Exhibit 10.1

EXECUTION VERSION

PUBLIC SERVICE COMPANY OF NEW MEXICO

$450,000,000

$55,000,000 3.15% Senior Unsecured Notes, Series A, due May 15, 2023

$104,000,000 3.45% Senior Unsecured Notes, Series B, due May 15, 2025

$88,000,000 3.68% Senior Unsecured Notes, Series C, due May 15, 2028

$15,000,000 3.78% Senior Unsecured Notes, Series D, due August 1, 2028

$38,000,000 3.93% Senior Unsecured Notes, Series E, due May 15, 2033

$45,000,000 4.22% Senior Unsecured Notes, Series F, due May 15, 2038

$20,000,000 4.50% Senior Unsecured Notes, Series G, due May 15, 2048

$85,000,000 4.60% Senior Unsecured Notes, Series H, due August 1, 2048

______________

NOTE PURCHASE AGREEMENT

______________

Dated July 28, 2017

4231937.05.05.docx

4241709

TABLE OF CONTENTS

SECTION HEADING PAGE

SECTION 1. | AUTHORIZATION OF NOTES 1 |

SECTION 2. | SALE AND PURCHASE OF NOTES 2 |

SECTION 3. | CLOSING 2 |

SECTION 4. | CONDITIONS TO CLOSING 2 |

Section 4.1. | Representations and Warranties 3 |

Section 4.2. | Performance; No Default 3 |

Section 4.3. | Compliance Certificates 3 |

Section 4.4. | Opinions of Counsel 3 |

Section 4.5. | Purchase Permitted By Applicable Law, Etc 3 |

Section 4.6. | Sale of Other Notes 3 |

Section 4.7. | Payment of Special Counsel Fees 4 |

Section 4.8. | Private Placement Number 4 |

Section 4.9. | Changes in Corporate Structure 4 |

Section 4.10. | Funding Instructions 4 |

Section 4.11. | Regulatory Approvals 4 |

Section 4.12. | Delayed Funding Closing Condition 4 |

Section 4.13. | Proceedings and Documents 4 |

SECTION 5. | REPRESENTATIONS AND WARRANTIES OF THE COMPANY 5 |

Section 5.1. | Organization; Power and Authority 5 |

Section 5.2. | Authorization, Etc 5 |

Section 5.3. | Disclosure 5 |

Section 5.4. | Organization; Affiliates 5 |

Section 5.5. | Financial Statements; Material Liabilities 5 |

Section 5.6. | Compliance with Laws, Other Instruments, Etc 6 |

Section 5.7. | Governmental Authorizations, Etc 6 |

Section 5.8. | Litigation; Observance of Agreements, Statutes and Orders 6 |

Section 5.9. | Taxes 7 |

Section 5.10. | Title to Property; Leases 7 |

Section 5.11. | Licenses, Permits, Etc 7 |

Section 5.12. | Compliance with Employee Benefit Plans 7 |

Section 5.13. | Private Offering by the Company 8 |

Section 5.14. | Use of Proceeds; Margin Regulations 8 |

Section 5.15. | Existing Indebtedness; Future Liens 9 |

Section 5.16. | Foreign Assets Control Regulations, Etc 9 |

Section 5.17. | Status under Certain Statutes 10 |

Section 5.18. | Environmental Matters 10 |

Section 5.19. | Solvency 10 |

-i-

SECTION 6. | REPRESENTATIONS OF THE PURCHASERS 10 |

Section 6.1. | Purchase for Investment 10 |

Section 6.2. | Source of Funds 11 |

SECTION 7. | INFORMATION AS TO COMPANY 12 |

Section 7.1. | Financial and Business Information 12 |

Section 7.2. | Officer’s Certificate 15 |

Section 7.3. | Visitation 16 |

Section 7.4. | Electronic Delivery 16 |

SECTION 8. | PAYMENT AND PREPAYMENT OF THE NOTES 17 |

Section 8.1. | Maturity 17 |

Section 8.2. | Optional Prepayments with Make‑Whole Amount 17 |

Section 8.3. | Allocation of Partial Prepayments 17 |

Section 8.4. | Maturity; Surrender, Etc. 18 |

Section 8.5. | Purchase of Notes 18 |

Section 8.6. | Make‑Whole Amount 18 |

Section 8.7. | Change of Control 20 |

Section 8.8. | Payments Due on Non‑Business Days 21 |

SECTION 9. | AFFIRMATIVE COVENANTS. 21 |

Section 9.1. | Compliance with Laws 21 |

Section 9.2. | Insurance 21 |

Section 9.3. | Maintenance of Properties 21 |

Section 9.4. | Payment of Taxes and Claims 22 |

Section 9.5. | Corporate Existence, Etc 22 |

Section 9.6. | Books and Records 22 |

Section 9.7. | Guarantors 22 |

Section 9.8. | Most Favored Lender. 24 |

SECTION 10. | NEGATIVE COVENANTS. 24 |

Section 10.1. | Transactions with Affiliates 25 |

Section 10.2. | Consolidation and Merger 25 |

Section 10.3. | Sale or Lease of Assets 25 |

Section 10.4. | Line of Business 25 |

Section 10.5. | Economic Sanctions, Etc 25 |

Section 10.6. | Liens 25 |

Section 10.7. | Financial Covenant 28 |

SECTION 11. | EVENTS OF DEFAULT 28 |

SECTION 12. | REMEDIES ON DEFAULT, ETC 30 |

Section 12.1. | Acceleration 30 |

-ii-

Section 12.2. | Other Remedies 31 |

Section 12.3. | Rescission 31 |

Section 12.4. | No Waivers or Election of Remedies, Expenses, Etc 31 |

SECTION 13. | REGISTRATION; EXCHANGE; SUBSTITUTION OF NOTES 32 |

Section 13.1. | Registration of Notes 32 |

Section 13.2. | Transfer and Exchange of Notes 32 |

Section 13.3. | Replacement of Notes 32 |

SECTION 14. | PAYMENTS ON NOTES 33 |

Section 14.1. | Place of Payment 33 |

Section 14.2. | Payment by Wire Transfer 33 |

Section 14.3. | FATCA Information 33 |

SECTION 15. | EXPENSES, ETC 34 |

Section 15.1. | Transaction Expenses 34 |

Section 15.2. | Certain Taxes 34 |

Section 15.3. | Survival 35 |

SECTION 16. | SURVIVAL OF REPRESENTATIONS AND WARRANTIES; ENTIRE AGREEMENT 35 |

SECTION 17. | AMENDMENT AND WAIVER 35 |

Section 17.1. | Requirements 35 |

Section 17.2. | Solicitation of Holders of Notes 36 |

Section 17.3. | Binding Effect, Etc 36 |

Section 17.4. | Notes Held by Company, Etc 36 |

SECTION 18. | NOTICES 37 |

SECTION 19. | REPRODUCTION OF DOCUMENTS 37 |

SECTION 20. | CONFIDENTIAL INFORMATION 38 |

SECTION 21. | SUBSTITUTION OF PURCHASER 39 |

SECTION 22. | MISCELLANEOUS 39 |

Section 22.1. | Successors and Assigns 39 |

Section 22.2. | Accounting Terms 39 |

Section 22.3. | Severability 40 |

Section 22.4. | Construction, Etc 40 |

Section 22.5. | Counterparts 41 |

Section 22.6. | Regulatory Statement 41 |

Section 22.7. | Governing Law 41 |

-iii-

Section 22.8. | Jurisdiction and Process; Waiver of Jury Trial 41 |

Signature 43

-iv-

SCHEDULE A — Defined Terms

SCHEDULE 1-A — Form of 3.15% Senior Unsecured Note, Series A, due May 15, 2023

SCHEDULE 1-B — Form of 3.45% Senior Unsecured Note, Series B, due May 15, 2025

SCHEDULE 1-C — Form of 3.68% Senior Unsecured Note, Series C, due May 15,

2028

SCHEDULE 1-D — Form of 3.78% Senior Unsecured Note, Series D, due August 1, 2028

SCHEDULE 1-E — Form of 3.93% Senior Unsecured Note, Series E, due May 15, 2033

SCHEDULE 1-F — Form of 4.22% Senior Unsecured Note, Series F, due May 15, 2038

SCHEDULE 1-G — Form of 4.50% Senior Unsecured Note, Series G, due May 15, 2048

SCHEDULE 1-H — Form of 4.60% Senior Unsecured Note, Series H, due August 1, 2048

SCHEDULE 4.4(a) — Form of Opinions of Various Counsel for the Company

SCHEDULE 5.3 — Disclosure Materials

SCHEDULE 5.4 | — Subsidiaries of the Company and Ownership of Subsidiary Stock |

SCHEDULE 5.5 — Financial Statements

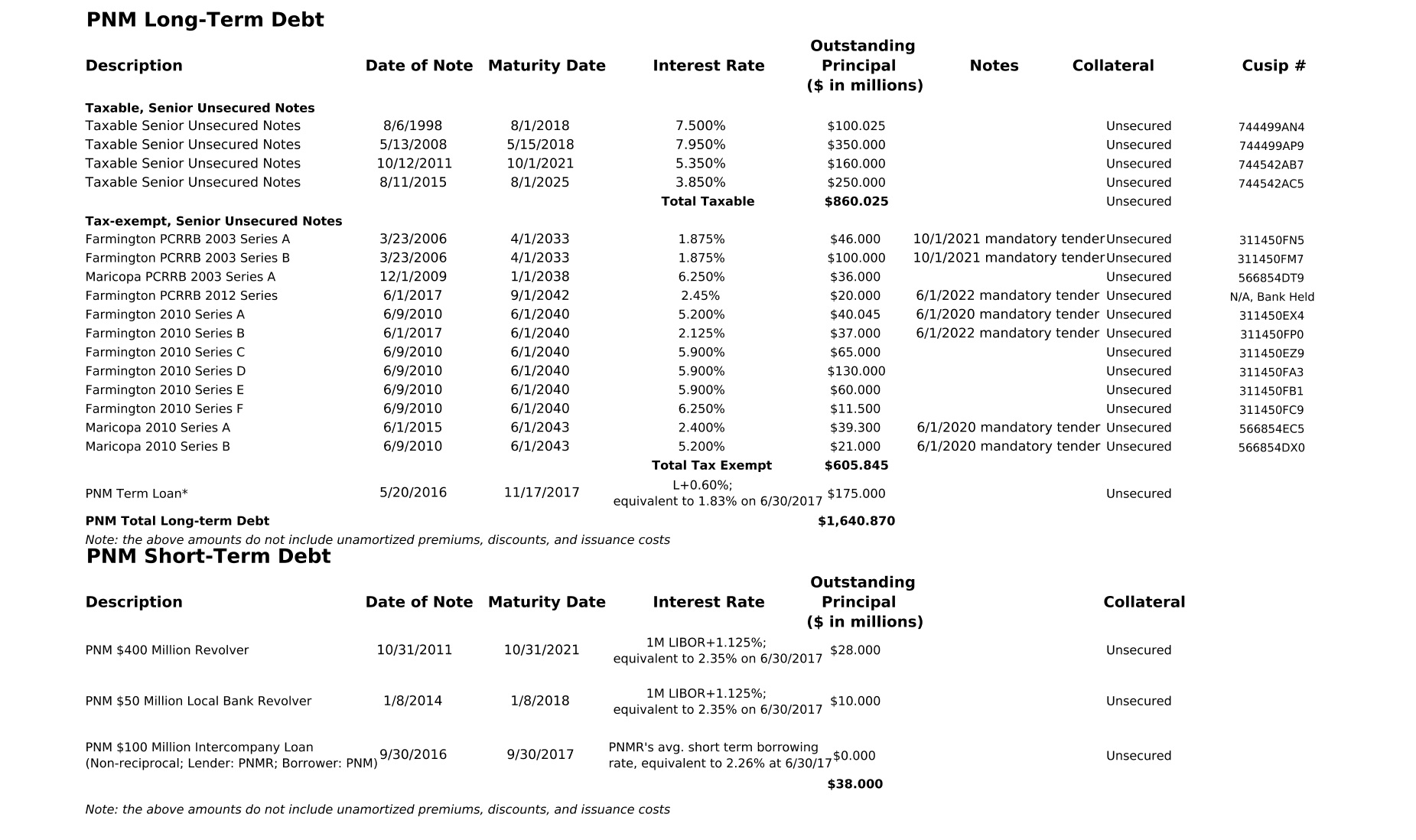

SCHEDULE 5.15 — Existing Indebtedness

PURCHASER SCHEDULE — Information Relating to Purchasers

-v-

PUBLIC SERVICE COMPANY OF NEW MEXICO

414 SILVER AVE. SW

ALBUQUERQUE, NEW MEXICO 87102

