2020 IBEW/NECA Employee Benefits Conference AFL - CIO HIT Chang Suh, CFA CEO & Co - Chief Portfolio Manager Presented to January 26, 2021

AFL - CIO Housing Investment Trust Competitive Returns | Union Construction Jobs | Affordable Housing x $ 6 . 75 billion investment grade fixed - income portfolio as of December 31 , 2020 x Mutual fund in operation since 1984 (successor to the Mortgage Investment Trust, 1965 ) x Created to pool together pension capital in order to : ▪ Encourage and assist development of lower income housing while creating employment for the construction trades ▪ Prudently invest in fixed income mortgage investments x Investment strategy focused on high credit quality multifamily mortgage securities x Multifamily Mortgage Investments offer significant relative value opportunities versus other investment grade products due to inefficiencies in the marketplace x Competitive Returns – 22 out of 25 years outperforming its benchmark on a gross basis ; 14 of those years on a net basis . x Union Job Creation – 100 % union construction requirement 1 Please see standardized performance information for the 1 - , 3 - , 5 - and 10 - year periods on page 10. Additional performance period information is available upon request.

Plan types include pension, health & welfare, annuity, among others. $2,224.73 33% $940.99 14% $1,338.31 20% $1,741.19 26% $504.07 7% Investors at a Glance (as of 12/31/2020) $ in Millions Building Trades - Local (248) Building Trades - National (20) Industrial - Other (51) Public (13) Service (32) Investor Profile: 364 Investors 2

HIT’s Long History of Impact Investing Successful history as a fixed income impact investor incorporating Environmental, Social, and Governance (ESG) factors into its investment strategy and signatory of the United Nations - supported Principles for Responsible Investment (PRI) NATIONWIDE ECONOMIC IMPACT OF INVESTMENTS * (1984 - present) Cote Village Boston, MA Gateway Northeast Minneapolis, MN Project 29 (Church + State) Cleveland, OH 18 Sixth Avenue at Pacific Park Brooklyn, NY 545 $9.1 B $17.1 B $34.0 B $13.8 B 182.2 M 200,113 118,679 Projects in HIT Investment, $185.0M in New Markets Tax Credit (NMTC) allocations in total development cost in total economic benefits in personal income, including wages and benefits with $7.0B for construction workers hours of on - site union construction work created total jobs generated across communities housing and healthcare units, with 67% affordable housing *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 . Economic impact data is in 201 9 dollars and all other figures are nominal . 3

IBEW Estimated Hours of Work on HIT Projects* Since Inception (1984 – 2020) Total hours of IBEW work generated: 27.5 million Total hours of union work generated: 182.2 million Last 10 Years (2010 – 2020) Total hours of IBEW work generated: 10.7 million Total hours of union work generated: 70.5 million 4 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 . Economic impact data is in 201 9 dollars and all other figures are nominal .

^ In addition, HIT subsidiary Building America CDE, Inc . (Building America) contributed New Markets Tax Credit (NMTC) allocations as follows : $ 21 M in Boston, $ 10 M in Chicago, $ 8 M in NYC . $ 185 . 0 M nationwide (1984 - 2020) Bay Area Boston Chicago New York City Twin Cities Major Markets Nationwide # of Projects 21 36 53 68 68 246 545 HIT Investment^ $467.2M $667.4M $742.8M $1.8B $1.2B $4.9B $9.1B Total Development Cost $866.0M $1.6B $1.7B $4.4B $1.8B $10.3B $17.1B Union Construction Hours 10.2M 12.9M 18.3M 24.2M 17.8M 83.5M 182.2M Total Jobs Created 11,127 14,890 18,590 26,220 22,079 92,906 200,113 Housing Units (% affordable) 3,520 (35%) 4,232 (89%) 12,151 (69%) 42,353 (92%) 9,940 (48%) 72,196 (79%) 118,679 (67%) Total Economic Impact $1.9B $2.8B $3.1B $4.7B $3.6B $16.2B $34.0B HIT’s Investment in Major Markets* 5 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 . Economic impact data is in 201 9 dollars and all other figures are nominal .

