UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File Number: 000-10822

One Horizon Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 46-3561419 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| T1-017 Tierney Building, University of Limerick, Limerick, Ireland. |

||

| (Address of principal executive offices) | (Zip Code) |

+353-61-518477

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | þ |

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of November 7, 2016, 35,809,348 shares of the registrant’s common stock, par value $0.0001 per share, were outstanding.

TABLE OF CONTENTS

| Part I – FINANCIAL INFORMATION | |||

| Item 1. | Financial Statements | 4 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 26 | |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 32 | |

| Item 4. | Controls and Procedures | 32 | |

| Part II – OTHER INFORMATION | |||

| Item 1. | Legal Proceedings | 33 | |

| Item 1A. | Risk Factors | 33 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 33 | |

| Item 3. | Defaults Upon Senior Securities | 33 | |

| Item 4. | Mine Safety Disclosures | 33 | |

| Item 5. | Other Information | 33 | |

| Item 6. | Exhibits | 33 | |

| SIGNATURES | 34 | ||

| 2 |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

The statements made in this Report, and in other materials that the Company has filed or may file with the Securities and Exchange Commission, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as any statements regarding the evaluation of strategic alternatives. These forward-looking statements are based on the current plans and expectations of management, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Among these risks and uncertainties are the competition we face; our ability to adapt to rapid changes in the market for voice and messaging services; our ability to retain customers and attract new customers; our ability to establish and expand strategic alliances; governmental regulation and related actions and taxes in our international operations; increased market and competitive risks, including currency restrictions, in our international operations; risks related to the acquisition or integration of future businesses or joint ventures; our ability to obtain or maintain relevant intellectual property rights; intellectual property and other litigation that may be brought against us; failure to protect our trademarks and internally developed software; security breaches and other compromises of information security; our dependence on third party facilities, equipment, systems and services; system disruptions or flaws in our technology and systems; uncertainties relating to regulation of VoIP services; liability under anti-corruption laws; results of regulatory inquiries into our business practices; fraudulent use of our name or services; our ability to maintain data security; our dependence upon key personnel; our dependence on our customers' existing broadband connections; differences between our service and traditional phone services; our ability to obtain additional financing if required; our early history of net losses and our ability to maintain consistent profitability in the future. These and other matters the Company discusses in this Report, or in the documents it incorporates by reference into this Report, may cause actual results to differ from those the Company describes. The Company assumes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

| 3 |

PART I – FINANCIAL INFORMATION

ONE HORIZON GROUP, INC.

Condensed Consolidated Balance Sheets

September 30, 2016 and December 31, 2015

(in thousands, except share data)

(unaudited)

| September 30, | December 31, | |||||||

| 2016 | 2015 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 304 | $ | 1,772 | ||||

| Accounts receivable, net | 3,037 | 3,560 | ||||||

| Other assets | 499 | 402 | ||||||

| Total current assets | 3,840 | 5,734 | ||||||

| Property and equipment, net | 58 | 96 | ||||||

| Intangible assets, net | 8,877 | 9,823 | ||||||

| Investment | 18 | 18 | ||||||

| Total assets | $ | 12,793 | $ | 15,671 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 202 | $ | 223 | ||||

| Accrued expenses | 172 | 220 | ||||||

| Accrued compensation | 185 | 18 | ||||||

| Income taxes | 90 | 90 | ||||||

| Current portion of long-term debt | - | 5 | ||||||

| Total current liabilities | 649 | 556 | ||||||

| Long-term liabilities | ||||||||

| Amount due to related parties | 2,343 | 2,354 | ||||||

| Convertible debenture | 2,960 | 2,636 | ||||||

| Deferred income taxes | 183 | 215 | ||||||

| Mandatorily redeemable preferred shares | 72 | 73 | ||||||

| Total liabilities | 6,207 | 5,834 | ||||||

| Stockholders’ equity | ||||||||

| Preferred stock: | ||||||||

| $0.0001 par value, authorized 50,000,000; issued and outstanding 170,940 shares | 1 | 1 | ||||||

| Common stock: | ||||||||

| $0.0001 par value, authorized 200,000,000 shares issued and outstanding 35,545,696 shares (December 2015 - 35,147,283) | 3 | 3 | ||||||

| Additional paid-in capital | 36,892 | 36,070 | ||||||

| Retained Earnings (Deficit) | (30,420 | ) | (26,201 | ) | ||||

| Accumulated other comprehensive income | 110 | (36 | ) | |||||

| Total stockholders' equity | 6,586 | 9,837 | ||||||

| Total liabilities and equity | $ | 12,793 | $ | 15,671 | ||||

See accompanying notes to condensed consolidated financial statements.

| 4 |

ONE HORIZON GROUP, INC.

Condensed Consolidated Statements of Operations

For the three and nine months ended September 30, 2016 and 2015

(in thousands, except per share data)

(unaudited)

| Three Months ended September 30, | Nine Months ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Revenue | $ | 287 | $ | 319 | $ | 1,262 | $ | 1,172 | ||||||||

| Cost of revenue - Hardware, calls and network charges | 12 | - | 87 | 108 | ||||||||||||

| - Amortization of software development costs | 513 | 483 | 1,518 | 1,575 | ||||||||||||

| 525 | 483 | 1,605 | 1,683 | |||||||||||||

| Gross margin | (238 | ) | (164 | ) | (343 | ) | (511 | ) | ||||||||

| Expenses: | ||||||||||||||||

| General and administrative | 881 | 1,182 | 2,723 | 2,674 | ||||||||||||

| Depreciation | 15 | 16 | 45 | 52 | ||||||||||||

| Research and development | 191 | 144 | 565 | 466 | ||||||||||||

| 1,087 | 1,342 | 3,333 | 3,192 | |||||||||||||

| Loss from operations | (1,325 | ) | (1,506 | ) | (3,676 | ) | (3,703 | ) | ||||||||

| Other income and expense: | ||||||||||||||||

| Interest expense | (178 | ) | (178 | ) | (534 | ) | (552 | ) | ||||||||

| Foreign exchange | - | 67 | 9 | 76 | ||||||||||||

| (178 | ) | (111 | ) | (525 | ) | (476 | ) | |||||||||

| Loss before income taxes | (1,503 | ) | (1,617 | ) | (4,201 | ) | (4,179 | ) | ||||||||

| Income taxes (recovery) – deferred | (10 | ) | (-) | (32 | ) | (45 | ) | |||||||||

| Net loss for the period | (1,493 | ) | (1,617 | ) | (4,169 | ) | (4,134 | ) | ||||||||

| Net loss attributable to the non-controlling interest | - | (14 | ) | - | (50 | ) | ||||||||||

| Net loss for the period attributable to One Horizon Group, Inc. | (1,493 | ) | (1,603 | ) | (4,169 | ) | (4,084 | ) | ||||||||

| Less: Preferred Dividends | (-) | (25 | ) | (50 | ) | (75 | ) | |||||||||

| Net loss attributable to common stockholders | $ | (1,493 | ) | $ | (1,628 | ) | $ | (4,219 | ) | $ | (4,159 | ) | ||||

| Earnings per share attributable to One Horizon Group, Inc. stockholders | ||||||||||||||||

| Basic and diluted net loss per share | $ | (0.04 | ) | $ | (0.05 | ) | $ | (0.12 | ) | $ | (0.12 | ) | ||||

| Weighted average number of shares (in thousands) outstanding | ||||||||||||||||

| Basic and diluted | 35,185 | 34,628 | 35,166 | 33,608 | ||||||||||||

See accompanying notes to condensed consolidated financial statements.

| 5 |

ONE HORIZON GROUP, INC.

