Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||||

| Filed by a Party other than the Registrant [ ] | ||||

| Check the appropriate box: | ||||

| [ ] | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 | |

| [ ] | Confidential, For Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||

| [X] | Definitive Proxy Statement | |||

| [ ] | Definitive Additional Materials | |||

| Computer Sciences Corporation | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if Other Than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

|

[

] |

Fee computed on

table below per Exchange Act Rules 14a-6(i)(4) and

0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

|

[

] |

Fee paid previously

with preliminary materials: | |||

|

[

] |

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration

statement number, or the form or schedule and the date of its

filing. | |||

| 1) | Amount previously paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

NOTICE OF 2013

ANNUAL

MEETING OF

STOCKHOLDERS

AND PROXY STATEMENT

|

Tuesday,

August 13, 2013 at 10:00 a.m., Eastern Time 3170 Fairview Park Drive Falls Church, Virginia 22042 |

Computer Sciences Corporation

Dear Stockholder:

You are cordially invited to join CSC’s Board of Directors and senior leadership at our 2013 Annual Meeting of Stockholders to be held on August 13, 2013. The attached Notice of Annual Meeting of Stockholders and Proxy Statement provide important information about the meeting and will serve as your guide to the business to be conducted at the meeting.

As stewards of your Company, the Board is focused on achieving long-term performance and creating value for our stockholders through prudent execution of business strategies, risk management, strong corporate governance and top quality talent and succession planning.

In Fiscal 2013, we made several important changes in the following areas:

- New Management Team

- Executive Compensation Oversight

- Good Corporate Governance Practices

- Stockholder Engagement and Outreach

New Management Team

Fiscal 2013 represents the beginning of a multi-year effort to return the Company to a path of sustained profitability. The key management changes that began in March 2012 with the appointment of the President and Chief Executive Officer (“CEO”), Mike Lawrie, continued in Fiscal 2013 with new appointments for the roles of Chief Financial Officer, General Manager of Global Infrastructure Services, General Manager of Global Sales and Marketing and Regional Operations, General Manager of the North American Public Sector, Chief Human Resources Officer, Controller and Principal Accounting Officer, Chief Technology Officer, Head of Internal Audit and Chief Information Officer.

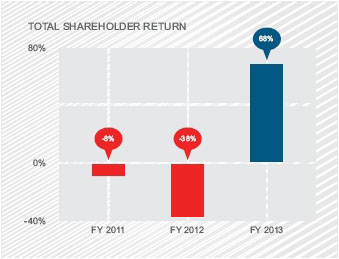

Under Mike Lawrie’s leadership, CSC has performed well with total shareholder return growing 68% in Fiscal 2013. This performance allowed CSC to return $428 million to stockholders in Fiscal 2013, including $123 million in dividends and $305 million in share repurchases. Mike and his management team continue to make important changes such as establishing a global set of CLEAR (Client-focused, Leadership, Execution Excellence, Aspiration and Results) values to drive a strong performance culture. Through these values, we have emphasized a return to profitability by managing costs and aligning the executive team to this one overriding goal. Mike has significantly strengthened the senior leadership team and has improved the Company’s effectiveness by setting the appropriate tone for driving accountability, discipline and long term stockholder value creation.

Executive Compensation Oversight

We believe that our compensation program provides an appropriate mix of elements to incentivize our executives to turn the business around and to foster a performance-based culture. We made significant changes to our executive compensation program to better align the mix of compensation with profitability and

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

stockholder value. We revised the 2013 compensation program to place greater emphasis on profitability, eliminate annual time vested RSU grants, focus on EPS growth and eliminate overlapping financial measures. More about these changes is contained in the Compensation Discussion and Analysis section of this Proxy Statement.

Good Corporate Governance Practices

We believe that the strength of our governance is key to our success, and we continually review our practices to ensure effective collaboration of management and our Board to deliver value for stockholders.

In Fiscal 2013, the Board engaged an independent consultant to facilitate an assessment of its performance and effectiveness. As part of the assessment, each director was individually interviewed. The consultant also interviewed certain members of senior management regarding Board performance and effectiveness. The collective ratings and comments of the directors and senior management were compiled and presented to the full Board for discussion. Consistent with our commitment to the quality of our Board, we expect to revise our annual Board assessment process going forward.

Additionally, in Fiscal 2013, the Board implemented an improved management succession planning process for the identification and development of succession candidates to our executive officers, including the Chief Executive Officer. This review occurs on an annual basis.

Stockholder Engagement and Outreach

Stockholders are key participants in the governance of the Company. For this reason, we continually seek to communicate with our stockholders and seek your perspective. Since joining the Company in March 2012, Mike Lawrie has regularly met with investors representing a substantial portion of our investor base to understand their perspectives. In our efforts to communicate with you, we improved the format of last year’s proxy statement to make it easier to read and to make the material more accessible. The Board and I were extremely pleased with the positive feedback we received about the redesigned proxy statement and the investor outreach. This year, we have further enhanced the presentation of the information by supplementing disclosure required by the SEC rules.

New Board Members

I am pleased to introduce two new nominees for election to the Board at the Annual Meeting. Nancy Killefer, Partner at McKinsey & Company, Inc., and Brian MacDonald, Chief Executive Officer of ETP Holdco, have the qualifications and experience that will enhance the skillset and quality of the Board. More about Brian and Nancy is contained in their biographies under Proposal 1. They are being nominated to replace Irv Bailey and Steve Baum, who are retiring from the Board effective at the Annual Meeting. We would like to thank Irv and Steve for their many contributions to the Company over their years of service.

I would also like to thank our CSC employees for their hard work in, and dedication to, the Company’s turnaround. Finally, I would like to thank you for being a stockholder and for the trust you have placed in CSC. We value your support. We encourage you to share your opinions, interests and concerns, and invite you to write to us with your reactions and suggestions to the Corporate Secretary, CSC, 3170 Fairview Park Drive, Falls Church, VA 22042.

| Sincerely, | |

| Rodney F. Chase | |

| |

| Chairman of the Board of Directors |

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Computer Sciences Corporation

Notice of 2013 Annual Meeting of

Stockholders

Tuesday,

August 13, 2013

10:00 a.m.,

Eastern Time

Executive Briefing

Center, 3170 Fairview Park Drive, Falls Church, Virginia 22042

The 2013 Annual Meeting of Stockholders will be held on Tuesday, August 13, 2013, at 10:00 a.m. Eastern Time, at the headquarters of the Company, 3170 Fairview Park Drive, Falls Church, Virginia 22042. The purpose of the meeting is to vote on:

| 1. | the election of the nine director nominees named in the attached proxy statement as directors of CSC; | |

| 2. | the approval, by non-binding vote, of the Company’s executive compensation; | |

| 3. | the approval of an amendment to the 2010 Non-Employee Director Incentive Plan; | |

| 4. | the approval of amendments to the 2011 Omnibus Incentive Plan; | |

| 5. | the ratification of the appointment of independent auditors; and | |

| 6. | such other business as may properly come before the meeting. | |

Only stockholders of record at the close of business on June 17, 2013 will be entitled to vote at the meeting and any postponements or adjournments thereof.

