UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from to

Commission File No. 1-9410

COMPUTER TASK GROUP, INCORPORATED

(Exact name of registrant as specified in its charter)

New York | 16-0912632 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

800 Delaware Avenue, Buffalo, New York | 14209 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (716) 882-8000 | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $.01 par value | The NASDAQ Stock Market LLC | |

Rights to Purchase Series A Participating Preferred Stock | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ¨ | Accelerated filer | x |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold on the last business day of the registrant’s most recently completed second quarter was $227.1 million. Solely for the purposes of this calculation, all persons who are or may be executive officers or directors of the registrant have been deemed to be affiliates.

The total number of shares of Common Stock of the Registrant outstanding at February 20, 2015 was 18,748,625.

DOCUMENTS INCORPORATED BY REFERENCE

Certain sections of the Company’s definitive proxy statement to be filed with the Securities and Exchange Commission (SEC) within 120 days of the end of the Company’s fiscal year ended December 31, 2014, are incorporated by reference into Part III hereof. Except for those portions specifically incorporated by reference herein, such document shall not be deemed to be filed with the SEC as part of this annual report on Form 10-K.

SEC Form 10-K Index

Section | Page | |

Part I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Part III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Part IV | ||

Item 15. | ||

As used in this annual report on Form 10-K, references to “CTG,” “the Company” or “the Registrant” refer to Computer Task Group, Incorporated and its subsidiaries, unless the context suggests otherwise.

PART I

Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements made by the management of Computer Task Group, Incorporated (CTG, the Company or the Registrant) that are subject to a number of risks and uncertainties. These forward-looking statements are based on information as of the date of this report. The Company assumes no obligation to update these statements based on information from and after the date of this report. Generally, forward-looking statements include words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “could,” “may,” “might,” “should,” “will” and words and phrases of similar impact. The forward-looking statements include, but are not limited to, statements regarding future operations, industry trends or conditions and the business environment, and statements regarding future levels of, or trends in business strategy and expectations, new business opportunities, cost control initiatives, business wins, market demand, revenue, operating expenses, capital expenditures, and financing. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Numerous factors could cause actual results to differ materially from those in the forward-looking statements, including the following: (i) the availability to CTG of qualified professional staff, (ii) domestic and foreign industry competition for customers and talent, (iii) increased bargaining power of large customers, (iv) the Company's ability to protect confidential client data, (v) the partial or complete loss of the revenue the Company generates from International Business Machines Corporation (IBM), (vi) the uncertainty of customers' implementations of cost reduction projects, (vii) the effect of healthcare reform and initiatives, (viii) the mix of work between staffing and solutions, (ix) currency exchange risks, (x) risks associated with operating in foreign jurisdictions, (xi) renegotiations, nullification, or breaches of contracts with customers, vendors, subcontractors or other parties, (xii) the change in valuation of recorded goodwill or capitalized software balances, (xiii) the impact of current and future laws and government regulation, as well as repeal or modification of such, affecting the information technology (IT) solutions and staffing industry, taxes and the Company's operations in particular, (xiv) industry and economic conditions, including fluctuations in demand for IT services, (xv) consolidation among the Company's competitors or customers, (xvi) the need to supplement or change our IT services in response to new offerings in the industry or changes in customer requirements for IT products and solutions, and (xvii) the risks described in Item 1A of this annual report on Form 10-K and from time to time in the Company's reports filed with the Securities and Exchange Commission (SEC).

Item 1. | Business |

Overview

CTG was incorporated in Buffalo, New York on March 11, 1966, and its corporate headquarters are located at 800 Delaware Avenue, Buffalo, New York 14209 (716-882-8000). CTG is an IT solutions and staffing services company with operations in North America and Europe. CTG employs approximately 3,800 people worldwide. During 2014, the Company had seven operating subsidiaries: Computer Task Group of Canada, Inc., providing services in Canada; and Computer Task Group Belgium N.V., CTG ITS S.A., Computer Task Group IT Solutions, S.A., Computer Task Group Luxembourg PSF, Computer Task Group (U.K.) Ltd., and etrinity N.V. (etrinity), each primarily providing services in Europe. Services provided in North America are primarily performed by the parent corporation, CTG.

Services

The Company operates in one industry segment, providing IT services to its clients. These services include IT Solutions and IT Staffing. CTG provides these primary services to all of the markets that it serves. The services provided typically encompass the IT business solution life cycle, including phases for planning, developing, implementing, managing, and ultimately maintaining the IT solution. A typical customer is an organization with large, complex information and data processing requirements. The Company’s IT Solutions and IT Staffing services are further described as follows:

• | IT Solutions: CTG’s services in this area include helping clients assess their business needs and identifying the right IT solutions to meet these needs. The delivery of services includes the selection and implementation of packaged software and the design, development, testing, and integration of new |

1

systems, and the development and implementation of customized software and solutions designed to fit the needs of a specific client or vertical market.

Generally, IT Solutions services include taking responsibility for the service-related deliverables on a project and may include high-end consulting services. CTG has significant experience in implementing electronic health records (EHR) systems in integrated delivery networks and other provider organizations. CTG also provides IT services to health insurance companies, and to the start-up and development of Health Information Exchanges (HIEs). HIEs are consortiums of providers, payers, and government agencies at the local level that are charged with implementing secure community-wide electronic medical records.

Also included within IT Solutions is Transitional Application Management (TAM). In 2014, the healthcare market accounted for most of CTG’s TAM services. In a TAM engagement, the client hires CTG to manage an existing application for an extended time period, typically ranging from one to three years, while its internal IT staff focuses on implementation of a new application replacing the application being phased out. Additionally, CTG’s services in this area could include outsourcing support of single or multiple applications and help desk functions. Depending on client needs, these engagements are performed either at a client or CTG site, or remotely.

In 2014, CTG continued to invest in and expand new IT Solutions development, primarily targeted to the healthcare market, which supports cost reductions and productivity improvements. Previously, healthcare solutions under development moved from the pilot stage of testing using live data into the sales process as completed tools. In 2014, the Company continued to invest in certain of these tools to expand their capabilities, including the Company's solution that focuses on medical care and disease management. The Company has developed proprietary software to support these offerings which expands the potential market for sale and support of these solutions. These solutions primarily support the healthcare provider market.

• | IT and Other Staffing: CTG recruits, retains, and manages IT and other talent for its clients, which are primarily large technology service providers and companies with multiple locations and significant need for high-volume external IT, administrative, or warehouse resources. The Company also supports larger companies and organizations that need to augment their own IT staff on a flexible basis. Our clients may require the services of our IT talent on a temporary or long-term basis. Our IT professionals generally work with the client’s internal IT staff at client sites. Our recruiting organization works with customers to define their staffing requirements and develop competitive pricing to meet those requirements. In certain limited instances for a small number of clients, the Company provides administrative or warehouse employees to clients to supplement the IT resources we place at those clients. |

The primary focus of the Company’s staffing services is a managed services model that provides large clients with higher value support through cost-effective supply models customized to client needs, resource management support, vendor management programs, and a highly automated recruiting process and system with global reach.

Independent software testing is a common service in both our North American and European businesses, and represents a significant portion of the IT staffing services of CTG’s European operations. This comprehensive testing offering supports IT environments across multiple industries.

