000002409012/312021Q3FALSEP3Y0M0D00000240902021-01-012021-09-30xbrli:shares0000024090us-gaap:CommonClassAMember2021-10-290000024090us-gaap:CommonClassBMember2021-10-29iso4217:USD00000240902021-09-3000000240902020-12-31iso4217:USDxbrli:shares0000024090us-gaap:CommonClassAMember2020-12-310000024090us-gaap:CommonClassAMember2021-09-300000024090us-gaap:CommonClassBMember2021-09-300000024090us-gaap:CommonClassBMember2020-12-3100000240902021-07-012021-09-3000000240902020-07-012020-09-3000000240902020-01-012020-09-300000024090us-gaap:CommonClassAMember2021-07-012021-09-300000024090us-gaap:CommonClassAMember2020-07-012020-09-300000024090us-gaap:CommonClassAMember2021-01-012021-09-300000024090us-gaap:CommonClassAMember2020-01-012020-09-300000024090us-gaap:CommonClassBMember2021-07-012021-09-300000024090us-gaap:CommonClassBMember2020-07-012020-09-300000024090us-gaap:CommonClassBMember2021-01-012021-09-300000024090us-gaap:CommonClassBMember2020-01-012020-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-12-310000024090us-gaap:RetainedEarningsMember2020-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000024090us-gaap:TreasuryStockMember2020-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-01-012021-03-310000024090us-gaap:RetainedEarningsMember2021-01-012021-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310000024090us-gaap:TreasuryStockMember2021-01-012021-03-3100000240902021-01-012021-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-03-310000024090us-gaap:RetainedEarningsMember2021-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310000024090us-gaap:TreasuryStockMember2021-03-3100000240902021-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-04-012021-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-04-012021-06-300000024090us-gaap:RetainedEarningsMember2021-04-012021-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300000024090us-gaap:TreasuryStockMember2021-04-012021-06-3000000240902021-04-012021-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-06-300000024090us-gaap:RetainedEarningsMember2021-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300000024090us-gaap:TreasuryStockMember2021-06-3000000240902021-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-07-012021-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-07-012021-09-300000024090us-gaap:RetainedEarningsMember2021-07-012021-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300000024090us-gaap:TreasuryStockMember2021-07-012021-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-09-300000024090us-gaap:RetainedEarningsMember2021-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300000024090us-gaap:TreasuryStockMember2021-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-12-310000024090us-gaap:RetainedEarningsMember2019-12-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000024090us-gaap:TreasuryStockMember2019-12-3100000240902019-12-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-01-012020-01-010000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-01-012020-01-010000024090us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-01-012020-01-010000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-01-010000024090us-gaap:TreasuryStockMember2020-01-012020-01-010000024090srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-01-012020-01-010000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-01-012020-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-01-012020-03-310000024090us-gaap:RetainedEarningsMember2020-01-012020-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000024090us-gaap:TreasuryStockMember2020-01-012020-03-3100000240902020-01-012020-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-03-310000024090us-gaap:RetainedEarningsMember2020-03-310000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000024090us-gaap:TreasuryStockMember2020-03-3100000240902020-03-310000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-04-012020-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-04-012020-06-300000024090us-gaap:RetainedEarningsMember2020-04-012020-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300000024090us-gaap:TreasuryStockMember2020-04-012020-06-3000000240902020-04-012020-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-06-300000024090us-gaap:RetainedEarningsMember2020-06-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300000024090us-gaap:TreasuryStockMember2020-06-3000000240902020-06-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-07-012020-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-07-012020-09-300000024090us-gaap:RetainedEarningsMember2020-07-012020-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300000024090us-gaap:TreasuryStockMember2020-07-012020-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-09-300000024090us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-09-300000024090us-gaap:RetainedEarningsMember2020-09-300000024090us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300000024090us-gaap:TreasuryStockMember2020-09-3000000240902020-09-300000024090us-gaap:UnusualOrInfrequentItemDomain2021-04-012021-04-010000024090us-gaap:AccountingStandardsUpdate201613Member2020-01-01xbrli:pure0000024090cia:LifeInsuranceBusinessSegmentMember2021-07-012021-09-300000024090cia:HomeServiceInsuranceSegmentMember2021-07-012021-09-300000024090cia:OtherNonInsuranceEnterpriseSegmentMember2021-07-012021-09-300000024090cia:LifeInsuranceBusinessSegmentMember2021-01-012021-09-300000024090cia:HomeServiceInsuranceSegmentMember2021-01-012021-09-300000024090cia:OtherNonInsuranceEnterpriseSegmentMember2021-01-012021-09-300000024090cia:LifeInsuranceBusinessSegmentMember2020-07-012020-09-300000024090cia:HomeServiceInsuranceSegmentMember2020-07-012020-09-300000024090cia:OtherNonInsuranceEnterpriseSegmentMember2020-07-012020-09-300000024090cia:LifeInsuranceBusinessSegmentMember2020-01-012020-09-300000024090cia:HomeServiceInsuranceSegmentMember2020-01-012020-09-300000024090cia:OtherNonInsuranceEnterpriseSegmentMember2020-01-012020-09-300000024090us-gaap:RetainedEarningsMember2021-01-012021-09-300000024090us-gaap:RetainedEarningsMember2020-01-012020-09-3000000240902021-04-1500000240902021-04-152021-04-150000024090us-gaap:USTreasurySecuritiesMember2021-09-300000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2021-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2021-09-300000024090cia:CorporateDebtSecuritiesFinancialSectorMember2021-09-300000024090cia:CorporateDebtSecurityConsumerSectorMember2021-09-300000024090cia:CorporateDebtSecurityEnergySectorMember2021-09-300000024090cia:CorporateDebtSecurityAllOtherSectorMember2021-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2021-09-300000024090us-gaap:AssetBackedSecuritiesMember2021-09-300000024090us-gaap:ForeignGovernmentDebtSecuritiesMember2021-09-300000024090us-gaap:USTreasurySecuritiesMember2020-12-310000024090us-gaap:USGovernmentAgenciesDebtSecuritiesMember2020-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310000024090cia:CorporateDebtSecuritiesFinancialSectorMember2020-12-310000024090cia:CorporateDebtSecurityConsumerSectorMember2020-12-310000024090cia:CorporateDebtSecurityEnergySectorMember2020-12-310000024090cia:CorporateDebtSecurityAllOtherSectorMember2020-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2020-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000024090us-gaap:AssetBackedSecuritiesMember2020-12-310000024090us-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000024090us-gaap:EquityFundsMember2021-09-300000024090us-gaap:EquityFundsMember2020-12-310000024090us-gaap:FixedIncomeFundsMember2021-09-300000024090us-gaap:FixedIncomeFundsMember2020-12-310000024090us-gaap:CommonStockMember2021-09-300000024090us-gaap:CommonStockMember2020-12-310000024090us-gaap:NonredeemablePreferredStockMember2021-09-300000024090us-gaap:NonredeemablePreferredStockMember2020-12-310000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2021-09-300000024090cia:CIA_NonredeemablePreferredStockFundMemberMember2020-12-310000024090us-gaap:EquitySecuritiesMember2021-07-012021-09-300000024090us-gaap:EquitySecuritiesMember2021-01-012021-09-300000024090us-gaap:EquitySecuritiesMember2020-07-012020-09-300000024090us-gaap:EquitySecuritiesMember2020-01-012020-09-300000024090us-gaap:DebtSecuritiesMember2020-07-012020-09-300000024090us-gaap:DebtSecuritiesMember2020-01-012020-09-300000024090us-gaap:DebtSecuritiesMember2021-01-012021-09-300000024090us-gaap:DebtSecuritiesMember2021-07-012021-09-300000024090us-gaap:DebtSecuritiesMember2021-09-300000024090us-gaap:DebtSecuritiesMember2020-12-310000024090us-gaap:LandBuildingsAndImprovementsMember2021-07-012021-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2021-09-300000024090us-gaap:USTreasuryAndGovernmentMember2021-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2021-09-300000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2021-09-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-09-300000024090us-gaap:CorporateDebtSecuritiesMember2021-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2021-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2021-09-300000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2021-09-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-09-300000024090us-gaap:AssetBackedSecuritiesMember2021-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