UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | Annual Report Pursuant under Section 13 or 15(d) of the Securities Act of 1934. |

For the year ended December 31, 2019

☐ Transition report under section 13 or 15(d) of the Securities Act of 1934.

For the Transition period from _______ to ________.

Commission File Number: 1-9927

ADVANZEON SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 95-2594724 | |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

2901 W. Busch Blvd. Suite 701 Tampa, FL |

33618 | |

| (Address of Principal Executive Offices) | (Zip Code) |

813-517-8484

(Registrant’s telephone number including area code)

Securities to be registered pursuant to Section 12(b) of the Exchange Act:

Securities registered or to be registered pursuant to Section 12(g) of the Exchange Act:

(Title of class)

Common Stock, Par Value $0.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to section 13 or Section 15 (d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(s) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $12,735,287. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purposes.

The number of shares of the registrant’s common stock outstanding on April 9, 2020 was 71,661,656.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| 1 |

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995: Certain information included in this Annual Report on Form 10-K and in our other reports, Securities and Exchange Commission (“SEC”) filings, statements, and presentations is forward looking within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, our anticipated operating results, financial resources, increases in revenues, increased profitability, growth and expansion. And our ability to enter into new contracts. Such forward-looking information involves important risks and uncertainties that could significantly affect actual results and cause them to differ materially from expectations expressed herein and in our other reports, SEC filings, statements, and presentations. These risks and uncertainties include, among others, changes in local, regional, and national economic and political conditions, the effect of governmental regulation, competitive market conditions, varying trends in member utilization, our ability to manage our operating expenses, our ability to obtain additional financing, our ability to renegotiate or extend expiring debt instruments, and other risks detailed in Item 1A in this Annual Report.

OVERVIEW

Established in 1969, Advanzeon Solutions, Inc., (formerly Comprehensive Care Corp.) (“Advanzeon”, “we”, “Parent”, or the “Company”), through its wholly-owned subsidiary Pharmacy Value Management Solutions, Inc., (“PVMS”) and its wholly-owned subsidiaries during 2015, and partly in 2016, provided managed care services by acting as the administrator for certain administrative service agreements in the behavioral health and substance abuse fields. We primarily offered these services to commercial, Medicare, Medicaid, Children’s Health Insurance Program (“CHIP”) health plans, as well as self-insured companies. Our managed care operations consisted solely of servicing administrative service agreements. Starting in July of 2015, we implemented our comprehensive sleep apnea program, called “SleepMaster Solutions” ™. SleepMaster Solutions (“SMS”) utilizes an administrative system for the convenient identification/testing and therapy of Obstructive Sleep Apnea (“OSA”). We partnered with a national health care provider by initiating a sleep apnea wellness program whereby we screened, tested and when needed, offered a treatment programs for treating this disorder. We also contracted with a union to treat its driver members. Beginning in 2017, our only business was our SMS sleep apnea program.

| 3 |

OBSTRUCTIVE SLEEP APENA

In 2014, the Department of Transportation (“DOT”) overhauled its system such that regulations now require commercial drivers, that is drivers with a commercial driver’s license (‘CDL”) must be specifically examined with respect to whether or not they have a respiratory dysfunction which is defined to include Obstructive Sleep Apnea (“OSA”). OSA is a breathing disorder that causes the airway in a person’s throat to close during sleep for ten seconds or more. This loss of breathing function can occur as many as 400 times during the night, and those who have the disorder wake up multiple times, which can lead to exhaustion during the day. Although OSA is diagnosed across a wide demographic, there are certain factors that increase the risk of a person developing this disorder:

| · | Obesity | |

| · | Smoking and drinking alcohol | |

| · | Family history | |

| · | Small airway | |

| · | Recessed chin, large overbite | |

| · | Ethnicity |

The troubling aspect of OSA as it relates to CDL drivers is that it causes intense fatigue often causing a driver to struggle with focusing and remaining alert while driving. Sleep apnea is one of the major contributing factors in truck accidents.

SOURCES OF REVENUE

For the years ended December 31, 2019 and 2018, all of our revenue was earned from our sleep apnea business.

OUR BUSINESS

The Company through its wholly-owned subsidiary Pharmacy Value Management Solutions, Inc. administers and operates a medically-driven sleep apnea program branded SleepMaster Solutions™ (“SMS”). Management believes that SMS is the largest provider of these combined services in the nation. We are in all 50 states and provide a turnkey solution designed to effectively keep drivers on the road with no down time and compliant with DOT regulations, improve their health, and significantly decrease legal liability risk for the employer. We are vertically integrated, and we provide a “Program” of services that addresses all the needs of a corporate transportation system, union or other driver-related organizations. We believe we are the only company capable of providing the full range of needed services in a timely manner.

