14_12 Form 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-05046

Con-way Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 94-1444798 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

2211 Old Earhart Road, Suite 100, Ann Arbor, MI | | 48105 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (734) 757-1444

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock ($0.625 par value) | | New York Stock Exchange (NYSE) |

Securities Registered Pursuant to Section 12(g) of the Act:

7.25% Senior Notes due 2018

6.70% Senior Debentures due 2034

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ýYes oNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. oYes ýNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ýYes oNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ýYes oNo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one): Large accelerated filer ý Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). oYes ýNo

The aggregate market value of the shares of common stock held by non-affiliates of the registrant on June 30, 2014 (based upon the closing price of the common stock as of that date on the NYSE) was $2,047,525,856.

The number of shares of common stock, $0.625 par value, outstanding as of January 31, 2015 was 57,580,945.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement related to its annual meeting of shareholders scheduled to be held on May 12, 2015 are incorporated by reference into Part III of this Form 10-K.

|

| | | |

Table of Contents |

| | | |

Item | | | Page |

| | PART I | |

1. | | Business | |

1A. | | Risk Factors | |

1B. | | Unresolved Staff Comments | |

2. | | Properties | |

3. | | Legal Proceedings | |

4. | | Mine Safety Disclosures | |

| | Executive Officers of the Registrant | |

| | | |

| | PART II | |

5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

6. | | Selected Financial Data | |

7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

7A. | | Quantitative and Qualitative Disclosures About Market Risk | |

| | Report of Independent Registered Public Accounting Firm | |

8. | | Financial Statements and Supplementary Data | |

9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

9A. | | Controls and Procedures | |

9B. | | Other Information | |

| | | |

| | PART III | |

10. | | Directors, Executive Officers and Corporate Governance | |

11. | | Executive Compensation | |

12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

13. | | Certain Relationships and Related Transactions, and Director Independence | |

14. | | Principal Accounting Fees and Services | |

| | | |

| | PART IV | |

15. | | Exhibits and Financial Statement Schedules | |

PART I

ITEM 1. BUSINESS

Overview

Con-way Inc. was incorporated in Delaware in 1958. Con-way Inc. and its subsidiaries ("Con-way" or "the Company") provide transportation, logistics and supply-chain management services for a wide range of manufacturing, industrial and retail customers. Con-way's business units operate in regional, inter-regional and transcontinental less-than-truckload and full-truckload freight transportation, contract logistics and supply-chain management, multimodal freight brokerage, and trailer manufacturing.

Reporting Segments

For financial reporting purposes, Con-way is divided into three reporting segments: Freight, Logistics and Truckload. For financial information concerning Con-way's geographic and reporting-segment operating results, refer to Note 12, "Segment Reporting," of Item 8, "Financial Statements and Supplementary Data."

Freight

The Freight segment consists of the operating results of the Con-way Freight business unit. Con-way Freight is a less-than-truckload ("LTL") motor carrier that utilizes a network of freight service centers to provide day-definite regional, inter-regional and transcontinental less-than-truckload freight services throughout North America.

LTL carriers transport shipments from multiple shippers utilizing a network of freight service centers combined with a fleet of linehaul and pickup-and-delivery tractors and trailers. Freight is picked up from customers and consolidated for shipment at the originating service center. Freight is consolidated for transportation to the destination service centers or other intermediate service centers (referred to as freight assembly centers). At freight assembly centers, freight from various service centers can be reconsolidated for transportation to other freight assembly centers or destination service centers. From the destination service center, the freight is delivered to the customer. Typically, LTL shipments weigh between 100 and 15,000 pounds. In 2014, Con-way Freight's average weight per shipment was approximately 1,350 pounds.

The LTL trucking environment is highly competitive. Principal competitors of Con-way Freight include regional and national LTL companies, some of which are subsidiaries of global, integrated transportation service providers. Competition is based on freight rates, service, reliability, transit times and scope of operations.

Logistics

The Logistics segment consists of the operating results of the Menlo Logistics ("Menlo") business unit. Menlo develops contract-logistics solutions, which can include managing complex distribution networks, and providing supply-chain engineering and consulting, and multimodal freight brokerage services. The term "supply chain" generally refers to a strategically designed process that directs the movement of materials and related information from the acquisition of raw materials to the delivery of products to the end-user.

Menlo's supply-chain management offerings are primarily related to transportation-management and contract-warehousing services. Transportation management refers to the management of asset-based carriers and third-party transportation providers for customers' inbound and outbound supply-chain needs through the use of logistics-management systems to consolidate, book and track shipments. Contract warehousing refers to the optimization and operation of warehouses for customers using technology and warehouse-management systems to reduce inventory carrying costs and supply-chain cycle times. For several customers, contract-warehousing operations include light assembly or kitting operations. Menlo's ability to link these systems with its customers' internal enterprise resource-planning systems is intended to provide customers with improved visibility to their supply chains. Compensation from Menlo's customers takes different forms, including cost-plus, transactional, fixed-dollar, performance-based and consulting-fee arrangements.

Menlo provides its services using a customer- or project-based approach when the supply-chain solution requires customer-specific transportation management, single-client warehouses, and/or single-customer technological solutions. However, Menlo also utilizes a shared-resource, process-based approach that leverages a centralized transportation-management group, multi-client warehouses and technology to provide scalable solutions to multiple customers. Additionally, Menlo segments its business based on customer type. These industry-focused groups leverage the capabilities of personnel, systems and solutions throughout the organization to give customers expertise in their respective industries.

In 2014, Menlo's three largest customers collectively accounted for 27.9% of the revenue and 12.7% of the net revenue (revenue less purchased transportation) reported for the Logistics reporting segment. Menlo's largest customer accounted for 3.0% of the consolidated revenue of Con-way in 2014.

There are numerous competitors in the contract-logistics market that include domestic and foreign logistics companies, the logistics arms of integrated transportation companies, and contract manufacturers. However, Menlo primarily competes against a limited number of major competitors that have sufficient resources to provide services under large logistics contracts. Competition for projects is generally based on price and the ability to rapidly implement technology-based transportation and logistics solutions. With an increase in the number of freight brokers and the increasing availability of commercial logistics-management systems, customers' cost-reduction efforts are often focused on price. In response to this competitive pressure, Menlo seeks to design logistics solutions for customers based on innovative solutions that use a structured continuous-improvement program.

Truckload

The Truckload segment consists of the operating results of the Con-way Truckload business unit. Con-way Truckload is a full-truckload motor carrier that utilizes a fleet of tractors and trailers to provide short- and long-haul, asset-based transportation services throughout North America. Con-way Truckload provides dry-van transportation services to manufacturing, industrial and retail customers while using single drivers as well as two-person driver teams over long-haul routes, with each trailer containing only one customer's goods. This origin-to-destination freight movement limits intermediate handling and is not dependent on the same network of locations utilized by LTL carriers. On average, Con-way Truckload transports shipments more than 800 miles from origin to destination. Under its regional service offering, Con-way Truckload transports truckload shipments between 100 and 600 miles, including local-area service for truckload shipments of less than 100 miles.

Con-way Truckload offers "through-trailer" service into and out of Mexico through major gateways in Texas, Arizona and California. This service eliminates the need for shipment transfer and/or storage fees at the border and typically involves equipment-interchange operations with various Mexican motor carriers. For a shipment with an origin or destination in Mexico, Con-way Truckload provides transportation for the domestic portion of the freight move, and a Mexican carrier provides the pick-up, linehaul and delivery services within Mexico.

The truckload market is fragmented with numerous carriers of varying sizes. Principal competitors of Con-way Truckload include other truckload carriers, logistics providers, railroads, private fleets, and to a lesser extent, LTL carriers. Competition is based on freight rates, service, reliability, transit times, and driver and equipment availability.