-09-300000024090us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-09-300000024090us-gaap:ForeignGovernmentDebtSecuritiesMember2021-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2021-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMember2021-09-300000024090us-gaap:DebtSecuritiesMember2021-09-300000024090us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:EquityFundsMember2021-09-300000024090us-gaap:EquityFundsMember2021-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2021-09-300000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeFundsMember2021-09-300000024090us-gaap:FixedIncomeFundsMember2021-09-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2021-09-300000024090us-gaap:CommonStockMember2021-09-300000024090us-gaap:FairValueInputsLevel1Memberus-gaap:NonredeemablePreferredStockMember2021-09-300000024090us-gaap:FairValueInputsLevel2Memberus-gaap:NonredeemablePreferredStockMember2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:NonredeemablePreferredStockMember2021-09-300000024090us-gaap:NonredeemablePreferredStockMember2021-09-300000024090us-gaap:FairValueInputsLevel1Membercia:CIA_NonredeemablePreferredStockFundMemberDomain2021-09-300000024090cia:CIA_NonredeemablePreferredStockFundMemberDomainus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Membercia:CIA_NonredeemablePreferredStockFundMemberDomain2021-09-300000024090cia:CIA_NonredeemablePreferredStockFundMemberDomain2021-09-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2021-09-300000024090us-gaap:EquitySecuritiesMember2021-09-300000024090us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMember2021-09-300000024090us-gaap:OtherLongTermInvestmentsMember2021-09-300000024090us-gaap:FairValueInputsLevel1Member2021-09-300000024090us-gaap:FairValueInputsLevel2Member2021-09-300000024090us-gaap:FairValueInputsLevel3Member2021-09-300000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMember2020-12-310000024090us-gaap:USTreasuryAndGovernmentMember2020-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:USStatesAndPoliticalSubdivisionsMember2020-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:CorporateDebtSecuritiesMember2020-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:CommercialMortgageBackedSecuritiesMember2020-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000024090us-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:AssetBackedSecuritiesMember2020-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000024090us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000024090us-gaap:ForeignGovernmentDebtSecuritiesMember2020-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:DebtSecuritiesMember2020-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:DebtSecuritiesMember2020-12-310000024090us-gaap:DebtSecuritiesMember2020-12-310000024090us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:EquityFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:EquityFundsMember2020-12-310000024090us-gaap:EquityFundsMember2020-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeFundsMember2020-12-310000024090us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeFundsMember2020-12-310000024090us-gaap:FixedIncomeFundsMember2020-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:CommonStockMemberus-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:CommonStockMember2020-12-310000024090us-gaap:FairValueInputsLevel1Memberus-gaap:NonredeemablePreferredStockMember2020-12-310000024090us-gaap:FairValueInputsLevel2Memberus-gaap:NonredeemablePreferredStockMember2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:NonredeemablePreferredStockMember2020-12-310000024090us-gaap:NonredeemablePreferredStockMember2020-12-310000024090us-gaap:FairValueInputsLevel1Membercia:CIA_NonredeemablePreferredStockFundMemberDomain2020-12-310000024090cia:CIA_NonredeemablePreferredStockFundMemberDomainus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Membercia:CIA_NonredeemablePreferredStockFundMemberDomain2020-12-310000024090cia:CIA_NonredeemablePreferredStockFundMemberDomain2020-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:EquitySecuritiesMember2020-12-310000024090us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Memberus-gaap:OtherLongTermInvestmentsMember2020-12-310000024090us-gaap:OtherLongTermInvestmentsMember2020-12-310000024090us-gaap:FairValueInputsLevel1Member2020-12-310000024090us-gaap:FairValueInputsLevel2Member2020-12-310000024090us-gaap:FairValueInputsLevel3Member2020-12-310000024090us-gaap:PrivateEquityFundsMember2021-07-012021-09-300000024090us-gaap:PrivateEquityFundsMember2021-01-012021-09-300000024090us-gaap:PrivateEquityFundsMember2020-01-012020-09-300000024090us-gaap:PrivateEquityFundsMember2020-07-012020-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMember2021-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMemberus-gaap:UnfundedLoanCommitmentMember2021-09-300000024090cia:PrivateEquityFundsMiddleMarketMember2021-01-012021-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMember2020-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsMiddleMarketMemberus-gaap:UnfundedLoanCommitmentMember2020-12-310000024090cia:PrivateEquityFundsMiddleMarketMember2020-01-012020-12-310000024090cia:PrivateEquityFundsTermLiquidityFacilityMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-09-300000024090cia:PrivateEquityFundsTermLiquidityFacilityMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2021-09-300000024090cia:PrivateEquityFundsTermLiquidityFacilityMember2021-01-012021-09-300000024090cia:PrivateEquityFundsTermLiquidityFacilityMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-12-310000024090cia:PrivateEquityFundsTermLiquidityFacilityMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2020-12-310000024090cia:PrivateEquityFundsTermLiquidityFacilityMember2020-01-012020-12-310000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-09-300000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2021-09-300000024090cia:PrivateEquityFundsLateStageGrowthMember2021-01-012021-09-300000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-12-310000024090cia:PrivateEquityFundsLateStageGrowthMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMember2020-12-310000024090cia:PrivateEquityFundsLateStageGrowthMember2020-01-012020-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsInfrastructureMember2021-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMembercia:PrivateEquityFundsInfrastructureMember2021-09-300000024090cia:PrivateEquityFundsInfrastructureMember2021-01-012021-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercia:PrivateEquityFundsInfrastructureMember2020-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMembercia:PrivateEquityFundsInfrastructureMember2020-12-310000024090cia:PrivateEquityFundsInfrastructureMember2020-01-012020-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMember2021-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMemberus-gaap:PrivateEquityFundsMember2021-09-300000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PrivateEquityFundsMember2020-12-310000024090us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:UnfundedLoanCommitmentMemberus-gaap:PrivateEquityFundsMember2020-12-310000024090us-gaap:PrivateEquityFundsMember2021-09-300000024090us-gaap:PrivateEquityFundsMember2020-12-310000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-09-300000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000024090us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000024090us-gaap:CarryingReportedAmountFairValueDisclosureMembersrt:OtherPropertyMember2021-09-300000024090us-gaap:EstimateOfFairValueFairValueDisclosureMembersrt:OtherPropertyMember2021-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMembersrt:OtherPropertyMember2020-12-310000024090us-gaap:EstimateOfFairValueFairValueDisclosureMembersrt:OtherPropertyMember2020-12-310000024090us-gaap:CarryingReportedAmountFairValueDisclosureMembersrt:SingleFamilyMember2021-09-300000024090us-gaap:EstimateOfFairValueFairValueDisclosureMembersrt:SingleFamilyMember2021-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMembersrt:SingleFamilyMember2020-12-310000024090us-gaap:EstimateOfFairValueFairValueDisclosureMembersrt:SingleFamilyMember2020-12-3100000240902020-01-012020-12-310000024090srt:OtherPropertyMember2021-01-012021-09-300000024090srt:OtherPropertyMember2021-09-300000024090srt:SingleFamilyMember2021-01-012021-09-300000024090srt:SingleFamilyMember2020-01-012020-12-310000024090srt:SingleFamilyMember2021-09-300000024090us-gaap:CarryingReportedAmountFairValueDisclosureMembersrt:ChiefExecutiveOfficerMember2020-12-3100000240902018-07-012018-07-010000024090us-gaap:UnfundedLoanCommitmentMember2021-09-3000000240902021-05-052021-05-050000024090us-gaap:RevolvingCreditFacilityMember2021-05-050000024090us-gaap:BaseRateMember2021-05-050000024090us-gaap:FederalFundsEffectiveSwapRateMember2021-01-012021-09-300000024090us-gaap:LondonInterbankOfferedRateLiborSwapRateMember2021-01-012021-09-300000024090us-gaap:RevolvingCreditFacilityMember2021-09-300000024090us-gaap:LondonInterbankOfferedRateLIBORMember2021-05-050000024090us-gaap:LondonInterbankOfferedRateLIBORMember2021-01-012021-09-300000024090us-gaap:RevolvingCreditFacilityMember2021-07-012021-09-3000000240902021-04-122021-04-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