Our services start with the identification of the target population and the potential risk the client currently has. We can do this through our SMS Program, which includes the ability to screen every driver to identify if signs and symptoms of sleep apnea are present. We can then take this data and provide the employer with a list of those drivers that should be tested and the statistical likelihood of the percentage of those drivers who will test positive for obstructive sleep apnea (OSA). Together with the employer/union, SMS provides a realistic time frame, actual total cost, and process for testing all drivers who need to be tested. For those drivers testing positive for OSA, we then provide the appropriate treatment such that the driver will meet the DOT requirements and remain on the road. We monitor 365 days per year driver’s usage of the treatment device according to DOT standards and we report that usage to all stakeholders as required/permitted. We utilize mathematical algorithms to determine if the driver is predicatively meeting the annual DOT requirements for usage. Using those predictive algorithms, we reach out to those drivers to provide case management and encouragement designed to solve problems such that the driver increases usage, if necessary, and remains compliant.

| 4 |

SMS constructed its model based upon the foregoing principles. The SMS Program includes all processes attended in sleep apnea screening, testing, treatment, monitoring and overall management of commercial drivers’ as well as their employers’ needs. We have successfully established relationships with national health care clinic providers, all with certified medical examiner (“CME”) status. These clinics total almost 1,000 throughout the U.S. We also have both formal and informal relationships with employers; municipalities; a significant veteran’s group; union and non-union driving organizations; suppliers of home sleep testing equipment and a variety of OSA treatment devices; and, a national network of telemedicine sleep specialists covering all 50 states. We have an internal medical team for governance and protocol purposes and a customer service department that interfaces directly with our drivers. We also have a marketing team that regularly interfaces with our existing accounts and markets our services to potential new accounts. Our services are performed utilizing a best medical practices model and an efficient, cost-effective delivery system. We obtain the required equipment on a per order basis from a durable medical equipment distributor.

Revenue is recognized when billed, which is approximately when the testing service is performed or CPAP machine is shipped. For the fiscal year ended December 31, 2019, two contractual relationships accounted for ten percent or more of our total revenues; the U.S. Healthworks account generated $132,518 in revenue representing 44% of our total revenue and Concentra accounted for $113,223 in revenue representing 38% of the total revenue. During the year U.S. Healthworks merged into Concentra. With these accounts the patients are invoiced individually and make their own payments but are referred through Concentra and US Healthworks.

In the past, the commercial transportation industry, and industry in general, did not fully appreciate OSA as a health/liability issue. Today, more and more companies have begun to identify OSA as a major health and liability concern. Part of this realization has been occasioned by the number of successful lawsuits initiated on account of drivers accused of having accidents caused, in part, by their having OSA (sleep apnea). Several years ago, the Company identified this health problem and an industry trend toward more attention being devoted to issues involving OSA. We took steps to address what we saw as a national healthcare epidemic, and in the process, we constructed a nationwide virtual system for the screening, testing and treatment of OSA. We believe we are the only nationwide, medically-driven company that actively engages and promotes to industry a national screening, testing and treatment program targeting OSA.

The United States government has provided impetus to certain employers and unions to start paying more attention to OSA by passing legislation requiring that commercial interstate drivers (including truckers, airline pilots and railway conductors) be examined for a respiratory dysfunction (sleep apnea) as a condition of their maintaining their commercial license. That, notwithstanding, however, the challenge we faced, and continue to face, is getting employers, associations, municipalities and unions (collectively, “employers”) to fully realize the health and economic value to them for actively promoting an internal OSA program to their employees and/or members (collectively, “employees”) which consists of providing our services to their employees on an employer-paid basis – no cost to the employee. Therefore, once we have made our initial contact with an employer who is willing to pay for all or a part of our SMS services, our job is to then assist them in implementing a comprehensive OSA program and, either directly or indirectly, promoting same to their employees.

| 5 |

We have found that while many companies wholeheartedly embrace the need to address OSA from a management perspective, others, while recognizing the problem, are not yet ready to actually promote such a program, internally, from a cost perspective. They are oftentimes not willing to enter into a formal contract for our services, preferring an informal relationship whereby they agree that while they will pay for the services we rendered to their employees, they will not engage in the active promotion of the program. The result is that unless we convince the employers to make their employees aware of such coverage, the employees often remain unaware of the fact that their employer is providing them with such a benefit. It is, therefore, our responsibility, and our cost, to work with each such employer, generally through their human resources staff to provide the design and necessary materials needed to implement and monitor an effective OSA benefit program. This requires an active marketing effort on our part both before the relationship is solidified, and consistently thereafter. As a result of our limited financial resources, while we have now successfully established a significant number of these relationships, there still remains the task of continuing our marketing efforts to fully realize the economic benefit of those relationships. We are confident that our continued efforts will ultimately provide a meaningful revenue stream in tandem with the growth of our patient population.

