10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________

FORM 10-K

___________________________________________________

x Annual Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

OR

¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

___________________________________________________

Commission File Number 1-14514

Consolidated Edison, Inc.

Exact name of registrant as specified in its charter

and principal office address and telephone number

|

| | |

New York | | 13-3965100 |

State of Incorporation | | I.R.S. Employer ID. Number |

4 Irving Place,

New York, New York 10003

(212) 460-4600

___________________________________________________

Commission File Number 1-1217

Consolidated Edison Company of New York, Inc.

Exact name of registrant as specified in its charter

and principal office address and telephone number

|

| | |

New York | | 13-5009340 |

State of Incorporation | | I.R.S. Employer ID. Number |

4 Irving Place,

New York, New York 10003

(212) 460-4600

___________________________________________________

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | | | |

Title of each class | | | Name of each exchange on which registered |

Consolidated Edison, Inc., | | | | |

Common Shares ($.10 par value) | | | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

| | | | | | | | | |

| Consolidated Edison, Inc. (Con Edison) | Yes | | x | | No | | ¨ | |

| Consolidated Edison Company of New York, Inc. (CECONY) | Yes | | x | | No | | ¨ | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

| | | | | | | | | |

| Con Edison | Yes | | ¨ | | No | | x | |

| CECONY | Yes | | ¨ | | No | | x | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| | | | | | | | | |

| Con Edison | Yes | | x | | No | | ¨ | |

| CECONY | Yes | | x | | No | | ¨ | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

| | | | | | | | | |

| Con Edison | Yes | | x | | No | | ¨ | |

| CECONY | Yes | | x | | No | | ¨ | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | | | | | |

Con Edison | | | | | | | | | | | | | | |

Large accelerated filer | | x | | Accelerated filer | | ¨ | | Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

CECONY | | | | | | | | | | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | ¨ | | Non-accelerated filer | | x | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

| | | | | | | | | |

Con Edison | | Yes | | ¨ | | No | | x | |

CECONY | | Yes | | ¨ | | No | | x | |

The aggregate market value of the common equity of Con Edison held by non-affiliates of Con Edison, as of June 30, 2015, was approximately $17.0 billion.

As of January 29, 2016, Con Edison had outstanding 293,589,401 Common Shares ($.10 par value).

All of the outstanding common equity of CECONY is held by Con Edison.

Documents Incorporated By Reference

Portions of Con Edison’s definitive proxy statement for its Annual Meeting of Stockholders to be held on May 16, 2016, to be filed with the Commission pursuant to Regulation 14A, not later than 120 days after December 31, 2015, is incorporated in Part III of this report.

Filing Format

This Annual Report on Form 10-K is a combined report being filed separately by two different registrants: Consolidated Edison, Inc. (Con Edison) and Consolidated Edison Company of New York, Inc. (CECONY). CECONY is a wholly-owned subsidiary of Con Edison and, as such, the information in this report about CECONY also applies to Con Edison. CECONY meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format.

As used in this report, the term the “Companies” refers to Con Edison and CECONY. However, CECONY makes no representation as to the information contained in this report relating to Con Edison or the subsidiaries of Con Edison other than itself.

Glossary of Terms

The following is a glossary of abbreviations or acronyms that are used in the Companies’ SEC reports:

|

| | |

Con Edison Companies | | |

Con Edison | | Consolidated Edison, Inc. |

CECONY | | Consolidated Edison Company of New York, Inc. |

Con Edison Development | | Consolidated Edison Development, Inc. |

Con Edison Energy | | Consolidated Edison Energy, Inc. |

Con Edison Solutions | | Consolidated Edison Solutions, Inc. |

Con Edison Transmission | | Con Edison Transmission, Inc. |

CET Electric | | Consolidated Edison Transmission, LLC |

CET Gas | | Con Edison Gas Midstream, LLC |

O&R | | Orange and Rockland Utilities, Inc. |

Pike | | Pike County Light & Power Company |

RECO | | Rockland Electric Company |

The Companies | | Con Edison and CECONY |

The Utilities | | CECONY and O&R |

|

Regulatory Agencies, Government Agencies and Other Organizations |

EPA | | U. S. Environmental Protection Agency |

FASB | | Financial Accounting Standards Board |

FERC | | Federal Energy Regulatory Commission |

IASB | | International Accounting Standards Board |

IRS | | Internal Revenue Service |

NJBPU | | New Jersey Board of Public Utilities |

NJDEP | | New Jersey Department of Environmental Protection |

NYISO | | New York Independent System Operator |

NYPA | | New York Power Authority |

NYSDEC | | New York State Department of Environmental Conservation |

NYSERDA | | New York State Energy Research and Development Authority |

NYSPSC | | New York State Public Service Commission |

NYSRC | | New York State Reliability Council, LLC |

PAPUC | | Pennsylvania Public Utility Commission |

PJM | | PJM Interconnection LLC |

SEC | | U.S. Securities and Exchange Commission |

| |

Accounting | | |

ASU | | Accounting Standards Update |

GAAP | | Generally Accepted Accounting Principles in the United States of America |

LILO | | Lease In/Lease Out |

OCI | | Other Comprehensive Income |

VIE | | Variable interest entity |

| |

Environmental | | |

CO2 | | Carbon dioxide |

GHG | | Greenhouse gases |

MGP Sites | | Manufactured gas plant sites |

PCBs | | Polychlorinated biphenyls |

PRP | | Potentially responsible party |

RGGI | | Regional Greenhouse Gas Initiative |

Superfund | | Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980 and similar state statutes |

|

| | |

Units of Measure | | |

AC | | Alternating current |

Dt | | Dekatherms |

kV | | Kilovolt |

kWh | | Kilowatt-hour |

MDt | | Thousand dekatherms |

MMlb | | Million pounds |

MVA | | Megavolt ampere |

MW | | Megawatt or thousand kilowatts |

MWh | | Megawatt hour |

| |

Other | | |

AFUDC | | Allowance for funds used during construction |

AMI | | Advance metering infrastructure |

COSO | | Committee of Sponsoring Organizations of the Treadway Commission |

DER | | Distributed energy resources |

EGWP | | Employer Group Waiver Plan |

Fitch | | Fitch Ratings |

LTIP | | Long Term Incentive Plan |

Moody’s | | Moody’s Investors Service |

REV | | Reforming the Energy Vision |

S&P | | Standard & Poor’s Financial Services LLC |

VaR | | Value-at-Risk |

TABLE OF CONTENTS

|

| | |

| PAGE |

| |

| |

| |

| |

| |

Item 1: | | |

Item 1A: | | |

Item 1B: | | |

Item 2: | | |

Item 3: | | |

Item 4: | | |

| | |

| | |

Item 5: | | |

Item 6: | | |

Item 7: | | |

Item 7A: | | |

Item 8: | | |

Item 9: | | |

Item 9A: | | |

Item 9B: | | |

| | |

Item 10: | | |

Item 11: | | |

Item 12: | | |

Item 13: | | |

Item 14: | | |

| | |

Item 15: | | |

| | |

Introduction

This introduction contains certain information about Con Edison and its subsidiaries, including CECONY, and is qualified in its entirety by reference to the more detailed information appearing elsewhere or incorporated by reference in this report.

Con Edison’s mission is to provide energy services to our customers safely, reliably, efficiently and in an environmentally sound manner; to provide a workplace that allows employees to realize their full potential; to provide a fair return to our investors; and to improve the quality of life in the communities we serve.

