UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

COVANTA HOLDING CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

COVANTA HOLDING CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 16, 2013

To our Stockholders:

We are notifying you that our 2013 Annual Meeting of Stockholders will be held on May 16, 2013, at Covanta Holding Corporation, 445 South Street, Morristown, New Jersey 07960, at 11:00 a.m. local time. At the meeting we will ask you to:

1. elect ten directors to our Board of Directors, each for a term of one year;

2. ratify the appointment of Ernst & Young LLP as our independent registered public accountants for the 2013 fiscal year; and

3. | consider such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

As permitted by the Securities and Exchange Commission, Covanta is providing stockholders with access to our proxy materials via the Internet rather than in paper form. Accordingly, on or about March 28, 2013, we mailed to stockholders a Notice of Internet Availability of Proxy Materials, which we refer to as the “Notice”, containing instructions on how to access the proxy materials over the Internet. If you receive a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy statement, our Annual Report on Form 10-K for the fiscal year ended 2012 and our 2012 Annual Report to Stockholders. The Notice also instructs you on how you may submit your proxy to vote by mail, by telephone or via the Internet. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

Our Board of Directors has fixed the close of business on March 19, 2013 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement of the Annual Meeting. A complete list of these stockholders will be available at our principal executive offices prior to the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the meeting, please follow the instructions on the proxy card for voting via the Internet, by telephone or by mail as promptly as possible in order to ensure your representation at the Annual Meeting. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy form issued in your name from the institution that is the record holder and bring the proxy form to the Annual Meeting.

By Order of the Board of Directors

COVANTA HOLDING CORPORATION

Timothy J. Simpson

Secretary

Morristown, New Jersey

March 28, 2013

COVANTA HOLDING CORPORATION

445 South Street

Morristown, New Jersey 07960

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of Covanta Holding Corporation for use at the Covanta Holding Corporation 2013 Annual Meeting of Stockholders to be held on May 16, 2013, at 11:00 a.m. local time, or any adjournment or postponement of the Annual Meeting, for the purposes described in this proxy statement and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at Covanta Holding Corporation, 445 South Street, Morristown, New Jersey 07960. These proxy materials were made available via the Internet on or about March 28, 2013 to all stockholders entitled to vote at the Annual Meeting. The proxy materials consist of this proxy statement, a proxy card, our Annual Report on Form 10-K for the fiscal year ended 2012 and our 2012 Annual Report to Stockholders. Throughout this proxy statement when the terms “Covanta,” the “Company,” “we,” “our,” “ours” or “us” are used, they refer to Covanta Holding Corporation and we sometimes refer to our Board of Directors as the “Board.” Our subsidiary, Covanta Energy Corporation, is often referred to in this proxy statement as “Covanta Energy.”

What is the purpose of the Annual Meeting?

At the Annual Meeting, you will be asked to act upon the matters outlined in the accompanying Notice of Annual Meeting of Stockholders, including:

• | election of ten directors to our Board of Directors, each for a term of one year (see page 10); and |

• | ratification of the appointment of Ernst & Young LLP as our independent registered public accountants for the 2013 fiscal year (see page 13). |

In addition, management will report on our performance and respond to questions from stockholders.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials in the mail?

In accordance with rules adopted by the Securities and Exchange Commission, referred to in this proxy statement as the “SEC,” we may furnish proxy materials, including this proxy statement and our 2012 Annual Report on Form 10-K, to our stockholders by providing access to those documents on the Internet instead of mailing printed copies. A Notice of Internet Availability of Proxy Materials, which we refer to as the “Notice,” was mailed to stockholders on March 28, 2013, and it will instruct you on how to access and review all of our proxy materials for the Annual Meeting on the Internet. The Notice also instructs you on how you may submit your proxy via the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

How do I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

• | View our proxy materials for the Annual Meeting via the Internet; and |

• | Instruct us to send our future proxy materials to you electronically by email. |

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing an Internet link to those materials and an Internet link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who is entitled to vote at the Annual Meeting?

Holders of our common stock at the close of business on the record date of March 19, 2013 are entitled to vote their shares at the Annual Meeting. On that date, there were 130,771,575 shares of our common stock outstanding and entitled to vote.

How many votes do I have?

You will have one vote for each outstanding share of our common stock that you owned on March 19, 2013 (the record date), as each outstanding share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

How many votes must be present to hold the Annual Meeting?

The presence, in person or by proxy, of stockholders entitled to cast a majority of all of the votes entitled to be cast at the Annual Meeting, including shares represented by proxies that reflect abstentions, constitutes a quorum. Abstentions and broker non-votes are counted as present and entitled to vote for the purposes of determining a quorum. A “broker non-vote” occurs when a broker, bank or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that record holder does not have discretionary voting power for that particular proposal and has not received voting instructions from the beneficial owner. If there is not a quorum at the Annual Meeting, the stockholders entitled to vote at the Annual Meeting, whether present in person or represented by proxy, will only have the power to adjourn the Annual Meeting until there is a quorum. The Annual Meeting may be reconvened without additional notice to the stockholders within 30 days after the date of the prior adjournment if we announce the reconvened meeting at the prior adjournment. A quorum must be present at such reconvened meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the “stockholder of record” or “record owner” of those shares. As a record owner, the Notice of Internet Availability of Proxy Materials has been sent directly to you. If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. As a beneficial owner, the Notice has been sent to the holder of record of your shares. If you wish to attend the Annual Meeting and vote shares of our common stock held through a broker, bank or other nominee, you will need to obtain a proxy form issued in your name to bring to the meeting from the institution that holds your shares and follow the voting instructions on that form.

How do I vote my shares at the Annual Meeting?

You may vote either in person at the Annual Meeting or by proxy. If you vote by proxy, you may still attend the Annual Meeting in person.

If you wish to vote in person at the Annual Meeting, please attend the meeting and you will be instructed there as to the balloting procedures. Please bring personal photo identification with you to the meeting. If you are a beneficial owner of shares, you must obtain a proxy form issued in your name from your broker, bank or other holder of record and present it to the inspector of election with your ballot to be able to vote at the Annual Meeting in person.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by proxy. You can vote by proxy via the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by telephone or mail pursuant to instructions provided on the proxy card. If you hold shares beneficially in street name, you may also vote by proxy via the Internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by telephone or mail by following the voting instruction card provided to you by your broker, bank or other nominee. If you do this, your shares of common stock represented by the proxy will be voted by the proxy holders in accordance with your instructions. The Internet and telephone voting facilities will close at 11:59 p.m. Eastern time on May 15, 2013. Anthony J. Orlando and Timothy J. Simpson are the proxy holders. If you are a beneficial owner of shares, you will need to obtain a proxy form issued in your name from the institution that holds your shares and follow the voting instructions on the proxy form.

If you do not intend to vote in person at the Annual Meeting, please remember to submit your proxy to us prior to the Annual Meeting to ensure that your vote is counted.

Can I revoke my proxy or change my vote after I have voted?

Even after you have submitted your proxy, you may revoke your proxy or change your vote. If you are the record owner of the shares, you can revoke your proxy by doing one of the following before your proxy is exercised at the Annual Meeting:

(1) | deliver a written notice of revocation to our Secretary at Covanta Holding Corporation, 445 South Street, Morristown, New Jersey 07960; or |

(2) | submit a properly executed proxy bearing a later date; or |

(3) | attend the Annual Meeting and cast your vote in person. |

To revoke a proxy previously submitted via the Internet or by telephone, you may simply vote again at a later date, using the same procedures, in which case the later submitted vote will be recorded and the earlier vote revoked. If you are the beneficial owner of shares and have submitted your proxy to the institution that holds your shares, you will need to contact that institution and follow its instructions for revoking a proxy.