Our Home Sleep Test (HST) Process:

After a driver has been diagnosed as at risk for OSA, the next step is for the driver to be evaluated with a Home Sleep Test ("HST”). The HST is a testing device used overnight by the driver. The device takes readings of the sleep interruptions, oxygen levels and other related data. SMS contacts the driver and coordinates where to send the Home Seep Test. The driver is advised what will come in the box and when the box will arrive. SMS then ships the test along with a return shipping box. When the test is completed, the driver places the device in the return box. The driver then calls USPS for a free pickup or drops off the box at a USPS location. The test is then returned to SMS where the test is downloaded, results evaluated by a certified sleep specialist, and a report generated. We coordinate with our supplier and provide the HST and related services to the driver for a fee.

CPAP Therapy:

Once the HST Is returned and results evaluated, the driver falls into one of two categories. If sleep apnea is ruled out, the driver and all relevant stakeholders are provided with a “Certificate of Compliance” which is used by the certified medical examiner (CME) to certify the driver’s medical card. If sleep apnea is confirmed, the driver and all relevant stakeholders are advised, and a medically correct and regulatory compliant treatment plan is recommended. This plan is most often Continuous Positive Air Pressure ("CPAP”) therapy. SMS will provide the driver with an auto-regulating CPAP machine and deliver same to the driver’s home, office, or wherever he/she prefers to receive it. The driver is instructed on how to use the CPAP machine and preferences for mask type, fitting size, etc. are customized for the driver. SMS employs staff who is skilled at walking a driver through the process. SMS also utilizes a “hotline” that a driver may call with any questions.

Monitoring:

SMS provides monitoring of drivers for compliance as required by the DOT. There are two phases of monitoring. For those drivers determined to require CPAP therapy, an initial thirty day report is required to demonstrate that the driver is using the CPAP machine at least 70% of the time. SMS not only monitors the driver, but actively intervenes with the driver to encourage compliance. SMS utilizes an algorithm based on current usage to predict if the driver will meet compliance guidelines. If our monitoring indicates the driver is not meeting guidelines, we alert them and offer suggestions and encouragement to help them meet compliance. At the conclusion of the thirty day period, SMS provides a DOT appropriate report documenting compliance performance. SMS also provides ongoing monitoring via a WIFI-based model to monitor the driver’s usage 24/365. We provide the same case management function of encouraging compliance and offering solutions to keep the driver healthy, safe, compliant and on the road.

| 6 |

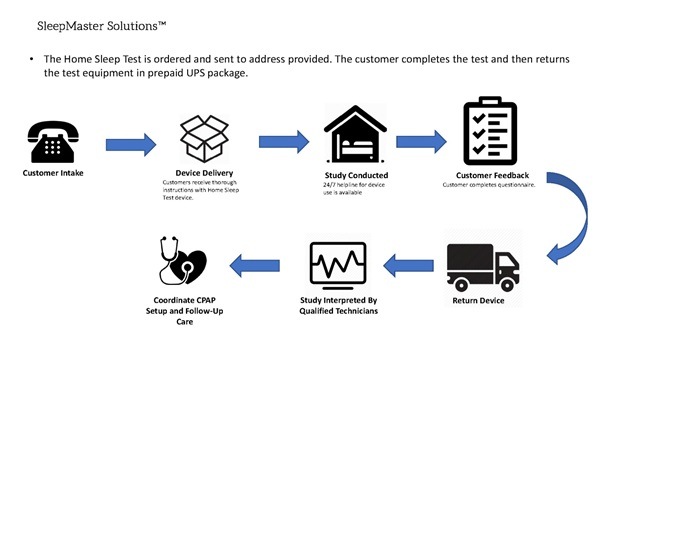

The following diagram shows how we deliver our services.

| 7 |

The Master Distributor Agreement:

During 2019, the Company entered into a supplemental agreement (the “Agreement”) with its durable medical equipment supplier (“Supplier”). The purpose of the Agreement was to provide the Company with increased back-office support in anticipation of growing business volume occurring in the latter part of 2019 and continuing into 2020. The Company’s primary concerns were that it would need (i) additional customer services reps and telephone sales personnel; (ii) additional support equipment for such expansion; (iii) additional space to house such SMS Personnel; and, (iv) an increased supply of home sleep testing and treatment equipment.

