UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary proxy statement |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

40 Wantage Avenue

Branchville, New Jersey 07890

March 27, 2024

NOTICE

OF 2024 ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Wednesday, May 1, 2024

9:00 AM Eastern Time

|

Attending the Annual Meeting

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Selective Insurance Group, Inc. (“Selective” and “we”) will be held on Wednesday, May 1, 2024, at 9:00 AM Eastern Time. The Annual Meeting will be a virtual meeting held exclusively via live audiocast.

To attend, vote, and submit questions during the Annual Meeting, please visit http://www.virtualshareholdermeeting.com/SIGI2024 and enter the 16-digit control number included on your Notice of Internet Availability or proxy card.

If you requested printed copies of the proxy materials, we encourage you to vote your shares by phone, by mail, or online in advance to ensure your vote will be represented at the Annual Meeting. Even if you plan to attend the Annual Meeting virtually, we encourage you to vote your shares in advance.

|

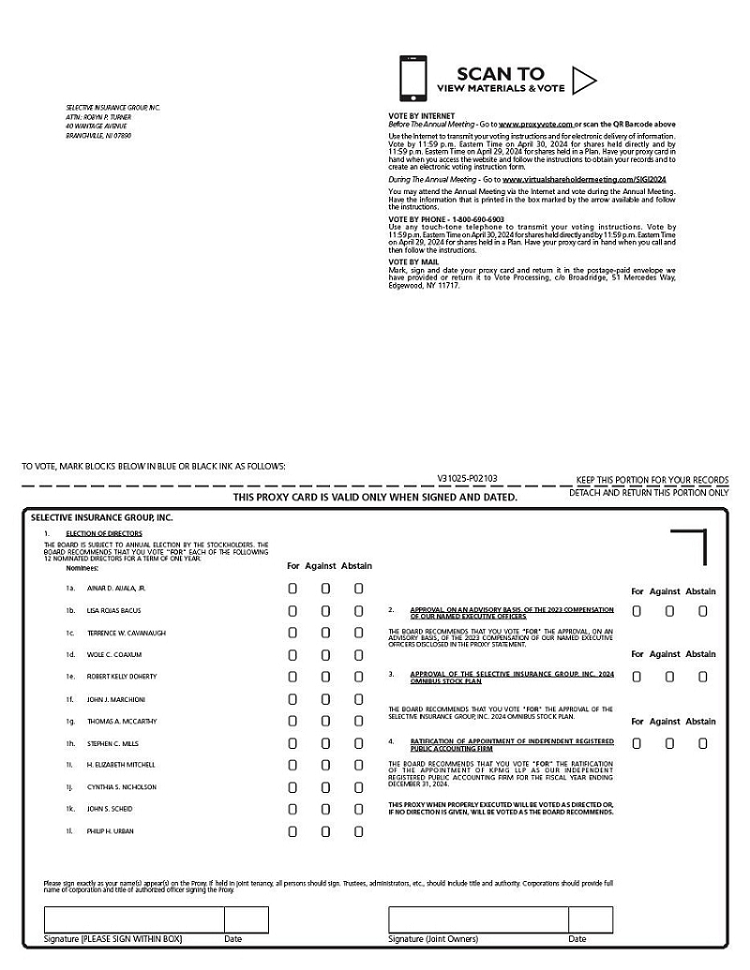

At the Annual Meeting, we will ask stockholders to:

| 1. | Elect 12 directors named in the accompanying Proxy Statement for a one-year term expiring in 2025; |

| 2. | Approve, on an advisory basis, the 2023 compensation of Selective’s named executive officers; |

| 3. | Approve the Selective Insurance Group, Inc. 2024 Omnibus Stock Plan; and |

| 4. | Ratify the appointment of KPMG LLP as Selective’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

In addition, we will attend to any other business properly brought before the Annual Meeting and its adjournments, postponements, or continuations, if any. After the Annual Meeting, we will offer time for your questions. In connection with the Annual Meeting, we are also making available Selective’s 2023 Annual Report to Stockholders (“2023 Annual Report”).

The Board of Directors recommends that you vote “FOR” each of the director nominees in Proposal 1 and “FOR” each of Proposals 2, 3, and 4. These proposals are further described in the Proxy Statement.

Selective stockholders of record as of the close of business on March 7, 2024 are entitled to notice of, and the right to vote at, the Annual Meeting and any adjournment, postponement, or continuation thereof.

YOUR VOTE IS IMPORTANT. VOTE YOUR SHARES BY (I) CALLING THE TOLL-FREE TELEPHONE NUMBER LISTED ON THE PROXY CARD, (II) ACCESSING THE INTERNET WEBSITE LISTED ON THE PROXY CARD, OR (III) COMPLETING, DATING, AND SIGNING THE PROXY CARD AND RETURNING IT IN THE ENCLOSED ENVELOPE. YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE IT IS VOTED AT THE ANNUAL MEETING THROUGH THE PROCESSES DESCRIBED IN THE PROXY STATEMENT. IF YOU HOLD SHARES THROUGH A BROKER OR OTHER CUSTODIAN, PLEASE SEE THE VOTING INSTRUCTIONS PROVIDED TO YOU BY THAT BROKER OR CUSTODIAN.

Very truly yours,

John J. Marchioni

Chairman of the Board, President and Chief Executive Officer

By Order of the Board of Directors:

Robyn

P. Turner

Corporate Secretary

TABLE OF CONTENTS

Page

| -i- |

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Forward-looking statements may be identified by words like “anticipate,” “expect,” “project,” “believe,” “plan,” “may,” “estimate,” “intend,” and other similar words. We base these forward-looking statements on our beliefs, assumptions, and estimates using information available to us at the time. They are not intended to be guarantees of future events or performance. Factors that may cause actual results to differ materially from forward-looking statements in this Proxy Statement can be found in our most recent Annual Report on Form 10-K filed with the SEC and in our subsequent filings with the SEC, including under the headings “Risk Factors” and “Forward-Looking Statements.”

We caution you not to unduly rely on any of our forward-looking statements. We disclaim any intention or obligation to publicly update or revise any forward-looking statements, except as required by law. This cautionary statement applies to all forward-looking statements contained in this document.

WEBSITES

Website addresses referenced in this Proxy Statement are provided for convenience only, and the content on the referenced websites does not constitute a part of, and is specifically not incorporated by reference into, this Proxy Statement.

Page 1

PROXY STATEMENT

FOR

THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, MAY 1, 2024

GENERAL INFORMATION ABOUT SELECTIVE’S ANNUAL MEETING

WHEN AND WHERE IS THE ANNUAL MEETING?

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Selective Insurance Group, Inc. (“Selective,” “Company,” “we,” “us,” and “our”) will be held virtually on Wednesday, May 1, 2024, at 9:00 AM Eastern Time exclusively via live audiocast. The Annual Meeting will not have a physical location, and you will not be able to attend the meeting in person. You can participate, vote, and submit your questions online during the Annual Meeting by visiting http://www.virtualshareholdermeeting.com/SIGI2024 and entering the 16-digit control number on your proxy card. See below for additional information regarding the virtual meeting format.

WHEN IS THIS PROXY STATEMENT BEING MAILED OR RELEASED TO STOCKHOLDERS?

This Proxy Statement and proxy card are first being mailed or given to Selective stockholders on or about March 27, 2024.

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Anyone who owned Selective common stock as of the close of business on March 7, 2024 (the “Record Date”) is entitled to one vote per share owned. There were 60,791,439 shares of Selective common stock outstanding at the close of business on the Record Date.

WHO IS SOLICITING MY PROXY TO VOTE MY SHARES AND WHEN?

Selective’s Board of Directors (the “Board”) is soliciting your proxy, meaning your authorization for our named proxies, H. Elizabeth Mitchell and Philip H. Urban, to vote your shares. Unless revoked by you, your proxy will be effective for the Annual Meeting and its adjournments, postponements, or continuations, if any.

WHAT IS THE COST OF SOLICITING PROXIES AND WHO IS PAYING FOR THE COST?

Selective is bearing the entire cost of soliciting proxies. Proxies will be solicited principally through the mail and by email. They also may be solicited in person, in writing, by telephone, text message, email, or otherwise by directors or employees, including officers of Selective or a Selective subsidiary, who will receive no additional compensation for these efforts. Selective has engaged Innisfree M&A Incorporated, a proxy solicitation firm (“Innisfree”), to assist in soliciting proxies and distributing proxy materials. Innisfree will provide such services for an estimated fee of approximately $17,500, plus expenses. Selective will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses they incur in sending proxy materials to their customers or principals who are the beneficial owners of shares of Selective common stock.

WHAT ARE THE REQUIREMENTS FOR BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING?

For business to be conducted at the Annual Meeting, owners of 30,395,721 shares of Selective common stock (a majority of the issued and outstanding shares entitled to vote), constituting a quorum, must be in attendance by virtual participation or represented by proxy. Our common stock is our only class of voting securities.

