Exhibit 99.1

COVANTA HOLDING CORPORATION REPORTS

2013 FULL YEAR AND FOURTH QUARTER RESULTS AND

PROVIDES 2014 GUIDANCE

MORRISTOWN, NJ, February 11, 2014 - Covanta Holding Corporation (NYSE: CVA) ("Covanta" or the "Company"), a leading global owner and operator of Energy-from-Waste ("EfW") projects, reported financial results today for the three and twelve months ended December 31, 2013.

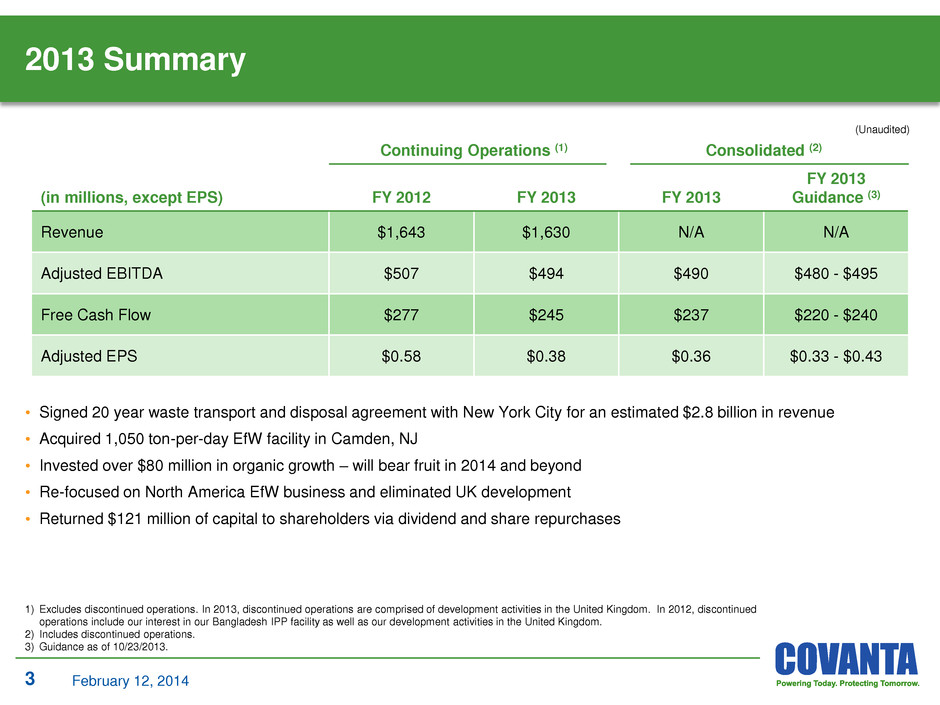

Consolidated | ||||||

(Unaudited, in millions, except EPS) | FY 2013 | FY 2013 Guidance (1) | ||||

Adjusted EBITDA | $ 490 | $480 - $495 | ||||

Free Cash Flow | $ 237 | $220 - $240 | ||||

Adjusted EPS | $ 0.36 | $0.33 - $0.43 | ||||

Continuing Operations (2) | ||||||

(Unaudited, in millions, except EPS) | FY 2012 | FY 2013 | ||||

Revenue | $ 1,643 | $ 1,630 | ||||

Income from Continuing Operations | $ 134 | $ 45 | ||||

Adjusted EBITDA | $ 507 | $ 494 | ||||

Free Cash Flow | $ 277 | $ 245 | ||||

Adjusted EPS | $ 0.58 | $ 0.38 | ||||

Full Year 2013 Highlights:

• | Signed 20 year waste transport and disposal agreement with New York City for an estimated $2.8 billion in revenue |

• | Renewed / extended waste disposal and service contracts totaling approximately 1.5 million annual tons with an average term of 5 years |

• | Acquired 1,050 ton-per-day EfW facility in Camden, New Jersey |

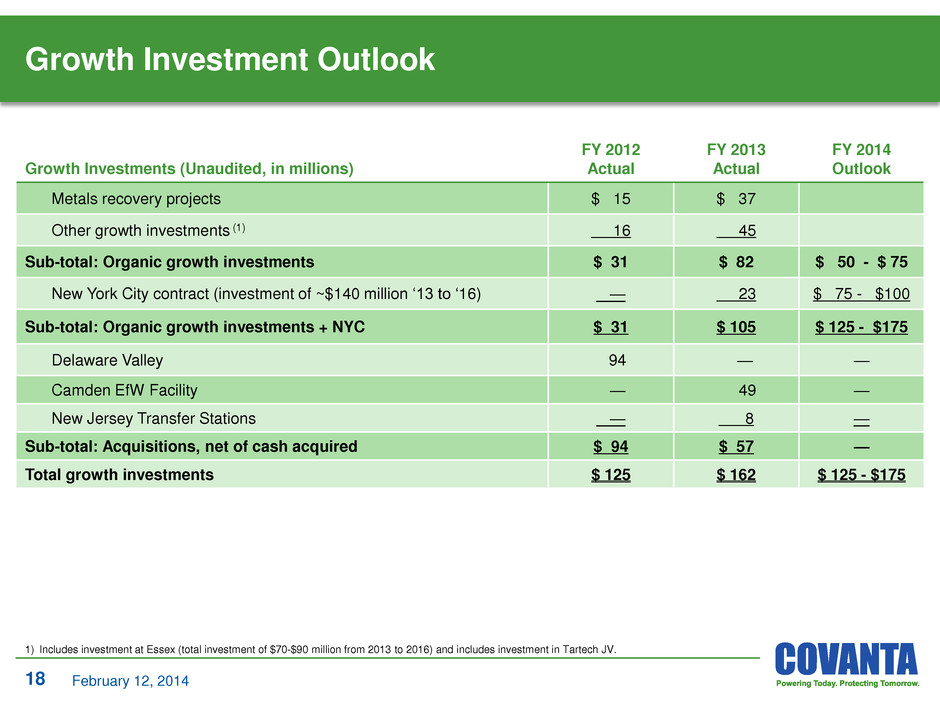

• | Invested over $80 million in organic growth |

• | Returned $121 million of capital to shareholders via dividend and share repurchases |

Commenting on Covanta’s 2013 performance and 2014 outlook, Anthony Orlando, Covanta’s President and CEO stated, “In 2013, we took a number of concrete steps to create long-term

_____________________________

(1) As of October 23, 2013.

(2) See Discontinued Operations discussion below.

value, most notably signing a 20 year waste contract with New York City, acquiring the Camden, New Jersey EfW facility, extending several municipal client contracts and investing in numerous metal recovery systems.”

Mr. Orlando continued, “As we head into 2014, we are focused on optimizing our Energy-from-Waste business by continuing to provide great customer service, extending contracts, executing our proactive maintenance program, increasing metal recovery and growing our sustainable waste solutions business.”

Full Year 2013 - From Continuing Operations

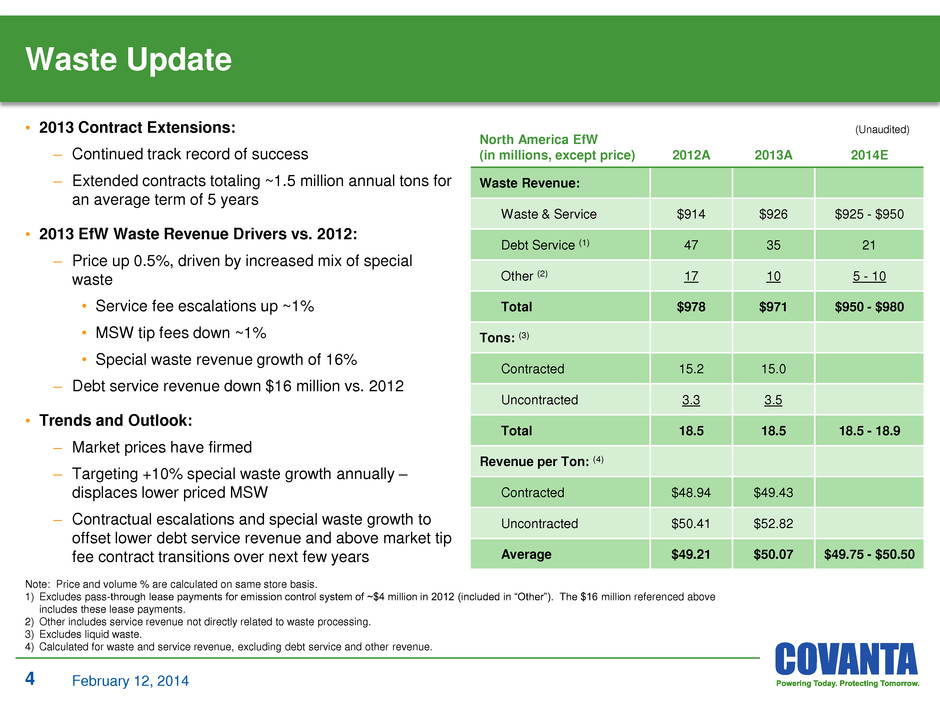

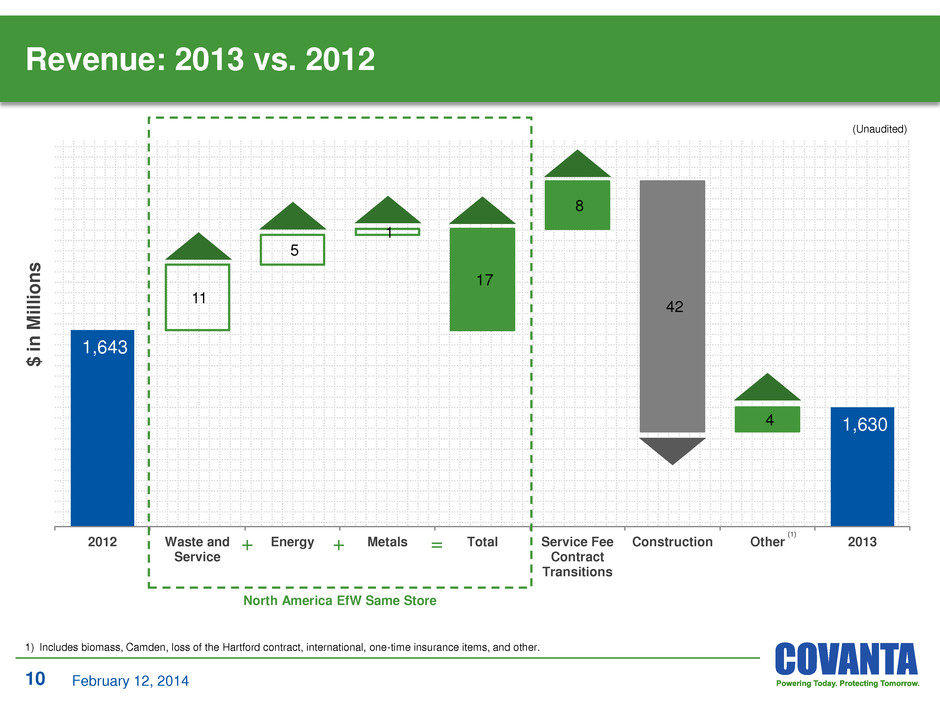

For the twelve months ended December 31, 2013, total operating revenues declined by $13 million to $1,630 million from $1,643 million in 2012. The primary driver for the decline was lower construction revenue due to the Honolulu facility expansion commencing commercial operation in 2012, which was partially offset by an increase in same store North America EfW revenue and higher revenue due to service fee contract transitions.

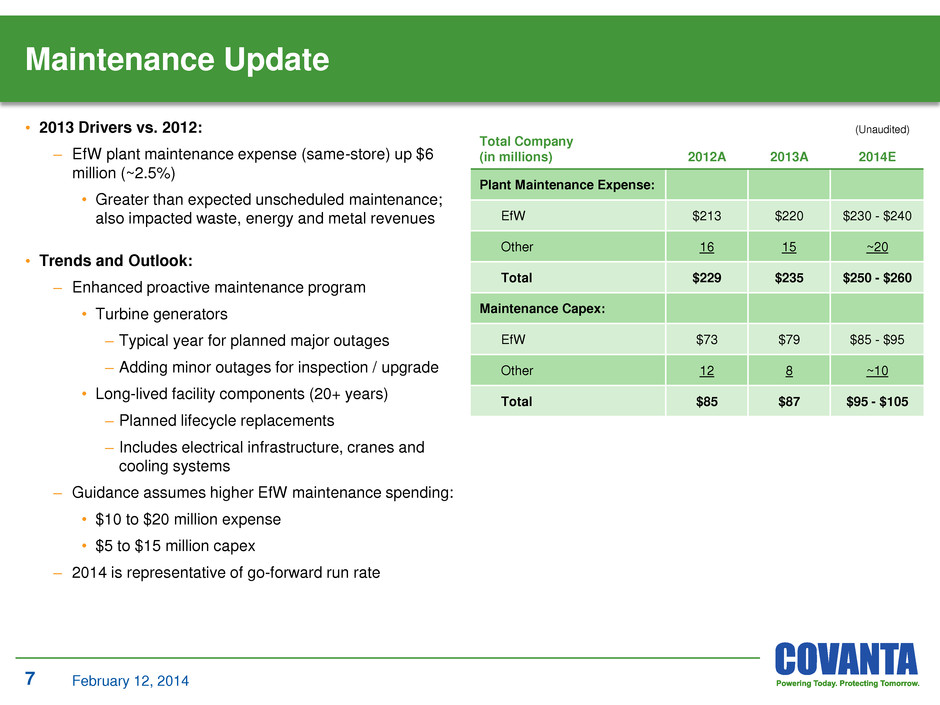

Excluding certain items (3), operating expenses of $1,400 million for 2013 decreased by $6 million compared to $1,406 million in 2012. The decline in operating expenses was driven by lower construction expense for the same reason noted above, as well as the benefit of a power purchase agreement buyout and higher renewable energy credits in 2013, both of which are reductions to operating expenses. These factors were partially offset by higher overall operating expenses, including higher costs related to service fee contract transitions and increased plant maintenance. As a result, operating income declined by $7 million to $230 million in 2013 versus $237 million in 2012.

