UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 02753

Guggenheim Variable Funds Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Guggenheim Variable Funds Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: January 1, 2022 - December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Reports to Stockholders.

|

12.31.2022

Guggenheim Variable Funds Trust Annual Report

Series |

||

Series A |

(StylePlus—Large Core Series) |

|

Series B |

(Large Cap Value Series) |

|

Series D |

(World Equity Income Series) |

|

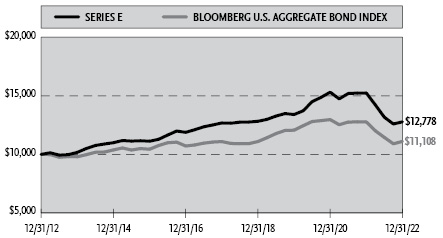

Series E |

(Total Return Bond Series) |

|

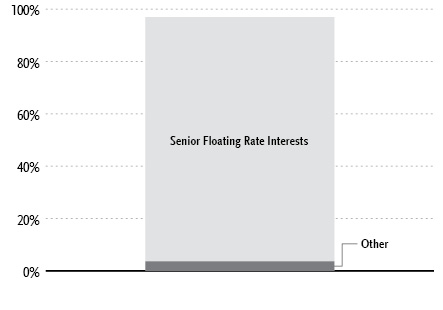

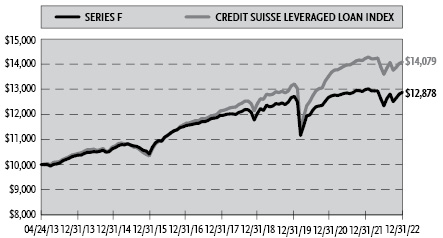

Series F |

(Floating Rate Strategies Series) |

|

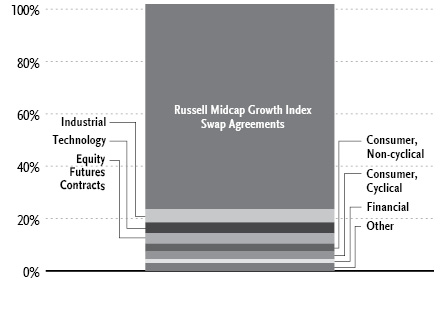

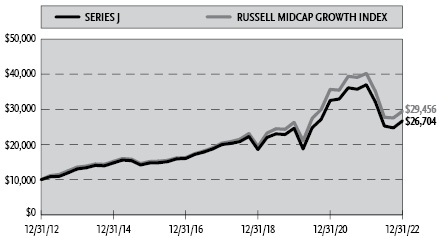

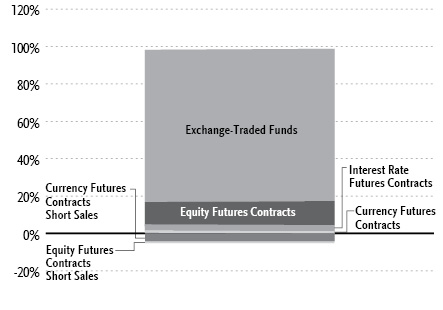

Series J |

(StylePlus—Mid Growth Series) |

|

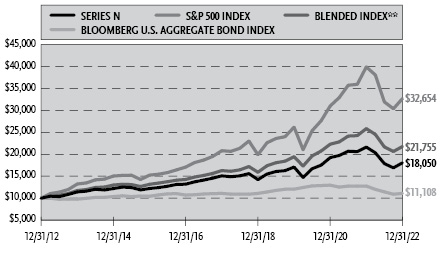

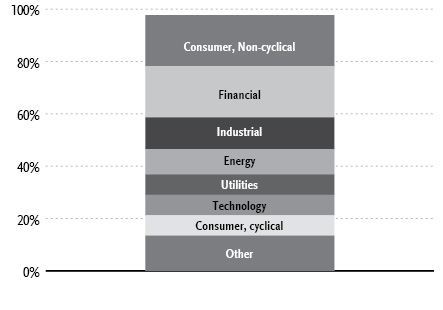

Series N |

(Managed Asset Allocation Series) |

|

Series O |

(All Cap Value Series) |

|

Series P |

(High Yield Series) |

|

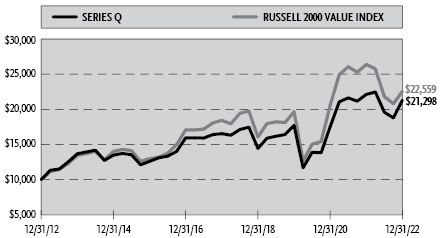

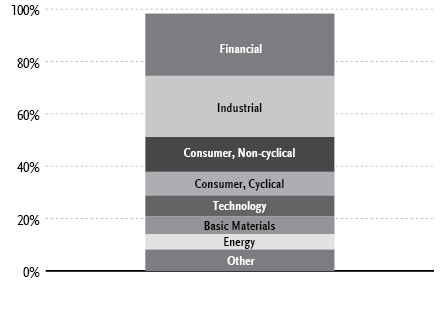

Series Q |

(Small Cap Value Series) |

|

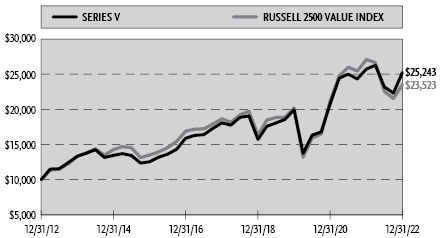

Series V |

(SMid Cap Value Series) |

|

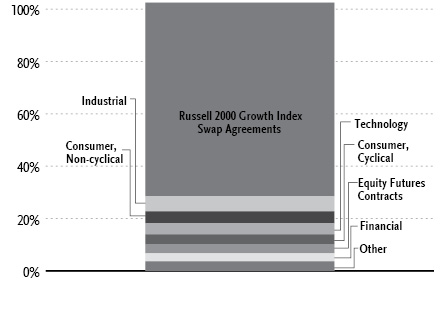

Series X |

(StylePlus—Small Growth Series) |

|

Series Y |

(StylePlus—Large Growth Series) |

|

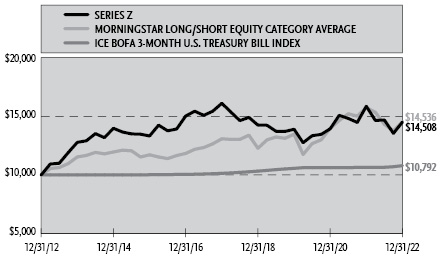

Series Z |

(Alpha Opportunity Series) |

|

GuggenheimInvestments.com |

GVFT-ANN-1222x1223 |

TABLE OF CONTENTS |

DEAR SHAREHOLDER |

2 |

ECONOMIC AND MARKET OVERVIEW |

5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES |

7 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

9 |

SERIES B (LARGE CAP VALUE SERIES) |

18 |

SERIES D (WORLD EQUITY INCOME SERIES) |

26 |

SERIES E (TOTAL RETURN BOND SERIES) |

35 |

SERIES F (FLOATING RATE STRATEGIES SERIES) |