Community Impact ▪ Types of Housing ▪ Affordable ▪ Workforce ▪ Senior 6 ▪ Other Impacts* ▪ Mixed - use including a union grocery store ▪ Healthcare Facilities ▪ Community Centers ▪ Workforce Training Facilities New Brunswick Performing Arts Center New Brunswick, NJ Building America The Penfield Saint Paul, MN HIT Longwood II Apartments Boston, MA HIT * HIT and subsidiary Building America 6

2020 – A Banner Year for HIT despite pandemic Betances Senior Apartments Bronx, NY Cote Village Mattapan, MA Lake Street Apartments Minneapolis, MN ▪ $6.75 billion AUM – raised $554 million in new capital ▪ Commitments of $429.7 million* to 13 projects, creating 4.5 million hours of union construction work and generating $652.7 million of development** ▪ 35 projects currently under construction ▪ Gross one - year return of 6.54% versus the Benchmarks’ return of 7.51%. On a credit - adjusted basis, the HIT beat the AAA component of the Barclays Aggregate’s 6.43% ▪ Reduced operating costs – a record low of 32 bps from 42 bps in 2018 7 * $ 406 . 2 million in HIT commitments and $ 23 . 5 million in NMTC . As of December 31 , 2020 , unless otherwise noted . ** Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 . Economic impact data is in 201 9 dollars and all other figures are nominal . Please see standardized performance information for the 1 - , 3 - , 5 - and 10 - year periods on page 10. Additional performance perio d information is available upon request.

HIT Projects Under Construction as of December 31, 2020 Commitment/ Construction Start HIT Projects City State Units Union Const Hrs HIT Commitment Total Development Cost 4Q 2016 Cherry Street Lofts Phase I Bridgeport CT 157 471,410 $35,000,000 $54,382,955 3Q 2018 Montclare Senior Residences of Calumet Heights Chicago IL 134 464,000 $9,200,000 $32,721,472 3Q 2018 Church & State (Project 29) Cleveland OH 158 459,220 $39,000,000 $54,834,231 4Q 2018 1490 Southern Boulevard Bronx NY 115 456,530 $35,000,000 $59,120,711 4Q 2018 Montclare Senior Residences of Englewood Chicago IL 102 352,240 $2,300,000 $25,397,680 4Q 2018 Ya Po Ah Terrace Condo B Eugene OR 112 177,980 $7,879,300 $32,226,372 4Q 2018 Ya Po Ah Terrace Condo A Eugene OR 109 136,270 $7,405,000 $29,179,063 4Q 2018 Lake Street Apartments Minneapolis MN 111 221,440 $13,500,000 $27,554,885 2Q 2019 Betances Residence Bronx NY 152 633,290 $52,000,000 $98,000,000 2Q 2019 95 Saint Alphonsus Street Apartments (Longwood II) Boston MA 115 478,300 $51,940,400 $66,685,759 2Q 2019 Bassett Creek Apartments Minneapolis MN 139 344,690 $33,609,500 $37,616,980 2Q 2019 Zvago Cooperative at Lake Superior Duluth MN 51 176,940 $14,033,700 $18,436,578 3Q 2019 The Block at 803 Waimanu Honolulu HI 153 375,700 $17,137,500 $54,228,601 3Q 2019 Old Colony Phase 3A Boston MA 135 511,510 $47,880,000 $64,040,972 4Q 2019 Cote Village Boston MA 76 415,960 $20,116,000 $49,049,428 4Q 2019 Parker Station Flats Robbinsdale MN 198 508,780 $41,393,900 $53,082,171 4Q 2019 Sundance at Settler's Ridge Woodbury MN 218 544,190 $53,545,900 $69,580,136 4Q 2019 Gateway Northeast Minneapolis MN 128 273,760 $20,950,000 $38,660,971 4Q 2019 18 Sixth Avenue at Pacific Park Brooklyn NY 858 3,881,830 $100,000,000 $710,000,000 2Q 2020 Wrigleyville North Apartments Chicago IL 120 289,900 $34,982,300 $40,912,471 3Q 2020 Northpoint Apartments Chicago IL 304 226,220 $68,984,000 $86,804,801 3Q 2020 Old Colony Phase Three B4 & B9 Boston MA 115 486,320 $42,449,000 $61,054,733 3Q 2020 Old Colony Phase Three C Boston MA 55 198,030 $36,430,000 $26,506,507 4Q 2020 Zvago Cooperative at Stillwater Stillwater MN 48 192,200 $15,825,900 $22,400,354 4Q 2020 Ventana Residences San Francisco CA 193 794,700 $52,000,000 $121,934,463 4Q 2020 Carl Mackley Houses Philadelphia PA 184 262,640 $13,800,000 $36,876,137 4Q 2020 Residences @ 150 Bagley Detroit MI 148 569,310 $37,000,000 $62,618,309 4Q 2020 University and Fairview Apartments Saint Paul MN 243 476,130 $79,100,713 $68,486,408 4Q 2020 53 Colton Apartments San Francisco CA 96 368,640 $19,058,892 $52,515,971 4Q 2020 Pinzone Towers Rocky River OH 100 75,910 $6,583,800 $12,601,487 HIT Projects 30 4,827 14,834,580 $1,008,105,805 $2,167,510,607 8

