Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-11350

CONSOLIDATED-TOMOKA LAND CO.

(Exact name of registrant as specified in its charter)

| Florida | 59-0483700 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1530 Cornerstone Boulevard, Suite 100 Daytona Beach, Florida |

32117 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s Telephone Number, including area code

(386) 274-2202

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

| Title of each class |

Name of each exchange on which registered | |

| COMMON STOCK, $1 PAR VALUE | NYSE Amex |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

NONE

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (S232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (S229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Smaller reporting company ¨ | Accelerated filer x | Non-accelerated filer ¨ |

(Do not check if smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the shares of common stock held by non-affiliates of the registrant at June 30, 2011, was approximately $159,763,448.

The number of shares of the registrant’s Common Stock outstanding on March 11, 2012 was 5,830,759.

Portions of the registrant’s Proxy Statement for the 2012 Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2011, are incorporated by reference in Part III of this report.

Table of Contents

“Safe Harbor”

Certain statements contained in this Form 10-K (other than statements of historical fact) are forward-looking statements. The words “believe,” “estimate,” “expect,” “intend,” “anticipate,” “will,” “could,” “may,” “should,” “plan,” “potential,” “predict,” “forecast,” “foresee,” “project,” and similar expressions and variations thereof identify certain of such forward-looking statements, which speak only as of the dates on which they were made. Forward-looking statements are made based upon management’s expectations and beliefs concerning future developments and their potential effect upon the Company. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on the Company will be those anticipated by management.

The Company wishes to caution readers that the assumptions which form the basis for forward-looking statements with respect to or that may impact earnings for the year ended December 31, 2012, and thereafter, include many factors that are beyond the Company’s ability to control or estimate precisely. These risks and uncertainties include the risk factors set forth in Item 1A.

While the Company periodically reassesses material trends and uncertainties affecting its results of operations and financial condition, the Company does not intend to review or revise any particular forward-looking statement referenced herein in light of future events.

Table of Contents

| Page # | ||||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

7 | |||||

| Item 1B. |

9 | |||||

| Item 2. |

9 | |||||

| Item 3. |

9 | |||||

| Item 4. |

10 | |||||

| PART II | ||||||

| Item 5. |

11 | |||||

| Item 6. |

14 | |||||

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

15 | ||||

| Item 7A. |

23 | |||||

| Item 8. |

23 | |||||

| Item 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

23 | ||||

| Item 9A. |

24 | |||||

| Item 9B. |

24 | |||||

| PART III | ||||||

| Item 10. |

25 | |||||

| Item 11. |

25 | |||||

| Item 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

25 | ||||

| Item 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

27 | ||||

| Item 14. |

27 | |||||

| PART IV | ||||||

| Item 15. |

28 | |||||

| 29 | ||||||

Table of Contents

| ITEM 1. | BUSINESS |

Consolidated-Tomoka Land Co. (which is referred to as the “Company,” “we,” “our,” or “us”) is primarily engaged in real estate, income properties, and golf operations (collectively, the “Real Estate Business”) through its wholly owned subsidiaries. Real estate operations include the ownership of approximately 11,000 acres of land in Daytona Beach, Florida, and the surrounding area. These operations include development, agricultural operations, and the ownership of 490,000 acres of subsurface acres in 20 counties in Florida, for leasing mineral rights for oil and mineral exploration. Income properties primarily consist of the ownership of twenty-five single tenant properties leased on a double and triple-net basis to national tenants, and two local office projects. These operations are predominantly located in Volusia County, Florida, with various income properties located in Florida, Georgia, and North Carolina. Golf operations consist of the operation of LPGA International which is comprised of two 18-hole championship golf courses with an additional three-hole practice academy, a clubhouse facility, and food and beverage activities, which are all leased from the City of Daytona Beach under a long-term lease.

The following is information regarding the Company’s business segments. The “General, Corporate, and Other” category includes general and administrative expenses, income earned on investment securities, and other miscellaneous income and expense items.

| 2011 | 2010 | 2009 | ||||||||||

| (IN THOUSANDS) | ||||||||||||

| Revenues of each segment are as follows: |

||||||||||||

| Real Estate/Agriculture/Subsurface Interests |

$ | 547 | $ | (933 | ) | $ | 2,634 | |||||

| Income Properties |

9,035 | 8,987 | 8,601 | |||||||||

| Golf |

4,661 | 4,474 | 4,724 | |||||||||

| General, Corporate, and Other |

459 | 176 | 231 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 14,702 | $ | 12,704 | $ | 16,190 | |||||||

|

|

|

|

|

|

|

|||||||

| Operating income (loss) from Continuing Operations before income tax for each segment is as follows: |

||||||||||||

| Real Estate/Agriculture/Subsurface Interests |

$ | (3,614 | ) | $ | (2,247 | ) | $ | 1,379 | ||||

| Income Properties |

6,535 | 6,567 | 6,446 | |||||||||

| Golf |

(5,666 | ) | (1,969 | ) | (1,920 | ) | ||||||

| General, Corporate, and Other |

(5,630 | ) | (3,738 | ) | (5,513 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| $ | (8,375 | ) | $ | (1,387 | ) | $ | 392 | |||||

|

|

|

|

|

|

|

|||||||

| Identifiable assets of each segment are as follows: |

||||||||||||

| Real Estate |

$ | 45,314 | $ | 44,568 | $ | 41,255 | ||||||

| Income Properties |

116,944 | 116,329 | 117,551 | |||||||||

| Golf |

2,858 | 6,888 | 7,349 | |||||||||

| General, Corporate, and Other |

5,150 | 9,974 | 10,420 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 170,266 | $ | 177,759 | $ | 176,575 | |||||||

|

|

|

|

|

|

|

|||||||

Identifiable assets by segment are those assets that are used in each segment. General corporate assets and those used in the Company’s other operations consist primarily of cash, investment securities, and property, plant, and equipment.

1

Table of Contents

ITEM 1. BUSINESS (Continued)

BUSINESS PLAN

Since 2000, we have transitioned from primarily a land company to a company balanced between income and land holdings. We plan to accelerate our ownership of broad income-producing real estate investments in diversified geographic locations.

Our business plan converts portions of our agricultural lands located in Daytona Beach into a geographically diverse portfolio of income properties utilizing income tax deferral under Section 1031 of the Internal Revenue Code. Our long-held lands are carried on our books at a very low tax basis, and as a result, qualifying real estate sales generate large taxable gains. The Section 1031 tax deferred exchange process allows us to postpone the related income taxes and reinvest 100% of the gross sales proceeds of qualifying sales into income properties. Our business plan is to utilize moderate company leverage, when appropriate, to accelerate our investment in income producing investments, which are at accretive spreads to our borrowing costs. This will enhance our Company’s income profile while keeping us cash flow positive with approximately half of our Company assets in lower-yielding agricultural lands.

REAL ESTATE OPERATIONS

LAND HOLDINGS. The Company owns over 11,000 acres of land in Daytona Beach, Florida along six miles of either side of I-95. Presently, the majority of this land is in agricultural use.

During 2011, the Company conducted an impairment analysis on approximately 300 acres of land, which had been reacquired in 2009 through the foreclosure process. This land was originally sold to MSKP Volusia Partners and was included in the LPGA DRI. The analysis resulted in an impairment charge of $2,606,412. The charge represents the entire cost basis of the property as management has decided to abandon the property due to the high carrying costs associated with these parcels, as they were subject to the Indigo Community Development District bond issue, relative to the current market environment for undeveloped land.