Condensed Consolidated Statements of Comprehensive Income

For the three and nine months ended September 30, 2016 and 2015

(in thousands)

(unaudited)

| Three Months ended September 30, | Nine Months ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Net loss | $ | (1,493 | ) | $ | (1,617 | ) | $ | (4,169 | ) | $ | (4,134 | ) | ||||

| Other comprehensive income: | ||||||||||||||||

| Foreign currency translation adjustment gain (loss) | 320 | (450 | ) | 146 | 193 | |||||||||||

| Comprehensive loss | (1,173 | ) | (2,067 | ) | (4,023 | ) | (3,941 | ) | ||||||||

| Comprehensive loss attributable to the non-controlling interest | - | (14 | ) | - | (50 | ) | ||||||||||

| Total comprehensive loss | $ | (1,173 | ) | $ | (2,053 | ) | $ | (4,023 | ) | $ | (3,891 | ) | ||||

See accompanying notes to condensed consolidated financial statements

| 6 |

ONE HORIZON GROUP, INC.

Consolidated Statement of Equity

For the nine months ended September 30, 2016

(in thousands)

(unaudited)

| Preferred Stock | Common Stock | Accumulated Other | ||||||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Shares | Amount | Additional Paid-in Capital | Accumulated (Deficit) | Comprehensive Income (Loss) | Total Equity | |||||||||||||||||||||||||

| Balance December 31, 2015 | 171 | $ | 1 | 35,148 | $ | 3 | $ | 36,070 | $ | (26,201 | ) | $ | (36 | ) | $ | 9,837 | ||||||||||||||||

| Net loss | (4,169 | ) | (4,169 | ) | ||||||||||||||||||||||||||||

| Foreign currency translations | 146 | 146 | ||||||||||||||||||||||||||||||

| Preferred dividends | (50 | ) | (50 | ) | ||||||||||||||||||||||||||||

| Issuance of common stock for cash | 198 | 125 | 125 | |||||||||||||||||||||||||||||

| Issuance of common shares for services | 200 | 134 | 134 | |||||||||||||||||||||||||||||

| Options issued for services | 563 | 563 | ||||||||||||||||||||||||||||||

| Balance September 30, 2016 | 171 | $ | 1 | 35,546 | $ | 3 | $ | 36,892 | $ | (30,420 | ) | $ | 110 | $ | 6,586 | |||||||||||||||||

See accompanying notes to condensed consolidated financial statements

| 7 |

ONE HORIZON GROUP, INC.

Condensed Consolidated Statements of Cash Flows

For the nine months ended September 30, 2016 and 2015

(in thousands)

(unaudited)

| 2016 | 2015 | |||||||

| Operating activities: | ||||||||

| Net loss | $ | (4,169 | ) | $ | (4,084 | ) | ||

| Adjustment to reconcile net loss to net cash flows from operating activities: | ||||||||

| Depreciation of property and equipment | 45 | 52 | ||||||

| Amortization of intangible assets | 1,518 | 1,575 | ||||||

| Increase in allowance for doubtful accounts | 300 | 200 | ||||||

| Amortization of debt issue costs | 99 | 99 | ||||||

| Amortization of beneficial conversion feature | 75 | 76 | ||||||

| Amortization of debt discount | 150 | 150 | ||||||

| Amortization of deferred compensation | - | 161 | ||||||

| Amortization of shares issued for services | 25 | - | ||||||

| Options issued for services | 563 | 462 | ||||||

| Net loss attributable to non-controlling interest | - | (50 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 223 | (66 | ) | |||||

| Other assets | 12 | 89 | ||||||

| Accounts payable and accrued expenses | 98 | (349 | ) | |||||

| Deferred income taxes | (32 | ) | (45 | ) | ||||

| Net cash flows from operating activities | (1,093 | ) | (1,730 | ) | ||||

| Investing activities: | ||||||||

| Acquisition of intangible assets | (333 | ) | (844 | ) | ||||

| Acquisition of property and equipment | (8 | ) | (1 | ) | ||||

| Proceeds from disposition of property and equipment | - | 32 | ||||||

| Net cash flows from investing activities | (341 | ) | (813 | ) | ||||

| Financing activities: | ||||||||

| Decrease in long-term borrowing, net | (5 | ) | (174 | ) | ||||

| Proceeds from issuance of common stock, net of costs | 125 | 2,875 | ||||||

| Repayments to related parties, net | (11 | ) | (677 | ) | ||||

| Dividends paid | (50 | ) | (75 | ) | ||||

| Net cash flows from financing activities | 59 | 1,949 | ||||||

| Foreign exchange effect on cash | (93 | ) | 27 | |||||

| Decrease in cash during the period | (1,468 | ) | (567 | ) | ||||

| Cash at beginning of the period | 1,772 | 3,172 | ||||||

| Cash at end of the period | $ | 304 | $ | 2,605 | ||||

See accompanying notes to condensed consolidated financial statements.

| 8 |

ONE HORIZON GROUP, INC.

Condensed Consolidated Statements of Cash Flows (continued)

For the nine months ended September 30, 2016 and 2015

(in thousands)

(unaudited)

Supplementary Information:

| 2016 | 2015 | |||||||

| Cash paid for interest | $ | 209 | $ | 146 | ||||

| Non-cash investing and financing activities: | ||||||||

| Common stock issued for services provided | $ | 134 | $ | - | ||||

See accompanying notes to condensed consolidated financial statements.

| 9 |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2016

Note 1. Description of Business, Organization and Principles of Consolidation

Description of Business

One Horizon Group, Inc., (the “Company” or “Horizon”) develops proprietary software primarily in the Voice over Internet Protocol (VoIP) and bandwidth optimization markets (“Horizon Globex”) and provides it to telecommunication companies under perpetual license arrangements (“Master License”) throughout the world. In addition, the Company either sells related user licenses and software maintenance services to or enters into revenue sharing agreements with telecommunication companies. Horizon, through its Chinese affiliate company Suzhou Aishuo Network Information Co. Ltd. provides the Aishuo App to end user customers through App stores based in China. Our Aishuo customers purchase call credits for Public Service Telephone Network (PSTN) access using a variety of Chinese on-line payment services including Union Pay and Apple Pay.

Interim Period Financial Statements

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) for interim financial information and with the Securities and Exchange Commission instructions. Accordingly, they do not include all the information and footnotes required by GAAP for complete financial statements. The results of operations reflect interim adjustments, all of which are of a normal recurring nature and, in the opinion of management, are necessary for a fair presentation of the results for such interim period. The results reported in these interim consolidated financial statements should not be regarded as necessarily indicative of results that may be expected for the entire year. Certain information and note disclosure normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to the Securities and Exchange Commission’s rules and regulations. These unaudited interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission on March 31, 2016.

| 10 |

Principles of Consolidation

The condensed consolidated financial statements include the accounts of One Horizon Group, Inc. and its wholly owned subsidiaries One Horizon Group plc, Horizon Globex GmbH, Abbey Technology GmbH, One Horizon Group Pte., Limited, Horizon Globex Ireland Limited, Global Phone Credit Limited and One Horizon Hong Kong Limited, and its wholly-owned subsidiary, Horizon Network Technology Co. Ltd. (“HNT”). In addition, included in the condensed consolidated financial statements for the three and nine months ended September 30, 2016 and 2015, are the accounts of Suzhou Aishuo Network Information Co., Ltd. which is controlled by One Horizon Group, Inc. through various contractual arrangements (Note 3).

During the year ended December 31, 2015, the minority parties which held ownership interests in HNT returned their shareholdings to HNT such that HNT is now fully owned by the Company. The amount of consolidated net loss attributable to the Company and the non-controlling interest, up to the time that the shareholdings were returned, are both presented in the face of the Condensed Consolidated Statement of Operations.

All significant intercompany balances and transactions have been eliminated.

