fair value of the indefinite-lived Miller, Coors and Carling brands were sufficiently in excess of their carrying values. We determined at the annual impairment testing date that the Staropramen indefinite-lived intangible asset in Europe was considered to be at risk of future impairment as a result of the coronavirus' impact on the on-premise business throughout Europe that commenced in 2020 and is continuing in 2021. No triggering events occurred during the first quarter of 2021 that would indicate the carrying value of these indefinite-lived assets was greater than their fair value.

We continuously monitor the performance of the underlying definite-lived intangible assets for potential triggering events suggesting an impairment review should be performed. While no triggering events have occurred in the first quarter of 2021, we continue to monitor the impacts of the coronavirus in our key markets and the potential implications that may have on the values of definite-lived intangible assets.

Fair Value Assumptions

Fair value determinations require considerable judgment and are sensitive to changes in underlying assumptions and factors. The key assumptions used to derive the estimated fair values of our reporting units and indefinite-lived intangible assets are discussed in Part II—Item 8 Financial Statements, Note 10, "Goodwill and Intangible Assets" in our Annual Report, and represent Level 3 measurements.

Overall Considerations

Based on known facts and circumstances, we evaluate and consider recent events and uncertain items, as well as the related potential implications, as part of our annual and interim assessments and incorporate into the analyses as appropriate. These facts and circumstances are subject to change and may impact future analyses. For example, we continue to monitor the progress we are making our revitalization plan, challenges within the beer industry for further weakening or additional systemic