Building America Projects Under Construction as of December 31, 2020 Commitment/ Construction Start Building America CDE, Inc. Projects (HIT Subsidiary) City State Square Feet Union Const Hours New Markets Tax Credits Allocation Total Development Cost 1Q 2018 Joseph P. Addabbo Family Health Center Queens NY 44,500 216,970 $8,000,000 $23,420,528 2Q 2019 Altgeld Family Resource Center Chicago IL 40,000 252,760 $10,000,000 $28,115,001 4Q 2019 Powel - Science Leadership Academy Middle School Philadelphia PA 90,000 340,530 $9,000,000 $49,873,280 1Q 2020 YWCA of Central Massachusetts Worcester MA 74,300 187,630 $9,000,000 $24,875,180 3Q 2020 Sugar Hill Detroit MI 54,760 314,560 $14,500,000 $35,080,214 Projects Receiving Building America CDE, Inc. New Markets Tax Credits Allocation 5 303,560 1,312,450 $50,500,000 $161,364,203 Grand Total (HIT and Building America) 35 16,147,030 $2,328,874,810 Job and economic impact figures are estimates calculated using IMPLAN, an input - output model, based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data is current as of December 31 , 2020 . Economic impact data is in 2019 dollars and all other figures are nominal . This table provides information about projects financed by the HIT that were pre- or under construction as of the date of this report . Projects are included until they reach permanent loan status . The projects shown on this table may not reflect HIT’s current portfolio for any or all of the following reasons : (i) the assets related to the project(s) shown on this table may no longer be held in the HIT’s current portfolio ; (ii) other assets in the HIT’s current portfolio may have characteristics different from those shown on this table ; and (iii) this table is not a complete list of all the projects financed by the HIT as of the date of this report . Investors should consider the HIT’s investment objectives, risks, and charges and expenses carefully before investing . This and other information is contained in the HIT’s current prospectus . To obtain a current prospectus, call the HIT at ( 202 ) 331 - 8055 or visit the HIT’s website at www . aflcio - hit . com . 9

6.54% 5.04% 4.20% 3.99% 6.20% 4.66% 3.81% 3.57% 7.51% 5.34% 4.44% 3.84% 6.43% 4.64% 3.53% 3.18% 0.0% 2.0% 4.0% 6.0% 8.0% 1-year 3-year 5-year 10-year HIT Gross HIT Net Barclays Aggregate AAA Index Annualized Total Returns vs. Benchmark and AAA Index As of December 31, 2020 The performance data quoted represents past performance and is no guarantee of future results. Periods over one year are annu ali zed. Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than th e original cost. The HIT’s current performance data may be lower or higher than the performance data quoted. Performance data current to the m ost recent month - end is available from the HIT’s website at www.aflcio - hit.com. Gross performance figures do not reflect the deduction of H IT expenses. Net performance figures reflect the deduction of HIT expenses and are the performance returns that HIT’s investors obtain. I nfo rmation about HIT expenses can be found on page 1 of the HIT’s current prospectus. AAA Index represents the AAA Component of the Bloomberg Barclays US Aggregate Bond Index. HIT Performance Relative to Benchmark 10