COMMISSION FILE NUMBER: 000-16509

| | |

| CITIZENS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | |

| Colorado | 84-0755371 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

11815 Alterra Pkwy, Floor 15, Austin, TX 78758

(Current Address)

Registrant's telephone number, including area code: (512) 837-7100

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

|

| Class A Common Stock | CIA | NYSE |

| (Title of each class) | (Trading symbol(s)) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ | | Emerging growth company | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

As of October 29, 2021, the Registrant had 49,789,339 shares of Class A common stock outstanding and 0 shares of Class B common stock outstanding.

THIS PAGE INTENTIONALLY LEFT BLANK

TABLE OF CONTENTS | | | | | | | | | | | |

| | | Page Number |

| Part I. FINANCIAL INFORMATION | |

| | | |

| | Item 1. | | |

| | | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | |

| | | | |

| | | |

| | Item 2. | | |

| | | |

| | Item 3. | | |

| | | |

| | Item 4. | | |

| | | |

| Part II. OTHER INFORMATION | |

| | | |

| | Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| | Item 2. | | |

| | | |

| | Item 3. | | |

| | | |

| | Item 4. | | |

| | | |

| | Item 5. | | |

| | | |

| | Item 6. | | |

September 30, 2021 | 10-Q 1

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets | | | | | | | | | | | |

| | | |

| | | |

| (In thousands) | September 30, 2021 | | December 31, 2020 |

| Assets | (Unaudited) | | |

| Investments: | | | |

Fixed maturity securities available-for-sale, at fair value (amortized cost: $1,324,307 and $1,321,487 in 2021 and 2020, respectively) | $ | 1,456,694 | | | 1,489,383 | |

| | | |

| Equity securities, at fair value | 22,335 | | | 22,102 | |

| | | |

| Policy loans | 80,102 | | | 83,318 | |

| | | |

| Real estate held-for-sale | — | | | 2,571 | |

Other long-term investments (portion measured at fair value $32,651 and $11,923 in 2021 and 2020, respectively; less allowance for losses of $11 in 2021 and 2020) | 34,013 | | | 27,294 | |

| | | |

| Total investments | 1,593,144 | | | 1,624,668 | |

| Cash and cash equivalents | 30,087 | | | 34,131 | |

| Accrued investment income | 15,625 | | | 16,137 | |

| Receivable for securities | 10,000 | | | — | |

| Reinsurance recoverable | 13,724 | | | 5,753 | |

| Deferred policy acquisition costs | 115,093 | | | 104,913 | |

| Cost of insurance acquired | 10,865 | | | 11,541 | |

| Goodwill and other intangible assets | 13,567 | | | 13,570 | |

| | | |

| | | |

| Property and equipment, net | 14,524 | | | 16,312 | |

| Due premiums | 9,369 | | | 11,309 | |

| | | |

Other assets (less allowance for losses of $223 and $297 in 2021 and 2020, respectively) | 5,500 | | | 5,086 | |

| Total assets | $ | 1,831,498 | | | 1,843,420 | |

See accompanying Notes to Consolidated Financial Statements.

September 30, 2021 | 10-Q 2

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets, Continued

| | | | | | | | | | | |

| | | |

| (In thousands, except share amounts) | September 30, 2021 | | December 31, 2020 |

| Liabilities and Stockholders' Equity | (Unaudited) | | |

| Liabilities: | | | |

| Policy liabilities: | | | |

| Future policy benefit reserves: | | | |

| Life insurance | $ | 1,266,745 | | | 1,246,423 | |

| Annuities | 83,223 | | | 78,304 | |

| Accident and health | 779 | | | 761 | |

| Dividend accumulations | 36,588 | | | 33,336 | |

| Premiums paid in advance | 42,132 | | | 40,605 | |

| Policy claims payable | 23,478 | | | 13,206 | |

| Other policyholders' funds | 28,064 | | | 22,447 | |

| Total policy liabilities | 1,481,009 | | | 1,435,082 | |

| Commissions payable | 2,197 | | | 2,572 | |

| Current federal income tax payable | 45,771 | | | 43,916 | |

| Deferred federal income tax payable | 9,162 | | | 9,564 | |

| Payable for securities in process of settlement | 560 | | | 5,265 | |

| Other liabilities | 27,768 | | | 46,076 | |

| Total liabilities | 1,566,467 | | | 1,542,475 | |

Commitments and contingencies (Note 7) | | | |

| Stockholders' Equity: | | | |

| Common stock: | | | |

Class A, no par value, 100,000,000 shares authorized, 52,765,837 and 52,654,016 shares issued and outstanding in 2021 and 2020, respectively, including shares in treasury of 3,135,738 in 2021 and 2020 | 263,160 | | | 262,869 | |

Class B, no par value, 2,000,000 shares authorized, 1,001,714 shares issued and outstanding in 2021 and 2020, including shares in treasury of 1,001,714 in 2021 | 3,184 | | | 3,184 | |

| Accumulated deficit | (83,702) | | | (82,352) | |

| Accumulated other comprehensive income: | | | |

| Net unrealized gains (losses) on fixed maturity securities, net of tax | 102,490 | | | 128,255 | |

| Treasury stock, at cost | (20,101) | | | (11,011) | |

| Total stockholders' equity | 265,031 | | | 300,945 | |

| Total liabilities and stockholders' equity | $ | 1,831,498 | | | 1,843,420 | |

See accompanying Notes to Consolidated Financial Statements.

September 30, 2021 | 10-Q 3

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

(In thousands, except per share amounts) | 2021 | | 2020 | | 2021 | | 2020 |

| Revenues: | | | | | | | |

| Premiums: | | | | | | | |

| Life insurance | $ | 43,239 | | | 42,732 | | | 122,319 | | | 122,863 | |

| Accident and health insurance | 311 | | | 236 | | | 945 | | | 745 | |

| Property insurance | (223) | | | 1,140 | | | 1,921 | | | 3,313 | |

| Net investment income | 15,454 | | | 14,997 | | | 46,018 | | | 45,081 | |

| Realized investment gains (losses), net | 2,126 | | | 527 | | | 7,277 | | | 669 | |

| Other income | 677 | | | 193 | | | 2,145 | | | 1,217 | |

| Total revenues | 61,584 | | | 59,825 | | | 180,625 | | | 173,888 | |

| Benefits and Expenses: | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | |

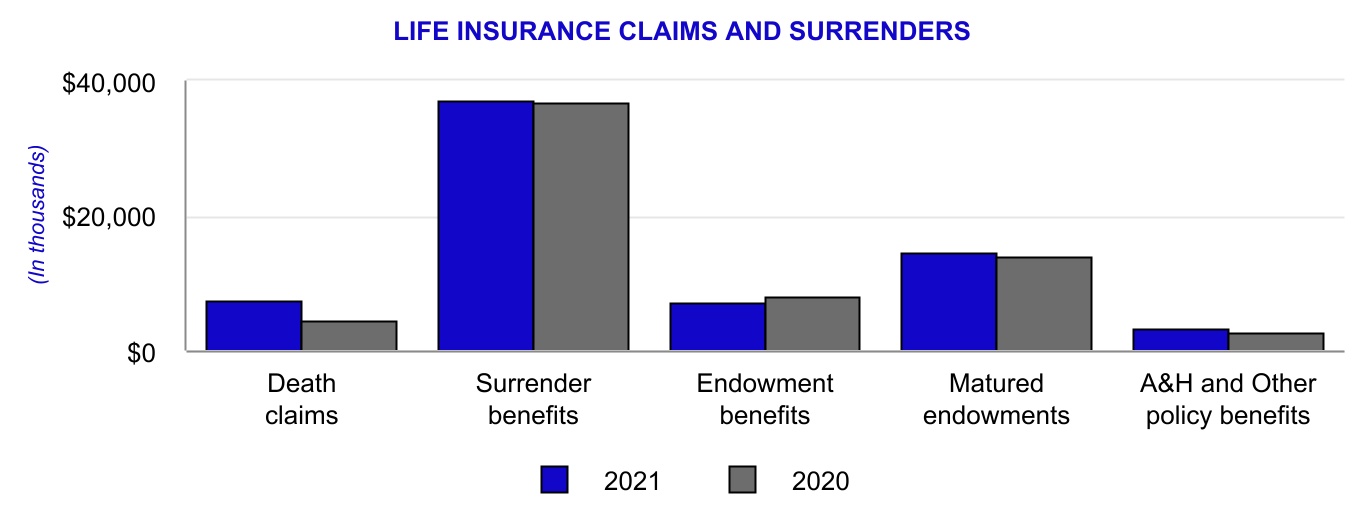

| Claims and surrenders | 31,816 | | | 32,958 | | | 91,701 | | | 87,161 | |

| Increase in future policy benefit reserves | 10,888 | | | 4,158 | | | 22,407 | | | 21,866 | |

| Policyholders' dividends | 1,650 | | | 1,450 | | | 4,431 | | | 4,011 | |

| Total insurance benefits paid or provided | 44,354 | | | 38,566 | | | 118,539 | | | 113,038 | |

| Commissions | 9,115 | | | 7,712 | | | 26,073 | | | 22,279 | |

| Other general expenses | 10,542 | | | 19,391 | | | 33,427 | | | 42,003 | |

| Capitalization of deferred policy acquisition costs | (6,026) | | | (4,892) | | | (16,798) | | | (13,632) | |

| Amortization of deferred policy acquisition costs | 6,043 | | | 6,760 | | | 18,300 | | | 18,940 | |

| Amortization of cost of insurance acquired | 283 | | | 459 | | | 959 | | | 1,228 | |

| Total benefits and expenses | 64,311 | | | 67,996 | | | 180,500 | | | 183,856 | |

| Income (loss) before federal income tax | (2,727) | | | (8,171) | | | 125 | | | (9,968) | |

| Federal income tax expense (benefit) | 72 | | | (256) | | | 1,475 | | | 2,558 | |

