Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| (Mark one) | ||

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020 | ||

| OR | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-04546

UNILEVER PLC

(Exact name of Registrant as specified in its charter)

ENGLAND

(Jurisdiction of incorporation or organization)

100 Victoria Embankment, London, England

(Address of principal executive offices)

R Sotamaa, Chief Legal Officer and Group Secretary

Tel: +44(0)2078225252, Fax: +44(0)2078225464

100 Victoria Embankment, London EC4Y 0DY, UK

(Name, Telephone Number, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Ordinary shares, nominal value of 3 1/9 pence per share | ULVR | New York Stock Exchange* | ||

| American Depositary Shares (evidenced by Depositary Receipts) each representing one ordinary share of the nominal amount of 3 1/9p each | UL | New York Stock Exchange |

*Not for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| Title of each class |

||

| 2.75% Notes due 2021 3.0% Notes due 2022 2.2% Notes due 2022 0.375% Notes due 2023 3.125% Notes due 2023 3.25% Notes due 2024 2.6% Notes due 2024 3.1% Notes due 2025 3.375% Notes due 2025 2.0% Notes due 2026 2.9% Notes due 2027 3.5% Notes due 2028 2.125% Notes due 2029 1.375% Notes due 2030 5.9% Notes due 2032 |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

The total number of outstanding shares of the issuer’s capital stock at the close of the period covered by the annual report was: 2,629,243,772 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act:

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934:

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging Growth Company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards* provided pursuant to Section 13(a) of the Exchange Act. ☐

*The term ‘‘new or revised financial accounting standard’’ refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If ‘Other’ has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes ☐ No ☒

Table of Contents

CAUTIONARY STATEMENT

This document may contain forward-looking statements, including ‘forward-looking statements’ within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as ‘will’, ‘aim’, ‘expects’, ‘anticipates’, ‘intends’, ‘looks’, ‘believes’, ‘vision’, or the negative of these terms and other similar expressions of future performance or results, and their negatives, are intended to identify such forward-looking statements. These forward-looking statements are based upon current expectations and assumptions regarding anticipated developments and other factors affecting the Unilever Group (the ‘Group’). They are not historical facts, nor are they guarantees of future performance.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Among other risks and uncertainties, the material or principal factors which could cause actual results to differ materially are: Unilever’s global brands not meeting consumer preferences; Unilever’s ability to innovate and remain competitive; Unilever’s investment choices in its portfolio management; the effect of climate change on Unilever’s business; Unilever’s ability to find sustainable solutions to its plastic packaging; significant changes or deterioration in customer relationships; the recruitment and retention of talented employees; disruptions in our supply chain and distribution; increases or volatility in the cost of raw materials and commodities; the production of safe and high quality products; secure and reliable IT infrastructure; execution of acquisitions, divestitures and business transformation projects; economic, social and political risks and natural disasters; financial risks; failure to meet high and ethical standards; and managing regulatory, tax and legal matters. A number of these risks have increased as a result of the current Covid-19 pandemic.

These forward-looking statements speak only as of the date of this document. Except as required by any applicable law or regulation, the Group expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Group’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Further details of potential risks and uncertainties affecting the Group are described in the Group’s filings with the London Stock Exchange, Euronext Amsterdam and the US Securities and Exchange Commission, including in the Annual Report on Form 20-F 2020 and the Unilever Annual Report and Accounts 2020.

Table of Contents

Table of Contents

Table of Contents

The events of 2020 have tested the world in ways few anticipated. They also tested the resilience of our business – our people, our operations, our financial strength. While this has not been an easy year, it’s made us a stronger business, better prepared for a fast-changing world.

We believe that the world needs businesses like Unilever more than ever. We have responded with speed and agility to protect lives and livelihoods, while growing our business. Driving a progressive agenda on issues like climate, social inequality and the future of work. And serving consumers through our purposeful brands, which are more relevant than ever.

Above all, this year has strengthened our commitment to being the global leader in sustainable business, and to showing that our purpose-led, future-fit business model delivers superior performance.

Table of Contents

| 2 | Unilever Annual Report on Form 20-F 2020 |

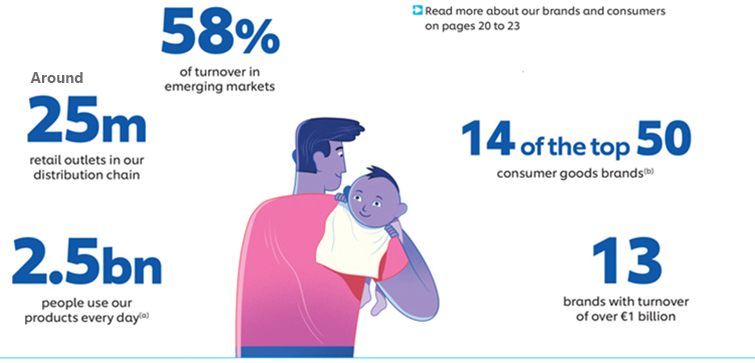

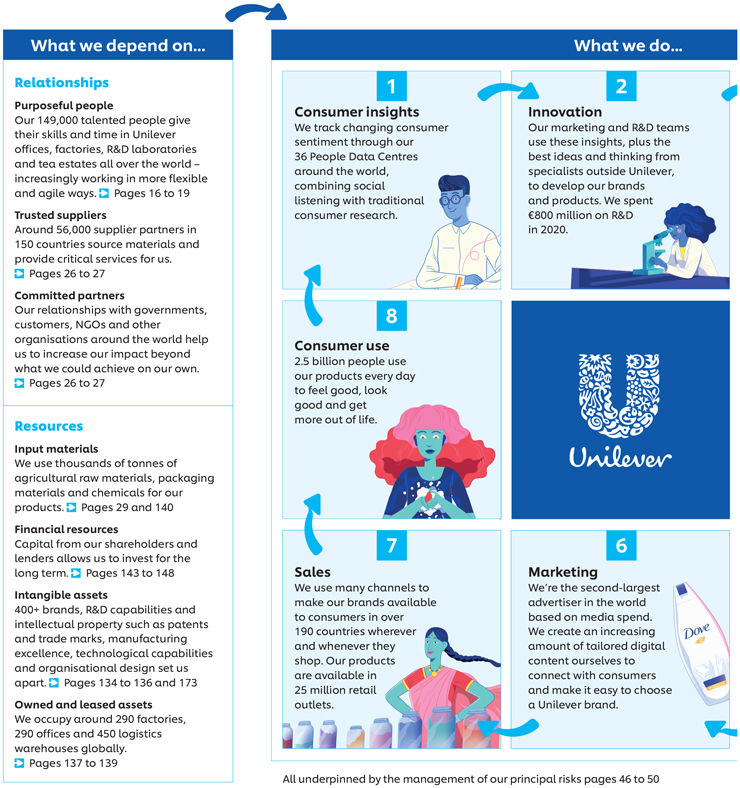

As one of the world’s largest consumer goods companies, we’re driven by our purpose to make sustainable living commonplace.

| A truly global business | Strong brands with purpose | |

| Our brands are available in over 190 countries | Our 400+ brands help people feel good, look good and get more out of life | |

Our financial highlights

| Turnover |

Underlying sales | Dividends paid | ||||||

| growth(c) | ||||||||

| €51bn |

1.9% | €4.3bn | ||||||

| 2019: €52bn |

2019: 2.9% | 2019: €4.2bn | ||||||

| 2018: €51bn |

2018: 3.2% | 2018: €4.1bn | ||||||

|

Underlying operating |

Operating margin |

Free cash flow(c) | ||||||

| margin(c) |

||||||||

| 18.5% |

16.4% | €7.7bn | ||||||

| 2019: 19.1% |

2019: 16.8% | 2019: €6.1bn | ||||||

| 2018: 18.6% |

2018: 24.8% | 2018: €5.4bn | ||||||

| (a) | Based on a detailed study carried out in 2016. |

| (b) | Based on market penetration and consumer interactions (Kantar Brand Footprint report). |

| (c) | Free cash flow, underlying operating margin and underlying sales growth are non-GAAP measures. For further information about these measures, and the reasons why we believe they are important for an understanding of the performance of the business, please refer to our commentary on non-GAAP measures on page 39. |

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 3 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 5 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 7 |

Table of Contents

| 8 | Unilever Annual Report on Form 20-F 2020 |

A belief that sustainable business drives superior

performance lies at the heart of the Unilever Compass.

