AFL - CIO HOUSING INVESTMENT TRUST Competitive Returns · Union Construction Jobs · Housing Opportunities Building Trades Leaders Conference October 25, 2019

www.aflcio - hit.com AFL - CIO Housing Investment Trust 2401 Pennsylvania Avenue, NW, Suite 200 Washington, DC 20037 (202) 331 - 8055 Chang Suh, CFA CEO/Co - Chief Portfolio Manager Confidential and Proprietary Information . 1

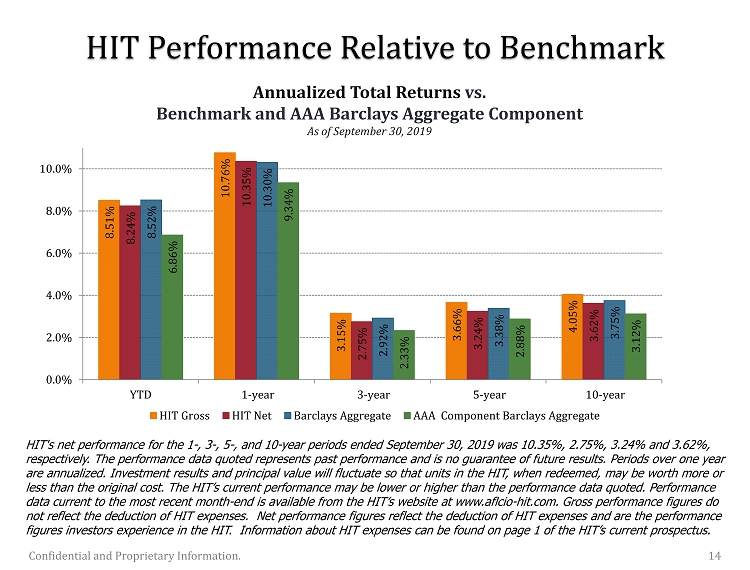

HIT Overview Mission: Returns · Construction Jobs · Affordable Housing x $6.6 billion investment grade fixed - income portfolio . x The AFL - CIO Housing Investment Trust (HIT or Trust) is a mutual fund in operation since 1984 (successor to the Mortgage Investment Trust, 1965). x 25 out of 26 consecutive years outperforming its benchmark on a gross basis, 16 of those years on a net basis. x 100% union construction requirement. HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended September 30, 2019 was 10.35%, 2.75%, 3.24% and 3.62%, respectively. The performance data quoted represents past performance and is no guarantee of future results. Periods over one year are annualized. Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost. The HIT’s current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month - end is available from the HIT’s website at www.aflcio - hit.com. Gross performance figures do not reflect the deduction of HIT expenses. Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT. Information about HIT expenses can be found on page 1 of the HIT’s current prospectus. Confidential and Proprietary Information . 2

The HIT seeks to offer investors: x Competitive Returns x High Credit Quality x Highly Liquid Investment x Value Added – Collateral Benefits ▪ Union Construction Jobs ▪ Affordable Housing ▪ Economic Impact Ya Po Ah Terrace Eugene, OR 2101 South Michigan Apts. Chicago, IL Competitive Returns and Collateral Benefits through Directly Sourced Multifamily Investments Confidential and Proprietary Information . 3 333 Harrison Apartments San Francisco, CA Bassett Creek Apartments Minneapolis, MN

*Letter from George Meany, President, AFL - CIO, dated March 23, 1964 regarding the establishment of a Mortgage Investment Trust and Auxiliary Housing Corporation at p.2 (the “Meany Letter”). x Opened doors in 1984 (successor to the Mortgage Investment Trust, started in 1965). x Created by the AFL - CIO Executive Council under President George Meany’s leadership. » Established to encourage and assist development of lower income housing while creating employment for the construction trades » “A massive attack would be made to meet America’s tremendous unmet housing needs”, George Meany* x 100 percent union labor requirement for all construction related investments. History of the HIT Confidential and Proprietary Information . 4 Corona Del Valle El Paso, TX Teachers Village (Building America), Newark, NJ Electchester Queens, NY

x Documentation – 100% union requirement laid out in loan documents, signed by General Contractor and Developer. x Monitoring and Enforcement – Labor Relations ensures compliance and solves issues that may arise. x Measurement – work hours measured and reported for every project. Labor Policies Success is Measured in the Implementation Confidential and Proprietary Information . 5

