Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | Quarterly Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2012

OR

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

| Commission |

Exact name of registrant as specified in its charter and principal office address and telephone number |

State of |

I.R.S. Employer | |||

| 1-14514 | Consolidated Edison, Inc. | New York | 13-3965100 | |||

| 4 Irving Place, New York, New York 10003 | ||||||

| (212) 460-4600 | ||||||

| 1-1217 | Consolidated Edison Company of New York, Inc. | New York | 13-5009340 | |||

| 4 Irving Place, New York, New York 10003 | ||||||

| (212) 460-4600 | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Consolidated Edison, Inc. (Con Edison) | Yes x | No ¨ | ||||||

| Consolidated Edison of New York, Inc. (CECONY) | Yes x | No ¨ | ||||||

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Con Edison | Yes x | No ¨ | ||||||

| CECONY | Yes x | No ¨ | ||||||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Con Edison | ||||||

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| CECONY | ||||||

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Con Edison | Yes ¨ | No x | ||||||

| CECONY | Yes ¨ | No x | ||||||

As of April 27, 2012, Con Edison had outstanding 292,904,261 Common Shares ($.10 par value). All of the outstanding common equity of CECONY is held by Con Edison.

Filing Format

This Quarterly Report on Form 10-Q is a combined report being filed separately by two different registrants: Consolidated Edison, Inc. (Con Edison) and Consolidated Edison Company of New York, Inc. (CECONY). CECONY is a subsidiary of Con Edison and, as such, the information in this report about CECONY also applies to Con Edison. As used in this report, the term the “Companies” refers to Con Edison and CECONY. However, CECONY makes no representation as to the information contained in this report relating to Con Edison or the subsidiaries of Con Edison other than itself.

Table of Contents

Glossary of Terms

The following is a glossary of frequently used abbreviations or acronyms that are used in the Companies’ SEC reports:

| Con Edison Companies | ||

| Con Edison | Consolidated Edison, Inc. | |

| CECONY | Consolidated Edison Company of New York, Inc. | |

| Con Edison Development | Consolidated Edison Development, Inc. | |

| Con Edison Energy | Consolidated Edison Energy, Inc. | |

| Con Edison Solutions | Consolidated Edison Solutions, Inc. | |

| O&R | Orange and Rockland Utilities, Inc. | |

| Pike | Pike County Light & Power Company | |

| RECO | Rockland Electric Company | |

| The Companies | Con Edison and CECONY | |

| The Utilities | CECONY and O&R | |

| Regulatory Agencies, Government Agencies, and Quasi-governmental Not-for-Profits | ||

| EPA | U. S. Environmental Protection Agency | |

| FERC | Federal Energy Regulatory Commission | |

| IRS | Internal Revenue Service | |

| ISO-NE | ISO New England Inc. | |

| NJBPU | New Jersey Board of Public Utilities | |

| NJDEP | New Jersey Department of Environmental Protection | |

| NYISO | New York Independent System Operator | |

| NYPA | New York Power Authority | |

| NYSAG | New York State Attorney General | |

| NYSDEC | New York State Department of Environmental Conservation | |

| NYSERDA | New York State Energy Research and Development Authority | |

| NYSPSC | New York State Public Service Commission | |

| NYSRC | New York State Reliability Council, LLC | |

| PAPUC | Pennsylvania Public Utility Commission | |

| PJM | PJM Interconnection LLC | |

| SEC | U.S. Securities and Exchange Commission | |

| Accounting | ||

| ABO | Accumulated Benefit Obligation | |

| ASU | Accounting Standards Update | |

| FASB | Financial Accounting Standards Board | |

| LILO | Lease In/Lease Out | |

| OCI | Other Comprehensive Income | |

| SFAS | Statement of Financial Accounting Standards | |

| VIE | Variable interest entity | |

| Environmental | ||

| CO2 | Carbon dioxide | |

| GHG | Greenhouse gases | |

| MGP Sites | Manufactured gas plant sites | |

| PCBs | Polychlorinated biphenyls | |

| PRP | Potentially responsible party | |

| SO2 | Sulfur dioxide | |

| Superfund | Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 and similar state statutes | |

| 2 |

Table of Contents

| Units of Measure | ||

| dths | Dekatherms | |

| kV | Kilovolt | |

| kWh | Kilowatt-hour | |

| mdths | Thousand dekatherms | |

| MMlbs | Million pounds | |

| MVA | Megavolt ampere | |

| MW | Megawatt or thousand kilowatts | |

| MWH | Megawatt hour | |

| Other | ||

| AFDC | Allowance for funds used during construction | |

| COSO | Committee of Sponsoring Organizations of the Treadway Commission | |

| EMF | Electric and magnetic fields | |

| ERRP | East River Repowering Project | |

| Fitch | Fitch Ratings | |

| First Quarter Form 10-Q | The Companies’ combined Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2012 | |

| Form 10-K | The Companies’ combined Annual Report on Form 10-K for the year ended December 31, 2011 | |

| LTIP | Long Term Incentive Plan | |

| Moody’s | Moody’s Investors Service | |

| S&P | Standard & Poor’s Financial Services LLC | |

| VaR | Value-at-Risk | |

| 3 |

Table of Contents

| PAGE | ||||||

| PART I—Financial Information | ||||||

| ITEM 1 | Financial Statements (Unaudited) |

|||||

| Con Edison |

||||||

| 6 | ||||||

| 7 | ||||||

| 8 | ||||||

| 9 | ||||||

| 11 | ||||||

| CECONY |

||||||

| 12 | ||||||

| 13 | ||||||

| 14 | ||||||

| 15 | ||||||

| 17 | ||||||

| 18 | ||||||

| ITEM 2 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

35 | ||||

| ITEM 3 | 50 | |||||

| ITEM 4 | 50 | |||||

| PART II—Other Information | ||||||

| ITEM 1 | 51 | |||||

| ITEM 1A | 51 | |||||

| ITEM 2 | 51 | |||||

| ITEM 6 | 52 | |||||

| Signatures | 52 | |||||

| 4 |

Table of Contents

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectation and not facts. Words such as “expects,” “estimates,” “anticipates,” “intends,” “believes,” “plans,” “will” and similar expressions identify forward-looking statements. Forward-looking statements are based on information available at the time the statements are made, and accordingly speak only as of that time. Actual results or developments might differ materially from those included in the forward-looking statements because of various risks, including:

| • | the failure to operate energy facilities safely and reliably could adversely affect the Companies; |

| • | the failure to properly complete construction projects could adversely affect the Companies; |

| • | the failure of processes and systems and the performance of employees and contractors could adversely affect the Companies; |

| • | the Companies are extensively regulated and are subject to penalties; |

| • | the Utilities’ rate plans may not provide a reasonable return; |

| • | the Companies may be adversely affected by changes to the Utilities’ rate plans; |

| • | the Companies are exposed to risks from the environmental consequences of their operations; |

| • | a disruption in the wholesale energy markets or failure by an energy supplier could adversely affect the Companies; |

| • | the Companies have substantial unfunded pension and other postretirement benefit liabilities; |

| • | Con Edison’s ability to pay dividends or interest depends on dividends from its subsidiaries; |

| • | the Companies require access to capital markets to satisfy funding requirements; |

| • | the Internal Revenue Service has disallowed substantial tax deductions taken by the company; |

| • | a cyber attack could adversely affect the Companies; and |

| • | the Companies also face other risks that are beyond their control. |

| 5 |

Table of Contents

| Consolidated Edison, Inc. |

CONSOLIDATED INCOME STATEMENT (UNAUDITED)

| For the Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (Millions of Dollars/ Except Share Data) |

||||||||

| OPERATING REVENUES |

||||||||

| Electric |

$ | 1,862 | $ | 1,869 | ||||

| Gas |

645 | 755 | ||||||

| Steam |

263 | 325 | ||||||

| Non-utility |

308 | 400 | ||||||

| TOTAL OPERATING REVENUES |

3,078 | 3,349 | ||||||

| OPERATING EXPENSES |

||||||||

| Purchased power |

781 | 865 | ||||||

| Fuel |

108 | 176 | ||||||

| Gas purchased for resale |

196 | 308 | ||||||

| Operations and maintenance |

749 | 698 | ||||||

| Depreciation and amortization |

233 | 218 | ||||||

| Taxes, other than income taxes |

450 | 458 | ||||||

| TOTAL OPERATING EXPENSES |

2,517 | 2,723 | ||||||

| OPERATING INCOME |

561 | 626 | ||||||

| OTHER INCOME (DEDUCTIONS) |

||||||||

| Investment and other income |

7 | 9 | ||||||

| Allowance for equity funds used during construction |

— | 4 | ||||||

| Other deductions |

(4 | ) | (4 | ) | ||||

| TOTAL OTHER INCOME (DEDUCTIONS) |

3 | 9 | ||||||

| INCOME BEFORE INTEREST AND INCOME TAX EXPENSE |

564 | 635 | ||||||

| INTEREST EXPENSE |

||||||||

| Interest on long-term debt |

145 | 147 | ||||||

| Other interest |

5 | 7 | ||||||

| Allowance for borrowed funds used during construction |

— | (2 | ) | |||||

| NET INTEREST EXPENSE |

150 | 152 | ||||||

| INCOME BEFORE INCOME TAX EXPENSE |

414 | 483 | ||||||

| INCOME TAX EXPENSE |

134 | 169 | ||||||

| NET INCOME |

280 | 314 | ||||||

| Preferred stock dividend requirements of subsidiary |

(3 | ) | (3 | ) | ||||

| NET INCOME FOR COMMON STOCK |

$ | 277 | $ | 311 | ||||

| Net income for common stock per common share – basic |

$ | 0.95 | $ | 1.07 | ||||

| Net income for common stock per common share – diluted |

$ | 0.94 | $ | 1.06 | ||||

| DIVIDENDS DECLARED PER SHARE OF COMMON STOCK |

$ | 0.605 | $ | 0.600 | ||||

| AVERAGE NUMBER OF SHARES OUTSTANDING – BASIC (IN MILLIONS) |

292.9 | 292.0 | ||||||

| AVERAGE NUMBER OF SHARES OUTSTANDING – DILUTED (IN MILLIONS) |

294.5 | 293.6 | ||||||

The accompanying notes are an integral part of these financial statements.

