Total | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AFL CIO HOUSING INVESTMENT TRUST | ||||||||||||

| AFL-CIO Housing Investment Trust | ||||||||||||

| INVESTMENT OBJECTIVES | ||||||||||||

The investment objective of the American Federation of Labor and Congress of Industrial Organizations Housing Investment Trust (“HIT”) is to generate competitive risk-adjusted total rates of return for its investors (“Participants”) by investing in fixed-income investments, primarily multifamily and single family mortgage-backed assets. Other important objectives of the HIT are to encourage the construction of housing and to facilitate employment for union members in the construction trades and related industries. All on-site construction work financed through the HIT’s investments is required to be performed by 100% union labor. | ||||||||||||

| EXPENSES OF THE HIT | ||||||||||||

This table describes the expenses that you may pay if you buy and hold units of beneficial interest in the HIT (“Units”). The HIT does not assess any sales charges (loads), redemption fees, exchange fees or any other account fees. | ||||||||||||

| ANNUAL HIT OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||

| ||||||||||||

| Example | ||||||||||||

This example is intended to help you compare the cost of investing in the HIT with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the HIT for the time periods indicated and then redeem all of your Units at the end of those periods. The example also assumes that your investment has a 5% return each year and that the HIT’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||

| ||||||||||||

| Portfolio Turnover | ||||||||||||

The HIT generally conducts securities transactions on a principal-to-principal basis and does not pay commissions for trades. The HIT may incur transaction costs when it buys and sells certain securities (or “turns over” parts of its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. During the most recent fiscal year, the HIT’s portfolio turnover rate was 17.6% of the average value of its portfolio. | ||||||||||||

| PRINCIPAL INVESTMENT STRATEGIES | ||||||||||||

The HIT’s principal investment strategy is to construct and manage a portfolio that is composed primarily of multifamily and single family mortgage-backed assets (collectively, “Mortgage Securities”) with higher yield, higher credit quality and similar interest rate risk versus the securities in the Bloomberg Barclays U.S. Aggregate Bond Index (the “Barclays Aggregate”). As such, the HIT pursues a fundamental policy to concentrate in fixed-income securities in the mortgage and mortgage finance sector of the real estate industry. The HIT holds government and agency issued, guaranteed or insured multifamily mortgage-backed securities (“MBS”) that have call (or prepayment) protection, in place of the following types of securities which are held in the Barclays Aggregate: (1) corporate debt; (2) some U.S. Treasury securities; and, (3) some government-sponsored enterprise debt. Since government/agency multifamily MBS offer higher yields than comparable securities with similar credit and interest rate risk, the HIT expects to offer superior risk-adjusted returns compared to the Barclays Aggregate.

All securities in which the HIT invests must meet certain requirements described in detail later in this Prospectus and in the HIT’s Statement of Additional Information (“SAI”). Some types of these securities must meet certain standards of nationally recognized statistical rating organizations among other indicia of creditworthiness. The investment personnel of the HIT monitor the HIT’s investments compared with those in the Barclays Aggregate and may adjust holdings by purchasing or selling securities. When deciding whether to buy or sell a specific security, the investment personnel of the HIT compare the security to other similar securities and consider factors such as price, yield, duration and convexity (measures of interest rate sensitivity), servicer, geographic location, call or prepayment protection, as well as liquidity. The HIT may purchase Mortgage Securities by way of forward commitments. The HIT does not invest in Mortgage Securities that contain subprime loans.

The HIT uses a variety of strategies to manage risk. These strategies include, but are not limited to, managing the duration of the HIT portfolio within a range comparable to the Barclays Aggregate and managing prepayment risk by negotiating prepayment restrictions for Mortgage Securities backed by multifamily housing or healthcare facility projects. The HIT seeks to minimize the risk of credit and default losses by purchasing securities that are guaranteed, insured, or otherwise credit-enhanced or that meet other criteria intended to manage risk. | ||||||||||||

| PRINCIPAL INVESTMENT RISKS | ||||||||||||

There is no assurance that the HIT will meet its investment objectives. The value of the HIT’s investments and the resulting value of the Units may go up or down and Participants’ holdings in the HIT could gain or lose value. As with any investment, you may lose money by investing in the HIT. The HIT’s principal risks are:

Market Risk: The value of securities held by the HIT may decline or fluctuate, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, inflation, changes in interest rates, adverse investor sentiment and other global market developments and disruptions, including those arising out of geopolitical events, health emergencies (such as pandemics), natural disasters, terrorism, and government or quasi-government actions. It is difficult to predict when events affecting the U.S. or global financial markets may occur.

Interest Rate Risk: Changes in interest rates may adversely affect the HIT’s fixed-income investments, such as the value or liquidity of, and income generated by, the investments. Interest rates may change as a result of a variety of factors, and any changes may be sudden and significant, with unpredictable impacts on the financial markets and the HIT’s investments. Fixed-income investments with longer durations are more sensitive to changes in interest rates, and thus, subject to more volatility than similar investments with shorter durations. Generally, the values of fixed-income investments will fall when market interest rates rise and rise when market interest rates fall. Rising interest rates may also reduce prepayment rates, causing the average life of certain securities of the HIT to increase, which could in turn further reduce the value of the HIT’s portfolio. The risks associated with rising interest rates are heightened given the recent low interest rate environment.