Attendance at the Annual Meeting will not cause your previously submitted proxy to be revoked unless you cast a vote at the Annual Meeting.

2

What if I do not vote for some of the matters listed on the proxy?

If you properly execute, date and return a proxy to us without indicating your vote, in accordance with the Board’s recommendation, your shares will be voted by the proxy holders as follows:

• | “FOR” election of the ten nominees for director; and |

• | “FOR” ratification of the appointment of Ernst & Young LLP as our independent registered public accountants for the 2013 fiscal year. |

In addition, if other matters are properly presented for voting at the Annual Meeting, or at any adjournment or postponement thereof, your proxy grants Messrs. Orlando and/or Simpson the discretion to vote your shares on such matters. If, for any unforeseen reason, any of the director nominees described in this proxy statement are not available as a candidate for director, then Messrs. Orlando and/or Simpson will vote the stockholder proxies for such other candidate or candidates as the Board may nominate.

How many votes are required to elect directors and to adopt the other proposals?

In the election for directors, the ten nominees receiving the highest number of “FOR” votes cast in person or by proxy will be elected. A “WITHHOLD” vote for a nominee is the equivalent of abstaining. Abstentions and broker non-votes are not counted as votes cast for the purposes of, and therefore will have no impact as to, the election of directors. Although the director nominees with the highest number of “FOR” votes cast will be elected at the Annual Meeting, our Corporate Governance Guidelines contain a Majority Voting Policy which requires any nominee for director in an uncontested election to tender his or her resignation to the Board if that nominee receives a greater number of “WITHHOLD” votes than “FOR” votes in any election. The Board's Nominating and Governance Committee will consider the resignation offer and recommend to the Board the action to be taken with respect to the tendered resignation. The Board will act upon the Nominating and Governance Committee's recommendation no later than 90 days following certification of the stockholder vote. A complete copy of our Corporate Governance Guidelines is posted on our website at www.covantaholding.com.

All proposals, other than the election of directors, require the affirmative “FOR” vote of a majority of those shares present and entitled to vote to pass. An abstention as to any matter, when passage requires the vote of a majority of the votes entitled to be cast at the Annual Meeting, will have the effect of a vote “AGAINST.” Broker non-votes will not be considered, and will not be counted for any purpose in determining whether a matter has been approved.

Brokers, banks or other nominees have discretionary authority to vote shares without instructions from beneficial owners only on matters considered “routine” by the New York Stock Exchange, such as the ratification of the appointment of Ernst & Young LLP as our independent registered public accountants addressed by Proposal No. 2 in this proxy statement; therefore, your shares may be voted on Proposal No. 2 if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. On non-routine matters, such as Proposal No. 1, brokers, banks or other nominees do not have discretion to vote shares without instructions from beneficial owners and thus are not entitled to vote on such proposals in the absence of such specific instructions, resulting in a broker non-vote for those shares.

Representatives of American Stock Transfer & Trust Company, our transfer agent, will tabulate the votes and act as the inspector of election at the Annual Meeting.

Can my shares be voted if I do not return my proxy and do not attend the Annual Meeting?

If you do not vote your shares and you are the beneficial owner of the shares, your broker can vote your shares on matters that the New York Stock Exchange has ruled are routine.

If you do not vote your shares and you are the record owner of the shares, your shares will not be voted.

Who pays the cost of solicitation of proxies for the Annual Meeting?

We will pay the cost of solicitation of proxies. We have engaged Laurel Hill Advisory Group, LLC to assist in soliciting proxies on our behalf. Laurel Hill Advisory Group, LLC may solicit proxies personally, electronically or by telephone. We have agreed to pay Laurel Hill Advisory Group, LLC a fee of $7,500 for its services. We have also agreed to reimburse Laurel Hill Advisory Group, LLC for its reasonable out-of-pocket expenses and to indemnify Laurel Hill Advisory Group, LLC and its employees against certain liabilities arising from or in connection with the engagement. Our directors, officers and employees may also solicit proxies personally, electronically or by telephone without additional compensation for such proxy solicitation activity. Brokers and other nominees who held our common stock on the record date will be asked to contact the beneficial owners of the shares that they hold to send proxy materials to and obtain proxies from such beneficial owners. Although there is no formal agreement to do so, we may reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding this proxy statement to our stockholders.

3

BOARD STRUCTURE AND COMPOSITION

The Board is currently comprised of ten directors. During 2012, the Board held four meetings and took action by unanimous written consent nine times. Each director attended at least 75% of all meetings of the Board and those Board committees on which he or she served during 2012. We expect our Board members to attend the Annual Meeting of Stockholders. In May 2012, all of the directors attended our Annual Meeting of Stockholders. The Board has adopted a Board Charter and Corporate Governance Guidelines which, among other matters, describe the responsibilities and certain qualifications of our directors. Our Board Charter and Corporate Governance Guidelines are posted on our website at www.covantaholding.com. Copies may also be obtained by writing to our Vice President of Investor Relations at our principal executive offices.

Our Corporate Governance Guidelines include a Majority Voting Policy, which provides that in an uncontested election (i.e., an election where the only nominees are those recommended by the Board), any nominee for director who receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” such election shall promptly tender his or her resignation to the Board for consideration in accordance with the procedures described in the Majority Voting Policy attached to our Corporate Governance Guidelines.

The Corporate Governance Guidelines also require that a majority of the Board qualify as independent within the meaning of the independence standards of the New York Stock Exchange. The applicable standards of independence for the Board are attached to our Corporate Governance Guidelines, and are referred to as the “Independence Standards.” These Independence Standards contain categorical standards that are currently used to provide assistance in the review by the Board of all facts and circumstances in making determinations of director independence required by New York Stock Exchange listing standards.

During the Board's annual review of director independence, the Board considered transactions and relationships between each director or any member of his or her immediate family and us and our subsidiaries and affiliates. The Board also considered whether there were any transactions or relationships between directors, their organizational affiliations or any member of their immediate family, on the one hand, and us and our executive management, on the other hand. As provided in the Independence Standards, the purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the director is independent.

As a result of this review, the Board affirmatively determined that the following directors nominated for re-election are independent of us and our management under the standards set forth in the Independence Standards: David M. Barse, Ronald J. Broglio, Peter C.B. Bynoe, Linda J. Fisher, Joseph M. Holsten, William C. Pate, Robert S. Silberman, Jean Smith and Samuel Zell, and that none of these directors had relationships with us except those that the Board has determined to be immaterial as set forth in the Independence Standards. In making these determinations, the Board considered that, in the ordinary course of business, transactions may occur between us and our subsidiaries and companies at which one or more of our directors are or have been officers. In each case, the amounts paid to these companies in each of the last three years did not exceed the applicable thresholds set forth in the Independence Standards or the nature of the relationships with these companies did not otherwise affect the independent judgment of any of such directors. The Board also considered charitable contributions to not-for-profit organizations of which directors or their immediate family members are affiliated, none of which exceeded the applicable thresholds set forth in the Independence Standards.

