UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

| Check the appropriate box: | |||||

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

x | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to § 240.14a-12 | ||||

| Adams Resources & Energy, Inc. | ||||||||

| (Name of Registrant as Specified in its Charter) | ||||||||

| N/A | ||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||

| x | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11 | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

ADAMS RESOURCES & ENERGY, INC.

17 South Briar Hollow Lane, Suite 100

Houston, Texas 77027

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 6, 2020

To the Shareholders of Adams Resources & Energy, Inc.:

The Annual Meeting of Shareholders of Adams Resources & Energy, Inc. will be held at 17 South Briar Hollow Lane, Suite 100, Houston, Texas 77027, on Wednesday, May 6, 2020 at 11:00 a.m., Houston time, to consider the following matters:

1.To elect a board of seven directors to serve for the next year or until their successors are elected and qualified;

2.To consider and act upon an Advisory Resolution on Executive Compensation; and

3.To transact any other business as may properly come before the annual meeting or any adjournments thereof.

Further information regarding the meeting and the above proposals is set forth in the accompanying Proxy Statement. The close of business on April 1, 2020 has been fixed as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting or any adjournment(s) thereof.

As part of our precautions regarding the coronavirus or COVID-19, we are also planning for the possibility that the annual meeting may be held solely by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be issued by press release and filed with the SEC as proxy material.

| By Order of the Board of Directors | |||||||||||

| /s/ David B. Hurst | |||||||||||

| David B. Hurst | |||||||||||

| Secretary | |||||||||||

| Houston, Texas | |||||||||||

| March 18, 2020 | |||||||||||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY | ||

| MATERIALS FOR THE ANNUAL SHAREHOLDER MEETING | ||

TO BE HELD ON MAY 6, 2020. | ||

OUR PROXY STATEMENT AND 2019 ANNUAL REPORT | ||

| ARE ALSO AVAILABLE AT www.adamsresources.com. | ||

| YOU ARE INVITED TO ATTEND THE MEETING. EVEN IF YOU PLAN TO ATTEND, YOU ARE URGED TO SIGN, DATE AND MAIL THE ENCLOSED PROXY PROMPTLY. THE ENCLOSED RETURN ENVELOPE MAY BE USED FOR THAT PURPOSE. IF YOU ATTEND THE MEETING, YOU CAN VOTE AT THE MEETING OR BY PROXY. | ||

ADAMS RESOURCES & ENERGY, INC.

PROXY STATEMENT

FOR

2020 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 6, 2020

This Proxy Statement and accompanying proxy are being furnished to our shareholders in connection with the solicitation of proxies by the Board of Directors (“Board”) of Adams Resources & Energy, Inc., a Delaware corporation (the “Company”), for use at our 2020 Annual Meeting of Shareholders to be held at 17 South Briar Hollow Lane, Suite 100, Houston, Texas 77027, on Wednesday, May 6, 2020 at 11:00 a.m., Houston time, and any and all adjournments thereof, (such meeting or adjournment(s) thereof referred to as the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. As part of our precautions regarding the coronavirus or COVID-19, we are also planning for the possibility that the annual meeting may be held solely by means of remote communications. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be issued by press release and filed with the SEC as proxy material.

This Proxy Statement and the accompanying proxy are being mailed to shareholders on or about April 10, 2020. Unless otherwise indicated, the terms the “Company,” “our,” “we,” “us” and similar terms refer to Adams Resources & Energy, Inc. together with our subsidiaries.

We will pay the cost of solicitation of the proxies. In addition to solicitation by mail, proxies may be solicited personally by telephone or e-mail by our directors, officers and employees, and arrangements may be made with brokerage houses or other custodians, nominees and fiduciaries to send proxies and proxy material to their principals. We will bear the compensation and expenses of such firms, if any, which are not expected to exceed $1,000. Currently, we have not entered into any arrangements with any firm to aid in the solicitation of proxies.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

At the close of business on April 1, 2020, the record date of those entitled to receive notice of and to vote at the Annual Meeting, we had outstanding 4,235,533 shares of common stock, $0.10 par value per share (“Common Stock”). The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock on the record date is necessary to constitute a quorum at the Annual Meeting. Abstentions will be considered present at the Annual Meeting and counted toward the quorum, but they will not be counted as votes cast. Broker non-votes (which are shares represented by proxies, received from a bank or broker, that are not voted on a matter because the bank or broker did not receive voting instructions from the shareholder) will be treated the same as abstentions. Therefore, abstentions and broker non-votes will not have an effect on any of the proposals at this meeting because they will not be counted as votes cast. Each share of Common Stock is entitled to one vote on all issues requiring a shareholder vote at the Annual Meeting. Shareholders may not cumulate their votes for the election of directors.

The election of directors and the advisory resolution on executive compensation are not considered “routine matters.” Thus, if a shareholder does not vote its shares with respect to any of these matters, such shareholder’s bank or broker may not vote such shares and such shares will be left unvoted on the matter.

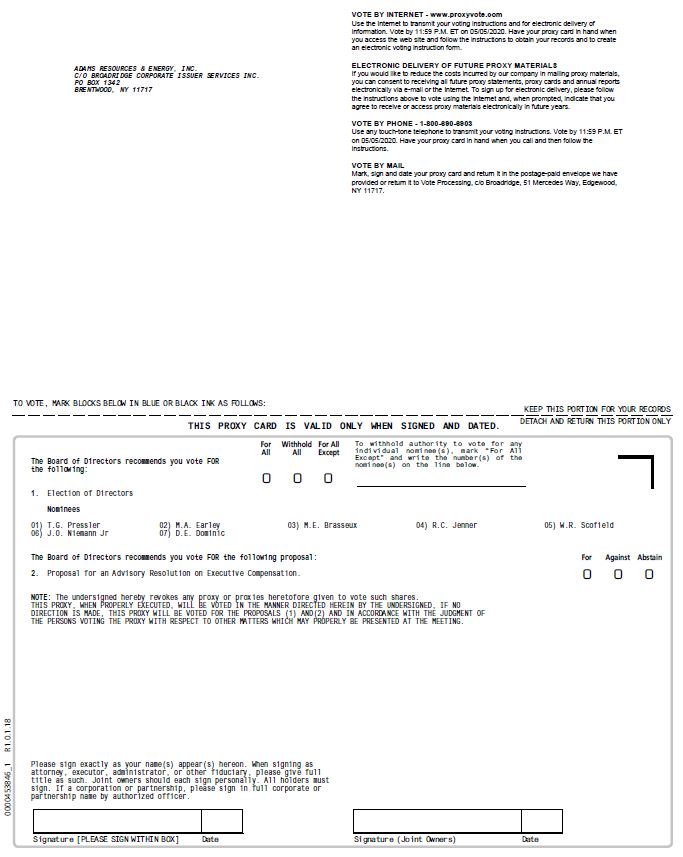

All shares represented by properly executed or submitted proxies, unless previously revoked, will be voted at the Annual Meeting in accordance with the directions on the proxies. If no direction is indicated, the shares will be voted “FOR” the election as directors of the nominees listed herein, “FOR” the advisory resolution on executive compensation, and in the discretion of the persons named in the proxy in connection with any other business that may properly come before the Annual Meeting. The enclosed proxy, even though executed and returned, may nevertheless be revoked at any time before it is voted by the subsequent execution and submission of a revised proxy, by written notice of revocation to our Secretary at the address set forth above or by voting at the Annual Meeting. However, simply attending the Annual Meeting and not voting will not revoke a previously submitted proxy.

1

ITEM 1 - APPROVAL OF NOMINEES FOR DIRECTOR

ELECTION OF DIRECTORS

The persons named in the enclosed proxy have been selected by the Board of Directors to serve as proxies (“Proxy Holders”) and will vote the shares represented by valid proxies at the Annual Meeting and any adjournments thereof. The Proxy Holders have indicated that they intend to vote “FOR” each of the persons named as a nominee below under “Nominees for Director” unless authority to vote in the election of directors is withheld on each proxy or unless otherwise specified on each proxy. Each duly elected director will hold office until the 2021 Annual Meeting of Shareholders or until his or her successor shall have been elected and qualified. Although our Board does not contemplate that a nominee will be unable to serve, if such a situation arises prior to the Annual Meeting, the Proxy Holders will vote for the election of such other person as may be nominated by the Board. Proxies cannot be voted in the election of directors for more than seven persons, as that is the number of nominees named herein.

