UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2737

Fidelity Summer Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | June 30, 2018 |

Item 1.

Reports to Stockholders

|

Fidelity® New Markets Income Fund Semi-Annual Report June 30, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Five Countries as of June 30, 2018

| (excluding cash equivalents) | % of fund's net assets |

| Mexico | 8.6 |

| Turkey | 6.8 |

| Ukraine | 5.7 |

| Lebanon | 5.4 |

| United States of America | 5.3 |

Percentages are adjusted for the effect of futures contracts, if applicable.

Top Five Holdings as of June 30, 2018

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| Turkish Republic | 6.2 |

| Ukraine Government | 5.7 |

| Petroleos Mexicanos | 5.7 |

| Lebanese Republic | 5.4 |

| Argentine Republic | 5.0 |

| 28.0 |

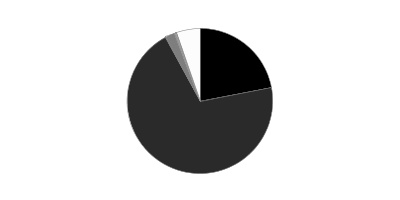

Asset Allocation (% of fund's net assets)

| As of June 30, 2018 | ||

| Corporate Bonds | 22.0% | |

| Government Obligations | 70.1% | |

| Supranational Obligations | 0.1% | |

| Stocks | 2.0% | |

| Preferred Securities | 0.3% | |

| Investment Companies | 0.3% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.2% | |

Schedule of Investments June 30, 2018 (Unaudited)

Showing Percentage of Net Assets

| Nonconvertible Bonds - 22.0% | |||

| Principal Amount(a) | Value | ||

| Azerbaijan - 1.7% | |||

| Southern Gas Corridor CJSC 6.875% 3/24/26 (b) | $54,940,000 | $59,231,913 | |

| State Oil Co. of Azerbaijan Republic 6.95% 3/18/30 (Reg. S) | 32,330,000 | 34,543,312 | |

| TOTAL AZERBAIJAN | 93,775,225 | ||

| Bahrain - 0.3% | |||

| The Oil and Gas Holding Co. 7.5% 10/25/27 (b) | 19,600,000 | 17,426,830 | |

| Brazil - 0.1% | |||

| Caixa Economica Federal 7.25% 7/23/24 (b)(c) | 3,285,000 | 3,289,106 | |

| British Virgin Islands - 0.3% | |||

| 1MDB Global Investments Ltd. 4.4% 3/9/23 | 20,400,000 | 17,914,464 | |

| Cayman Islands - 0.6% | |||

| Alibaba Group Holding Ltd. 3.4% 12/6/27 | 25,790,000 | 24,029,523 | |

| Brazil Minas SPE 5.333% 2/15/28 (b) | 7,515,000 | 7,176,825 | |

| TOTAL CAYMAN ISLANDS | 31,206,348 | ||

| Costa Rica - 0.2% | |||

| Banco Nacional de Costa Rica 6.25% 11/1/23 (b) | 3,245,000 | 3,294,486 | |

| Instituto Costarricense de Electricidad: | |||

| 6.375% 5/15/43 (b) | 2,900,000 | 2,407,000 | |

| 6.95% 11/10/21 (b) | 3,501,000 | 3,623,535 | |

| TOTAL COSTA RICA | 9,325,021 | ||

| Georgia - 0.9% | |||

| Georgian Oil & Gas Corp. 6.75% 4/26/21 (b) | 22,540,000 | 22,649,094 | |

| JSC BGEO Group 6% 7/26/23 (b) | 10,845,000 | 10,788,541 | |

| JSC Georgian Railway 7.75% 7/11/22 (b) | 15,686,000 | 16,464,026 | |

| TOTAL GEORGIA | 49,901,661 | ||

| Indonesia - 1.2% | |||

| PT Pertamina Persero: | |||

| 5.625% 5/20/43 (b) | 6,500,000 | 6,155,409 | |

| 6% 5/3/42 (b) | 34,835,000 | 34,614,042 | |

| 6.5% 5/27/41 (b) | 26,960,000 | 28,370,143 | |

| TOTAL INDONESIA | 69,139,594 | ||

| Ireland - 0.9% | |||

| SCF Capital Ltd. 5.375% 6/16/23 (b) | 11,100,000 | 11,083,350 | |

| Vnesheconombank Via VEB Finance PLC: | |||

| 5.942% 11/21/23 (b) | 5,550,000 | 5,702,625 | |

| 6.025% 7/5/22 (b) | 22,120,000 | 22,728,300 | |

| 6.8% 11/22/25 (b) | 9,180,000 | 9,712,660 | |

| TOTAL IRELAND | 49,226,935 | ||

| Kazakhstan - 0.7% | |||

| Development Bank of Kazakhstan JSC 4.125% 12/10/22 (b) | 6,385,000 | 6,249,638 | |

| JSC KazTransGaz 4.375% 9/26/27 (b) | 7,970,000 | 7,392,175 | |

| Kazagro National Management Holding JSC 4.625% 5/24/23 (b) | 11,690,000 | 11,239,935 | |

| Kazakhstan Temir Zholy 4.85% 11/17/27 (b) | 8,200,000 | 7,933,926 | |

| KazMunaiGaz Finance Sub BV 5.75% 4/19/47 (b) | 8,410,000 | 8,010,525 | |

| TOTAL KAZAKHSTAN | 40,826,199 | ||

| Luxembourg - 0.1% | |||

| RSHB Capital SA 8.5% 10/16/23 (b) | 3,540,000 | 3,787,800 | |

| Mexico - 8.1% | |||

| Comision Federal de Electricid: | |||

| 4.75% 2/23/27 (b) | 10,770,000 | 10,473,825 | |

| 4.875% 1/15/24 (b) | 12,760,000 | 12,823,800 | |

| Pemex Project Funding Master Trust: | |||

| 6.625% 6/15/35 | 82,390,000 | 80,536,225 | |

| 8.625% 2/1/22 | 28,592,000 | 32,093,719 | |

| Petroleos Mexicanos: | |||

| 3 month U.S. LIBOR + 3.650% 5.9771% 3/11/22 (c)(d) | 26,665,000 | 28,464,888 | |