Your vote is important. Whether or not you plan to attend the meeting, we encourage you to read this proxy statement and vote as soon as possible. Information on how to vote is contained in this proxy statement. In addition, voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you requested printed materials, the instructions are printed on your proxy card and included in the accompanying proxy statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the proxy statement.

| By Order of the Board of Directors, | |

| |

| M. Louise Turilli Secretary | |

| Falls Church, Virginia June 28, 2013 |

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully, before voting.

| Annual Meeting of Stockholders | Meeting Agenda | |||

| Meeting Date: | August 13, 2013 |

| ||

| Meeting Time: | 10:00 a.m. Eastern Time | |||

| Location: | Computer Sciences Corporation | |||

| Executive Briefing Center | ||||

| 3170 Fairview Park Drive | ||||

| Falls Church, VA 22042 | ||||

| Record Date: | June 17, 2013 | |||

| Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. | |||

| Admission

to Meeting: |

Proof of share ownership will be required to enter the CSC Annual Meeting | |||

Voting matters and vote recommendation

| Matter | Vote Recommendation | |||

| Management Proposals | ||||

| 1. | Election of directors | FOR each nominee | ||

| 2. | Advisory vote to approve executive compensation | FOR | ||

| 3. | Approval of an amendment to the 2010 Non-Employee Director Incentive Plan | FOR | ||

| 4. | Approval of amendments to the 2011 Omnibus Incentive Plan | FOR | ||

| 5. | Ratification of Deloitte & Touche LLP as our independent auditor for fiscal year 2014 | FOR | ||

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Our Director Nominees

The following table provides summary information about each director nominee. Each director is elected annually by a majority of votes cast.

| Director | Other Public | Committee Memberships | ||||||||||||||

| Name | Age | Since | Independent | Boards | AC | CC | NCG | EC | ||||||||

| David J. Barram | 69 | 2004 | • | 0 | M | C | M | |||||||||

| Erik Brynjolfsson | 51 | 2010 | • | 0 | M | M | ||||||||||

| Rodney F. Chase | 70 | 2001 | • | 3 | EO | EO | EO | M | ||||||||

| Judith R. Haberkorn | 66 | 2007 | • | 0 | C | M | ||||||||||

| Nancy Killefer | 59 | Nominee | • | 0 | ||||||||||||

| J. Michael Lawrie | 60 | 2012 | 1 | C | ||||||||||||

| Brian P. MacDonald | 47 | Nominee | • | 1 | ||||||||||||

| C.S. Park | 65 | 2007 | • | 1 | M | |||||||||||

| Lawrence A. | ||||||||||||||||

| Zimmerman | 70 | 2012 | • | 3 | C | |||||||||||

| AC | Audit Committee | C Chair | ||

| CC | Compensation Committee | M Member | ||

| NCG | Nominating Corporate Governance Committee | EO Ex-Officio Member | ||

| EC | Executive Committee |

Attendance

Each director nominee who is a current director attended at least 75% of the aggregate of all fiscal year 2013 meetings of the Board.

| CORPORATE GOVERNANCE HIGHLIGHTS |

CSC’s governance is guided by our CLEAR (Client-Focused, Leadership, Execution Excellence, Aspiration and Results) values. We believe that the strength of our governance is key to our success, and we continually review our practices to ensure effective collaboration of management and our Board to yield value for stockholders. Highlights of our governance include:

BOARD OF DIRECTORS

- Independent Chairman

- 9 Directors; 8 are independent

- All Audit, Compensation and Nominating/Corporate Governance Committee members are independent

- Majority of members of our Audit Committee are “financial experts”

- Executive Sessions at each regularly-scheduled meeting

- All Directors attended at least 75% of Board and Committee meetings in Fiscal 2013

- Limited membership on other public company boards

- Regular assessments and Director evaluations

- Declassified Board

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

STOCKHOLDERS’ INTERESTS

- Majority voting in uncontested Director elections

- Annual advisory vote to approve executive compensation

- Annual advisory vote to ratify auditor independence

| STOCKHOLDER RETURN AND FISCAL 2013 COMPENSATION |

CSC’s Total Shareholder Return (“TSR”) was 68% in Fiscal 2013. The Compensation Committee emphasized the turnaround strategy in setting compensation for NEOs and others in Fiscal 2013. Consistent with that strategy, the Committee revised the design of our annual cash incentive program to create a near-term focus on operating income, simplified the financial metrics used in connection with performance share units to focus on earnings per share and eliminated overlapping financial measures between short and long term incentives.

New CEO Performance

Under Mike’s leadership, the Company’s Fiscal 2013 performance has significantly improved over the prior fiscal year, with total stockholder return growing 68% in Fiscal 2013. The Compensation Committee awarded Mr. Lawrie an inducement grant of 200,000 performance-based Restricted Stock Units (“RSUs”) in connection with hiring him as the President and CEO. These RSUs vest if the average closing price over any 30 consecutive trading day period equals or exceeds the following percentage increases over a “base price” calculated as the average closing price over the three calendar months preceding Mr. Lawrie’s first day of employment, March 19, 2012, as follows:

| Common Stock price | ||

| increase from Base Price of | Cumulative Number of | |

| $28.32 | RSUs Vesting | |

| 20% | 50,000 | |

| 40% | 100,000 | |

| 60% | 150,000 | |

| 80% | 200,000 |

Increases in the trading price of the common stock since April 16, 2012 have resulted in the first three tranches of the units vesting, with the first tranche vesting on November 29, 2012, the second tranche vesting on January 10, 2013, and the third tranche vesting on March 4, 2013.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Say-on-Pay Vote

The Company’s executive compensation programs for Fiscal 2013 were designed to support the Company’s turnaround strategy. Our compensation design successfully:

- Encouraged a performance-based culture driven by our CLEAR values

- Based short and long-term incentive compensation on company-wide achievement and individual performance goals

- Aligned the interests of the executives with those of our stockholders

In Fiscal 2014, the Compensation Committee has made additional design changes to our programs to continue to strengthen our performance-based culture by awarding performance share units more deeply in the executive population and standardizing the calibration of employee performance globally.

Amendment of the 2010 Non-Employee Director Incentive Plan

At the Annual Meeting, stockholders will be asked to consider and vote upon an amendment to the 2010 Non-employee Director Incentive Plan to increase the number of shares available for issuance from 150,000 to 300,000 shares. Only 69,400 shares of CSC common stock remain available under the 2010 Director Plan as of May 31, 2013.

Amendment of the 2011 Omnibus Incentive Plan

At the Annual Meeting, stockholders will be asked to consider and vote upon amendments to the 2011 Omnibus Incentive Plan to:

- increase in the number of shares authorized

for issuance under the plan from 11,000,000 to 19,300,000. Only 6,591,913 shares of CSC common stock remain available

under the 2011 Incentive Plan as of May

31, 2013. The Board believes that this share reserve should be sufficient for

a period of two to three years, taking

into account potential grant increases over at least that

period;

- add Client Satisfaction as a new performance

goal to be used in connection with awards intended to qualify as performance-based compensation under

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”);

- eliminate interest on dividend equivalents

paid in connection with the settlement of RSUs;

- streamline the provisions relating to the

determination of specified employees under Section 409A of the Code; and

- extend the term of the 2011 Incentive Plan through the ten year anniversary of the date stockholders approve the amended 2011 Incentive Plan.