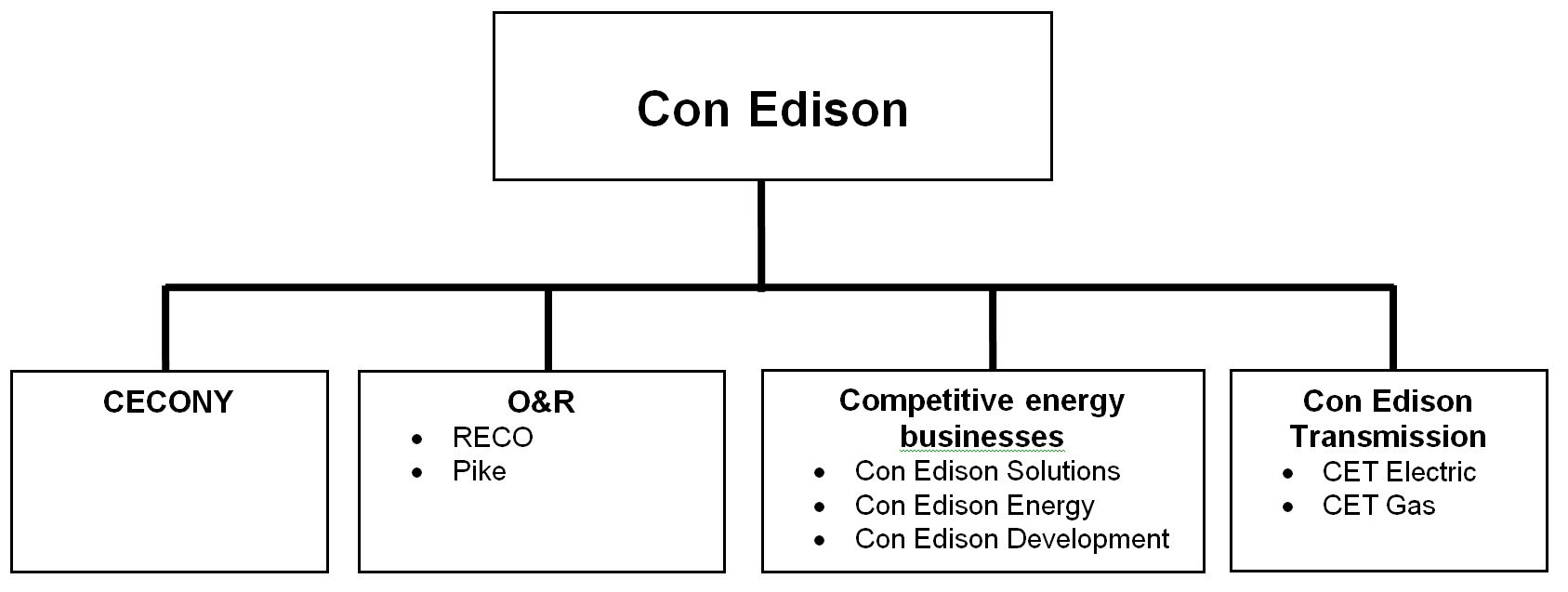

Con Edison is a holding company that owns:

| |

• | CECONY, which delivers electricity, natural gas and steam to customers in New York City and Westchester County; |

| |

• | Orange & Rockland Utilities, Inc. (O&R) (together with CECONY referred to as the Utilities), which delivers electricity and natural gas to customers primarily located in southeastern New York, and northern New Jersey and northeastern Pennsylvania; |

| |

• | Competitive energy businesses, which sell to retail customers electricity purchased in wholesale markets and enter into related hedging transactions; provide energy-related products and services to wholesale and retail customers, and develop, own and operate renewable and energy infrastructure projects; and |

| |

• | Con Edison Transmission, Inc. (Con Edison Transmission), which invests in electric and gas transmission projects. |

Con Edison anticipates that the Utilities, which are subject to extensive regulation, will continue to provide substantially all of its earnings over the next few years. The Utilities have approved rate plans that are generally designed to cover each company’s cost of service, including the capital and other costs of the company’s energy delivery systems. The Utilities recover from their full-service customers (who purchase electricity from the company), generally on a current basis, the cost the Utilities pay for energy and charge all of their customers the cost of delivery service.

Selected Financial Data

Con Edison

|

| | | | | | | | | | |

| For the Year Ended December 31, |

(Millions of Dollars, except per share amounts) | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | |

Operating revenues | $12,886 | | $12,188 | | $12,354 | | $12,919 | | $12,554 | |

Energy costs | 5,001 | | 3,887 | | 4,054 | | 4,513 | | 3,716 | |

Operating income | 2,239 | | 2,339 | | 2,244 | | 2,209 | | 2,427 | |

Net income | 1,062 | | 1,141 | | 1,062 | (b) | 1,092 | | 1,193 | |

Total assets (f)(g) | 38,873 | | 40,845 | (a) | 40,451 | (c) | 44,071 | (d) | 45,642 | (e) |

Long-term debt (f) | 10,068 | | 9,994 | | 10,415 | | 11,546 | | 12,006 | |

Total equity | 11,649 | | 11,869 | | 12,245 | | 12,585 | | 13,061 | |

Net Income per common share – basic | $3.59 | | $3.88 | | $3.62 | | $3.73 | | $4.07 | |

Net Income per common share – diluted | $3.57 | | $3.86 | | $3.61 | | $3.71 | | $4.05 | |

Dividends declared per common share | $2.40 | | $2.42 | | $2.46 | | $2.52 | | $2.60 | |

Book value per share | $39.05 | | $40.53 | | $41.81 | | $42.97 | | $44.50 | |

Average common shares outstanding (millions) | 293 | | 293 | | 293 | | 293 | | 293 | |

Stock price low | $48.55 | | $53.63 | | $54.33 | | $52.23 | | $56.86 | |

Stock price high | $62.74 | | $65.98 | | $63.66 | | $68.92 | | $72.25 | |

| |

(a) | Reflects a $1,846 million increase in net plant and a $304 million increase in regulatory assets for deferred storm costs. |

| |

(b) | Reflects a charge to earnings of $95 million (after taxes of $63 million) relating to the LILO transactions. See “Lease In/Lease Out Transactions” in Note J to the financial statements in Item 8. |

| |

(c) | Reflects a $2,947 million decrease in regulatory assets for unrecognized pension and other postretirement costs offset by an increase of $1,497 million, $280 million, $257 million and $223 million in net plant, cash, special deposits and regulatory assets for future income tax, respectively. |

| |

(d) | Reflects a $2,116 million increase in regulatory assets for unrecognized pension and other postretirement costs and a $1,391 million increase in net plant. See Notes B, E and F to the financial statements in Item 8. |

| |

(e) | Reflects a $2,382 million increase in net plant offset by a $970 million decrease in regulatory assets for unrecognized pension and other postretirement costs. See Notes B, E and F to the financial statements in Item 8. |

| |

(f) | Reflects $75 million, $68 million, $74 million and $85 million in 2011, 2012, 2013 and 2014, respectively, related to the adoption of Accounting Standards Update (ASU) No. 2015-03, “Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs.” See Note C to the financial statements in Item 8. |

| |

(g) | Reflects $266 million, $296 million, $122 million and $152 million in 2011, 2012, 2013, 2014, respectively, related to the adoption of ASU No. 2015-17, “Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes.” See Note L to the financial statements in Item 8. |

CECONY |

| | | | | | | | | | |

| For the Year Ended December 31, |

(Millions of Dollars) | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | |

Operating revenues | $10,432 | | $10,187 | | $10,430 | | $10,786 | | $10,328 | |

Energy costs | 3,243 | | 2,665 | | 2,873 | | 2,985 | | 2,304 | |

Operating income | 2,083 | | 2,093 | | 2,060 | | 2,139 | | 2,247 | |

Net income | 978 | | 1,014 | | 1,020 | | 1,058 | | 1,084 | |

Total assets (e)(f) | 34,994 | | 36,630 | (a) | 36,095 | (b) | 39,443 | (c) | 40,230 | (d) |

Long-term debt (e) | 9,153 | | 9,083 | | 9,303 | | 10,788 | | 10,787 | |

Shareholder’s equity | 10,431 | | 10,552 | | 10,847 | | 11,188 | | 11,415 | |

| |

(a) | Reflects a $1,243 million increase in net plant and a $229 million increase in regulatory assets for deferred storm costs. |

| |

(b) | Reflects a $2,797 million decrease in regulatory assets for unrecognized pension and other postretirement costs offset by an increase of $1,405 million, $280 million, $215 million and $199 million in net plant, cash, regulatory assets for environmental remediation costs and regulatory assets for future income tax, respectively. |

| |

(c) | Reflects a $1,999 million increase in regulatory assets for unrecognized pension and other postretirement costs and a $1,440 million increase in net plant. See Notes B, E and F to the financial statements in Item 8. |

| |

(d) | Reflects a $1,725 million increase in net plant and a $912 million decrease in regulatory assets for unrecognized pension and other postretirement costs. See Notes B, E and F to the financial statements in Item 8. |

| |

(e) | Reflects $67 million, $62 million, $63 million and $76 million in 2011, 2012, 2013 and 2014, respectively, related to the adoption of ASU No. 2015-03, “Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs.” See Note C to the financial statements in Item 8. |

| |

(f) | Reflects $157 million, $193 million, $100 million and $118 million in 2011, 2012, 2013 and 2014, respectively, related to the adoption of ASU No. 2015-17, “Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes.” See Note L to the financial statements in Item 8. |