57 |

SERIES J (STYLEPLUS—MID GROWTH SERIES) |

72 |

SERIES N (MANAGED ASSET ALLOCATION SERIES) |

82 |

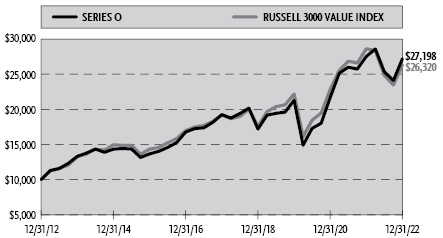

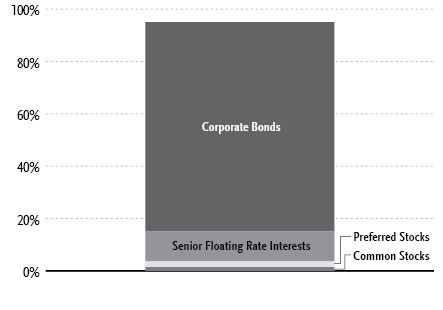

SERIES O (ALL CAP VALUE SERIES) |

91 |

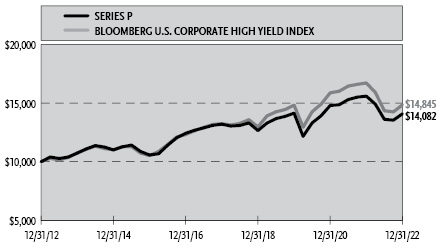

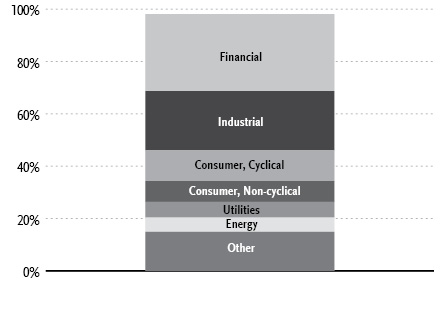

SERIES P (HIGH YIELD SERIES) |

101 |

SERIES Q (SMALL CAP VALUE SERIES) |

116 |

SERIES V (SMID CAP VALUE SERIES) |

125 |

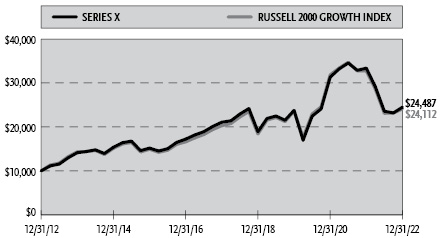

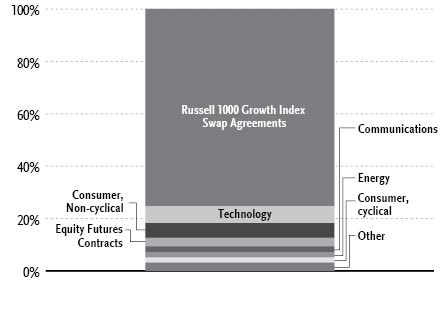

SERIES X (STYLEPLUS—SMALL GROWTH SERIES) |

135 |

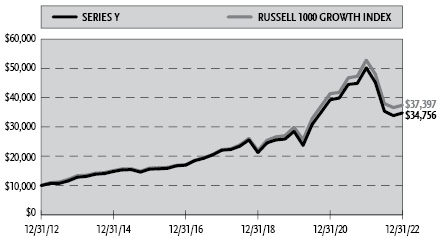

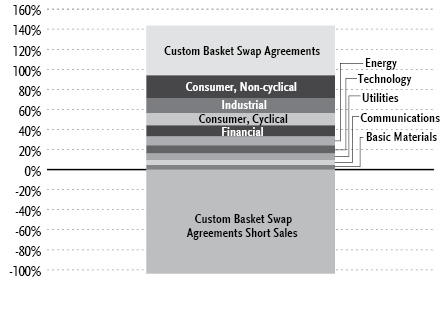

SERIES Y (STYLEPLUS—LARGE GROWTH SERIES) |

145 |

SERIES Z (ALPHA OPPORTUNITY SERIES) |

154 |

NOTES TO FINANCIAL STATEMENTS |

172 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

197 |

OTHER INFORMATION |

198 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS |

200 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE |

205 |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 1 |

|

December 31, 2022 |

Dear Shareholder:

Security Investors, LLC and Guggenheim Partners Investment Management, LLC (“SI”, “GPIM”, or the “Investment Advisers”) are pleased to present the annual shareholder report for funds that are part of the Guggenheim Variable Funds Trust (the “Funds”). This report covers performance of the Funds for the annual period ended December 31, 2022 (the “Reporting Period”).

In December 2022, Guggenheim Partners announced the untimely and unexpected death of Scott Minerd, one of Guggenheim’s Managing Partners and its Global Chief Investment Officer. He joined Guggenheim as a Managing Partner shortly after the firm was formed. He was a frequent commentator on markets and investments, both on television and via social media. He also was one of the designers of the organization, systems and processes that make Guggenheim Investments a strong, robust and scalable leader in the asset management business.