Note 2. Summary of Significant Accounting Policies

Basis of Accounting and Presentation

These consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States

Foreign Currency Translation

The reporting currency of the Company is the United States dollar. Assets and liabilities of operations other than those denominated in U.S. dollars, primarily in Switzerland, Ireland, the United Kingdom and China, are translated into United States dollars at the rate of exchange at the balance sheet date. Revenues and expenses are translated at the average rate of exchange throughout the period. Gains or losses from these translations are reported as a separate component of other comprehensive income (loss) until all or a part of the investment in the subsidiaries is sold or liquidated. The translation adjustments do not recognize the effect of income tax because the Company expects to reinvest the amounts indefinitely in operations.

Transaction gains and losses that arise from exchange-rate fluctuations on transactions denominated in a currency other than the functional currency are included in general and administrative expenses.

| 11 |

Accounts Receivable

Accounts receivable result primarily from sale of software and licenses to customers and are recorded at their principal amounts less an estimation of uncollectable amounts. The categories of sales and receivables and their terms of payment are as follows:

| a) | Master License Agreement (“Agreement”) Deposits – Deposits are payable in accordance with the terms of the Agreement. Payment terms may vary from Agreement to Agreement, with payment due between 30 days to 9 months from the execution of an Agreement. |

| b) | Software consultancy and hardware fees – The terms of payment are fixed terms, with payment due within stated terms, normally 30 days from the date of the invoice. |

| c) | Maintenance and operational fees and end user licenses fees– Payments vary from customer to customer. For customers who have not entered into a revenue share agreement, the terms of payment are fixed and payment is due within stated terms, normally 30 days from the date of the invoice. For customers who have entered into a revenue share agreement, the Company will receive an agreed proportion of a customer’s revenue from the customer's operation of the Horizon service. The proportion of a customer's revenue received is used to pay the receivable balance until the balance is paid. |

The revenue share agreement was introduced in October 2014, and at that time the Company reported that it had converted a significant number of its customers to a revenue share basis of collection. Accounts receivable balances from certain customers arose from revenue recognized prior to September 30, 2014 (prior revenue was recognized in accordance with revenue recognition policies in place at that time - see Revenue Recognition note). Those revenue share arrangements changed the basis under which the customers would pay their existing balances, as described, effective starting as early as October 1, 2014.

At December 31, 2015 a significant portion of those receivables that are due under the revenue share agreement remained uncollected. Considering the effects of the revenue share arrangements on collection of accounts receivable and the timing of those collections, along with other factors, management estimated the amount of existing accounts receivable they expect to collect within 12 months of the balance sheet date from those customers operating under revenue share arrangements. The portion of the receivable balance expected to be collected in more than 12 months was considered a non-current receivable. The Company maintains its opinion that current and non-current accounts receivable continue to be due from its customers. Further, management is of the opinion that its customers are contractually obligated to pay the full amount due as provided under the Master License Agreements executed by each of its customers.

At December 31, 2015, management believed there was general uncertainty in the collection of those balances considered long-term and increased the general provision for doubtful accounts by $5.7 million to cover those balances. The slow-pay uncertainties arise from a number of factors, including the effects of revenue share arrangements, the extended time customers are talking to generate significant revenue under revenue share arrangements, and general technological changes in the industry.

| 12 |

At September 30, 2016, due to continuing uncertainty in the timing of collections of amounts due from certain customers, management reassessed the collectability of its accounts receivable balances and has decided to write off balances where there is significant uncertainty over the timing of the collection against the allowance previously recorded.

As a result of the management decision the amount of the gross accounts receivable has been reduced by approximately $6.0 million and the allowance for doubtful accounts has been similarly reduced. As at September 30, 2016 the remaining allowance for doubtful accounts totals $338,000 of which $300,000 has been provided in 2016.

For any future collections of amounts written off, the Company will account for those as recoveries of written-off receivables, and will include those amounts in other income (non-operating income).

Receivables are generally unsecured. Account balances are charged off against the allowance when the Company determines that certain receivable will probably not be recovered.

The Company does not have off-balance sheet credit exposure related to its customers. As of December 31, 2015 and December 31, 2014, two customers accounted for 24% and 28%, respectively, of the accounts receivable balance.

Fair Value Measurements

Fair value is defined as the exchange price that will be received for an asset or paid to transfer a liability (an exit price) in the principal. Valuation techniques used to measure fair value should maximize the use of observable inputs and minimize the use of unobservable inputs. To measure fair value, the Company uses the following fair value hierarchy based on three levels of inputs, of which the first two are considered to be observable and the third unobservable:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs are supported by little or no market activity and are significant to the fair value of the assets or liabilities.

| 13 |

Intangible Assets

Intangible assets include software development costs and customer lists and are amortized on a straight-line basis over the estimated useful lives of five years for customer lists and ten years for software development. The Company periodically evaluates whether changes have occurred that would require revision of the remaining estimated useful life. The Company performs periodic reviews of its capitalized intangible assets to determine if the assets have continuing value to the Company.

The Company expenses all costs related to the development of internal-use software as incurred, other than those incurred during the application development stage, after achievement of technological feasibility. Costs incurred in the application development stage are capitalized and amortized over the estimated useful life of the software. Internally developed software costs are amortized on a straight-line basis over the estimated useful life of the software. The Company performs periodic reviews of its capitalized software development costs to determine if the assets have continuing value to the Company. Costs for assets that are determined to be of no continuing value are written off. The amortization of these costs is included in cost of revenue over the estimated life of the products.

During the nine months ended September 30, 2016 and 2015, software development costs of $833,000 and $844,000, respectively, have been capitalized.

Revenue Recognition

The Company recognizes revenue when it is realized or realizable and earned. The Company establishes persuasive evidence of a sales arrangement for each type of revenue transaction based on a signed contract with a customer and that a delivery has occurred or services have been rendered, the price is fixed and determinable, and collectability is reasonably assured.

| ● | Software and licenses – revenue from sales of perpetual licenses to telecom entities is recognized at the date of invoices raised for installments due under the agreement, unless payment terms exceed one year, as described below, presuming all other relevant revenue recognition criteria are met. Revenue from sales of perpetual licenses to other entities is recognized over the agreed collection period. |

| o | ● | Revenues for user licenses purchased by customers are recognized when the user license is delivered. |

| ● | Revenues for maintenance services are recognized over the period of delivery of the services. |

| 14 |

| ● | Effective October 1, 2014, the Company amended certain existing customer contracts with respect to the terms under which those customers would pay the Company for perpetual licenses, user licenses and maintenance services provided by the Company. Existing customer contracts required payments for maintenance services to be made based on contractually specified fixed amounts, which were billed regularly through September 2014. Through that date the Company recorded revenue for licenses and maintenance services when those licenses and services were billed. Revenue for user licenses was recorded as earned and revenue for maintenance services was recorded based on a fixed annual fee, billed quarterly. The Company has modified the payment terms under certain of those existing customer contracts by entering into Revenue Sharing agreements with those customers. Under the terms of these Revenue Sharing agreements, future payments will be due from the customer when that customer has generated revenue from its customers who subscribe to use the Horizon products and services. Hosted services are offered to customers on revenue share arrangements whereby the Company can provide fully terminated services and sells vouchers for minutes which can be resold by the customer. Sales for this service are recognized when the supply is made and the invoice raised. | |

| Effective October 1, 2014, revenue has been recorded by the Company when it invoices the customer for the revenue share due to the Company. Certain customers who entered into revenue sharing arrangements had outstanding balances due to the Company as of September 30, 2014, which balances were included in accounts receivable as at that date. Payments received after September 30, 2014, from those customers under revenue sharing agreements have been applied to the customer’s existing accounts receivable balances first. For those customers having balances due at September 30, 2014, revenue related to perpetual and user licenses and maintenance services are recorded only after existing accounts receivable balances are fully collected. |

| ● | Revenues from Aishuo retail sales are recognized when the PSTN calls and texts are made. |

Where the Company has entered into a Revenue Share with the customer, then all future revenue from granting of user licenses and for maintenance services will be recognized when the Company has delivered user licenses and is entitled to invoice.