| 6 |

Table of Contents

| Consolidated Edison, Inc. |

| For the Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (Millions of Dollars) | ||||||||

| NET INCOME |

$ | 280 | $ | 314 | ||||

| OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAXES |

||||||||

| Pension plan liability adjustments, net of $5 and $2 taxes in 2012 and 2011, respectively |

7 | 3 | ||||||

| TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAXES |

7 | 3 | ||||||

| COMPREHENSIVE INCOME |

$ | 287 | $ | 317 | ||||

| Preferred stock dividend requirements of subsidiary |

(3 | ) | (3 | ) | ||||

| COMPREHENSIVE INCOME FOR COMMON STOCK |

$ | 284 | $ | 314 | ||||

The accompanying notes are an integral part of these financial statements.

| 7 |

Table of Contents

| Consolidated Edison, Inc. |

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

| For the Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (Millions of Dollars) | ||||||||

| OPERATING ACTIVITIES |

||||||||

| Net Income |

$ | 280 | $ | 314 | ||||

| PRINCIPAL NON-CASH CHARGES/(CREDITS) TO INCOME |

||||||||

| Depreciation and amortization |

233 | 218 | ||||||

| Deferred income taxes |

68 | 232 | ||||||

| Rate case amortization and accruals |

31 | 19 | ||||||

| Common equity component of allowance for funds used during construction |

— | (4 | ) | |||||

| Net derivative losses/(gains) |

31 | (37 | ) | |||||

| Other non-cash items (net) |

64 | (17 | ) | |||||

| CHANGES IN ASSETS AND LIABILITIES |

||||||||

| Accounts receivable – customers, less allowance for uncollectibles |

54 | (5 | ) | |||||

| Materials and supplies, including fuel oil and gas in storage |

31 | 103 | ||||||

| Other receivables and other current assets |

(2 | ) | 66 | |||||

| Prepayments |

(286 | ) | (217 | ) | ||||

| Accounts payable |

(78 | ) | (154 | ) | ||||

| Pensions and retiree benefits obligations |

253 | 259 | ||||||

| Pensions and retiree benefits contribution |

(184 | ) | (491 | ) | ||||

| Accrued taxes |

41 | (20 | ) | |||||

| Accrued interest |

52 | 51 | ||||||

| Deferred charges, noncurrent assets and other regulatory assets |

(255 | ) | (19 | ) | ||||

| Deferred credits and other regulatory liabilities |

117 | 67 | ||||||

| Other assets |

— | (1 | ) | |||||

| Other liabilities |

(48 | ) | (2 | ) | ||||

| NET CASH FLOWS FROM OPERATING ACTIVITIES |

402 | 362 | ||||||

| INVESTING ACTIVITIES |

||||||||

| Utility construction expenditures |

(471 | ) | (394 | ) | ||||

| Cost of removal less salvage |

(43 | ) | (39 | ) | ||||

| Non-utility construction expenditures |

(9 | ) | (23 | ) | ||||

| Proceeds from investment tax credits and grants related to renewable energy investments |

6 | — | ||||||

| Net investment in Pilesgrove solar project and other |

27 | — | ||||||

| Loan to affiliate |

— | (40 | ) | |||||

| NET CASH FLOWS USED IN INVESTING ACTIVITIES |

(490 | ) | (496 | ) | ||||

| FINANCING ACTIVITIES |

||||||||

| Net proceeds from short-term debt |

— | 464 | ||||||

| Retirement of long-term debt |

(1 | ) | (1 | ) | ||||

| Issuance of long-term debt |

400 | — | ||||||

| Issuance of common shares for stock plans, net of repurchases |

(8 | ) | 25 | |||||

| Debt issuance costs |

(4 | ) | — | |||||

| Common stock dividends |

(175 | ) | (173 | ) | ||||

| Preferred stock dividends |

(3 | ) | (3 | ) | ||||

| NET CASH FLOWS FROM FINANCING ACTIVITIES |

209 | 312 | ||||||

| CASH AND TEMPORARY CASH INVESTMENTS: |

||||||||

| NET CHANGE FOR THE PERIOD |

121 | 178 | ||||||

| BALANCE AT BEGINNING OF PERIOD |

648 | 338 | ||||||

| BALANCE AT END OF PERIOD |

$ | 769 | $ | 516 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

||||||||

| Cash paid/(refunded) during the period for: |

||||||||

| Interest |

$ | 89 | $ | 90 | ||||

| Income taxes |

$ | — | $ | (172 | ) | |||

The accompanying notes are an integral part of these financial statements.

| 8 |

Table of Contents

| Consolidated Edison, Inc. |

CONSOLIDATED BALANCE SHEET (UNAUDITED)

| March 31, 2012 |

December 31, 2011 |

|||||||

| (Millions of Dollars) | ||||||||

| ASSETS |

||||||||

| CURRENT ASSETS |

||||||||

| Cash and temporary cash investments |

$ | 769 | $ | 648 | ||||

| Accounts receivable – customers, less allowance for uncollectible accounts of $87 in 2012 and 2011 |

1,069 | 1,123 | ||||||

| Accrued unbilled revenue |

379 | 474 | ||||||

| Other receivables, less allowance for uncollectible accounts of $10 in 2012 and 2011 |

249 | 303 | ||||||

| Fuel oil, gas in storage, materials and supplies, at average cost |

325 | 356 | ||||||

| Prepayments |

431 | 145 | ||||||

| Deferred tax assets – current |

285 | 266 | ||||||

| Regulatory assets |

192 | 164 | ||||||

| Other current assets |

205 | 159 | ||||||

| TOTAL CURRENT ASSETS |

3,904 | 3,638 | ||||||

| INVESTMENTS |

440 | 455 | ||||||

| UTILITY PLANT, AT ORIGINAL COST |

||||||||

| Electric |

21,520 | 21,105 | ||||||

| Gas |

4,821 | 4,727 | ||||||

| Steam |

2,015 | 1,983 | ||||||

| General |

2,093 | 1,960 | ||||||

| TOTAL |

30,449 | 29,775 | ||||||

| Less: Accumulated depreciation |

6,153 | 6,051 | ||||||

| Net |

24,296 | 23,724 | ||||||

| Construction work in progress |

920 | 1,241 | ||||||

| NET UTILITY PLANT |

25,216 | 24,965 | ||||||

| NON-UTILITY PLANT |

||||||||

| Non-utility property, less accumulated depreciation of $61 and $59 in 2012 and 2011, respectively |

98 | 89 | ||||||

| Construction work in progress |

39 | 39 | ||||||

| NET PLANT |

25,353 | 25,093 | ||||||

| OTHER NONCURRENT ASSETS |

||||||||

| Goodwill |

429 | 429 | ||||||

| Intangible assets, less accumulated amortization of $3 in 2012 and 2011 |

3 | 3 | ||||||

| Regulatory assets |

9,276 | 9,337 | ||||||

| Other deferred charges and noncurrent assets |

296 | 259 | ||||||

| TOTAL OTHER NONCURRENT ASSETS |

10,004 | 10,028 | ||||||

| TOTAL ASSETS |

$ | 39,701 | $ | 39,214 | ||||

The accompanying notes are an integral part of these financial statements.