The Company’s Agreement with its Supplier provides, in material part, that Supplier would serve as the Company’s master distributor for purposes of obtaining and distributing testing and treatment equipment necessary to service the Company’s patients. In exchange for this appointment, the Supplier agreed to provide the Company, at no cost to the Company (i) sufficient dedicated space at the Supplier’s facility (“SMS Utah Facility) to accommodate at least fifteen (15) customer service and sales personnel; (ii) hire and train fifteen (15) customer service and sales personnel; and, (iii) at the Company’s request, hire and train an additional five (5) customer service and sales personnel to work offsite for the Company (collectively, “SMS Personnel”). The SMS Personnel were to be exclusively dedicated to servicing the Company’s sales and customer service needs. Compensation for all SMS Personnel at the SMS Utah Facility was the sole responsibility of Supplier.

Additionally, Supplier agreed that it would be responsible for providing SMS Personnel with appropriate local hardware, telephone system, telephones and computers. The Supplier also agreed that if additional SMS Personnel were needed, as determined in the Company’s sole discretion, the Supplier would pay 45% of the compensation costs of such additional personnel.

As compensation for the Supplier performing its contractual obligations, the Company granted the Supplier a three-year warrant to purchase one-million (1,000,000) shares of the Company’s common stock at an exercise price of $0.11 per share (the “Warrant”). The Warrant vests in equal quarterly amounts over a period of time commencing June 2019 through March 2020, provided that vesting is conditioned upon the Agreement being in full force and effect and not the subject of litigation, mediation or arbitration at the time of each vesting. The term of the Company’s Agreement with Supplier is five years, ending in June 2024 and includes a fifteen-day termination clause, with or without cause.

OUR ADVISORY BOARDS

Medical Advisory Board

Our SMS program is a medically-driven program dedicated to the concept that by attacking and containing root causes of various ailments affecting our population, we can dramatically reduce the cost of healthcare; increase workplace productivity; decrease and, in many cases, eliminate unnecessary expenses; and, provide for a healthier population, both in and out of the workplace. The primary focus of our Medical Advisory Board panel in regard to the foregoing is sleep apnea.

The Medical Advisory Board consists of 33 members at present and is composed of members with specialties and sub-specialties specifically selected so that it can address all of the various sleep-disorder breathing co-morbidities. Some of the practices represented on the Board include cardiovascular, pathology and diabetes The Board meets at least twice a year, and more often as needed. Management consults with individual members on an as needed basis. The Medical Advisory Board furthers the SMS program mission to perform its services utilizing a best medical practices model and an efficient, cost-effective delivery system.

| 8 |

Dental Advisory Board

The Dental Advisory Board meets jointly with the Medicinal Advisory Board. With the expansion of dental practice into the areas of detection and treatment of OSA the Board advises management on advances and new solutions for the treatment of OSA. It presently has three members.

MARKETING AND SALES

Our marketing and sales efforts are led by our management. In addition, we utilized independent sales agents for direct sales to commercial, CHIP health plans, health care providers as well as self-insured companies and unions. We enter into written agreements with these sales agents whereby we pay a base amount of compensation plus a commission amount. In September,2019, we hired a national manager of sales and marketing. In December 2019, we hired a chief marketing officer. We currently have five such agents. Our customer service operations and telemarketing efforts are handles by independent contractors. We pay these contractors a set amount of compensation. We currently have seven such contractors.

COMPETITION

We operate in a very competitive but highly fractured health care environment. There are traditional sleep test centers that have operated for a long time and are well established. The services provide by such centers are most often covered by insurance. Our services are not generally covered by insurance as we are not presently credentialed to be able to accept insurance. Once a person has been diagnosed with OSA there are a number of ways that equipment may be obtained. Again, insurance may cover the purchase of such equipment. Equipment for the treatment of OSA is readily obtainable from many sources including the internet. In addition, there are a number of devices advertised that claim to treat OSA without the need for CPAP equipment. We believe that our SMS Program is the only medically driven comprehensive program that provides the customer/employer with a turnkey solution from initial screening through testing, when required, treatment and ongoing compliance monitoring.

GOVERNMENT REGULATION

We are subject to the requirements of the Health Insurance Portability and Accountability Act of 1996, as amended (“HIPAA”). One of the purposes of HIPAA is to improve the efficiency and effectiveness of the healthcare system through standardization of the electronic data interchange of certain administrative and financial transactions and, also, to protect the security and privacy of protected health information. Entities subject to HIPAA include some healthcare providers and all healthcare plans.

MANAGEMENT INFORMATION SYSTEMS

All of our OSA information technology and systems operate on a single platform. This approach avoids the costs associated with maintaining multiple systems and improves productivity. The open architecture of the systems gives us the ability to transfer data from other systems thereby facilitating the integration of new health plan business. We use our information system for customer processing, utilization management, reporting, cost trending, planning, and analysis. The system also supports customer and provider service functions.

| 9 |

We significantly enhanced our network by installing a storage area network and virtualizing our computer servers. This implementation brought in the current best practices approach and permitted a major overhaul of our information technology infrastructure. The technology centralizes storage management, increases the utilization of equipment, improves redundancy of the servers, reduces the overall hardware requirements, and facilitates growth, while driving down the total cost of ownership.