| 6.35% 2/12/48 (b) | 21,074,000 | 19,019,285 | |

| 6.375% 2/4/21 | 12,525,000 | 13,182,563 | |

| 6.375% 1/23/45 | 18,910,000 | 17,416,110 | |

| 6.5% 3/13/27 | 24,280,000 | 24,897,198 | |

| 6.5% 6/2/41 | 124,835,000 | 117,394,834 | |

| 6.75% 9/21/47 | 28,890,000 | 27,459,945 | |

| 6.875% 8/4/26 | 67,365,000 | 70,800,615 | |

| TOTAL MEXICO | 454,563,007 | ||

| Mongolia - 0.3% | |||

| Trade and Development Bank of Mongolia LLC 9.375% 5/19/20 (Reg. S) | 14,039,000 | 14,764,325 | |

| Morocco - 0.3% | |||

| OCP SA 6.875% 4/25/44 (b) | 13,655,000 | 14,334,336 | |

| Netherlands - 0.4% | |||

| Dilijan Finance BV 12% 7/29/20 (b) | 3,020,000 | 3,242,725 | |

| Kazakhstan Temir Zholy Finance BV 6.95% 7/10/42 (b) | 7,125,000 | 7,714,124 | |

| Metinvest BV: | |||

| 7.75% 4/23/23 (b) | 5,200,000 | 4,882,800 | |

| 8.5% 4/23/26 (b) | 7,820,000 | 7,307,477 | |

| TOTAL NETHERLANDS | 23,147,126 | ||

| Oman - 0.2% | |||

| Oman Sovereign Sukuk SAOC 4.397% 6/1/24 (b) | 13,525,000 | 12,690,508 | |

| Peru - 0.3% | |||

| Petroleos Del Peru Petroperu SA: | |||

| 4.75% 6/19/32 (b) | 8,000,000 | 7,656,000 | |

| 5.625% 6/19/47 (b) | 7,165,000 | 6,967,963 | |

| TOTAL PERU | 14,623,963 | ||

| South Africa - 1.0% | |||

| Eskom Holdings SOC Ltd.: | |||

| 5.75% 1/26/21 (Reg. S) | 15,800,000 | 15,246,242 | |

| 6.75% 8/6/23 (b) | 27,940,000 | 26,682,700 | |

| 7.125% 2/11/25 (b) | 9,485,000 | 9,052,769 | |

| TransCanada PipeLines Ltd. 4% 7/26/22 (b) | 6,625,000 | 6,276,406 | |

| TOTAL SOUTH AFRICA | 57,258,117 | ||

| Trinidad & Tobago - 0.3% | |||

| Petroleum Co. of Trinidad & Tobago Ltd. 9.75% 8/14/19 (b) | 19,009,000 | 19,555,509 | |

| Tunisia - 0.1% | |||

| Banque Centrale de Tunisie 5.75% 1/30/25 (b) | 9,000,000 | 7,915,536 | |

| Turkey - 0.5% | |||

| Export Credit Bank of Turkey 5% 9/23/21 (b) | 5,080,000 | 4,800,600 | |

| Petkim Petrokimya Holding A/S 5.875% 1/26/23 (b) | 6,275,000 | 5,701,791 | |

| Turkiye Ihracat Kredi Bankasi A/S: | |||

| 5.375% 10/24/23 (b) | 5,325,000 | 4,831,117 | |

| 6.125% 5/3/24 (b) | 14,110,000 | 13,058,805 | |

| TOTAL TURKEY | 28,392,313 | ||

| United Arab Emirates - 0.5% | |||

| Abu Dhabi Crude Oil Pipeline 4.6% 11/2/47 (b) | 19,740,000 | 18,081,840 | |

| Oztel Holdings SPC Ltd.: | |||

| 5.625% 10/24/23 (b) | 3,525,000 | 3,458,906 | |

| 6.625% 4/24/28 (b) | 5,220,000 | 4,959,877 | |

| TOTAL UNITED ARAB EMIRATES | 26,500,623 | ||

| United Kingdom - 0.9% | |||

| Biz Finance PLC: | |||

| 9.625% 4/27/22 (b) | 41,880,000 | 41,888,376 | |

| 9.75% 1/22/25 (b) | 3,500,000 | 3,500,000 | |

| Oschadbank Via SSB #1 PLC: | |||

| 9.375% 3/10/23 (b) | 4,045,000 | 4,074,723 | |

| 9.625% 3/20/25 (b) | 2,690,000 | 2,687,149 | |

| TOTAL UNITED KINGDOM | 52,150,248 | ||

| Venezuela - 2.1% | |||

| Petroleos de Venezuela SA: | |||

| 5.375% 4/12/27 (e) | 88,680,000 | 20,396,400 | |

| 5.5% 4/12/37 (e) | 104,390,000 | 23,487,750 | |

| 6% 5/16/24 (b)(e) | 79,210,000 | 16,689,547 | |

| 6% 11/15/26 (Reg. S) (e) | 58,610,000 | 12,308,100 | |

| 8.5% 10/27/20 (Reg. S) (e) | 24,056,250 | 20,748,516 | |

| 9% 11/17/21 (Reg. S) (e) | 24,340,000 | 5,841,600 | |

| 9.75% 5/17/35 (b)(e) | 46,590,000 | 10,985,922 | |

| 12.75% 2/17/22 (b)(e) | 28,610,000 | 7,352,770 | |

| TOTAL VENEZUELA | 117,810,605 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $1,350,888,628) | 1,229,525,399 | ||

