UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| Registration Statement Under The Securities Act of 1933 | ☒ |

| Pre-Effective Amendment No. __ | ☐ |

| Post-Effective Amendment No. 83 | ☒ |

| and/or | |

| Registration Statement Under The Investment Company Act of 1940 | ☒ |

| Amendment No. 86 | ☒ |

Registrant's Name, Address and Telephone Number:

American Federation of Labor and Congress of Industrial Organizations

Housing Investment Trust*

1227 25th Street, N.W., Suite 500

Washington, D.C. 20037

(202) 331-8055

Name and Address of Agent for Service:

Corey F. Rose, Esq.

Dechert LLP

1900 K Street, N.W.

Washington, DC 20006-1110

It is proposed that this filing will become effective:

| ☒ | immediately upon filing pursuant to paragraph (b) | |

| ☐ | on (date) pursuant to paragraph (b) | |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) | |

| ☐ | on (date) pursuant to paragraph (a)(1) | |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) | |

| ☐ | on (date) pursuant to paragraph (a)(2) of rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

*This filing relates solely to Series A—AFL-CIO Housing Investment Trust

AFL-CIO

HOUSING INVESTMENT TRUST

PROSPECTUS

The investment objective of the American Federation of Labor and Congress of Industrial Organizations Housing Investment Trust (“HIT”) is to generate competitive risk-adjusted total rates of return for its participants by investing in fixed-income investments, primarily multifamily and single family mortgage-backed securities and mortgage-backed obligations. Other important objectives of the HIT are to encourage the construction of housing and to facilitate employment for union members in the construction trades and related industries.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is

TABLE OF CONTENTS

The investment objective of the American Federation of Labor and Congress of Industrial Organizations Housing Investment Trust (“HIT”) is to generate competitive risk-adjusted total rates of return for its investors (“Participants”) by investing in fixed-income investments, primarily multifamily and single family mortgage-backed assets. Other important objectives of the HIT are to encourage the construction of housing and to facilitate employment for union members in the construction trades and related industries. All on-site construction work financed through the HIT’s investments is required to be performed by 100% union labor.

This table describes the expenses that you may pay if you buy and hold units of beneficial interest in the HIT (“Units”). The HIT does not assess any sales charges (loads), redemption fees, exchange fees or any other account fees.

ANNUAL HIT OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

| Management Fees | |

| Distribution (12b-1) Fees | |

| Other Expenses | |

| Total Annual HIT Operating Expenses |

This example is intended to help you compare the cost of investing in the HIT with the cost of investing in other mutual funds.

1

The example assumes that you invest $10,000 in the HIT for the time periods indicated and then redeem all of your Units at the end of those periods. The example also assumes that your investment has a 5% return each year and that the HIT’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| One Year | Three Years | Five Years | Ten Years | |||

| $ |

$ |

$ |

$ |

The

HIT generally conducts securities transactions on a principal-to-principal basis and does not pay commissions for trades. The

HIT may incur transaction costs when it buys and sells certain securities (or “turns over” parts of its portfolio).

A higher portfolio turnover rate may indicate higher transaction costs. During the most recent fiscal year, the HIT’s portfolio

turnover rate was

The HIT’s principal investment strategy is to construct and manage a portfolio that is composed primarily of multifamily and single family mortgage-backed assets (collectively, “Mortgage Securities”) with higher yield, higher credit quality and similar interest rate risk versus the securities in the Bloomberg U.S. Aggregate Bond Index (the “Bloomberg Aggregate”). As such, the HIT pursues a fundamental policy to concentrate in fixed-income securities in the mortgage and mortgage finance sector of the real estate industry. The HIT holds government and agency issued, guaranteed or insured multifamily mortgage-backed securities (“MBS”) that have call (or prepayment) protection, in place of the following types of securities which are held in the Bloomberg Aggregate: (1) corporate debt; (2) some U.S. Treasury securities; and, (3) some government-sponsored enterprise debt. Since government/agency multifamily MBS offer higher yields than comparable securities with similar credit and interest rate risk, the HIT expects to offer superior risk-adjusted returns compared to the Bloomberg Aggregate.

All securities in which the HIT invests must meet certain requirements described in detail later in this Prospectus and in the HIT’s Statement of Additional Information (“SAI”). Some types of these securities must meet certain standards of nationally recognized statistical rating organizations among other indicia of creditworthiness. The investment personnel of the HIT monitor the HIT’s investments compared with those in the Bloomberg Aggregate and may adjust holdings by purchasing or selling securities. When deciding whether to buy or sell a

2

specific security, the investment personnel of the HIT compare the security to other similar securities and consider factors such as price, yield, duration and convexity (measures of interest rate sensitivity), servicer, geographic location, call or prepayment protection, as well as liquidity. The HIT may purchase Mortgage Securities by way of forward commitments. The HIT does not invest in Mortgage Securities that contain subprime loans.

The HIT uses a variety of strategies to manage risk. These strategies include, but are not limited to, managing the duration of the HIT portfolio within a range comparable to the Bloomberg Aggregate and managing prepayment risk by negotiating prepayment restrictions for Mortgage Securities backed by multifamily housing or healthcare facility projects. The HIT may use U.S. Treasury futures contracts to manage the duration of the HIT’s portfolio (i.e., to manage interest rate risk). The HIT may invest up to 5% of its assets (measured using notional value) in U.S. Treasury futures contracts for duration management purposes. The HIT seeks to minimize the risk of credit and default losses by purchasing securities that are guaranteed, insured, or otherwise credit-enhanced or that meet other criteria intended to manage risk.

There

is no assurance that the HIT will meet its investment objectives. The value of the HIT’s investments and the resulting value

of the Units may go up or down and Participants’ holdings in the HIT could gain or lose value.

Market Risk: The value of a Participant’s investment is based on the values of the HIT’s investments. The value of securities held by the HIT may fluctuate, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, inflation, changes in interest rates, adverse investor sentiment and other global market developments and disruptions, including those arising out of geopolitical events (such as war), health emergencies (such as pandemics), natural disasters, terrorism, supply chain disruptions, sanctions and government or quasi-government actions. It is difficult to predict when events affecting the U.S. or global financial markets may occur.

Interest Rate Risk: Changes in interest rates may adversely affect the HIT’s fixed-income investments, such as the value or liquidity of, and income generated by, the investments. Interest rates may change as a result of a variety of factors, and any changes may be sudden and significant, with unpredictable impacts on the financial markets and the HIT’s investments. Fixed-income investments with longer durations are more sensitive to changes in interest rates, and thus, subject to more volatility than similar investments with shorter durations. Generally, the values of fixed-income investments will fall when market interest rates rise and rise when

3

market interest rates fall. Rising interest rates may also reduce prepayment rates, causing the average life of certain securities of the HIT to increase, which could in turn further reduce the value of the HIT’s portfolio.

Prepayment and Extension Risk: Generally, the market value of the HIT’s investments will rise at times when market interest rates fall. However, at times when market interest rates fall below the interest rates on HIT’s investments, some borrowers may prepay the HIT’s fixed- income securities or their underlying mortgages more quickly than might otherwise be the case. In such an event, the HIT may be required to reinvest the proceeds of such prepayments in other investments bearing lower interest rates than those which were prepaid. When market interest rates rise above the interest rates of the HIT’s investments, the prepayment rate of the mortgage loans backing certain HIT securities may decrease, causing the average maturity of the HIT’s investments to lengthen and making these investments more sensitive to interest rate changes. This could, in turn, further reduce the value of the HIT’s portfolio and make the HIT’s Unit price more volatile.