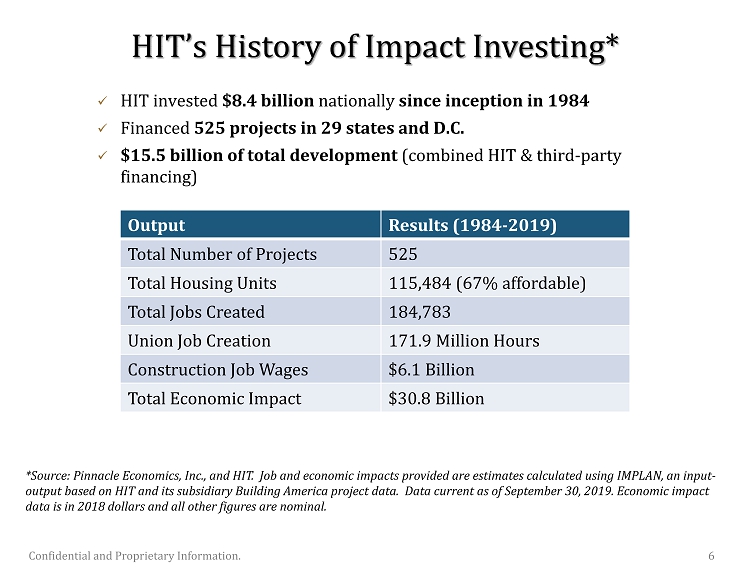

x HIT invested $8.4 billion nationally since inception in 1984 x Financed 525 projects in 29 states and D.C. x $15.5 billion of total development (combined HIT & third - party financing) Output Results (1984 - 2019) Total Number of Projects 525 Total Housing Units 115,484 (67% affordable) Total Jobs Created 184,783 Union Job Creation 171.9 Million Hours Construction Job Wages $6.1 Billion Total Economic Impact $30.8 Billion *Source: Pinnacle Economics, Inc., and HIT. Job and economic impacts provided are estimates calculated using IMPLAN, an inpu t - output based on HIT and its subsidiary Building America project data. Data current as of September 30, 2019. Economic impact data is in 2018 dollars and all other figures are nominal. HIT’s History of Impact Investing* Confidential and Proprietary Information . 6