HOW DO STOCKHOLDERS ATTEND THE VIRTUAL ANNUAL MEETING?

The Annual Meeting will be held exclusively via live audiocast, allowing meeting attendance from any location in the world. We are pleased to use virtual stockholder meeting technology to provide ready access and cost savings for Selective and its stockholders.

To be admitted to the Annual Meeting at http://www.virtualshareholdermeeting.com/SIGI2024, you must enter the 16-digit control number on the proxy card you received. You can vote online, submit your questions, and examine Selective’s stockholder list by following the instructions provided on the meeting website during the Annual Meeting.

Page 2

The meeting will begin promptly at 9:00 AM Eastern Time on May 1, 2024. Online access will start at 8:45 AM Eastern Time. We encourage you to access the meeting website before the start time to ensure sufficient time to complete the check-in procedures. If you are not a stockholder, you may still access the meeting website as a guest, but you will not be able to vote, ask questions, or view the stockholder list.

The virtual meeting platform is fully supported across internet browsers (Microsoft Edge, Mozilla Firefox, Google Chrome, and Safari) and devices (desktops, laptops, tablets, and mobile phones) running the most updated version of applicable software and plugins. You will be able to test the system before the Annual Meeting starts. If you encounter any technical difficulties logging onto http://www.virtualshareholdermeeting.com/SIGI2024 or during the Annual Meeting, a toll-free number and international number will be available on the meeting website to help you. Technicians will be ready to assist you with any technical difficulties, beginning at 8:45 AM Eastern Time through the conclusion of the Annual Meeting.

HOW DO STOCKHOLDERS ASK QUESTIONS AT THE ANNUAL MEETING?

The Annual Meeting will include a question-and-answer session. We will answer questions relevant to Selective and meeting matters submitted in accordance with the meeting rules posted on the meeting website (http://www.virtualshareholdermeeting.com/SIGI2024). Stockholders can submit written questions via the Internet at any time during the Annual Meeting by following the instructions that will be available on the meeting website. Stockholders must have their control number to ask a question. In order to answer questions from as many stockholders as possible, each stockholder is limited to two questions. Substantially similar questions will be grouped and answered once to avoid repetition and allow more time for other questions. To ensure the meeting is conducted fairly for all stockholders, the Chairperson of the Annual Meeting may exercise discretion in recognizing stockholders wishing to participate, the order that questions are addressed, and the amount of time devoted to any one question. By virtually attending the Annual Meeting, stockholders agree to abide by the agenda and procedures for the Annual Meeting.

PROPOSALS FOR STOCKHOLDER VOTE AND APPROVAL REQUIREMENTS

Management is presenting four proposals for a stockholder vote.

| PROPOSAL 1. | ELECTION OF DIRECTORS |

DIRECTORS ARE SUBJECT TO ANNUAL ELECTION BY THE STOCKHOLDERS. THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE FOLLOWING 12 DIRECTOR NOMINEES FOR A TERM OF ONE YEAR:

| AINAR D. AIJALA, JR. | THOMAS A. MCCARTHY |

| LISA ROJAS BACUS | STEPHEN C. MILLS |

| TERRENCE W. CAVANAUGH | H. ELIZABETH MITCHELL |

| WOLE C. COAXUM | CYNTHIA S. NICHOLSON |

| ROBERT KELLY DOHERTY | JOHN S. SCHEID |

| JOHN J. MARCHIONI | PHILIP H. URBAN |

You can find information about the director nominees, the Board, its committees, and other related matters in the section entitled, “Information about Proposal 1” of this Proxy Statement.

New Jersey law and Selective’s By-Laws govern the vote on Proposal 1, on which you may:

| ▪ | Vote “FOR” all of the director nominees; |

| ▪ | Vote “AGAINST” all of the director nominees; |

| ▪ | Vote “FOR” or “AGAINST” specific director nominees; or |

| ▪ | Abstain from voting for all or specific director nominees. |

Under our By-Laws and assuming a quorum is present, a director nominee in an uncontested election must be elected by a majority of votes cast at the Annual Meeting. A majority exists when the number of votes cast “For” a director nominee exceeds the number of votes cast “Against” the director nominee. A director nominee who fails to receive a majority of votes cast in an uncontested election is required to tender their resignation from the Board

Page 3

within five days following the certification of the election results. In that event, (i) the Corporate Governance and Nominating Committee must recommend to the Board whether it should accept the resignation, and (ii) the Board must decide whether to accept the resignation and disclose its decision-making process.

Stockholders may not cumulate their votes. Abstentions and broker non-votes will not be taken into account in determining the outcome of the vote.

| PROPOSAL 2. | APPROVAL, ON AN ADVISORY BASIS, OF THE 2023 COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE 2023 COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS DISCLOSED IN THIS PROXY STATEMENT.

You can find information about the compensation of our named executive officers in the section entitled, “Executive Compensation” and about Proposal 2 in the section entitled, “Information about Proposal 2” of this Proxy Statement.

New Jersey law and Selective’s By-Laws govern the vote on Proposal 2, on which you may:

| ▪ | Vote “FOR” Proposal 2; |

| ▪ | Vote “AGAINST” Proposal 2; or |

| ▪ | Abstain from voting on Proposal 2. |

Assuming a quorum is present, Proposal 2 will pass if approved by an affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will not be taken into account in determining the outcome of the vote.

| PROPOSAL 3. | APPROVAL OF THE SELECTIVE INSURANCE GROUP, INC. 2024 OMNIBUS STOCK PLAN |

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE 2024 OMNIBUS STOCK PLAN.

You can find information about Proposal 3 in the section entitled, “Information about Proposal 3” of this Proxy Statement.

New Jersey law and Selective’s By-Laws govern the vote on Proposal 3, on which you may:

| ▪ | Vote “FOR” Proposal 3; |

| ▪ | Vote “AGAINST” Proposal 3; or |

| ▪ | Abstain from voting on Proposal 3. |

Assuming a quorum is present, Proposal 3 will pass if approved by an affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will not be taken into account in determining the outcome of the vote.

| PROPOSAL 4. | RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

You can find information about Selective’s relationship with KPMG LLP in the section entitled, “Information about Proposal 4” of this Proxy Statement. New Jersey law and Selective’s By-Laws govern the vote on Proposal 4, on which you may:

| ▪ | Vote “FOR” Proposal 4; |

| ▪ | Vote “AGAINST” Proposal 4; or |

| ▪ | Abstain from voting on Proposal 4. |

Page 4

Assuming a quorum is present, Proposal 4 will pass if it receives an affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions will not be taken into account in determining the outcome of the vote. Proposal 4 is considered a “routine” matter on which brokers may cast a vote.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The Board is unaware of any other business to be presented for a vote at the Annual Meeting. If any other matters are properly presented for a vote, the individuals named as proxies will have discretionary authority to vote on such matters using their best judgment to the extent permitted by applicable law and rules and regulations of Nasdaq Stock Market (“Nasdaq”) and the U.S. Securities and Exchange Commission (the “SEC”).

The Chairperson of the Annual Meeting may refuse to allow the presentation of a proposal or nominee for the Board if the proposal or nominee is not properly submitted. The requirements for submitting proposals and director nominations for the Annual Meeting are detailed in Selective’s By-Laws.

VOTING AND PROXY PROCEDURE

HOW DO I VOTE?

If you are the record holder of your shares, you can vote in four ways:

| 1. | BY MAIL (PROXY CARD MUST BE RECEIVED BEFORE THE ANNUAL MEETING): |

| ▪ | Mark your voting instructions on your proxy card; |

| ▪ | Sign your name exactly as it appears on your proxy card; |

| ▪ | Date your proxy card; and |

| ▪ | Mail your proxy card to us in the provided postage-paid envelope. |

Timing is important, so please mail your proxy card promptly. We must receive it before the beginning of the Annual Meeting. If you do not give voting instructions on your signed and mailed proxy card, the named proxies will vote your shares “FOR” each of the director nominees in Proposal 1 and “FOR” each of Proposals 2, 3, and 4.

| 2. | BY TELEPHONE (MAY BE DONE AT ANY TIME UNTIL TUESDAY, APRIL 30, 2024, AT 11:59 PM EASTERN TIME): |

| ▪ | Call the toll-free number on your proxy card; and |

| ▪ | Follow the instructions on your proxy card and the voice prompts. |

IF YOU VOTE BY TELEPHONE, YOU DO NOT NEED TO RETURN YOUR PROXY CARD.

| 3. | BY INTERNET (MAY BE DONE AT ANY TIME UNTIL TUESDAY, APRIL 30, 2024 AT 11:59 PM EASTERN TIME): |

| ▪ | Go to the website listed on your proxy card; and |

| ▪ | Follow the instructions on your proxy card and the website. |

IF YOU VOTE BY INTERNET, YOU DO NOT NEED TO RETURN YOUR PROXY CARD.

| 4. | BY VIRTUAL PARTICIPATION (MAY ONLY BE DONE ON WEDNESDAY, MAY 1, 2024 DURING THE ANNUAL MEETING): |

| ▪ | Virtually attend the Annual Meeting and vote online during the audiocast. |

Page 5

As of the date of this proxy statement, we do not know of any other matters that may be presented for action at the Annual Meeting. However, should other matters properly come before the meeting, the persons named as proxies will vote in a manner as they may, in their discretion and to the extent permitted by applicable laws, rules, and regulations, determine.