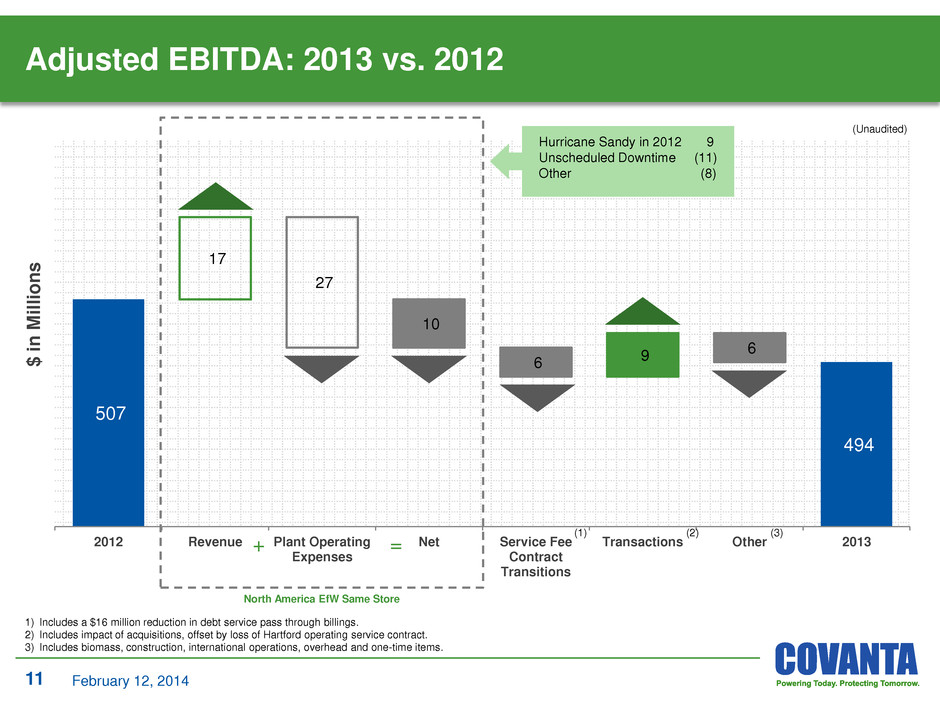

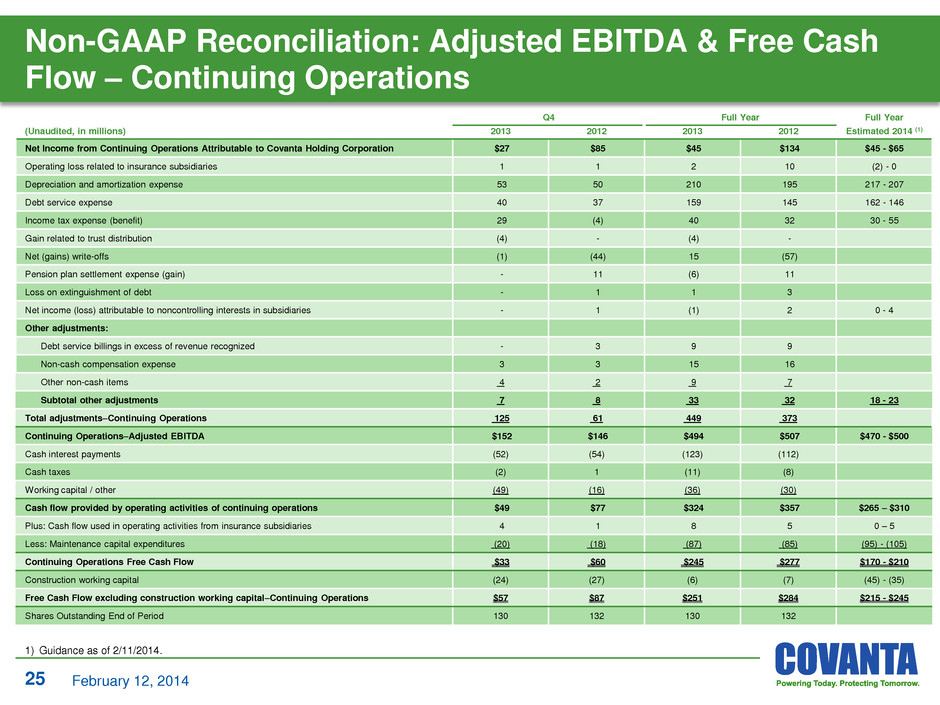

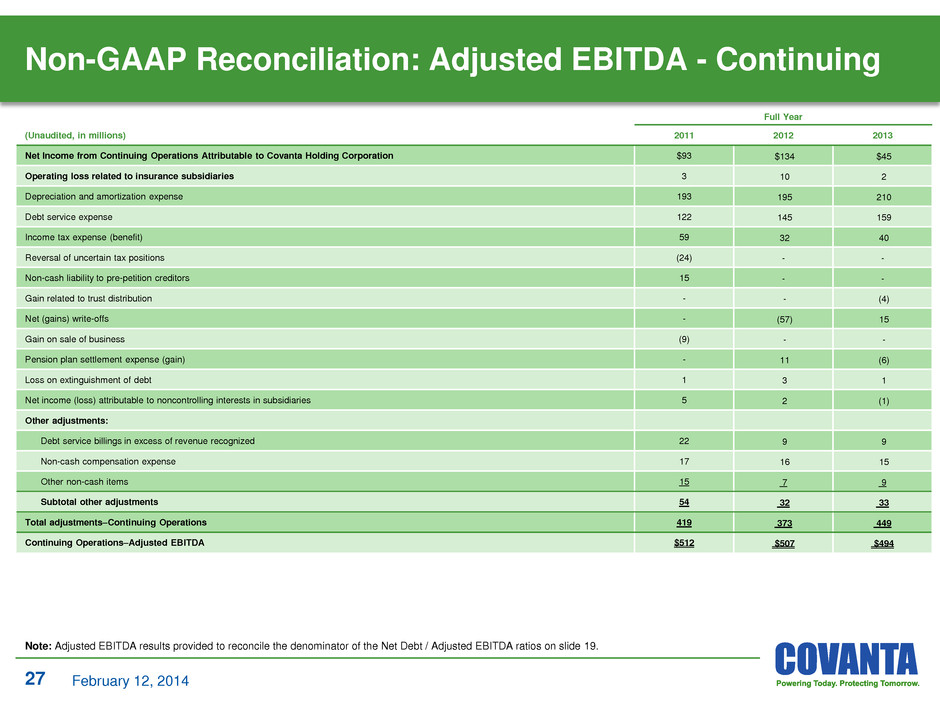

Adjusted EBITDA declined by $13 million to $494 million from $507 million in 2012. The decline was driven by the net impact of service fee contract transitions and reduced North America EfW plant operating margins on a same store basis. These factors were partially offset by improved biomass profit and the acquisition of the Camden EfW facility.

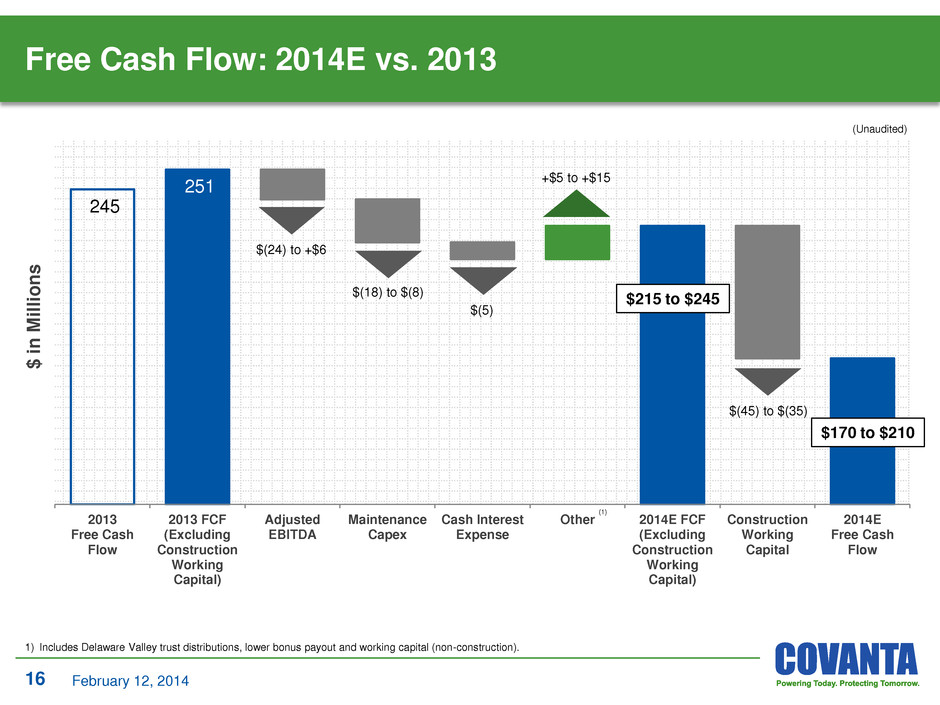

Free Cash Flow for 2013 was $245 million compared to $277 million in the prior year period. The decline was largely driven by lower Adjusted EBITDA and higher cash interest expense.

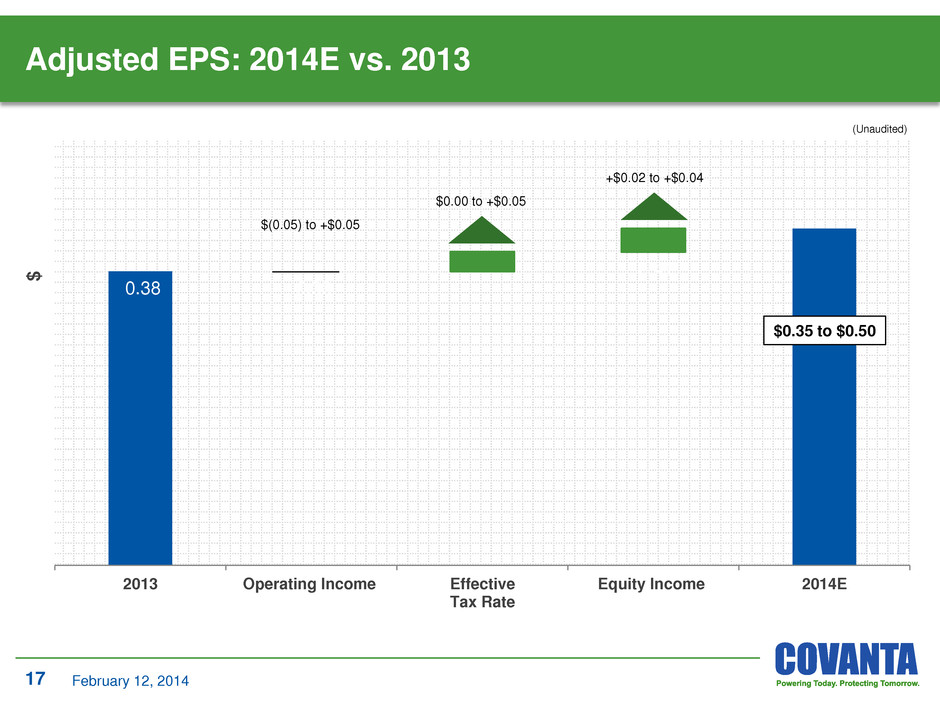

Adjusted EPS of $0.38 was down $0.20 compared to $0.58 in 2012. The decline was driven by lower operating income, a higher effective tax rate, higher interest expense and lower equity income. These factors were partially offset by the benefit of share repurchases.