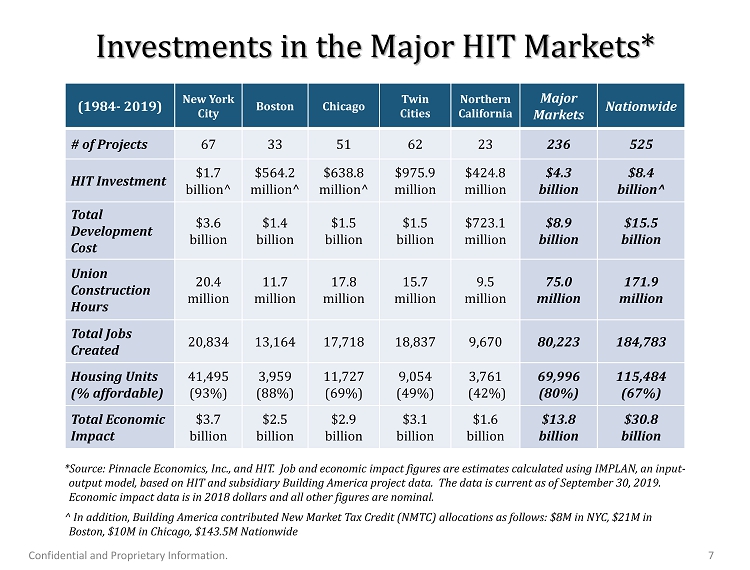

Investments in the Major HIT Markets* *Source: Pinnacle Economics , Inc., and HIT. Job and economic impact figures are estimates calculated using IMPLAN, an input - output model, based on HIT and subsidiary Building America project data. The data is current as of September 30, 2019. Economic impact data is in 2018 dollars and all other figures are nominal. ^ In addition, Building America contributed New Market Tax Credit (NMTC) allocations as follows: $8M in NYC, $21M in Boston, $10M in Chicago, $143.5M Nationwide (1984 - 2019) New York City Boston Chicago Twin Cities Northern California Major Markets Nationwide # of Projects 67 33 51 62 23 236 525 HIT Investment $1.7 billion ^ $564.2 million^ $638.8 million^ $975.9 million $424.8 million $4.3 billion $8.4 billion^ Total Development Cost $3.6 billion $1.4 billion $1.5 billion $1.5 billion $723.1 million $8.9 billion $15.5 billion Union Construction Hours 20.4 million 11.7 million 17.8 million 15.7 million 9.5 million 75.0 million 171.9 million Total Jobs Created 20,834 13,164 17,718 18,837 9,670 80,223 184,783 Housing Units (% affordable) 41,495 (93%) 3,959 (88%) 11,727 (69%) 9,054 (49%) 3,761 (42%) 69,996 (80%) 115,484 (67%) Total Economic Impact $3.7 billion $2.5 billion $2.9 billion $3.1 billion $1.6 billion $13.8 billion $30.8 billion Confidential and Proprietary Information . 7

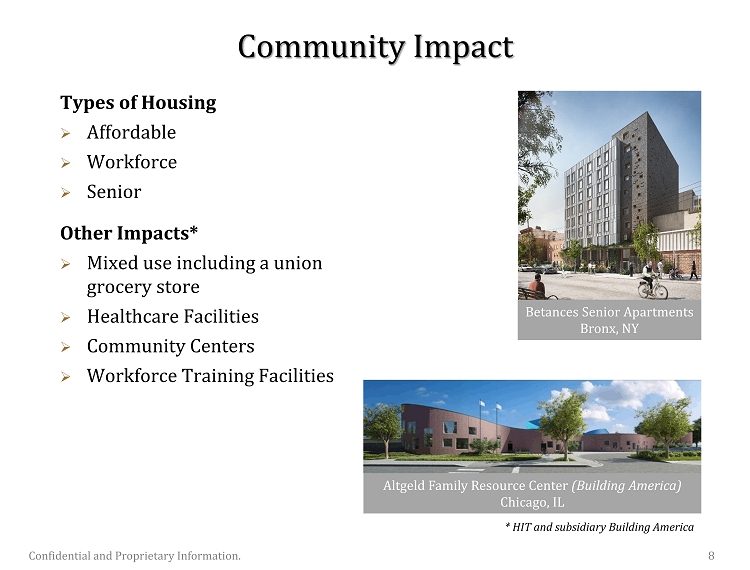

Betances Senior Apartments Bronx, NY Types of Housing » Affordable » Workforce » Senior Other Impacts* » Mixed use including a union grocery store » Healthcare Facilities » Community Centers » Workforce Training Facilities Community Impact Confidential and Proprietary Information . 8 Altgeld Family Resource Center (Building America) Chicago, IL * HIT and subsidiary Building America