East of I-95-Cornerstone Office Park. The Company owns approximately 1,500 acres located east of Interstate 95, and develops some select sites. The Company holdings include two permitted office sites in the Cornerstone Office Park located within the 250-acre Gateway Business Center at the southeast quadrant of the Interstate 95 interchange at LPGA Boulevard. These two sites are permitted for a total of over 100,000 square feet of office space.

Gateway Business Center South. Development of Gateway Business Center South, a 250-acre industrial, warehouse, and distribution park located south of the Gateway Business Center South on the east side of Interstate 95 in Daytona Beach, commenced in 2004 with the first phase substantially completed prior to year-end 2004. Through December 2011, seven sales totaling approximately 70 acres have closed within the Gateway Commerce Park with approximately 350,000 square feet of industrial office space having been built. During early 2011, construction commenced on a 50,000 square-foot third party owned auto parts manufacturing facility on land formerly owned by the Company, which is projected for occupancy in the second quarter of 2012. Buildings owned by the Company include a two-building, 31,000 square-foot flex office space complex, which was self-developed by the Company to be held in its portfolio of income properties, known as Mason Commerce Center. During the second half of 2011, two new tenants took occupancy within the complex, including the State of Florida for 19,200 square feet. The addition of these tenants brings occupancy of the complex to 94%. Phase II of Mason Commerce Center is permitted for another two buildings, totaling approximately 31,000 square feet on five acres. Total build-out within Gateway Commerce Park, including expansions of existing buildings on the sold and developed parcels, may exceed 1,000,000 square feet.

Concierge Office Park. Development of a 12-acre, 4-lot commercial complex, located at the northeast corner of LPGA and Williamson Boulevards, commenced in 2007. This parcel includes a 22,000 square-foot

2

Table of Contents

ITEM 1. BUSINESS (Continued)

Company owned office building that was built in 2009 and is known as the Concierge office building. The office building was 75% occupied at year-end 2011, with Merrill Lynch occupying 7,930 square feet. The remaining land can accommodate approximately 40,000 square feet of additional office space.

Agricultural Operations. The Company’s agricultural lands encompass approximately 9,700 acres on the west side of Daytona Beach, Florida. Management believes the geographic location of this tract is well situated for future development. We are currently operating this land for timber and hay. In addition to access by major highways (Interstate 95, Interstate 4, State Road 40, and International Speedway Boulevard), the internal road system for forestry and other agricultural purposes is good.

Subsurface Interests. The Company owns full or fractional subsurface oil, gas, and mineral interests in approximately 490,000 subsurface acres of land owned by others in various parts of Florida. The Company leases its interests to mineral exploration firms when such firms deem exploration to be financially feasible. In September 2011, the Company received a $913,657 first year lease payment on an eight-year oil exploration lease covering approximately 136,000 net mineral acres primarily in Lee and Hendry Counties. An additional $922,000, representing the guaranteed second year’s lease payment, is being held in escrow. There is no assurance that the Company will receive payments beyond what has been escrowed. The Company also receives oil royalties from operating oil wells on 800 acres under a separate lease with a separate operator.

At December 31, 2011, there were two producing oil wells on 800 acres of the Company’s royalty land. Volume in 2011 was 104,211 barrels and volume in 2010 was 71,693 barrels from these two producing wells. The Company received oil royalties of $222,034 in 2011 and $178,891 in 2010. Production in barrels for prior recent years was: 2009—95,882; 2008—74,876; 2007—103,899; and 2006—105,553.

The Company’s current policy is to not release any ownership rights with respect to its reserved mineral rights. The Company may release surface entry rights or other rights upon request of a surface owner who requires such a release for a negotiated release price based on a percentage of the surface value. In connection with any release, the Company charges a minimum administrative fee.

3

Table of Contents

ITEM 1. BUSINESS (Continued)

INCOME PROPERTIES

The Company’s business strategy involves expanding its interests in income-producing investments in a geographically diverse way. The Company owns twenty-five income properties. Additionally, the Company has self-developed select properties. Following is a summary of these properties:

| LOCATION |

TENANT |

AREA (SQUARE FEET) |

YEAR BUILT |

|||||||

| Tallahassee, Florida |

CVS | 10,880 | 1995/2011 | (1) | ||||||

| Daytona Beach, Florida |

Barnes & Noble | 28,000 | 1995 | |||||||

| Sanford, Florida |

CVS | 11,900 | 2003 | |||||||

| Palm Bay, Florida |

Walgreen | 13,905 | 1999 | |||||||

| Clermont, Florida |

CVS | 13,824 | 2002 | |||||||

| Melbourne, Florida |

CVS | 10,908 | 2001 | |||||||

| Sebring, Florida |

CVS | 12,174 | 1999 | |||||||

| Kissimmee, Florida |

Walgreen | 13,905 | 1998 | |||||||

| Orlando, Florida |

Walgreen | 15,120 | 1997 | |||||||

| Sanford, Florida |

CVS |

13,813 | 2004 | |||||||

| Apopka, Florida |

Walgreen |

14,560 | 2003 | |||||||

| Clermont, Florida |

Walgreen |

13,650 | 2003 | |||||||

| Sebastian, Florida |

CVS |

13,813 | 2003 | |||||||

| Alpharetta, Georgia |

Walgreen |

15,120 | 2000 | |||||||

| Powder Springs, Georgia |

Walgreen |

15,120 | 2001 | |||||||

| Lexington, North Carolina |

Lowe’s |

114,734 | 1996 | |||||||

| Alpharetta, Georgia |

RBC Centura Bank |

4,128 | 2001 | |||||||

| Asheville, North Carolina |

Northern Tool & Equipment |

25,454 | 2001 | |||||||

| Altamonte Springs, Florida |

RBC Centura Bank |

4,135 | 2004 | |||||||

| Vero Beach, Florida |

CVS |

13,813 | 2001 | |||||||

| Orlando, Florida |

RBC Centura Bank |

4,128 | 2004 | |||||||

| Clermont, Florida |

CVS |

13,813 | 2004 | |||||||

| McDonough, Georgia |

Dick’s Sporting Goods |

46,315 | 2006 | |||||||

| McDonough, Georgia |

Best Buy |

30,038 | 2005 | |||||||

| Charlotte, North Carolina |

Harris Teeter Supermarket |

45,089 | 1993 | |||||||

|

|

|

|||||||||

| 25 Properties Acquired |

518,339 | |||||||||

|

|

|

|||||||||

| Self-Developed Properties |

Primary Tenant |

|||||||||

| Concierge, Daytona Beach, Florida |

Merrill Lynch (36%) |

22,012 | 2009 | |||||||

| Mason Commerce Center, Daytona Beach, Florida |

State of Florida (62%) |

30,720 | 2009 | |||||||

|

|

|

|||||||||

| 2 Self-Developed Properties |

52,732 | |||||||||

|

|

|

|||||||||

| Total 27 Properties |

571,071 | |||||||||

|

|

|

|||||||||

| (1) | This property was expanded in 2011 at a cost of $1,600,000 in exchange for a new twenty-five year lease term. |

With the exception of the Dick’s Sporting Goods and Best Buy properties acquired in 2006 and the two self-developed properties, all properties are leased on a long-term, double or triple-net lease basis.

Other rental property consists of twenty-two billboards, primarily along Interstate 95 and Interstate 4, and hunting leases covering 5,720 acres.