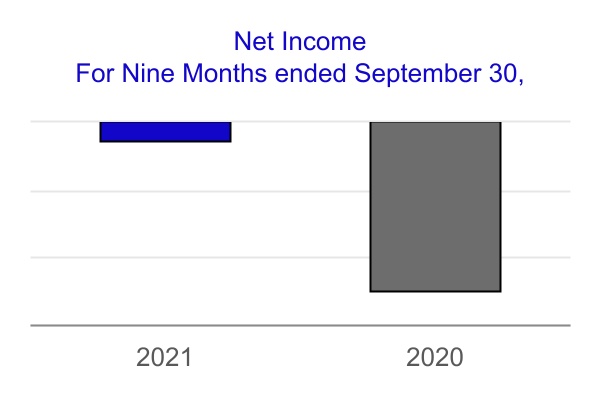

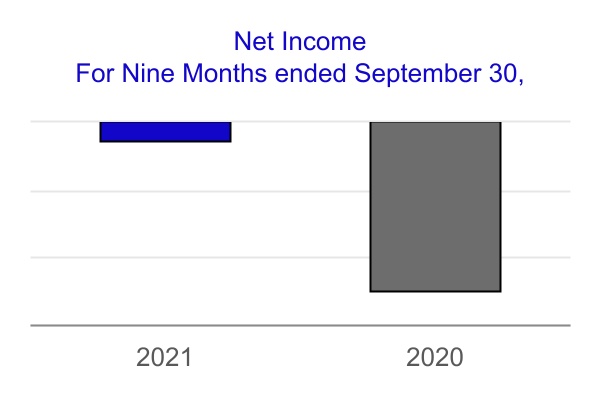

| Net income (loss) | (2,799) | | | (7,915) | | | (1,350) | | | (12,526) | |

| Per Share Amounts: | | | | | | | |

| Basic and diluted earnings (losses) per share of Class A common stock | (0.06) | | | (0.16) | | | (0.03) | | | (0.25) | |

| Basic and diluted earnings (losses) per share of Class B common stock | — | | | (0.07) | | | (0.01) | | | (0.12) | |

| Other Comprehensive Income (Loss): | | | | | | | |

| Unrealized gains (losses) on fixed maturity securities: | | | | | | | |

| Unrealized holding gains (losses) arising during period | (1,564) | | | 15,128 | | | (25,706) | | | 52,707 | |

| Reclassification adjustment for losses (gains) included in net income (loss) | (102) | | | 2 | | | (91) | | | 46 | |

| Unrealized gains (losses) on fixed maturity securities, net | (1,666) | | | 15,130 | | | (25,797) | | | 52,753 | |

| Income tax expense (benefit) on unrealized gains (losses) on fixed maturity securities | (271) | | | 1,020 | | | (32) | | | 4,067 | |

| Other comprehensive income (loss) | (1,395) | | | 14,110 | | | (25,765) | | | 48,686 | |

| Total comprehensive income (loss) | $ | (4,194) | | | 6,195 | | | (27,115) | | | 36,160 | |

See accompanying Notes to Consolidated Financial Statements.

September 30, 2021 | 10-Q 4

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Stockholders' Equity

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Common Stock | | Accumulated

deficit | | Accumulated other

comprehensive

income (loss) | | Treasury

stock | | Total

Stock-holders'

equity |

| (In thousands) | Class A | | Class B | | | | |

| | | | | | | | | | |

| Balance at December 31, 2020 | $ | 262,869 | | | 3,184 | | | (82,352) | | | 128,255 | | | (11,011) | | | 300,945 | |

| Comprehensive income (loss): | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | (3,573) | | | — | | | — | | | (3,573) | |

| Unrealized investment gains (losses), net | — | | | — | | | — | | | (56,518) | | | — | | | (56,518) | |

| Total comprehensive income (loss) | — | | | — | | | (3,573) | | | (56,518) | | | — | | | (60,091) | |

| Stock-based compensation | (14) | | | — | | | — | | | — | | | — | | | (14) | |

| Balance at March 31, 2021 | 262,855 | | | 3,184 | | | (85,925) | | | 71,737 | | | (11,011) | | | 240,840 | |

| Comprehensive income (loss): | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | 5,022 | | | — | | | — | | | 5,022 | |

| Unrealized investment gains (losses), net | — | | | — | | | — | | | 32,148 | | | — | | | 32,148 | |

| Total comprehensive income (loss) | — | | | — | | | 5,022 | | | 32,148 | | | — | | | 37,170 | |

| Acquisition of treasury stock | — | | | — | | | — | | | — | | | (9,090) | | | (9,090) | |

| Stock-based compensation | 205 | | | — | | | — | | | — | | | — | | | 205 | |

| Balance at June 30, 2021 | 263,060 | | | 3,184 | | | (80,903) | | | 103,885 | | | (20,101) | | | 269,125 | |

| Comprehensive income (loss): | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | (2,799) | | | — | | | — | | | (2,799) | |

| Unrealized investment gains (losses), net | — | | | — | | | — | | | (1,395) | | | — | | | (1,395) | |

| Total comprehensive income (loss) | — | | | — | | | (2,799) | | | (1,395) | | | — | | | (4,194) | |

| Stock-based compensation | 100 | | | — | | | — | | | — | | | — | | | 100 | |

| Balance at September 30, 2021 | $ | 263,160 | | | 3,184 | | | (83,702) | | | 102,490 | | | (20,101) | | | 265,031 | |

See accompanying Notes to Consolidated Financial Statements.

September 30, 2021 | 10-Q 5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES |

| Consolidated Statements of Stockholders' Equity, Continued |

| (Unaudited) |

| | | | | | | | | | | |

| | Common Stock | | Accumulated

deficit | | Accumulated other

comprehensive

income (loss) | | Treasury

stock | | Total

Stock-holders'

equity |

| (In thousands) | Class A | | Class B | | | | |

| | | | | | | | | | |

| Balance at December 31, 2019 | $ | 261,515 | | | 3,184 | | | (70,969) | | | 77,117 | | | (11,011) | | | 259,836 | |

| Accounting standards adopted January 1, 2020 | — | | | — | | | (395) | | | — | | | — | | | (395) | |

| Comprehensive income (loss): | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | (3,584) | | | — | | | — | | | (3,584) | |

| Unrealized investment gains (losses), net | — | | | — | | | — | | | (40,070) | | | — | | | (40,070) | |

| Total comprehensive income (loss) | — | | | — | | | (3,584) | | | (40,070) | | | — | | | (43,654) | |

| Stock-based compensation | (53) | | | — | | | — | | | — | | | — | | | (53) | |

| Balance at March 31, 2020 | 261,462 | | | 3,184 | | | (74,948) | | | 37,047 | | | (11,011) | | | 215,734 | |

| Comprehensive income (loss): | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | (1,027) | | | — | | | — | | | (1,027) | |

| Unrealized investment gains (losses), net | — | | | — | | | — | | | 74,647 | | | — | | | 74,647 | |

| Total comprehensive income (loss) | — | | | — | | | (1,027) | | | 74,647 | | | — | | | 73,620 | |

| Stock-based compensation | 439 | | | — | | | — | | | — | | | — | | | 439 | |

| Balance at June 30, 2020 | 261,901 | | | 3,184 | | | (75,975) | | | 111,694 | | | (11,011) | | | 289,793 | |

| Comprehensive income (loss): | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | (7,915) | | | — | | | — | | | (7,915) | |

| Unrealized investment gains (losses), net | — | | | — | | | — | | | 14,110 | | | — | | | 14,110 | |

| Total comprehensive income (loss) | — | | | — | | | (7,915) | | | 14,110 | | | — | | | 6,195 | |

| Stock-based compensation | 766 | | | — | | | — | | | — | | | — | | | 766 | |

| Balance at September 30, 2020 | $ | 262,667 | | | 3,184 | | | (83,890) | | | 125,804 | | | (11,011) | | | 296,754 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

See accompanying Notes to Consolidated Financial Statements.