Significant 2015 Developments and Outlook

| |

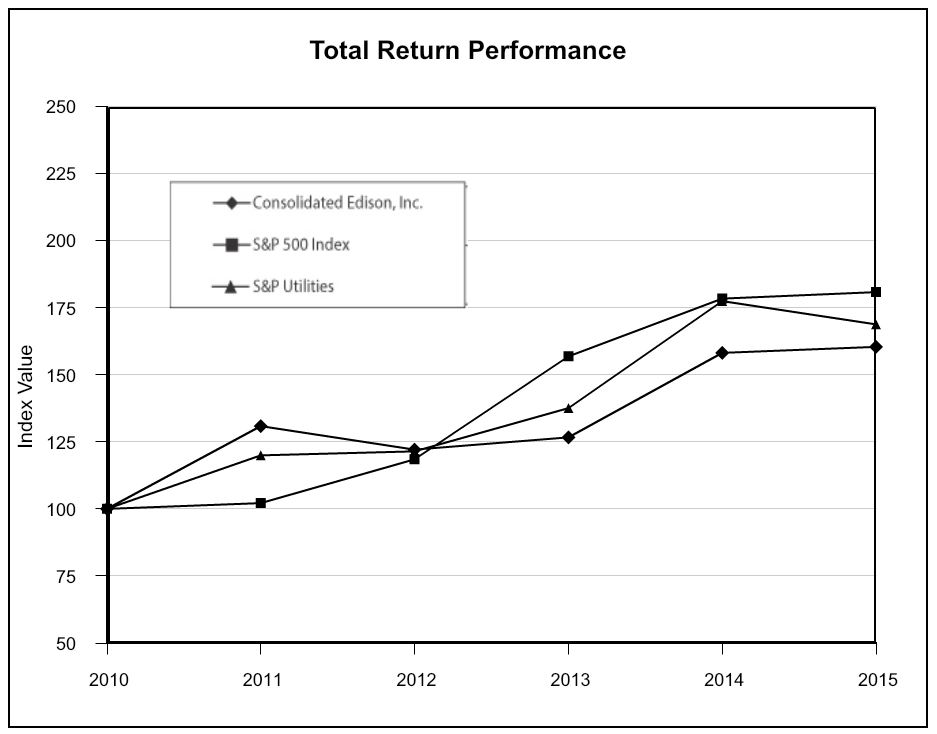

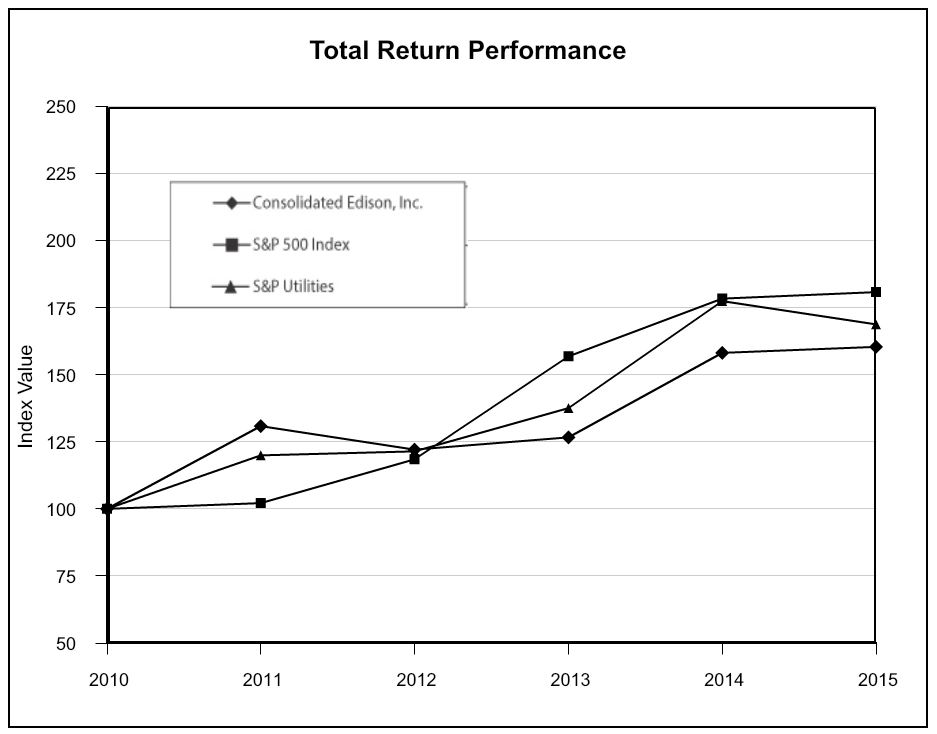

• | Con Edison reported 2015 net income of $1,193 million or $4.07 a share compared with $1,092 million or $3.73 a share in 2014. Adjusted earnings were $1,196 million or $4.08 a share in 2015 compared with $1,140 million or $3.89 a share in 2014. See “Results of Operations” in Item 7 and “Non-GAAP Financial Measure” below. |

| |

• | In 2015, the Utilities invested $2,595 million to upgrade and reinforce their energy delivery systems, and the competitive energy businesses invested $823 million in renewable electric production projects. In 2016, the Companies are expected to invest $3,168 million for their energy delivery systems and $985 million in renewable electric production projects. Con Edison plans to meet its 2016 capital requirements, including for maturing securities, through internally-generated funds and the issuance of securities. The company’s plans include the issuance of between $1,000 million and $1,500 million of long-term debt at the Utilities and the issuance of additional debt secured by its renewable electric production projects. The company’s plans also include the issuance of up to $200 million of common equity in addition to equity under its dividend reinvestment, employee stock purchase and long term incentive plans. See “Capital Requirements and Resources” in Item 1. |

| |

• | In June 2015, Con Edison initiated a plan to sell the retail electric supply business of its competitive energy businesses. In October 2015 O&R entered into an agreement to sell Pike to Corning Natural Gas Holding Corporation. See Note U to the financial statements in Item 8. |

| |

• | CECONY forecasts average annual growth in peak demand in its service area at design conditions over the next five years for electric and gas to be approximately 0.2 percent and 2.3 percent, respectively, and average annual decrease in steam peak demand in its service area at design conditions over the next five years to be approximately 0.8 percent. O&R forecasts average annual growth of the peak demand in its service area over the next five years at design conditions for electric and gas to be approximately 0.3 percent and 0.6 percent, respectively. See “The Utilities” in Item 1. |

| |

• | In September 2015, CECONY, the New York State Public Service Commission (NYSPSC) staff and others entered into a Joint Proposal to settle the proceeding the NYSPSC commenced in February 2009 to examine the prudence of certain CECONY expenditures and related matters. Pursuant to the Joint Proposal, which is subject to NYSPSC approval, the company is required to credit $116 million to customers and, for the period |

2017 through 2044, to not seek to recover from customers an aggregate $55 million relating to return on its capital expenditures. In addition, the company’s revenues that were made subject to potential refund in this proceeding would no longer be subject to refund. See “Other Regulatory Matters” in Note B to the financial statements in Item 8 .

| |

• | In June 2015, the National Transportation Safety Board determined that the probable cause of a March 2014 explosion and fire, in which eight people died and more than 50 people were injured, was (1) the failure of a defective fusion joint at a service tee (which joined a plastic service line to a plastic distribution main) installed by CECONY that allowed gas to leak from the distribution main and migrate into a building where it ignited and (2) a breach in a New York City sewer line that allowed groundwater and soil to flow into the sewer, resulting in a loss of support for the distribution main, which caused it to sag and overstressed the defective fusion joint. In November 2015, the NYSPSC ordered CECONY to show cause why the NYSPSC should not commence proceedings to penalize the company for alleged violations of gas safety regulations identified by the NYSPSC staff in its investigation of the incident and to review the prudence of the company’s conduct associated with the incident. In December 2015, the company responded that the NYSPSC should not institute the proceedings and disputed the alleged violations. See “Other Regulatory Matters” in Note B and “Manhattan Explosion and Fire” in Note H to the financial statements in Item 8. |

| |

• | In 2015, the NYSPSC adopted Joint Proposals with respect to CECONY’s rates for electric delivery service for 2016 and O&R’s rates for electric and gas delivery service through October 2017 and 2018, respectively; the NYSPSC continued its Reforming the Energy Vision (REV) proceeding to improve system efficiency and reliability, encourage renewable energy and distributed energy resources and empower customer choice; and the NYSPSC continued its proceeding to investigate the practices of qualifying persons to perform plastic fusions on gas facilities. See “Utility Regulation” in Item 1 and Note B to the financial statements in Item 8. |

| |

• | In January 2016, CECONY filed a request with the NYSPSC for electric and gas rate increases of $482 million and $154 million, respectively, effective January 2017. The filing reflects a return on common equity of 9.75 percent and a common equity ratio of 48 percent. See “Rate Plans” in Note B to the financial statements in Item 8. |

Available Information

Con Edison and CECONY file annual, quarterly and current reports and other information, and Con Edison files proxy statements, with the Securities and Exchange Commission (SEC). The public may read and copy any materials that the Companies file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580 Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy statements, and other information regarding issuers (including Con Edison and CECONY) that file electronically with the SEC.

This information the Companies file with the SEC is also available free of charge on or through the Investor Information section of their websites as soon as reasonably practicable after the reports are electronically filed with, or furnished to, the SEC. Con Edison’s internet website is at: www.conedison.com; and CECONY’s is at: www.coned.com.