Directors shall be elected by a plurality of the votes of the shares present or represented by proxy and entitled to vote at the Annual Meeting. Withholding authority will have the effect of a vote cast “AGAINST” Item 1. Broker non-votes will not be counted in the tabulations of the votes cast on Item 1 and will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that shareholders vote “FOR” the election of the nominees listed below to our Board of Directors.

For each of our directors, the following table sets forth their names, ages, principal occupations, other directorships of public companies held by them and length of continuous service as a director of the Company. Any directorship of public companies held by the nominees within the last five years is also presented below.

| Principal Occupation | Director | |||||||||||||||||||

| Nominee | Age | and Other Directorships | Since | |||||||||||||||||

| Townes G. Pressler | 84 | Chairman of the Board of the Company | 2011 | |||||||||||||||||

| Michelle A. Earley | 48 | Partner — Locke Lord LLP | 2015 | |||||||||||||||||

| Murray E. Brasseux | 71 | Retired — Former Bank Managing Director | 2015 | |||||||||||||||||

| Director and member of Audit & Conflicts Committee of | ||||||||||||||||||||

| general partner of Enterprise Products Partners, L.P. | ||||||||||||||||||||

| Dennis E. Dominic | 67 | Retired — Former Vice President of Domestic Crude Supply | 2019 | |||||||||||||||||

| and Trading | ||||||||||||||||||||

| Richard C. Jenner | 58 | Co-Managing Partner — Endeavor Natural Gas, LP | 2016 | |||||||||||||||||

| W.R. Scofield | 67 | President and Chief Operating Officer — KSA Industries, Inc. | 2016 | |||||||||||||||||

| John O. Niemann, Jr. | 63 | Managing Director — Andersen Tax LLC | 2019 | |||||||||||||||||

2

Townes G. Pressler

Mr. Pressler was appointed our Executive Chairman and Chairman of the Board in September 2017. He retired as Executive Chairman effective December 31, 2019 and remains Chairman of the Board. Mr. Pressler is President and founder of Tepee Petroleum, an independent oil and gas producer based in Houston, that he founded in 1978. He was also the founder and chairman of VSO Inc. (formerly Pressler Petroleum Consultants, Inc.), which provides engineering consulting services and appraisals, which he founded in 1985, and divested his interest in October 2018. Prior to 1985, Mr. Pressler was President of Philip Hill Energy, President of Republic Oil and Gas Corp., and Chief Petroleum Engineer for Barnhart Co. after his initial years with Exxon. Mr. Pressler is a 1959 graduate of the University of Texas and holds a Bachelor of Science in Petroleum Engineering, and is a Registered Professional Engineer.

Mr. Pressler has been nominated to serve on the Board in light of his extensive business and management experience in the energy industry and his history with the company.

Michelle A. Earley

Ms. Earley is a Partner at the law firm of Locke Lord LLP, having joined the law firm in 1998 and having served as a Partner since 2008. Ms. Earley has extensive experience in merger, acquisition, and disposition transactions, securities regulation matters and securities offerings, including representing purchasers and sellers of publicly-traded and privately-held companies, representing issuers and selling shareholders in connection with the public offering and private placement of debt and equity securities, tender offers, exchange offers and advising management and boards of directors on general corporate governance matters. She holds an undergraduate degree from Texas A&M University and a Juris Doctor from Yale Law School.

Ms. Earley has been nominated to serve on the Board in light of her extensive experience in merger and acquisition transactions, including representing publicly traded companies for many years.

Murray E. Brasseux

Mr. Brasseux has extensive banking experience including energy lending practices. He retired from Compass Bank in December 2014 after 20 years of service, having most recently served as Managing Director of Oil & Gas Finance. Mr. Brasseux also served as a consultant to Compass Bank from January 2015 to June 2015 and as a consultant to Loughlin Management Partners (a restructuring and advisory firm) from June 2015 to December 2017. Mr. Brasseux also serves on the board of directors and audit and conflicts committee of the general partner of Enterprise Products Partners, L.P. and on the board of the Rare Book School (an affiliate of the University of Virginia). He holds a Bachelor of Science in Finance and a Master of Science in Finance from Louisiana State University.

Mr. Brasseux has been nominated to serve on the Board in light of his extensive experience in the banking industry, including energy lending practices.

Dennis E. Dominic

Mr. Dominic has more than 40 years of experience in the energy industry in the areas of refining, marketing and trading. He retired from Valero Energy Corporation (“Valero”) in July 2019 where he served as Vice President of Domestic Crude Supply and Trading from January 2002 until his retirement. Prior to his more than 17 years of service at Valero, Mr. Dominic worked at and enjoyed increasing levels of responsibility at Conoco, Inc., Horizon Trading Company and Sigmor Refining Company (“Sigmor”). In 1982, Mr. Dominic joined Diamond Shamrock Refining Company (“Diamond Shamrock”) when it acquired Sigmor. In 1996, Mr. Dominic joined Ultramar Diamond Shamrock (“Ultramar”) upon Ultramar’s merger with Diamond Shamrock. He was with Ultramar from 1996 until Ultramar was purchased by Valero in 2001. Mr. Dominic holds a Bachelor of Applied Arts and Sciences from Southwest Texas State University and a Master of Business Administration from Incarnate Word University.

3

Mr. Dominic has been nominated to serve on the Board in light of his extensive experience in the energy industry, including in crude oil marketing, and his broad management experience.

Richard C. Jenner

Mr. Jenner is the co-managing partner of Endeavor Natural Gas, LP (“Endeavor”), a position he has held since he founded the company in November 2001. Endeavor is a private equity backed upstream energy company with operations throughout Texas and Louisiana. Mr. Jenner has been active in the oil and gas industry for over 30 years, having worked for Santa Fe Minerals, Torch Energy Advisors and Tepee Petroleum Company. His experience throughout his career has touched on all aspects of running an independent oil and gas producer, including operations, engineering, accounting, and mergers and acquisitions. Mr. Jenner holds a Bachelor of Science in Petroleum Engineering from the Colorado School of Mines and a Master of Business Administration from the University of Chicago.

Mr. Jenner has been nominated to serve on the Board in light of his extensive experience in the energy industry, including in crude oil marketing, and his broad management experience.

W. R. Scofield

Mr. Scofield is the President and Chief Operating Officer of KSA Industries, Inc. (“KSAI”), our affiliate, having served in this position since April 2015. Mr. Scofield served as Vice President of Corporate Development and Tax Planning at KSAI for more than five years prior to 2015. He has extensive experience with a diverse group of businesses, including oil and gas, agriculture, automotive, insurance and professional sports. Mr. Scofield is a graduate of the University of Texas and holds a Bachelor of Business Administration and a Master of Professional Accounting, specializing in taxation.

Mr. Scofield has been nominated to serve on the Board in light of his diversified managerial experience in various industries.

John O. Niemann, Jr.

Mr. Niemann is a Managing Director of Andersen Tax LLC (formerly known as WTAS LLC), having served in this position since June 2013. He is also the president and chief operating officer of Arthur Andersen LLP, and has been since 2003. He previously served on the administrative board of Arthur Andersen LLP and on the board of partners of Andersen Worldwide. Mr. Niemann began his career at Arthur Andersen LLP in 1978 and has served in increasing responsibilities in senior management positions since 1992.

Mr. Niemann has served as a director and chairman of the audit committee of Hines Global Income Trust, Inc. since August 2014. Since May 2012, he has also served as a director and is currently the chairman of the audit committee of HMS Income Fund, Inc. He previously served as a director and chairman of the audit committee of Gateway Energy Corporation from June 2010 until December 2013 when the company went private.

Mr. Niemann has served on the board of directors of many Houston area non-profit organizations, including Strake Jesuit College Preparatory School (past chair of the board), The Regis School of the Sacred Heart (past chair of the board), The Houston Symphony, The University of St. Thomas, The Alley Theatre and Taping for the Blind, Inc. He graduated with a Bachelor of Arts in Managerial Studies and a master’s degree in accounting from Rice University, received a juris doctor from the South Texas College of Law and a Masters of Law in taxation from the University of San Francisco School of Law.

Mr. Niemann has been nominated to serve on the Board in light of his extensive business, management and accounting and finance experience.