Ratification of Independent Auditors

At the Annual Meeting, stockholders will be asked to consider and to vote upon the ratification of the appointment of Deloitte & Touche LLC as CSC’s independent auditors. In order to assure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered public accounting firm. The members of the Audit Committee and the Board believe that the continued retention of Deloitte & Touche LLC to serve as the Company’s independent registered public accounting firm is in the best interests of the Company and its stockholders.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

| TABLE OF CONTENTS | |

| PROXY STATEMENT | 1 |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING | 2 |

| HOW DO I VOTE? | 8 |

| CORPORATE GOVERNANCE | 9 |

| Corporate Governance Guidelines | 9 |

| Board Leadership Structure | 10 |

| Director Independence | 10 |

| Oversight of Risk Management | 11 |

| Compensation and Risk | 12 |

| Equity Ownership Guidelines | 12 |

| Talent Management and Succession Planning | 12 |

| Director Education | 12 |

| Oversight of Related Party Transactions | 13 |

| Code of Ethics and Standards of Conduct | 13 |

| Board Diversity | 14 |

| Mandatory Retirement of Directors | 14 |

| Resignation of Employee Directors | 14 |

| Communicating with the Board or the Chairman | 14 |

| BOARD STRUCTURE AND COMMITTEE COMPOSITION | 15 |

| DIRECTOR COMPENSATION | 18 |

| PROPOSAL 1 - ELECTION OF DIRECTORS | 21 |

| Director Nomination Process | 21 |

| 2013 Director Nominees | 22 |

| Summary of Director Qualifications and Experience | 28 |

| CERTAIN LITIGATION | 29 |

| STOCK OWNERSHIP | 33 |

| AUDIT COMMITTEE REPORT | 35 |

| EXECUTIVE COMPENSATION | 36 |

| Compensation Committee Report | 36 |

| Compensation Discussion and Analysis | 36 |

| Executive Summary | 36 |

| Fiscal 2013 Direct Compensation | 39 |

| Other Executive Compensation | 51 |

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

i |

| Compensation Framework | 53 | |

| Additional Compensation Policies | 56 | |

| Summary Compensation Table | 58 | |

| Summary of CEO Compensation Realized in Fiscal 2013 | 61 | |

| Grants of Plan-Based Awards | 63 | |

| Outstanding Equity Awards at Fiscal Year-End | 64 | |

| Option Exercises and Stock Vested | 67 | |

| Pension Benefits | 68 | |

| Fiscal Year 2013 Nonqualified Deferred Compensation | 68 | |

| Potential Payments Upon Change in Control and Termination of Employment | 69 | |

| PROPOSAL 2 - ADVISORY VOTE APPROVING EXECUTIVE COMPENSATION | 78 | |

| PROPOSAL 3 - APPROVAL OF AN AMENDMENT TO THE | ||

| 2010 NON-EMPLOYEE DIRECTOR INCENTIVE PLAN | 79 | |

| PROPOSAL 4 - APPROVAL OF AMENDMENTS TO THE 2011 OMNIBUS | ||

| INCENTIVE PLAN | 86 | |

| PROPOSAL 5 - RATIFICATION OF INDEPENDENT AUDITORS | 96 | |

| Fees | 96 | |

| Pre-Approval Policy | 97 | |

| Vote Required | 97 | |

| ADDITIONAL INFORMATION | 98 | |

| Section 16(a) Beneficial Ownership Reporting Compliance | 98 | |

| Business for 2014 Annual Meeting | 98 | |

| APPENDIX A - INDEPENDENCE STANDARDS | A-1 | |

| APPENDIX B - 2010 NON-EMPLOYEE DIRECTOR INCENTIVE PLAN | B-1 | |

| APPENDIX C - 2011 OMNIBUS INCENTIVE PLAN | C-1 | |

|

ii |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Computer Sciences Corporation

3170 Fairview

Park Drive

Falls Church, Virginia

22042

June 28, 2013

PROXY STATEMENT

We are providing these proxy materials in connection with the 2013 Annual Meeting of Stockholders (the “Annual Meeting”) of Computer Sciences Corporation (“CSC” or the “Company” and sometimes referred to with the pronouns “we”, “us” and “our”). The Notice of Internet Availability of Proxy Materials, this proxy statement, any accompanying proxy card or voting instruction card and our 2013 Annual Report to Stockholders (“2013 Annual Report”), which includes our 2013 Annual Report on Form 10-K, were first made available to stockholders on or about June 28, 2013. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

We are delivering proxy materials for the Annual Meeting under the United States Securities and Exchange Commission’s “Notice and Access” rules. These rules permit us to furnish proxy materials, including this proxy statement and our 2013 Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders received a Notice of Internet Availability of Proxy Materials (the “Notice”), which provides instructions on how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. More information about Notice and Access is set forth in “Questions and Answers about the Annual Meeting and Voting.”

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

1 |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

| 1. | Who is soliciting my vote? |

The Board of Directors of CSC (sometimes referred to herein as the “Board”) is soliciting your vote at the 2013 Annual Meeting.

| 2. | When will the meeting take place? |

The Annual Meeting will be held on Tuesday, August 13, 2013 at 10:00 a.m., Eastern Time, at the headquarters of the Company, 3170 Fairview Park Drive, Falls Church, Virginia 22042.

| 3. | What is the purpose of the Annual Meeting? |

You will be voting on:

- the election of each of the nine nominees as

directors of CSC;

- the approval, by non-binding vote, of the

Company’s executive compensation;

- the approval of an amendment to the 2010

Non-Employee Director Incentive Plan;

- the approval of amendments to the 2011

Omnibus Incentive Plan;

- the ratification of the selection of Deloitte

& Touche LLP as our auditors for the fiscal year ending March 28, 2014 (“Fiscal 2014”);

and

- any other business that may properly come before the meeting.

| 4. | What are the Board of Directors’ recommendations? |

The Board recommends a vote:

| 1. | for the election of each of the nine nominees for director; | ||

| 2. | for the approval, on an advisory basis, of the Company’s executive compensation; | ||

| 3. | for the approval of the amendment to the 2010 Non-Employee Director Incentive Plan; | ||

| 4. | for the approval of the amendments to the 2011 Omnibus Incentive Plan; | ||

| 5. | for the ratification of the selection of Deloitte & Touche LLP as our auditors for Fiscal 2014; and | ||

| 6. | for or against other matters that come before the Annual Meeting, as the proxy holders deem advisable. | ||

|

2 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

| 5. | Who is entitled to vote at the Annual Meeting? |

The Board of Directors set June 17, 2013 as the record date for the Annual Meeting (the “Record Date”). All stockholders who owned CSC common stock at the close of business on June 17, 2013 may attend and vote at the Annual Meeting and any postponements or adjournments thereof.

| 6. |

Why did I receive a notice in the mail regarding the Internet availability of proxy materials this year instead of a paper copy of proxy materials? |

Under the “Notice and Access” rules of the United States Securities and Exchange Commission (the “SEC”), we are permitted to furnish proxy materials, including this proxy statement and our 2013 Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or electronic copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. Any request to receive proxy materials by mail or electronically will remain in effect until you revoke it.

| 7. | Can I vote my shares by filling out and returning the Notice? |

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by (i) Internet, (ii) telephone, (iii) requesting and returning a paper proxy card or voting instruction card, or (iv) submitting a ballot in person at the meeting.

| 8. |

Why didn’t I receive a Notice in the mail regarding the Internet availability of proxy materials? | ||||||

If you previously elected to access proxy materials over the Internet, you will not receive a Notice in the mail. You should have received an email with links to the proxy materials and online proxy voting. Additionally, if you previously requested paper copies of the proxy materials or if applicable regulations require delivery of the proxy materials, you will not receive the Notice.