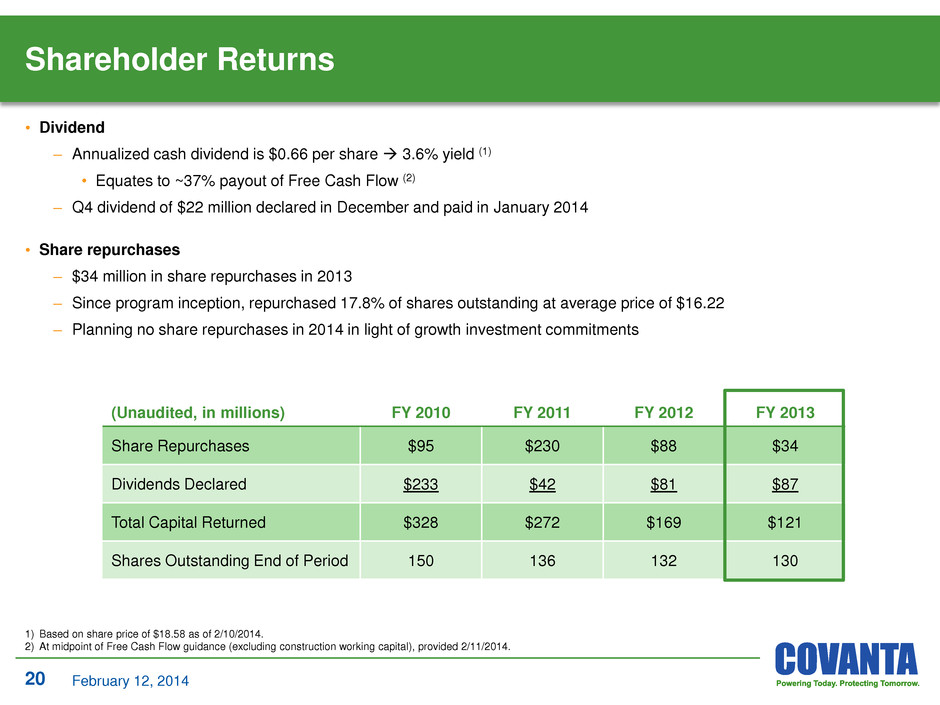

Shareholder Returns

In 2013, the Company increased its annual cash dividend to $0.66 per share and returned $121 million to shareholders, consisting of $87 million in cash dividends and $34 million in share repurchases (1.3% of common stock outstanding).

_____________________________

(3) Includes pension plan settlement (gain) expense of $(6) million and $11 million, respectively, and net non-cash write-offs (gains) of $15 million and $(57) million, respectively for 2013 and 2012, as well as transition to run-off of our insurance business of $7 million for 2012. For additional information, see Exhibit 4A of this press release.

Fourth Quarter Results - From Continuing Operations

For the three months ended December 31, 2013, total operating revenues declined by $7 million to $422 million from $429 million in 2013.

Excluding certain items (4), operating expenses decreased by $11 million to $336 million versus $347 million in 2012. As a result, operating income increased by $4 million to $86 million in 2013 versus $82 million in 2012.

Adjusted EBITDA increased by $6 million to $152 million compared to $146 million in 2012.

Free Cash Flow declined by $27 million to $33 million in 2013 versus $60 million in the prior year period,

Adjusted EPS was $0.18 compared to $0.22 in 2012.

Discontinued Operations

During the fourth quarter of 2013, our development projects in the United Kingdom met the criteria for classification as discontinued operations. Consequently, all corresponding prior year periods have been reclassified to conform to this presentation.

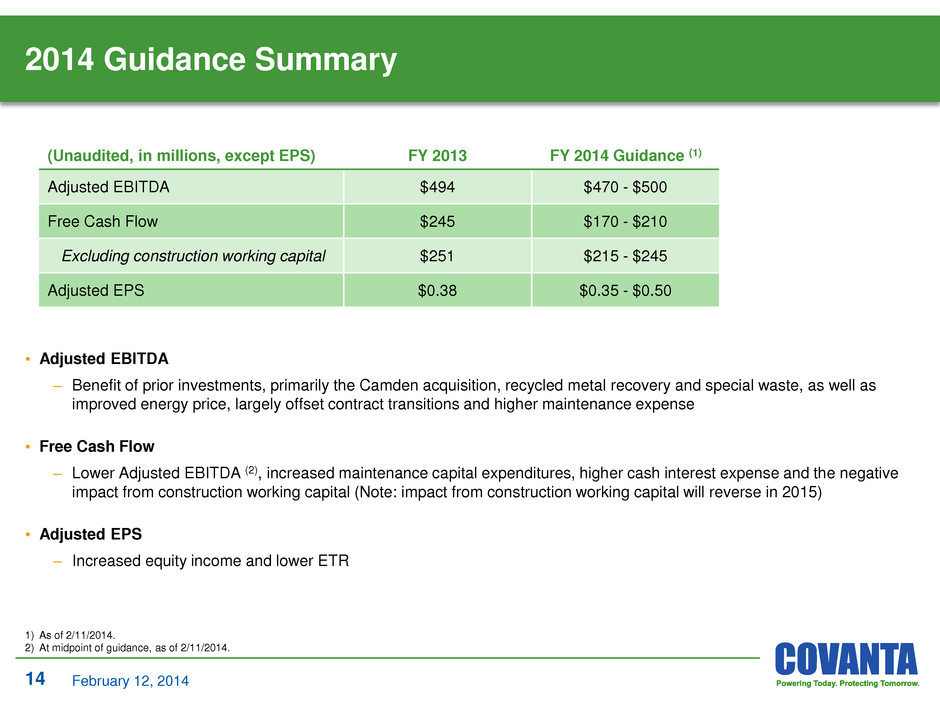

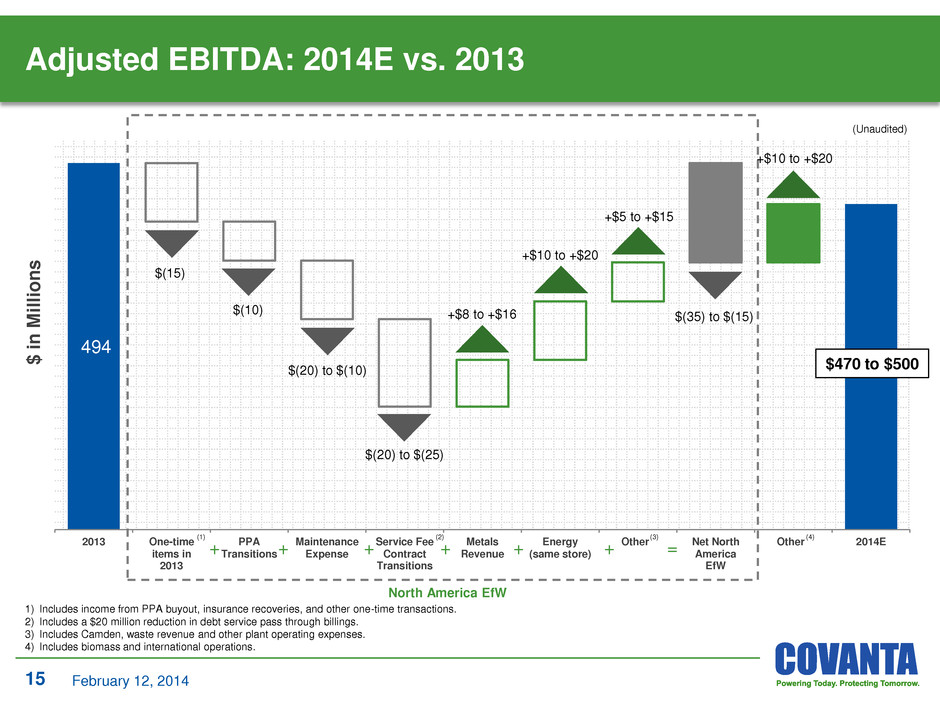

2014 Full Year Guidance

The Company is establishing guidance for 2014 for the following key metrics:

(In millions, except per share amounts)

Metric | 2013 Actual | 2014 Guidance Range |

Adjusted EBITDA | $ 494 | $470 - $500 |

Free Cash Flow | $ 245 | $170 - $210 |

Excluding Construction Working Capital | $ 251 | $215 - $245 |

Adjusted EPS | $ 0.38 | $0.35 - $0.50 |

Conference Call Information

Covanta will host a conference call at 8:30 AM (Eastern) on Wednesday, February 12, 2014 to discuss its fourth quarter results. The conference call will begin with prepared remarks, which will be followed by a question and answer session. To participate, please dial 800-860-2442 approximately 10 minutes prior to the scheduled start of the call. If calling from Canada, please dial 866-605-3852. If calling outside of the United States and Canada, please dial 412-858-4600. Please request the “Covanta Holding Corporation call” when prompted by the conference call operator. The conference call will also be webcast live from the Investor Relations section of the Company’s website. A presentation will be made available during the call and will be found on the Investor Relations section of the Covanta website at www.covanta.com.

_____________________________

(4) Includes pension plan settlement expense of $11 million in Q412 and net non-cash gains of $1 million and $44 million for Q413 and Q412, respectively. For additional information, see Exhibit 4A of this press release.

A replay will be available one hour after the end of the conference call through 9:00 AM (Eastern) Wednesday, February 19, 2014. To access the replay, please dial 877-344-7529, or from outside of the United States 412-317-0088 and use the replay conference ID number 10038565. The webcast will also be archived on www.covanta.com.

About Covanta

Covanta is a world leader in providing sustainable waste and energy solutions. The Company’s 45 Energy-from-Waste facilities provide communities and businesses around the world with environmentally sound solid waste disposal by using waste to generate clean, renewable energy. Annually, Covanta’s modern Energy-from-Waste facilities safely and securely convert approximately 20 million tons of waste into clean, renewable electricity to power one million homes and recycle over 440,000 tons of metal. Energy-from-Waste facilities reduce greenhouse gases, complement recycling and are a critical component to sustainable solid waste management. For more information, visit www.covanta.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking” statements as defined in Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange Commission (“SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Covanta Holding Corporation and its subsidiaries (“Covanta”) or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. For additional information see the Cautionary Note Regarding Forward-Looking Statements at the end of the Exhibits.

Investor Contacts

Alan Katz

1.862.345.5456

Clare Rauseo

1.862.345.5236

IR@covanta.com

Media Contact

James Regan

1.862.345.5216

Covanta Holding Corporation | Exhibit 1 |

Consolidated Statements of Operations | |

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2012 (a) | 2013 | 2012 (a) | ||||||||||||

(Unaudited) (In millions, except per share amounts) | |||||||||||||||

Operating revenues | |||||||||||||||

Waste and service revenues | $ | 266 | $ | 263 | $ | 1,008 | $ | 1,010 | |||||||

Recycled metals revenues | 21 | 17 | 73 | 72 | |||||||||||

Energy revenues | 109 | 97 | 431 | 394 | |||||||||||

Other operating revenues | 26 | 52 | 118 | 167 | |||||||||||

Total operating revenues | 422 | 429 | 1,630 | 1,643 | |||||||||||

Operating expenses | |||||||||||||||

Plant operating expenses | 233 | 227 | 993 | 962 | |||||||||||

Other operating expenses | 27 | 56 | 94 | 156 | |||||||||||

General and administrative expenses | 20 | 20 | 84 | 84 | |||||||||||

Depreciation and amortization expense | 53 | 50 | 210 | 195 | |||||||||||

Net interest expense on project debt | 3 | 5 | 13 | 27 | |||||||||||

Net (gains) write-offs (b) | (1 | ) | (44 | ) | 15 | (57 | ) | ||||||||

Total operating expenses | 335 | 314 | 1,409 | 1,367 | |||||||||||

Operating income | 87 | 115 | 221 | 276 | |||||||||||

Other income (expense) | |||||||||||||||

Investment income | — | 1 | — | 1 | |||||||||||

Interest expense | (30 | ) | (27 | ) | (118 | ) | (94 | ) | |||||||

Non-cash convertible debt related expense | (7 | ) | (6 | ) | (28 | ) | (25 | ) | |||||||

Loss on extinguishment of debt | — | (1 | ) | (1 | ) | (3 | ) | ||||||||

Other income, net | 4 | — | 4 | 3 | |||||||||||

Total other expenses | (33 | ) | (33 | ) | (143 | ) | (118 | ) | |||||||

Income from continuing operations before income tax (expense) benefit and equity in net income from unconsolidated investments | 54 | 82 | 78 | 158 | |||||||||||

Income tax (expense) benefit | (29 | ) | 4 | (40 | ) | (32 | ) | ||||||||

Equity in net income from unconsolidated investments | 2 | — | 6 | 10 | |||||||||||

Income from continuing operations | 27 | 86 | 44 | 136 | |||||||||||

Income (loss) from discontinued operations, net of income tax benefit of $0, $0, $1 and $5, respectively (a) | 1 | (3 | ) | (52 | ) | (20 | ) | ||||||||

Net Income (Loss) | 28 | 83 | (8 | ) | 116 | ||||||||||

Noncontrolling interests: | |||||||||||||||

Less: Net (income) loss from continuing operations attributable to noncontrolling interests in subsidiaries | — | (1 | ) | 1 | (2 | ) | |||||||||

Net Income (Loss) Attributable to Covanta Holding Corporation | $ | 28 | $ | 82 | $ | (7 | ) | $ | 114 | ||||||

Covanta Holding Corporation | |||||||||||||||

Consolidated Statements of Operations (continued) | |||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