4

Table of Contents

ITEM 1. BUSINESS (Continued)

The average occupancy rates, expressed as a percentage, of our acquired single-tenant net-lease income properties for each of the last five years on a portfolio basis are as follows:

| Year |

Occupancy (1) | |||

| 2007 |

94 | % | ||

| 2008 |

95 | % | ||

| 2009 |

95 | % | ||

| 2010 |

92 | % | ||

| 2011 |

91 | % | ||

| (1) | Based on weighted average physical occupancy. |

The weighted average effective annual rental per square foot for our income properties for each of the last five years is as follows:

| Year |

Annual Rental Per Square Foot |

|||

| 2007 |

$ | 17.30 | ||

| 2008 |

$ | 17.02 | ||

| 2009 |

$ | 17.03 | ||

| 2010 |

$ | 16.61 | ||

| 2011 |

$ | 16.40 | ||

| 2007 – 2011 |

$ | 16.87 | ||

The information on lease expirations for each of the ten years starting with 2011 is as follows:

| Year |

# of Tenant Leases Expiring |

Total Square Feet of Leases Expiring |

Annual Rents Expiring |

Percentage of Gross Annual Rents Expiring |

||||||||||||

| 2011 |

0 | 0 | 0 | 0 | ||||||||||||

| 2012 |

0 | 0 | 0 | 0 | ||||||||||||

| 2013 |

0 | 0 | 0 | 0 | ||||||||||||

| 2014 |

0 | 0 | 0 | 0 | ||||||||||||

| 2015 |

1 | 28,000 | $ | 394,800 | 4.3 | % | ||||||||||

| 2016 |

1 | 30,038 | $ | 480,000 | 5.2 | % | ||||||||||

| 2017 |

2 | 161,049 | $ | 1,266,785 | 13.6 | % | ||||||||||

| 2018 |

0 | 0 | 0 | 0 | ||||||||||||

| 2019 |

5 | 55,104 | $ | 1,501,795 | 16.2 | % | ||||||||||

| 2020 |

5 | 60,737 | $ | 1,575,455 | 17.0 | % | ||||||||||

Each lease has additional option periods beyond the original term of the lease, which are exercisable at the tenant’s option.

CVS and Walgreen account for 15% or more of both rentable square feet and gross income property revenues, while Lowe’s accounts for more than 10% of rentable square feet. Information regarding these tenants, including principal provisions of our leases with these tenants, is as follows:

Holiday CVS, L.L.C., (a subsidiary of CVS Caremark Corporation)—22% of portfolio by square-feet, 27% by revenue

| • | 100% of CVS Stores owned by the Company were originally leased and occupied by Eckerd Corporation; CVS acquired Eckerd Corporation in August 2004 and assumed the leases. |

| • | Primarily 20-year initial lease terms (one lease term is 25 years). |

5

Table of Contents

ITEM 1. BUSINESS (Continued)

| • | Primarily 4 option periods of 5 years each. |

| • | Primarily no rent increases until option period. |

| • | Rent ranges from $19+/- per square foot (PSF) to $27+/- PSF. |

| • | All CVS leases are triple-net (no landlord operating expense and maintenance responsibility). |

Walgreen Co.—20% of portfolio by square-feet, 24% by revenue

| • | 20-year or 25-year initial lease terms. |

| • | Primarily 6 option periods of 5 years each. |

| • | No rent increases until option period. |

| • | Rent ranges from $19+/- to $26+/- PSF. |

| • | Walgreen leases are either double-net (landlord responsible for structure, roof, and in some leases the parking lot) or triple-net (no landlord operating expense and maintenance responsibility). |

Lowe’s Corporation—22% of portfolio by square-feet, 7% by revenue

| • | 20-year initial lease term. |

| • | 6 option periods of 5 years each. |

| • | No rent increases until option period. |

| • | Rent of $6+ PSF. |

| • | Double-net (landlord responsible for structure, roof, and parking lot). |

GOLF OPERATIONS

The Company leases two 18-hole championship golf courses from the City of Daytona and owns a clubhouse facility, collectively known as LPGA International. The LPGA International clubhouse opened in January 2001. The annual lease payments to the City of Daytona Beach increase from $250,000 to $500,000 per year in September 2012, and the lease matures in 2022 with seven renewal options for five years.

COMPETITION

The real estate business in the Volusia County area is highly competitive and fragmented. We compete with numerous developers of varying sizes, ranging from local to national in scope. The local market is extremely price competitive with an abundance of older office and retail inventory and high vacancy rates.

EMPLOYEES

At December 31, 2011, the Company had seventeen full-time employees, and one part-time employee and considers its employee relations to be satisfactory. At the end of February 2012, the Company had fourteen full-time employees and one part-time employee.

AVAILABLE INFORMATION

The Company’s website is www.ctlc.com. The Company makes available on this website, free of charge, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after the Company electronically files or furnishes such materials to the SEC. The Company will also provide paper copies of these filings free of charge upon a specific request in writing for such

6

Table of Contents

ITEM 1. BUSINESS (Continued)

filing to the Company’s Corporate Secretary, P.O. Box 10809, Daytona Beach, Florida 32120-0809. All reports the Company files with or furnishes to the SEC also are available free of charge via the SEC’s electronic data gathering and retrieval (“EDGAR”) system available through the SEC’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

| ITEM 1A. | RISK FACTORS |

Our business is subject to a number of significant risks. The risks described below may not be the only risks which potentially could impact our business. These additional risks include those which are unknown at this time or that are currently considered immaterial. If any of the circumstances described below actually occur to a significant degree, our business, financial condition, and/or results of operations could suffer, and the trading price of our common stock could decline.

A prolonged downturn in economic conditions, especially in Daytona Beach, Florida, could continue to adversely impact our business. The collapse of the housing market, together with the crisis in the credit markets, resulted in a recession in the national economy with rising unemployment, shrinking gross domestic product, and drastically reduced consumer spending. At such times, potential customers often defer or avoid real estate purchases due to the substantial costs involved. The real estate industry is particularly vulnerable to shifts in local, regional, and national economic conditions outside of our control, such as short and long-term interest rates, housing demand, population growth, and employment levels and job growth. Our business is especially sensitive to economic conditions in Daytona Beach, Florida, where most of our real estate and self-developed properties are located. Florida has continued to experience weak economic conditions and could take longer to recover than the rest of the nation. A prolonged economic downturn could continue to have a material adverse effect on our business, results of operations, and financial condition.

Our future success will depend upon our ability to successfully execute acquisition or development strategies. There is no assurance that we will be able to continue to implement our strategy of investing in income properties successfully. Additionally, there is no assurance that the income property portfolio will expand at all, or if it will expand at any specified rate or to any specified size. If we invest in geographic markets other than the ones in which currently owned properties are located, we will be subject to risks associated with investment in new markets that may be relatively unfamiliar to us. In addition, development activities are subject to risks relating to the availability and timely receipt of zoning and other regulatory approvals, the cost and timely completion of construction (including risks from factors beyond our control, such as weather, labor conditions, or material shortages), and the ability to obtain both construction and permanent financing on favorable terms. These risks could result in substantial unanticipated delays or expenses and, under certain circumstances, could prevent completion of development activities once undertaken or provide a tenant the opportunity to terminate a lease. Any of these situations may delay or eliminate proceeds or cash flows expected from these projects, which could have an adverse affect on our financial condition and results of operations.

Our operations could be negatively impacted by the loss of key management personnel. Our future success depends, to a significant degree, on the efforts of each member of senior management. Replacement of any member of senior management could adversely affect our operations and our ability to execute business strategies. We do not have key man life insurance policies on members of senior management.