4

Director Independence

Our Board of Directors is comprised of a majority of independent directors as defined under NYSE American listing standards. There are no family relationships among any of our directors or executive officers. The Board has determined that the following Directors are independent: Messrs. Brasseux, Dominic, Jenner and Niemann and Ms. Earley. The Board has determined that none of the designated independent directors have any relationship that, under NYSE American rules, would preclude their service on any of the standing committees of the Board. In making its determination, the Board considered transactions and relationships between each director or his immediate family and us and our subsidiaries, including those reported under “Compensation Committee Interlocks and Insider Participation” and “Transactions with Related Persons” below. The purpose of this review was to determine whether any such relationships or transactions were material and, therefore, inconsistent with a determination that the director is independent. In addition, the Board requires each of its members and each of the director nominees to disclose in an annual questionnaire any relationship they or their family members may have had with us, our subsidiaries, our independent accountants, directors and officers within the past five years. The Board considers any such relationship in making its determination. Mr. Pressler is considered an inside director because of his previous employment with the Company. Mr. Scofield is considered an inside director because of his employment with KSAI.

Board Leadership and Governance

Our Board, with the assistance of the Nominating and Corporate Governance Committee, evaluates its size, function, needs and composition on an annual basis, with the intent that the Board as a whole collectively possess a broad range of skills, expertise, industry and other knowledge, and business, diversity and other experience useful to the effective oversight of the Company’s business.

Our Bylaws provide the Board flexibility to determine the appropriate leadership of the Board, and whether the roles of Chairman and Chief Executive Officer should be combined or separate. The Board believes it is in the best interests of the Company and its shareholders for the Board to determine which director is best qualified to serve as Chairman in light of the circumstances at the time, rather than based on a fixed policy. As a result, the roles of Chairman and CEO have been split from time to time, while at other times the roles have been combined. During 2019, Mr. Pressler held the role of Executive Chairman and Chairman of the Board. Effective December 31, 2019, Mr. Pressler retired as Executive Chairman and Kevin J. Roycraft was appointed as Chief Executive Officer effective January 1, 2020.

During 2019, the Board held executive sessions of independent directors without the presence of non-independent directors and management. Mr. Brasseux, as longest serving independent member, presided at such executive sessions since the Executive Chairman, a non-independent director, was not present.

5

Meetings of the Board of Directors and its Committees

During 2019, the full Board of Directors met nine times and all director nominees attended all of the meetings of the Board and the committees on which they served for the period in which they held office. It is our policy that all persons nominated for election to the Board at the time of the annual meeting be present at such meeting. All directors at the time of the 2019 annual meeting attended the 2019 annual meeting. The Board has four standing committees – the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Investment Committee.

| Committees | Summary of | Committee | Meetings in | |||||||||||||||||

| of the Board | Responsibilities | Members | 2019 | |||||||||||||||||

| Audit | Retains independent registered public accounting firm and pre-approves their services. Reviews and approves financial statements, internal controls and related party transactions. | Niemann (1) | Seven | |||||||||||||||||

Bell (2) | ||||||||||||||||||||

Brasseux (3) | ||||||||||||||||||||

| Jenner | ||||||||||||||||||||

| Compensation | Evaluates the performance of the Chief Executive Officer or Executive Chairman and establishes the compensation of the Chief Executive Officer or Executive Chairman and other executive officers. | Jenner (4) | Eight | |||||||||||||||||

Brasseux (5) | ||||||||||||||||||||

| Niemann | ||||||||||||||||||||

Bell (6) | ||||||||||||||||||||

| Nominating and Corporate Governance | Identifies, considers and recommends to the Board nominees for directors. Periodically assesses corporate governance and makes recommendations to the Board. | Brasseux (5) | Five | |||||||||||||||||

Bell (6) | ||||||||||||||||||||

Earley (7) | ||||||||||||||||||||

| Investment | Evaluates, reviews and monitors investment, acquisition and divestiture transactions. | Jenner (4) | Six | |||||||||||||||||

Bell (6) | ||||||||||||||||||||

| Brasseux | ||||||||||||||||||||

| Niemann | ||||||||||||||||||||

| Earley | ||||||||||||||||||||

| Scofield | ||||||||||||||||||||

______________________________

| (1) | Mr. Niemann is an independent director and was appointed to the Board on May 20, 2019. He was appointed Chairman of the Audit Committee and was designated the Audit Committee financial expert as defined by Item 407(d) (5) of Regulation S-K. | ||||||||||

| (2) | Mr. Bell was an independent director, served as Chairman of the Audit Committee and was our designated Audit Committee financial expert as defined by Item 407(d) (5) of Regulation S-K until his death on February 27, 2019. | ||||||||||

| (3) | Mr. Brasseux is an independent director and was appointed interim Chairman of the Audit Committee upon Mr. Bell’s death, a capacity in which he served until the appointment of Mr. Niemann in May 2019. | ||||||||||

| (4) | Mr. Jenner is an independent director and serves as Chairman of the Compensation Committee and Chairman of the Investment Committee. Mr. Jenner was appointed Chairman of the Compensation Committee on March 11, 2019. | ||||||||||

| (5) | Mr. Brasseux served as Chairman of the Compensation Committee and Chairman of the Nominating and Corporate Governance Committee until March 11, 2019. | ||||||||||

| (6) | Mr. Bell was a member of the Compensation, Investment and Nominating and Corporate Governance Committees until his death on February 27, 2019. | ||||||||||

| (7) | Ms. Earley was appointed Chairwoman of the Nominating and Corporate Governance Committee on March 11, 2019. | ||||||||||

6

On February 25, 2020, the Board adjusted the committee appointments as follows:

| Committee | ||||||||||||||||||||||||||

| Nominating & | ||||||||||||||||||||||||||

| Corporate | ||||||||||||||||||||||||||

| Audit | Compensation | Governance | Investment | |||||||||||||||||||||||

| Mr. Brasseux | ü | ü | ü | |||||||||||||||||||||||

| Mr. Dominic | ü | ü | ü* | |||||||||||||||||||||||

| Ms. Earley | ü* | ü | ||||||||||||||||||||||||

| Mr. Jenner | ü* | ü* | ü | |||||||||||||||||||||||

| Mr. Niemann | ü | ü | ü | |||||||||||||||||||||||

| Mr. Scofield | ü | |||||||||||||||||||||||||

_____________

| * | Indicates committee chair | ||||||||||

The responsibilities of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and the Investment Committee are described in each of the committees’ respective charters, which were adopted by the respective committees and the Board. These committee charters are available on our website at www.adamsresources.com, under Investor Relations – Corporate Governance. Copies may also be obtained by writing to Investor Relations, Adams Resources & Energy, Inc., 17 South Briar Hollow Lane, Suite 100, Houston, Texas 77027.

Nomination Policy

The Nominating and Corporate Governance Committee identifies and recommends to the Board nominees for directors to be considered at the Annual Meeting or to serve as replacements in the event of a vacancy on the Board. Each of the members of the Nominating and Corporate Governance Committee is independent, as defined in Section 803A of the company guide of the NYSE American LLC. The Nominating and Corporate Governance Committee will also consider nominees submitted by shareholders to our Secretary if submitted in accordance with the general notification procedures set forth in our Bylaws. You may obtain a copy of the Bylaws by writing to Adams Resources & Energy, Inc., 17 South Briar Hollow Lane, Suite 101, Houston Texas 77027, Attention: Corporate Secretary, David Hurst. Our Bylaws can also be found on our website at www.adamsresources.com, under Investor Relations – Corporate Governance.

In identifying and evaluating candidates for nomination to the Board, the Nominating and Corporate Governance Committee considers several factors including: education, experience, knowledge, expertise, independence and availability to effectively carry out the duties of a Board member. The qualifications and backgrounds of prospective candidates are reviewed in the context of the current composition of the Board to ensure the Board maintains the proper balance of knowledge and experience to effectively manage our business for the long-term interests of our shareholders. The Nominating and Corporate Governance Committee initially identifies candidates for nomination through the Committee’s and management’s general industry contacts. The Nominating and Corporate Governance Committee does not have a policy, nor has it been our practice, to consider for nomination any specific director candidates recommended by shareholders as no such request has ever occurred. The Nominating and Corporate Governance Committee will review its policy position if such a request is received. Shareholders may communicate with the Board as described herein below.

7

The Nominating and Corporate Governance Committee views diversity expansively and considers, among other things, functional areas of business and financial expertise, educational and professional background, and those competencies that it deems appropriate to develop a cohesive board such as ethics, integrity, values, practical wisdom, mature judgment and the ability of the candidate to represent the interests of all shareholders and not those of a special interest group. Specifically with respect to the experience and qualifications of each of the persons nominated to serve on the Board, the Nominating and Corporate Governance Committee considered the foregoing information to conclude that each nominee should serve as a director of our Board.