Mr. Zell is currently the non-executive Chairman of the Board of the Company. Mr. Zell is the former Chairman of the Board of Equity Group Investments, LLC, referred to as “EGI,” and is currently an officer of the Equity Group Investments division of Chai Trust Company, LLC, referred to as “EGI Division,” SZ Investments L.L.C., referred to as “SZ Investments,” and EGI-Fund (05-07) Investors, L.L.C., referred to as “EGI-Fund (05-07),” a group of affiliated companies. SZ Investments and EGI-Fund (05-07) are, collectively, the holders of approximately 11.4% of our common stock as of March 19, 2013, as described under “Equity Ownership of Certain Beneficial Owners.” In reviewing the independence of Mr. Zell, the Board noted that although Mr. Zell was our President and Chief Executive Officer from July 2002 until April 2004, such prior service as our executive officer occurred more than three years ago and since that time, Mr. Zell's involvement with the Company has been solely in his capacity as a director and the nature and size of the business of the Company has been transformed. Thus in his current role as Chairman of the Board, Mr. Zell does not oversee any of his former reports nor has his prior position affected his rigorous independent and objective oversight of management or promotion of management's accountability to the Company's stockholders. Additionally, the Board noted that Mr. Zell's service as non-executive Chairman of the Board of the Company is not as an executive officer of the Company and is consistent with and pursuant to his duties as a director. Mr. Zell, who was paid at a rate of $600,000 ($150,000 in cash and $450,000 in shares of restricted stock) in 2012 for serving as the non-executive Chairman of the Board, was not among the five most highly paid individuals at the Company in 2012, nor will he be so in 2013. The Board noted Mr. Zell's substantial reported net worth, such that the compensation received from the Company for serving as the non-executive Chairman of the Board of Directors has not and does not appear to hinder Mr. Zell's independence from management or impair his rigorous independent judgment. Mr. Zell's roles at EGI, EGI Division, SZ Investments, and EGI-Fund (05-07) neither imply a conflict of interest nor appear to interfere with Mr. Zell's independent judgment, and his influence and active involvement as a member of the Company's Board of Directors on strategy and the direction of Covanta's business

4

has been aligned with the interests of the Company's stockholders. Finally, the Board noted the absence of any payments made to EGI, EGI Division, SZ Investments, EGI-Fund (05-07) or their affiliates within the past three years (not including any dividends paid on shares of our common stock payable to all stockholders). After considering all relevant factors, the Board determined that these relationships do not interfere with Mr. Zell's independent judgment as a director. Therefore, the Board concluded that Mr. Zell qualifies as an independent director under applicable SEC rules and regulations and New York Stock Exchange listing standards.

Mr. Pate is an officer of EGI Division. As noted above, EGI Division is affiliated with SZ Investments and EGI-Fund (05-07), holders of approximately 11.4% of our common stock as of March 19, 2013, as described under “Equity Ownership of Certain Beneficial Owners.” The Board reviewed the independence of Mr. Pate. In particular, the Board noted the absence of any payments made to EGI Division, SZ Investments, EGI-Fund (05-07) or their affiliates within the past three years (not including any dividends paid on shares of our common stock payable to all stockholders), and also the subjective nature of Mr. Pate's relationship with us, as our former non-executive Chairman of the Board. The Board determined that these relationships do not interfere with Mr. Pate's exercise of independent judgment as a director. Therefore, the Board concluded that Mr. Pate qualifies as an independent director under applicable SEC rules and regulations and New York Stock Exchange listing standards.

Mr. Barse is the President and Chief Executive Officer of Third Avenue Management LLC, referred to as “Third Avenue,” a holder of approximately 6.0% of our common stock as of March 19, 2013, as described under “Equity Ownership of Certain Beneficial Owners.” The Board noted that although Mr. Barse was our President and Chief Operating Officer from July 1996 until July 2002, such prior service as our executive officer occurred more than three years ago and does not interfere with his exercise of independent judgment as a director. Further, the Board noted the absence of any amounts paid to Third Avenue and its affiliates within the past three years (not including any dividends paid on shares of our common stock payable to all stockholders). Therefore, the Board concluded that Mr. Barse qualifies as an independent director under applicable SEC rules and regulations and New York Stock Exchange listing standards.

Mr. Bynoe is Senior Counsel to the law firm of DLA Piper US, LLP, referred to as “DLA Piper US.” DLA Piper UK LLP, a separate entity that is not affiliated for tax purposes with DLA Piper US, provided Covanta Energy with certain legal services in 2012, totaling approximately $240,000. Mr. Bynoe did not direct or have any direct or indirect involvement in the procurement, provision, oversight or billing of such legal services and does not directly or indirectly benefit from those fees paid to DLA Piper UK LLP. Therefore, the Board concluded that Mr. Bynoe qualifies as an independent director under applicable SEC rules and regulations and New York Stock Exchange listing standards.

Committees of the Board

Audit Committee. The current members of the Audit Committee are Mr. Holsten (Chair), Mr. Barse, Mr. Pate and Ms. Smith. Each of the members of the Audit Committee is an independent director under applicable SEC rules and regulations and New York Stock Exchange listing standards. The Board has determined that each of the members of the Audit Committee qualifies as an audit committee “financial expert” under applicable SEC rules and regulations. Our Board has determined that Mr. Pate is a financial expert in part due to his “other relevant experience,” which includes Mr. Pate's extensive investment banking experience involving the critical evaluation of financial statements as (a) a director of several public companies, (b) our former non-executive Chairman of the Board and (c) an investment manager of private capital. In this latter role, our Board has determined that he had oversight of the preparation, auditing or evaluation of financial statements in conjunction with numerous acquisitions in a variety of industries and in conjunction with raising public fixed income and equity capital for associated corporations.

The Audit Committee operates under a written charter, a copy of which is available on our website at www.covantaholding.com or may be obtained by writing to our Vice President of Investor Relations at our principal executive offices. Under its charter, the functions of the Audit Committee include assisting the Board in its oversight of the quality and integrity of our financial statements and accounting processes, compliance with legal and regulatory requirements, assessing and reviewing the qualifications, independence and performance of our independent registered public accountants and overseeing our internal audit function. The Audit Committee has the sole authority to select, evaluate, appoint or replace the independent registered public accountants and has the sole authority to approve all audit engagement fees and terms. The Audit Committee must pre-approve all permitted non-auditing services to be provided by the independent auditors; discuss with management and the independent auditors our financial statements and any disclosures and SEC filings relating thereto; recommend for stockholder approval the ratification of our independent registered public accountants; review the integrity of our financial reporting process; establish policies for the hiring of employees or former employees of the independent registered public accountants; and investigate any matters pertaining to the integrity of management. The Audit Committee held eight meetings during 2012.

5

Compensation Committee. The current members of the Compensation Committee are Mr. Bynoe (Chair), Mr. Silberman and Ms. Smith. Each of the members of the Compensation Committee qualifies as an independent director under applicable New York Stock Exchange listing standards and is considered to be a “non-employee director” under Rule 16b-3 of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this proxy statement. All of the current members of the Compensation Committee are “outside directors” under section 162(m) of the Internal Revenue Code of 1986, as amended, which we refer to as the “Tax Code” in this proxy statement.

