AFL - CIO HOUSING INVESTMENT TRUST [Date] 2018 [Fund Name] AFL - CIO Housing Investment Trust 2401 Pennsylvania Avenue, NW, Suite 200 Washington, DC 20037 (202) 331 - 8055 www.aflcio - hit.com

▪ A nearly $5.8 billion investment grade fixed - income portfolio • Open - end institutional commingled mutual fund registered under Investment Company Act of 1940 and regulated by federal securities laws administered by the U.S. Securities and Exchange Commission • Monthly unit valuation and income distribution – independent third - party pricing provides integrity ▪ Record of consistent and competitive returns • Gross returns exceeded benchmark for 24 of past 25 calendar years; net returns for 15 of those years. ▪ Investment strategy • With its focus on high credit quality multifamily mortgage securities, the portfolio is designed to seek: • a higher income, • a superior credit profile, and • a similar interest rate risk compared to the benchmark. AFL - CIO Housing Investment Trust 1 As of September 30, 2018, unless otherwise denoted HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended October 31 , 2018 was - 1 . 98 % , 0 . 73 % , 1 . 80 % , and 3 . 77 % , respectively . The performance data quoted represents past performance and is no guarantee of future results . Periods over one year are annualized . Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost . The HIT’s current performance may be lower or higher than the performance data quoted . Performance data current to the most recent month - end is available from the HIT’s website at www . aflcio - hit . com . Gross performance figures do not reflect the deduction of HIT expenses . Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT . Information about HIT expenses can be found on page 1 of the HIT’s current prospectus .

▪ Invested $11.3 billion nationally (in current dollars) since inception in 1984 ▪ Financed 508 projects in 29 states ; $19.2 billion total development investment ▪ Created $29.1 billion in total economic activity • $11.4 billion in total salaries and benefits, with $5.7 billion for construction workers • $1.2 billion in local tax revenues and $2.4 billion in federal revenues ▪ Utilized 100% union labor ▪ Generated 167.7 million hours of union construction work ▪ Created over 178,680 total jobs across all industries in the U.S. ▪ Financed the preservation of 109,760 housing units ; 66% affordable/workforce housing AFL - CIO Housing Investment Trust 2 Features of the HIT: 30 + Years of Impact Investing* *Source: Pinnacle Economics, Inc., and HIT. Figures provided by Pinnacle are estimates calculated using an IMPLAN input - output m odel based on HIT project data. Projects include those with financing by HIT’s subsidiary, Building America. Data current as of September 30, 2018 and in 2017 dollars. As of September 30, 2018

374Taft - Hartley pension plans/labor organizations ▪ $4.35 billion in net assets ▪ 75% total net assets ▪ 283 building trades funds and 91 industrial and service funds; ▪ 42 of these are Health & Welfare plans 12 public employee plans ▪ $1.47 billion in net assets ▪ 25% total net assets AFL - CIO Housing Investment Trust 3 As of September 30, 2018