Messrs. Pressler, Brasseux, Jenner and Scofield and Ms. Earley have previously stood for election to the Board of Directors. In connection with the Annual Meeting, the Nominating and Corporate Governance Committee has recommended the Directors listed in this proxy.

Communications with the Board

Any shareholder or other interested party who wishes to communicate with the Board, a committee of the Board or any individual director may do so by contacting David Hurst, Corporate Secretary, Adams Resources & Energy, Inc., 17 South Briar Hollow Lane, Suite 100, Houston, Texas 77027. Communications will be relayed to the intended recipient on the Board in accordance with the request of the shareholder.

8

Board’s Role in Risk Oversight

The Board’s role in our risk oversight process includes receiving regular reports from members of our senior management on areas of material risk to us, including operational, financial, legal, regulatory, and strategic risks.

Mr. Pressler serves as the Chairman of the Board of the Company. The Board has not designated a lead independent director, but believes its leadership structure is appropriate given the active role the independent directors play on the Board’s standing committees. While the Board is aware of the potential conflicts that may arise when an interested director serves as Chairman, it believes these potential conflicts are offset by the Company’s strong corporate governance practices.

The Audit Committee is responsible for oversight of risks relating to our accounting matters, financial reporting and legal and regulatory compliance. To satisfy these oversight responsibilities, the Audit Committee meets regularly with management, our internal auditor and independent registered public accounting firm.

The Compensation Committee is responsible for overseeing risks relating to employment policies and our policies on structuring compensation programs. To satisfy these oversight responsibilities, the Compensation Committee meets regularly with management to understand the implications of compensation decisions, particularly the risks our compensation policies pose to our finances, human resources and shareholders.

9

EXECUTIVE OFFICERS

The following table provides information regarding our executive officers as of March 18, 2020. Our officers serve at the discretion of our Board of Directors.

| Name | Age | Position | ||||||||||||

| Kevin J. Roycraft | 50 | Chief Executive Officer and President; | ||||||||||||

| Interim President, GulfMark Energy, Inc. | ||||||||||||||

| Tracy E. Ohmart | 52 | Executive Vice President, Chief Financial Officer and Treasurer | ||||||||||||

| Sharon C. Davis | 60 | Executive Vice President, Chief Operating Officer and | ||||||||||||

| Chief Accounting Officer | ||||||||||||||

| Wade M. Harrison | 45 | President, Service Transport Company | ||||||||||||

Kevin J. Roycraft currently serves as Chief Executive Officer and President of the Company and Interim President of GulfMark Energy, Inc., a wholly owned subsidiary of the Company, and has served in these capacities since January 2020 and August 2019, respectively. He was previously President of Service Transport Company, the Company’s other wholly owned subsidiary, from November 2017 to January 2020. Mr. Roycraft was previously Executive Vice President at Dana Transport Inc. from January 2016 through November 2017. From November 2012 through October 2015, Mr. Roycraft was the President and Chief Executive Officer of Aveda Transportation and Energy Services. He holds a Bachelor of Science in Organizational Leadership and Supervision from Purdue University.

Tracy E. Ohmart currently serves as Executive Vice President, Chief Financial Officer and Treasurer and has served in these capacities since June 2018. He was most recently with Horn Solutions, Inc. from 2017 to June 2018, and prior to that as Vice President and Chief Financial Officer of United Bulk Terminals USA, Inc., a privately-held subsidiary of Marquard & Bahls AG, from 2012 to 2016. Immediately prior to joining United Bulk Terminals USA, Inc., he was Assistant Controller for Southwestern Energy Company from 2010 to 2012. From 2005 to 2009, Mr. Ohmart was Assistant Controller of EPCO, Inc. Prior to that, he held various accounting, finance, management and special projects positions with increasing responsibilities with TEPPCO Partners, L.P. from 2001 to 2005, and ARCO Pipe Line Company from 1989 to 2001. Mr. Ohmart holds a Bachelor of Science in Accounting and Business Administration from the University of Kansas. He serves as our principal financial and accounting officer. Mr. Ohmart is a Certified Public Accountant in the State of Texas.

Sharon C. Davis currently serves as Executive Vice President, Chief Operating Officer and Chief Accounting Officer and has served in these capacities since March 2015. She joined the company in 1992 and was previously employed by Arthur Andersen & Co. Ms. Davis holds a Bachelor of Business Administration in Accounting from the University of Houston. Ms. Davis is a Certified Public Accountant in the State of Texas.

Wade M. Harrison currently serves as President of Service Transport Company and has served in that capacity since January 2020. Mr. Harrison joined Service Transport Company in August 2018 as Vice President of Sales and has 17 years of experience in transportation and logistics operations, management and leadership. Prior to joining Service Transport Company, Mr. Harrison was with Groendyke Transport, Inc. from January 2010 to August 2018, where he held positions of increasing responsibility, which culminated in his role as Vice President of Gulf Coast Operations. He began his career in transportation and logistics in 2003 with CTL Distribution Logistics, LLC, where he most recently served as Vice President of National Accounts. Mr. Harrison holds a Bachelor of Business Administration degree in Marketing from Sam Houston State University.

10

SUMMARY COMPENSATION TABLE

The following table sets forth the total compensation of our Executive Chairman, Chief Executive Officer, Chief Financial Officer and each of our other most highly compensated executive officers during the years ended December 31, 2019, 2018 and 2017, whose total annual salary and bonus for fiscal 2019 exceeded $100,000 (the “Named Executive Officers”).

| Stock | All | |||||||||||||||||||||||||||||||||||||

| Name and | Salary | Bonus | Awards (1) | Other (2) | Total | |||||||||||||||||||||||||||||||||

| Principal Position | Year | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||||||||||

Townes G. Pressler (3) | 2019 | 395,769 | 200,000 | 59,500 | 12,706 | 667,975 | ||||||||||||||||||||||||||||||||

| Fomerly Executive Chairman; | 2018 | 300,000 | 300,000 | 75,250 | 575 | 675,825 | ||||||||||||||||||||||||||||||||

| Chairman of the Board | 2017 | 83,077 | 75,000 | — | 10 | 158,087 | ||||||||||||||||||||||||||||||||

Tracy E. Ohmart (4) | 2019 | 300,000 | 180,000 | 51,000 | 12,885 | 543,885 | ||||||||||||||||||||||||||||||||

| Executive Vice President, | 2018 | 150,000 | 101,000 | 64,500 | 350 | 315,850 | ||||||||||||||||||||||||||||||||

| Chief Financial Officer and | ||||||||||||||||||||||||||||||||||||||

| Treasurer | ||||||||||||||||||||||||||||||||||||||

| Sharon C. Davis | 2019 | 275,000 | 130,500 | 46,750 | 20,189 | 472,439 | ||||||||||||||||||||||||||||||||

| Executive Vice President, | 2018 | 275,000 | 150,500 | 59,125 | 19,817 | 504,442 | ||||||||||||||||||||||||||||||||

| Chief Operating Officer and | 2017 | 275,000 | 206,250 | — | 19,437 | 500,687 | ||||||||||||||||||||||||||||||||

| Chief Accounting Officer | ||||||||||||||||||||||||||||||||||||||

Geoffrey L. Griffith (5) | 2019 | 196,154 | 135,000 | 51,000 | 24,084 | 406,238 | ||||||||||||||||||||||||||||||||

| Formerly President, | 2018 | 300,000 | 610,000 | 64,500 | 29,554 | 1,004,054 | ||||||||||||||||||||||||||||||||

| GulfMark Energy, Inc. | 2017 | 300,000 | 350,000 | — | 29,174 | 679,174 | ||||||||||||||||||||||||||||||||