Credit Risk: Credit risk is the risk of loss of principal and interest as a result of a failure of an issuer of the HIT’s investments to make timely payments, a failure of a credit enhancement backing the HIT’s investments after a default on the underlying mortgage loan or other asset, a downgrading of the credit rating (or a perceived decline in the creditworthiness) of an investment or the provider of the credit enhancement for an investment, or a decline in the value of assets underlying the mortgage loan or other asset.

Default Risk: There is a risk that borrowers may default under the mortgage loans or other assets that directly or indirectly secure the HIT’s investments. In the event of default, the HIT may experience a loss of principal and interest and any premium value on the related securities. This risk may be lessened to the extent that the securities are guaranteed or insured by a third party, including an agency of the U.S. government.

Concentration Risk: The HIT concentrates its investments in fixed-income securities in the mortgage and mortgage finance sectors of the real estate industry. These sectors have experienced price volatility in the past. This concentration subjects the HIT to greater risk of loss as a result of adverse economic, political or regulatory conditions, or other developments than if its investments were diversified across different industries.

U.S. Government-Related Securities Risk: There are different types of U.S. government-related securities with different levels of credit risk, including the risk of default, depending on the nature of the particular government support for that security. For example, a U.S. government- sponsored entity, such as Federal National Mortgage Association (“Fannie Mae”) or Federal Home Loan Mortgage Corporation (“Freddie Mac”), although chartered or

4

sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the U.S. Treasury and are therefore riskier than those that are.

Liquidity Risk: Markets for particular types of investments, including futures contracts, may experience issues with liquidity. That is, a lack of buyers at a particular time could negatively impact the value of a security during such period, even though over time the payment obligations under the security may be met. Markets for some of the types of securities in which the HIT may invest have experienced liquidity issues in the past, and its investments may experience liquidity issues in the future. Liquidity risk may be magnified in a market where credit spread and interest rate volatility is rising and where investor redemptions from fixed-income mutual funds may be higher than normal.

Leverage Risk: The use of some investments or investing techniques, including futures contracts, may have the effect of magnifying, or leveraging, small changes in an asset, index or market. The HIT does not leverage its portfolio through the use of borrowings, but it may invest in forward commitments and U.S. Treasury futures contracts which may effectively add leverage to its portfolio. Forward commitments generally involve the purchase or sale of securities by the HIT at an established price with payment and delivery/settlement taking place in the future. Forward commitments may add leverage because the HIT would be subject to potential compound losses on the asset that it is committed to purchase and on the assets that it holds pending that purchase. Investments in U.S. Treasury futures contracts may add leverage because, in addition to its total net assets, the HIT would be subject to investment exposure on the notional amount of the futures contracts.

Derivatives Risk: In addition to the liquidity and leverage risks discussed above, the use of derivatives (namely U.S. Treasury futures contracts) involves additional risks, such as potential losses if interest rates do not move as expected and the potential for greater losses than if derivatives had not been used. Investments in derivatives can increase the volatility of the HIT’s Unit price and may expose it to significant additional costs. Such investments can also create liquidity demands on the portfolio, in the event unexpected losses cause the HIT to sell other assets to meet margin or settlement payments related to its futures trading. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments. There is no guarantee that the use of derivatives will achieve its intended result.

5

also

shows how the HIT’s average annual total returns for the one-, five-, and ten-year periods compare with those of the Bloomberg

Aggregate.

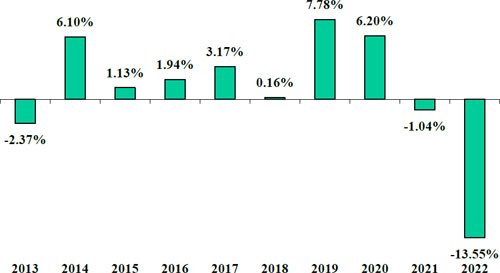

ANNUAL TOTAL RETURNS

(Calendar Years—Net of Operating Expenses)

During the ten-year period identified in the bar chart above, the was % (quarter ended ) and the was % (quarter ended ).

AVERAGE ANNUAL TOTAL RETURNS

(for the periods ended December 31, 2022)

| ONE

YEAR |

FIVE

YEARS |

TEN

YEARS | ||||

| AFL-CIO Housing | ||||||

| Investment Trust | - |

- |

||||

| Bloomberg

U.S. Aggregate Bond Index |

- |

6

PORTFOLIO MANAGEMENT

The HIT’s portfolio is internally managed and has no external investment adviser.

Chang Suh, Chief Executive Officer and Chief Investment Officer, and William K. Pierce, Senior Portfolio Manager, are jointly and primarily responsible for the day-to-day management of the HIT’s portfolio. Mr. Suh has been a key member of the HIT’s Portfolio Management Team since 1998, including 20 years as Chief Portfolio Manager and Chief Investment Officer. Mr. Pierce, who joined the HIT’s Portfolio Management Team as Portfolio Manager in October 2020, has 9 years’ experience in the financial markets. Both hold the CFA Institute’s Chartered Financial Analyst designation. Messrs. Suh and Pierce do not manage other accounts.

PURCHASE AND SALE OF UNITS

A minimum initial investment of $50,000 is required. There is no restriction on the amount of subsequent purchases. The HIT accepts subscriptions for the purchase of Units on a monthly basis as of the last business day of each month.

Units of the HIT are redeemable. The HIT currently accepts and satisfies redemption requests on a monthly basis as of the last business day of each month. If you want to sell your Units, you must submit a signed redemption request to the HIT care of its transfer agent, BNY Mellon Investment Servicing (US), Inc. (“BNYM”), in writing by first-class mail to mail to P.O. Box 534418, Pittsburgh, PA 15253-4418; by overnight mail to 500 Ross Street, 154-0520, Attention: 534418, Pittsburgh, PA 15262; or by facsimile to (508) 599-7912. All redemption requests must be received by BNYM on a business day at least 15 days before the last business day of the month to be honored as of the last business day of that month. Any redemption request received after such date will be honored as of the last business day of the following month. The HIT may in its sole discretion waive the 15-day notice requirement.

TAX INFORMATION

The HIT intends to make distributions that may be taxed as ordinary income or capital gains unless Participants are tax exempt.

OVERVIEW

The HIT is an open-end investment company, commonly called a mutual fund. The HIT’s Declaration of Trust (“Declaration of Trust”) permits the HIT’s Board of Trustees (the “Board”) to establish one or more additional, separate investment portfolios within the HIT.

7

While the Board may exercise this authority as future market conditions warrant, the HIT currently operates a single portfolio and offers units of beneficial interest in the HIT (or “Units”) representing shares of that portfolio through this Prospectus. More detailed information about the HIT is contained in the SAI.

MORE ON THE HIT’S INVESTMENT OBJECTIVES, PRINCIPAL

INVESTMENT STRATEGIES AND RISKS

INVESTMENT OBJECTIVES

The HIT’s investment objective is to generate competitive risk- adjusted total rates of return for its Participants by investing in fixed-income investments, primarily Mortgage Securities. Other important objectives of the HIT are to encourage the construction of housing and to facilitate employment for union members in the construction trades and related industries. To accomplish its objectives, the HIT focuses its investments in multifamily Mortgage Securities (including those that directly or indirectly finance new construction or rehabilitation of multifamily housing projects and healthcare facilities) and in Mortgage Securities backed by multifamily or single family loans. All on-site construction work financed through the HIT’s investments is required to be performed by 100% union labor. The Board has the authority to change the HIT’s investment objectives without Participant notice or approval, subject to the federal securities laws and other legal requirements. However, the HIT generally expects to provide reasonable advance notice in connection with material changes to its investment objectives.