ALBUQUERQUE, NEW MEXICO 87102

$55,000,000 3.15% Senior Unsecured Notes, Series A, due May 15, 2023

$104,000,000 3.45% Senior Unsecured Notes, Series B, due May 15, 2025

$88,000,000 3.68% Senior Unsecured Notes, Series C, due May 15, 2028

$15,000,000 3.78% Senior Unsecured Notes, Series D, due August 1, 2028

$38,000,000 3.93% Senior Unsecured Notes, Series E, due May 15, 2033

$45,000,000 4.22% Senior Unsecured Notes, Series F, due May 15, 2038

$20,000,000 4.50% Senior Unsecured Notes, Series G, due May 15, 2048

$85,000,000 4.60% Senior Unsecured Notes, Series H, due August 1, 2048

July 28, 2017

TO EACH OF THE PURCHASERS LISTED IN

THE PURCHASER SCHEDULE HERETO:

Ladies and Gentlemen:

Public Service Company of New Mexico, a New Mexico corporation (the “Company”), agrees with each of the Purchasers as follows:

SECTION 1. | AUTHORIZATION OF NOTES . |

The Company will authorize the issue and sale of (i) $55,000,000 aggregate principal amount of its 3.15% Senior Unsecured Notes, Series A, due May 15, 2023 (the “Series A Notes”); (ii) $104,000,000 aggregate principal amount of its 3.45% Senior Unsecured Notes, Series B, due May 15, 2025 (the “Series B Notes”); (iii) $88,000,000 aggregate principal amount of its 3.68% Senior Unsecured Notes, Series C, due May 15, 2028 (the “Series C Notes”); (iv) $15,000,000 aggregate principal amount of its 3.78% Senior Unsecured Notes, Series D, due August 1, 2028 (the “Series D Notes”); (v) $38,000,000 aggregate principal amount of its 3.93% Senior Unsecured Notes, Series E, due May 15, 2033 (the “Series E Notes”), (vi) $45,000,000 aggregate principal amount of its 4.22% Senior Unsecured Notes, Series F, due May 15, 2038 (the “Series F Notes”); (vii) $20,000,000 aggregate principal amount of its 4.50% Senior Unsecured Notes, Series G, due May 15, 2048 (the “Series G Notes”); and (vii) $85,000,000 aggregate principal amount of its 4.60% Senior Unsecured Notes, Series H, due August 1, 2048 (the “Series H Notes”; collectively with the Series A Notes, the Series B Notes, the Series C Notes, the Series D Notes, the Series E Notes, the Series F Notes and the Series G Notes, the “Notes”). The Notes shall be substantially in the form set out in Schedule 1‑A through Schedule 1-H, as applicable. Certain capitalized and other terms used in this Agreement are defined in Schedule A and, for purposes of this Agreement, the rules of construction set forth in Section 22.4 shall govern. References to “Series” of Notes shall refer to the Series A Notes, the Series B Notes, Series C Notes, the Series

D Notes, the Series E Notes, the Series F Notes, the Series G Notes or the Series H Notes or all, as the context may require.

SECTION 2. | SALE AND PURCHASE OF NOTES. |

Subject to the terms and conditions of this Agreement, the Company will issue and sell to each Purchaser and each Purchaser will purchase from the Company, at the Closing provided for in Section 3, Notes in the principal amount specified opposite such Purchaser’s name in the Purchaser Schedule at the purchase price of 100% of the principal amount thereof. The Purchasers’ obligations hereunder are several and not joint obligations and no Purchaser shall have any liability to any Person for the performance or non‑performance of any obligation by any other Purchaser hereunder.

SECTION 3. | CLOSING. |

The execution and delivery of this Agreement shall occur on July 28, 2017. The sale and purchase of the Notes to be purchased by each Purchaser shall occur at the offices of Chapman and Cutler LLP, 111 West Monroe Street, Chicago, Illinois 60603, at 7:00 a.m. Chicago time, at two closings (each a “Closing”). The Closing in relation to the Series A Notes, the Series B Notes, the Series C Notes, the Series E Notes, the Series F Notes and the Series G Notes (the “First Closing”) shall occur on May 15, 2018 and the Closing in relation to the Series D Notes and the Series H Notes (the “Second Closing”) shall occur on August 1, 2018; provided that the Company shall have the option to select an earlier date for either Closing, provided that (i) such earlier date must be a Business Day, (ii) such earlier date must be no more than two (2) Business Days before the date specified for the First Closing or Second Closing, as applicable, and (iii) the Company shall provide the applicable Purchasers at least five (5) Business Days’ written notice of the earlier date for such Closing. At each Closing the Company will deliver to each Purchaser the Notes of such Series to be purchased by such Purchaser in the form of a single Note of such Series (or such greater number of Notes in denominations of at least $100,000 as such Purchaser may request) dated the date of such Closing and registered in such Purchaser’s name (or in the name of its nominee), against delivery by such Purchaser to the Company or its order of immediately available funds in the amount of the purchase price therefor by wire transfer of immediately available funds for the account of the Company in accordance with the instructions delivered by the Company pursuant to Section 4.10. If at such Closing the Company shall fail to tender such Notes to any Purchaser as provided above in this Section 3, or any of the conditions specified in Section 4 shall not have been fulfilled to such Purchaser’s satisfaction, such Purchaser shall, at its election, be relieved of all further obligations under this Agreement, without thereby waiving any rights such Purchaser may have by reason of such failure by the Company to tender such Notes or any of the conditions specified in Section 4 not having been fulfilled to such Purchaser’s satisfaction.

SECTION 4. | CONDITIONS TO CLOSING. |

Each Purchaser’s obligation to purchase and pay for the Notes to be sold to such Purchaser at the applicable Closing is subject to the fulfillment to such Purchaser’s satisfaction, prior to or at such Closing, of the following conditions:

-2-

Section 4.1. Representations and Warranties. The representations and warranties of the Company in this Agreement shall be correct when made and at such Closing.

Section 4.2. Performance; No Default. The Company shall have performed and complied with all agreements and conditions contained in this Agreement required to be performed or complied with by it prior to or at such Closing. From the date of this Agreement until such Closing, before and after giving effect to the issue and sale of the Notes (and the application of the proceeds thereof as contemplated by Section 5.14), no Change of Control, Default or Event of Default shall have occurred and be continuing.

Section 4.3. Compliance Certificates.

(a) Officer’s Certificate. The Company shall have delivered to such Purchaser an Officer’s Certificate, dated the date of such Closing, certifying that the conditions specified in Sections 4.1, 4.2 and 4.9 have been fulfilled.