If you received a paper copy of the proxy materials or the Notice by mail, you can eliminate all such paper mailings in the future by electing to receive an email that will provide Internet links to these documents. Opting to receive all future proxy materials online will save us the cost of producing and mailing documents to your home or business and help us conserve natural resources. See http://www.icsdelivery.com/csc to request complete electronic delivery. Enrollment for electronic delivery is effective until cancelled.

| 9. | How many votes do I have? |

You will have one vote for each share of our common stock you owned at the close of business on the record date, provided those shares are either held directly in your name as the stockholder of record or were held for you as the beneficial owner through a broker, bank or other nominee.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

3 |

| 10. | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, you are considered the stockholder of record with respect to those shares, and the Notice or these proxy materials are being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to us, to submit proxies electronically or by telephone or to vote in person at the Annual Meeting. If you have requested printed proxy materials, we have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the Notice or these proxy materials are being forwarded to you by your broker, bank or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting, unless you request, complete and deliver a legal proxy from your broker, bank or nominee. If you requested printed proxy materials, your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the broker, bank or nominee regarding how to vote your shares.

| 11. | How many votes must be present to hold the Annual Meeting? |

A majority of our issued and outstanding shares entitled to vote at the Annual Meeting as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or by telephone or on the Internet or a proxy card has been properly submitted by you or on your behalf. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

As of the record date there were 148,770,270 shares of CSC common stock outstanding.

|

12. |

How many votes are required to elect directors and adopt the other proposals? |

Proposal 1 – Election of Directors. Directors are elected by a majority vote in uncontested elections. Therefore, each director nominee must receive a majority of the votes cast with respect to such nominee at the Annual Meeting (the number of “FOR” votes must exceed the number of “AGAINST” votes). Abstentions and, if applicable, broker non-votes are not counted as votes “FOR” or “AGAINST” any nominee; therefore, they will have no effect on the outcome of the vote on this proposal. In accordance with the Company’s Corporate Governance Guidelines, if an incumbent director nominee fails to receive the requisite number of votes, such director nominee shall promptly tender his or her resignation for consideration by the Nominating/Corporate Governance Committee. Within 30 days following the certification of the stockholder vote, the Nominating/Corporate Governance Committee will make a recommendation to the Board of Directors as to the treatment of any director who did not receive a majority vote, including whether to accept or reject any tendered resignation. The Board of Directors will make a final determination within 90 days following the certification of the election results, and publicly disclose its decision and rationale.

|

4 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Proposal 2 – Advisory Vote on Executive Compensation. This proposal, which is non-binding, requires an affirmative “FOR” vote of a majority of the votes cast (i.e., of the votes “FOR” or “AGAINST”) to be approved. Abstentions and, if applicable, broker non-votes are not counted as votes “FOR” or “AGAINST” this proposal; therefore, they will have no effect on the outcome of the vote on this proposal.

Proposal 3 – Approval of an Amendment to the 2010 Non-Employee Director Incentive Plan. This proposal requires an affirmative “FOR” vote of a majority of the votes cast (i.e., of the votes “FOR” or “AGAINST”) to be approved. In accordance with NYSE listing requirements, approval of the Amendment to the 2010 Non-Employee Director Incentive Plan requires an affirmative vote of the holders of a majority of the shares of Common Stock cast on such proposal, in person or by proxy, provided the total vote cast on the proposal represents more than 50% of the outstanding shares of common stock entitled to vote on the proposal. Votes “for” and “against” and abstentions count as votes cast, while broker non-votes do not count as votes cast. All outstanding shares, including broker non-votes, count as shares entitled to vote. Thus, the total sum of votes “for,” plus votes “against,” plus abstentions, which is referred to as the “NYSE Votes Cast,” must be greater than 50% of the total outstanding shares of our common stock. Once satisfied, the number of votes “for” the proposal must be greater than 50% of NYSE Votes Cast. Abstentions will have the effect of a vote against this proposal. Thus, broker non-votes can make it difficult to satisfy the NYSE Votes Cast requirement, and abstentions have the effect of a vote against this proposal.

Proposal 4 - Approval of Amendments to the 2011 Omnibus Incentive Plan. This proposal requires an affirmative “FOR” vote of a majority of the votes cast (i.e., of the votes “FOR” or “AGAINST”) to be approved. In accordance with NYSE listing requirements, approval of the Amendments to the 2011 Omnibus Incentive Plan requires an affirmative vote of the holders of a majority of the shares of common stock cast on such proposal, in person or by proxy, provided the total vote cast on the proposal represents more than 50% of the outstanding shares of Common Stock entitled to vote on the proposal. Votes “for” and “against” and abstentions count as votes cast, while broker non-votes do not count as votes cast. All outstanding shares, including broker non-votes, count as shares entitled to vote. Thus, the total sum of votes “for,” plus votes “against,” plus abstentions, which is referred to as the “NYSE Votes Cast,” must be greater than 50% of the total outstanding shares of our Common Stock. Once satisfied, the number of votes “for” the proposal must be greater than 50% of NYSE Votes Cast. Abstentions will have the effect of a vote against this proposal. Thus, broker non-votes can make it difficult to satisfy the NYSE Votes Cast requirement, and abstentions have the effect of a vote against this proposal.

Proposal 5 – Ratification of Independent Auditors. This proposal requires an affirmative “FOR” vote of a majority of the votes cast (i.e., of the votes “FOR” or “AGAINST”) to be approved. Abstentions are not counted as votes “FOR” or “AGAINST” this proposal; therefore, they will have no effect on the outcome of the vote on this proposal.

| 13. | What if I don’t give specific voting instructions? |

Stockholders of Record. If you are a stockholder of record and you:

- Indicate when voting by Internet or by

telephone that you wish to vote as recommended by our Board of Directors; or

- Return a signed proxy card but do not indicate how you wish to vote;

then your shares will be voted in accordance with the recommendations of the Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion regarding any other matters properly presented for a vote at the meeting. If you indicate a choice with respect to any matter to be acted upon on your proxy card or voting instruction card, the shares will be voted in accordance with your instructions.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

5 |

Beneficial Owners. If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes” on certain proposals. Generally, broker non-votes occur on a non-routine proposal where a broker is not permitted to vote on that proposal without instructions from the beneficial owner, and instructions are not given. Broker non-votes are considered present at the Annual Meeting, but not as voting on a matter. Thus, broker non-votes are counted as present for purposes of determining the existence of a quorum, but are not counted for purposes of determining whether a matter has been approved. Thus, broker non-votes will not affect the outcome of the election of directors, approval of the Company’s executive compensation or the ratification of the appointment of independent auditors. Broker non-votes may affect the outcome of the approval of the amendment to the 2010 Non-Employee Directors Incentive Plan and Approval of Amendments to the 2011 Omnibus Incentive Plan if broker non-votes cause less than a majority of the shares outstanding to be voted in favor of these matters.