Kevin J. Roycraft (6) | 2019 | 293,116 | 225,000 | 51,000 | 19,905 | 589,021 | ||||||||||||||||||||||||||||||||

| Formerly President, Service | 2018 | 263,000 | 200,000 | 56,545 | 23,693 | 543,238 | ||||||||||||||||||||||||||||||||

| Transport Company; Interim | 2017 | 20,231 | — | — | — | 20,231 | ||||||||||||||||||||||||||||||||

| President, GulfMark Energy, Inc. | ||||||||||||||||||||||||||||||||||||||

_____________

| (1) | Amounts reflect the grant date fair value (computed in accordance with FASB ASC Topic 718) of restricted stock unit awards and performance share unit awards granted under the Adams Resources & Energy, Inc. 2018 Long-Term Incentive Plan (“2018 LTIP”) in 2019. For a discussion of the valuations of the restricted stock unit awards and the performance share unit awards, please see the discussion in Note 14 in the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019. We adopted a long-term compensation plan in 2018 and made grants to our Named Executive Officers beginning in 2018. | ||||||||||

| (2) | All Other compensation includes employer matching contributions to our 401(k) savings plan, a car allowance, reimbursement for club dues, life and disability insurance premiums and dividends paid under the 2018 LTIP. The Named Executive Officers receive no other perquisites or personal benefits. For further information, see the “All Other Compensation” table to follow. | ||||||||||

| (3) | Mr. Pressler was Executive Chairman from September 2017 to December 2019; therefore, his compensation for 2017 covers September to December 2017 only. Effective December 31, 2019, Mr. Pressler retired as Executive Chairman. He currently serves as Chairman of the Board. | ||||||||||

| (4) | Mr. Ohmart’s role as Executive Vice President, Chief Financial Officer and Treasurer began in June 2018; therefore, his compensation for 2018 covers June to December 2018 only. | ||||||||||

| (5) | Mr. Griffith resigned his position on August 9, 2019. | ||||||||||

| (6) | Mr. Roycraft served as President of Service Transport Company from November 2017 to January 2020. His compensation for 2017 covers November to December 2017 only. Mr. Roycraft currently serves as Interim President of GulfMark Energy, Inc. and has served in that capacity since August 2019, upon Mr. Griffith’s resignation. Upon his appointment to Interim President of GulfMark Energy, Inc., Mr. Roycraft’s annual salary was increased to $350,000. Effective January 1, 2020, Mr. Roycraft was appointed Chief Executive Officer and President of the Company, with an annual salary of $400,000. In January 2020, Mr. Harrison was appointed President of Service Transport Company with an annual salary of $230,000. | ||||||||||

11

The following table presents the components of “All Other Compensation” for each Named Executive Officer for the year ended December 31, 2019.

| Dividends | ||||||||||||||||||||||||||||||||

| Contributions | Paid on | Life and | ||||||||||||||||||||||||||||||

| Under | Plan | Disability | Total | |||||||||||||||||||||||||||||

| 401(k) | Based | Insurance | All Other | |||||||||||||||||||||||||||||

| Savings Plan | Awards | Premiums | Other | Compensation | ||||||||||||||||||||||||||||

| Named Executive Officer | ($) | ($) (1) | ($) | ($) | ($) | |||||||||||||||||||||||||||

| Townes G. Pressler | 11,200 | 192 | 1,314 | — | 12,706 | |||||||||||||||||||||||||||

| Tracy E. Ohmart | 11,200 | 165 | 1,520 | — | 12,885 | |||||||||||||||||||||||||||

| Sharon C. Davis | 11,200 | 151 | 3,638 | 5,200 | 20,189 | |||||||||||||||||||||||||||

| Geoffrey L. Griffith | 11,200 | 165 | 2,770 | 9,949 | 24,084 | |||||||||||||||||||||||||||

| Kevin J. Roycraft | 11,200 | 145 | 1,360 | 7,200 | 19,905 | |||||||||||||||||||||||||||

_____________

| (1) | Reflects cash payments made to the Named Executive Officer in connection with dividend equivalent rights issued in connection with awards under the 2018 LTIP. | ||||||||||

12

COMPENSATION, DISCUSSION AND ANALYSIS

Background

We compete for talent in the Houston, Texas marketplace, which is heavily tied to the energy industry and related fields. There is strong demand for executives in the energy industry (and in Houston in particular). Within the public company community, Adams Resources & Energy, Inc. is consistently listed as one of the Houston areas’ top 100 companies as ranked by revenues. As a measure of results, our “Performance Graph” prepared under the applicable rules of the U.S. Securities and Exchange Commission (“SEC”) appears in our 2019 Annual Report on Form 10-K. The Performance Graph data indicates that our Integrated Oil and Gas peer group and the S&P 500 index had higher returns than us in each of the past five years.

Role of the Compensation Committee

The Compensation Committee, composed entirely of independent directors, reviews and approves our executive compensation program for all senior executive officers, including our Named Executive Officers, to ensure that our compensation program is adequate to attract, motivate, and retain well-qualified senior executives and that it is directly and materially related to the short-term and long-term objectives of our Company and our shareholders. The Compensation Committee annually reviews and evaluates our executive compensation program to ensure that the program is aligned with our compensation philosophy. To carry out its role, among other things, the Compensation Committee:

•reviews the major compensation and benefit practices, policies, and programs with respect to our senior executives;

•reviews appropriate criteria for establishing performance targets for executive compensation;

•determines appropriate levels of executive compensation;

•administers and determines equity awards to be granted under our 2018 LTIP; and

•reviews and recommends to the Board any changes to director compensation.

The Compensation Committee is authorized to act on behalf of the Board on all issues pertaining to the compensation of our senior executive officers, including individual components of total compensation, goals and performance criteria for incentive compensation and the grant of equity awards. However, it is the practice of the Compensation Committee to fully review its activities and recommendations with the full Board.

Compensation Philosophy and Objectives

Our compensation philosophy, as implemented through the Compensation Committee, is to match executive compensation with the performance of the Company and the individual by using several compensation components for our executive officer group. The Compensation Committee has adopted the following objectives, and executive compensation levels are determined in consideration thereof:

•Establish and maintain a level of compensation that is competitive within our industry and region.

•Provide an incentive mechanism for favorable results.

•Maintain a compensation system that is consistent with the objectives of sound corporate governance.

13

Design of Reward

Through mid-year 2018, it was our policy to pay all forms of compensation in cash. In May 2018, we adopted a long-term incentive plan that we believe appropriately aligns our officers and promotes retention of talent.

Our management and the Compensation Committee review the results of the annual “Say on Pay” vote by shareholders for feedback on our executive compensation amounts. Our Compensation Committee, which is responsible for designing and administering our executive compensation program, has designed our executive compensation program to provide a competitive and internally equitable compensation and benefits package that, among other objectives, reflects Company performance, job complexity and value of the position, while ensuring long-term retention, motivation and alignment with the long-term interests of our shareholders.

Elements of Compensation

We utilize the following four elements of executive compensation to retain our executive officer group:

•Base salary

•Discretionary bonus

•Awards under our long-term incentive plan

•Benefits

Base Salary

The Compensation Committee considers adjustments to base salary for our executive officer group on an annual basis and may do so more frequently upon a change in circumstances. The annual base salary of our Chief Executive Officer is decided solely by the Compensation Committee in executive session without management present. The annual base salaries of the other members of our executive officer group are determined by the Compensation Committee with input or recommendations from our Chief Executive Officer and Chairman of the Board. None of the members of our executive officer group have employment agreements.

The Compensation Committee did not adjust the 2018 base salaries of the Named Executive Officers during 2019.

Discretionary Bonus

Discretionary bonuses are used as an incentive for favorable results. The discretionary bonus may also serve as a supplement to base salary levels, while allowing the Board flexibility when results are not consistent with expectations. Discretionary bonuses are anticipated to increase or decrease with the prevailing trend for consolidated net earnings, cash flow and execution of our growth strategy.