17

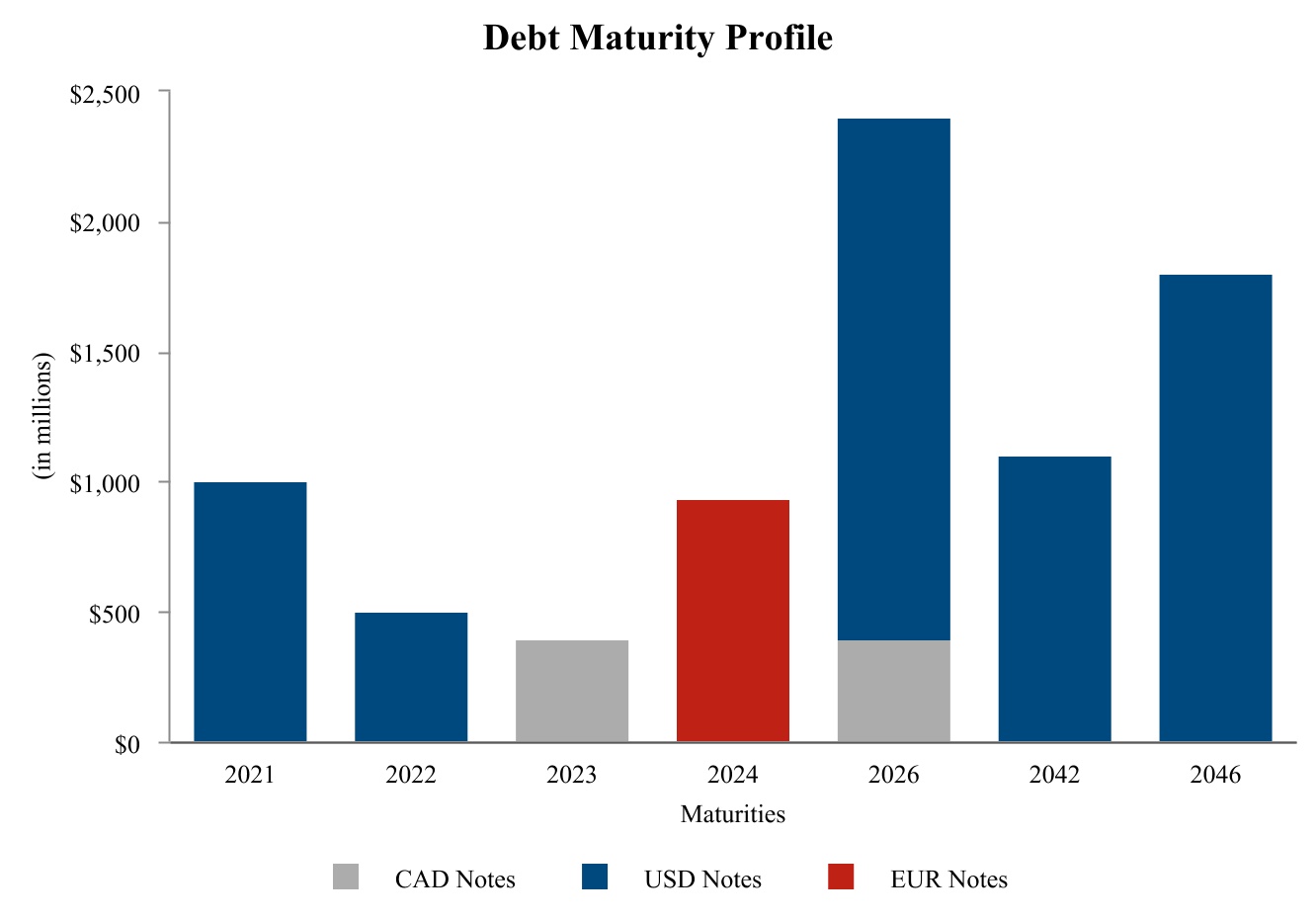

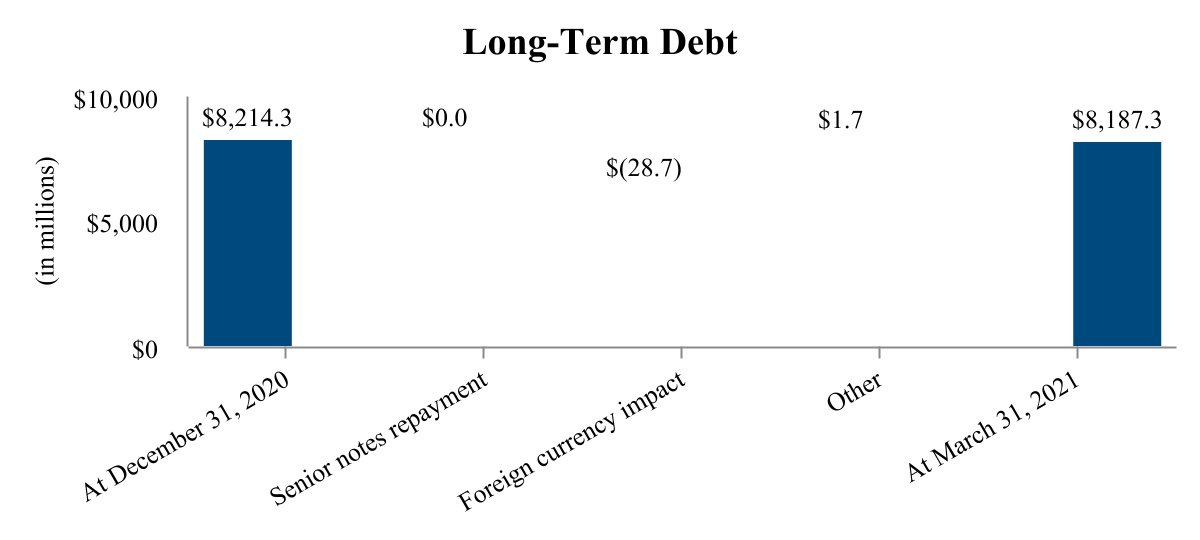

8. Debt

Debt Obligations

| As of | |||||||||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Long-term debt: | |||||||||||

CAD | $ | $ | |||||||||

CAD | |||||||||||

$ | |||||||||||

$ | |||||||||||

$ | |||||||||||

$ | |||||||||||

$ | |||||||||||

EUR | |||||||||||

| Finance leases and other | |||||||||||

| Less: unamortized debt discounts and debt issuance costs | ( | ( | |||||||||

| Total long-term debt (including current portion) | |||||||||||

| Less: current portion of long-term debt | ( | ( | |||||||||

| Total long-term debt | $ | $ | |||||||||

Short-term borrowings(3) | $ | $ | |||||||||

| Current portion of long-term debt | |||||||||||

| Current portion of long-term debt and short-term borrowings | $ | $ | |||||||||

(1)As of March 31, 2021, we have cross currency swaps associated with our $1.0 billion 2.1 % senior notes due July 2021 in order to hedge a portion of the foreign currency translational impacts of our European investment. As a result of the swaps, we have economically converted a portion of these notes and associated interest to EUR denominated, which results in a EUR interest rate to be received of 0.71 %. See Note 11, "Derivative Instruments and Hedging Activities" for further details.