Guggenheim has implemented its succession plan, which is designed to deal with unexpected events. There has been and will continue to be no disruption of service to our clients, no change in the daily management of client portfolios and no change in the process of selecting investment assets, all of which continue to be handled by the longstanding committees and long-tenured investment professionals who, every day, implement our investment processes.

Guggenheim Investments continues to be led by its Co-Presidents, Dina DiLorenzo and David Rone, and by Anne B. Walsh, a Managing Partner and Chief Investment Officer of Guggenheim Partners Investment Management. Ms. Walsh will continue her current role leading the team managing client investments and will assume many of Mr. Minerd’s responsibilities on an interim basis.

The Investment Advisers are part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Advisers.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter, and then the Performance Report and Fund Profile for each Fund.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security

Investors, LLC

Guggenheim Partners Investment Management, LLC

January 31, 2023

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

The Series StylePlus Funds may not be suitable for all investors. Investments in large capitalization stocks may underperform other segments of the equity market or the equity market as a whole. ● Investments in small-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. ● Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. ● The Funds may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● The Funds’ use of leverage, through borrowings or instruments such as derivatives, may cause the Funds to be more volatile than if they had not been leveraged. ● The Funds’ investments in other investment vehicles subject the Funds to those risks and expenses affecting the investment vehicle. ● The Funds may invest in foreign securities which carry