We enter into arrangements with telecommunication entities in which a customer purchases a combination of software licenses, maintenance services and post-contract customer support (“PCS”). As a result, judgment is sometimes required to determine the appropriate accounting, including how the price should be allocated among multiple deliverable elements. PCS may include rights to upgrades, when and if available, support, updates and enhancements. When vendor specific objective evidence (“VSOE”) of fair value exists for all elements in a multiple element arrangement, revenue is allocated to each element based on the relative fair value of each of the elements. VSOE of fair value is established by the price charged when the same element is sold separately. Accordingly, the judgments involved in assessing the fair values of various elements of an agreement can impact the recognition of revenue in each period. Changes in the allocation of the sales price between deliverables might impact the timing of revenue recognition, but would not change the total revenue recognized on the contract. When elements such as software and services are contained in a single arrangement, or in related arrangements with the same customer, we allocate revenue to each element based on its relative fair value, provided that such element meets the criteria for treatment as a separate unit of accounting. In the absence of fair value for a delivered element, revenue is first allocated to the fair value of the undelivered elements and then allocated to the residual delivered elements. In the absence of fair value for an undelivered element, the arrangement is accounted for as a single unit of accounting, resulting in a delay of revenue recognition for the delivered elements until the undelivered elements are fulfilled. No sales arrangements to date include undelivered elements for which VSOE does not exist.

For purposes of revenue recognition for perpetual licenses, the Company considers payment terms exceeding one year as a presumption that the fee in the transaction is not fixed and determinable. This presumption however, may be overcome if persuasive evidence demonstrates that the Company has a business practice of extending payment terms and has been successful in collecting under the original terms, without providing any concessions. In doing so, the Company considers if the arrangement is sufficiently similar to historical arrangements in terms of similar customers and products is assessing whether there is evidence of a history of successful collection.

| 15 |

In order to determine the company’s historical experience is based on sufficiently similar arrangements, the Company considers the various factors including the types of customers and products, product life cycle, elements Included in the arrangement, length of payment terms and economics of license arrangement.

During the three months ended September 30, 2016, $100,000 or 34.8% of the Company’s revenue was concentrated in the hands of one major customer. In the three months ended September 30, 2015 the equivalent amount was $272,000 or 85% of the revenue. During the nine months ended September 30, 2016, $795,000 or 81% of the Company’s revenue was concentrated in the hands of one major customer. In the nine months ended September 30, 2015, $500,000 or 42% of the Company’s revenue was concentrated in the hands of one major customer

Research and Development Expenses

Research and development expenses include all direct costs, primarily salaries for Company personnel and outside consultants, costs related to the development of new products, significant enhancements to existing products, and the portion of costs of development of internal-use software required to be expensed. Research and development costs are charged to operations as incurred with the exception of those software development costs that may qualify for capitalization. The Company expensed research and development costs in the nine month period ended September 30, 2016 and 2015 of $565,000 and $466,000 respectively.

Debt Issue Costs

Debt issue costs related to long-term debt are deducted from the carrying amount of that debt liability on the balance sheet and amortized over the term of the related debt using the effective interest method.

Income Taxes

Deferred income tax assets and liabilities are determined based on temporary differences between financial reporting and tax bases of assets and liabilities, operating loss, and tax credit carryforwards, and are measured using the enacted income tax rates and laws that will be in effect when the differences are expected to be recovered or settled. Realization of certain deferred income tax assets is dependent upon generating sufficient taxable income in the appropriate jurisdiction. The Company records a valuation allowance to reduce deferred income tax assets to amounts that are more likely than not to be realized. The initial recording and any subsequent changes to valuation allowances are based on a number of factors (positive and negative evidence). The Company considers its actual historical results to have a stronger weight than other, more subjective, indicators when considering whether to establish or reduce a valuation allowance.

The Company continually evaluates its uncertain income tax positions and may record a liability for any unrecognized tax benefits resulting from uncertain income tax positions taken or expected to be taken in an income tax return. Estimated interest and penalties are recorded as a component of interest expense and other expense, respectively.

Because tax laws are complex and subject to different interpretations, significant judgment is required. As a result, the Company makes certain estimates and assumptions in: (1) calculating its income tax expense, deferred tax assets, and deferred tax liabilities; (2) determining any valuation allowance recorded against deferred tax assets; and (3) evaluating the amount of unrecognized tax benefits, as well as the interest and penalties related to such uncertain tax positions. The Company’s estimates and assumptions may differ significantly from tax benefits ultimately realized.

| 16 |

Net Loss per Share

Basic net loss per share is calculated by dividing the net loss attributable to common shareholders by the weighted average number of common shares outstanding in the period. Diluted loss per share takes into consideration common shares outstanding (computed under basic loss per share) and potentially dilutive securities. For the three and nine month periods ended September 30, 2016 and 2015, outstanding stock options, warrants and convertible debt are antidilutive because of net losses, and as such, their effect has not been included in the calculation of diluted net loss per share. Common shares issuable are considered outstanding as of the original approval date for purposes of earnings per share computations.

Accumulated Other Comprehensive Income (Loss)

Other comprehensive income (loss), as defined, includes net loss, foreign currency translation adjustments, and all changes in equity (net assets) during a period from non-owner sources. To date, the Company has not had any significant transactions that are required to be reported in other comprehensive income (loss), except for foreign currency translation adjustments.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the fiscal year. The Company makes estimates for, among other items, useful lives for depreciation and amortization, determination of future cash flows associated with impairment testing for long-lived assets, determination of the fair value of stock options and warrants, determining fair values of assets acquired and liabilities assumed in business combinations, valuation allowance for deferred tax assets, allowances for doubtful accounts, and potential income tax assessments and other contingencies. The Company bases its estimates on historical experience, current conditions, and other assumptions that it believes to be reasonable under the circumstances. Actual results could differ from those estimates and assumptions.

Share-Based Compensation

The Company accounts for stock-based awards at fair value on date of grant and recognition of compensation over the service period for awards expected to vest. The fair value of stock options is determined using the Black-Scholes valuation model, which includes subjective judgments about the expected life of the awards, forfeiture rates and stock price volatility.

| 17 |

Recently Issued Accounting Standards Not Yet Adopted

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) 2014-09 – Revenue From Contracts with Customers, which will supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principal of this ASU is that an entity should recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This ASU also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract.

The original effective date for ASU 2014-09 would have required the Company to adopt beginning in its first quarter 2017. In July 2015, the FASB voted to amend ASU 2014-09 by approving a one year deferral of the effective date as well as providing the option to early adopt the standard on the original effective date. Accordingly, the Company may adopt the standard in either its first quarter of 2017 or 2018. The new revenue standard may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. The Company is currently evaluating the timing of its adoption and the impact of adopting the new revenue standard on its consolidated financial statements.

Recently Issued Accounting Standards Adopted

There have been no significant changes to the Company’s significant accounting policies as described in the Company’s Annual Report on Form 10-K for the year-ended December 31, 2015. During the three months ended March 31, 2016, the Company adopted Accounting Standards Update (“ASU”) ASU 2015-03, Simplifying the Presentation of Debt Issuance Cost which requires entities to present debt issuance costs related to a debt liability as a direct deduction from the carrying amount of that debt liability on the balance sheet as opposed to being presented as a deferred charge. As of September 30, 2016, unamortized debt issuance costs related to the Company’s convertible senior notes are reported on the consolidated balance sheets as a reduction of the carrying value of the related debt. Prior to adoption, the Company reported the unamortized debt issuance costs in “Other Assets” on the Consolidated Balance Sheets.

Note 3. Suzhou Aishuo Network Information Co. Ltd.