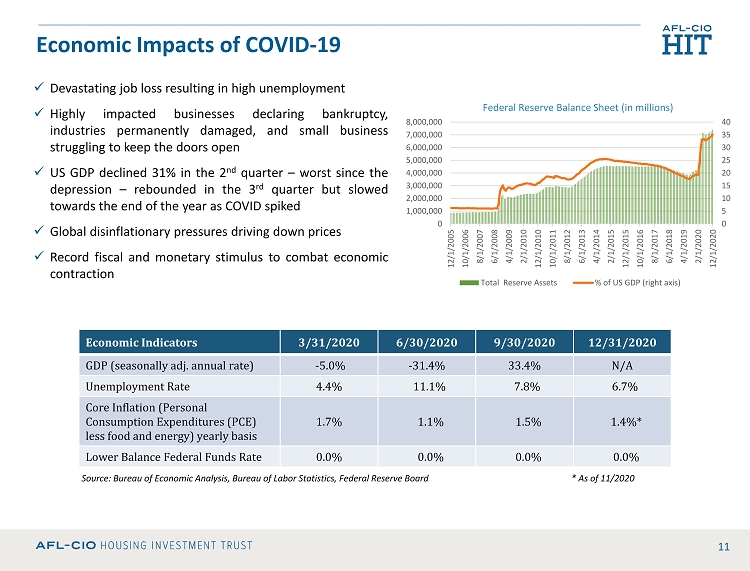

x Devastating job loss resulting in high unemployment x Highly impacted businesses declaring bankruptcy, industries permanently damaged, and small business struggling to keep the doors open x US GDP declined 31 % in the 2 nd quarter – worst since the depression – rebounded in the 3 rd quarter but slowed towards the end of the year as COVID spiked x Global disinflationary pressures driving down prices x Record fiscal and monetary stimulus to combat economic contraction 11 Economic Impacts of COVID - 19 Source: Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Board * As of 11/2020 0 5 10 15 20 25 30 35 40 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 12/1/2005 10/1/2006 8/1/2007 6/1/2008 4/1/2009 2/1/2010 12/1/2010 10/1/2011 8/1/2012 6/1/2013 4/1/2014 2/1/2015 12/1/2015 10/1/2016 8/1/2017 6/1/2018 4/1/2019 2/1/2020 12/1/2020 Total Reserve Assets % of US GDP (right axis) Federal Reserve Balance Sheet (in millions) Economic Indicators 3/31/2020 6/30/2020 9/30/2020 12/31/2020 GDP (seasonally adj. annual rate) - 5.0% - 31.4% 33.4% N/A Unemployment Rate 4.4% 11.1% 7.8% 6.7% Core Inflation (Personal Consumption Expenditures (PCE) less food and energy) yearly basis 1.7% 1.1% 1.5% 1.4%* Lower Balance Federal Funds Rate 0.0% 0.0% 0.0% 0.0%

Economic Environment and Outlook 12 x The COVID - 19 pandemic will continue to be a major factor effecting the global economy as we look ahead to 2021 . ▪ Global economic growth has lost momentum as output struggles with recent economic restrictions in the face of record numbers of COVID cases amplifying the health crisis . ▪ Permanent long - term damage to the broad economy remains uncertain as the recovery in employment has slowed with permanent unemployment rising and small businesses struggling to survive without support from the federal government . ▪ Growth is expected to return in 2021. Capital market pricing has looked past the short - term risks emphasizing future growth, government spending and inflation expectations that have risen on the prospect of vaccine distribution, optimistic reopening of the economy and Democratic control of the US government. x Federal Reserve committed to accommodative monetary policy . ▪ With inflation and unemployment well below their projected targets, the Federal Reserve has committed to maintain current interest rates until at least 2023 , aligning with market expectations . ▪ The Federal Reserve is expected to maintain its current level of $ 120 billion of monthly net asset purchases for some time - $ 80 billion in treasuries and $ 40 billion in net MBS ▪ The Federal Reserve’s new principles and framework are intended to maximize employment and allow inflation averaging above 2%. x Affordable and workforce housing development will continue to be an essential stimulus to the economy as the lingering crisis and permanent damage to the economy weigh down on low - income households. x With a sound portfolio of liquid assets, HIT is well - positioned to provide competitive financing for high credit quality construction/permanent debt that generates attractive risk - adjusted yield in this historically low - rate environment .

Biden Administration: Prioritizing Affordable Housing x Housing policy is likely to focus on affordability and increasing the supply of units x Key budget priorities include : ▪ Fully fund Section 8 rental assistance ▪ Provide downpayment assistance for homeownership ▪ First - time homebuyer tax credit ▪ Establish “floor” on 4 % low - income housing tax credit ▪ Continued or expanded eviction and foreclosure moratoria x Changes to Fannie Mae and Freddie Mac purchase limits ▪ 50 percent of the GSEs’ multifamily loans for low/moderate income tenants ▪ 20 % of GSE multifamily business affordable to low - income tenants x FHFA Director Calabria may be replaced 13