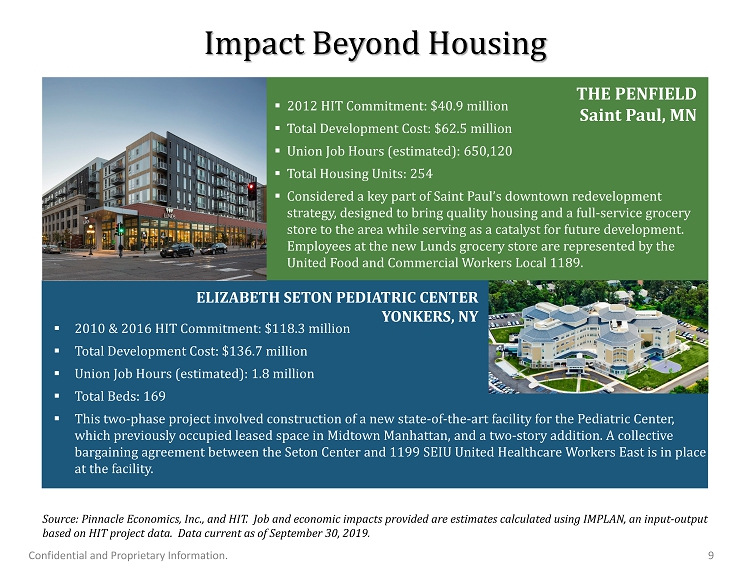

Impact Beyond Housing THE PENFIELD Saint Paul, MN ▪ 2012 HIT Commitment: $40.9 million ▪ Total Development Cost: $62.5 million ▪ Union Job Hours (estimated): 650,120 ▪ Total Housing Units: 254 ▪ Considered a key part of Saint Paul’s downtown redevelopment strategy, designed to bring quality housing and a full - service grocery store to the area while serving as a catalyst for future development. Employees at the new Lunds grocery store are represented by the United Food and Commercial Workers Local 1189. ELIZABETH SETON PEDIATRIC CENTER YONKERS, NY ▪ 2010 & 2016 HIT Commitment: $118.3 million ▪ Total Development Cost: $136.7 million ▪ Union Job Hours (estimated): 1.8 million ▪ Total Beds: 169 ▪ This two - phase project involved construction of a new state - of - the - art facility for the Pediatric Center, which previously occupied leased space in Midtown Manhattan, and a two - story addition. A collective bargaining agreement between the Seton Center and 1199 SEIU United Healthcare Workers East is in place at the facility. Source : Pinnacle Economics, Inc . , and HIT . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output based on HIT project data . Data current as of September 30 , 2019 . Confidential and Proprietary Information . 9

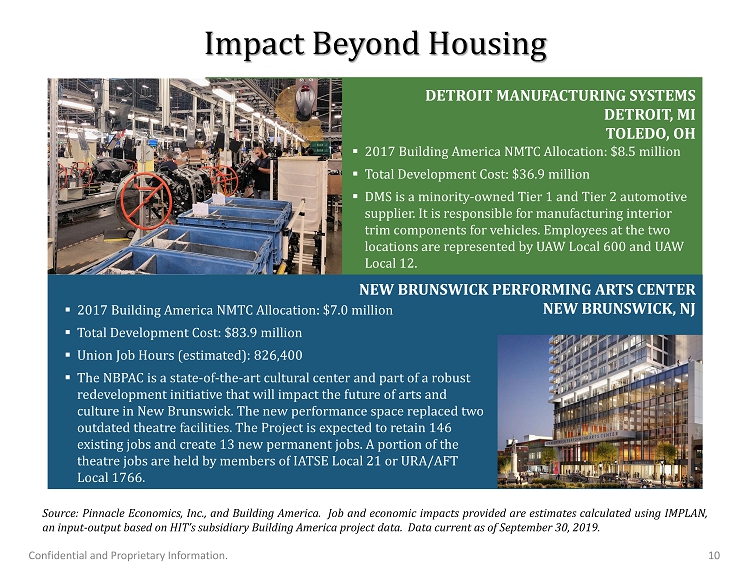

▪ 2017 Building America NMTC Allocation: $8.5 million ▪ Total Development Cost: $36.9 million ▪ DMS is a minority - owned Tier 1 and Tier 2 automotive supplier. It is responsible for manufacturing interior trim components for vehicles. Employees at the two locations are represented by UAW Local 600 and UAW Local 12. Impact Beyond Housing DETROIT MANUFACTURING SYSTEMS DETROIT, MI TOLEDO, OH Source : Pinnacle Economics, Inc . , and Building America . Job and economic impacts provided are estimates calculated using IMPLAN, an input - output based on HIT’s subsidiary Building America project data . Data current as of September 30 , 2019 . Confidential and Proprietary Information . 10 ▪ 2017 Building America NMTC Allocation: $7.0 million ▪ Total Development Cost: $83.9 million ▪ Union Job Hours (estimated): 826,400 ▪ The NBPAC is a state - of - the - art cultural center and part of a robust redevelopment initiative that will impact the future of arts and culture in New Brunswick. The new performance space replaced two outdated theatre facilities. The Project is expected to retain 146 existing jobs and create 13 new permanent jobs. A portion of the theatre jobs are held by members of IATSE Local 21 or URA/AFT Local 1766. NEW BRUNSWICK PERFORMING ARTS CENTER NEW BRUNSWICK, NJ