The Company has control of a Chinese entity Suzhou Aishuo Network Information Co. Ltd.(“Aishuo”) through various contractual arrangements. As a result of this control, one hundred percent of the operations, assets, liabilities and cash flows of Aishuo have been consolidated in the accompanying consolidated financial statements.

Summarized assets, liabilities and results of operations of Aishuo are as follows: (in thousands)

| September 30 | December 31 | |||||||

| 2016 | 2015 | |||||||

| Assets | $ | 6 | $ | 43 | ||||

| Intercompany receivables/(payables) | (319 | ) | (123 | ) | ||||

| Other liabilities | (28 | ) | (60 | ) | ||||

| Revenue | 212 | 56 | ||||||

| Net Loss | (147 | ) | (286 | ) | ||||

| 18 |

Note 4. Intangible Assets

Intangible assets consist primarily of software development costs and customer and reseller relationships which are amortized over the estimated useful life, generally on a straight-line basis with the exception of customer relationships, which are generally amortized over the greater of straight-line or the related asset’s pattern of economic benefit (in thousands):

| September 30 | December 31 | |||||||

| 2016 | 2015 | |||||||

| Horizon software | $ | 18,712 | $ | 17,879 | ||||

| ZTEsoft Telecom software | 456 | 469 | ||||||

| Contractual relationships | 885 | 885 | ||||||

| 20,053 | 19,233 | |||||||

| Less accumulated amortization | (11,176 | ) | (9,410 | ) | ||||

| Intangible assets, net | $ | 8,877 | $ | 9,823 | ||||

Amortization of intangible assets for each of the next five years is estimated to be approximately $2,000,000 per year

| 19 |

Note 5. Convertible Debenture

In December 22, 2014 the Company closed a private placement with gross proceeds of $3,500,000 under Regulation S whereby we issued to an investor a convertible debenture that is convertible into 1,555,556 shares of common stock, Class C warrant to purchase 388,889 shares of common stock, Class D warrant to purchase 388,889 shares of common stock and the potential for performance warrants.

The unsecured convertible debenture is for a term of three years from date of issue and has an interest rate of 8% per annum, payable quarterly in arrears in either cash, shares of common stock or a combination of cash and shares of common stock. The Company has the right to repurchase the convertible debenture upon notice at any time after the first twelve months.

The Class C and Class D warrants have a term of four years and are each entitled to purchase one-fourth of a share of common stock. In total the Company issued 388,889 Class C warrants and 388,889 Class D warrants.

Performance Warrants associated with the convertible debenture were potentially issuable and exercisable based on the Company’s annual reported subscriber numbers, twenty-four (24) months after December 22, 2014, as reflected in our 2014 Form 10-K. In the first quarter of 2016 the Company announced it has achieved the required number subscriber downloads and therefore the additional performance warrants are not issuable by the Company.

Proceeds received in 2014 from the convertible debentures were allocated between the convertible debenture and warrants based on their relative fair values. The resulting discount for the warrants is amortized using the effective interest method over the life of the debentures. The relative fair value of Class C and Class D warrants resulted in a discount of $598,500 at the date of issuance. After allocating a portion of the proceeds to the warrants, the effective conversion price of the convertible debentures was determined to result in a beneficial conversion feature. The beneficial conversion feature has a relative fair value of $302,994 at the date of issuance and is being amortized over the life of the convertible debenture. The beneficial conversion feature discount is amortized using the effective interest method over the life of the debentures. The amortization of the debt discount is included in interest expense in the consolidated statement of operations.

A total of 1,555,556 shares of common stock have been reserved for the potential conversion of the convertible debenture.

Note 6. Related-Party Transactions

Amounts due to related parties include the following: (in thousands)

| September 30 | December 31 | |||||||

| 2016 | 2015 | |||||||

| Loans due to stockholders (current officers and directors) | $ | 2,343 | $ | 2,354 | ||||

At September 30, 2016, $2,343,000 of related party debt was outstanding and will mature on April 1, 2018, which is unsecured and is interest free.

Note 7. Share Capital

Preferred Stock

The Company’s authorized capital includes 50,000,000 shares of preferred stock of $0.0001 par value per share. The designation of rights including voting powers, preferences, and restrictions shall be determined by the Board of Directors before the issuance of any shares.

| 20 |

The holders of Series A Preferred Stock are entitled to receive cumulative dividends during a period of twenty-four (24) months from and after the Issuance Date (the “Dividend Period”). The dividend period finished on July 21, 2016. During the Dividend Period for each outstanding share of Series Preferred Stock, dividends shall be payable quarterly in cash, at the rate of 10% per annum on or before each ninety (90) day period following the Issuance Date (each a “Dividend Payment Date”), with the first Dividend Payment Date to occur promptly following the three month period following the Issuance Date, and continuing until the end of the Dividend Period. Following the expiration of the Dividend Period, the holders of Series A Preferred Stock shall not be entitled to any additional dividend payment or coupon rate.

Shares of Series A Preferred Stock are convertible in whole or in part, at the option of the holders, into shares of common stock at $5.85 per share prior to the Maturity, and all outstanding shares of Series A Preferred Stock shall automatically convert to shares of common stock upon maturity, provided however, at no time may holders convert shares of Series A Preferred Stock if the number of shares of common stock to be issued pursuant to such conversion would cause the number of shares of common stock beneficially owned by such holder and its affiliates to exceed 9.99% of the then issued and outstanding shares of common stock outstanding at such time, unless the holder provides us with a waiver notice in such form and with such content specified in the Series A Certificate of Designation.

Shares of Series A Preferred Stock are redeemable, at the option of the holders commencing any time after 12 months from and after the closing at a price equal to the original purchase price plus all accrued but unpaid dividends. In the event that the Company completes a financing of $10 million or greater prior to maturity, the Series A Preferred Stock will be redeemed at a price equal to the original purchase price plus all accrued but unpaid dividends.

170,940 shares of Series A preferred stock are issued and outstanding as of September 30, 2016.

Mandatorily Redeemable Preferred Shares (Deferred Stock)

The Company’s subsidiary OHG is authorized to issue 50,000 shares of deferred stock, par value of £1. These shares are non-voting, non-participating, redeemable and have been presented as a long-term liability.

Common Stock

The Company is authorized to issue 200 million shares of common stock, par value of $0.0001 per share.

During the nine months ended September 30, 2016 the Company issued 200,000 shares of common stock for services provided with a fair value of $133,960. The Company also issued a further 198,413 shares of common stock for cash proceeds of $125,000.

On August 10, 2015, in connection with an Underwriting Agreement dated August 4, 2015 (the “Underwriting Agreement”) with Aegis Capital Corp. (“Aegis”), as representative of the several underwriters named therein (the “Underwriters”), the Company closed a firm commitment underwritten public offering of 1,714,286 shares of Common Stock, and warrants to purchase up to an aggregate of 857,143 shares of Common Stock at a combined offering price of $1.75 per share and accompanying warrant. Pursuant to the Underwriting Agreement, the Underwriters exercised an option to purchase 151,928 additional shares of Common Stock and 75,964 additional warrants. The net proceeds of the offering were approximately $2.89 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The warrants offered have a per share exercise price of $2.50 (subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets, including cash, stock or other property to our stockholder), are exercisable immediately and will expire three years from the date of issuance. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.

| 21 |

Stock Purchase Warrants

At September 30, 2016, the Company had reserved 3,282,556 shares of its common stock for the following outstanding warrants:

| Number of Warrants | Exercise Price | Expiry | ||||||

| 116,760 | $ | 0.86 | no expiry date | |||||

| 1,209,675 | 4.25 | January 2019 | ||||||

| 68,850 | 2.25 | December 2018 | ||||||

| 402,786 | 3.00 | December 2018 | ||||||

| 402,568 | 3.50 | December 2018 | ||||||

| 857,143 | 2.50 | August 2018 | ||||||

| 75,964 | 2.50 | September 2018 | ||||||

| 148,810 | 0.819 | September 2019 | ||||||

During the nine months ended September 30, 2016, 160,000 warrants were forfeited, 148,810 warrants issued and none exercised.