| 9 |

Table of Contents

| Consolidated Edison, Inc. |

CONSOLIDATED BALANCE SHEET (UNAUDITED)

| March 31, 2012 |

December 31, 2011 |

|||||||

| (Millions of Dollars) | ||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

| CURRENT LIABILITIES |

||||||||

| Long-term debt due within one year |

$ | 1,030 | $ | 530 | ||||

| Accounts payable |

844 | 955 | ||||||

| Customer deposits |

306 | 303 | ||||||

| Accrued taxes |

229 | 188 | ||||||

| Accrued interest |

212 | 160 | ||||||

| Accrued wages |

91 | 91 | ||||||

| Fair value of derivative liabilities |

198 | 169 | ||||||

| Regulatory liabilities |

286 | 118 | ||||||

| Preferred stock redemption |

239 | — | ||||||

| Other current liabilities |

405 | 473 | ||||||

| TOTAL CURRENT LIABILITIES |

3,840 | 2,987 | ||||||

| NONCURRENT LIABILITIES |

||||||||

| Obligations under capital leases |

2 | 2 | ||||||

| Provision for injuries and damages |

158 | 181 | ||||||

| Pensions and retiree benefits |

4,605 | 4,835 | ||||||

| Superfund and other environmental costs |

537 | 489 | ||||||

| Asset retirement obligations |

147 | 145 | ||||||

| Fair value of derivative liabilities |

54 | 48 | ||||||

| Other noncurrent liabilities |

131 | 131 | ||||||

| TOTAL NONCURRENT LIABILITIES |

5,634 | 5,831 | ||||||

| DEFERRED CREDITS AND REGULATORY LIABILITIES |

||||||||

| Deferred income taxes and investment tax credits |

7,712 | 7,563 | ||||||

| Regulatory liabilities |

846 | 977 | ||||||

| Other deferred credits |

83 | 64 | ||||||

| TOTAL DEFERRED CREDITS AND REGULATORY LIABILITIES |

8,641 | 8,604 | ||||||

| LONG-TERM DEBT |

10,041 | 10,143 | ||||||

| SHAREHOLDERS’ EQUITY |

||||||||

| Common shareholders’ equity (See Statement of Common Shareholders’ Equity) |

11,545 | 11,436 | ||||||

| Preferred stock of subsidiary |

— | 213 | ||||||

| TOTAL SHAREHOLDERS’ EQUITY |

11,545 | 11,649 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ | 39,701 | $ | 39,214 | ||||

The accompanying notes are an integral part of these financial statements.

| 10 |

Table of Contents

Consolidated Edison, Inc.

CONSOLIDATED STATEMENT OF COMMON SHAREHOLDERS’ EQUITY (UNAUDITED)

| Common Stock | Additional Paid-In Capital |

Retained Earnings |

Treasury Stock | Capital Expense |

Accumulated Income/(Loss) |

Total |

||||||||||||||||||||||||||||||

| (Millions of Dollars/Except Share Data) | Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||

| BALANCE AS OF DECEMBER 31, 2010 |

291,616,334 | $ | 31 | $ | 4,915 | $ | 7,220 | 23,210,700 | $ | (1,001 | ) | $ | (64 | ) | $ | (40 | ) | $ | 11,061 | |||||||||||||||||

| Net income for common stock |

311 | 311 | ||||||||||||||||||||||||||||||||||

| Common stock dividends |

(175 | ) | (175 | ) | ||||||||||||||||||||||||||||||||

| Issuance of common shares – dividend reinvestment and employee stock plans |

656,049 | 1 | 30 | 31 | ||||||||||||||||||||||||||||||||

| Other comprehensive income |

3 | 3 | ||||||||||||||||||||||||||||||||||

| BALANCE AS OF MARCH 31, 2011 |

292,272,383 | $ | 32 | $ | 4,945 | $ | 7,356 | 23,210,700 | $ | (1,001 | ) | $ | (64 | ) | $ | (37 | ) | $ | 11,231 | |||||||||||||||||

| BALANCE AS OF DECEMBER 31, 2011 |

292,888,521 | $ | 32 | $ | 4,991 | $ | 7,568 | 23,194,075 | $ | (1,033 | ) | $ | (64 | ) | $ | (58 | ) | $ | 11,436 | |||||||||||||||||

| Net income for common stock |

277 | 277 | ||||||||||||||||||||||||||||||||||

| Common stock dividends |

(177 | ) | (177 | ) | ||||||||||||||||||||||||||||||||

| Issuance of common shares for stock plans, net of repurchases |

(7,225 | ) | 7,225 | (2 | ) | (2 | ) | |||||||||||||||||||||||||||||

| Preferred stock redemption |

4 | 4 | ||||||||||||||||||||||||||||||||||

| Other comprehensive income |

7 | 7 | ||||||||||||||||||||||||||||||||||

| BALANCE AS OF MARCH 31, 2012 |

292,881,296 | $ | 32 | $ | 4,991 | $ | 7,668 | 23,201,300 | $ | (1,035 | ) | $ | (60 | ) | $ | (51 | ) | $ | 11,545 | |||||||||||||||||

The accompanying notes are an integral part of these financial statements.

| 11 |

Table of Contents

| Consolidated Edison Company of New York, Inc. |

CONSOLIDATED INCOME STATEMENT (UNAUDITED)

| For the Three Month Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (Millions of Dollars) | ||||||||

| OPERATING REVENUES |

||||||||

| Electric |

$ | 1,735 | $ | 1,721 | ||||

| Gas |

563 | 663 | ||||||

| Steam |

263 | 325 | ||||||

| TOTAL OPERATING REVENUES |

2,561 | 2,709 | ||||||

| OPERATING EXPENSES |

||||||||

| Purchased power |

447 | 483 | ||||||

| Fuel |

108 | 176 | ||||||

| Gas purchased for resale |

169 | 263 | ||||||

| Operations and maintenance |

645 | 597 | ||||||

| Depreciation and amortization |

218 | 204 | ||||||

| Taxes, other than income taxes |

430 | 440 | ||||||

| TOTAL OPERATING EXPENSES |

2,017 | 2,163 | ||||||

| OPERATING INCOME |

544 | 546 | ||||||

| OTHER INCOME (DEDUCTIONS) |

||||||||

| Investment and other income |

5 | 5 | ||||||

| Allowance for equity funds used during construction |

— | 3 | ||||||

| Other deductions |

(3 | ) | (3 | ) | ||||

| TOTAL OTHER INCOME (DEDUCTIONS) |

2 | 5 | ||||||

| INCOME BEFORE INTEREST AND INCOME TAX EXPENSE |

546 | 551 | ||||||

| INTEREST EXPENSE |

||||||||

| Interest on long-term debt |

131 | 132 | ||||||

| Other interest |

5 | 5 | ||||||

| Allowance for borrowed funds used during construction |

— | (2 | ) | |||||

| NET INTEREST EXPENSE |

136 | 135 | ||||||

| INCOME BEFORE INCOME TAX EXPENSE |

410 | 416 | ||||||

| INCOME TAX EXPENSE |

134 | 145 | ||||||

| NET INCOME |

276 | 271 | ||||||

| Preferred stock dividend requirements |

(3 | ) | (3 | ) | ||||

| NET INCOME FOR COMMON STOCK |

$ | 273 | $ | 268 | ||||

The accompanying notes are an integral part of these financial statements.

| 12 |

Table of Contents

| Consolidated Edison Company of New York, Inc. |

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

| For the Three Month Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (Millions of Dollars) | ||||||||

| NET INCOME |

$ | 276 | $ | 271 | ||||

| OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAXES |

||||||||

| Pension plan liability adjustments, net of $— taxes in 2012 and 2011 |

— | — | ||||||

| TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAXES |

— | — | ||||||

| COMPREHENSIVE INCOME |

$ | 276 | $ | 271 | ||||

The accompanying notes are an integral part of these financial statements.

| 13 |

Table of Contents

| Consolidated Edison Company of New York, Inc. |

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

| For the Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| (Millions of Dollars) | ||||||||

| OPERATING ACTIVITIES |

||||||||

| Net income |

$ | 276 | $ | 271 | ||||

| PRINCIPAL NON-CASH CHARGES/(CREDITS) TO INCOME |

||||||||

| Depreciation and amortization |

218 | 204 | ||||||

| Deferred income taxes |

66 | 207 | ||||||

| Rate case amortization and accruals |

31 | 19 | ||||||

| Common equity component of allowance for funds used during construction |

— | (3 | ) | |||||

| Other non-cash items (net) |

15 | 10 | ||||||

| CHANGES IN ASSETS AND LIABILITIES |

||||||||

| Accounts receivable – customers, less allowance for uncollectibles |

43 | 22 | ||||||

| Materials and supplies, including fuel oil and gas in storage |

22 | 84 | ||||||

| Other receivables and other current assets |

16 | (77 | ) | |||||

| Prepayments |

(287 | ) | (291 | ) | ||||

| Accounts payable |

(48 | ) | (119 | ) | ||||

| Pensions and retiree benefits obligations |

209 | 236 | ||||||

| Pensions and retiree benefits contribution |

(184 | ) | (491 | ) | ||||

| Accrued taxes |

57 | (37 | ) | |||||

| Accrued interest |

42 | 44 | ||||||

| Superfund and environmental remediation costs (net) |

(1 | ) | — | |||||

| Deferred charges, noncurrent assets and other regulatory assets |

(179 | ) | (63 | ) | ||||

| Deferred credits and other regulatory liabilities |

108 | 52 | ||||||

| Other liabilities |

(36 | ) | 4 | |||||

| NET CASH FLOWS FROM OPERATING ACTIVITIES |

368 | 72 | ||||||

| INVESTING ACTIVITIES |

||||||||

| Utility construction expenditures |

(446 | ) | (376 | ) | ||||

| Cost of removal less salvage |

(41 | ) | (37 | ) | ||||

| NET CASH FLOWS USED IN INVESTING ACTIVITIES |

(487 | ) | (413 | ) | ||||

| FINANCING ACTIVITIES |

||||||||

| Net proceeds from short-term debt |

— | 464 | ||||||

| Issuance of long-term debt |

400 | — | ||||||

| Debt issuance costs |

(4 | ) | — | |||||

| Dividend to parent |

(171 | ) | (170 | ) | ||||

| Preferred stock dividends |

(3 | ) | (3 | ) | ||||

| NET CASH FLOWS USED IN FINANCING ACTIVITIES |

222 | 291 | ||||||

| CASH AND TEMPORARY CASH INVESTMENTS: |

||||||||

| NET CHANGE FOR THE PERIOD |

103 | (50 | ) | |||||

| BALANCE AT BEGINNING OF PERIOD |

372 | 78 | ||||||

| BALANCE AT END OF PERIOD |

$ | 475 | $ | 28 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

||||||||

| Cash paid/(refunded) during the period for: |

||||||||

| Interest |

$ | 83 | $ | 82 | ||||

| Income taxes |

$ | (20 | ) | $ | 35 | |||

The accompanying notes are an integral part of these financial statements.