The Compensation Committee operates under a written charter, a copy of which is available on our website at www.covantaholding.com or may be obtained by writing to our Vice President of Investor Relations at our principal executive offices. Under its charter, the Compensation Committee, among other things, has the following authority:

(1) | to review and approve the Company’s goals relating to the chief executive officer’s compensation, evaluate the chief executive officer’s performance under those goals and set the chief executive officer’s compensation; |

(2) | to evaluate, review and approve the compensation structure and process for our other officers and the officers of our subsidiaries; |

(3) | to evaluate, review and recommend to our Board any changes to, or additional, stock-based and other incentive compensation plans; |

(4) | to engage independent advisors to assist the members of the Compensation Committee in carrying out their duties; and |

(5) | to recommend inclusion of the Compensation Discussion and Analysis in this proxy statement and our Annual Report on Form 10-K. |

The Compensation Committee held five meetings during 2012 and took two actions by unanimous written consent.

Nominating and Governance Committee. The current members of the Nominating and Governance Committee are Ms. Smith (Chair), Mr. Bynoe and Ms. Fisher. Each of the members of the Nominating and Governance Committee qualifies as an independent director under applicable New York Stock Exchange listing standards.

The Nominating and Governance Committee operates under a written charter, a copy of which is available on our website at www.covantaholding.com, or may be obtained by writing to our Vice President of Investor Relations at our principal executive offices. Under its charter, the Nominating and Governance Committee is responsible for assisting the Board in identifying qualified candidates to serve on the Board, recommending director nominees for the Annual Meeting of Stockholders, identifying individuals to fill vacancies on the Board, recommending Corporate Governance Guidelines to the Board, leading the Board in its annual self evaluations and recommending nominees to serve on each committee of the Board. The Nominating and Governance Committee, among other things, has the authority to evaluate candidates for the position of director, retain and terminate any search firm used to identify director candidates and review and reassess the adequacy of our corporate governance procedures.

In identifying candidates for positions on the Board, the Nominating and Governance Committee generally relies on suggestions and recommendations from members of the Board, management and stockholders. In 2012, we did not use any search firm or pay fees to other third parties in connection with seeking or evaluating Board nominee candidates.

The Nominating and Governance Committee does not set specific minimum qualifications for director positions. Instead, the Nominating and Governance Committee believes that nominations for election or re-election to the Board should be based on a particular candidate's merits and our needs after taking into account the current composition of the Board. When evaluating candidates annually for nomination for election, the Nominating and Governance Committee considers an individual's skills, diversity, independence from us, experience in areas that address the needs of the Board and ability to devote adequate time to Board duties. The Nominating and Governance Committee does not specifically define diversity, but values diversity of experience, perspective, education, race, gender and national origin as part of its overall annual evaluation of director nominees for election or re-election. Whenever a new seat or a vacated seat on the Board is being filled, candidates that appear to best fit the needs of the Board and the Company are identified and, unless such individuals are well known to the Board, they are interviewed and further evaluated by the Nominating and Governance Committee. Candidates selected by the Nominating and Governance Committee are then recommended to the full Board. After the Board approves a candidate, the Chair of the Nominating and Governance Committee extends an invitation to the candidate to join the Board.

The Nominating and Governance Committee will consider candidates recommended by stockholders if such recommendations are provided to the Secretary of the Company in writing within the time periods set forth in our applicable proxy statement and accompanied by the relevant biographical and other information required by Section 2.7 of our Amended and Restated Bylaws and are submitted in accordance with our organizational documents, New York Stock Exchange requirements and SEC rules and regulations, each as in effect from time to time. Candidates recommended by stockholders will be evaluated in the same manner as other candidates. Under our Amended and Restated Bylaws, any holder of 20% or more of our outstanding voting securities has the right, but not the obligation, to nominate one qualified candidate for election as a

6

director. Provided that such stockholder adequately notifies us of a nominee within the time periods set forth in our applicable proxy statement, that individual will be included in our proxy statement as a nominee.

The Nominating and Governance Committee held four meetings during 2012.

Finance Committee. The current members of the Finance Committee are Messrs. Pate (Chair), Barse, Holsten and Silberman. The Finance Committee operates under a written charter, a copy of which is available on our website at www.covantaholding.com, or may be obtained by writing to our Vice President of Investor Relations at our principal executive offices. Under its charter, the Finance Committee is responsible for assisting the Board in its oversight of our consideration of new financial commitments, acquisitions, investments, and other transactions that are either material to our financial condition or prospects, or are otherwise not contemplated by our annual budget or business/financial plan. The Finance Committee is also responsible for establishing policies with respect to the issuance of dividends on our common stock, establishing guidelines for approvals for proposed transactions and spending authorization by our senior executives.

The Finance Committee held five meetings and took one action by unanimous written consent during 2012.

Public Policy Committee. The current members of the Public Policy Committee are Ms. Fisher (Chair) and Messrs. Broglio and Orlando. The Public Policy Committee operates under a written charter, a copy of which is available on our website at www.covantaholding.com, or may be obtained by writing to our Vice President of Investor Relations at our principal executive offices. Under its charter, the Public Policy Committee is responsible for assisting the Board in its oversight responsibilities for matters relating to public policy. The Public Policy Committee's responsibilities include oversight of legislative and regulatory developments affecting our business, employee safety programs and procedures, community relations programs, political and charitable contributions by us, and other matters of public policy affecting our renewable energy and waste business.

The Public Policy Committee held four meetings during 2012.

Technology Committee. The current members of the Technology Committee are Messrs. Broglio (Chair), Orlando and Pate. The Technology Committee operates under a written charter, a copy of which is available on our website at www.covantaholding.com, or may be obtained by writing to our Vice President of Investor Relations at our principal executive offices. Under its charter, the primary purpose of the Technology Committee is to assist the Board in fulfilling its oversight responsibilities for matters relating to technology and technology development as it relates to our renewable energy and waste and energy services businesses. The Technology Committee's responsibilities include the development and implementation of major strategies relating to our approach to technical and commercial innovation and the process of innovation and technology acquisition to assure ongoing business growth; the evaluation of the implications of new technologies on our competitive position in the renewable energy and waste industries, both in the Americas and internationally; the research, development and implementation of new technologies in the renewable energy and waste industries; the research, development and implementation of improvements to our existing technologies; and all matters related to the protection of intellectual property, including patents, trademarks and copyrights, involving existing or new technologies of the Company and its businesses.

The Technology Committee held four meetings during 2012.