|

||

| Our vision is to be the global leader in sustainable business. We will demonstrate how our purpose-led, future-fit business model drives superior performance, consistently delivering financial results in the top third of our industry. | ||

|

Our strategic choices and actions will help us fulfil our purpose and vision

|

|

Develop our portfolio into high growth spaces

| ||||||||

| Hygiene | Skin care | Prestige beauty | Functional nutrition | Plant-based foods | ||||

|

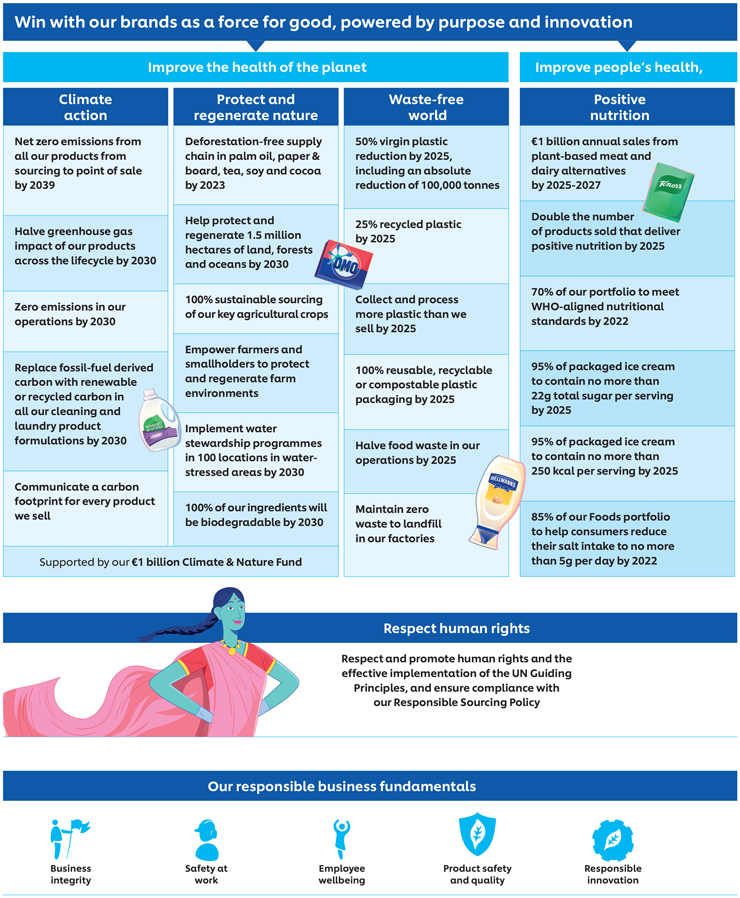

Win with our brands as a force for good, powered by purpose and innovation

| ||||||

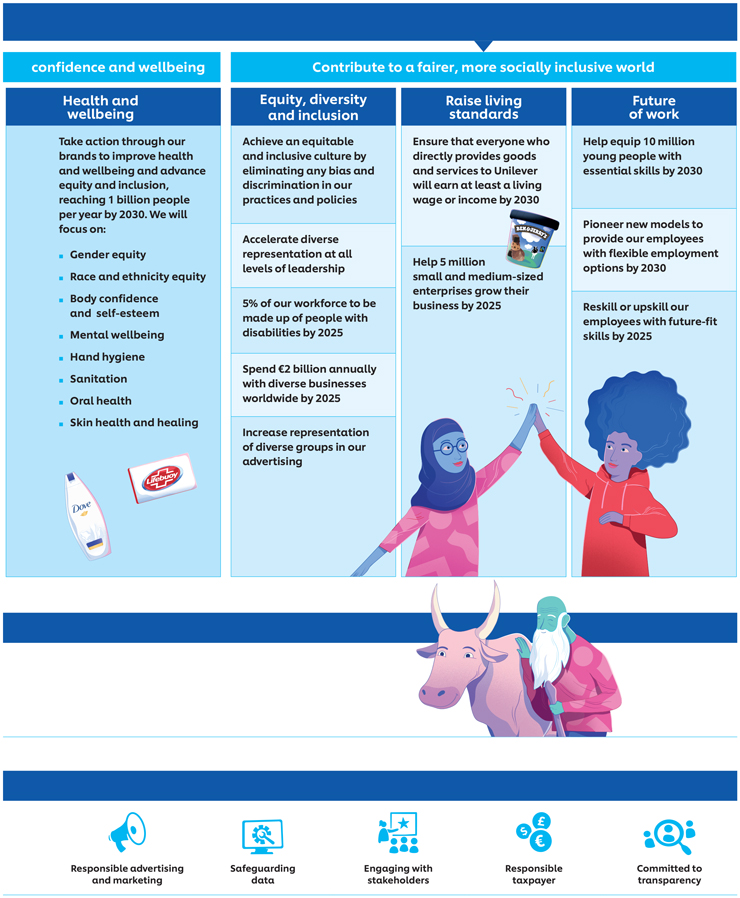

| Improve the health of the planet |

Improve people’s health, confidence and wellbeing |

Contribute to a fairer, more socially inclusive world |

Win with differentiated science and technology | |||

|

Accelerate in USA, India, China and key growth markets

| ||

| Build further scale in USA, India and China |

Leverage emerging market strength | |

|

Lead in the channels of the future

| ||||

| Accelerate pure-play and omnichannel eCommerce |

Develop eB2B business platforms |

Drive category leadership through shopper insight | ||

|

Build a purpose-led, future-fit organisation and growth culture

| ||||

| Unlock capacity through agility and digital transformation |

Be a beacon for diversity, inclusion and values-based leadership |

Build capability through lifelong learning | ||

|

Operational Excellence through the 5 Growth Fundamentals

| ||||||||

| 1 | 2 | 3 | 4 | 5 | ||||

| Purposeful | Improved | Impactful | Design | Fuel | ||||

| brands | penetration | innovation | for channel | for growth | ||||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 9 |

Table of Contents

| 10 | Unilever Annual Report on Form 20-F 2020 |

Our strategy continued

Our Compass sustainability commitments

will help us deliver our purpose and vision.

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 11 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 13 |

Table of Contents

| 14 | Unilever Annual Report on Form 20-F 2020 |

The Unilever Compass and our business model are designed to

create value for our stakeholders. Understanding their changing

needs helps us to make informed strategic decisions.

Our multi-stakeholder model in action

We’ve identified six stakeholder groups critical to our future success: our people, consumers, customers, suppliers & business partners, planet & society, and shareholders. The stakeholder reviews on pages 14 to 33 explain how we’ve worked to create value for each of our stakeholders in 2020, as well as how our business benefits from these vital relationships.

The Governance of Unilever sets out the roles and responsibilities of the Board and, with the exception of specified Board responsibilities, delegates the running of Unilever to the CEO. The CFO also has certain powers in relation to financial matters set out within the Governance of Unilever. The CEO heads the Unilever Leadership Executive (ULE) which comprises the CFO, the Group Secretary and the most senior management of Unilever as set out on pages 66 to 67. The Board provides guidance and advice to the CEO and the ULE on multiple issues throughout the year. The table below highlights key Board considerations and outcomes and also where relevant the key considerations and outcomes of the ULE in line with their duties and the Board Rules outlined in the Governance of Unilever.

|

Under Section 172 of the UK Companies Act 2006 (‘Section 172’) directors must act in the way that they consider, in good faith, would be most likely to promote the success of their company. In doing so, our Directors must have regard to stakeholders and the other matters set out in Section 172. Pages 14 and 15 comprise our Section 172 statement, which describes how the Directors have had regard to these matters when performing their duty. In light of our purpose to make sustainable living commonplace and the Unilever Compass strategy to drive superior performance as set out on pages 8 to 9, our Directors take steps to understand the needs and priorities of each stakeholder group and do so via a number of mediums, including by direct engagement or via their delegated committees and forums. The relevance of each stakeholder may change depending on the matter at hand. In line with the UK Companies Act 2006, below we provide a high-level summary of the concerns of our stakeholders and how our Directors and ULE engaged with them and had regard to their interests when setting Unilever’s strategy and taking decisions concerning the business.

|

| Stakeholder | Interests and concerns in 2020 |

How we engaged in 2020 | Board and ULE considerations and outcomes in 2020 | |||

|

Our people

We stepped up our engagement with employees significantly to help our people through the pandemic.

pages 16 to 19 |

Covid-19 has been the overriding concern for our people during the year as the pandemic impacted virtually every part of their lives, especially working arrangements. Through our engagement, we also consistently see that concerns such as career opportunities, wellbeing, purpose, sustainability and being a more simple and agile business remain important for our people. | This year our annual UniVoice survey focused on our office-based employees, and more than 42,000 people responded (see pages 16, 17 and 18 for results). We continued to run monthly UniPulse surveys throughout the year for more instant feedback. Covid-19 accelerated a widescale use of new digital platforms. We held a bi-weekly ‘Your Call’ with our CEO and ULE which gave people direct access to our leadership team in rotating guest slots, including our Chairman. We consulted with our people on a new Future Reward Framework through multiple employee focus groups and surveys, as well as consultation with the European Works Council and other local employee representation bodies. |