| Government Obligations - 70.1% | |||

| Angola - 0.5% | |||

| Angola Republic: | |||

| 8.25% 5/9/28 (b) | 13,105,000 | 13,109,613 | |

| 9.375% 5/8/48 (b) | 7,995,000 | 8,061,838 | |

| 9.5% 11/12/25 (b) | 5,685,000 | 6,199,890 | |

| TOTAL ANGOLA | 27,371,341 | ||

| Argentina - 5.0% | |||

| Argentine Republic: | |||

| 5.875% 1/11/28 | 33,510,000 | 27,226,875 | |

| 6.625% 7/6/28 | 14,945,000 | 12,591,163 | |

| 6.875% 4/22/21 | 13,000,000 | 12,805,000 | |

| 6.875% 1/26/27 | 62,065,000 | 54,617,200 | |

| 7.125% 6/28/2117 | 22,570,000 | 17,337,146 | |

| 7.125% 7/6/36 | 22,755,000 | 18,260,888 | |

| 7.5% 4/22/26 | 115,265,000 | 106,331,963 | |

| 8.28% 12/31/33 | 34,356,941 | 32,123,740 | |

| TOTAL ARGENTINA | 281,293,975 | ||

| Armenia - 0.4% | |||

| Republic of Armenia: | |||

| 6% 9/30/20 (b) | 15,675,000 | 16,007,310 | |

| 7.15% 3/26/25 (b) | 5,308,000 | 5,549,514 | |

| TOTAL ARMENIA | 21,556,824 | ||

| Belarus - 0.3% | |||

| Belarus Republic: | |||

| 6.875% 2/28/23 (b) | 8,150,000 | 8,426,693 | |

| 7.625% 6/29/27 (b) | 5,400,000 | 5,637,330 | |

| TOTAL BELARUS | 14,064,023 | ||

| Bolivia - 0.2% | |||

| Plurinational State of Bolivia 4.5% 3/20/28 (b) | 9,850,000 | 8,520,250 | |

| Brazil - 3.2% | |||

| Brazilian Federative Republic: | |||

| 4.25% 1/7/25 | 25,090,000 | 23,710,050 | |

| 4.625% 1/13/28 | 20,125,000 | 18,162,813 | |

| 5% 1/27/45 | 22,095,000 | 17,488,413 | |

| 5.625% 1/7/41 | 17,755,000 | 15,420,218 | |

| 5.625% 2/21/47 | 11,025,000 | 9,354,713 | |

| 6% 4/7/26 | 14,675,000 | 14,997,850 | |

| 7.125% 1/20/37 | 13,270,000 | 13,966,675 | |

| 8.25% 1/20/34 | 36,920,000 | 42,107,260 | |

| 10.125% 5/15/27 | 9,232,000 | 11,978,520 | |

| 12.25% 3/6/30 | 9,165,000 | 13,793,325 | |

| TOTAL BRAZIL | 180,979,837 | ||

| Cameroon - 0.5% | |||

| Cameroon Republic 9.5% 11/19/25 (b) | 25,940,000 | 27,287,220 | |

| Costa Rica - 0.5% | |||

| Costa Rican Republic: | |||

| 4.25% 1/26/23 (b) | 7,115,000 | 6,732,925 | |

| 4.375% 4/30/25 (b) | 4,210,000 | 3,888,188 | |

| 5.625% 4/30/43 (b) | 3,430,000 | 2,902,706 | |

| 7% 4/4/44 (b) | 6,650,000 | 6,483,750 | |

| 7.158% 3/12/45 (b) | 6,311,000 | 6,232,113 | |

| TOTAL COSTA RICA | 26,239,682 | ||

| Dominican Republic - 1.3% | |||

| Dominican Republic: | |||

| 5.5% 1/27/25 (b) | 8,500,000 | 8,434,720 | |

| 5.875% 4/18/24 (b) | 5,530,000 | 5,658,407 | |

| 5.95% 1/25/27 (b) | 16,175,000 | 15,972,813 | |

| 6.6% 1/28/24 (b) | 5,105,000 | 5,352,286 | |

| 6.85% 1/27/45 (b) | 11,510,000 | 11,391,217 | |

| 6.875% 1/29/26 (b) | 13,155,000 | 13,935,749 | |

| 7.45% 4/30/44 (b) | 10,420,000 | 10,810,750 | |

| TOTAL DOMINICAN REPUBLIC | 71,555,942 | ||

| Ecuador - 1.8% | |||

| Ecuador Republic: | |||

| 7.875% 1/23/28 (b) | 8,365,000 | 7,007,361 | |

| 7.95% 6/20/24 (b) | 19,825,000 | 17,499,528 | |

| 8.75% 6/2/23 (b) | 15,010,000 | 14,059,867 | |

| 8.875% 10/23/27 (b) | 16,185,000 | 14,302,685 | |

| 9.625% 6/2/27 (b) | 6,385,000 | 5,929,750 | |

| 9.65% 12/13/26 (b) | 14,975,000 | 14,027,083 | |

| 10.5% 3/24/20 (b) | 11,960,000 | 12,248,834 | |

| 10.75% 3/28/22 (b) | 14,625,000 | 15,015,488 | |

| TOTAL ECUADOR | 100,090,596 | ||

| Egypt - 3.1% | |||

| Arab Republic of Egypt: | |||

| yield at date of purchase 17.4007% to 18.6494% 9/11/18 to 12/18/18 | EGP | 266,475,000 | 13,808,903 |

| 5.577% 2/21/23 (b) | 41,860,000 | 39,662,350 | |

| 6.125% 1/31/22 (b) | 25,020,000 | 24,595,961 | |

| 6.875% 4/30/40 (b) | 4,830,000 | 4,108,736 | |

| 7.5% 1/31/27 (b) | 37,000,000 | 36,371,740 | |

| 7.903% 2/21/48 (b) | 20,755,000 | 18,883,729 | |

| 8.5% 1/31/47 (b) | 34,605,000 | 33,484,490 | |

| TOTAL EGYPT | 170,915,909 | ||

| El Salvador - 1.4% | |||

| El Salvador Republic: | |||

| 5.875% 1/30/25 (Reg.S) | 9,990,000 | 9,339,551 | |

| 6.375% 1/18/27 (b) | 7,905,000 | 7,371,413 | |

| 7.375% 12/1/19 | 8,555,000 | 8,736,879 | |

| 7.625% 2/1/41 (b) | 11,555,000 | 11,197,142 | |

| 7.65% 6/15/35 (Reg. S) | 22,020,000 | 21,528,514 | |

| 7.75% 1/24/23 (Reg. S) | 3,505,000 | 3,670,997 | |

| 8.25% 4/10/32 (Reg. S) | 2,570,000 | 2,645,918 | |

| 8.625% 2/28/29 (b) | 15,360,000 | 16,435,200 | |

| TOTAL EL SALVADOR | 80,925,614 | ||

| Ethiopia - 0.3% | |||

| Federal Democratic Republic of Ethiopia 6.625% 12/11/24 (b) | 15,232,000 | 14,892,326 | |