General

Employees

At December 31, 2014, Con-way had approximately 30,100 regular full-time employees. The approximate number of regular full-time employees by segment was as follows: Freight, 20,000; Logistics, 6,000; and Truckload, 3,200. In addition to the regular full-time employees at the reporting segments, Con-way had approximately 900 regular full-time employees consisting primarily of executive, technology and administrative positions that support Con-way's operating subsidiaries.

Con-way's business units utilize other sources of labor that provide flexibility in responding to varying levels of economic activity and customer demand. In addition to regular full-time employees, Con-way Freight employs part-time employees and non-employee contract labor; Menlo utilizes non-employee contract labor primarily related to its warehouse-management services; and Con-way Truckload contracts with owner-operators to transport shipments.

Cyclicality and Seasonality

Con-way's operations are affected, in large part, by conditions in the cyclical markets of its customers and in the U.S. and global economies, as more fully discussed in Item 1A, "Risk Factors."

Con-way's operating results are also affected by seasonal fluctuations that change demand for transportation services. In the Freight segment, generally the second and third quarters have the highest business levels while the fourth quarter usually has the lowest business levels. In the Truckload segment, the months of August and October typically have the highest business levels while the month of December usually has the lowest business levels. The Logistics segment does not generally experience seasonal fluctuations.

Price and Availability of Fuel

Con-way is exposed to the effects of changes in the price and availability of diesel fuel, as more fully discussed in Item 1A, "Risk Factors."

Regulation

Ground Transportation

The motor-carrier industry is subject to federal regulation by the Federal Motor Carrier Safety Administration ("FMCSA"), the Pipeline and Hazardous Materials Safety Agency ("PHMSA"), and the Surface Transportation Board ("STB"), which are units of the U.S. Department of Transportation. The FMCSA publishes and enforces comprehensive trucking safety regulations and performs certain functions relating to motor-carrier registration, cargo and liability insurance, extension of credit to motor-carrier customers, and leasing of equipment by motor carriers from owner-operators. The PHMSA publishes and enforces regulations regarding the transportation of hazardous materials. The STB has authority to resolve certain types of pricing disputes and authorize certain types of intercarrier agreements.

The FMCSA operates the Compliance Safety Accountability ("CSA") program in an effort to improve commercial truck and bus safety. A component of the CSA program is the Safety Measurement System, which analyzes all safety-based violations to determine a commercial motor carrier's safety performance. This safety program allows the FMCSA to identify carriers with safety-performance issues and intervene to address a carrier's specific safety problems.

Federal law allows all states to impose insurance requirements on motor carriers conducting business within their borders, and empowers most states to require motor carriers conducting interstate operations through their territory to make annual filings verifying that they hold appropriate registrations from FMCSA. Motor carriers also must pay state fuel taxes and vehicle registration fees, which normally are apportioned on the basis of mileage operated in each state.

Hours of service ("HOS") regulations by the FMCSA establish the maximum number of hours that a commercial truck driver may work. An HOS rule that went into effect in July 2013 reduced the number of hours a commercial truck driver may work during his or her work day. Congress recently required FMCSA to suspend part of the HOS regulation that eliminated the "34-hour restart" provision pending a mandated study of the safety implications. Depending on the timing and outcome of the study, there may or may not be further HOS regulatory changes.

Environmental

Con-way's operations involve the storage, handling and use of diesel fuel and other hazardous substances. Con-way is subject to laws and regulations that (1) govern activities or operations that may have adverse environmental effects such as discharges to air and water, and the handling and disposal practices for solid and hazardous waste, and (2) impose liability for the costs of remediation of, and certain damages resulting from, sites of past spills, disposals, or other releases of hazardous materials.

Environmental liabilities relating to Con-way's properties may be imposed regardless of whether Con-way leases or owns the properties in question and regardless of whether such environmental conditions were created by Con-way or by a prior owner or tenant, and also may be imposed with respect to properties that Con-way may have owned or leased in the past. Con-way has accrued for its estimate of remediation costs at these sites.

Homeland Security

Con-way is subject to compliance with various cargo-security and transportation regulations issued by the Department of Homeland Security, including regulation by the Transportation Security Administration and the Bureau of Customs and Border Protection.

Other Information

Information Available on Website

Con-way makes available, free of charge, on its website at http://www.con-way.com, under the heading "Annual Reports & SEC Filings," within the "Investors" tab, copies of its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and any amendments to those reports, in each case as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission.

In addition, Con-way makes available, free of charge, on its website under the heading "Corporate Governance," within the "Investors" tab, current copies of the following documents: (1) the charters of the Audit, Compensation, Finance, and Governance and Nominating Committees of its Board of Directors; (2) its Corporate Governance Guidelines; and (3) its Code of Business Ethics. Copies of these documents are also available in print to shareholders upon request, addressed to the Corporate Secretary at 2211 Old Earhart Road, Suite 100, Ann Arbor, Michigan 48105.

None of the information on Con-way's website shall be deemed to be a part of this report.

Regulatory Certifications

In 2014, Con-way filed the written affirmations and Chief Executive Officer certifications required by Section 303A.12 of the NYSE Listing Manual and Section 302 of the Sarbanes-Oxley Act.

ITEM 1A. RISK FACTORS

Con-way's consolidated financial condition, results of operations and cash flows could be adversely affected by various risks. These risks include, but are not limited to, the principal factors listed below and other matters set forth in this Annual Report on Form 10-K. You should carefully consider all of these risks before making any investment or other decisions.

Economic Cyclicality

Con-way's operating results are affected, in large part, by cyclical conditions in its customers' markets and in the U.S. and global economies. While economic conditions affect most companies, the transportation industry is cyclical and susceptible to trends in economic activity. When individuals and companies purchase and produce fewer goods, Con-way's businesses transport fewer goods. In addition, Con-way Freight and Con-way Truckload are capital-intensive and Con-way Freight has a relatively high fixed-cost structure that is difficult to adjust to match shifting volume levels. Accordingly, any sustained weakness in demand or continued downturn or uncertainty in the economy generally would have an adverse effect on Con-way.

Industry Competition

The transportation market is highly competitive and sensitive to price and service, especially in periods of little or no macro-economic growth. Some of the Company's competitors have more financial resources than Con-way, more equipment, a broader global network, a wider range of services or have other competitive advantages. Some competitors periodically reduce their prices to gain business, especially during times of reduced growth rates in the economy, which may limit Con-way's ability to maintain or increase prices or maintain revenue. Consolidation in the ground transportation industry may create other large carriers with greater financial resources and other competitive advantages relating to their size.

Customer behavior may also change in response to market pressures in a way that adversely affects Con-way's business units. Many customers reduce the number of carriers they use by selecting "core carriers" as approved transportation service providers and Con-way may not be among those selected. Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress prices or result in the loss of some business to competitors. Some customers may choose to consolidate certain shipments through a different mode of transportation. In addition, high volume package shippers could develop in-house ground delivery capabilities, which would in turn reduce Con-way's revenue and market share. If Con-way is unable to compete effectively through its current service offerings, if current competitors or potential future competitors offer a broader range of services or more effectively bundle their services or if Con-way's current customers become competitors, it could have a material adverse effect on Con-way's business, financial condition and results of operations.