Further declines in real estate values could result in impairment write-downs. Further declines in the real estate market could result in future impairments (as defined by FASB authoritative accounting guidance) to certain of our properties. The value of our properties depends on market conditions, including estimates of future demand for, and the revenues that can be generated from, such properties. The downturn in the real estate market has caused the fair value of certain of our properties to fall. Because of our assessments of fair value, we have

7

Table of Contents

ITEM 1A. RISK FACTORS (Continued)

written down the carrying value of certain of our properties, and taken corresponding non-cash charges against our earnings to reflect the impaired value. If the real estate market declines further, we may need to take charges against our earnings for impairments. Any such non-cash charges could have an adverse effect on our results of operations.

Land use and environmental regulations could restrict, make more costly, or otherwise adversely impact our business. We are subject to a wide variety of federal, state, and local laws and regulations relating to land use and development and to environmental compliance and permitting obligations. Any failure to comply with these laws could result in capital or operating expenditures or the imposition of severe penalties or restrictions on operations that could adversely effect present and future operations. Municipalities may restrict or place moratoriums on the availability of utilities, such as water and sewer taps. Additionally, development moratoriums may be imposed due to over capacity traffic on roads. In some areas, municipalities may enact growth control initiatives, which will restrict the number of building permits available in a given year. If municipalities in which we own land and operate take actions like these, it could have an adverse effect by causing delays, increasing costs, or limiting the ability to operate in those municipalities.

Most of our property is located in a highly competitive real estate market, which could adversely impact our business. Our competitors are primarily other landowners in the Daytona Beach area. These competitive conditions can make it difficult to engage in real estate transactions on acceptable terms and can adversely affect operations, financial condition, or results of operations.

Our quarterly results are subject to variability. We have historically derived a substantial portion of our income from real estate transactions. The timing of commercial real estate transactions activity is not predictable and is generally subject to the purchaser’s ability to obtain acceptable financing and approvals from local municipalities and regulatory agencies for the intended use of the land on a timely basis. As these approvals are subject to third party responses, it is not uncommon for delays to occur, which affect the timing of transaction closings. These timing issues have caused, and may continue to cause, our operating results to vary significantly from quarter to quarter and year to year.

The loss of revenues from major income property tenants would adversely impact cash flow. Our two largest income property tenants—CVS and Walgreen—each accounted for in excess of 23% of consolidated revenues individually and in the aggregate approximately 51% of consolidated revenues for the year ended December 31, 2011. The default, financial distress, or bankruptcy of one or both of these tenants could cause substantial vacancies among our income properties. Vacancies reduce revenues until the affected properties can be re-leased and could decrease the value of each such vacant property. Upon the expiration of the leases that are currently in place, we may not be able to re-lease a vacant property at a comparable lease rate or without incurring additional expenditures in connection with such re-leasing. If, following the loss of an income property tenant, we are unable to re-lease the income property at comparable rental rates and in a timely manner, our results of operations could be adversely affected.

We are subject to a number of risks inherent in the ownership of income properties. Factors beyond our control can affect the performance and value of our income properties. Changes in national, regional, and local economic and market conditions may affect the performance of the income properties and their value. Local real estate market conditions may include excess supply and intense competition for tenants, including competition based on rental rates, attractiveness and location of the property and quality of maintenance, insurance, and management services. In addition, the performance and value of the income properties can be impacted by changes in laws and governmental regulations, changes in interest rates, and the availability of financing. In addition, because real estate investments are relatively illiquid, the ability to adjust the portfolio of income properties promptly in response to economic or other conditions is limited. Certain significant expenditures generally do not change in response to economic or other conditions, including debt service, real estate taxes, and operating and maintenance costs.

8

Table of Contents

ITEM 1A. RISK FACTORS (Continued)

Our operations and properties in Florida could be adversely affected in the event of a hurricane, natural disaster, or other significant disruption. Our corporate headquarters and most of our properties are located in Florida, where major hurricanes have occurred. Depending on where any particular hurricane makes landfall, our properties in Florida could experience significant damage. In addition, the occurrence and frequency of hurricanes in Florida could also negatively impact demand for our real estate products because of consumer perceptions of hurricane risks. In addition to hurricanes, the occurrence of other natural disasters and climate conditions in Florida, such as tornadoes, floods, fires, unusually heavy or prolonged rain, droughts and heat waves, could have am adverse effect on our ability to develop properties or realize income from our properties. If a hurricane, natural disaster or other significant disruption occurs, we may experience disruptions to our operations and properties, which could have an adverse effect on our business and our results of operations.

Competition and market conditions relating to golf operations could adversely affect our operating results. Golf operations face competition from similar nearby golf operations. Any new competitive golf operations that are developed close to our existing golf operations also may adversely impact results of operations. Golf operations are also subject to adverse market conditions, such as population trends and changing demographics, any of which could adversely affect results of operations. In addition, the golf operations may suffer if the economy weakens, if the popularity of golf decreases, or if unusual weather conditions or other factors cause a reduction in rounds played. Our golf operations are seasonal, primarily due to the impact of the winter tourist season and Florida summer heat and rain.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

NONE

| ITEM 2. | PROPERTIES |

Land holdings of the Company and its affiliates, which are primarily located in Florida, include: approximately 11,000 acres (including commercial/retail sites) in the Daytona Beach area of Volusia County; approximately 1 acre in Highlands County; retail buildings located on 74 acres throughout Florida, Georgia, and North Carolina, two self-developed multi-tenant buildings located on 12 acres in Daytona Beach, Florida; and full or fractional subsurface oil, gas, and mineral interests in approximately 490,000 “surface acres” in 20 Florida counties. The conversion and subsequent utilization of these assets provides the base of the Company’s operations.

The lands not currently being developed, including those on which development approvals have been received, are involved in active agricultural operations. These lands straddle Interstate 95 for 6.5 miles between International Speedway Boulevard (U. S. Highway 92) and State Road 40, with approximately 9,700 acres west and 1,500 acres east of the interstate.

Subsidiaries of the Company are holders of the developed Volusia County properties and are involved in the development of additional lands zoned for commercial or industrial purposes.

The Company also owns and operates properties for leasing. These properties are discussed under “Item 1. Business-Income Properties” above.

| ITEM 3. | LEGAL PROCEEDINGS |

In December 2008, Wintergreen Advisers, LLC (“Wintergreen”), a Delaware limited liability company and the largest shareholder of the Company, filed a Verified Application for Court Ordered Inspection of the Company’s business records in the Circuit Court for the Seventh Judicial Circuit for Volusia County, Florida.

9

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS (Continued) |

Following a hearing on this matter, the trial court entered a Final Order Partially Granting and Partially Denying Wintergreen’s Verified Application in May 2010. Wintergreen subsequently appealed this matter to Florida Fifth District Court of Appeal, which affirmed the trial court’s decision and in January 2012 denied a motion for rehearing. On March 2, 2012, the Company and Wintergreen reached a resolution and the Company considers this matter to be concluded.

In September 2010, St. Johns River Water Management District (the “District”) served the Company with an administrative complaint in connection with certain Company agricultural operations. The complaint alleges that the Company constructed and operated a surface water management system without the proper permit. The Company disagreed with the District’s assertions in the complaint and requested an administrative hearing originally scheduled for late March 2011, which was subsequently rescheduled for July 2011. Due to proposed legislation involving the agricultural exemption, the parties agreed to place this matter in abeyance. The legislation, which passed and was made effective July 1, 2011, clarifies the application of the agricultural exemption to certain agricultural activities. It also provided that, in the event of a dispute between the District and a landowner as to whether the agricultural exemption is applicable to particular activities, either party could request a binding determination by the Florida Department of Agriculture and Consumer Services (“DACS”). Since the new law was applicable retroactively, the case continued in abeyance until the facts of the case could be assessed in context with the new law. The District has since elected to have a determination made by DACS and made its request for a binding determination on January 31, 2012. The parties were required to file a status report with the Court on February 17, 2012. On February 16, 2012, the parties filed a joint motion for extension of abeyance, which was granted on February 17, 2012. The parties are to confer and advise the court of the status of this matter no later than May 15, 2012. While it is too early to evaluate a potential outcome, the Company does not believe the resolution of this matter will have a material adverse effect on the Company’s net income or financial condition.