MORE ON PRINCIPAL INVESTMENT STRATEGIES AND PRINCIPAL INVESTMENTS

Principal Investment Strategies

The investment strategy of the HIT is to construct and manage a portfolio that is composed primarily of Mortgage Securities, with higher yield, higher credit quality and similar interest rate risk versus the Bloomberg Aggregate. The HIT substitutes government and agency issued, guaranteed or insured multifamily MBS that have call protection for other securities in the Bloomberg Aggregate. Because government/agency multifamily MBS typically offer higher yields than comparable securities with similar credit and interest rate risk, the HIT expects to offer risk-adjusted returns that are superior to the Bloomberg Aggregate. All securities in which the HIT invests must meet certain requirements described in detail in the HIT’s SAI. Some types of these securities must meet certain standards of nationally recognized statistical rating organizations among other indicia of creditworthiness, all of which are set out

8

in more detail later in this document and in the HIT’s SAI. The investment personnel of the HIT monitor the allocation to various sectors, such as single family MBS or U.S. Treasury issues, compared to the Bloomberg Aggregate and may adjust allocations by purchasing or selling securities. Relative value is the most important consideration undertaken by the investment personnel of the HIT when deciding whether to buy or sell a specific security. Factors affecting relative value include price, yield, duration, convexity, option adjusted spread (“OAS”), seasoning, issuer, servicer, geographic location, call/prepayment protection, social and environmental impacts, as well as liquidity.

Other principal investment strategies, pursued under normal conditions, are as follows:

| ● | To manage interest rate risk, the HIT’s policy is generally to maintain the effective duration of its portfolio within the range of plus or minus one-half year of the effective duration of the Bloomberg Aggregate. The effective duration of the Bloomberg Aggregate has ranged from approximately 5.437 to 6.376 and has averaged approximately 5.780 over the past five calendar years. The HIT regularly compares the effective duration of its portfolio to the effective duration of the Bloomberg Aggregate and may sell or acquire securities or may use U.S. Treasury futures contracts in order to adjust its duration to remain within this range and thus remain effectively market neutral when compared to the Bloomberg Aggregate. The HIT does not employ interest rate anticipation strategies outside the narrow one-year range. |

| ● | To mitigate prepayment risk, the HIT typically negotiates prepayment restrictions for its investments in Mortgage Securities backed by multifamily real estate projects. Such prepayment restrictions, also known as “call protection,” can take the form of prepayment lockouts, prepayment premiums, yield maintenance premiums or a combination of the foregoing. As of December 31, 2022, 75.4% of the HIT’s portfolio possessed some form of call protection. |

| ● | To reduce credit risk, the HIT seeks to maximize the portion of its assets in investments (i) insured by the Federal Housing Administration (“FHA”) or guaranteed by the Government National Mortgage Association (“Ginnie Mae”); (ii) issued or guaranteed by Fannie Mae or Freddie Mac, directly or indirectly; (iii) issued or guaranteed by a state or local government agency or instrumentality; or (iv) having, or being issued by an entity having, a certain rating from a nationally recognized statistical rating organization, to the extent that market conditions permit |

9

and consistent with its overall objectives.

| ● | The HIT invests in Mortgage Securities originated under forward commitments, in which the HIT agrees to purchase an investment in or backed by mortgage loans that have not yet closed. For multifamily projects, including market-rate housing, low-income housing, housing for the elderly or handicapped, intermediate care facilities, assisted living facilities, nursing homes and other healthcare facilities (collectively, “Multifamily Projects”) to be built, the HIT typically agrees to a fixed interest rate and purchase price for Mortgage Securities to be delivered in the future. It is possible that Mortgage Securities for which the HIT has issued commitments may not be delivered to the HIT, particularly in periods of declining interest rates. The HIT typically seeks to reduce the likelihood of non-delivery for Mortgage Securities backed by Multifamily Projects by including in its commitments provisions related to good faith deposits, damages for non-delivery, rights of first refusal and, in some cases, liens on the properties. These mechanisms help assure delivery of the related Mortgage Securities, but there is no guarantee that all investments the HIT commits to purchase will actually be delivered to it, or that the deposit will cover the lost value of any Mortgage Security not delivered as required. |

Many of the Mortgage Securities in which the HIT invests are backed by mortgage loans for Multifamily Projects, which the HIT directly negotiates and structures to meet its requirements. The HIT may also invest in these Mortgage Securities together with other institutional investors. In each case, the HIT may consider a number of factors in addition to its primary goal of generating competitive risk-adjusted total returns in order to enhance production of such Mortgage Securities or otherwise benefit the HIT. For example, the HIT may seek securities that finance projects that will enhance environmental sustainability, job training opportunities, health care delivery or other local community development efforts. It may also engage in targeted investment initiatives designed to increase activity in particular geographic regions or other segments of the housing sector. It may also seek assets with financial or other support from local or state governments, such as tax credits or subsidies.

In times of unusual or adverse market, economic or political conditions or abnormal circumstances (such as large cash inflows or anticipated large redemptions), the HIT may, for temporary defensive purposes or for liquidity purposes and as approved by the Board of Trustees, not invest in accordance with its investment objectives or principal investment strategies and, as a result, there is no assurance that the HIT will achieve its investment objectives during such times.

10

Principal Investments

The HIT invests principally in the following types of securities:

Federally Insured or Guaranteed Mortgage Securities; Fannie Mae or Freddie Mac-Related Investments; and Other High Credit Quality Mortgage-Backed Securities. These Mortgage Securities include:

| ● | Construction and permanent mortgage loans or MBS that are insured or guaranteed by the federal government or an agency of the federal government, including FHA, Ginnie Mae and the Department of Veterans Affairs, or interests in such mortgage loans or securities; |

| ● | Securities that are secured by mortgage loans and/or securities insured or guaranteed by the federal government or an agency of the federal government and that are rated in one of the two highest categories by a nationally recognized statistical rating organization, e.g., Real Estate Mortgage Investment Conduit Securities (“REMICS”); |

| ● | Mortgage loans, securities or other obligations that are issued or guaranteed by Fannie Mae or Freddie Mac (including Fannie Mae MBS, Freddie Mac participation certificates, and REMICS); |

| ● | Securities that are backed by Fannie Mae or Freddie Mac and are rated in one of the two highest rating categories by a nationally recognized statistical rating organization; and |

| ● | Securities that are secured by single family or multifamily mortgage securities and/or single family or multifamily mortgage loans and are rated in the highest rating category by a nationally recognized statistical rating organization. |

The HIT intends to concentrate its investments in the foregoing types of Mortgage Securities to the extent that market conditions permit, consistent with the overall objectives of the HIT. The HIT may invest up to 100% of its assets in Mortgage Securities that meet these

11

criteria, notwithstanding the fact that they may also be eligible for investment in categories of securities described below in which the HIT may invest only subject to certain limitations.

State/Local Government Credit-Enhanced Mortgage Securities; Other Credit-Enhanced Mortgage Securities; Bridge Loans; Direct Mortgage Loans; and Loans to Investment Funds That Involve New Markets Tax Credit Transactions. Subject to certain limitations set out below, the HIT may invest in Mortgage Securities that are insured or guaranteed by state or local governments or are represented by loans made by lenders, which meet or provide certain indicia of credit quality (but which are not insured or guaranteed by state or local governments); bridge loans for tax credit projects; and construction and/or permanent mortgage loans (or securities or interests backed by such loans) for projects that have evidence of support from a state or local government (or an agency or instrumentality thereof) or that are undertaken by a private entity with a successful record of real estate development, provided that any such investments meet certain underwriting criteria. In addition, certain of the investments in these categories are subject to caps, expressed as a maximum percentage of the HIT’s assets, as set forth below. The caps described in this section do not limit the HIT’s ability to invest in any asset that also meets the criteria of a different category of assets for which such cap does not apply.