Government Regulation and Taxes

Con-way operates in a highly regulated and highly taxed industry. As discussed more fully in Item 1, "Business," Con-way is subject to the regulatory powers of the U.S. Department of Transportation, the Environmental Protection Agency, and the Department of Homeland Security, among other federal agencies, as well as various state, local and foreign laws and regulations that apply to its business activities. These include regulations related to, among other things, driver hours-of-service limitations, labor organizing activities, cargo security requirements, anti-corruption and anti-bribery laws, tax, data privacy and data security laws, employment practices, healthcare and environmental matters, including potential limits on carbon emissions under climate change legislation. Con-way may become subject to new or more restrictive regulations imposed by such agencies in respect of engine exhaust emissions, driver hours of service, security, ergonomics, and a number of other unforeseen issues potentially applicable to its businesses or the industry.

Concern over climate change, for example, has led to increased legislative and regulatory efforts to limit carbon dioxide and other greenhouse gas emissions. Even without such regulation, Con-way's response to customer-led sustainability initiatives could lead to increased costs to implement additional efforts to reduce its emissions. Additionally, Con-way may experience reduced demand for its services if it does not comply with customers' sustainability requirements. As a result, increased costs or loss of revenue resulting from sustainability initiatives could have an adverse effect on Con-way.

The costs of compliance with existing or future laws or regulations, as well as any potential liabilities under or violations of such laws or regulations, could have an adverse effect on Con-way. As these regulatory requirements continue to evolve, Con-way is not able to accurately predict how new governmental laws and regulations, or changes to existing laws and regulations, will affect the transportation industry generally, or Con-way in particular. As a result, Con-way believes that any additional

measures that may be required by future laws and regulations or changes to existing laws and regulations could result in additional costs and could have an adverse effect on Con-way.

Various federal, state and local authorities impose operating taxes, including fuel taxes, tolls, and excise and other taxes, on the transportation industry. In addition, various license and registration fees and bonding requirements apply to Con-way's business activities. Increases in these operating taxes, fees and requirements, or new forms of such operating taxes, fees and requirements, could result in additional costs and could have an adverse effect on Con-way.

Capital Markets

Significant disruptions or volatility in the global capital markets may increase Con-way's cost of borrowing or affect its ability to access credit, debt and equity capital markets. Market conditions may affect Con-way's ability to refinance indebtedness as and when it becomes due. In addition, changes in Con-way's credit ratings could adversely affect its ability and cost to borrow funds. Con-way is unable to predict how conditions in the capital markets will affect its financial condition, results of operations or cash flows.

Price and Availability of Fuel

Con-way is subject to risks associated with the availability and price of fuel, which are subject to political, economic and market factors that are outside of Con-way's control.

Con-way would be adversely affected by an inability to obtain fuel in the future. Although, historically, Con-way has been able to obtain fuel from various sources and in the desired quantities, there can be no assurance that this would continue to be the case in the future.

Con-way may also be adversely affected by the timing and degree of fluctuations and volatility in fuel prices. Currently, Con-way's business units have fuel-surcharge revenue programs or cost-recovery mechanisms in place with a majority of customers. Con-way Freight and Con-way Truckload maintain fuel-surcharge programs designed to offset or mitigate the adverse effect of rising fuel prices. Menlo has cost-recovery mechanisms incorporated into most of its customer contracts under which it recognizes fuel-surcharge revenue designed to mitigate the adverse effect of rising fuel prices on the costs for purchased transportation.

Con-way's competitors in the LTL and truckload markets also impose fuel surcharges. Although fuel surcharges are generally based on a published national index, there is no industry-wide standard fuel-surcharge formula. As a result, fuel-surcharge revenue constitutes only part of the overall rate structure. Revenue excluding fuel surcharges (usually referred to as base freight rates) represents the collective pricing elements other than fuel surcharges. Ultimately, the total amount that Con-way Freight and Con-way Truckload can charge for their services is determined by competitive pricing pressures and market factors.

Historically, Con-way Freight's fuel-surcharge program has enabled it to more than offset changes in fuel costs and fuel-related volatility in purchased transportation costs. However, market conditions for fuel can impact Con-way Freight's ability to fully absorb and recover such changes under its fuel-surcharge program over time. Con-way Freight also modifies its fuel-surcharge program from time to time in response to market conditions and industry dynamics. Such modifications can impact the extent of fuel-surcharge revenue collected or the volatility of fuel surcharges imposed under the program. As a result, Con-way Freight may be adversely affected to the extent fuel price changes or pricing volatility impacts Con-way Freight's ability to offset such changes with fuel surcharges under its then-current program or base freight rates.

Con-way Truckload's fuel-surcharge program mitigates the effect of rising fuel prices but does not always result in Con-way Truckload fully recovering increases in its cost of fuel. The extent of recovery may vary depending on the amount of customer-negotiated adjustments and the degree to which Con-way Truckload is not compensated due to empty and out-of-route miles or from engine idling during cold or warm weather.

Con-way would be adversely affected if, due to competitive and market factors, its business units are unable to continue with their fuel-surcharge programs and/or cost-recovery mechanisms. In addition, there can be no assurance that these programs, as currently maintained or as modified in the future, will be sufficiently effective to offset changes in the price of fuel in the future.

Driver Availability and Driver Compensation

Con-way hires drivers primarily for Con-way Freight and Con-way Truckload. Recently, there has been intense competition for qualified drivers in the transportation industry due to a nationwide shortage of drivers. The availability of qualified drivers may be affected from time to time by changing workforce demographics, competition from other transportation companies and industries for employees, the availability and affordability of driver training schools, changing industry regulations, and the demand for drivers in the labor market. If the industry-wide shortage of qualified drivers continues, Con-way will likely continue to experience difficulty in attracting and retaining enough qualified drivers to fully satisfy customer demands.

As a result of the current highly-competitive labor market for drivers, in 2014 and early 2015, Con-way Freight and Con-way Truckload implemented increases in compensation and benefits for their drivers and may be required to further increase driver compensation and benefits, or face difficulty meeting customer demands, all of which could adversely affect Con-way's profitability. Additionally, a shortage of drivers could result in underutilization of Con-way's truck fleet, lost revenue, increased costs for purchased transportation or increased costs for driver recruitment.

Cyber Threats and Business Interruption

Con-way and its business units rely on shared-service facilities that provide shared administrative and technology services. A sustained interruption in Con-way's systems or operations due to a catastrophic event, such as terrorist activity, earthquake, weather event, or cyber attack, could have a material adverse effect on Con-way's operations and financial results.

Con-way is dependent on its operational and information technology systems to operate its businesses and to provide critical services to its employees and customers. Con-way has outsourced a significant portion of its information technology infrastructure and a portion of its operational, administrative and accounting functions to third-party service providers. Although Con-way and its third-party service providers collectively maintain backup systems and have disaster-recovery processes and procedures, Con-way's operational and information technology systems are susceptible to sustained interruption due to events such as failures during transition to upgraded or replacement technology, power outages, computer viruses, code anomalies, telecommunications failures, user errors, third-party contractual failures and other reasons. They are also susceptible to cyber threats and attacks, such as malware, attacks by computer hackers, denial of service attacks by groups of hackers and other threats. Certain of the outsourced services are also performed in developing countries and, as a result, may be subject to geopolitical and other uncertainty or risk. A sustained interruption to critical networks or to Con-way's operational and information technology systems, including those affecting the Company's computer systems and customer websites, could adversely impact its operations, customer service, reputation, volumes and revenue and could have a material adverse effect on Con-way's operations and financial results. Further, although Con-way and its third-party providers have preventive systems and processes in place to protect against the risk of cyber attacks, data losses and security breaches, these measures cannot fully insulate Con-way from technology disruptions that compromise the confidentiality, integrity, or availability of Company and customer information, which in turn could adversely affect Con-way's operations, customer service and reputation and could have a material adverse effect on Con-way's operations and financial results.