2013 | 2012 (a) | 2013 | 2012 (a) | ||||||||||||

(Unaudited) (In millions, except per share amounts) | |||||||||||||||

Amounts Attributable to Covanta Holding Corporation stockholders: | |||||||||||||||

Continuing operations | $ | 27 | $ | 85 | $ | 45 | $ | 134 | |||||||

Discontinued operations (a) | 1 | (3 | ) | (52 | ) | (20 | ) | ||||||||

Net Income (Loss) Attributable to Covanta Holding Corporation | $ | 28 | $ | 82 | $ | (7 | ) | $ | 114 | ||||||

Earnings (Loss) Per Share Attributable to Covanta Holding Corporation stockholders: | |||||||||||||||

Basic | |||||||||||||||

Continuing operations | $ | 0.21 | $ | 0.65 | $ | 0.35 | $ | 1.02 | |||||||

Discontinued operations (a) | 0.01 | (0.02 | ) | (0.40 | ) | (0.15 | ) | ||||||||

Covanta Holding Corporation | $ | 0.22 | $ | 0.63 | $ | (0.05 | ) | $ | 0.87 | ||||||

Weighted Average Shares | 129 | 130 | 129 | 132 | |||||||||||

Diluted | |||||||||||||||

Continuing operations | $ | 0.21 | $ | 0.64 | $ | 0.35 | $ | 1.01 | |||||||

Discontinued operations (a) | 0.01 | (0.02 | ) | (0.40 | ) | (0.15 | ) | ||||||||

Covanta Holding Corporation | $ | 0.22 | $ | 0.62 | $ | (0.05 | ) | $ | 0.86 | ||||||

Weighted Average Shares | 130 | 132 | 130 | 133 | |||||||||||

Cash Dividend Declared Per Share: | $ | 0.165 | $ | 0.15 | $ | 0.66 | $ | 0.60 | |||||||

Supplemental Information - Non-GAAP | |||||||||||||||

Adjusted EPS (c) | $ | 0.19 | $ | 0.20 | $ | 0.36 | $ | 0.53 | |||||||

(a) During the fourth quarter of 2013, our development projects in the United Kingdom met the criteria to be classified as discontinued operations. Consequently, all corresponding prior year periods presented in our consolidated financial statements have been reclassified to reflect these assets as discontinued operations. | |||||||||||||||

(b) For additional information, see Exhibit 4B of this Press Release. | |||||||||||||||

(c) For additional information, see Exhibit 4 of this Press Release. | |||||||||||||||

Covanta Holding Corporation | Exhibit 2 |

Consolidated Balance Sheets | |

As of December 31, | |||||||

2013 | 2012 (a) | ||||||

(Unaudited) | |||||||

(In millions, except per share amounts) | |||||||

ASSETS | |||||||

Current: | |||||||

Cash and cash equivalents | $ | 198 | $ | 243 | |||

Restricted funds held in trust | 41 | 53 | |||||

Receivables (less allowances of $4 and $6, respectively) | 265 | 256 | |||||

Unbilled service receivables | 16 | 18 | |||||

Deferred income taxes | 25 | 18 | |||||

Note Hedge | 78 | — | |||||

Prepaid expenses and other current assets | 110 | 97 | |||||

Assets held for sale (a) | 7 | 55 | |||||

Total Current Assets | 740 | 740 | |||||

Property, plant and equipment, net | 2,636 | 2,559 | |||||

Investments in fixed maturities at market (cost: $32 and $36, respectively) | 32 | 36 | |||||

Restricted funds held in trust | 126 | 161 | |||||

Unbilled service receivables | 13 | 17 | |||||

Waste, service and energy contract intangibles, net | 364 | 399 | |||||

Other intangible assets, net | 20 | 23 | |||||

Goodwill | 249 | 249 | |||||

Investments in investees and joint ventures | 47 | 49 | |||||

Other assets | 151 | 293 | |||||

Total Assets | $ | 4,378 | $ | 4,526 | |||

LIABILITIES AND EQUITY | |||||||

Current: | |||||||

Current portion of long-term debt | $ | 528 | $ | 3 | |||

Current portion of project debt | 55 | 80 | |||||

Accounts payable | 24 | 40 | |||||

Accrued expenses and other current liabilities | 250 | 235 | |||||

Liabilities held for sale (a) | 2 | 2 | |||||

Total Current Liabilities | 859 | 360 | |||||

Long-term debt | 1,557 | 2,012 | |||||

Project debt | 181 | 237 | |||||

Deferred income taxes | 722 | 691 | |||||

Waste, service and other contract intangibles, net | 30 | 35 | |||||

Other liabilities | 118 | 136 | |||||

Total Liabilities | 3,467 | 3,471 | |||||

Equity: | |||||||

Covanta Holding Corporation stockholders' equity: | |||||||

Preferred stock ($0.10 par value; authorized 10 shares; none issued and outstanding) | — | — | |||||

Common stock ($0.10 par value; authorized 250 shares; issued 136 and 159 shares, respectively; outstanding 130 and 132 shares, respectively) | 14 | 16 | |||||

Additional paid-in capital | 790 | 806 | |||||

Accumulated other comprehensive (loss) income | (2 | ) | 7 | ||||

Accumulated earnings | 106 | 222 | |||||

Treasury stock, at par | (1 | ) | (3 | ) | |||

Total Covanta Holding Corporation stockholders equity | 907 | 1,048 | |||||

Noncontrolling interests in subsidiaries | 4 | 7 | |||||

Total Equity | 911 | 1,055 | |||||

Total Liabilities and Equity | $ | 4,378 | $ | 4,526 | |||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||

Covanta Holding Corporation | Exhibit 3 |

Consolidated Statements of Cash Flow | |

Twelve Months Ended December 31, | |||||||

2013 | 2012(a) | ||||||

(Unaudited, in millions) | |||||||

OPERATING ACTIVITIES: | |||||||

Net (loss) income | $ | (8 | ) | $ | 116 | ||

Less: Loss from discontinued operations, net of tax expense (a) | (52 | ) | (20 | ) | |||

Income from continuing operations | 44 | 136 | |||||

Adjustments to reconcile net income from continuing operations to net cash provided by operating activities from continuing operations: | |||||||

Depreciation and amortization expense | 210 | 195 | |||||

Net write-offs (gains) (b) | 15 | (57 | ) | ||||

Pension plan settlement (gain) loss | (6 | ) | 11 | ||||

Loss on extinguishment of debt | 1 | 3 | |||||

Non-cash convertible debt related expense | 28 | 25 | |||||

Stock-based compensation expense | 15 | 16 | |||||

Deferred income taxes | 28 | 20 | |||||

Other, net | 2 | (5 | ) | ||||

Change in restricted funds held in trust | 20 | 34 | |||||

Change in working capital, net of effects of acquisitions | (33 | ) | (21 | ) | |||

Net cash provided by operating activities from continuing operations | 324 | 357 | |||||

Net cash used in operating activities of discontinued operations (a) | (8 | ) | (15 | ) | |||

Net cash provided by operating activities | 316 | 342 | |||||

INVESTING ACTIVITIES: | |||||||

Purchase of property, plant and equipment | (188 | ) | (126 | ) | |||

Acquisition of business, net of cash acquired | (57 | ) | (94 | ) | |||

Acquisition of noncontrolling interest in subsidiary | (14 | ) | — | ||||

Acquisition of land use rights | — | (1 | ) | ||||

Payment received for loan issued for the Harrisburg EfW facility | 9 | — | |||||

Property insurance proceeds | 4 | 8 | |||||

Other, net | (12 | ) | (9 | ) | |||

Net cash used in investing activities from continuing operations | (258 | ) | (222 | ) | |||

Net cash provided by investing activities of discontinued operations (a) | — | 9 | |||||

Net cash used in investing activities | (258 | ) | (213 | ) | |||

FINANCING ACTIVITIES: | |||||||

Proceeds from borrowings on long-term debt | 22 | 1,034 | |||||

Payment of deferred financing costs | (1 | ) | (33 | ) | |||

Principal payments on long-term debt | (3 | ) | (622 | ) | |||

Principal payments on project debt | (83 | ) | (424 | ) | |||

Convertible debenture repurchases | — | (25 | ) | ||||

Payments of borrowings on revolving credit facility | (595 | ) | (191 | ) | |||

Proceeds from borrowings on revolving credit facility | 645 | 251 | |||||

Change in restricted funds held in trust | 27 | 65 | |||||

Cash dividends paid to stockholders | (65 | ) | (90 | ) | |||

Common stock repurchased | (34 | ) | (88 | ) | |||

Financing of insurance premiums, net | — | (10 | ) | ||||

Distributions to partners of noncontrolling interests in subsidiaries | — | (1 | ) | ||||

Other, net | (24 | ) | 2 | ||||

Net cash used in financing activities from continuing operations | (111 | ) | (132 | ) | |||

Net cash provided by financing activities of discontinued operations (a) | 8 | 15 | |||||

Net cash used in financing activities | (103 | ) | (117 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | (1 | ) | — | ||||

Net (decrease) increase in cash and cash equivalents | (46 | ) | 12 | ||||

Cash and cash equivalents at beginning of period | 246 | 234 | |||||

Cash and cash equivalents at end of period | 200 | 246 | |||||

Less: Cash and cash equivalents of discontinued operations at end of period | 2 | 3 | |||||

Cash and cash equivalents of continuing operations at end of period | $ | 198 | $ | 243 | |||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||

(b) For additional information, see Exhibit 4B of this Press Release. | |||||||

Covanta Holding Corporation | Exhibit 4 | ||||||||||||||||

Reconciliation of Diluted Earnings Per Share to Adjusted EPS | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | Full Year Estimated 2014 | |||||||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||||||||

(Unaudited) | |||||||||||||||||

Continuing Operations - Diluted EPS | $ | 0.21 | $ | 0.64 | $ | 0.35 | $ | 1.01 | $0.35 - $0.50 | ||||||||

Continuing Operations - Reconciling Items (b) | (0.03 | ) | (0.42 | ) | 0.03 | (0.43 | ) | — | |||||||||

Continuing Operations - Adjusted EPS | $ | 0.18 | $ | 0.22 | $ | 0.38 | $ | 0.58 | $0.35 - $0.50 | ||||||||

Discontinued Operations - Diluted EPS (c) | $ | 0.01 | $ | (0.02 | ) | $ | (0.40 | ) | $ | (0.15 | ) | ||||||

Discontinued Operations - Reconciling Items (b) | — | — | 0.38 | 0.10 | |||||||||||||

Discontinued Operations - Adjusted EPS | 0.01 | (0.02 | ) | (0.02 | ) | (0.05 | ) | ||||||||||

Consolidated - Adjusted EPS | $ | 0.19 | $ | 0.20 | $ | 0.36 | $ | 0.53 | |||||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||

(b) For details related to the Reconciling Items, see Exhibit 4A of this Press Release. | |||||||||||||||||

(c) Discontinued Operations - Diluted EPS for the twelve months ended December 31, 2012 includes $0.01 per share related to independent power production facilities in Asia. | |||||||||||||||||

Covanta Holding Corporation | Exhibit 4A | ||||||||||||||||

Reconciling Items | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||||||||

(Unaudited) (In millions, except per share amounts) | |||||||||||||||||

Continuing Operations - Reconciling Items | |||||||||||||||||

Operating loss related to insurance subsidiaries(b) | $ | 1 | $ | 1 | $ | 2 | $ | 10 | |||||||||

Net (gains) write-offs (c) | (1 | ) | (44 | ) | 15 | (57 | ) | ||||||||||

Severance and other restructuring | 2 | — | 2 | — | |||||||||||||

Pension plan settlement expense (gain) (d) | — | 11 | (6 | ) | 11 | ||||||||||||

Gain related to trust distribution (e) | (4 | ) | — | (4 | ) | — | |||||||||||

Loss on extinguishment of debt | — | 1 | 1 | 3 | |||||||||||||

Loss on derivative instruments not designated as hedging instruments | (1 | ) | — | (1 | ) | (1 | ) | ||||||||||

Effect of foreign exchange gain on indebtedness | — | — | — | (3 | ) | ||||||||||||

Other | (1 | ) | (1 | ) | — | — | |||||||||||

Total Reconciling Items, pre-tax | (4 | ) | (32 | ) | 9 | (37 | ) | ||||||||||

Proforma income tax impact | — | (24 | ) | (5 | ) | (22 | ) | ||||||||||

Grantor trust activity | — | 1 | — | 1 | |||||||||||||

Total Continuing Operations Reconciling Items, net of tax | $ | (4 | ) | $ | (55 | ) | $ | 4 | $ | (58 | ) | ||||||

Continuing Operations - Diluted EPS Impact from Reconciling Items | $ | (0.03 | ) | $ | (0.42 | ) | $ | 0.03 | $ | (0.43 | ) | ||||||

Discontinued Operations - Reconciling Items (a) | |||||||||||||||||

Net write-offs (c) | $ | — | $ | — | $ | 47 | $ | 13 | |||||||||

Severance and other restructuring | — | — | 3 | — | |||||||||||||

Effect of foreign exchange gain on indebtedness | (1 | ) | — | (1 | ) | (1 | ) | ||||||||||