(b) Secretary’s Certificate. The Company shall have delivered to such Purchaser a certificate of its Secretary or Assistant Secretary, dated the date of such Closing, certifying as to (i) the resolutions attached thereto and other corporate proceedings relating to the authorization, execution and delivery of the Notes and this Agreement and (ii) the Company’s organizational documents as then in effect.

Section 4.4. Opinions of Counsel. Such Purchaser shall have received opinions in form and substance satisfactory to such Purchaser, dated the date of such Closing (a) from McGuireWoods LLP, counsel for the Company, and in-house legal counsel to the Company, covering the matters set forth in Schedule 4.4(a) and covering such other matters incident to the transactions contemplated hereby as such Purchaser or its counsel may reasonably request (and the Company hereby instructs its counsel to deliver such opinion to the Purchasers) and (b) from Chapman and Cutler LLP, the Purchasers’ special counsel in connection with such transactions, covering such matters incident to such transactions as such Purchaser may reasonably request.

Section 4.5. Purchase Permitted By Applicable Law, Etc. On the date of such Closing such Purchaser’s purchase of Notes shall (a) be permitted by the laws and regulations of each jurisdiction to which such Purchaser is subject, without recourse to provisions (such as section 1405(a)(8) of the New York Insurance Law) permitting limited investments by insurance companies without restriction as to the character of the particular investment, (b) not violate any applicable law or regulation (including Regulation T, U or X of the Board of Governors of the Federal Reserve System) and (c) not subject such Purchaser to any tax, penalty or liability under or pursuant to any applicable law or regulation, which law or regulation was not in effect on the date hereof. If requested by such Purchaser, such Purchaser shall have received an Officer’s Certificate certifying as to such matters of fact as such Purchaser may reasonably specify to enable such Purchaser to determine whether such purchase is so permitted.

Section 4.6. Sale of Other Notes. Contemporaneously with such Closing the Company shall sell to each other Purchaser and each other Purchaser shall purchase the Notes to be purchased by it at such Closing as specified in the Purchaser Schedule.

-3-

Section 4.7. Payment of Special Counsel Fees. Without limiting Section 15.1, the Company shall have paid on or before the date of this Agreement and the date of such Closing the fees, charges and disbursements of the Purchasers’ special counsel referred to in Section 4.4 to the extent reflected in a statement of such counsel rendered to the Company at least one Business Day prior to the date of this Agreement or the date of such Closing, as applicable.

Section 4.8. Private Placement Number. A Private Placement Number issued by Standard & Poor’s CUSIP Service Bureau (in cooperation with the SVO) shall have been obtained for each Series of Notes.

Section 4.9. Changes in Corporate Structure. Other than transactions permitted by Section 10, the Company shall not have changed its jurisdiction of incorporation or organization, as applicable, or been a party to any merger or consolidation or succeeded to all or any substantial part of the liabilities of any other entity, at any time following the date of the most recent financial statements referred to in Schedule 5.5.

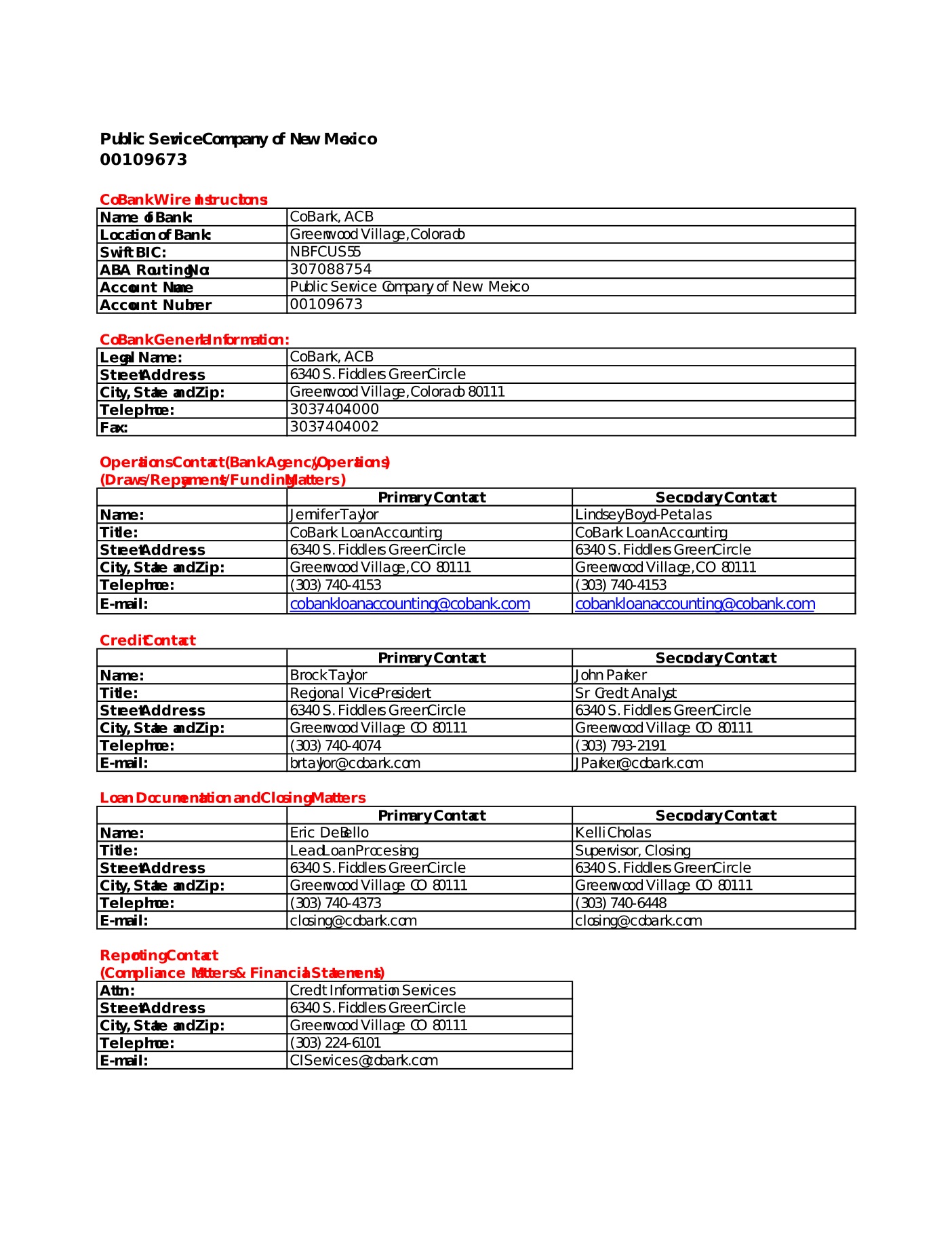

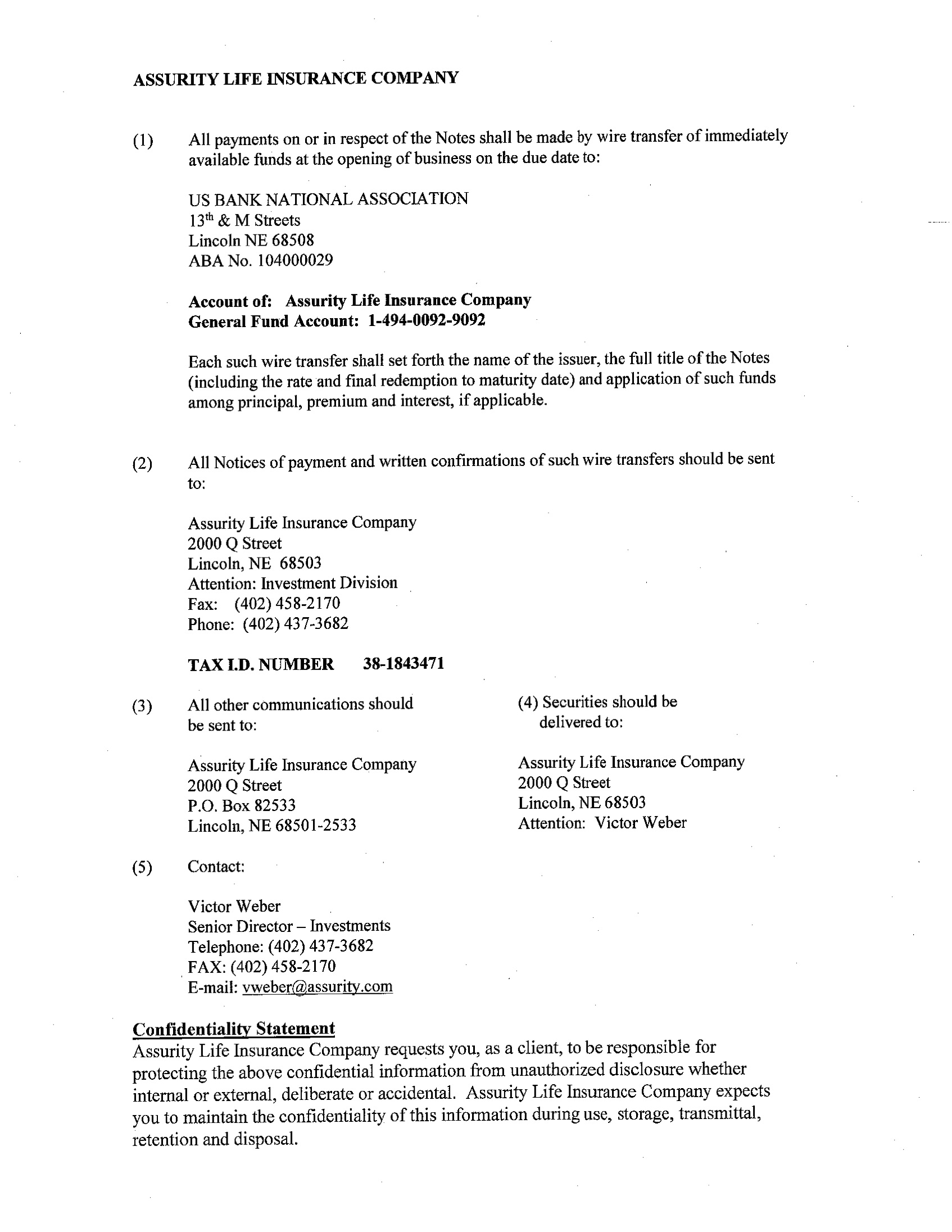

Section 4.10. Funding Instructions. At least three (3) Business Days prior to the date of such Closing, each Purchaser shall have received written wire transfer instructions signed by a Responsible Officer on letterhead of the Company including (i) the name and address of the transferee bank, (ii) such transferee bank’s ABA number and (iii) the account name and number into which the purchase price for the Notes is to be deposited.