(2)The fair value hedges related to these notes have been settled and are being amortized over the life of the respective note.

(3)As of March 31, 2021, we had $54.2 million in bank overdrafts and $90.3 million in bank cash related to our cross-border, cross-currency cash pool, for a net positive position of $36.1 million. As of December 31, 2020, we had $11.0 million in bank overdrafts and $103.7 million in bank cash related to our cross-border, cross-currency cash pool for a net positive position of $92.7 million. We had total outstanding borrowings of $3.2 million and $3.0 million under our two

18

Debt Fair Value Measurements

We utilize market approaches to estimate the fair value of certain outstanding borrowings by discounting anticipated future cash flows derived from the contractual terms of the obligations and observable market interest and foreign exchange rates. As of March 31, 2021 and December 31, 2020, the fair value of our outstanding long-term debt (including the current portion of long-term debt) was approximately $8.6 billion and $9.1 billion, respectively. All senior notes are valued based on significant observable inputs and classified as Level 2 in the fair value hierarchy. The carrying values of all other outstanding long-term borrowings and our short-term borrowings approximate their fair values and are also classified as Level 2 in the fair value hierarchy.

Revolving Credit Facility and Commercial Paper

We maintain a $1.5 billion revolving credit facility with a maturity date of July 7, 2024 that allows us to issue a maximum aggregate amount of $1.5 billion in commercial paper or other borrowings at any time at variable interest rates. We use this facility from time to time to leverage cash needs including debt repayments. We had no borrowings drawn on this revolving credit facility and no commercial paper borrowings as of March 31, 2021 or December 31, 2020.

In addition, Molson Coors Brewing Company (UK) Limited (“MCBC U.K.”), a subsidiary of MCBC that operates and manages the Company’s business in the U.K., maintained a commercial paper facility for the purpose of issuing short-term, unsecured Sterling-denominated notes that were eligible for purchase under the Joint HM Treasury and Bank of England’s COVID Corporate Financing Facility commercial paper program (the “CCFF Program”) in an aggregate principal amount up to GBP 300 million, subject to certain conditions. The CCFF Program was closed to new purchases as of March 23, 2021, and therefore is no longer a source of available liquidity for MCBC U.K.. As of both March 31, 2021 and December 31, 2020, we had no borrowings outstanding under the CCFF Program.

Debt Covenants

9. Inventories

| As of | |||||||||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| (In millions) | |||||||||||

| Finished goods | $ | $ | |||||||||

| Work in process | |||||||||||

| Raw materials | |||||||||||

| Packaging materials | |||||||||||

| Inventories, net | $ | $ | |||||||||

19

10. Accumulated Other Comprehensive Income (Loss)

| MCBC stockholders' equity | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments | Gain (loss) on derivative instruments | Pension and postretirement benefit adjustments | Equity method investments | Accumulated other comprehensive income (loss) | |||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||

| As of December 31, 2020 | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||

| Foreign currency translation adjustments | ( | — | — | — | ( | ||||||||||||||||||||||||

Reclassification of cumulative translation adjustment to income (loss)(1) | — | — | — | ||||||||||||||||||||||||||

| Gain (loss) on net investment hedges | — | — | — | ||||||||||||||||||||||||||

| Unrealized gain (loss) on derivative instruments | — | — | — | ||||||||||||||||||||||||||

| Reclassification of derivative (gain) loss to income (loss) | — | — | — | ||||||||||||||||||||||||||

| Amortization of net prior service (benefit) cost and net actuarial (gain) loss to income (loss) | — | — | — | ||||||||||||||||||||||||||

| Ownership share of unconsolidated subsidiaries' other comprehensive income (loss) | — | — | — | ||||||||||||||||||||||||||

| Tax benefit (expense) | ( | ( | ( | ( | |||||||||||||||||||||||||

| As of March 31, 2021 | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||

(1) As a result of the sale of a disposal group within our India business, the associated cumulative foreign currency translation adjustment was reclassified from AOCI and recognized within special items.