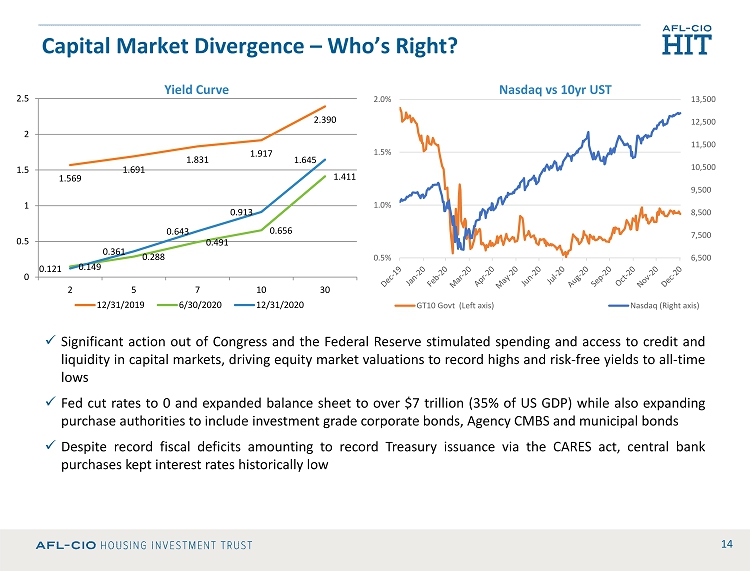

Capital Market Divergence – Who’s Right? Yield Curve Nasdaq vs 10yr UST x Significant action out of Congress and the Federal Reserve stimulated spending and access to credit and liquidity in capital markets, driving equity market valuations to record highs and risk - free yields to all - time lows x Fed cut rates to 0 and expanded balance sheet to over $ 7 trillion ( 35 % of US GDP) while also expanding purchase authorities to include investment grade corporate bonds, Agency CMBS and municipal bonds x Despite record fiscal deficits amounting to record Treasury issuance via the CARES act, central bank purchases kept interest rates historically low 14 6,500 7,500 8,500 9,500 10,500 11,500 12,500 13,500 0.5% 1.0% 1.5% 2.0% GT10 Govt (Left axis) Nasdaq (Right axis) 1.569 1.691 1.831 1.917 2.390 0.149 0.288 0.491 0.656 1.411 0.121 0.361 0.643 0.913 1.645 0 0.5 1 1.5 2 2.5 2 5 7 10 30 12/31/2019 6/30/2020 12/31/2020

COVID - 19 Investment Opportunities in Fixed Income Multifamily Mortgage Backed Securities (MBS) x With unpresented uncertainty in the outlook given the pandemic, agency multifamily securities may be a diversifier for other risk assets as they offer : 1. Capital preservation through government/agency credit quality 2. Yield spread relative to credit - equivalent bonds, e . g . Treasuries, AAA corporate bonds 3. Prepayment protection via call protection, providing a steady income stream unlike residential mortgage securities x Multifamily MBS offer government credit quality equivalent to US Treasuries and generate spread similar to or higher than high credit quality corporate bonds x Residential MBS experienced record prepayments resulting in the Index duration contracting by nearly a third from 3 . 2 years ending 2019 to 2 . 3 years at the end of December 2020 x Fundamentally, agency construction - related multifamily provide an attractive income opportunity far in excess of a duration - equivalent Treasury that has the same credit quality with prepayment protection x With the Federal Reserve projecting to keep interest rates at the zero bound for the next 2 years, agency multifamily securities offer investors yield spread over Treasuries in a liquid market having prepayment protection 15

x Government - guaranteed, multifamily construction - related loan spreads provide an attractive opportunity for risk - adjusted returns relative to other investment grade sectors as GNMA MBS construction loans offer one of the widest yield spreads to Treasuries in agency credit investments x Construction - related, HUD/FHA - insured securities provide additional yield spreads above permanent loans ( 50 - 60 bps typically) and could contribute 4 - 5 points of price appreciation at permanent conversion x As the project completes construction and stabilizes spread compression benefits returns and the loan becomes REMIC - eligible enhancing the liquidity and premium of the security Source: HIT and Securities Dealers Agency - insured Construction Securities: Inefficient Market with Attractive Return Profiles 16 Investment Comparison As of December 31 , 2020 Investment Type Effective Duration (Years) Effective Convexity Yield (%) Spread to 10 - Yr (bps) Spread/ Dur 10 Year UST 9.60 0.49 0.91% 0 0.0 GNMA Construction/Permanent 9.52 0.53 2.35% 144 15.1 GNMA Permanent 8.49 0.42 1.71% 80 9.4 Agency CMBS (e.g., BMOC - 2374 AL ) 7.04 -- 1.51% 60 8.5 FNMA Multifamily 10/9.5 DUS 8.33 0.41 1.27% 36 4.4 UMBS 2.0% 30yr MBS 3.40 - 4.50 1.09% 18 5.3 GNMA 2.0% 30yr MBS 4.00 - 2.50 1.09% 18 4.5 AAA Corporate Component of Barclays Aggregate 12.96 3.03 1.59% 68 5.2 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 0 50 100 150 200 250 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Spreads to 10 - Year Treasury in Basis Points Historical Multifamily Spreads June 2018 - December 2020 GNMA Permanent GNMA Construction/Permanent FNMA Multifamily 10/9.5 DUS 10-year Treas (right axis)