Labor Organization

Con-way believes that maintaining a union-free environment within its business units provides a competitive advantage in the marketplace and allows the Company to most effectively and directly serve the needs of its employees. Without the possible constraints of a union, each Con-way business unit is able to operate with efficiency and flexibility, providing customers with reliable, innovative and cost-competitive services.

In 2014, the International Brotherhood of Teamsters union, or the Teamsters, made organizing attempts at a small number of Con-way Freight locations. The outcomes of those efforts have generally been favorable for the Company, although a very small percentage of Con-way Freight employees have selected Teamsters representation. As of December 31, 2014, the Teamsters union has been certified as the bargaining representative for employees at only one of Con-way Freight's nearly 300 locations. Further unionizing efforts by the Teamsters are likely to continue in 2015, and the Company cannot predict with certainty whether that activity will result in the unionization of any additional Con-way Freight locations. A further unionized workforce could potentially result in reduced operational flexibility and impair Con-way's ability to quickly respond to market conditions with innovative solutions for customers.

Capital Intensity

Con-way Freight and Con-way Truckload make significant investments in revenue equipment, and Con-way Freight also makes significant investments in freight service centers. The amount and timing of capital investments depend on various factors, including anticipated volume levels and the price and availability of appropriate-use property for service centers and newly manufactured tractors, which are subject to restrictive Environmental Protection Agency engine-design requirements. If anticipated service center and/or fleet requirements differ materially from actual usage, Con-way's capital-intensive business units may have too much or too little capacity. Con-way attempts to mitigate the risk associated with too much or too little revenue equipment capacity by adjusting capital expenditures and by utilizing short-term equipment rentals and sub-contracted operators in order to match capacity with business volumes. Con-way's investments in revenue equipment and freight service centers depend on its ability to generate cash flow from operations and its access to credit, debt and equity capital markets. A decline in the availability of these funding sources could adversely affect Con-way.

With respect to Menlo, implementing warehouse-management services for customers can require a significant commitment of capital in the form of shelving, racking and other warehousing systems. In the event that Menlo is not able to fully amortize the cost of that capital across the term of the related customer agreement, or to the extent that the customer defaults on its obligations under the agreement, Menlo could be forced to take a significant loss on the unrecovered portion of the capital cost.

Asset Impairments

Con-way's assets include significant amounts of goodwill and other long-lived assets. Con-way's regular reviews of the carrying value of its assets have resulted, from time to time, in significant impairment charges. It is possible that Con-way may be required to recognize additional impairment charges in the future, which could adversely affect Con-way's results of operations.

Defined Benefit Plans

Con-way maintains defined benefit plans, including funded qualified pension plans, unfunded non-qualified pension plans, and an unfunded postretirement medical plan. A decline in interest rates and/or lower returns on funded plan assets may cause increases in the expense and funding requirements for Con-way's defined benefit pension plans. Despite past amendments that permanently curtailed benefits under its defined benefit pension plans, Con-way's defined benefit pension plans remain subject to volatility associated with interest rates, returns on plan assets, other actuarial assumptions and funding requirements. In addition to being subject to volatility associated with interest rates, Con-way's expense and obligation under its postretirement medical plan are also subject to actuarial assumptions and trends in health-care costs. As a result, Con-way is unable to predict the effect on the Company's financial statements associated with the defined benefit pension plans and the postretirement medical plan.

Self-Insurance Accruals

Con-way uses a combination of self-insurance programs and large-deductible purchased insurance to provide for the costs of employee medical, vehicular, cargo and workers' compensation claims. Con-way's estimated liability for self-retained insurance claims reflects certain actuarial assumptions and judgments, which are subject to a high degree of variability. Con-way periodically evaluates the level of insurance coverage and adjusts insurance levels based on targeted risk tolerance and premium expense. An increase in the number and/or severity of self-insured claims or an increase in insurance premiums could have an adverse effect on Con-way.

Con-way has a captive insurance company that participates in a reinsurance pool to reinsure a portion of Con-way's workers' compensation claims. Each company that participates in the pool cedes premiums and claims to the pool and assumes premiums and claims from the pool. The operating results of the captive insurance company are affected by the number and/or severity of claims and the associated premiums paid or received. Con-way's financial condition, results of operations and cash flows could be adversely affected by the risk assumed and ceded by the captive insurance company. In addition, Con-way's captive insurance companies are subject to financial and insurance regulation by a foreign regulatory authority and changes in these applicable regulations could affect Con-way's liquidity and asset allocation with its captive insurance companies.

Con-way expects costs associated with providing benefits under postretirement medical plans and employee medical plans to increase due to health care reform legislation. Changes made to the design of Con-way's medical plans have the potential to mitigate some of the cost impact of the provisions included in the legislation. Ultimately, the cost of providing benefits under medical plans is dependent on a variety of factors, including governmental laws and regulations, health care cost trends, claims experience and health care decisions by plan participants. As a result, Con-way is unable to predict how the cost of providing benefits under medical plans will affect its financial condition, results of operations or cash flows.

Customer Concentration and Contract Terms

Menlo is subject to risk related to customer concentration because of the relative importance of its largest customers and the ability of those customers to negotiate aggressive pricing and other customer-favorable contract terms. Many of its competitors in the logistics industry segment are subject to the same risk. Although Menlo strives to broaden and diversify its customer base, a significant portion of its revenue is derived from a relatively small number of large and sophisticated customers, as more fully discussed in Item 1, "Business." Consequently, a significant loss of business from, or adverse performance by, Menlo's major customers may have a material adverse effect on Con-way's financial condition, results of operations and cash flows. Similarly, the renegotiation of major customer contracts may also have an adverse effect on Con-way.

Menlo is also subject to credit risk associated with its customer concentration. If one or more of its largest customers were to become bankrupt, insolvent or otherwise were unable to pay for services provided, Menlo may incur significant write-offs of accounts receivable or incur lease or asset-impairment charges that may have a material adverse effect on Con-way's financial condition, results of operations or cash flows. Menlo always seeks to reduce risks related to the termination of a customer relationship, for reasons other than the business failure of a customer, by requiring, upon the termination of the contract, that

the customer assume any related lease obligations and/or purchase contract-specific assets purchased by Menlo. Its ability to successfully negotiate for those contract terms with any particular customer is, however, dependent upon many factors.

Additionally, Menlo is subject to risk if contract terms and conditions do not adequately cover Menlo's exposure to increased or unexpected expenses. Changes in customers' business needs or operations may result in Menlo incurring expenses it may not be able to completely recover or offset through contractual pricing terms or contract renegotiations. Also, contract terms and conditions may not sufficiently limit Menlo's exposure to claims from customers or third parties. As a result, increased expenses resulting from these exposures could have an adverse effect on Con-way.

Other Factors

In addition to the risks identified above, Con-way's annual and quarterly operating results may be affected by a number of business, economic, regulatory and competitive factors, including:

| |

• | loss of senior management or other key employees who implement Con-way's business strategy; |

| |

• | the creditworthiness of Con-way's customers and their ability to pay for services rendered; |

| |

• | any liability resulting from and the costs of defending against litigation and claims related to labor and employment, personal injury, property damage, business practices, environmental liability and other matters; |

| |

• | the effect of severe winter weather or other weather or disaster-related events; and |

| |

• | the possibility of defaults under Con-way's $325 million credit agreement and other debt instruments. |

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Con-way believes that its facilities are suitable and adequate, that they are being appropriately utilized and that they have sufficient capacity to meet current operational needs. Management continuously reviews anticipated requirements for facilities and may acquire additional facilities and/or dispose of existing facilities as appropriate.