Section 4.11. Regulatory Approvals. The issue and sale of the Notes hereunder shall have been duly authorized by each regulatory authority whose consent or approval shall be required for the issue and sale of the Notes to such Purchaser and any orders issued pursuant thereto shall be in full force and effect as of such Closing and all appeal periods, if any, shall have expired; provided, however, that with respect to the registration requirements of section 5 of the Securities Act or to the registration requirements of any Securities or blue sky laws of any applicable jurisdiction, satisfaction of the foregoing condition assumes the accuracy of the representations and warranties of the Purchasers contained in Section 6.1 of this Agreement. Such Purchaser shall have received copies of such consents, approvals or orders including a copy of the approval of the NMPRC authorizing this transaction.

Section 4.12. Delayed Funding Closing Condition. If the Company fails to comply with any provisions of this Agreement on or after the date of this Agreement but prior to such Closing (before and after giving effect to the issuance of the Notes on a pro forma basis), then any of the Purchasers may elect not to purchase the Notes on the date of such Closing specified in Section 3. Furthermore, it shall be a condition to the Second Closing that the First Closing shall have occurred.

Section 4.13. Proceedings and Documents. All corporate and other proceedings in connection with the transactions contemplated by this Agreement and all documents and instruments incident to such transactions shall be satisfactory to such Purchaser and its special counsel, and such Purchaser and its special counsel shall have received all such counterpart originals or certified or other copies of such documents as such Purchaser or such special counsel may reasonably request.

-4-

SECTION 5. | REPRESENTATIONS AND WARRANTIES OF THE COMPANY. |

The Company represents and warrants to each Purchaser that:

Section 5.1. Organization; Power and Authority. The Company is a corporation duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation, and is duly qualified as a foreign corporation and is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Company has the corporate power and authority to own or hold under lease the properties it purports to own or hold under lease, to transact the business it transacts, to execute and deliver this Agreement and the Notes and to perform the provisions hereof and thereof.

Section 5.2. Authorization, Etc. This Agreement and the Notes have been duly authorized by all necessary corporate action on the part of the Company, and this Agreement constitutes, and upon execution and delivery thereof each Note will constitute, a legal, valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except as such enforceability may be limited by (i) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

Section 5.3. Disclosure. The Company, through its agents, J.P. Morgan Securities LLC and MUFG Securities Americas Inc., has delivered to each Purchaser a copy of a Private Placement Memorandum, dated July 2017 (the “Memorandum”), relating to the transactions contemplated hereby. This Agreement, the Memorandum, the financial statements listed in Schedule 5.5 and the documents, certificates or other writings delivered to the Purchasers by or on behalf of the Company prior to July 21, 2017 in connection with the transactions contemplated hereby and identified in Schedule 5.3 (this Agreement, the Memorandum and such documents, certificates or other writings and such financial statements delivered to each Purchaser being referred to, collectively, as the “Disclosure Documents”), taken as a whole, do not contain any untrue statement of a material fact or omit to state any material fact necessary to make the statements therein not misleading in light of the circumstances under which they were made. Except as disclosed in the Disclosure Documents, since March 31, 2017, there has been no change in the financial condition, operations, business, or properties of the Company or any Subsidiary except changes that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 5.4. Organization and Ownership of Shares of Subsidiaries; Affiliates. Schedule 5.4 contains (except as noted therein) complete and correct lists of (i) the Company’s Affiliates and (ii) the Company’s directors and senior officers. The Company has no active Subsidiaries as of the date of this Agreement.

Section 5.5. Financial Statements; Material Liabilities. The Company has delivered to each Purchaser copies of the financial statements of the Company and its Subsidiaries listed on

-5-

Schedule 5.5. All of such financial statements (including in each case the related schedules and notes) fairly present in all material respects the consolidated financial position of the Company and its Subsidiaries as of the respective dates specified in such Schedule and the consolidated results of their operations and cash flows for the respective periods so specified and have been prepared in accordance with GAAP consistently applied throughout the periods involved except as set forth in the notes thereto (subject, in the case of any interim financial statements, to normal year‑end adjustments).

Section 5.6. Compliance with Laws, Other Instruments, Etc. The execution, delivery and performance by the Company of this Agreement and the Notes will not (i) contravene, result in any breach of, or constitute a default under, or result in the creation of any Lien in respect of any property of the Company or any Subsidiary under, any indenture, mortgage, deed of trust, loan, purchase or credit agreement, lease, corporate charter, regulations or by‑laws, shareholders agreement or any other agreement or instrument to which the Company or any Subsidiary is bound or by which the Company or any Subsidiary or any of their respective properties may be bound or affected, the violation of which would have or would be reasonably be expected to have a Material Adverse Effect, (ii) conflict with or result in a breach of any of the terms, conditions or provisions of any order, judgment, decree or ruling of any court, arbitrator or Governmental Authority applicable to the Company or any Subsidiary or (iii) violate any provision of any statute or other rule or regulation of any Governmental Authority applicable to the Company or any Subsidiary.

Section 5.7. Governmental Authorizations, Etc. No consent, approval, authorization or order of, or registration, filing or declaration with, any Governmental Authority or body having jurisdiction over the Company is required in connection with the execution, delivery or performance by the Company of this Agreement or the Notes, except for (i) such approval by the NMPRC as has been obtained and (ii) required notice filings related to this Agreement with the SEC or the NMPRC; provided that with respect to the registration requirements of section 5 of the Securities Act or to the registration requirements of any Securities or blue sky laws of any applicable jurisdiction, the foregoing representation and warranty assumes the accuracy of the representations and warranties of the Purchasers contained in Section 6.1 of this Agreement.

Section 5.8. Litigation; Observance of Agreements, Statutes and Orders. (a) Except as disclosed in the Disclosure Documents, there are no actions, suits, investigations or proceedings pending or, to the knowledge of the Company, threatened against or affecting the Company or any Subsidiary or any property of the Company or any Subsidiary in any court or before any arbitrator of any kind or before or by any Governmental Authority that would, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(b) Neither the Company nor any Subsidiary is (i) in violation of any order, judgment, decree or ruling of any court, any arbitrator of any kind or any Governmental Authority or (ii) in violation of any applicable law, ordinance, rule or regulation of any Governmental Authority (including Environmental Laws, the USA PATRIOT Act or any of the other laws and regulations that are referred to in Section 5.16), which default or violation would, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

-6-

Section 5.9. Taxes. The Company and its Subsidiaries have filed all tax returns that are required to have been filed in any jurisdiction, and have paid all taxes shown to be due and payable on such returns and all other taxes and assessments payable by them, to the extent such taxes and assessments have become due and payable and before they have become delinquent, except for any taxes and assessments (i) the amount of which, individually or in the aggregate, is not Material or (ii) the amount, applicability or validity of which is currently being contested in good faith by appropriate proceedings and with respect to which the Company or a Subsidiary, as the case may be, has established adequate reserves in accordance with GAAP. The charges, accruals and reserves on the books of the Company and its Subsidiaries in respect of U.S. federal, state or other taxes for all fiscal periods are adequate. The U.S. federal income tax liabilities of the Company and its Subsidiaries have been finally determined (whether by reason of completed audits or the statute of limitations having run) for all fiscal years up to and including the fiscal year ended December 31, 2012.

Section 5.10. Title to Property; Leases. The Company and its Subsidiaries have good and sufficient title to their respective properties that individually or in the aggregate are Material, including all such properties reflected in the most recent audited balance sheet referred to in Section 5.5 or purported to have been acquired by the Company or any Subsidiary after such date (except as sold or otherwise disposed of in the ordinary course of business), in each case free and clear of Liens prohibited by this Agreement except for those defects in title and Liens that, individually or in the aggregate, would not have a Material Adverse Effect. All Material leases are valid and subsisting and are in full force and effect in all material respects.

Section 5.11. Licenses, Permits, Etc. Except as disclosed in the Disclosure Documents, the Company and its Subsidiaries own or possess all licenses, permits, franchises, authorizations, patents, copyrights, proprietary software, service marks, trademarks and trade names, or rights thereto, that individually or in the aggregate are Material, without known conflict with the rights of others, except for those conflicts that, individually or in the aggregate, would not have a Material Adverse Effect.