Prepayment and Extension Risk: Generally, the market value of the HIT’s investments will rise at times when market interest rates fall. However, at times when market interest rates fall below the interest rates on the investments, some borrowers may prepay the HIT’s fixed-income securities or their underlying mortgages more quickly than might otherwise be the case. In such an event, the HIT may be required to reinvest the proceeds of such prepayments in other investments bearing lower interest rates than those which were prepaid. When market interest rates rise above the interest rates of the HIT’s investments, the prepayment rate of the mortgage loans backing certain HIT securities may decrease, causing the average maturity of the HIT’s investments to lengthen and making these investments more sensitive to interest rate changes. This could, in turn, further reduce the value of the HIT’s portfolio and make the HIT’s Unit price more volatile.

Credit Risk: Credit risk is the risk of loss of principal and interest as a result of a failure of an issuer of the HIT’s investments to make timely payments, a failure of a credit enhancement backing the HIT’s investments after a default on the underlying mortgage loan or other asset, a downgrading of the credit rating (or a perceived decline in the creditworthiness) of an investment or the provider of the credit enhancement for an investment, or a decline in the value of assets underlying the mortgage loan or other asset.

Default Risk: There is a risk that borrowers may default under the mortgage loans or other assets that directly or indirectly secure the HIT’s investments. In the event of default, the HIT may experience a loss of principal and interest and any premium value on the related securities. This risk may be lessened to the extent that the securities are guaranteed or insured by a third party, including an agency of the U.S. government.

Concentration Risk: The HIT concentrates its investments in fixed-income securities in the mortgage and mortgage finance sectors of the real estate industry. These sectors have experienced price volatility in the past. This concentration subjects the HIT to greater risk of loss as a result of adverse economic, political or regulatory conditions, or other developments than if its investments were diversified across different industries.

U.S. Government-Related Securities Risk: There are different types of U.S. government-related securities with different levels of credit risk, including the risk of default, depending on the nature of the particular government support for that security. For example, a U.S. government-sponsored entity, such as Federal National Mortgage Association (“Fannie Mae”) or Federal Home Loan Mortgage Corporation (“Freddie Mac”), although chartered or sponsored by an Act of Congress, may issue securities that are neither insured nor guaranteed by the U.S. Treasury and are therefore riskier than those that are.

Liquidity Risk: Markets for particular types of securities may experience issues with liquidity. That is, a lack of buyers at a particular time could negatively impact the value of a security during such period, even though over time the payment obligations under the security may be met. Markets for some of the types of securities in which the HIT may invest have experienced liquidity issues in the past, and its investments may experience liquidity issues in the future.

Leverage Risk: The use of some investment or investing techniques may have the effect of magnifying, or leveraging, small changes in an asset, index or market. The HIT does not leverage its portfolio through the use of borrowings, but it may invest in forward commitments which may effectively add leverage to its portfolio. Forward commitments involve the purchase or sale of securities by the HIT at an established price with payment and delivery taking place in the future.

| ||||||||||||

| HIT PAST PERFORMANCE | ||||||||||||

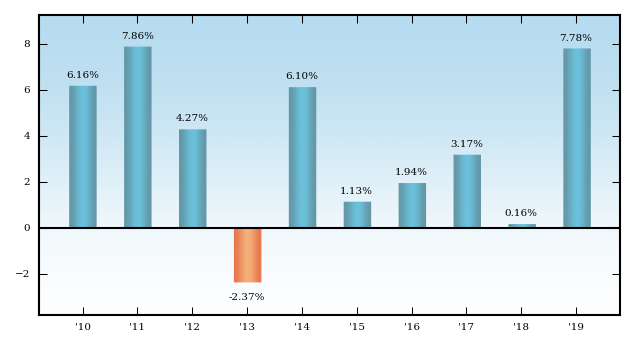

The bar chart below and the following table provide an indication of the risks of investing in the HIT by illustrating how returns can differ from one year to the next. The table also shows how the HIT’s average annual total returns for the one-, five-, and ten-year periods compare with those of the Barclays Aggregate. The HIT’s past performance is not necessarily an indication of how the HIT will perform in the future. Updated performance information is available on the HIT’s website at www.aflcio-hit.com. | ||||||||||||

| ANNUAL TOTAL RETURNS (Calendar Years-Net of Operating Expenses) | ||||||||||||

| ||||||||||||

During the ten-year period identified in the bar chart above, the highest return for a quarter was 3.28% (quarters ended September 30, 2011 and June 30, 2019) and the lowest return for a quarter was -3.00% (quarter ended December 31, 2016).

| ||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (for the periods ended December 31, 2019) | ||||||||||||

|