Freight

As of December 31, 2014, Con-way Freight operated 297 freight service centers, of which 146 were owned and 151 were leased. The service centers are strategically located to cover the geographic areas served by Con-way Freight and represent physical buildings and real property with dock, office and/or shop space. These facilities do not include meet-and-turn points or zone operations, which generally represent small owned or leased real property with no physical structures. At December 31, 2014, Con-way Freight's owned service centers accounted for 69% of its door capacity. At December 31, 2014, Con-way Freight owned and operated approximately 9,500 tractors and 25,500 trailers, including tractors held under capital lease agreements. The headquarters for Con-way Freight are located at a leased facility in Ann Arbor, Michigan, which is shared with Con-way's executive offices.

Logistics

As of December 31, 2014, Menlo operated 78 warehouses in North America, of which 61 were leased by Menlo and 17 were leased or owned by clients of Menlo. Outside of North America, Menlo operated an additional 81 warehouses, of which 62 were leased by Menlo and 19 were leased or owned by clients. Menlo owns and operates a small fleet of tractors and trailers to support its operations, but primarily utilizes third-party transportation providers for the movement of customer shipments. The headquarters for Menlo are located at a leased facility in San Francisco, California.

Truckload

As of December 31, 2014, Con-way Truckload operated five owned terminals with bulk fuel, tractor and trailer parking, and in some cases, equipment maintenance and washing facilities. In addition, Con-way Truckload also utilizes various drop yards for temporary trailer storage throughout the United States. At December 31, 2014, Con-way Truckload owned and operated approximately 2,600 tractors and 7,800 trailers. The Con-way Truckload headquarters are located at an owned facility in Joplin, Missouri.

Corporate

Other principal properties include Con-way's leased executive offices in Ann Arbor, Michigan and its owned shared-services center in Portland, Oregon. Con-way's trailer manufacturing business owns and operates a facility in Searcy, Arkansas.

ITEM 3. LEGAL PROCEEDINGS

Certain legal proceedings of Con-way are discussed in Note 11, "Commitments and Contingencies," of Item 8, "Financial Statements and Supplementary Data."

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

Executive Officers of Con-way Inc.

The name, age and relevant business experience of Con-way's executive officers as of February 23, 2015, are set forth below.

|

| |

Name, Age and Positions with the Company | Relevant Business Experience |

Douglas W. Stotlar 54, President and Chief Executive Officer | Served as Con-way's President and Chief Executive Officer since April 2005. Prior to this, served as Con-way's Senior Vice President and Con-way Freight's President and Chief Executive Officer since December 2004. Prior to this, served as Con-way Freight's Executive Vice President and Chief Operating Officer since June 2002. Prior to this, served as Con-way Freight's Executive Vice President of Operations since 1999. Prior to this, from 1985 to 1999, served in various capacities with Con-way and Con-way Freight, including as Vice President and General Manager of Con-way's expediting business. |

Stephen L. Bruffett 51, Executive Vice President and Chief Financial Officer | Served as Con-way's Executive Vice President and Chief Financial Officer since September 2008. Prior to this, from 1998 to 2008, served in various capacities in finance and accounting, operations, investor relations and sales and marketing with YRC Worldwide, including as Chief Financial Officer. |

Robert L. Bianco, Jr. 50, Executive Vice President of Con-way and President of Menlo Worldwide, LLC | Served as Con-way's Executive Vice President and Menlo Worldwide, LLC's President since June 2005. Prior to this, served as Menlo Logistics' President since 2002. Prior to this, from 1992 to 2002, served in various capacities with Menlo Logistics, including as Vice President of Operations since 1997. |

Kevin S. Coel 56, Senior Vice President and Corporate Controller | Served as Con-way's Senior Vice President since April 2009 and Corporate Controller since 2000. Prior to this, from 1990 to 2000, served in various capacities in finance and accounting with Con-way. |

Joseph M. Dagnese 54, Executive Vice President of Con-way and President of Con-way Truckload Inc. | Served as Con-way's Executive Vice President and Con-way Truckload Inc.'s President since February 2014. Prior to this, from 1995 to 2014, served in various capacities with Menlo Logistics including as Vice President of International since October 2013 and prior to that, as Vice President of Menlo's Automotive and Government Services Group since September 2008. |

Stephen K. Krull 50, Executive Vice President, General Counsel and Secretary | Served as Con-way's Executive Vice President, General Counsel and Secretary since April 2011. Prior to this, from 2003 to 2011, served as Senior Vice President, General Counsel and Secretary of Owens Corning. Prior to this, from 1996 to 2003, served in various capacities in legal and corporate communications with Owens Corning. |

W. Gregory Lehmkuhl 42, Executive Vice President of Con-way and President of Con-way Freight Inc. | Served as Con-way's Executive Vice President and Con-way Freight Inc.'s President since September 2011. Prior to this, served as Con-way Freight's Executive Vice President of Operations since August 2008. Served previously in various capacities with Menlo Logistics, including as Vice President of Menlo's Automotive Industry Group since January 2005. |

Leslie P. Lundberg 57, Senior Vice President, Human Resources | Served as Con-way's Senior Vice President, Human Resources since January 2006. Prior to this, served as Executive Director of Compensation, Benefits and Human Resource Information Systems for a division of Sun Microsystems since 2003. |

C. Randal Mullett 61, Vice President, Government Relations and Public Affairs | Served as Con-way's Vice President, Government Relations and Public Affairs since September 2007. Prior to this, served as Vice President of Government Relations since January 2005, and before that as Director Government Relations since January 2003. Prior to this, from 1989 to 2003, served in various capacities in operations and sales management with Con-way Freight Inc. |

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Con-way's common stock is listed for trading on the New York Stock Exchange ("NYSE") under the symbol "CNW."

See Note 13, "Quarterly Financial Data," of Item 8, "Financial Statements and Supplementary Data" for the range of common stock prices as reported on the NYSE and for the common stock dividends paid in 2014 and 2013. At January 31, 2015, Con-way had 5,090 common stockholders of record. The following table provides information on shares of common stock repurchased by Con-way during the quarter ended December 31, 2014:

ISSUER PURCHASES OF EQUITY SECURITIES

|

| | | | | | | | | | | | | | |

Period | | Total Number of Shares (or Units) Purchased 1 | | Average Price Paid per Share (or Unit) | | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs 1 | | Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs 1 |

October 1, 2014 - October 31, 2014 | | 85,000 |

| | $ | 43.51 |

| | 85,000 |

| | $ | 141,693,850 |

|

November 1, 2014 - November 30, 2014 | | 90,000 |

| | 46.11 |

| | 90,000 |

| | 137,543,950 |

|

December 1, 2014 - December 31, 2014 | | 90,000 |

| | 48.92 |

| | 90,000 |

| | 133,141,150 |

|

| | 265,000 |

| | $ | 46.39 |

| | 265,000 |

| | $ | 133,141,150 |

|

| |

[1] | On July 30, 2014, Con-way announced that its Board of Directors had authorized a program to repurchase up to $150 million of Con-way's common stock in open market purchases or in privately negotiated transactions from time to time in such amounts as management determines. |

Performance Graph

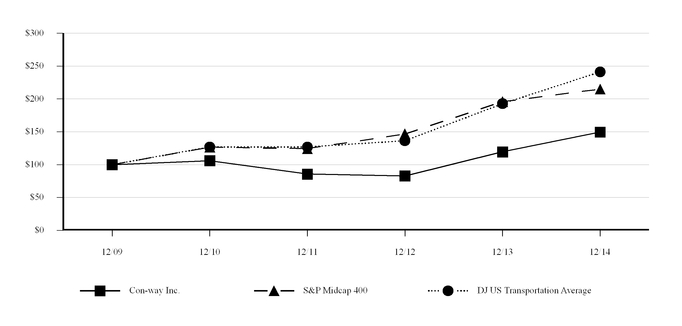

The following performance graph compares Con-way's five-year cumulative return (assuming an initial investment of $100 on December 31, 2009 and reinvestment of dividends), with the S&P Midcap 400 Index and Dow Jones US Transportation Average Index.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDERS RETURN