Section 5.12. Compliance with Employee Benefit Plans. (a) The Company and each ERISA Affiliate have operated and administered each Plan in compliance with all applicable laws except for such instances of noncompliance as have not resulted in and would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect. Neither the Company nor any ERISA Affiliate has incurred any liability pursuant to Titles I or IV of ERISA or the penalty or excise tax provisions of the Code relating to employee benefit plans (as defined in section 3 of ERISA), and no event, transaction or condition relating to such employee benefit plans has occurred or exists that would, individually or in the aggregate, reasonably be expected to result in the incurrence of any such liability by the Company or any ERISA Affiliate, or in the imposition of any Lien on any of the rights, properties or assets of the Company or any ERISA Affiliate, in either case pursuant to Titles I or IV of ERISA or to section 430(k) of the Code or to any such penalty or excise tax provisions under the Code or federal law or section 4068 of ERISA or by the granting of a security interest in connection with the amendment of a Plan, other than such liabilities or Liens as would not be individually or in the aggregate Material.

-7-

(b) The present value of the aggregate benefit liabilities under each of the Plans (other than Multiemployer Plans), determined as of the end of such Plan’s most recently ended plan year on the basis of the actuarial assumptions specified for funding purposes in such Plan’s most recent actuarial valuation report, did not exceed the aggregate current value of the assets of such Plan allocable to such benefit liabilities by more than $70,000,000 in the case of any single Plan and by more than $70,000,000 in the aggregate for all Plans. The term “benefit liabilities” has the meaning specified in section 4001 of ERISA and the terms “current value” and “present value” have the meaning specified in section 3 of ERISA.

(c) The Company and its ERISA Affiliates have not incurred withdrawal liabilities (and are not subject to contingent withdrawal liabilities) under section 4201 or 4204 of ERISA in respect of Multiemployer Plans that individually or in the aggregate are Material.

(d) The expected postretirement benefit obligation (determined as of the last day of the Company’s most recently ended fiscal year in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 715-60, without regard to liabilities attributable to continuation coverage mandated by section 4980B of the Code) of the Company and its Subsidiaries is not Material.

(e) The execution and delivery of this Agreement and the issuance and sale of the Notes hereunder will not involve any transaction that is subject to the prohibitions of section 406 of ERISA or in connection with which a tax could be imposed pursuant to section 4975(c)(1)(A)-(D) of the Code. The representation by the Company to each Purchaser in the first sentence of this Section 5.12(e) is made in reliance upon and subject to the accuracy of such Purchaser’s representation in Section 6.2 as to the sources of the funds to be used to pay the purchase price of the Notes to be purchased by such Purchaser.

(f) The Company and its Subsidiaries do not have any Non-U.S. Plans.

Section 5.13. Private Offering by the Company. Neither the Company nor anyone acting on its behalf has offered the Notes or any similar Securities for sale to, or solicited any offer to buy the Notes or any similar Securities from, or otherwise approached or negotiated in respect thereof with, any Person other than seventy-five (75) Institutional Investors (including the Purchasers), each of which has been offered the Notes at a private sale for investment. Neither the Company nor anyone acting on its behalf has taken, or will take, any action that would subject the issuance or sale of the Notes to the registration requirements of section 5 of the Securities Act or to the registration requirements of any Securities or blue sky laws of any applicable jurisdiction.

Section 5.14. Use of Proceeds; Margin Regulations. The Company will apply the proceeds of the sale of the Notes hereunder as set forth in “The Offering and Use of Proceeds” section of the Memorandum. No part of the proceeds from the sale of the Notes hereunder will be used, directly or indirectly, for the purpose of buying or carrying any margin stock within the meaning of Regulation U of the Board of Governors of the Federal Reserve System (12 CFR 221), or for the purpose of buying or carrying or trading in any Securities under such circumstances as to involve the Company in a violation of Regulation X of said Board (12 CFR 224) or to involve any broker or dealer in a violation of Regulation T of said Board (12 CFR 220). Margin stock

-8-

does not constitute more than 5% of the value of the consolidated assets of the Company and its Subsidiaries and the Company does not have any present intention that margin stock will constitute more than 5% of the value of such assets. As used in this Section, the terms “margin stock” and “purpose of buying or carrying” shall have the meanings assigned to them in said Regulation U.

Section 5.15. Existing Indebtedness; Future Liens. (a) Except as described therein, Schedule 5.15 sets forth a complete and correct list of all individual items of outstanding Indebtedness of the Company and its Subsidiaries that exceeds $20,000,000 (or in the case of Contingent Obligations, such Contingent Obligations guaranteeing or otherwise in respect of obligations that exceed $20,000,000 described in the definition of “Indebtedness”) as of June 30, 2017 (including descriptions of the obligors and obligees, principal amounts outstanding, any collateral therefor and any Guaranty thereof), since which date there has been no Material change in the amounts, interest rates, sinking funds, installment payments or maturities of the Indebtedness of the Company or its Subsidiaries. Neither the Company nor any Subsidiary is in default and no waiver of default is currently in effect, in the payment of any principal or interest on any Indebtedness of the Company or such Subsidiary and no event or condition exists with respect to any Indebtedness of the Company or any Subsidiary the outstanding principal amount of which exceeds $20,000,000 that would permit (or that with notice or the lapse of time, or both, would permit) one or more Persons to cause such Indebtedness to become due and payable before its stated maturity or before its regularly scheduled dates of payment.

(b) Except as disclosed in Schedule 5.15 or as permitted in Section 10.6, neither the Company nor any Subsidiary has agreed or consented to cause or permit any of its property, whether now owned or hereafter acquired, to be subject to a Lien that secures Indebtedness or to cause or permit in the future (upon the happening of a contingency or otherwise) any of its property, whether now owned or hereafter acquired, to be subject to a Lien that secures Indebtedness.

(c) Neither the Company nor any Subsidiary is a party to, or otherwise subject to any provision contained in, any instrument evidencing Indebtedness of the Company or such Subsidiary, any agreement relating thereto or any other agreement (including its charter or any other organizational document) which limits the amount of, or otherwise imposes restrictions on the incurring of, Indebtedness of the Company, except as disclosed in Schedule 5.15.

Section 5.16. Foreign Assets Control Regulations, Etc. (a) Neither the Company nor any Controlled Entity (i) is a Blocked Person, (ii) has been notified that its name appears or may in the future appear on a State Sanctions List or (iii) is a target of sanctions that have been imposed by the United Nations or the European Union.

(b) Neither the Company nor any Controlled Entity (i) has violated, been found in violation of, or been charged or convicted under, any applicable U.S. Economic Sanctions Laws, Anti‑Money Laundering Laws or Anti‑Corruption Laws or (ii) to the Company’s knowledge, is under investigation by any Governmental Authority for possible violation of any U.S. Economic Sanctions Laws, Anti‑Money Laundering Laws or Anti‑Corruption Laws.

(c) No part of the proceeds from the sale of the Notes hereunder:

-9-

(i) constitutes or will constitute funds obtained on behalf of any Blocked Person in violation of applicable law or will otherwise be used by the Company or any Controlled Entity, directly or indirectly, (A) in connection with any investment in, or any transactions or dealings with, any Blocked Person or any Sanctioned Jurisdiction in violation of applicable law, (B) for any purpose that would cause any Purchaser to be in violation of any U.S. Economic Sanctions Laws or (C) otherwise in violation of any U.S. Economic Sanctions Laws;

(ii) will be used, directly or indirectly, in violation of, or cause any Purchaser to be in violation of, any applicable Anti‑Money Laundering Laws; or

(iii) will be used, directly or indirectly, for the purpose of making any improper payments, including bribes, to any Governmental Official or commercial counterparty in order to obtain, retain or direct business or obtain any improper advantage, in each case which would be in violation of, or cause any Purchaser to be in violation of, any applicable Anti‑Corruption Laws.

(d) The Company has established procedures and controls which it reasonably believes are adequate (and otherwise in compliance with applicable law) to ensure that the Company and each Controlled Entity is and will continue to be in compliance with all applicable U.S. Economic Sanctions Laws, Anti‑Money Laundering Laws and Anti‑Corruption Laws.

Section 5.17. Status under Certain Statutes. Neither the Company nor any Subsidiary is subject to regulation under the Investment Company Act of 1940, the ICC Termination Act of 1995, or Section 204 of the Federal Power Act, nor is the Company or any Subsidiary a holding company for the purposes of the Public Utility Holding Company Act of 2005.

Section 5.18. Environmental Matters. Except as would not result or reasonably be expected to result in a Material Adverse Effect: (a) each of the real properties of the Company and its Subsidiaries and all operations at such real properties are in substantial compliance with all applicable Environmental Laws, (b) there is no undocumented or unreported violation of any Environmental Laws with respect to such real properties or the businesses operated by the Company and its Subsidiaries that the Company is aware of, and (c) to the Company’s knowledge, there are no conditions relating to such businesses or real properties that have given rise to or would reasonably be expected to give rise to a liability under any applicable Environmental Laws or to any Environmental Claim.

Section 5.19. Solvency. The Company is and, after the issuance of Notes and the consummation of the transactions contemplated by this Agreement, will be, Solvent.

SECTION 6. | REPRESENTATIONS OF THE PURCHASERS. |

Section 6.1. Purchase for Investment. Each Purchaser severally represents that it is (a) purchasing the Notes for its own account or for one or more separate accounts maintained by such Purchaser or for the account of one or more pension or trust funds and not with a view to the distribution thereof, provided that the disposition of such Purchaser’s or their property shall at all

-10-

times be within such Purchaser’s or their control and (b) it is an “accredited investor” (as defined in Rule 501(a)(1), (2), (3) or (7) under the Securities Act). Each Purchaser understands that the Notes have not been registered under the Securities Act and may be resold only if registered pursuant to the provisions of the Securities Act or if an exemption from registration is available, except under circumstances where neither such registration nor such an exemption is required by law, and that the Company is not required to register the Notes.