A trend affecting the staffing industry in recent years is that large users of external technology support are reducing their number of approved suppliers to fewer firms with a preference for those firms able to fulfill high volume requirements at competitive rates and to locate resources with specialized skills on a national level. CTG’s staffing services model fits this profile and it has consistently remained a preferred provider with large technology service providers and users that have reduced their lists of approved IT staffing suppliers.

IT solutions and staffing revenue as a percentage of consolidated revenue for the years ended December 31, 2014, 2013 and 2012 is as follows:

2014 | 2013 | 2012 | ||||||

IT solutions | 38.0 | % | 39.3 | % | 40.8 | % | ||

IT staffing | 62.0 | % | 60.7 | % | 59.2 | % | ||

Total | 100.0 | % | 100.0 | % | 100.0 | % | ||

2

A major strategic initiative of the Company in recent years has been to focus on its IT solutions services, as operating margins generated by the IT solutions services are generally higher than those of the IT staffing services. However, growth from the IT solutions business unit has been challenging in the past several years. Overall, the Company’s revenue decreased $25.8 million or 6.1% from 2013 to 2014 due to a general reduction in spending by many of our healthcare clients (which is included in IT solutions services) in part due to the U.S. federal government sequestration which cut Medicare reimbursements to hospitals and health systems beginning on April 1, 2013. Additionally, there were reductions in demand from some of our IT staffing services clients. The higher margin IT solutions services business decreased $15.2 million or 9.2% from 2013 to 2014, while IT staffing services decreased $10.6 million or 4.2% in the same period. The Company’s operating margin in 2014 was 4.4%. The decrease in operating income in 2014 from 2013 was primarily due to reduced operating leverage due to lower consolidated revenue, a change in the business mix to a higher level of IT staffing services which has lower direct profit than the IT solutions business, competitive pricing pressure from a large IT staffing client, higher medical costs due to increased utilization of the Company's self insured medical plan, costs of $2.0 million associated with the death of the Company's Chairman and CEO in the 2014 fourth quarter, and the Company's decision to take an impairment charge of approximately $1.5 million for software costs capitalized for an IT solution. The Company’s operating margin was 5.9% in 2013, and 5.8% in 2012.

Vertical Markets

The Company promotes a majority of its services through four vertical market focus areas: Healthcare (which includes services provided to healthcare providers, health insurers (payers), and life sciences companies), Technology Service Providers, Financial Services, and Energy. The remainder of CTG’s revenue is derived from general markets.

CTG’s revenue by vertical market as a percentage of consolidated revenue for the years ended December 31, 2014, 2013 and 2012 is as follows:

2014 | 2013 | 2012 | ||||||

Healthcare | 28.6 | % | 31.4 | % | 33.0 | % | ||

Technology service providers | 26.4 | % | 28.0 | % | 30.8 | % | ||

Financial services | 7.9 | % | 6.8 | % | 6.1 | % | ||

Energy | 6.1 | % | 6.2 | % | 6.0 | % | ||

General markets | 31.0 | % | 27.6 | % | 24.1 | % | ||

Total | 100.0 | % | 100.0 | % | 100.0 | % | ||

The Company’s growth efforts are primarily focused in the healthcare market based on its leading position in serving the provider market, and its expertise and experience serving other segments of this market (payers and life sciences companies). In 2012, there had been higher demand for solutions offerings and support from healthcare companies, and in general, higher demand compared with other sectors of the U.S. economy. However, in 2013 and 2014, the demand from our healthcare clients decreased. This decrease was directly related to the U.S. federal government sequestration which cut Medicare reimbursements to hospitals and health systems by 2% starting in April 2013. As a result, the Company’s healthcare revenue continued to decrease in 2014, decreasing $19.3 million or 14.7% from 2013.

Revenue for the Company's technology service providers vertical market as a percentage of total revenue decreased in 2014 as compared with 2013 due to weak demand from several of the Company's largest clients in its IT staffing services business unit, which are included in this vertical market.

During 2014, the percentage of revenue attributable to the financial services market increased from 2013, primarily due to strong demand in our European operations. In recent years, most of CTG’s revenue in the financial services market was generated from its European operations, which accounted for 97.3% of the Company’s total 2014 revenue from the financial services vertical market.

Revenue for the Company's energy vertical market remained consistent as a percentage of consolidated revenue in 2014 as compared with 2013 as demand in this vertical market declined with the overall revenue decrease of the Company of approximately 6.1%. Generally, the decrease in the price of oil caused several of our clients to reduce their overall spending, including requirements for IT services, during 2014.

3

For the year ended December 31, 2014, CTG provided its services to approximately 475 clients in North America and Europe. In North America, the Company operates in the United States and Canada, with greater than 99% of 2014 North American revenue generated in the United States. In Europe, the Company operates in Belgium, Luxembourg, and the United Kingdom. Of total 2014 consolidated revenue of $393.3 million, approximately 80% was generated in North America and 20% in Europe. One client, International Business Machines Corporation (IBM), accounted for greater than 10% of CTG’s consolidated revenue in 2014, 2013, and 2012.

Pricing and Backlog

The Company recognizes revenue when persuasive evidence of an arrangement exists, when the services have been rendered, when the price is determinable, and when collectibility of the amounts due is reasonably assured. For time-and-material contracts, revenue is recognized as hours are incurred and costs are expended. For contracts with periodic billing schedules, primarily monthly, revenue is recognized as services are rendered to the customer. Revenue for fixed-price contracts is recognized per the proportional method of accounting using an input-based approach. On a given project, actual salary and indirect labor costs incurred are measured and compared against the total estimated costs of such items at the completion of the project. Revenue is recognized based upon the percentage-of-completion calculation of total incurred costs to total estimated costs. The Company infrequently works on fixed-price projects that include significant amounts of material or other non-labor related costs which could distort the percent complete within a percentage-of-completion calculation. The Company’s estimate of the total labor costs it expects to incur over the term of the contract is based on the nature of the project and our past experience on similar projects, and includes management judgments and estimates which affect the amount of revenue recognized on fixed-price contracts in any accounting period.

The Company’s revenue from contracts accounted for under time-and-material, progress billing, and percentage-of-completion methods as a percentage of consolidated revenue for the years ended December 31, 2014, 2013 and 2012 is as follows:

2014 | 2013 | 2012 | ||||||

Time-and-material | 86.2 | % | 88.8 | % | 90.3 | % | ||

Progress billing | 11.2 | % | 8.8 | % | 7.9 | % | ||

Percentage-of-completion | 2.6 | % | 2.4 | % | 1.8 | % | ||

Total | 100.0 | % | 100.0 | % | 100.0 | % | ||

As of December 31, 2014 and 2013, the backlog for fixed-price and all managed-support contracts was approximately $41.8 million and $44.1 million, respectively. Approximately 69.2% or $28.9 million of the December 31, 2014 backlog is expected to be earned in 2015. Of the $44.1 million of backlog at December 31, 2013, approximately 73.8%, or $32.6 million was earned in 2014. Revenue is subject to slight seasonal variations, with a minor slowdown in months of high vacation and legal holidays (July, August, and December). Backlog does not tend to be seasonal; however, it does fluctuate based upon the timing of entry into long-term contracts.