The Investor Information section of Con Edison’s website also includes the company’s Standards of Business Conduct (its code of ethics) and amendments or waivers of the standards for executive officers or directors, corporate governance guidelines and the charters of the following committees of the company’s Board of Directors: Audit Committee, Management Development and Compensation Committee, and Corporate Governance and Nominating Committee. This information is available in print to any shareholder who requests it. Requests should be directed to: Corporate Secretary, Consolidated Edison, Inc., 4 Irving Place, New York, NY 10003.

Information on the Companies’ websites is not incorporated herein.

Forward-Looking Statements

This report includes forward-looking statements intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectation and not facts. Words such as “forecasts,” “expects,” “estimates,” “anticipates,” “intends,” “believes,” “plans,” “will” and similar expressions identify forward-looking statements. Forward-looking statements are based on information available at the time the statements are made, and accordingly speak only as of that time. Actual results or developments might differ materially from those included in the forward-looking statements because of various factors including, but not limited to, those discussed under “Risk Factors,” in Item 1A.

Non-GAAP Financial Measure

Adjusted earnings (which Con Edison formerly referred to as earnings from ongoing operations) is a financial measure that is not determined in accordance with generally accepted accounting principles in the United States of America (GAAP). This non-GAAP financial measure should not be considered as an alternative to net income, which is an indicator of financial performance determined in accordance with GAAP. Adjusted earnings excludes from net income the net mark-to-market changes in the fair value of the derivative instruments the competitive energy businesses use to economically hedge market price fluctuations in related underlying physical transactions for the purchase or sale of electricity and gas. Adjusted earnings may also exclude from net income certain other items that the company does not consider indicative of its ongoing financial performance. Management uses this non-GAAP financial measure to facilitate the analysis of the company's financial performance as compared to its internal budgets and previous financial results. Management also uses this non-GAAP financial measure to communicate to investors and others the company’s expectations regarding its future earnings and dividends on its common stock. Management believes that this non-GAAP financial measure also is useful and meaningful to investors to facilitate their analysis of the company's financial performance. The following table is a reconciliation of Con Edison’s reported net income to adjusted earnings and reported earnings per share to adjusted earnings per share.

|

| | | | | | | | | | |

(Millions of Dollars, except per share amounts) | 2011 | 2012 | 2013 | 2014 | 2015 |

Reported net income – GAAP basis | $1,051 | $1,138 | $1,062 | $1,092 | $1,193 |

Impairment of assets held for sale (a) | — |

| — |

| — |

| — |

| 3 |

Gain on sale of solar electric production projects (b) | — |

| — |

| — |

| (26) | — |

|

Loss from LILO transactions (c) | — |

| — |

| 95 | 1 | — |

|

Net mark-to-market effects of the competitive energy businesses (d) | 13 | (40) | (45) | 73 | — |

|

Adjusted earnings | $1,064 | $1,098 | $1,112 | $1,140 | $1,196 |

Reported earnings per share – GAAP basis (basic) | $3.59 | $3.88 | $3.62 | $3.73 | $4.07 |

Impairment of assets held for sale | — |

| — |

| — |

| — |

| 0.01 |

Gain on sale of solar electric production projects | — |

| — |

| — |

| (0.09) | — |

|

Loss from LILO transactions | — |

| — |

| 0.32 | — |

| — |

|

Net mark-to-market effects of the competitive energy businesses | 0.05 | (0.13) | (0.14) | 0.25 | — |

|

Adjusted earnings per share | $3.64 | $3.75 | $3.80 | $3.89 | $4.08 |

| |

(a) | An impairment charge of $3 million, after taxes of $2 million, was recorded related to O&R's wholly-owned subsidiary, Pike County Light & Power Company (Pike). |

| |

(b) | After taxes of $19 million. |

| |

(c) | In 2013, a court disallowed tax losses claimed by Con Edison relating to Con Edison Development’s Lease In/Lease Out (LILO) transactions and the company subsequently terminated the transactions, resulting in a charge to earnings of $95 million (after taxes of $63 million). In 2014, adjustments were made to taxes and accrued interest. See Note J to the financial statements in Item 8. |

| |

(d) | After taxes of $9 million, $29 million, $30 million and $55 million for the years ended December 31, 2011 through 2014, respectively. |

Item 1: Business

Incorporation By Reference

Information in any item of this report as to which reference is made in this Item 1 is hereby incorporated by reference in this Item 1. The use of terms such as “see” or “refer to” shall be deemed to incorporate into Item 1 at the place such term is used the information to which such reference is made.

PART I

Item 1: Business

Overview

Consolidated Edison, Inc. (Con Edison), incorporated in New York State in 1997, is a holding company that owns all of the outstanding common stock of Consolidated Edison Company of New York, Inc. (CECONY), Orange and Rockland Utilities, Inc. (O&R), the competitive energy businesses and Con Edison Transmission, Inc. (Con Edison Transmission). As used in this report, the term the “Companies” refers to Con Edison and CECONY.

Con Edison’s principal business operations are those of CECONY, O&R and the competitive energy businesses. CECONY’s principal business operations are its regulated electric, gas and steam delivery businesses. O&R’s principal business operations are its regulated electric and gas delivery businesses. The competitive energy businesses sell electricity to retail customers, provide energy-related products and services, and develop, own and operate renewable and energy infrastructure projects.

Con Edison seeks to provide shareholder value through continued dividend growth, supported by earnings growth in regulated utilities and contracted assets. The company invests to provide reliable, resilient, safe and clean energy critical for New York City’s growing economy. The company is an industry-leading owner and operator of contracted, large-scale solar generation in the United States. Con Edison is a responsible neighbor, helping the communities it serves become more sustainable.

CECONY

Electric

CECONY provides electric service to approximately 3.4 million customers in all of New York City (except a part of Queens) and most of Westchester County, an approximately 660 square mile service area with a population of more than nine million.

Gas

CECONY delivers gas to approximately 1.1 million customers in Manhattan, the Bronx, parts of Queens and most of Westchester County.

Steam

CECONY operates the largest steam distribution system in the United States by producing and delivering approximately 22,000 MMlb of steam annually to approximately 1,700 customers in parts of Manhattan.

O&R

Electric

O&R and its utility subsidiaries, Rockland Electric Company (RECO) and Pike County Light & Power Company (Pike) (together referred to herein as O&R) provide electric service to approximately 0.3 million customers in southeastern New York and in adjacent areas of northern New Jersey and northeastern Pennsylvania, an approximately 1,350 square mile service area.

Gas

O&R delivers gas to over 0.1 million customers in southeastern New York and adjacent areas of northeastern Pennsylvania.

Assets Held for Sale

In October 2015, O&R entered into an agreement to sell Pike to Corning Natural Gas Holding Corporation (see

Note U to the financial statements in Item 8).

Competitive Energy Businesses

Con Edison pursues competitive energy opportunities through three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy and Con Edison Development. These businesses sell to retail customers electricity purchased in wholesale markets and enter into related hedging transactions, provide energy-related products and services to wholesale and retail customers, and develop, own and operate renewable and energy infrastructure projects.

Assets Held for Sale

In June 2015, Con Edison initiated a plan to sell the retail electric supply business of its competitive energy businesses (see Note U to the financial statements in Item 8).

Con Edison Transmission

Con Edison Transmission invests in electric and gas transmission projects through its wholly-owned subsidiaries, Consolidated Edison Transmission, LLC (CET Electric) and Con Edison Gas Midstream, LLC (CET Gas). CET Electric, which was formed in 2014, is investing in a company that is expected to own electric transmission assets being developed in New York. At December 31, 2015, Con Edison’s capital contribution to CET Electric was $3 million. CET Gas, which was formed in 2016, is investing in a company developing a proposed gas transmission project in West Virginia and Virginia. See “Con Edison Transmission,” below.

Utility Regulation

State Utility Regulation

Regulators

The Utilities are subject to regulation by the NYSPSC, which under the New York Public Service Law, is authorized to set the terms of service and the rates the Utilities charge for providing service in New York. See “Rate Plans,” below and in Note B to the financial statements in Item 8. It also approves the issuance of the Utilities’ securities. See “Capital Resources,” below. It exercises jurisdiction over the siting of the Utilities’ electric transmission lines (see “Con Edison Transmission,” below) and approves mergers or other business combinations involving New York utilities. In addition, it has the authority to impose penalties on utilities, which could be substantial, for violating state utility laws and regulations and its orders. See “Other Regulatory Matters” in Note B to the financial statements in Item 8. O&R’s New Jersey subsidiary, RECO, is subject to similar regulation by the New Jersey Board of Public Utilities (NJBPU). O&R’s Pennsylvania subsidiary, Pike, is subject to similar regulation by the Pennsylvania Public Utility Commission (PAPUC). The NYSPSC, together with the NJBPU and the PAPUC, are referred to herein as state utility regulators.