Section 6.2. Source of Funds. Each Purchaser severally represents that at least one of the following statements is an accurate representation as to each source of funds (a “Source”) to be used by such Purchaser to pay the purchase price of the Notes to be purchased by such Purchaser hereunder:

(a) the Source is an “insurance company general account” (as the term is defined in the United States Department of Labor’s Prohibited Transaction Exemption (“PTE”) 95‑60) in respect of which the reserves and liabilities (as defined by the annual statement for life insurance companies approved by the NAIC (the “NAIC Annual Statement”)) for the general account contract(s) held by or on behalf of any employee benefit plan together with the amount of the reserves and liabilities for the general account contract(s) held by or on behalf of any other employee benefit plans maintained by the same employer (or affiliate thereof as defined in PTE 95‑60) or by the same employee organization in the general account do not exceed 10% of the total reserves and liabilities of the general account (exclusive of separate account liabilities) plus surplus as set forth in the NAIC Annual Statement filed with such Purchaser’s state of domicile; or

(b) the Source is a separate account that is maintained solely in connection with such Purchaser’s fixed contractual obligations under which the amounts payable, or credited, to any employee benefit plan (or its related trust) that has any interest in such separate account (or to any participant or beneficiary of such plan (including any annuitant)) are not affected in any manner by the investment performance of the separate account; or

(c) the Source is either (i) an insurance company pooled separate account, within the meaning of PTE 90‑1 or (ii) a bank collective investment fund, within the meaning of the PTE 91‑38 and, except as disclosed by such Purchaser to the Company in writing pursuant to this clause (c), no employee benefit plan or group of plans maintained by the same employer or employee organization beneficially owns more than 10% of all assets allocated to such pooled separate account or collective investment fund; or

(d) the Source constitutes assets of an “investment fund” (within the meaning of Part VI of PTE 84‑14 (the “QPAM Exemption”)) managed by a “qualified professional asset manager” or “QPAM” (within the meaning of Part VI of the QPAM Exemption), no employee benefit plan’s assets that are managed by the QPAM in such investment fund, when combined with the assets of all other employee benefit plans established or maintained by the same employer or by an affiliate (within the meaning of Part VI(c)(1) of the QPAM Exemption) of such employer or by the same employee organization and managed by such QPAM, represent more than 20% of the total client assets managed by

-11-

such QPAM, the conditions of Part I(c) and (g) of the QPAM Exemption are satisfied, neither the QPAM nor a person controlling or controlled by the QPAM maintains an ownership interest in the Company that would cause the QPAM and the Company to be “related” within the meaning of Part VI(h) of the QPAM Exemption and (i) the identity of such QPAM and (ii) the names of any employee benefit plans whose assets in the investment fund, when combined with the assets of all other employee benefit plans established or maintained by the same employer or by an affiliate (within the meaning of Part VI(c)(1) of the QPAM Exemption) of such employer or by the same employee organization, represent 10% or more of the assets of such investment fund, have been disclosed to the Company in writing pursuant to this clause (d); or

(e) the Source constitutes assets of a “plan(s)” (within the meaning of Part IV(h) of PTE 96‑23 (the “INHAM Exemption”)) managed by an “in‑house asset manager” or “INHAM” (within the meaning of Part IV(a) of the INHAM Exemption), the conditions of Part I(a), (g) and (h) of the INHAM Exemption are satisfied, neither the INHAM nor a person controlling or controlled by the INHAM (applying the definition of “control” in Part IV(d)(3) of the INHAM Exemption) owns a 10% or more interest in the Company and (i) the identity of such INHAM and (ii) the name(s) of the employee benefit plan(s) whose assets constitute the Source have been disclosed to the Company in writing pursuant to this clause (e); or

(f) the Source is a governmental plan; or

(g) the Source is one or more employee benefit plans, or a separate account or trust fund comprised of one or more employee benefit plans, each of which has been identified to the Company in writing pursuant to this clause (g); or

(h) the Source does not include assets of any employee benefit plan, other than a plan exempt from the coverage of ERISA.

As used in this Section 6.2, the terms “employee benefit plan,” “governmental plan,” and “separate account” shall have the respective meanings assigned to such terms in section 3 of ERISA.

SECTION 7. | INFORMATION AS TO COMPANY |

Section 7.1. Financial and Business Information. The Company shall deliver to each Purchaser and each holder of a Note that is an Institutional Investor:

(a) Quarterly Statements — within sixty (60) days (or such shorter period as is the earlier of (x) fifteen (15) days greater than the period applicable to the filing of the Company’s Quarterly Report on Form 10‑Q (the “Form 10‑Q”) with the SEC regardless of whether the Company is subject to the filing requirements thereof and (y) the date by which such financial statements are required to be delivered under any Material Credit Facility or the date on which such corresponding financial statements are delivered under any Material Credit Facility if such delivery occurs earlier than such required delivery date)

-12-

after the end of each Fiscal Quarter in each Fiscal Year of the Company (other than the last quarterly fiscal period of each such Fiscal Year), duplicate copies of

(i) a consolidated balance sheet of the Company and its Subsidiaries as at the end of such Fiscal Quarter,

(ii) consolidated statements of income of the Company and its Subsidiaries, for such Fiscal Quarter and (in the case of the second and third quarters) for the portion of the Fiscal Year ending with such Fiscal Quarter, and

(iii) consolidated statements of changes in shareholders’ equity and cash flows of the Company and its Subsidiaries for the portion of the Fiscal Year ending with such Fiscal Quarter,

setting forth in each case in comparative form the figures for the corresponding periods in the previous fiscal year, all in reasonable detail, prepared in accordance with GAAP applicable to quarterly financial statements generally, and certified by a Senior Financial Officer as fairly presenting, in all material respects, the financial position of the companies being reported on and their results of operations and cash flows, subject to changes resulting from year‑end adjustments;

(b) Annual Statements — within one hundred twenty (120) days (or such shorter period as is the earlier of (x) fifteen (15) days greater than the period applicable to the filing of the Company’s Annual Report on Form 10‑K (the “Form 10‑K”) with the SEC regardless of whether the Company is subject to the filing requirements thereof and (y) the date by which such financial statements are required to be delivered under any Material Credit Facility or the date on which such corresponding financial statements are delivered under any Material Credit Facility if such delivery occurs earlier than such required delivery date) after the end of each Fiscal Year of the Company, duplicate copies of

(i) a consolidated balance sheet of the Company and its Subsidiaries as at the end of such Fiscal Year, and

(ii) consolidated statements of income, changes in shareholders’ equity and cash flows of the Company and its Subsidiaries for such Fiscal Year,

setting forth in each case in comparative form the figures for the previous Fiscal Year, all in reasonable detail, prepared in accordance with GAAP, and accompanied by an opinion thereon (without a “going concern” or similar qualification or exception and without any qualification or exception as to the scope of the audit on which such opinion is based) of independent public accountants of recognized national standing, which opinion shall state that such financial statements present fairly, in all material respects, the financial position of the companies being reported upon and their results of operations and cash flows and have been prepared in conformity with GAAP, and that the examination of such accountants in connection with such financial statements has been made in accordance with

-13-

generally accepted auditing standards, and that such audit provides a reasonable basis for such opinion in the circumstances;

(c) SEC and Other Reports — promptly upon their becoming available, one copy of (i) each financial statement, report, notice, proxy statement or similar document sent by the Company or any Subsidiary (x) to its creditors under any Material Credit Facility (excluding information sent to such creditors in the ordinary course of administration of a credit facility, such as information relating to pricing and borrowing availability) or (y) to its public Securities holders generally, and (ii) each regular or periodic report, each registration statement (without exhibits except as expressly requested by such holder), and each prospectus and all amendments thereto filed by the Company or any Subsidiary with the SEC;

(d) Notice of Default or Event of Default — promptly, and in any event within ten (10) days after a Responsible Officer becoming aware of the existence of any Default or Event of Default or that any Person has given any notice or taken any action with respect to a claimed default hereunder or that any Person has given any notice or taken any action with respect to a claimed default of the type referred to in Section 11(f), a written notice specifying the nature and period of existence thereof and what action the Company is taking or proposes to take with respect thereto;

(e) Employee Benefits Matters — promptly, and in any event within ten (10) days after a Responsible Officer becoming aware of any of the following, a written notice setting forth the nature thereof and the action, if any, that the Company or an ERISA Affiliate proposes to take with respect thereto:

(i) with respect to any Plan, any reportable event, as defined in section 4043(c) of ERISA and the regulations thereunder, for which notice thereof has not been waived pursuant to such regulations as in effect on the date hereof;

(ii) the taking by the PBGC of steps to institute, or the threatening by the PBGC of the institution of, proceedings under section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Plan, or the receipt by the Company or any ERISA Affiliate of a notice from a Multiemployer Plan that such action has been taken by the PBGC with respect to such Multiemployer Plan; or

(iii) any event, transaction or condition that could result in the incurrence of any liability by the Company or any ERISA Affiliate pursuant to Title I or IV of ERISA or the penalty or excise tax provisions of the Code relating to employee benefit plans, or in the imposition of any Lien on any of the rights, properties or assets of the Company or any ERISA Affiliate pursuant to Title I or IV of ERISA or such penalty or excise tax provisions, if such liability or Lien, taken together with any other such liabilities or Liens then existing, would reasonably be expected to have a Material Adverse Effect;

-14-

(f) Debt Ratings — prompt notice of any change in its Debt Ratings; and

(g) Requested Information — with reasonable promptness, such other data and information relating to the business, operations, affairs, financial condition, assets or properties of the Company or any of its Subsidiaries (including actual copies of the Company’s Form 10‑Q and Form 10‑K) or relating to the ability of the Company to perform its obligations hereunder and under the Notes as from time to time may be reasonably requested by any such Purchaser or holder of a Note; provided that any such requested information is subject to the confidentiality provisions set forth in Section 20.