| Gabon - 0.3% | |||

| Gabonese Republic: | |||

| 6.375% 12/12/24 (b) | 11,585,000 | 10,347,305 | |

| 6.95% 6/16/25 (b) | 7,125,000 | 6,431,453 | |

| TOTAL GABON | 16,778,758 | ||

| Ghana - 1.6% | |||

| Ghana Republic: | |||

| 7.625% 5/16/29 (b) | 10,400,000 | 10,153,000 | |

| 7.875% 8/7/23 (Reg.S) | 30,155,000 | 30,862,135 | |

| 8.125% 1/18/26 (b) | 14,550,000 | 14,913,750 | |

| 8.627% 6/16/49 (b) | 7,800,000 | 7,589,556 | |

| 10.75% 10/14/30 (b) | 23,425,000 | 28,421,553 | |

| TOTAL GHANA | 91,939,994 | ||

| Guatemala - 0.2% | |||

| Guatemalan Republic: | |||

| 4.375% 6/5/27 (b) | 7,560,000 | 7,011,900 | |

| 4.5% 5/3/26 (b) | 7,200,000 | 6,876,000 | |

| TOTAL GUATEMALA | 13,887,900 | ||

| Honduras - 0.2% | |||

| Republic of Honduras 6.25% 1/19/27 | 13,340,000 | 13,352,006 | |

| Indonesia - 3.0% | |||

| Indonesian Republic: | |||

| 3.5% 1/11/28 | 13,660,000 | 12,614,709 | |

| 3.85% 7/18/27 (b) | 21,620,000 | 20,512,710 | |

| 4.35% 1/11/48 | 12,015,000 | 10,771,279 | |

| 4.75% 1/8/26 (b) | 7,340,000 | 7,438,973 | |

| 4.75% 7/18/47 (b) | 5,700,000 | 5,382,641 | |

| 5.875% 1/15/24 (b) | 8,545,000 | 9,149,935 | |

| 6.625% 2/17/37 | 12,425,000 | 14,254,146 | |

| 7.75% 1/17/38 (b) | 24,440,000 | 31,391,518 | |

| 8.5% 10/12/35 (b) | 25,765,000 | 34,661,371 | |

| Perusahaan Penerbit SBSN: | |||

| 3.75% 3/1/23 (b) | 10,690,000 | 10,467,007 | |

| 4.4% 3/1/28 (b) | 10,690,000 | 10,433,440 | |

| TOTAL INDONESIA | 167,077,729 | ||

| Iraq - 1.3% | |||

| Republic of Iraq: | |||

| 5.8% 1/15/28 (Reg. S) | 69,590,000 | 62,325,082 | |

| 6.752% 3/9/23 (b) | 11,430,000 | 10,964,113 | |

| TOTAL IRAQ | 73,289,195 | ||

| Ivory Coast - 0.6% | |||

| Ivory Coast 5.75% 12/31/32 | 39,084,255 | 36,195,147 | |

| Jamaica - 0.4% | |||

| Jamaican Government: | |||

| 6.75% 4/28/28 | 7,755,000 | 8,294,593 | |

| 7.875% 7/28/45 | 3,020,000 | 3,344,650 | |

| 8% 3/15/39 | 9,448,000 | 10,559,085 | |

| TOTAL JAMAICA | 22,198,328 | ||

| Jordan - 1.4% | |||

| Jordanian Kingdom: | |||

| 5.75% 1/31/27 (b) | 10,685,000 | 9,911,620 | |

| 6.125% 1/29/26 (b) | 27,920,000 | 26,975,020 | |

| 7.375% 10/10/47 (b) | 46,975,000 | 43,013,035 | |

| TOTAL JORDAN | 79,899,675 | ||

| Kenya - 0.6% | |||

| Republic of Kenya: | |||

| 6.875% 6/24/24 (b) | 16,705,000 | 16,478,848 | |

| 7.25% 2/28/28 (b) | 8,955,000 | 8,597,104 | |

| 8.25% 2/28/48 (b) | 7,110,000 | 6,657,377 | |

| TOTAL KENYA | 31,733,329 | ||

| Kuwait - 1.6% | |||

| State of Kuwait 3.5% 3/20/27 (b) | 94,575,000 | 92,061,197 | |

| Lebanon - 5.4% | |||

| Lebanese Republic: | |||

| 5.15% 11/12/18 | 21,050,000 | 20,978,430 | |

| 5.45% 11/28/19 | 107,445,000 | 103,012,894 | |

| 6% 5/20/19 | 44,810,000 | 43,929,573 | |

| 6% 1/27/23 | 10,765,000 | 9,044,753 | |

| 6.1% 10/4/22 | 58,750,000 | 50,385,175 | |

| 6.375% 3/9/20 | 29,395,000 | 28,143,949 | |

| 6.6% 11/27/26 | 18,665,000 | 14,652,025 | |

| 6.65% 2/26/30 (Reg. S) | 9,110,000 | 6,781,302 | |

| 8.25% 4/12/21 (Reg.S) | 24,550,000 | 23,396,150 | |

| TOTAL LEBANON | 300,324,251 | ||

| Mexico - 0.5% | |||

| United Mexican States 7.5% 6/3/27 | MXN | 575,105,000 | 28,782,687 |

| Mongolia - 0.2% | |||

| Mongolian People's Republic: | |||

| 8.75% 3/9/24 (b) | 6,680,000 | 7,158,575 | |

| 10.875% 4/6/21 (b) | 3,905,000 | 4,351,728 | |

| TOTAL MONGOLIA | 11,510,303 | ||

| Namibia - 0.1% | |||

| Republic of Namibia 5.25% 10/29/25 (b) | 8,165,000 | 7,522,219 | |

| Nigeria - 1.0% | |||

| Republic of Nigeria: | |||

| yield at date of purchase 0% 11/22/18 (f) | NGN | 532,960,000 | 1,401,907 |

| yield at date of purchase 0% 12/6/18 (f) | NGN | 5,603,095,000 | 14,664,532 |

| 6.5% 11/28/27 (b) | 14,200,000 | 13,195,662 | |

| 7.143% 2/23/30 (b) | 6,390,000 | 6,027,840 | |

| 7.696% 2/23/38 (b) | 9,055,000 | 8,554,802 | |

| 7.875% 2/16/32 (b) | 11,905,000 | 11,672,853 | |

| TOTAL NIGERIA | 55,517,596 | ||

| Oman - 1.8% | |||

| Sultanate of Oman: | |||

| 4.75% 6/15/26 (b) | 14,995,000 | 13,741,118 | |

| 5.375% 3/8/27 (b) | 14,850,000 | 13,985,671 | |

| 5.625% 1/17/28 (b) | 13,370,000 | 12,584,513 | |