If your shares are held in our 401(k) plan or employee stock purchase plan, you can vote in any of the above four ways; provided, however, if you choose to vote by telephone (option 2) or by internet (option 3), you must do so before 11:59 PM Eastern Time on Monday, April 29, 2024.

HOW DO I REVOKE MY PROXY OR CHANGE MY VOTING INSTRUCTIONS?

You may revoke your proxy at any time before the proxy is exercised at the Annual Meeting by:

| ▪ | Submitting a new vote by telephone, via the Internet, or by returning a properly executed new proxy card bearing a later date. Any subsequent timely and valid vote by any method will change your prior vote. For example, if you voted by telephone, a subsequent Internet vote will change your vote. The vote counted will be the last vote received before 11:59 PM Eastern Time on Tuesday, April 30, 2024 (if you are the record holder of your shares) or 11:59 PM Eastern Time on Monday, April 29, 2024 (if your shares are held in our 401(k) plan or employee stock purchase plan) – unless you change your vote by virtually attending the Annual Meeting and voting online during the Annual Meeting; |

| ▪ | Writing to Selective’s Corporate Secretary, Robyn P. Turner, at 40 Wantage Avenue, Branchville, New Jersey 07890 (such revocation must be received before the commencement of the Annual Meeting); and |

| ▪ | Virtually attending the Annual Meeting and voting online during the audiocast. |

HOW WILL PROXIES BE VOTED IF I GIVE MY AUTHORIZATION?

If you (i) properly execute your proxy card and return it to Selective, or (ii) submit your proxy by telephone or via the Internet and do not subsequently revoke your proxy, your shares of common stock will be voted at the Annual Meeting according to your instructions. In the absence of voting instructions, the named proxies will vote your shares “FOR” each of the director nominees in Proposal 1 and “FOR” each of Proposals 2, 3, and 4. If other matters properly come before the Annual Meeting, the named proxies will vote on such matters using their best judgment to the extent permitted by applicable laws, rules, and regulations.

WHAT IF MY SHARES ARE NOT REGISTERED IN MY NAME?

If the Selective stock you own is held in the name of a bank, broker, or other nominee (commonly referred to as holding shares in “street name”), your bank, broker, or other nominee should have provided you access to these proxy materials by mail or e-mail with information on how to submit your voting instructions. If you do not provide voting instructions, the broker, bank, or other holder of record cannot vote your shares with respect to “non-routine” matters, but can vote the shares with respect to “routine” matters. “Broker non-votes” occur when a beneficial owner of shares held in street name fails to provide instructions to the broker, bank, or other nominee as to how to vote on matters deemed “non-routine.” We believe the election of directors (Proposal 1), the advisory (non-binding) vote on the 2023 compensation of Selective’s named executive officers (Proposal 2), and the approval of the 2024 Omnibus Stock Plan (Proposal 3) are “non-routine” matters, and brokers, banks, or other nominees cannot vote your shares on such proposals if you have not given voting instructions. In these cases, the broker, bank, or other nominee can register your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the New York Stock Exchange (“NYSE”) rules that apply to brokers.

HOW WILL VOTES, ABSTENTIONS, AND BROKER NON-VOTES BE COUNTED?

The inspectors of election appointed for the Annual Meeting by the Board will separately tabulate affirmative and negative votes, abstentions, and broker non-votes. Shares represented by proxies that reflect abstentions and broker non-votes are counted to determine whether there is a quorum.

Page 6

The below chart summarizes the required voting standard for each proposal and the impacts of abstentions and broker non-votes.

| Proposal | Voting Approval Standard | Effect of Abstention(1) |

Effect of Broker Non-Vote(2) | |

| 1. | Election of Directors | A nominee for director shall be elected to the Board if the votes cast for such nominee's election exceed the votes cast against such nominee's election(3) | No effect | No effect |

| 2. | Approval, on an Advisory Basis, of the 2023 Compensation of our Named Executive Officers | Affirmative vote of a majority of votes cast | No effect | No effect |

| 3. | Approval of the Selective Insurance Group, Inc. 2024 Omnibus Stock Plan | Affirmative vote of a majority of votes cast | No effect | No effect |

| 4. | Ratification of the Appointment of Independent Registered Public Accounting Firm | Affirmative vote of a majority of votes cast | No effect | Not applicable |

(1) For purposes of determining the number of votes cast concerning a particular matter, only those cast “For” or “Against” are included.

(2) Under NYSE rules that apply to brokers, Proposal 4 is considered a “routine” proposal on which brokers are permitted to vote in their discretion even if the beneficial owners do not provide voting instructions. However, Proposals 1, 2, and 3 are not considered to be routine matters and brokers will not be entitled to vote thereon unless beneficial owners provide voting instructions. Accordingly, broker non-votes will not be counted toward the tabulation of votes on Proposals 1, 2, and 3.

(3) Directors shall be elected by a plurality of the votes cast at any meeting of stockholders for which the Secretary of the Company determines that the number of nominees exceeds the number of directors to be elected as of the date seven days prior to the scheduled mailing date of the proxy statement for such meeting.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, MAY 1, 2024

This Proxy Statement and our 2023 Annual Report are available on Selective’s Internet website at www.Selective.com.

Page 7

INFORMATION ABOUT PROPOSAL 1

Election of Directors

Under our By-Laws, directors in uncontested elections must be elected by a majority of votes cast. A majority exists when the number of votes cast “for” a director nominee exceeds the number of votes cast “against” that director nominee. For more information on our majority voting policy, please see the section entitled, “Corporate Governance – Majority Voting for Directors in Uncontested Elections” of this Proxy Statement.

All directors stand for election for a one-year term. In all cases, each director will hold office until a successor has been elected and qualified, or until the director’s earlier resignation or removal.

The Board currently has 13 members, 12 of whom are standing for reelection at the Annual Meeting. Mr. Thebault has reached the mandatory director retirement age specified in our By-Laws and is not standing for reelection at the Annual Meeting. We acknowledge and thank Mr. Thebault for his service on the Board. Following the Annual Meeting, the Board will reduce its size from 13 members to 12 members. Under Selective’s Amended and Restated Certificate of Incorporation and By-Laws, Selective may have a minimum of seven and a maximum of 20 directors. By majority vote, the Board may set the number of directors within this range at any time.

Process for Review and Nomination of Director Candidates

We believe the Board’s membership should encompass a broad range of skills, expertise, industry knowledge, and diversity of opinion. Directors should possess the highest personal and professional ethics, integrity, and values, and must be committed to representing the long-term interests of Selective and its stockholders.

The Corporate Governance and Nominating Committee is responsible for reviewing and nominating candidates to the Board. The Corporate Governance and Nominating Committee reviews all director candidates for possible nomination and election to the Board and seeks such candidates from any source, including:

| ▪ | Directors and management; |

| ▪ | Third-party search firms that the Corporate Governance and Nominating Committee may engage from time to time for a fee to identify and assess candidates; and |

| ▪ | Stockholders. |

Any stockholder proposing one or more director candidates must submit in writing all applicable information required under the Exchange Act, and Selective’s By-Laws to the Chairperson of the Corporate Governance and Nominating Committee, c/o Corporate Secretary, Selective Insurance Group, Inc., 40 Wantage Avenue, Branchville, New Jersey 07890.

The Corporate Governance and Nominating Committee evaluates all candidates, including any recommended by stockholders, using the same criteria, including, among other things:

| ▪ | Personal and professional ethics, integrity, character, and values; |

| ▪ | Professional and personal experience; |

| ▪ | Business judgment; |

| ▪ | Skills and expertise; |

| ▪ | Industry knowledge; |

| ▪ | Independence and avoidance or limitation of potential or actual conflicts of interest; |

| ▪ | Dedication and commitment to representing the long-term interests of Selective and its stockholders; |

| ▪ | Willingness to dedicate and devote sufficient time to Board duties and activities; |

| ▪ | Cultural diversity, and expertise in areas expected to contribute to the Board’s effectiveness, such as general operations, technology, finance, investment, marketing, financial reporting, legal and regulatory, risk management, cybersecurity, and human capital management, among others; and |

| ▪ | Other appropriate and relevant factors, including the qualifications and skills of the current members of the Board. |

Page 8

The table below summarizes some of the attributes, expertise, and skills we find relevant to our business that our director nominees bring to the Board. The table does not include every attribute, expertise, or skill that each director nominee offers. The fact that a particular attribute, expertise, or skill is not listed does not mean that a director nominee does not possess it. All our director nominees exhibit high integrity, an appreciation for diversity of background, experience, and thought, innovative thinking, proven records of success, and knowledge of corporate governance requirements and best practices.

| ATTRIBUTES,

EXPERTISE & SKILLS |

AINAR

D. AIJALA, JR. |

LISA ROJAS BACUS |

TERRENCE

W. CAVANAUGH |

WOLE

C. COAXUM |

ROBERT KELLY DOHERTY |

JOHN

J. MARCHIONI |

THOMAS

A. MCCARTHY |

STEPHEN

C. MILLS |

H.