Competition

The IT services market, for both IT solutions and IT staffing services, is highly competitive. The market is also highly fragmented with many providers and no single competitor maintaining clear market leadership. Competition varies by location, the type of service provided, and the customer to whom services are provided. The Company’s competition comes from four major channels: large national or international companies, including major accounting and consulting firms; hardware vendors and suppliers of packaged software systems; small local firms or individuals specializing in specific programming services or applications; and from a customer’s internal IT staff. CTG competes against all four of these channels for its share of the market. The Company believes that to compete successfully it is necessary to have a local geographic presence, offer appropriate IT solutions, provide skilled professional resources, and price its services competitively.

CTG has implemented a Global Management System, with the goal to achieve continuous, measured improvements in services and deliverables. As part of this program, CTG has developed specific methodologies for providing high value services that result in unique solutions and specified deliverables for its clients. The Company believes these methodologies will enhance its ability to compete. CTG initially achieved worldwide ISO 9001:1994 certification in June 2000. CTG received its worldwide ISO 9001:2000 certification in January 2003. The Company believes it is the only IT services company of its size to achieve worldwide certification.

4

Intellectual Property

The Company has registered its symbol and logo with the U.S. Patent and Trademark Office and has taken steps to preserve its rights in other countries where it operates. We regard patents, trademarks, copyrights and other intellectual property as important to our success, and we rely on them in the United States and foreign countries to protect our investments in products and technology. Our patents expire at various times, but we believe that the loss or expiration of any individual patent would not materially affect our business. We, like any other company, may be subject to claims of alleged infringement of the patents, trademarks and other intellectual property rights of third parties from time to time in the ordinary course of business. CTG has entered into agreements with various software and hardware vendors from time to time in the normal course of business, and has capitalized certain costs under software development projects.

Employees

CTG’s business depends on the Company’s ability to attract and retain qualified professional staff to provide services to its customers. The Company has a structured recruiting organization that works with its clients to meet their requirements by recruiting and providing high quality, motivated staff. The Company employs approximately 3,800 employees worldwide, with approximately 3,200 in the United States and Canada and 600 in Europe. Of these employees, approximately 3,500 are IT professionals and 300 are individuals who work in sales, recruiting, delivery, administrative and support positions. The Company believes that its relationship with its employees is good. No employees are covered by a collective bargaining agreement or are represented by a labor union. CTG is an equal opportunity employer.

5

Financial Information About Geographic Areas

The following table sets forth certain financial information relating to the performance of the Company for the years ended December 31, 2014, 2013, and 2012. This information should be read in conjunction with the audited consolidated financial statements and notes thereto included in Item 8, “Financial Statements and Supplementary Data” included in this report.

2014 | 2013 | 2012 | |||||||||

(amounts in thousands) | |||||||||||

Revenue from External Customers: | |||||||||||

United States | $ | 314,500 | $ | 341,391 | $ | 355,022 | |||||

Belgium(1) | 44,692 | 48,428 | 41,957 | ||||||||

Other European countries | 33,652 | 28,684 | 26,653 | ||||||||

Other country | 424 | 533 | 783 | ||||||||

Total foreign revenue | 78,768 | 77,645 | 69,393 | ||||||||

Total revenue | $ | 393,268 | $ | 419,036 | $ | 424,415 | |||||

Operating Income: | |||||||||||

United States | $ | 14,196 | $ | 21,828 | $ | 21,203 | |||||

Europe | 2,923 | 2,864 | 3,209 | ||||||||

Other country | 33 | 35 | 50 | ||||||||

Total foreign operating income | 2,956 | 2,899 | 3,259 | ||||||||

Total operating income | $ | 17,152 | $ | 24,727 | $ | 24,462 | |||||

Total Assets: | |||||||||||

United States | $ | 139,239 | $ | 139,576 | $ | 132,795 | |||||

Belgium (1) | 15,621 | 18,037 | 18,908 | ||||||||

Other European countries | 15,739 | 16,621 | 14,211 | ||||||||

Other country | 197 | 197 | 291 | ||||||||

Total foreign assets | 31,557 | 34,855 | 33,410 | ||||||||

Total assets | $ | 170,796 | $ | 174,431 | $ | 166,205 | |||||

(1) | Revenue and total assets for our Belgium operations have been disclosed separately as they exceed 10% of the consolidated balances in certain of the years presented. |

6

Executive Officers of the Company

As of December 31, 2014, the following individuals were executive officers of the Company:

Name | Age | Office | Period During Which Served as Executive Officer | Other Positions and Offices with Registrant | |

Brendan M. Harrington | 48 | Interim Chief Executive Officer | October 15, 2014 to date | None | |

Senior Vice President, Chief Financial Officer | September 13, 2006 to October 14, 2014 | ||||

John M. Laubacker | 48 | Interim Chief Financial Officer | October 15, 2014 to date | Treasurer | |

Filip J. L. Gydé | 54 | Interim Executive Vice President of Operations | October 15, 2014 to date | None | |

Senior Vice President | October 1, 2000 to October 14, 2014 | ||||

Arthur W. Crumlish | 60 | Senior Vice President | September 24, 2001 to date | None | |

Peter P. Radetich | 60 | Senior Vice President, General Counsel | April 28, 1999 to date | Secretary | |

Ted Reynolds | 59 | Senior Vice President | November 11, 2014 to date | None | |

Vice President, Health Solutions | March 7, 2011 to November 10, 2014 | ||||

Mr. Harrington was promoted to Interim Chief Executive Officer on October 15, 2014. Previously he was Senior Vice President and Chief Financial Officer from September 13, 2006 to October 14, 2014, and Interim Chief Financial Officer and Treasurer from October 17, 2005 to September 12, 2006. Mr. Harrington joined the Company in February 1994 and served in a number of managerial financial positions in the Company’s corporate and European operations, including as the Director of Accounting since 2003, before being appointed Corporate Controller in May 2005.

Mr. Laubacker was promoted to Interim Chief Financial Officer on October 15, 2014. He has served as the Company’s Treasurer since 2006, responsible for management of the Company’s treasury, audit and financial reporting functions. Prior to joining the Company in January 1996, Mr. Laubacker was a Senior Manager employed at KPMG from 1988 to 1996.

Mr. Gydé was promoted to Interim Executive Vice President of Operations on October 15, 2014, responsible for operating activities of the overall Company. Previously he was Senior Vice President and General Manager of CTG Europe from October 1, 2000 through October 14, 2014. Prior to that, Mr. Gydé was Managing Director of the Company’s operations in Belgium. Mr. Gydé has been with the Company since May 1987.

Mr. Crumlish was promoted to Senior Vice President in September 2001, and is currently responsible for the Company’s Strategic Staffing Services organization. Prior to that, Mr. Crumlish was the Financial Controller of the Company’s Strategic Staffing Services organization. Mr. Crumlish joined the Company in 1990.

Mr. Radetich joined the Company in June 1988 as Associate General Counsel, and was promoted to General Counsel and Secretary in April 1999.

Mr. Reynolds was promoted to Senior Vice President on November 11, 2014, and is currently responsible for the Company's healthcare IT business unit, CTG Health Solutions. Previously he was Vice President for CTG Health Solutions from March 7, 2011 through November 10, 2014. Prior to that, Mr. Reynolds served as the Company’s Client Services Executive for its Epic practice. Mr. Reynolds joined CTG in 2006, and previously had approximately 30 years of experience in healthcare and IT.