Your broker will vote your street name shares at the Annual Meeting with respect to (i) the election of directors, (ii) approval of the Company’s executive compensation, (iii) approval of the amendment to the 2010 Non-Employee Incentive Plan and (iv) approval of amendments to the 2011 Omnibus Incentive Plan only if you instruct your broker how to vote. You should instruct your broker how to vote. If you do not provide your broker with instructions, under the rules of the New York Stock Exchange, your broker will not be authorized to vote your street name shares with respect to Proposals 1, 2, 3 and 4.

Your broker, at his or her discretion, may vote your street name shares on the ratification of the independent auditors if you do not provide voting instructions.

Participants in the Matched Asset Plan (MAP) If you participate in the MAP, you will receive a voting instruction form for all shares you may vote under the plan. Under the terms of the MAP, the MAP trustee votes all shares held in the CSC Stock Fund, but each participant in the MAP may direct the trustee how to vote the shares of Company common stock allocated to his or her account. The MAP trustee, subject to the exercise of its fiduciary duties, will vote all unallocated shares of common stock held by the MAP and all allocated shares for which no timely voting instructions are received in the same proportion as shares for which it has received valid voting instructions. The deadline for returning your voting instructions to the MAP trustee is 11.59 p.m. Eastern Time on August 8, 2013.

| 14. | Can I change my vote after I voted? |

Yes. Even if you voted by telephone or on the Internet or if you requested paper proxy materials and signed the proxy card or voting instruction card in the form accompanying this proxy statement, you retain the power to revoke your proxy or change your vote. You can revoke your proxy or change your vote at any time before it is exercised by giving written notice to the Corporate Secretary of CSC, specifying such revocation. You may change your vote by a later-dated vote by telephone or on the Internet or timely delivery of a valid, later-dated proxy or by voting by ballot at the Annual Meeting. However, please note that if you would like to vote at the Annual Meeting and you are not the stockholder of record, you must request, complete and deliver a legal proxy from your broker, bank or nominee.

| 15. |

What does it mean if I receive more than one Notice, proxy or voting instruction card? |

It generally means your shares are registered differently or are in more than one account. Please provide voting instructions for all Notices, proxy cards and voting instruction cards you receive.

|

6 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

| 16. | Are there other matters to be acted upon at the meeting? |

The Company does not know of any matter to be presented at the Annual Meeting other than those described in this proxy statement. If, however, other matters are properly presented for action at the Annual Meeting, the proxy holders named in the proxy will have the discretion to vote on such matters in accordance with their best judgment.

| 17. | Who is paying for the solicitation of proxies? |

CSC is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. Our officers and employees may, without any compensation other than the compensation they receive in their capacities as officers and employees, solicit proxies personally or by telephone, facsimile, e-mail or further mailings. We will, upon request, reimburse brokerage firms and others for their reasonable expense in forwarding proxy materials to beneficial owners of CSC stock. We have engaged the services of Morrow & Co., LLC, 470 West Avenue, Stamford, CT 06902, with respect to proxy soliciting matters at an expected cost of approximately $10,000 not including incidental expenses.

| 18. |

What if I have any questions about voting, electronic delivery or Internet voting? |

Questions regarding voting, electronic delivery or Internet voting should be directed to Investor Relations at 800.542.3070 or e-mail address, investorrelations@csc.com.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

7 |

HOW DO I VOTE?

Your vote is important. You may vote on the Internet, by telephone, by mail or by attending the Annual Meeting and voting by ballot, all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your Notice, proxy card or voting instruction card. Telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on August 12, 2013.

Vote on the Internet

If you have Internet access, you may submit your proxy by following the instructions provided in the Notice, or if you requested printed proxy materials, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can also request electronic delivery of future proxy materials.

Vote by Telephone

You can also vote by telephone by following the instructions provided on the Internet voting site, or if you requested printed proxy materials, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card.

Vote by Mail

If you elected to receive printed proxy materials by mail, you may choose to vote by mail by marking your proxy card or voting instruction card, dating and signing it, and returning it to Broadridge Financial Solutions, Inc. in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card or voting instruction card to CSC, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717. Please allow sufficient time for mailing if you decide to vote by mail.

Voting at the Annual Meeting

The method or timing of your vote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However, if your shares are held in the name of a bank, broker or other nominee, you must obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

The shares voted electronically, by telephone or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting.

|

8 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

CORPORATE GOVERNANCE

CSC is committed to maintaining the highest standards of corporate governance, which we believe is essential for sustained success and long-term stockholder value. In light of this goal, the Board oversees, counsels and directs management in the long-term interests of the Company and our stockholders. The Board’s responsibilities include, but are not limited to:

- overseeing the management of our business and

the assessment of our business risks;

- overseeing the processes for maintaining

integrity with regard to our financial statements and other public disclosures, and compliance with law and

ethics;

- reviewing and approving our major financial

objectives and strategic and operating plans, and other significant actions; and

- overseeing our talent management and succession planning.

The Board discharges its responsibilities through regularly scheduled meetings as well as through telephonic meetings, action by written consent and other communications with management as appropriate. CSC expects directors to attend all meetings of the Board and the Board committees upon which they serve, and all annual meetings of the Company’s stockholders at which they are standing for election or re-election as directors. During the fiscal year ended March 29, 2013 (“Fiscal Year 2013” or “Fiscal 2013”), the Board held 8 meetings. During Fiscal 2013, the Audit Committee held 11 meetings, the Compensation Committee held 11 meetings, the Nominating/Corporate Governance Committee held 9 meetings and the Executive Committee held 2 meetings. No director attended fewer than 75% of the aggregate of (1) the total number of meetings of the Board, and (2) the total number of meetings held by all committees of the board on which he or she served during Fiscal 2013. Each of the directors then serving attended the 2012 Annual Meeting of Stockholders.

In Fiscal 2013, an independent consulting firm assisted the Board in evaluating its performance. The effectiveness of each individual director who is standing for re-election was also considered.

Governance is a continuing focus at CSC, starting with the Board and extending to all employees. In this section, we describe some of our key governance policies and practices. In addition, we solicit feedback from our stockholders on governance and executive compensation practices and engage in discussions with various groups and individuals on governance issues and improvements.

| Corporate Governance Guidelines |

The Board has long adhered to governance principles designed to assure excellence in the execution of its duties and regularly reviews the Company’s governance policies and practices. These principles are outlined in CSC’s Corporate Governance Guidelines (the “Guidelines”), which, in conjunction with our Amended and Restated Articles of Incorporation (“Articles of Incorporation”), Amended and Restated Bylaws (“Bylaws”), Code of Business Conduct (“Code of Conduct”), Board committee charters and related policies, form the framework for the effective governance of CSC.