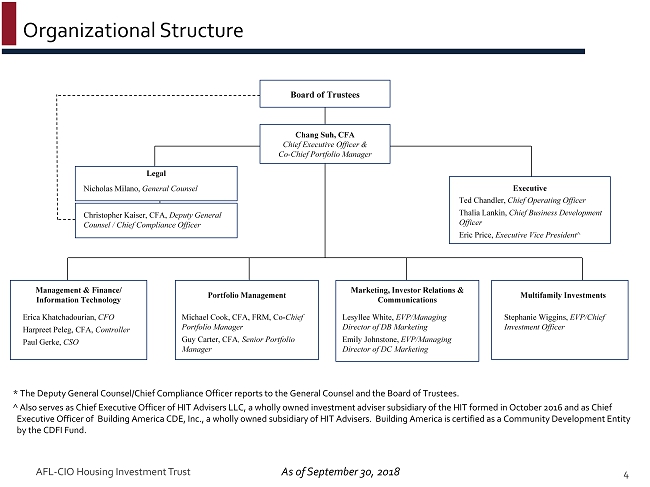

AFL - CIO Housing Investment Trust 4 * The Deputy General Counsel/Chief Compliance Officer reports to the General Counsel and the Board of Trustees. ^ Also serves as Chief Executive Officer of HIT Advisers LLC, a wholly owned investment adviser subsidiary of the HIT formed in October 2016 and as Chief Executive Officer of Building America CDE, Inc., a wholly owned subsidiary of HIT Advisers. Building America is certified a s a Community Development Entity by the CDFI Fund. Marketing, Investor Relations & Communications Management & Finance/ Information Technology Chang Suh, CFA Chief Executive Officer & Co - Chief Portfolio Manager Ted Chandler, Chief Operating Officer Thalia Lankin, Chief Business Development Officer Eric Price, Executive Vice President^ Lesyllee White, EVP/Managing Director of DB Marketing Emily Johnstone, EVP/Managing Director of DC Marketing Board of Trustees Michael Cook, CFA, FRM, Co - Chief Portfolio Manager Guy Carter, CFA , Senior Portfolio Manager Nicholas Milano, General Counsel Stephanie Wiggins, EVP/Chief Investment Officer Erica Khatchadourian, CFO Harpreet Peleg, CFA, Controller Paul Gerke, CSO Legal Executive Multifamily Investments Portfolio Management Christopher Kaiser, CFA, Deputy General Counsel / Chief Compliance Officer As of September 30, 2018

AFL - CIO Housing Investment Trust 5 Leadership – Chang Suh, CFA, CEO & Co - Chief Portfolio Manager: 20+ years experience in the financial services industry, specializing in the commercial mortgage industry and 20 years at the HIT – Ted Chandler, COO: 30+ years experience in housing finance and community development, including 15 years at Fannie Mae and 9 years at the HIT – Erica Khatchadourian, CFO: 20+ years experience in accounting for financial transactions, general and personnel management and policy development, with 25 years at the HIT – Nicholas Milano, General Counsel: 25 years of experience including 2 years at SEC Portfolio Management – Michael Cook, CFA, FRM, Co - Chief Portfolio Manager: 15 years of experience managing, trading and structuring investments at the HIT – Guy Carter, CFA, Senior Portfolio Manager: 17 years of experience in capital markets and housing finance including 6 years at Freddie Mac and 10 years at the HIT – David Phillips, Senior Financial Analyst: 20 years of experience at the HIT As of September 30, 2018

▪ HIT named to the “2017 Best Places to Work” in Money Management program by Pensions &Investments ▪ 2017 Total Investment Activity – 22 Deals totaling $446 million , representing total development investment of $1.7 billion – HIT: invested $421.7 million in 19 deals – BACDE: $24.5 million in New Markets Tax Credits in 3 deals AFL - CIO Housing Investment Trust 6

AFL - CIO Housing Investment Trust 7 HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended October 31 , 2018 was - 1 . 98 % , 0 . 73 % , 1 . 80 % , and 3 . 77 % , respectively . Returns over one year are annualized . The performance data quoted represents past performance and is no guarantee of future results . Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost . The HIT’s current performance may be lower or higher than the performance data quoted . Performance data current to the most recent month - end is available from the HIT’s website at www . aflcio - hit . com . Gross performance figures do not reflect the deduction of HIT expenses . Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT . Information about HIT expenses can be found on page 1 of the HIT’s current prospectus . Important Notice . The information furnished in this report is provided as a courtesy only to assist you in your internal reviews and does not constitute a statement of your account . Unless expressly stated otherwise, the HIT makes no representations, express or implied, as to the accuracy of the information being reported . In accordance with the Investment Company Act of 1940 , as amended, the HIT files numerous reports with the Securities and Exchange Commission, including information on its performance in its annual (audited) and semi - annual (unaudited) reports and its complete schedule of portfolio holdings for the 1 st and 3 rd quarters on Form N - Q . Performance for Periods Ending [Date] 1 Year 3 Year 5 Year 10 Year Since Inception [Date] Participant Dollar - Weighted [ x.xx ]% [x.xx]% [x.xx]% [ x.xx ]% [ x.xx ]% Market Value of Units Held at [Date]: [$ xxxxxx ] Investments Since Inception: [$ xxxxxx ] Income Earned Since Inception[$ xxxxxx ] As of September 30, 2018, unless otherwise denoted

AFL - CIO Housing Investment Trust 8 The cycle of sustainable investment begins when union pension plans invest capital in the HIT. This capital allows the HIT to fi nance multifamily development projects through government/agency credit multifamily new construction and substantial rehabilitation securities, which provide pension plan investors with competitive returns. The projects create good union construction jobs. As workers at the projects earn income, the pension plan contributions increase. The pension plans have more capital to invest in the HI T a nd the cycle continues. Construction securities help provide competitive returns Union pension funds invest in HIT HIT finances development projects through guaranteed securities Union workers contribute to pension funds Construction projects generate good union jobs The HIT Investment Cycle 2 3 4 5 1