Our Board engaged directly with employees throughout the year on issues of concern such as working in factories and at home through the pandemic, the new starter onboarding process and learning opportunities. These perspectives were taken into consideration in decision making (see page 63 for more details). The Board’s Corporate Responsibility Committee looked at a range of people-related issues in the year, including safety and our Code of Business Principles (see page 18). As part of the Unification of our legal structure, and after engaging with the Dutch Central Works Council and the European Works Council, the Board agreed to provide a guarantee to Unilever APF, the Dutch Pension Fund, to safeguard the pensions of Dutch employees. | |||

|

Consumers

Changes in consumer behaviour have accelerated, leading to new insights about the ways people shop and buy our products.

pages 20 to 23 |

The pandemic has impacted consumer spending habits, particularly for discretionary purchases. This has led to a back-to-basics approach to consumption, with value for money and quality remaining key concerns, alongside sustainability as consumers have become more mindful of the impact of their spending decisions on the world. Health and wellness concerns also increased as people looked to protect themselves from the physical and mental consequences of the pandemic. | We have many direct and indirect touchpoints with our consumers. Our People Data Centres combine social listening with traditional consumer research while our Consumer Carelines give us rich insights into the experiences of consumers when using our products – during 2020 we had around 2.5 million interactions through calls, emails, letters, social media and webchats. We also consulted with almost 1.8 million consumers this year through regular surveys using partners like Kantar, Nielsen and Ipsos. These insights help to inform our understanding of consumer trends, including those likely to continue in a post- Covid world. |

Our Board and ULE members are regularly informed of consumer trends and consider these when making decisions. For example, during a strategy focused Board meeting in October, the Board discussed how to ensure our divisional portfolios remain attractive and differentiated, the growing importance of eCommerce and large retailer omnichannel partnerships. The ULE considered a range of 3-5 year scenarios in the early months of the pandemic to understand how consumer trends might change, how to best prepare for a global recession, and where growth opportunities might be. The work informed Unilever’s portfolio and investment strategies by helping to identify growth opportunities. | |||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 15 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 17 |

Table of Contents

| 18 | Unilever Annual Report on Form 20-F 2020 |

Our people continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 19 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 21 |

Table of Contents

| 22 | Unilever Annual Report on Form 20-F 2020 |

Consumers continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 23 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 25 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 27 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 29 |

Table of Contents

| 30 | Unilever Annual Report on Form 20-F 2020 |

Planet & society continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 31 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 33 |

Table of Contents

| 34 | Unilever Annual Report on Form 20-F 2020 |

We measure our success by tracking both non-financial

and financial key performance indicators.

Non-financial performance

| Target | 2020 | 2019 | 2018 | |||||

| Improving health & wellbeing |

||||||||

| Health & hygiene Target: By 2020 we will help more than a billion people to improve their health and hygiene. This will help reduce the incidence of life-threatening diseases like diarrhoea(a) |

1 billion | On ground reach: 625 million |

On ground reach: 615 million |

On ground reach: 570 million | ||||

| TV reach: 715 million |

TV reach: 710 million |

TV reach: 670 million | ||||||

| Nutrition Target: By 2020 we will double (i.e. up to 60%) the proportion of our portfolio that meets the Highest Nutritional Standards, based on globally recognised dietary guidelines |

60% | 61%† | 56%à | 48% | ||||

| Reducing environmental impact |

||||||||

| Greenhouse gases Target: Halve the greenhouse gas impact of our products across the lifecycle (from the sourcing of the raw materials to the greenhouse gas emissions linked to people using our products) by 2030 (greenhouse gas impact per consumer use; 2010 baseline)(c)(d) |

(50%) | (10%) | (8%)(b)à | (3%)(b) | ||||

| Target: By 2020 CO2 emissions from energy from our factories will be at or below 2008 levels (£145.92) despite significantly higher volumes (reduction in CO2 from energy in kg per tonne of production since 2008)* |

£145.92 | 36.94† | 50.76à | 70.46D | ||||

| Water Target: Halve the water associated with the consumer use of our products by 2020 (water impact per consumer use; 2010 baseline)(c) |

(50%) | 0% | 1%à | (2%) | ||||

| Target: By 2020 water abstraction by our global factory network will be at or below 2008 levels (£2.97) despite significantly higher volumes (reduction in water abstraction in m³ per tonne of production since 2008)* |

£2.97 | 1.52† | 1.58à | 1.67D | ||||

| Waste Target: Halve the waste associated with the disposal of our products by 2020 (waste impact per consumer use; 2010 baseline)(c) |

(50%) | (34%)† | (32%) | (31%) | ||||

| Target: By 2020 total waste sent for disposal will be at or below 2008 levels (£7.91) despite significantly higher volumes (reduction in total waste in kg per tonne of production since 2008)* |

£7.91 | 0.34† | 0.30à | 0.23(e) | ||||

| Sustainable sourcing Target: By 2020 we will source 100% of our agricultural raw materials sustainably (% of tonnes purchased) |

100% | 67% | 62%à | 56% | ||||

| Enhancing livelihoods |

||||||||

| Fairness in the workplace Target: By 2020 we will advance human rights across our operations and extended supply chain, by: |

||||||||

| • Sourcing 100% of procurement spend from suppliers meeting the mandatory requirements of the Responsible Sourcing Policy (% of spend of suppliers meeting the Policy) |

100% | 83%† | 70% | 61%D | ||||

| • Reducing workplace injuries and accidents by 50%, from 2.10 accidents per 1 million hours worked in 2008 (reduction in Total Recordable Frequency Rate of workplace accidents per million hours worked since 2008)* |

1.05 | 0.63† | 0.76(f)à | 0.69D | ||||

| Opportunities for women Target: By 2020 we will empower 5 million women, by: |

||||||||

| • Promoting safety for women in communities where we operate (number of women) |

||||||||

| • Enhancing access to training and skills (number of women) |

5 million | 2.63 million(g)† | 2.34 million | 1.85 millionD | ||||

| • Expanding opportunities in our value chain (number of women) |

||||||||

| • Building a gender-balanced organisation with a focus on management (% of managers that are women)* |

50% | 50%† | 51% | 49%D | ||||

| Inclusive business Target: By 2020 we will have a positive impact on the lives of 5.5 million people by: |

||||||||

| • Enabling 5 million small-scale retailers to access initiatives aiming to improve their income (number of small-scale retailers since 2015) |

5 million | 1.83 million(g)† | 1.81 millionà | 1.73 million | ||||

| • Enabling 500,000 smallholder farmers to access initiatives aiming to improve their agricultural practices (number of smallholder farmers since 2011) |

0.50 million | 0.83 million(g)† | 0.79 millionà | 0.75 million | ||||

| * | Key Non-Financial Indicators. |

| † | PwC assured in 2020. For details and 2020 basis of preparation see www.unilever.com/investor-relations/annual-report-and-accounts |

| à | PwC assured in 2019. For details and 2019 basis of preparation see www.unilever.com/planet-and-society/sustainability-reporting-centre/reporting-archive |

| D | PwC assured in 2018. For details and 2018 basis of preparation see www.unilever.com/planet-and-society/sustainability-reporting-centre/reporting-archive |

| (a) | The number of people reached through TV advertisements and programmes aimed at encouraging health and hygiene behaviour change (‘TV reach’) includes Signal, Dove and Lifebuoy. |

| (b) | We have restated the change in our GHG emissions ‘per consumer use’ for prior years as a result of incorporating new data relating to the usage of our products, which changed the estimated GHG emissions in our 2010 baseline. See page 56 for more information. |

| (c) | Brackets around our GHG, waste and water footprints indicate that we have reduced our footprints by the numbers quoted. |

| (d) | Target approved by the Science Based Targets initiative. |

| (e) | Restated from 0.20 kg/tonne of production due to a classification error during the data reporting process. |

| (f) | 2019 Total Recordable Frequency Rate (TRFR) included for the first time all acquisitions which operate as decentralised business units, as we now have processes in place to collect the data. Had we included these acquisitions in 2018, our reported TRFR would have been approximately 6% higher. |

| (g) | Around 592,000 women have accessed initiatives under both the Inclusive business and the Opportunities for women pillars in 2020. |