Transaction-related costs | 1 | — | 1 | 1 | |||||||||||||

Total Discontinued Operations - Reconciling Items | $ | — | $ | — | $ | 50 | $ | 13 | |||||||||

Discontinued Operations - Diluted EPS Impact from Reconciling Items | $ | — | $ | — | $ | 0.38 | $ | 0.10 | |||||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||

(b) During the year ended December 31, 2012, we transitioned our remaining insurance business to run-off and recorded additional losses and reserve increases of $7 million primarily relating to adverse loss development. | |||||||||||||||||

(c) For details on the components of Net (gains) write-offs, see Exhibit 4B of this Press Release. | |||||||||||||||||

(d) During the year ended December 31, 2013 and 2012, we recorded a defined benefit pension plan settlement (gain) expense of $(6) million and $11 million, respectively. | |||||||||||||||||

(e) In 2013, we recorded a $4 million gain related to a distribution received from an insurance subsidiary grantor trust. | |||||||||||||||||

Covanta Holding Corporation | Exhibit 4B | ||||||||||||||||

Net (Gains) Write-Offs | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||||||||

(Unaudited, in millions) | |||||||||||||||||

Net (Gains) Write-Offs - Continuing Operations | |||||||||||||||||

Write-down of Wallingford EfW facility assets(b) | $ | — | $ | — | $ | 9 | $ | — | |||||||||

Write-down of equity investment in biomass facility (c) | (1 | ) | — | 2 | — | ||||||||||||

Write-off of loan issued for the Harrisburg EfW facility to fund certain facility improvements (d) | — | — | 4 | — | |||||||||||||

Write-off of intangible liability (e) | — | — | — | (29 | ) | ||||||||||||

Write-down of renewable fuels project (f) | — | — | — | 16 | |||||||||||||

Net gain related to lease termination (g) | — | (44 | ) | — | (44 | ) | |||||||||||

Total net (gains) write-offs - Continuing Operations | $ | (1 | ) | $ | (44 | ) | $ | 15 | $ | (57 | ) | ||||||

Net Write-Offs - Discontinued Operations | |||||||||||||||||

Development costs - UK (h) | $ | — | $ | — | $ | 47 | $ | 11 | |||||||||

Independent power production assets - Asia (i) | — | — | — | 2 | |||||||||||||

Total net write-offs - Discontinued Operations | $ | — | $ | — | $ | 47 | $ | 13 | |||||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||

(b) During the twelve months ended December 31, 2013, we recorded a non-cash write-down of $9 million resulting from an impairment charge related to our Wallingford EfW facility assets in Connecticut. | |||||||||||||||||

(c) During the twelve months ended December 31, 2013, we recorded a non-cash write-down of $2 million related to our 55% equity investment in the Pacific Ultrapower Chinese Station biomass facility in California. | |||||||||||||||||

(d) During the twelve months ended December 31, 2013, we recorded a non-cash write-off of $4 million associated with funds advanced related to the Harrisburg EfW facility. | |||||||||||||||||

(e) During the twelve months ended December 31, 2012, we recorded a non-cash write-off of an intangible liability in connection with a contract amendment for our Essex EfW facility, which resulted in a gain of $29 million. | |||||||||||||||||

(f) During the twelve months ended December 31, 2012, we recorded a non-cash write-off of $16 million representing the capitalized costs of a suspended renewable fuels project. | |||||||||||||||||

(g) During the twelve months ended December 31, 2012, we recorded a net gain of $44 million related to the termination of the pre-existing lease in connection with the acquisition of the Delaware Valley energy-from-waste facility. | |||||||||||||||||

(h) During the twelve months ended December 31, 2013 and 2012, we recorded non-cash write-offs of $47 million and $11 million, respectively, of capitalized development costs and land related to United Kingdom development projects which we ceased to pursue in their current form and are classified as discontinued operations. | |||||||||||||||||

(i) During the twelve months ended December 31, 2012, we recorded a non-cash write-off of $2 million related to certain independent power production facilities located in Asia. | |||||||||||||||||

Covanta Holding Corporation | Exhibit 4C |

Effective Tax Rate ("ETR") | |

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||

(Unaudited) | |||||||||||

Effective Tax Rate from Continuing Operations | 55 | % | (5 | )% | 51 | % | 20 | % | |||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||

Covanta Holding Corporation | Exhibit 5 | ||||||||||||||||

Reconciliation of Net Income to Adjusted EBITDA | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | Full Year Estimated 2014 | |||||||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||||||||

Continuing Operations - Adjusted EBITDA | (Unaudited, in millions) | ||||||||||||||||

Net Income from Continuing Operations Attributable to Covanta Holding Corporation | $ | 27 | $ | 85 | $ | 45 | $ | 134 | $45 - $65 | ||||||||

Operating loss related to insurance subsidiaries | 1 | 1 | 2 | 10 | (2) - 0 | ||||||||||||

Depreciation and amortization expense | 53 | 50 | 210 | 195 | 217 - 207 | ||||||||||||

Debt service: | |||||||||||||||||

Net interest expense on project debt | 3 | 5 | 13 | 27 | |||||||||||||

Interest expense | 30 | 27 | 118 | 94 | |||||||||||||

Non-cash convertible debt related expense | 7 | 6 | 28 | 25 | |||||||||||||

Investment income | — | (1 | ) | — | (1 | ) | |||||||||||

Subtotal debt service | 40 | 37 | 159 | 145 | 162 - 146 | ||||||||||||

Income tax expense (benefit) | 29 | (4 | ) | 40 | 32 | 30 - 55 | |||||||||||

Gain related to trust distribution (b) | (4 | ) | — | (4 | ) | — | |||||||||||

Net (gains) write-offs (c) | (1 | ) | (44 | ) | 15 | (57 | ) | ||||||||||

Pension plan settlement expense (gain) (b) | — | 11 | (6 | ) | 11 | ||||||||||||

Loss on extinguishment of debt | — | 1 | 1 | 3 | |||||||||||||

Net income (loss) attributable to noncontrolling interests in subsidiaries | — | 1 | (1 | ) | 2 | 0 - 4 | |||||||||||

Other adjustments: | |||||||||||||||||

Debt service billings in excess of revenue recognized | — | 3 | 9 | 9 | |||||||||||||

Non-cash compensation expense | 3 | 3 | 15 | 16 | |||||||||||||

Other non-cash items (d) | 4 | 2 | 9 | 7 | |||||||||||||

Subtotal other adjustments | 7 | 8 | 33 | 32 | 18 - 23 | ||||||||||||

Total adjustments - Continuing Operations | 125 | 61 | 449 | 373 | |||||||||||||

Continuing Operations - Adjusted EBITDA | $ | 152 | $ | 146 | $ | 494 | $ | 507 | $470 - $500 | ||||||||

Discontinued Operations - Adjusted EBITDA (a) | |||||||||||||||||

Income (loss) from discontinued operations | $ | 1 | $ | (3 | ) | $ | (52 | ) | $ | (20 | ) | ||||||

Income tax benefit | — | — | (1 | ) | (5 | ) | |||||||||||

Net write-offs (c) | — | — | 47 | 13 | |||||||||||||

Severance and other restructuring | — | 1 | 3 | 1 | |||||||||||||

Other non-cash items | 1 | — | (1 | ) | — | ||||||||||||

Discontinued Operations - Adjusted EBITDA | $ | 2 | $ | (2 | ) | $ | (4 | ) | $ | (11 | ) | ||||||

Consolidated - Adjusted EBITDA | $ | 154 | $ | 144 | $ | 490 | $ | 496 | |||||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||

(b) See Exhibit 4A of this Press Release. | |||||||||||||||||

(c) For details on the components of Net (gains) write-offs, see Exhibit 4B of this Press Release. | |||||||||||||||||

(d) Includes certain non-cash items that are added back under the definition of Adjusted EBITDA in Covanta Energy Corporation's credit agreement. | |||||||||||||||||

Covanta Holding Corporation | Exhibit 6 |

Consolidated Reconciliation of Cash Flow Provided by Operating Activities to Adjusted EBITDA | |

Three Months Ended December 31, | Twelve Months Ended December 31, | Full Year Estimated 2014 | |||||||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||||||||

(Unaudited, in millions) | |||||||||||||||||

Cash flow provided by operating activities from continuing operations | $ | 49 | $ | 77 | $ | 324 | $ | 357 | $265 - $310 | ||||||||

Cash flow used in operating activities from insurance subsidiaries | 4 | 1 | 8 | 5 | 0 - 5 | ||||||||||||

Debt service | 40 | 37 | 159 | 145 | 162 - 146 | ||||||||||||

Change in working capital | 69 | 75 | 33 | 21 | |||||||||||||

Change in restricted funds held in trust | (3 | ) | (44 | ) | (20 | ) | (34 | ) | |||||||||

Non-cash convertible debt related expense | (7 | ) | (6 | ) | (28 | ) | (25 | ) | |||||||||

Equity in net income from unconsolidated investments | 2 | — | 6 | 10 | |||||||||||||

Dividends from unconsolidated investments | — | (1 | ) | (7 | ) | (8 | ) | ||||||||||

Current tax provision | 8 | 4 | 12 | 12 | |||||||||||||

Other | (10 | ) | 3 | 7 | 24 | ||||||||||||

Sub-total | 59 | 31 | 3 | — | 43 - 39 | ||||||||||||

Adjusted EBITDA - Continuing Operations | $ | 152 | $ | 146 | $ | 494 | $ | 507 | $470 - $500 | ||||||||

Cash flow provided by operating activities from discontinued operations | $ | — | $ | (3 | ) | $ | (8 | ) | $ | (15 | ) | ||||||

Change in working capital | (2 | ) | (1 | ) | (2 | ) | (2 | ) | |||||||||

Current tax provision | — | — | 3 | 9 | |||||||||||||

Other | 4 | 2 | 3 | (3 | ) | ||||||||||||

Sub-total | 2 | 1 | 4 | 4 | |||||||||||||

Adjusted EBITDA - Discontinued Operations | $ | 2 | $ | (2 | ) | $ | (4 | ) | $ | (11 | ) | ||||||

Adjusted EBITDA - Consolidated | $ | 154 | $ | 144 | $ | 490 | $ | 496 | |||||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||

Covanta Holding Corporation | Exhibit 7 |

Reconciliation of Cash Flow Provided by Operating Activities to Free Cash Flow | |

Three Months Ended December 31, | Twelve Months Ended December 31, | Full Year Estimated 2014 | |||||||||||||||

2013 | 2012(a) | 2013 | 2012(a) | ||||||||||||||

(Unaudited, in millions) | |||||||||||||||||

Free Cash Flow - Consolidated | |||||||||||||||||

Cash flow provided by operating activities | $ | 49 | $ | 74 | $ | 316 | $ | 342 | |||||||||

Plus: Cash flow used in operating activities from insurance subsidiaries | 4 | 1 | 8 | 5 | |||||||||||||

Less: Maintenance capital expenditures (b) | (20 | ) | (18 | ) | (87 | ) | (85 | ) | |||||||||

Free Cash Flow | $ | 33 | $ | 57 | $ | 237 | $ | 262 | |||||||||

Construction working capital | (24 | ) | (27 | ) | (6 | ) | (7 | ) | |||||||||

Free Cash Flow Excluding Construction Working Capital | $ | 57 | $ | 84 | $ | 243 | $ | 269 | |||||||||

Free Cash Flow - Continuing Operations | |||||||||||||||||

Cash flow provided by operating activities of continuing operations | $ | 49 | $ | 77 | $ | 324 | $ | 357 | $265 - $310 | ||||||||

Plus: Cash flow used in operating activities from insurance subsidiaries | 4 | 1 | 8 | 5 | 0 - 5 | ||||||||||||

Less: Maintenance capital expenditures (b) | (20 | ) | (18 | ) | (87 | ) | (85 | ) | (95) - (105) | ||||||||

Continuing Operations Free Cash Flow | $ | 33 | $ | 60 | $ | 245 | $ | 277 | $170 - $210 | ||||||||

Construction working capital | (24 | ) | (27 | ) | (6 | ) | (7 | ) | (45) - (35) | ||||||||

Free Cash Flow Excluding Construction Working Capital - Continuing Operations | $ | 57 | $ | 87 | $ | 251 | $ | 284 | $215 - $245 | ||||||||

Weighted Average Diluted Shares Outstanding | 130 | 132 | 130 | 133 | |||||||||||||

Uses of Continuing Operations Free Cash Flow | |||||||||||||||||

Investments: | |||||||||||||||||

Acquisition of business, net of cash acquired | $ | (8 | ) | $ | (94 | ) | $ | (57 | ) | $ | (94 | ) | |||||

Acquisition of noncontrolling interest in subsidiary | — | — | (14 | ) | — | ||||||||||||

Property insurance proceeds | — | 1 | 4 | 8 | |||||||||||||

Non-maintenance capital expenditures (c) | (28 | ) | (14 | ) | (101 | ) | (41 | ) | |||||||||