AFL - CIO Housing Investment Trust 9 Kenmore Plaza Apartments Chicago, IL Portner Flats Washington, DC 333 Harrison San Francisco, CA Electchester Housing Queens, NY The HIT offers investors: ▪ Competitive Returns ▪ Low Credit Risk Liquid Investment ▪ Diversification ▪ Impact Investing ▪ Union Construction Jobs ▪ Affordable Housing

AFL - CIO Housing Investment Trust 10 OBJECTIVE: Generate competitive risk - adjusted fixed - income total returns while encouraging the construction of housing, including affordable and workforce housing, and facilitating employment for the union members in the construction trades and related industries. STRATEGY : ▪ Construct and manage a portfolio with superior credit quality, higher yield, and similar interest rate risk relative to the Bloomberg Barclays U . S . Aggregate Bond Index (Barclays Aggregate) . ▪ Overweight government/agency multifamily mortgage - backed securities (MBS), which tend to provide an income advantage compared to other securities with comparable credit and interest rate risk . – Has expertise in government/agency multifamily MBS. – Directly sources construction - related multifamily MBS. – Focuses on construction - related multifamily MBS can provide a yield advantage. – Substitutes prepayment - protected multifamily MBS for corporates and some Treasuries in the benchmark, which can help make the HIT a better source of diversification than other core fixed - income strategies.

AFL - CIO Housing Investment Trust 11 INVESTMENT OFFICERS IDENTIFY PROJECTS Mortgage Bankers Developers Housing Finance Agencies Community Organizations Labor Community City Representatives INVESTMENT COMMITTEE * Reviews information on all construction - related multifamily and healthcare investments for the portfolio Reviews pricing provided by Portfolio Management Group Approves transactions for investment or recommends transactions to Executive Committee, if required EXECUTIVE COMMITTEE OF BOARD OF TRUSTEES Reviews and approves PORTFOLIO MANAGER Rate lock after issuance of agency (e.g., FHA/Fannie Mae/HFA) commitment INVESTMENT OFFICERS ANALYZE PROJECTS Development Team Financial Analysis Market Analysis Property Characteristics Project Status Labor Concurrence Third - Party Reports Site Visit MORTGAGE BANKER UNDERWRITING & PROCESSING Financial Analysis Market Review Mortgage Credit Sponsor/Management PUBLIC SECTOR APPROVAL , if appropriate under $75M $75M or over *Standard process : ( 1 ) Letter of Interest or Conditional Commitment is issued after Investment Committee approval based on analysis of the financing structure and pro formas, property description, proposed rents, market demand, sponsor, management, etc .; ( 2 ) Preliminary Financing Proposal is approved to be issued when information is available on site control, zoning ; third - party reports, and labor confirmation that the project will be built with 100 % union labor ; ( 3 ) after confirmation that the necessary credit enhancement/agency endorsement or approval has been obtained, the final commitment is based on proposed pricing from the Portfolio Management Group . For transactions of $ 75 million or more, approval by the Executive Committee of the Board is then required . Finally, the project is eligible for rate lock and final commitment documentation . (The first two steps may not occur in each transaction and do not obligate the HIT . )

HIT Barclays Aggregate Credit Profile U.S. Government/Agency /AAA/Cash 95.7% 71.9% A & Below 0.1% 24.3% Yield Current Yield 3.43% 3.17% Interest Rate Risk Effective Duration 5.61 6.01 Convexity 0.10 0.19 Call /Prepayment Risk Call Protected 76% 72% Not Call Protected 24% 28% AFL - CIO Housing Investment Trust 12 As of September 30, 2018 The calculation of the HIT yield herein represents a widely accepted portfolio characteristic based on coupon rate and curren t p rice and is not current yield or other performance data as defined by the SEC in Rule 482.