7

Available Company Information

The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Exchange Act), and reports pertaining to the Company filed under Section 16 of the Exchange Act are available without charge on the Company’s website at www.ctg.com as soon as reasonably practicable after the Company electronically files the information with, or furnishes it to, the SEC. The Company’s code of ethics (Code of Conduct), committee charters and governance policies are also available without charge on the Company’s website at http://investors.ctg.com/governance.cfm. The Company intends to disclose future amendments to, or waivers from, certain provisions of the Code of Conduct on the Company's website or in a current report on Form 8-K.

8

Item 1A. | Risk Factors |

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. The risk factors below represent what we believe are the known material risk factors with respect to the Company and our business. Any of the following risks could materially adversely affect our business, our operations, the industry in which we operate, our financial position or our future financial results.

Our business depends on the availability of a large number of highly qualified IT professionals and our ability to recruit and retain these professionals.

We actively compete with many other IT service providers for qualified professional staff. The availability of qualified professional staff may affect our ability to provide services and meet the needs of our customers in the future. An inability to fulfill customer requirements at agreed upon rates due to a lack of available qualified staff may adversely impact our revenue and operating results in the future.

Increased competition and the bargaining power of our large customers may cause our billing rates to decline, which would have an adverse effect on our revenue and, if we are unable to control our personnel costs accordingly, on our margins and operating results.

We have experienced reductions in the rates at which we bill some of our larger customers for services due to the highly competitive market conditions that exist at this time. Additionally, we actively compete against many other companies for business at new and existing clients. Billing rate reductions or competitive pressures may lead to a further decline in revenue. If we are unable to make commensurate reductions in our personnel costs, our margins and operating results in the future would be adversely affected.

We derive a significant portion of our revenue from a single customer and a significant reduction in the amount of IT services requested by this customer would have an adverse effect on our revenue and operating results.

IBM is CTG’s largest customer. CTG provides services to various IBM divisions in many locations. During 2014, the National Technical Services Agreement (NTS Agreement) with IBM was renewed for three years until December 31, 2017. In 2014, 2013, and 2012, IBM accounted for $90.5 million or 23.0%, $101.7 million or 24.3%, and $113.8 million or 26.8% of the Company’s consolidated revenue, respectively. No other customer accounted for more than 10% of the Company’s revenue in 2014, 2013 or 2012. The Company’s accounts receivable from IBM at December 31, 2014 and 2013 amounted to $7.8 million and $11.5 million, respectively. In January 2014, IBM announced its intention to sell off its x86 server division to Lenovo, and the initial closing of that sale occurred on September 29, 2014. A portion of the Company's 2014 and 2013 revenue from IBM was related to the x86 server division. Lenovo has not made any assurances that the Company will retain a significant share of the revenue derived from the x86 server division. If IBM or Lenovo were to significantly reduce the amount of IT services they purchase from the Company, our revenue and operating results would be adversely affected.

Our customer contracts generally have a short term or are terminable on short notice and a significant number of failures to renew contracts, early terminations or renegotiations of our existing customer contracts could adversely affect our results of operations.

Our clients typically retain us on a non-exclusive, engagement-by-engagement basis, rather than under exclusive long-term contracts. We performed 86.2% of our services on a time-and-materials basis during 2014. As such, our customers generally have the right to terminate a contract with us upon written notice without the payment of any financial penalty. Client projects may involve multiple engagements or stages, and there is a risk that a client may choose not to retain us for additional stages of a project, or that a client will cancel or delay additional planned engagements. These terminations, cancellations or delays could result from factors that are beyond our control and are unrelated to our work product or the progress of the project, but could be related to business or financial conditions of the client, changes in client strategies or the economy in general. When contracts are terminated, we lose the anticipated future revenue and we may not be able to eliminate the associated costs required to support those contracts in a timely manner. Consequently, our operating results in subsequent periods may be lower than expected. Our clients can cancel or reduce the scope of their engagements with us on short notice. If they do so, we may be unable to reassign our professionals to new engagements without delay. The cancellation or reduction in scope of an engagement could, therefore, reduce the utilization rate of our professionals, which would have a negative impact on our business, financial condition, and results of operations. As a result of these and other factors, our past financial performance should not be relied on as a guarantee of similar or better future

9

performance. Due to these factors, we believe that our results from operations may fluctuate from period to period in the future.

A significant portion of our total assets consists of goodwill and capitalized software projects, which are subject to a periodic impairment analysis and a significant impairment determination in any future period could have an adverse effect on our results of operations even without a significant loss of revenue or increase in cash expenses attributable to such period.

We have goodwill recorded totaling approximately $37.4 million at December 31, 2014. We also have capitalized software projects recorded totaling $5.5 million at December 31, 2014. At least annually, we evaluate this goodwill and capitalized software for impairment. The goodwill is evaluated based on the fair value of the business operations or projects to which this goodwill relates. This estimated fair value could change if there is a significant decrease in the enterprise value of CTG, if we are unable to achieve operating results at the levels that have been forecasted, the market valuation of transactions involving similar companies decreases which could occur given the economic downturn in recent years in the countries in which the Company operates, or there is a permanent, negative change in the market demand for the services offered by this business unit, or in the case of capitalized software, there is an absence of historical or projected revenue for the solution. These changes could result in an impairment of the existing goodwill balance or the capitalized software costs that could require a material non-cash charge which would have an adverse impact on our results of operations.

The introduction of new IT products or services or changes in customer requirements for IT products or services may render our existing IT Solutions or IT Staffing offerings obsolete or unnecessary, which, if we are unable to keep pace with these corresponding changes, could have an adverse effect on our business.

Our success depends, in part, on our ability to implement and deliver IT Solutions or IT Staffing services that anticipate and keep pace with rapid and continuing changes in technology, industry standards and client preferences and requirements. We may not be successful in anticipating or responding to these developments on a timely basis, and our offerings may not be successful in the marketplace. Also, services, solutions and technologies developed by our competitors may make our solutions or staffing offerings uncompetitive or obsolete. Any one of these circumstances could have a material adverse effect on our ability to obtain and successfully complete client engagements.

We could be subject to liability and damage to our reputation resulting from cyber attacks or data breaches.

Information security risks for companies providing information technology (IT) and professional services, especially in Healthcare-related industries, have increased over recent years. This increase in risk may be attributed to the value of personally identifiable information or personal data used for identity theft and fraud, the increasing sophistication and activities of attackers including organized crime, hackers, terrorists, activists, and other third parties, and the reliance on Internet-based communications, and new technologies. The Company’s operations and business rely on the secure processing, transmission, storage and availability of information and resources provided by our information technology environment. This complex environment supports a variety of technologies, industries, and delivery teams across the United States and Europe.

Although the Company has not experienced any prior material data breaches or cyber incidents, its technical environment may become the target of cyber attacks or data breaches caused by external entities, third-party vendors, or the Company's personnel, both intentionally and unintentionally. These cyber attacks or data breaches could result in the disruption of the Company's internal and customer-facing business operations, and could also result in the unauthorized disclosure, misuse, loss, and destruction of both the Company’s and its customers’ confidential and regulated information, including United States designated personally identifiable information (PII), personal data under the European Union Data Protection Directive, or protected health information (PHI) under the United States Health Insurance Portability and Accountability Act of 1996 (HIPAA).