Acquisition of land use rights (c) | — | — | — | (1 | ) | ||||||||||||

Other growth investments (c) | (1 | ) | (2 | ) | (4 | ) | (2 | ) | |||||||||

Other investing activities, net (d) | 9 | 1 | 1 | (7 | ) | ||||||||||||

Total investments | $ | (28 | ) | $ | (108 | ) | $ | (171 | ) | $ | (137 | ) | |||||

Return of capital to stockholders: | |||||||||||||||||

Cash dividends paid to stockholders | $ | (20 | ) | $ | (39 | ) | $ | (65 | ) | $ | (90 | ) | |||||

Common stock repurchased | — | (5 | ) | (34 | ) | (88 | ) | ||||||||||

Total return of capital to stockholders | $ | (20 | ) | $ | (44 | ) | $ | (99 | ) | $ | (178 | ) | |||||

Capital raising activities: | |||||||||||||||||

Net proceeds from issuance of corporate debt (e) | $ | — | $ | 328 | $ | 21 | $ | 1,001 | |||||||||

Other financing activities, net | (7 | ) | 12 | (24 | ) | 2 | |||||||||||

Net proceeds from capital raising activities | $ | (7 | ) | $ | 340 | $ | (3 | ) | $ | 1,003 | |||||||

Debt repayments: | |||||||||||||||||

Net cash used for scheduled principal payments on corporate debt | $ | (1 | ) | $ | (1 | ) | $ | (3 | ) | $ | (26 | ) | |||||

Net cash used for scheduled principal payments on project debt (f) | (6 | ) | (64 | ) | (56 | ) | (121 | ) | |||||||||

Optional repayment of corporate debt (g) | — | — | — | (621 | ) | ||||||||||||

Net cash used for optional repayment of project debt (h) | — | (238 | ) | — | (238 | ) | |||||||||||

Total debt repayments | $ | (7 | ) | $ | (303 | ) | $ | (59 | ) | $ | (1,006 | ) | |||||

Borrowing activities - Revolving credit facility, net | $ | (16 | ) | $ | 40 | $ | 50 | $ | 60 | ||||||||

Short-term borrowing activities - Financing of insurance premiums, net | $ | — | $ | — | $ | — | $ | (10 | ) | ||||||||

Distributions to partners of noncontrolling interests in subsidiaries | $ | — | $ | — | $ | — | $ | (1 | ) | ||||||||

Effect of exchange rate changes on cash and cash equivalents | $ | (2 | ) | $ | (1 | ) | $ | (1 | ) | $ | — | ||||||

Net change in cash and cash equivalents | $ | (47 | ) | $ | (16 | ) | $ | (38 | ) | $ | 8 | ||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||

(b) Purchases of property, plant and equipment are also referred to as capital expenditures. Capital expenditures that primarily maintain existing facilities are classified as maintenance capital expenditures. The following table provides the components of total purchases of property, plant and equipment: | |||||||||||||||||

Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

2013 | 2012 | 2013 | 2012 | ||||||||||||||

Maintenance capital expenditures | $ | (20 | ) | $ | (18 | ) | $ | (87 | ) | $ | (85 | ) | |||||

Capital expenditures associated with organic growth initiatives and technology development (c) | (28 | ) | (9 | ) | (101 | ) | (27 | ) | |||||||||

Capital expenditures - other (c) | — | (5 | ) | — | (14 | ) | |||||||||||

Total purchases of property, plant and equipment | $ | (48 | ) | $ | (32 | ) | $ | (188 | ) | $ | (126 | ) | |||||

(c) Growth investments includes investments in growth opportunities, including organic growth initiatives, technology, business development, and other similar expenditures. Capital expenditures - other includes capital expenditures associated with property insurance events. Other growth investments include investments primarily in our TARTECH joint venture. | |||||||||||||||||

Capital expenditures associated with organic growth initiatives and technology development | $ | (28 | ) | $ | (9 | ) | $ | (101 | ) | $ | (27 | ) | |||||

Capital expenditures - other | — | (5 | ) | — | (14 | ) | |||||||||||

Total non-maintenance capital expenditures | (28 | ) | (14 | ) | (101 | ) | (41 | ) | |||||||||

Acquisition of land use rights | — | — | — | (1 | ) | ||||||||||||

Other growth investments | (1 | ) | (2 | ) | (4 | ) | (2 | ) | |||||||||

Less: Capital expenditures associated with property insurance events | — | 4 | — | 13 | |||||||||||||

Organic growth investments | (29 | ) | (12 | ) | (105 | ) | (31 | ) | |||||||||

Acquisition of business, net of cash acquired | (8 | ) | (94 | ) | (57 | ) | (94 | ) | |||||||||

Total growth investments | $ | (37 | ) | $ | (106 | ) | $ | (162 | ) | $ | (125 | ) | |||||

(d) Other investing activities is primarily comprised of net payments from the purchase/sale of investment securities. | |||||||||||||||||

(e) Excludes borrowings under Revolving Credit Facility. Calculated as follows: | |||||||||||||||||

Proceeds from borrowings on long-term debt | $ | — | $ | 335 | $ | 22 | $ | 1,034 | |||||||||

Less: Financing costs related to issuance of long-term debt | — | (7 | ) | (1 | ) | (33 | ) | ||||||||||

Net proceeds from issuance of corporate debt | $ | — | $ | 328 | $ | 21 | $ | 1,001 | |||||||||

(f) Calculated as follows: | |||||||||||||||||

Total scheduled principal payments on project debt | $ | (30 | ) | $ | (100 | ) | $ | (83 | ) | $ | (146 | ) | |||||

Decrease (increase) in related restricted funds held in trust | 24 | 36 | 27 | 25 | |||||||||||||

Net cash used for principal payments on project debt | $ | (6 | ) | $ | (64 | ) | $ | (56 | ) | $ | (121 | ) | |||||

(g) Calculated as follows: | |||||||||||||||||

Repayment of Term Loan due 2014 | $ | — | $ | — | $ | — | $ | (619 | ) | ||||||||

Redemption of Convertible Debentures | — | — | — | (2 | ) | ||||||||||||

Total optional repayment of corporate debt | $ | — | $ | — | $ | — | $ | (621 | ) | ||||||||

(h) Calculated as follows: | |||||||||||||||||

Total optional principal payments on project debt | $ | — | $ | (278 | ) | $ | — | $ | (278 | ) | |||||||

Decrease in related restricted funds held in trust | — | 40 | — | 40 | |||||||||||||

Net cash used for optional repayment of project debt | $ | — | $ | (238 | ) | $ | — | $ | (238 | ) | |||||||

Covanta Holding Corporation | Exhibit 8 | ||||||||||||||||||||||||||||||

Calculation of Continuing Operations Key Metrics For 2013 and 2012(a) | |||||||||||||||||||||||||||||||

(Unaudited) (In millions, except per share amounts) | |||||||||||||||||||||||||||||||

Adjusted EPS | Three Months Ended | Year Ended | Three Months Ended | Year Ended | |||||||||||||||||||||||||||

Mar. 31, 2013 | June 30, 2013 | Sept. 30, 2013 | Dec. 31, 2013 | Dec. 31, 2013 | Mar. 31, 2012 | June 30, 2012 | Sept. 30, 2012 | Dec. 31, 2012 | Dec. 31, 2012 | ||||||||||||||||||||||

Continuing Operations - Diluted (Loss) Earnings Per Share | $ | (0.17 | ) | $ | 0.09 | $ | 0.22 | $ | 0.21 | $ | 0.35 | $ | (0.08 | ) | $ | 0.18 | $ | 0.27 | $ | 0.64 | $ | 1.01 | |||||||||

Reconciling Items | (0.02 | ) | 0.03 | 0.06 | (0.03 | ) | 0.03 | — | — | (0.02 | ) | (0.42 | ) | (0.43 | ) | ||||||||||||||||

Adjusted EPS | $ | (0.19 | ) | $ | 0.12 | $ | 0.28 | $ | 0.18 | $ | 0.38 | $ | (0.08 | ) | $ | 0.18 | $ | 0.25 | $ | 0.22 | $ | 0.58 | |||||||||

Three Months Ended | Year Ended | Three Months Ended | Year Ended | ||||||||||||||||||||||||||||

Reconciling Items | Mar. 31, 2013 | June 30, 2013 | Sept. 30, 2013 | Dec. 31, 2013 | Dec. 31, 2013 | Mar. 31, 2012 | June 30, 2012 | Sept. 30, 2012 | Dec. 31, 2012 | Dec. 31, 2012 | |||||||||||||||||||||

Operating loss related to insurance subsidiaries | $ | — | $ | 1 | $ | — | $ | 1 | $ | 2 | $ | 1 | $ | — | $ | 8 | $ | 1 | $ | 10 | |||||||||||

Net write-offs (gains)(b) | — | 4 | 12 | (1 | ) | 15 | — | — | (13 | ) | (44 | ) | (57 | ) | |||||||||||||||||

Severance and other restructuring | — | — | — | 2 | 2 | — | — | — | — | — | |||||||||||||||||||||

Pension plan settlement (gain) expense | (6 | ) | — | — | — | (6 | ) | — | — | — | 11 | 11 | |||||||||||||||||||

Loss on extinguishment of debt | 1 | — | — | — | 1 | 2 | — | — | 1 | 3 | |||||||||||||||||||||

Loss on derivative instruments not designated as hedging instruments | — | — | — | (1 | ) | (1 | ) | — | — | (1 | ) | — | (1 | ) | |||||||||||||||||

Effect of foreign exchange gain on indebtedness | — | — | — | — | — | (3 | ) | — | — | — | (3 | ) | |||||||||||||||||||

Gain related to trust distribution | — | — | — | (4 | ) | (4 | ) | — | — | — | — | — | |||||||||||||||||||

Other | — | — | 1 | (1 | ) | — | — | 1 | — | (1 | ) | — | |||||||||||||||||||

Total Reconciling Items, pre-tax | (5 | ) | 5 | 13 | (4 | ) | 9 | — | 1 | (6 | ) | (32 | ) | (37 | ) | ||||||||||||||||

Pro forma income tax impact | 2 | (2 | ) | (5 | ) | — | (5 | ) | — | (1 | ) | 3 | (24 | ) | (22 | ) | |||||||||||||||

Grantor trust activity | — | — | — | — | — | — | — | — | 1 | 1 | |||||||||||||||||||||

Total Reconciling Items, net of tax | $ | (3 | ) | $ | 3 | $ | 8 | $ | (4 | ) | $ | 4 | $ | — | $ | — | $ | (3 | ) | $ | (55 | ) | $ | (58 | ) | ||||||

Diluted (Loss) Earnings Per Share Impact | $ | (0.02 | ) | $ | 0.03 | $ | 0.06 | $ | (0.03 | ) | $ | 0.03 | $ | — | $ | — | $ | (0.02 | ) | $ | (0.42 | ) | $ | (0.43 | ) | ||||||

Weighted Average Diluted Shares Outstanding | 130 | 129 | 130 | 130 | 130 | 134 | 134 | 132 | 132 | 133 | |||||||||||||||||||||

Adjusted EBITDA | Three Months Ended | Year Ended | Three Months Ended | Year Ended | |||||||||||||||||||||||||||

Mar. 31, 2013 | June 30, 2013 | Sept. 30, 2013 | Dec. 31, 2013 | Dec. 31, 2013 | Mar. 31, 2012 | June 30, 2012 | Sept. 30, 2012 | Dec. 31, 2012 | Dec. 31, 2012 | ||||||||||||||||||||||

Net (Loss) income from Continuing Operations Attributable to Covanta Holding Corporation | $ | (23 | ) | $ | 13 | $ | 28 | $ | 27 | $ | 45 | $ | (11 | ) | $ | 23 | $ | 37 | $ | 85 | $ | 134 | |||||||||

Operating loss related to insurance subsidiaries | — | 1 | — | 1 | 2 | 1 | — | 8 | 1 | 10 | |||||||||||||||||||||

Depreciation and amortization expense | 53 | 52 | 52 | 53 | 210 | 50 | 49 | 46 | 50 | 195 | |||||||||||||||||||||

Debt service | 39 | 40 | 40 | 40 | 159 | 32 | 38 | 38 | 37 | 145 | |||||||||||||||||||||

Income tax (benefit) expense | (16 | ) | 7 | 20 | 29 | 40 | (5 | ) | 11 | 30 | (4 | ) | 32 | ||||||||||||||||||

Gain related to trust distribution | — | — | — | (4 | ) | (4 | ) | — | — | — | — | — | |||||||||||||||||||

Net write-offs (gains)(b) | — | 4 | 12 | (1 | ) | 15 | — | — | (13 | ) | (44 | ) | (57 | ) | |||||||||||||||||

Pension plan settlement (gain) expense | (6 | ) | — | — | — | (6 | ) | — | — | — | 11 | 11 | |||||||||||||||||||

Loss on extinguishment of debt | 1 | — | — | — | 1 | 2 | — | — | 1 | 3 | |||||||||||||||||||||

Net (loss) income attributable to noncontrolling interests in subsidiaries | (1 | ) | — | — | — | (1 | ) | 1 | (1 | ) | 1 | 1 | 2 | ||||||||||||||||||