Section 7.2. Officer’s Certificate. In connection with each set of financial statements delivered to a Purchaser or holder of a Note pursuant to Section 7.1(a) or Section 7.1(b), the Company shall deliver on or before the deadline set forth in Section 7.1(a) or Section 7.1(b), as applicable, a certificate of a Senior Financial Officer:

(a) Covenant Compliance — setting forth the information from such financial statements that is required in order to establish whether the Company was in compliance with the requirements of Section 10 during the quarterly or annual period covered by the financial statements then being furnished (including with respect to each such provision that involves mathematical calculations, the information from such financial statements that is required to perform such calculations) and detailed calculations of the maximum or minimum amount, ratio or percentage, as the case may be, permissible under the terms of such Section, and the calculation of the amount, ratio or percentage then in existence. In the event that the Company or any Subsidiary has made an election to measure any financial liability using fair value (which election is being disregarded for purposes of determining compliance with this Agreement pursuant to Section 22.2) as to the period covered by any such financial statement, such Senior Financial Officer’s certificate as to such period shall include a reconciliation from GAAP with respect to such election;

(b) Event of Default — certifying that such Senior Financial Officer has reviewed the relevant terms hereof and has made, or caused to be made, under his or her supervision, a review of the transactions and conditions of the Company and its Subsidiaries from the beginning of the quarterly or annual period covered by the statements then being furnished to the date of the certificate and that such review shall not have disclosed the existence during such period of any condition or event that constitutes a Default or an Event of Default or, if any such condition or event existed or exists (including any such event or condition resulting from the failure of the Company or any Subsidiary to comply with any Environmental Law), specifying the nature and period of existence thereof and what action the Company shall have taken or proposes to take with respect thereto; and

(c) Guarantors – setting forth a list of all Subsidiaries and other entities that are Guarantors and certifying that each Subsidiary or other entity that is required to be a Guarantor pursuant to Section 9.7 is a Guarantor, in each case, as of the date of such certificate of Senior Financial Officer.

-15-

Section 7.3. Visitation. The Company shall permit the representatives of each Purchaser and holder of a Note that is an Institutional Investor:

(a) No Default — if no Default or Event of Default then exists, at the expense of such Purchaser or holder and upon reasonable prior notice to the Company, to visit the principal executive office of the Company, to discuss the affairs, finances and accounts of the Company and its Subsidiaries with the Company’s officers, and (with the consent of the Company, which consent will not be unreasonably withheld) to visit the other offices and properties of the Company and each Subsidiary, all at such reasonable times and as often as may be reasonably requested in writing; and

(b) Default — if a Default or Event of Default then exists, at the expense of the Company to visit and inspect any of the offices or properties of the Company or any Subsidiary, to examine all their respective books of account, records, reports and other papers, to make copies and extracts therefrom, and to discuss their respective affairs, finances and accounts with their respective officers and independent public accountants (and by this provision the Company authorizes said accountants to discuss the affairs, finances and accounts of the Company and its Subsidiaries), all at such times and as often as may be requested.

Section 7.4. Electronic Delivery. Financial statements, opinions of independent certified public accountants, other information and Officer’s Certificates that are required to be delivered by the Company pursuant to Sections 7.1(a), (b) or (c) and Section 7.2 shall be deemed to have been delivered if the Company satisfies any of the following requirements with respect thereto:

(a) such financial statements satisfying the requirements of Section 7.1(a) or (b) and related Officer’s Certificate satisfying the requirements of Section 7.2 and any other information required under Section 7.1(c) are delivered to each Purchaser or holder of a Note by e‑mail at the e‑mail address set forth in such Purchaser’s or holder’s Purchaser Schedule or as communicated from time to time in a separate writing delivered to the Company;

(b) the Company shall have timely filed such Form 10–Q or Form 10–K, satisfying the requirements of Section 7.1(a) or Section 7.1(b), as the case may be, with the SEC on EDGAR and shall have made such form and the related Officer’s Certificate satisfying the requirements of Section 7.2 available on its home page on the internet, which is located at https://www.pnm.com as of the date of this Agreement;

(c) such financial statements satisfying the requirements of Section 7.1(a) or Section 7.1(b) and related Officer’s Certificate(s) satisfying the requirements of Section 7.2 and any other information required under Section 7.1(c) are timely posted by or on behalf of the Company on IntraLinks or on any other similar website to which each Purchaser and holder of Notes has free access; or

(d) the Company shall have timely filed any of the items referred to in Section 7.1(c) with the SEC on EDGAR and shall have made such items available on its

-16-

home page on the internet or on IntraLinks or on any other similar website to which each Purchaser and each holder of Notes has free access;

provided, however, that in no case shall access to such financial statements, other information and Officer’s Certificates be conditioned upon any waiver or other agreement or consent (other than confidentiality provisions consistent with Section 20 of this Agreement); provided, further, that in the case of any of clauses (b), (c) or (d), the Company shall have given each Purchaser and each holder of a Note prior written notice, which may be by e‑mail or in accordance with Section 18, of such posting or filing in connection with each delivery, provided, further, that upon request of any Purchaser or any holder to receive paper copies of such forms, financial statements, other information and Officer’s Certificates or to receive them by e‑mail, the Company will promptly e‑mail them or deliver such paper copies, as the case may be, to such Purchaser or such holder.

SECTION 8. | PAYMENT AND PREPAYMENT OF THE NOTES. |

Section 8.1. Maturity. As provided therein, the entire unpaid principal balance of each Note shall be due and payable on the Maturity Date thereof.

Section 8.2. Optional Prepayments with Make‑Whole Amount. (a) The Company may, at its option, upon notice as provided below, prepay at any time all, or from time to time any part of, the Notes of any Series, in an amount not less than 20% of the aggregate principal amount of the Notes of any Series to be prepaid then outstanding in the case of a partial prepayment, at 100% of the principal amount so prepaid, and the Make‑Whole Amount determined for the prepayment date with respect to such principal amount. The Company will give each holder of Notes written notice of each optional prepayment under this Section 8.2 not less than ten (10) days and not more than sixty (60) days prior to the date fixed for such prepayment unless the Company and the Required Holders agree to another time period pursuant to Section 17. Each such notice shall specify such date (which shall be a Business Day), the aggregate principal amount of the Notes of each Series to be prepaid on such date, the principal amount of each Note of each Series held by such holder to be prepaid (determined in accordance with Section 8.3), and the interest to be paid on the prepayment date with respect to such principal amount being prepaid, and shall be accompanied by a certificate of a Senior Financial Officer as to the estimated Make‑Whole Amount due with respect to each Series of Notes to be prepaid in connection with such prepayment (calculated as if the date of such notice were the date of the prepayment), setting forth the details of such computation. Two (2) Business Days prior to such prepayment, the Company shall deliver to each holder of Notes a certificate of a Senior Financial Officer specifying the calculation of such Make‑Whole Amount as of the specified prepayment date.

(b) Notwithstanding anything contained in this Section 8.2 to the contrary, if and so long as any Default or Event of Default shall have occurred and be continuing, any prepayment of the Notes pursuant to the provisions of Section 8.2(a) shall be allocated among all of the Notes of all Series at the time outstanding in proportion, as nearly as practicable, to the respective unpaid principal amounts thereof.

Section 8.3. Allocation of Partial Prepayments. In the case of each partial prepayment of the Notes pursuant to Section 8.2, the principal amount of the Notes of the Series to be prepaid

-17-

shall be allocated among all of the Notes of such Series at the time outstanding in proportion, as nearly as practicable, to the respective unpaid principal amounts thereof not theretofore called for prepayment.

Section 8.4. Maturity; Surrender, Etc. In the case of each prepayment of Notes pursuant to this Section 8, the principal amount of each Note to be prepaid shall mature and become due and payable on the date fixed for such prepayment, together with interest on such principal amount accrued to such date and the applicable Make‑Whole Amount, if any. From and after such date, unless the Company shall fail to pay such principal amount when so due and payable, together with the interest and Make‑Whole Amount, if any, as aforesaid, interest on such principal amount shall cease to accrue. Any Note paid or prepaid in full shall be surrendered to the Company and cancelled and shall not be reissued, and no Note shall be issued in lieu of any prepaid principal amount of any Note.

Section 8.5. Purchase of Notes. The Company will not and will not permit any Affiliate to purchase, redeem, prepay or otherwise acquire, directly or indirectly, any of the outstanding Notes of any Series except (a) upon the payment or prepayment of the Notes of any Series in accordance with this Agreement and the Notes or (b) pursuant to an offer to purchase made by the Company or an Affiliate pro rata to the holders of all Notes of any Series at the time outstanding upon the same terms and conditions, provided that if and so long as any Default or Event of Default exists, such written offer shall be made pro rata to the holders of all Notes of all Series outstanding upon the same terms and conditions. Any such offer shall provide each holder with sufficient information to enable it to make an informed decision with respect to such offer, and shall remain open for at least five (5) Business Days. If the holders of more than 20% of the principal amount of the Notes of the applicable Series then outstanding accept such offer, the Company shall promptly notify the remaining holders of such Series of Notes of such fact and the expiration date for the acceptance by holders of such Series of Notes of such offer shall be extended by the number of days necessary to give each such remaining holder at least ten (10) Business Days from its receipt of such notice to accept such offer. The Company will promptly cancel all Notes acquired by it or any Affiliate pursuant to any payment or prepayment of Notes pursuant to this Agreement and no Notes may be issued in substitution or exchange for any such Notes.