The reclassifications from AOCI to net income (loss) were immaterial for the three months ended March 31, 2021 and March 31, 2020.

11. Derivative Instruments and Hedging Activities

Our risk management and derivative accounting policies are presented within Part II—Item 8 Financial Statements, Note 1, "Basis of Presentation and Summary of Significant Accounting Policies" and Note 16, "Derivative Instruments and Hedging Activities" in our Annual Report and did not significantly change during the first quarter of 2021. As noted in Note 16 of the Notes included in our Annual Report, due to the nature of our counterparty agreements, and the fact that we are not subject to master netting arrangements, we are not able to net positions with the same counterparty and, therefore, present our derivative positions on a gross basis in our unaudited condensed consolidated balance sheets. Our significant derivative positions have not changed considerably since December 31, 2020.

Derivative Fair Value Measurements

We utilize market approaches to estimate the fair value of our derivative instruments by discounting anticipated future cash flows derived from the derivative's contractual terms and observable market interest, foreign exchange and commodity rates. The fair values of our derivatives also include credit risk adjustments to account for our counterparties' credit risk, as well as our own non-performance risk, as appropriate. The fair value of our warrants to acquire common shares of HEXO Corp. ("HEXO") at a strike price of CAD 24.00 per share are estimated using the Black-Scholes option-pricing model.

The table below summarizes our derivative assets and liabilities that were measured at fair value as of March 31, 2021 and December 31, 2020.

| Fair value measurements as of March 31, 2021 | |||||||||||||||||||||||

| As of March 31, 2021 | Quoted prices in active markets (Level 1) | Significant other observable inputs (Level 2) | Significant unobservable inputs (Level 3) | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Cross currency swaps | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Interest rate swaps | ( | ( | |||||||||||||||||||||

| Foreign currency forwards | ( | ( | |||||||||||||||||||||

| Commodity swaps | |||||||||||||||||||||||

| Warrants | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

20

| Fair value measurements as of December 31, 2020 | |||||||||||||||||||||||

| As of December 31, 2020 | Quoted prices in active markets (Level 1) | Significant other observable inputs (Level 2) | Significant unobservable inputs (Level 3) | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Cross currency swaps | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Interest rate swaps | ( | ( | |||||||||||||||||||||

| Foreign currency forwards | ( | ( | |||||||||||||||||||||

| Commodity swaps and options | |||||||||||||||||||||||

| Warrants | |||||||||||||||||||||||

| Total | $ | ( | $ | $ | ( | $ | |||||||||||||||||

As of March 31, 2021 and December 31, 2020, we had no significant transfers between Level 1 and Level 2. New derivative contracts transacted during the three months ended March 31, 2021 were all included in Level 2.

Results of Period Derivative Activity

The tables below include the results of our derivative activity in our unaudited condensed consolidated balance sheets as of March 31, 2021 and December 31, 2020, and our unaudited condensed consolidated statements of operations for the three months ended March 31, 2021 and March 31, 2020.

Fair Value of Derivative Instruments in the Unaudited Condensed Consolidated Balance Sheets (in millions):

| As of March 31, 2021 | |||||||||||||||||||||||||||||

| Derivative Assets | Derivative Liabilities | ||||||||||||||||||||||||||||

| Notional amount | Balance sheet location | Fair value | Balance sheet location | Fair value | |||||||||||||||||||||||||

| Derivatives designated as hedging instruments: | |||||||||||||||||||||||||||||

| Cross currency swaps | $ | Other current assets | $ | Accounts payable and other current liabilities | $ | ( | |||||||||||||||||||||||

| Interest rate swaps | $ | Other current assets | Accounts payable and other current liabilities | ( | |||||||||||||||||||||||||

| Other non-current assets | Other liabilities | ( | |||||||||||||||||||||||||||

| Foreign currency forwards | $ | Other current assets | Accounts payable and other current liabilities | ( | |||||||||||||||||||||||||

| Other non-current assets | Other liabilities | ( | |||||||||||||||||||||||||||

| Total derivatives designated as hedging instruments | $ | $ | ( | ||||||||||||||||||||||||||

| Derivatives not designated as hedging instruments: | |||||||||||||||||||||||||||||