x Historically, credit enhanced government/agency commercial loans were meant to be a counter - cyclical product that gave developers/borrowers access to debt financing in economic downturns when conventional bank financing dried up – no longer the case x Total multifamily origination from all capital sources for construction and/or permanent loans totaled $ 359 billion in 2019 , a 6 % increase over 2018 . GSE (Fannie Mae and Freddie Mac) originations are the majority of security issuance in agency lending totaling $ 148 . 6 billion in 2019 ( 42 % of total) . GSEs do not originate construction loans x FHFA, the regulator of the GSEs, has required now 50 % of originations to be mission - related (affordable) to help combat the affordable housing crisis by credit enhancing the loans reducing the cost of funds for affordable developers x FHA origination is consistently low year over year with new construction and substantial renovation originations averaging $ 4 - 6 billion per year x Long processing times deter many borrowers from using HUD/FHA financing for construction development (opting for direct loans from balance sheet institutions) . But there is no other, cheaper, financing like it on the market offering credit - enhanced construction to permanent loan in place at origination with a 40 - year term and the ability to draw down funding to reduce negative arbitrage to the developer GSE Issuance Dominates the Agency Multifamily Market $65.4 $78.0 $15.2 $8.1 $6.3 $70.2 $78.4 $11.7 $5.6 $5.2 $- $20.0 $40.0 $60.0 $80.0 $100.0 Fannie Freddie Total FHA FHA Refi/ Purchase Apts FHA NC/SR Apts Multifamily Production Fiscal Year 2018 vs 2019 (in billions) 2018 2019 $- $50 $100 $150 $200 $250 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 E Mortgage Bankers Originations, by Capital Source (in billions) Banks GSEs Life Cos CMBS FHA Other 17

x Typical capital sources for permanent multifamily mortgage loans originate from commercial banks, life companies, and government/agency credit enhanced lenders x Market share of debt financed with agency and GSE guarantees has grown to become 47 % at the end of 2019 from 29 % in 2007 before the financial crisis x Agency commercial multifamily is an inefficient market with issuance a fraction of other investment grade fixed income sectors : ▪ According to the MBA, total commercial origination for multifamily loans across all sources were down in 2020 as year - to - date production stands 17 % lower from 2019 as of September ▪ Agency CMBS annual issuance ranges from $ 140 - $ 160 billion per year ; 2020 agency production hit a record high of $ 181 billion (+ 14 % increase YoY) ▪ Agency residential gross issuance expected to be over $ 3 trillion in 2020 with nearly $ 7 trillion outstanding Multifamily Market – Commercial Mortgage Debt Outstanding Gateway North Lynn, MA Church + State Cleveland, OH 18

Source: Fannie Mae, numbers may not sum due to rounding 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total 811 854 864 864 865 893 941 1,011 1,117 1,235 1,355 1,471 1,593 Fannie Mae 132 156 168 172 179 190 185 189 200 231 266 295 329 Freddie Mac 67 88 98 100 107 119 124 135 160 191 231 262 291 Ginnie Mae 38 39 44 52 60 71 82 90 94 99 109 118 125 CMBS 126 118 112 103 91 80 71 68 62 48 43 42 48 Banks & Thrifts 261 280 271 258 251 259 290 327 379 425 451 482 513 State & Local Credit Agencies 83 76 83 90 89 87 91 91 91 95 97 90 88 Life Insurance Companies 56 52 47 46 48 51 62 75 86 99 115 136 149 Other 50 44 41 43 39 36 36 37 45 46 44 47 51 $ 811 $ 854 $ 864 $ 864 $ 865 $ 893 $ 941 $ 1,011 $ 1,117 $ 1,235 $ 1,355 $ 1,471 $ 1,593 0 200 400 600 800 1,000 1,200 1,400 1,600 In $ Billions Commercial Mortgage Debt Outstanding 19

Directly Sourcing Provides Additional Benefits x Most common way to invest is through broker/dealer syndications in structured agency multifamily products • Give up yield spread and pay transaction costs through bid/ask x With extensive knowledge, resources, experience and relationships, the HIT’s capacity to source directly generates substantial value : • Deep understanding of the real estate market • Developing relationships with lenders, state housing authorities and agencies to execute complex transactions in various structures • Providing capital in GNMA/FHA - insured construction/perm loans directly with sellers out of competition with the market • Sourcing DUS bonds directly can pick up additional yield • Benefits from government subsidies and guarantees 1490 Southern Boulevard Bronx, NY 20

Construction - Related Multifamily Investment Process INVESTMENT COMMITTEE Reviews information on all construction - related multifamily and healthcare investments for the portfolio Reviews pricing provided Approves or disapproves transactions for investment, recommends transactions to Executive Committee, if required INVESTMENT MANAGEMENT TEAM IDENTIFY PROJECTS Mortgage Bankers Developers Housing Finance Agencies Community Organizations Labor Community City Representatives EXECUTIVE COMMITTEE OF BOARD OF TRUSTEES Reviews and approves or disapproves PORTFOLIO MANAGER Rate lock after issuance of agency (e.g., FHA/Fannie Mae/HFA) commitment INVESTMENT MANAGEMENT TEAM ANALYZE PROJECTS Development Team Financial Analysis Market Analysis Property Characteristics Project Status Labor Concurrence Third - Party Reports Site Visits ESG Considerations UNDERWRITING Financial Analysis Market Review Mortgage Credit Sponsor/Management $75M or over under $75M 21