Investments in the categories described in the immediately preceding paragraph include the following types of loans (as well as interests in and securities backed by these types of loans), provided, however, that the total amount invested in all such categories does not exceed 30% of value of the HIT’s assets at the time of acquisition:

| ● | Construction and/or permanent loans that (i) are supported either by the full faith and credit of a state or local government (or an agency or instrumentality thereof); (ii) are issued or guaranteed by a state or local housing finance agency and meet certain rating requirements; (iii) are issued by such an agency that meets certain rating requirements and provide specified recourse in the event of default; or (iv) are made by a lender acceptable to the HIT, including a state or local government entity lender, as long as the loan (or securities backed by the loan) is secured by cash placed in escrow or trust, a letter of credit, insurance or another form of guaranty issued by an entity that meets certain credit rating requirements. The total principal amount of the investment in this category shall not exceed 15% of the value of the HIT’s assets at the time of acquisition. |

12

| ● | Loans described below that, in the aggregate, do not exceed 15% of the value of the HIT’s assets, at the time of purchase: |

| ■ | Bridge loans for multifamily housing development projects which have allocations or other rights to receive state or federal tax credits; and |

| ■ | Construction and/or permanent mortgage loans for projects that (i) have evidence of support from state or local governments and/or that are undertaken by a private entity with a successful record of real estate development, and that meet specified underwriting criteria or other additional requirements; or (ii) meet certain specified underwriting criteria but that need not be guaranteed, insured or backed by any other collateral other than the mortgage on the project (together Direct Mortgage Loans). |

| ● | Loans to certain investment funds which are involved with federal New Markets Tax Credit transactions. The total principal amount of such investments outstanding from time to time shall not exceed 3% of the value of all of the HIT’s assets at the time of purchase. |

For purposes of calculating the value of investments at the time of acquisition on forward commitments in order to meet the thresholds noted for the categories above, the HIT will not include principal amounts that the HIT has promised to fund but has not yet actually funded.

The HIT may also invest in state and local government credit-enhanced Mortgage Securities or privately credit-enhanced Mortgage Securities that have any combination of the types of credit enhancement required for HIT investments, provided that 100% of the principal portion of the investment has an acceptable form of credit enhancement. Multiple forms of credit enhancement may be combined either concurrently or sequentially.

The Mortgage Securities described in this section will not typically be insured by FHA, guaranteed by Ginnie Mae, or issued or guaranteed by Fannie Mae or Freddie Mac. For more information about these types of investments, including the underwriting and credit

13

enhancement criteria that apply to each, see “DESCRIPTION OF THE HIT, ITS INVESTMENTS AND RISKS” in the HIT’s SAI.

Other Securities. The HIT may invest up to 20% of its assets in the following categories, in the aggregate: (i) securities issued by the U.S. Treasury and futures contracts on securities issued by the U.S. Treasury, (ii) corporate securities issued or guaranteed by Fannie Mae and Freddie Mac or the Federal Home Loan Banks (“FHLBs”), (iii) securities backed by Fannie Mae, Freddie Mac, or the FHLBs, as long as such securities are rated in one of the two highest rating categories at the time of acquisition by at least one nationally recognized statistical rating organization, and (iv) Commercial Mortgage Backed Securities (“CMBS”), provided that such securities are rated in the highest rating category by at least one nationally recognized statistical rating organization at the time of acquisition (collectively, “Other Securities”). The HIT may invest up to 5% of its assets (measured using notional value) in U.S. Treasury futures contracts. Note that caps described in this section do not limit the HIT’s ability to invest in any asset that also meets the criteria of a different category of assets for which no cap applies or for which another cap applies.

CMBS are generally multi-class pass-through securities backed by a mortgage loan or a pool of mortgage loans secured by commercial properties, including multifamily housing, office buildings, shopping centers, retail space, hotel, motel and other hospitality properties, mobile home parks, self-storage facilities and industrial and warehouse properties. The underlying mortgage loans are often balloon loans, rather than loans that fully amortize over their terms and the properties securing the mortgage loans that back the CMBS may also be subject to subordinate debt and/or mezzanine debt.

Other Liquid Investments. Pending investment in Mortgage Securities or Other Securities, the HIT may hold its assets in cash or various cash-like or other liquid instruments, including U.S. Treasury issues, repurchase agreements, federal agency issues, mutual funds that invest in such securities, certificates of deposit and other obligations of domestic banks, commercial paper, collateral loans and warehousing agreements and instruments, which are liquid but which may or may not be secured by real estate or by federal guarantees or insurance (collectively “Other Liquid Investments”).

MORE ON PRINCIPAL INVESTMENT RISKS

As with any mutual fund, there can be no guarantee that the HIT will meet its objectives, or that the HIT’s returns will be positive over any period of time. This section provides additional discussion of the primary risks that can affect the value of an investment in the HIT.

14

Market Risk

The value of a Participant’s investment in the HIT is based on the values of HIT’s investments, which will fluctuate and/or may decline due to economic and other events that affect the markets in which the HIT invests. These events may be sudden and unexpected, and could adversely affect the liquidity of the HIT’s investments, which may in turn impact valuation, the HIT’s ability to sell securities and/or its ability to meet redemptions, and could cause the HIT to underperform other funds with similar objectives. The risks associated with these developments may be magnified in response to adverse issuer, regulatory, political, economic and other global market developments and disruptions, including those arising out of geopolitical events (such as war), health emergencies (such as pandemics and epidemics), natural disasters, terrorism, recessions, inflation, rapid interest rate changes, supply chain disruptions, sanctions, and governmental or quasi-governmental actions. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region, sector or financial market may adversely impact issuers in a different country, region, sector, industry or financial market. Different sectors of the market and different security types may react differently to such developments; however, these events may negatively affect issuers, industries and markets worldwide and adversely affect the HIT. Changes in these markets may be rapid and unpredictable. Fluctuations in the markets generally or in a specific industry or sector may impact the securities in which the HIT invests. From time to time, markets may experience periods of stress for potentially prolonged periods that may result in: (i) increased market volatility; (ii) reduced market liquidity; and (iii) increased redemptions. Such conditions may add significantly to the risk of volatility in the net asset value (“NAV”) of the HIT’s Units and adversely affect the HIT and its investments.

Interest Rate Risk

The NAV of each Unit in the HIT reflects such Unit’s pro rata portion of the market value of the HIT’s portfolio. The value of the HIT’s portfolio, and the resulting NAV of the HIT Units, will fluctuate, primarily in response to changing interest rates. Generally, when market interest rates rise, the NAV will fall and conversely, when market interest rates fall, the NAV will rise. If market interest rates rise, the value of the HIT’s securities, and therefore the value of a Participant’s investment in the HIT, may fall below the principal amount of such an investment. Participants who redeem Units at such times may suffer a loss. The HIT may face a heightened level of interest rate risk in times of monetary policy change and/or uncertainty, such as when the Federal Reserve Board, as in recent times, adjusts a quantitative easing program and/or changes the federal funds rate. The risk associated with rising interest rates, which may be higher during periods of high inflation, may lead to declines in the value of fixed-income assets, including those held by the HIT. Because longer-term fixed-income assets may

15

be more sensitive to interest rate changes, rising interest rates may pose additional risk to funds, such as the HIT, whose portfolios include such assets.