ELIZABETH MITCHELL |

CYNTHIA

S. NICHOLSON |

JOHN

S. SCHEID |

PHILIP

H. URBAN |

| INSURANCE INDUSTRY | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||||

| FINANCIAL

STATEMENT/ AUDIT/PUBLIC DISCLOSURE |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||

| FINANCE/CAPITAL

MANAGEMENT EXPERTISE/ M&A |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||||

| INVESTMENT | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||||

| PUBLIC

COMPANY EXECUTIVE EXPERIENCE |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||||

| ACTUARIAL | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||||||

| HUMAN

CAPITAL MANAGEMENT |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ |

| RISK

MANAGEMENT, INCLUDING SUSTAINABILITY |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ |

| TECHNOLOGY/ CYBERSECURITY |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||||

| LEGAL OR REGULATORY | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ||

| MARKETING/ BRANDING |

☒ | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ | |||||

| AGENCY DISTRIBUTION | ☒ | ☒ | ☒ | ☒ | ☒ | ☒ |

Page 9

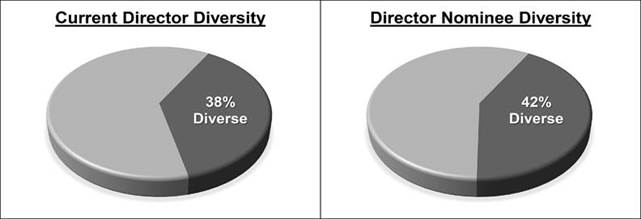

Diversity

In addition to the above attributes, expertise, and skills, the Corporate Governance and Nominating Committee considers diversity when evaluating the suitability of individual director nominees. Under our Corporate Governance Guidelines, the Corporate Governance and Nominating Committee is required to ensure that all interviewee pools for director candidates include individuals of diverse gender, race, and culture.

The following graphs depict the racial/ethnic, gender, and LGBTQ+ diversity of Selective’s current directors and director nominees, based on the self-identification information that the current directors and director nominees provided, along with consent for its public disclosure:

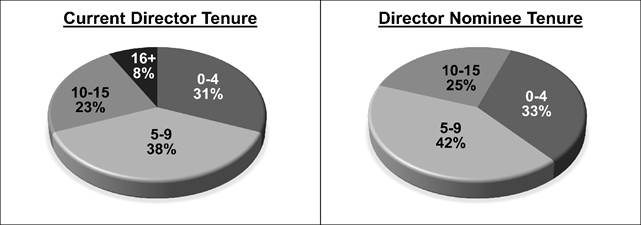

The following graphs depict the tenure (in years) of Selective’s current directors and director nominees:

The following graphs depict the age of Selective’s current directors and director nominees:

Page 10

As shown in the table below, five of our 13 current directors self-identify as diverse. Three directors self-identify as female; three directors self-identify as underrepresented minorities (meaning individuals who self-identify as Black or African American, Hispanic or Latin, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more races or ethnicities); and one director self-identifies as LGBTQ+.

| Board Diversity Matrix As of January 24, 2024 | ||||

| Total Number of Directors | 13* | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 3 | 10 | 0 | 0 |

| Part II: Demographic Background | ||||

| African American or Black | 0 | 2 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latin | 1 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 8 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 1 | |||

| Did Not Disclose Demographic Background | 0 | |||

* J. Brian Thebault is included in this table but is not standing for reelection at the Annual Meeting.

Page 11

| Board Diversity Matrix As of January 29, 2023 | ||||

| Total Number of Directors | 16* | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 3 | 13 | 0 | 0 |

| Part II: Demographic Background | ||||

| African American or Black | 0 | 2 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latin | 1 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 11 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 1 | |||

| Did Not Disclose Demographic Background | 0 | |||

* John C. Burville, Michael J. Morrissey, and William M. Rue are included in this table but did not stand for reelection at the 2023 Annual Meeting of Stockholders.

Director Nominees

No family relationships exist among Selective’s current directors, director nominees, and executive officers.

The Board ratified the Corporate Governance and Nominating Committee’s nomination of the 12 director nominees listed below to stand for election at the Annual Meeting for terms expiring at the 2025 Annual Meeting of Stockholders or until their respective successors have been duly elected and qualified.

All 12 director nominees have consented to be named in this Proxy Statement and to serve if elected. The Board does not know of any reason a director nominee would decline or be unable to serve if elected. If a director nominee becomes unavailable or unable to serve before the Annual Meeting, the Board can reduce its size or designate a substitute director nominee. If the Board designates a substitute director nominee, proxies that would have been cast for the original director nominee will be cast for the substitute director nominee unless contrary instructions are given.

Page 12

| NOMINEES OF THE BOARD OF DIRECTORS | |

| Ainar D. Aijala, Jr. | |

|

Age: 67

Director since: 2020

Independent Director

Board Committees:

Compensation and Human Capital, Corporate Governance and Nominating |

Background Information

◾ Senior Advisor to the Global CEO and other senior-level positions, including Chief Global Corporate Development Officer and Global Managing Partner of Consulting and Human Capital, Deloitte & Touche LLP (“Deloitte”), 1982 to 2020.

◾ Senior Manager, Coopers & Lybrand Consulting, 1977 to 1982.

◾ Board of Managers, DLED, Inc., 2021 to 2023.

◾ Enrolled Actuary pursuant to the Employee Retirement Income Security Act of 1974, since 1982.

◾ Emeritus Governor, Board of Governors, Junior Achievement Worldwide, since 2021; Member, Junior Achievement Worldwide, 2003 to 2021, and Junior Achievement USA, 2015 to 2021; Member of the Executive Compensation Committee, 2003 to 2021, and past Chairman of Junior Achievement Worldwide, 2006 to 2009.

◾ Ocean Ridge, Florida Town Commissioner, since January 2024.

◾ University of Michigan at Ann Arbor (B.S.).

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Aijala has significant experience as an actuary and as a corporate development and human capital executive. As a senior global advisor and managing partner at Deloitte for 38 years, he advised public companies on various strategic issues relevant to Selective, particularly with respect to human capital and benefit plan issues. Deloitte grew rapidly during his tenure as Global Managing Partner, and he was responsible for attracting, developing, and retaining top human capital. Mr. Aijala also has devoted considerable time to educating primary and secondary school students about entrepreneurship, work readiness, and financial literacy through Junior Achievement Worldwide. His broad knowledge of human relations matters, notably recruiting, developing, and retaining human capital, benefits Selective in developing its talent strategies. For these reasons, the Board believes Mr. Aijala is qualified to serve as a director. |

| Lisa Rojas Bacus | |

|

Age: 60

Director since: 2020

Independent Director

Board Committees:

Compensation and Human Capital, Corporate Governance and Nominating |

Background Information

◾ Executive Vice President, Global Chief Marketing Officer, Cigna Corporation (“Cigna”), 2013 to 2019.

◾ Executive Vice President and Chief Marketer, American Family Insurance Group, 2008 to 2013.

◾ Executive Director, Global Marketing Strategy and other senior positions, Ford Motor Company, 1986 to 2008.

◾ Board Member, Culver’s Franchising System, Inc., since 2010.

◾ Board Member, PetSmart Charities Inc., since 2019.

◾ Member, Latino Corporate Directors Association.

◾ Member, Prospanica.

◾ Northern Arizona University (B.S.) and Duke University (M.B.A.).

◾ Diligent Institute ESG Leadership Certification.

Other Public Company Board Service

◾ Board Member, Teradata Corporation (NYSE: TDC), since 2015.

◾ Board Member and Audit Committee Member, Douglas Dynamics, Inc. (NYSE: PLOW), since 2020.

Discussion of individual experience, qualifications, attributes, and skills.