Con-way Inc., S&P Midcap 400 Index, Dow Jones US Transportation Average Index

|

| | | | | | | | | | | | | | | | | | |

| Cumulative Total Return |

| 12/31/2009 | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 |

Con-way Inc. | $ | 100.00 |

| $ | 106.07 |

| $ | 85.69 |

| $ | 82.83 |

| $ | 119.49 |

| $ | 149.63 |

|

S&P Midcap 400 | 100.00 |

| 126.64 |

| 124.45 |

| 146.69 |

| 195.84 |

| 214.97 |

|

Dow Jones US Transportation Average | 100.00 |

| 126.74 |

| 126.75 |

| 136.31 |

| 192.72 |

| 241.04 |

|

ITEM 6. SELECTED FINANCIAL DATA

The following table includes selected financial and operating data for Con-way as of and for the five years ended December 31, 2014. This information should be read in conjunction with Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and Item 8, "Financial Statements and Supplementary Data."

Con-way Inc.

Five-Year Financial Summary |

| | | | | | | | | | | | | | | | | | | |

(Dollars in thousands, except per share data) | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Results of Operations | | | | | | | | | |

Revenue | $ | 5,806,069 |

| | $ | 5,473,356 |

| | $ | 5,580,247 |

| | $ | 5,289,953 |

| | $ | 4,952,000 |

|

Operating Income [a] | 268,450 |

| | 208,953 |

| | 228,841 |

| | 207,928 |

| | 78,170 |

|

Income before Income Tax Provision | 210,697 |

| | 154,365 |

| | 170,954 |

| | 148,072 |

| | 16,557 |

|

Income Tax Provision [b] | 73,658 |

| | 55,212 |

| | 66,408 |

| | 59,629 |

| | 12,572 |

|

Net Income | 137,039 |

| | 99,153 |

| | 104,546 |

| | 88,443 |

| | 3,985 |

|

Weighted-Average Common Shares Outstanding | | | | | | | | | |

Basic | 57,390,945 |

| | 56,511,563 |

| | 55,837,574 |

| | 55,388,297 |

| | 52,507,320 |

|

Diluted | 58,018,443 |

| | 57,240,588 |

| | 56,485,987 |

| | 56,101,903 |

| | 53,169,299 |

|

Per Common Share | | | | | | | | | |

Basic Earnings | $ | 2.39 |

| | $ | 1.75 |

| | $ | 1.87 |

| | $ | 1.60 |

| | $ | 0.08 |

|

Diluted Earnings | 2.36 |

| | 1.73 |

| | 1.85 |

| | 1.58 |

| | 0.07 |

|

Cash Dividends Declared | 0.50 |

| | 0.40 |

| | 0.40 |

| | 0.40 |

| | 0.40 |

|

Market Price | | | | | | | | | |

High | 53.53 |

| | 46.04 |

| | 38.78 |

| | 42.38 |

| | 40.34 |

|

Low | 37.00 |

| | 29.12 |

| | 25.97 |

| | 20.56 |

| | 26.15 |

|

Financial Condition | | | | | | | | | |

Cash and cash equivalents | $ | 432,759 |

| | $ | 484,502 |

| | $ | 429,784 |

| | $ | 438,010 |

| | $ | 421,420 |

|

Total assets | 3,335,618 |

| | 3,279,931 |

| | 3,152,415 |

| | 3,100,016 |

| | 2,943,732 |

|

Long-term debt and capital leases | 729,890 |

| | 735,340 |

| | 749,371 |

| | 770,238 |

| | 793,950 |

|

Other Data at Year End | | | | | | | | | |

Number of shareholders | 5,100 |

| | 5,452 |

| | 5,803 |

| | 6,168 |

| | 6,481 |

|

Approximate number of regular full-time

employees | 30,100 |

| | 29,500 |

| | 29,100 |

| | 27,800 |

| | 27,900 |

|

| |

[a] | The comparability of Con-way's consolidated operating income was affected by the following: |

| |

• | Charge of $16.0 million in 2014 at Con-way Corporate for the settlement of a legacy pension plan. |

| |

• | Gain of $10.0 million in 2011 at Menlo Logistics ("Menlo") resulting from a purchase-price adjustment to settle a dispute associated with the 2007 acquisition of Chic Logistics. |

| |

• | Charge of $19.2 million in 2010 for the impairment of goodwill and other intangible assets at Menlo. |

| |

[b] | The comparability of Con-way's income tax provision was affected by a non-deductible goodwill impairment charge at Menlo in 2010. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

Management's Discussion and Analysis of Financial Condition and Results of Operations (referred to as "Management's Discussion and Analysis") is intended to assist in a historical and prospective understanding of Con-way's financial condition, results of operations and cash flows, including a discussion and analysis of the following:

| |

• | Liquidity and Capital Resources |

| |

• | Critical Accounting Policies and Estimates |

| |

• | New Accounting Standards |

| |

• | Forward-Looking Statements |

Overview of Business

Con-way provides transportation, logistics and supply-chain management services for a wide range of manufacturing, industrial and retail customers. Con-way's business units operate in regional, inter-regional and transcontinental less-than-truckload and full-truckload freight transportation, contract logistics and supply-chain management, multimodal freight brokerage, and trailer manufacturing. For financial reporting purposes, Con-way is divided into three reporting segments: Freight, Logistics and Truckload.

Con-way Freight primarily transports shipments utilizing a network of freight service centers combined with a fleet of company-operated linehaul and pickup-and-delivery tractors and trailers. Menlo Logistics ("Menlo") manages the logistics functions of its customers and primarily utilizes third-party transportation providers for the movement of customer shipments. Con-way Truckload primarily transports shipments using a fleet of company-operated tractors and trailers.

Prior to 2013, the former Other segment consisted of the operating results of Con-way's trailer manufacturer and certain corporate activities for which the related income or expense was not allocated to other reporting segments. Beginning in the first quarter of 2013, inter-segment eliminations were combined with the Other segment and reported as Corporate and Eliminations in order to reconcile the segment results to the consolidated totals. All periods presented reflect this change to the reporting segment structure.

Con-way's primary business-unit results generally depend on the number, weight and distance of shipments transported, the prices received on those shipments or services and the mix of services provided to customers, as well as the fixed and variable costs incurred by Con-way in providing the services and the ability to manage those costs under changing circumstances. Due to Con-way Freight's relatively high fixed-cost structure, sudden or severe changes in shipment volumes can have a negative impact on management's ability to manage costs.

Con-way's primary business units are affected by the timing and degree of fluctuations and volatility in fuel prices and their ability to recover incremental fuel costs through fuel-surcharge programs and/or cost-recovery mechanisms, as more fully discussed in Item 1A, "Risk Factors."