| 14 |

Table of Contents

| Consolidated Edison Company of New York, Inc. |

CONSOLIDATED BALANCE SHEET (UNAUDITED)

| March 31, 2012 |

December 31, 2011 |

|||||||

| (Millions of Dollars) | ||||||||

| ASSETS |

||||||||

| CURRENT ASSETS |

||||||||

| Cash and temporary cash investments |

$ | 475 | $ | 372 | ||||

| Accounts receivable – customers, less allowance for uncollectible accounts of $79 in 2012 and 2011 |

934 | 977 | ||||||

| Other receivables, less allowance for uncollectible accounts of $9 in 2012 and 2011 |

110 | 102 | ||||||

| Accrued unbilled revenue |

285 | 366 | ||||||

| Accounts receivable from affiliated companies |

36 | 54 | ||||||

| Fuel oil, gas in storage, materials and supplies, at average cost |

286 | 308 | ||||||

| Prepayments |

372 | 85 | ||||||

| Regulatory assets |

159 | 140 | ||||||

| Deferred tax assets – current |

170 | 157 | ||||||

| Other current assets |

97 | 100 | ||||||

| TOTAL CURRENT ASSETS |

2,924 | 2,661 | ||||||

| INVESTMENTS |

188 | 177 | ||||||

| UTILITY PLANT AT ORIGINAL COST |

||||||||

| Electric |

20,284 | 19,886 | ||||||

| Gas |

4,285 | 4,200 | ||||||

| Steam |

2,015 | 1,983 | ||||||

| General |

1,917 | 1,785 | ||||||

| TOTAL |

28,501 | 27,854 | ||||||

| Less: Accumulated depreciation |

5,616 | 5,523 | ||||||

| Net |

22,885 | 22,331 | ||||||

| Construction work in progress |

853 | 1,165 | ||||||

| NET UTILITY PLANT |

23,738 | 23,496 | ||||||

| NON-UTILITY PROPERTY |

||||||||

| Non-utility property, less accumulated depreciation of $24 in 2012 and 2011 |

6 | 6 | ||||||

| NET PLANT |

23,744 | 23,502 | ||||||

| OTHER NONCURRENT ASSETS |

||||||||

| Regulatory assets |

8,645 | 8,661 | ||||||

| Other deferred charges and noncurrent assets |

254 | 217 | ||||||

| TOTAL OTHER NONCURRENT ASSETS |

8,899 | 8,878 | ||||||

| TOTAL ASSETS |

$ | 35,755 | $ | 35,218 | ||||

The accompanying notes are an integral part of these financial statements.

| 15 |

Table of Contents

| Consolidated Edison Company of New York, Inc. |

CONSOLIDATED BALANCE SHEET (UNAUDITED)

| March 31, 2012 |

December 31, 2011 |

|||||||

| (Millions of Dollars) | ||||||||

| LIABILITIES AND SHAREHOLDER’S EQUITY |

||||||||

| CURRENT LIABILITIES |

||||||||

| Long-term debt due within one year |

$ | 1,024 | $ | 525 | ||||

| Accounts payable |

690 | 774 | ||||||

| Accounts payable to affiliated companies |

17 | 16 | ||||||

| Customer deposits |

293 | 290 | ||||||

| Accrued taxes |

17 | 32 | ||||||

| Accrued taxes to affiliated companies |

198 | 126 | ||||||

| Accrued interest |

175 | 133 | ||||||

| Accrued wages |

82 | 81 | ||||||

| Fair value of derivative liabilities |

112 | 98 | ||||||

| Regulatory liabilities |

242 | 79 | ||||||

| Preferred stock redemption |

239 | — | ||||||

| Other current liabilities |

338 | 396 | ||||||

| TOTAL CURRENT LIABILITIES |

3,427 | 2,550 | ||||||

| NONCURRENT LIABILITIES |

||||||||

| Obligations under capital leases |

2 | 2 | ||||||

| Provision for injuries and damages |

151 | 173 | ||||||

| Pensions and retiree benefits |

4,142 | 4,337 | ||||||

| Superfund and other environmental costs |

421 | 373 | ||||||

| Asset retirement obligations |

147 | 145 | ||||||

| Fair value of derivative liabilities |

31 | 24 | ||||||

| Other noncurrent liabilities |

121 | 120 | ||||||

| TOTAL NONCURRENT LIABILITIES |

5,015 | 5,174 | ||||||

| DEFERRED CREDITS AND REGULATORY LIABILITIES |

||||||||

| Deferred income taxes and investment tax credits |

7,059 | 6,921 | ||||||

| Regulatory liabilities |

730 | 861 | ||||||

| Other deferred credits |

81 | 61 | ||||||

| TOTAL DEFERRED CREDITS AND REGULATORY LIABILITIES |

7,870 | 7,843 | ||||||

| LONG-TERM DEBT |

9,119 | 9,220 | ||||||

| SHAREHOLDER’S EQUITY |

||||||||

| Common shareholder’s equity (See Statement of Common Shareholder’s Equity) |

10,324 | 10,218 | ||||||

| Preferred stock |

— | 213 | ||||||

| TOTAL SHAREHOLDER’S EQUITY |

10,324 | 10,431 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDER’S EQUITY |

$ | 35,755 | $ | 35,218 | ||||

The accompanying notes are an integral part of these financial statements.

| 16 |

Table of Contents

| Consolidated Edison Company of New York, Inc. |

CONSOLIDATED STATEMENT OF COMMON SHAREHOLDER’S EQUITY (UNAUDITED)

| Common Stock | Additional Paid- In Capital |

Retained Earnings |

Repurchased Stock |

Capital Expense |

Accumulated Income/(Loss) |

Total |

||||||||||||||||||||||||||

| (Millions of Dollars/Except Share Data) | Shares | Amount | ||||||||||||||||||||||||||||||

| BALANCE AS OF DECEMBER 31, 2010 |

235,488,094 | $ | 589 | $ | 4,234 | $ | 6,132 | $ | (962 | ) | $ | (64 | ) | $ | (6 | ) | $ | 9,923 | ||||||||||||||

| Net income |

271 | 271 | ||||||||||||||||||||||||||||||

| Common stock dividend to parent |

(170 | ) | (170 | ) | ||||||||||||||||||||||||||||

| Cumulative preferred dividends |

(3 | ) | (3 | ) | ||||||||||||||||||||||||||||

| Other comprehensive income |

— | — | ||||||||||||||||||||||||||||||

| BALANCE AS OF MARCH 31, 2011 |

235,488,094 | $ | 589 | $ | 4,234 | $ | 6,230 | $ | (962 | ) | $ | (64 | ) | $ | (6 | ) | $ | 10,021 | ||||||||||||||

| BALANCE AS OF DECEMBER 31, 2011 |

235,488,094 | $ | 589 | $ | 4,234 | $ | 6,429 | $ | (962 | ) | $ | (64 | ) | $ | (8 | ) | $ | 10,218 | ||||||||||||||

| Net income |

276 | 276 | ||||||||||||||||||||||||||||||

| Common stock dividend to parent |

(171 | ) | (171 | ) | ||||||||||||||||||||||||||||

| Cumulative preferred dividends |

(3 | ) | (3 | ) | ||||||||||||||||||||||||||||

| Preferred stock redemption |

4 | 4 | ||||||||||||||||||||||||||||||

| Other comprehensive income |

— | — | ||||||||||||||||||||||||||||||

| BALANCE AS OF MARCH 31, 2012 |

235,488,094 | $ | 589 | $ | 4,234 | $ | 6,531 | $ | (962 | ) | $ | (60 | ) | $ | (8 | ) | $ | 10,324 | ||||||||||||||

The accompanying notes are an integral part of these financial statements.

| 17 |

Table of Contents

NOTES TO THE FINANCIAL STATEMENTS (UNAUDITED)

General

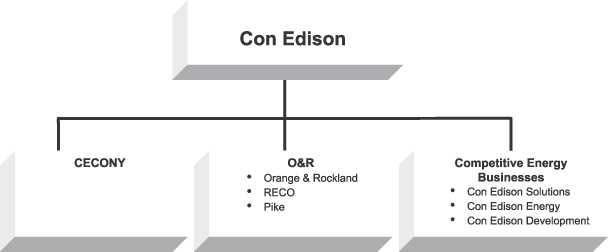

These combined notes accompany and form an integral part of the separate consolidated financial statements of each of the two separate registrants: Consolidated Edison, Inc. and its subsidiaries (Con Edison) and Consolidated Edison Company of New York, Inc. and its subsidiaries (CECONY). CECONY is a subsidiary of Con Edison and as such its financial condition and results of operations and cash flows, which are presented separately in the CECONY consolidated financial statements, are also consolidated, along with those of Con Edison’s other utility subsidiary, Orange and Rockland Utilities, Inc. (O&R), and Con Edison’s competitive energy businesses (discussed below) in Con Edison’s consolidated financial statements. The term “Utilities” is used in these notes to refer to CECONY and O&R.