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 35 |

Table of Contents

| 36 | Unilever Annual Report on Form 20-F 2020 |

| Highlights for the year ended | ||||||||||||||||||||||||||||||||||||||||||||

| Beauty & Personal Care | Foods & Refreshment | Home Care | Group | |||||||||||||||||||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||||||||||||||||||||

| Turnover (€ million) | 21,124 | 21,868 | 19,140 | 19,287 | 10,460 | 10,825 | 50,724 | 51,980 | ||||||||||||||||||||||||||||||||||||

| Underlying sales growth (%) | 1.2 | 2.6 | 1.3 | 1.5 | 4.5 | 6.1 | 1.9 | 2.9 | ||||||||||||||||||||||||||||||||||||

| Underlying volume growth (%) | 1.2 | 1.7 | 0.1 | (0.2 | ) | 5.1 | 2.9 | 1.6 | 1.2 | |||||||||||||||||||||||||||||||||||

| Underlying price growth (%) | – | 0.9 | 1.1 | 1.7 | (0.6 | ) | 3.1 | 0.3 | 1.6 | |||||||||||||||||||||||||||||||||||

| Operating profit (€ million) | 4,311 | 4,520 | 2,749 | 2,811 | 1,243 | 1,377 | 8,303 | 8,708 | ||||||||||||||||||||||||||||||||||||

| Underlying operating profit (€ million) | 4,591 | 4,960 | 3,257 | 3,382 | 1,519 | 1,605 | 9,367 | 9,947 | ||||||||||||||||||||||||||||||||||||

| Operating margin (%) | 20.4 | 20.7 | 14.4 | 14.6 | 11.9 | 12.7 | 16.4 | 16.8 | ||||||||||||||||||||||||||||||||||||

| Underlying operating margin (%) | 21.7 | 22.7 | 17.0 | 17.5 | 14.5 | 14.8 | 18.5 | 19.1 | ||||||||||||||||||||||||||||||||||||

| Return on assets (%) | 140 | 124 | 69 | 61 | 129 | 99 | 102 | 89 | ||||||||||||||||||||||||||||||||||||

| Free cash flow (€ million) | 7,671 | 6,132 | ||||||||||||||||||||||||||||||||||||||||||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 37 |

Table of Contents

| 38 | Unilever Annual Report on Form 20-F 2020 |

Financial review continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 39 |

Table of Contents

| 40 | Unilever Annual Report on Form 20-F 2020 |

Financial review continued

The reconciliation of changes in the GAAP measure of turnover to USG is as follows:

| 2020 vs 2019 (%) | Beauty & Personal Care |

Foods & Refreshment |

Home Care |

Total Group |

||||||||||||

| Turnover growth(a) | (3.4 | ) | (0.8 | ) | (3.4 | ) | (2.4 | ) | ||||||||

| Effect of acquisitions | 0.9 | 2.7 | 0.2 | 1.4 | ||||||||||||

| Effect of disposals | - | (0.4 | ) | (0.2 | ) | (0.2 | ) | |||||||||

| Effect of currency-related items, | (5.4 | ) | (4.2 | ) | (7.5 | ) | (5.4 | ) | ||||||||

| of which: | ||||||||||||||||

| Exchange rate changes |

(5.6 | ) | (4.6 | ) | (7.8 | ) | (5.7 | ) | ||||||||

| Extreme price growth in hyperinflationary markets(b) |

0.2 | 0.5 | 0.3 | 0.3 | ||||||||||||

| Underlying sales growth(b) | 1.2 | 1.3 | 4.5 | 1.9 | ||||||||||||

| 2019 vs 2018 (%) | ||||||||||||||||

| Turnover growth(a) | 6.0 | (4.6 | ) | 6.9 | 2.0 | |||||||||||

| Effect of acquisitions | 0.9 | 0.6 | 0.3 | 0.7 | ||||||||||||

| Effect of disposals | - | (7.5 | ) | - | (3.0 | ) | ||||||||||

| Effect of currency-related items, | 2.4 | 1.0 | 0.4 | 1.5 | ||||||||||||

| of which: | ||||||||||||||||

| Exchange rate changes |

1.7 | (3.5 | ) | (0.3 | ) | (0.7 | ) | |||||||||

| Extreme price growth in hyperinflationary markets(b) |

0.6 | 4.7 | 0.7 | 2.2 | ||||||||||||

| Underlying sales growth(b) | 2.6 | 1.5 | 6.1 | 2.9 | ||||||||||||

| 2018 vs 2017 (%) | ||||||||||||||||

| Turnover growth(a) | (0.3 | ) | (9.9 | ) | (4.2 | ) | (5.1 | ) | ||||||||

| Effect of acquisitions | 3.9 | 0.8 | 0.5 | 2.0 | ||||||||||||

| Effect of disposals | – | (7.2 | ) | (0.2 | ) | (3.0 | ) | |||||||||

| Effect of currency-related items, | (7.2 | ) | (5.8 | ) | (8.8 | ) | (7.0 | ) | ||||||||

| of which: | ||||||||||||||||

| Exchange rate changes |

(8.1 | ) | (47.7 | ) | (9.1 | ) | (29.4 | ) | ||||||||

| Extreme price growth in hyperinflationary markets(b) |

1.0 | 79.1 | 0.4 | 31.7 | ||||||||||||

| Underlying sales growth(b) | 3.4 | 2.2 | 4.7 | 3.2 | ||||||||||||

| (a) | Turnover growth is made up of distinct individual growth components, namely underlying sales, currency impact, acquisitions and disposals. Turnover growth is arrived at by multiplying these individual components on a compounded basis as there is a currency impact on each of the other components. Accordingly, turnover growth is more than just the sum of the individual components. |

| (b) | Underlying price growth in excess of 26% per year in hyperinflationary economies has been excluded when calculating the underlying sales growth in the tables above, and an equal and opposite amount is shown as extreme price growth in hyperinflationary markets. |

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 41 |

Table of Contents

| 42 | Unilever Annual Report on Form 20-F 2020 |

Financial review continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 43 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 45 |

Table of Contents

| 46 | Unilever Annual Report on Form 20-F 2020 |

Our risks continued

Principal risk factors

| Risk

|

Risk description

|

Level of risk

| ||||

| Brand preference | Our success depends on the value and relevance of our brands and products to consumers around the world and on our ability to innovate and remain competitive. |

Increase | ||||

|

Consumer tastes, preferences and behaviours are changing more rapidly than ever before. We see a growing trend for consumers preferring brands which both meet their functional needs and have an explicit social purpose. |

||||||

| Technological change is disrupting our traditional brand communication models. Our ability to develop and deploy the right communication, both in terms of messaging content and medium is critical to the continued strength of our brands. | ||||||

| We are dependent on creating innovative products that continue to meet the needs of our consumers and getting these new products to market with speed. | ||||||

| The Covid-19 pandemic has driven significant changes in consumer habits and demand which is requiring a continuing and rapid evolution of our brands.

|

||||||

| Portfolio management | Unilever’s strategic investment choices will affect the long-term growth and profits of our business. |

No change | ||||

|

Unilever’s growth and profitability are determined by our portfolio of divisions, geographies and channels and how these evolve over time. If Unilever does not make optimal strategic investment decisions, then opportunities for growth and improved margin could be missed.

|

||||||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 47 |

Table of Contents

| 48 | Unilever Annual Report on Form 20-F 2020 |

Our risks continued

| Risk

|

Risk description

|

Level of risk

| ||||

| Talent | A skilled workforce and agile ways of working are essential for the continued success of our business. |

Increase | ||||

|

With the rapidly changing nature of work and skills, there is a risk that our workforce is not equipped with the skills required for the new environment. |

||||||

| Our ability to attract, develop and retain a diverse range of skilled people is critical if we are to compete and grow effectively. This is especially true in our key emerging markets where there can be a high level of competition for a limited talent pool. | ||||||

| The loss of management or other key personnel or the inability to identify, attract and retain qualified personnel could make it difficult to manage the business and could adversely affect operations and financial results. | ||||||

| The wellbeing of our employees is vital to the success of our business. Covid-19 has had a significant impact on their wellbeing, therefore helping our employees manage the impact of Covid-19 on their lives and their ability to work effectively requires continued focus.

|

||||||

| Supply chain | Our business depends on purchasing materials, efficient manufacturing and the timely distribution of products to our customers. |

Increase | ||||

|

Our supply chain network is exposed to potentially adverse events such as physical disruptions, environmental and industrial accidents, trade restrictions or disruptions at a key supplier, which could impact our ability to deliver orders to our customers. |

||||||

| Covid-19 is an adverse event that has challenged and continues to challenge the continuity of our supply chain. Maintaining manufacturing and logistics operations whilst adhering to changing local regulations and meeting enhanced health and safety standards requires continued focus and flexibility. | ||||||

| The cost of our products can be significantly affected by the cost of the underlying commodities and materials from which they are made. Fluctuations in these costs cannot always be passed on to the consumer through pricing.

|

||||||

| Safe and high-quality products | The quality and safety of our products are of paramount importance for our brands and our reputation. |

No change | ||||

|

The risk that raw materials are accidentally or maliciously contaminated throughout the supply chain or that other product defects occur due to human error, equipment failure or other factors cannot be excluded. |

||||||

| Labelling errors can have potentially serious consequences for both consumer safety and brand reputation. Therefore on-pack labelling needs to provide clear and accurate ingredient information in order that consumers can make informed decisions regarding the products they buy.

|

||||||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 49 |

Table of Contents

| 50 | Unilever Annual Report on Form 20-F 2020 |

Our risks continued

| Risk

|

Risk description

|

Level of risk

| ||||

| Treasury and Tax | Unilever is exposed to a variety of external financial risks in relation to Treasury and Tax. |