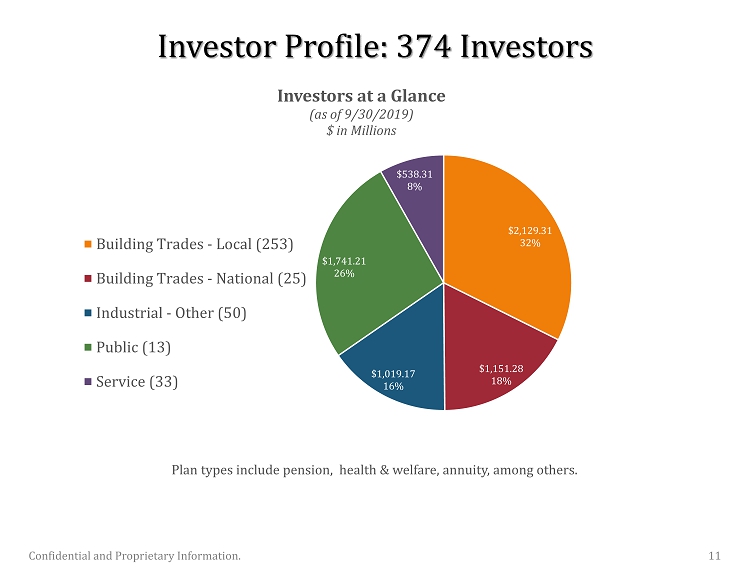

Investor Profile: 374 Investors Plan types include pension, health & welfare, annuity, among others. $2,129.31 32% $1,151.28 18% $1,019.17 16% $1,741.21 26% $538.31 8% Investors at a Glance (as of 9/30/2019) $ in Millions Building Trades - Local (253) Building Trades - National (25) Industrial - Other (50) Public (13) Service (33) Confidential and Proprietary Information . 11