The Company’s failure to protect PII, personal data, or PHI could result in reputational damage, fines and penalties, litigation costs, external investigations, compensation costs including reimbursement and monetary awards, and/or additional compliance costs which could have a material, adverse impact. It could also have an adverse impact on the Company’s ability to execute contracts with customers that produce or work with this data, and make it more difficult to recruit qualified personnel to perform its services in the future. As the cyber threat landscape continues to evolve or the Company’s risk profile changes, it may be required to expend additional resources to enhance existing protective measures or implement new mitigation strategies.

10

The foreign currency exchange, legislative, tax, regulatory and economic risks associated with international operations could have an adverse effect on our operating results if we are unable to mitigate or hedge these risks.

We have operations in the United States and Canada in North America, and in Belgium, Luxembourg, and the United Kingdom in Europe. Although our foreign operations conduct their business in their local currencies, these operations are subject to their own currency fluctuations, legislation, employment and tax law changes, and economic climates. These factors as they relate to our foreign operations are different than those of the United States. Although we actively manage these foreign operations with local management teams, our overall operating results may be negatively affected by local economic conditions, changes in foreign currency exchange rates, or tax, regulatory or other economic changes beyond our control.

Government cuts in healthcare programs, such as Medicare, and delays in legislative or regulatory healthcare mandates could cause a reduction in IT spending by our healthcare customers, which could materially and adversely affect our revenues and results of operations.

The Company’s growth efforts are primarily focused in the healthcare market. Growth in this market depends on continued spending by our healthcare customers on IT projects. Cuts in government healthcare programs, such as sequestration, which cut Medicare reimbursements to hospitals and health systems in April 2013, may result in reduced expenditures by our healthcare customers on IT projects. For example, the Company’s healthcare revenue decreased $19.3 million or 14.7% in 2014 from 2013. If further government cuts in healthcare programs were to occur, whether due to the failure of Congress to adopt a budget, pass appropriations bills or raise the U.S. debt ceiling or for other reasons, there may be delays, reductions or cessation of funding to our customers, which could cause them to purchase less IT services from us, which could materially and adversely affect our revenues and results of operations.

In addition, delays in implementation of legislative or regulatory healthcare mandates could adversely affect the IT spending by our healthcare customers to implement such mandates. For example, the implementation date for ICD-10, a diagnostic coding system used for billing in the healthcare industry, was delayed in early 2014 until October 1, 2015. This delay caused a number of our healthcare customers to defer spending allocated for 2014 for IT projects that would have updated their billings systems. If implementation of existing or contemplated legislative or regulatory healthcare mandates are further deferred, the resulting reduction in IT spending by our healthcare customers could materially and adversely affect our revenues and results of operations.

Changes in government regulations and laws affecting the IT services industry, and the industries in which our clients operate, including accounting principles and interpretations, and the taxation of domestic operations could adversely affect our results of operations.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Patient Protection and Affordable Care Act (PPACA), and new SEC regulations, create uncertainty for companies such as ours. These new or updated laws, regulations and standards are subject to varying interpretations which, in many instances, is due to their lack of specificity. As a result, the application of these new standards and regulations in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, our efforts to comply with evolving laws, tax regulations and other standards have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. In particular, our continuing efforts to comply with Section 404 of the Sarbanes-Oxley Act of 2002 and the related regulations regarding our required assessment of our internal controls over financial reporting and our independent auditors’ audit of internal control require the commitment of significant internal, financial and managerial resources.

The Financial Accounting Standards Board (FASB), the SEC, and the Public Company Accounting Oversight Board (PCAOB) or other accounting rule making authorities may issue new accounting rules or auditing standards that are different than those that we presently apply to our financial results. Such new accounting rules or auditing standards could require significant changes from the way we currently report our financial condition, results of operations or cash flows.

U.S. generally accepted accounting principles have been the subject of frequent changes in interpretations. As a result of the enactment of the Sarbanes-Oxley Act of 2002 and the review of accounting policies by the SEC as well as by national and international accounting standards bodies, the frequency of future accounting policy

11

changes may accelerate. Such future changes in financial accounting standards may have a significant effect on our reported results of operations, including results of transactions entered into before the effective date of the changes.

In 2014 and previous years, the Company offered limited healthcare coverage to its hourly employees, which includes nearly half of its total employees. Under the PPACA, the Company will be required to offer expanded healthcare coverage to those employees, or potentially pay financial penalties. Beginning in 2015, the Company is in the process of offering compliant healthcare coverage as required. Although it is difficult to estimate the financial impact of this healthcare coverage, the Company's intention is to pass the additional costs on to the customers where our hourly employees who elect this coverage are engaged. However, in the event the Company is not able to pass some or all of these costs to its customers, the Company’s operating results would be negatively impacted.

We are subject to income and other taxes in the United States (federal and state) and numerous foreign jurisdictions. Our provisions for income and other taxes and our tax liabilities in the future could be adversely affected by numerous factors. These factors include, but are not limited to, income before taxes being lower than anticipated in countries with lower statutory tax rates and higher than anticipated in countries with higher statutory tax rates, changes in the valuation of deferred tax assets and liabilities, and changes in various federal, state and international tax laws, regulations, accounting principles or interpretations thereof, which could adversely impact our financial condition, results of operations and cash flows in future periods.

During 2014 and 2013, the Company experienced higher unemployment tax rates in many of the states in which we do business, which increased our direct costs and negatively impacted our profitability. Considering current economic conditions in the U.S. in the markets in which we operate and the IT staffing nature of a large portion of our business, the Company expects these rates will not significantly change in 2015 and future years.

Existing and potential customers may outsource or consider outsourcing their IT requirements to foreign countries in which we may not currently have operations, which could have an adverse effect on our ability to obtain new customers or retain existing customers.

In the past few years, more companies have started using, or are considering using, low cost offshore outsourcing centers to perform technology-related work and complete projects. Currently, we have partnered with clients to perform services outside of North America to mitigate and reduce this risk to our Company. However, the risk of additional increases in the future in the outsourcing of IT solutions overseas to countries where we do not have operations could have a material, negative impact on our future operations.

Decreases in demand for IT Solutions and IT Staffing services in the future would cause an adverse effect on our revenue and operating results.

The Company’s revenue and operating results are significantly affected by changes in demand for its services. In the past, the U.S. economy, where the Company performs approximately 80% of its total business based upon revenue, significantly deteriorated primarily due to subprime mortgage issues, financial market conditions, and other economic concerns. In 2009, these economic pressures also extended to the European markets where the Company operates. These negative pressures on the economy led to a worldwide contraction of the credit markets, more severe recessionary conditions, and a decline in demand for the Company’s services which negatively affected the Company’s revenue and operating results in 2009 as compared with prior years. Economic pressures also led to customers’ reducing their spending on IT projects and external professional services. Overall economic conditions in 2010 through 2014 stabilized in the U.S., and in 2013 began to improve in Europe. While economic conditions improved in 2014 in the U.S., the Company experienced a decline in revenue for its electronic health record business as the April 2013 sequestration caused a reduction in demand for our services from our healthcare clients. Declines in spending for IT services in 2015 or future years may adversely affect our operating results as they have in the past.

The IT services industry is highly competitive and fragmented, which means that our customers have a number of choices for providers of IT services and we may not be able to compete effectively.