No change | ||||

|

The relative values of currencies can fluctuate widely and could have a significant impact on business results. Further, because Unilever consolidates its financial statements in euros, it is subject to exchange risks associated with the translation of the underlying net assets and earnings of its foreign subsidiaries. |

||||||

| We are also subject to the imposition of exchange controls by individual countries which could limit our ability to import materials paid in foreign currency or to remit dividends to the parent company. | ||||||

| A material shortfall in our cash flow could undermine Unilever’s credit rating, impair investor confidence and restrict Unilever’s ability to raise funds. In times of financial crisis, there is a further risk that we may not be able to raise funds due to market liquidity. | ||||||

| We are exposed to counter-party risks with banks, suppliers and customers which could result in financial losses. | ||||||

| Tax is a complex and evolving area where laws and their interpretation are changing regularly, leading to the risk of unexpected tax exposures. International tax reform remains a key focus of attention with the OECD’s Base Erosion and Profit Shifting project, and the Digitalising Economy Project, and further potential tax reform in the EU.

|

||||||

| Ethical | Unilever’s brands and reputation are valuable assets and the way in which we operate, contribute to society and engage with the world around us is always under scrutiny both internally and externally. |

No change | ||||

|

Acting in an ethical manner, consistent with the expectations of customers, consumers and other stakeholders, is essential for the protection of the reputation of Unilever and its brands. |

||||||

| A key element of our ethical approach to business is to reduce inequality and promote fairness. Our activities touch the lives of millions of people and it is our responsibility to protect their rights and help them live well. The safety of our employees and the people and communities we work with is critical. Failure to meet these high standards could result in damage to Unilever’s corporate reputation and business results.

|

||||||

| Legal and regulatory | Compliance with laws and regulations is an essential part of Unilever’s business operations. |

No change | ||||

|

Unilever is subject to national and regional laws and regulations in such diverse areas as product safety, product claims, trademarks, copyright, patents, competition, employee health and safety, data privacy, the environment, corporate governance, listing and disclosure, employment and taxes. |

||||||

| Failure to comply with laws and regulations could expose Unilever to civil and/or criminal actions leading to damages, fines and criminal sanctions against us and/or our employees with possible consequences for our corporate reputation. Changes to laws and regulations could have a material impact on the cost of doing business.

|

||||||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 51 |

Table of Contents

| 52 | Unilever Annual Report on Form 20-F 2020 |

Sustainability deep-dives continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 53 |

Table of Contents

| 54 | Unilever Annual Report on Form 20-F 2020 |

Sustainability deep-dives continued

Soybean oil

Soybean oil

Black tea

Black tea

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 55 |

Table of Contents

| 56 | Unilever Annual Report on Form 20-F 2020 |

Sustainability deep-dives continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 57 |

Table of Contents

| 58 | Unilever Annual Report on Form 20-F 2020 |

Sustainability deep-dives continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 59 |

Table of Contents

| 60 | Unilever Annual Report on Form 20-F 2020 |

Sustainability deep-dives continued

Non-financial information statement

In accordance with sections 414CA and 414CB of the Companies Act 2006 which outline requirements for non-financial reporting, the table below is intended to provide our stakeholders with the content they need to understand our development, performance, position and the impact of our activities with regards to specified non-financial matters. Further information on these matters can be found on our website and in our Human Rights Report, including relevant policies.

| Non-financial matter and relevant sections of Annual Report

|

Annual Report page reference | |

|

Environmental matters

Relevant sections of Annual Report and Accounts: ◾ Protecting climate and nature ◾ Net zero emissions ◾ A waste-free world ◾ Protecting and regenerating nature ◾ Protecting water ◾ In focus: Climate change ◾ In focus: Plastic packaging

|

◾ Policy: pages 28 to 29 ◾ Position and performance: pages 28 to 29, 34, 56 to 57 and 59 ◾ Risk: pages 47, 55 to 56 and 58 to 59 ◾ Impact: pages 28 to 29 | |

| Social and community matters

Relevant sections of Annual Report and Accounts: ◾ A fairer more socially inclusive world ◾ Better health and hygiene

|

◾ Policy: pages 30 to 31 ◾ Position and performance: pages 30 to 31 and 34 ◾ Risk: page 50 ◾ Impact: pages 30 to 31

| |

| Employee matters

Relevant sections of Annual Report and Accounts: ◾ Making our supply chain more diverse ◾ Protecting wellbeing ◾ Safety at work ◾ A year of learning ◾ Managing talent ◾ A beacon for diversity

|

◾ Policy: pages 16 to 19 ◾ Position and performance: pages 16 to 19 and 34 ◾ Risk: page 48 ◾ Impact: pages 16 to 19 | |

| Human rights matters

Relevant sections of Annual Report and Accounts: ◾ Promoting human rights ◾ Raising living standards

|

◾ Policy: page 30 ◾ Position and performance: page 30 ◾ Risk: pages 50 and 59 ◾ Impact: page 30

| |

| Anti-corruption and bribery matters

Relevant sections of Annual Report and Accounts: ◾ Working with integrity |

◾ Policy: Page 18 ◾ Position and performance: Page 18 ◾ Risk: Page 50 ◾ Impact: Page 18

| |

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 61 |

Table of Contents

| 62 | Unilever Annual Report on Form 20-F 2020 |

Corporate Governance continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 63 |

Table of Contents

| 64 | Unilever Annual Report on Form 20-F 2020 |

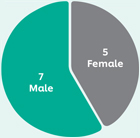

Our Board of Directors

Our Non-Executive Directors bring diverse experience to the Board’s

strategic discussions and decision-making.

|

|

|

| ||||||||||||

|

Nils Andersen Chairman

Nationality Danish Age 62, Male Appointed April 2015

|

|

Youngme Moon Vice-Chairman/Senior Independent Director

Nationality American Age 56, Female Appointed April 2016

|

|

Alan Jope CEO

Nationality British Age 56, Male Appointed CEO January 2019 Appointed Director May 2019 | |||||||||

|

|

|

| ||||||||||||

| Previous experience: BP plc (NED); A.P. Moller – Maersk A/S (Group CEO); Carlsberg A/S and Carlsberg Breweries A/S (CEO); European Round Table of Industrialists (Vice-Chairman); Unifeeder S/A (Chairman).

Current external appointments: AKZO Nobel N.V. (Chairman); Faerch Plast (Chairman); Salling Foundation (NED); Worldwide Flight Services (Chairman). |

Previous experience: Harvard Business School (Chairman and Senior Associate Dean for the MBA Program); Massachusetts Institute of Technology (Professor); Avid Technology (NED); Rakuten Inc (NED).

Current external appointments: Mastercard INC (Board Member); Sweetgreen Inc (Board Member); JAND Inc (Board Member); Harvard Business School (Professor). |

Previous experience: Beauty and Personal Care Division (President); Unilever Russia, Africa and Middle East (President); Unilever North Asia (President); SCC and Dressings (Global Category Leader); Home and Personal Care North America (President).

Current external appointments: Generation Unlimited (Board Member). | ||||||||||||

|

|

|

| ||||||||||||

|

Graeme Pitkethly CFO

Nationality British Age 54, Male Appointed CFO October 2015 Appointed Director April 2016 |

|

Laura Cha Non-Executive Director

Nationality Chinese Age 71, Female Appointed May 2013

|

|

Vittorio Colao Non-Executive Director

Nationality Italian Age 59, Male Appointed July 2015 Stepped down as a director on 18 February 2021

| |||||||||

|

|

|

| ||||||||||||

| Previous experience: Unilever UK and Ireland (EVP and General Manager); Finance Global Markets (EVP); Group Treasurer; Head of M&A; FLAG Telecom (VP Corporate Development); PwC.

Current external appointments: Pearson Plc (NED); Financial Stability Board Task Force on Climate-related Financial Disclosures (Vice Chair); The 100 Group Main Committee (Vice Chair); UN Global Compact CFO Task Force. |

Previous experience: Securities and Futures Commission, Hong Kong (Deputy Chairman); China Securities Regulatory Commission (Vice Chairman); China Telecom Corporation Limited (NED); 12th National People’s Congress of China (Hong Kong Delegate).

Current external appointments: HSBC Holdings plc (NED); Hong Kong Exchanges and Clearing Ltd (Non-Executive Chairman); Foundation Asset Management Sweden AB (Senior International Adviser); Executive Council of the Hong Kong Special Administrative Region (Non-official member); CSRC International Advisory Council (Vice Chairman). |

Previous experience: Vodafone Group plc (CEO); RCS MediaGroup SpA (CEO); McKinsey & Company (Partner); Finmeccanica Group Services SpA (renamed to Leonardo SpA) (NED); RAS Insurance SpA (merged with Allianz AG) (NED).

Current external appointments: Verizon Communications Inc. (NED); General Atlantic (Senior Advisor / Vice Chairman EMEA); Bocconi University Italy (Executive Trustee); Oxford Martin School – UK (Advisor); MedTech-Humanitas / Politecnico – Italy (Advisor). | ||||||||||||

|

|

|

| ||||||||||||

|

Judith Hartmann Non-Executive Director

Nationality Austrian Age 51, Female Appointed April 2015

|

|

Andrea Jung Non-Executive Director

Nationality American/Canadian Age 61, Female Appointed May 2018

|

|

Susan Kilsby Non-Executive Director

Nationality American/British Age 62, Female Appointed August 2019

| |||||||||

|

|

|

| ||||||||||||

| Previous experience: Suez (NED); General Electric (various roles); Bertelsmann SE & Co. KGaA (CFO); RTL Group SA (NED); Penguin Random House LLC (NED).