As used in these notes, the term “Companies” refers to Con Edison and CECONY and, except as otherwise noted, the information in these combined notes relates to each of the Companies. However, CECONY makes no representation as to information relating to Con Edison or the subsidiaries of Con Edison other than itself.

The separate interim consolidated financial statements of each of the Companies are unaudited but, in the opinion of their respective managements, reflect all adjustments (which include only normally recurring adjustments) necessary for a fair presentation of the results for the interim periods presented. The Companies’ separate interim consolidated financial statements should be read together with their separate audited financial statements (including the combined notes thereto) included in Item 8 of their combined Annual Report on Form 10-K for the year ended December 31, 2011. Certain prior period amounts have been reclassified to conform to the current period presentation.

Con Edison has two regulated utility subsidiaries: CECONY and O&R. CECONY provides electric service and gas service in New York City and Westchester County. The company also provides steam service in parts of Manhattan. O&R, along with its regulated utility subsidiaries, provides electric service in southeastern New York and adjacent areas of northern New Jersey and eastern Pennsylvania and gas service in southeastern New York and adjacent areas of eastern Pennsylvania. Con Edison has the following competitive energy businesses: Consolidated Edison Solutions, Inc. (Con Edison Solutions), a retail energy services company that sells electricity and also offers energy-related services; Consolidated Edison Energy, Inc. (Con Edison Energy), a wholesale energy supply and services company; and Consolidated Edison Development, Inc. (Con Edison Development), a company that develops and participates in infrastructure projects.

| 18 |

Table of Contents

Note A — Summary of Significant Accounting Policies

Earnings Per Common Share

For the three months ended March 31, 2012 and 2011, basic and diluted EPS for Con Edison are calculated as follows:

| (Millions of Dollars, except per share amounts/Shares in Millions) | 2012 | 2011 | ||||||

| Net income for common stock |

$ | 277 | $ | 311 | ||||

| Weighted average common shares outstanding – Basic |

292.9 | 292.0 | ||||||

| Add: Incremental shares attributable to effect of potentially dilutive securities |

1.6 | 1.6 | ||||||

| Adjusted weighted average common shares outstanding – Diluted |

294.5 | 293.6 | ||||||

| Net income for common stock per common share – basic |

$ | 0.95 | $ | 1.07 | ||||

| Net income for common stock per common share – diluted |

$ | 0.94 | $ | 1.06 | ||||

Note B — Regulatory Matters

Rate Agreements

CECONY — Electric

In March 2012, the NYSPSC issued an order requiring that the $134 million surcharge that was to have been collected from customers during the rate year ending March 2013 instead be offset using certain CECONY regulatory liabilities that would have otherwise been refundable to or applied for the benefit of customers after the rate year.

O&R — Electric

On February 24, 2012, O&R, the staff of the NYSPSC and the Utility Intervention Unit of New York State’s Division of Consumer Protection entered into a Joint Proposal with respect to the Company’s rates for electric delivery service rendered in New York. The Joint Proposal, which is subject to NYSPSC approval, covers the three-year period from July 2012 through June 2015. The Joint Proposal provides for electric base rate increases of $19.4 million, $8.8 million and $15.2 million, effective July 2012, 2013 and 2014, respectively, which can be implemented, at the NYSPSC’s option, with increases of $15.2 million effective July 2012 and 2013 and an increase of $13.1 million, together with a surcharge of $2.1 million, effective July 2014. The Joint Proposal reflects the following major items:

| • | a weighted average cost of capital of 7.61 percent, 7.65 percent and 7.48 percent for the rate years ending June 30, 2013, 2014 and 2015, respectively, reflecting: |

| • | a return on common equity of 9.4 percent, 9.5 percent and 9.6 percent for the rate years ending June 30, 2013, 2014 and 2015, respectively; |

| • | cost of long-term debt of 6.07 percent for each of the rate years ending June 30, 2013 and 2014 and 5.64 percent for the rate year ending June 30 2015; |

| • | common equity ratio of 48 percent for each of the rate years ending June 30, 2013, 2014 and 2015; and |

| • | average rate base of $671 million, $708 million and $759 million for the rate years ending June 30, 2013, 2014 and 2015, respectively; |

| • | sharing with electric customers of any actual earnings, excluding the effects of any penalties and certain other items, above specified percentage returns on common equity (based on the actual average common equity ratio, subject to a 50 percent maximum): |

| • | the company will allocate to customers the revenue requirement equivalent of 50 percent, 75 percent and 90 percent of any such earnings for each rate year in excess of 80 basis points, 180 basis points and 280 basis points, respectively, above the return on common equity for that rate year indicated above; and |

| • | the earnings sharing allocation between the company and customers will be done on a cumulative basis at the end of rate year three; |

| • | continuation of a revenue decoupling mechanism; |

| 19 |

Table of Contents

| • | continuation of a provision which defers as a regulatory liability for the benefit of customers or, subject to certain limitations, a regulatory asset for recovery from customers, as the case may be, the revenue requirement impact of the amount by which actual average net utility plant for each rate year is different than the average net utility plant reflected in rates ($678 million, $704 million and $753 million for the rate years ending June 30, 2013, 2014 and 2015, respectively); |

| • | continuation of the rate provisions pursuant to which the company recovers its purchased power costs from customers; |

| • | continuation of rate provisions under which pension and other post-retirement benefit expenses, environmental remediation expenses, tax-exempt debt costs and certain other expenses are reconciled to amounts for those expenses reflected in rates; |

| • | provisions under which property taxes are reconciled to amounts reflected in rates; and |

| • | continuation of provisions for potential operations penalties of up to $3 million annually if certain customer service and system reliability performance targets are not met. |

Other Regulatory Matters

In February 2009, the NYSPSC commenced a proceeding to examine the prudence of certain CECONY expenditures (see “Investigations of Vendor Payments” in Note H). Pursuant to NYSPSC orders, a portion of the company’s revenues (currently, $249 million, $32 million and $6 million on an annual basis for electric, gas and steam service, respectively) is being collected subject to potential refund to customers. At March 31, 2012, the company had collected an estimated $887 million from customers subject to potential refund in connection with this proceeding. In October 2010, a NYSPSC consultant reported its $21 million provisional assessment, which the company has disputed, of potential overcharges for construction work. The potential overcharges related to transactions that involved certain employees who were arrested and a contractor that performed work for the company. The NYSPSC’s consultant is expected to continue to review the company’s expenditures. At March 31, 2012, the company had an $8 million regulatory liability relating to this matter. The company is unable to estimate the amount, if any, by which any refund required by the NYSPSC may exceed this regulatory liability.

In February 2011, the NYSPSC initiated a proceeding to examine the existing mechanisms pursuant to which utilities recover site investigation and remediation costs and possible alternatives. See Note G.