Results of Operations

The overview below provides a high-level summary of Con-way's results of operations for the periods presented and is intended to provide context for the remainder of the discussion on reporting segments. Refer to "Reporting Segment Review" below for more complete and detailed discussion and analysis.

|

| | | | | | | | | | | |

| Years ended December 31, |

(Dollars in thousands, except per share data) | 2014 | | 2013 | | 2012 |

Revenue | $ | 5,806,069 |

| | $ | 5,473,356 |

| | $ | 5,580,247 |

|

| | | | | |

Operating expenses | 5,537,619 |

| | 5,264,403 |

| | 5,351,406 |

|

Operating income | 268,450 |

| | 208,953 |

| | 228,841 |

|

Other income (expense) | (57,753 | ) | | (54,588 | ) | | (57,887 | ) |

Income before income tax provision | 210,697 |

| | 154,365 |

| | 170,954 |

|

Income tax provision | 73,658 |

| | 55,212 |

| | 66,408 |

|

Net income | $ | 137,039 |

| | $ | 99,153 |

| | $ | 104,546 |

|

| | | | | |

Diluted earnings per common share | $ | 2.36 |

| | $ | 1.73 |

| | $ | 1.85 |

|

Operating margin | 4.6 | % | | 3.8 | % | | 4.1 | % |

Overview

2014 Compared to 2013

Con-way's consolidated revenue of $5.8 billion in 2014 increased 6.1% from $5.5 billion in 2013 due to increased revenue from Logistics and Freight, partially offset by slightly lower revenue from Truckload. Increased revenue from Logistics was the result of increased transportation- and warehouse-management services. Freight's revenue increased primarily due to an increase in yield. Truckload's revenue decreased primarily due to a decrease in loaded miles and lower fuel-surcharge revenue.

Con-way's consolidated operating income increased 28.5% to $268.5 million in 2014 from $209.0 million in 2013. The increase in operating income was due to higher operating income at all three segments, partially offset by a $16.0 million charge related to the settlement of a legacy pension plan. Higher operating income at Freight benefited from revenue-management and linehaul-optimization initiatives. Higher operating income at Logistics was largely due to revenue growth and improved margins from transportation-management services. Higher operating income at Truckload was the result of decreased operating expenses and increased freight revenue per loaded mile.

Other income (expense) in 2014 was $57.8 million compared to $54.6 million in 2013. Other income (expense) was adversely affected by an increase in foreign currency exchange rate losses from foreign denominated balances at Logistics.

Con-way's effective tax rate in 2014 was 35.0% compared to 35.8% in 2013. The tax provision in 2014 included benefits of $5.4 million related to a change in state tax rates and $3.8 million to recognize the 2014 alternative-fuel credit. The tax provision in 2013 included $7.0 million in benefits to recognize the 2012 and 2013 alternative-fuel credits. The 2012 alternative-fuel credit was not available until legislation was enacted in early 2013. The alternative-fuel credit is not expected to be available for 2015.

2013 Compared to 2012

Con-way's consolidated revenue of $5.5 billion in 2013 decreased 1.9% from $5.6 billion in 2012 due to lower revenue from Logistics, partially offset by higher revenue from Freight and Truckload. Lower revenue from Logistics was the result of decreased transportation-management services, partially offset by increased warehouse-management services. Freight's revenue increased due to an increase in yield, partially offset by a decrease in weight per day. Truckload's revenue increased primarily due to improved revenue per mile, partially offset by a decrease in loaded miles.

Con-way's consolidated operating income decreased to $209.0 million in 2013 from $228.8 million in 2012. The decrease in operating income was due to lower operating income at Logistics and Truckload, partially offset by improved operating income at Freight. Logistics' operating income declined due to higher warehouse-related operating costs for certain warehouse-management contracts. Truckload's operating income decreased due to higher operating expenses, primarily from increases in depreciation and maintenance.

Other income (expense) in 2013 decreased $3.3 million compared to 2012, reflecting lower interest expense and lower letters-of-credit fees.

Con-way's effective tax rate in 2013 was 35.8% compared to 38.8% in 2012. The lower effective tax rate in 2013 was due primarily to the $7.0 million of tax benefits to recognize 2012 and 2013 alternative-fuel credits. The 2012 alternative-fuel credit was not available until legislation was enacted in early 2013.

Reporting Segment Review

For the discussion and analysis of segment operating results, management utilizes revenue before inter-segment eliminations. Management believes that revenue before inter-segment eliminations, combined with the detailed operating expense information, provides the most meaningful analysis of segment results. Both revenue from external customers and revenue from internal customers are reported in Note 12, "Segment Reporting," of Item 8, "Financial Statements and Supplementary Data."

Freight

The table below compares operating results, operating margins and the percentage change in selected operating statistics of the Freight reporting segment:

|

| | | | | | | | | | | |

| Years ended December 31, |

(Dollars in thousands) | 2014 | | 2013 | | 2012 |

Revenue before inter-segment eliminations | $ | 3,632,065 |

| | $ | 3,466,100 |

| | $ | 3,392,596 |

|

| | | | | |

Salaries, wages and employee benefits | 1,641,018 |

| | 1,572,021 |

| | 1,551,742 |

|

Purchased transportation | 587,002 |

| | 594,356 |

| | 585,489 |

|

Other operating expenses | 501,664 |

| | 480,649 |

| | 445,940 |

|

Fuel and fuel-related taxes | 347,032 |

| | 363,026 |

| | 376,323 |

|

Depreciation and amortization | 150,528 |

| | 135,310 |

| | 124,372 |

|

Purchased labor | 46,828 |

| | 33,669 |

| | 22,704 |

|

Rents and leases | 47,391 |

| | 49,477 |

| | 48,755 |

|

Maintenance | 100,278 |

| | 91,545 |

| | 93,402 |

|

Total operating expenses | 3,421,741 |

| | 3,320,053 |

| | 3,248,727 |

|

Operating income | $ | 210,324 |

| | $ | 146,047 |

| | $ | 143,869 |

|

| | | | | |

Operating margin | 5.8 | % | | 4.2 | % | | 4.2 | % |

|

| | | | | | |

| 2014 vs. 2013 | | 2013 vs. 2012 | |

Selected Operating Statistics | | | | |

Weight per day | +0.6 | % | | -0.2 | % | |

Revenue per hundredweight ("yield") | +4.5 | % | | +2.2 | % | |

Shipments per day | -0.9 | % | | -0.8 | % | |

Weight per shipment | +1.5 | % | | +0.6 | % | |

2014 Compared to 2013

Freight's revenue in 2014 increased 4.8% compared to 2013 due to a 4.5% increase in yield and a 0.6% increase in weight per day. The 4.5% increase in yield was largely due to increased base freight rates, while the 0.6% increase in weight per day reflects a 1.5% increase in weight per shipment, partially offset by a 0.9% decline in shipments per day. In 2014, higher yields also include the effects of general rate increases that were effective on March 31 and October 27. In 2013, the general rate increase was effective on June 24. These general rate increases apply to customers with pricing governed by Con-way Freight's standard tariff, which accounts for approximately 25% of Freight's business. Competitive and other factors impact the extent to which general rate increases are retained over time.

Excluding fuel surcharges, yield increased 4.7% in 2014 compared to 2013. Fuel-surcharge revenue decreased slightly to 17.2% of revenue in 2014 from 17.3% in 2013. The fuel surcharge is intended to compensate Con-way Freight for the adverse effects of higher fuel costs and fuel-related increases in purchased transportation. Fuel surcharges are only one part of Con-way Freight's overall rate structure, and the total price that Con-way Freight receives from customers for its services is governed by market forces, as more fully discussed in Item 1A, "Risk Factors."

Freight's operating income in 2014 increased 44.0% compared to 2013. Operating income benefited from revenue-management and linehaul-optimization initiatives.