14

Grants of Plan Based Awards

During 2018, we adopted the 2018 LTIP. We granted restricted stock unit awards and performance share unit awards to each executive officer in 2019. The following table presents information concerning each grant of an equity-based award in 2019 to our Named Executive Officers.

| Grant | ||||||||||||||||||||||||||||||||

| Date Fair | ||||||||||||||||||||||||||||||||

| Value of | ||||||||||||||||||||||||||||||||

| Equity- | ||||||||||||||||||||||||||||||||

| Based | ||||||||||||||||||||||||||||||||

| Award Type/ | Grant | Threshold | Target | Maximum | Awards | |||||||||||||||||||||||||||

| Named Executive Officer | Date | (#) | (#) | (#) | ($) (1) | |||||||||||||||||||||||||||

Restricted stock unit awards: (2) | ||||||||||||||||||||||||||||||||

Townes G. Pressler (3) | 6/3/2019 | — | 875 | — | 29,750 | |||||||||||||||||||||||||||

| Tracy E. Ohmart | 6/3/2019 | — | 750 | — | 25,500 | |||||||||||||||||||||||||||

| Sharon C. Davis | 6/3/2019 | — | 688 | — | 23,392 | |||||||||||||||||||||||||||

Geoffrey L. Griffith (4) | 6/3/2019 | — | 750 | — | 25,500 | |||||||||||||||||||||||||||

| Kevin J. Roycraft | 6/3/2019 | — | 750 | — | 25,500 | |||||||||||||||||||||||||||

Performance share unit awards: (5) | ||||||||||||||||||||||||||||||||

Townes G. Pressler (3) | 6/3/2019 | 438 | 875 | 1,750 | 29,750 | |||||||||||||||||||||||||||

| Tracy E. Ohmart | 6/3/2019 | 375 | 750 | 1,500 | 25,500 | |||||||||||||||||||||||||||

| Sharon C. Davis | 6/3/2019 | 344 | 687 | 1,374 | 23,358 | |||||||||||||||||||||||||||

Geoffrey L. Griffith (4) | 6/3/2019 | 375 | 750 | 1,500 | 25,500 | |||||||||||||||||||||||||||

| Kevin J. Roycraft | 6/3/2019 | 375 | 750 | 1,500 | 25,500 | |||||||||||||||||||||||||||

_______________

| (1) | The grant date fair value presented for the restricted stock unit awards and the performance share unit awards is based on the closing price of our common shares on June 3, 2019 of $34.00 per share. For information on the assumptions used in the valuation of these awards, see Note 14 in the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019. | ||||||||||

| (2) | These awards vest approximately 33 percent annually over a three-year period, with the first vesting date of May 22, 2020, and subsequently each of the next two years thereafter. The awards accrue dividends, if declared by us on our common shares, and will be paid to the recipient upon vesting of the awards. | ||||||||||

| (3) | Upon Mr. Pressler’s retirement as Executive Chairman on December 31, 2019, these awards vested in accordance with the provisions in the 2018 LTIP. | ||||||||||

| (4) | Mr. Griffith forfeited all of his unvested awards upon his resignation on August 9, 2019. | ||||||||||

| (5) | These awards vest on May 22, 2022. The awards accrue dividends, if declared by us on our common shares, and will be paid to the recipient upon vesting of the awards. The performance factor for these awards was lowered to 0 percent based upon a comparison of actual results for 2019 to performance goals, which effectively terminated the outstanding awards. | ||||||||||

15

Restricted Stock Unit Awards

The restricted stock unit awards are granted under the 2018 LTIP. A restricted stock unit award is a grant of a right to receive our common shares in the future at no cost to the recipient apart from fulfilling service and other conditions once a defined vesting period expires, subject to customary forfeiture provisions. Restricted stock unit awards generally vest at a rate of approximately 33 percent per year beginning approximately one year after the grant date and are non-vested until the required service periods are satisfied by the recipient. For 2018 and 2019, restricted stock unit awards were made in the number of shares equal to the approved award dollar value divided by the closing price of our common stock on the NYSE American on the date of grant, rounded up to the nearest whole share. Each 2018 award of restricted stock units to our Named Executive Officers were granted on June 29, 2018 and began vesting on May 8, 2019 upon fulfillment of service and other customary conditions. Each 2019 award of restricted stock units to our Named Executive Officers were granted on June 3, 2019 and will begin vesting on May 22, 2020 upon fulfillment of service and other customary conditions.

If dividends are paid with respect to our common shares during the vesting period, an equivalent amount of dividends will accrue and be held by us without interest until the restricted stock unit awards vest, at which time the amount will be paid to the recipient.

Performance Share Unit Awards

The performance share unit awards are granted under the 2018 LTIP. These awards are contingent upon (i) continued service with the Company for three years after the vesting commencement date, as defined in the award agreement, and (ii) the attainment of performance goals during the performance cycle. The performance goals are pre-established by the Compensation Committee. Following the end of the performance period, the holder of a performance-based compensation award is entitled to receive payment of an amount not exceeding the number of shares of common stock subject to, or the maximum value of, the performance-based compensation award, based on the achievement of the performance goals for the performance period. The performance share unit awards generally vest in full approximately three years after grant date, and are non-vested until the requisite service period is satisfied by the recipient.

If dividends are paid with respect to our common shares during the vesting period, an equivalent amount of dividends will accrue and be held by us without interest until the restricted stock unit awards vest, at which time the amount will be paid to the recipient.

16

2018 Performance Share Unit Awards (the “2018 awards”)

The performance period for the 2018 awards was the period between January 1, 2018 and December 31, 2018. The 2018 awards were granted to our Named Executive Officers on June 29, 2018 and will vest, to the extent earned, on May 8, 2021.

The 2018 award determination was based upon our performance relative to specified performance goals during the applicable performance period, as follows: Seventy-five percent of the award was earned based upon our attainment of adjusted pre-tax cash flow, as defined in the award agreement, and twenty-five percent of the award was earned based on our attainment of adjusted pre-tax earnings, as defined in the award agreement.

For the 2018 performance year, the following metrics were used to determine award levels:

| Adjusted Pre-Tax | % of Target Performance | |||||||||||||

| Performance Level | Cash Flow Amount | Share Units Earned* | ||||||||||||

| Maximum | $26,800,000 | 200% | ||||||||||||

| Target | $21,400,000 | 100% | ||||||||||||

| Threshold | $16,000,000 | 50% | ||||||||||||

| <Threshold | <$16,000,000 | 0% | ||||||||||||

_______________

| * | Linear interpolation will be applicable to the percentages between the Performance Levels. | ||||||||||

| Adjusted Pre-Tax | % of Target Performance | |||||||||||||

| Performance Level | Earnings Amount | Share Units Earned* | ||||||||||||

| Maximum | $13,800,000 | 200% | ||||||||||||

| Target | $11,000,000 | 100% | ||||||||||||

| Threshold | $8,300,000 | 50% | ||||||||||||

| <Threshold | <$8,300,000 | 0% | ||||||||||||

_______________

| * | Linear interpolation will be applicable to the percentages between the Performance Levels. | ||||||||||

The performance period for the 2018 awards was completed on December 31 2018, and the performance factor was set at 47.5 percent.

17

2019 Performance Share Unit Awards (the “2019 awards”)

The performance period for the 2019 awards was the period between January 1, 2019 and December 31, 2019. The 2019 awards were granted to our Named Executive Officers on June 3, 2019 and would vest, to the extent earned, on May 22, 2022; however, no awards were earned for the 2019 performance year (as discussed further below).

The performance share unit award determination was based upon our performance relative to specified performance goals during the applicable performance period, as follows: Seventy-five percent of the award was to be earned based upon our attainment of adjusted pre-tax cash flow, as defined in the award agreement, and twenty-five percent of the award was to be earned based on our attainment of adjusted pre-tax earnings, as defined in the award agreement.

For the 2019 performance year, the following metrics were used to determine award levels:

| Adjusted Pre-Tax | % of Target Performance | |||||||||||||

| Performance Level | Cash Flow Amount | Share Units Earned* | ||||||||||||

| Maximum | $40,500,000 | 200% | ||||||||||||

| Target | $32,400,000 | 100% | ||||||||||||

| Threshold | $24,300,000 | 50% | ||||||||||||

| <Threshold | <$24,300,000 | 0% | ||||||||||||

_______________

| * | Linear interpolation will be applicable to the percentages between the Performance Levels. | ||||||||||

| Adjusted Pre-Tax | % of Target Performance | |||||||||||||

| Performance Level | Earnings Amount | Share Units Earned* | ||||||||||||

| Maximum | $21,900,000 | 200% | ||||||||||||

| Target | $17,500,000 | 100% | ||||||||||||

| Threshold | $13,200,000 | 50% | ||||||||||||

| <Threshold | <$13,200,000 | 0% | ||||||||||||

_______________

| * | Linear interpolation will be applicable to the percentages between the Performance Levels. | ||||||||||

The performance period for the 2019 awards was completed on December 31, 2019, and the performance factor was set at 0 percent, which effectively terminated these awards.

18

2020 Performance Share Unit Awards (the “2020 awards”)

The performance period for the 2020 awards will be the period between January 1, 2020 and December 31, 2020. The 2020 awards are expected to be granted to our Named Executive Officers in mid-2020 and are expected to vest, to the extent earned, in 2023.