In March 2013, following the issuance of recommendations by a commission established by the Governor of New York and submission by the Governor of a bill to the State legislature, the New York Public Service Law was amended to, among other things, authorize the NYSPSC to (i) levy expanded penalties against combination gas and electric utilities; (ii) review, at least every five years, an electric utility’s capability to provide safe, adequate and reliable service, order the utility to comply with additional and more stringent terms of service than existed prior to the review, assess the continued operation of the utility as the provider of electric service in its service territory and propose, and act upon, such measures as are necessary to ensure safe and adequate service; and (iii) based on findings of repeated violations of the New York Public Service Law or rules or regulations adopted thereto that demonstrate a failure of a combination gas and electric utility to continue to provide safe and adequate service, revoke or modify an operating certificate issued to the utility by the NYSPSC (following consideration of certain factors, including public interest and standards deemed necessary by the NYSPSC to ensure continuity of service, and due process).

New York Utility Industry

Restructuring in the 1990s

In the 1990s, the NYSPSC restructured the electric utility industry in the state. In accordance with NYSPSC orders, the Utilities sold all of their electric generating facilities other than those that also produce steam for CECONY’s steam business (see Electric Operations – Electric Facilities below) and provided all of their customers the choice to buy electricity or gas from the Utilities or other suppliers (see Electric Operations – Electric Sales and Deliveries and

Gas Operations – Gas Sales and Deliveries below). In 2015, 65 percent of the electricity and 31 percent of the gas CECONY delivered to its customers, and 58 percent of the electricity and 45 percent of the gas O&R delivered to its customers, was purchased by the customers from other suppliers. In addition, the Utilities no longer control and operate their bulk power electric transmission facilities. See “New York Independent System Operator (NYISO),” below.

Following industry restructuring, there were several utility mergers as a result of which substantially all of the electric and gas delivery service in New York State is now provided by one of four investor-owned utility companies – Con Edison, National Grid plc, Avangrid, Inc. (an affiliate of Iberdrola, S.A.) and Fortis Inc. – or one of two state authorities – New York Power Authority (NYPA) or Long Island Power Authority.

Reforming the Energy Vision

In April 2014, the NYSPSC instituted its REV proceeding, the goals of which are to improve electric system efficiency and reliability, encourage renewable energy resources, support distributed energy resources (DER) and empower customer choice. In this proceeding, the NYSPSC is examining the establishment of a distributed system platform to manage and coordinate DER, and provide customers with market data and tools to manage their energy use. The NYSPSC also is examining how its regulatory practices should be modified to incent utility practices to promote REV objectives.

In February 2015, the NYSPSC issued an order in its REV proceeding in which, among other things, the NYSPSC:

| |

• | ordered CECONY, O&R and the other electric utilities to file distributed system implementation plans pursuant to which the utilities, under the NYSPSC’s authority and supervision, would serve as distributed system platforms to optimize the use of DER; |

| |

• | indicated that the utilities will be allowed to own DER only under limited circumstances, and that utility affiliate ownership of DER within the utility’s service territory will require market power protections; |

| |

• | ordered the utilities to file energy efficiency plans See “Environmental Matters - Climate Change," below; |

| |

• | instituted a separate proceeding to consider large-scale renewable generation; |

| |

• | required the utilities to file demonstration projects for approval by NYSPSC staff; and |

| |

• | indicated that the design and implementation of the reformed energy system will occur over a period of years. |

In June 2015, the New York State Energy Research and Development Authority (NYSERDA) submitted a report in the large-scale renewable generation proceeding. The report included program design principles and strategies. The NYSPSC requested comments on, among other things: customer funding mechanisms; utility-backed power purchase agreements; financing options; and utility-owned generation. In December 2015, the Governor of New York directed the NYSPSC to establish a clean energy standard to mandate achievement by 2030 of the State Energy Plan’s goals of 50 percent of the State’s electricity being provided from renewable resources and reducing carbon emissions by 40 percent (see “Environmental Matters - Climate Change,” below) and to support the continued operation of upstate nuclear plants. In January 2016, the NYSPSC expanded the scope of this proceeding to include consideration of a clean energy standard and the NYSPSC staff issued a report in which it recommended that New York load serving entities be responsible for supplying a defined percentage of their retail customer load from eligible resources. The NYSPSC staff recommended that compliance be demonstrated through the use of tradable renewable energy credits and zero emissions credits or an alternative compliance payment mechanism. The NYSPSC staff suggested that utilities should act as the financial guarantor of NYSERDA’s renewable energy credit activities. In addition, the NYSPSC staff recommended that New York utilities be required to procure an appropriate percentage of their renewable energy credit targets through long-term power purchase agreements with developers of renewable generation and that utility ownership of generation be permitted only in exceptional circumstances.

In July 2015, the NYSPSC staff issued a white paper on ratemaking and utility business models in the REV proceeding. The NYSPSC staff indicated that the proposals included in the white paper reflect several foundational principles: align earning opportunities with customer value; maintain flexibility; provide accurate and appropriate value signals; maintain a sound electric industry; shift balance of regulatory incentives to market incentives; and achieve public policy objectives. The white paper, among other things, included proposals for: market based earnings opportunities, including distributed system platform revenues; adoption of earnings impact mechanisms to incent peak demand reduction, energy efficiency, customer engagement and information access, affordability and interconnection; retention of existing safety, reliability, customer service and utility-specific performance mechanisms; modifications to rate plan net utility plant reconciliations to encourage cost-effective use of operating resources and third-party investment; tying rate plan earnings sharing mechanisms to a performance index;

pre-approval, where appropriate, of investments in distributed system platform capabilities; three-year rate plans, with an opportunity for two-year extensions; and rate design and DER compensation, including net energy metering, standby service tariffs, study of demand charges and facilitation of time-of use rates. The NYSPSC is expected to make policy determinations in 2016 on the regulatory design and regulatory matters addressed in the white paper.

In November 2015, CECONY submitted to the NYSPSC an update to the company’s advanced metering infrastructure (AMI) plan for its electric and gas delivery businesses. The plan, which is subject to NYSPSC review and approval, addresses AMI’s financial, operations and environmental benefits to customers and how AMI supports the REV proceeding’s objectives. AMI components include smart meters, a communication network, information technology systems and business applications. The plan provides for full deployment of AMI to the company’s customers to be implemented over a six-year period. Under the plan, aggregate estimated capital expenditures for AMI implementation would be approximately $1,300 million, including $69 million of AMI capital expenditures in 2016. O&R’s electric and gas rate plans authorize, subject to NYSPSC modification or halt following its further consideration of AMI implementation, aggregate capital expenditures of approximately $30 million to begin AMI implementation for the company’s customers.

In December 2015, the NYSPSC authorized a cost recovery surcharge mechanism for REV demonstration projects. Three CECONY and one O&R demonstration projects have been approved by the NYSPSC staff. The demonstration projects are expected to inform decisions with respect to developing distributed system platform functionalities, measuring customer response to programs and prices associated with REV markets.

In January 2016, the NYSPSC established a benefit cost analysis framework that will apply to, among other things, utility proposals to make investments that could instead be met through DER alternatives that meet all applicable reliability and safety requirements. The framework’s primary measure is a societal cost test which, in addition to addressing avoided utility costs, is to quantitatively address certain environmental externalities and, where appropriate, qualitatively address other externalities. The NYSPSC directed the utilities to develop and file benefit cost analysis handbooks to guide DER providers in structuring their projects and proposals.

The NYSPSC is conducting additional proceedings to consider certain REV-related matters, including proceedings on DER valuation and net energy metering.

The Companies are not able to predict the outcome of the REV proceeding or related proceedings or their impact.

Rate Plans

Investor-owned utilities in the United States provide delivery service to customers according to the terms of tariffs approved by the appropriate state utility regulator. The tariffs include schedules of rates for service that limit the rates charged by the utilities to amounts that recover from their customers costs approved by the regulator, including capital costs, of providing service to customers as defined by the tariff. The tariffs implement rate plans adopted by state utility regulators in rate orders issued at the conclusion of rate proceedings. The utilities’ earnings depend on the limits on rates authorized in their rate plans and their ability to operate their businesses in a manner consistent with such rate plans.

The utilities’ rate plans cover specified periods, but rates determined pursuant to a plan generally continue in effect until a new rate plan is approved by the state utility regulator. In New York, either the utility or the NYSPSC can commence a proceeding for a new rate plan, and a new rate plan filed by the utility will generally take effect automatically in approximately 11 months unless prior to such time the NYSPSC approves a rate plan.