| 6.5% 3/8/47 (b) | 39,160,000 | 35,049,766 | |

| 6.75% 1/17/48 (b) | 28,910,000 | 26,163,550 | |

| TOTAL OMAN | 101,524,618 | ||

| Pakistan - 0.8% | |||

| Islamic Republic of Pakistan: | |||

| 6.75% 12/3/19 (b) | 11,330,000 | 11,091,424 | |

| 6.875% 12/5/27 (b) | 10,130,000 | 8,775,822 | |

| 8.25% 4/15/24 (b) | 15,605,000 | 14,896,876 | |

| 8.25% 9/30/25 (b) | 7,965,000 | 7,595,846 | |

| TOTAL PAKISTAN | 42,359,968 | ||

| Panama - 0.3% | |||

| Panamanian Republic: | |||

| 8.875% 9/30/27 | 5,610,000 | 7,531,425 | |

| 9.375% 4/1/29 | 8,030,000 | 11,242,000 | |

| TOTAL PANAMA | 18,773,425 | ||

| Paraguay - 0.4% | |||

| Republic of Paraguay: | |||

| 4.7% 3/27/27 (b) | 5,195,000 | 5,065,125 | |

| 5% 4/15/26 (b) | 5,395,000 | 5,408,488 | |

| 5.6% 3/13/48 (b) | 3,445,000 | 3,341,650 | |

| 6.1% 8/11/44 (b) | 7,400,000 | 7,566,500 | |

| TOTAL PARAGUAY | 21,381,763 | ||

| Qatar - 2.0% | |||

| State of Qatar: | |||

| 2.375% 6/2/21 | 18,920,000 | 18,259,692 | |

| 3.875% 4/23/23 (b) | 22,975,000 | 22,958,274 | |

| 4.5% 4/23/28 (b) | 24,620,000 | 24,846,258 | |

| 5.103% 4/23/48 (b) | 28,450,000 | 28,363,512 | |

| 9.75% 6/15/30 (Reg. S) | 10,327,000 | 15,073,599 | |

| TOTAL QATAR | 109,501,335 | ||

| Russia - 3.8% | |||

| Ministry of Finance Russian Federation: | |||

| 4.75% 5/27/26 (b) | 10,200,000 | 10,210,241 | |

| 4.75% 5/27/26 | 21,000,000 | 21,021,084 | |

| Russian Federation: | |||

| 4.25% 6/23/27 (b) | 25,000,000 | 24,091,750 | |

| 5.25% 6/23/47 (b) | 63,000,000 | 60,669,000 | |

| 5.625% 4/4/42 (b) | 19,845,000 | 20,728,103 | |

| 7.5% 8/18/21 | RUB | 791,800,000 | 12,747,096 |

| 12.75% 6/24/28 (Reg. S) | 16,187,000 | 26,394,846 | |

| Russian Federation Ministry of Finance 4.375% 3/21/29 (b) | 35,400,000 | 34,218,490 | |

| TOTAL RUSSIA | 210,080,610 | ||

| Rwanda - 0.3% | |||

| Rwanda Republic 6.625% 5/2/23 (b) | 16,964,000 | 16,830,086 | |

| Saudi Arabia - 1.7% | |||

| Kingdom of Saudi Arabia: | |||

| 3.625% 3/4/28 (b) | 34,650,000 | 32,947,992 | |

| 4.5% 10/26/46 (b) | 68,325,000 | 63,065,751 | |

| TOTAL SAUDI ARABIA | 96,013,743 | ||

| Senegal - 0.3% | |||

| Republic of Senegal: | |||

| 6.25% 7/30/24 (b) | 3,835,000 | 3,753,790 | |

| 6.25% 5/23/33 (b) | 6,865,000 | 6,084,106 | |

| 6.75% 3/13/48 (b) | 7,050,000 | 6,017,951 | |

| TOTAL SENEGAL | 15,855,847 | ||

| South Africa - 0.9% | |||

| South African Republic: | |||

| 4.3% 10/12/28 | 28,245,000 | 25,161,211 | |

| 5.375% 7/24/44 | 8,110,000 | 7,100,305 | |

| 5.875% 9/16/25 | 18,130,000 | 18,608,632 | |

| TOTAL SOUTH AFRICA | 50,870,148 | ||

| Sri Lanka - 1.1% | |||

| Democratic Socialist Republic of Sri Lanka: | |||

| 5.75% 4/18/23 (b) | 5,310,000 | 5,083,847 | |

| 5.875% 7/25/22 (b) | 4,225,000 | 4,148,198 | |

| 6.2% 5/11/27 (b) | 17,190,000 | 15,686,459 | |

| 6.25% 7/27/21 (b) | 5,125,000 | 5,157,016 | |

| 6.75% 4/18/28 (b) | 5,310,000 | 5,010,787 | |

| 6.825% 7/18/26 (b) | 7,000,000 | 6,703,571 | |

| 6.85% 11/3/25 (b) | 18,250,000 | 17,657,623 | |

| TOTAL SRI LANKA | 59,447,501 | ||

| Suriname - 0.4% | |||

| Republic of Suriname 9.25% 10/26/26 (b) | 24,355,000 | 23,259,025 | |

| Tajikistan - 0.2% | |||

| Tajikistan Republic 7.125% 9/14/27 (b) | 15,345,000 | 13,566,699 | |

| Turkey - 6.3% | |||

| Turkish Republic: | |||

| 4.875% 10/9/26 | 18,605,000 | 16,363,432 | |

| 5.125% 3/25/22 | 22,040,000 | 21,336,131 | |

| 5.125% 2/17/28 | 42,010,000 | 36,980,563 | |

| 5.75% 3/22/24 | 16,995,000 | 16,373,867 | |

| 5.75% 5/11/47 | 27,645,000 | 22,306,198 | |

| 6% 3/25/27 | 42,015,000 | 39,479,647 | |

| 6% 1/14/41 | 19,730,000 | 16,721,254 | |

| 6.25% 9/26/22 | 38,370,000 | 38,479,048 | |

| 6.75% 5/30/40 | 15,570,000 | 14,228,987 | |

| 6.875% 3/17/36 | 34,475,000 | 32,420,980 | |

| 7.25% 3/5/38 | 15,595,000 | 15,220,720 | |

| 7.375% 2/5/25 | 29,925,000 | 30,942,450 | |

| 8% 2/14/34 | 19,460,000 | 20,378,590 | |

| 11.875% 1/15/30 | 9,850,000 | 13,459,730 | |

| 12.4% 3/8/28 | TRY | 65,985,000 | 11,850,109 |

| Turkiye Ihracat Kredi Bankasi A/S 5.375% 2/8/21 (b) | 7,875,000 | 7,661,383 | |