Current external appointments: ENGIE Group (Deputy CEO). |

Previous experience: Avon Products Inc (CEO); General Electric (Board Member); Daimler AG (Board Member).

Current external appointments: Grameen America Inc (President and CEO); Apple Inc (NED); Wayfair Inc (NED). |

Previous experience: L’Occitane International (NED); Keurig Green Mountain (NED); Coca-Cola HBC AG (NED); Goldman Sachs International (NED); Shire Plc (Chair); Mergers and Acquisitions, EMEA – Credit Suisse (Chair).

Current external appointments: Fortune Brands Home & Security Inc (Chair); Diageo Plc (Senior Independent Director); BHP Plc (NED).

| ||||||||||||

|

|

|

| ||||||||||||

| Committee membership key | ||||||||

|

Audit Committee |

|

Nominating and Corporate Governance Committee | |||||

|

Compensation Committee |

|

Chair | |||||

|

Corporate Responsibility Committee | |||||||

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 65 |

Table of Contents

| 66 | Unilever Annual Report on Form 20-F 2020 |

Unilever Leadership Executive (ULE)

Our executive management team is responsible for the day-to-day

running of the business and the execution of our strategy.

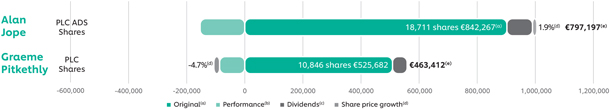

For Alan Jope and Graeme Pitkethly see page 64

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 67 |

Table of Contents

| 68 | Unilever Annual Report on Form 20-F 2020 |

Corporate Governance continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 69 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 71 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 73 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 75 |

Table of Contents

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 77 |

Table of Contents

| 78 | Unilever Annual Report on Form 20-F 2020 |

Directors’ Remuneration Report continued

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 79 |

Table of Contents

| 80 | Unilever Annual Report on Form 20-F 2020 |

Directors’ Remuneration Report continued

|

Annual bonus

|

||

| Purpose and link to strategy | Performance measures | |

| Incentivises year-on-year delivery of rigorous short-term financial, strategic and operational objectives selected to support our annual business strategy and the ongoing enhancement of shareholder value.

The ability to recognise performance through annual bonus enables us to manage our cost base flexibly and react to events and market circumstances.

Operation

Each year Executive Directors may have the opportunity to participate in the annual bonus plan. Executive Directors are set a target opportunity that is assessed against the business performance multiplier of up to 150% of target opportunity at the end of the year.

Directors are required to defer 50% of their bonus into shares or share awards for three years. Deferred bonus awards can earn dividends or dividend equivalents during the vesting period and may be satisfied in cash and/or shares. Deferral may be effected under the Unilever Share Plan, or by such other method as the Committee determines.

Ultimate remedy/malus and claw-back provisions apply (see details on page 81).

Opportunity

The maximum annual bonus opportunity under this Policy is 225% of fixed pay.

The normal target bonus opportunity for the CEO is 150% of fixed pay, and for the CFO is 120% of fixed pay. This results in normal maximums of 225% and 180% respectively.

Achievement of threshold performance results in a payout of 0% of the maximum opportunity.

|

The business performance multiplier is based on a range of business metrics set by the Committee on an annual basis to ensure that they are appropriately stretching for the delivery of threshold, target and maximum performance. These performance measures may include Underlying Sales Growth (USG), Underlying Operating Margin improvement (UOM) and Free Cash Flow (FCF), along with any other measures chosen by the Committee, as appropriate. The Committee also sets the weightings of the respective metrics on an annual basis.

The Committee has discretion to adjust the formulaic outcome of the business performance multiplier, if it believes this better reflects the underlying performance of Unilever. In any event, the overall business performance multiplier will not exceed 150%. The use of any discretion will be fully disclosed in the directors’ remuneration report for the year to which discretion relates.

The Committee may introduce non-financial measures in the future subject to a minimum of 70% of targets being financial in nature.

Performance is normally measured over the financial year.

Supporting information

There are two changes from the previous policy. The first is the requirement for 50% of bonus to be deferred, rather than voluntarily invested into the Management Co-Investment Plan (the historic long-term incentive plan). The second is that the Committee can now override any formulaic outcome (including to nil), instead of being limited to adjusting by 25%. This is in line with best practice and the UK Corporate Governance Code. Any exercise of discretion will continue to be disclosed in full in the relevant directors’ remuneration report.

The Policy sets out a single maximum opportunity that applies to any potential Executive Director, this is different to the previous policy which sets out different maximum opportunities for each Director. This is intended to simplify the Policy, and provide flexibility if needed over the course of the Policy. If the Committee sought to increase the annual grant for the CFO, it would only do so after engaging with shareholders.

| |

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 81 |

Table of Contents

| 82 | Unilever Annual Report on Form 20-F 2020 |

Directors’ Remuneration Report continued

Malus: Malus is the adjustment of bonus, unvested deferred bonus awards or unvested LTIP awards (both PSP awards under this Remuneration Policy, and predecessor awards under any previous remuneration policies). The Committee may apply malus to reduce an award or determine that it will not vest or only vest in part. Malus applies to deferred bonus awards during the three-year deferral period and to unvested LTIP awards (PSP awards under this Remuneration Policy and predecessor awards under any previous remuneration policies) during the vesting period and retention period, in the event of:

| ◾ a significant downward restatement of the financial results of Unilever; |

| ◾ gross misconduct or gross negligence; |

| ◾ material breach of Unilever’s Code of Business Principles or any of the Unilever Code Policies; |

| ◾ breach of restrictive covenants by which the individual has agreed to be bound, or conduct by the individual which results in significant losses or serious reputation damage to Unilever; and |

| ◾ for PSP awards and deferred bonus awards, error in calculation or misleading data or corporate failure. |

The annual bonus will also be subject to malus on the same grounds as apply for deferred bonus awards and unvested LTIP awards. This power is an addition to the normal discretion to adjust awards and the additional sustainability test outlined in the policy table.

Ultimate remedy: Awards under the PSP (and predecessor long-term incentives under any previous remuneration policy) are subject to ultimate remedy. Upon vesting of an award, the Committee shall have the discretionary power to adjust the value of the award if the award, in the Committee’s opinion taking all circumstances into account, produces an unfair result. In exercising this discretion, the Committee may take into account Unilever’s performance against non-financial measures.

These powers are in addition to the normal discretion to adjust awards and the additional sustainability test outlined in the policy table.

Ultimate remedy/malus and claw-back will not apply to an award which has been exchanged following a change of control and claw-back will not apply where an award vests on a change of control.

Committee discretion to amend targets/measures: For PSP awards (or MCIP awards under the previous policy) and annual bonus, the Committee may change a performance measure or target (including replacing a measure) in accordance with the award’s terms or if anything happens which causes the Committee reasonably to consider it appropriate to do so. The Committee may also adjust the number or class of shares subject to MCIP, PSP and deferred bonus awards if certain corporate events (e.g. rights issues) occur.

The Committee will continue to review targets on all unvested awards in the event of any material acquisitions or disposals that were not included in the financial plan, or were not anticipated at the time of target setting. The Committee may make adjustments if deemed appropriate to ensure that all targets remain relevant and equally stretching in light of any M&A activity, other corporate events, or any other event that the Committee considers to be material, that was not foreseen at the time of target setting.

Legacy arrangements

For the duration of this Remuneration Policy, entitlements arising before the adoption of this Remuneration Policy will continue to be honoured in line with the approved remuneration policy under which they were granted, or their contractual terms.

The Committee reserves the right to make any remuneration payments and payments for loss of office (including exercising any relevant discretions) notwithstanding that they are not in line with this Remuneration Policy where the terms of the payment were agreed before this Remuneration Policy came into effect or at a time when the relevant individual was not a Director of Unilever and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a Director of Unilever. For these purposes, ‘payments’ includes the Committee satisfying awards of variable remuneration and, in relation to an award over shares, the terms of the payment are ‘agreed’ at the time the award is granted.

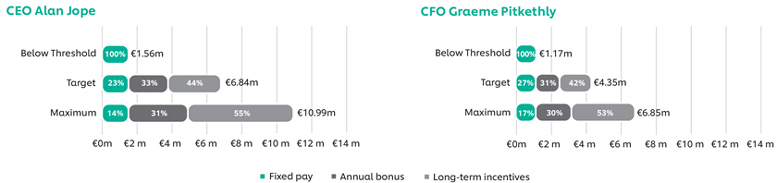

Remuneration scenarios: our emphasis on performance-related pay

It is Unilever’s policy that the total remuneration package for Executive Directors should be competitive with other global companies and that a significant proportion should be performance-related.