In each rate proceeding, rates are determined by the state utility regulator following the submission by the utility of testimony and supporting information, which are subject to review by the staff of the regulator. Other parties with an interest in the proceeding can also review the utility’s proposal and become involved in the rate proceeding. The review process is overseen by an administrative law judge who is employed by the NYSPSC. After an administrative law judge issues a recommended decision, that generally considers the interests of the utility, the regulatory staff, other parties, and legal requisites, the regulator will issue a rate order. The utility and the regulator’s staff and interested parties may enter jointly into a proposed settlement agreement prior to the completion of this administrative process, in which case the agreement could be approved by the regulator with or without modification.

For each rate plan, the revenues needed to provide the utility a return on invested capital is determined by multiplying the utilities’ forecasted rate base by the pre-tax weighted average cost of capital determined in the rate plan. In general, rate base is the sum of the utility’s net plant and working capital less deferred taxes. The NYSPSC uses a forecast of the average rate base for the year that new rates would be in effect (rate year). The NJBPU and

the PAPUC use the rate base balances that would exist at the beginning of the rate year. The capital structure used in the weighted average cost of capital is determined using actual and forecast data for the same time periods as rate base. The costs of long-term debt, customer deposits and the allowed return on common equity represent a combination of actual and forecast financing information. The allowed return on common equity is determined by each state’s respective utility regulator. The NYSPSC’s current methodology for determining the allowed return on common equity assigns a one-third weight to an estimate determined from a capital asset pricing model applied to a peer group of utility companies and a two-thirds weight to an estimate determined from a dividend discount model using stock prices and dividend forecasts for a peer group of utility companies. Both methodologies employ market measurements of equity capital to estimate returns rather than the accounting measurements to which such estimates are applied in setting rates.

Pursuant to the Utilities’ rate plans, there generally can be no change to the rates charged to customers during the respective terms of the rate plans other than specified adjustments provided for in the rate plans.

For information about the Utilities’ rate plans see Note B to the financial statements in Item 8.

Liability for Service Interruptions

The tariff provisions under which CECONY provides electric, gas and steam service, and O&R provides electric and gas service, limit each company’s liability to pay for damages resulting from service interruptions to circumstances resulting from its gross negligence or willful misconduct. The tariff provisions under which RECO and Pike provide electric service provide that the company is not liable for interruptions that are due to causes beyond its control.

CECONY’s tariff for electric service also provides for reimbursement to electric customers for spoilage losses resulting from service interruptions in certain circumstances. In general, the company is obligated to reimburse affected residential and commercial customers for food spoilage of up to approximately $500 and $10,000, respectively, and reimburse affected residential customers for prescription medicine spoilage losses without limitation on amount per claim. The company’s maximum aggregate liability for such reimbursement for an incident is $15 million. The company is not required to provide reimbursement to electric customers for outages attributable to generation or transmission system facilities or events beyond its control, such as storms, provided the company makes reasonable efforts to restore service as soon as practicable.

New York electric utilities are required to provide credits to customers who are without electric service for more than three days. The credit to a customer would equal the portion of the monthly customer charge attributable to the period the customer was without service. If an extraordinary event occurs, the NYSPSC may direct New York gas utilities to implement the same policies.

The NYSPSC has approved a scorecard for use as a guide to assess electric utility performance in restoring electric service during outages that result from a major storm event. The scorecard, which could also be applied by the NYSPSC for other outages or actions, was developed to work with the penalty and emergency response plan provisions of the New York Public Service Law. The scorecard includes performance metrics in categories for preparation, operations response and communications.

Each New York electric utility is required to submit to the NYSPSC annually a plan for the reasonably prompt restoration of service in the case of widespread outages in the utility’s service territory due to storms or other events beyond the control of the utility. If, after evidentiary hearings or other investigatory proceedings, the NYSPSC finds that the utility failed to implement its plan reasonably, the NYSPSC may deny recovery of any part of the service restoration costs caused by such failure. In March 2015, the NYSPSC approved emergency response plans submitted by CECONY and O&R, subject to certain modifications. In December 2015, CECONY and O&R submitted updated plans.

Generic Proceedings

The NYSPSC from time to time conducts “generic” proceedings to consider issues relating to all electric and gas utilities operating in New York State. Pending proceedings include the REV proceeding and related proceedings, discussed above, and proceedings relating to data access; retail access; utility staffing levels; energy efficiency and renewable energy programs; low income customers and consumer protections. The Utilities are typically active participants in such proceedings.

Federal Utility Regulation

The Federal Energy Regulatory Commission (FERC), among other things, regulates the transmission and wholesale sales of electricity in interstate commerce and the transmission and sale of natural gas for resale in interstate commerce. In addition, the FERC has the authority to impose penalties, which could be substantial, including penalties for the violation of reliability and cyber security rules. Certain activities of the Utilities and the competitive energy businesses are subject to the jurisdiction of the FERC. The Utilities are subject to regulation by the FERC with respect to electric transmission rates and to regulation by the NYSPSC with respect to electric and gas retail commodity sales and local delivery service. As a matter of practice, the NYSPSC has approved delivery service rates for the Utilities that include both transmission and distribution costs. The electric and gas transmission projects in which CET Electric and CET Gas invest are also subject to regulation by the FERC. See “Con Edison Transmission,” below.

New York Independent System Operator (NYISO)

The NYISO is a not-for-profit organization that controls and operates most of the electric transmission facilities in New York State, including those of the Utilities, as an integrated system. It also administers wholesale markets for electricity in New York State and facilitates the construction of new transmission it considers necessary to meet identified reliability, economic or public policy needs. The New York State Reliability Council (NYSRC) promulgates reliability standards subject to FERC oversight. Pursuant to a requirement that is set annually by the NYSRC, the NYISO requires that entities supplying electricity to customers in New York State have generating capacity (owned, procured through the NYISO capacity markets or contracted for) in an amount equal to the peak demand of their customers plus the applicable reserve margin. In addition, the NYISO has determined that entities that serve customers in New York City must procure sufficient capacity from resources that are electrically located in New York City to cover a substantial percentage of the peak demands of their New York City customers. It also requires entities that serve customers in the lower Hudson valley and New York City customers that are served through the lower Hudson valley to procure sufficient capacity from resources electrically located in the lower Hudson valley. These requirements apply both to regulated utilities such as CECONY and O&R for the customers they supply under regulated tariffs and to companies such as Con Edison Solutions that supply customers on market terms. To address the possibility of a disruption due to the unavailability of gas, generating units located in New York City that are capable of using either gas or oil as fuel may be required to use oil as fuel for certain periods and new generating units are required to have dual fuel capability. RECO, O&R’s New Jersey subsidiary, provides electric service in an area that has a different independent system operator – PJM Interconnection LLC (PJM). See “CECONY – Electric Operations – Electric Supply” and “O&R – Electric Operations – Electric Supply,” below.

Competition

The Utilities do not consider it reasonably likely that another company would be authorized to provide utility delivery service of electricity, natural gas or steam where the company already provides service. Any such other company would need to obtain NYSPSC consent, satisfy applicable local requirements, install facilities to provide the service, meet applicable services standards, and charge customers comparable taxes and other fees and costs imposed on the service. A new delivery company would also be subject to extensive ongoing regulation by the NYSPSC. See “Utility Regulation – State Utility Regulation – Regulators,” above.

Distributed generation, such as solar energy production facilities, fuel cells and micro-turbines, provide alternative sources of energy for the Utilities’ electric delivery customers, as does oil for the Utilities’ gas delivery customers. Micro-grids and community-based micro-grids enable distributed generation to serve multiple locations and multiple customers. Other distributed energy resources, such as demand reduction and energy efficiency programs, provide alternatives for the Utilities’ delivery customers to manage their energy usage. The following table shows the aggregate capacities of the distributed generation projects connected to the Utilities’ distribution systems at December 31, 2015 and 2014:

|

| | | | | | | | |

Technology | CECONY | O&R |

Total MW, except project number | 2015 | 2014 | 2015 | 2014 |

Internal-combustion engines | 103 |

| 101 |

| 25 |

| 25 |

|

Photovoltaic solar | 95 |

| 58 |

| 46 |

| 28 |

|

Gas turbines | 40 |

| 40 |

| — |

| — |

|

Micro turbines | 10 |

| 9 |

| 1 |

| 1 |

|

Fuel cells | 8 |

| 8 |

| — |

| — |

|

Steam turbines | 3 |

| 3 |

| — |

| — |

|

Total distribution-level distributed generation | 259 |

| 219 |

| 72 |

| 54 |

|

Number of distributed generation projects | 7,451 |

| 4,200 |

| 3,709 |

| 1,953 |

|

The competitive energy businesses participate in competitive energy supply and services businesses and renewable and energy infrastructure projects that are subject to different risks than those found in the businesses of the Utilities.

The Utilities

CECONY

CECONY, incorporated in New York State in 1884, is a subsidiary of Con Edison and has no significant subsidiaries of its own. Its principal business segments are its regulated electric, gas and steam businesses.