The full text of the Guidelines, the charters for each of the Board committees, the Code of Conduct, the Equity Grant Policy, the Related Party Transactions Policy and Clawback Policy are available on CSC’s Website, www.csc.com, under “Corporate Governance.” These materials are also available in print to any person, without charge, upon request, by calling 800.542.3070 or writing to:

Investor

Relations

CSC

3170 Fairview Park

Drive

Falls Church, Virginia 22042

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

9 |

| Board Leadership Structure |

Mr. Rodney F. Chase, serves as the Chairman of our Board of Directors. Our independent directors determined that it is in the best interests of the stockholders of the Company to separate the roles of Chairman and CEO after thoughtful and rigorous consideration of its governance structure. Separating the roles of Chairman and CEO creates clear and unambiguous lines of authority. This strong counter balancing structure allows the Board to focus on corporate governance and oversight and the CEO to focus on the Company’s business.

|

Board Leadership Structure

The Board believes that this structure provides effective oversight of management. |

CSC’s governance processes include executive sessions of the independent directors before and after every board meeting, annual evaluations by the independent directors of the CEO’s performance, succession planning, annual Board and committee self assessments and the various governance processes contained in the Guidelines and the Board committee charters.

| Director Independence |

Independent Directors. The Board assesses the independence of our directors and examines the nature and extent of any relations between the Company and our directors, their families and their affiliates. The Guidelines provide that a director is “independent” if he or she satisfies the New York Stock Exchange (“NYSE”) requirements for director independence (as set forth in Appendix A) and the Board of Directors affirmatively determines that the director has no material relationship with CSC (either directly, or as a partner, stockholder or officer of an organization that has a relationship with CSC). In Fiscal 2013, the Board determined that, with the exception of our CEO, each of the remaining eight directors – Irving W. Bailey, II, David J. Barram, Stephen L. Baum, Erik Brynjolfsson, Rodney F. Chase, Judith R. Haberkorn, Chong Sup Park and Lawrence A. Zimmerman – is independent.

Independent Director Meetings. The non-management directors regularly meet in executive session prior to the commencement and/or after the conclusion of each regularly scheduled Board meeting, and meet at such additional times as they may determine.

Committee Independence Requirements. All members serving on the Audit Committee, Compensation Committee and Nominating/Corporate Governance Committee must be independent as defined by the Guidelines. In addition, Audit Committee members must meet heightened independence criteria under the rules and regulations of the NYSE and the SEC relating to audit committees and each Compensation Committee member must be a “non-employee director” pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”).

|

10 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

| Oversight of Risk Management |

We believe our Board leadership structure supports a risk-management process in which senior management is responsible for our day-to-day risk-management processes and the Board provides oversight of our risk management. As part of its oversight responsibility, the Board oversees and maintains the Company’s governance and compliance processes and procedures to promote high standards of responsibility, ethics and integrity.

Management Role. In order for the Company to identify and mitigate the Company’s risk exposures, the Company has established an Enterprise Risk Management (“ERM”) function to (i) identify risks in the strategic, operational, financial reporting and compliance domains, for the Company as a whole, as well as for each operating unit, and (ii) evaluate the effectiveness of existing mitigation strategies. The ERM function reports to the CFO, and coordinates and reviews assessments of internal processes and controls for ongoing compliance with internal policies and legal regulatory requirements. The ERM function periodically reports potential areas of risk to the Board and its committees.

During Fiscal 2013, CSC has centralized ownership of our enterprise risk, issue, and opportunity management framework under a single executive. We are developing and deploying globally consistent processes, definitions, and tools to proactively address operational, financial, compliance and strategic risks, issues, and opportunities.

Board Role. The Board has overall responsibility for oversight of risk and assesses our strategic and operational risks throughout the year on an ongoing basis. Senior management regularly report on the opportunities and risks faced by the Company in the markets in which the Company conducts business.

Committee Role. In fulfilling its oversight role, the Board delegates certain risk management oversight responsibility to the Board’s committees. The committees meet regularly and report any significant issues and recommendations discussed during the committee meetings to the Board. Specifically, each committee fulfills the following oversight roles:

- The Audit Committee oversees risks related to

accounting, financial reporting processes and internal controls, of the

Company as well as reviews the Company’s policies and practices with respect

to risk assessment and risk management. During the Audit Committee review, the

Committee discusses the Company’s major risk exposures and the steps that have

been taken to monitor and control such exposures with management and meets

separately with management, internal auditors and independent auditors. The

Audit Committee reports the results of its review to the

Board.

- The Compensation Committee monitors the risks

associated with succession planning and leadership development as well as

compensation plans, including evaluating the effect that the Company’s

executive and sales compensation plans may have on decision making.

- The Nominating/Corporate Governance Committee monitors the risks related to the Company’s governance structure and process. The Nominating/Corporate Governance Committee is responsible for developing and implementing a director evaluation program to measure the individual and collective performance of directors and the fulfillment of their responsibilities to our stockholders, including an assessment of the Board’s compliance with applicable corporate governance requirements and identification of areas in which the Board might improve its performance. The Nominating Committee also is responsible for developing and implementing an annual self-evaluation process for the Board designed to assure that directors contribute to our corporate governance and to our performance. These tasks are accomplished in part through our annual Board evaluation.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

11 |

| Compensation and Risk |

During Fiscal 2013, CSC management reviewed its executive and non-executive (non-sales) compensation programs and also undertook a comprehensive global review of its sales force incentive compensation programs. Management determined that none of its compensation programs encourages or creates unnecessary risk taking, and none is reasonably likely to have a material adverse effect on the Company. In conducting this assessment, CSC inventoried its executive, non-executive and sales plans and programs and analyzed the components and design features of these programs in the context of risk mitigation. A summary of the findings of the assessment was provided to the Compensation Committee and the Board. Overall, CSC concluded that (1) CSC’s executive compensation programs provide a mix of awards with performance criteria and design features that mitigate excessive risk taking; (2) non-executive employee (non-sales) arrangements are primarily fixed compensation (salary and benefits) with limited incentive opportunity and do not encourage excessive risk taking; and (3) sales force compensation has been more closely aligned to total contract value. In Fiscal 2014, the Company is undertaking to further align its annual incentive compensation plans and its sales compensation plans to support the Company’s overall turnaround strategy.

| Equity Ownership Guidelines |

Under stock ownership guidelines adopted by the Board, Board members, other than the CEO, have an equity ownership requirement of five times their annual retainer to be achieved over a three-year period. Restricted stock units, as well as directly held shares, are taken into account for purposes of determining whether requirements have been met. Stock ownership guidelines for the executive officers, including the CEO, are described under “Compensation Discussion and Analysis – Additional Compensation Policies - Equity Ownership Guidelines.”

| Talent Management and Succession Planning |

The Company’s Compensation Committee and Board are actively engaged and involved in succession planning and talent management and they engage annually in a review of succession plans in August. The annual review focuses on emerging talent and key positions at the executive officer and operating unit leadership level that are important to the execution of the Company’s strategic priorities and are critical to achieving the Company’s business goals. The Compensation Committee is also updated on issues relating to the overall workforce such as diversity, health and welfare benefits, performance management, turnover, attrition and engagement.

| Director Education |

The Board recognizes the importance of its members keeping current on Company and industry issues and their responsibilities as directors. All new directors attend orientation training soon after being elected to the Board. Also, the Board encourages attendance at continuing education programs for Board members, which may include internal strategy or topical meetings, third-party presentations, and externally-offered programs.

|

12 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

| Oversight of Related Party Transactions |

The Company has adopted a written policy requiring the approval of the Nominating/Corporate Governance Committee of all transactions in excess of $120,000 between the Company and any related person (“Interested Transactions”). For the purposes of this policy, a related person is any person who was in any of the following categories at any time during Fiscal 2013:

- A director or executive officer of the

Company;

- Any nominee for director;

- Any immediate family member of a director or

executive officer, or of any nominee for director. Immediate family members

are any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law,

father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law

of such director, executive officer or nominee for director, and any person

(other than a tenant or employee) sharing the household of such director,

executive officer or nominee for director; and

- Any person who was in any of the following categories when a transaction in which such person had a direct or indirect material interest occurred or existed:

- Any beneficial owner of more than 5% of the

Company’s common stock; or

- Any immediate family member of any such beneficial owner, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of such security holder, and any person (other than a tenant or employee) sharing the household of such security holder.