| TOTAL TURKEY | 354,203,089 | ||

| Ukraine - 5.7% | |||

| Ukraine Government: | |||

| 0% 5/31/40 (b)(c) | 40,665,000 | 25,700,280 | |

| 7.375% 9/25/32 (b) | 21,284,000 | 18,235,067 | |

| 7.75% 9/1/20 (b) | 36,074,000 | 35,859,937 | |

| 7.75% 9/1/21 (b) | 70,989,000 | 69,924,165 | |

| 7.75% 9/1/22 (b) | 63,619,000 | 62,109,448 | |

| 7.75% 9/1/23 (b) | 8,809,000 | 8,477,782 | |

| 7.75% 9/1/24 (b) | 55,464,000 | 52,535,501 | |

| 7.75% 9/1/25 (b) | 10,469,000 | 9,800,136 | |

| 7.75% 9/1/26 (b) | 28,039,000 | 25,969,161 | |

| 7.75% 9/1/27 (b) | 10,934,000 | 10,030,961 | |

| TOTAL UKRAINE | 318,642,438 | ||

| United States of America - 5.0% | |||

| U.S. Treasury Bonds: | |||

| 3% 2/15/48 | 9,718,000 | 9,740,777 | |

| 3.125% 5/15/48 | 263,300,000 | 270,365,878 | |

| TOTAL UNITED STATES OF AMERICA | 280,106,655 | ||

| Uruguay - 0.3% | |||

| Uruguay Republic: | |||

| 7.625% 3/21/36 | 5,295,000 | 6,842,464 | |

| 7.875% 1/15/33 pay-in-kind | 6,455,000 | 8,429,262 | |

| TOTAL URUGUAY | 15,271,726 | ||

| Venezuela - 1.4% | |||

| Venezuelan Republic: | |||

| oil recovery warrants 4/15/20 (f)(g) | 458,489 | 687,734 | |

| 6% 12/9/20 (e) | 11,240,000 | 2,950,500 | |

| 7% 3/31/38 (e) | 10,280,000 | 2,762,236 | |

| 7.65% 4/21/25 (e) | 18,830,000 | 5,059,621 | |

| 7.75% 10/13/19 (Reg. S) (e) | 16,120,000 | 4,379,804 | |

| 8.25% 10/13/24 (e) | 16,705,000 | 4,538,749 | |

| 9% 5/7/23 (Reg. S) (e) | 23,495,000 | 6,343,650 | |

| 9.25% 9/15/27 (e) | 28,625,000 | 8,063,663 | |

| 9.25% 5/7/28 (Reg. S) (e) | 37,725,000 | 10,212,158 | |

| 9.375% 1/13/34 (e) | 23,275,000 | 6,719,493 | |

| 11.75% 10/21/26 (Reg. S) (e) | 34,870,000 | 9,892,619 | |

| 11.95% 8/5/31 (Reg. S) (e) | 47,005,000 | 13,335,319 | |

| 12.75% 8/23/22 (e) | 22,610,000 | 6,301,407 | |

| TOTAL VENEZUELA | 81,246,953 | ||

| Vietnam - 0.1% | |||

| Vietnamese Socialist Republic 4.8% 11/19/24 (b) | 6,305,000 | 6,258,633 | |

| Zambia - 0.4% | |||

| Republic of Zambia: | |||

| 5.375% 9/20/22 (b) | 5,105,000 | 4,244,052 | |

| 8.5% 4/14/24 (b) | 4,165,000 | 3,699,653 | |

| 8.97% 7/30/27 (b) | 16,340,000 | 14,423,514 | |

| TOTAL ZAMBIA | 22,367,219 | ||

| TOTAL GOVERNMENT OBLIGATIONS | |||

| (Cost $4,180,726,506) | 3,925,325,334 | ||

| Supranational Obligations - 0.1% | |||

| European Bank for Reconstruction & Development 6% 5/4/20 (Reg. S) (Cost $5,199,869) | INR | 327,200,000 | 4,649,911 |

| Shares | Value | ||

| Common Stocks - 1.9% | |||

| Cayman Islands - 1.5% | |||

| Alibaba Group Holding Ltd. sponsored ADR (h) | 314,000 | 58,256,420 | |

| ENN Energy Holdings Ltd. | 344,000 | 3,382,737 | |

| Geely Automobile Holdings Ltd. | 1,136,000 | 2,946,569 | |

| JD.com, Inc. sponsored ADR (h) | 231,600 | 9,020,820 | |

| Longfor Properties Co. Ltd. | 401,500 | 1,082,355 | |

| New Oriental Education & Technology Group, Inc. sponsored ADR | 34,700 | 3,284,702 | |

| Shenzhou International Group Holdings Ltd. | 115,000 | 1,419,617 | |

| Tencent Holdings Ltd. | 62,300 | 3,128,420 | |

| Wuxi Biologics (Cayman), Inc. | 319,500 | 3,557,194 | |

| TOTAL CAYMAN ISLANDS | 86,078,834 | ||

| China - 0.1% | |||

| Jiangsu Hengrui Medicine Co. Ltd. (A Shares) | 288,730 | 3,303,758 | |

| India - 0.2% | |||

| Avenue Supermarts Ltd. (b)(h) | 27,765 | 602,427 | |

| Godrej Consumer Products Ltd. | 37,589 | 672,989 | |

| HDFC Bank Ltd. sponsored ADR | 13,100 | 1,375,762 | |

| InterGlobe Aviation Ltd. (b) | 55,042 | 875,157 | |

| Kotak Mahindra Bank Ltd. (h) | 175,963 | 3,451,790 | |

| Motherson Sumi Systems Ltd. | 232,563 | 967,144 | |

| Reliance Industries Ltd. | 211,745 | 3,007,763 | |

| TOTAL INDIA | 10,953,032 | ||

| Korea (South) - 0.1% | |||

| NAVER Corp. | 4,474 | 3,063,531 | |

| United States of America - 0.0% | |||

| MercadoLibre, Inc. | 9,100 | 2,720,263 | |

| TOTAL COMMON STOCKS | |||

| (Cost $95,449,213) | 106,119,418 | ||

| Nonconvertible Preferred Stocks - 0.1% | |||

| Brazil - 0.1% | |||

| Petroleo Brasileiro SA - Petrobras sponsored ADR | |||

| (Cost $6,809,484) | 711,500 | 7,136,345 | |

| Investment Companies - 0.3% | |||

| United States of America - 0.3% | |||

| iShares MSCI Emerging Markets Index ETF | |||

| (Cost $14,154,550) | 327,500 | 14,190,575 | |

| Principal Amount(a) | Value | ||

| Preferred Securities - 0.3% | |||

| British Virgin Islands - 0.3% | |||

| Cnrc Capitale Ltd. 3.9% (Reg. S) (c)(i) | 3,275,000 | 3,112,056 | |

| Dianjian Haixing Ltd. 4.05% (Reg. S) (c)(i) | 3,280,000 | 3,297,583 | |

| Dianjian Haiyu Ltd. 3.5%(Reg. S) (c)(i) | 3,830,000 | 3,562,243 | |

| Huaneng Hong Kong Capital Ltd. 3.6% (Reg. S) (c)(i) | 3,220,000 | 2,925,494 | |