Board Oversight of Risk Management

The Board of Directors and the committees of the Board play a significant role in the oversight of Company-wide risk management. As part of our enterprise risk management protocol, senior management discusses and identifies major areas of risk on an ongoing basis. Management annually reviews with the Board risks to the enterprise and our efforts to address them. In addition, presentations are made in the ordinary course at scheduled Board meetings regarding market trends, competition and the various other risks that face the Company. On an ongoing basis, the various committees of the Board address risk in the areas germane to their scope. For example:

• | The Nominating and Governance Committee evaluates Board effectiveness, succession planning, enterprise risk management and general corporate best practices; |

• | The Public Policy Committee oversees policy and regulatory risk, as well as risks in the areas of safety and environmental compliance, through an ongoing dialog with management regarding developments on these topics and by monitoring our progress and maintenance of the Clean World Initiative; |

• | Operational risk management is overseen by the Compensation Committee with respect to attracting, retaining and motivating talented employees and by tying compensation awards to actual performance; |

• | The Technology Committee also plays a role in operational risk management, and oversees risk associated with managing existing technology and developing new technology to enhance and protect our competitive advantage; |

• | The Finance and Audit Committees play key roles in the oversight of financial and market risk, currency risk, liquidity and tax risk; and |

• | Overall ethics, policy and compliance risk is also overseen by the Audit Committee and the Nominating and Governance Committee. |

7

Separation of the Roles of Chairman and Chief Executive Officer

For the last nine years, the Company has maintained a separation of the roles of Chairman and Chief Executive Officer. The Chairman has held the role of overseeing the Board and working with and providing guidance to the Chief Executive Officer on our overall strategic objectives and risk management. The Chairman of the Nominating and Governance Committee will act as Lead Director in the event of a potential conflict of interest involving the Chairman. In addition to being the primary liaison with the Chairman and the Board, the Chief Executive Officer's role is to directly oversee the day-to-day operations of the Company, lead and manage the senior management of the Company and implement the strategic plans, risk management and policies of the Company. The Chairman and Chief Executive Officer work closely together to ensure that critical information flows to the full Board, that discussions and debate of key business issues are fostered and afforded adequate time and consideration, that consensus on important matters is reached and decisions, delegation of authority and actions are taken in such a manner as to enhance our businesses and functions. While the Board believes that the separation of these two roles currently best serves the Company and its stockholders, it recognizes that combining these roles may be appropriate in the future if circumstances change.

Executive Sessions of Non-Management Directors and Independent Directors

The independent directors of the Board meet regularly in executive session without our management present. Our Lead Director will serve as the Chair of each executive session of independent directors in the event of any potential conflict of interest with our Chairman. Stockholders wishing to communicate with the independent directors may contact them by writing to: Independent Directors, c/o Corporate Secretary, Covanta Holding Corporation, 445 South Street, Morristown, New Jersey 07960. Any such communication will be promptly distributed by the Corporate Secretary to the individual director or directors named in the communication in the same manner as described below in “Communications with the Board.”

Communications with the Board

Stockholders and other interested parties can send communications to one or more members of the Board by writing to the Board or to specific directors or group of directors at the following address: Covanta Holding Corporation Board of Directors, c/o Corporate Secretary, Covanta Holding Corporation, 445 South Street, Morristown, New Jersey 07960. Any such communication will be promptly distributed by the Corporate Secretary to the individual director or directors named in the communication or to all directors if the communication is addressed to the entire Board.

Compensation of the Board

On an annual basis, at the Annual Meeting of Stockholders at which directors are elected, each non-employee director, other than the Chairman of the Board, is awarded 4,500 shares of restricted stock, which vest as follows: one-third vest upon the grant of the award, one-third will vest one year after the date of grant and the final one-third of the restricted stock will vest two years after the date of grant. Mr. Barse waived his right to receive equity awards for 2012 and has indicated his intention to waive his right to receive equity compensation in 2013. The Chairman of the Board receives annual compensation equal to $150,000 in cash and $450,000 in restricted stock, which vests as follows: one-third of the shares vest upon the grant of the award, one-third will vest one year after the date of grant and the final one-third of the shares will vest two years after the date of grant. Non-employee directors, other than the Chairman of the Board, also will receive an annual fee of $50,000 for 2013, increased from $30,000 in 2012. In addition, the chairs of the Audit Committee and Compensation Committee will each receive an additional annual fee of $10,000 for such service and the chair of each of the other committees of the Board, including without limitation, the Nominating and Governance Committee, the Finance Committee, the Public Policy Committee and the Technology Committee, will be entitled to receive an additional annual fee of $5,000 for such service. Non-employee directors will be entitled to receive a meeting fee of $2,000 for each Audit Committee meeting and $1,500 for each other committee meeting they attend. Directors who are appointed at a date other than the Annual Meeting will be entitled to receive a pro rata portion of the annual director compensation.

8

The following table sets forth the compensation paid to each of our non-employee directors for the year ended December 31, 2012.

DIRECTOR COMPENSATION FOR 2012

Name(1) | Fees Earned or Paid in Cash ($) | Stock Awards(2) ($) | Option Awards(3) ($) | Total ($) | ||||||||||||

David M. Barse(4) | $ | 51,500 | $ | — | $ | — | $ | 51,500 | ||||||||

Ronald J. Broglio | $ | 45,500 | $ | 73,215 | $ | — | $ | 118,715 | ||||||||

Peter C.B. Bynoe | $ | 49,500 | $ | 73,215 | $ | — | $ | 122,715 | ||||||||

Linda J. Fisher | $ | 47,000 | $ | 73,215 | $ | — | $ | 120,215 | ||||||||

Joseph M. Holsten | $ | 56,000 | $ | 73,215 | $ | — | $ | 129,215 | ||||||||

William C. Pate | $ | 61,500 | $ | 73,215 | $ | — | $ | 134,715 | ||||||||

Robert S. Silberman | $ | 51,500 | $ | 73,215 | $ | — | $ | 124,715 | ||||||||

Jean Smith | $ | 52,000 | $ | 73,215 | $ | — | $ | 125,215 | ||||||||

Samuel Zell | $ | 150,000 | $ | 450,000 | $ | — | $ | 600,000 | ||||||||

(1) | As an employee, Mr. Orlando is not entitled to additional compensation for serving as a member of the Board or any committee of the Board. See the “Summary Compensation Table For The Year Ended December 31, 2012” for his compensation information. |

(2) | Each non-employee director, except for Mr. Zell as Chairman of the Board, and Mr. Barse, who declined to receive any non-cash compensation, received an award of 4,500 shares of restricted stock on May 9, 2012 that had a grant date fair value of $16.27 per share, as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, “Compensation — Stock Compensation,” referred to in this proxy statement as “FASB ASC Topic 718.” The grant date fair value is computed using the closing price of shares on the grant date. For a discussion of valuation assumptions, see Note 17, “Stock-Based Award Plans,” to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2012. Set forth below is the total number of shares of unvested restricted stock that each non-employee director has been granted in his or her role as a director in 2012, as well as the shares of restricted stock which vested during 2012. Mr. Zell received a $450,000 restricted stock award based on the closing price of the common stock on the New York Stock Exchange on the grant date of $16.27. |

Director | Number of Unvested Restricted Stock Awards Held as of December 31, 2012(a)(b) | Number of Restricted Stock Awards Vested During Fiscal Year Ended December 31, 2012 | ||||

David M. Barse | — | — | ||||

Ronald J. Broglio | 4,500 | 4,646 | ||||

Peter C.B. Bynoe | 4,500 | 4,646 | ||||

Linda J. Fisher | 4,500 | 4,646 | ||||

Joseph M. Holsten | 4,500 | 4,646 | ||||

William C. Pate | 4,500 | 4,646 | ||||

Robert S. Silberman | 4,500 | 4,646 | ||||

Jean Smith | 4,500 | 4,646 | ||||

Samuel Zell (c) | 19,939 | 12,365 | ||||

a. | For each director except Mr. Barse and Mr. Zell, 1,500 shares of restricted stock vest on each of May 5, 2013, May 9, 2013 and May 9, 2014. |

b. | Notwithstanding the vesting schedule attached to such restricted stock awards granted in 2012, all such restricted stock awards were considered to be vested for purposes of FASB ASC Topic 718. |

c. | For Mr. Zell, 1,500 shares of restricted stock will vest on May 5, 2013, 9,219 shares will vest on May 9, 2013 and 9,220 shares will vest May 9, 2014. |