Ms. Bacus has over 30 years of marketing and senior leadership experience in Fortune 100 global companies in the insurance and automotive industries. She has extensive property and casualty marketing experience, including developing relationships with independent agents. She is a strategic thinker and highly regarded customer experience expert. Ms. Bacus is an advocate for sustainability issues, and gender and ethnic diversity matters. Her marketing, digital, and analytics experience contribute significantly to Selective’s strategies. For these reasons, the Board believes Ms. Bacus is qualified to serve as a director. |

Page 13

| NOMINEES OF THE BOARD OF DIRECTORS | |

| Terrence W. Cavanaugh | |

|

Age: 70

Director since: 2018

Independent Director

Board Committees:

Audit, Risk |

Background Information

◾ Founding partner, Accretive Consulting LLC, since 2017.

◾ President and Chief Executive Officer, Erie Indemnity Company, 2008 to 2016.

◾ Chief Operating Officer of Chubb Surety & Trade Credit, Chubb Group of Insurance Companies (“Chubb Group”), 2002 to 2007; Chief Marketing Officer, Chubb Group, 1998 to 2001; various underwriting and field management roles, 1975 to 1997.

◾ Director, Highmark Health, since 2013.

◾ Board of Commissioners, Naples Airport Authority, since 2022.

◾ Director, Property Casualty Insurance Association, 2008 to 2017; Chairman, 2014 to 2015.

◾ Trustee, The Institutes, 2010 to 2016.

◾ Director, Insurance Information Institute, 2011 to 2016; Chairman, 2015 to 2016.

◾ University of Notre Dame (B.B.A.).

◾ Harvard Business School (Program for Management Development).

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Cavanaugh has more than 40 years of insurance expertise, including serving for eight years as the chief executive officer of a Fortune 500® insurer. He has extensive experience growing property and casualty direct premiums written and increasing policyholder surplus, delivering profitability, and developing relationships with independent agents. Mr. Cavanaugh has significant customer experience and talent development knowledge and expertise. For these reasons, the Board believes Mr. Cavanaugh is qualified to serve as a director. |

| Wole C. Coaxum | |

|

Age: 53

Director since: 2020

Independent Director

Board Committees:

Finance and Investments, Risk |

Background Information

◾ Founder and Chief Executive Officer, Mobility Capital Finance, Inc. (MoCaFi), since 2016.

◾ Managing Director and other senior management positions, JPMorgan Chase & Company, 2007 to 2015.

◾ President and Chief Executive Officer, Willis Canada Inc., 2005 to 2007; Chief Operating Officer and Chief Finance Officer, Willis North America, 2002 to 2005.

◾ Vice President, Corporate and Investment Bank, and other various positions, Citigroup Inc., 1992 to 2002.

◾ Trustee, Phillips Exeter Academy, since 2012.

◾ Director, Roosevelt Institute, since 2016; Board Treasurer, since 2019.

◾ Williams College (B.A.).

◾ New York University’s Stern School of Business (M.B.A.).

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Coaxum is the president and chief executive officer of a digital banking platform that he founded to support underserved communities. His experience in FinTech is relevant to Selective’s InsurTech strategies. His senior management, financial services, and insurance experience at JPMorgan Chase & Company, Willis Group, and Citigroup Inc. influence our overall strategies. Mr. Coaxum’s experience providing underserved communities with financial services helps Selective evaluate its geographic expansion and diversity, equity, and inclusion (“DE&I”) strategies. Mr. Coaxum is an executive with large public company and FinTech experience with keen insights into underserved communities and DE&I issues. Mr. Coaxum’s experience as a reinsurance broker will support the newly-formed Risk Committee. For these reasons, the Board believes Mr. Coaxum is qualified to serve as a director. |

Page 14

| NOMINEES OF THE BOARD OF DIRECTORS | |

| Robert Kelly Doherty | |

|

Age: 65

Director since: 2015

Independent Director

Lead Independent Director since: 2022

Board Committees:

Audit, Finance and Investments, Executive |

Background Information

◾ Managing Partner and Founder, Caymen Partners, since 1999, and Caymen Advisors, 1999 to 2020.

◾ Vice Chairman, Bankers Trust Company and Bankers Trust New York Corporation, 1997 to 1998; various positions in global trading and investment operations, 1982 to 1997.

◾ Director, Harding Loevner Funds, Inc., since 2004; Lead Director and Audit Committee Member, since 2014.

◾ Director, Cyota, Inc., 2000 to 2005; Non-Executive Chairman, 2002 to 2005.

◾ Princeton University (B.A.).

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Doherty has significant investment experience in both public and private companies. He plays a key advisory role in contributing to Selective’s investment strategies, particularly in the private equity sector, and has substantial knowledge about investment products. Mr. Doherty also has significant senior management experience with a large financial services company. He is familiar with the issues that Selective’s senior management faces, including business strategy development and execution. For these reasons, the Board believes Mr. Doherty is qualified to serve as a director. |

| John J. Marchioni | |

|

Age: 54

Director since: 2019

Chairman of the Board since: 2022

Board Committees:

Executive |

Background Information

◾ President and Chief Executive Officer (“CEO”), Selective, since 2020.

◾ President and Chief Operating Officer, Selective, 2013 to 2020.

◾ Executive Vice President, Insurance Operations, Selective, 2010 to 2013.

◾ Executive Vice President, Chief Underwriting and Field Operations Officer, Selective, 2008 to 2010.

◾ Executive Vice President, Chief Field Operations Officer, Selective, 2007 to 2008.

◾ Senior Vice President, Director of Personal Lines, Selective, 2005 to 2007.

◾ Various insurance operations and government affairs positions, Selective, 1998 to 2005.

◾ Board of Trustees, The Institutes, since 2022.

◾ Director, The American Property Casualty Insurance Association, since 2020; Executive Committee Member, since January 2024.

◾ Director, Commerce and Industry Association of New Jersey, since 2015.

◾ Member of the Board of Overseers at St. John’s University School of Risk Management, Insurance and Actuarial Science, since 2021.

◾ Chartered Property Casualty Underwriter (CPCU).

◾ Princeton University (B.A.).

◾ Harvard University (Advanced Management Program).

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Marchioni became Chairman of the Board in 2022, after becoming President and CEO of Selective in 2020, having served as our President and Chief Operating Officer since 2013. As Selective’s President and CEO, he oversees all aspects of the company, where he has been employed for over 25 years. Mr. Marchioni has exhibited strong leadership, guiding Selective’s management team in executing our strategic initiatives. He has extensive knowledge of the property and casualty industry and its regulation, having begun his Selective career in government affairs. He serves on several significant industry-related boards, including the American Property Casualty Insurance Association, The Institutes, and the St. John’s University School of Risk Management. His demonstrated talents and abilities will continue to help position Selective for its next phase of growth. For these reasons, the Board believes Mr. Marchioni is qualified to serve as a director. |

Page 15

| NOMINEES OF THE BOARD OF DIRECTORS | |

| Thomas A. McCarthy | |

|

Age: 67

Director since: 2018

Independent Director

Board Committees:

Finance and Investments, Risk, Executive |

Background Information

◾ Executive Vice President and Chief Financial Officer, Cigna, 2013 to 2017; Vice President, Finance, 2011 to 2013; Acting Chief Financial Officer, 2010 to 2011; Vice President and Treasurer, 2008 to 2010; and Vice President, Strategy and Corporate Development, 2003 to 2008.

◾ Director, Avenue of the Arts, since 2022.

◾ Trustee, American University of Rome, since 2018.

◾ Director, Habitat for Humanity of Montgomery & Delaware Counties, since 2017.

◾ Wharton School of the University of Pennsylvania (B.S.).

◾ Carnegie Mellon University (M.B.A.).

◾ NACD Directorship Certified®.

Other Public Company Board Service

◾ Director and Audit Committee Member, Privia Health Group, Inc. (Nasdaq: PRVA), since 2021.

Discussion of individual experience, qualifications, attributes, and skills.

Mr. McCarthy retired in 2017 after more than 30 years with Cigna, where his responsibilities included strategy and corporate development, including mergers and acquisitions, corporate risk management, corporate finance, capital management, and treasury operations. Mr. McCarthy’s significant operational experience as the chief financial officer of a Fortune 100 company and his knowledge of investments, finance, public company operations, controls, and disclosures are invaluable assets to Selective as it develops and implements its investment and growth strategies. For these reasons, the Board believes Mr. McCarthy is qualified to serve as a director. |

| Stephen C. Mills | |

|

Age: 64

Director since: 2020

Independent Director

Board Committees:

Compensation and Human Capital, Corporate Governance and Nominating, Finance and Investments |

Background Information

◾ President and General Manager, New York Knicks, 2013 to 2020.

◾ Founding Partner and Chief Executive Officer, Athletes & Entertainers Wealth Management, LLC, 2010 to 2013.

◾ President and Chief Operating Officer, MSG Sports, and previously Executive Vice President, Franchise Operations, New York Knicks, Madison Square Garden, 2000 to 2009.

◾ Member, Board of Trustees and Audit Committee, Ariel Investments, since 2015.