ADMINISTRATION AND EMPLOYEES

Our executive and administrative offices are located in Tampa, Florida, where we maintain operations, business development, accounting, reporting and information systems, and provider and customer service functions. As of December 31, 2019, we employed two people and contracted for ten others.

AVAILABLE INFORMATION

Our investors’ website can be found at www.advanzeonshareholders.com. We make available free of charge, through a link to the SEC internet site, our annual, quarterly, and current reports, and any amendments to these reports, as well as any beneficial ownership reports of officers and directors filed electronically on Forms 3, 4, and 5. Information contained on our website or linked through our website is not part of this Annual Report on Form 10-K. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

Our Board of Directors has two committees, an audit committee and a compensation and stock option committee. Each of these committees has a formal charter which was filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2009. Any references to our stockholder website and the SEC’s website above are intended to be inactive textual references only, and the contents of those Web sites are not incorporated by reference herein.

In addition, you may request a copy of the foregoing charters at no cost by writing us at the following address or telephoning us at the following telephone number:

Advanzeon Solutions, Inc.

P.O. Box 271485

Tampa, FL 33688

Attention: Investor Relations

Tel: (813) 517-8484

| 10 |

You should carefully consider and evaluate all of the information in this Annual Report on Form 10-K, including the risk factors listed below. Risks and uncertainties in addition to those we describe below, that may not be presently known to us, or that we currently believe are immaterial, may also harm our business and operations in the future. If any of these risks occur, our business, and its future financial condition, results of operations and cash flows could be harmed, the price of shares of our common stock could decline, and future events and circumstances could differ significantly from those expected that are set forth in or underlie the forward-looking statements contained in this report.

Dependence on our Chief Executive Officer

We are dependent on the services of Mr. Clark A. Marcus, our Chief Executive Officer. The loss of his services would have a materially adverse effect on the performance and growth of our business for some period of time. We do not have any “Key Man” insurance for Mr. Marcus.

Our inability to renew, extend or replace expiring or terminated contracts in the near term could adversely affect our liquidity, profitability and financial condition.

Many of the contracts we service could be terminated immediately either for cause or without cause by the client upon notice of a specified time (typically between 30 and 60 days). The loss of one of these contracts could materially reduce our net revenue and have a material adverse effect on our liquidity, profitability and financial condition.

A compromise of our information systems or unauthorized access to confidential information or our customers personal information could materially harm our business and/or our reputation.

An effective and secure information system, available at all times, is vital to our individual and corporate customers. We collect and store confidential medical and personal from our customers. Certain of the information we collect is Personnel Health Information as that term is defined under HIPPA. We depend on our computer systems for significant service and management functions, such as providing membership monitoring, utilization, processing customer information, and providing regulatory data and other client and managerial reports. Although our computer and communications hardware is protected by physical and software safeguards and other internal controls, it is still vulnerable to computer hacking which if successful, could cause such information to be misappropriated. We could be subject to liability for failure to comply with HIPPA or other privacy laws. Any compromise of our systems or data could disrupt our operations, damage our reputation, and expose us to claims from customers. This could have an adverse effect on our business, financial condition and results of operations. We do not have 100% redundancy for all of our computer operations.

We are subject to intense competition that may prevent us from gaining new customers or pricing our contracts at levels sufficient to achieve gross margins to ensure profitability.

We are continually pursuing new business. Many of our competitors are significantly larger and better capitalized than we are. Our smaller size and weak financial condition have been a deterrent to some prospective customers. One of the general ways in which testing is presently done for OSA is a “sleep center”. These facilities are able to accept insurance. We are not presently credentialed to accept insurance. As a result, we may not be able to successfully compete in our industry in some respects.

| 11 |

Failure to adequately comply with HIPAA may result in penalties.

Our industry is subject to the security and privacy requirements of HIPAA relative to patients’ health information. Although we believe we are fully compliant with all HIPAA regulations, any assertions of lack of compliance with HIPAA regulations could result in penalties and have a material adverse effect on our ability to retain our customers or to gain new business.

We may require additional funding, and we cannot guarantee that we will find adequate sources of capital at acceptable terms in the future.

Our available revenue from operations is not currently sufficient to fund our business. If we are unable to increase our revenue from operations, we may need to seek new financing, possibly in the form of additional debt or equity (which could dilute current stockholders’ ownership interests). We cannot provide assurance that such additional funding will be available on acceptable terms.

Risks related to our common and preferred stock.

Our Series C Convertible Preferred stockholders have significant rights and preferences over the holders of our common stock and may be deemed to operate as an anti-takeover device.