The performance share unit award determination is based upon our performance relative to specified performance goals during the applicable performance period, as follows: Seventy-five percent of the award is to be earned based upon our attainment of adjusted pre-tax cash flow, as defined in the award agreement, and twenty-five percent of the award is to be earned based on our attainment of adjusted pre-tax earnings, as defined in the award agreement.

For the 2020 performance year, the following metrics will be used to determine award levels:

| Adjusted Pre-Tax | % of Target Performance | |||||||||||||

| Performance Level | Cash Flow Amount | Share Units Earned* | ||||||||||||

| Maximum | $30,875,000 | 200% | ||||||||||||

| Target | $24,700,000 | 100% | ||||||||||||

| Threshold | $18,525,000 | 50% | ||||||||||||

| <Threshold | <$18,525,000 | 0% | ||||||||||||

_______________

| * | Linear interpolation will be applicable to the percentages between the Performance Levels. | ||||||||||

| Adjusted Pre-Tax | % of Target Performance | |||||||||||||

| Performance Level | Earnings Amount | Share Units Earned* | ||||||||||||

| Maximum | $8,500,000 | 200% | ||||||||||||

| Target | $6,800,000 | 100% | ||||||||||||

| Threshold | $5,100,000 | 50% | ||||||||||||

| <Threshold | <$5,100,000 | 0% | ||||||||||||

_______________

| * | Linear interpolation will be applicable to the percentages between the Performance Levels. | ||||||||||

The performance period for the 2020 awards will be completed on December 31, 2020.

19

Vesting of Plan Based Awards

The following table presents the vesting of restricted stock unit awards to our Named Executive Officers during the year ended December 31, 2019.

| Number of | ||||||||||||||

| Shares | Value | |||||||||||||

| Acquired on | Realized on | |||||||||||||

| Vesting | Vesting | |||||||||||||

| Named Executive Officer | (#) (1) | ($) (2) | ||||||||||||

| Townes G. Pressler | 291 | 10,205 | ||||||||||||

| Tracy E. Ohmart | 250 | 8,768 | ||||||||||||

| Sharon C. Davis | 229 | 8,031 | ||||||||||||

| Geoffrey L. Griffith | 250 | 8,768 | ||||||||||||

| Kevin J. Roycraft | 219 | 7,680 | ||||||||||||

_______________

| (1) | Represents the gross number of shares acquired upon vesting of restricted stock unit awards before adjustments for associated tax withholdings. | ||||||||||

| (2) | Amount was determined by multiplying the gross number of vested restricted stock unit awards by the closing price of our common shares on the date of vesting, a price of $35.07 on May 8, 2019. | ||||||||||

Plan Based Awards Outstanding at December 31, 2019

The following table summarizes each Named Executive Officer’s long-term incentive awards outstanding at December 31, 2019.

| Market | ||||||||||||||||||||

| Number | Value | |||||||||||||||||||

| of Shares | of Shares | |||||||||||||||||||

| That Have | That Have | |||||||||||||||||||

| Award Type/ | Vesting | Not Vested | Not Vested | |||||||||||||||||

| Named Executive Officer | Date | (#) (1) | ($) (2) | |||||||||||||||||

Restricted stock unit awards: (3) | ||||||||||||||||||||

| Tracy E. Ohmart | Various | 1,250 | 47,588 | |||||||||||||||||

| Sharon C. Davis | Various | 1,147 | 43,666 | |||||||||||||||||

| Kevin J. Roycraft | Various | 1,189 | 45,265 | |||||||||||||||||

| Performance share unit awards: | ||||||||||||||||||||

| Tracy E. Ohmart | 5/8/2021 | 357 | 13,591 | |||||||||||||||||

| Sharon C. Davis | 5/8/2021 | 327 | 12,449 | |||||||||||||||||

| Kevin J. Roycraft | 5/8/2021 | 313 | 11,916 | |||||||||||||||||

_______________

| (1) | Represents the total number of outstanding awards by award type for each Named Executive Officer. | ||||||||||

| (2) | The market values were derived by multiplying the total number of each award type outstanding for the Named Executive Officer by the closing price of our common shares on December 31, 2019 (the last trading date of 2019) of $38.07 per share. | ||||||||||

| (3) | Of the 3,589 restricted stock unit awards presented in the table, the vesting schedule is as follows: 1,427 in 2020, 1,429 in 2021 and 730 in 2022. | ||||||||||

20

Benefits

We also provide employee benefits, primarily consisting of a 401(k) plan (discussed below) and an employer sponsored medical plan. The benefits provided to the executive officer group are no different than those offered to non-executive employees. At the current time, we do not offer a defined benefit pension plan nor do we offer deferred compensation.

Perquisites

We provide the following perquisites:

•Life and Disability Insurance Premiums

•Automobile Allowance

•Club Dues Reimbursement

Club dues reimbursements and automobile allowances are paid to the executive officers consistent with the payment of such amounts to non-executive employees. The requirement to pay such amounts is negotiated with the executive at the time of their initial employment. Life and disability insurance premiums are paid on behalf of the executives consistent with the payment of such insurance premiums for non-executive employees. Perquisite amounts are not considered annual salary for bonus purposes.

401(k) Plan

We offer a 401(k) plan to our employees and our executive officers. As referenced in footnote (1) to the Summary Compensation Table, we make a matching contribution to the plan. In 2018, we matched 100 percent of employee contributions up to 3 percent of compensation and matched 50 percent of employee contributions from 3 percent to 5 percent of compensation, subject to the Internal Revenue Code (“Code”) annual limits. This level of matching contributions conforms to the Code’s safe harbor rules for 401(k) plans.

Compensation and Risk

In order to establish and maintain profitability, we become exposed to risk. The most significant areas of risk involve commodity price risk, customer credit risk, and safety and security concerns. Compensation policies for all employees are designed to promote the provision of management safeguards against risk and not incentivize excessive risk-taking. Compensation policies toward this aim include the following:

•generally short-term contractual obligations with actual results fixed and determinable prior to the payment of employee bonuses; and

•a segregated internal reporting structure that puts the employees charged with managing and reporting risk on a separate reporting track from those employees committing us to contractual obligations, thereby providing independent monitoring of risk mitigation practices and procedures.

On a scheduled basis over the course of the year, Mr. Niemann, representing the Audit Committee, conducted interviews with key non-executive operating and accounting personnel to monitor compliance with our designed internal control structure and overall corporate strategies. Management has concluded that compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

21

Compensation Process

Mr. Pressler, Former Executive Chairman

Mr. Pressler was appointed Executive Chairman and Chairman of the Board in September 2017, and he served as Executive Chairman until his retirement on December 31, 2019. By mutual agreement between Mr. Pressler and the Compensation Committee, Mr. Pressler’s 2019 annual base salary was set at $300,000, an amount aligned with the compensation of the current executive officers. The Compensation Committee determined the 2019 bonus amount for Mr. Pressler based on the Compensation Committee’s discretion consistent with historic trends.

Mr. Roycraft, Chief Executive Officer and President

Mr. Roycraft was appointed Chief Executive Officer and President effective January 1, 2020. By mutual agreement between Mr. Roycraft and the Compensation Committee, Mr. Roycraft’s 2020 annual base salary was set at $400,000, an amount aligned with the compensation of the current executive officers.

Role of the External Compensation Advisor

In the fall of 2017, the Compensation Committee engaged Meridian Compensation Partners, LLC to assist the Company with the design of the 2018 LTIP.

Pay Ratio Disclosure Rule

In August 2015, pursuant to a mandate of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the SEC adopted a rule requiring annual disclosure of the ratio of the median employee’s annual total compensation to the total annual compensation of the principal executive officer (“PEO”). Our PEO for the fiscal year ended December 31, 2019 was Mr. Pressler. The purpose of this disclosure is to provide a measure of the equitability of pay within the organization. We believe our compensation philosophy and process yield an equitable result and our ratio is as follows:

| Median Employee total annual compensation | $ | 74,358 | |||

Mr. Pressler’s total annual compensation | $ | 600,000 | |||

| Ratio of PEO to Median Employee Compensation | 8.1:1.0 | ||||

For purposes of this calculation, we aggregated Mr. Pressler’s annual salary of $400,000 and 2019 bonus amount of $200,000 to arrive at the total PEO annual compensation for 2019.

In determining the median employee, a listing was prepared of all employees as of December 31, 2019. Employees on leave of absence were excluded from the list and wages and salaries were annualized for those employees that were not employed for the full year of 2019. The median amount was selected from the annualized list. For simplicity, the value of our 401(k) plan and medical benefits provided was excluded as all employees including the PEO are offered the exact same benefits, and we utilize the Internal Revenue Code safe harbor provision for 401(k) discrimination testing. As of December 31, 2019, we employed 664 persons of which 458 are professional truck drivers.

