UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02688

Name of Fund: BlackRock Municipal Bond Fund, Inc.

|

BlackRock High Yield Municipal Fund BlackRock Municipal Insured Fund BlackRock National Municipal Fund BlackRock Short-Term Municipal Fund |

| Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809 |

| Name and address of agent for service: Donald C. Burke, Chief Executive Officer, BlackRock |

| Municipal Bond Fund, Inc., 800 Scudders Mill Road, Plainsboro, NJ, 08536. Mailing |

| address: P.O. Box 9011, Princeton, NJ, 08543-9011 |

| Registrant’s telephone number, including area code: (800) 441-7762 |

| Date of fiscal year end: 06/30/2008 |

| Date of reporting period: 07/01/2007 – 12/31/2007 |

| Item 1 – Report to Stockholders |

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

|

BlackRock Municipal Bond |

| SEMI-ANNUAL REPORT DECEMBER 31, 2007 | (UNAUDITED) |

| BlackRock Short-Term Municipal Fund BlackRock Municipal Insured Fund BlackRock National Municipal Fund BlackRock High Yield Municipal Fund |

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

| Table of Contents | ||

|

|

|

|

| Page | ||

|

|

|

|

| A Letter to Shareholders | 3 | |

| Semi-Annual Report: | ||

| Fund Summaries | 4 | |

| About Fund Performance | 12 | |

| Disclosure of Expenses | 14 | |

| Financial Statements: | ||

| Schedules of Investments | 18 | |

| Statements of Assets and Liabilities | 38 | |

| Statements of Operations | 40 | |

| Statements of Changes in Net Assets | 41 | |

| Financial Highlights | 45 | |

| Notes to Financial Statements | 64 | |

| Proxy Results | 74 | |

| Officers and Directors | 76 | |

| Swap Agreements | 76 | |

| BlackRock Fund Information | 77 | |

| Mutual Fund Family | 79 | |

2 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| A Letter to Shareholders |

Dear Shareholder

Financial markets endured heightened volatility during 2007, culminating in mixed results for some of the major benchmark indexes:

| Total Returns as of December 31, 2007 | 6-month | 12-month | |||

|

|

|

| |||

| U.S. equities (S&P 500 Index) | –1.37% | + 5.49% | |||

|

|

|

|

| ||

| Small cap U.S. equities (Russell 2000 Index) | –7.53 | – 1.57 | |||

|

|

|

|

| ||

| International equities (MSCI Europe, Australasia, Far East Index) | +0.39 | +11.17 | |||

|

|

|

| |||

| Fixed income (Lehman Brothers U.S. Aggregate Bond Index) | +5.93 | + 6.97 | |||

|

|

|

|

| ||

| Tax-exempt fixed income (Lehman Brothers Municipal Bond Index) | +3.22 | + 3.36 | |||

|

|

|

|

| ||

| High yield bonds (Lehman Brothers U.S. Corporate High Yield 2% Issuer Cap Index) | –0.67 | + 2.27 | |||

|

|

|

|

| ||

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index.

Subprime mortgage woes dominated headlines for much of 2007, spawning a widespread liquidity and credit crisis with ramifications across global markets. The Federal Reserve Board (the “Fed”) stepped in to inject liquidity into the markets and bolster investor confidence, cutting the federal funds rate by 0.50% in September, 0.25% in October and 0.25% in December, which brought the target short-term interest rate to 4.25% . In taking action, the central bankers, who had long deemed themselves inflation fighters, were seeking to stem the fallout from the credit crunch and forestall a wider economic unraveling.

Amid the volatility, equity markets displayed surprising resilience. Market fundamentals generally held firm, dividend payouts and share buybacks continued, and valuations remained attractive. To some extent, the credit turmoil dampened corporate merger-and-acquisition (M&A) activity, a key source of strength for equity markets, but 2007 remained a record year for global M&A nonetheless. As the returns indicate, the most recent six months were more trying, reflecting the slowing U.S. economy, a troubled housing market and a more difficult corporate earnings backdrop. Overall, large cap stocks outperformed small caps as investors grew increasingly risk averse. International markets fared better than their U.S. counterparts, benefiting from generally stronger economies.

In fixed income markets, mixed economic signals and subprime fallout resulted in a flight to quality. Investors shunned bonds associated with the housing and credit markets in favor of higher-quality Treasury issues. The yield on 10-year Treasury issues, which touched 5.30% in June (its highest level in five years), fell to 4.04% by year-end, while prices correspondingly rose. The tax-exempt bond market waffled amid the economic uncertainty and concerns around the credit worthiness of bond insurers, but set a new-issuance record in 2007. A drop in municipal bond prices created buying opportunities, and the heightened supply was generally well absorbed.

As you navigate the uncertainties inherent in the financial markets, we encourage you to start the year by reviewing your investment goals with your financial professional and making portfolio changes, as needed. For more reflection on 2007 and our 10 predictions for 2008, please ask your financial professional for a copy of “What’s Ahead in 2008: An Investment Perspective,” or view it online at www.blackrock.com/funds. As always, we thank you for entrusting BlackRock with your investment assets, and we look forward to continuing to serve you in the new year and beyond.

Sincerely,

THIS PAGE NOT PART OF YOUR FUND REPORT

3

| Fund Summary | BlackRock Short-Term Municipal Fund | |

|

|

| |

| Portfolio Management Commentary | ||

|

|

|

- How did the Fund perform?

- The Fund’s total return lagged its broad market benchmark, but exceeded its comparable Lipper category average for the six months ended December 31, 2007.

What factors influenced performance? - Interest rates rose early in 2007 until the U.S. housing slowdown and subprime turmoil caused asset-backed securities to decline in value, putting pressure on financial markets and the overall economy. This eventually led the Federal Reserve Board (the “Fed”) to cut interest rates. Yields generally declined in the fourth quarter, with municipals largely underperforming. Mortgage-related losses in the monoline muni- cipal insurers also hindered price improvement in tax-exempt issues.Municipal bonds rated AAA and AA, and maturing inside 10 years,performed the best. Credit spreads generally continued to widen, leading to poor performance among lower-quality issues.

- New municipal issuance for 2007 totaled $427.5 billion, a new annual record. Volume was up 11.5% versus 2006 and 5% versus 2005, the previous record year. Issuance slowed late in 2007 as market volatility and potential downgrades for the municipal insurance companies led to the postponement of several larger deals.

- The Fund’s conservative investment strategy and overweight in the front part of the yield curve were the main factors behind the outperformance of the Lipper group. Much of this occurred later in 2007 as the turmoil in the credit markets caused a flight to quality and to shorter maturities. Additionally, the Fed began easing monetary policy in September, whichfurther aided performance as the front end of the curve benefited mostfrom this action. Interest rates on one-year general obligation bonds fell 60 basis points (.60%) for the year, while rates on 20-year bonds rose approximately 20 basis points (as their prices correspondingly fell). This outperformance in shorter-dated issues benefited the Fund, which was more heavily weighted in the one- to two-year part of the curve.

- The main detractor from performance was the portfolio’s small position in lower-rated issues, which suffered as credit spreads generally widened amid the market turmoil.

Describe recent portfolio activity. - We drew the Fund’s cash reserves down to a minimum in the belief that Fed easing would have the greatest beneficial impact on very short- maturity bonds. Also, given the negative outlook for some monoline insurers, we generally focused purchases on high-quality general obli- gation bonds and prerefunded bonds. The portfolio’s duration was extended modestly to approximately 1.5 years as a result of spending cash reserves.

Describe Fund positioning at period-end. - The Fund is positioned for additional Fed interest rate cuts, which would benefit performance as the curve continues to steepen. We believe the portfolio’s average credit quality of AA also bodes well given the contin- ued uncertainty in the economy and the impact this has already had on lower-quality issues.

| Fund Profile as of December 31, 2007 | ||

|

|

| |

| Percent of | ||

| Long Term | ||

| Investments | ||

|

|

| |

| Other Revenue Bonds | 44.3% | |

| General Obligation & Tax Revenue Bonds | 32.6 | |

| Prerefunded Bonds | 23.1 | |

4 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| BlackRock Short-Term Municipal Fund |

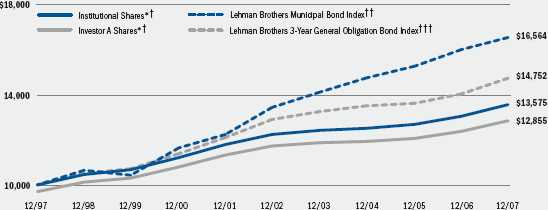

| Total Return Based on a $10,000 Investment |

| * Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. † The Fund invests primarily in investment grade municipal bonds (bonds rated Baa or better) with a maximum maturity not to exceed four years. † † This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature within 30 years. † † † This unmanaged Index consists of state and local government obligation bonds that mature in three – four years, rated Baa or better. |

| Performance Summary for the Period Ended December 31, 2007 | ||||||||||||||||

|

|

|

|

|

|

|

| ||||||||||

| Average Annual Total Returns* | ||||||||||||||||

|

|

|

|

|

| ||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||

|

|

|

|

|

| ||||||||||||

| Standardized | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |||||||||

| 30-Day Yields | Total Returns | charge | charge | charge | charge | charge | charge | |||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| BlackRock | 3.02% | +2.62% | +4.04% | — | +2.10% | — | +3.11% | — | ||||||||

| Institutional | 3.13 | +2.65 | +3.97 | — | +2.08 | — | +3.10 | — | ||||||||

| Investor A | 2.79 | +2.62 | +3.81 | +0.70% | +1.85 | +1.23% | +2.86 | +2.54% | ||||||||

| Investor A1 | 3.00 | +2.60 | +3.87 | +2.83 | +1.98 | +1.78 | +3.00 | +2.90 | ||||||||

| Investor B | 2.78 | +2.47 | +3.61 | +2.61 | +1.72 | +1.72 | +2.73 | +2.73 | ||||||||

| Investor C | 2.13 | +2.14 | +2.93 | +1.93 | +1.07 | +1.07 | +2.08 | +2.08 | ||||||||

| Lehman Brothers 3-Year | ||||||||||||||||

| General Obligation | ||||||||||||||||

| Bond Index | — | +3.73 | +4.99 | — | +2.70 | — | +3.96 | — | ||||||||

| Lehman Brothers Municipal | ||||||||||||||||

| Bond Index | — | +3.22 | +3.36 | — | +4.30 | — | +5.18 | — | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| * Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees. Past performance is not indicative of future results. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 5 |

| Fund Summary | BlackRock Municipal Insured Fund | |

|

|

| |

| Portfolio Management Commentary | ||

|

|

|

How did the Fund perform?

- The Fund performed in line with its comparable Lipper category average for the six-month period ended December 31, 2007, but underperformed the Lehman Brothers Municipal Bond Index.

- Conversely, the Fund’s yield curve position detracted from performance. The curve steepened significantly during the period, leading shorter maturities to outperform longer maturities. The Fund was early in extending out on the yield curve in the previous reporting period, there- by missing some of the relative outperformance at the short end.

What factors influenced performance?

- Interest rates rose early in 2007 until the U.S. housing slowdown and subprime turmoil caused asset-backed securities to decline in value, putting pressure on financial markets and the overall economy. This eventually led the Federal Reserve Board to cut interest rates in September, October and December. Yields generally declined in the fourth quarter, with municipals largely underperforming. Mortgage- related losses in the monoline municipal insurers also hindered price improvement in tax-exempt issues. Municipal bonds rated AAA and AA, and maturing inside 10 years, performed the best. Credit spreads generally widened, leading to poor performance among lower-quality issues.

- New municipal issuance for 2007 totaled $427.5 billion, a new annual record. Volume increased 11.5% versus 2006 and 5% versus 2005, the previous record year. Issuance slowed late in 2007 as market volatility and potential downgrades for the municipal insurance companies led to the postponement of several larger deals.

- During this period of high volatility, the Fund remained essentially fully invested, which helped maintain a strong income accrual and aided performance as yields fell toward period-end. Our efforts to lengthen call protections also contributed to performance as yields fell.

| Describe recent portfolio activity. |

- During the fourth quarter of 2007, the monoline insurers of municipal bonds experienced significant stress. The exact nature of each insurer’s problems (if any) and the extent thereof evolved throughout the period, but was largely unresolved at the end. Working with our Municipal Research Group, we combed through the Fund’s holdings to identify sale candidates based on our underlying issuer rating and insurer profile. At the same time, we looked to purchase strong underlying credits with favored insurers, particularly Financial Security Assurance Inc.

- Generally speaking, the municipal market experienced significant volatility and certain sectors, despite high credit quality, came under pressure. We sought to add to positions in these areas, such as airports and certain callable zero-coupon bonds, as spreads had widened significantly.

Describe Fund positioning at period-end.

- The Fund ended the period fully invested with a modestly constructive view of the market and a bias toward the longer end of the yield curve.

The yield curve steepened significantly in the past six months. We willlook to add bonds that can be advance refunded, premium-coupon bonds with favored insurers, and strong underlying credits in the 20-to 25-year area of the curve.

| Fund Profile as of December 31, 2007 | ||

| Percent of | ||

| Long Term | ||

| Investments | ||

|

|

| |

| Other Revenue Bonds | 77.8% | |

| General Obligation & Tax Revenue Bonds | 11.6 | |

| Prerefunded Bonds | 10.6 | |

6 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| BlackRock Municipal Insured Fund |

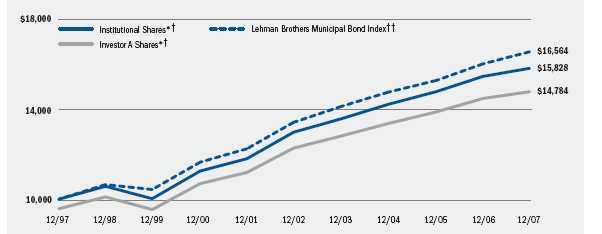

| Total Return Based on a $10,000 Investment |

| * Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. † The Fund invests primarily in long-term, investment grade municipal bonds (bonds rated Baa or better) covered by portfolio insurance guaranteeing the timely payment of principal at maturity and interest. This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature within 30 years. |

| Performance Summary for the Period Ended December 31, 2007 | ||||||||||||||||

|

|

|

|

|

|

|

| ||||||||||

| Average Annual Total Returns* | ||||||||||||||||

|

|

|

|

|

| ||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||

|

|

|

|

|

| ||||||||||||

| Standardized | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |||||||||

| 30-Day Yields | Total Returns | charge | charge | charge | charge | charge | charge | |||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| Institutional | 3.95% | +2.31% | +2.34% | — | +4.05% | — | +4.70% | — | ||||||||

| Investor A | 3.53 | +2.18 | +2.07 | –2.26% | +3.79 | +2.89% | +4.44 | +3.99% | ||||||||

| Investor B | 3.18 | +1.92 | +1.56 | –2.36 | +3.27 | +2.93 | +3.91 | +3.91 | ||||||||

| Investor C | 2.94 | +1.80 | +1.31 | +0.33 | +3.04 | +3.04 | +3.67 | +3.67 | ||||||||

| Investor C1 | 3.14 | +1.90 | +1.52 | +0.54 | +3.22 | +3.22 | +3.86 | +3.86 | ||||||||

| Lehman Brothers Municipal | ||||||||||||||||

| Bond Index | — | +3.22 | +3.36 | — | +4.30 | — | +5.18 | — | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| * Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees. Past performance is not indicative of future results. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 7 |

| Fund Summary | BlackRock National Municipal Fund | |

|

|

| |

| Portfolio Management Commentary | ||

|

|

|

How did the Fund perform?

- The Fund’s total return lagged the broad-market benchmark and its comparable Lipper category average for the six months ended December 31, 2007.

What factors influenced performance?

- Interest rates rose early in 2007 until the U.S. housing slowdown and subprime turmoil caused asset-backed securities to decline in value, putting pressure on financial markets and the overall economy. This eventually led the Federal Reserve Board to cut interest rates in September, October and December. Yields generally declined in the fourth quarter, with municipals largely underperforming. Mortgage- related losses in the monoline municipal insurers also hindered price improvement in tax-exempt issues. Municipal bonds rated AAA and AA, and maturing inside 10 years, performed the best. Credit spreads generally widened, leading to poor performance among lower- quality issues.

- New municipal issuance for 2007 totaled $427.5 billion, a new annual record. Volume increased 11.5% versus 2006 and 5% versus 2005, the previous record year.

- Against the underlying backdrop, Fund performance was hindered by our relatively short duration stance (a measure of interest rate sensitivity); longer yield curve position at a time when shorter-term securities outperformed; and exposure, albeit limited, to lower-rated municipal credits, which underperformed as spreads widened.

- We have consistently focused our efforts on achieving a steady, high level of income for shareholders. This contributes to the Fund’s above- average accrual rate and current yield advantage. However, the flight to quality experienced in the fixed income markets left the Fund in a defensive interest rate posture, which caused it to trail on a price appreciation basis amid the dramatic fall in interest rates.

| Describe recent portfolio activity. |

- We purchased and sold securities in keeping with our aim to maximize the Fund’s coupon structure and optimize current income for share- holders. This involved swapping into more attractive opportunities in the secondary market — in one case, we sold a lower-coupon bond (5%) to purchase a 5.50% coupon bond from the same issuer. With the dramatic widening in credit spreads, we also participated in some primary issuance in the high yield sector.

- We continued to use inverse floating-rate product as the steepening of the tax-exempt yield curve resulted in lower borrowing rates, thereby improving the execution on these products.

Describe Fund positioning at period-end.

- With respect to interest rate sensitivity, the Fund entered 2008 with a continued low duration posture. Long-term tax-exempt bonds currently yield less than when the 10-year Treasury yielded 3.10% and the federal funds target rate was 1%. As such, we see little value in the current level of high-grade municipal securities.

- In terms of lower-rated municipal debt, we are working closely with our Municipal Research Group to review each sector and the Fund’s exposures therein. We have ample cash to take advantage of appro- priate opportunities as they present themselves.

| Fund Profile as of December 31, 2007 | ||

| Percent of | ||

| Long Term | ||

| Investments | ||

|

|

| |

| Other Revenue Bonds | 78.7% | |

| General Obligation & Tax Revenue Bonds | 7.9 | |

| Prerefunded Bonds | 13.4 | |

8

BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| BlackRock National Municipal Fund |

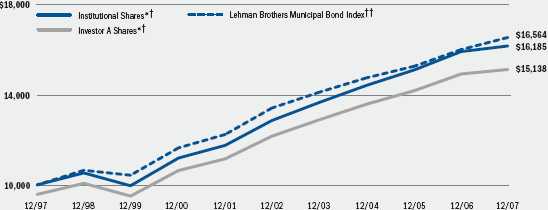

| Total Return Based on a $10,000 Investment |

| * Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. † The Fund invests primarily in long-term municipal bonds rated in any rating category. † † This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature within 30 years. |

| Performance Summary for the Period Ended December 31, 2007 | ||||||||||||||||

|

|

|

|

|

|

|

| ||||||||||

| Average Annual Total Returns* | ||||||||||||||||

|

|

|

|

|

| ||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||

|

|

|

|

|

| ||||||||||||

| Standardized | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |||||||||

| 30-Day Yields | Total Returns | charge | charge | charge | charge | charge | charge | |||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| Institutional | 4.20% | +0.97% | +1.57% | — | +4.70% | — | +4.93% | — | ||||||||

| Investor A | 3.80 | +0.96 | +1.34 | –2.97% | +4.47 | +3.56% | +4.69 | +4.23% | ||||||||

| Investor B | 3.45 | +0.70 | +0.82 | –3.06 | +3.94 | +3.60 | +4.15 | +4.15 | ||||||||

| Investor C | 3.17 | +0.56 | +0.54 | –0.43 | +3.66 | +3.66 | +3.89 | +3.89 | ||||||||

| Investor C1 | 3.41 | +0.58 | +0.77 | –0.20 | +3.87 | +3.87 | +4.10 | +4.10 | ||||||||

| Lehman Brothers Municipal | ||||||||||||||||

| Bond Index | — | +3.22 | +3.36 | — | +4.30 | — | +5.18 | — | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| * Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees. Past performance is not indicative of future results. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 9 |

| Fund Summary | BlackRock High Yield Municipal Fund | |

|

|

| |

| Portfolio Management Commentary | ||

|

|

|

How did the Fund perform?

- The Fund’s total return lagged its benchmark and comparable Lipper category average for the six months ended December 31, 2007.

What factors influenced performance?

- Interest rates rose early in 2007 until the U.S. housing slowdown and subprime turmoil caused asset-backed securities to decline in value, putting pressure on financial markets and the overall economy. This eventually led the Federal Reserve Board to cut interest rates in September, October and December. Yields generally declined in the fourth quarter, with municipals largely underperforming. Mortgage- related losses in the monoline municipal insurers also hindered price improvement in tax-exempt issues. Municipal bonds rated AAA and AA, and maturing inside 10 years, performed the best. Credit spreads generally widened, leading to poor performance among lower-quality issues.

- New municipal issuance for 2007 totaled $427.5 billion, a new annual record. Volume increased 11.5% versus 2006 and 5% versus 2005, the previous record year. Issuance slowed late in 2007 as market volatility and potential downgrades for the municipal insurance companies led to the postponement of several larger deals.

- Fund results suffered as credit spreads widened appreciably amid heightened investor risk aversion and deteriorating liquidity. The Fund’s exposure at the lower end of the credit spectrum suffered dispropor- tionately due to a prevalence of discounted securities exhibiting relatively high duration profiles. These had been purchased during the Fund’s first year of operations, when the supply of attractively structured low duration, high yield securities was quite sparse.

- The Fund’s yield curve exposure also proved detrimental. The municipal curve continued to steepen, with the best performance occurring on the short end. However, much of our focus has been on the long end in an effort to generate a more competitive distribution yield.

- An increasing bias toward higher-quality bonds helped to insulate the portfolio from some of the widening in credit spreads. However, these high-quality investments failed to perform as well as expected given the mounting uncertainty surrounding the monoline insurers.

| Describe recent portfolio activity. |

• We continued to seek opportunities to boost the Fund’s distribution yield. Some progress was made amid the volatility and associated widening of credit spreads during the fourth quarter.

• Also, given the change in the yield curve, market conditions have grown more favorable for the creation of tender option bond trusts, which are a leveraged form of income enhancement. We established a modest position, but expect to add to it as opportunities present themselves.

Describe Fund positioning at period-end.

- The portfolio remains positioned for lower interest rates. However, given the low absolute level of market yields, we have tempered somewhat the Fund’s above-market duration. Of more interest to us are the evolving opportunities in the high yield municipal space as spreads have widened. Given the swift return to more attractive valuations, we expect to selectively add credit exposure in the coming months.

| Fund Profile as of December 31, 2007 | ||

| Percent of | ||

| Long Term | ||

| Investments | ||

|

|

| |

| Other Revenue Bonds | 98.5% | |

| General Obligation & Tax Revenue Bonds | 1.5 | |

10 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| BlackRock High Yield Municipal Fund |

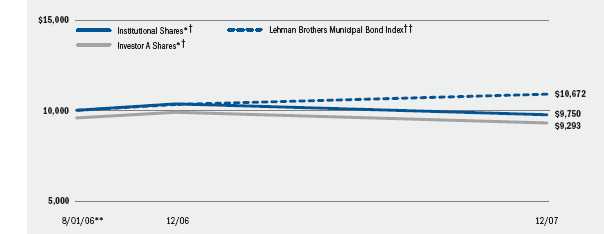

| Total Return Based on a $10,000 Investment |

| * Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. ** Commencement of Operations. † The Fund invests primarily in municipal bonds rated in any rating category or in unrated municipal bonds. ††This unmanaged Index consists of revenue bonds, prerefunded bonds, general obligation bonds and insured bonds, all of which mature within 30 years. |

| Performance Summary for the Period Ended December 31, 2007 | ||||||||||||

|

|

|

|

|

|

| |||||||

| Average Annual Total Returns* | ||||||||||||

|

|

|

| ||||||||||

| 1 Year | Since Inception** | |||||||||||

|

|

| |||||||||||

| Standardized | 6-Month | w/o sales | w/sales | w/o sales | w/sales | |||||||

| 30-Day Yields | Total Returns | charge | charge | charge | charge | |||||||

|

|

|

|

|

|

|

| ||||||

| Institutional | 4.95% | –5.91% | –5.88% | — | –1.77% | — | ||||||

| Investor A | 4.49 | –6.03 | –6.04 | –10.04% | –2.09 | –5.05% | ||||||

| Investor C | 3.94 | –6.49 | –6.76 | – 7.65 | –2.71 | –2.71 | ||||||

| Lehman Brothers Municipal Bond Index | — | +3.22 | +3.36 | — | +4.70 | — | ||||||

|

|

|

|

|

|

|

| ||||||

| * Assuming maximum sales charges. See “About Fund Performance” on pages 12–13 for a detailed description of share classes, including any related sales charges and fees. ** The Portfolio commenced operations on 8/1/06. Past performance is not indicative of future results. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 11 |

| About Fund Performance For BlackRock Short-Term Municipal Fund |

- BlackRock Shares are not subject to any sales charge. BlackRock Shares bear no ongoing distribution or service fees and are available only to eligible investors. Prior to October 2, 2006, BlackRock Share performance results are those of the Institutional Shares (which have no distribution or service fees).

- Institutional Shares are not subject to any sales charge. Institutional Shares bear no ongoing distribution or service fees and are available only to eligible investors.

- Investor A Shares incur a maximum initial sales charge (front-end load) of 3% and a service fee of 0.25% per year (but no distribution fee).

Prior to October 2, 2006, Investor A Share performance results are thoseof the Institutional Shares (which have no distribution or service fees)restated to reflect Investor A Share fees.

- Investor A1 Shares incur a maximum initial sales charge (front-end load) of 1% and a service fee of 0.10% per year (but no distribution fee).

- Investor B Shares are subject to a maximum contingent deferred sales charge of 1% declining to 0% after three years. In addition, Investor B

Shares are subject to a distribution fee of 0.20% per year and a servicefee of 0.15% per year. These shares automatically convert to Investor A1 Shares after approximately 10 years. (There is no initial sales charge forautomatic share conversions.) - Investor C Shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. In addition, Investor C shares are subject to a 1% contingent deferred sales charge if redeemed within one year of purchase. Prior to October 2, 2006, Investor C Share perform- ance results are those of the Institutional Shares (which have no distri- bution or service fees) restated to reflect Investor C Share fees.

| For BlackRock Municipal Insured Fund and BlackRock National Municipal Fund |

- Institutional Shares are not subject to any sales charge. Institutional Shares bear no ongoing distribution or service fees and are available only to eligible investors.

- Investor A Shares incur a maximum initial sales charge (front-end load) of 4.25% and a service fee of 0.25% per year (but no distribution fee).

- Investor B Shares are subject to a maximum contingent deferred sales charge of 4% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.50% per year and a servicefee of 0.25% per year. These shares automatically convert to Investor AShares after approximately 10 years. (There is no initial sales charge forautomatic share conversions.). - Investor C Shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. In addition, Investor C shares are subject to a 1% contingent deferred sales charge if redeemed within one year of purchase. Prior to October 2, 2006, Investor C Share performance results are those of the Institutional Shares (which have no distribution or service fees) restated to reflect Investor C Share fees.

- Investor C1 Shares are subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. In addition, Investor C1 shares are subject to a 1% contingent deferred sales charge if redeemed within one year of purchase.

12 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

About Fund Performance (concluded)

For BlackRock High Yield Municipal Fund

- Institutional Shares are not subject to any sales charge. Institutional Shares bear no ongoing distribution or service fees and are available only to eligible investors.

- Investor A Shares incur a maximum initial sales charge (front-end load) of 4.25% and a service fee of 0.25% per year (but no distribution fee).

- Investor C Shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. In addition, Investor C shares are subject to a 1% contingent deferred sales charge if redeemed within one year of purchase.

For All Funds

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on pages 5, 7, 9 and 11 assume reinvestment of all dividends and capital gain distributions, if any, at net asset value on the payable date. The Fund’s investment adviser reimbursed a portion of the Fund’s expenses. Without such reimbursement, the Fund’s performance would have been lower. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 13 |

Disclosure of Expenses

|

Shareholders of these Funds may incur the following charges: (a) expenses related to transactions, including sales charges, redemption fees and exchange fees; and (b) operating expenses including advisory fees, distribution fees including 12b-1 fees, and other Fund expenses. The expense examples on pages 14 – 17 (which are based on a hypothetical investment of $1,000 invested on July 1, 2007 and held through December 31, 2007) is intended to assist shareholders both in calculat- ing expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds. The tables provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number correspon- ding to their share class under the heading entitled “Expenses Paid During the Period.” |

|

The tables also provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds’ shareholder reports. The expenses shown in the tables are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, redemption fees or exchange fees. Therefore, the hypotheti- cal tables are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning differ- ent funds. If these transactional expenses were included, shareholder expenses would have been higher. |

| BlackRock Short-Term Municipal Fund | ||||||||||||

|

|

|

|

|

|

|

|

||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| BlackRock | $1,000 | $1,026.20 | $2.09 | $1,000 | $1,023.14 | $2.09 | ||||||

| Institutional | $1,000 | $1,026.50 | $1.79 | $1,000 | $1,023.44 | $1.79 | ||||||

| Investor A | $1,000 | $1,026.20 | $3.06 | $1,000 | $1,022.18 | $3.06 | ||||||

| Investor A1 | $1,000 | $1,026.00 | $2.30 | $1,000 | $1,022.94 | $2.29 | ||||||

| Investor B | $1,000 | $1,024.70 | $3.57 | $1,000 | $1,021.68 | $3.57 | ||||||

| Investor C | $1,000 | $1,021.40 | $6.88 | $1,000 | $1,018.40 | $6.87 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.41% for BlackRock, .35% for Institutional, .60% for Investor A, .45% for

Investor A1, .70% for Investor B and 1.35% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period shown. ** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

14 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| Disclosure of Expenses (continued) | ||||||||||||

|

|

|

|

|

|

||||||||

| BlackRock Municipal Insured Fund (Including Interest Expense and Fees) | ||||||||||||

|

|

|

|

|

|

||||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| Institutional | $1,000 | $1,023.10 | $ 5.00 | $1,000 | $1,020.27 | $ 4.99 | ||||||

| Investor A | $1,000 | $1,021.80 | $ 6.32 | $1,000 | $1,018.95 | $ 6.31 | ||||||

| Investor B | $1,000 | $1,019.20 | $ 8.96 | $1,000 | $1,016.33 | $ 8.94 | ||||||

| Investor C | $1,000 | $1,018.00 | $10.12 | $1,000 | $1,015.17 | $10.11 | ||||||

| Investor C1 | $1,000 | $1,019.00 | $ 9.11 | $1,000 | $1,016.18 | $ 9.10 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.98% for Institutional, 1.24% for Investor A, 1.76% for Investor B, 1.99% for

Investor C and 1.79% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). ** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

| BlackRock Municipal Insured Fund (Excluding Interest Expense and Fees) | ||||||||||||

|

|

|

|

|

|

||||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| Institutional | $1,000 | $1,023.10 | $2.40 | $1,000 | $1,022.84 | $2.40 | ||||||

| Investor A | $1,000 | $1,021.80 | $3.72 | $1,000 | $1,021.53 | $3.72 | ||||||

| Investor B | $1,000 | $1,019.20 | $6.31 | $1,000 | $1,018.95 | $6.31 | ||||||

| Investor C | $1,000 | $1,018.00 | $7.48 | $1,000 | $1,017.80 | $7.48 | ||||||

| Investor C1 | $1,000 | $1,019.00 | $6.51 | $1,000 | $1,018.75 | $6.51 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.47% for Institutional, .73% for Investor A, 1.24% for Investor B, 1.47% for

Investor C and 1.28% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period shown. ** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 15 |

| Disclosure of Expenses (continued) | ||||||||||||

|

|

|

|

|

|

||||||||

| BlackRock National Municipal Fund (Including Interest Expense and Fees) | ||||||||||||

|

|

|

|

|

|

||||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| Institutional | $1,000 | $1,009.70 | $4.61 | $1,000 | $1,020.62 | $4.63 | ||||||

| Investor A | $1,000 | $1,009.60 | $5.72 | $1,000 | $1,019.51 | $5.75 | ||||||

| Investor B | $1,000 | $1,007.00 | $8.40 | $1,000 | $1,016.84 | $8.44 | ||||||

| Investor C | $1,000 | $1,005.60 | $9.81 | $1,000 | $1,015.43 | $9.86 | ||||||

| Investor C1 | $1,000 | $1,005.80 | $8.54 | $1,000 | $1,016.69 | $8.59 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.91% for Institutional, 1.13% for Investor A, 1.66% for Investor B, 1.94% for

Investor C and 1.69% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period shown. ** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

| BlackRock National Municipal Fund (Excluding Interest Expense and Fees) | ||||||||||||

|

|

|

|

|

|

||||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| Institutional | $1,000 | $1,009.70 | $3.04 | $1,000 | $1,022.18 | $3.06 | ||||||

| Investor A | $1,000 | $1,009.60 | $4.15 | $1,000 | $1,021.07 | $4.18 | ||||||

| Investor B | $1,000 | $1,007.00 | $6.83 | $1,000 | $1,018.40 | $6.87 | ||||||

| Investor C | $1,000 | $1,000.50 | $8.24 | $1,000 | $1,016.99 | $8.29 | ||||||

| Investor C1 | $1,000 | $1,005.80 | $7.03 | $1,000 | $1,018.20 | $7.07 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.60% for Institutional, .82% for Investor A, 1.35% for Investor B, 1.63% for

Investor C and 1.39% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period shown. ** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

16 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| Disclosure of Expenses (concluded) | ||||||||||||

|

|

|

|

|

|

||||||||

| BlackRock High Yield Municipal Fund (Including Interest Expense and Fees) | ||||||||||||

|

|

|

|

|

|

||||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| Institutional | $1,000 | $940.90 | $3.77 | $1,000 | $1,021.32 | $3.92 | ||||||

| Investor A | $1,000 | $939.70 | $4.94 | $1,000 | $1,020.11 | $5.14 | ||||||

| Investor C | $1,000 | $935.10 | $8.73 | $1,000 | $1,016.18 | $9.10 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.77% for Institutional, 1.01% for Investor A and 1.79% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period shown. ** Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365. |

| BlackRock High Yield Municipal Fund (Excluding Interest Expense and Fees) | ||||||||||||

|

|

|

|

|

|

||||||||

| Actual | Hypothetical** | |||||||||||

|

|

|

|

|

|

|

|||||||

| Beginning | Ending | Beginning | Ending | |||||||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | |||||||

| July 1, 2007 | December 31, 2007 During the Period* | July 1, 2007 | December 31, 2007 During the Period* | |||||||||

|

|

|

|

|

|

||||||||

| Institutional | $1,000 | $940.90 | $3.72 | $1,000 | $1,021.37 | $3.87 | ||||||

| Investor A | $1,000 | $939.70 | $4.94 | $1,000 | $1,020.11 | $5.14 | ||||||

| Investor C | $1,000 | $935.10 | $8.68 | $1,000 | $1,016.23 | $9.05 | ||||||

|

|

|

|

|

|

|

|

||||||

|

* For each class of the Fund, expenses are equal to the annualized expense ratio for the class (.76% for Institutional, 1.01% for Investor A and 1.78% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period shown. ** Hypothetical 5% annual return before expenses is calculated by pro-rating the actual days in the most recent fiscal half year divided by 365. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 17 |

| Schedule of Investments as of December 31, 2007 BlackRock Short-Term Municipal Fund (In Thousands) (Unaudited) |

| Face | ||||

| Amount | Municipal Bonds | Value | ||

|

|

|

| ||

| Alabama — 3.1% | ||||

| $ 8,095 | Huntsville, Alabama, GO, Refunding, Series A, 5.25% | |||

| due 2/01/2009 (j) | $ 8,286 | |||

|

|

|

| ||

| Arizona — 2.6% | ||||

| 7,000 | Yavapai County, Arizona, IDA, Solid Waste Disposal | |||

| Revenue Bonds (Waste Management Inc. Project), | ||||

| AMT, 4% due 6/01/2027 | 6,909 | |||

|

|

|

| ||

| California — 0.3% | ||||

| 750 | California Pollution Control Financing Authority, | |||

| Solid Waste Disposal Revenue Bonds (Republic | ||||

| Services, Inc. Project), VRDN, AMT, 4.15% | ||||

| due 3/01/2028 (b) | 750 | |||

|

|

|

| ||

| District of Columbia — 1.8% | ||||

| 4,665 | Metropolitan Washington Airports Authority, D.C., | |||

| Airport System Revenue Refunding Bonds, AMT, | ||||

| Series A, 5% due 10/01/2010 (a) | 4,843 | |||

|

|

|

| ||

| Florida — 9.0% | ||||

| 7,000 | Florida Hurricane Catastrophe Fund Financing | |||

| Corporation Revenue Bonds, Series A, 5% | ||||

| due 7/01/2010 | 7,285 | |||

| 2,020 | Miami-Dade County, Florida, Educational Facilities | |||

| Authority Revenue Bonds (University of Miami), | ||||

| Series A, 5.75% due 4/01/2010 (a)(c) | 2,154 | |||

| 14,195 | Orange County, Florida, Tourist Development, Tax | |||

| Revenue Bonds, 5.50% due 10/01/2009 (a)(c) | 14,795 | |||

|

|

|

| ||

| Georgia — 8.7% | ||||

| 5,600 | Catoosa County, Georgia, School District, GO, 4.25% | |||

| due 8/01/2008 (h) | 5,642 | |||

| 6,005 | Georgia Municipal Electric Authority, Power Revenue | |||

| Refunding Bonds, Series DD, 7% due 1/01/2008 (h) | 6,005 | |||

| 11,905 | Georgia State, GO, Series B, 5% due 3/01/2008 | 11,945 | ||

|

|

|

| ||

| Illinois — 2.0% | ||||

| 5,000 | Illinois Educational Facilities Authority, Revenue | |||

| Refunding Bonds (University of Chicago), | ||||

| Series A, 5.25% due 7/01/2011 (c) | 5,390 | |||

|

|

|

| ||

| Indiana — 2.2% | ||||

| 4,750 | Indiana Bond Bank Revenue Bonds (State Revolving | |||

| Fund), Series B, 5.30% due 8/01/2010 (c) | 5,049 | |||

| 1,000 | Indiana State Development Finance Authority, IDR | |||

| (Republic Services, Inc. Project), VRDN, AMT, 3.79% | ||||

| due 11/01/2035 (b) | 1,000 | |||

|

|

|

| ||

| Massachusetts — 3.2% | ||||

| 8,505 | Massachusetts State Consolidated Loan, GO, | |||

| Series C, 5% due 5/01/2008 (f) | 8,561 | |||

|

|

|

| ||

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Michigan — 3.7% | ||||||

| $ 5,000 | Detroit, Michigan, Water Supply System Revenue | |||||

| Bonds, Second Lien, Series B, 5.50% | ||||||

| due 7/01/2011 (c)(g) | $ 5,428 | |||||

| 280 | Michigan State Strategic Fund, Limited Obligation | |||||

| Revenue Bonds (Kay Screen Printing, Inc. Project), | ||||||

| VRDN, AMT, 3.70% due 5/01/2020 (b) | 280 | |||||

| 4,120 | Michigan State Trunk Line Fund, Revenue Refunding | |||||

| Bonds, Series B, 5% due 9/01/2010 (j) | 4,317 | |||||

|

|

|

|

| |||

| Minnesota — 1.0% | ||||||

| 2,620 | Minneapolis and Saint Paul, Minnesota, Metropolitan | |||||

| Airports Commission, Airport Revenue Bonds, AMT, | ||||||

| Series B, 5.50% due 1/01/2010 (g) | 2,691 | |||||

|

|

|

|

| |||

| Nebraska — 0.9% | ||||||

| 2,500 | Central Plains Energy Project, Nebraska, Revenue | |||||

| Bonds (Gas Project Number 1), VRDN, 3.908% | ||||||

| due 12/01/2010 (b) | 2,453 | |||||

|

|

|

|

| |||

| Nevada — 5.3% | ||||||

| 6,500 | Clark County, Nevada, Airport System Subordinate | |||||

| Lien Revenue Bonds, AMT, Series B-1, 5% | ||||||

| due 7/01/2008 | 6,559 | |||||

| 7,500 | Clark County, Nevada, EDR (Alexander Dawson | |||||

| School of Nevada Project), 5.50% due 5/15/2009 (c) | 7,814 | |||||

|

|

|

| ||||

| New Jersey — 1.9% | ||||||

| 4,790 | New Jersey Building Authority, State Building | |||||

| Revenue Refunding Bonds, Series B, 5.25% | ||||||

| due 12/15/2010 (a) | 5,077 | |||||

|

|

|

|

| |||

| New Mexico — 2.1% | ||||||

| 5,685 | New Mexico State, Severance Tax Bonds, | |||||

| Series A, 5% due 7/01/2008 (h) | 5,742 | |||||

|

|

|

|

| |||

| New York — 4.9% | ||||||

| 5,000 | Metropolitan Transportation Authority, New York, | |||||

| Dedicated Tax Fund Revenue Bonds, Series A, | ||||||

| 5.875% due 4/01/2010 (c)(g) | 5,304 | |||||

| 7,705 | New York State Urban Development Corporation, | |||||

| Personal Income Tax Revenue Bonds, Series C, 5% | ||||||

| due 3/15/2010 | 8,009 | |||||

|

|

|

|

| |||

| Ohio — 3.2% | ||||||

| 4,400 | Ohio State Building Authority, State Facilities Revenue | |||||

| Bonds (Administrative Building Fund Projects), | ||||||

| Series A, 5.375% due 10/01/2008 (c) | 4,521 | |||||

| 3,875 | Ohio State, Common Schools, GO, Series A, 5% | |||||

| due 3/15/2011 | 4,090 | |||||

|

|

|

|

| |||

| Portfolio Abbreviations | ||||||||||

|

|

|

|

|

| ||||||

| To simplify the listings of BlackRock Municipal Bond | CARS | Complementary Auction Rate Securities | IDA | Industrial Development Authority | ||||||

| Fund, Inc.’s portfolio holdings in the Schedules of | COP | Certificates of Participation | IDB | Industrial Development Board | ||||||

| Investments, we have abbreviated the names of | CP | Commercial Paper | IDR | Industrial Development Revenue Bonds | ||||||

| many of the securities according to the list below | DRIVERS | Derivative Inverse Tax-Exempt Receipts | M/F | Multi-Family | ||||||

| and at right. | EDA | Economic Development Authority | PCR | Pollution Control Revenue Bonds | ||||||

| EDR | Economic Development Revenue Bonds | S/F | Single-Family | |||||||

| AMT | Alternative Minimum Tax (subject to) | GO | General Obligation Bonds | SAVRS | Select Auction Variable Rate Securities | |||||

| ARS | Auction Rate Securities | HDA | Housing Development Agency | TRAN | Tax Revenue Anticipation Notes | |||||

| BAN | Bond Anticipation Notes | HFA | Housing Finance Agency | VRDN | Variable Rate Demand Notes | |||||

18 BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| Schedule of Investments (concluded) BlackRock Short-Term Municipal Fund (In Thousands) |

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Pennsylvania — 5.4% | ||||||

| $ 4,000 | Bethlehem, Pennsylvania, Area School District, GO, | |||||

| Refunding, Series A, 5% due 9/01/2010 (h) | $ 4,191 | |||||

| 5,000 | Pennsylvania State, GO, Refunding, Third Series, 5% | |||||

| due 7/01/2009 | 5,144 | |||||

| 5,000 | University of Pittsburgh, Pennsylvania, The | |||||

| Commonwealth System of Higher Education, | ||||||

| Revenue Refunding Bonds (Pittsburgh Asset Notes — | ||||||

| Panthers), 5% due 8/01/2010 | 5,206 | |||||

|

|

|

|

| |||

| South Carolina — 3.4% | ||||||

| 4,590 | Aiken County, South Carolina, Consolidated School | |||||

| District, GO, Refunding, 5% due 3/01/2009 | 4,695 | |||||

| Hilton Head Island, South Carolina, Public Facility | ||||||

| Corporation, COP (Beach Preservation Fee Pledge) (h): | ||||||

| 2,160 | 5% due 8/01/2008 | 2,184 | ||||

| 2,240 | 5% due 8/01/2009 | 2,303 | ||||

|

|

|

|

| |||

| Tennessee — 1.5% | ||||||

| 4,000 | Tennessee Energy Acquisition Corporation, Gas | |||||

| Revenue Bonds, Series A, 5% due 9/01/2009 | 4,078 | |||||

|

|

|

|

| |||

| Texas — 15.2% | ||||||

| 3,980 | Austin, Texas, Independent School District, GO, | |||||

| Refunding, 5.25% due 8/01/2009 | 4,115 | |||||

| 5,000 | Harris County, Texas, Toll Road Revenue Refunding | |||||

| Bonds, Series B-2, 5% due 8/15/2021 (b)(g) | 5,135 | |||||

| 2,200 | Montgomery County, Texas, Unlimited Tax Adjustable | |||||

| Rate Road, GO, Series B, 5% due 3/01/2028 (b)(j) | 2,228 | |||||

| 2,790 | North Texas Thruway Authority, Dallas North Thruway | |||||

| System, Revenue Refunding Bonds, Series B, 5% | ||||||

| due 1/01/2038 (a)(b) | 2,812 | |||||

| 7,000 | North Texas Thruway Authority Revenue Bonds, | |||||

| BAN, 4.125% due 11/19/2008 | 7,010 | |||||

| 5,000 | San Antonio, Texas, Electric and Gas Revenue Bonds, | |||||

| Junior Lien, VRDN, 3.625% due 12/01/2027 (b) | 5,021 | |||||

| 4,275 | Tarrant County, Texas, Cultural Education Facilities | |||||

| Financing Corporation, Revenue Refunding | ||||||

| Bonds (Texas Health Resources), Series A, 5% | ||||||

| due 2/15/2011 | 4,457 | |||||

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Texas (concluded) | ||||||

| $ 5,000 | Texas State, GO, TRAN, 4.50% due 8/28/2008 | $ 5,049 | ||||

| 5,000 | University of Texas, Financing System Revenue | |||||

| Refunding Bonds, Series B, 5% due 8/15/2010 | 5,236 | |||||

|

|

|

|

| |||

| Virginia — 1.8% | ||||||

| 4,885 | Virginia State Public School Authority, School | |||||

| Financing Revenue Bonds, Series B, 5% | ||||||

| due 8/01/2008 (c) | 4,990 | |||||

|

|

|

|

| |||

| Washington — 4.9% | ||||||

| 9,940 | Energy Northwest, Washington, Electric Revenue | |||||

| Refunding Bonds (Columbia Generating Station), | ||||||

| Series A, 5.25% due 7/01/2009 (a) | 10,257 | |||||

| 2,900 | Tacoma, Washington, Electric System Revenue | |||||

| Refunding Bonds, Series A, 5.625% | ||||||

| due 1/01/2011 (c)(j) | 3,130 | |||||

|

|

|

|

| |||

| Wisconsin — 2.7% | ||||||

| 7,070 | Wisconsin Public Power Inc., Power Supply System, | |||||

| Revenue Refunding Bonds, Series A, 5.25% | ||||||

| due 7/01/2010 (h) | 7,407 | |||||

|

|

|

|

| |||

| Puerto Rico — 3.1% | ||||||

| 8,400 | Government Development Bank of Puerto Rico, | |||||

| CP, 4.25% due 1/09/2008 | 8,400 | |||||

|

|

|

|

| |||

| Total Municipal Bonds | ||||||

| (Cost — $252,023) — 93.9% | 253,947 | |||||

|

|

|

|

| |||

| Shares | ||||||

| Held | Short-Term Securities | |||||

|

|

|

|

| |||

| 12,521 | Merrill Lynch Institutional Tax-Exempt Fund, 3.35% (d)(e) | 12,521 | ||||

|

|

|

| ||||

| Total Short-Term Securities | ||||||

| (Cost — $12,521) — 4.6% | 12,521 | |||||

|

|

|

|

| |||

| Total Investments (Cost — $264,544*) — 98.5% | 266,468 | |||||

| Other Assets Less Liabilities — 1.5% | 4,151 | |||||

|

|

| |||||

| Net Assets — 100.0% | $ 270,619 | |||||

|

| ||||||

| * | The cost and unrealized appreciation (depreciation) of investments as of December 31, 2007, as computed for federal income tax purposes, were as follows: |

| Aggregate cost | $ 264,544 | |

|

| ||

| Gross unrealized appreciation | $ 2,046 | |

| Gross unrealized depreciation | (122) | |

|

| ||

| Net unrealized appreciation | $ 1,924 | |

|

|

| (a) | AMBAC Insured. |

| (b) | Security may have a maturity of more than one year at time of issuance, but has variable rate and demand features that qualify it as a short-term security. The rate disclosed is that currently in effect. This rate changes periodically based upon prevailing market rates. |

| See Notes to Financial Statements. | |

(c) Prerefunded.

(d) Investments in companies considered to be an affiliate of the Fund, for purposes of Section 2(a)(3) of the Investment Company Act of 1940, were as follows:

| Net | Dividend | |||

| Affiliate | Activity | Income | ||

|

|

|

| ||

| Merrill Lynch Institutional Tax-Exempt Fund | 5,918 | $236 | ||

|

|

|

| ||

| (e) Represents the current yield as of December 31, 2007. | ||||

| (f) CIFG Insured. | ||||

| (g) FGIC Insured. | ||||

| (h) MBIA Insured. | ||||

| (j) FSA Insured. |

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 19 |

| Schedule of Investments as of December 31, 2007 BlackRock Municipal Insured Fund (In Thousands) (Unaudited) |

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Alabama — 3.1% | ||||||

| $10,000 | Lauderdale County and Florence, Alabama, Health | |||||

| Care Authority Revenue Refunding Bonds (Coffee | ||||||

| Health Group), Series A, 6% due 7/01/2029 (g) | $ 10,693 | |||||

| 7,840 | University of Alabama, General Revenue Bonds, | |||||

| Series A, 5% due 7/01/2034 (g) | 8,028 | |||||

| 7,000 | University of Alabama, University Revenue Bonds | |||||

| (Birmingham), 6% due 10/01/2009 (c)(h) | 7,354 | |||||

|

|

|

|

| |||

| Arizona — 0.7% | ||||||

| 5,000 | Downtown Phoenix Hotel Corporation, Arizona, | |||||

| Revenue Bonds, Senior Series A, 5% | ||||||

| due 7/01/2040 (c) | 5,030 | |||||

| 1,250 | Salt Verde Financial Corporation, Arizona, Senior Gas | |||||

| Revenue Bonds, 5% due 12/01/2037 | 1,169 | |||||

|

|

|

|

| |||

| Arkansas — 0.5% | ||||||

| 4,000 | University of Arkansas, University Revenue Bonds | |||||

| (Various Facilities — Fayetteville Campus), 5% | ||||||

| due 12/01/2027 (c) | 4,117 | |||||

|

|

|

|

| |||

| California — 15.0% | ||||||

| 1,050 | Antelope Valley, California, Community College | |||||

| District, GO (Election of 2004), Series B, 5.25% | ||||||

| due 8/01/2039 (g) | 1,123 | |||||

| 2,800 | Arcadia, California, Unified School District, Capital | |||||

| Appreciation, GO (Election of 2006), Series A, 4.96% | ||||||

| due 8/01/2039 (e)(m) | 508 | |||||

| 4,100 | Cabrillo, California, Community College District, | |||||

| GO (Election of 2004), Series B, 5.20% | ||||||

| due 8/01/2037 (g)(m) | 830 | |||||

| 2,075 | California State Department of Veteran Affairs, Home | |||||

| Purchase Revenue Refunding Bonds, Series A, 5.35% | ||||||

| due 12/01/2027 (a) | 2,170 | |||||

| 5,800 | Coast Community College District, California, GO | |||||

| (Election of 2002), Series C, 5.392% | ||||||

| due 8/01/2036 (e)(m) | 1,267 | |||||

| 2,000 | Corona-Norco, California, Unified School District, GO | |||||

| (Election of 2006), Series A, 5% due 8/01/2031 (e) | 2,098 | |||||

| Fresno, California, Unified School District, GO | ||||||

| (Election of 2001): | ||||||

| 5,170 | Series D, 5% due 8/01/2027 (g) | 5,402 | ||||

| 1,500 | Series E, 5% due 8/01/2030 (e) | 1,568 | ||||

| 5,595 | Grossmont-Cuyamaca Community College District, | |||||

| California, GO (Election of 2002), Series B, 5% | ||||||

| due 8/01/2029 (c) | 5,813 | |||||

| 15,000 | Los Angeles, California, Municipal Improvement | |||||

| Corporation, Lease Revenue Bonds, Series B1, 4.75% | ||||||

| due 8/01/2037 (c) | 14,882 | |||||

| 8,965 | Modesto, California, Schools Infrastructure | |||||

| Financing Agency, Special Tax Bonds, 5.50% | ||||||

| due 9/01/2036 (a) | 9,413 | |||||

| 1,380 | Orange County, California, Sanitation District, COP, | |||||

| Series B, 5% due 2/01/2031 (e) | 1,424 | |||||

| 6,440 | Palm Springs, California, Financing Authority, Lease | |||||

| Revenue Refunding Bonds (Convention Center | ||||||

| Project), Series A, 5.50% due 11/01/2035 (g) | 6,949 | |||||

| 10,500 | Ramona, California, Unified School District, | |||||

| Convertible Capital Appreciation Refunding Bonds, | ||||||

| COP, 5.106% due 5/01/2032 (c)(m) | 8,658 | |||||

| 675 | Rancho Cucamonga, California, Redevelopment | |||||

| Agency, Tax Allocation Refunding Bonds (Rancho | ||||||

| Redevelopment Project), Series A, 5% | ||||||

| due 9/01/2034 (g) | 690 | |||||

| 3,900 | Redlands, California, Unified School District, GO | |||||

| (Election of 2002), 5% due 7/01/2025 (e) | 4,091 | |||||

|

|

|

|||||

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| California (concluded) | ||||||

| $11,685 | Rialto, California, Unified School District, GO, | |||||

| Series A, 6.24% due 6/01/2025 (c)(m) | $ 4,927 | |||||

| 5,000 | Roseville, California, Joint Union High School | |||||

| District, GO (Election of 2004), Series A, 5% | ||||||

| due 8/01/2029 (c) | 5,173 | |||||

| 5,075 | Sacramento, California, Unified School District, GO | |||||

| (Election of 1999), Series B, 5% due 7/01/2026 (c) | 5,236 | |||||

| 2,685 | San Diego, California, Community College District, | |||||

| GO (Election of 2002), 5% due 5/01/2030 (e) | 2,794 | |||||

| 6,600 | San Jose, California, Airport Revenue Refunding | |||||

| Bonds, AMT, Series A, 5.50% due 3/01/2032 (a) | 6,889 | |||||

| 3,700 | San Jose, California, GO (Libraries, Parks and Public | |||||

| Safety Projects), 5% due 9/01/2030 (g) | 3,820 | |||||

| 10,055 | Sequoia, California, Unified High School District, GO, | |||||

| Refunding, Series B, 5.50% due 7/01/2035 (e) | 10,959 | |||||

| 2,755 | Tahoe Truckee, California, Unified School District, GO | |||||

| (School Facilities Improvement District Number 2), | ||||||

| Series A, 5.25% due 8/01/2029 (g) | 2,885 | |||||

| Tustin, California, Unified School District, Senior Lien | ||||||

| Special Tax Bonds (Community Facilities District | ||||||

| Number 97-1), Series A (e): | ||||||

| 7,980 | 5% due 9/01/2032 | 8,100 | ||||

| 9,330 | 5% due 9/01/2038 | 9,461 | ||||

|

|

|

|

| |||

| Colorado — 2.5% | ||||||

| 19,250 | Aurora, Colorado, COP, 6% due 12/01/2010 (a)(h) | 20,767 | ||||

|

|

|

| ||||

| Connecticut — 0.7% | ||||||

| 6,035 | Connecticut State, HFA, Housing Mortgage Finance | |||||

| Program Revenue Bonds, AMT, Sub-Series B-2, 5.10% | ||||||

| due 11/15/2038 (a) | 5,870 | |||||

|

|

|

|

| |||

| Florida — 0.8% | ||||||

| 3,800 | Duval County, Florida, School Board, COP (Master | |||||

| Lease Program), 5% due 7/01/2033 (e) | 3,887 | |||||

| 1,350 | Miami, Florida, Special Obligation Revenue Bonds | |||||

| (Street and Sidewalk Improvement Program), 5% | ||||||

| due 1/01/2037 (g) | 1,365 | |||||

| 1,260 | West Coast Regional Water Supply Authority, Florida, | |||||

| Capital Improvement Revenue Bonds, 10.40% | ||||||

| due 10/01/2010 (a)(h) | 1,410 | |||||

|

|

|

|

| |||

| Georgia — 4.3% | ||||||

| Georgia Municipal Electric Authority, Power Revenue | ||||||

| Refunding Bonds: | ||||||

| 20,000 | Series EE, 7% due 1/01/2025 (a) | 26,264 | ||||

| 90 | Series Y, 6.40% due 1/01/2011 (h) | 98 | ||||

| 490 | Series Y, 6.40% due 1/01/2013 (a)(b) | 544 | ||||

| 8,420 | Series Y, 6.40% due 1/01/2013 (a) | 9,271 | ||||

|

|

|

|

| |||

| Illinois — 1.0% | ||||||

| 8,640 | Chicago, Illinois, O'Hare International Airport, | |||||

| Revenue Refunding Bonds, Third Lien, AMT, | ||||||

| Series C-2, 5.25% due 1/01/2034 (k) | 8,675 | |||||

|

|

|

|

| |||

| Indiana — 0.4% | ||||||

| 3,530 | Indiana Municipal Power Agency, Power Supply System | |||||

| Revenue Bonds, Series A, 5% due 1/01/2037 (g) | 3,615 | |||||

|

|

|

|

| |||

| Kansas — 0.6% | ||||||

| 5,145 | Manhattan, Kansas, Hospital Revenue Bonds (Mercy | |||||

| Health Center), 5.50% due 8/15/2020 (e) | 5,463 | |||||

|

|

|

|

| |||

| Louisiana — 1.8% | ||||||

| 2,500 | Louisiana State Citizens Property Insurance | |||||

| Corporation, Assessment Revenue Bonds, | ||||||

| Series B, 5% due 6/01/2022 (a) | 2,590 | |||||

20

BLACKROCK MUNICIPAL BOND FUND, INC.

| DECEMBER 31, 2007 |

| Schedule of Investments (continued) BlackRock Municipal Insured Fund (In Thousands) |

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Louisiana (concluded) | ||||||

| $ 2,400 | Louisiana State, Gas and Fuels Tax Revenue Bonds, | |||||

| Series A, 4.75% due 5/01/2039 (e) | $ 2,365 | |||||

| 2,800 | New Orleans, Louisiana, Aviation Board Revenue | |||||

| Bonds, AMT, Series A, 5% due 1/01/2038 (e) | 2,774 | |||||

| 5,000 | New Orleans, Louisiana, GO (Public Improve- | |||||

| ments), 5.25% due 12/01/2029 (a) | 5,266 | |||||

| 2,800 | Rapides Financing Authority, Louisiana, Revenue | |||||

| Bonds (Cleco Power LLC Project), AMT, 4.70% | ||||||

| due 11/01/2036 (a) | 2,616 | |||||

|

|

|

|

| |||

| Maryland — 0.7% | ||||||

| 4,400 | Maryland State Health and Higher Educational | |||||

| Facilities Authority Revenue Bonds (University of | ||||||

| Maryland Medical System), Series B, 7% | ||||||

| due 7/01/2022 (c) | 5,644 | |||||

|

|

|

|

| |||

| Massachusetts — 5.7% | ||||||

| 15,000 | Massachusetts State School Building Authority, | |||||

| Dedicated Sales Tax Revenue Bonds, Series A, 5% | ||||||

| due 8/15/2030 (e) | 15,616 | |||||

| 4,000 | Massachusetts State, HFA, Rental Housing | |||||

| Mortgage Revenue Bonds, AMT, Series C, 5.60% | ||||||

| due 1/01/2045 (e) | 4,119 | |||||

| Massachusetts State, HFA, S/F Housing Revenue | ||||||

| Bonds, AMT(e): | ||||||

| 2,845 | Series 128, 4.80% due 12/01/2027 | 2,715 | ||||

| 7,000 | Series 128, 4.875% due 12/01/2038 | 6,500 | ||||

| 17,500 | Massachusetts State Special Obligation Dedicated | |||||

| Tax Revenue Bonds, 5.25% due 1/01/2014 (c)(h) | 19,214 | |||||

|

|

|

| ||||

| Michigan — 0.2% | ||||||

| 1,500 | Detroit, Michigan, Water Supply System Revenue | |||||

| Bonds, Senior Lien, Series A, 5% due 7/01/2030 (c) | 1,522 | |||||

|

|

|

| ||||

| Minnesota — 1.8% | ||||||

| 5,860 | Delano, Minnesota, Independent School | |||||

| District Number 879, GO, Series A, 5.875% | ||||||

| due 2/01/2025 (e) | 6,295 | |||||

| Sauk Rapids, Minnesota, Independent School | ||||||

| District Number 047, GO, Series A (g): | ||||||

| 3,735 | 5.65% due 2/01/2020 | 3,988 | ||||

| 4,440 | 5.70% due 2/01/2021 | 4,747 | ||||

|

|

|

|

| |||

| Mississippi — 1.5% | ||||||

| 1,320 | Harrison County, Mississippi, Wastewater | |||||

| Management District, Revenue Refunding Bonds | ||||||

| (Wastewater Treatment Facilities), Series A, 8.50% | ||||||

| due 2/01/2013 (b)(c) | 1,631 | |||||

| 10,000 | Mississippi Hospital Equipment and Facilities | |||||

| Authority Revenue Bonds (Forrest County General | ||||||

| Hospital Project), 6% due 1/01/2011 (e)(h) | 10,895 | |||||

|

|

|

|

| |||

| Missouri — 4.3% | ||||||

| Kansas City, Missouri, Airport Revenue Refunding and | ||||||

| Improvement Bonds, Series A (g): | ||||||

| 12,990 | 5.50% due 9/01/2013 | 13,209 | ||||

| 9,000 | 5.50% due 9/01/2014 | 9,152 | ||||

| Missouri Joint Municipal Electric Utility Commission, | ||||||

| Power Project Revenue Bonds (Latan 2 Project), | ||||||

| Series A (a): | ||||||

| 5,595 | 5% due 1/01/2027 | 5,755 | ||||

| 8,325 | 5% due 1/01/2028 | 8,540 | ||||

|

|

|

|

| |||

| Nebraska — 0.6% | ||||||

| 5,000 | Public Power Generation Agency, Nebraska, Revenue | |||||

| Bonds (Whelan Energy Center Unit 2), Series A, 5% | ||||||

| due 1/01/2032 (a) | 5,168 | |||||

|

|

|

|

| |||

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Nevada — 0.4% | ||||||

| Clark County, Nevada, IDR (Southwest Gas | ||||||

| Corporation Project), AMT (c): | ||||||

| $ 1,300 | Series A, 4.75% due 9/01/2036 | $ 1,221 | ||||

| 2,200 | Series D, 5.25% due 3/01/2038 | 2,223 | ||||

|

|

|

|

| |||

| New Jersey — 8.6% | ||||||

| 6,810 | Cape May County, New Jersey, Industrial Pollution | |||||

| Control Financing Authority, Revenue Refunding | ||||||

| Bonds (Atlantic City Electric Company Project), | ||||||

| Series A, 6.80% due 3/01/2021 (g) | 8,685 | |||||

| Garden State Preservation Trust of New Jersey, Open | ||||||

| Space and Farmland Preservation Revenue Bonds, | ||||||

| Series A (e): | ||||||

| 3,125 | 5.80% due 11/01/2021 | 3,568 | ||||

| 8,310 | 5.80% due 11/01/2022 | 9,469 | ||||

| 4,340 | 5.80% due 11/01/2023 | 4,937 | ||||

| New Jersey EDA, Motor Vehicle Surcharge Revenue | ||||||

| Bonds, Series A (g): | ||||||

| 5,000 | 5% due 7/01/2027 | 5,191 | ||||

| 23,000 | 5.25% due 7/01/2033 | 24,174 | ||||

| New Jersey State Transportation Trust Fund Authority, | ||||||

| Transportation System Revenue Bonds, Series D: | ||||||

| 4,240 | 5% due 6/15/2018 (a) | 4,539 | ||||

| 11,530 | 5% due 6/15/2019 (e) | 12,297 | ||||

|

|

|

|

| |||

| New Mexico — 0.6% | ||||||

| 5,000 | New Mexico Finance Authority, Senior Lien State | |||||

| Transportation Revenue Bonds, Series A, 5.125% | ||||||

| due 6/15/2018 (g) | 5,382 | |||||

|

|

|

|

| |||

| New York — 11.7% | ||||||

| New York City, New York, GO: | ||||||

| 11,495 | Series C, 5.625% due 3/15/2012 (h)(k) | 12,583 | ||||

| 5 | Series C, 5.625% due 3/15/2018 (k) | 5 | ||||

| 6,155 | Series I, 6% due 4/15/2012 (e) | 6,224 | ||||

| 3 | New York City, New York, Sales Tax Asset Receivable | |||||

| Corporation Revenue Bonds, DRIVERS, Series 1133Z, | ||||||

| 6.753% due 10/15/2012 (a)(j) | 3 | |||||

| New York City, New York, Sales Tax Asset Receivable | ||||||

| Corporation Revenue Bonds, Series A: | ||||||

| 16,905 | 5% due 10/15/2020 (g) | 17,990 | ||||

| 15,650 | 5% due 10/15/2032 (a) | 16,269 | ||||

| 11,795 | New York State Dormitory Authority Revenue Bonds | |||||

| (School Districts Financing Program), Series D, 5.25% | ||||||

| due 10/01/2023 (g) | 12,558 | |||||

| 9,110 | New York State Urban Development Corporation, | |||||

| Personal Income Tax Revenue Bonds (State | ||||||

| Facilities), Series A-1, 5.25% due 3/15/2034 (c) | 9,552 | |||||

| 5 | Niagara Falls, New York, GO, Public Improvement, 6.90% | |||||

| due 3/01/2024 (g) | 5 | |||||

| 22,500 | Tobacco Settlement Financing Corporation of | |||||

| New York Revenue Bonds, Series A-1, 5.25% | ||||||

| due 6/01/2022 (a) | 23,879 | |||||

|

|

|

|

| |||

| North Carolina — 0.3% | ||||||

| 2,880 | North Carolina HFA, Home Ownership Revenue | |||||

| Bonds, AMT, Series 14-A, 5.35% due 1/01/2022 (a) | 2,913 | |||||

|

|

|

| ||||

| North Dakota — 0.3% | ||||||

| 2,630 | North Dakota State, HFA, Revenue Bonds | |||||

| (Housing Finance Program), Series C, 5.30% | ||||||

| due 7/01/2022 (a) | 2,656 | |||||

|

|

|

|

| |||

| Oklahoma — 0.8% | ||||||

| 6,385 | Oklahoma State Industries Authority, Health System | |||||

| Revenue Refunding Bonds (Integris Obligated Group), | ||||||

| Series A, 6.25% due 8/15/2009 (g)(h) | 6,768 | |||||

|

|

|

|

| |||

| BLACKROCK MUNICIPAL BOND FUND, INC. |

| DECEMBER 31, 2007 |

| 21 |

| Schedule of Investments (continued) BlackRock Municipal Insured Fund (In Thousands) |

| Face | ||||||

| Amount | Municipal Bonds | Value | ||||

|

|

|

|

| |||

| Oregon — 1.6% | ||||||

| $ 8,700 | Oregon State Department, Administrative Services, | |||||

| COP, Series A, 6.25% due 5/01/2010 (a)(h) | $ 9,393 | |||||

| 3,865 | Port of Portland, Oregon, Airport Revenue Refunding | |||||

| Bonds (Portland International Airport), AMT, | ||||||