On November 21, 2011, the Company (and its affiliates, Indigo Mallard Creek LLC and Indigo Development LLC) was served with pleadings for a highway condemnation action for the Harris Teeter income property located in Charlotte, North Carolina. As a result of the proposed road modifications, an all-access intersection with a traffic signal at Mallard Creek Road will be modified to a right-in/right-out only access. Harris Teeter, as the tenant under the lease for this property, recently notified the Company that it believes the loss of the all-access intersection materially adversely affects its business at this location. According to Harris Teeter’s interpretation of the lease, this allows it the right to terminate the lease, which it anticipates would occur immediately preceding construction commencement (which Harris Teeter estimates to be approximately July 31, 2012). The Company does not agree with Harris Teeter’s position in this matter and has engaged North Carolina counsel to represent its interests in both the condemnation proceedings and the tenant matter.

From time to time, the Company may be a party to certain legal proceedings, incidental to the normal course of our business. While the outcome of the legal proceedings cannot be predicted with certainty, the Company does not expect that these proceedings will have a material effect upon our financial condition or results of operations.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable

10

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

COMMON STOCK PRICES AND DIVIDENDS

The Company’s common stock trades on the NYSE Amex under the symbol CTO. The Company has paid dividends on a continuous basis since 1976, the year in which its initial dividends were paid. The following table summarizes aggregate annual dividends paid per share over the two years ended December 31, 2011:

| 2011 |

$ | 0.04 | ||

| 2010 |

$ | 0.04 |

The level of future dividends will be subject to an ongoing review of the overall economy with emphasis on our local real estate market, cash flow, and our capital needs including stock repurchases.

Indicated below are high and low sales prices of our stock for each full quarter within the last two fiscal years. All quotations represent actual transactions.

| 2011 | 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| First Quarter |

35.05 | 28.23 | 37.10 | 30.15 | ||||||||||||

| Second Quarter |

33.69 | 27.65 | 35.50 | 27.42 | ||||||||||||

| Third Quarter |

30.89 | 25.94 | 32.00 | 26.19 | ||||||||||||

| Fourth Quarter |

30.60 | 24.65 | 29.99 | 26.02 | ||||||||||||

The number of shareholders of record as of March 1, 2012 (without regard to shares held in nominee or street name) was 621.

Recent Sales of Unregistered Securities

On August 1, 2011, pursuant to the Restricted Share Award Agreement between John P. Albright and the Company, we issued to Mr. Albright 96,000 shares of restricted Company common stock outside of our 2010 Equity Incentive Plan, in accordance with and subject to the exception set forth in Section 711(a) of the NYSE Amex Company Guide, and in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act of 1933, as amended.

11

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES (Continued) |

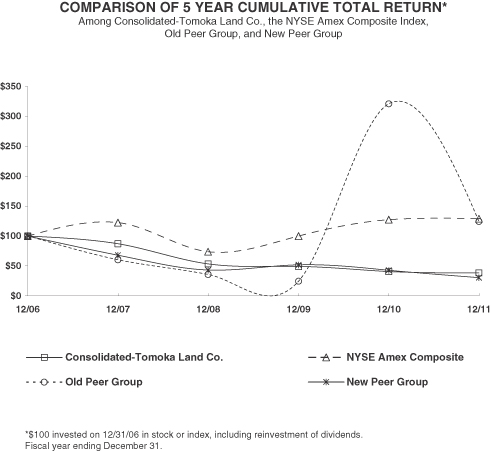

STOCK PERFORMANCE GRAPH

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN*

Among Consolidated-Tomoka Land Co., the NYSE AMEX Composite Index, and a Peer Group

The following performance graph shows a comparison of cumulative total shareholder return from a $100 investment in stock of the Company over the five-year period ending December 31, 2011, with the cumulative shareholder return of the NYSE Amex Composite Index, a Real Estate Industry Index provided by Research Data Group that was previously used by the Company that consists of AV Homes Inc. (formerly known as Avatar Holdings) and Oakridge Holdings Inc. (the “Old Peer Group”) and a new peer group that consists of Alico Inc., AV Homes Inc., Forestar Group Inc., St. Joe Company, Stratus Properties Inc., and Tejon Ranch Co. (the “New Peer Group”). The Company is switching to the New Peer Group for the purposes of the performance graph disclosure because the Old Peer Group included California Coastal Communities Inc., which declared bankruptcy, and Maxxam Inc., which is no longer a public company. The Company believes that the New Peer Group reflects a better mix of companies that reflect the businesses of the Company, including real estate, land management, income properties, and mineral resources, and the location of the Company’s properties.

| 12/06 | 12/07 | 12/08 | 12/09 | 12/10 | 12/11 | |||||||||||||||||||

| Consolidated-Tomoka Land Co. |

100.00 | 87.04 | 53.51 | 49.40 | 40.92 | 38.38 | ||||||||||||||||||

| NYSE Amex Composite |

100.00 | 122.46 | 73.97 | 100.19 | 127.31 | 128.98 | ||||||||||||||||||

| Old Peer Group |

100.00 | 60.18 | 35.49 | 24.00 | 321.32 | 124.13 | ||||||||||||||||||

| New Peer Group |

100.00 | 68.20 | 43.14 | 52.20 | 43.03 | 30.68 | ||||||||||||||||||

12

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES (Continued) |

ISSUER REPURCHASES OF EQUITY SECURITIES

In November 2008, the Company’s Board of Directors authorized the Company to repurchase from time to time up to $8 million of its common stock. The Company has repurchased 4,660 shares of its common stock at a cost of $104,648 under this plan and remains authorized to repurchase shares of its common stock up to a dollar value of $8 million. There is no expiration date for the plan.

The following table shows that the Company made no repurchases of its common stock during the quarter ended December 31, 2011, under the stock repurchase program described above:

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs |

||||||||||||

| October 1, 2011 – October 31, 2011 |

— | — | — | $ | 7,895,352 | |||||||||||

| November 1, 2011 – November 30, 2011 |

— | — | — | $ | 7,895,352 | |||||||||||

| December 1, 2011 – December 31, 2011 |

— | — | — | $ | 7,895,352 | |||||||||||

|

|

|

|||||||||||||||

| Total |

— | — | — | $ | 7,895,352 | |||||||||||

|

|

|

|||||||||||||||

13

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table summarizes our selected historical financial information for each of the last five fiscal years. All amounts presented have been restated on a continuing operations basis. Discontinued Operations are more fully discussed in Note 3, in the Notes to Consolidated Financial Statements. The selected financial information has been derived from our audited Consolidated Financial Statements, which for data presented for fiscal years 2011 and 2010 are included elsewhere in this report.