As a risk mitigation strategy, the HIT periodically buys or sells portfolio investments and invests in U.S. Treasury futures contracts in order to address fluctuations in the expected weighted average life of the portfolio, manage the duration of the portfolio and/or maintain a desirable level of portfolio diversification. Weighted average life is the average expected life of a security, taking into account the maturity, amortization and likelihood of prepayment of the security. Duration is a risk measure used to express the price (value) sensitivity of a fixed-income security as it relates to changes in the general level of interest rates. It measures this sensitivity more accurately than maturity because it takes into account the time value of the projected cash flows generated by the security over its life. Duration is calculated by discounting the future interest and principal payments to reflect their present value and then multiplying such payments by the number of years they are expected to be received to produce a value expressed in years. Effective duration takes into account call features and prepayment expectations that may shorten or extend the expected life of a security. There is no assurance that the HIT’s risk mitigation strategy will be effective.

Prepayment and Extension Risk

Falling market interest rates generally cause the value of the HIT’s investments to rise. However, unlike most other fixed-income investments, falling market interest rate environments may also result in downward pressures on the value of the HIT’s investments, including Mortgage Securities and CMBS, if these investments are not subject to prepayment protections, because borrowers tend to refinance in that environment. The reduction of principal on high-yielding investments as a result of refinancing and the reinvestment of proceeds at lower interest rates can reduce the potential increase in the value of investments which might otherwise occur in response to falling interest rates, reduce the yield on investments, and cause values of investments to fall below what the HIT paid for them, resulting in an unrealized loss. Any of these events could cause a decrease in the HIT’s income and/or Unit price. As described above, the HIT typically negotiates forms of prepayment restrictions on its Mortgage Securities backed by Multifamily Projects to mitigate this risk. There is no assurance that the HIT’s risk mitigation strategy will be effective.

When market interest rates rise above the interest rates of the HIT investments, the prepayment rate of the mortgage loans backing the HIT’s investments may decrease, causing the average maturity of HIT investments to lengthen. This may increase the HIT portfolio’s sensitivity to rising rates and the potential for the value of the portfolio to decline.

16

Economic conditions may affect prepayment and extension risk for investments of the HIT and may not be predictable.

Credit Risk

Credit risk is the risk of loss of principal and interest as a result of a failure of an issuer of the HIT’s investments to make timely payments, a failure of a credit enhancement backing a HIT investment after a default on the underlying mortgage loan or other asset, a downgrading of the credit rating of an investment (or a perceived decline in creditworthiness) or of the provider of the credit enhancement for an investment, or a decline in the value of assets underlying the mortgage loan.

The HIT’s assets are primarily invested in securities that are issued, guaranteed or insured by the U.S. government, Fannie Mae, or Freddie Mac or the FHLBs. As of December 31, 2022, approximately 86.13% of the HIT’s assets (excluding cash) were issued, guaranteed or insured by the U.S. government, Fannie Mae, or Freddie Mac. Fannie Mae, Freddie Mac and the FHLBs are privately-owned government-sponsored enterprises and their obligations are not directly backed by the U.S. government. It is possible that these entities may not have the funds to meet their payment obligations in the future. However, the U.S. government through the Federal Housing Finance Agency (“FHFA”) has taken Fannie Mae and Freddie Mac into conservatorship and has the authority to transfer any of Fannie Mae’s or Freddie Mac’s assets or liabilities, including their guaranties, without the approval of any other party, including any holder of Mortgage Securities guaranteed by Fannie Mae or Freddie Mac. Accordingly, Fannie Mae and Freddie Mac are dependent upon the continued support of the U.S. Treasury and FHFA in order to continue their business operations. Any changes related to the government guarantees could negatively affect the credit ratings and/or the value of assets issued, guaranteed or insured by Fannie Mae, Freddie Mac and the FHLBs. For more information on the federal policies with regard to these entities, including information related to becoming a receiver of one of these entities, see the “Risks Related to Fannie Mae and Freddie Mac Investments” section of the SAI.

To the extent credit enhancement for the HIT’s investments is provided by private entities, by state or local governments, or by agencies or instrumentalities of state or local governments, there is a risk that, in the event of a default on the underlying mortgage loan (or other asset), the insurer/guarantor will not be able to meet its insurance or guaranty obligations. A significant portion of the HIT’s assets may be invested in Mortgage Securities that have credit enhancement provided by such entities, or have evidence of support by a state or local government or agency or instrumentality thereof. The Declaration of Trust generally imposes certain rating requirements on the entities providing such credit enhancement, but the investments themselves may not have to be rated or ratable.

17

Credit ratings reflect the opinions of the issuing ratings organization and are not guarantees as to liquidity or creditworthiness. Although credit ratings may not accurately reflect the true credit risk of an instrument, a change in the credit rating of an instrument or an issuer can have a rapid, adverse effect on the instrument’s valuation and liquidity and make it more difficult for the HIT to sell at an advantageous price or time. There is no assurance that a rated security or rated credit enhancement provider will retain the required rating level for the life of the investment. Instead, as is the case with any rating, the rating could be revised downward or withdrawn entirely at any time by the rating entity that issued it. A rating downgrade or the withdrawal of a rating may indicate an increase in the risk of default by the credit enhancement provider in the event of a default on the related asset and may also result in a reduction in the value of the investment and/or render it illiquid. Whether an investment, or a provider of the credit enhancement, meets the required credit rating is determined at the time of purchase. The HIT is not required to dispose of any asset solely because the rating of any investment or any entity providing credit enhancement for an investment has been downgraded or withdrawn, even if the HIT would not have been authorized to acquire such asset had the reduced rating been in effect at the time the HIT acquired such asset. For more information on these rating requirements, see the “DESCRIPTION OF THE HIT, ITS INVESTMENTS AND RISKS” section of the SAI.

As noted above, the HIT may invest in securities that are not rated or credit-enhanced. A rating does not provide any assurance of repayment and is subject to revision or withdrawal at any time by the rating agency, but ratings do provide a prospective investor with some indication that the proposed structure and revenue analysis for the investment satisfy the rating agency’s internal criteria for the applicable rating. Unrated investments may also be less liquid than rated investments. Market events have caused some to question the extent to which one can rely on ratings.

CMBS typically do not have credit enhancement provided by a government agency or instrumentality, by any private mortgage insurer or any other firm or entity. Instead, a CMBS offering will consist of several different classes or “tranches” of securities, which have varying exposure to default. The credit risk with respect to CMBS is the risk that the level of defaults on the underlying mortgage loans may be severe enough to result in shortfalls in the payments due to the particular tranche of the CMBS in which the HIT has invested. The HIT may invest only in CMBS rated in the highest rating category by at least one nationally recognized statistical rating organization at the time the CMBS is acquired (e.g., AAA or Aaa), which should have the lowest credit risk within the offering. As discussed above, ratings reflect the opinions of the issuing ratings organization and are not guarantees as to quality.

18

Default Risk

There is a risk that borrowers may default on the securities held by the HIT or under the mortgage loans that directly or indirectly secure the HIT’s Mortgage Securities, Bridge Loans, Direct Mortgage Loans or other investments. In the event of default, the HIT may experience a loss of principal and interest on the related investments. The HIT seeks to minimize the risk of default by seeking in most, but not all, cases to invest in credit-enhanced investments. Notwithstanding the credit enhancement protection, the HIT may experience losses in the event of defaults. In addition, credit enhancements extend only to the principal and interest due on the security but not to any premium in the price or value of such securities.