| Sinochem Global Capital Co. Ltd. 5% (b)(c)(i) | 4,460,000 | 4,515,091 | |

| TOTAL PREFERRED SECURITIES | |||

| (Cost $17,710,220) | 17,412,467 | ||

| Shares | Value | ||

| Money Market Funds - 4.5% | |||

| Fidelity Cash Central Fund, 1.93% (j) | |||

| (Cost $254,121,563) | 254,087,570 | 254,138,388 | |

| TOTAL INVESTMENT IN SECURITIES - 99.3% | |||

| (Cost $5,925,060,033) | 5,558,497,837 | ||

| NET OTHER ASSETS (LIABILITIES) - 0.7% | 41,967,201 | ||

| NET ASSETS - 100% | $5,600,465,038 |

Currency Abbreviations

EGP – Egyptian pound

INR – Indian rupee

MXN – Mexican peso

NGN – Nigerian naira

RUB – Russian ruble

TRY – Turkish Lira

Security Type Abbreviations

ETF – Exchange-Traded Fund

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Amount is stated in United States dollars unless otherwise noted.

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,603,259,366 or 46.5% of net assets.

(c) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(d) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(e) Non-income producing - Security is in default.

(f) Level 3 security

(g) Quantity represents share amount.

(h) Non-income producing

(i) Security is perpetual in nature with no stated maturity date.

(j) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $3,525,832 |

| Fidelity Securities Lending Cash Central Fund | 4,934 |

| Total | $3,530,766 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2018, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Equities: | ||||

| Consumer Discretionary | $18,241,279 | $18,241,279 | $-- | $-- |

| Consumer Staples | 672,989 | 672,989 | -- | -- |

| Energy | 10,144,108 | 10,144,108 | -- | -- |

| Financials | 4,827,552 | 4,827,552 | -- | -- |

| Health Care | 6,860,952 | 6,860,952 | -- | -- |

| Industrials | 875,157 | 875,157 | -- | -- |

| Information Technology | 67,168,634 | 64,040,214 | 3,128,420 | -- |

| Real Estate | 1,082,355 | 1,082,355 | -- | -- |

| Utilities | 3,382,737 | 3,382,737 | -- | -- |

| Corporate Bonds | 1,229,525,399 | -- | 1,229,525,399 | -- |

| Government Obligations | 3,925,325,334 | -- | 3,908,571,161 | 16,754,173 |

| Supranational Obligations | 4,649,911 | -- | 4,649,911 | -- |

| Investment Companies | 14,190,575 | 14,190,575 | -- | -- |

| Preferred Securities | 17,412,467 | -- | 17,412,467 | -- |

| Money Market Funds | 254,138,388 | 254,138,388 | -- | -- |

| Total Investments in Securities: | $5,558,497,837 | $378,456,306 | $5,163,287,358 | $16,754,173 |

Other Information

The composition of credit quality ratings as a percentage of Total Net Assets is as follows (Unaudited):

| U.S. Government and U.S. Government Agency Obligations | 5.0% |

| AAA,AA,A | 6.7% |

| BBB | 18.2% |

| BB | 16.2% |

| B | 29.9% |

| CCC,CC,C | 8.1% |

| D | 1.4% |

| Not Rated | 7.0% |

| Equities | 2.3% |

| Short-Term Investments and Net Other Assets | 5.2% |

| 100.0% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| June 30, 2018 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $5,670,938,470) | $5,304,359,449 | |

| Fidelity Central Funds (cost $254,121,563) | 254,138,388 | |

| Total Investment in Securities (cost $5,925,060,033) | $5,558,497,837 | |

| Foreign currency held at value (cost $109,851) | 106,202 | |

| Receivable for fund shares sold | 2,852,481 | |

| Dividends receivable | 149,248 | |

| Interest receivable | 85,155,743 | |

| Distributions receivable from Fidelity Central Funds | 636,191 | |

| Other receivables | 42,840 | |

| Total assets | 5,647,440,542 | |

| Liabilities | ||

| Payable for investments purchased | $29,746,578 | |

| Payable for fund shares redeemed | 10,257,490 | |

| Distributions payable | 2,902,928 | |

| Accrued management fee | 3,116,226 | |

| Other affiliated payables | 793,301 | |

| Other payables and accrued expenses | 158,981 | |

| Total liabilities | 46,975,504 | |

| Net Assets | $5,600,465,038 | |

| Net Assets consist of: | ||

| Paid in capital | $5,991,565,744 | |

| Undistributed net investment income | 62,683,045 | |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (87,205,312) | |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | (366,578,439) | |

| Net Assets, for 375,754,150 shares outstanding | $5,600,465,038 | |

| Net Asset Value, offering price and redemption price per share ($5,600,465,038 ÷ 375,754,150 shares) | $14.90 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended June 30, 2018 (Unaudited) | ||

| Investment Income | ||

| Dividends | $540,942 | |

| Interest | 145,587,324 | |

| Income from Fidelity Central Funds | 3,530,766 | |

| Income before foreign taxes withheld | 149,659,032 | |

| Less foreign taxes withheld | (1,522) | |

| Total income | 149,657,510 | |

| Expenses | ||

| Management fee | $20,213,861 | |

| Transfer agent fees | 4,220,282 | |

| Accounting and security lending fees | 610,074 | |

| Custodian fees and expenses | 142,959 | |

| Independent trustees' fees and expenses | 13,930 | |

| Registration fees | 84,086 | |

| Audit | 57,850 | |

| Legal | 11,965 | |

| Miscellaneous | 24,095 | |

| Total expenses before reductions | 25,379,102 | |

| Expense reductions | (126,334) | |

| Total expenses after reductions | 25,252,768 | |

| Net investment income (loss) | 124,404,742 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (85,063,315) | |

| Fidelity Central Funds | 936 | |

| Foreign currency transactions | 725,363 | |

| Total net realized gain (loss) | (84,337,016) | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (419,161,786) | |

| Assets and liabilities in foreign currencies | 22,524 | |

| Total change in net unrealized appreciation (depreciation) | (419,139,262) | |

| Net gain (loss) | (503,476,278) | |

| Net increase (decrease) in net assets resulting from operations | $(379,071,536) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended June 30, 2018 (Unaudited) | Year ended December 31, 2017 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $124,404,742 | $325,865,652 |