◾ Director, Madison Square Garden Networks, 2020 to 2021.

◾ Director, Ladies Professional Golf Association, since 2023.

◾ Director, Harlem Junior Tennis, 2017 to 2022.

◾ Member, Board of Advisors, Hospital for Special Surgery, since 2011.

◾ Director, Princeton University Varsity Club, since 2010.

◾ Princeton University (B.A.).

Other Public Company Board Service

◾ Director, Madison Square Garden Sports Corp. (NYSE: MSGS), since 2020.

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Mills has extensive general management, marketing, brand communication, and human capital experience after three decades in senior positions with Madison Square Garden Sports, the New York Knicks, the National Basketball Association, and his own sports agency. As an investment fiduciary on the Mutual Fund Board of Trustees of Ariel Investments, he can contribute insights to our investment strategies. Mr. Mills has been active with several prominent charities, and these experiences and his knowledge of media-intensive public companies furthers our marketing and sustainability strategies. He is very knowledgeable on sustainability and DE&I issues. For these reasons, the Board believes Mr. Mills is qualified to serve as a director. |

Page 16

| NOMINEES OF THE BOARD OF DIRECTORS | |

| H. Elizabeth Mitchell | |

|

Age: 62

Director since: 2018

Independent Director

Board Committees:

Audit, Risk, Executive |

Background Information

◾ President, CEO and Director, Renaissance Reinsurance U.S. Inc., 2015 to 2016.

◾ President, Platinum Underwriters Reinsurance, Inc., 2005 to 2015; Chief Executive Officer, 2007 to 2015; Chief Operating Officer and Executive Vice President, 2004 to 2005; Executive Vice President, 2002 to 2004; Director, 2002 to 2015.

◾ Executive Vice President, St. Paul Reinsurance, Inc., 1998 to 2002; Senior Vice President, 1998; Vice President, 1993 to 1998.

◾ Advisor, Hudson Structured Capital Management Ltd., since 2018.

◾ Director, StanCorp Financial Group, Inc., 2017 to 2022.

◾ Chairperson, Weston Insurance Holdings, 2020 to 2022.

◾ Board of Overseers, St. John’s University School of Risk Management, Insurance and Actuarial Science, 2007 to 2016.

◾ Trustee, The Institutes, 2010 to 2016.

◾ Board Member, Reinsurance Association of America, 2002 to 2007; 2014 to 2016.

◾ Board Member, Broker and Reinsurance Market Association, 2002 to 2016; Chair of the Board, 2007 to 2008; Vice Chair, 2006 to 2007; Executive Committee, 2006 to 2010.

◾ Fellow of the Casualty Actuarial Society.

◾ Member, American Academy of Actuaries.

◾ Member, Association of Professional Insurance Women.

◾ College of the Holy Cross (B.A.).

◾ NACD Directorship Certified®.

◾ CERT Certificate in Cybersecurity Oversight.

Other Public Company Board Service

◾ Director and Audit Committee Member, Principal Financial Group (Nasdaq: PFG), since 2022.

Discussion of individual experience, qualifications, attributes, and skills.

Ms. Mitchell is an experienced insurance industry executive with a proven record of accomplishment leading an organization with sustained profitability. In addition to her extensive senior management experience in the property and casualty insurance and reinsurance industries, Ms. Mitchell is an actuary and very knowledgeable about risk, actuarial science, insurance operations, mergers and acquisitions, and operational reorganization matters. For these reasons, the Board believes Ms. Mitchell is qualified to serve as a director. |

Page 17

| NOMINEES OF THE BOARD OF DIRECTORS | |

| Cynthia S. Nicholson | |

|

Age: 60

Director since: 2009

Independent Director

Board Committees:

Compensation and Human Capital, Corporate Governance and Nominating, Executive |

Background Information

◾ Band of Sisters, LLC, Managing Member, since 2021.

◾ Advisor, Yext, Inc., since 2019.

◾ Advisor, Tangelo (formerly known as Tangerine/Feed Each Other/Forkcast), since 2018; Chief Marketing Officer, 2017 to 2018; Chief Operating Officer, 2015 to 2017.

◾ Chief Marketing Officer, Softcard®, 2013 to 2015.

◾ Executive Vice President and Chief Marketing Officer, Equinox Holdings, Inc., 2010 to 2012.

◾ Advisor, GamesThatGive, Inc., 2010 to 2011; Principal Strategist and Director, 2009 to 2010.

◾ Senior Vice President and Chief Marketing Officer, Pepsi-Cola North America, a division of PepsiCo, Inc., 2005 to 2008.

◾ Member of Advisory Board, Lavit, LLC, since 2017.

◾ Director, Heartland Consumer Products Investments Holdings, LLC, 2016 to 2018.

◾ Director, Association of National Advertisers, 2006 to 2008.

◾ University of Illinois (B.S.).

◾ Kelley School of Business, Indiana University (M.B.A.).

Discussion of individual experience, qualifications, attributes, and skills.

Ms. Nicholson is a marketing expert with over 30 years of experience in several consumer-focused industries. She was chief marketing officer at Equinox Holdings, Inc. and Pepsi-Cola North America. Ms. Nicholson has extensive experience with building brands, developing advertising messaging, buying media, and developing and implementing strategies for promotions, innovation, digital and social media, and direct marketing. Her strong consumer marketing and branding experience benefits our efforts to expand our brand with distribution partners, businesses, and consumers in property and casualty insurance markets. Ms. Nicholson’s marketing experience includes developing messaging related to diversity and culture building. She is a Managing Member of Band of Sisters, LLC, which assists corporate leaders in leveraging diversity to build inclusive cultures. This experience and knowledge will help inform Selective’s DE&I initiatives. For these reasons, the Board believes Ms. Nicholson is qualified to serve as a director. |

| John S. Scheid | |

|

Age: 68

Director since: 2014

Independent Director

Board Committees:

Audit, Risk, Executive |

Background Information

◾ Owner and sole member, Scheid Investment Group, LLC, since 2013.

◾ PricewaterhouseCoopers LLP, Senior Partner, 2009 to 2013; Global Insurance Assurance Practice Leader, 2001 to 2009; Chairman, Americas Insurance Practice, 2001 to 2010; U.S. Insurance Practice Leader, 1995 to 2001; Midwest Region Financial Services Leader, 1991 to 1995; Partner, 1988 to 1991; other positions, 1977 to 1988.

◾ Director, Extraordinary Re Holdings LTD and Extraordinary Reinsurance Bermuda, 2018 to 2022.

◾ Director, Groupware Technologies Holdings, Inc., since 2021.

◾ Director, Catholic Relief Services, since 2021; Audit and Risk Committee Chair, since 2020.

◾ Director, Sprecher Brewing Company, since 2022.

◾ Director, Dynamis Software Corporation, 2014 to 2018.

◾ Director, Messmer Catholic Schools, 2013 to 2021; Chairman, 2016 to 2021.

◾ Member, Finance Council for the Archdiocese of Milwaukee, since 2016; Chairman since 2023.

◾ Chairman, Accounting Examining Board, State of Wisconsin, 2013 to 2019.

◾ Member, Golden Angels Investment Group, since 2013.

◾ Director, University of Wisconsin-Milwaukee Foundation, 2002 to 2011; Emeritus Director, since 2011.

◾ Investment Committee Member, Marquette University High School, since 2011.

|

Page 18

|

|

◾ Member, Board of Governors, Junior Achievement Worldwide, 2004 to 2019; Audit Committee Chair, 2004 to 2019.

◾ Certified Public Accountant (Wisconsin).

◾ University of Notre Dame (B.B.A.).

◾ NACD Directorship Certified®.

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Scheid retired after 36 years at PricewaterhouseCoopers LLP, most recently serving as a senior partner, primarily in the insurance and asset management industries. He has extensive experience in finance and insurance, financial management, public company governance and disclosure, corporate transactions, strategic leadership, succession planning, and cybersecurity. For these reasons, the Board believes Mr. Scheid is qualified to serve as a director. |

| Philip H. Urban | |

|

Age: 71

Director since: 2014

Independent Director

Board Committees:

Audit, Compensation and Human Capital, Executive |

Background Information

◾ President and Chief Executive Officer, Grange Insurance, 1999 to 2010.

◾ President, Personal Lines, Guaranty National Insurance Company, 1996 to 1999.

◾ Senior Vice President, Great American Insurance Company, 1990 to 1996.

◾ Chairman, Integrity Insurance, 2002 to 2010.

◾ Chairman, The Grange Bank, 1999 to 2007.

◾ Director, The Jeffrey Company, since 2005; Lead Director, since May 2023; Member, Audit and Risk Committee, since 2005; Member, Management Oversight and Compensation Committee, since 2021 and Chair, since May 2023.

◾ Miami University of Ohio (B.A.).

◾ Ohio State University (M.B.A.).