As of December 31, 2022, 86.33% of the HIT’s assets were directly or indirectly insured by FHA or guaranteed by Ginnie Mae or issued or guaranteed by Fannie Mae, or Freddie Mac or the FHLBs or were in cash, Other Liquid Investments or U.S. Treasury securities. In addition, almost all of the HIT’s other Mortgage Securities have some form of credit enhancement to help protect against losses in the event of default. Notwithstanding the credit enhancement protection, the HIT may experience losses in the event of defaults under the loans that directly or indirectly back the HIT’s Mortgage Securities. Some forms of credit enhancement, including Ginnie Mae, Fannie Mae and Freddie Mac guarantees, may eliminate the risk of loss of principal and interest on the Mortgage Securities if honored in accordance with their terms. Mortgage Securities backed by Ginnie Mae bear the full faith and credit of the U.S. government. As of December 31, 2022, approximately 29.97% of the HIT’s portfolio was backed by Ginnie Mae, which guarantees 100% reimbursement of the principal and interest on its Mortgage Securities. Credit enhancement by Ginnie Mae mitigates the risk of loss of principal and interest on the Mortgage Securities. Other forms of credit enhancement, including Fannie Mae and Freddie Mac guarantees, would mitigate the risk of loss of principal and interest on the Mortgage Securities if honored in accordance with their terms. As of December 31, 2022, approximately 49.63% of the HIT’s assets were issued or guaranteed by Fannie Mae or Freddie Mac. Mortgage Securities backed by Fannie Mae or Freddie Mac are not insured or directly guaranteed by the U.S. government, any government agency or any other firm or entity. However, the U.S. Treasury Department has committed to cover certain losses of Fannie Mae and Freddie Mac up to the amounts detailed in the “Risks Related to Fannie Mae and Freddie Mac Investments” section of the SAI.

Mortgage Securities insured by FHA are fully insured as to the principal amount of the related mortgage loan, but FHA deducts 1% of the principal amount of the defaulted mortgage loan as an assignment fee on an insurance claim. FHA insures interest on the defaulted mortgage loan through the date of default, but mortgage insurance benefits do not include the accrued interest due on the date of default. FHA may also deduct certain other

19

amounts or make other adjustments in the mortgage insurance benefits payable in accordance with its mortgage insurance program.

If guarantees, insurance or other credit enhancements cover any resulting losses of principal and interest, the impact on the HIT’s portfolio of any default on a mortgage loan or other asset securing an investment will be the premature liquidation of the relevant loan or other asset and the loss of any premium in the value of such investment. An investment in the HIT is not insured by the federal government, any government agency, Fannie Mae, Freddie Mac, the FHLBs or any other firm or entity.

If a state or local government entity or private entity providing credit enhancement for an investment fails to meet its obligations under the credit enhancement in the event of a default of the underlying mortgage loan, the HIT would be subject to the risks that apply to real estate investments generally with respect to that investment. In the case of investments backed by nursing home, assisted living or other healthcare facilities, economic performance may also be affected by state and federal laws and regulations affecting the operation of the underlying facility, as well as state and federal reimbursement programs and delays or reductions in reimbursements. The portion of the HIT’s portfolio holdings with no form of credit enhancement, such as Bridge Loans and Direct Mortgage Loans, will be subject to all the risks inherent in investing in loans or other assets secured by real estate or other collateral.

During the five years ended on December 31, 2022, the HIT realized no losses because of defaults. However, there is no guarantee that defaults will not result in losses in the future, and the risk of default is increased under current market conditions because of rising interest rates, rising costs of building materials and an increased risk of recession, among other reasons.

The HIT seeks to minimize the risk of default with respect to mortgage loans securing CMBS by investing only in CMBS rated in the highest rating category by at least one nationally recognized statistical rating organization at the time of acquisition. However, ratings are only the opinions of the companies issuing them and are not guarantees as to quality. For more information about real estate-related risks and potential losses, see the “Defaults on Loans” and “Real Estate-Related Risks” sections of the SAI.

Mortgage-Backed Securities Risk

As in the case with other fixed- income securities, when interest rates rise, the value of MBS generally will decline; however, when interest rates decline, the value of MBS with prepayment features may not increase as much as other fixed-income securities. The value of some MBS in which the HIT may invest may be particularly sensitive to changes in prevailing interest rates, and, like the other investments of the HIT, the ability of the HIT to successfully

20

utilize these instruments may depend in part upon the ability of the portfolio managers to forecast interest rates and other economic factors correctly. If the portfolio managers incorrectly forecast such factors and have taken a position in MBS that is or becomes contrary to prevailing market trends, the HIT could be exposed to the risk of a loss. Investments in MBS pose several risks associated with the performance of the underlying mortgage properties, including prepayment, extension, market, default, interest rate and credit risk, each of which is discussed in this Prospectus. Besides the effect of prevailing interest rates, factors such as changes in home values, consumer spending habits, tenant occupancy rates, regulatory or zoning restrictions, ease of the refinancing process and local economic conditions may adversely affect the economic viability of the mortgaged property. In addition, while the terms of most structured finance investments, including MBS, have transitioned to the Secured Overnight Funding Rate (“SOFR”) as a reference rate or benchmark, some assets continue to be tied to the London Interbank Offered Rate (“LIBOR”). It is expected that U.S. Dollar LIBOR will be discontinued by June, 30 2023 at which point legacy securities will transition to reference SOFR plus the spread adjustment set by the International Swaps and Derivatives Association on March 5, 2021 for various funding terms.

U.S. Government-Related Securities Risk

Some of the U.S. government-related securities in which the HIT invests are not backed by the full faith and credit of the United States government, which means they are neither issued nor guaranteed by the U.S. Treasury. Issuers such as the FHLBs maintain limited access to credit lines from the U.S. Treasury. Others are supported solely by the credit of the issuer. There can be no assurance that the U.S. government will provide financial support to securities of its agencies and instrumentalities if it is not obligated to do so under law. Also, any government guarantees on securities the HIT owns do not extend to Units of the HIT themselves.

Liquidity Risk

Markets for particular types of securities may experience liquidity issues. That is, a lack of buyers at a particular time could negatively impact the value of a security during such period, even though over time the payment obligations under the security may be met. This is sometimes referred to as liquidity risk. If the HIT is forced to sell an illiquid asset to meet redemption or other cash needs, the HIT may be forced to sell at a loss. In addition, rising interest rates could result in periods of increased market volatility and increases in redemptions.

The lack of an active trading market may also make it difficult to sell or obtain an accurate price for a security. Liquidity risk may also refer to the risk that the HIT may not be able to meet redemption requests without significant dilution of the remaining Participants’

21

interests in the HIT because of unusual market conditions, an unusually high volume of redemption requests, redemption requests from one or more large Participants or other reasons. To meet redemption requests or to raise cash to pursue other investment opportunities, the HIT may be forced to sell securities at an unfavorable time and/or under unfavorable conditions, which may adversely affect the HIT.

Leverage Risk

Leverage risk can occur when securities or investing techniques magnify the effect of small changes in an index or a market. As noted above, the HIT may invest in forward commitments and U.S. Treasury futures contracts (and is permitted to invest in Total Return Swap (“TRS”) contracts), which may effectively add leverage to the HIT’s portfolio. Forward commitments may add leverage because the HIT would be subject to potential compound losses on the asset that it is committed to purchase and on the assets that it holds pending that purchase. Investments in U.S. Treasury futures contracts may add leverage because, in addition to its total net assets, the HIT would be subject to investment exposure on the notional amount of the futures contracts. TRS contracts are not a principal investment strategy, but if entered into, they may add similar leverage to the HIT’s portfolio. Leverage risk may impact the HIT to the extent that losses taken on both a TRS contract and the investments made with proceeds from the associated sale of the tax-exempt bonds could compound one another.

Large Participant Transaction Risk

The HIT may experience adverse effects if Participants purchase or redeem large amounts of Units of the Fund. Such large Participant redemptions, which may occur rapidly or unexpectedly, may cause the HIT to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the HIT’s NAV and liquidity. Similarly, large Unit purchases may adversely affect performance to the extent that the HIT is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. In addition, a large redemption could result in the HIT’s current expenses being allocated over a smaller asset base, leading to an increase in the HIT’s expense ratio.