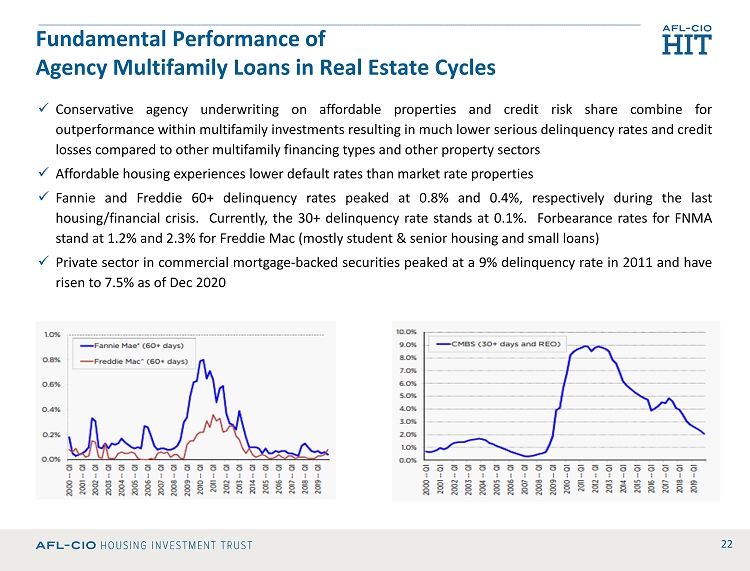

Fundamental Performance of Agency Multifamily Loans in Real Estate Cycles x Conservative agency underwriting on affordable properties and credit risk share combine for outperformance within multifamily investments resulting in much lower serious delinquency rates and credit losses compared to other multifamily financing types and other property sectors x Affordable housing experiences lower default rates than market rate properties x Fannie and Freddie 60 + delinquency rates peaked at 0 . 8 % and 0 . 4 % , respectively during the last housing/financial crisis . Currently, the 30 + delinquency rate stands at 0 . 1 % . Forbearance rates for FNMA stand at 1 . 2 % and 2 . 3 % for Freddie Mac (mostly student & senior housing and small loans) x Private sector in commercial mortgage - backed securities peaked at a 9 % delinquency rate in 2011 and have risen to 7 . 5 % as of Dec 2020 22

Multifamily Housing Demand Dwarfs Supply Source: National Multifamily Housing Council; Bureau of Labor Statistics; Labor Department; US Census Bureau; National Low I nco me Housing Coalition As of December 31, 2020, unless otherwise denoted 23 ▪ 19.8 million rental households (40 million people) live in multifamily apartments ▪ 30 - 40 million Americans could face evictions when the eviction moratorium ends ▪ Shifts in demographic trends and income loss to COVID - 19 are driving historic rental demand ▪ The US needs to build an average of 328,000 new apartment units annually through 2030 to meet demand from household growth and losses to the existing stock ▪ From 2001 to 2018, adjusted for inflation renter incomes grew just 0.5 percent while rents were up nearly 13 percent ▪ Low income renters face a shortage of 7 million rental units; only 36 affordable homes exist for every 100 low income households - according to the National Low Income Housing Coalition study in 2020 ▪ A weak and contracting economy will create more demand for affordable rental housing Net Household Formation (in Thousands) Record Job Loss in the Economy (Nonfarm Payroll, thousands) 130000 135000 140000 145000 150000 155000 Dec-18 Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 -500 0 500 1000 1500 2000 2500 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

x Phase 3 B - 115 affordable units, 4 % and 9 % Low Income Housing Tax Credit (LIHTC) transaction x Phase 3 C - 55 affordable units, 4 % LIHTC transaction x HIT Investment - $ 79 million ; TDC $ 86 million ▪ $ 37 million Taxable Construction Loan Notes, Private Placement o Phase 3 B 4 % and Phase 3 B 9 % ▪ $ 10 million Tax exempt Bridge Loans, Private Placement Separate Series o Phase 3 B 4 % and Phase 3 C ▪ $ 6 million Taxable Construction/ Perm Loan, Private Placement o Phase 3 C ▪ $ 26 million Tax exempt Bonds, Private Placement Separate Series o Phase 3 B 4 % and Phase 3 C This document contains information about a project or projects financed by the HIT which may or may not be reflective of other financed projects or refer to an asset currently held in the HIT’s portfolio . It is intended as a representation of a real estate project, not an indication of actual pricing or deal terms . 24 Old Colony Phases 3B & 3C | Boston, MA HIT Investment: $79M Total Development Cost: $86M Hours of Union Construction Work: 684,350* *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 .