Our Series C Convertible Preferred stockholders are entitled to receive dividends when declared by our Board of Directors before dividends are paid on our common stock and also have a claim against our assets senior to the claim of the holders of our common stock in the event of our liquidation, dissolution or winding-up. The aggregate amount of that senior claim is currently $2,608,500. In addition, each Series C Convertible Preferred stockholder is entitled to vote together with the holders of our common stock on an “as converted” basis, and, voting together as a separate class, all holders have the right to elect five of our nine directors to our Board of Directors. The holders by their ability to control a majority of our Directors may be deemed to be an anti-takeover device.

The holders of our Series C Convertible Preferred Stock have other rights and preferences as detailed elsewhere in this report. These rights and preferences could adversely affect our ability to finance future operations, satisfy capital needs or engage in other business activities that may be in our interest.

Our Series D Convertible Preferred stockholders have significant rights and preferences over the holders of our common stock and may be deemed to operate as an anti-takeover device.

We also have a class of convertible preferred stock, Series D, for which 7,000 shares are authorized and 250 shares have been issued. On August 26, 2019, the Board of Directors changed the vesting date of the Series D from January 4, 2022, to August 27, 2019. Each share is convertible into 100,000 shares of common stock. Prior to conversion, each Series D convertible preferred share is entitled to all voting, dividend, liquidation and other rights accorded a share of Series D convertible preferred stock. If a dividend is declared on the common stock, each share of Series D stock is entitled to receive a dividend equal to 50% of the dividend declared for the common stock as if the Series D stock had been converted. Despite their nonvested status, voting rights of each share nevertheless consist of the right to cast the number of votes equal to those of 500,000 shares of common stock. Unless otherwise required by applicable law, holders of shares of Series D have the right to vote together with holders of common stock as a single class on all matters submitted to a vote of our stockholders. The holders by virtue of their superior voting rights may be deemed to operate as an anti-takeover device.

| 12 |

We may raise additional funds in the future through issuances of securities and such additional funding may be dilutive to stockholders or impose operational restrictions.

To fund our operations, repay our existing debt and grow our business we may raise additional capital in the future through sales of shares of our common stock or securities convertible into shares of our common stock or through debt. Such additional financing may be dilutive to our stockholders, and debt financing, if available, may involve significant interest costs and/or restrictive covenants which may limit our operating flexibility.

Applicable SEC rules governing the trading of “penny stocks” may limit the trading and liquidity of our common stock which, along with our small public capitalization may affect the trading price of our common stock and may subject us to securities litigation.

Our common stock is a “penny stock” as defined under Rule 3a51-1 of the Exchange Act and is accordingly subject to SEC rules and regulations that impose limitations upon the manner in which our common stock may be publicly traded. These regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the associated risks. Under these regulations, certain brokers who recommend such securities to persons other than established customers or certain accredited investors must make a special written suitability determination regarding such a purchaser and receive such purchaser’s written agreement to a transaction prior to sale. These regulations may have the effect of limiting the trading activity of our common stock and reducing the liquidity of an investment in our common stock. In addition, the size of our public market capitalization is relatively small, resulting in highly limited trading volume in, and high volatility in the price of, our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

We leased our Tampa corporate office and paid annual rent of $97,850 in 2019. The term of the lease is on a month to month basis. We currently lease approximately 3,133 square feet and pay approximately $8,229 per month. We consider the condition of our leased property to be average and adequate for our current needs. In our Tampa office, we maintain clinical operations, business development, accounting, financial and regulatory reporting and other management information symptoms information systems, and provider and member service functions. During 2019, the Company renegotiated the Tampa office lease and verbally agreed to a three-year extension of the lease with no increase in payments.

We leased our Huntington Beach office and paid annual rent of $46,800 in 2019. The term of the lease is for 1 year beginning April 18, 2018 and ending April 30, 2019 at a monthly rent of $3,700 per month. The lease has been extended on a month to month basis. We currently pay a monthly rent of $4,000. We consider the condition of our leased property to be average and adequate for our current needs.

| 13 |

Advanzeon is a party to litigation in the Circuit Court of the Thirteenth Judicial Circuit in and for Hillsborough County, Florida, Case No. 12-CA-2570, arising from an alleged breach of a Term Sheet. On March 8, 2017 the Court determined that Advanzeon breached the Term Sheet and entered a Final Judgment in the amount of $866,052 bearing interest at the statutory rate. In February 2018, a final judgment awarding attorney’s in the amount of $167,960 was entered in favor of the Plaintiff, Katzman. In June 2018, as part of the execution of judgment process, in a motion for proceedings supplementary, pursuant to agreement of the parties the court entered an order appointing a special master to review the financial condition of Advanzeon to determine if the foregoing judgment could be paid and if so from what assets. Advanzeon has objected to paying the Final Judgment amount and the Parties have been ordered to Mediation to take place in 2020.