Expenses for salaries, wages and employee benefits increased 4.4% in 2014 compared to 2013 due to increased costs related to salaries and wages (excluding variable compensation), employee benefits and variable compensation. Salaries and wages (excluding variable compensation) increased 3.4% in 2014 largely due to increased miles driven by company drivers and annual salary and wage rate increases. Employee benefits expense increased 4.9% in 2014, reflecting increases in workers' compensation claims and costs for employee medical benefits. Variable-compensation expense increased $9.3 million or 35.3% due to variations in performance relative to variable compensation plan targets. The increase in workers' compensation claims was due to an increase in the number of claims. The increase in costs for employee medical benefits was due to an increase in the cost per claim, partially offset by a decrease in the number of claims. Comparative changes in year-to-date expenses for salaries, wages and employee benefits were also affected by the timing of salary and wage rate increases; in 2014, those increases were effective in July compared to 2013, when the increases were effective in April. In January 2015, Con-way Freight implemented wage rate increases for drivers that included adjustments to ensure Con-way Freight's pay structures are competitive and market based. The overall amount and timing of the increase are also designed to improve Con-way Freight's ability to attract and retain professional drivers in the context of an industry-wide driver shortage. As a result of these adjustments, management expects 2015 expense for driver wages and benefits to increase $60 million over 2014. In recent years, the comparable year-over-year impact of an annual driver wage increase has been approximately half this amount.

Purchased transportation expense decreased 1.2% in 2014 from 2013 due to a decrease in the number of third-party miles, partially offset by a higher cost per mile. The decrease in third-party miles is the result of Con-way Freight's ongoing linehaul-optimization initiative.

Other operating expenses increased 4.4% in 2014 compared to 2013 due to increased costs for cargo claims and higher expenses for information-technology services, partially offset by higher gains from the sale of property and decreased vehicular claims. Cargo loss and damage claims increased due to increases in the cost per claim and the number of claims. The increase in information-technology expenses was primarily due to higher costs for network infrastructure upgrades and electronic onboard technologies. Vehicular claims decreased due to decreases in the cost per claim and the number of claims.

Expenses for fuel and fuel-related taxes decreased 4.4% compared to 2013 primarily due to a lower cost per gallon of diesel fuel and lower fuel consumption as a result of improved miles per gallon.

Depreciation and amortization expense increased 11.2% in 2014 compared to 2013 primarily due to the replacement of older tractors with newer models. Newer models are more costly due in part to the inclusion of more expensive emissions-control and safety technology.

Purchased labor expense increased 39.1% in 2014 compared to 2013 as more of this source of labor was used in freight handling and clerical functions.

Maintenance expense increased 9.5% in 2014 compared to 2013 primarily due to increases in the frequency and cost of maintenance related to tractors.

2013 Compared to 2012

Freight's revenue in 2013 increased 2.2% compared to 2012 due to a 2.2% increase in yield, partially offset by a 0.2% decline in weight per day. The 2.2% increase in yield was largely due to increased base freight rates, while the 0.2% decline in weight per day reflects a 0.8% decline in shipments per day, partially offset by a 0.6% increase in weight per shipment.

Excluding fuel surcharges, yield increased 2.4% in 2013 compared to 2012. Fuel-surcharge revenue decreased to 17.3% of revenue in 2013 from 17.5% in 2012.

Freight's operating income increased by $2.2 million in 2013 compared to 2012 primarily due to an increase in yield. In addition, operating results in 2013 reflect progress made under Freight's lane-based pricing and linehaul optimization initiatives. These initiatives were implemented over the course of 2013; however, the benefits of these initiatives were largely offset by increased costs for cargo, workers' compensation and vehicular claims.

Expenses for salaries, wages and employee benefits increased 1.3% in 2013 compared to 2012 due to a 2.2% increase in salaries and wages (excluding variable compensation), which was partially offset by a $2.9 million or 9.8% decrease in variable compensation. Benefits expense was relatively flat in 2013 as a decrease in costs for employee medical benefits was offset by an increase in workers' compensation expense. The 2.2% increase in salaries and wages (excluding variable compensation) was largely due to annual salary and wage rate increases. The 9.8% decrease in variable compensation was based primarily on variations in performance relative to variable compensation plan targets. The decrease in costs for employee medical benefits was primarily due to a decrease in the number of claims. The increase in workers' compensation expense was due to an increase in the expense per claim, partially offset by a decrease in the number of claims.

Purchased transportation expense increased 1.5% in 2013 from 2012 due to higher carrier rates and increased third-party miles.

Other operating expenses increased 7.8% in 2013 compared to 2012 due to higher expenses for information-technology services, increased costs for cargo and vehicular claims, and a decline in gains from the sale of property. The increase in information-technology expenses was primarily due to higher costs for information-technology projects (including the initiatives discussed above) and infrastructure. The increase in costs for cargo and vehicular claims resulted from an increase in the cost per claim and the number of claims.

Expenses for fuel and fuel-related taxes decreased 3.5% compared to 2012 primarily due to lower fuel consumption, which reflects improved miles per gallon and fewer miles driven by company drivers, and a lower cost per gallon of diesel fuel. The decline in miles driven by company drivers included the effect of improved linehaul productivity (as measured by average weight per trailer).

Depreciation and amortization expense increased 8.8% in 2013 compared to 2012 primarily due to the replacement of older tractors with newer models. Newer models are more costly due in part to the inclusion of more expensive emissions-control and safety technology.

Purchased labor expense increased 48.3% in 2013 compared to 2012 as more of this source of labor was used in freight-handling functions.

Logistics

The table below compares operating results and operating margins of the Logistics reporting segment. The table summarizes Logistics' revenue and net revenue (revenue less purchased transportation expense). Transportation-management revenue is attributable to contracts for which Menlo manages the transportation of freight but subcontracts to carriers the actual transportation and delivery of products, which Menlo refers to as purchased transportation. Menlo's management places emphasis on net revenue as a meaningful measure of the relative importance of its principal services since revenue earned on most transportation-management services includes the carriers' charges to Menlo for transporting the shipments.

|

| | | | | | | | | | | |

| Years ended December 31, |

(Dollars in thousands) | 2014 | | 2013 | | 2012 |

Revenue before inter-segment eliminations | $ | 1,717,711 |

| | $ | 1,540,399 |

| | $ | 1,726,200 |

|

Purchased transportation | (968,845 | ) | | (858,468 | ) | | (1,087,056 | ) |

Net revenue | 748,866 |

| | 681,931 |

| | 639,144 |

|

| | | | | |

Salaries, wages and employee benefits | 293,662 |

| | 265,837 |

| | 260,863 |

|

Other operating expenses | 200,403 |

| | 198,187 |

| | 167,478 |

|

Fuel and fuel-related taxes | 1,235 |

| | 780 |

| | 850 |

|

Depreciation and amortization | 12,368 |

| | 9,647 |

| | 9,605 |

|

Purchased labor | 119,985 |

| | 104,914 |

| | 88,092 |

|

Rents and leases | 90,588 |

| | 76,243 |

| | 64,508 |

|

Maintenance | 3,432 |

| | 2,856 |

| | 3,132 |

|

Total operating expenses excluding purchased transportation | 721,673 |

| | 658,464 |

| | 594,528 |

|

Operating income | $ | 27,193 |

| | $ | 23,467 |

| | $ | 44,616 |

|

| | | | | |

Operating margin on revenue | 1.6 | % | | 1.5 | % | | 2.6 | % |

Operating margin on net revenue | 3.6 | % | | 3.4 | % | | 7.0 | % |

2014 Compared to 2013

In 2014, Logistics' revenue increased 11.5% compared to 2013 due to increases of 10.9% and 12.7% in revenue from transportation- and warehouse-management services, respectively. Increased revenue from transportation-management services was primarily due to new business and improved volumes and growth in services at existing customers, partially offset by a change in the scope of a large customer contract and the conclusion of work under other customer contracts. Increased revenue from warehouse-management services was primarily due to improved volumes and growth in services at existing customers and new business, partially offset by conclusion of work under other customer contracts.

Logistics' net revenue in 2014 increased 9.8% compared to 2013 primarily due to increased revenue from warehouse-management services. Purchased transportation expense in 2014 increased 12.9% compared to 2013 as a result of increased revenue from transportation-management services.