For a discussion of the company’s operating revenues and operating income for each segment, see “Results of Operations” in Item 7. For additional information about the segments, see Note N to the financial statements in Item 8.

Electric Operations

Electric Facilities

CECONY’s capitalized costs for utility plant, net of accumulated depreciation, for distribution facilities were $16,394 million and $15,531 million at December 31, 2015 and 2014, respectively. For its transmission facilities, the costs for utility plant, net of accumulated depreciation, were $2,833 million and $2,744 million at December 31, 2015 and 2014, respectively, and for its portion of the steam-electric generation facilities, the costs for utility plant, net of accumulated depreciation, were $459 million and $451 million, at December 31, 2015 and 2014, respectively.

Distribution Facilities. CECONY owns 62 area distribution substations and various distribution facilities located throughout New York City and Westchester County. At December 31, 2015, the company’s distribution system had a transformer capacity of 29,762 MVA, with 36,929 miles of overhead distribution lines and 97,286 miles of underground distribution lines. The underground distribution lines represent the single longest underground electric delivery system in the United States.

Transmission Facilities. The company’s transmission facilities are located in New York City and Westchester, Orange, Rockland, Putnam and Dutchess counties in New York State. At December 31, 2015, CECONY owned or jointly owned 438 miles of overhead circuits operating at 138, 230, 345 and 500 kV and 749 miles of underground circuits operating at 69, 138 and 345 kV. The company’s 39 transmission substations and 62 area stations are supplied by circuits operated at 69 kV and above. For information about transmission projects to address, among other things, reliability concerns associated with the potential closure of the Indian Point Energy Center (which is owned by Entergy Corporation subsidiaries) see “CECONY – Electric Operations – Electric Supply” and “Con Edison Transmission,” below.

CECONY’s transmission facilities interconnect with those of National Grid, Central Hudson Gas & Electric Corporation, O&R, New York State Electric & Gas, Connecticut Light & Power Company, Long Island Power Authority, NYPA and Public Service Electric and Gas Company.

Generating Facilities. CECONY’s electric generating facilities consist of plants located in Manhattan whose primary purpose is to produce steam for the company's steam business. The facilities have an aggregate capacity of 724 MW. The company expects to have sufficient amounts of gas and fuel oil available in 2016 for use in these facilities.

Electric Sales and Deliveries

CECONY delivers electricity to its full-service customers who purchase electricity from the company. The company also delivers electricity to its customers who choose to purchase electricity from other energy suppliers (retail choice program). In addition, the company delivers electricity to state and municipal customers of NYPA and economic development customers of municipal electric agencies.

The company charges all customers in its service area for the delivery of electricity. The company generally recovers, on a current basis, the cost of the electricity that it buys and then sells to its full-service customers. It does not make any margin or profit on the electricity it sells. CECONY’s electric revenues are subject to a revenue decoupling mechanism. As a result, its electric delivery revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. CECONY’s electric sales and deliveries for the last five years were:

|

| | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2011 | | 2012 | | 2013 | | 2014 | | 2015 |

Electric Energy Delivered (millions of kWh) | | | | | | | | | | |

CECONY full service customers | | 22,622 | | 20,622 | | 20,118 | | 19,757 | | 20,206 |

Delivery service for retail choice customers | | 24,234 | | 25,990 | | 26,574 | | 26,221 | | 26,662 |

Delivery service to NYPA customers and others | | 10,408 | | 10,267 | | 10,226 | | 10,325 | | 10,147 |

Delivery service for municipal agencies | | 562 | | 322 | | — |

| | — |

| | — |

|

Total Deliveries in Franchise Area | | 57,826 | | 57,201 | | 56,918 | | 56,303 | | 57,015 |

Electric Energy Delivered ($ in millions) | | | | | | | | | | |

CECONY full service customers | | $5,237 | | $4,731 | | $4,799 | | $5,023 | | $4,757 |

Delivery service for retail choice customers | | 2,354 | | 2,750 | | 2,683 | | 2,646 | | 2,714 |

Delivery service to NYPA customers and others | | 555 | | 596 | | 602 | | 625 | | 600 |

Delivery service for municipal agencies | | 22 | | 10 | | — |

| | — |

| | — |

|

Other operating revenues | | 60 | | 89 | | 47 | | 143 | | 101 |

Total Deliveries in Franchise Area | | $8,228 | | $8,176 | | $8,131 | | $8,437 | | $8,172 |

Average Revenue per kWh Sold (Cents) (a) | | | | | | | | | | |

Residential | | 25.6 | | 25.6 | | 27.0 | | 28.9 | | 26.3 |

Commercial and Industrial | | 20.7 | | 20.0 | | 20.6 | | 22.1 | | 20.6 |

| |

(a) | Includes Municipal Agency sales. |

For further discussion of the company’s electric operating revenues and its electric results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Electric Peak Demand

The electric peak demand in CECONY’s service area generally occurs during the summer air conditioning season. The weather during the summer of 2015 was cooler than design conditions. CECONY’s 2015 service area peak demand was 12,316 MW, which occurred on July 20, 2015. The 2015 peak demand included an estimated 4,795 MW for CECONY’s full-service customers, 5,745 MW for customers participating in its electric retail choice program and 1,776 MW for NYPA’s electric commodity customers and municipal electric agency customers. “Design weather” for the electric system is a standard to which the actual peak demand is adjusted for evaluation and planning purposes. Since the NYISO can invoke demand reduction programs under specific circumstances, design conditions do not include these programs’ potential impact. However, the CECONY forecasted peak demand at design conditions does include the impact of certain demand reduction programs. The company estimates that, under design weather conditions, the 2016 service area peak demand will be 13,650 MW, including an estimated 6,340 MW for its full-service customers, 5,315 MW for its electric retail choice customers and 1,995 MW for NYPA’s customers and municipal electric agency customers. The company forecasts an average annual growth in electric peak demand in its service area at design conditions over the next five years to be approximately 0.2 percent per year.

Electric Supply

Most of the electricity sold by CECONY to its full-service customers in 2015 was purchased under firm power contracts or through the wholesale electricity market administered by the NYISO. The company expects that these resources will again be adequate to meet the requirements of its customers in 2016. The company plans to meet its continuing obligation to supply electricity to its customers through a combination of electricity purchased under contracts, purchased through the NYISO’s wholesale electricity market, or generated from its electricity generating facilities. For information about the company’s contracts for approximately 1,900 MW of electric generating capacity, see Notes I and O to the financial statements in Item 8. To reduce the volatility of its customers’ electric energy costs, the company has contracts to purchase electric energy and enters into derivative transactions to hedge the costs of a portion of its expected purchases under these contracts and through the NYISO’s wholesale electricity market.

CECONY owns generating stations in New York City associated primarily with its steam system. As of December 31, 2015, the generating stations had a combined electric capacity of approximately 724 MW, based on 2015 summer test ratings. For information about electric generating capacity owned by the company, see “Electric Operations – Electric Facilities – Generating Facilities,” above.

In general, the Utilities recover their purchased power costs, including the cost of hedging purchase prices, pursuant to rate provisions approved by the state public utility regulatory authority having jurisdiction. See “Financial

and Commodity Market Risks – Commodity Price Risk,” in Item 7 and “Recoverable Energy Costs” in Note A to the financial statements in Item 8. From time to time, certain parties have petitioned the NYSPSC to review these provisions, the elimination of which could have a material adverse effect on the Companies’ financial position, results of operations or liquidity.

CECONY monitors the adequacy of the electric capacity resources and related developments in its service area, and works with other parties on long-term resource adequacy within the framework of the NYISO. In addition, the NYISO has adopted reliability rules that include obligations on transmission owners (such as CECONY) to construct facilities that may be needed for system reliability if the market does not solve a reliability need identified by the NYISO. See “New York Independent System Operator” above. In a July 1998 order, the NYSPSC indicated that it “agree(s) generally that CECONY need not plan on constructing new generation as the competitive market develops,” but considers “overly broad” and did not adopt CECONY’s request for a declaration that, solely with respect to providing generating capacity, it will no longer be required to engage in long-range planning to meet potential demand and, in particular, that it will no longer have the obligation to construct new generating facilities, regardless of the market price of capacity.

In November 2012, the NYSPSC directed CECONY to work with NYPA to develop a contingency plan to address reliability concerns associated with the potential closure of the nuclear power plants at the Indian Point Energy Center (which is owned by Entergy Corporation subsidiaries). In February 2013, CECONY and NYPA submitted their plan, and, in October 2013, the NYSPSC approved three transmission projects and several energy efficiency, demand reduction and combined heat and power programs to address concerns associated with the potential closure. The transmission projects, which also address transmission congestion between upstate and downstate and make available more generation from Staten Island, are scheduled to be placed into service in 2016. See “Con Edison Transmission” below. In February 2014, CECONY submitted to the NYSPSC the implementation plan for the energy efficiency, demand reduction and combined heat and power programs, which are estimated to cost up to $285 million. In April 2014, the NYSPSC authorized CECONY to recover its program costs, the majority of which are expected to be incurred from 2014 through 2016, over a ten-year period through a surcharge billed to its electric delivery customers.