The market for our services is highly competitive. The market is fragmented, and no company holds a dominant position. Consequently, our competition for client requirements and experienced personnel varies significantly by geographic area and by the type of service provided. Some of our competitors are larger and have greater technical, financial, and marketing resources and greater name recognition than we have in the markets we collectively serve. In addition, clients may elect to increase their internal IT systems resources to satisfy their custom software development and integration needs. Finally, our industry is being impacted by the growing use of lower-cost offshore delivery capabilities (primarily India and other parts of Asia). There can be no assurance that

12

we will be able to continue to compete successfully with existing or future competitors or that future competition will not have a material adverse affect on our results of operations and financial condition.

If we are unable to collect our receivables or unbilled services, our results of operations, financial condition and cash flows could be adversely affected.

Our business depends on our ability to successfully obtain payment from our clients of the amounts they owe us for work performed. We evaluate the financial condition of our clients and typically bill and collect on reasonable cycles. We might, however, not accurately assess the creditworthiness of our clients, or macroeconomic conditions could also result in financial difficulties for our clients, including bankruptcy and insolvency. In certain industries, some clients have requested longer payment terms, which has adversely affected, and may continue to adversely affect, our cash flows. The timely collection of client balances also depends on our ability to complete our contractual commitments as required. If we are unable to meet our commitments, or bill our clients on a timely basis, our results of operations and cash flows could be adversely affected. We have established allowances for losses of receivables and unbilled services where we deem the amounts to be uncollectible. The uncollectible amounts due to the Company from clients could differ from those that we currently anticipate.

Our share price could fluctuate and be difficult to predict.

Our share price has fluctuated in the past and could continue to fluctuate in the future in response to various factors. These factors include changes in macroeconomic or political factors unrelated to our business in the geographies in which we operate, general or industry-specific market conditions or changes in financial markets, our failure to meet our growth and financial objectives, including revenue growth, operating margin expansion and earnings per share growth, our ability to generate enough cash flow to return cash to our shareholders at historical levels or levels expected by our shareholders, announcements by us or competitors about developments in our business or prospects, and projections or speculation about our business by the media or investment analysts.

If we repatriate our cash balances from our foreign operations, we may be subject to additional tax liabilities.

We earn a portion of our operating income outside of the United States, and any repatriation of funds currently held in foreign jurisdictions to the United States may result in higher effective tax rates and additional tax liabilities for the Company. In addition, there have been proposals to change the tax laws in the United States that would significantly impact how United States based multinational corporations are taxed on foreign earnings. Although we cannot predict whether or in what form, or in what time frame, any proposed legislation may be passed, if enacted, these tax laws could have a material adverse impact on our tax expense and cash flows.

Ineffective internal controls could impact the Company's business and operating results.

The Company's internal control over financial reporting may not prevent or detect misstatements because of the inherent limitations of internal controls, including the possibility of human error, the circumvention or overriding of controls, poorly designed or ineffective controls, or fraud. Internal controls that are deemed to be effective can provide only reasonable assurance with respect to the preparation and fair presentation of the Company's financial statements. If the Company fails to maintain the adequacy of its internal controls, including the failure to implement new or improve existing controls, or fails to properly execute or properly test these controls, the Company's business and operating results could be negatively impacted and the Company could fail to meet its financial reporting obligations.

Changing economic conditions and the effect of such changes on accounting estimates could have a material impact on our results of operations.

The Company has also made a number of estimates and assumptions relating to the reporting of its assets and liabilities and the disclosure of contingent assets and liabilities to prepare its consolidated financial statements pursuant to the rules and regulations of the SEC and other accounting rulemaking authorities. Such estimates primarily relate to the valuation of goodwill, the valuation of stock options for recording equity-based compensation expense, allowances for doubtful accounts receivable, investment valuation, incurred but not recorded claims related to the Company's self insured medical plan, valuation allowances for deferred tax assets, legal matters, other contingencies and estimates of progress toward completion and direct profit or loss on contracts, as applicable. As future events and their effects cannot be determined with precision, actual results could differ from these estimates. Changes in the economic climates in which the Company operates may affect these estimates and will be reflected in the Company’s financial statements in the event they occur. Such changes could result in a material impact on the Company’s results of operations.

13

Item 1B. | Unresolved Staff Comments |

None.

Item 2. | Properties |

The Company owns and occupies its headquarters building at 800 Delaware Avenue, and an office building at 700 Delaware Avenue, both located in Buffalo, New York. These buildings are operated by CTG of Buffalo, a subsidiary of the Company which is part of the Company’s North American operations. The corporate headquarters consists of approximately 48,000 square feet and is occupied by corporate administrative operations. The office building consists of approximately 42,000 square feet and is also occupied by corporate administrative operations. At December 31, 2014, these properties were not used as collateral as part of the Company’s existing demand credit agreement.

All of the remaining Company locations, totaling approximately 20 sites, are leased facilities. Most of these facilities are located in the United States, with approximately five of these locations in Europe in the countries of Belgium, Luxembourg and the United Kingdom, where our European operations are located. These facilities generally serve as sales and support offices and their size varies with the number of people employed at each office, ranging from 300 to 26,000 square feet. The Company’s lease terms generally vary from periods of less than a year to five years and typically have flexible renewal options. The Company believes that its presently owned and leased facilities are adequate to support its current and anticipated future needs.

Item 3. | Legal Proceedings |

The Company and its subsidiaries are involved from time to time in various legal proceedings arising in the ordinary course of business. Although the outcome of lawsuits or other proceedings involving the Company and its subsidiaries cannot be predicted with certainty and the amount of any liability that could arise with respect to such lawsuits or other proceedings cannot be predicted accurately, management does not expect these matters, if any, to have a material adverse effect on the financial position, results of operations, or cash flows of the Company.

Item 4. | Mine Safety Disclosures |

Not applicable.

14

PART II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Stock Market Information

The Company’s common stock is traded on The NASDAQ Stock Market LLC under the symbol CTG. The following table sets forth the high and low sales prices for the Company’s common stock for each quarter of the previous two years.

Stock Price | High | Low | |||||

Year Ended December 31, 2014 | |||||||

Fourth Quarter | $ | 11.84 | $ | 8.15 | |||

Third Quarter | $ | 17.47 | $ | 11.14 | |||

Second Quarter | $ | 17.46 | $ | 13.90 | |||

First Quarter | $ | 19.02 | $ | 13.57 | |||

Year Ended December 31, 2013 | |||||||

Fourth Quarter | $ | 19.20 | $ | 15.51 | |||

Third Quarter | $ | 26.11 | $ | 16.25 | |||

Second Quarter | $ | 24.70 | $ | 18.80 | |||

First Quarter | $ | 23.08 | $ | 18.29 | |||

On February 20, 2015, there were 1,566 holders of record of the Company’s common shares. Although the Company had not previously paid a dividend since 2000, it initiated a quarterly dividend of $0.05 per common share beginning in March 2013, and increased that dividend to $0.06 per common share beginning in March 2014. At December 31, 2012 and 2013, when the Company had a revolving line of credit in place, the Company was required to meet certain financial covenants under its current revolving credit agreement in order to pay dividends. The Company was in compliance with these financial covenants at both December 31, 2012 and 2013. There are no measured financial covenants under the Company's new demand line of credit. For additional information regarding such financial covenants, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations - Financial Condition and Liquidity." The determination of the timing, amount and the continuation of the payment of dividends on the Company’s common stock in the future is at the discretion of the Board of Directors and will depend upon, among other things, the Company’s profitability, liquidity, financial condition, and capital requirements.