A transaction includes, but is not limited to, any financial transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements or relationships.

In determining whether to approve an interested transaction, the Nominating/Corporate Governance Committee will take into account, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction. No director will participate in any discussion or approval of an interested transaction for which he or she (or an immediate family member) is a related party, except that the director will provide all material information concerning the interested transaction to the Nominating/Corporate Governance Committee.

There have been no transactions since March 31, 2012 (i.e., the first day of Fiscal 2013), nor are there any currently proposed transactions, in which the Company was or is to be a participant and the amount involved exceeds $120,000, which required the approval of the Nominating/Corporate Governance Committee under the Company’s interested transaction policy or in which any related person had, has or will have a direct or indirect material interest and which is required to be disclosed under applicable SEC rules.

| Code of Ethics and Standards of Conduct |

CSC is committed to high standards of ethical conduct and professionalism, and our Code of Business Conduct (the “Code of Conduct”) confirms our commitment to ethical behavior in the conduct of all CSC activities and reflects our CLEAR values. The Code of Conduct applies to all directors, all officers (including our CEO, Chief Financial Officer (“CFO”) and Chief Accounting Officer (“CAO”)) and employees of CSC and it sets forth our policies and expectations on a number of topics including avoiding conflicts of interest, confidentiality, insider

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

13 |

trading, protection of CSC and customer property and providing a proper and professional work environment. We maintain a worldwide toll-free and internet-based helpline, the CSC OpenLine, which employees can use to communicate any ethics-related concerns, and we provide training on ethics and compliance topics for all employees. The CSC OpenLine is administered by a third-party provider. The ethics and compliance function resides in the Ethics and Compliance Office and is managed by CSC’s Chief Ethics and Compliance Officer.

In Fiscal 2013, there were no waivers of any provisions of the Code of Conduct for the CEO, CFO or CAO. In the event the Company amends or waives any of the provisions of the Code of Conduct applicable to our CEO, CFO and CAO that relates to any element of the definition of “code of ethics” enumerated in Item 406(b) of Regulation S-K under the 1934 Act, the Company intends to disclose these actions on the Company website.

| Board Diversity |

The Company’s policy on Board diversity is set forth in the Guidelines, which provide that Board membership should reflect diversity in many respects, by including, for example, persons diverse in geography, gender and ethnicity. In addition, the Nominating/Corporate Governance Committee seeks to maintain a mix of individuals who possess experience in the sectors in which the Company operates, such as international business, technology, health care, government service and public policy, as well as those having backgrounds as executives in operations, finance, accounting, marketing and sales. The Nominating/Corporate Governance Committee deems this policy to be effective.

| Mandatory Retirement of Directors |

Under our Bylaws, directors must retire by the close of the first annual meeting of stockholders held after they reach age 72, unless the Board determines that it is in the best interests of CSC and its stockholders for the director to continue to serve until the close of a subsequent annual meeting. Pursuant to the Bylaws, Irving W. Bailey, II and Stephen L. Baum are retiring from the Board effective at the 2013 Annual Meeting.

| Resignation of Employee Directors |

Under the Guidelines, the CEO must offer to resign from the Board when he or she ceases to be a CSC employee.

| Communicating with the Board or the Chairman |

Stockholders and other interested parties may communicate with the Board, individual directors, the non-management directors as a group, or with the non-executive Chairman, by writing in care of the Corporate Secretary, Computer Sciences Corporation, 3170 Fairview Park Drive, Falls Church, Virginia 22042. The Corporate Secretary reviews all submissions and forwards to members of the Board all appropriate communications that in his judgment are not offensive or otherwise objectionable and do not constitute commercial solicitations.

|

14 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

BOARD STRUCTURE AND COMMITTEE COMPOSITION

As of the date of this proxy statement, the Board has nine directors and four standing committees: the Audit Committee, the Compensation Committee, the Nominating/Corporate Governance Committee and the Executive Committee.

Each director serving on the Audit Committee, Compensation Committee or Nominating/Corporate Governance Committee must be independent. A majority of the members of the Executive Committee are independent. In addition:

- Each Audit Committee member must meet

heightened independence criteria under the rules and regulations of the NYSE

and the SEC relating to audit committees, and must be financially literate. No

member of the Audit Committee may simultaneously serve on the audit committees

of more than three other public companies unless the Board determines that

such simultaneous service would not impair

the member’s ability to effectively serve on the Audit Committee. One member

of the Audit Committee serves on three other public company audit committees.

The Board has determined that such simultaneous service does not impair the

ability of the members of the Audit Committee who serve on the other public

company audit committees to effectively serve in their CSC Audit Committee

roles.

- Messrs. Barram, Baum and Zimmerman each

qualifies as an “audit committee financial expert”, for purposes of the rules

of the SEC, and all members of the Committee are financially literate. Mr.

Baum is retiring from the Board effective at the Annual Meeting. Brian P.

MacDonald, a nominee for election to the Board at the Annual Meeting, has

extensive experience in corporation finance and accounting, including as

former Chief Financial Officer at Sunoco, Inc. and Dell, Inc. If elected, Mr.

MacDonald is expected to serve on the Company’s Audit

Committee.

- Each Compensation Committee member must be a

“non-employee director” for purposes of Rule 16b-3 promulgated under the

Exchange Act and an “outside director” for purposes of Section 162(m) of the

Internal Revenue Code. The Board has determined that each committee member

satisfies all applicable requirements for membership on that

committee.

- The current committee membership, the number of meetings during the last fiscal year and the function of each of the standing committees are described below.

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

15 |

Audit Committee

| Number of Fiscal | |||

| Committee | Current Members | Primary Responsibilities | 2013 Meetings |

| Audit |

Lawrence A. |

Ø Oversees financial

reporting, accounting, control and compliance matters.

Ø Appoints and evaluates the independent

auditor.

Ø Reviews with the internal and independent auditors

the scope, results and adequacy of their audits and effectiveness of

internal controls.

Ø Reviews material financial disclosures.

Ø Pre-approves all audit and permitted non-audit

services.

Ø Annually reviews the Company’s compliance programs

and receives regular updates about compliance matters.

Ø Annually reviews the Company’s disclosure controls

and procedures.

Ø

Reviews, and makes recommendations to the Board about related person

transactions. |

11 |

Anyone with questions or complaints regarding accounting, internal accounting controls or auditing matters may communicate them to the Audit Committee by calling CSC’s Open Line available at http://www.cscopenline.ethicspoint.com. Calls may be confidential or anonymous. All such questions and complaints will be forwarded to the Audit Committee for its review and will be simultaneously reviewed and addressed under the direction of the Vice President, Internal Audit. The Audit Committee may direct special treatment, including the retention of outside advisors, for any concern communicated to it. The Code of Conduct prohibits retaliation against CSC employees for any report or communication made in good faith through the Open Line.