September 30, 2021 | 10-Q 6

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

Nine Months Ended September 30, (In thousands) | 2021 | | 2020 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (1,350) | | | (12,526) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Realized investment (gains) losses on sale of investments and other assets | (7,277) | | | (669) | |

| Net deferred policy acquisition costs | 1,502 | | | 5,308 | |

| Amortization of cost of insurance acquired | 959 | | | 1,228 | |

| Depreciation | 954 | | | 771 | |

| Amortization of premiums and discounts on investments | 4,065 | | | 6,616 | |

| Stock-based compensation | 406 | | | 2,020 | |

| Deferred federal income tax expense (benefit) | (370) | | | (386) | |

| Change in: | | | |

| Accrued investment income | 512 | | | 1,133 | |

| Reinsurance recoverable | (7,971) | | | (8,274) | |

| Due premiums | 1,940 | | | 1,434 | |

| Future policy benefit reserves | 22,292 | | | 21,654 | |

| Other policyholders' liabilities | 20,668 | | | 15,364 | |

| Federal income tax payable | 1,855 | | | 3,165 | |

| Commissions payable and other liabilities | (14,342) | | | 145 | |

| Other, net | (73) | | | (2,967) | |

| Net cash provided by (used in) operating activities | 23,770 | | | 34,016 | |

| Cash flows from investing activities: | | | |

| Purchases of fixed maturity securities, available-for-sale | (62,809) | | | (187,267) | |

| Sales of fixed maturity securities, available-for-sale | 8,238 | | | 17,524 | |

| Maturities and calls of fixed maturity securities, available-for-sale | 40,395 | | | 154,873 | |

| Purchases of equity securities | — | | | (4,473) | |

| Principal payments on mortgage loans | 7 | | | 9 | |

| Funding of mortgage loans | (1,000) | | | — | |

| (Increase) decrease in policy loans, net | 3,216 | | | (1,957) | |

| Sales of other long-term investments and real estate | 20,893 | | | — | |

| Purchases of other long-term investments | (27,514) | | | (19,115) | |

| Sales of property and equipment | 14 | | | — | |

| Purchases of property and equipment | (847) | | | (124) | |

| Maturities of short-term investments | — | | | 1,300 | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) investing activities | (19,407) | | | (39,230) | |

| | | |

| See accompanying Notes to Consolidated Financial Statements. |

September 30, 2021 | 10-Q 7

| | | | | | | | | | | |

| CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES |

| Consolidated Statements of Cash Flows, Continued |

| (Unaudited) |

| | | |

| | | |

Nine Months Ended September 30, (In thousands) | 2021 | | 2020 |

| Cash flows from financing activities: | | | |

| Annuity deposits | $ | 6,901 | | | 5,542 | |

| Annuity withdrawals | (5,855) | | | (3,403) | |

| Acquisition of treasury stock | (9,090) | | | — | |

| Other | (363) | | | (869) | |

| Net cash provided by (used in) financing activities | (8,407) | | | 1,270 | |

| Net increase (decrease) in cash and cash equivalents | (4,044) | | | (3,944) | |

| Cash and cash equivalents at beginning of year | 34,131 | | | 46,205 | |

| Cash and cash equivalents at end of period | $ | 30,087 | | | 42,261 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES:

During the nine months ended September 30, 2021 and 2020, various fixed maturity issuers exchanged securities with book values of $10.9 million and $5.3 million, respectively, for securities of equal value.

The Company had $9.4 million net unsettled security trades at September 30, 2021 and $6.0 million at September 30, 2020.

The Company recognized right-of-use assets of $12.0 million in exchange for new operating lease liabilities during the nine months ended September 30, 2020. None were recognized during the nine months ended September 30, 2021.

See accompanying Notes to Consolidated Financial Statements.

September 30, 2021 | 10-Q 8

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

(1) FINANCIAL STATEMENTS

BASIS OF PRESENTATION AND CONSOLIDATION

The consolidated financial statements include the accounts and operations of Citizens, Inc. ("Citizens" or the "Company"), a Colorado corporation, and its wholly-owned subsidiaries, CICA Life Insurance Company of America ("CICA"), CICA Life Ltd. ("CICA Ltd."), Citizens National Life Insurance Company ("CNLIC"), Security Plan Life Insurance Company ("SPLIC"), Security Plan Fire Insurance Company ("SPFIC"), Magnolia Guaranty Life Insurance Company ("MGLIC") and Computing Technology, Inc. ("CTI"). All significant inter-company accounts and transactions have been eliminated. Citizens and its wholly-owned subsidiaries are collectively referred to as the "Company", "we", "us" or "our".

The consolidated balance sheets as of September 30, 2021, the consolidated statements of operations and comprehensive income (loss) and stockholders' equity for the three and nine months ended September 30, 2021 and September 30, 2020 and the consolidated statements of cash flows for the nine months ended September 30, 2021 and September 30, 2020 have been prepared by the Company without audit and are not subject to audit. In the opinion of management, all normal and recurring adjustments to present fairly the financial position, results of operations, and changes in cash flows at September 30, 2021 and for comparative periods have been made. The consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") for interim financial information and with the instructions to Form 10-Q adopted by the Securities and Exchange Commission ("SEC"). Accordingly, the consolidated financial statements do not include all the information and footnotes required for complete financial statements and should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2020 ("Form 10-K"). Operating results for the interim periods disclosed herein are not necessarily indicative of the results that may be expected for a full year or any future period.

Our Life Insurance segment operates through CICA Ltd., CICA and CNLIC. Our international life insurance business, which operates through CICA Ltd., issues U.S. dollar-denominated endowment contracts internationally, which are principally accumulation contracts that incorporate an element of life insurance protection and ordinary whole life insurance in U.S. dollar-denominated amounts sold to non-U.S. residents. These contracts are designed to provide a fixed amount of insurance coverage over the life of the insured and may utilize rider benefits to provide additional increasing or decreasing coverage and annuity benefits to enhance accumulations. Our domestic life insurance business, which operates through CICA and CNLIC, primarily focused on living needs and provided benefits toward accumulating financial benefits for the policyowners throughout the Midwest and southern U.S. until they ceased most domestic sales beginning January 1, 2017. We have recently developed a whole life insurance product and have begun selling this product in Florida in 2021.

Our Home Service Insurance segment operates through our subsidiaries SPLIC, MGLIC and SPFIC, and focuses on the life insurance needs of the middle- and lower-income markets, primarily in Louisiana, Mississippi and Arkansas. Our products in this segment consist primarily of small face amount ordinary whole life, industrial life and pre-need policies, which are designed to fund final expenses for the insured, primarily consisting of funeral and burial costs as well as property insurance policies, which are named peril property policies covering dwelling and contents.

CTI provides data processing systems and services to the Company.

We converted the small block of ordinary whole life policies of CNLIC from a legacy platform to our new actuarial valuation software solution which provides enhanced modeling capabilities as of April 1, 2021. The impact of this system conversion reflected in the accompanying consolidated financial statements as of and for the nine months ended September 30, 2021 was an increase to pretax income of $0.7 million consisting of a reduced increase in future policy benefit reserves of $0.8 million and increased amortization of deferred policy acquisition costs of $0.1 million.

September 30, 2021 | 10-Q 9

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

USE OF ESTIMATES

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant estimates include those used in the evaluation of credit allowances on fixed maturity securities, actuarially determined assets and liabilities and assumptions, tests of goodwill impairment and valuation allowance on deferred tax assets. Certain of these estimates are particularly sensitive to market conditions, and deterioration and/or volatility in the worldwide debt or equity markets could have a material impact on the consolidated financial statements.