(3) | No stock options were granted to non-employee directors in 2012. Set forth below is the total number of stock option awards made to each non-employee director in his or her role as a director that were outstanding as of December 31, 2012. |

9

Director | Number of Stock Options Outstanding as of December 31, 2012(a) | ||

David M. Barse | — | ||

Ronald J. Broglio | — | ||

Peter C.B. Bynoe | 13,334 | ||

Linda J. Fisher | — | ||

Joseph M. Holsten | — | ||

William C. Pate | 26,668 | ||

Robert S. Silberman | — | ||

Jean Smith | 13,334 | ||

Samuel Zell | 13,334 | ||

a. | All options are exercisable at $11.40 per share except for 13,334 options held by Mr. Pate which are exercisable at $5.93 per share. |

(4) | Mr. Barse waived his right to receive equity awards for 2012. |

Director Stock Ownership Guidelines

Our Board believes it is important for all of our directors to acquire and maintain a significant equity ownership position in our Company. Accordingly, we have established stock ownership guidelines for our directors in order to specifically identify and align the interests of our directors with our stockholders. Accordingly, each director is required under our guidelines to hold at least 15,000 shares of our common stock. Directors are given five years to reach their target ownership levels and, given that a majority of each director's annual compensation is in the form of restricted stock vesting over a period of time, our guidelines provide that credit is given for unvested restricted stock holdings toward individual targets.

Policies on Business Conduct and Ethics

We have a Code of Conduct and Ethics for Senior Financial Officers and a Policy of Business Conduct. The Code of Conduct and Ethics applies to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Controller or persons performing similar functions. The Policy of Business Conduct applies to all of our, and our subsidiaries', directors, officers and employees. Both the Code of Conduct and Ethics and the Policy of Business Conduct are available on our website at www.covantaholding.com and copies may be obtained by writing to our Vice President of Investor Relations at our principal executive offices.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently comprised of ten directors. The Board, at the recommendation of the Nominating and Governance Committee, has nominated each of the following ten individuals to serve as a director for a term of one year:

David M. Barse

Ronald J. Broglio

Peter C.B. Bynoe

Linda J. Fisher

Joseph M. Holsten

Anthony J. Orlando

William C. Pate

Robert S. Silberman

Jean Smith

Samuel Zell

Each of the nominees currently serves as a member of the Board. If elected at this year's Annual Meeting, each nominee will serve until the date of next year's Annual Meeting or until his or her successor has been elected and qualified. Each nominee provides a depth of knowledge, experience and diversity of perspective to facilitate meaningful participation and, through service on the Board, satisfy the needs of the Company and its stockholders.

Each nominee has consented to serve as a member of the Board if re-elected for another term. Nevertheless, if any nominee becomes unable to stand for election (which is not anticipated by the Board), each proxy will be voted for a substitute designated by the Board or, if no substitute is designated by the Board prior to or at the Annual Meeting, the Board will act to reduce the membership of the Board to the number of individuals nominated.

10

There is no family relationship between any nominee and any other nominee or any executive officer of ours. The information set forth below concerning the nominees has been furnished to us by the nominees.

The Board recommends that you vote “FOR” the election of each of the above named nominees to the Board. Proxies solicited by the Board will be voted “FOR” the election of each of the nominees named above unless instructions to the contrary are given.

Our Directors

David M. Barse has served as a director since 1996 and is a member of the Audit Committee and Finance Committee. Mr. Barse's one-year term as a director will expire at the next Annual Meeting. Mr. Barse served as our President and Chief Operating Officer from July 1996 until July 24, 2002. Mr. Barse has served as Chief Executive Officer of Third Avenue Management LLC, sometimes referred to as "Third Avenue", an investment adviser to mutual funds, private funds, solo-advised funds and separately managed accounts, since June 2003 and previously served as President of Third Avenue from February 1998 until September 2012. From April 1995 until February 1998, Mr. Barse served as the Executive Vice President and Chief Operating Officer of Third Avenue Trust and its predecessor, Third Avenue Value Fund, Inc., before assuming the position of President in May 1998 and Chief Executive Officer in September 2003. In 2001, Mr. Barse became Trustee of both the Third Avenue Trust and Third Avenue Variable Series Trust, and he continues to serve in that capacity. Since June 1995, Mr. Barse has been the President and, since July 1999, Chief Executive Officer of MJ Whitman LLC and its predecessor, a full service broker dealer. Mr. Barse joined the predecessor of MJ Whitman LLC and Third Avenue in December 1991 as General Counsel. Mr. Barse also presently serves as a Trustee of Brooklyn Law School and as a director of Manifold Capital Corp. (formerly American Capital Access Holdings, Inc.), a privately held financial services company. In addition, Mr. Barse serves on the Board of Directors of City Parks Foundation and is a member of the World Presidents' Organization. Mr. Barse's in-depth institutional knowledge of the Company's business, dating back more than 15 years, and his prior role as President and Chief Operating Officer, his legal background and experience in investing in companies in a range of sectors, provide a direct benefit to the Board and our stockholders. Mr. Barse is 50 years old.

Ronald J. Broglio has served as a director since October 2004 and is Chair of the Technology Committee and a member of the Public Policy Committee. Mr. Broglio's one-year term as a director will expire at the next Annual Meeting. Mr. Broglio has been the President of RJB Associates, a consulting firm specializing in energy and environmental solutions, since 1996. Mr. Broglio was Managing Director of Waste to Energy for Waste Management International Ltd. from 1991 to 1996. Prior to joining Waste Management, Mr. Broglio held a number of positions with Wheelabrator Environmental Systems Inc. from 1980 through 1990, including Managing Director, Senior Vice President — Engineering, Construction & Operations and Vice President of Engineering & Construction. Mr. Broglio served as Manager of Staff Engineering and as a staff engineer for Rust Engineering Company from 1970 through 1980. Mr. Broglio has more than 40 years of experience in the waste and energy-from-waste industries, and has an in-depth technical knowledge of combustion systems, complimentary technologies, and the engineering associated with our business. In these areas, as well as his management experience in the waste and energy-from-waste sectors both in the Americas and in Europe, he provides valuable insight to management and the Board. Mr. Broglio is 72 years old.

Peter C.B. Bynoe has served as a director since July 2004 and is Chair of the Compensation Committee and a member of the Nominating and Governance Committee. Mr. Bynoe's one-year term as a director will expire at the next Annual Meeting. As of February 2009, Mr. Bynoe became partner and Chief Operating Officer of Loop Capital LLC, a full-service investment banking firm based in Chicago, where he had been Managing Director since February 2008. Mr. Bynoe also currently serves as Senior Counsel to the law firm of DLA Piper US, LLP, which he joined as a partner in 1995. Mr. Bynoe has been a principal of Telemat Ltd., a consulting and project management firm, since 1982. Mr. Bynoe is a director of Frontier Communications Corporation (formerly known as Citizens Communication Corporation), a telephone, television and internet service provider, and was formerly a director of Rewards Network Inc., a provider of credit card loyalty and rewards programs. The Board benefits from Mr. Bynoe's extensive legal and financial expertise, his background in infrastructure projects, his public sector service and his extensive knowledge of public policy issues. Mr. Bynoe's service as a board member for other public and private companies also enables him to provide valuable insight and perspective on governance matters. Mr. Bynoe is 62 years old.