Debt service billings in excess of revenue recognized | 7 | 1 | 1 | — | 9 | 6 | — | — | 3 | 9 | |||||||||||||||||||||

Non-cash compensation expense | 5 | 4 | 3 | 3 | 15 | 5 | 5 | 3 | 3 | 16 | |||||||||||||||||||||

Other non-cash items | 2 | 2 | 1 | 4 | 9 | (3 | ) | 5 | 3 | 2 | 7 | ||||||||||||||||||||

Adjusted EBITDA | $ | 61 | $ | 124 | $ | 157 | $ | 152 | $ | 494 | $ | 78 | $ | 130 | $ | 153 | $ | 146 | $ | 507 | |||||||||||

Free Cash Flow | Three Months Ended | Year Ended | Three Months Ended | Year Ended | |||||||||||||||||||||||||||

Mar. 31, 2013 | June 30, 2013 | Sept. 30, 2013 | Dec. 31, 2013 | Dec. 31, 2013 | Mar. 31, 2012 | June 30, 2012 | Sept. 30, 2012 | Dec. 31, 2012 | Dec. 31, 2012 | ||||||||||||||||||||||

Cash flow provided by operating activities | $ | 64 | $ | 40 | $ | 171 | $ | 49 | $ | 324 | $ | 108 | $ | 45 | $ | 127 | $ | 77 | $ | 357 | |||||||||||

Plus: Cash flow used in operating activities from insurance subsidiaries | 1 | 2 | 1 | 4 | 8 | 1 | 1 | 2 | 1 | 5 | |||||||||||||||||||||

Less: Maintenance capital expenditures | (38 | ) | (19 | ) | (10 | ) | (20 | ) | (87 | ) | (28 | ) | (24 | ) | (15 | ) | (18 | ) | (85 | ) | |||||||||||

Free Cash Flow | $ | 27 | $ | 23 | $ | 162 | $ | 33 | $ | 245 | $ | 81 | $ | 22 | $ | 114 | $ | 60 | $ | 277 | |||||||||||

Weighted Average Diluted Shares Outstanding | 130 | 129 | 130 | 130 | 130 | 134 | 134 | 132 | 132 | 133 | |||||||||||||||||||||

(a) See Exhibit 1 - Note (a) of this Press Release. | |||||||||||||||||||||||||||||||

(b) For additional details on Net write-offs (gains), see Exhibit 4B of this Press Release and Item 1. Financial Statements - Note 8. Supplementary Information - Net Write-offs (gains) in our Forms 10-Q filed for the respective periods. | |||||||||||||||||||||||||||||||

Covanta Holding Corporation | Exhibit 9A |

Supplemental Information on Operations (a) | |

(Unaudited, $ in millions) | |

Twelve Months Ended December 31, 2013 | ||||||||||||||||||||

North America | ||||||||||||||||||||

EfW | Other | Total | Other | Consolidated | ||||||||||||||||

Revenue: | ||||||||||||||||||||

Waste and Service: | ||||||||||||||||||||

Waste and Service | $ | 926 | $ | 31 | $ | 957 | $ | 1 | $ | 958 | ||||||||||

Debt Service | 35 | — | 35 | — | 35 | |||||||||||||||

Other Revenues | 10 | 4 | 14 | 1 | 15 | |||||||||||||||

Total Waste and Service | 971 | 35 | 1,006 | 2 | 1,008 | |||||||||||||||

Recycled Metals: | ||||||||||||||||||||

Ferrous | 56 | — | 56 | — | 56 | |||||||||||||||

Non-Ferrous | 17 | — | 17 | — | 17 | |||||||||||||||

Total Recycled Metals | 73 | — | 73 | — | 73 | |||||||||||||||

Energy: | ||||||||||||||||||||

Energy Sales | 298 | 48 | 346 | 30 | 376 | |||||||||||||||

Capacity | 40 | 15 | 55 | — | 55 | |||||||||||||||

Total Energy Revenue | 338 | 63 | 401 | 30 | 431 | |||||||||||||||

Other Revenue | 1 | 114 | 115 | 3 | 118 | |||||||||||||||

Total Revenue | $ | 1,383 | $ | 212 | $ | 1,595 | $ | 35 | $ | 1,630 | ||||||||||

Operating Expenses: | ||||||||||||||||||||

Plant Operating Expenses: | ||||||||||||||||||||

Plant Maintenance | 220 | 12 | 232 | 3 | 235 | |||||||||||||||

Other Plant Operating Expenses | 633 | 95 | 728 | 30 | 758 | |||||||||||||||

Total Plant Operating Expenses | 853 | 107 | 960 | 33 | 993 | |||||||||||||||

Other Operating Expenses | (20 | ) | 112 | 92 | 2 | 94 | ||||||||||||||

General and Administrative | — | 79 | 79 | 5 | 84 | |||||||||||||||

Depreciation and Amortization | 190 | 18 | 208 | 2 | 210 | |||||||||||||||

Net Interest Expense on Project Debt | 11 | — | 11 | 2 | 13 | |||||||||||||||

Net Write-offs | 12 | 3 | 15 | — | 15 | |||||||||||||||

Total Operating Expenses | $ | 1,046 | $ | 319 | $ | 1,365 | $ | 44 | $ | 1,409 | ||||||||||

Operating Income (Loss) | $ | 337 | $ | (107 | ) | $ | 230 | $ | (9 | ) | $ | 221 | ||||||||

Operating income (loss) excluding Net write-offs (gains): | $ | 349 | $ | (104 | ) | $ | 245 | $ | (9 | ) | $ | 236 | ||||||||

(a) Supplemental information provided in order to present the financial performance of our North America EfW operations. “Other” within our North America segment includes all non-EfW operations, including transfer stations, landfills, e-waste, biomass facilities, construction and corporate overhead. The results for EfW operations include the results of certain transfer stations and landfills which are dedicated to EfW facilities and share business unit financial reporting. This information is provided as supplemental detail only and is not intended to replace our North America reporting segment. | ||||||||||||||||||||

Note: Certain amounts may not total due to rounding | ||||||||||||||||||||

Covanta Holding Corporation | Exhibit 9B |

Supplemental Information on Operations (a) | |

(Unaudited, $ in millions) | |

Twelve Months Ended December 31, 2012 | ||||||||||||||||||||

North America | ||||||||||||||||||||

EfW | Other | Total | Other | Consolidated | ||||||||||||||||

Revenue: | ||||||||||||||||||||

Waste and Service: | ||||||||||||||||||||

Waste and Service | $ | 914 | $ | 28 | $ | 942 | $ | 1 | $ | 943 | ||||||||||

Debt Service | 47 | — | 47 | — | 47 | |||||||||||||||

Other Revenues | 17 | 2 | 19 | 1 | 20 | |||||||||||||||

Total Waste and Service | 978 | 30 | 1,008 | 2 | 1,010 | |||||||||||||||

Recycled Metals: | ||||||||||||||||||||

Ferrous | 58 | — | 58 | — | 58 | |||||||||||||||

Non-Ferrous | 14 | — | 14 | — | 14 | |||||||||||||||

Total Recycled Metals | 72 | — | 72 | — | 72 | |||||||||||||||

Energy: | ||||||||||||||||||||

Energy Sales | 271 | 42 | 313 | 27 | 340 | |||||||||||||||

Capacity | 36 | 18 | 54 | — | 54 | |||||||||||||||

Total Energy Revenue | 307 | 60 | 367 | 27 | 394 | |||||||||||||||

Other Revenue | — | 156 | 156 | 11 | 167 | |||||||||||||||

Total Revenue | $ | 1,357 | $ | 246 | $ | 1,603 | $ | 40 | $ | 1,643 | ||||||||||

Operating Expenses: | ||||||||||||||||||||

Plant Operating Expenses: | ||||||||||||||||||||

Plant Maintenance | 213 | 13 | 226 | 3 | 229 | |||||||||||||||

Other Plant Operating Expenses | 609 | 96 | 705 | 28 | 733 | |||||||||||||||

Total Plant Operating Expenses | 822 | 109 | 931 | 31 | 962 | |||||||||||||||

Other Operating Expenses | 2 | 138 | 140 | 16 | 156 | |||||||||||||||

General and Administrative | — | 77 | 77 | 7 | 84 | |||||||||||||||

Depreciation and Amortization | 176 | 16 | 192 | 3 | 195 | |||||||||||||||

Net Interest Expense on Project Debt | 26 | — | 26 | 1 | 27 | |||||||||||||||

Net Write-offs | (73 | ) | 16 | (57 | ) | — | (57 | ) | ||||||||||||

Total Operating Expenses | $ | 953 | $ | 356 | $ | 1,309 | $ | 58 | $ | 1,367 | ||||||||||

Operating Income (Loss) | $ | 404 | $ | (110 | ) | $ | 294 | $ | (18 | ) | $ | 276 | ||||||||

Operating income (loss) excluding Net write-offs (gains): | $ | 331 | $ | (94 | ) | $ | 237 | $ | (18 | ) | $ | 219 | ||||||||

(a) Supplemental information provided in order to present the financial performance of our North America EfW operations. “Other” within our North America segment includes all non-EfW operations, including transfer stations, landfills, e-waste, biomass facilities, construction and corporate overhead. The results for EfW operations include the results of certain transfer stations and landfills which are dedicated to EfW facilities and share business unit financial reporting. This information is provided as supplemental detail only and is not intended to replace our North America reporting segment. | ||||||||||||||||||||

Note: Certain amounts may not total due to rounding | ||||||||||||||||||||

North America EfW | Exhibit 10 |

Revenue and Operating Income Changes - FY2012 to FY2013 | |

(Unaudited, $ in millions) | |

Same Store | Contract Transitions | ||||||||||||||||||||||||||||||||||||||||||||

FY2012 | Price | % | Volume | % | Total | % | Service Fee | PPA | Transactions | Total Changes | FY2013 | ||||||||||||||||||||||||||||||||||

Waste and Service: | |||||||||||||||||||||||||||||||||||||||||||||

Waste and Service | $ | 914 | $ | 5 | 0.5 | % | $ | 6 | 0.7 | % | $ | 11 | 1.2 | % | $ | 1 | $ | — | $ | — | $ | 12 | $ | 926 | |||||||||||||||||||||

Debt Service | 47 | — | (12 | ) | — | — | (12 | ) | 35 | ||||||||||||||||||||||||||||||||||||

Other Revenues | 17 | — | (4 | ) | — | (3 | ) | (8 | ) | 10 | |||||||||||||||||||||||||||||||||||

Total Waste and Service | $ | 978 | $ | 11 | 1.1 | % | $ | (15 | ) | $ | — | $ | (3 | ) | $ | (8 | ) | $ | 971 | ||||||||||||||||||||||||||

Recycled Metals: | |||||||||||||||||||||||||||||||||||||||||||||

Ferrous | 58 | (3 | ) | -4.6 | % | — | -0.5 | % | (3 | ) | -5.1 | % | — | — | — | (3 | ) | 56 | |||||||||||||||||||||||||||

Non-Ferrous | 14 | (1 | ) | -5.9 | % | 4 | 33.3 | % | 4 | 27.3 | % | — | — | — | 4 | 17 | |||||||||||||||||||||||||||||

Total Recycled Metals | 72 | (4 | ) | -4.9 | % | 4 | 5.9 | % | 1 | 1.0 | % | — | — | — | 1 | 73 | |||||||||||||||||||||||||||||

Energy: | |||||||||||||||||||||||||||||||||||||||||||||

Energy Sales | 271 | (2 | ) | -0.8 | % | 8 | 2.6 | % | 5 | 2.0 | % | 20 | — | 2 | 27 | 298 | |||||||||||||||||||||||||||||

Capacity | 36 | — | 0.4 | % | 4 | — | — | 4 | 40 | ||||||||||||||||||||||||||||||||||||

Total Energy Revenue | 307 | 5 | 1.8 | % | 23 | — | 2 | 31 | 338 | ||||||||||||||||||||||||||||||||||||

Other Revenue | — | — | -3.7 | % | — | — | — | — | 1 | ||||||||||||||||||||||||||||||||||||

Total Revenue | $ | 1,357 | $ | 17 | 1.2 | % | $ | 8 | $ | — | $ | (1 | ) | $ | 24 | $ | 1,383 | ||||||||||||||||||||||||||||

Operating Expenses: | |||||||||||||||||||||||||||||||||||||||||||||

Plant Operating Expenses: | |||||||||||||||||||||||||||||||||||||||||||||

Plant Maintenance | 213 | 6 | 2.6 | % | — | — | 1 | 7 | 220 | ||||||||||||||||||||||||||||||||||||

Other Plant Operating Expenses | 609 | 21 | 3.5 | % | 14 | — | (11 | ) | 24 | 633 | |||||||||||||||||||||||||||||||||||

Total Plant Operating Expenses | 822 | 27 | 3.3 | % | 14 | — | (10 | ) | 31 | 853 | |||||||||||||||||||||||||||||||||||

Other Operating Expenses | 2 | (21 | ) | — | — | — | (21 | ) | (20 | ) | |||||||||||||||||||||||||||||||||||

General and Administrative | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