If, at the time of exercise of warrants issued pursuant to the financing of August 2015, wherein a total of 933,107 warrants were issued, that the shares issued upon exercise are not able to be included in a registration statement then the holder may request that the warrants so exercised be done on a cashless basis.

Note 8. Stock-Based Compensation

The shareholders approved a stock option plan on August 6, 2013 (the “2013 Equity Incentive Plan”). This stock option plan is for the issuance of stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, dividend equivalents, cash bonuses and other stock-based awards to employees, directors and consultants of the Company.

There are 3,000,000 shares of common stock available for granting awards under the plan. Each year, commencing 2014 until 2016, the number of shares of common stock available for granting awards shall be increased by the lesser of 1,000,000 shares of common stock and 5% of the total number of shares of common stock outstanding. On January 1, 2014, 2015 and 2016 the number of shares available for granting awards under the 2013 Equity Incentive Plan was increased by 1,000,000 shares.

| 22 |

There have been no options issued in the nine months ended September 30, 2016

A summary of the Company’s 2013 Equity Incentive Plan as of September 30, 2016, is as follows:

| Weighted Average | ||||||||

| Number of Options | Exercise Price | |||||||

| Outstanding at December 31, 2015 | 944,000 | $ | 2.48 | |||||

| Options forfeited | (96,500 | ) | 2.52 | |||||

| Outstanding at September 30, 2016 | 847,500 | 3.40 | ||||||

As at September 30, 2016 there was unrecognized compensation expense of approximately $211,000 to be recognized over the remaining vesting periods.

Prior to the 2013 Equity Incentive Plan, the Company issued stock options to directors, employees, advisors, and consultants.

A summary of the Company’s other stock options as of September 30, 2016, is as follows:

| Weighted Average | ||||||||

| Number of Options | Exercise Price | |||||||

| Outstanding at December 31, 2015 and September 30, 2016 | 875,700 | $ | 0.53 | |||||

As at September 30, 2016 there was unrecognized compensation expense of approximately $95,000 to be recognized over the remaining vesting period.

There were no other options issued, exercised or forfeited during the nine months ended September 30, 2016.

The following table summarizes stock options outstanding at September 30, 2016:

| Exercise | Number Outstanding at September 30, | Average Remaining Contractual Life | Number Exercisable at September 30, | Intrinsic Value at September 30, | ||||||||||||||

| Price | 2016 | (Years) | 2016 | 2016 | ||||||||||||||

| $ | 0.53 | 291,900 | 3.75 | 291,900 | 2,919 | |||||||||||||

| 0.53 | 291,900 | 5.75 | 291,900 | 2,919 | ||||||||||||||

| 0.53 | 291,900 | 9.00 | - | - | ||||||||||||||

| 4.54 | 340,000 | 7.25 | - | - | ||||||||||||||

| 1.09 | 507,500 | 8.75 | - | - | ||||||||||||||

| TOTAL | 1,723,200 | 583,800 | 5,838 | |||||||||||||||

| 23 |

At September 30, 2016, 6,875,700 shares of common stock were reserved for all outstanding options and future commitments under the 2013 Equity Incentive Plan.

The fair value of each option granted is estimated at the date of grant using the Black-Scholes option-pricing model.

Note 9. Commitments and Contingencies

Notice of Delisting or Failure to Satisfy a Continued Listing Rule

On August 30, 2016, the Company received a written alert from Nasdaq Listing Qualifications that our listed security has not regained compliance with the minimum $1 bid price per share requirement, within the 180 calendar days. However, the Staff has determined that the Company is eligible for an additional 180 calendar day period, pursuant to Listing Rule 5810(c)(3)(a). If at any time during this 180 days period the closing bid price of our common stock is at least $1 for a minimum of ten consecutive business days, we will regain compliance. In order to regain compliance, we may have to affect a reverse stock-split. If we are required to affect a reverse stock-split, it would have to be completed at least 10 days prior to the expiration of the date by which we must regain compliance with Rule 5550(a)(2).

Legal Proceedings

In 2012, we sold certain former subsidiaries engaged in provision of satellite service in 2012 to Broadband Satellite Services (“BSS”), a company incorporated under laws of England and Wales. Horizon Globex, a company incorporated in Switzerland and a subsidiary of us, had provided these subsidiary companies with software and IT services. In connection with its acquisition of our former subsidiary companies, BSS entered into three agreements with Horizon Globex pursuant to which BSS continued to use Horizon Globex to supply software and IT services. Notwithstanding the fact that Horizon Globex has provided such ongoing software and IT services, BSS has failed to pay our fees pursuant to the agreements. As a result, on December 23, 2014, we initiated legal proceedings in the High Court, Queens Bench Division, Commercial Court No. 2014 folio 1560 against BSS in the United Kingdom to collect such fees in the amount of $640,000. Subsequently, BSS asserted counter claims in the amount of $5.8 million, alleging among other claims, civil fraud in connection with the sale of subsidiary companies. Based on the timing of these claims, which were never raised until we filed our action against BSS, it is our position that these claims are specious and represent nothing more than an attempt to improve BSS's negotiating position with regard to our legitimate claims against it. As a result, we plan to continue to carry out our claims against BSS to the fullest extent possible and to defend BSS's counter-claims vigorously. We note further that several of BSS's counter claims may be time barred by applicable sections of the contracts and plan to assert the same as an affirmative defense to such counter claim. Notwithstanding our views with regard to our claims against BSS and BSS's counterclaims, litigation is by its nature unpredictable and therefore we cannot guarantee with certainty the outcome of our dispute with BSS.

| 24 |

Note 10. Segment Information

The Company has two business segments, both of which involve the development and licensing of software for mobile VoIP. One for business to business line and one for business to consumer line, primarily represented by Aishuo. For the three and nine months ended September 30, 2016 and 2015 activity in the business to consumer line is not material for separate segment presentation.

The Company’s revenues were generated in the following geographic areas: (in thousands)

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| China | $ | 78,000 | $ | 16,000 | $ | 212,000 | $ | 23,000 | ||||||||

| Rest of Asia | $ | 172,000 | $ | 291,000 | $ | 995,000 | $ | 566,000 | ||||||||

| Europe, Africa and Russia | $ | 37,000 | $ | 1,000 | $ | 48,000 | $ | 7,000 | ||||||||

| The Americas | $ | 0 | $ | 11,000 | $ | 7,000 | $ | 576,000 | ||||||||

| Total | $ | 287,000 | $ | 319,000 | $ | 1,262,000 | $ | 1,172,000 | ||||||||

Note 11. Subsequent events

On October 20, 2016 the Company issued 320,512 shares of common stock for $0.39 per share for total proceeds of $125,000 in a registered direct offering. In this offering the Company also issued a warrant to purchase 240,385 shares of common stock exercisable within 3 years from issue with an exercise price of $0.5616 per share.

| 25 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our unaudited condensed consolidated financial statements for the nine months ended September 30, 2016 and 2015 and notes thereto contained elsewhere in this Report, and our annual report on Form 10-K for the twelve months ended December 31, 2015 and 2014, including the consolidated financial statements and notes thereto. The following discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements. See “Cautionary Note Concerning Forward-Looking Statements.”

Overview

Business

One Horizon Group, Inc. and its Subsidiaries (the “Company”) is the inventor of the patented SmartPacketTM Voice over Internet Protocol (“VoIP”) platform. Our software is designed to capitalize on numerous industry trends, including the rapid adoption of smartphones, the adoption of cloud based Internet services, the migration towards all IP voice networks and the expansion of enterprise bring-your-own- device to work programs.