Discussion of individual experience, qualifications, attributes, and skills.

Mr. Urban has a wealth of property and casualty insurance experience, both as a senior executive and board member. He has first-hand knowledge of the independent agent distribution channel, geographic market expansion, insurance products, and technology, which he uses to contribute to Selective’s strategic direction. For these reasons, the Board believes Mr. Urban is qualified to serve as a director. |

Board Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

Page 19

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

Security Ownership of Management and the Board

The following table shows, as of February 20, 2024:

| ◾ | The number of shares of Selective common stock beneficially owned by each director, director nominee, and the named executive officers; and |

| ◾ | The number of shares of Selective common stock beneficially owned by our directors and executive officers as a group. |

None of the directors, director nominees, or named executive officers held any stock options exercisable or any restricted stock units that vest within 60 days of February 20, 2024. Except as indicated by footnote, the persons named below have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to community property laws where applicable. Unless otherwise indicated, the business address of each individual is Selective Insurance Group, Inc., 40 Wantage Avenue, Branchville, New Jersey 07890.

| Name of Beneficial Owner | Total Shares of Common Stock Beneficially Owned(1) |

Percent of Class |

| Aijala, Ainar D., Jr. | 4,445 | * |

| Bacus, Lisa Rojas | 3,328 | * |

| Cavanaugh, Terrence W. | 16,464 | * |

| Coaxum, Wole C. | 4,679 | * |

| Doherty, Robert Kelly | 21,515 | * |

| Hall, Brenda M. | 13,137 | * |

| Harnett, Anthony D. | 17,100 | * |

| Lanza, Michael H. | 28,761 | * |

| Marchioni, John J. | 133,997(2) | * |

| McCarthy, Thomas A. | 15,203 | * |

| Mills, Stephen C. | 3,328 | * |

| Mitchell, H. Elizabeth | 11,692 | * |

| Nicholson, Cynthia S. | 16,753 | * |

| Scheid, John S. | 26,928 | * |

| Senia, Vincent M. | 11,528 | * |

| Thebault, J. Brian | 52,583(3) | * |

| Urban, Philip H. | 26,575 | * |

| Wilcox, Mark A.(4) | 41,969 | * |

| All directors and executive officers, as a group (21 persons) | 541,290 | 1% |

* Less than 1% of the common stock outstanding.

(1) No directors or executive officers hold Selective common stock in margin accounts or have Selective common stock pledged for a loan or stock purchase.

(2) Includes 133,997 shares held in a trust.

(3) Mr. Thebault is not standing for reelection at the Annual Meeting and therefore will no longer serve on the Board following the Annual Meeting.

(4) Mr. Wilcox served as Chief Financial Officer until his resignation effective November 3, 2023.

Page 20

Security Ownership of Certain Beneficial Owners

The following table lists the only persons or groups known to Selective to be the beneficial owners of more than 5% of any class of Selective’s voting securities based on Schedules 13G and amendments thereto filed by the beneficial owners with the SEC.

| Title of Class | Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

| Common Stock |

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 |

7,764,200 shares of common stock(1) |

12.8% |

| Common Stock |

The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 |

6,206,485 shares of common stock(2) |

10.24% |

| Common Stock |

FMR LLC 245 Summer Street Boston, Massachusetts 02210 |

3,501,088 shares of common stock(3) |

5.778% |

(1) BlackRock, Inc. (“BlackRock”) filed an amendment to Schedule 13G with the SEC on January 23, 2024, reporting that it is deemed to be the beneficial owner of an excess of 5% of the outstanding shares of Selective common stock. BlackRock reported that, as of December 31, 2023, it had sole voting power with respect to 7,609,534 shares, shared voting power with respect to 0 shares, sole dispositive power with respect to 7,764,200 shares, and shared dispositive power with respect to 0 shares.

(2) The Vanguard Group, Inc. (“Vanguard”) filed an amendment to Schedule 13G with the SEC on February 13, 2024, reporting that it is deemed to be the beneficial owner of an excess of 5% of the outstanding shares of Selective common stock. Vanguard reported that, as of December 29, 2023, it had sole voting power with respect to 0 shares, shared voting power with respect to 111,200 shares, sole dispositive power with respect to 6,030,816 shares, and shared dispositive power with respect to 175,669 shares.

(3) FMR LLC (“Fidelity”) filed a Schedule 13G with the SEC on February 9, 2024, reporting that it is deemed to be the beneficial owners of an excess of 5% of the outstanding shares of Selective common stock. Fidelity reported that, as of December 31, 2023, it had sole voting power with respect to 3,496,976 shares, shared voting power with respect to 0 shares, sole dispositive power with respect to 3,501,088 shares, and shared dispositive power with respect to 0 shares.

Page 21

EXECUTIVE OFFICERS

The names of our executive officers and their ages, positions, and biographies are set forth below. Our executive officers are appointed by and serve at the discretion of our Board.

| EXECUTIVE OFFICERS | |

| John J. Marchioni | |

| President and Chief Executive Officer |

Background Information

◾ For information regarding Mr. Marchioni, please see the section entitled, “Information about Proposal 1 – Director Nominees” of this Proxy Statement.

|

| Joseph O. Eppers | |

|

Age: 55 Executive Vice President, Chief Investment Officer

|

Background Information

◾ Present position since 2022. ◾ Senior Vice President, Chief Investment Officer, Selective, 2015 to 2022. ◾ Director, BlackRock (Financial Institutions Group), 2013 to 2015. ◾ Senior Vice President of Investments, Endurance Services Ltd, 2005 to 2013. ◾ Purdue University (B.S. Economics). ◾ Butler University, M.B.A. ◾ Chartered Financial Analyst.

|

| Brenda M. Hall | |

Age: 53 Executive Vice President, Chief Operating Officer, Standard Lines

|

Background Information

◾ Present position since 2022. ◾ Executive Vice President, Commercial Lines Chief Operating Officer, Selective, 2019 to 2022. ◾ Senior Vice President, Chief Strategic Operations Officer, Selective, 2015 to 2019. ◾ Vice President, Director of Field Underwriting, Selective, 2008 to 2015. ◾ Certified Insurance Counselor. ◾ Certified Risk Manager. ◾ University of Mount Union (B.A.). ◾ Webster University (M.A.).

|

Page 22

| EXECUTIVE OFFICERS | |

| Anthony D. Harnett | |

Age: 51 Senior Vice President, Chief Accounting Officer and Interim Chief Financial Officer

|

Background Information

◾ Present position since November 2023. ◾ Senior Vice President and Chief Accounting Officer, Selective, 2016 to 2023. ◾ Senior Vice President, Controller, Selective, 2010 to 2016. ◾ Vice President, Controller, Selective, 2008 to 2010. ◾ Senior Accountant and various finance positions, Selective, 1999 to 2008. ◾ Previously held financial roles at Deloitte and Toys “R” Us, 1997 to 1999. ◾ Certified Public Accountant (Pennsylvania). ◾ Chartered Global Management Accountant. ◾ Albright College (B.A.). ◾ Member of American Institute of Certified Public Accountants. ◾ Member of Pennsylvania Institute of Certified Public Accountants. |

| Jeffrey F. Kamrowski | |

Age: 59 Executive Vice President, MUSIC

|

Background Information

◾ Present position since 2020. ◾ Various roles of increasing seniority in Business Services, Commercial Lines Underwriting, Excess and Surplus Lines, and Information Technology, Selective, 1988 to 2020. ◾ Hartwick College (B.S.). ◾ Columbia University (Executive Management Program). ◾ Chartered Property Casualty Underwriter (CPCU). |

| Paul Kush | |

Age: 63 Executive Vice President, Chief Claims Officer

|

Background Information

◾ Present position since 2019. ◾ Chief Claims Officer, ProSight Specialty Insurance, 2010 to 2019. ◾ Senior Vice President, Claims, and other management roles, Crum and Forster, 1982 to 2009. ◾ Duquesne University (B.S.). ◾ Wharton School of the University of Pennsylvania’s American Institute of CPCU Advanced Executive Education Program.

|

Page 23

| EXECUTIVE OFFICERS | |

| Michael H. Lanza | |

|

Age: 62 Executive Vice President, General Counsel, and Chief Compliance Officer

|

Background Information

◾ Present position since 2007. ◾ Senior Vice President and General Counsel, Selective, 2004 to 2007. ◾ Director, National Center for State Courts, since 2021. ◾ Trustee, Newton Medical Center Foundation, since 2014. ◾ Member, Warren E. Burger Society of the National Center for State Courts. ◾ Member, Society of Corporate Secretaries and Corporate Governance Professionals. ◾ Member, National Investor Relations Institute. ◾ University of Connecticut (B.A.). ◾ University of Connecticut School of Law (J.D.).

|

| Vincent M. Senia | |

|

Age: 60 Executive Vice President, Chief Actuary

|

Background Information

◾ Present position since 2017. ◾ Senior Vice President, Actuarial Reserving, Selective, 2010 to 2017. ◾ Vice President and Chief Reserving Actuary, Munich Re America, 2003 to 2010; various actuarial management positions, 2001 to 2003. ◾ Fellow of the Casualty Actuarial Society. ◾ Member, American Academy of Actuaries. ◾ New Jersey Institute of Technology (B.S.).

|

Page 24

TRANSACTIONS WITH RELATED PERSONS

Review, Approval, or Ratification of Transactions with Related Persons

Selective has a written Related Person Transactions Policy and Procedures (the “Related Person Policy”). The Related Person Policy defines “Related Person Transactions” as any transaction, arrangement, or relationship in which Selective or any of its subsidiaries was, is, or will be a participant and the amount involved exceeds $20,000, and in which any “Related Person” had, has, or will have a direct or indirect interest. A “Related Person” under the Related Person Policy is generally: (i) any director, executive officer, or nominee to become director of Selective or an immediate family member of any such person; (ii) a beneficial owner of more than 5% of Selective’s common stock or an immediate family member of any such beneficial owner; and (iii) any firm, corporation, or other entity in which any person included in (i) or (ii) is employed or is a general partner or principal or in a similar position or in which such person is a 5% or greater beneficial owner.