Compensation Committee

| Number of Fiscal | |||

| Committee | Current Members | Primary Responsibilities | 2013 meetings |

|

Compensation |

Judith R.

Haberkorn |

Ø Approves and recommends

full Board approval of the CEO’s compensation based upon an evaluation of

his performance by the independent directors.

Ø Reviews and approves senior management’s

compensation and approves compensation guidelines for all other

officers.

Ø Administers incentive and equity compensation

plans and, in consultation with senior management, approves compensation

policies.

Ø Reviews executive compensation disclosures and the

annual compensation risk assessment. |

11 |

|

16 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee was at any time during Fiscal 2013, or at any other time, one of our officers or employees. No executive officer of the Company served or serves on the compensation committee or board of any company that employed or employs any member of the Compensation Committee or Board. For information regarding certain related party transactions, see “Oversight of Related Party Transactions.”

Nominating/Corporate Governance Committee

| Number of Fiscal | |||

| Committee | Current Members | Primary Responsibilities | 2013 meetings |

|

Nominating/ |

David J. Barram |

Ø Monitors the Board’s

structure and operations.

Ø Sets criteria for Board membership.

Ø Searches for and screens candidates to fill Board

vacancies and recommends candidates for election.

Ø Evaluates Director and Board performance and

assesses Board composition and size.

Ø Evaluates the Company’s corporate governance

process.

Ø Recommends to the Board whether to accept the

resignation of incumbent Directors that fail to be re-elected in

uncontested elections. |

9 |

Executive Committee

| Number of Fiscal | |||

| Committee | Current Members | Primary Responsibilities | 2013 meetings |

|

Executive |

J. Michael Lawrie |

Ø Assists the CEO in making

decisions on how best to progress the strategy set by the Board between

Board meetings.

Ø Assists in time sensitive decision-making to

achieve strategic objectives.

Ø Assists in implementation of strategy set by the

Board. |

2 |

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

17 |

DIRECTOR COMPENSATION

Mr. Lawrie, as CEO and an employee director, does not receive any separate compensation for his Board activities. The following table sets forth the annual retainer and attendance fees paid to our non-employee directors. On August 7, 2012 the retainers and fees paid to our non-management directors were amended as set forth below.

| Fiscal 2013 Director Retainers and Fees | |||

| Annual Retainer1 | $90,000 | ||

| Annual Equity Award2 | $135,000 | ||

| Non-Executive Chairman Retainer1 | $150,000 | ||

| Audit Committee Chairman Retainer1 | $20,000 | ||

| Compensation Committee Chairman Retainer1 | $15,000 | ||

| Nominating/Corporate Governance Committee Chairman Retainer1 | $10,000 | ||

| Committee Member Retainer1 | $10,000 | ||

| Additional Meeting Attendance Fee1,3 | $2,500 per meeting | ||

| 1. | Amounts payable in cash may be deferred pursuant to the Company’s Deferred Compensation Plan, which is described further below in this proxy statement. | |

| 2. | Restricted stock unit awards vest in full at the 2013 Annual Meeting and are automatically redeemed for CSC stock and dividend equivalents (plus interest) when a CSC director ceases to serve on the Board, either in a lump sum or in annual installments over periods of 5, 10 or 15 years, at the director’s election. In addition, restricted stock units vest in full upon a change in control of the Company. | |

| 3. | For meetings, special projects and assignments involving travel, once a Director has exceeded (i) an aggregate of 8 Board meetings, projects and assignments or (ii) an aggregate of Committee meetings, projects and assignments equal to 6 times the number of Committees on which the Director serves. | |

|

18 |

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

The following table sets forth for each of the non-management directors certain information with respect to compensation earned in Fiscal 2013.

| Change in Pension | |||||||||||||||||||||||

| Value and | |||||||||||||||||||||||

| Nonqualified | |||||||||||||||||||||||

| Deferred | |||||||||||||||||||||||

| Fees Earned1 | Compensation | All Other | |||||||||||||||||||||

| Name | or Paid in Cash | Stock Awards2 | Earnings3 | Compensation | Total | ||||||||||||||||||

| (a) | (b) | (c) | (f) | (g) | (h) | ||||||||||||||||||

| Irving W. Bailey, II | $ | 99,870 | $ | 135,063 | $ | 45,571 | $ | – | $ | 280,504 | |||||||||||||

| David J. Barram | 134,402 | 135,063 | – | – | 269,465 | ||||||||||||||||||

| Stephen L. Baum | 106,337 | 135,063 | 31,801 | – | 273,201 | ||||||||||||||||||

| Erik Brynjolfsson | 106,870 | 135,063 | 634 | – | 242,567 | ||||||||||||||||||

| Rodney F. Chase4 | 154,000 | 351,217 | – | – | 505,217 | ||||||||||||||||||

| Judith R. Haberkorn | 120,038 | 135,063 | – | – | 255,101 | ||||||||||||||||||

| F. Warren McFarlan | 35,196 | – | 5,301 | 44,475 | 84,972 | ||||||||||||||||||

| Chong Sup Park | 105,168 | 135,063 | 11,234 | – | 251,465 | ||||||||||||||||||

| Thomas H. Patrick | 35,196 | – | – | 34,886 | 70,082 | ||||||||||||||||||

| Lawrence A. Zimmerman | 84,853 | 135,063 | – | – | 219,916 | ||||||||||||||||||

| 1. | Column (b) reflects all cash compensation earned during Fiscal 2013, whether or not payment was deferred pursuant to the Deferred Compensation Plan. | |

| 2. | Each Non-Employee Director as of the close of the Company’s 2012 Annual Meeting of Stockholders on August 7, 2012, received 4,300 Restricted Stock Units (“RSUs”) determined by (i) dividing $135,000 by the closing price of $31.41 of the Company’s Common Stock on the New York Stock Exchange Composite Tape on the grant date of August 13, 2012 and (ii) rounding the result to the nearest multiple of 100. Column (c) reflects the grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 – Compensation – Stock Compensation (“FASB ASC Topic 718”) in connection with the RSUs granted on August 13, 2012 to our directors then serving. For a discussion of the assumptions made in the valuation of RSUs, reference is made to the section of Note 1 of the Consolidated Financial Statements in the Company’s 2013 Annual Report filed on Form 10-K providing details of the Company’s accounting under FASB ASC Topic 718. The aggregate number of stock awards outstanding for each director at fiscal year-end are as follows: | |

| Aggregate Stock | ||||

| Awards | ||||

| Outstanding | ||||

| Name | as of March 29, 2013 | |||

| Irving W. Bailey, II | 35,352 | |||

| David J. Barram | 24,700 | |||

| Stephen L. Baum | 32,419 | |||

| Erik Brynjolfsson | 10,200 | |||

| Rodney F. Chase | 39,540 | |||

| Judith R. Haberkorn | 18,600 | |||

| Chong Sup Park | 19,300 | |||

| Lawrence A. Zimmerman | 4,300 | |||

|

COMPUTER SCIENCES CORPORATION |

|

2013 Proxy Statement |

19 |