AFL - CIO Housing Investment Trust 13 HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended October 31 , 2018 was - 1 . 98 % , 0 . 73 % , 1 . 80 % , and 3 . 77 % , respectively . The performance data quoted represents past performance and is no guarantee of future results . Periods over one year are annualized . Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost . The HIT’s current performance may be lower or higher than the performance data quoted . Performance data current to the most recent month - end is available from the HIT’s website at www . aflcio - hit . com . Gross performance figures do not reflect the deduction of HIT expenses . Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT . Information about HIT expenses can be found on page 1 of the HIT’s current prospectus . HIT’s gross returns exceeded the Barclays Aggregate for the 1 - , 5 - and 10 - year periods ending September 30 , 2018 . Barclays Aggregate AAA Component has comparable credit risk and duration to the HIT . However, HIT’s gross and net returns exceeded the AAA Component for the 3 - , 5 - and 10 - year periods ending September 30 , 2018 , showing the value of HIT’s overweight to multifamily MBS . - 1.46% - 1.13% 1.27% 2.53% 4.03% - 1.76% - 1.53% 0.86% 2.10% 3.59% - 1.60% - 1.22% 1.31% 2.16% 3.77% - 1.36% - 1.27% 0.59% 1.64% 3.00% -2.5% -1.5% -0.5% 0.5% 1.5% 2.5% 3.5% 4.5% YTD 1-year 3-year 5-year 10-year HIT Gross HIT Net Barclays Aggregate AAA Component Barclays Aggregate Annualized Total Returns vs. Benchmark and AAA Barclays Aggregate Component As of September 30, 2018 As of September 30, 2018, unless otherwise denoted

8.60% 12.04% 4.17% 4.59% 3.03% 5.08% 7.14% 5.68% 6.73% 6.62% 8.34% 4.71% - 1.95% 6.56% 1.58% 2.35% 3.58% 8.21% 11.64% 3.78% 4.20% 2.64% 4.65% 6.70% 5.25% 6.28% 6.16% 7.86% 4.27% - 2.37% 6.10% 1.13% 1.94% 3.17% 8.44% 10.25% 4.10% 4.34% 2.43% 4.33% 6.97% 5.24% 5.93% 6.54% 7.84% 4.22% - 2.02% 5.97% 0.55% 2.65% 3.54% -3% -1% 1% 3% 5% 7% 9% 11% 13% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 HIT Gross HIT Net Barclays Aggregate AFL - CIO Housing Investment Trust 14 Calendar Year Returns as of Year - end HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended October 31 , 2018 was - 1 . 98 % , 0 . 73 % , 1 . 80 % , and 3 . 77 % , respectively . The performance data quoted represents past performance and is no guarantee of future results . Periods over one year are annualized . Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost . The HIT’s current performance may be lower or higher than the performance data quoted . Performance data current to the most recent month - end is available from the HIT’s website at www . aflcio - hit . com . Gross performance figures do not reflect the deduction of HIT expenses . Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT . Information about HIT expenses can be found on page 1 of the HIT’s current prospectus . The HIT’s gross returns have exceeded the Barclays Aggregate for 24 of 25 calendar years, including 2008, when many fixed - income investments’ returns were lower than the benchmark or negative. As of September 30, 2018, unless otherwise denoted