2 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

|

December 31, 2022 |

additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). ● The Funds may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Funds’ exposure to high yield securities may subject the Funds to greater volatility. ● The Funds may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. ● The Funds may invest in restricted securities which may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Funds are not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series Value Funds may not be suitable for all investors. ● An investment in the Funds will fluctuate and is subject to investment risks, which means investors could lose money. The intrinsic value of the underlying stocks may never be realized or the stocks may decline in value. Investments in small- and/or mid-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series D (World Equity Income Series) may not be suitable for all investors. ● Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. ●The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets are generally subject to an even greater level of risks). Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. Dollar. ● The Fund’s investments in derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. ●The Fund’s use of leverage, through instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ●The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ●The Fund may have significant exposure to securities in a particular capitalization range e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the pre-denominate capitalization range may underperform other segments of the equity market or the equity market as a whole. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series E (Total Return Bond Series) may not be suitable for all investors. ● The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● When market conditions are deemed appropriate, the Fund will leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. ● Investments in reverse repurchase agreements expose the Fund to many of the same risks as investments in derivatives. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political, or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. ● The Fund’s investments in municipal securities can be affected by events that affect the municipal bond market. ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s investments in restricted securities may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series F (Floating Rate Strategies Series) may not be suitable for all investors. ● Investments in floating rate senior secured syndicated bank loans and other floating rate securities involve special types of risks, including credit rate risk, interest rate risk, liquidity risk and prepayment risk. ● The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● When market conditions are deemed appropriate, the Fund may use leverage to the full extent permitted by its investment policies and restrictions and applicable law. Leveraging will exaggerate the effect on net asset value of any increase or decrease in the market value of the Fund’s portfolio. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ● Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. ● Investments in reverse repurchase agreements and synthetic instruments (such as synthetic collateralized debt obligations) expose the Fund to many of the same risks as investments in derivatives. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risk). ● The Fund’s investments in real estate securities subject the Fund to the same risks as direct investments in real estate, which is particularly sensitive to economic downturns. ● The Fund’s investments in restricted securities may involve financial and liquidity risk. ● The Fund is subject to active trading risks that may increase volatility and impact its ability to achieve its investment objective. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series N (Managed Asset Allocation Series) may not be suitable for all investors. ● The value of an investment in the Fund will fluctuate and is subject to investment risks, which means investors could lose money. The Fund could lose money if the issuer of a bond or a counterparty to a derivatives transaction or other transaction is unable to repay interest and principal on time or defaults. The issuer of a bond could also suffer a decrease in quality rating, which would affect the volatility and liquidity of the bond. Derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including the risk that the Fund will be unable to sell, unwind or value the derivative because of an illiquid market, the risk that the derivative is not well correlated with underlying investments or the Fund’s other portfolio holdings, and the risk that the counterparty is unwilling or unable to meet its obligation. The use of derivatives by the Fund to hedge risk may reduce the opportunity for gain by offsetting the positive effect of favorable price movements. Furthermore, if the Investment Manager is incorrect about its expectations of market conditions, the use of derivatives could result in a loss, which in some cases may be unlimited. Foreign securities carry additional risks when compared to U.S. securities, including currency fluctuations, adverse political and economic developments, unreliable or untimely information, less liquidity, limited legal recourse and higher transactional costs. The Investment Manager may not be able to cause certain of the underlying funds’ performance to match or correlate to that of the underlying funds’

THE GUGGENHEIM FUNDS ANNUAL REPORT | 3 |

|

December 31, 2022 |

respective underlying index or benchmark, either on a daily or aggregate basis. Factors such as underlying fund expenses, imperfect correlation between an underlying fund’s investments and those of its underlying index or underlying benchmark, rounding of share prices, changes to the composition of the underlying index or underlying benchmark, regulatory policies, high portfolio turnover rate, and the use of leverage all contribute to tracking error. Tracking error may cause an underlying fund’s and, thus the Fund’s, performance to be less than you expect. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series P (High Yield Series) may not be suitable for all investors. ● The Fund’s market value will change in response to interest rate changes and market conditions among other factors. In general, bond prices rise when interest rates fall and vice versa. ● The Fund’s exposure to high yield securities may subject the Fund to greater volatility. ● The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. ●The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. ● Instruments and strategies (such as borrowing transactions and reverse repurchase agreements) may provide leveraged exposure to a particular investment, which will magnify any gains or losses on those investments. ● The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). ● Investments in syndicated bank loans generally offer a floating interest rate and involve special types of risks. ● The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. ● The Fund’s investments in restricted securities may involve financial and liquidity risk. ● You may have a gain or loss when you sell your shares. ● It is important to note that the Fund is not guaranteed by the U.S. government. ● Please read the prospectus for more detailed information regarding these and other risks.

The Series Z (Alpha Opportunity Series) may not be suitable for all investors. ● Investments in securities and derivatives, in general, are subject to market risks that may cause their prices to fluctuate over time. An investment in the Fund may lose money. There can be no guarantee the Fund will achieve it investment objective. ●The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● Certain of the derivative instruments, such as swaps and structured notes, are also subject to the risks of counterparty default and adverse tax treatment. ●The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risk and costs, including paying more for a security than it received from its sale and the risk of unlimited losses. ●In certain circumstances the Fund may be subject to liquidity risk and it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. ●The Fund’s fixed income investments will change in value in response to interest rate changes and other factors. ● Please read the prospectus for more detailed information regarding these and other risks.

4 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

ECONOMIC AND MARKET OVERVIEW (Unaudited) |

December 31, 2022 |

Helped by lower energy prices, real economic growth reaccelerated in the fourth quarter of 2022. Amid this continued strong growth, the Federal Reserve (the “Fed”) is explicitly targeting a weaker labor market, and several leading indicators point to rising unemployment by the middle of the year. Consumption also faces headwinds from dwindling excess savings buffers and a sharply negative wealth shock as financial asset and home prices fall. Business investment also appears to be weakening due to the sharp tightening in financial conditions and more challenging outlook for economic growth. The housing sector could subtract further from gross domestic product (“GDP”) as the spike in mortgage rates has adversely impacted demand.

Because private sector balance sheets are generally healthy in the aggregate and the economy lacks major imbalances, we do not expect a particularly deep recession. But the likelihood of a limited monetary and fiscal policy response means the economic recovery could be weak, and certain highly levered companies may suffer.

Moderation in goods prices as supply chains normalize should bring inflation lower over the next several months, and shelter inflation should roll over by mid-2023. Services inflation outside of shelter is the main concern for the Fed, but a softening labor market and cooling wage growth may keep this category contained. As a result, core inflation could fall below 3 percent by the end of the year.

The Fed’s continued rate hike campaign may cause the front end of the yield curve to remain elevated in the near term. But should the economic cycle roll over later this year, Treasury yields may see a significant decline. Weakening corporate earnings growth and an emerging recession would present downside risk to equity returns later in 2023 but, given corporate fundamentals remain solid, high quality fixed income and carefully selected high yield issuers should provide attractive returns.

For the Reporting Period, the S&P 500® Index* returned -18.11%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned -14.45%. The return of the MSCI Emerging Markets Index* was -20.09%.

In the bond market, the Bloomberg U.S. Aggregate Bond Index* posted a -13.01% return for the Reporting Period, while the Bloomberg U.S. Corporate High Yield Index* returned -11.19%. The return of the ICE Bank of America (“BofA”) 3-Month U.S. Treasury Bill Index* was 1.47% for the Reporting Period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market.

ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World (Net) Index is calculated with net dividends reinvested. It is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

THE GUGGENHEIM FUNDS ANNUAL REPORT | 5 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) |

December 31, 2022 |

Morningstar Long/Short Equity Category Average represents long-short portfolios which hold sizable stakes in both long and short positions in equities and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom-up research. Some funds may simply hedge long stock positions through exchange traded funds or derivatives. At least 75% of the assets are in equity securities or derivatives.

Russell 3000® Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market.

Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2500® Value Index measures the performance of the small- to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth value.

Russell 1000® Value Index: A measure of the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

Russell Midcap® Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

S&P 500® Index is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

6 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) |

|

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning June 30, 2022 and ending December 31, 2022.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

THE GUGGENHEIM FUNDS ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) |

|

|

Expense |

Fund |

Beginning |

Ending |

Expenses |

Table 1. Based on actual Fund return3 |

|||||

Series A (StylePlus—Large Core Series) |

0.97% |

1.63% |

$ 1,000.00 |

$ 1,016.30 |

$ 4.93 |

Series B (Large Cap Value Series) |

0.77% |

7.10% |

1,000.00 |

1,071.00 |

4.02 |

Series D (World Equity Income Series) |

0.87% |

3.95% |

1,000.00 |

1,039.50 |

4.47 |

Series E (Total Return Bond Series) |

0.92% |

(2.97%) |

1,000.00 |

970.30 |

4.57 |

Series F (Floating Rate Strategies Series) |

1.15% |

4.37% |

1,000.00 |

1,043.70 |

5.92 |

Series J (StylePlus—Mid Growth Series) |

1.00% |

5.73% |

1,000.00 |

1,057.30 |

5.19 |

Series N (Managed Asset Allocation Series) |

0.97% |

1.01% |

1,000.00 |

1,010.10 |

4.91 |

Series O (All Cap Value Series) |

0.85% |

7.41% |

1,000.00 |

1,074.10 |

4.44 |

Series P (High Yield Series) |

1.05% |

3.44% |

1,000.00 |

1,034.40 |

5.38 |

Series Q (Small Cap Value Series) |

1.11% |

8.72% |

1,000.00 |

1,087.20 |

5.84 |

Series V (SMid Cap Value Series) |

0.88% |

8.84% |

1,000.00 |

1,088.40 |

4.63 |

Series X (StylePlus—Small Growth Series) |

1.03% |

3.93% |

1,000.00 |

1,039.30 |

5.29 |

Series Y (StylePlus—Large Growth Series) |

0.94% |

(1.75%) |

1,000.00 |

982.50 |

4.70 |

Series Z (Alpha Opportunity Series) |

1.98% |

(1.22%) |

1,000.00 |

987.80 |

9.92 |

|

|||||

Table 2. Based on hypothetical 5% return (before expenses) |

|||||

Series A (StylePlus—Large Core Series) |

0.97% |

5.00% |

$ 1,000.00 |

$ 1,020.32 |

$ 4.94 |

Series B (Large Cap Value Series) |

0.77% |

5.00% |

1,000.00 |

1,021.32 |

3.92 |

Series D (World Equity Income Series) |

0.87% |

5.00% |

1,000.00 |

1,020.82 |

4.43 |

Series E (Total Return Bond Series) |

0.92% |

5.00% |

1,000.00 |

1,020.57 |

4.69 |

Series F (Floating Rate Strategies Series) |

1.15% |

5.00% |

1,000.00 |

1,019.41 |

5.85 |

Series J (StylePlus—Mid Growth Series) |

1.00% |

5.00% |

1,000.00 |

1,020.16 |

5.09 |

Series N (Managed Asset Allocation Series) |

0.97% |

5.00% |

1,000.00 |

1,020.32 |

4.94 |

Series O (All Cap Value Series) |

0.85% |

5.00% |

1,000.00 |

1,020.92 |

4.33 |

Series P (High Yield Series) |

1.05% |

5.00% |

1,000.00 |

1,019.91 |

5.35 |

Series Q (Small Cap Value Series) |

1.11% |

5.00% |

1,000.00 |

1,019.61 |

5.65 |

Series V (SMid Cap Value Series) |

0.88% |

5.00% |

1,000.00 |

1,020.77 |

4.48 |

Series X (StylePlus—Small Growth Series) |

1.03% |

5.00% |

1,000.00 |

1,020.01 |

5.24 |

Series Y (StylePlus—Large Growth Series) |

0.94% |

5.00% |

1,000.00 |

1,020.47 |

4.79 |

Series Z (Alpha Opportunity Series) |

1.98% |

5.00% |

1,000.00 |

1,015.22 |

10.06 |

1 |

Annualized and excludes expenses of the underlying funds in which the Funds invest, if any. This ratio represents net expenses, which may include expenses that are excluded from the expense limitation agreement and affiliated waivers. Excluding these expenses, the net expense ratios for the period would be: |

Fund |

12/31/22 |

|

Series A (StylePlus—Large Core Series) |

0.87% |

|

Series B (Large Cap Value Series) |

0.77% |

|

Series D (World Equity Income Series) |

0.86% |

|

Series E (Total Return Bond Series) |

0.76% |

|

Series F (Floating Rate Strategies Series) |

1.13% |

|

Series J (StylePlus—Mid Growth Series) |

0.91% |

|

Series O (All Cap Value Series) |

0.85% |

|

Series P (High Yield Series) |

1.05% |

|

Series Q (Small Cap Value Series) |

1.11% |

|

Series V (SMid Cap Value Series) |

0.88% |

|

Series X (StylePlus—Small Growth Series) |

1.03% |

|

Series Y (StylePlus—Large Growth Series) |

0.88% |

|

Series Z (Alpha Opportunity Series) |

1.98% |

2 |

Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses shown do not include fees charged by insurance companies. |

3 |

Actual cumulative return at net asset value for the period June 30, 2022 to December 31, 2022. |

8 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

MANAGERS’ COMMENTARY (Unaudited) |

December 31, 2022 |

To Our Shareholders

The Series A (StylePlusTM—Large Core Series, or the “Fund”) is managed by a team of seasoned professionals, including Farhan Sharaff, Senior Managing Director and Assistant Chief Investment Officer, Equities, and Portfolio Manager; Qi Yan, Managing Director and Portfolio Manager; and Adam J. Bloch, Managing Director and Portfolio Manager. In the subsequent paragraphs, the investment team discusses the Fund’s performance for the 12-month period ended December 31, 2022 (the “Reporting Period”).