The following selected financial data should be read in conjunction with the Company’s Consolidated Financial Statements and Notes along with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this report.

| Fiscal Years Ended | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In thousands except per share amounts) | ||||||||||||||||||||

| Summary of Operations: |

||||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Real Estate |

$ | 14,243 | $ | 12,528 | $ | 15,959 | $ | 17,504 | $ | 38,864 | ||||||||||

| Profit on Sales of Other Real Estate Interest |

22 | 19 | 36 | 1,370 | 2,580 | |||||||||||||||

| Interest and Other Income |

437 | 157 | 195 | 712 | 663 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL |

14,702 | 12,704 | 16,190 | 19,586 | 42,107 | |||||||||||||||

| Operating Costs and Expenses |

(10,369 | ) | (10,177 | ) | (10,054 | ) | (9,890 | ) | (15,497 | ) | ||||||||||

| Impairment Charges |

(6,619 | ) | — | — | — | — | ||||||||||||||

| General and Administrative Expenses |

(6,089 | ) | (3,914 | ) | (5,744 | ) | (2,813 | ) | (6,170 | ) | ||||||||||

| Income Taxes |

3,287 | 457 | (115 | ) | (2,572 | ) | (7,431 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (Loss) from Continuing Operations |

(5,088 | ) | (930 | ) | 277 | 4,311 | 13,009 | |||||||||||||

| Income from Discontinued Operations, Net of tax |

382 | 327 | 524 | 524 | 524 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

$ | (4,706 | ) | $ | (603 | ) | $ | 801 | $ | 4,835 | $ | 13,533 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic Earnings Per Share: |

||||||||||||||||||||

| Income (Loss) from Continuing Operations |

$ | (0.89 | ) | $ | (0.16 | ) | $ | 0.05 | $ | 0.75 | $ | 2.28 | ||||||||

| Income from Discontinued Operations, Net of Tax |

0.07 | 0.05 | 0.09 | 0.09 | 0.09 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

$ | (0.82 | ) | $ | (0.11 | ) | $ | 0.14 | $ | 0.84 | $ | 2.37 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted Earnings Per Share: |

||||||||||||||||||||

| Income (Loss) from Continuing Operations |

$ | (0.89 | ) | $ | (0.16 | ) | $ | 0.05 | $ | 0.75 | $ | 2.27 | ||||||||

| Income from Discontinued Operations, Net of Tax |

0.07 | 0.05 | 0.09 | $ | 0.09 | 0.09 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

$ | (0.82 | ) | $ | (0.11 | ) | $ | 0.14 | $ | 0.84 | $ | 2.36 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends Paid Per Share |

$ | 0.04 | $ | 0.04 | $ | 0.30 | $ | 0.40 | $ | 0.38 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Summary of Financial Position: |

||||||||||||||||||||

| Total Assets |

$ | 170,266 | $ | 177,759 | $ | 176,575 | $ | 173,146 | $ | 171,833 | ||||||||||

| Shareholders’ Equity |

$ | 113,164 | $ | 117,600 | $ | 118,034 | $ | 117,814 | $ | 116,671 | ||||||||||

| Long-Term Debt |

$ | 9,684 | $ | 15,249 | $ | 13,210 | $ | 8,550 | $ | 6,807 | ||||||||||

14

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OPERATIONS OVERVIEW

We are primarily engaged in real estate operations, which include agriculture and development, as well as golf course operations. We own approximately 11,300 acres in Florida, net of the approximate 272 acres we have written off as described below, of which approximately 9,700 are located within and form a substantial portion of the western boundary of the City of Daytona Beach. Our lands are well-located in central Florida’s Interstate 4 corridor, providing an opportunity for reasonably stable growth in future years.

Until the dramatic downturn in the national and local economies in 2008, activity on Company owned lands had been strong over the preceding several years. During 2009, land transactions were minimal with no activity occurring in 2010 or 2011. Over the last several years, roads and interstate overpasses, which benefit Company owned land, have been constructed, extended, or improved.

Historical sales and profits are not indicative of future results because of the unique nature of real estate transactions and variations in the cost basis of owned land. A significant portion of the Company’s profits in any given year may be generated through relatively large commercial real estate transactions. The process for these real estate transactions, from the time of preliminary discussions through contract negotiations, due diligence periods, and the closing, can last from several months to several years. The trend in Company profits in 2005 through 2011, in particular profits from real estate transactions during that period, followed the overall general trend of the national and local economies and the real estate markets. The residential real estate market reached its peak in late 2005 and early 2006, weakening thereafter with the market hampered by the overall economy and credit crisis. The local commercial real estate market lagged the residential market downturn by approximately two years.

We entered 2008 with a relatively strong contract backlog of real estate contracts. As the economy, real estate markets, and credit markets continued to slow, several of the contracts in place did not result in closings as buyers took a more conservative approach. Although there have been recent signals of improvement in the overall economy and credit markets, we do not expect a significant improvement of economic conditions, in particular the real estate market, during 2012. The Company does anticipate the possibility of a few select opportunities to generate real estate transactions in the near term.

As part of our strategy to prepare the Company for the potential upturn in the real estate market, two major land use initiatives were pursued: a major comprehensive land use plan change on approximately 3,000 acres of land west of I-95 and south of State Road 40 and a rescission of the 4,500-acre LPGA Development of Regional Impact Development Order. The comprehensive land use change, which was approved in late 2010, provides for significantly increased residential and commercial density on the land, which includes 2,539 residential units and 3.3 million square feet of commercial development. We expect that the rescission that was approved in June 2011 will relieve the Company of many regulatory requirements.

The Company has evaluated the carrying value of certain assets. In doing so, we have written off as an impairment charge the $2,606,412 cost basis of the 272-acre property within the LPGA development, due to recently rising assessments and carrying costs associated with these parcels relative to the current market environment.

In 2000, we initiated a strategy of investing in income properties utilizing the proceeds from real estate transactions qualifying for income tax deferral through like-kind exchange treatment for tax purposes. Through the end of 2011, we had invested approximately $120 million in twenty-six income properties through this process, one of which was sold at the end of the year.

15

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) |

The Lakeland, Florida property, formerly occupied by Barnes & Noble, was sold in the fourth quarter of 2011 at a price of $2,900,000. A profit approximating $147,000 was recognized on this transaction. Proceeds from this transaction are anticipated to be reinvested in an additional income producing property through the Section 1031 tax-deferred like-kind exchange process.

With the investment base in income properties, lease revenue of approximately $8.8 million is projected to be generated annually. This income, along with income from additional net-lease income property investments, is expected to continue to decrease earnings volatility in future years and add to overall financial performance. This has enabled us to enter into the business of building, leasing, and holding in our portfolio select income properties that are strategically located on our lands.

The lease on the Barnes & Noble store located on International Speedway Boulevard in Daytona Beach, Florida, was scheduled to expire at the end of January 2011, excluding option years. An amendment to the lease was executed in October 2010, which extended the lease term through January 31, 2015, at a current market lease rate.

In June 2011, the Company funded the acquisition of land and leasehold improvements approximating $1,600,000, for the expansion of our CVS store site located in Tallahassee, Florida, in exchange for a new twenty-five year triple-net lease term. On June 15, 2011, the investment was completed with rent increasing by approximately $130,000 a year.

The Company owns three RBC Centura Bank (“RBC”) retail banking sites in Florida and Georgia. In June 2011, RBC agreed to sell its U.S. retail banking unit to PNC Financial Services Group Inc. The Company does not expect the sale, which is scheduled to close in 2012, to have an immediate impact on these properties. During the fourth quarter of 2009, RBC closed its branch in Altamonte Springs, Florida. The tenant is obligated on the lease and continues to make lease payments.