Under the Related Person Policy, the Audit Committee (or Chairperson of the Audit Committee if between meetings) must approve Related Person Transactions. In its review, the Audit Committee considers all available relevant facts and circumstances of the proposed transaction, including (i) the benefits to Selective, (ii) the impact on a director’s independence, (iii) the availability of other sources for comparable products and services, (iv) the terms of the transaction, and (v) the terms available to unrelated third parties or employees generally. No Audit Committee member may participate in any review, consideration, or approval of any Related Person Transaction in which such director or any of their immediate family members is the Related Person. The Audit Committee only approves Related Person Transactions that it considers are in, or not inconsistent with, the best interests of Selective and its stockholders.

William M. Rue

William M. Rue served as a director on the Board until May 3, 2023. Mr. Rue owns more than 10% of the equity, of Rue Holding Company, which owns 100% of Chas. E. Rue & Son, Inc., t/a Rue Insurance, a general independent retail insurance agency (“Rue Insurance”). Rue Insurance has been appointed as a distribution partner of Selective’s insurance subsidiaries since 1928, on terms and conditions similar to those of the other distribution partners of Selective’s insurance subsidiaries and includes the right to: (i) receive commissions for policies placed; and (ii) participate in the Amended and Restated Selective Insurance Group, Inc. Stock Purchase Plan for Independent Insurance Agencies (2010), Amended and Restated as of February 1, 2017. Mr. Rue has two children who are employed by Rue Insurance: a daughter, who owns less than 10% of the equity of Rue Holding Company; and a son, who serves as president of Rue Insurance and owns more than 10% of the equity of Rue Holding Company.

In 2023, Rue Insurance placed insurance policies for its customers and itself with Selective’s insurance subsidiaries and was paid standard market commissions, including supplemental commissions, of $2.9 million on direct premiums written of $15.7 million. All contracts and transactions with Rue Insurance were consummated in the ordinary course of business on an arm’s-length basis.

The Selective Insurance Group Foundation

In 2005, we established a private foundation, now named The Selective Insurance Group Foundation (the “Foundation”), under Section 501(c)(3) of the Internal Revenue Code of 1986, as amended (the “Code”). The board of directors of the Foundation is comprised of some of the officers of Selective and its insurance subsidiaries. We did not make any contributions to the Foundation in 2023. We contributed $0.3 million in 2022 and $1.3 million in 2021.

BlackRock

BlackRock, a leading publicly traded investment management firm, has purchased our common shares in the ordinary course of its investment business and has previously filed Schedules 13G/A with the SEC. On January 23, 2024, BlackRock filed a Schedule 13G/A reporting beneficial ownership, as of December 31, 2023, of 12.8% of our outstanding common stock. In connection with purchasing our common shares, BlackRock filed the necessary filings with insurance regulatory authorities. On the basis of those filings, BlackRock is deemed not to be a controlling person for the purposes of applicable insurance law.

Page 25

We are required to disclose related-party information for our transactions with BlackRock. BlackRock is highly regulated, serves its clients as a fiduciary, and has a diverse platform of active (alpha) and index (beta) investment strategies across asset classes that enables it to tailor investment outcomes and asset allocation solutions for clients. BlackRock also offers the BlackRock Solutions® investment and risk management technology platform, Aladdin®, risk analytics, advisory, and technology services and solutions to a broad base of institutional and wealth management investors. We incurred expenses related to BlackRock for services rendered of $2.1 million in 2023.

As part of our overall investment diversification, we invest in various BlackRock funds from time to time. These funds accounted for less than 1% of our invested assets, at December 31, 2023. During 2023, with regard to BlackRock funds, we (i) purchased $7.9 million in securities, (ii) sold $2.8 million in securities, (iii) recognized net realized and unrealized gains of $1.7 million, and (iv) recorded $2.5 million in income.

Our pension plan’s investment portfolio contained investments in BlackRock funds of $114.2 million, at December 31, 2023. During 2023, with regard to BlackRock funds, our pension plan (i) purchased $19.9 million in securities, (ii) sold $35.1 million in securities, and (iii) recorded net investment income of $9.3 million. In addition, our employee deferred compensation plan and defined contribution plan may offer our employees the option to invest in various BlackRock funds. All contracts and transactions with BlackRock were consummated in the ordinary course of business on an arm’s-length basis.

Vanguard

Vanguard, one of the world’s largest investment management companies, has purchased our common shares in the ordinary course of its investment business and has previously filed Schedules 13G/A with the SEC. Vanguard offers low-cost mutual funds and exchange-traded funds, as well as other investment-related services. On February 13, 2024, Vanguard filed a Schedule 13G/A reporting beneficial ownership of 10.24% of our common stock as of December 29, 2023. In connection with purchasing our common shares, Vanguard filed the necessary filings with insurance regulatory authorities. On the basis of those filings, we do not expect Vanguard to be deemed a controlling person for the purposes of applicable insurance law.

As part of our overall investment diversification, we may invest in various Vanguard funds from time to time. These funds accounted for less than 1% of our invested assets, at December 31, 2023. During 2023, with regard to Vanguard funds, we (i) purchased $0.5 million in securities, (ii) sold $32.9 million, (iii) recognized net realized and unrealized gains of $0.1 million, and (iv) recorded $0.7 million in income. Our deferred compensation plan offers our employees investment options based on the notional value of various Vanguard funds. Our defined contribution plan offers our employees the option to invest in a Vanguard fund. All transactions with Vanguard are consummated in the ordinary course of business on an arm’s-length basis.

Fidelity

Fidelity, one of the world’s largest investment management companies, has purchased our common shares in the ordinary course of its investment business and filed a Schedule 13G with the SEC. Fidelity provides diversified, financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. On February 9, 2024, Fidelity filed a Schedule 13G reporting beneficial ownership of 5.778% of our common stock as of December 31, 2023.

As part of our overall investment diversification, we may invest in various Fidelity funds from time to time. These funds accounted for less than 0.1% of our invested assets at December 31, 2023. During 2023, with regard to Fidelity funds, we (i) purchased $34 thousand in securities, (ii) sold $1.3 million in securities, (iii) recognized no net realized and unrealized losses or gains, and (iv) recorded $34 thousand in income. One of the notional investment options under our deferred compensation plan is based on the notional value of a Fidelity fund.

Director Independence

Our securities are listed on Nasdaq, and we use the standards of “independence” prescribed by rules set forth by Nasdaq. Under Nasdaq rules, a majority of a listed company’s board of directors must be comprised of independent directors. Under Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out a director’s responsibilities. Our Board has determined that all current

Page 26

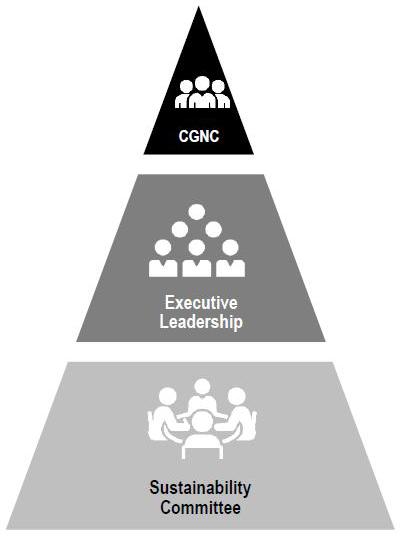

directors and director nominees1 are independent under applicable Nasdaq and SEC rules and regulations – except our CEO, Mr. Marchioni. In making its determination, the Board considered disclosures each director made related to various transactions, relationships, or arrangements involving Selective. Disclosures by the following three directors required analysis: