UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02737

Fidelity Summer Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | April 30 |

Date of reporting period: | October 31, 2019 |

Item 1.

Reports to Stockholders

Fidelity® Capital & Income Fund

Semi-Annual Report

October 31, 2019

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

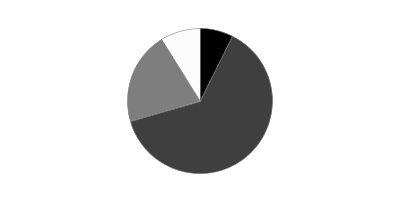

Top Five Holdings as of October 31, 2019

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 3.3 |

| Ally Financial, Inc. | 2.7 |

| Bank of America Corp. | 2.3 |

| JPMorgan Chase & Co. | 2.0 |

| Citigroup, Inc. | 1.6 |

| 11.9 |

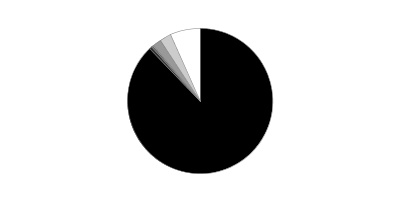

Top Five Market Sectors as of October 31, 2019

| % of fund's net assets | |

| Energy | 12.9 |

| Banks & Thrifts | 11.0 |

| Technology | 9.6 |

| Healthcare | 7.5 |

| Telecommunications | 7.1 |

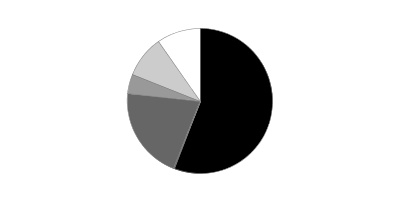

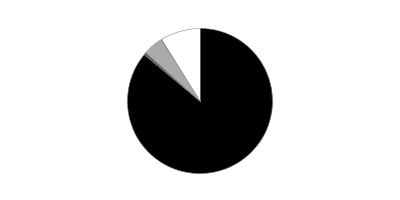

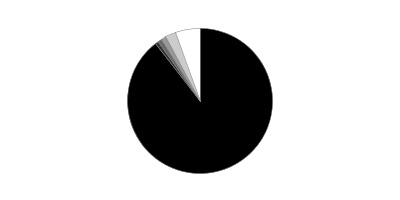

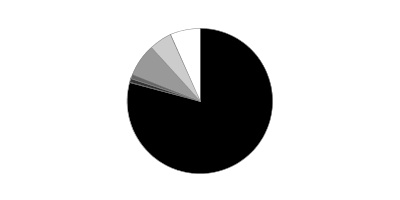

Quality Diversification (% of fund's net assets)

| As of October 31, 2019 | ||

| AAA,AA,A | 0.1% | |

| BBB | 6.6% | |

| BB | 26.7% | |

| B | 25.8% | |

| CCC,CC,C | 8.8% | |

| D | 1.2% | |

| Not Rated | 0.5% | |

| Equities | 20.6% | |

| Short-Term Investments and Net Other Assets | 9.7% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

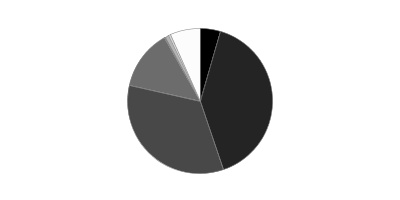

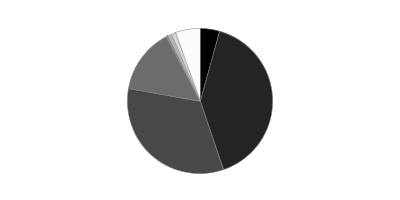

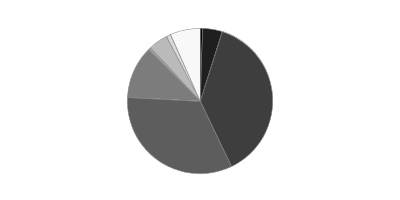

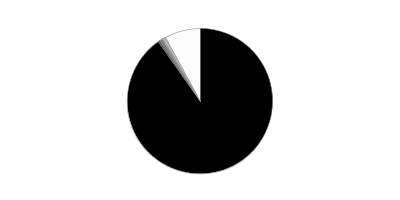

Asset Allocation (% of fund's net assets)

| As of October 31, 2019* | ||

| Nonconvertible Bonds | 55.8% | |

| Convertible Bonds, Preferred Stocks | 0.2% | |

| Common Stocks | 20.6% | |

| Bank Loan Obligations | 4.4% | |

| Other Investments | 9.3% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 9.7% | |

* Foreign investments – 14.8%

Schedule of Investments October 31, 2019 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 56.0% | |||

| Principal Amount (000s) | Value (000s) | ||

| Convertible Bonds - 0.2% | |||

| Automotive & Auto Parts - 0.0% | |||

| Exide Technologies 7.25% 4/30/27 pay-in-kind (a)(b) | $1,694 | $254 | |

| Energy - 0.2% | |||

| Denbury Resources, Inc. 6.375% 12/31/24 (a) | 37,706 | 20,426 | |

| TOTAL CONVERTIBLE BONDS | 20,680 | ||

| Nonconvertible Bonds - 55.8% | |||

| Aerospace - 2.7% | |||

| BBA U.S. Holdings, Inc. 5.375% 5/1/26 (a) | 4,405 | 4,603 | |

| Bombardier, Inc.: | |||

| 6.125% 1/15/23 (a) | 10,790 | 10,547 | |

| 7.5% 12/1/24 (a) | 2,990 | 2,898 | |

| 7.5% 3/15/25 (a) | 47,010 | 44,953 | |

| 7.875% 4/15/27 (a) | 33,840 | 31,979 | |

| BWX Technologies, Inc. 5.375% 7/15/26 (a) | 8,510 | 9,013 | |

| DAE Funding LLC 4% 8/1/20 (a) | 5,145 | 5,177 | |

| TransDigm UK Holdings PLC 6.875% 5/15/26 | 35,725 | 38,136 | |

| TransDigm, Inc.: | |||

| 5.5% 11/15/27 (a)(c) | 55,655 | 55,471 | |

| 6.25% 3/15/26 (a) | 17,925 | 19,202 | |

| 6.375% 6/15/26 | 61,985 | 64,852 | |

| 6.5% 5/15/25 | 16,505 | 17,145 | |

| 7.5% 3/15/27 | 18,012 | 19,453 | |

| 323,429 | |||

| Air Transportation - 0.2% | |||

| Air Canada 2013-1 Pass Through Trust 5.375% 11/15/22 (a) | 1,989 | 2,047 | |

| Continental Airlines, Inc. pass-thru certificates 6.903% 10/19/23 | 390 | 406 | |

| Delta Air Lines, Inc. pass-thru trust certificates 8.021% 2/10/24 | 4,789 | 5,291 | |

| Hawaiian Airlines pass-thru certificates Series 2013-1 Class B, 4.95% 7/15/23 | 3,478 | 3,542 | |

| U.S. Airways pass-thru certificates: | |||

| Series 2011-1 Class A, 7.125% 4/22/25 | 6,872 | 7,804 | |

| Series 2012-2 Class B, 6.75% 6/3/21 | 2,521 | 2,657 | |

| Series 2013-1 Class B, 5.375% 11/15/21 | 3,440 | 3,592 | |

| 25,339 | |||

| Automotive & Auto Parts - 0.3% | |||

| Allison Transmission, Inc.: | |||

| 5% 10/1/24 (a) | 11,405 | 11,690 | |

| 5.875% 6/1/29 (a) | 7,960 | 8,577 | |

| Exide Technologies: | |||

| 10.75% 10/31/21 pay-in-kind (a)(b)(d) | 839 | 755 | |

| 11% 10/31/24 pay-in-kind (a)(b)(d) | 2,063 | 1,341 | |

| 11% 10/31/24 pay-in-kind (a)(b)(d) | 857 | 386 | |

| IAA Spinco, Inc. 5.5% 6/15/27 (a) | 4,680 | 5,014 | |

| LKQ Corp. 4.75% 5/15/23 | 2,190 | 2,233 | |

| Penske Automotive Group, Inc. 5.5% 5/15/26 | 8,565 | 8,950 | |

| 38,946 | |||

| Banks & Thrifts - 2.7% | |||

| Ally Financial, Inc.: | |||

| 8% 11/1/31 | 20,638 | 28,371 | |

| 8% 11/1/31 | 206,609 | 288,734 | |

| 317,105 | |||

| Broadcasting - 1.6% | |||

| iHeartCommunications, Inc.: | |||

| 6.375% 5/1/26 | 671 | 722 | |

| 8.375% 5/1/27 | 1,216 | 1,304 | |

| 11.25% 3/1/21 (d) | 11,660 | 0 | |

| Netflix, Inc.: | |||

| 4.375% 11/15/26 | 5,760 | 5,863 | |

| 4.875% 4/15/28 | 28,755 | 29,712 | |

| 5.375% 11/15/29 (a) | 11,075 | 11,670 | |

| 5.875% 11/15/28 | 64,825 | 71,389 | |

| Nexstar Escrow, Inc. 5.625% 7/15/27 (a) | 12,530 | 13,215 | |

| Sirius XM Radio, Inc.: | |||

| 4.625% 5/15/23 (a) | 4,925 | 5,002 | |

| 5% 8/1/27 (a) | 14,525 | 15,269 | |

| 5.375% 4/15/25 (a) | 12,000 | 12,480 | |

| 5.375% 7/15/26 (a) | 11,315 | 11,937 | |

| Tegna, Inc. 5% 9/15/29 (a) | 12,060 | 12,226 | |

| 190,789 | |||

| Building Materials - 0.1% | |||

| Advanced Drain Systems, Inc. 5% 9/30/27 (a) | 2,325 | 2,377 | |

| Summit Materials LLC/Summit Materials Finance Corp. 5.125% 6/1/25 (a) | 5,095 | 5,229 | |

| U.S. Concrete, Inc. 6.375% 6/1/24 | 5,535 | 5,761 | |

| 13,367 | |||

| Cable/Satellite TV - 5.5% | |||

| CCO Holdings LLC/CCO Holdings Capital Corp.: | |||

| 4.75% 3/1/30 (a) | 56,140 | 57,193 | |

| 5% 2/1/28 (a) | 91,490 | 95,721 | |

| 5.125% 2/15/23 | 30,665 | 31,317 | |

| 5.125% 5/1/23 (a) | 14,050 | 14,384 | |

| 5.125% 5/1/27 (a) | 69,885 | 73,641 | |

| 5.375% 5/1/25 (a) | 14,050 | 14,577 | |

| 5.375% 6/1/29 (a) | 18,080 | 19,300 | |

| 5.5% 5/1/26 (a) | 17,605 | 18,551 | |

| 5.75% 9/1/23 | 9,495 | 9,685 | |

| 5.75% 1/15/24 | 1,638 | 1,678 | |

| 5.75% 2/15/26 (a) | 20,340 | 21,479 | |

| 5.875% 5/1/27 (a) | 17,965 | 19,043 | |

| CSC Holdings LLC: | |||

| 5.375% 2/1/28 (a) | 23,655 | 25,015 | |

| 5.5% 5/15/26 (a) | 50,968 | 53,708 | |

| 5.75% 1/15/30 (a) | 67,025 | 70,544 | |

| 6.5% 2/1/29 (a) | 24,795 | 27,693 | |

| 7.5% 4/1/28 (a) | 14,375 | 16,172 | |

| LCPR Senior Secured Financing DAC 6.75% 10/15/27 (a) | 11,285 | 11,581 | |

| Videotron Ltd. 5.125% 4/15/27 (a) | 12,060 | 12,814 | |

| Virgin Media Finance PLC 4.875% 2/15/22 | 10,880 | 10,989 | |

| Ziggo B.V.: | |||

| 4.875% 1/15/30 (a) | 7,990 | 8,132 | |

| 5.5% 1/15/27 (a) | 22,875 | 24,133 | |

| Ziggo Bond Co. BV 6% 1/15/27 (a) | 11,435 | 11,950 | |

| Ziggo Bond Finance BV 5.875% 1/15/25 (a) | 1,175 | 1,210 | |

| 650,510 | |||

| Capital Goods - 0.1% | |||

| AECOM 5.125% 3/15/27 | 11,885 | 12,535 | |

| Stevens Holding Co., Inc. 6.125% 10/1/26 (a) | 3,245 | 3,488 | |

| 16,023 | |||

| Chemicals - 1.7% | |||

| CF Industries Holdings, Inc.: | |||

| 4.95% 6/1/43 | 46,712 | 46,770 | |

| 5.15% 3/15/34 | 21,693 | 22,995 | |

| 5.375% 3/15/44 | 30,801 | 31,571 | |

| Element Solutions, Inc. 5.875% 12/1/25 (a) | 18,605 | 19,422 | |

| LSB Industries, Inc. 9.625% 5/1/23 (a) | 6,090 | 6,455 | |

| Neon Holdings, Inc. 10.125% 4/1/26 (a) | 12,060 | 11,924 | |

| NOVA Chemicals Corp.: | |||

| 4.875% 6/1/24 (a) | 15,135 | 15,362 | |

| 5.25% 6/1/27 (a) | 12,980 | 13,337 | |

| OCI NV: | |||

| 5.25% 11/1/24 (a) | 16,670 | 17,253 | |

| 6.625% 4/15/23 (a) | 5,370 | 5,605 | |

| Starfruit Finco BV / Starfruit U.S. Holdco LLC 8% 10/1/26 (a) | 11,315 | 11,258 | |

| Valvoline, Inc. 5.5% 7/15/24 | 4,170 | 4,328 | |

| 206,280 | |||

| Consumer Products - 0.1% | |||

| First Quality Finance Co., Inc. 5% 7/1/25 (a) | 9,675 | 10,016 | |

| Containers - 0.6% | |||

| Crown Cork & Seal, Inc.: | |||

| 7.375% 12/15/26 | 4,845 | 5,814 | |

| 7.5% 12/15/96 | 12,871 | 14,158 | |

| Labl Escrow Issuer LLC: | |||

| 6.75% 7/15/26 (a) | 18,015 | 18,646 | |

| 10.5% 7/15/27 (a) | 12,010 | 12,040 | |

| Trivium Packaging Finance BV: | |||

| 5.5% 8/15/26 (a) | 6,930 | 7,259 | |

| 8.5% 8/15/27 (a) | 6,950 | 7,410 | |

| 65,327 | |||

| Diversified Financial Services - 3.7% | |||

| AssuredPartners, Inc. 7% 8/15/25 (a) | 4,865 | 4,847 | |

| FLY Leasing Ltd. 5.25% 10/15/24 | 9,470 | 9,754 | |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | |||

| 6.25% 5/15/26 | 24,085 | 25,530 | |

| 6.375% 12/15/25 | 54,810 | 57,551 | |

| 6.75% 2/1/24 | 10,075 | 10,503 | |

| Intelsat Connect Finance SA 9.5% 2/15/23 (a) | 18,015 | 16,711 | |

| James Hardie International Finance Ltd.: | |||

| 4.75% 1/15/25 (a) | 8,815 | 9,144 | |

| 5% 1/15/28 (a) | 8,900 | 9,323 | |

| MSCI, Inc.: | |||

| 5.25% 11/15/24 (a) | 6,725 | 6,910 | |

| 5.75% 8/15/25 (a) | 7,185 | 7,535 | |

| Navient Corp.: | |||

| 5.5% 1/25/23 | 44,765 | 46,500 | |

| 5.875% 10/25/24 | 28,294 | 28,931 | |

| 6.125% 3/25/24 | 15,595 | 16,301 | |

| 6.5% 6/15/22 | 27,055 | 28,949 | |

| 7.25% 1/25/22 | 27,370 | 29,688 | |

| 7.25% 9/25/23 | 5,688 | 6,214 | |

| Park Aerospace Holdings Ltd.: | |||

| 4.5% 3/15/23 (a) | 4,315 | 4,533 | |

| 5.25% 8/15/22 (a) | 9,140 | 9,734 | |

| 5.5% 2/15/24 (a) | 790 | 869 | |

| Springleaf Finance Corp.: | |||

| 6.625% 1/15/28 | 7,305 | 8,090 | |

| 6.875% 3/15/25 | 51,610 | 58,448 | |

| 7.125% 3/15/26 | 38,380 | 43,753 | |

| 439,818 | |||

| Diversified Media - 0.4% | |||

| Block Communications, Inc. 6.875% 2/15/25 (a) | 9,080 | 9,466 | |

| Liberty Media Corp.: | |||

| 8.25% 2/1/30 | 12,298 | 12,513 | |

| 8.5% 7/15/29 | 7,900 | 8,157 | |

| Quebecor Media, Inc. 5.75% 1/15/23 | 15,820 | 17,120 | |

| 47,256 | |||

| Energy - 9.7% | |||

| Antero Midstream Partners LP/Antero Midstream Finance Corp. 5.75% 1/15/28 (a) | 14,790 | 10,982 | |

| Antero Resources Corp. 5.625% 6/1/23 (Reg. S) | 2,240 | 1,571 | |

| Antero Resources Finance Corp. 5.375% 11/1/21 | 2,795 | 2,495 | |

| Callon Petroleum Co. 6.125% 10/1/24 | 4,090 | 3,886 | |

| Carrizo Oil & Gas, Inc. 6.25% 4/15/23 | 7,400 | 6,882 | |

| Chesapeake Energy Corp.: | |||

| 8% 1/15/25 | 7,850 | 5,181 | |

| 8% 6/15/27 | 4,560 | 2,850 | |

| Citgo Holding, Inc. 9.25% 8/1/24 (a) | 27,185 | 28,374 | |

| CNX Midstream Partners LP 6.5% 3/15/26 (a) | 6,675 | 6,224 | |

| Comstock Escrow Corp. 9.75% 8/15/26 | 61,450 | 48,546 | |

| Consolidated Energy Finance SA: | |||

| 3 month U.S. LIBOR + 3.750% 5.8685% 6/15/22 (a)(b)(e) | 3,025 | 3,002 | |

| 6.5% 5/15/26 (a) | 12,170 | 11,714 | |

| 6.875% 6/15/25 (a) | 6,050 | 5,869 | |

| Covey Park Energy LLC 7.5% 5/15/25 (a) | 10,865 | 8,040 | |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.: | |||

| 5.625% 5/1/27 (a) | 18,015 | 18,128 | |

| 5.75% 4/1/25 | 8,985 | 9,277 | |

| 6.25% 4/1/23 | 9,260 | 9,419 | |

| CVR Refining LLC/Coffeyville Finance, Inc. 6.5% 11/1/22 | 20,970 | 21,180 | |

| DCP Midstream LLC 5.85% 5/21/43 (a)(b) | 18,335 | 16,410 | |

| Denbury Resources, Inc.: | |||

| 7.75% 2/15/24 (a) | 43,134 | 31,703 | |

| 9% 5/15/21 (a) | 47,050 | 41,169 | |

| 9.25% 3/31/22 (a) | 7,030 | 5,765 | |

| Diamondback Energy, Inc.: | |||

| 4.75% 11/1/24 | 9,930 | 10,265 | |

| 5.375% 5/31/25 | 5,155 | 5,387 | |

| EG Global Finance PLC 8.5% 10/30/25 (a) | 11,590 | 12,174 | |

| Endeavor Energy Resources LP/EER Finance, Inc.: | |||

| 5.5% 1/30/26 (a) | 9,698 | 9,989 | |

| 5.75% 1/30/28 (a) | 16,811 | 17,694 | |

| Energy Transfer Equity LP 5.5% 6/1/27 | 16,735 | 19,250 | |

| EP Energy LLC/Everest Acquisition Finance, Inc. 7.75% 5/15/26 (a)(f) | 76,525 | 53,185 | |

| EQT Corp. 3.9% 10/1/27 | 27,454 | 24,223 | |

| Exterran Energy Solutions LP 8.125% 5/1/25 | 11,280 | 11,167 | |

| Exterran Partners LP/EXLP Finance Corp. 6% 10/1/22 | 8,075 | 8,136 | |

| Extraction Oil & Gas, Inc. 7.375% 5/15/24 (a) | 7,165 | 2,938 | |

| Forum Energy Technologies, Inc. 6.25% 10/1/21 | 13,870 | 11,235 | |

| Genesis Energy LP/Genesis Energy Finance Corp. 6.25% 5/15/26 | 9,130 | 8,445 | |

| Hess Infrastructure Partners LP 5.625% 2/15/26 (a) | 15,535 | 16,253 | |

| Hilcorp Energy I LP/Hilcorp Finance Co.: | |||

| 5% 12/1/24 (a) | 9,920 | 8,807 | |

| 5.75% 10/1/25 (a) | 11,285 | 10,072 | |

| 6.25% 11/1/28 (a) | 12,280 | 10,377 | |

| Holly Energy Partners LP/Holly Finance Corp. 6% 8/1/24 (a) | 7,145 | 7,440 | |

| Indigo Natural Resources LLC 6.875% 2/15/26 (a) | 22,135 | 20,143 | |

| Jonah Energy LLC 7.25% 10/15/25 (a) | 18,030 | 5,048 | |

| MPLX LP 6.375% 5/1/24 (a) | 4,570 | 4,787 | |

| Murphy Oil U.S.A., Inc.: | |||

| 4.75% 9/15/29 | 6,860 | 7,160 | |

| 5.625% 5/1/27 | 6,030 | 6,471 | |

| Nabors Industries, Inc.: | |||

| 5.1% 9/15/23 | 15,755 | 12,053 | |

| 5.75% 2/1/25 | 19,210 | 14,317 | |

| NextEra Energy Partners LP 4.25% 7/15/24 (a) | 12,015 | 12,342 | |

| NGL Energy Partners LP/NGL Energy Finance Corp.: | |||

| 6.125% 3/1/25 | 11,920 | 11,026 | |

| 7.5% 4/15/26 (a) | 12,005 | 11,461 | |

| NGPL PipeCo LLC: | |||

| 4.375% 8/15/22 (a) | 2,995 | 3,110 | |

| 4.875% 8/15/27 (a) | 3,000 | 3,227 | |

| Nine Energy Service, Inc. 8.75% 11/1/23 (a) | 6,245 | 4,684 | |

| NuStar Logistics LP 6% 6/1/26 | 12,025 | 12,851 | |

| Parsley Energy LLC/Parsley: | |||

| 5.25% 8/15/25 (a) | 5,435 | 5,571 | |

| 5.625% 10/15/27 (a) | 3,105 | 3,206 | |

| PBF Holding Co. LLC/PBF Finance Corp.: | |||

| 7% 11/15/23 | 32,600 | 33,578 | |

| 7.25% 6/15/25 | 22,875 | 23,904 | |

| PBF Logistics LP/PBF Logistics Finance, Inc. 6.875% 5/15/23 | 8,455 | 8,666 | |

| PDC Energy, Inc. 6.125% 9/15/24 | 3,555 | 3,451 | |

| Range Resources Corp.: | |||

| 4.875% 5/15/25 | 8,965 | 7,194 | |

| 5% 3/15/23 | 33,270 | 28,779 | |

| Sanchez Energy Corp.: | |||

| 6.125% 1/15/23 (f) | 34,330 | 1,545 | |

| 7.25% 2/15/23 (a)(f) | 24,505 | 16,663 | |

| SemGroup Corp.: | |||

| 6.375% 3/15/25 | 5,990 | 6,207 | |

| 7.25% 3/15/26 | 11,220 | 12,118 | |

| SESI LLC 7.75% 9/15/24 | 7,245 | 3,985 | |

| SM Energy Co.: | |||

| 5.625% 6/1/25 | 7,285 | 6,174 | |

| 6.625% 1/15/27 | 36,085 | 30,311 | |

| 6.75% 9/15/26 | 4,550 | 3,902 | |

| Southern Natural Gas Co.: | |||

| 7.35% 2/15/31 | 23,497 | 30,723 | |

| 8% 3/1/32 | 12,475 | 17,941 | |

| Southern Star Central Corp. 5.125% 7/15/22 (a) | 6,750 | 6,833 | |

| Southwestern Energy Co.: | |||

| 4.1% 3/15/22 | 15,400 | 14,900 | |

| 6.2% 1/23/25 (b) | 1,805 | 1,588 | |

| 7.5% 4/1/26 | 20,490 | 17,982 | |

| 7.75% 10/1/27 | 12,945 | 11,133 | |

| SRC Energy, Inc. 6.25% 12/1/25 | 7,435 | 6,950 | |

| Summit Midstream Holdings LLC 5.75% 4/15/25 | 5,390 | 4,177 | |

| Sunoco LP/Sunoco Finance Corp.: | |||

| 4.875% 1/15/23 | 9,145 | 9,385 | |

| 5.5% 2/15/26 | 11,640 | 12,034 | |

| Targa Resources Partners LP/Targa Resources Partners Finance Corp. 5% 1/15/28 | 3,650 | 3,623 | |

| Teine Energy Ltd. 6.875% 9/30/22 (a) | 11,950 | 11,950 | |

| Tennessee Gas Pipeline Co. 7.625% 4/1/37 | 5,445 | 7,297 | |

| TerraForm Power Operating LLC: | |||

| 4.25% 1/31/23 (a) | 6,270 | 6,458 | |

| 4.75% 1/15/30 (a) | 11,110 | 11,485 | |

| 5% 1/31/28 (a) | 6,295 | 6,639 | |

| Tervita Escrow Corp. 7.625% 12/1/21 (a) | 2,475 | 2,444 | |

| Transocean, Inc. 7.5% 1/15/26 (a) | 12,910 | 11,490 | |

| Ultra Resources, Inc. 11% 7/12/24 pay-in-kind | 10,628 | 1,594 | |

| Unit Corp. 6.625% 5/15/21 | 2,202 | 1,453 | |

| Viper Energy Partners LP 5.375% 11/1/27 (a) | 15,415 | 15,685 | |

| W&T Offshore, Inc. 9.75% 11/1/23 (a) | 41,795 | 39,183 | |

| Whiting Petroleum Corp. 6.625% 1/15/26 | 8,380 | 5,196 | |

| WPX Energy, Inc.: | |||

| 5.25% 9/15/24 | 8,725 | 8,812 | |

| 5.25% 10/15/27 | 15,080 | 14,665 | |

| 5.75% 6/1/26 | 9,125 | 9,171 | |

| 1,160,429 | |||

| Entertainment/Film - 0.1% | |||

| Lions Gate Entertainment Corp. 5.875% 11/1/24 (a) | 3,865 | 3,643 | |

| New Cotai LLC/New Cotai Capital Corp. 10.625% 5/1/19 pay-in-kind (a)(b)(f) | 28,594 | 13,725 | |

| 17,368 | |||

| Environmental - 0.4% | |||

| ADS Waste Holdings, Inc. 5.625% 11/15/24 (a) | 10,140 | 10,584 | |

| Covanta Holding Corp.: | |||

| 5.875% 3/1/24 | 7,775 | 7,989 | |

| 5.875% 7/1/25 | 3,205 | 3,325 | |

| 6% 1/1/27 | 12,335 | 12,890 | |

| Kissner Holdings LP/Kissner Milling Co. Ltd./BSC Holding, Inc./Kissner U.S.A. 8.375% 12/1/22 (a) | 9,525 | 9,912 | |

| 44,700 | |||

| Food & Drug Retail - 0.1% | |||

| Performance Food Group, Inc. 5.5% 10/15/27 (a) | 12,635 | 13,362 | |

| Food/Beverage/Tobacco - 1.9% | |||

| JBS Investments II GmbH: | |||

| 5.75% 1/15/28 (a) | 10,705 | 11,155 | |

| 7% 1/15/26 (a) | 11,630 | 12,607 | |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc.: | |||

| 5.75% 6/15/25 (a) | 24,630 | 25,584 | |

| 6.75% 2/15/28 (a) | 18,350 | 20,185 | |

| JBS U.S.A. Lux SA / JBS Food Co.: | |||

| 5.5% 1/15/30 (a) | 20,180 | 21,744 | |

| 6.5% 4/15/29 (a) | 29,320 | 32,619 | |

| KeHE Distributors LLC / KeHE Finance Corp. 8.625% 10/15/26 (a) | 9,735 | 9,984 | |

| Lamb Weston Holdings, Inc.: | |||

| 4.625% 11/1/24 (a) | 7,660 | 8,053 | |

| 4.875% 11/1/26 (a) | 7,740 | 8,137 | |

| Pilgrim's Pride Corp. 5.75% 3/15/25 (a) | 17,930 | 18,602 | |

| Post Holdings, Inc.: | |||

| 5% 8/15/26 (a) | 17,030 | 17,713 | |

| 5.5% 3/1/25 (a) | 10,085 | 10,565 | |

| 5.5% 12/15/29 (a) | 14,975 | 15,787 | |

| 5.75% 3/1/27 (a) | 7,710 | 8,208 | |

| 220,943 | |||

| Gaming - 0.5% | |||

| MCE Finance Ltd.: | |||

| 4.875% 6/6/25 (a) | 30,275 | 30,939 | |

| 5.25% 4/26/26 (a) | 12,015 | 12,503 | |

| Transocean, Inc. 7.25% 11/1/25 (a) | 12,270 | 10,828 | |

| 54,270 | |||

| Healthcare - 5.3% | |||

| BCPE Cycle Merger Sub II, Inc. 10.625% 7/15/27 (a) | 24,025 | 22,463 | |

| Catalent Pharma Solutions: | |||

| 4.875% 1/15/26 (a) | 4,000 | 4,130 | |

| 5% 7/15/27 (a) | 3,765 | 3,934 | |

| Centene Corp. 5.375% 6/1/26 (a) | 30,420 | 32,200 | |

| Charles River Laboratories International, Inc. 4.25% 5/1/28 (a) | 3,400 | 3,464 | |

| Community Health Systems, Inc.: | |||

| 8% 3/15/26 (a) | 64,115 | 62,672 | |

| 8.125% 6/30/24 (a) | 67,698 | 51,450 | |

| 8.625% 1/15/24 (a) | 48,790 | 49,860 | |

| 9.875% 6/30/23 (a) | 36,023 | 30,079 | |

| Encompass Health Corp.: | |||

| 5.125% 3/15/23 | 6,440 | 6,569 | |

| 5.75% 11/1/24 | 20,291 | 20,519 | |

| Hologic, Inc.: | |||

| 4.375% 10/15/25 (a) | 6,295 | 6,449 | |

| 4.625% 2/1/28 (a) | 4,255 | 4,452 | |

| Horizon Pharma U.S.A., Inc. 5.5% 8/1/27 (a) | 12,050 | 12,562 | |

| IMS Health, Inc. 5% 5/15/27 (a) | 12,070 | 12,794 | |

| MPH Acquisition Holdings LLC 7.125% 6/1/24 (a) | 6,095 | 5,684 | |

| MPT Operating Partnership LP/MPT Finance Corp.: | |||

| 4.625% 8/1/29 | 18,080 | 18,860 | |

| 5% 10/15/27 | 25,968 | 27,331 | |

| 5.25% 8/1/26 | 7,453 | 7,826 | |

| 6.375% 3/1/24 | 3,970 | 4,144 | |

| NVA Holdings, Inc. 6.875% 4/1/26 (a) | 6,560 | 7,036 | |

| Polaris Intermediate Corp. 8.5% 12/1/22 pay-in-kind (a)(b) | 29,900 | 25,116 | |

| Service Corp. International 5.125% 6/1/29 | 5,665 | 6,033 | |

| Teleflex, Inc. 4.625% 11/15/27 | 4,975 | 5,211 | |

| Tenet Healthcare Corp.: | |||

| 4.625% 7/15/24 | 6,055 | 6,237 | |

| 4.625% 9/1/24 (a) | 12,045 | 12,353 | |

| 4.875% 1/1/26 (a) | 30,115 | 31,150 | |

| 5.125% 5/1/25 | 6,055 | 6,199 | |

| 5.125% 11/1/27 (a) | 18,070 | 18,838 | |

| 6.25% 2/1/27 (a) | 17,930 | 18,939 | |

| Valeant Pharmaceuticals International, Inc.: | |||

| 5.5% 11/1/25 (a) | 20,817 | 21,754 | |

| 5.75% 8/15/27 (a) | 3,120 | 3,388 | |

| 7% 1/15/28 (a) | 24,125 | 26,025 | |

| 7.25% 5/30/29 (a) | 12,065 | 13,287 | |

| 8.5% 1/31/27 (a) | 21,745 | 24,463 | |

| Vizient, Inc. 6.25% 5/15/27 (a) | 2,760 | 2,976 | |

| Wellcare Health Plans, Inc.: | |||

| 5.25% 4/1/25 | 9,245 | 9,675 | |

| 5.375% 8/15/26 (a) | 7,920 | 8,425 | |

| 634,547 | |||

| Homebuilders/Real Estate - 0.9% | |||

| Alliant Holdings Intermediate LLC 6.75% 10/15/27 (a) | 5,555 | 5,778 | |

| Howard Hughes Corp. 5.375% 3/15/25 (a) | 12,730 | 13,223 | |

| Lennar Corp. 4.75% 11/29/27 | 12,205 | 13,181 | |

| LGI Homes, Inc. 6.875% 7/15/26 (a) | 12,190 | 12,617 | |

| Mattamy Group Corp. 6.875% 12/15/23 (a) | 8,755 | 9,072 | |

| Odebrecht Finance Ltd.: | |||

| 4.375% 4/25/25 (a)(f) | 12,020 | 856 | |

| 5.25% 6/27/29 (a)(f) | 10,987 | 786 | |

| 7.125% 6/26/42 (a)(f) | 5,370 | 376 | |

| Starwood Property Trust, Inc. 4.75% 3/15/25 | 11,625 | 12,072 | |

| Taylor Morrison Communities, Inc./Monarch Communities, Inc.: | |||

| 5.625% 3/1/24 (a) | 1,312 | 1,415 | |

| 5.875% 6/15/27 (a) | 9,260 | 10,341 | |

| TRI Pointe Homes, Inc. 5.875% 6/15/24 | 16,130 | 17,380 | |

| William Lyon Homes, Inc.: | |||

| 5.875% 1/31/25 | 7,125 | 7,250 | |

| 6% 9/1/23 | 7,430 | 7,690 | |

| 112,037 | |||

| Hotels - 0.8% | |||

| Choice Hotels International, Inc. 5.75% 7/1/22 | 3,035 | 3,293 | |

| FelCor Lodging LP 6% 6/1/25 | 10,935 | 11,413 | |

| Hilton Domestic Operating Co., Inc.: | |||

| 4.875% 1/15/30 (a) | 18,000 | 19,125 | |

| 5.125% 5/1/26 | 18,255 | 19,168 | |

| Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp.: | |||

| 4.625% 4/1/25 | 17,975 | 18,469 | |

| 4.875% 4/1/27 | 8,435 | 8,920 | |

| Marriott Ownership Resorts, Inc. 6.5% 9/15/26 | 9,495 | 10,266 | |

| 90,654 | |||

| Insurance - 0.5% | |||

| Acrisure LLC / Acrisure Finance, Inc.: | |||

| 7% 11/15/25 (a) | 17,915 | 16,392 | |

| 8.125% 2/15/24 (a) | 12,845 | 13,688 | |

| AmWINS Group, Inc. 7.75% 7/1/26 (a) | 6,100 | 6,558 | |

| HUB International Ltd. 7% 5/1/26 (a) | 11,770 | 12,123 | |

| USIS Merger Sub, Inc. 6.875% 5/1/25 (a) | 12,080 | 12,291 | |

| 61,052 | |||

| Leisure - 0.5% | |||

| Merlin Entertainments PLC 5.75% 6/15/26 (a) | 12,170 | 12,961 | |

| Six Flags Entertainment Corp.: | |||

| 4.875% 7/31/24 (a) | 14,040 | 14,496 | |

| 5.5% 4/15/27 (a) | 7,460 | 7,814 | |

| Studio City Co. Ltd. 7.25% 11/30/21 (a) | 6,220 | 6,366 | |

| Viking Cruises Ltd. 5.875% 9/15/27 (a) | 11,595 | 12,320 | |

| Voc Escrow Ltd. 5% 2/15/28 (a) | 10,755 | 11,185 | |

| 65,142 | |||

| Metals/Mining - 1.0% | |||

| Alcoa Nederland Holding BV: | |||

| 6.125% 5/15/28 (a) | 3,565 | 3,823 | |

| 6.75% 9/30/24 (a) | 7,705 | 8,119 | |

| 7% 9/30/26 (a) | 6,385 | 6,936 | |

| Aleris International, Inc. 6% 6/1/20 (a)(d) | 151 | 151 | |

| First Quantum Minerals Ltd.: | |||

| 6.5% 3/1/24 (a) | 2,110 | 2,068 | |

| 6.875% 3/1/26 (a) | 18,720 | 18,346 | |

| 7.5% 4/1/25 (a) | 1,810 | 1,812 | |

| FMG Resources (August 2006) Pty Ltd.: | |||

| 4.5% 9/15/27 (a) | 9,015 | 8,897 | |

| 4.75% 5/15/22 (a) | 7,950 | 8,189 | |

| 5.125% 3/15/23 (a) | 12,860 | 13,390 | |

| 5.125% 5/15/24 (a) | 9,780 | 10,269 | |

| Freeport-McMoRan, Inc. 5.45% 3/15/43 | 5,135 | 4,776 | |

| Joseph T Ryerson & Son, Inc. 11% 5/15/22 (a) | 6,445 | 6,824 | |

| Mineral Resources Ltd. 8.125% 5/1/27 (a) | 18,015 | 18,961 | |

| Murray Energy Corp.: | |||

| 11.25% 4/15/21 (a)(f) | 8,915 | 11 | |

| 12% 4/15/24 pay-in-kind (a)(b)(f) | 10,343 | 90 | |

| SunCoke Energy Partners LP/SunCoke Energy Partners Finance Corp. 7.5% 6/15/25 (a) | 9,795 | 8,326 | |

| 120,988 | |||

| Paper - 0.1% | |||

| Boise Cascade Co. 5.625% 9/1/24 (a) | 4,105 | 4,269 | |

| Mercer International, Inc. 7.375% 1/15/25 (a) | 12,070 | 12,523 | |

| NewPage Corp.: | |||

| 3 month U.S. LIBOR + 6.250% 6.7159% 5/1/12 (b)(d)(e)(f) | 6,337 | 0 | |

| 11.375% 12/31/2014 (d)(f) | 12,582 | 0 | |

| 16,792 | |||

| Publishing/Printing - 0.4% | |||

| Cengage Learning, Inc. 9.5% 6/15/24 (a) | 24,130 | 21,596 | |

| Getty Images, Inc. 9.75% 3/1/27 (a) | 20,665 | 20,897 | |

| 42,493 | |||

| Restaurants - 1.4% | |||

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | |||

| 3.875% 1/15/28 (a) | 9,165 | 9,214 | |

| 5% 10/15/25 (a) | 65,605 | 67,573 | |

| Golden Nugget, Inc.: | |||

| 6.75% 10/15/24 (a) | 22,555 | 23,234 | |

| 8.75% 10/1/25 (a) | 24,245 | 25,518 | |

| KFC Holding Co./Pizza Hut Holding LLC: | |||

| 4.75% 6/1/27 (a) | 9,215 | 9,630 | |

| 5% 6/1/24 (a) | 8,800 | 9,130 | |

| 5.25% 6/1/26 (a) | 8,800 | 9,306 | |

| Yum! Brands, Inc. 4.75% 1/15/30 (a) | 10,355 | 10,860 | |

| 164,465 | |||

| Services - 1.2% | |||

| Avantor, Inc. 6% 10/1/24 (a) | 12,090 | 12,923 | |

| BidFair MergeRight, Inc. 7.375% 10/15/27 (a) | 25,215 | 25,215 | |

| CDK Global, Inc. 5.875% 6/15/26 | 4,545 | 4,863 | |

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (a) | 8,765 | 9,110 | |

| Iron Mountain, Inc. 4.875% 9/15/29 (a) | 24,110 | 24,683 | |

| KAR Auction Services, Inc. 5.125% 6/1/25 (a) | 10,355 | 10,808 | |

| Ritchie Bros. Auctioneers, Inc. 5.375% 1/15/25 (a) | 3,510 | 3,659 | |

| Tempo Acquisition LLC 6.75% 6/1/25 (a) | 8,815 | 9,068 | |

| The Brink's Co. 4.625% 10/15/27 (a) | 12,180 | 12,332 | |

| The GEO Group, Inc.: | |||

| 5.125% 4/1/23 | 5,835 | 5,135 | |

| 5.875% 10/15/24 | 5,045 | 4,213 | |

| 6% 4/15/26 | 4,130 | 3,273 | |

| United Rentals North America, Inc.: | |||

| 3.875% 11/15/27 (c) | 5,560 | 5,617 | |

| 5.5% 5/15/27 | 7,325 | 7,723 | |

| 138,622 | |||

| Steel - 0.6% | |||

| Algoma Steel SCA 0% 12/31/23 (d) | 1,982 | 1,407 | |

| Cleveland-Cliffs, Inc.: | |||

| 4.875% 1/15/24 (a) | 12,165 | 12,500 | |

| 5.75% 3/1/25 | 3,141 | 3,102 | |

| 5.875% 6/1/27 (a) | 18,030 | 17,196 | |

| Commercial Metals Co. 5.75% 4/15/26 | 9,135 | 9,420 | |

| Infrabuild Australia Pty Ltd. 12% 10/1/24 (a) | 9,055 | 9,228 | |

| JMC Steel Group, Inc. 9.875% 6/15/23 (a) | 3,000 | 3,164 | |

| United States Steel Corp. 6.25% 3/15/26 | 12,205 | 10,219 | |

| 66,236 | |||

| Technology - 2.1% | |||

| Ascend Learning LLC: | |||

| 6.875% 8/1/25 (a) | 11,865 | 12,384 | |

| 6.875% 8/1/25 (a) | 4,115 | 4,305 | |

| Balboa Merger Sub, Inc. 11.375% 12/1/21 (a) | 23,415 | 24,205 | |

| Banff Merger Sub, Inc. 9.75% 9/1/26 (a) | 34,618 | 32,238 | |

| Camelot Finance SA 4.5% 11/1/26 (a) | 10,590 | 10,700 | |

| CDW LLC/CDW Finance Corp. 5% 9/1/25 | 6,380 | 6,667 | |

| Ensemble S Merger Sub, Inc. 9% 9/30/23 (a) | 19,115 | 19,629 | |

| Go Daddy Operating Co. LLC / GD Finance Co., Inc. 5.25% 12/1/27 (a) | 9,345 | 9,906 | |

| j2 Cloud Services LLC/j2 Global Communications, Inc. 6% 7/15/25 (a) | 8,065 | 8,569 | |

| JDA Escrow LLC/JDA Bond Finance, Inc. 7.375% 10/15/24 (a) | 4,060 | 4,211 | |

| MTS Systems Corp. 5.75% 8/15/27 (a) | 3,140 | 3,289 | |

| NCR Corp.: | |||

| 5.75% 9/1/27 (a) | 9,035 | 9,250 | |

| 6.125% 9/1/29 (a) | 9,035 | 9,464 | |

| Open Text Corp. 5.875% 6/1/26 (a) | 8,535 | 9,100 | |

| Parametric Technology Corp. 6% 5/15/24 | 3,490 | 3,708 | |

| Qorvo, Inc. 5.5% 7/15/26 | 6,085 | 6,496 | |

| Sensata Technologies BV 5% 10/1/25 (a) | 11,210 | 12,081 | |

| Sensata Technologies UK Financing Co. PLC 6.25% 2/15/26 (a) | 11,535 | 12,335 | |

| Symantec Corp. 5% 4/15/25 (a) | 10,050 | 10,301 | |

| Veritas U.S., Inc./Veritas Bermuda Ltd.: | |||

| 7.5% 2/1/23 (a) | 16,225 | 15,941 | |

| 10.5% 2/1/24 (a) | 29,743 | 28,107 | |

| 252,886 | |||

| Telecommunications - 5.9% | |||

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (a) | 22,740 | 23,934 | |

| Connect Finco SARL / Connect U.S. Finco LLC 6.75% 10/1/26 (a) | 24,135 | 25,070 | |

| CyrusOne LP/CyrusOne Finance Corp.: | |||

| 5% 3/15/24 | 3,190 | 3,290 | |

| 5.375% 3/15/27 | 2,735 | 2,923 | |

| Frontier Communications Corp. 8.5% 4/1/26 (a) | 31,445 | 31,524 | |

| GCI, Inc. 6.875% 4/15/25 | 10,905 | 11,464 | |

| Gogo Intermediate Holdings LLC/Gogo Finance Co., Inc. 9.875% 5/1/24 (a) | 24,025 | 25,286 | |

| Intelsat Jackson Holdings SA: | |||

| 5.5% 8/1/23 | 15,020 | 14,044 | |

| 8.5% 10/15/24 (a) | 46,525 | 46,883 | |

| 9.75% 7/15/25 (a) | 56,970 | 59,117 | |

| Sable International Finance Ltd. 5.75% 9/7/27 (a) | 15,035 | 15,636 | |

| SFR Group SA: | |||

| 5.5% 1/15/28 (a) | 22,110 | 22,525 | |

| 7.375% 5/1/26 (a) | 125,670 | 134,573 | |

| 8.125% 2/1/27 (a) | 7,635 | 8,465 | |

| Sprint Capital Corp.: | |||

| 6.875% 11/15/28 | 60,109 | 65,218 | |

| 8.75% 3/15/32 | 67,236 | 81,986 | |

| Sprint Corp. 7.625% 3/1/26 | 34,025 | 37,640 | |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (a) | 25,600 | 27,226 | |

| Telesat Canada/Telesat LLC 6.5% 10/15/27 (a) | 7,880 | 8,225 | |

| U.S. West Communications 7.25% 9/15/25 | 1,480 | 1,697 | |

| UPCB Finance IV Ltd. 5.375% 1/15/25 (a) | 11,930 | 12,303 | |

| Zayo Group LLC/Zayo Capital, Inc.: | |||

| 5.75% 1/15/27 (a) | 31,195 | 31,706 | |

| 6% 4/1/23 | 11,035 | 11,350 | |

| 6.375% 5/15/25 | 2,440 | 2,508 | |

| 704,593 | |||

| Transportation Ex Air/Rail - 0.3% | |||

| Avolon Holdings Funding Ltd.: | |||

| 5.125% 10/1/23 (a) | 3,310 | 3,571 | |

| 5.25% 5/15/24 (a) | 17,970 | 19,596 | |

| 5.5% 1/15/23 (a) | 5,305 | 5,725 | |

| Navios South American Logistics, Inc./Navios Logistics Finance U.S., Inc. 7.25% 5/1/22 (a) | 10,180 | 10,065 | |

| 38,957 | |||

| Utilities - 2.4% | |||

| EnLink Midstream Partners LP: | |||

| 4.15% 6/1/25 | 5,410 | 4,882 | |

| 4.4% 4/1/24 | 5,415 | 5,077 | |

| Global Partners LP/GLP Finance Corp. 7% 6/15/23 | 11,295 | 11,670 | |

| NextEra Energy Partners LP: | |||

| 4.25% 9/15/24 (a) | 8,025 | 8,346 | |

| 4.5% 9/15/27 (a) | 5,580 | 5,692 | |

| NRG Energy, Inc.: | |||

| 5.75% 1/15/28 | 34,385 | 37,222 | |

| 6.625% 1/15/27 | 26,747 | 28,987 | |

| Pacific Gas & Electric Co.: | |||

| 3.75% 8/15/42 (f) | 7,585 | 6,902 | |

| 3.95% 12/1/47 (f) | 53,930 | 48,807 | |

| 4% 12/1/46 (f) | 24,380 | 22,186 | |

| 4.25% 3/15/46 (f) | 2,400 | 2,208 | |

| 4.3% 3/15/45 (f) | 5,995 | 5,515 | |

| 6.05% 3/1/34 (f) | 7,690 | 7,709 | |

| Pattern Energy Group, Inc. 5.875% 2/1/24 (a) | 5,475 | 5,612 | |

| The AES Corp. 4.5% 3/15/23 | 5,175 | 5,291 | |

| Vertiv Group Corp. 9.25% 10/15/24 (a) | 2,785 | 2,620 | |

| Vistra Operations Co. LLC: | |||

| 5% 7/31/27 (a) | 22,585 | 23,375 | |

| 5.5% 9/1/26 (a) | 16,965 | 17,927 | |

| 5.625% 2/15/27 (a) | 28,195 | 29,887 | |

| 279,915 | |||

| TOTAL NONCONVERTIBLE BONDS | 6,644,656 | ||

| TOTAL CORPORATE BONDS | |||

| (Cost $6,527,631) | 6,665,336 | ||

| Shares | Value (000s) | ||

| Common Stocks - 20.6% | |||

| Air Transportation - 1.0% | |||

| Air Canada (g) | 3,438,100 | 122,426 | |

| Automotive & Auto Parts - 0.2% | |||

| Allison Transmission Holdings, Inc. | 285,200 | 12,438 | |

| Chassix Holdings, Inc. warrants 7/29/20 (d)(g) | 37,382 | 184 | |

| Exide Technologies (d)(g) | 9,824 | 10 | |

| Exide Technologies (d)(g) | 32,746 | 0 | |

| Exide Technologies (d)(h) | 146,110 | 1,302 | |

| Motors Liquidation Co. GUC Trust (g) | 11,464 | 113 | |

| UC Holdings, Inc. (d)(g) | 677,217 | 13,077 | |

| TOTAL AUTOMOTIVE & AUTO PARTS | 27,124 | ||

| Banks & Thrifts - 0.5% | |||

| Bank of America Corp. | 747,115 | 23,362 | |

| JPMorgan Chase & Co. | 250,380 | 31,277 | |

| TOTAL BANKS & THRIFTS | 54,639 | ||

| Broadcasting - 0.5% | |||

| iHeartMedia, Inc. (g)(i) | 118,490 | 1,699 | |

| iHeartMedia, Inc. warrants 5/1/39 (g) | 104 | 1 | |

| Nexstar Broadcasting Group, Inc. Class A | 376,429 | 36,623 | |

| Sinclair Broadcast Group, Inc. Class A | 402,800 | 16,048 | |

| TOTAL BROADCASTING | 54,371 | ||

| Cable/Satellite TV - 0.8% | |||

| Altice U.S.A., Inc. Class A (g) | 1,930,500 | 59,749 | |

| Comcast Corp. Class A | 806,200 | 36,134 | |

| TOTAL CABLE/SATELLITE TV | 95,883 | ||

| Capital Goods - 0.7% | |||

| Fortive Corp. | 268,800 | 18,547 | |

| Thermo Fisher Scientific, Inc. | 112,300 | 33,912 | |

| Zebra Technologies Corp. Class A (g) | 115,500 | 27,474 | |

| TOTAL CAPITAL GOODS | 79,933 | ||

| Chemicals - 0.2% | |||

| CF Industries Holdings, Inc. | 355,000 | 16,099 | |

| Hexion U.S. Finance Corp. (g) | 90,260 | 912 | |

| The Chemours Co. LLC | 781,940 | 12,832 | |

| TOTAL CHEMICALS | 29,843 | ||

| Consumer Products - 0.1% | |||

| Reddy Ice Holdings, Inc. (d) | 199,717 | 60 | |

| Reddy Ice Holdings, Inc. (d)(g) | 496,439 | 0 | |

| Ulta Beauty, Inc. (g) | 72,500 | 16,903 | |

| TOTAL CONSUMER PRODUCTS | 16,963 | ||

| Diversified Financial Services - 1.3% | |||

| American Express Co. | 270,700 | 31,748 | |

| MasterCard, Inc. Class A | 317,600 | 87,915 | |

| OneMain Holdings, Inc. | 764,900 | 30,596 | |

| Penson Worldwide, Inc. Class A (d)(g) | 10,322,034 | 0 | |

| PJT Partners, Inc. | 5,092 | 211 | |

| TOTAL DIVERSIFIED FINANCIAL SERVICES | 150,470 | ||

| Energy - 0.1% | |||

| Chaparral Energy, Inc. Class A (g)(i) | 146,806 | 138 | |

| Forbes Energy Services Ltd. (g) | 193,218 | 58 | |

| Goodrich Petroleum Corp. (g) | 129,527 | 1,247 | |

| Harvest Oil & Gas Corp. | 254,828 | 1,389 | |

| MEG Energy Corp. (g) | 2,376,100 | 9,128 | |

| Ultra Petroleum Corp. warrants 7/14/25 (g) | 211,400 | 0 | |

| VNR Finance Corp. (d)(g) | 119,961 | 0 | |

| VNR Finance Corp. (a)(d)(g) | 577,714 | 0 | |

| TOTAL ENERGY | 11,960 | ||

| Food & Drug Retail - 0.1% | |||

| Southeastern Grocers, Inc. (d)(g) | 183,263 | 6,445 | |

| Food/Beverage/Tobacco - 0.9% | |||

| Darling International, Inc. (g) | 1,038,617 | 20,045 | |

| JBS SA | 12,222,900 | 86,220 | |

| TOTAL FOOD/BEVERAGE/TOBACCO | 106,265 | ||

| Gaming - 1.6% | |||

| Boyd Gaming Corp. | 1,699,600 | 46,314 | |

| Eldorado Resorts, Inc. (g)(i) | 1,155,536 | 51,733 | |

| Melco Crown Entertainment Ltd. sponsored ADR | 940,927 | 20,268 | |

| MGM Mirage, Inc. | 603,800 | 17,208 | |

| Penn National Gaming, Inc. (g) | 1,786,500 | 38,079 | |

| Studio City International Holdings Ltd. ADR | 695,700 | 13,371 | |

| TOTAL GAMING | 186,973 | ||

| Healthcare - 1.9% | |||

| Alexion Pharmaceuticals, Inc. (g) | 182,800 | 19,267 | |

| Charles River Laboratories International, Inc. (g) | 185,000 | 24,046 | |

| Cigna Corp. | 158,700 | 28,322 | |

| Encompass Health Corp. | 34 | 2 | |

| Humana, Inc. | 105,400 | 31,009 | |

| IQVIA Holdings, Inc. (g) | 393,500 | 56,829 | |

| Jazz Pharmaceuticals PLC (g) | 197,900 | 24,862 | |

| Rotech Healthcare, Inc. (d)(g) | 185,710 | 1,924 | |

| UnitedHealth Group, Inc. | 144,600 | 36,540 | |

| TOTAL HEALTHCARE | 222,801 | ||

| Homebuilders/Real Estate - 0.0% | |||

| American Tower Corp. | 11,612 | 2,532 | |

| Leisure - 0.1% | |||

| Royal Caribbean Cruises Ltd. | 148,900 | 16,205 | |

| Metals/Mining - 0.1% | |||

| Aleris Corp. (d)(g) | 127,520 | 0 | |

| Elah Holdings, Inc. (g) | 906 | 53 | |

| First Quantum Minerals Ltd. | 1,764,200 | 14,908 | |

| TOTAL METALS/MINING | 14,961 | ||

| Services - 1.6% | |||

| Air Lease Corp. Class A | 594,900 | 26,164 | |

| HD Supply Holdings, Inc. (g) | 1,062,000 | 41,991 | |

| Novus Holdings Ltd. | 100,408 | 18 | |

| Penhall Acquisition Co.: | |||

| Class A (d)(g) | 26,163 | 1,717 | |

| Class B (d)(g) | 8,721 | 572 | |

| United Rentals, Inc. (g) | 524,794 | 70,097 | |

| Visa, Inc. Class A | 255,040 | 45,616 | |

| TOTAL SERVICES | 186,175 | ||

| Steel - 0.0% | |||

| Algoma Steel GP (d) | 198,162 | 4 | |

| Algoma Steel SCA (d) | 198,162 | 32 | |

| TOTAL STEEL | 36 | ||

| Super Retail - 0.4% | |||

| Amazon.com, Inc. (g) | 22,800 | 40,508 | |

| Arena Brands Holding Corp. Class B (d)(g)(h) | 659,302 | 5,301 | |

| TOTAL SUPER RETAIL | 45,809 | ||

| Technology - 6.4% | |||

| Adobe, Inc. (g) | 256,400 | 71,261 | |

| Advanced Micro Devices, Inc. (g) | 800,500 | 27,161 | |

| Alphabet, Inc. Class A (g) | 49,800 | 62,688 | |

| CDW Corp. | 247,000 | 31,594 | |

| EPAM Systems, Inc. (g) | 261,900 | 46,084 | |

| Facebook, Inc. Class A (g) | 257,000 | 49,254 | |

| Fiserv, Inc. (g) | 316,513 | 33,595 | |

| Global Payments, Inc. | 456,924 | 77,302 | |

| GoDaddy, Inc. (g) | 281,500 | 18,306 | |

| Lam Research Corp. | 153,700 | 41,659 | |

| Microchip Technology, Inc. (i) | 511,900 | 48,267 | |

| Micron Technology, Inc. (g) | 528,100 | 25,111 | |

| Microsoft Corp. | 513,800 | 73,664 | |

| ON Semiconductor Corp. (g) | 1,315,038 | 26,827 | |

| PayPal Holdings, Inc. (g) | 609,400 | 63,439 | |

| Salesforce.com, Inc. (g) | 153,800 | 24,068 | |

| SS&C Technologies Holdings, Inc. | 333,382 | 17,339 | |

| Verra Mobility Corp. (g) | 627,800 | 9,009 | |

| VMware, Inc. Class A | 113,600 | 17,979 | |

| TOTAL TECHNOLOGY | 764,607 | ||

| Telecommunications - 1.1% | |||

| Crown Castle International Corp. | 293,400 | 40,721 | |

| Palo Alto Networks, Inc. (g) | 118,300 | 26,900 | |

| T-Mobile U.S., Inc. (g) | 810,400 | 66,988 | |

| TOTAL TELECOMMUNICATIONS | 134,609 | ||

| Transportation Ex Air/Rail - 0.0% | |||

| Tricer Holdco SCA: | |||

| Class A1 (d)(g)(h) | 598,287 | 1 | |

| Class A2 (d)(g)(h) | 598,287 | 1 | |

| Class A3 (d)(g)(h) | 598,287 | 1 | |

| Class A4 (d)(g)(h) | 598,287 | 1 | |

| Class A5 (d)(g)(h) | 598,287 | 1 | |

| Class A6 (d)(g)(h) | 598,287 | 1 | |

| Class A7 (d)(g)(h) | 598,287 | 1 | |

| Class A8 (d)(g)(h) | 598,287 | 1 | |

| Class A9 (d)(g)(h) | 598,287 | 1 | |

| U.S. Shipping Partners Corp. (d)(g) | 51,736 | 0 | |

| U.S. Shipping Partners Corp. warrants 12/31/29 (d)(g) | 484,379 | 0 | |

| TOTAL TRANSPORTATION EX AIR/RAIL | 9 | ||

| Utilities - 1.0% | |||

| NRG Energy, Inc. | 986,100 | 39,562 | |

| Portland General Electric Co. | 14,817 | 843 | |

| Vistra Energy Corp. | 3,126,400 | 84,507 | |

| TOTAL UTILITIES | 124,912 | ||

| TOTAL COMMON STOCKS | |||

| (Cost $1,871,633) | 2,455,951 | ||

| Nonconvertible Preferred Stocks - 0.0% | |||

| Transportation Ex Air/Rail - 0.0% | |||

| Tricer Holdco SCA (d)(g)(h) | |||

| (Cost $10,250) | 287,159,690 | 97 | |

| Principal Amount (000s) | Value (000s) | ||

| Bank Loan Obligations - 4.4% | |||

| Air Transportation - 0.0% | |||

| Dynasty Acquisition Co., Inc.: | |||

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 6.1044% 4/4/26 (b)(e) | 1,197 | 1,198 | |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 4.000% 6.1044% 4/4/26 (b)(e) | 643 | 644 | |

| TOTAL AIR TRANSPORTATION | 1,842 | ||

| Automotive & Auto Parts - 0.2% | |||

| Wand NewCo 3, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 5.2859% 2/5/26 (b)(e) | 17,880 | 17,938 | |

| Banks & Thrifts - 0.0% | |||

| Citadel Securities LP Tranche B, term loan 3 month U.S. LIBOR + 3.500% 5.2859% 2/27/26 (b)(e) | 2,980 | 2,986 | |

| Broadcasting - 0.1% | |||

| iHeartMedia Capital I LLC 1LN, term loan 3 month U.S. LIBOR + 4.000% 6.0315% 5/1/26 (b)(e) | 2,313 | 2,320 | |

| Nexstar Broadcasting, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.750% 4.5543% 9/19/26 (b)(e) | 4,445 | 4,459 | |

| TOTAL BROADCASTING | 6,779 | ||

| Building Materials - 0.0% | |||

| Traverse Midstream Partners Ll Tranche B, term loan 3 month U.S. LIBOR + 4.000% 5.8% 9/27/24 (b)(e) | 2,950 | 2,581 | |

| Cable/Satellite TV - 0.0% | |||

| LCPR Loan Financing LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 6.8282% 10/22/26 (b)(e) | 2,140 | 2,152 | |

| Energy - 1.7% | |||

| BCP Raptor II LLC Tranche B, term loan 3 month U.S. LIBOR + 4.750% 6.5359% 11/3/25 (b)(e) | 6,055 | 5,306 | |

| BCP Raptor LLC Tranche B, term loan 3 month U.S. LIBOR + 4.250% 6.0359% 6/24/24 (b)(e) | 8,846 | 7,752 | |

| California Resources Corp.: | |||

| Tranche 1LN, term loan 3 month U.S. LIBOR + 10.375% 12.1746% 12/31/21 (b)(e) | 90,370 | 59,644 | |

| Tranche B, term loan 3 month U.S. LIBOR + 4.750% 6.5496% 12/31/22 (b)(e) | 102,975 | 88,095 | |

| Citgo Holding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.000% 8.7859% 8/1/23 (b)(e) | 1,405 | 1,416 | |

| Epic Crude Services LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 7.04% 3/1/26 (b)(e) | 35,950 | 33,771 | |

| Forbes Energy Services LLC Tranche B, term loan 16% 4/13/21 (b)(d) | 1,879 | 1,893 | |

| Sanchez Energy Corp. 1LN, term loan 3 month U.S. LIBOR + 8.000% 10% 5/11/20 (b)(d)(e)(j) | 10,780 | 10,241 | |

| TOTAL ENERGY | 208,118 | ||

| Healthcare - 0.3% | |||

| U.S. Renal Care, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 6.7859% 6/13/26 (b)(e) | 37,715 | 34,772 | |

| Valeant Pharmaceuticals International, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 4.9213% 6/1/25 (b)(e) | 2,003 | 2,009 | |

| TOTAL HEALTHCARE | 36,781 | ||

| Hotels - 0.2% | |||

| Travelport Finance Luxembourg SARL Tranche B 2LN, term loan 3 month U.S. LIBOR + 9.000% 11.1044% 5/28/27 (b)(e) | 23,945 | 20,353 | |

| Insurance - 0.2% | |||

| HUB International Ltd. Tranche B, term loan: | |||

| 3 month U.S. LIBOR + 3.000% 4.9395% 4/25/25 (b)(e) | 5,372 | 5,250 | |

| 3 month U.S. LIBOR + 4.000% 4/25/25 (e)(k) | 19,275 | 19,236 | |

| TOTAL INSURANCE | 24,486 | ||

| Metals/Mining - 0.1% | |||

| Murray Energy Corp.: | |||

| term loan 3 month U.S. LIBOR + 11.000% 7.4286% 7/29/20 (b)(e) | 7,607 | 6,998 | |

| Tranche B 2LN, term loan 3 month U.S. LIBOR + 7.250% 10/17/22 (e)(f)(k) | 22,488 | 7,079 | |

| TOTAL METALS/MINING | 14,077 | ||

| Services - 0.4% | |||

| Almonde, Inc. Tranche 2LN, term loan 3 month U.S. LIBOR + 7.250% 9.4463% 6/13/25 (b)(e) | 30,761 | 28,697 | |

| BidFair MergeRight, Inc. 1LN, term loan 3 month U.S. LIBOR + 5.500% 7.4085% 1/23/27 (b)(e) | 11,264 | 10,989 | |

| KUEHG Corp. Tranche B 2LN, term loan 3 month U.S. LIBOR + 8.250% 10.3544% 8/22/25 (b)(e) | 6,055 | 6,010 | |

| TOTAL SERVICES | 45,696 | ||

| Technology - 1.1% | |||

| Boxer Parent Co., Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.250% 6.0359% 10/2/25 (b)(e) | 36,737 | 33,943 | |

| Camelot Finance SA Tranche B, term loan 3 month U.S. LIBOR + 3.250% 10/31/26 (e)(k) | 1,150 | 1,153 | |

| Curie Merger Sub LLC 1LN, term loan 3 month U.S. LIBOR + 4.250% 10/28/26 (e)(k) | 600 | 599 | |

| Kronos, Inc. 2LN, term loan 3 month U.S. LIBOR + 8.250% 10.5031% 11/1/24 (b)(e) | 19,695 | 19,772 | |

| Landesk Group, Inc. term loan: | |||

| 3 month U.S. LIBOR + 4.250% 6.2% 1/20/24 (b)(e) | 3,085 | 3,014 | |

| 3 month U.S. LIBOR + 9.000% 10.95% 1/20/25 (b)(e) | 10,270 | 10,065 | |

| McAfee LLC Tranche B, term loan: | |||

| 3 month U.S. LIBOR + 3.750% 5.5549% 9/29/24 (b)(e) | 4,598 | 4,595 | |

| 3 month U.S. LIBOR + 8.500% 10.3049% 9/29/25 (b)(e) | 24,662 | 24,748 | |

| ON Semiconductor Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.000% 3.7859% 9/19/26 (b)(e) | 7,845 | 7,875 | |

| Web.com Group, Inc.: | |||

| 2LN, term loan 3 month U.S. LIBOR + 7.750% 9.6635% 10/11/26 (b)(e) | 15,014 | 14,404 | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 5.6635% 10/11/25 (b)(e) | 11,054 | 10,747 | |

| TOTAL TECHNOLOGY | 130,915 | ||

| Telecommunications - 0.1% | |||

| Iridium Satellite LLC 1LN, term loan 1 month U.S. LIBOR + 3.750% 10/18/26 (e)(k) | 2,125 | 2,136 | |

| Triton Bidco Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 9/23/26 (e)(k) | 9,050 | 8,906 | |

| TOTAL TELECOMMUNICATIONS | 11,042 | ||

| TOTAL BANK LOAN OBLIGATIONS | |||

| (Cost $597,077) | 525,746 | ||

| Preferred Securities - 9.3% | |||

| Banks & Thrifts - 7.8% | |||

| Bank of America Corp.: | |||

| 5.125% (b)(l) | 36,030 | 38,643 | |

| 5.2% (b)(l) | 61,440 | 65,387 | |

| 5.875% (b)(l) | 102,630 | 113,615 | |

| 6.25% (b)(l) | 28,555 | 31,861 | |

| Citigroup, Inc.: | |||

| 5% (b)(l) | 60,300 | 62,825 | |

| 5.8% (b)(l) | 41,925 | 43,069 | |

| 5.9% (b)(l) | 27,015 | 28,906 | |

| 5.95% (b)(l) | 51,015 | 54,778 | |

| 6.3% (b)(l) | 5,610 | 6,197 | |

| Goldman Sachs Group, Inc.: | |||

| 3 month U.S. LIBOR + 3.884% 6.065% (b)(e)(l) | 25,687 | 26,099 | |

| 5% (b)(l) | 84,915 | 86,255 | |

| 5.375% (b)(l) | 31,615 | 32,884 | |

| Huntington Bancshares, Inc. 5.7% (b)(l) | 12,990 | 13,428 | |

| JPMorgan Chase & Co.: | |||

| 3 month U.S. LIBOR + 3.320% 5.4186% (b)(e)(l) | 43,545 | 44,016 | |

| 5% (b)(l) | 30,845 | 32,419 | |

| 5.3% (b)(l) | 16,855 | 17,554 | |

| 6% (b)(l) | 69,385 | 75,513 | |

| 6.125% (b)(l) | 17,585 | 19,174 | |

| 6.75% (b)(l) | 8,330 | 9,471 | |

| Wells Fargo & Co.: | |||

| 5.875% (b)(l) | 50,420 | 56,965 | |

| 5.9% (b)(l) | 63,075 | 69,534 | |

| TOTAL BANKS & THRIFTS | 928,593 | ||

| Diversified Financial Services - 0.3% | |||

| AerCap Holdings NV 5.875% 10/10/79 (b) | 33,325 | 34,859 | |

| Energy - 1.2% | |||

| DCP Midstream Partners LP 7.375% (b)(l) | 15,260 | 15,115 | |

| Energy Transfer Partners LP: | |||

| 6.25% (b)(l) | 70,123 | 66,143 | |

| 6.625% (b)(l) | 27,290 | 26,411 | |

| MPLX LP 6.875% (b)(l) | 30,450 | 31,310 | |

| Summit Midstream Partners LP 9.5% (b)(l) | 15,260 | 9,249 | |

| TOTAL ENERGY | 148,228 | ||

| Homebuilders/Real Estate - 0.0% | |||

| Odebrecht Finance Ltd. 7.5% (a)(f)(l) | 2,940 | 221 | |

| TOTAL PREFERRED SECURITIES | |||

| (Cost $1,066,761) | 1,111,901 | ||

| Shares | Value (000s) | ||

| Money Market Funds - 10.1% | |||

| Fidelity Cash Central Fund 1.83% (m) | 1,147,771,189 | 1,148,001 | |

| Fidelity Securities Lending Cash Central Fund 1.84% (m)(n) | 57,487,687 | 57,493 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $1,205,447) | 1,205,494 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.4% | |||

| (Cost $11,278,799) | 11,964,525 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.4)% | (52,217) | ||

| NET ASSETS - 100% | $11,912,308 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $4,070,982,000 or 34.2% of net assets.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(d) Level 3 security

(e) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(f) Non-income producing - Security is in default.

(g) Non-income producing

(h) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $6,706,000 or 0.1% of net assets.

(i) Security or a portion of the security is on loan at period end.

(j) Position or a portion of the position represents an unfunded loan commitment. At period end, the total principal amount and market value of unfunded commitments totaled $7,700,000 and $7,315,000, respectively.

(k) The coupon rate will be determined upon settlement of the loan after period end.

(l) Security is perpetual in nature with no stated maturity date.

(m) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(n) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| Arena Brands Holding Corp. Class B | 6/18/97 - 1/12/99 | $21,592 |

| Exide Technologies | 4/30/15 - 6/1/19 | $2,366 |

| Tricer Holdco SCA | 10/16/09 - 12/30/17 | $10,248 |

| Tricer Holdco SCA Class A1 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A2 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A3 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A4 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A5 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A6 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A7 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A8 | 10/16/09 - 10/29/09 | $1,653 |

| Tricer Holdco SCA Class A9 | 10/16/09 - 10/29/09 | $1,654 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| (Amounts in thousands) | |

| Fidelity Cash Central Fund | $10,780 |

| Fidelity Securities Lending Cash Central Fund | 123 |

| Total | $10,903 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | ||||

| Investments in Securities: | ||||

| Equities: | ||||

| Communication Services | $329,184 | $329,183 | $1 | $-- |

| Consumer Discretionary | 280,463 | 260,589 | -- | 19,874 |

| Consumer Staples | 112,770 | 106,265 | -- | 6,505 |

| Energy | 11,960 | 11,960 | -- | -- |

| Financials | 117,307 | 117,307 | -- | -- |

| Health Care | 256,713 | 254,789 | -- | 1,924 |

| Industrials | 294,076 | 291,681 | -- | 2,395 |

| Information Technology | 840,570 | 840,570 | -- | -- |

| Materials | 44,840 | 44,804 | -- | 36 |

| Real Estate | 43,253 | 43,253 | -- | -- |

| Utilities | 124,912 | 124,912 | -- | -- |

| Corporate Bonds | 6,665,336 | -- | 6,661,296 | 4,040 |

| Bank Loan Obligations | 525,746 | -- | 513,612 | 12,134 |

| Preferred Securities | 1,111,901 | -- | 1,111,901 | -- |

| Money Market Funds | 1,205,494 | 1,205,494 | -- | -- |

| Total Investments in Securities: | $11,964,525 | $3,630,807 | $8,286,810 | $46,908 |

Other Information

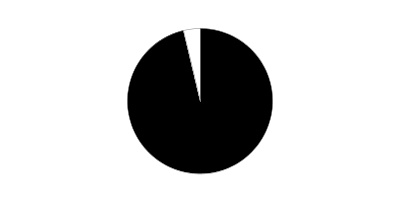

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 85.2% |

| Canada | 4.1% |

| Luxembourg | 1.7% |

| Cayman Islands | 1.4% |

| France | 1.4% |

| Netherlands | 1.3% |

| Multi-National | 1.1% |

| Others (Individually Less Than 1%) | 3.8% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amount) | October 31, 2019 (Unaudited) | |

| Assets | ||

| Investment in securities, at value (including securities loaned of $55,767) — See accompanying schedule: Unaffiliated issuers (cost $10,073,352) | $10,759,031 | |

| Fidelity Central Funds (cost $1,205,447) | 1,205,494 | |

| Total Investment in Securities (cost $11,278,799) | $11,964,525 | |

| Cash | 6,812 | |

| Receivable for investments sold | 24,629 | |

| Receivable for fund shares sold | 10,545 | |

| Dividends receivable | 301 | |

| Interest receivable | 124,061 | |

| Distributions receivable from Fidelity Central Funds | 1,532 | |

| Prepaid expenses | 21 | |

| Other receivables | 566 | |

| Total assets | 12,132,992 | |

| Liabilities | ||

| Payable for investments purchased | ||

| Regular delivery | $79,005 | |

| Delayed delivery | 61,215 | |

| Payable for fund shares redeemed | 11,073 | |

| Distributions payable | 4,464 | |

| Accrued management fee | 5,437 | |

| Other affiliated payables | 1,197 | |

| Other payables and accrued expenses | 799 | |

| Collateral on securities loaned | 57,494 | |

| Total liabilities | 220,684 | |

| Net Assets | $11,912,308 | |

| Net Assets consist of: | ||

| Paid in capital | $11,098,021 | |

| Total accumulated earnings (loss) | 814,287 | |

| Net Assets, for 1,188,113 shares outstanding | $11,912,308 | |

| Net Asset Value, offering price and redemption price per share ($11,912,308 ÷ 1,188,113 shares) | $10.03 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | Six months ended October 31, 2019 (Unaudited) | |

| Investment Income | ||

| Dividends | $43,814 | |

| Interest | 241,931 | |

| Income from Fidelity Central Funds (including $123 from security lending) | 10,903 | |

| Total income | 296,648 | |

| Expenses | ||

| Management fee | $32,415 | |

| Transfer agent fees | 6,436 | |

| Accounting fees | 724 | |

| Custodian fees and expenses | 58 | |

| Independent trustees' fees and expenses | 33 | |

| Registration fees | 154 | |

| Audit | 61 | |

| Legal | 97 | |

| Miscellaneous | 88 | |

| Total expenses before reductions | 40,066 | |

| Expense reductions | (32) | |

| Total expenses after reductions | 40,034 | |

| Net investment income (loss) | 256,614 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 51,020 | |

| Fidelity Central Funds | 2 | |

| Total net realized gain (loss) | 51,022 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (97,330) | |

| Assets and liabilities in foreign currencies | 2 | |

| Total change in net unrealized appreciation (depreciation) | (97,328) | |

| Net gain (loss) | (46,306) | |

| Net increase (decrease) in net assets resulting from operations | $210,308 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended October 31, 2019 (Unaudited) | Year ended April 30, 2019 |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $256,614 | $514,624 |

| Net realized gain (loss) | 51,022 | 78,620 |

| Change in net unrealized appreciation (depreciation) | (97,328) | 114,337 |

| Net increase (decrease) in net assets resulting from operations | 210,308 | 707,581 |

| Distributions to shareholders | (271,923) | (807,791) |

| Share transactions | ||

| Proceeds from sales of shares | 1,256,229 | 2,212,313 |

| Reinvestment of distributions | 240,851 | 721,792 |

| Cost of shares redeemed | (1,154,279) | (3,255,515) |

| Net increase (decrease) in net assets resulting from share transactions | 342,801 | (321,410) |

| Total increase (decrease) in net assets | 281,186 | (421,620) |

| Net Assets | ||

| Beginning of period | 11,631,122 | 12,052,742 |

| End of period | $11,912,308 | $11,631,122 |

| Other Information | ||

| Shares | ||

| Sold | 125,725 | 223,038 |

| Issued in reinvestment of distributions | 24,156 | 73,721 |

| Redeemed | (115,539) | (333,577) |

| Net increase (decrease) | 34,342 | (36,818) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Capital & Income Fund

| Six months ended (Unaudited) October 31, | Years endedApril 30, | |||||

| 2019 | 2019 | 2018 | 2017 | 2016 | 2015 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $10.08 | $10.12 | $10.09 | $9.24 | $9.99 | $10.07 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .219 | .432 | .482 | .430 | .404 | .416 |

| Net realized and unrealized gain (loss) | (.037) | .207 | .065 | .824 | (.710) | .276 |

| Total from investment operations | .182 | .639 | .547 | 1.254 | (.306) | .692 |

| Distributions from net investment income | (.200) | (.487) | (.410) | (.405) | (.387) | (.411) |

| Distributions from net realized gain | (.032) | (.192) | (.107) | – | (.058) | (.362) |

| Total distributions | (.232) | (.679) | (.517) | (.405) | (.445) | (.773) |

| Redemption fees added to paid in capitalA | – | – | –B | .001 | .001 | .001 |

| Net asset value, end of period | $10.03 | $10.08 | $10.12 | $10.09 | $9.24 | $9.99 |

| Total ReturnC,D | 1.84% | 6.74% | 5.51% | 13.85% | (3.05)% | 7.17% |

| Ratios to Average Net AssetsE,F | ||||||

| Expenses before reductions | .68%G | .69% | .67% | .73% | .75% | .72% |

| Expenses net of fee waivers, if any | .68%G | .69% | .67% | .73% | .75% | .72% |

| Expenses net of all reductions | .68%G | .69% | .67% | .73% | .74% | .72% |

| Net investment income (loss) | 4.36%G | 4.37% | 4.71% | 4.45% | 4.30% | 4.16% |

| Supplemental Data | ||||||

| Net assets, end of period (in millions) | $11,912 | $11,631 | $12,053 | $11,230 | $10,188 | $11,160 |

| Portfolio turnover rateH | 51%G | 43% | 39% | 39% | 35% | 41% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended October 31, 2019

(Amounts in thousands except percentages)

1. Organization.

Fidelity Capital & Income Fund (the Fund) is a fund of Fidelity Summer Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, bank loan obligations and preferred securities are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of October 31, 2019 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Paid in Kind (PIK) income is recorded at the fair market value of the securities received. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for the Fund, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees of $539 are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, respectively.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.