Depreciation and Amortization | 176 | 2 | — | — | 11 | 13 | 190 | ||||||||||||||||||||||||||||||||||||||

Net Interest Expense on Project Debt | 26 | (15 | ) | — | — | — | (15 | ) | 11 | ||||||||||||||||||||||||||||||||||||

Total Operating Expenses | $ | 1,026 | $ | (7 | ) | $ | 14 | $ | — | $ | 2 | $ | 8 | $ | 1,034 | ||||||||||||||||||||||||||||||

Operating Income (Loss) | $ | 331 | $ | 24 | $ | (6 | ) | $ | — | $ | (2 | ) | $ | 16 | $ | 349 | |||||||||||||||||||||||||||||

Note: Excludes Net Write-offs (Gains). | |||||||||||||||||||||||||||||||||||||||||||||

Note: Certain amounts may not total due to rounding | |||||||||||||||||||||||||||||||||||||||||||||

North America EfW | Exhibit 11 |

Operating Metrics (Unaudited) | |

Twelve Months Ended December 31, | |||||||

2012 | 2013 | ||||||

Waste | |||||||

Tons: (in millions) | |||||||

Contracted | 15.2 | 15.0 | |||||

Uncontracted | 3.3 | 3.5 | |||||

Total Tons | 18.5 | 18.5 | |||||

Revenue per Ton: | |||||||

Contracted | $ | 48.94 | $ | 49.43 | |||

Uncontracted | $ | 50.41 | $ | 52.82 | |||

Average Revenue per Ton | $ | 49.21 | $ | 50.07 | |||

Metals | |||||||

Tons Sold: (000s) | |||||||

Ferrous | 309 | 311 | |||||

Non-Ferrous | 15 | 20 | |||||

Revenue per Ton: | |||||||

Ferrous | $ | 188 | $ | 178 | |||

Non-Ferrous | $ | 910 | $ | 852 | |||

Energy | |||||||

Energy Sales: (GWh) | |||||||

Contracted | 3.5 | 3.6 | |||||

Hedged | 0.4 | 0.8 | |||||

Market | 0.9 | 1.0 | |||||

Total Energy Sales | 4.8 | 5.4 | |||||

Market Sales by Geography: | |||||||

PJM East | 0.4 | 0.6 | |||||

NEPOOL | 0.2 | 0.3 | |||||

NYISO | 0.1 | — | |||||

Other | 0.2 | 0.1 | |||||

Revenue per MWh: | |||||||

Contracted | $ | 60.85 | $ | 63.92 | |||

Hedged | $ | 50.17 | $ | 39.01 | |||

Market | $ | 42.73 | $ | 40.76 | |||

Average Revenue per MWh | $ | 56.58 | $ | 55.98 | |||

Plant Operating Expenses ($ in millions) | |||||||

Plant Operating Expenses - Gross | $ | 893 | $ | 928 | |||

Less: Client Pass-Through Costs | (68 | ) | (68 | ) | |||

Less: REC Sales - Contra Expense | (3 | ) | (7 | ) | |||

Plant Operating Expenses - Reported | $ | 822 | $ | 853 | |||

Client Pass-Throughs as % of Gross Costs | 7.6 | % | 7.3 | % | |||

Note: Waste volume includes solid tons only. Metals and energy volume are presented net of client revenue sharing. Steam sales are converted to MWh equivalent at an assumed average rate of 11 klbs of steam / MWh. Uncontracted energy sales include sales under PPAs that are based on market prices. | |||||||

Discussion of Non-GAAP Financial Measures |

We use a number of different financial measures, both United States generally accepted accounting principles (“GAAP”) and non-GAAP, in assessing the overall performance of our business. To supplement our assessment of results prepared in accordance with GAAP, we use the measures of Adjusted EBITDA, Free Cash Flow, and Adjusted EPS, which are non-GAAP measures as defined by the Securities and Exchange Commission. The non-GAAP financial measures of Adjusted EBITDA, Free Cash Flow, and Adjusted EPS as described below, and used in the tables above, are not intended as a substitute or as an alternative to net income, cash flow provided by operating activities or diluted income per share as indicators of our performance or liquidity or any other measures of performance or liquidity derived in accordance with GAAP. In addition, our non-GAAP financial measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. |

The presentations of Adjusted EBITDA, Free Cash Flow and Adjusted EPS are intended to enhance the usefulness of our financial information by providing measures which management internally use to assess and evaluate the overall performance of its business and those of possible acquisition candidates, and highlight trends in the overall business. |

Adjusted EBITDA |

We use Adjusted EBITDA to provide further information that is useful to an understanding of the financial covenants contained in the credit facilities as of December 31, 2013 of our most significant subsidiary, Covanta Energy, through which we conduct our core waste and energy services business, and as additional ways of viewing aspects of its operations that, when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of our core business. The calculation of Adjusted EBITDA is based on the definition in Covanta Energy’s credit facilities as of December 31, 2013, which we have guaranteed. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, as adjusted for additional items subtracted from or added to net income. Because our business is substantially comprised of that of Covanta Energy, our financial performance is substantially similar to that of Covanta Energy. For this reason, and in order to avoid use of multiple financial measures which are not all from the same entity, the calculation of Adjusted EBITDA and other financial measures presented herein are ours, measured on a consolidated basis, less the results of operations of our insurance subsidiaries. |

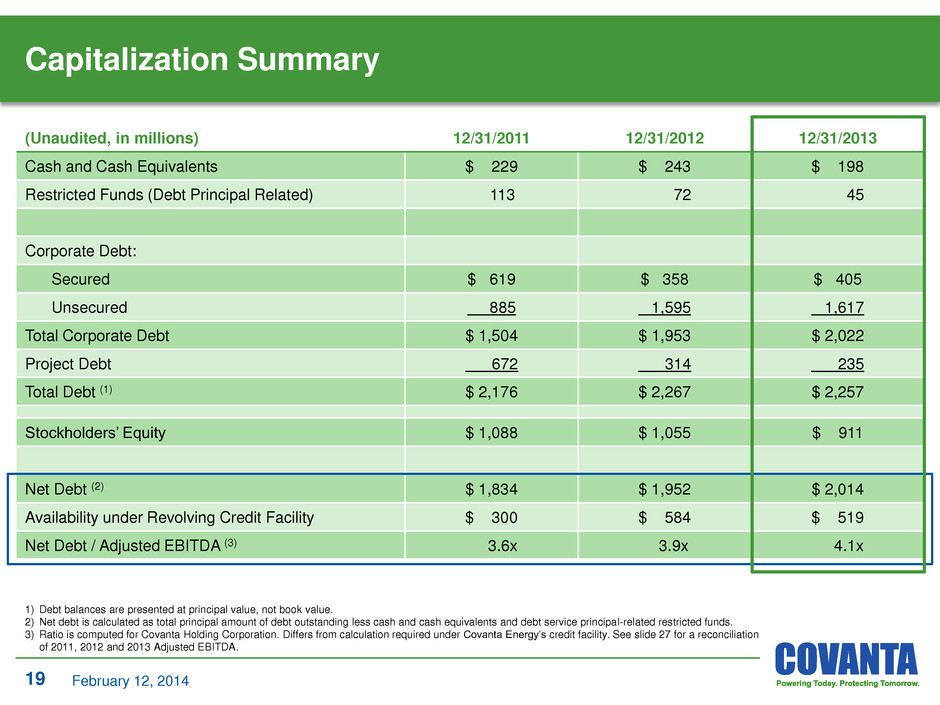

Under the credit facilities as of December 31, 2013, Covanta Energy is required to satisfy certain financial covenants, including certain ratios of which Adjusted EBITDA is an important component. Compliance with such financial covenants is expected to be the principal limiting factor which will affect our ability to engage in a broad range of activities in furtherance of our business, including making certain investments, acquiring businesses and incurring additional debt. Covanta Energy was in compliance with these covenants as of December 31, 2013. Failure to comply with such financial covenants could result in a default under these credit facilities, which default would have a material adverse affect on our financial condition and liquidity. |

These financial covenants are measured on a trailing four quarter period basis and the material covenants are as follows: |

- maximum Covanta Energy leverage ratio of 4.00 to 1.00, which measures Covanta Energy’s Consolidated Adjusted Debt (which is the principal amount of its consolidated debt less certain restricted funds dedicated to repayment of project debt principal and construction costs) to its Adjusted EBITDA (which for purposes of calculating the leverage ratio and interest coverage ratio, is adjusted on a pro forma basis for acquisitions and dispositions made during the relevant period); and |

- minimum Covanta Energy interest coverage ratio of 3.00 to 1.00, which measures Covanta Energy’s Adjusted EBITDA to its consolidated interest expense plus certain interest expense of ours, to the extent paid by Covanta Energy. |

In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EBITDA for the three and twelve months ended December 31, 2013 and 2012, reconciled for each such period to net income and cash flow provided by operating activities, which are believed to be the most directly comparable measures under GAAP. |

Free Cash Flow |

Free Cash Flow is defined as cash flow provided by operating activities from continuing operations, excluding the cash flow provided by or used in our insurance subsidiaries, less maintenance capital expenditures, which are capital expenditures primarily to maintain our existing facilities. We use the non-GAAP measure of Free Cash Flow as a criterion of liquidity and performance-based components of employee compensation. We use Free Cash Flow as a measure of liquidity to determine amounts we can reinvest in our core businesses, such as amounts available to make acquisitions, invest in construction of new projects, make principal payments on debt, or amounts we can return to our stockholders through dividends and/or stock repurchases. |

In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow for the three and twelve months ended December 31, 2013 and 2012, reconciled for each such period to cash flow provided by operating activities, which we believe to be the most directly comparable measure under GAAP. |

Adjusted EPS |

Adjusted EPS excludes certain income and expense items that are not representative of our ongoing business and operations, which are included in the calculation of Diluted Earnings Per Share in accordance with GAAP. The following items are not all-inclusive, but are examples of reconciling items in prior comparative and future periods. They would include the results of operations of our insurance subsidiaries, write-off of assets and liabilities, the effect of derivative instruments not designated as hedging instruments, significant gains or losses from the disposition or restructuring of businesses, gains and losses on assets held for sale, transaction-related costs, income and loss on the extinguishment of debt and other significant items that would not be representative of our ongoing business. |

We will use the non-GAAP measure of Adjusted EPS to enhance the usefulness of our financial information by providing a measure which management internally uses to assess and evaluate the overall performance and highlight trends in the ongoing business. |

In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EPS for the three and twelve months ended December 31, 2013 and 2012, reconciled for each such period to diluted income per share, which is believed to be the most directly comparable measure under GAAP. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute “forward-looking” statements as defined in Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange Commission (“SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Covanta Holding Corporation and its subsidiaries (“Covanta”) or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “may,” “will,” “would,” “could,” “should,” “seeks,” or “scheduled to,” or other similar words, or the negative of these terms or other variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws. Covanta cautions investors that any forward-looking statements made by us are not guarantees or indicative of future performance. Important factors, risks and uncertainties that could cause actual results to differ materially from those forward-looking statements include, but are not limited to:

• | seasonal or long-term fluctuations in the prices of energy, waste disposal, scrap metal and commodities; |

• | our ability to renew or replace expiring contracts at comparable pricing and with other acceptable terms; |

• | adoption of new laws and regulations in the United States and abroad, including energy laws, environmental laws, labor laws and healthcare laws; |

• | our ability to utilize net operating loss carryforwards; |

• | failure to maintain historical performance levels at our facilities and our ability to retain the rights to operate facilities we do not own; |

• | our ability to avoid adverse publicity relating to our business expansion efforts; |

• | advances in technology; |

• | difficulties in the operation of our facilities, including fuel supply and energy delivery interruptions, failure to obtain regulatory approvals, equipment failures, labor disputes and work stoppages, and weather interference and catastrophic events; |

• | difficulties in the financing, development and construction of new projects and expansions, including increased construction costs and delays; |

• | limits of insurance coverage; |

• | our ability to avoid defaults under our long-term contracts; |

• | performance of third parties under our contracts and such third parties' observance of laws and regulations; |

• | concentration of suppliers and customers; |

• | geographic concentration of facilities; |

• | increased competitiveness in the energy and waste industries; |

• | changes in foreign currency exchange rates; |

• | limitations imposed by our existing indebtedness and our ability to perform our financial obligations and guarantees and to refinance our existing indebtedness; |

• | exposure to counterparty credit risk and instability of financial institutions in connection with financing transactions; |

• | the scalability of our business; |

• | restrictions in our certificate of incorporation and debt documents regarding strategic alternatives; |

• | failures of disclosure controls and procedures and internal controls over financial reporting; |

• | our ability to attract and retain talented people; |

• | general economic conditions in the United States and abroad, including the availability of credit and debt financing; and |

• | other risks and uncertainties affecting our businesses described in Item 1A. Risk Factors of Covanta's Annual Report on Form 10-K for the year ended December 31, 2012 and in other filings by Covanta with the SEC. |

Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, actual results could differ materially from a projection or assumption in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The forward-looking statements contained in this press release are made only as of the date hereof and we do not have, or undertake, any obligation to update or revise any forward-looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law.