For the Reporting Period, the Fund provided a total return of -20.67%, underperforming the S&P 500 Index (“Index”), the Fund’s benchmark, which returned -18.11% for the same period.

What factors contributed or detracted from the Fund’s performance during the Reporting Period?

Over the Reporting Period, 15%-25% of the total equity position was allocated to actively managed equity and 75%-85% to passive equity. Remaining Fund assets were invested in the Guggenheim Strategy Funds, short-term fixed-income investment companies advised by Guggenheim Investments, and the Guggenheim Ultra Short Duration Fund, whose objective is to seek a high level of income consistent with the preservation of capital.

The Fund underperformed the S&P 500 Index for the Reporting Period by 2.6% net of fees. During this Reporting Period, active equity and active fixed income contributed 0.2% and -0.8% to the Fund’s relative return differential, respectively. The remainder resulted from equity index swap cost, implementation shortfall and Fund’s expenses.

How did the Fund use derivatives during the Reporting Period?

The passive equity component, which accounted for 75%-85% of the Fund’s exposure to the broad equity market, consisted of equity index swaps and equity index futures. On average, the equity index futures accounted for 0%-5% of the overall exposure, with the remainder from equity index swaps.

Performance displayed represents past performance which is no guarantee of future results.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

THE GUGGENHEIM FUNDS ANNUAL REPORT | 9 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) |

December 31, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

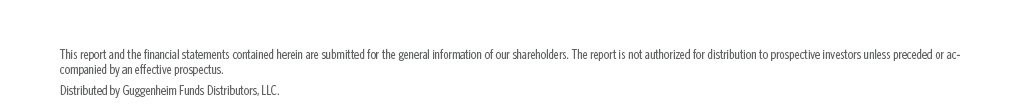

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund.