The Company is continually reviewing its income property portfolio for potential asset sales. The review has resulted in the listing of six income properties for sale. We have received offers on two of these properties. Sales of the properties are anticipated to occur in the second quarter of 2012. The Company anticipates making new investments in other income-producing assets with the proceeds from these transactions, utilizing the tax-deferred like-kind exchange process.

Self-Development—Mason Commerce Center. The Company has currently have two self-developed projects in the lease-up stage. The first project is a two-building 31,000 square-foot flex office space complex located within Mason Commerce Center. This represents the first phase of a 4-lot planned commercial development. The second phase would allow for an identical two building project to be built. Construction of these buildings was completed in 2008. During the third quarter of 2010, the Company executed a five-year lease with the State of Florida for 19,200 square feet in the flex office space complex. Tenant improvements were completed with occupancy on November 1, 2011. Additionally, a ten-year lease was signed with Walgreen Co. for an additional 3,840 square feet within the complex with occupancy occurring in the third quarter of 2011. The addition of these two new leases brings occupancy of the buildings to approximately 94%.

Concierge Office Building. The second self-developed property is the first phase of a 12-acre, 4-lot commercial complex located at the northeast corner of LPGA and Williamson Boulevards in Daytona Beach, Florida. The parcel includes a 22,000 square-foot two-story office building known as the Concierge Building. Approximately 75% of the building is under lease to two tenants, both of which commenced occupancy in the third quarter of 2009.

Golf Operations. Golf operations consist of the operation of two 18-hole championship golf courses with a three-hole practice facility, a clubhouse facility, and food and beverage activities within the LPGA International

16

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) |

mixed-use residential community on the west side of Interstate 95. LPGA International is a semi-private golf club consisting of the Champions course designed by Rees Jones and the Legends course designed by Arthur Hills. The Company leases the golf courses under a long-term lease with the City of Daytona Beach, Florida (the “City”). A significant increase in the lease rate takes effect on September 1, 2012. Due to the continuing losses of the golf operations, the Company has recorded an impairment charge totaling $4,012,476, before income tax. See “GOLF OPERATIONS” for a full discussion of the impairment charge. In order to counter the operating losses and the loss of memberships the last few years, the Company has dramatically reduced initiation fees and plans to make further investment in the club to enhance the member experience. Additionally, effective January 25, 2012, the Company contracted with a subsidiary of ClubCorp to manage the facility. ClubCorp, which owns and operates clubs and golf courses worldwide, brings golf management expertise and knowledge to the operation.

Agricultural Operations. Our agricultural operations consist of growing, managing, and selling timber and hay on approximately 9,700 acres of land on the west side of Daytona Beach, Florida. In previous periods we converted approximately 2,200 acres of our timberlands to hay production. Historically, the hay operations have produced losses. The Company is addressing these losses by reducing expenses and selling some of its related equipment in addition to aggressively selling the hay produced and harvested. The Company concluded the hay conversion process in the third quarter of 2011.

Subsurface. During 2011, an eight-year oil exploration lease covering approximately 136,000 net mineral acres primarily in Lee and Hendry Counties was executed and a $913,657 first year bonus rental payment was received. An additional $922,000, representing the guaranteed second year’s lease payment, is being held in escrow. The Company will also receive royalty payments if production occurs. In finalizing this lease, a review of our subsurface ownership interests was undertaken, which resulted in a true-up of acreage owned. The Company owns full or fractional subsurface oil, gas and mineral interests in approximately 490,000 surface acres in 20 Florida counties.

SUMMARY OF OPERATING RESULTS

The Company recorded a loss totaling $4,706,191, equivalent to $0.82 per share for the year ended December 31, 2011. This loss includes impairment charges totaling $4,065,000, after income tax, recorded on our golf operations and approximately 300 acres of land. This loss represents a significant increase from the loss of $602,954, equivalent to $0.11 per share, posted in 2010, and 2009’s profit of $800,680, equivalent to $0.14 per share.

The 2010 loss was primarily due to the modification of an accounting treatment related to the recording of land sales in the second quarter of 2009, as discussed in “NOTE 2. MODIFICATION OF AN ACCOUNTING TREATMENT” in the consolidated financial statements. This correction had the effect of decreasing net income by $720,000. During 2009’s first nine months, the Company had ancillary sales of sixteen acres of land to Volusia County for a road construction project generating revenues totaling $2,633,947.

REAL ESTATE OPERATIONS

2011 Compared to 2010

Losses from real estate operations totaled $3,614,076 for the twelve months ended December 31, 2011. These losses include an impairment charge of $2,606,412, described below. No real estate transactions were closed during the year. Revenues, which were realized on oil royalties and subsurface lease income in addition to modest hay sales, amounted to $546,584 during the year.

17

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) |

The Company conducted an impairment analysis on 317 acres of land in 2011, which resulted in an impairment charge of $2,606,412. The charge represents the entire cost basis of the property as management has decided to abandon the property due to the high carrying costs associated with these parcels relative to the current market environment. During the third quarter 2011, several facts and circumstances changed surrounding the property, including the following:

| • | The master developer abandoned its property and vacated the development. |

| • | Proposed property tax and Community Development District assessments were received and reflected significant increases. |

| • | Fully developed lots were recently sold within the community at depressed prices. |

| • | The national, state, and local economies, after earlier showing signs of recovery, weakened further during the period. |

The impairment analysis was conducted in accordance with the Accounting for the Impairment or Disposal of Long-Lived Assets topic of the Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”).

2010 Compared to 2009

Real estate operations posted a loss of $2,247,256 for the calendar year 2010. This loss was the result of no real estate transactions closed during the period. In addition, during the second quarter of 2010, a $1,125,000 modification of accounting treatment was recorded to real estate sales revenues from transactions which occurred in the prior year. This modification of an accounting treatment resulted in negative revenues totaling $932,669 for 2010 (see “NOTE 2. MODIFICATION OF AN ACCOUNTING TREATMENT” to the consolidated financial statements). Profits from real estate transactions during 2009 amounted to $1,378,594 and were realized on the ancillary sale of sixteen acres of property to Volusia County for the Dunn Avenue road extension project. Revenues of $2,633,947 were produced from real estate transactions for the year.

INCOME PROPERTIES

2011 Compared to 2010

Profits from income properties for the twelve months of 2011 totaled $6,535,289 and represented a modest decline from the prior year’s same period profits totaling $6,567,609. This slight downturn was posted on revenues substantially equivalent to the prior year’s same period and a 3% rise in costs and expenses. Revenues totaled $9,035,370 and $8,986,771 for 2011 and 2010, respectively.

Decreases in revenue on the expiration of the lease, at the end of January 2010, of the former Barnes & Noble property located in Lakeland, Florida, and the lower lease revenues from the Daytona Beach, Florida, Barnes & Noble property due to the renegotiated lease were offset by additional revenues recognized from the self-developed properties due to new leasing activities. Income properties’ costs and expenses totaled $2,500,081 and $2,419,162 for 2011 and 2010, respectively. The rise in expenses was due to higher interest expense, commissions and depreciation on the self-developed properties.

2010 Compared to 2009

The profits recognized in 2010 represented a 2% decrease from profits amounting to $6,446,068 recorded in 2009. The downturn in profits was the result of a 12% increase in costs and expenses during the year. The cost and expense increase was primarily attributable to costs, including depreciation, associated with the self-developed properties.

18

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) |

Partially offsetting the rise in costs and expenses was a 4% gain in leasing revenues. The rise in revenues during the 2010 was attained on increased rents from our two-self-developed properties. Revenues from income properties amounting to $8,601,106 were posted in 2009. Results of operations for 2010 and 2009 from the three income properties either sold or classified as held for sale during the fourth quarter of 2011 have been reclassified as discontinued operations.