The Company designs, develops and sells white label SmartPacketTM VoIP software and services to large Tier-1 telecommunications operators. Our licensees market and deliver an operator-branded mobile Internet communication solution to smartphones including VoIP, multi-media messaging, video, conference calling, and mobile advertising to their retail subscribers; and to their Business to Business (“B2B”) business subscribers.

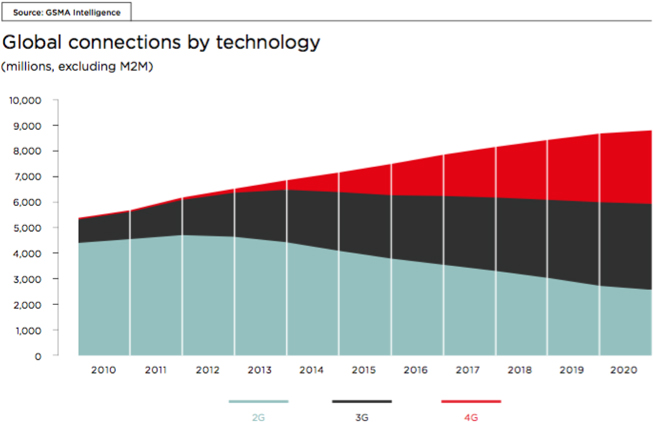

The SmartPacketTM platform, significantly improves the efficiency by which voice signals are transmitted from smartphones over the Internet resulting in a 10X reduction in mobile bandwidth consumption and battery usage required to transmit a smartphone VoIP call. This is of commercial interest to operators that wish to have a high quality VoIP call on congested metropolitan 4G networks and on legacy 2G and 3G cellular networks and our optimizations benefits operators by reducing their payments by over 10x to overseas operators when their subscribers make VoIP calls whilst roaming. The following diagram (source GSMA Intelligence, GSMA Mobile Economy 2016) shows the global penetration of mobile broadband and with the Company’s patented technology being one of the leading mobile VoIP solution for all mobile network types management believes that this represents a very large opportunity for future growth in sales.

| 26 |

By leveraging its SmartPacketTM solution, the Company is also a VoIP as a Service (“VaaS”) cloud communications leader for hosted smartphone VoIP that run globally on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector; and the “VaaS” business. Our existing licensees come from around the world including USA, China, United Kingdom, Singapore, Canada and Hong Kong.

Based on the SmartPacketTM solution, the Company is the sole owner and operator its own branded retail smartphone VoIP, messaging and advertising service in the People’s Republic of China called AishuoTM; Since its inception in the second quarter of 2015 Aishuo has been downloaded over 40 million times and has increased its revenues for the first 5 quarters of operations. Aishuo offers subscribers very competitive telephone call rates and a travel-SIM rental service plus lots of innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a free VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Our business model is focused on winning new B2B Tier-1 telecommunications operators, winning new VaaS subscribers and driving Aishuo retail revenues. We are also commercially focused on expanding sales of new and existing licensed products and services to existing customers, and renewing subscriptions and software support agreements. We target customers of all sizes and across a broad range of industries.

We are an ISO 9001 and ISO 20000-1 certified company with assets and operations in Switzerland, Ireland, the United Kingdom, China, India, Russia, Singapore, Hong Kong and Latin America.

In February 2015, we announced the rollout of our platform in China, brand named, Aishuo. The Aishuo platform provides VoIP services, a travel SIM solution delivered through a People’s Republic of China (“PRC”) entity controlled by us via various contractual arrangements, Suzhou Aishuo. The Aishuo product has been delivered to the major stores in Chinese App marketplace including Baidu’s 91.com and Baidu.com, the Tencent App store MyApp.com, 360 Qihoo store 360.cn, Apple’s iTunes and the ever growing Xiaomi store mi.com. The Aishuo smartphone app is expected to drive multiple revenue streams from the supply of its value-added services including the rental of Chinese telephone phone numbers linked to the app, low cost local and international calling plans and sponsorship from advertisers. Subscribers can top up their app credit from the biggest online payment services in China including AliPay (from Alibaba), Union Pay, PayPal and Tencent’s WeChat payment service.

| 27 |

Aishuo sought to acquire 15 million new app subscribers for the smartphone app over a two-year period and expects to achieve industry average revenues per user (ARPU) for similar social media apps. By the end of September 30, 2016, we had exceeded our two year target of 15 million and in September 2016 had grown to 40 million downloads of Aishuo smartphone app.

In addition to the developments in the rollout of Aishuo smartphone app brand in mainland China, we delivered a data roaming VoIP solution with, Smart Communications, the Philippines' leading wireless service provider with an estimated 55 million prepaid subscribers. For the first time ever, prepaid subscribers that travel abroad are now able to call home on their operators' data roaming service free from roaming fees (http://smart.com.ph/smartroamer). The management expect this commercial rollout of an optimized data voice solution for roamers to drive further mobile operator interest in the Company’s products and to drive revenues from its rollout to Filipinos throughout 2016.

During this quarter we opened the market in Africa with the signing of a contract for our SmartPacketTM solution with one of Zimabawe’s leading mobile operators.

Research & Development

During the nine months to September 30, 2016, we spent approximately $833,000 on capitalizable research and development together with approximately $565,000 on expensed research and development.

During the nine months to September 30, 2016, we continued with our drive for innovation and our research and development teams brought us software that allows our customer to offer call and messaging Bundles. This is a common feature for SIM cards and popular with mobile subscribers whereby the user pre purchases bulk minutes at a lower per minute rate that when they pay for a call minute by minute. The Company now offers such innovations to its subscribers right inside the operators’ smartphone app supplied to Company thereby driving up the operator’s revenue per user.

During the nine months to September 30, 2016, we also continued our R&D Effort that allows our service to directly connect to an operators Unstructured Supplementary Service Data (USSD) service thereby allowing all mobile prepaid subscribers to add credit to their mobile account in a traditional way and then allowing this USSD top up to be applied to a mobile VoIP smartphone app, an industry first.

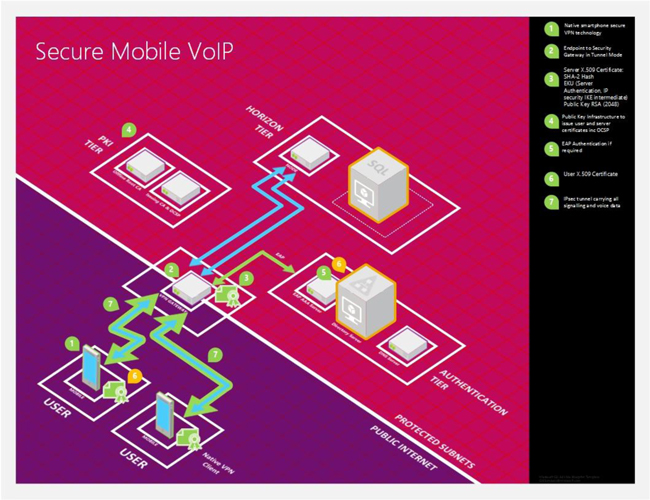

The R&D team also delivered a cyber-secure VoIP service that leverages the low bandwidth benefits of Company’s patented technology to allow VoIP over the strongest security protocols on the Internet. By leveraging the power of Virtual Private Networks (VPN) native client on the smartphone the Company’s VoIP protocols work where other traditional VoIP solutions cannot due to call quality issues with high data consumption protocols. Customer trials commenced and management expect this platform to drive a new revenue stream for Cyber Secure VoIP.

During the three months to September 30, 2016, our R&D delivered a Shrink-wrapped version of our optimized VoIP service targeting Government, Banks and other Small to Medium Enterprise that require complete control of a cryptographically secure VoIP solution for their employees.