For information concerning common stock issued in connection with the Company’s equity compensation plans, see Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

15

Issuer Purchases of Equity Securities

The Company’s share repurchase program (originally announced on May 12, 2005) does not have an expiration date, nor was it terminated during the 2014 fourth quarter. The information in the table below does not include shares withheld by or surrendered to the Company either to satisfy the exercise cost for the cashless exercise of employee stock options, or to satisfy tax withholding obligations associated with employee equity awards.

Purchases by the Company of its common stock on the open market during the fourth quarter ended December 31, 2014 are as follows:

Period | Total Number of Shares Purchased | Average Price Paid per Share* | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs | ||||||||

September 27 - October 31 | 15,000 | $ | 8.78 | 15,000 | 735,541 | |||||||

November 1 - November 30 | 35,400 | $ | 8.90 | 35,400 | 700,141 | |||||||

December 1 - December 31 | 62,859 | $ | 8.64 | 62,859 | 637,282 | |||||||

Total | 113,259 | $ | 8.74 | 113,259 | ||||||||

* | Excludes broker commissions |

16

Company Performance Graph

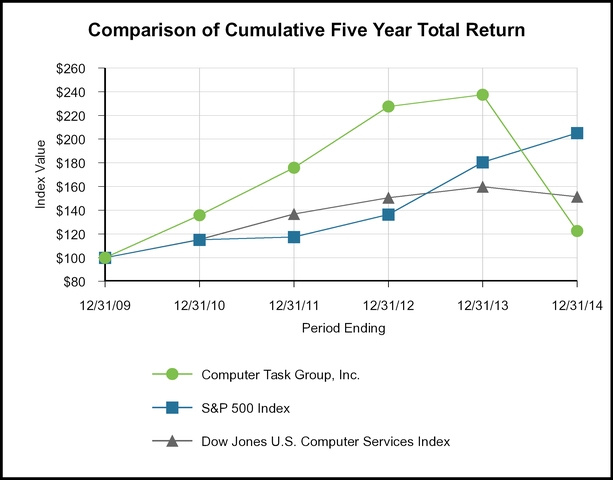

The following graph displays a five-year comparison of cumulative total shareholder returns for the Company’s common stock, the S&P 500 Index, and the Dow Jones U.S. Computer Services Index, assuming a base index of $100 at the end of 2009. The cumulative total return for each annual period within the five years presented is measured by dividing (1) the sum of (A) the cumulative amount of dividends for the period, assuming dividend reinvestment, and (B) the difference between the Company’s share price at the end and the beginning of the period by (2) the share price at the beginning of the period. The calculations were made excluding trading commissions and taxes.

Base Period | Indexed Returns Years Ending | ||||||||||||||||||||||

December | December | December | December | December | December | ||||||||||||||||||

2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||||

Computer Task Group, Inc. | $ | 100.00 | $ | 135.83 | $ | 175.78 | $ | 227.59 | $ | 237.50 | $ | 122.49 | |||||||||||

S&P 500 Index | $ | 100.00 | $ | 115.06 | $ | 117.49 | $ | 136.30 | $ | 180.44 | $ | 205.14 | |||||||||||

Dow Jones U.S. Computer Services Index | $ | 100.00 | $ | 115.21 | $ | 136.73 | $ | 150.43 | $ | 159.84 | $ | 151.36 | |||||||||||

The information included under this section entitled “Company Performance Graph” is deemed not to be “soliciting material” or “filed” with the SEC, is not subject to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any of the filings previously made or made in the future by the Company under the Exchange Act or the Securities Act of 1933, except to the extent the Company specifically incorporates any such information into a document that is filed.

17

Item 6. | Selected Financial Data |

Consolidated Summary—Five-Year Selected Financial Information

The selected operating data and financial position information set forth below for each of the years in the five-year period ended December 31, 2014 has been derived from the Company’s audited consolidated financial statements. This information should be read in conjunction with the audited consolidated financial statements and notes thereto included in Item 8, “Financial Statements and Supplementary Data” included in this report.

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

(amounts in millions, except per-share data) | (1) | (2) | |||||||||||||||||

Operating Data | |||||||||||||||||||

Revenue | $ | 393.3 | $ | 419.0 | $ | 424.4 | $ | 396.3 | $ | 331.4 | |||||||||

Operating Income | $ | 17.2 | $ | 24.7 | $ | 24.5 | $ | 19.3 | $ | 13.9 | |||||||||

Net Income | $ | 10.4 | $ | 15.7 | $ | 16.2 | $ | 11.9 | $ | 8.4 | |||||||||

Basic net income per share | $ | 0.68 | $ | 1.02 | $ | 1.07 | $ | 0.80 | $ | 0.57 | |||||||||

Diluted net income per share | $ | 0.64 | $ | 0.92 | $ | 0.96 | $ | 0.71 | $ | 0.52 | |||||||||

Cash dividend per share | $ | 0.24 | $ | 0.20 | $ | — | $ | — | $ | — | |||||||||

Financial Position | |||||||||||||||||||

Working capital | $ | 69.2 | $ | 67.5 | $ | 63.5 | $ | 45.4 | $ | 33.0 | |||||||||

Total assets | $ | 170.8 | $ | 174.4 | $ | 166.2 | $ | 147.5 | $ | 130.3 | |||||||||

Long-term debt | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||

Shareholders’ equity | $ | 111.0 | $ | 113.8 | $ | 102.8 | $ | 88.8 | $ | 77.9 | |||||||||

(1) | During 2014, the Company incurred $2.0 million in costs associated with the death of the Company's Chairman and CEO under his employment agreement. The Company also recorded an impairment charge totaling $1.5 million for capitalized software costs associated with one of its IT solutions. In total, these costs reduced operating income by $3.5 million, net income by $2.2 million, and basic and diluted net income per share by $0.14 and $0.13, respectively. |

(2) | During 2012, the Company received life insurance proceeds upon the death of two of its former executives. In total, the Company received $1.3 million, which is included in net income, and equaled $0.08 basic and diluted net income per share. |

18

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements made by the management of Computer Task Group, Incorporated (CTG, the Company or the Registrant) that are subject to a number of risks and uncertainties. These forward-looking statements are based on information as of the date of this report. The Company assumes no obligation to update these statements based on information from and after the date of this report. Generally, forward-looking statements include words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “could,” “may,” “might,” “should,” “will” and words and phrases of similar impact. The forward-looking statements include, but are not limited to, statements regarding future operations, industry trends or conditions and the business environment, and statements regarding future levels of, or trends in business strategy and expectations, new business opportunities, cost control initiatives, business wins, market demand, revenue, operating expenses, capital expenditures, and financing. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Numerous factors could cause actual results to differ materially from those in the forward-looking statements, including the following: (i) the availability to CTG of qualified professional staff, (ii) domestic and foreign industry competition for customers and talent, (iii) increased bargaining power of large customers, (iv) the Company's ability to protect confidential client data, (v) the partial or complete loss of the revenue the Company generates from International Business Machines Corporation (IBM), (vi) the uncertainty of customers' implementations of cost reduction projects, (vii) the effect of healthcare reform and initiatives, (viii) the mix of work between staffing and solutions, (ix) currency exchange risks, (x) risks associated with operating in foreign jurisdictions, (xi) renegotiations, nullification, or breaches of contracts with customers, vendors, subcontractors or other parties, (xii) the change in valuation of recorded goodwill or capitalized software balances, (xiii) the impact of current and future laws and government regulation, as well as repeal or modification of such, affecting the information technology (IT) solutions and staffing industry, taxes and the Company's operations in particular, (xiv) industry and economic conditions, including fluctuations in demand for IT services, (xv) consolidation among the Company's competitors or customers, (xvi) the need to supplement or change our IT services in response to new offerings in the industry or changes in customer requirements for IT products and solutions, and (xvii) the risks described in Item 1A of this annual report on Form 10-K and from time to time in the Company's reports filed with the Securities and Exchange Commission (SEC).