Linda J. Fisher has served as a director since December 2007 and is Chair of the Public Policy Committee and a member of the Nominating and Governance Committee. Ms. Fisher's one-year term as a director will expire at the next Annual Meeting. Ms. Fisher has been Vice President, Safety, Health and Environment and Chief Sustainability Officer at E.I. du Pont de Nemours and Company, referred to as “DuPont,” since 2004. Prior to joining DuPont, Ms. Fisher was Deputy Administrator of the United States Environmental Protection Agency. Ms. Fisher has served on the boards of several environmental and conservation organizations and currently serves as a director of Resources for the Future, a non-profit, non-partisan organization that conducts independent research on environmental, energy and natural resource issues. Ms. Fisher's background at the United States Environmental Protection Agency and her current position as Chief Sustainability Officer, with responsibility over safety and environmental compliance at DuPont, provide to management and the Board valuable insight into

11

the regulatory and policy developments affecting the Company's business. Ms. Fisher's depth of knowledge in matters relating to the environment and public policy add to the Board's breadth and further enhance our ability to improve and build upon the Clean World Initiative. Ms. Fisher is 60 years old.

Joseph M. Holsten has served as a director since May 2009 and is Chair of the Audit Committee and a member of the Finance Committee. Mr. Holsten's one-year term as a director will expire at the next Annual Meeting. Since November 2011, Mr. Holsten has been Chairman of the Board of LKQ Corporation, referred to as “LKQ,” the largest provider in the U.S. of aftermarket, recycled and refurbished collision replacement parts. He has been a member of the Board of Directors of LKQ since February 1999. Mr. Holsten was the President and Chief Executive Officer of LKQ from November 1998 to January 2011 when he became Co-Chief Executive Officer as part of his transition to retirement. He retired from his position of Co-Chief Executive Officer in January 2012. Prior to joining LKQ, Mr. Holsten held various positions of increasing responsibility with the North American and International operations of Waste Management, Inc. for approximately 17 years. From February 1997 until July 1998, Mr. Holsten served as Executive Vice President and Chief Operating Officer of Waste Management, Inc. From July 1995 until February 1997, he served as Chief Executive Officer of Waste Management International, plc. Prior to working for Waste Management, Inc., Mr. Holsten was a staff auditor at a public accounting firm. Mr. Holsten's experience in the waste industry, in both domestic and international markets, combined with his knowledge of commodities markets, provides the Board with valuable insight and perspective on industry specific issues. In addition, as a recent chief executive officer of a public company, Mr. Holsten brings valuable perspective to management on a range of issues, as well as a deep financial expertise and understanding. Mr. Holsten is 60 years old.

Anthony J. Orlando has served as our President and Chief Executive Officer since October 2004. He has served as a director since September 2005 and is a member of the Public Policy Committee and the Technology Committee. Mr. Orlando's one-year term as a director will expire at the next Annual Meeting. Previously, Mr. Orlando had been President and Chief Executive Officer of Covanta Energy since November 2003. From March 2003 to November 2003, Mr. Orlando served as Senior Vice President, Business and Financial Management of Covanta Energy. From January 2001 until March 2003, Mr. Orlando served as Covanta Energy's Senior Vice President, Waste-to-Energy. Mr. Orlando joined Covanta Energy in 1987. Mr. Orlando's extensive first-hand knowledge and experience with the Company and the industry provides the Board with a greater understanding of all aspects of the Company's business. Mr. Orlando is 53 years old.

William C. Pate has served as a director since 1999 and is Chair of the Finance Committee and a member of the Audit Committee and the Technology Committee. Mr. Pate's one-year term as a director will expire at the next Annual Meeting. He was our Chairman of the Board from October 2004 through September 2005. Mr. Pate is Co-President of EGI, a division of Chai Trust Company LLC. Mr. Pate has been employed by EGI or its predecessors in various capacities since 1994. Mr. Pate also serves as a director of Exterran Holdings, Inc., a global market leader in natural gas production and processing services, and Wapiti Oil & Gas LLC, a North American-focused exploration and production company. Mr. Pate served as a director of Tribune Company, a Chicago-based media conglomerate, until December 2012. Mr. Pate's familiarity with all aspects of capital markets, financial transactions and investing in a range of businesses across domestic and international markets, provides value and informed perspective to management and the Board. His experience as a board member of other public and private companies provides additional perspective on governance issues. Mr. Pate is 49 years old.

Robert S. Silberman has served as a director since December 2004 and is a member of the Compensation Committee and the Finance Committee. Mr. Silberman's one-year term as a director will expire at the next Annual Meeting. Mr. Silberman has been Chairman of the Board of Directors of Strayer Education, Inc. since February 2003 and its Chief Executive Officer since March 2001. Strayer Education, Inc. is an education services company, whose main operating asset, Strayer University, is a leading provider of graduate and undergraduate degree programs focusing on working adults. From 1995 to 2000, Mr. Silberman held several senior positions, including President and Chief Operating Officer of CalEnergy Company, Inc., an independent energy producer. Mr. Silberman has also held senior positions within the U.S. Department of Defense, including Assistant Secretary of the Army. Mr. Silberman is a member of the Council on Foreign Relations, a nonpartisan resource for information and analysis on foreign relations. He also serves on the Board of Trustees of the Philips Exeter Academy and on the Board of Visitors of The Johns Hopkins University School of Advanced International Studies. Mr. Silberman was previously a director of Surgis, Inc., an ambulatory surgery center and surgical services company, and New Page Holding Corporation, a paper manufacturer. Mr. Silberman's positions as chief executive officer and board member of public companies, coupled with his background in energy, project development and the public sector, combine to provide valuable insight and perspective to both the Board and management. Mr. Silberman is 55 years old.

12

Jean Smith has served as a director since December 2003 and is Chair of the Nominating and Governance Committee and a member of the Audit Committee and the Compensation Committee. Ms. Smith's one-year term as a director will expire at the next Annual Meeting. Ms. Smith is a Managing Director of Gordian Group, LLC, an independently owned investment bank. From 2006 through 2008, Ms. Smith served as Managing Director of Plainfield Asset Management LLC, an investment manager for institutions and high net worth individuals. Ms. Smith previously held the position of President of Sure Fit Inc., a home textiles company, from 2004 to 2006 and was a private investor and consultant on various special situation projects from 2001 to 2004. Ms. Smith has more than 25 years of investment and international banking experience, having previously held the position of Managing Director of Corporate Finance for U.S. Bancorp Libra and senior positions with Bankers Trust Company, Citicorp Investment Bank, Security Pacific Merchant Bank and UBS Securities. Ms. Smith was originally recommended to the Board in 2003 by a significant stockholder to be an independent director. Ms. Smith brings a range of extensive and diverse financial and business experience to the Board, including in the areas of capital markets, investment management, and operations and business management in both domestic and international markets. Ms. Smith is 57 years old.