For the remuneration scenarios below, the maximum and target pay opportunities have been chosen to be consistent with the current levels for Executive Directors. In reviewing the appropriate level of pay opportunity for the Executive Directors, the Committee considers internal and external comparators. Although pay is not driven by benchmarking, the Committee is aware that pay needs to be within a reasonable range of competitive practice. The Committee notes that total target pay is slightly below lower quartile for the CEO and slightly below median for our CFO for the benchmark group used by the Committee.

The Committee typically reviews, on at least an annual basis, the impact of different performance scenarios on the potential reward opportunity and payouts to be received by Executive Directors and the alignment of these with the returns that might be received by shareholders. The Committee believes that the level of remuneration that can be delivered in the various scenarios is appropriate for the level of performance delivered and the value that would be delivered to shareholders. The charts below show hypothetical values of the remuneration package for Executive Directors in the first full year of the policy under below threshold, target and maximum performance scenarios.

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 83 |

Table of Contents

| 84 | Unilever Annual Report on Form 20-F 2020 |

Directors’ Remuneration Report continued

Changes in pay policy generally

The key changes in the new Remuneration Policy are to:

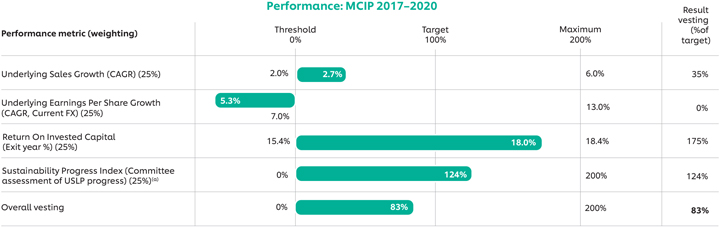

| ◾ | replace the current long-term incentive plan, the MCIP with the PSP – a long-term incentive plan that is operated entirely separately from the annual bonus plan; |

| ◾ | replace voluntary investment in the long-term incentive plan with a mandatory deferral of 50% of the annual bonus into shares or share awards, for three years; |

| ◾ | change the performance measures for the long-term incentive plan (to maximise the strategic alignment as outlined above); |

| ◾ | reduce maximum total pay; and |

| ◾ | maintain a five-year period from award to release on PSP by reducing the performance period from four years to three years, and increasing the retention period from one year to two years. |

The Committee wants to increase the impact, traction and resilience of Unilever’s incentives to drive sustainable long-term growth which can be better achieved with distinct short- and long-term incentive plans, enabling the Committee to set stretching but achievable performance targets over realistic timeframes. This change more closely aligns Unilever’s reward structure with standard market practice.

By separating short- and long-term incentive plans the policy will further simplify executive pay. Currently, these are linked by our MCIP as the MCIP opportunity is driven by the outcome of the annual bonus plan. Delinking the two plans will deleverage incentives, reduce maximum pay and make our incentives more resilient and less dependent on the short-term incentive.

Change in target and maximum pay levels

In moving from the current MCIP to the proposed PSP structure, the quantum of the previous annual bonus has been unchanged and the quantum of the PSP has been increased at target and decreased at maximum. The overall result is an increase in target pay of 13%/12% for the CEO/CFO respectively and decrease in maximum pay of 6% for both individuals.

As fixed pay and annual bonus opportunities have been unchanged, this increase in target opportunity will only be realised subject to performance against stretching three-year performance conditions and will be delivered fully in shares which executives will not normally be able to sell until five years after grant. This is to create an even stronger alignment to both the long-term performance of the business and the shareholder experience, and to address shareholder comments on the levels of maximum pay available under the previous structure.

In determining the appropriate quantum, the Committee did consider external benchmarking data against a group of comparable major European companies. Whilst the Committee is not led by benchmarking data, or target a specific benchmark position, this data is used as a reference point to ensure that pay levels are not significantly out of line with the market. Under the proposed changes total target compensation is slightly below lower quartile for our CEO and slightly below median for our CFO. This is despite the fact that Unilever is above the upper quartile of this group by market capitalisation. The Committee believes this data shows that the proposals do not provide excessive levels of remuneration versus the market. In addition, the Committee believes that a lower level of target compensation would create undue risks in terms of retention or any future recruitment.

The Committee was also cognisant of the need to maintain a sufficient pay differential between the Executive Directors and the rest of the ULE and this modest increase at target pay helps the Committee to do this.

Application beyond the Board

Remuneration arrangements are determined throughout the Group based on the same principle: that reward should support our business strategy and should be sufficient to attract and retain high-performing individuals without paying more than is necessary. Unilever is a global organisation with employees at a number of different levels of seniority and in a number of different countries and, while this principle underpins all reward arrangements, the way it is implemented varies by geography and level.

In principle, all our managers participate in the same Unilever annual bonus scheme with the same performance measures based on Unilever’s overall performance and the requirement to defer 50% of bonus also extends to the ULE. The intention is to extend the new policy across all of Unilever’s 14,400+ managers worldwide in 2021. Wherever possible, all other employees have the opportunity to participate in the global ’buy 3 get 1 free’ employee share plan called ‘SHARES’, which is offered in more than 100 countries.

Through these initiatives we continue to encourage all our employees to adopt an owner’s mindset with the goal of achieving our growth ambition, so they can share in the future long-term success of Unilever.

Stakeholders’ considerations:

Guided by our purpose-led and future-fit business model the Committee has applied a multi-stakeholder approach in reviewing the current reward framework in view of the 2021 policy renewal. The Committee has therefore engaged with various stakeholders, both internally and externally as set out below.

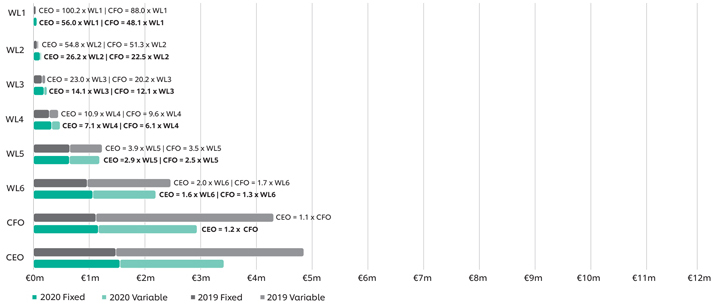

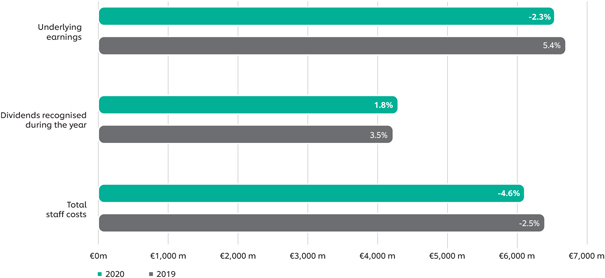

Consideration of conditions elsewhere in the Group

When determining the pay of Executive Directors, the Committee considers the pay arrangements for other employees in the Group, including considering the average global pay review budget for the management population, to ensure that remuneration arrangements for Executive Directors remain reasonable. Unilever takes the views of its employees seriously and on an ongoing basis, we conduct the ‘Rate-My-Reward’ survey to gauge the views of employees on the different parts of their reward package.

In establishing the Future Reward Framework, Unilever conducted an employee survey amongst its WL1+ population to seek their views on Unilever’s approach to reward. Interviews and focus groups have also been organised for the management population to receive feedback on the proposed Future Reward Framework. In addition, the company consulted with the European Works Council and employee representation bodies in other relevant jurisdictions. Employees value the mix between fixed and variable pay, and the various benefits (including non-cash benefits), but there is also a desire for more flexibility in reward to fit individual’s different life stages. The Future Reward Framework is well received for its simplicity and market alignment. It is seen as a more competitive, inclusive and fair reward programme. The ability to receive the bonus in cash rather than having to invest it to receive a long-term incentive award is valued in times of uncertainty caused by the Covid-19 pandemic. More senior employees would have preferred the continuation of an attractive opportunity to investment in Unilever shares. Based on feedback from the European Works Council, we will continue to explore opportunities to widen and deepen Unilever’s all-employee share scheme.