Commodity swaps(1) | $ | Other current assets | $ | Accounts payable and other current liabilities | $ | ( | |||||||||||||||||||||||

| Other non-current assets | Other liabilities | ( | |||||||||||||||||||||||||||

Commodity options(1) | $ | Other current assets | Accounts payable and other current liabilities | ||||||||||||||||||||||||||

| Warrants | $ | Other current assets | Accounts payable and other current liabilities | ||||||||||||||||||||||||||

| Total derivatives not designated as hedging instruments | $ | $ | ( | ||||||||||||||||||||||||||

| As of December 31, 2020 | |||||||||||||||||||||||||||||

| Derivative Assets | Derivative Liabilities | ||||||||||||||||||||||||||||

| Notional amount | Balance sheet location | Fair value | Balance sheet location | Fair value | |||||||||||||||||||||||||

| Derivatives designated as hedging instruments: | |||||||||||||||||||||||||||||

| Cross currency swaps | $ | Other current assets | $ | Accounts payable and other current liabilities | $ | ( | |||||||||||||||||||||||

| Interest rate swaps | $ | Other non-current assets | Accounts payable and other current liabilities | ( | |||||||||||||||||||||||||

| Other liabilities | (173.8) | ||||||||||||||||||||||||||||

| Foreign currency forwards | $ | Other current assets | Accounts payable and other current liabilities | ( | |||||||||||||||||||||||||

| Other non-current assets | Other liabilities | ( | |||||||||||||||||||||||||||

| Total derivatives designated as hedging instruments | $ | $ | ( | ||||||||||||||||||||||||||

| Derivatives not designated as hedging instruments: | |||||||||||||||||||||||||||||

Commodity swaps(1) | $ | Other current assets | $ | Accounts payable and other current liabilities | $ | ( | |||||||||||||||||||||||

| Other non-current assets | Other liabilities | ( | |||||||||||||||||||||||||||

Commodity options(1) | $ | Other current assets | Accounts payable and other current liabilities | ||||||||||||||||||||||||||

| Warrants | $ | Other non-current assets | Other liabilities | ||||||||||||||||||||||||||

| Total derivatives not designated as hedging instruments | $ | $ | ( | ||||||||||||||||||||||||||

21

(1)Notional includes offsetting buy and sell positions, shown in terms of absolute value. Buy and sell positions are shown gross in the asset and/or liability position, as appropriate.

Items Designated and Qualifying as Hedged Items in Fair Value Hedging Relationships in the Unaudited Condensed Consolidated Balance Sheets (in millions):

Line item in the balance sheet in which the hedged item is included | Carrying amount of the hedged assets/liabilities | Cumulative amount of fair value hedging adjustment(s) in the hedged assets/liabilities(1) Increase/(Decrease) | ||||||||||||||||||||||||

| As of March 31, 2021 | As of December 31, 2020 | As of March 31, 2021 | As of December 31, 2020 | |||||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||

| Current portion of long-term debt and short-term borrowings | $ | $ | $ | $ | ||||||||||||||||||||||

| Long-term debt | $ | $ | $ | $ | ||||||||||||||||||||||

(1) Entire balances relate to hedging adjustments on discontinued hedging relationships.