| 20 |

Table of Contents

Regulatory Assets and Liabilities

Regulatory assets and liabilities at March 31, 2012 and December 31, 2011 were comprised of the following items:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Regulatory assets |

||||||||||||||||

| Unrecognized pension and other postretirement costs |

$ | 5,594 | $ | 5,852 | $ | 5,337 | $ | 5,554 | ||||||||

| Future income tax |

1,840 | 1,798 | 1,764 | 1,724 | ||||||||||||

| Environmental remediation costs |

729 | 681 | 613 | 564 | ||||||||||||

| Pension and other post retirement benefits deferrals |

219 | 198 | 185 | 157 | ||||||||||||

| Revenue taxes |

167 | 163 | 161 | 158 | ||||||||||||

| Surcharge for New York State assessment |

143 | 90 | 133 | 82 | ||||||||||||

| Deferred storm costs |

125 | 128 | 79 | 80 | ||||||||||||

| Net electric deferrals |

116 | 121 | 116 | 121 | ||||||||||||

| Deferred derivative losses – long-term |

78 | 60 | 61 | 44 | ||||||||||||

| O&R transition bond charges |

43 | 44 | — | — | ||||||||||||

| Preferred stock redemption |

30 | — | 30 | — | ||||||||||||

| Workers’ compensation |

22 | 23 | 21 | 23 | ||||||||||||

| Property tax reconciliation |

13 | 13 | — | — | ||||||||||||

| Recoverable energy costs – long-term |

— | 14 | — | 14 | ||||||||||||

| Other |

157 | 152 | 145 | 140 | ||||||||||||

| Regulatory assets – long-term |

9,276 | 9,337 | 8,645 | 8,661 | ||||||||||||

| Deferred derivative losses – current |

192 | 164 | 159 | 140 | ||||||||||||

| Regulatory assets – current |

192 | 164 | 159 | 140 | ||||||||||||

| Total Regulatory Assets |

$ | 9,468 | $ | 9,501 | $ | 8,804 | $ | 8,801 | ||||||||

| Regulatory liabilities |

||||||||||||||||

| Allowance for cost of removal less salvage |

$ | 457 | $ | 448 | $ | 379 | $ | 372 | ||||||||

| Property tax reconciliation |

68 | 35 | 68 | 35 | ||||||||||||

| World Trade Center settlement proceeds |

62 | 62 | 62 | 62 | ||||||||||||

| Net unbilled revenue deferrals |

51 | 104 | 51 | 104 | ||||||||||||

| Long-term interest rate reconciliation |

42 | 30 | 42 | 30 | ||||||||||||

| Carrying charges on transmission and distribution net plant |

41 | 38 | 18 | 14 | ||||||||||||

| Gas line losses |

17 | 21 | 17 | 21 | ||||||||||||

| Expenditure prudence proceeding |

8 | 11 | 8 | 11 | ||||||||||||

| Energy efficiency programs |

6 | 22 | 6 | 20 | ||||||||||||

| Other |

94 | 206 | 79 | 192 | ||||||||||||

| Regulatory liabilities – long-term |

846 | 977 | 730 | 861 | ||||||||||||

| Electric surcharge offset |

134 | — | 134 | — | ||||||||||||

| Refundable energy costs – current |

99 | 51 | 55 | 12 | ||||||||||||

| Revenue decoupling mechanism |

51 | 66 | 51 | 66 | ||||||||||||

| Deferred derivative gains – current |

2 | 1 | 2 | 1 | ||||||||||||

| Regulatory liabilities – current |

286 | 118 | 242 | 79 | ||||||||||||

| Total Regulatory Liabilities |

$ | 1,132 | $ | 1,095 | $ | 972 | $ | 940 | ||||||||

Note C — Capitalization

In March 2012, CECONY issued $400 million of 4.20 percent 30-year debentures, $239 million of the net proceeds from the sale of which were used to redeem on May 1, 2012 all outstanding shares of its $5 Cumulative Preferred Stock and Cumulative Preferred Stock ($100 par value).

The carrying amounts and fair values of long-term debt are:

| (millions of dollars) | March 31, 2012 | December 31, 2011 | ||||||||||||||

| Long-Term Debt (including current portion) | Carrying Amount |

Fair Value |

Carrying Amount |

Fair Value |

||||||||||||

| Con Edison |

$ | 11,071 | $ | 12,892 | $ | 10,673 | $ | 12,744 | ||||||||

| CECONY |

$ | 10,143 | $ | 11,757 | $ | 9,745 | $ | 11,593 | ||||||||

| 21 |

Table of Contents

Fair values of long-term debt have been estimated primarily using available market information. For Con Edison, $12,256 million and $636 million of the fair value of long-term debt at March 31, 2012 are classified as Level 2 and Level 3, respectively. For CECONY, $11,121 million and $636 million of the fair value of long-term debt at March 31, 2012 are classified as Level 2 and Level 3, respectively (see Note K).

Note D — Short-Term Borrowing

At March 31, 2012, Con Edison and CECONY had no commercial paper outstanding. The Companies have not borrowed under their October 2011 credit agreement. Con Edison had $183 million of letters of credit outstanding under the credit agreement (including $168 million for CECONY).

Note E — Pension Benefits

Net Periodic Benefit Cost

The components of the Companies’ net periodic benefit costs for the three months ended March 31, 2012 and 2011 were as follows:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Service cost – including administrative expenses |

$ | 59 | $ | 47 | $ | 55 | $ | 44 | ||||||||

| Interest cost on projected benefit obligation |

137 | 140 | 128 | 131 | ||||||||||||

| Expected return on plan assets |

(176 | ) | (183 | ) | (168 | ) | (175 | ) | ||||||||

| Amortization of net actuarial loss |

177 | 132 | 168 | 125 | ||||||||||||

| Amortization of prior service costs |

2 | 2 | 2 | 2 | ||||||||||||

| NET PERIODIC BENEFIT COST |

$ | 199 | $ | 138 | $ | 185 | $ | 127 | ||||||||

| Cost capitalized |

(64 | ) | (48 | ) | (63 | ) | (45 | ) | ||||||||

| Cost deferred |

(37 | ) | (51 | ) | (38 | ) | (52 | ) | ||||||||

| Cost charged to operating expenses |

$ | 98 | $ | 39 | $ | 84 | $ | 30 | ||||||||

Expected Contributions

Based on estimates as of March 31, 2012, the Companies expect to make contributions to the pension plan during 2012 of $775 million (of which $721 million is to be contributed by CECONY). During the first quarter of 2012, CECONY contributed $184 million to the pension plan. The Companies expect to fund $12 million for the non-qualified supplemental plans in 2012. The Companies’ policy is to fund their accounting cost to the extent tax deductible.

Note F — Other Postretirement Benefits

Net Periodic Benefit Cost

The components of the Companies’ net periodic postretirement benefit costs for the three months ended March 31, 2012 and 2011 were as follows:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Service cost |

$ | 7 | $ | 6 | $ | 5 | $ | 5 | ||||||||

| Interest cost on accumulated other postretirement benefit obligation |

18 | 21 | 16 | 18 | ||||||||||||

| Expected return on plan assets |

(21 | ) | (22 | ) | (18 | ) | (19 | ) | ||||||||

| Amortization of net actuarial loss |

25 | 22 | 22 | 20 | ||||||||||||

| Amortization of prior service cost |

(5 | ) | (2 | ) | (4 | ) | (3 | ) | ||||||||

| Amortization of transition obligation |

— | 1 | — | 1 | ||||||||||||

| NET PERIODIC POSTRETIREMENT BENEFIT COST |

$ | 24 | $ | 26 | $ | 21 | $ | 22 | ||||||||

| Cost capitalized |

(8 | ) | (9 | ) | (7 | ) | (8 | ) | ||||||||

| Cost charged |

7 | 4 | 4 | 3 | ||||||||||||

| Cost charged to operating expenses |

$ | 23 | $ | 21 | $ | 18 | $ | 17 | ||||||||

| 22 |

Table of Contents

Expected Contributions

Based on estimates as of March 31, 2012, Con Edison expects to make a contribution of $87 million, including $74 million for CECONY, to the other postretirement benefit plans in 2012.

Note G — Environmental Matters

Superfund Sites

Hazardous substances, such as asbestos, polychlorinated biphenyls (PCBs) and coal tar, have been used or generated in the course of operations of the Utilities and their predecessors and are present at sites and in facilities and equipment they currently or previously owned, including sites at which gas was manufactured or stored.

The Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 and similar state statutes (Superfund) impose joint and several liability, regardless of fault, upon generators of hazardous substances for investigation and remediation costs (which include costs of demolition, removal, disposal, storage, replacement, containment, and monitoring) and natural resource damages. Liability under these laws can be material and may be imposed for contamination from past acts, even though such past acts may have been lawful at the time they occurred. The sites at which the Utilities have been asserted to have liability under these laws, including their manufactured gas plant sites and any neighboring areas to which contamination may have migrated, are referred to herein as “Superfund Sites.”

For Superfund Sites where there are other potentially responsible parties and the Utilities are not managing the site investigation and remediation, the accrued liability represents an estimate of the amount the Utilities will need to pay to investigate and, where determinable, discharge their related obligations. For Superfund Sites (including the manufactured gas plant sites) for which one of the Utilities is managing the investigation and remediation, the accrued liability represents an estimate of the company’s share of undiscounted cost to investigate the sites and, for sites that have been investigated in whole or in part, the cost to remediate the sites, if remediation is necessary and if a reasonable estimate of such cost can be made. Remediation costs are estimated in light of the information available, applicable remediation standards, and experience with similar sites.

The accrued liabilities and regulatory assets related to Superfund Sites at March 31, 2012 and December 31, 2011 were as follows:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Accrued Liabilities: |

||||||||||||||||

| Manufactured gas plant sites |

$ | 466 | $ | 422 | $ | 351 | $ | 307 | ||||||||

| Other Superfund Sites |

71 | 67 | 70 | 66 | ||||||||||||

| Total |

$ | 537 | $ | 489 | $ | 421 | $ | 373 | ||||||||

| Regulatory assets |

$ | 729 | $ | 681 | $ | 613 | $ | 564 | ||||||||

Most of the accrued Superfund Site liability relates to sites that have been investigated, in whole or in part. However, for some of the sites, the extent and associated cost of the required remediation has not yet been determined. As investigations progress and information pertaining to the required remediation becomes available, the Utilities expect that additional liability may be accrued, the amount of which is not presently determinable but may be material. Under their current rate agreements, the Utilities are permitted to recover or defer as regulatory assets (for subsequent recovery through rates) certain site investigation and remediation costs. In February 2011, the NYSPSC initiated a proceeding to examine the existing mechanisms pursuant to which utilities recover such costs and possible alternatives.