GOLF OPERATIONS

2011 Compared to 2010

For the year ended December 31, 2011, losses from golf operations totaled $5,666,554, including a $4,012,476 impairment charge. The loss before the impairment charge represented an improvement of 16% when compared to 2010’s loss of $1,969,274. The improvement was accomplished on a 4% revenue gain with both golf and food and beverage activities contributing to the revenue gain during the period. Golf revenues increased 4% and food and beverage revenues gained 3% over the prior year. Golf rounds played during the twelve months rose 12% but were somewhat offset by a 4% reduction in the average green fee paid. Golf operating costs and expenses were reduced 2% from the prior year primarily due to lower depreciation expense on the reduced value of the assets after the impairment charge.

During the third quarter of 2011, the Company recognized an impairment charge for its golf operations’ assets totaling $4,012,476. The fair market value of the property was determined to be $2,500,000. This fair market value was determined through a third party valuation specialist in the golf course industry. The impairment charge was taken as several facts and circumstances changed surrounding the property during the period, including the following:

| • | The community master developer abandoned its property and vacated the development. |

| • | The national, state, and local economies, after showing earlier signs of recovery, weakened further during the period. |

| • | This economic slowdown was significantly impacted by the residential home market which is soft. The absence of significant residential home growth in and around LPGA International, as well as the Volusia and Flagler Counties’ markets, significantly reduces the potential for increased golf play. |

| • | Fully developed lots within the community were being sold at low prices indicating that the product to be sold in the community will be sold to a first time home buyers’ market segment. This market segment is not expected to support the golf operations in the same manner as the premium priced market segment. |

| • | The Company had a change in management, who changed the asset’s estimated holding period. New management does not believe it is in the Company’s best interest to absorb the negative income and cash flow losses until the possibility of a turnaround in future years may be realized and made the decision that this is not a future core holding of the Company. |

2010 Compared to 2009

Despite improved results during each of the last three quarters of 2010, harsh weather conditions, including record cold and rain experienced during the first quarter of the year, resulted in increased losses from golf operations for calendar year 2010 when compared to the prior year. Losses from golf operations totaling $1,920,000 were posted for the twelve months of 2009. Revenues decreased 5% from the revenues posted in 2009 totaling $4,723,825. This revenue decline was due to a 4% decline in the number of rounds played during the period, coupled with a 3% decrease in average rate paid per round played. Golf operations costs and expenses

19

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) |

totaled $6,442,703 and represented a 3% decrease from 2009’s same period costs and expenses totaling $6,642,825. The reduction of golf costs and expenses was due to the reduced activity during the period coupled with lower course maintenance expenses.

GENERAL, CORPORATE, AND OTHER

There were releases of 66 acres of subsurface entry rights producing $22,000 during 2011, with releases on 13 acres producing profits on the sale of other real estate interests of $19,225 during 2010. Income of $35,840 was generated on the release of 20 acres of mineral surface entry rights during 2009.

Interest and other income totaled $437,391 for the twelve months of 2011 and included the recognition of an approximate $384,000 gain on the disposition of agriculture equipment and the sale of fill dirt totaling $26,000. Interest earned on investment securities was down from the prior year approximately $43,000 due to the liquidation of the investment portfolio in the third and fourth quarters of 2011. Losses on the sale of investment securities approximated $140,000 for the year.

Interest and other income totaled $156,914 in 2010. This amount represented a 20% decrease from 2009’s interest and other income which totaled $195,609. The fall was primarily due to lower investment returns earned during the period.

General and administrative expenses totaled $6,089,133 during 2011 and represented a 56% increase over 2010’s costs totaling $3,914,218. Several factors contributed to the higher expenses recorded during the year, including: increased stock option accruals, higher compensation costs attributed to severance costs for the former chief executive officer, the addition of the new chief executive officer, increased business association expenses and costs related to the termination of the interest rate swap. The increase in stock option accruals accounted for approximately $890,000 of the rise in expenses as accruals in 2010 were an addition to income of $630,000 primarily the result of a decline in the Company’s stock price.

A substantial reduction in general and administrative expenses was achieved during 2010 when compared to 2009. The 32% reduction was the result of lower compensation due to employee reductions and stockholders expense in addition to lower stock option accrual costs. Partially offsetting these cost savings were higher legal fees primarily associated with shareholder litigation. General and administrative expenses totaled $5,744,659 for the twelve months of 2009.

DISCONTINUED OPERATIONS

During the fourth quarter of 2011, two income properties, the Northern Tool & Equipment property located in Asheville, North Carolina, and the Walgreen property located in Powder Springs, Georgia, were classified as assets held for sale on the balance sheet with results of operations classified as discontinued operations, net of income tax. These two properties are being actively marketed with sales anticipated to be completed within one year. Additionally, the former Barnes & Noble property in Lakeland, Florida, was sold during the period with a before tax profit of $146,977 recognized on the transaction. Results of operations and profit on the sale were shown as discontinued operations with results for 2010 and 2009 also reclassified to this category.

LIQUIDITY AND CAPITAL RESOURCES

Cash, including restricted cash of $2,779,511, totaled $2,785,685 at December 31, 2011. The restricted cash is being held for reinvestment into additional income property through the Section 1031 tax-deferred like-kind exchange process. There were no investment securities at year-end 2011 as the approximate $5,000,000 portfolio of investment securities was liquidated in the third and fourth quarters of 2011. Overall debt balances were

20

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued) |

substantially unchanged during the year, with balances of $15,266,714 and $15,249,248 at December 31, 2011 and 2010, respectively. The notes payable balance at December 31, 2011 included $9,683,726 outstanding on the $25,000,000 revolving line of credit and $5,582,988 outstanding on the term loan due in July 2012.

On February 27, 2012, the Company entered into a Credit Agreement (the “Agreement”) consisting of a $46,000,000 revolving credit facility with a maturity date of February 27, 2015, subject to a one-year extension at the option of the Company. The indebtedness outstanding under the Agreement accrues interest at a rate ranging from LIBOR plus 175 basis points to LIBOR plus 250 basis points, with the spread over LIBOR based on a ratio of the Company’s total indebtedness to total asset value. Under an accordion feature, the Company has the option to expand the borrowing capacity under the Agreement to $75,000,000. The indebtedness outstanding under the Agreement is unsecured and is guaranteed by certain subsidiaries of the Company. The Agreement replaces the $25,000,000 revolving credit facility with a maturity date of June 27, 2014, and the term loan, which had a $5,582,988 outstanding at December 31, 2011, and would have matured on July 1, 2012.

Major uses of funds during the period were centered on development and construction activities in addition to the acquisition of land and leasehold improvements. Land and leasehold improvement acquisitions, which approximated $4,800,000, were funded utilizing the tax-deferred Internal Revenue Service Section 1033 process. These acquisitions included the repurchase of the final 17 acres from Halifax Hospital for $3,245,000, and the acquisition of land and leasehold improvements at the Tallahassee, Florida, CVS store at a cost approximating $1,600,000.

Development activities, which approximated $435,000 in 2011, included the continuation of our hay conversion program, obtaining approval for the 15-acre first phase of a professional/medical office park across from the new Florida Hospital-Memorial Medical Center, and beginning the permitting process for a 10-acre pre-permitted industrial site capable of supporting a facility of up to 148,000 square feet in the Gateway Business Center South development. An additional $1,170,000 was expended on tenant improvements for our self-developed flex office complex in Mason Commerce Center.