The Pretax Effect of Cash Flow Hedge and Net Investment Hedge Accounting on Accumulated Other Comprehensive Income (Loss) (in millions):

| Three Months Ended March 31, 2021 | ||||||||||||||||||||

| Derivatives in cash flow hedge relationships | Amount of gain (loss) recognized in OCI on derivative | Location of gain (loss) reclassified from AOCI into income | Amount of gain (loss) recognized from AOCI on derivative | |||||||||||||||||

| Forward starting interest rate swaps | $ | Interest income (expense), net | $ | ( | ||||||||||||||||

| Foreign currency forwards | ( | Cost of goods sold | ( | |||||||||||||||||

| Other income (expense), net | ||||||||||||||||||||

| Total | $ | $ | ( | |||||||||||||||||

| Three Months Ended March 31, 2021 | ||||||||||||||||||||||||||||||||

| Derivatives in net investment hedge relationships | Amount of gain (loss) recognized in OCI on derivative | Location of gain (loss) reclassified from AOCI into income | Amount of gain (loss) recognized from AOCI on derivative | Location of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing) | Amount of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing)(1) | |||||||||||||||||||||||||||

| Cross currency swaps | $ | Interest income (expense), net | $ | Interest income (expense), net | $ | |||||||||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||||||||||||||

| Three Months Ended March 31, 2021 | ||||||||||||||||||||||||||||||||

| Non-derivative financial instruments in net investment hedge relationships | Amount of gain (loss) recognized in OCI on derivative | Location of gain (loss) reclassified from AOCI into income | Amount of gain (loss) recognized from AOCI on derivative | Location of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing) | Amount of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing) | |||||||||||||||||||||||||||

EUR | $ | Other income (expense), net | $ | Other income (expense), net | $ | |||||||||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||||||||||||||

| Three Months Ended March 31, 2020 | ||||||||||||||||||||

| Derivatives in cash flow hedge relationships | Amount of gain (loss) recognized in OCI on derivative | Location of gain (loss) reclassified from AOCI into income | Amount of gain (loss) recognized from AOCI on derivative | |||||||||||||||||

| Forward starting interest rate swaps | $ | ( | Interest income (expense), net | $ | ( | |||||||||||||||

| Foreign currency forwards | Cost of goods sold | |||||||||||||||||||

| Other income (expense), net | ( | |||||||||||||||||||

| Total | $ | ( | $ | |||||||||||||||||

22

| Three Months Ended March 31, 2020 | ||||||||||||||||||||||||||||||||

| Derivatives in net investment hedge relationships | Amount of gain (loss) recognized in OCI on derivative | Location of gain (loss) reclassified from AOCI into income | Amount of gain (loss) recognized from AOCI on derivative | Location of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing) | Amount of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing)(1) | |||||||||||||||||||||||||||

| Cross currency swaps | $ | Interest income (expense), net | $ | Interest income (expense), net | $ | |||||||||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||||||||||||||

| Three Months Ended March 31, 2020 | ||||||||||||||||||||||||||||||||

| Non-derivative financial instruments in net investment hedge relationships | Amount of gain (loss) recognized in OCI on derivative | Location of gain (loss) reclassified from AOCI into income | Amount of gain (loss) recognized from AOCI on derivative | Location of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing) | Amount of gain (loss) recognized in income on derivative (amount excluded from effectiveness testing) | |||||||||||||||||||||||||||

EUR | $ | Other income (expense), net | $ | Other income (expense), net | $ | |||||||||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||||||||||||||

(1)Represents amounts excluded from the assessment of effectiveness for which the difference between changes in fair value and period amortization is recorded in other comprehensive income.

As of March 31, 2021, we expect our reclassification of AOCI into earnings related to cash flow hedges to be $7 million over the next 12 months. For derivatives designated in cash flow hedge relationships, the maximum length of time over which forecasted transactions are hedged as of March 31, 2021 is approximately 4 years, as well as those related to our forecasted debt issuances in 2021, 2022, and 2026.

The Effect of Fair Value and Cash Flow Hedge Accounting on the Unaudited Condensed Consolidated Statements of Operations (in millions):

| Three Months Ended March 31, 2021 | ||||||||||||||||||||

Location and amount of gain (loss) recognized in income on fair value and cash flow hedging relationships(1) | ||||||||||||||||||||

| Cost of goods sold | Other income (expense), net | Interest income (expense), net | ||||||||||||||||||

| Total amount of income and expense line items presented in the unaudited condensed consolidated statement of operations in which the effects of fair value or cash flow hedges are recorded | $ | ( | $ | $ | ( | |||||||||||||||

| Gain (loss) on cash flow hedging relationships: | ||||||||||||||||||||

| Forward starting interest rate swaps | ||||||||||||||||||||

| Amount of gain (loss) reclassified from AOCI into income | ( | |||||||||||||||||||

| Foreign currency forwards | ||||||||||||||||||||

| Amount of gain (loss) reclassified from AOCI into income | ( | |||||||||||||||||||

23

| Three Months Ended March 31, 2020 | ||||||||||||||||||||

Location and amount of gain (loss) recognized in income on fair value and cash flow hedging relationships(1) | ||||||||||||||||||||

| Cost of goods sold | Other income (expense), net | Interest income (expense), net | ||||||||||||||||||

| Total amount of income and expense line items presented in the unaudited condensed consolidated statement of operations in which the effects of fair value or cash flow hedges are recorded | $ | ( | $ | ( | $ | ( | ||||||||||||||

| Gain (loss) on cash flow hedging relationships: | ||||||||||||||||||||

| Forward starting interest rate swaps | ||||||||||||||||||||

| Amount of gain (loss) reclassified from AOCI into income | ( | |||||||||||||||||||

| Foreign currency forwards | ||||||||||||||||||||

| Amount of gain (loss) reclassified from AOCI into income | ( | |||||||||||||||||||

(1) We had no outstanding fair value hedges during the first quarter of 2021 or 2020.

The Effect of Derivatives Not Designated as Hedging Instruments on the Unaudited Condensed Consolidated Statements of Operations (in millions):

| Three Months Ended March 31, 2021 | ||||||||||||||

| Derivatives not in hedging relationships | Location of gain (loss) recognized in income on derivative | Amount of gain (loss) recognized in income on derivative | ||||||||||||

| Commodity swaps | Cost of goods sold | $ | ||||||||||||

| Warrants | Other income (expense), net | |||||||||||||

| Total | $ | |||||||||||||

| Three Months Ended March 31, 2020 | ||||||||||||||

| Derivatives not in hedging relationships | Location of gain (loss) recognized in income on derivative | Amount of gain (loss) recognized in income on derivative | ||||||||||||

| Commodity swaps | Cost of goods sold | $ | ( | |||||||||||

| Warrants | Other income (expense), net | ( | ||||||||||||

| Total | $ | ( | ||||||||||||

The gains and losses recognized in income related to our commodity swaps are largely driven by changes in the respective commodity market prices, primarily in aluminum.

12. Commitments and Contingencies

Litigation and Other Disputes and Environmental

Related to litigation, other disputes and environmental issues, we have an aggregate accrued contingent liability of $33.3 million and $17.9 million as of March 31, 2021 and December 31, 2020, respectively. While we cannot predict the eventual aggregate cost for litigation, other disputes and environmental matters in which we are currently involved, we believe adequate reserves have been provided for losses that are probable and estimable. Additionally, as noted below, there are certain loss contingencies that we deem reasonably possible for which a range of loss is not estimable at this time; for all other matters, we believe that any reasonably possible losses in excess of the amounts accrued are immaterial to our unaudited condensed consolidated interim financial statements. Our litigation, other disputes and environmental issues are discussed in further detail within Part II—Item 8 Financial Statements, Note 18, "Commitments and Contingencies" in our Annual Report and did not significantly change during the first quarter of 2021, except as noted below.

Other than those disclosed below, we are also involved in other disputes and legal actions arising in the ordinary course of our business. While it is not feasible to predict or determine the outcome of these proceedings, in our opinion, based on a review with legal counsel, other than as noted, none of these disputes or legal actions are expected to have a material impact on our business, consolidated financial position, results of operations or cash flows. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business.

On February 12, 2018, Stone Brewing Company filed a trademark infringement lawsuit in federal court in the Southern District of California against Molson Coors Beverage Company USA LLC ("MCBC USA" formerly known as MillerCoors LLC) alleging that the Keystone brand has “rebranded” itself as “Stone” and is marketing itself in a manner confusingly similar

24