Environmental remediation costs incurred and insurance recoveries received related to Superfund Sites for the three months ended March 31, 2012 and 2011, were as follows:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Remediation costs incurred |

$ | 7 | $ | 6 | $ | 7 | $ | 5 | ||||||||

| Insurance recoveries received |

— | — | — | — | ||||||||||||

In 2010, CECONY estimated that for its manufactured gas plant sites, its aggregate undiscounted potential liability for the investigation and remediation of coal tar and/or other manufactured gas plant-related environmental contaminants could range up to

| 23 |

Table of Contents

$1.9 billion. In 2010, O&R estimated that for its manufactured gas plant sites, each of which has been investigated, the aggregate undiscounted potential liability for the remediation of such contaminants could range up to $200 million. These estimates were based on the assumption that there is contamination at all sites, including those that have not yet been fully investigated and additional assumptions about the extent of the contamination and the type and extent of the remediation that may be required. Actual experience may be materially different.

Asbestos Proceedings

Suits have been brought in New York State and federal courts against the Utilities and many other defendants, wherein a large number of plaintiffs sought large amounts of compensatory and punitive damages for deaths and injuries allegedly caused by exposure to asbestos at various premises of the Utilities. The suits that have been resolved, which are many, have been resolved without any payment by the Utilities, or for amounts that were not, in the aggregate, material to them. The amounts specified in all the remaining thousands of suits total billions of dollars; however, the Utilities believe that these amounts are greatly exaggerated, based on the disposition of previous claims. In 2010, CECONY estimated that its aggregate undiscounted potential liability for these suits and additional suits that may be brought over the next 15 years is $10 million. The estimate was based upon a combination of modeling, historical data analysis and risk factor assessment. Actual experience may be materially different. In addition, certain current and former employees have claimed or are claiming workers’ compensation benefits based on alleged disability from exposure to asbestos. Under its current rate agreements, CECONY is permitted to defer as regulatory assets (for subsequent recovery through rates) costs incurred for its asbestos lawsuits and workers’ compensation claims. The accrued liability for asbestos suits and workers’ compensation proceedings (including those related to asbestos exposure) and the amounts deferred as regulatory assets for the Companies at March 31, 2012 and December 31, 2011 were as follows:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Accrued liability – asbestos suits |

$ | 10 | $ | 10 | $ | 10 | $ | 10 | ||||||||

| Regulatory assets – asbestos suits |

$ | 10 | $ | 10 | $ | 10 | $ | 10 | ||||||||

| Accrued liability – workers’ compensation |

$ | 96 | $ | 98 | $ | 92 | $ | 93 | ||||||||

| Regulatory assets – workers’ compensation |

$ | 22 | $ | 23 | $ | 21 | $ | 23 | ||||||||

Note H — Other Material Contingencies

Manhattan Steam Main Rupture

In July 2007, a CECONY steam main located in midtown Manhattan ruptured. It has been reported that one person died and others were injured as a result of the incident. Several buildings in the area were damaged. Debris from the incident included dirt and mud containing asbestos. The response to the incident required the closing of several buildings and streets for various periods. Approximately 93 suits are pending against the company seeking generally unspecified compensatory and, in some cases, punitive damages, for personal injury, property damage and business interruption. The company has not accrued a liability for the suits. The company has notified its insurers of the incident and believes that the policies in force at the time of the incident will cover most of the company’s costs, which the company is unable to estimate, but which could be substantial, to satisfy its liability to others in connection with the incident.

Investigations of Vendor Payments

In January 2009, CECONY commenced an internal investigation relating to the arrests of certain employees and retired employees (all of whom have since been convicted) for accepting kickbacks from contractors that performed construction work for the company. The company has retained a law firm, which has retained an accounting firm, to assist in the company’s

| 24 |

Table of Contents

investigation. The company has provided information to governmental authorities, which consider the company to be a victim of unlawful conduct, in connection with their investigation of the arrested employees and contractors. The company has terminated its employment of the arrested employees and its contracts with the contractors. In February 2009, the NYSPSC commenced a proceeding that, among other things, will examine the prudence of certain of the company’s expenditures relating to the arrests and consider whether additional expenditures should also be examined (see “Other Regulatory Matters” in Note B).

CECONY is also investigating the September 2010 arrest of a retired employee (who has since been convicted of participating in a bribery scheme in which the employee received payments from two companies that supplied materials to the company) and the January 2011 arrest of an employee (for accepting kickbacks from an engineering firm that performed work for the company). CECONY has provided information to governmental authorities in connection with their ongoing investigations of these matters.

The company, based upon its evaluation of its internal controls for 2011 and previous years, believes that the controls were effective to provide reasonable assurance that its financial statements have been fairly presented, in all material respects, in conformity with generally accepted accounting principles. Because the company’s investigations are ongoing, the company is unable to predict the impact of any of the employees’ unlawful conduct on the company’s internal controls, business, results of operations or financial position.

Lease In/Lease Out Transactions

In each of 1997 and 1999, Con Edison Development entered into a transaction in which it leased property and then immediately subleased it back to the lessor (termed “Lease In/Lease Out,” or LILO transactions). The transactions respectively involve electric generating and gas distribution facilities in the Netherlands, with a total investment of $259 million. The transactions were financed with $93 million of equity and $166 million of non-recourse, long-term debt secured by the underlying assets. In accordance with the accounting rules for leases, Con Edison is accounting for the two LILO transactions as leveraged leases. Accordingly, the company’s investment in these leases, net of non-recourse debt, is carried as a single amount in Con Edison’s consolidated balance sheet and income is recognized pursuant to a method that incorporates a level rate of return for those years when net investment in the lease is positive, based upon the after-tax cash flows projected at the inception of the leveraged leases. The company’s investment in these leveraged leases was $(65) million at March 31, 2012 and $(55) million at December 31, 2011 and is comprised of a $228 million gross investment less $293 million of deferred tax liabilities at March 31, 2012 and $234 million gross investment less $289 million of deferred tax liabilities at December 31, 2011.

On audit of Con Edison’s tax return for 1997, the IRS disallowed the tax losses in connection with the 1997 LILO transaction. In December 2005, Con Edison paid a $0.3 million income tax deficiency asserted by the IRS for the tax year 1997 with respect to the 1997 LILO transaction. In April 2006, the company paid interest of $0.2 million associated with the deficiency and commenced an action in the United States Court of Federal Claims, entitled Consolidated Edison Company of New York, Inc. v. United States, to obtain a refund of this tax payment and interest. A trial was completed in November 2007. In October 2009, the court issued a decision in favor of the company concluding that the 1997 LILO transaction was, in substance, a true lease that possessed economic substance, the loans relating to the lease constituted bona fide indebtedness, and the deductions for the 1997 LILO transactions claimed by the company in its 1997 federal income tax return are allowable. The IRS appealed the decision in December 2011.

In connection with its audit of Con Edison’s federal income tax returns for 1998 through 2007, the IRS disallowed $416 million of net tax deductions taken with respect to both of the LILO transactions for the tax years. Con Edison is pursuing administrative appeals of these audit level disallowances. In connection with its audit of Con Edison’s federal income tax returns for 2010, 2009 and 2008, the IRS has disallowed $40 million, $41 million and $42 million, respectively, of

| 25 |

Table of Contents

net tax deductions taken with respect to both of the LILO transactions. When these audit level disallowances become appealable, Con Edison intends to file an appeal of the disallowances.

Con Edison believes that its LILO transactions have been correctly reported, and has not recorded any reserve with respect to the disallowance of tax losses, or related interest, in connection with its LILO transactions. Con Edison’s estimated tax savings, reflected in its financial statements, from the two LILO transactions through March 31, 2012, in the aggregate, was $240 million. If Con Edison were required to repay all or a portion of these amounts, it would also be required to pay interest of up to $114 million net of tax at March 31, 2012.

Pursuant to the accounting rules for leveraged lease transactions, the expected timing of income tax cash flows generated by Con Edison’s LILO transactions are required to be reviewed at least annually. If the expected timing of the cash flows is revised, the rate of return and the allocation of income would be recalculated from the inception of the LILO transactions, and the company would be required to recalculate the accounting effect of the LILO transactions, which would result in a charge to earnings that could have a material adverse effect on the company’s results of operations.

Guarantees

Con Edison and its subsidiaries enter into various agreements providing financial or performance assurance primarily to third parties on behalf of their subsidiaries. Maximum amounts guaranteed by Con Edison totaled $760 million at March 31, 2012 and December 31, 2011, respectively.