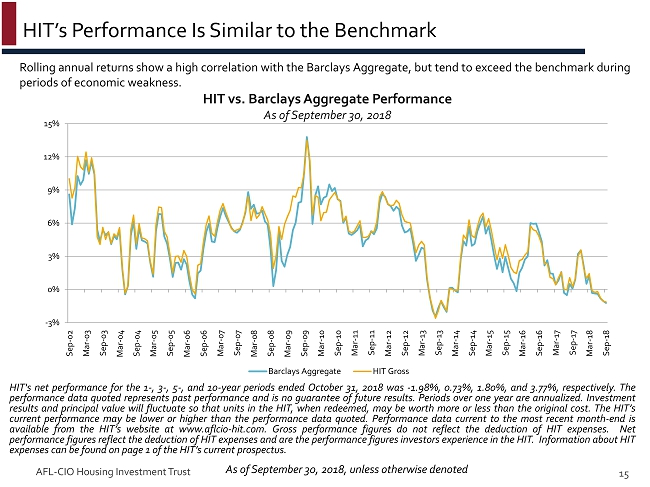

AFL - CIO Housing Investment Trust 15 HIT's net performance for the 1 - , 3 - , 5 - , and 10 - year periods ended October 31 , 2018 was - 1 . 98 % , 0 . 73 % , 1 . 80 % , and 3 . 77 % , respectively . The performance data quoted represents past performance and is no guarantee of future results . Periods over one year are annualized . Investment results and principal value will fluctuate so that units in the HIT, when redeemed, may be worth more or less than the original cost . The HIT’s current performance may be lower or higher than the performance data quoted . Performance data current to the most recent month - end is available from the HIT’s website at www . aflcio - hit . com . Gross performance figures do not reflect the deduction of HIT expenses . Net performance figures reflect the deduction of HIT expenses and are the performance figures investors experience in the HIT . Information about HIT expenses can be found on page 1 of the HIT’s current prospectus . Rolling annual returns show a high correlation with the Barclays Aggregate, but tend to exceed the benchmark during periods of economic weakness . HIT vs. Barclays Aggregate Performance As of September 30, 2018 -3% 0% 3% 6% 9% 12% 15% Sep-02 Mar-03 Sep-03 Mar-04 Sep-04 Mar-05 Sep-05 Mar-06 Sep-06 Mar-07 Sep-07 Mar-08 Sep-08 Mar-09 Sep-09 Mar-10 Sep-10 Mar-11 Sep-11 Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 Sep-16 Mar-17 Sep-17 Mar-18 Sep-18 Barclays Aggregate HIT Gross As of September 30, 2018, unless otherwise denoted

AFL - CIO Housing Investment Trust 16 Risk characteristics are actively measured, monitored and managed relative to the benchmark, the Barclays Aggregate ▪ Lower credit risk – Higher credit quality – Government/agency MBS – Substitutes call - protected multifamily MBS for corporate debt and some Treasuries and agency debt – No derivatives – No leverage through borrowing ▪ Similar interest rate risk – Duration and convexity similar to the benchmark ▪ Strong liquidity – More than 99 % invested in liquid securities

Oversight Committees comprised of senior management ▪ Portfolio Management Committee – Sets portfolio macro - strategy, oversees Portfolio Management Group (PMG), monitors trading matters, and approves counterparties, among other duties ▪ Valuation Committee – Oversees HIT’s valuation process, including review of the reliability of pricing by independent sources, appropriateness of valuation methodologies and determination of fair value under Board - approved policies and procedures ▪ Investment Committee – Reviews and approves all commitments related to internally sourced construction transactions, including pricing by PMG – Board of Trustees Executive Committee approves all such transactions greater than $75 million AFL - CIO Housing Investment Trust 17

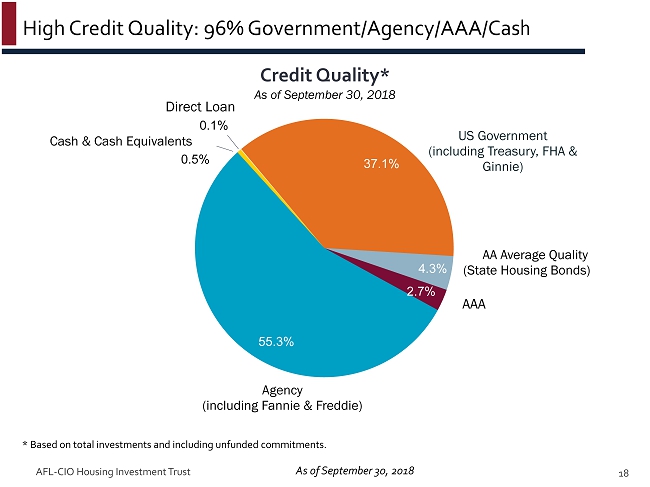

AFL - CIO Housing Investment Trust 18 37.1% 4.3% 2.7% 55.3% 0.5% 0.1% Cash & Cash Equivalents AAA Agency (including Fannie & Freddie) US Government (including Treasury, FHA & Ginnie) AA Average Quality (State Housing Bonds) Direct Loan Credit Quality* As of September 30, 2018 * Based on total investments and including unfunded commitments. As of September 30, 2018

AFL - CIO Housing Investment Trust 19 * Based on total investments and including unfunded commitments. ** Includes 5.77% FN DUS SARM allocation 17.2% 0.6% 4.6% 9.8% 62.9% 1.9% 0.5% 2.6% Short Term Treasury Construction - Related MF MBS AAA Private - Label CMBS 30 - Year SF MBS Permanent MF MBS** 15 - Year SF MBS ARMS/floaters SF MBS Sector Allocation* As of September 30, 2018 As of September 30, 2018