| Net realized gain (loss) | (84,337,016) | 52,117,794 |

| Change in net unrealized appreciation (depreciation) | (419,139,262) | 151,277,030 |

| Net increase (decrease) in net assets resulting from operations | (379,071,536) | 529,260,476 |

| Distributions to shareholders from net investment income | (118,531,554) | (309,887,647) |

| Distributions to shareholders from net realized gain | (17,632,481) | (29,051,448) |

| Total distributions | (136,164,035) | (338,939,095) |

| Share transactions | ||

| Proceeds from sales of shares | 659,855,130 | 2,112,459,823 |

| Reinvestment of distributions | 117,885,328 | 296,799,094 |

| Cost of shares redeemed | (1,118,277,955) | (970,288,976) |

| Net increase (decrease) in net assets resulting from share transactions | (340,537,497) | 1,438,969,941 |

| Redemption fees | – | 377,921 |

| Total increase (decrease) in net assets | (855,773,068) | 1,629,669,243 |

| Net Assets | ||

| Beginning of period | 6,456,238,106 | 4,826,568,863 |

| End of period | $5,600,465,038 | $6,456,238,106 |

| Other Information | ||

| Undistributed net investment income end of period | $62,683,045 | $56,809,857 |

| Shares | ||

| Sold | 41,697,135 | 130,294,261 |

| Issued in reinvestment of distributions | 7,560,710 | 18,274,331 |

| Redeemed | (71,640,080) | (59,814,089) |

| Net increase (decrease) | (22,382,235) | 88,754,503 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity New Markets Income Fund

| Six months ended (Unaudited) June 30, | Years endedDecember 31, | |||||

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $16.22 | $15.60 | $14.52 | $15.26 | $15.59 | $17.80 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .317 | .907 | .983 | .896 | .859 | .828 |

| Net realized and unrealized gain (loss) | (1.291) | .649 | 1.108 | (.850) | (.173) | (1.952) |

| Total from investment operations | (.974) | 1.556 | 2.091 | .046 | .686 | (1.124) |

| Distributions from net investment income | (.302) | (.863) | (.874) | (.787) | (.767) | (.754) |

| Distributions from net realized gain | (.044) | (.074) | (.138) | – | (.251) | (.336) |

| Total distributions | (.346) | (.937) | (1.012) | (.787) | (1.018) | (1.090) |

| Redemption fees added to paid in capitalA | – | .001 | .001 | .001 | .002 | .004 |

| Net asset value, end of period | $14.90 | $16.22 | $15.60 | $14.52 | $15.26 | $15.59 |

| Total ReturnB,C | (6.08)% | 10.14% | 14.70% | .24% | 4.32% | (6.41)% |

| Ratios to Average Net AssetsD,E | ||||||

| Expenses before reductions | .83%F | .82% | .83% | .84% | .84% | .84% |

| Expenses net of fee waivers, if any | .83%F | .82% | .83% | .84% | .84% | .84% |

| Expenses net of all reductions | .83%F | .82% | .83% | .84% | .84% | .84% |

| Net investment income (loss) | 4.07%F | 5.60% | 6.37% | 5.93% | 5.31% | 4.96% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $5,600,465 | $6,456,238 | $4,826,569 | $3,990,397 | $4,525,377 | $4,518,454 |

| Portfolio turnover rateG | 68%F | 54% | 82% | 110% | 146% | 131% |

A Calculated based on average shares outstanding during the period.

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

F Annualized

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2018

1. Organization.

Fidelity New Markets Income Fund (the Fund) is a non-diversified fund of Fidelity Summer Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, foreign government and government agency obligations, preferred securities, supranational obligations and U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. For foreign debt securities, when significant market or security specific events arise, valuations may be determined in good faith in accordance with procedures adopted by the Board. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

ETFs are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of June 30, 2018 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Paid in Kind (PIK) income is recorded at the fair market value of the securities received. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, market discount, deferred trustees compensation and losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $116,909,345 |

| Gross unrealized depreciation | (440,290,905) |

| Net unrealized appreciation (depreciation) | $(323,381,560) |

| Tax cost | $5,881,879,397 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

New Accounting Pronouncement. In March 2017, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU), ASU 2017-08, which amends the amortization period for certain callable debt securities that are held at a premium. The amendment requires the premium to be amortized to the earliest call date. The amendments do not require an accounting change for securities held at a discount. The ASU is effective for annual periods beginning after December 15, 2018. Management is currently evaluating the potential impact of these changes to the financial statements.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $1,541,738,852 and $1,884,290,735, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .55% of the Fund's average net assets and an annualized group fee rate that averaged .11% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annualized management fee rate was .66% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing and shareholder servicing agent. FIIOC receives account fees and asset-based fees that vary according to account size and type of account. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annualized rate of .14% of average net assets.

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions. For the period, the fees were equivalent to an annualized rate of .02%.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $2,520 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $9,079 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. At period end, there were no security loans outstanding. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $4,934. During the period, there were no securities loaned to FCM.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $105,886 for the period. Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $1,244.

In addition, during the period the investment adviser reimbursed and/or waived a portion of operating expenses in the amount of $19,204.

9. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

10. Credit Risk.

The Fund's relatively large investment in countries with limited or developing capital markets may involve greater risks than investments in more developed markets and the prices of such investments may be volatile. The yields of emerging market debt obligations reflect, among other things, perceived credit risk. The consequences of political, social or economic changes in these markets may have disruptive effects on the market prices of the Fund's investments and the income they generate, as well as the Fund's ability to repatriate such amounts.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2018 to June 30, 2018).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized Expense Ratio-A | Beginning Account Value January 1, 2018 | Ending Account Value June 30, 2018 | Expenses Paid During Period-B January 1, 2018 to June 30, 2018 |

|

| Actual | .83% | $1,000.00 | $939.20 | $3.99 |

| Hypothetical-C | $1,000.00 | $1,020.68 | $4.16 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

C 5% return per year before expenses

Corporate Headquarters

245 Summer St.

Boston, MA 02210

www.fidelity.com

NMI-SANN-0818

1.705564.120

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Summer Street Trust’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Summer Street Trust’s (the “Trust”) disclosure controls and procedures (as

defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 13.

Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. |

(a) | (3) | Not applicable. |

(b) | Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Summer Street Trust

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | August 23, 2018 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | August 23, 2018 |

By: | /s/John J. Burke III |

John J. Burke III | |

Chief Financial Officer | |

Date: | August 23, 2018 |