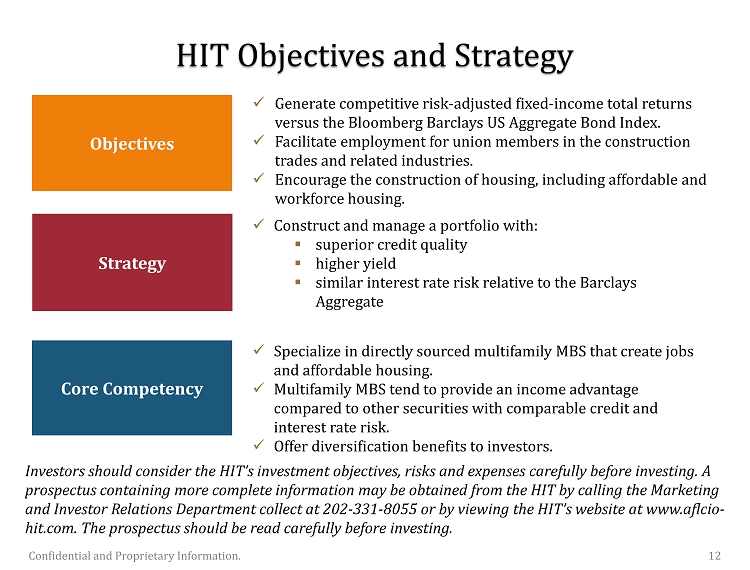

HIT Objectives and Strategy Objectives Strategy Core Competency x Generate competitive risk - adjusted fixed - income total returns versus the Bloomberg Barclays US Aggregate Bond Index. x Facilitate employment for union members in the construction trades and related industries. x Encourage the construction of housing, including affordable and workforce housing. x Specialize in directly sourced multifamily MBS that create jobs and affordable housing. x Multifamily MBS tend to provide an income advantage compared to other securities with comparable credit and interest rate risk. x Offer diversification benefits to investors. x Construct and manage a portfolio with: ▪ superior credit quality ▪ higher yield ▪ similar interest rate risk relative to the Barclays Aggregate Investors should consider the HIT’s investment objectives, risks and expenses carefully before investing. A prospectus containing more complete information may be obtained from the HIT by calling the Marketing and Investor Relations Department collect at 202 - 331 - 8055 or by viewing the HIT’s website at www.aflcio - hit.com. The prospectus should be read carefully before investing. Confidential and Proprietary Information . 12

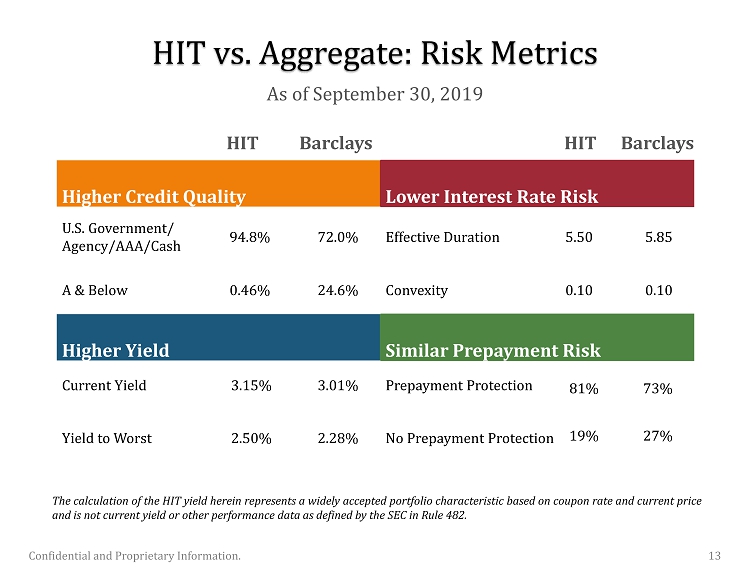

HIT vs. Aggregate: Risk Metrics As of September 30, 2019 The calculation of the HIT yield herein represents a widely accepted portfolio characteristic based on coupon rate and current price and is not current yield or other performance data as defined by the SEC in Rule 482 . Confidential and Proprietary Information . 13 HIT Barclays HIT Barclays Higher Credit Quality Lower Interest Rate Risk U.S. Government/ Agency/AAA/Cash 94.8% 72.0% Effective Duration 5.50 5.85 A & Below 0.46% 24.6% Convexity 0.10 0.10 Higher Yield Similar Prepayment Risk Current Yield 3.15% 3.01% Prepayment Protection 81% 73% Yield to Worst 2.50% 2.28% No Prepayment Protection 19% 27%

HIT Performance Relative to Benchmark 8.51% 10.76% 3.15% 3.66% 4.05% 8.24% 10.35% 2.75% 3.24% 3.62% 8.52% 10.30% 2.92% 3.38% 3.75% 6.86% 9.34% 2.33% 2.88% 3.12% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% YTD 1-year 3-year 5-year 10-year HIT Gross HIT Net Barclays Aggregate AAA Component Barclays Aggregate Annualized Total Returns vs. Benchmark and AAA Barclays Aggregate Component As of September 30, 2019 HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended September 30, 2019 was 10.35%, 2.75%, 3.24% and 3.62%, respectively. The performance data quoted represents past performance and is no guarantee of future results. Periods over one ye ar are annualized. Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth m ore or less than the original cost. The HIT’s current performance may be lower or higher than the performance data quoted. Performan ce data current to the most recent month - end is available from the HIT’s website at www.aflcio - hit.com. Gross performance figures d o not reflect the deduction of HIT expenses. Net performance figures reflect the deduction of HIT expenses and are the performanc e figures investors experience in the HIT. Information about HIT expenses can be found on page 1 of the HIT’s current prospectus. Confidential and Proprietary Information . 14