Gas Operations

Gas Facilities

CECONY’s capitalized costs for utility plant, net of accumulated depreciation, for gas facilities, which are primarily distribution facilities, were $5,196 million and $4,530 million at December 31, 2015 and 2014, respectively.

Natural gas is delivered by pipeline to CECONY at various points in or near its service territory and is distributed to customers by the company through an estimated 4,348 miles of mains and 369,791 service lines. The company owns a natural gas liquefaction facility and storage tank at its Astoria property in Queens, New York. The plant can store 1,062 MDt of which a maximum of about 250 MDt can be withdrawn per day. The company has about 1,226 MDt of additional natural gas storage capacity at a field in upstate New York, owned and operated by Honeoye Storage Corporation, a corporation 28.8 percent owned by CECONY and 71.2 percent owned by Con Edison Development.

Gas Sales and Deliveries

The company generally recovers the cost of the gas that it buys and then sells to its full-service customers. It does not make any margin or profit on the gas it sells. CECONY’s gas revenues are subject to a weather normalization clause and a revenue decoupling mechanism. As a result, its gas delivery revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. CECONY’s gas sales and deliveries for the last five years were:

|

| | | | | | | |

| Year Ended December 31, |

| 2011 | 2012 | 2013 | 2014 | 2015 |

Gas Delivered (MDt) | | | | | |

Firm Sales | | | | | |

Full service | 64,696 | 57,595 | 67,007 | 75,630 | 77,197 |

Firm transportation of customer-owned gas | 54,291 | 52,860 | 61,139 | 68,731 | 72,864 |

Total Firm Sales | 118,987 | 110,455 | 128,146 | 144,361 | 150,061 |

Interruptible Sales (a) | 10,035 | 5,961 | 10,900 | 10,498 | 6,332 |

Total Gas Delivered to CECONY Customers | 129,022 | 116,416 | 139,046 | 154,859 | 156,393 |

Transportation of customer-owned gas | | | | | |

NYPA | 34,893 | 48,107 | 48,682 | 47,548 | 44,038 |

Other (mainly generating plants and interruptible transportation) | 97,163 | 108,086 | 87,379 | 105,012 | 104,857 |

Off-System Sales | 97 | 730 | 4,638 | 15 | 389 |

Total Sales | 261,175 | 273,339 | 279,745 | 307,434 | 305,677 |

Gas Delivered ($ in millions) | | | | | |

Firm Sales | | | | | |

Full service | $1,048 | $889 | $1,059 | $1,141 | $956 |

Firm transportation of customer-owned gas | 356 | 380 | 414 | 453 | 458 |

Total Firm Sales | 1,404 | 1,269 | 1,473 | 1,594 | 1,414 |

Interruptible Sales | 74 | 39 | 69 | 91 | 46 |

Total Gas Delivered to CECONY Customers | 1,478 | 1,308 | 1,542 | 1,685 | 1,460 |

Transportation of customer-owned gas | | | |

NYPA | 2 | 2 | 2 | 2 | 2 |

Other (mainly generating plants and interruptible transportation) | 71 | 68 | 71 | 70 | 54 |

Off-System Sales | — |

| 5 | 18 | — |

| 1 |

Other operating revenues (mainly regulatory amortizations) | (30) | 32 | (17) | (36) | 11 |

Total Sales | $1,521 | $1,415 | $1,616 | $1,721 | $1,528 |

Average Revenue per Dt Sold | | | |

Residential | $18.45 | $18.14 | $18.52 | $16.76 | $13.91 |

General | $12.96 | $11.68 | $12.05 | $12.38 | $9.73 |

| |

(a) | Includes 3,801, 563, 5,362, 6,057, 1,229 MDt for 2011, 2012, 2013, 2014 and 2015, respectively, which are also reflected in firm transportation and other. |

For further discussion of the company’s gas operating revenues and its gas results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Gas Peak Demand

The gas peak demand for firm sales customers in CECONY’s service area occurs during the winter heating season. The peak day demand during the winter 2015/2016 (through February 1, 2016) occurred on January 4, 2016 when the demand reached 1,068 MDt. The 2015/2016 peak day demand included 551 MDt for CECONY’s full-service customers and 517 MDt for customers participating in its gas retail choice program. “Design weather” for the gas system is a standard to which the actual peak demand is adjusted for evaluation and planning purposes. The company estimates that, under design weather conditions, the 2016/2017 service area peak day demand will be 1,456 MDt, including an estimated 757 MDt for its full-service customers and 699 MDt for its gas retail choice customers. The forecasted peak day demand at design conditions does not include gas used by interruptible gas customers including electric and steam generating stations. The company forecasts an average annual growth of the gas peak demand over the next five years at design conditions to be approximately 2.3 percent in its service area.

Gas Supply

CECONY and O&R have combined their gas requirements, and contracts to meet those requirements, into a single portfolio. The combined portfolio is administered by, and related management services are provided by, CECONY (for itself and as agent for O&R) and costs are allocated between the Utilities in accordance with provisions approved by the NYSPSC. See Note S to the financial statements in Item 8.

Charges from suppliers for the firm purchase of gas, which are based on formulas or indexes or are subject to negotiation, are generally designed to approximate market prices. The Utilities have contracts with interstate

pipeline companies for the purchase of firm transportation from upstream points where gas has been purchased to the Utilities’ distribution systems, and for upstream storage services. Charges under these transportation and storage contracts are approved by the FERC. The Utilities are required to pay certain fixed charges under the supply, transportation and storage contracts whether or not the contracted capacity is actually used. These fixed charges amounted to approximately $291 million in 2015, including $252 million for CECONY. See “Contractual Obligations” below. At December 31, 2015, the contracts were for various terms extending to 2020 for supply and 2027 for the transportation and storage. In January 2016, CECONY entered into two 20-year transportation contracts, one of which is for capacity on the proposed Mountain Valley Pipeline (MVP) (see “Con Edison Transmission - CET Gas" below). In addition, the Utilities purchase gas on the spot market and contract for interruptible gas transportation. See “Recoverable Energy Costs” in Note A to the financial statements in Item 8.

Steam Operations

Steam Facilities

CECONY’s capitalized costs for utility plant, net of accumulated depreciation, for steam facilities, including steam's portion of the steam-electric generation facilities, were $1,849 million and $1,795 million at December 31, 2015 and 2014, respectively.

CECONY generates steam at one steam-electric generating station and five steam-only generating stations and distributes steam to its customers through approximately 105 miles of transmission, distribution and service piping.

Steam Sales and Deliveries

CECONY’s steam sales and deliveries for the last five years were:

|

| | | | | |

| Year Ended December 31, |

| 2011 | 2012 | 2013 | 2014 | 2015 |

Steam Sold (MMlb) | | | | | |

General | 519 | 425 | 547 | 594 | 538 |

Apartment house | 5,779 | 5,240 | 6,181 | 6,574 | 6,272 |

Annual power | 16,024 | 14,076 | 15,195 | 15,848 | 15,109 |

Total Steam Delivered to CECONY Customers | 22,322 | 19,741 | 21,923 | 23,016 | 21,919 |

Steam Sold ($ in millions) | | | | | |

General | $28 | $25 | $31 | $30 | $29 |

Apartment house | 175 | 158 | 187 | 180 | 176 |

Annual power | 487 | 429 | 491 | 469 | 453 |

Other operating revenues | (7) | (16) | (26) | (51) | (29) |

Total Steam Delivered to CECONY Customers | $683 | $596 | $683 | $628 | $629 |

Average Revenue per MMlb Sold | $30.91 | $31.00 | $32.34 | $29.50 | $30.02 |

For further discussion of the company’s steam operating revenues and its steam results, see “Results of Operations” in Item 7. For additional segment information, see Note N to the financial statements in Item 8.

Steam Peak Demand and Capacity

Demand for steam in CECONY’s service area peaks during the winter heating season. The one-hour peak demand during the winter of 2015/2016 (through February 1, 2016) occurred on January 5, 2016 when the demand reached 8.0 MMlb per hour. “Design weather” for the steam system is a standard to which the actual peak demand is adjusted for evaluation and planning purposes. The company’s estimate for the winter of 2016/2017 peak demand of its steam customers is about 8.9 MMlb per hour under design conditions. The company forecasts an average annual decrease in steam peak demand in its service area at design conditions over the next five years to be approximately 0.8 percent.

On December 31, 2015, the steam system was capable of delivering approximately 11.3 MMlb of steam per hour, and CECONY estimates that the system will have a capacity of 11.6 MMlb of steam per hour in the 2016/2017 winter.

Steam Supply