A summary, by type and term, of Con Edison’s total guarantees at March 31, 2012 is as follows:

| Guarantee Type | 0 – 3 years | 4 – 10 years | > 10 years | Total | ||||||||||||

| (Millions of Dollars) | ||||||||||||||||

| Energy transactions |

$ | 637 | $ | 4 | $ | 66 | $ | 707 | ||||||||

| Intra-company guarantees |

15 | — | 1 | 16 | ||||||||||||

| Other guarantees |

33 | 4 | — | 37 | ||||||||||||

| TOTAL |

$ | 685 | $ | 8 | $ | 67 | $ | 760 | ||||||||

Energy Transactions — Con Edison guarantees payments on behalf of its competitive energy businesses in order to facilitate physical and financial transactions in gas, pipeline capacity, transportation, oil, electricity and energy services. To the extent that liabilities exist under the contracts subject to these guarantees, such liabilities are included in Con Edison’s consolidated balance sheet.

Intra-company Guarantees — Con Edison guarantees electricity sales made by Con Edison Energy and Con Edison Solutions to O&R and CECONY.

Other Guarantees — Con Edison and Con Edison Development also guarantee the following:

| • | $7 million relates to guarantees issued by Con Edison to CECONY covering a former Con Edison subsidiary’s lease payment to use CECONY’s conduit system in accordance with a tariff approved by the NYSPSC and a guarantee issued by Con Edison to a landlord to guarantee the former subsidiary’s obligations under a building lease. The former subsidiary is obligated to reimburse Con Edison for any payments made under these guarantees. This obligation is fully secured by letters of credit; |

| • | $25 million for guarantees provided by Con Edison to Travelers Insurance Company for indemnity agreements for surety bonds in connection with energy service projects performed by Con Edison Solutions; |

| • | $5 million for guarantees provided by Con Edison Development to Travelers Insurance Company for indemnity agreements for surety bonds in connection with the construction and operation of solar facilities performed by its subsidiaries; and |

| • | Con Edison, on behalf of Con Edison Solutions, as a retail electric provider, issued a guarantee to the Public Utility Commission of Texas with no specified limitation on the amount guaranteed, covering the payment of all obligations of a retail electric provider. Con Edison’s estimate of the maximum potential obligation is $5 million as of March 31, 2012. |

| 26 |

Table of Contents

Note I — Financial Information by Business Segment

The financial data for the business segments are as follows:

| For the Three Months Ended March 31, | ||||||||||||||||||||||||||||||||

| Operating revenues |

Inter-segment revenues |

Depreciation and amortization |

Operating income |

|||||||||||||||||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | 2012 | 2011 | ||||||||||||||||||||||||

| CECONY |

||||||||||||||||||||||||||||||||

| Electric |

$ | 1,735 | $ | 1,721 | $ | 3 | $ | 3 | $ | 173 | $ | 161 | $ | 224 | $ | 217 | ||||||||||||||||

| Gas |

563 | 663 | 1 | 1 | 29 | 27 | 221 | 204 | ||||||||||||||||||||||||

| Steam |

263 | 325 | 19 | 20 | 16 | 16 | 99 | 125 | ||||||||||||||||||||||||

| Consolidation adjustments |

— | — | (23 | ) | (24 | ) | — | — | — | — | ||||||||||||||||||||||

| Total CECONY |

$ | 2,561 | $ | 2,709 | $ | — | $ | — | $ | 218 | $ | 204 | $ | 544 | $ | 546 | ||||||||||||||||

| O&R |

||||||||||||||||||||||||||||||||

| Electric |

$ | 128 | $ | 149 | $ | — | $ | — | $ | 9 | $ | 9 | $ | 8 | $ | 10 | ||||||||||||||||

| Gas |

82 | 92 | — | — | 4 | 3 | 30 | 28 | ||||||||||||||||||||||||

| Total O&R |

$ | 210 | $ | 241 | $ | — | $ | — | $ | 13 | $ | 12 | $ | 38 | $ | 38 | ||||||||||||||||

| Competitive energy businesses |

$ | 310 | $ | 408 | $ | 2 | $ | 3 | $ | 2 | $ | 2 | $ | (20 | ) | $ | 44 | |||||||||||||||

| Other* |

(3 | ) | (9 | ) | (2 | ) | (3 | ) | — | — | (1 | ) | (2 | ) | ||||||||||||||||||

| Total Con Edison |

$ | 3,078 | $ | 3,349 | $ | — | $ | — | $ | 233 | $ | 218 | $ | 561 | $ | 626 | ||||||||||||||||

| * | Parent company expenses, primarily interest, and consolidation adjustments. Other does not represent a business segment. |

Note J — Derivative Instruments and Hedging Activities

Under the accounting rules for derivatives and hedging, derivatives are recognized on the balance sheet at fair value, unless an exception is available under the accounting rules. Certain qualifying derivative contracts have been designated as normal purchases or normal sales contracts. These contracts are not reported at fair value under the accounting rules.

Energy Price Hedging

Con Edison’s subsidiaries hedge market price fluctuations associated with physical purchases and sales of electricity, natural gas, and steam by using derivative instruments including futures, forwards, basis swaps, options, transmission congestion contracts and financial transmission rights contracts. The fair values of the Companies’ commodity derivatives at March 31, 2012 and December 31, 2011 were as follows:

| Con Edison | CECONY | |||||||||||||||

| (Millions of Dollars) | 2012 | 2011 | 2012 | 2011 | ||||||||||||

| Fair value of net derivative assets/(liabilities) – gross |

$ | (331 | ) | $ | (249 | ) | $ | (181 | ) | $ | (144 | ) | ||||

| Impact of netting of cash collateral |

156 | 110 | 64 | 46 | ||||||||||||

| Fair value of net derivative assets/(liabilities) – net |

$ | (175 | ) | $ | (139 | ) | $ | (117 | ) | $ | (98 | ) | ||||

Credit Exposure

The Companies are exposed to credit risk related to transactions entered into primarily for the various energy supply and hedging activities by the Utilities and the competitive energy businesses. The Companies use credit policies to manage this risk, including an established credit approval process, monitoring of counterparty limits, netting provisions within agreements, collateral or prepayment arrangements, credit insurance and credit default swaps.

At March 31, 2012, Con Edison and CECONY had $121 million and $12 million of credit exposure in connection with energy supply and hedging activities, net of collateral, respectively. Con Edison’s net credit exposure consisted of $46 million with investment-grade counterparties, $37 million with commodity exchange brokers, $36 million with independent system operators and $2 million with non-rated counterparties. CECONY’s net credit exposure was with commodity exchange brokers.

Economic Hedges

The Companies enter into certain derivative instruments that do not qualify or are not designated as hedges under the accounting rules for derivatives and hedging. However, management believes these instruments represent economic hedges that mitigate exposure to fluctuations in commodity prices.

| 27 |

Table of Contents

The fair values of the Companies’ commodity derivatives at March 31, 2012 were:

| (Millions of Dollars) | Fair Value of Commodity Derivatives (a) Balance Sheet Location |

Con Edison |

CECONY | |||||||

| Derivatives Asset | ||||||||||

| Current |

Other current assets | $ | 179 | $ | 20 | |||||

| Long-term |

Other deferred charges and non-current assets | 25 | 6 | |||||||

| Total derivatives asset |

$ | 204 | $ | 26 | ||||||

| Impact of netting |

(134 | ) | — | |||||||

| Net derivatives asset |

$ | 70 | $ | 26 | ||||||

| Derivatives Liability | ||||||||||

| Current |

Fair value of derivative liabilities | $ | 433 | $ | 149 | |||||

| Long-term |

Fair value of derivative liabilities | 102 | 58 | |||||||

| Total derivatives liability |

$ | 535 | $ | 207 | ||||||

| Impact of netting |

(290 | ) | (64 | ) | ||||||

| Net derivatives liability |

$ | 245 | $ | 143 | ||||||

| (a) | Qualifying derivative contracts, which have been designated as normal purchases or normal sales contracts, are not reported at fair value under the accounting rules for derivatives and hedging and, therefore, are excluded from the table. |

The fair values of the Companies’ commodity derivatives at December 31, 2011 were:

| (Millions of Dollars) | Fair Value of Commodity Derivatives (a) Balance Sheet Location |

Con Edison |

CECONY | |||||||

| Derivatives Asset | ||||||||||

| Current |

Other current assets | $ | 139 | $ | 16 | |||||

| Long-term |

Other deferred charges and non-current assets | 26 | 14 | |||||||

| Total derivatives asset |

$ | 165 | $ | 30 | ||||||

| Impact of netting |

(95 | ) | (6 | ) | ||||||

| Net derivatives asset |

$ | 70 | $ | 24 | ||||||

| Derivatives Liability | ||||||||||

| Current |

Fair value of derivative liabilities | $ | 331 | $ | 127 | |||||

| Long-term |

Fair value of derivative liabilities | 83 | 48 | |||||||

| Total derivatives liability |

$ | 414 | $ | 175 | ||||||

| Impact of netting |

(205 | ) | (53 | ) | ||||||

| Net derivatives liability |

$ | 209 | $ | 122 | ||||||

| (a) | Qualifying derivative contracts, which have been designated as normal purchases or normal sales contracts, are not reported at fair value under the accounting rules for derivatives and hedging and, therefore, are excluded from the table. |