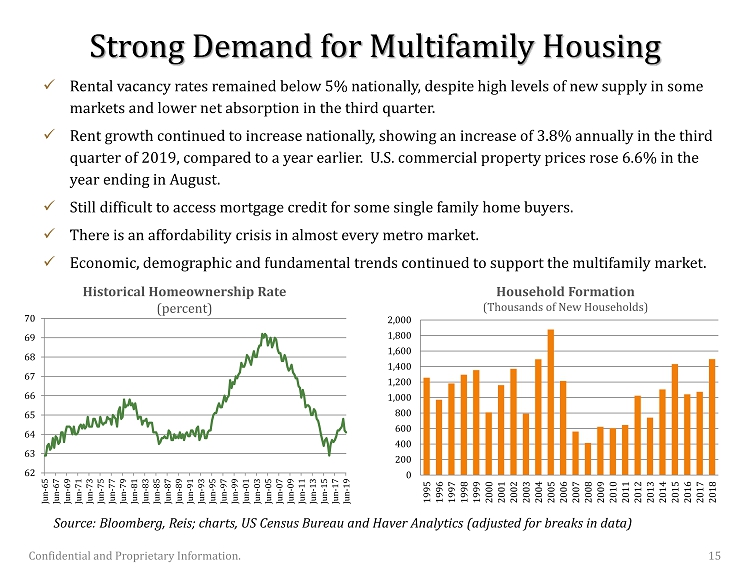

Strong Demand for Multifamily Housing x Rental vacancy rates remained below 5% nationally, despite high levels of new supply in some markets and lower net absorption in the third quarter. x Rent growth continued to increase nationally, showing an increase of 3.8% annually in the third quarter of 2019, compared to a year earlier. U.S. commercial property prices rose 6.6% in the year ending in August. x Still difficult to access mortgage credit for some single family home buyers. x There is an affordability crisis in almost every metro market. x Economic, demographic and fundamental trends continued to support the multifamily market. Source: Bloomberg, Reis; charts, US Census Bureau and Haver Analytics (adjusted for breaks in data) Historical Homeownership Rate (percent) 62 63 64 65 66 67 68 69 70 Jun-65 Jun-67 Jun-69 Jun-71 Jun-73 Jun-75 Jun-77 Jun-79 Jun-81 Jun-83 Jun-85 Jun-87 Jun-89 Jun-91 Jun-93 Jun-95 Jun-97 Jun-99 Jun-01 Jun-03 Jun-05 Jun-07 Jun-09 Jun-11 Jun-13 Jun-15 Jun-17 Jun-19 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Household Formation (Thousands of New Households) Confidential and Proprietary Information . 15

Investment Opportunities for the HIT x High demand for multifamily housing – especially affordable and workforce housing x Increase in household formation x Rise in rents x Not able to live near work Confidential and Proprietary Information . 16 Paseo Verde (Building America) Philadelphia, PA Charlesview Apartments Boston, MA Casa del Pueblo San Jose, CA

The Future of HIT under New Leadership Renewed Commitment to: x Lower Costs x Add New Authorities to help generate: x More Impact Investing x More Yield Confidential and Proprietary Information . 17 Project 29 (Church + State) Cleveland, OH North and South Constitution Hoboken, NJ Gateway North Lynn, MA

HIT is a Tool for the Building Trades – We Welcome Your Support “ Therefore, it is requested that … all affiliated local unions in order that their officials acting as custodian of treasury and special purpose funds or as a Labor Trustee of a negotiated plan might have the opportunity to favorably consider (supporting the HIT)” – George Meany, 1964 x Advocate to consultants and advisors – revisit HIT given recent changes and enhancements made to lower costs and increase construction - related investments x Identify Potential Projects – refer future deal opportunities to the HIT x Actively promote public policies that encourage the building of more affordable housing using building and construction trades unions Confidential and Proprietary Information . 18 *Letter from George Meany, President, AFL - CIO, dated March 23, 1964 regarding the establishment of a Mortgage Investment Trust and Auxiliary Housing Corporation at p.5 (the “Meany Letter”).