22

Compensation Practices—Tax Considerations

In establishing total compensation for our executive officer group, the Compensation Committee considers the accounting treatment and tax treatment of its compensation decisions, including Section 162(m) of the Code, which limits the deductibility of compensation paid to each covered employee. Generally, Section 162(m) of the Code prevents a company from receiving a corporate income tax deduction for annual compensation paid to the chief executive officer and the three other most highly compensated officers of a public corporation in excess of $1 million. Although the Compensation Committee takes the requirements of Section 162(m) into account in designing executive compensation, the Compensation Committee believes that the potential deductibility of the compensation payable under the Company’s incentive compensation plans and arrangements should be only one of a number of relevant factors taken into consideration in establishing those plans and arrangements for our executive officers and not the sole governing factor.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee was an officer or employee of us or any of our subsidiaries, or was formerly an officer of us or any of our subsidiaries or had any relationship requiring disclosure by us during the year ended December 31, 2019. None of our executive officers have served as a member of the Compensation Committee (or other board committee performing equivalent functions) of another entity that had an executive officer serving as a member of our Board of Directors or the Compensation Committee.

23

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information as of March 18, 2020, with respect to compensation plans under which our common stock may be issued:

| Number of | ||||||||||||||||||||

| securities | ||||||||||||||||||||

| remaining | ||||||||||||||||||||

| available for | ||||||||||||||||||||

| Number of | equity | |||||||||||||||||||

| securities to | Weighted- | compensation | ||||||||||||||||||

| be issued | average | plans (excluding | ||||||||||||||||||

| upon exercise | exercise price | securities | ||||||||||||||||||

| of warrants | of outstanding | reflected in | ||||||||||||||||||

| Plan Category | and rights | rights | column (a)) | |||||||||||||||||

| (a) | (b) | (c) | ||||||||||||||||||

| Equity compensation plans approved by security holders | 150,000 | — | 82,270 | |||||||||||||||||

| Equity compensation plans not approved | ||||||||||||||||||||

| by security holders | — | — | — | |||||||||||||||||

| Total | 150,000 | — | 82,270 | |||||||||||||||||

24

COMPENSATION COMMITTEE REPORT

March 18, 2020

To the Board of Directors:

The following report of the Compensation Committee of the Board of Directors shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission (“SEC”) or subject to the SEC’s proxy rules, except for the required disclosure in this Proxy Statement, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that we specifically incorporate by reference into any filing we make under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act.

The Compensation Committee of the Board of Directors consists of Messrs. Brasseux, Dominic, Jenner and Niemann. The duties and responsibilities of the Compensation Committee are set forth in a written charter adopted by the Board of Directors and such charter is available on our website at www.adamsresources.com, under Investor Relations – Corporate Governance. Each of the members of the Compensation Committee is independent, as defined in Section 803A of the NYSE American LLC Company Guide.

We have reviewed and discussed with management the above Compensation Discussion and Analysis (“CD&A”) and based on our review and discussions with management, we recommended to the Board of Directors that the CD&A be included in this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2019.

Richard C. Jenner, Chairman

Murray E. Brasseux

Dennis E. Dominic

John O. Niemann, Jr.

25

ITEM 2 – APPROVAL OF ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

Under the provisions of Section 951 of the Dodd-Frank Act, our shareholders are entitled to vote at the Annual Meeting to approve the compensation of our Named Executive Officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K. Pursuant to the Dodd-Frank Act, the shareholder vote on executive compensation is an advisory vote only, and it is not binding on us or our Board of Directors.

Although the vote is non-binding, the Compensation Committee and the Board of Directors value the opinions of our shareholders and will consider the outcome of the vote when making future compensation decisions. As described more fully in the “Compensation Discussion and Analysis” section of this Proxy Statement, our executive compensation program is designed to provide aggregate compensation opportunities for our Named Executive Officers that are both competitive in the business marketplace and are based upon company and individual performance.

The advisory vote regarding the compensation of the Named Executive Officers described in this Item 2 shall be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. Abstentions and broker non-votes will not be counted as either votes cast for or against Item 2.

If no voting specification is made on a properly returned or voted proxy card, the persons named as Proxy Holders in the enclosed proxy have indicated they will vote “FOR” the approval of the compensation of the Named Executive Officers as disclosed in this Proxy Statement and described in this Item 2.

The Board of Directors unanimously recommends a vote “FOR” the approval of the compensation of the Named Executive Officers as disclosed in this Proxy Statement pursuant to item 402 of regulation S-K.

26

2019 DIRECTOR COMPENSATION

Directors who are our employees do not receive fees or any other compensation for their services as directors. Directors who are not employees received cash compensation as presented in the table below. Director fees are based on a flat amount and are paid on a quarterly basis. Directors are also reimbursed for direct out-of-pocket expenses in connection with travel associated with meeting attendance. Directors also receive an annual grant under the 2018 LTIP.

| Director Compensation | ||||||||||||||||||||||||||

| Other | ||||||||||||||||||||||||||

| Cash fees | Stock Awards (1) | Compensation (2) | Total | |||||||||||||||||||||||

Larry E. Bell (3) | $ | 18,750 | $ | — | $ | 248 | $ | 18,998 | ||||||||||||||||||

| Murray E. Brasseux | 65,000 | 12,750 | 248 | 77,998 | ||||||||||||||||||||||

Dennis E. Dominic (4) | — | — | — | — | ||||||||||||||||||||||

| Michelle A. Earley | 65,000 | 12,750 | 248 | 77,998 | ||||||||||||||||||||||

| Richard C. Jenner | 70,000 | 12,750 | 248 | 82,998 | ||||||||||||||||||||||

| John O. Niemann, Jr. | 37,500 | 12,750 | — | 50,250 | ||||||||||||||||||||||

| W.R. Scofield | 60,000 | 12,750 | 248 | 72,998 | ||||||||||||||||||||||

_______________

| (1) | Represents the grant date fair value of grants of 375 restricted stock unit awards to directors on June 3, 2019. The grant date fair value of restricted stock unit awards is based on the grant date market price of our common shares of $34.00 per share (computed in accordance with FASB ASC Topic 718). For a discussion of the valuation of restricted stock unit awards, please see the discussion in Note 14 in the Notes to Consolidated Financial Statements of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019. As of December 31, 2019, each of our directors held 375 restricted stock unit awards that will vest on May 22, 2020. | ||||||||||

| (2) | Amounts represent the distribution equivalents paid during 2019 upon vesting of restricted share unit awards. | ||||||||||

| (3) | Mr. Bell passed away on February 27, 2019. His 2018 restricted stock unit awards vested upon his death. He received no further compensation after his death. | ||||||||||

| (4) | Mr. Dominic was appointed to the Board in November 2019. He received no cash fees in 2019, and as of December 31, 2019, had not yet been granted restricted stock unit awards. | ||||||||||

27

PRINCIPAL ACCOUNTANT FEES AND SERVICES

KPMG LLP served as our independent registered public accounting firm, providing audit and financing services since their appointment in June 2017.

Fees for professional services provided by KPMG LLP in each of the last two years in each of the following categories were as follows:

| 2019 | 2018 | |||||||||||||

Audit Fees (1) | $ | 887,000 | $ | 864,000 | ||||||||||

Audit-related Fees (2) | — | 10,000 | ||||||||||||

Tax Fees (3) | — | 50,000 | ||||||||||||

| All Other Fees | — | — | ||||||||||||

| Total | $ | 887,000 | $ | 924,000 | ||||||||||

_______________

| (1) | Audit fees consist of fees billed for professional services rendered in connection with the audit of our annual financial statements, review of our quarterly financial statements, and services that are normally provided by our independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years. | ||||||||||

| (2) | Audit-related fees represent amounts billed for assurance and related services that are reasonably related to the performance of the annual audit or quarterly reviews. This category primarily includes fees for services normally provided in connection with regulatory filings or engagements including comfort letters and other services related to SEC matters. For the year ended December 31, 2018, the category includes fees for the filing of a registration statement on Form S-8. | ||||||||||

| (3) | Tax fees represent amounts billed for professional services rendered in connection with tax advisory services related to the bankruptcy of our upstream crude oil and natural gas exploration and production subsidiary. | ||||||||||