The Company has filed a claim for money it maintains is owed by Universal Health Care Insurance Company. In re: The Receivership of Universal Health Care Insurance Company. Case number 2013-CA-00358 and Case number 2013-CA-00375 in the Second Judicial Circuit Court, Leon County, FL. The objection to the claim by the receivership was heard April 4, 2018 and on May 15, 2018 the court entered an Order awarding Company $139,344 and $130,406, representing a portion of monies claimed by the Company owed it by Universal. The Company agrees it is owed the $269,750.10 and filed for a rehearing as to that portion of the Order specific to the additional monies owed to it. The rehearing was denied. On July 20, 2018 Company filed an appeal with the First District Court of Appeals with respect the denial by the court. The Company filed the appeal from the court denial of the additional monies owed to the Company by Universal Health Care Insurance Company. The additional monies the Company believes are owed to it are in excess of $900,000, but less than $1,000,000.

In Michael Ross et. al v. Advanzeon Solutions, Inc., Plaintiff is suing the Company for money it claims is owed pursuant to a promissory note. Plaintiff has not proceeded with any action and maybe subject to a motion to dismiss for failure to prosecute. If any further action is taken by the Plaintiff the Company will file a motion for summary judgment. Case Number 16-CA-005737, Thirteenth Judicial Circuit Court Hillsborough County, FL. Filed April 7, 2015. This is the third attempt by the Plaintiff on the same note. The prior two actions were dismissed. The Company will continue to vigorously defend its position.

In Advanzeon Solutions, Inc. v. Mayer Hoffman et. al., Case Number 16-CA-005737 Filed June 17, 2016 Thirteenth Judicial Circuit Court Hillsborough County, FL., the Company sued Defendants for damages for breach of audit services contract. The Judge ruled in favor of Defendants motion for summary judgment, but no judgment was entered. The Company will file for a rehearing of the summary judgment and or an appeal in the event the Court enters a judgment in favor of Defendants.

| 14 |

In a matter entitled Pharmacy Value Management Solutions, Inc. vs. Young & Son Tax and Accounting, LLC, Charles Young Sr., Charles Young Jr. and Jay Jacques, the Company sued for breach of accounting service contract, mandatory injunction, return of documents and conversion of accounting funds held in the accountants’ trust account. The case is in the initial discovery stage. Case Number 18-CA-000960 Thirteenth Judicial Circuit, Hillsborough County, FL. Filed March 31, 2018. The Company will aggressively pursue recovery of monies owed to it.

In a matter entitled Advanzeon Solutions, Inc. v. Cook Children’s Health Plan and Intervenors Cook Children’s medical center and Cook Children Physician Network, file 4/20/18 Company filed an action contesting the validity of a final foreign judgment (Texas) which judgment was filed in the records of Hillsborough County. The Company has objected to collection activities in Hillsborough County on the judgment based upon the Texas action filed by the Company contesting the judgment.

In a matter entitled Pharmacy Value Management Solutions, Inc., d/b/a SleepMaster Solutions™ vs. Kristi Staite filed 5/7/2018 Thirteenth Judicial Circuit, PVMS brought suit against Staite for damages based upon fraud in the non performance of services Ms. Staite owed to Company in reference to obtaining insurance qualification. The case is in the beginning stages of response and discovery. The Company will aggressively pursue recovery of the monies paid to Ms. Staite for services not rendered.

In a matter entitled Rotech Healthcare, Inc. vs. Pharmacy Value Management Solutions, Inc. case no. 18-CA – 4218 Thirteenth Judicial Circuit Court – Tampa, the Plaintiff is suing the Company for breach of contract and open account for money owed in the amount of $160,355 for services and supplies. Company disputes the charges were permitted under the contract and disputes the claimed amounts. Previously, the Company incorrectly reported that the matter had been settled. In fact, the Company did not execute the draft settlement agreement and the matter remains in litigation. The Company is aggressively defending against the claims asserted by Plaintiff.