Samuel Zell has served as our Chairman of the Board since September 2005, and had also previously served as a director from 1999 to 2004, as our President and Chief Executive Officer from July 2002 to April 2004 and as our Chairman of the Board from July 2002 to October 2004. Mr. Zell's one-year term as our Chairman and as a director will expire at the next Annual Meeting. Currently, and for more than the past five years, Mr. Zell has served as Chairman of Equity Group Investments and its predecessors, the private firm he founded over 40 years ago. He also serves as Chairman of Anixter International, Inc., a global distributor of electrical and cable systems; Equity Lifestyle Properties, Inc., an equity real estate investment trust (REIT) primarily engaged in the ownership and operation of manufactured home resort communities; and Equity Residential, an equity REIT that owns and operates multi-family residential properties. Mr. Zell served as the Chairman of the Board of Tribune Company, a Chicago-based media conglomerate, from December 2007 until December 2012 and served as its Chief Executive Officer from December 2007 until December 2009. In December 2008, the Tribune Company filed for protection under Chapter 11 of the Bankruptcy Code. Mr. Zell previously served as the Chairman of the Board of Equity Office Properties Trust, an equity REIT that owned and operated office buildings, and was the company's Interim President from April 2002 until November 2002 and was its Interim Chief Executive Officer from April 2002 until April 2003. Mr. Zell also previously served as Chairman of the Board of Rewards Network, a dining rewards company and Capital Trust, Inc., a specialized finance company. Mr. Zell's financial sophistication, extensive investment and management experience, dynamic business and strategic expertise and vast network significantly augment the Board in substantially every aspect of its functionality. Mr. Zell is 71 years old.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has appointed Ernst & Young LLP as our independent registered public accountants to audit our consolidated financial statements for the year ending December 31, 2013, subject to ratification of the appointment by our stockholders. During the 2012 fiscal year, Ernst & Young LLP served as our independent registered public accountants and also provided certain tax and audit-related services. We have been advised by Ernst & Young LLP that neither it nor any of its members has any direct or indirect financial interest in us.

Although we are not required to seek stockholder ratification of this appointment, the Audit Committee and the Board believe it to be sound corporate practice to do so. If the appointment is not ratified, the Audit Committee will investigate the reasons for stockholder rejection and the Audit Committee will reconsider the appointment. Representatives of Ernst & Young LLP are expected to attend the Annual Meeting where they will be available to respond to appropriate questions and, if they desire, to make a statement.

The Audit Committee recommends a vote “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accountants for the 2013 fiscal year. Proxies solicited by the Board will be voted “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accountants unless instructions to the contrary are given.

13

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary and Overview

Executive Summary

We are one of the world's largest owners and operators of infrastructure for the conversion of waste to energy (known as “energy-from-waste” or “EfW”), as well as other waste treatment and renewable energy production businesses. Energy-from-waste serves two key markets as both a sustainable waste management solution that is environmentally superior to landfilling and as a source of clean energy that reduces overall greenhouse gas emissions and is considered renewable under the laws of many states and under federal law. Our facilities are critical infrastructure assets that allow our customers, which are principally municipal entities, to provide an essential public service. Maintaining this reputation and continuing to position ourselves for future success requires high caliber talent to protect and grow our business in support of our goal of producing superior financial returns for our stockholders.

We designed our executive compensation program with the following goals:

• | to align the interests of our stockholders and management by putting a significant portion of management's compensation “at risk” by tying their potential compensation to actual performance, with greater relative percentages for the most senior officers to reflect their respective areas and levels of responsibility for our performance; |

• | to provide a market competitive and internally equitable compensation and benefits package that reflects individual and company performance, job responsibilities and the strategic value of our market position and reputation; |

• | to motivate and reward our senior management team for maintaining and creating long-term value by effectively operating our existing business and executing our strategic and growth initiatives; and |

• | to ensure retention, engagement, and motivation of our senior management team as productive long-term employees, to lead our strategic and growth initiatives, to manage effectively our businesses and related risks and to drive financial performance. |

Most of our named executive officers are longstanding members of our management team with extensive experience in our business. As a result, our named executive officers are especially knowledgeable about our business and our industry and thus particularly valuable to us and our stockholders as we continue to manage through dynamic market, economic and regulatory environments.

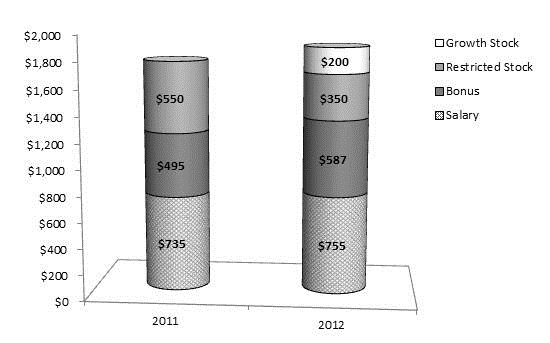

As set forth in the charts below, a significant percentage of the total compensation payable in 2011 and 2012 to the Chief Executive Officer and the named executive officers as a group was at risk and subject to the performance of the individual officer and the Company:

CEO – 2011 & 2012 Compensation (in thousands)

14

All Other Named Executive Officers – 2011 & 2012 Compensation (in thousands)

The relative percentages of at risk, performance-based compensation generally increased slightly in 2012 compared to 2011 due to higher non-equity incentive cash awards reflecting our strong performance towards our strategic business objectives and the grant of growth-based equity awards, which we refer to as “Growth Equity Awards” offset by generally lower restricted stock award grants. In addition, as a result of a special equity award grant in 2011 to our Chief Financial Officer, his 2012 equity award was lower than in 2011 while our Chief Operating Officer received significantly higher equity awards due to his promotion and assumption of expanded operating responsibilities and his responsibilities for the projects qualifying for Growth Equity Awards. Equity grants in the form of Growth Equity Awards and restricted stock awards are long term awards which vest over a period of three years in the case of restricted stock awards and not before at least three years and confirmed performance in the case of Growth Equity Awards.

Consistent with our corporate objectives, our compensation programs are broadly-based and equitable, with over 350 employees participating in the Long-Term Incentive Plan, ranging from certain Managers, Engineers and Supervisors to the Chief Executive Officer. In addition, none of our named executive officers have an employment agreement, nor are they entitled to receive tax reimbursements or perquisites.

2012 Compensation

In order to create economic incentives to successfully implement our strategic and organic growth objectives, compensation for the named executive officers in 2012 consisted of the following components:

• | Competitive annual base salary; |

• | Annual cash bonus based upon performance and weighted among achieving objectives measured by: |

• | corporate financial metrics - 67%, and |

• | strategic goals aligned with individual performance approved by the Compensation Committee - 33%; |

• | Annual restricted stock grants vesting ratably over three years based upon time; and |

• | Growth Equity Awards of restricted stock units vesting based upon actual performance measured by a "bring down" calculation at least three years following the grant date. |

2012 Performance Highlights

As shown in the diagrams below, our financial performance reflected in our Free Cash Flow and Adjusted Earnings Before Interest, Depreciation and Amortization (referred to as "Adjusted EBITDA") has remained strong in each of the past three years; Free Cash Flow having fluctuated largely due to timing of payments related to a construction projects. Free Cash Flow and Adjusted EBITDA are not generally accepted accounting principles ("GAAP") financial measures, and are not intended as a substitute for GAAP measures. Both Free Cash Flow and Adjusted EBITDA are used in our compensation programs and are presented in order to show the correlation between these financial measures and compensation to our named executive officers. We also use Free Cash Flow to assess and evaluate the overall performance of the Company’s business and to highlight trends in our overall business and we use Adjusted EBITDA to provide a more complete understanding of our

15