Church & State | Cleveland, OH HIT Investment: $39.0M Total Development Cost: $54.8M Hours of Union Construction Work: 459,220* This document contains information about a project or projects financed by the HIT which may or may not be reflective of other financed projects or refer to an asset currently held in the HIT’s portfolio . It is intended as a representation of a real estate project, not an indication of actual pricing or deal terms . 25 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 .

18 Sixth Avenue at Pacific Park | Brooklyn, NY HIT Investment: $100 M Total Development Cost: $710 M Hours of Union Construction Work: 3,881,830* This document contains information about a project or projects financed by the HIT which may or may not be reflective of other financed projects or refer to an asset currently held in the HIT’s portfolio . It is intended as a representation of a real estate project, not an indication of actual pricing or deal terms . 26 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 .

Lake Street Apartments | Minneapolis, MN HIT Investment: $13.5M Total Development Cost: $27.6M Hours of Union Construction Work: 221,440* This document contains information about a project or projects financed by the HIT which may or may not be reflective of other financed projects or refer to an asset currently held in the HIT’s portfolio . It is intended as a representation of a real estate project, not an indication of actual pricing or deal terms . 27 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 .

Wrigleyville North Apartments | Chicago, IL HIT Investment: $35.0M Total Development Cost: $40.9M Hours of Union Construction Work: 289,900* This document contains information about a project or projects financed by the HIT which may or may not be reflective of other financed projects or refer to an asset currently held in the HIT’s portfolio . It is intended as a representation of a real estate project, not an indication of actual pricing or deal terms . 28 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 .

Electchester Housing Companies| New York, NY HIT Investment: $49.0M Total Development Cost: $49.0M Hours of Union Construction Work: 351,900* This document contains information about a project or projects financed by the HIT which may or may not be reflective of other financed projects or refer to an asset currently held in the HIT’s portfolio . It is intended as a representation of a real estate project, not an indication of actual pricing or deal terms . 29 *Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output model based on HIT and HIT subsidiary Building America CDE, Inc . project data . Data current as of December 31 , 2020 .

HIT: Cycle of Sustainable, Responsible Investment HIT finances projects through guaranteed securities Construction securities help provide competitive returns Construction projects generate family - supporting union jobs, hours of work and benefits Union Pension Plan invests in HIT Union workers contribute to pension funds 30 HIT finances projects primarily through guaranteed securities HIT investments provide competitive returns Construction projects generate family - supporting union jobs, hours of work and benefits Union Pension Plan invests in HIT Union workers contribute to pension funds

x Uncertainty remains high with global challenges brought on by the pandemic. x Vaccine distribution and effectiveness are critical to returning to a normal and healthy global economy. It is important for the US to get COVID under control, but we are not alone. Many parts of our pre - COVID economy will be permanently affected. x Equity markets at an all - time high and growth expectations mean there is little room for error or unforeseen negative events. x Multifamily mortgage investments provide an attractive opportunity for added yield in a low interest rate environment, plus credit protection and diversification in a highly uncertain environment. x The political landscape has changed – a new administration, change in power in Washington, is a positive for more affordable housing. x The close elections in November and run offs in Georgia serve as a reminder that every deal done with labor’s capital to generate union jobs, housing is important. Every deal, every job, every apartment, counts. 31 Closing Remarks

Contact Information AFL - CIO Housing Investment Trust 2401 Pennsylvania Avenue, NW, Suite 200 Washington, DC 20037 (202) 331 - 8055 www.aflcio - hit.com Chang Suh, CFA | CEO & Co - Chief Portfolio Manager | csuh@aflcio - hit.com Lesyllee White | Chief Marketing Officer | lwhite@aflcio - hit.com Rosa Moreno | Managing Director | rmoreno @aflcio - hit.com Kevin Murphy | Marketing Director | kmurphy@aflcio - hit.com Brian Norton | Northeast Regional Director | bnorton@aflcio - hit.com Paul Sommers | Midwest Regional Director | psommers@aflcio - hit.com Investors should consider the HIT’s investment objectives, risks and expenses carefully before investing. Investors may view the HIT’s current prospectus, which contains more complete information, on its website at www.aflcio - hit.com and may obtain a copy from the HIT by calling the Marketing and Investor Relations Department collect at 202 - 331 - 8055. Investors should read the current prospectus carefully befo re investing. This document contains forecasts, estimates, opinions, and/or other information that is subjective. Statements concerning eco nom ic, financial, or market trends are based on current conditions, which will fluctuate. There is no guarantee that such statements will be appli cab le under all market conditions, especially during periods of downturn. It should not be considered as investment advice or as a recommenda tio n of any kind.