Derivatives Risk

In addition to the liquidity and leverage risk discussed above, the use of derivatives (such as U.S. Treasury futures and TRS contracts) can involve additional risks, such as potential losses if interest rates do not move as expected and the potential for greater losses than if derivatives had not been used. Derivatives, including U.S. Treasury futures and TRS contracts, may pose risks in addition to and greater than those associated with investing directly in securities. Investments in derivatives can increase the volatility of the HIT’s Unit price and may

22

expose it to significant additional costs. The use of derivatives can also create liquidity demands on the portfolio, in the event unexpected losses cause the HIT to sell other assets to meet margin or settlement payments related to its futures trading. Derivatives may be less liquid and more difficult to sell or value. TRS contracts are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments. There is no guarantee that the use of derivatives will achieve their intended result.

For more information about the risks of an investment in the HIT, please see the “DESCRIPTION OF THE HIT, ITS INVESTMENTS AND RISKS – RISK FACTORS” section of the SAI.

Portfolio Holdings

A description of the HIT’s policies and procedures with respect to the disclosure of the HIT’s portfolio securities is set forth in the “Disclosure of Portfolio Holdings” section of the SAI available on the HIT’s website at www.aflcio-hit.com. A full list of portfolio holdings is also available on the HIT’s website generally within 10 days of month-end.

BUYING AND SELLING UNITS IN THE HIT

ELIGIBLE INVESTORS

Only “Labor Organizations” and “Eligible Pension Plans” may purchase Units in the HIT. Pursuant to the Declaration of Trust, a “Labor Organization” is an organization in which employees participate, directly or through affiliated organizations, and which exists for the purpose, in whole or in part, of dealing directly or through affiliated organizations with employers concerning terms or conditions of employment. The term also includes any employee benefit plan (such as a voluntary employee beneficiary association (VEBA) and health and welfare funds) that benefits the members of such a Labor Organization or any other organization that is, in the discretion of the Board of Trustees of the HIT, affiliated with or sponsored by such a Labor Organization.

Pursuant to the Declaration of Trust, “Eligible Pension Plans” means certain plans which have beneficiaries who are represented by a Labor Organization and which are managed without the direct intervention of the beneficiaries, including trustee-directed annuity or supplemental plans. These include pension plans constituting qualified trusts under Section 401(a) of the Internal Revenue Code of 1986, as amended (the “Code”), governmental plans within the meaning of Section 414(d) of the Code, and master trusts (such as collective

23

investment trusts (CITs)) that hold assets of at least one such pension plan or governmental plan. These also include non-United States pension or retirement programs, including those in Canada and the European Union, that are similar to U.S. state or local governmental plans or that are subject to regulations that are similar in purpose and intent to the Employees Retirement Income Security Act of 1974, as amended.

For more information about the HIT’s eligible investors, please see the “Eligible Participants” section of the SAI.

To inquire about the purchase or sale of Units in the HIT, contact the HIT at the address and telephone number on the back cover of this Prospectus.

PURCHASING AND PRICING UNITS

Units in the HIT may be purchased only from the HIT. A minimum initial investment of $50,000 is required. Whole or fractional Units may be purchased. Units may only be purchased as of the last business day of each month (each a “Purchase Date”). The HIT defines “business day” as a day on which the New York Stock Exchange (“NYSE”) is open. Each purchase request, if received in good order, will be processed and priced as of the last business day of the month in which it is received. “Good order” generally means that any applicable participation form is fully completed and your instructions are provided by the person(s) authorized to request transactions in the account and are received by the HIT’s transfer agent before 4:00 p.m. Eastern Time on the last business day of the month, the Purchase Date. You must remit the required payment for your Units to the HIT’s transfer agent by check or wire transfer for receipt by the transfer agent generally no later than 8:00 p.m. Eastern Time (under normal conditions) on the Purchase Date. All purchase payments received prior to the Purchase Date (e.g., mid-month) will be held in the HIT’s non -interest-bearing demand deposit account by its transfer agent, as directed by the Participant, until the Purchase Date. A copy of the participation form that must accompany your initial purchase order is available from the HIT at no charge upon request. All Units are sold without any sales charge (load) or commission. Units are issued and redeemed by book entry and without physical delivery of any securities. The HIT has the right to reject any purchase order, or to suspend or modify the sale of Units.

The price of any Unit purchased will be equal to its NAV as of the close of regular trading (normally 4:00 p.m.) of the NYSE on the last business day of each month (“NYSE Close”). Information that becomes known to the HIT or its agents after the NYSE Close will not generally be used to retroactively adjust the price of a security or the NAV determined as of the applicable month end. The HIT reserves the right to change the time of which its NAV is calculated if the HIT closes earlier, or as permitted by the U.S. Securities and Exchange Commission (“SEC”). The NYSE is typically closed on New Year’s Day, Martin Luther King

24

Jr. Day, Washington’s Birthday, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day, and on the preceding Friday or subsequent Monday when one of these holidays falls on a Saturday or Sunday, respectively. The NAV is calculated by dividing the total value of the HIT (the value of all of the HIT’s assets minus all of the HIT’s liabilities) by the total number of Units outstanding on the date of calculation. The HIT calculates the NAV of the Units only as of the last business day of each month.

The Board has ultimate responsibility for valuation but has delegated day-to-day valuation responsibilities to officers of the HIT who comprise the valuation committee (“Valuation Committee”) as the “valuation designee”. For the bulk of its investments, the HIT uses evaluated prices, generally furnished by independent pricing services through its fund accountant, to value the HIT’s assets for which such prices are readily available and deemed reliable. These pricing services have been approved by the Board. For certain other investments, the HIT uses price quotes from exchanges or mutual funds, as appropriate.

The HIT’s assets for which third-party evaluated prices are not readily available or are deemed unreliable are valued at fair value determined in good faith under consistently applied procedures approved by the Board and implemented by the Valuation Committee. In these cases, the fair value of an asset is the amount, as determined in good faith, that the HIT reasonably expects to receive upon a current sale of the asset. Fair value determinations are made using the methodologies deemed most appropriate under the circumstances and considering all available, relevant factors and indications of value. The HIT has retained an independent firm to determine the fair value of portfolio assets when necessary and appropriate, in accordance with the policies and procedures established and approved by the Board. Securities purchased with a stated maturity of less than 60 days are valued at amortized cost, which constitutes fair value under the policies and procedures adopted by the Board. Valuing assets using fair value methodologies involves greater reliance on judgment than valuing assets based on market quotations. A fund that uses fair value methodologies may value those assets higher or lower than another fund using its own fair value methodologies to price the same securities. Because of the judgment involved in fair valuation decisions, there can be no assurance that the value ascribed to a particular asset is accurate or that the HIT could sell the asset at the value assigned to the asset by the HIT.

The HIT’s fund accountant calculates an estimated value of the HIT’s portfolio on a daily basis based on pricing inputs and fair value modeling from various sources, which it combines with expense and Unit holdings information from the HIT to produce an estimated daily value (“EDV”) for the HIT. The HIT posts the EDV on its website after the close of business on each business day. There can be no assurance that the EDV thus generated is the same as or will accurately predict the NAV calculated by the HIT as described above as part of

25

its monthly valuation process, and the value of a Participant’s Units and the price at which a Unit may be redeemed is determined solely through the HIT’s monthly valuation process. The EDV is not binding in any way on the HIT and should not be relied upon by Participants as an indication of the value of their Units.

For more information on the valuation methodology that the HIT uses, see the “VALUATION OF UNITS” section of the SAI.