Section 8.6. Make‑Whole Amount.

The term “Make‑Whole Amount” means, with respect to any Note, an amount equal to the excess, if any, of the Discounted Value of the Remaining Scheduled Payments with respect to the Called Principal of such Note over the amount of such Called Principal, provided that the Make‑Whole Amount may in no event be less than zero; provided further that the Make-Whole Amount shall equal zero with respect to the relevant Series of Notes if such prepayment occurs (i) on or after the date which is thirty (30) days prior to their respective Maturity Dates in the case of the Series A Notes, the Series B Notes, the Series C Notes and the Series D Notes, (ii) on or after the date which is sixty (60) days prior to the Maturity Date in the case of the Series E Notes or (iii) on or after the date which is ninety (90) days prior to their respective Maturity Dates in the case of the Series F Notes, the Series G Notes and the Series H Notes. For the purposes of determining the Make‑Whole Amount, the following terms have the following meanings: “Called Principal” means, with respect to any Note, the principal of such Note that is to be prepaid pursuant to

-18-

Section 8.2 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

“Discounted Value” means, with respect to the Called Principal of any Note, the amount obtained by discounting all Remaining Scheduled Payments with respect to such Called Principal from their respective scheduled due dates to the Settlement Date with respect to such Called Principal, in accordance with accepted financial practice and at a discount factor (applied on the same periodic basis as that on which interest on the Notes is payable) equal to the Reinvestment Yield with respect to such Called Principal.

“Reinvestment Yield” means, with respect to the Called Principal of any Note, the sum of (a) 0.50% plus (b) the yield to maturity implied by the “Ask Yield(s)” reported as of 10:00 a.m. (New York City time) on the second Business Day preceding the Settlement Date with respect to such Called Principal, on the display designated as “Page PX1” (or such other display as may replace Page PX1) on Bloomberg Financial Markets for the most recently issued actively traded on‑the‑run U.S. Treasury securities (“Reported”) having a maturity equal to the Remaining Average Life of such Called Principal as of such Settlement Date. If there are no such U.S. Treasury securities Reported having a maturity equal to such Remaining Average Life, then such implied yield to maturity will be determined by (i) converting U.S. Treasury bill quotations to bond equivalent yields in accordance with accepted financial practice and (ii) interpolating linearly between the “Ask Yields” Reported for the applicable most recently issued actively traded on‑the‑run U.S. Treasury securities with the maturities (1) closest to and greater than such Remaining Average Life and (2) closest to and less than such Remaining Average Life. The Reinvestment Yield shall be rounded to the number of decimal places as appears in the interest rate of the applicable Note.

If such yields are not Reported or the yields Reported as of such time are not ascertainable (including by way of interpolation), then “Reinvestment Yield” means, with respect to the Called Principal of any Note, the sum of (x) 0.50% plus (y) the yield to maturity implied by the U.S. Treasury constant maturity yields reported, for the latest day for which such yields have been so reported as of the second Business Day preceding the Settlement Date with respect to such Called Principal, in Federal Reserve Statistical Release H.15 (or any comparable successor publication) for the U.S. Treasury constant maturity having a term equal to the Remaining Average Life of such Called Principal as of such Settlement Date. If there is no such U.S. Treasury constant maturity having a term equal to such Remaining Average Life, such implied yield to maturity will be determined by interpolating linearly between (1) the U.S. Treasury constant maturity so reported with the term closest to and greater than such Remaining Average Life and (2) the U.S. Treasury constant maturity so reported with the term closest to and less than such Remaining Average Life. The Reinvestment Yield shall be rounded to the number of decimal places as appears in the interest rate of the applicable Note.

“Remaining Average Life” means, with respect to any Called Principal, the number of years obtained by dividing (i) such Called Principal into (ii) the sum of the products obtained by multiplying (a) the principal component of each Remaining Scheduled Payment with respect to such Called Principal by (b) the number of years, computed on the basis of a 360‑day year comprised of twelve 30‑day months and calculated to two decimal places, that will elapse between

-19-

the Settlement Date with respect to such Called Principal and the scheduled due date of such Remaining Scheduled Payment.

“Remaining Scheduled Payments” means, with respect to the Called Principal of any Note, all payments of such Called Principal and interest thereon that would be due after the Settlement Date with respect to such Called Principal if no payment of such Called Principal were made prior to its scheduled due date, provided that if such Settlement Date is not a date on which interest payments are due to be made under the Notes, then the amount of the next succeeding scheduled interest payment will be reduced by the amount of interest accrued to such Settlement Date and required to be paid on such Settlement Date pursuant to Section 8.2 or Section 12.1.

“Settlement Date” means, with respect to the Called Principal of any Note, the date on which such Called Principal is to be prepaid pursuant to Section 8.2 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

Section 8.7. Change of Control.

(a) Notice of Change of Control. The Company will, within fifteen (15) Business Days after the occurrence of any Change of Control, give written notice (the “Change of Control Notice”) of such Change of Control to each holder of Notes. Such Change of Control Notice shall contain and constitute an offer to prepay the Notes as described in Section 8.7(b) hereof and shall be accompanied by the certificate described in Section 8.7(e).

(b) Offer to Prepay Notes. The offer to prepay Notes contemplated by Section 8.7(a) shall be an offer to prepay, in accordance with and subject to this Section 8.7, all, but not less than all, of the Notes held by each holder (in this case only, “holder” in respect of any Note registered in the name of a nominee for a disclosed beneficial owner shall mean such beneficial owner) on a date specified in such Change of Control Notice (the “Proposed Prepayment Date”). Such date shall be not fewer than thirty (30) days and not more than sixty (60) days after the date of delivery of the Change of Control Notice.

(c) Acceptance. Any holder of Notes may accept the offer to prepay made pursuant to this Section 8.7 by causing a notice of such acceptance to be delivered to the Company not fewer than ten (10) days prior to the Proposed Prepayment Date. A failure by a holder of Notes to respond to an offer to prepay made pursuant to this Section 8.7 shall be deemed to constitute a rejection of such offer by such holder.

(d) Prepayment. Prepayment of the Notes to be prepaid pursuant to this Section 8.7 shall be at 100% of the principal amount of such Notes together with accrued and unpaid interest thereon but without any Make‑Whole Amount or other premium. The prepayment shall be made on the Proposed Prepayment Date.

(e) Officer’s Certificate. Each offer to prepay the Notes pursuant to this Section 8.7 shall be accompanied by a certificate, executed by a Senior Financial Officer and dated the date of delivery of the Change of Control Notice, specifying: (i) the Proposed Prepayment Date; (ii) that such offer is made pursuant to this Section 8.7; (iii) the principal amount of each Note offered to

-20-

be prepaid (which shall be 100% of the outstanding principal balance of each such Note); (iv) the interest that would be due on each Note offered to be prepaid, accrued to the Proposed Prepayment Date; (v) that the conditions of this Section 8.7 required to be fulfilled prior to the giving of notice have been fulfilled; and (vi) in reasonable detail, the general nature and date of the Change of Control.

Section 8.8. Payments Due on Non‑Business Days. Anything in this Agreement or the Notes to the contrary notwithstanding, (x) except as set forth in clause (y), any payment of interest on any Note that is due on a date that is not a Business Day shall be made on the next succeeding Business Day without including the additional days elapsed in the computation of the interest payable on such next succeeding Business Day; and (y) any payment of principal of or Make‑Whole Amount on any Note (including principal due on the Maturity Date of such Note) that is due on a date that is not a Business Day shall be made on the next succeeding Business Day and shall include the additional days elapsed in the computation of interest payable on such next succeeding Business Day.

SECTION 9. | AFFIRMATIVE COVENANTS. |

From the date of this Agreement until the Second Closing and thereafter, so long as any of the Notes are outstanding, the Company covenants that:

Section 9.1. Compliance with Laws. Without limiting Section 10.4, the Company will, and will cause each of its Subsidiaries to, comply with all laws, ordinances or governmental rules or regulations to which each of them is subject (including ERISA, Environmental Laws, the USA PATRIOT Act and the other laws and regulations that are referred to in Section 5.16) and will obtain and maintain in effect all licenses, certificates, permits, franchises and other governmental authorizations necessary to the ownership of their respective properties or to the conduct of their respective businesses, in each case to the extent necessary to ensure that non‑compliance with such laws, ordinances or governmental rules or regulations or failures to obtain or maintain in effect such licenses, certificates, permits, franchises and other governmental authorizations would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 9.2. Insurance. The Company will, and will cause each of its Subsidiaries to, maintain, with financially sound and reputable insurers, insurance with respect to their respective properties and businesses against such casualties and contingencies, of such types, on such terms and in such amounts (including deductibles, co‑insurance and self‑insurance, if adequate reserves are maintained with respect thereto) as is customary in the case of entities of established reputations engaged in the same or a similar business and similarly situated.

Section 9.3. Maintenance of Properties. The Company will, and will cause each of its Subsidiaries to, maintain and keep, or cause to be maintained and kept, their respective properties in good working order and condition (other than ordinary wear and tear), so that the business carried on in connection therewith may be properly conducted at all times, provided that this Section 9.3 shall not prevent the Company or any Subsidiary from discontinuing the operation and the maintenance of any of its properties if such discontinuance is desirable in the conduct of its business and the Company has concluded that such discontinuance would not, individually or in

-21-

the aggregate, reasonably be expected to have a Material Adverse Effect; and provided, further, that this provision shall not apply to properties required to be closed, discontinued or abandoned pursuant to a law, legal order, mandate or requirement from the NMPRC or any other federal or state governmental authority or regulatory authority with the authority to regulate or oversee any aspect of the business of the Company or its Affiliates.