Fairness in the workplace is a core pillar of the Compass and incorporates our Framework for Fair Compensation. As part of our Framework’s living wage element, we are committed to pay a living wage to all our direct employees. At the end of 2020, 100% of Unilever’s direct employees globally were paid at or above a certified living wage level. Further detail can be found on page 19. The living wage principle is also endorsed as good practice in Unilever’s Responsible Sourcing Policy. The Committee already upholds its obligation under Section 172 of the UK Companies Act 2006 (see page 14) to consider the impact of what we do on our multiple stakeholders. These considerations shape the way the Committee looks at pay and sets pay rates for our Executive and Non-Executive Directors relative to our wider workforce. We will continue to advance these initiatives over the years ahead to enhance the livelihoods of all our employees.

www.unilever.com/planet-and-society

www.unilever.com/planet-and-society

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 85 |

Table of Contents

| 86 | Unilever Annual Report on Form 20-F 2020 |

Directors’ Remuneration Report continued

| Service contracts | ||||

| Policy in relation to Executive Director service contracts and payments in the event of loss of office | ||||

| Service contracts & notice period |

Current Executive Directors’ service contracts are not for a fixed duration but are terminable upon notice (12 months’ notice from Unilever, six months’ notice from the Executive Director), and are available for shareholders to view at the AGM or on request from the Group Secretary. Starting dates of the service contracts for the current CEO and CFO: CEO: 1 January 2019 (signed on 16 December 2020); and CFO: 1 October 2015 (signed on 16 December 2015). | |||

| Termination payments | A payment in lieu of notice can be made, to the value of no more than 12 months’ fixed pay and other benefits (unless dictated by applicable law). | |||

| Other elements | ◾ |

Executive Directors may, at the discretion of the Board, remain eligible to receive an annual bonus for the financial year in which they cease employment. Such annual bonus will be determined by the Committee taking into account time in employment and performance. | ||

| ◾ |

Treatment of share awards is as set out in the section on leaver provisions, below. | |||

| ◾ |

Any outstanding all-employee share arrangements will be treated in accordance with HMRC-approved terms. | |||

| ◾ |

Other payments, such as legal or other professional fees, repatriation or relocation costs and/or outplacement fees, may be paid if it is considered appropriate. Additional payments may be permitted at the proposal of the Committee if the Committee considers not allowing such a payment would be manifestly unreasonable given the circumstances. | |||

| ◾ |

The Committee reserves the discretion to approve gifts to Executive Directors who are retiring or who are considered by the Board to be otherwise leaving in good standing (e.g. those leaving office for any reason other than termination by Unilever or in the context of misconduct). If the value of the gift for any one Executive Director exceeds £5,000 it will be disclosed in the relevant directors’ remuneration report. Where a tax liability is incurred on any such a gift, the Committee has the discretion to approve the payment of such liability on behalf of the Executive Director in addition to the value of the gift. | |||

| Leaver provisions in share plan rules | ||||||

| ‘Good leavers’ as determined by the Committee in accordance with the plan rules*

|

Leavers in other circumstances* |

Change of control | ||||

| Investment shares under the MCIP |

Investment shares are not impacted by termination (although they may be transferred to the personal representative of the Executive Director in the event of his or her death without causing the corresponding matching shares to lapse). | Investment shares are not impacted by termination. | Investment shares may normally be disposed of in connection with a change of control without causing the corresponding matching shares to lapse. Alternatively, Executive Directors may be required to exchange the investment shares for equivalent shares in the acquiring company.

| |||

| PSP awards and awards of matching shares under MCIP | Awards will normally vest following the end of the original performance period, taking into account performance and (unless the Board on the proposal of the Committee determine otherwise) pro-rated for time in employment. Alternatively, the Board may determine that awards shall vest upon termination based on performance at that time and pro-rated for time in employment (unless the Board on the proposal of the Committee determine otherwise). If an Executive Director dies or leaves due to ill health, injury or disability, awards will vest at the time of death or leaving at the target level of vesting (in case of death pro-rated for time in employment if the Director had previously left as a good leaver).

|

Awards will normally lapse upon termination. | Awards will vest based on performance at the time of the change of control and the Board, on the proposal of the Committee, have the discretion to pro-rate for time. Alternatively, Executive Directors may be required to exchange the awards for equivalent awards over shares in the acquiring company.

The retention period of a PSP award will end on a change of control. | |||

|

Deferred bonus awards |

Unvested deferred bonus awards will continue in effect and vest on the normal timescale unless the Executive Director is terminated for misconduct or breach of the terms of their employment, unless the Committee decides otherwise.

|

Unvested deferred bonus awards vest in full. | ||||

| * | An Executive Director will usually be treated as a good leaver if he or she leaves due to ill health, injury or disability, retirement with Unilever’s agreement or redundancy, or death in service. The Board may decide to treat an Executive Director who leaves in other circumstances as a good leaver. An Executive Director will not be treated as a good leaver if he or she chooses to leave for another job elsewhere unless the Board determines otherwise, if he or she is summarily dismissed or leaves because of concerns about performance. In deciding whether or not to treat an Executive Director as a good leaver, the Board will have regard to his or her performance in the role. |

If Unilever is affected by a demerger, special distribution or other transaction which may affect the value of awards, the Committee may allow PSP awards, matching shares under legacy MCIP and/or deferred bonus awards to vest early over such number of shares as it shall determine (to the extent any performance measures have been met) and awards may be pro-rated to reflect the acceleration of vesting at the Committee’s discretion.

Table of Contents

| Unilever Annual Report on Form 20-F 2020 | 87 |

Table of Contents

| 88 | Unilever Annual Report on Form 20-F 2020 |

Directors’ Remuneration Report continued

Annual report on remuneration

This section sets out how Unilever’s remuneration policy (which was approved by shareholders at the May 2018 AGMs and is available on our website) was implemented in 2020. Furthermore, the following sets out how our new Remuneration Policy (as set out on pages 79 to 87) will be implemented if it receives shareholder approval at the 2021 AGM.

www.unilever.com/remuneration-policy

www.unilever.com/remuneration-policy

Implementation of the Remuneration Policy for Executive Directors

If approved by shareholders, Unilever’s new Remuneration Policy will be implemented with effect from the 2021 AGM as set out below. If the updated Remuneration Policy is not approved, Unilever’s existing remuneration policy will continue to apply.

| Elements of remuneration | ||

| Fixed Pay | ||

| Purpose and link to strategy | Supports the recruitment and retention of Executive Directors of the calibre required to implement our strategy. Reflects the individual’s skills, experience, performance and role within the Group. Provides a simple competitive alternative to the separate provision of salary, fixed allowance and pension. | |

| At a glance | Details of the rationale for our Executive Directors’ fixed pay amounts can be found on page 78. | |

| Implementation in 2020 | Effective from January 2020: | |

| ◾ CEO: €1,508,000 | ||

| ◾ CFO: € 1,135,960 | ||

| Planned for 2021 | Effective from January 2021: ◾ CEO: €1,508,000 ◾ CFO: € 1,135,960 | |

| Annual Bonus | ||

| Purpose and link to strategy | Incentivises year-on-year delivery of rigorous short-term financial, strategic and operational objectives selected to support our annual business strategy and the ongoing enhancement of shareholder value. | |

| The ability to recognise performance through an annual bonus enables us to manage our cost base flexibly and react to events and market circumstances. | ||

| At a glance | ◾ Target annual bonus of 150% of fixed pay for the CEO and 120% of fixed pay for the CFO. | |

| ◾ Business performance multiplier of between 0% and 150% based on achievement against business targets over the year. | ||

| ◾ Performance target ranges are considered to be commercially sensitive and will be disclosed in full with the corresponding performance outcomes retrospectively following the end of the relevant performance year. | ||

| ◾ Maximum annual bonus is 225% of fixed pay for the CEO and 180% for the CFO. | ||

| ◾ Subject to ultimate remedy/malus and claw-back provisions. | ||

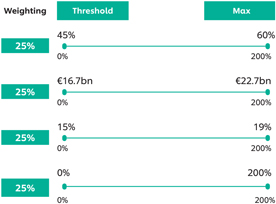

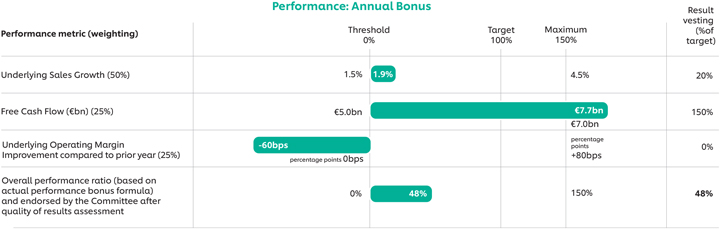

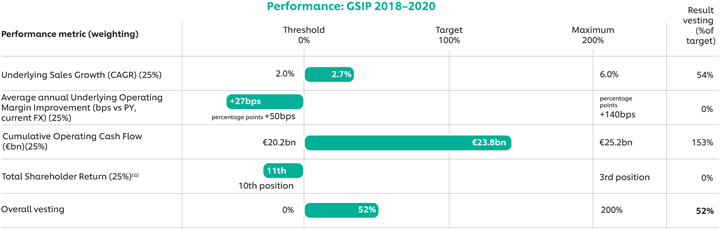

| Implementation in 2020 | Implemented in line with the 2018 remuneration policy; however, the weight attached to each performance measure changed to reflect management’s focus on delivering growth as a key priority for 2020 (pre Covid 19): | |

| ◾ Underlying Sales Growth: 50% | ||

| ◾ Underlying Operating Margin Improvement: 25% | ||

| ◾ Free Cash Flow: 25% | ||