SELLING OR REDEEMING UNITS

The HIT has been granted an exemption by the SEC permitting it to value its assets and accept redemption requests on a quarterly basis. However, the HIT currently accepts and satisfies redemption requests on a monthly basis as of the last business day of each month. You may not sell or transfer your Units to anyone other than the HIT and you may not pledge your Units. You may redeem whole or fractional Units. If you want to sell your Units, you must submit a signed written redemption request to the HIT’s transfer agent and it must be received on a business day at least 15 days before the last business day of the month, although the HIT may in its sole discretion waive the 15-day notice requirement. Absent a waiver, redemption requests received less than 15 days before the last business day of the month will be processed as of the last business day of the following month. You must send a signed redemption request to the HIT care of its transfer agent by first-class mail to mail to P.O. Box 534418, Pittsburgh, PA 15253-4418; by overnight mail to 500 Ross Street, 154-0520, Attention: 534418, Pittsburgh, PA 15262; or by facsimile to (508) 599-7912.

The HIT will redeem Units, without charge, at their NAV calculated as of the last business day of the applicable month. It usually takes five business days to calculate the Units’ NAV after the last business day of the month. The proceeds of any redemption request will be paid to redeeming Participants by check or wire transfer as soon as practicable beginning on the first day after the last business day of the month, but no later than seven business days after the last business day of the month.

The HIT generally expects that the 15-day redemption period notice requirement and the nature of the portfolio assets would permit the HIT to manage its redemption requests from cash or cash-equivalent assets on hand. In the event that market conditions make such redemptions impractical, the HIT would be able to sell portfolio assets and borrow money against a line of credit to help meet redemptions. In addition, if the redeeming Participant agrees, the HIT may deliver securities, mortgages or other assets in full or partial satisfaction of a redemption request. A Participant that receives such assets may incur expenses in selling or disposing of such assets for cash. Such a Participant would also bear the investment risk until it is able to dispose of the asset.

26

As described above, pursuant to an exemption granted by the SEC, the HIT prices its portfolio and accepts purchase and redemption requests monthly. Accordingly, there is minimal risk that Participants can engage in frequent purchases and redemptions of Units in a manner that would affect the interests of other Participants. Because of this very low risk, the Board of Trustees has not found it necessary to adopt policies and procedures with respect to frequent purchases and redemptions of Units by Participants.

DISTRIBUTION CHARGES (RULE 12b-1 FEES)

The HIT has adopted a Distribution Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “1940 Act”) that allows it to pay for the sale and distribution of its Units in an amount per fiscal year up to the greater of $600,000 or 0.05% of the HIT’s average net assets on an annualized basis, which equaled approximately $3,225,000 for 2022. For the year ended December 31, 2022, the actual distribution fees paid by the HIT were $1,251,353, representing roughly 0.019% of the HIT’s average net assets. The expenses covered by the HIT’s distribution fees primarily include, without limitation, the costs associated with the printing and mailing of prospectuses to prospective investors, compensation of sales personnel (salaries plus fringe benefits), travel and meeting expenses, office supplies, consulting fees and expenses, and expenses for printing and mailing of sales literature. Any change in the Rule 12b-1 Distribution Plan that materially increases the amount of distribution fees to be paid by the HIT requires the approval of the holders of a majority of the HIT’s outstanding Units.

Because distribution fees are paid out of the HIT’s net assets on an on-going basis, over time, these fees will increase the cost of your investment and may cost you more than paying other types of sales charges.

From time to time, the HIT makes contributions or other payments to organizations that promote, among other things, the production of housing, the labor movement or charitable activities. Some of these payments, such as the purchase of an advertisement at a sponsored event, are included in the expenses covered under the HIT’s Rule 12b-1 Distribution Plan. In the fiscal year ended December 31, 2022, these contributions and payments totaled approximately $362,351 of which approximately $104,416 was included as Rule 12b-1 expenses.

27

MANAGEMENT AND STRUCTURE

MANAGEMENT

The HIT’s portfolio is internally managed and has no advisory contract with an investment adviser. Management of the HIT’s portfolio is conducted by the Portfolio Management Team and by the Portfolio Management Committee, comprised of senior executive managers. The Portfolio Management Team is responsible for the day -to-day operations of the HIT’s portfolio, including managing the portfolio to maintain a risk profile similar to the Bloomberg Aggregate. The Portfolio Management Committee sets the HIT’s portfolio management strategy and oversees the work of the Portfolio Management Team.

Chang Suh, Chief Executive Officer and Chief Investment Officer, and William K. Pierce, Senior Portfolio Manager, are jointly and primarily responsible for day-to-day management of the HIT’s portfolio. Mr. Suh has been a key member of the HIT’s Portfolio Management Team since 1998, including 20 years as Chief Portfolio Manager and Chief Investment Officer. Mr. Pierce, who joined the HIT’s Portfolio Management Team as Portfolio Manager in October 2020, has 9 years’ experience in the financial markets. Both hold the CFA Institute’s Chartered Financial Analyst designation.

The SAI provides information about the structure of Messrs. Suh’s and Pierce’s compensation and their potential ownership of an indirect interest in the HIT through the HIT’s 401(k) Plan. Messrs. Suh and Pierce do not manage other accounts.

The Investment Committee reviews and approves proposed investments in Mortgage Securities for transactions negotiated and structured by HIT staff to ensure that they meet the risk and return requirements of the HIT. The Investment Committee is comprised of senior HIT staff. Any proposed investment or transaction in any single newly originated mortgage investment that exceeds $75 million or in any other single asset that exceeds two percent (2%) of net assets of the HIT requires the approval of the Executive Committee of the Board of Trustees.

HIT STRUCTURE

The HIT is organized in the District of Columbia as a common law business trust and is registered under the 1940 Act as an open-end investment company (or mutual fund). Because the HIT is internally managed, all of the officers and employees who oversee the management of the HIT are employees of the HIT.

The majority of jurisdictions in the United States recognize a trust such as the HIT as

28

a separate legal entity, wholly distinct from its beneficiaries. In these jurisdictions, the beneficiaries are not liable for the debts or other obligations of a business trust. Certain jurisdictions do not recognize “business trusts” as separate legal entities and instead hold the beneficiaries of such trusts personally liable for actions of the business trusts. The HIT will not exclude otherwise eligible investors in jurisdictions that take this position from investing in Units.

It is the practice of the HIT to seek to include in its written contracts that the HIT executes a provision stating that the contract is not binding upon any of the Trustees, officers or Participants personally, but is solely an obligation of the HIT. In most jurisdictions, Participants will have no personal liability under any contract which contains this provision. However, in jurisdictions that do not recognize the separate legal status of a trust such as the HIT, Participants could be held personally liable for claims against the HIT. These claims could include contract claims where the contract does not limit personal liability, tort claims, tax claims and certain other statutory liabilities. If such liability were ever imposed upon Participants, Participants would be liable only to the extent that the HIT’s assets and insurance were not adequate to satisfy the claims.

HIT’s Wholly Owned Investment Adviser

As authorized by the HIT’s Participants and in accordance with no action relief granted by the SEC under Section 12(d)(3) of the 1940 Act, the HIT wholly owns a subsidiary investment adviser, HIT Advisers LLC (“HIT Advisers”), a Delaware limited liability company, which can provide investment advisory services to external parties. More specifically, the HIT holds a 99.9% direct membership interest in HIT Advisers and indirectly holds the remaining membership interest through its 100% ownership of HIT Adviser’s managing member, HIT Advisers Managing Member LLC (“Managing Member”), a Delaware limited liability company. This structure is intended to mitigate any risk of liability for the HIT associated with any claims that may arise from the operations of HIT Advisers.