Industry Trends

The market demand for the Company’s services is heavily dependent on IT spending by major corporations, organizations and government entities in the markets and regions that we serve. The pace of technology advances and changes in business requirements and practices of our clients all have a significant impact on the demand for the services that we provide. Competition for new engagements and pricing pressure has been strong. In 2014 there was a further overall decline in demand for our services as compared with 2013 as many of our healthcare clients did not begin new projects when existing projects ended due to their capital constraints. This trend began when the U.S. government imposed the budget sequestration in April 2013. Additionally, the requirements for our personnel were also lower in our IT staffing business in 2014.

The Company operates in one industry segment, providing IT services to its clients. These services include IT solutions and IT and other staffing. With IT solutions services, we generally take responsibility for the deliverables on a project and the services may include high-end consulting services. When providing IT and other staffing services, we typically supply personnel to our customers who then, in turn, take their direction from the client’s managers. In certain limited instances for a small number of clients, the Company provides administrative or warehouse employees to clients to supplement the IT resources we place at those clients.

IT solutions and IT staffing revenue as a percentage of consolidated revenue for the years ended December 31, 2014, 2013 and 2012 is as follows:

2014 | 2013 | 2012 | ||||||

IT solutions | 38.0 | % | 39.3 | % | 40.8 | % | ||

IT staffing | 62.0 | % | 60.7 | % | 59.2 | % | ||

Total | 100.0 | % | 100.0 | % | 100.0 | % | ||

19

The Company promotes a majority of its services through four vertical market focus areas: Healthcare (which includes services provided to healthcare providers, health insurers, and life sciences companies), Technology Service Providers, Financial Services, and Energy. The remainder of CTG’s revenue is derived from general markets.

CTG’s revenue by vertical market as a percentage of consolidated revenue for the years ended December 31, 2014, 2013 and 2012 is as follows:

2014 | 2013 | 2012 | ||||||

Healthcare | 28.6 | % | 31.4 | % | 33.0 | % | ||

Technology service providers | 26.4 | % | 28.0 | % | 30.8 | % | ||

Financial services | 7.9 | % | 6.8 | % | 6.1 | % | ||

Energy | 6.1 | % | 6.2 | % | 6.0 | % | ||

General markets | 31.0 | % | 27.6 | % | 24.1 | % | ||

Total | 100.0 | % | 100.0 | % | 100.0 | % | ||

The IT services industry is extremely competitive and characterized by continuous changes in customer requirements and improvements in technologies. Our competition varies significantly by geographic region, as well as by the type of service provided. Many of our competitors are larger than CTG, and have greater financial, technical, sales and marketing resources. In addition, the Company frequently competes with a client’s own internal IT staff. Our industry is being impacted by the growing use of lower-cost offshore delivery capabilities (primarily India and other parts of Asia). There can be no assurance that we will be able to continue to compete successfully with existing or future competitors or that future competition will not have a material adverse effect on our results of operations and financial condition.

Revenue Recognition

The Company recognizes revenue when persuasive evidence of an arrangement exists, when the services have been rendered, when the price is determinable, and when collectibility of the amounts due is reasonably assured. For time-and-material contracts, revenue is recognized as hours are incurred and costs are expended. For contracts with periodic billing schedules, primarily monthly, revenue is recognized as services are rendered to the customer. Revenue for fixed-price contracts is recognized per the proportional method of accounting using an input-based approach. On a given project, actual salary and indirect labor costs incurred are measured and compared against the total estimated costs of such items at the completion of the project. Revenue is recognized based upon the percentage-of-completion calculation of total incurred costs to total estimated costs. The Company infrequently works on fixed-price projects that include significant amounts of material or other non-labor related costs which could distort the percent complete within a percentage-of-completion calculation. The Company’s estimate of the total labor costs it expects to incur over the term of the contract is based on the nature of the project and our past experience on similar projects, and includes management judgments and estimates which affect the amount of revenue recognized on fixed-price contracts in any accounting period.

In 2012 and 2013, the Company performed services for a customer under a series of contracts that provided for application customization and integration services, specifically utilizing one of the software tools the Company had developed for internal use. These services were provided under a software-as-a-service model. As the contracts were closely interrelated and dependent on each other, for accounting purposes the contracts were considered to be one arrangement. As the project included significant modification and customization services to transform the previously developed software tool into an expanded tool intended to meet the customer’s requirements, the percentage-of-completion method of contract accounting was utilized for the project.

The Company’s revenue from contracts accounted for under time-and-material, progress billing, and percentage-of-completion methods as a percentage of consolidated revenue for the years ended December 31, 2014, 2013 and 2012 is as follows:

20

2014 | 2013 | 2012 | ||||||

Time-and-material | 86.2 | % | 88.8 | % | 90.3 | % | ||

Progress billing | 11.2 | % | 8.8 | % | 7.9 | % | ||

Percentage-of-completion | 2.6 | % | 2.4 | % | 1.8 | % | ||

Total | 100.0 | % | 100.0 | % | 100.0 | % | ||

Results of Operations

The table below sets forth percentage information calculated as a percentage of consolidated revenue as reported on the Company’s consolidated statements of income as included in Item 8, “Financial Statements and Supplementary Data” in this report.

Year Ended December 31, | 2014 | 2013 | 2012 | |||||

(percentage of revenue) | ||||||||

Revenue | 100.0 | % | 100.0 | % | 100.0 | % | ||

Direct costs | 79.8 | % | 78.8 | % | 78.4 | % | ||

Selling, general and administrative expenses | 15.8 | % | 15.3 | % | 15.8 | % | ||

Operating income | 4.4 | % | 5.9 | % | 5.8 | % | ||

Interest and other income (expense), net | (0.1 | )% | (0.1 | )% | 0.2 | % | ||

Income before income taxes | 4.3 | % | 5.8 | % | 6.0 | % | ||

Provision for income taxes | 1.7 | % | 2.1 | % | 2.2 | % | ||

Net income | 2.6 | % | 3.7 | % | 3.8 | % | ||

2014 as compared with 2013

The Company recorded revenue in 2014 and 2013 as follows:

Year Ended December 31, | % of total | 2014 | % of total | 2013 | Year-Over-Year Change | |||||||||||

(dollars in thousands) | ||||||||||||||||

North America | 80.1 | % | $ | 314,924 | 81.6 | % | $ | 341,924 | (7.9 | )% | ||||||