AFL - CIO Housing Investment Trust 20 Construction - related GNMA MBS convert to permanent MBS, with the potential for significant price appreciation. Multifamily construction - related loan spreads remain higher than permanent loan spreads and some other high credit quality options. Investment Comparison As of September 30, 2018 Investment Type Effective Duration (Years) Effective Convexity Yield (%) Spread to 10 - Year (bps) 10 Year UST 8.54 0.42 3.06% 0 GNMA Construction/Permanent 8.64 0.46 4.11% 105 GNMA Permanent 7.87 0.38 3.56% 50 Agency CMBS (GNMA REMICS) 7.96 0.75 4.16% 111 FNMA Multifamily 10/9.5 DUS 7.57 0.36 3.66% 60 FNMA 4.0% 30yr MBS 5.22 - 1.81 3.85% 79 Gold (Freddie Mac) 4.0% 30yr MBS 5.25 - 1.75 3.86% 80 GNMA 4.0% 30yr MBS 4.83 - 1.05 3.59% 53 Barclays Corporate AAA Index 10.51 2.04 3.64% 58 As of September 30, 2018 Source: HIT and Securities Dealers 20 40 60 80 100 120 140 Sep-16 Mar-17 Sep-17 Mar-18 Sep-18 Spreads to 10 - Year Treasury in Basis Points Historical Multifamily Spreads September 2016 - September 2018 Ginnie Mae Permanent Ginnie Mae Construction/Permanent Fannie Mae Multifamily 10/9.5 DUS

AFL - CIO Housing Investment Trust 21 ▪ Still difficult to access mortgage credit for some single family home buyers ▪ Demand for affordable housing remains strong ▪ Rehabilitation opportunities: aging multifamily projects will need substantial rehab in dense urban markets ▪ Migration into major cities and limited land – need to build up and increase density ▪ Multifamily housing demand expected to be strong and ongoing for the foreseeable future As of September 30, 2018

AFL - CIO Housing Investment Trust 22 Source: Bloomberg and the HIT 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 Sep-16 Mar-17 Sep-17 Mar-18 Sep-18 Percent 10 - Year Treasury vs. Ginnie Mae Construction/Permanent MBS Yields 10-year Treasury Yield Ginnie Mae Construction/Permanent Yield As of September 30, 2018 1.88 1.97 2.21 2.41 2.74 2.53 2.62 2.74 2.86 2.99 2.82 2.88 2.95 3.06 3.21 1.0 1.5 2.0 2.5 3.0 3.5 2-Year 3-Year 5-Year 10-Year 30-Year Percent U.S. Treasury Yield Curve Shift 12/31/2017 06/30/2018 09/30/2018

AFL - CIO Housing Investment Trust 23 Source: Bureau of Labor Statistics As of September 30, 2018 -1 0 1 2 3 4 5 PCE Core PCE 2 4 6 8 10 12 14 16 18 Percent Unemployment Rate (U-3) Unemployed+Marginally Attached+Part Time Econ Reasons (U-6)

AFL - CIO Housing Investment Trust 24 Source: Haver and Barclays Live ▪ The FOMC has communicated a plan for gradual rate hikes, likely to include one additional 25 basis point hikes in 2018; actions will be data dependent. ▪ The FOMC has consistently underestimated the low level of output and inflation in recent years. Most other central banks’ monetary policies around the globe should remain accommodative in the near term. As of September 30, 2018 -1.0 -0.5 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 Recession 3/2001 Recession 12/2007

AFL - CIO Housing Investment Trust 25 Investors should consider the HIT’s investment objectives, risks and expenses carefully before investing. A prospectus containing more complete information may be obtained from the HIT by calling the Marketing and Investor Relations Department collect at 202 - 331 - 8055 or by viewing the HIT’s website at www.aflcio - hit.com. The prospectus should be read carefully before investing. This document contains forecasts, estimates, opinions, and/or other information that is subjective. Statements concerning economic, financial, or market trends are based on current conditions, which will fluctuate. There is no guarantee that such statements will be applicable under all market conditions, especially during periods of downturn. It should not be considered as investment advice or as a recommendation of any kind. www.aflcio - hit.com Washington, DC, Headquarters 2401 Pennsylvania Avenue, NW, Suite 200 Washington, DC 20037 (202) 331 - 8055 [Name , Title, contact information] As of September 30, 2018, unless otherwise denoted