R&D also delivered a standalone Lawful Intercept module for operators that are legally required to have call recording features. This service is capable of recording calls from VoIP application on the handset to another handset or to the traditional telephone network. Such features are required by regulators in certain jurisdictions around the world.

R&D also delivered a complete mobile app telephone conferencing service where a user of our VoIP service can bring in other parties to an on-going call, an ad-hoc conference. This feature is targeting the B2B user that may need multi-party calls on lower quality or congested mobile data networks.

| 28 |

Results of Operations

Comparison of three months ended September 30, 2016 and 2015

The following table sets forth key components of our results of operations for the periods indicated.

(All amounts, other than percentages, in thousands of U.S. dollars)

| Three Months Ended September 30, | Change | |||||||||||||||

| 2016 | 2015 | Increase/ (decrease) | Percentage Change | |||||||||||||

| Revenue | $ | 287 | $ | 319 | $ | (32 | ) | (10.0 | ) | |||||||

| Cost of revenue | 525 | 483 | 42 | 8.7 | ||||||||||||

| Gross margin | (238 | ) | (164 | ) | (74 | ) | (45.1 | ) | ||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 881 | 1,182 | (301 | ) | (25.5 | ) | ||||||||||

| Depreciation | 15 | 16 | (1 | ) | (6.7 | ) | ||||||||||

| Research and development | 191 | 144 | 47 | 32.6 | ||||||||||||

| Total operating expenses | 1,087 | 1,342 | (255 | ) | (19.0 | ) | ||||||||||

| Loss from operations | (1,325 | ) | (1,506 | ) | 181 | 12.0 | ||||||||||

| Other expense | (178 | ) | (111 | ) | (67 | ) | (60.4 | ) | ||||||||

| Loss before income taxes | (1,503 | ) | (1,617 | ) | 114 | 7.1 | ||||||||||

| Income taxes (recovery) | (10 | ) | (- | ) | 10 | N/A | ||||||||||

| Net Loss for period | (1,493 | ) | (1,617 | ) | 124 | 7.7 | ||||||||||

| Net loss attributable to non-controlling interest | - | (14 | ) | 14 | 100.0 | |||||||||||

| Net loss attributable to One Horizon Group, Inc. | (1,493 | ) | (1,603 | ) | 110 | 6.9 | ||||||||||

Revenue: Our revenue for the three months ended September 30, 2016 was approximately $287,000 as compared to approximately $319,000 for the three months ended September 30, 2015, a decrease of approximately $32,000, or 10.0%. The decrease was primarily due to a small reduction in the B2B business income. The management believes further growth in revenue and particularly with the launch of “Roam Like Home” software for Telecommunication companies will occur.

Cost of Revenue: Cost of revenue excluding amortization of software development costs, was approximately $12,000 or 4.2% of sales for the three months ended September 30, 2016, compared to cost of revenue of $0 or 0% of sales for the three months ended September 30, 2015. Our cost of sales excluding amortization of software development costs, is composed of the cost of ancillary hardware equipment sold and costs of PSTN calls breakout and other network charges. The small increase in cost during the three months ended September 30, 2016, when compared to the same period in 2015 is due to the increase in the number PSTN calls made on the Aishuo and Horizon Globex networks.

Gross Profit: Gross profit (excluding the Amortization of software development costs) for the three months ended September 30, 2016 was approximately $275,000 as compared to $319,000 for the three months ended September 30, 2015, a decrease of approximately 13.8%. The small decrease was mainly due to the increased revenue and related costs resulting from PSTN calls broken out through the network. Moving forward, management expects that gross margin will begin to increase with the growth of our business in both B2B and B2C sectors of the Company.

| 29 |

Operating Expenses: Operating expenses, including general and administrative expenses, depreciation and research and development were approximately $1,087,000 and $1,342,000 during the three months ended September 30, 2016 and 2015, respectively. The decrease of $255,000 or 19.0% was primarily due to additional research and development costs expensed offset by reduction in General and Administrative expenses in the quarter.

Loss before taxes: Loss before taxes for the three months ended September 30, 2016 was approximately $1,503,000 as compared to net loss of approximately $1,617,000 for the same period in 2015. The decrease in loss was primarily due to reduction in operating expenses mentioned above. Management believes the net loss will decrease and eventually become net income going forward with our growth in the business in Asia and also elsewhere in the world.

Comparison of nine months ended September 30, 2016 and 2015

The following table sets forth key components of our results of operations for the periods indicated above.

(All amounts, other than percentages, in thousands of U.S. dollars)

| Nine Months Ended September 30, | Change | |||||||||||||||

| 2016 | 2015 | Increase/ (decrease) | Percentage Change | |||||||||||||

| Revenue | $ | 1,262 | $ | 1,172 | $ | 90 | 7.7 | |||||||||

| Cost of revenue | 1,605 | 1,683 | (78 | ) | (4.6 | ) | ||||||||||

| Gross margin | (343 | ) | (511 | ) | 168 | 32.9 | ||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 2,723 | 2,674 | 49 | 1.8 | ||||||||||||

| Depreciation | 45 | 52 | (7 | ) | (13.6 | ) | ||||||||||

| Research and development | 565 | 466 | 99 | 21.2 | ||||||||||||

| Total operating expenses | 3,333 | 3,192 | 141 | 4.4 | ||||||||||||

| Loss from operations | (3,676 | ) | (3,703 | ) | (27 | ) | 0.1 | |||||||||

| Other expense | (525 | ) | (476 | ) | (49 | ) | (10.3 | ) | ||||||||

| Loss before income taxes | (4,201 | ) | (4,179 | ) | (22 | ) | (0.5 | ) | ||||||||

| Income taxes (recovery) | (32 | ) | (45 | ) | (13 | ) | (28.9 | ) | ||||||||

| Net Loss for period | (4,169 | ) | (4,134 | ) | (35 | ) | (0.8 | ) | ||||||||

| Net loss attributable to non-controlling interest | - | (50 | ) | 50 | N/A | |||||||||||

| Net loss attributable to One Horizon Group, Inc. | (4,169 | ) | (4,084 | ) | (85 | ) | (2.1 | ) | ||||||||

Revenue: Our revenue for the nine months ended September 30, 2016 was approximately $1,262,000 as compared to approximately $1,172,000 for the nine months ended September 30, 2015, an increase of approximately $90,000, or 7.7%. The increase was primarily due to the increase in B2B and B2C revenue in China together with the additional software revenue achieved in the rest of Asia. The management expects further growth in both sectors of revenue and particularly the B2B sector with the launch of “Roam Like Home” software for Telecommunication companies

| 30 |

Cost of Revenue: Cost of revenue excluding amortization of software development costs, was approximately $87,000 or 6.9% of sales for the nine months ended September 30, 2016, compared to cost of revenue of $108,000 or 9.2% of sales for the nine months ended September 30, 2015. Our cost of sales excluding amortization of software development costs, is composed of cost of ancillary hardware equipment sold and costs of PSTN calls breakout and other network charges. The decrease in cost during the nine months ended September 30, 2016, when compared to the same period in 2015 is due sales in 2015 of hardware which has not occurred in the same period in 2016 and the cost of the hardware associated with those sales.

Gross Profit: Gross profit (excluding the Amortization of software development costs) for the nine months ended September 30, 2016 was approximately $1,175,000 as compared to $1,064,000 for the nine months ended September 30, 2015, an increase of approximately $111,000 or 10.4%. The increase was mainly due to the increased revenue as set forth above herein. Moving forward, management expects that gross margin will begin to increase with the growth of our business in both sectors of the Company.

Operating Expenses: Operating expenses, including general and administrative expenses, depreciation and research and development were approximately $3.3 million and $3.2 million during the nine months ended September 30, 2016 and 2015, respectively. The increase of approximately $0.1 million or 3.1% was primarily due to additional research and development costs expensed and other non cash items expensed in General and administrative costs.