In the matter Oceans Healthcare, LLC, et al, v. Comprehensive Behavior Care, Inc., et al, 19th JDC No. 59633, Div. D, the Company is aware of a claim Oceans Healthcare seeks to assert against the Company arising from services rendered by a former subsidiary. Plaintiff is attempting to serve the Company and the Company disputes service. The amount at issue is unknown at this time. In the event the Company is served at a later date, it will aggressively defend against this claim.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 15 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

| (a) | Market Information - Our common stock is traded on the OTCBB under the symbol CHCR. The following table sets forth the range of high and low bid quotations for the common stock, as reported by the OTCBB, for the fiscal quarters indicated. The market quotations reflect inter-dealer prices without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions. |

The below quotations, as determined through a query of Bloomberg LLP, reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

| High | Low | |||||||||

| Year ended December 31, 2019 | ||||||||||

| 4th quarter, ended December 31, 2019 | $ | 0.40 | $ | 0.37 | ||||||

| 3rd quarter, ended September 30, 2019 | $ | 0.42 | $ | 0.41 | ||||||

| 2nd quarter, ended June 30, 2019 | $ | 0.29 | $ | 0.26 | ||||||

| 1st quarter, ended March 31, 2019 | $ | 0.08 | $ | 0.08 | ||||||

| (b) | Holders – As of April 9, 2020, we had 412 holders of record of our common stock. |

| (c) | Dividends - We did not pay any cash dividends on our common stock during the year ended December 31, 2019 and do not contemplate the initiation of payment of any cash dividends in the foreseeable future. In the event that we do pay dividends, the holders of record of our Series C Convertible Preferred Stock and Series D Convertible Preferred Stock are entitled to receive such dividends in preference to the holders of our common stock, when and if declared by our Board of Directors. If declared, holders of our Series C Convertible Preferred Stock will receive dividends in an amount equal to the amount that would have been payable had the Series C Convertible Preferred Stock been converted into shares of our common stock immediately prior to the declaration of such dividend. Holders of our Series D Convertible Preferred Stock will receive dividends in an amount equal to 50% of the amount that would have been payable had the Series D Convertible Preferred Stock been converted into shares of our common stock. No dividends shall be authorized, declared, paid or set apart for payment on any class or series of our stock ranking, as to dividends, on a parity with or junior to the Series C Convertible Preferred Stock for any period unless full cumulative dividends have been, or contemporaneously are authorized, declared, paid or set apart in trust for such payment on the Series C Convertible Preferred Stock. In addition, as long as a majority of the 10,434 shares of our Series C Convertible Preferred Stock are outstanding, we cannot declare or pay any dividend or other distribution with respect to any equity securities without the affirmative vote of holders of at least 50% of the outstanding shares of Series C Convertible Preferred Stock. |

| 16 |

RECENT SALES OF UNREGISTERED SECURITIES

With the exception of the transactions set forth below, the sale of unregistered securities for the year ended December 31, 2019 were disclosed in our Annual Report on the December 31, 2018 Form 10-K filed on May 24, 2019.

On May 1, 2019, we issued a convertible promissory note in the principle amount of $50,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On May 8, 2019, we issued a convertible promissory note in the principle amount of $50,250 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 105,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On May 21, 2019, we issued a convertible promissory note in the principle amount of $50,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 17 |

On May 22, 2019, we issued a convertible promissory note in the principle amount of $50,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On May 22, 2019, we issued a convertible promissory note in the principle amount of $15,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 30,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On May 30, 2019, we issued a convertible promissory note in the principle amount of $50,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On May 31, 2019, we issued a convertible promissory note in the principle amount of $150,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 300,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 18 |

On June 12, 2019, we issued a convertible promissory note in the principle amount of $100,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 200,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On June 19, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On June 24, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 19 |

On June 27, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 1, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 1, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 20 |

On July 1, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 2, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 2, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 2, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 21 |

On July 2, 2019, we issued a convertible promissory note in the principle amount of $125,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 250,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 2, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 3, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 3, 2019, we issued a convertible promissory note in the principle amount of $100,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 200,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 22 |

On July 5, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 5, 2019, we issued a convertible promissory note in the principle amount of $50,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

| 23 |

On July 8, 2019, we issued a convertible promissory note in the principle amount of $25,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 50,000 shares of the Company’s common stock at an exercise price of $0.15 per share.

On July 10, 2019, we issued a convertible promissory note in the principle amount of $50,000 to an accredited investor. The interest rate was 12%. The Holder of the note has the right to convert all or a portion of the principle and any accrued interest into shares of our common stock at a per share price equal to the lesser of (i) 15% below the average daily closing price of our common stock for the immediately preceding twenty (20) business days or (ii) $0.11. The principal amount and any accrued but unpaid interest under the note shall be due and payable on the earliest to occur (i) the date which is twelve months from the effective date of the note or (ii) the receipt by the Company of payment on its account receivable owed to it by Universal Health Care, Inc. and Universal Health Care Insurance Company, which accounts receivable is currently being processed in the matter of The Receivership of Universal Health Care, Inc., a Florida corporation and The Receivership of Universal Health Care Insurance Company, Inc., a Florida corporation under case numbers 2013-CA and 2013-CA, respectively. The Company also granted to the purchaser a five-year warrant to purchase 100,000 shares of the Company’s common stock at an exercise price of $0.15 per share.