SIGNIFICANT ACCOUNTING POLICIES

For a description of our significant accounting policies, see Part IV, Item 15, Note 1. Summary of Significant Accounting Policies in the notes to our consolidated financial statements included in our Form 10-K, which should be read in conjunction with these accompanying consolidated financial statements.

(2) ACCOUNTING PRONOUNCEMENTS

ACCOUNTING STANDARDS RECENTLY ADOPTED

In June 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2016-13, Financial Instruments-Credit Losses (Topic 326), with the main objective to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments and other commitments to extend credit held by a reporting entity at each reporting date. The ASU requires a financial asset (or a group of financial assets) measured at amortized cost to be presented at the net amount expected to be collected. The allowance for credit losses is a valuation account that is deducted from the amortized cost of the financial asset(s) to present the net carrying value at the amount expected to be collected on the financial asset. The income statement reflects the measurement of credit losses for newly recognized financial assets, as well as the increases or decreases of expected credit losses that have taken place during the period. Credit losses on available-for-sale ("AFS") fixed maturity securities should be measured in a manner similar to current U.S. GAAP; however, the credit losses are recorded through an allowance for credit losses rather than as a write-down. This approach is an improvement to prior U.S. GAAP because an entity will be able to record reversals of credit losses (in situations in which the estimate of credit losses declines) in current period net income, which in turn should align the income statement recognition of credit losses with the reporting period in which changes occur. Prior U.S. GAAP prohibited reflecting those improvements in current-period earnings. The Company adopted this standard effective January 1, 2020 using the modified retrospective approach. The adoption resulted in an increase in accumulated deficit of $0.4 million related to agents' debit balance collectability.

September 30, 2021 | 10-Q 10

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

ACCOUNTING STANDARDS NOT YET ADOPTED

In August 2018, the FASB issued ASU No. 2018-12, Financial Services-Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts. This ASU amends four key areas of the accounting and impacts disclosures for long-duration insurance and investment contracts:

•Requires updated assumptions for liability measurement. Assumptions used to measure the liability for traditional insurance contracts, which are typically determined at contract inception, will now be reviewed at least annually, and, if there is a change, updated, with the effect recorded in net income;

•Standardizes the liability discount rate. The liability discount rate will be a market-observable discount rate (upper-medium grade fixed-income instrument yield), with the effect of rate changes recorded in other comprehensive income;

•Provides greater consistency in measurement of market risk benefits. The two previous measurement models have been reduced to one measurement model (fair value), resulting in greater uniformity across similar market-based benefits and better alignment with the fair value measurement of derivatives used to hedge capital market risk;

•Simplifies amortization of deferred acquisition costs ("DAC"). Previous earnings-based amortization methods have been replaced with a more level amortization basis; and

•Requires enhanced disclosures. The new disclosures include rollforwards and information about significant assumptions and the effects of changes in those assumptions.

For calendar-year public companies, the changes will be effective on January 1, 2023, however, early adoption is permitted. While it is not possible to estimate the expected impact of adoption at this time, the Company believes there is a reasonable possibility that implementation of ASU No. 2018-12 may result in a material impact on our consolidated statements of stockholders' equity and future earnings patterns.

No other new accounting pronouncement issued or effective during the year had, or is expected to have, a material impact on our consolidated financial statements.

(3) SEGMENT INFORMATION

The Company has two reportable segments: Life Insurance and Home Service Insurance.

Our Life Insurance segment primarily issues endowment contracts, which are principally accumulation contracts that incorporate an element of life insurance protection and ordinary whole life insurance, to non-U.S. residents through CICA Ltd. These contracts are designed to provide a fixed amount of insurance coverage over the life of the insured and may utilize rider benefits to provide additional coverage and annuity benefits to enhance accumulations. CICA and CNLIC issued ordinary whole life, credit life and disability and accident and health related policies, throughout the Midwest and southern U.S. until they ceased most domestic sales beginning January 1, 2017. We restarted marketing domestically in Florida in 2021.

Our Home Service Insurance segment operates through our subsidiaries SPLIC, MGLIC and SPFIC, and focuses on the life insurance needs of the middle- and lower-income markets in Louisiana, Mississippi and Arkansas. Our policies are sold and serviced through funeral homes and independent agents who sell policies, collect premiums and service policyholders. To a lesser extent, our Home Service Insurance segment also sells property insurance policies in Louisiana.

The Company also operates other non-insurance portions of the Company ("Other Non-Insurance Enterprises"), which primarily include the Company’s IT and Corporate-support functions that are included in the tables presented. The Company's Other Non-Insurance Enterprises are the only reportable difference between segments and consolidated operations.

September 30, 2021 | 10-Q 11

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

The accounting policies of the reportable segments and Other Non-Insurance Enterprises are presented in accordance with U.S. GAAP and are the same as those used in the preparation of the consolidated financial statements. The Company evaluates profit and loss performance based on U.S. GAAP income before federal income taxes for its two reportable segments.

| | | | | | | | | | | | | | | | | | | | | | | |

| Life Insurance | | Home Service Insurance | | Other Non-Insurance Enterprises | | Consolidated |

| Three Months Ended September 30, 2021 | | | |

| (In thousands) | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Premiums | $ | 32,198 | | | 11,129 | | | — | | | 43,327 | |

| Net investment income | 11,991 | | | 3,238 | | | 225 | | | 15,454 | |

| Realized investment gains (losses), net | 1,205 | | | (36) | | | 957 | | | 2,126 | |

| Other income | 676 | | | 1 | | | — | | | 677 | |

| Total revenues | 46,070 | | | 14,332 | | | 1,182 | | | 61,584 | |

| Benefits and expenses: | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | |

| Claims and surrenders | 22,565 | | | 9,251 | | | — | | | 31,816 | |

| Increase in future policy benefit reserves | 9,369 | | | 1,519 | | | — | | | 10,888 | |

| Policyholders' dividends | 1,638 | | | 12 | | | — | | | 1,650 | |

| Total insurance benefits paid or provided | 33,572 | | | 10,782 | | | — | | | 44,354 | |

| Commissions | 4,854 | | | 4,261 | | | — | | | 9,115 | |

| Other general expenses | 4,900 | | | 4,146 | | | 1,496 | | | 10,542 | |

| Capitalization of deferred policy acquisition costs | (4,201) | | | (1,825) | | | — | | | (6,026) | |

| Amortization of deferred policy acquisition costs | 5,191 | | | 852 | | | — | | | 6,043 | |

| Amortization of cost of insurance acquired | 68 | | | 215 | | | — | | | 283 | |

| Total benefits and expenses | 44,384 | | | 18,431 | | | 1,496 | | | 64,311 | |

| Income (loss) before federal income tax expense | $ | 1,686 | | | (4,099) | | | (314) | | | (2,727) | |

September 30, 2021 | 10-Q 12

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Life Insurance | | Home Service Insurance | | Other Non-Insurance Enterprises | | Consolidated |

| Nine Months Ended September 30, 2021 | | | |

| (In thousands) | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Premiums | $ | 89,399 | | | 35,786 | | | — | | | 125,185 | |

| Net investment income | 35,468 | | | 9,826 | | | 724 | | | 46,018 | |

| Realized investment gains (losses), net | 5,741 | | | 393 | | | 1,143 | | | 7,277 | |

| Other income | 2,142 | | | 3 | | | — | | | 2,145 | |

| Total revenues | 132,750 | | | 46,008 | | | 1,867 | | | 180,625 | |

| Benefits and expenses: | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | |

| Claims and surrenders | 69,366 | | | 22,335 | | | — | | | 91,701 | |

| Increase in future policy benefit reserves | 17,081 | | | 5,326 | | | — | | | 22,407 | |

| Policyholders' dividends | 4,400 | | | 31 | | | — | | | 4,431 | |

| Total insurance benefits paid or provided | 90,847 | | | 27,692 | | | — | | | 118,539 | |

| Commissions | 13,483 | | | 12,590 | | | — | | | 26,073 | |

| Other general expenses | 15,273 | | | 12,024 | | | 6,130 | | | 33,427 | |

| Capitalization of deferred policy acquisition costs | (11,578) | | | (5,220) | | | — | | | (16,798) | |

| Amortization of deferred policy acquisition costs | 15,739 | | | 2,561 | | | — | | | 18,300 | |

| Amortization of cost of insurance acquired | 279 | | | 680 | | | — | | | 959 | |

| Total benefits and expenses | 124,043 | | | 50,327 | | | 6,130 | | | 180,500 | |

| Income (loss) before federal income tax expense | $ | 8,707 | | | (4,319) | | | (4,263) | | | 125 | |

September 30, 2021 | 10-Q 13

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Life Insurance | | Home Service Insurance | | Other Non-Insurance Enterprises | | Consolidated |

| Three Months Ended September 30, 2020 | | | |

| (In thousands) | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Premiums | $ | 32,265 | | | 11,843 | | | — | | | 44,108 | |

| Net investment income | 11,507 | | | 3,200 | | | 290 | | | 14,997 | |

| Realized investment gains (losses), net | 133 | | | 388 | | | 6 | | | 527 | |

| Other income | 189 | | | 1 | | | 3 | | | 193 | |

| Total revenues | 44,094 | | | 15,432 | | | 299 | | | 59,825 | |

| Benefits and expenses: | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | |

| Claims and surrenders | 25,023 | | | 7,935 | | | — | | | 32,958 | |

| Increase in future policy benefit reserves | 3,274 | | | 884 | | | — | | | 4,158 | |

| Policyholders' dividends | 1,443 | | | 7 | | | — | | | 1,450 | |

| Total insurance benefits paid or provided | 29,740 | | | 8,826 | | | — | | | 38,566 | |

| Commissions | 4,140 | | | 3,572 | | | — | | | 7,712 | |

| Other general expenses | 1,915 | | | 4,524 | | | 12,952 | | | 19,391 | |

| Capitalization of deferred policy acquisition costs | (3,512) | | | (1,380) | | | — | | | (4,892) | |

| Amortization of deferred policy acquisition costs | 6,190 | | | 570 | | | — | | | 6,760 | |

| Amortization of cost of insurance acquired | 113 | | | 346 | | | — | | | 459 | |

| Total benefits and expenses | 38,586 | | | 16,458 | | | 12,952 | | | 67,996 | |

| Income (loss) before federal income tax expense | $ | 5,508 | | | (1,026) | | | (12,653) | | | (8,171) | |

September 30, 2021 | 10-Q 14

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Life Insurance | | Home Service Insurance | | Other Non-Insurance Enterprises | | Consolidated |

| Nine Months Ended September 30, 2020 | | | |

| (In thousands) | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Premiums | $ | 92,146 | | | 34,775 | | | — | | | 126,921 | |

| Net investment income | 34,332 | | | 9,788 | | | 961 | | | 45,081 | |

| Realized investment gains (losses), net | 1,259 | | | (405) | | | (185) | | | 669 | |

| Other income | 1,195 | | | 19 | | | 3 | | | 1,217 | |

| Total revenues | 128,932 | | | 44,177 | | | 779 | | | 173,888 | |

| Benefits and expenses: | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | |

| Claims and surrenders | 66,071 | | | 21,090 | | | — | | | 87,161 | |

| Increase in future policy benefit reserves | 18,804 | | | 3,062 | | | — | | | 21,866 | |

| Policyholders' dividends | 3,987 | | | 24 | | | — | | | 4,011 | |

| Total insurance benefits paid or provided | 88,862 | | | 24,176 | | | — | | | 113,038 | |

| Commissions | 11,912 | | | 10,367 | | | — | | | 22,279 | |

| Other general expenses | 11,309 | | | 13,431 | | | 17,263 | | | 42,003 | |

| Capitalization of deferred policy acquisition costs | (10,149) | | | (3,483) | | | — | | | (13,632) | |

| Amortization of deferred policy acquisition costs | 16,927 | | | 2,013 | | | — | | | 18,940 | |

| Amortization of cost of insurance acquired | 358 | | | 870 | | | — | | | 1,228 | |

| Total benefits and expenses | 119,219 | | | 47,374 | | | 17,263 | | | 183,856 | |

| Income (loss) before federal income tax expense | $ | 9,713 | | | (3,197) | | | (16,484) | | | (9,968) | |

September 30, 2021 | 10-Q 15

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

(4) STOCKHOLDERS' EQUITY AND RESTRICTIONS

EARNINGS PER SHARE

The following tables set forth the computation of basic and diluted earnings (loss) per share.

| | | | | | | | | | | |

| | | |

| Three Months Ended September 30, | 2021 | | 2020 |

| (In thousands, except per share amounts) | |

| | | |

| Basic and diluted earnings (loss) per share: | | | |

| Numerator: | | | |

| Net income (loss) | $ | (2,799) | | | (7,915) | |

| Net income (loss) allocated to Class A common stock | $ | (2,799) | | | (7,836) | |

| Net income (loss) allocated to Class B common stock | — | | | (79) | |

| Net income (loss) | $ | (2,799) | | | (7,915) | |

| | | |

| Denominator: | | | |

| Weighted average shares of Class A outstanding - basic | 49,630 | | | 49,437 | |

| Weighted average shares of Class A outstanding - diluted | 50,263 | | | 49,832 | |

| Weighted average shares of Class B outstanding - basic and diluted | — | | | 1,002 | |

| Basic and diluted earnings (loss) per share of Class A common stock | $ | (0.06) | | | (0.16) | |

| Basic and diluted earnings (loss) per share of Class B common stock | — | | | (0.07) | |

| | | | | | | | | | | |

| Nine Months Ended September 30, | 2021 | | 2020 |

| (In thousands, except per share amounts) | |

| Basic and diluted earnings (loss) per share: | | | |

| Numerator: | | | |

| Net income (loss) | $ | (1,350) | | | (12,526) | |

| Net income (loss) allocated to Class A common stock | $ | (1,345) | | | (12,401) | |

| Net income (loss) allocated to Class B common stock | (5) | | | (125) | |

| Net income (loss) | $ | (1,350) | | | (12,526) | |

| | | |

| Denominator: | | | |

| Weighted average shares of Class A outstanding - basic | 49,594 | | | 49,365 | |

| Weighted average shares of Class A outstanding - diluted | 50,226 | | | 49,760 | |

| Weighted average shares of Class B outstanding - basic and diluted | 401 | | | 1,002 | |

| Basic and diluted earnings (loss) per share of Class A common stock | $ | (0.03) | | | (0.25) | |

| Basic and diluted earnings (loss) per share of Class B common stock | (0.01) | | | (0.12) | |

CAPITAL AND SURPLUS

Each of our regulated insurance subsidiaries is required to meet stipulated regulatory capital requirements. These include capital requirements imposed by the U.S. National Association of Insurance Commissioners ("NAIC") and the Bermuda Monetary Authority ("BMA"). All insurance subsidiaries exceeded the minimum capital requirements at September 30, 2021.

September 30, 2021 | 10-Q 16

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

In order to minimize the risk of a shortfall in capital arising from an unexpected adverse deviation or excess risk, the BMA has established a threshold capital level (termed the Target Capital Level ("TCL")), which is set at 120% of a company’s enhanced capital requirement. The TCL serves as an early warning tool for the BMA. As of September 30, 2021, CICA Ltd. was above the TCL threshold. At the request of the BMA, on April 15, 2021, Citizens and CICA Ltd. entered into a Keep Well Agreement. The Keep Well Agreement requires Citizens to contribute up to $10 million in capital to CICA Ltd. as necessary to ensure that CICA Ltd. has a minimum capital level of 120% (equal to the TCL). Since CICA Ltd.’s capital level currently exceeds 120%, Citizens is not currently required to make a capital contribution.

(5) INVESTMENTS

The Company invests primarily in fixed maturity securities, which totaled 89.7% of total cash and invested assets at September 30, 2021, as shown below.

| | | | | | | | | | | | | | | | | | | | | | | |

Carrying Value (In thousands, except for %) | September 30, 2021 | | December 31, 2020 |

| Amount | | % | | Amount | | % |

| | | | | | | |

| Cash and invested assets: | | | | | | | |

| Fixed maturity securities | $ | 1,456,694 | | | 89.7 | % | | 1,489,383 | | | 89.8 | % |

| Equity securities | 22,335 | | | 1.4 | % | | 22,102 | | | 1.3 | % |

| Policy loans | 80,102 | | | 4.9 | % | | 83,318 | | | 5.0 | % |

| Real estate and other long-term investments | 34,013 | | | 2.1 | % | | 29,865 | | | 1.8 | % |

| | | | | | | |

| Cash and cash equivalents | 30,087 | | | 1.9 | % | | 34,131 | | | 2.1 | % |

| | | | | | | |

| Total cash and invested assets | $ | 1,623,231 | | | 100.0 | % | | 1,658,799 | | | 100.0 | % |

The following tables represent the amortized cost, gross unrealized gains and losses and fair value of fixed maturity securities as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | |

| Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value |

| September 30, 2021 | | | |

| (In thousands) | | | |

| | | | | | | |

| Fixed maturity securities: | | | | | | | |

| Available-for-sale: | | | | | | | |

| U.S. Treasury securities | $ | 7,257 | | | 1,078 | | | — | | | 8,335 | |

| U.S. Government-sponsored enterprises | 3,470 | | | 1,045 | | | — | | | 4,515 | |

| States and political subdivisions | 353,653 | | | 29,186 | | | 517 | | | 382,322 | |

| Corporate: | | | | | | | |

| Financial | 203,997 | | | 22,774 | | | 120 | | | 226,651 | |

| Consumer | 212,805 | | | 23,842 | | | 787 | | | 235,860 | |

| Energy | 79,442 | | | 8,147 | | | 89 | | | 87,500 | |

| All other | 300,594 | | | 31,884 | | | 1,147 | | | 331,331 | |

| | | | | | | |

| Residential mortgage-backed | 117,845 | | | 16,681 | | | 4 | | | 134,522 | |

| Asset-backed | 45,143 | | | 413 | | | 10 | | | 45,546 | |

| Foreign governments | 101 | | | 11 | | | — | | | 112 | |

| Total fixed maturity securities | $ | 1,324,307 | | | 135,061 | | | 2,674 | | | 1,456,694 | |

September 30, 2021 | 10-Q 17

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value |

| December 31, 2020 | | | |

| (In thousands) | | | |

| |

| Fixed maturity securities: | | | | | | | |

| Available-for-sale: | | | | | | | |

| U.S. Treasury securities | $ | 9,529 | | | 1,797 | | | — | | | 11,326 | |

| U.S. Government-sponsored enterprises | 3,490 | | | 1,301 | | | — | | | 4,791 | |

| States and political subdivisions | 377,462 | | | 32,751 | | | 548 | | | 409,665 | |

| Corporate: | | | | | | | |

| Financial | 204,160 | | | 31,000 | | | 13 | | | 235,147 | |

| Consumer | 196,648 | | | 30,116 | | | 245 | | | 226,519 | |

| Energy | 81,223 | | | 8,174 | | | 536 | | | 88,861 | |

| All other | 284,209 | | | 42,554 | | | 82 | | | 326,681 | |

| Commercial mortgage-backed | 225 | | | — | | | 4 | | | 221 | |

| Residential mortgage-backed | 118,144 | | | 21,819 | | | — | | | 139,963 | |

| Asset-backed | 46,295 | | | 278 | | | 482 | | | 46,091 | |

| Foreign governments | 102 | | | 16 | | | — | | | 118 | |

| Total fixed maturity securities | $ | 1,321,487 | | | 169,806 | | | 1,910 | | | 1,489,383 | |

Most of the Company's equity securities are diversified stock and bond mutual funds.

| | | | | | | | | | | |

Fair Value (In thousands) | September 30, 2021 | | December 31, 2020 |

| | | |

| Equity securities: | | | |

| Stock mutual funds | $ | 3,407 | | | 3,174 | |

| Bond mutual funds | 12,512 | | | 12,354 | |

| Common stock | 1,072 | | | 1,143 | |

| Non-redeemable preferred stock | 272 | | | 281 | |

| Non-redeemable preferred stock fund | 5,072 | | | 5,150 | |

| Total equity securities | $ | 22,335 | | | 22,102 | |

VALUATION OF INVESTMENTS

Available-for-sale securities are reported in the consolidated financial statements at fair value. Equity securities are measured at fair value with the change in fair value recorded through net income. The Company recognized net realized losses of $0.4 million and net realized gains of $0.2 million on equity securities held for the three and nine months ended September 30, 2021 and gains of $0.4 million and $0.6 million for the same periods ended September 30, 2020.

The Company considers several factors in its review and evaluation of individual investments, using the process described in Part IV, Item 15, Note 2. Investments in the notes to the consolidated financial statements of our Form 10-K to determine whether a credit loss impairment exists. For the three and nine months ended September 30, 2021 and 2020, the Company recorded no credit valuation losses on fixed maturity securities.

September 30, 2021 | 10-Q 18

| | | | | | | | |

CITIZENS, INC. | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| | (Unaudited) |

The following tables present the fair values and gross unrealized losses of fixed maturity securities that are not deemed to have credit losses, aggregated by investment category and length of time that individual securities have been in a continuous loss position at September 30, 2021 and December 31, 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2021 | Less than 12 months | Greater than 12 months | Total |

| (In thousands, except for # of securities) | Fair

Value | Unrealized

Losses | # of

Securities | Fair

Value | Unrealized

Losses | # of

Securities | Fair

Value | Unrealized

Losses | # of

Securities |

| | | | | | | | | |

| Fixed maturity securities: | | | | | | | | |

| Available-for-sale securities: | | | | | | | | | |

| U.S. Treasury securities | $ | 72 | | — | | 2 | | $ | — | | — | | — | | $ | 72 | | — | | 2 | |

| States and political subdivisions | 22,636 | | 517 | | 17 | | — | | — | | — | | 22,636 | | 517 | | 17 | |

| Corporate: | | | | | | | | | |

| Financial | 3,264 | | 24 | | 7 | | 1,219 | | 96 | | 1 | | 4,483 | | 120 | | 8 | |

| Consumer | 26,204 | | 651 | | 28 | | 2,410 | | 136 | | 1 | | 28,614 | | 787 | | 29 | |

| Energy | 6,778 | | 89 | | 8 | | — | | — | | — | | 6,778 | | 89 | | 8 | |

| All Other | 32,946 | | 1,147 | | 29 | | — | | — | | — | | 32,946 | | 1,147 | | 29 | |

| | | | | | | | | |

| Residential mortgage-backed | 1,009 | | 4 | | 5 | | — | | — | | — | | 1,009 | | 4 | | 5 | |

| Asset-backed | 9,215 | | 9 | | 14 | | 664 | | 1 | | 1 | | 9,879 | | 10 | | 15 | |

| | | | | | | | | |

| Total fixed maturity securities | $ | 102,124 | | 2,441 | | 110 | | $ | 4,293 | | 233 | | 3 | | $ | 106,417 | | 2,674 | | 113 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2020 | Less than 12 months | Greater than 12 months | Total |

| (In thousands, except for # of securities) | Fair

Value | Unrealized

Losses | # of

Securities | Fair

Value | Unrealized

Losses | # of

Securities | Fair

Value | Unrealized

Losses | # of

Securities |

| | | | | | | | | |

| Fixed maturity securities: | | | | | | | | |

| Available-for-sale securities: | | | | | | | | | |

| | | | | | | | | |

| States and political subdivisions | $ | 32,487 | | 548 | | 27 | | $ | — | | — | | — | | $ | 32,487 | | 548 | | 27 | |

| Corporate: | | | | | | | | | |

| Financial | 1,308 | | 13 | | 1 | | — | | — | | — | | 1,308 | | 13 | | 1 | |

| Consumer | 10,740 | | 230 | | 5 | | 1,667 | | 15 | | 1 | | 12,407 | | 245 | | 6 | |

| Energy | 6,350 | | 536 | | 8 | | — | | — | | — | | 6,350 | | 536 | | 8 | |

| All Other | 9,418 | | 82 | | 11 | | — | | — | | — | | 9,418 | | 82 | | 11 | |

| Commercial mortgage-backed | 221 | | 4 | | 1 | | — | | — | | — | | 221 | | 4 | | 1 | |

| Residential mortgage-backed | 83 | | — | | 1 | | — | | — | | — | | 83 | | — | | 1 | |

| Asset-backed | 26,353 | | 481 | | 26 | | 994 | | 1 | | 1 | | 27,347 | | 482 | | 27 | |

| Total fixed maturity securities | $ | 86,960 | | 1,894 | | 80 | | $ | 2,661 | | 16 | | 2 | | $ | 89,621 | | 1,910 | | 82 | |

In each category of our fixed maturity securities described above, we do not intend to sell our investments and it is not more likely than not that the Company will be required to sell the investments before recovery of their amortized cost bases.