Inception Date: May 1, 1979 |

Ten Largest Holdings |

(% of Total Net Assets) |

Guggenheim Strategy Fund III |

27.9% |

Guggenheim Variable Insurance Strategy Fund III |

27.2% |

Guggenheim Ultra Short Duration Fund — Institutional Class |

13.2% |

Guggenheim Strategy Fund II |

10.8% |

Microsoft Corp. |

1.2% |

Apple, Inc. |

1.2% |

Alphabet, Inc. — Class C |

0.6% |

Exxon Mobil Corp. |

0.5% |

Visa, Inc. — Class A |

0.4% |

Home Depot, Inc. |

0.4% |

Top Ten Total |

83.4% |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

|

10 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) |

December 31, 2022 |

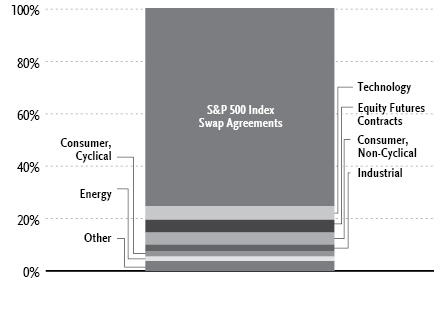

Cumulative Fund Performance*,†

Average Annual Returns*,†

Periods Ended December 31, 2022

|

1 Year |

5 Year |

10 Year |

Series A (StylePlus—Large Core Series) |

(20.67%) |

8.01% |

11.89% |

S&P 500 Index |

(18.11%) |

9.42% |

12.56% |

* |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

† |

Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 11 |

SCHEDULE OF INVESTMENTS |

December 31, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

|

Shares |

Value |

||||||

COMMON STOCKS† - 19.8% |

||||||||

Technology - 5.2% |

||||||||

Microsoft Corp. |

10,019 | $ | 2,402,757 | |||||

Apple, Inc. |

18,333 | 2,382,007 | ||||||

QUALCOMM, Inc. |

4,079 | 448,445 | ||||||

Applied Materials, Inc. |

3,884 | 378,224 | ||||||

Skyworks Solutions, Inc. |

4,143 | 377,552 | ||||||

NXP Semiconductor N.V. |

2,289 | 361,731 | ||||||

Microchip Technology, Inc. |

5,113 | 359,188 | ||||||

Texas Instruments, Inc. |

2,147 | 354,727 | ||||||

Hewlett Packard Enterprise Co. |

21,387 | 341,337 | ||||||

International Business Machines Corp. |

2,306 | 324,892 | ||||||

KLA Corp. |

846 | 318,967 | ||||||

NetApp, Inc. |

5,274 | 316,756 | ||||||

HP, Inc. |

10,930 | 293,689 | ||||||

Broadcom, Inc. |

498 | 278,447 | ||||||

Seagate Technology Holdings plc |

4,868 | 256,105 | ||||||

Adobe, Inc.* |

704 | 236,917 | ||||||

ON Semiconductor Corp.* |

3,388 | 211,309 | ||||||

Qorvo, Inc.* |

2,279 | 206,569 | ||||||

Micron Technology, Inc. |

3,314 | 165,634 | ||||||

NVIDIA Corp. |

984 | 143,802 | ||||||

Total Technology |

10,159,055 | |||||||

Consumer, Non-cyclical - 4.6% |

||||||||

Philip Morris International, Inc. |

5,778 | 584,792 | ||||||

Bristol-Myers Squibb Co. |

7,681 | 552,648 | ||||||

Gilead Sciences, Inc. |

6,165 | 529,265 | ||||||

Quest Diagnostics, Inc. |

2,903 | 454,145 | ||||||

Hershey Co. |

1,948 | 451,098 | ||||||

Pfizer, Inc. |

8,702 | 445,891 | ||||||

Johnson & Johnson |

2,473 | 436,856 | ||||||

Vertex Pharmaceuticals, Inc.* |

1,490 | 430,282 | ||||||

Hologic, Inc.* |

5,732 | 428,811 | ||||||

Incyte Corp.* |

5,212 | 418,628 | ||||||

Altria Group, Inc. |

9,113 | 416,555 | ||||||

Tyson Foods, Inc. — Class A |

6,035 | 375,679 | ||||||

Organon & Co. |

13,366 | 373,312 | ||||||

Amgen, Inc. |

1,320 | 346,685 | ||||||

Merck & Company, Inc. |

3,071 | 340,727 | ||||||

General Mills, Inc. |

3,500 | 293,475 | ||||||

UnitedHealth Group, Inc. |

538 | 285,237 | ||||||

Regeneron Pharmaceuticals, Inc.* |

394 | 284,267 | ||||||

AbbVie, Inc. |

1,710 | 276,353 | ||||||

United Rentals, Inc.* |

718 | 255,192 | ||||||

FleetCor Technologies, Inc.* |

1,316 | 241,723 | ||||||

Campbell Soup Co. |

3,720 | 211,110 | ||||||

Eli Lilly & Co. |

556 | 203,407 | ||||||

Procter & Gamble Co. |

827 | 125,340 | ||||||

Coca-Cola Co. |

1,937 | 123,212 | ||||||

PepsiCo, Inc. |

671 | 121,223 | ||||||

Total Consumer, Non-cyclical |

9,005,913 | |||||||

Industrial - 2.7% |

||||||||

Lockheed Martin Corp. |

1,116 | 542,923 | ||||||

Emerson Electric Co. |

4,997 | 480,012 | ||||||

3M Co. |

3,937 | 472,125 | ||||||

General Dynamics Corp. |

1,893 | 469,672 | ||||||

Otis Worldwide Corp. |

5,708 | 446,993 | ||||||

Textron, Inc. |

5,908 | 418,287 | ||||||

Snap-on, Inc. |

1,759 | 401,914 | ||||||

Packaging Corporation of America |

3,126 | 399,847 | ||||||

Sealed Air Corp. |

7,939 | 395,997 | ||||||

Keysight Technologies, Inc.* |

2,047 | 350,180 | ||||||

Masco Corp. |

6,800 | 317,356 | ||||||

Allegion plc |

2,562 | 269,676 | ||||||

Fortune Brands Innovations, Inc. |

2,393 | 136,664 | ||||||

A O Smith Corp. |

2,367 | 135,487 | ||||||

Masterbrand, Inc.* |

2,393 | 18,067 | ||||||

Total Industrial |

5,255,200 | |||||||

Consumer, Cyclical - 1.9% |

||||||||

Home Depot, Inc. |

2,243 | 708,474 | ||||||

McDonald’s Corp. |

2,404 | 633,526 | ||||||

Lowe’s Companies, Inc. |

2,700 | 537,948 | ||||||

Yum! Brands, Inc. |

3,545 | 454,044 | ||||||

PACCAR, Inc. |

3,784 | 374,503 | ||||||

NVR, Inc.* |

74 | 341,331 | ||||||

Cummins, Inc. |

1,332 | 322,730 | ||||||

Tesla, Inc.* |

1,302 | 160,380 | ||||||

Bath & Body Works, Inc. |

3,337 | 140,621 | ||||||

Walmart, Inc. |

796 | 112,865 | ||||||

Total Consumer, Cyclical |

3,786,422 | |||||||

Energy - 1.7% |

||||||||

Exxon Mobil Corp. |

8,900 | 981,670 | ||||||

Marathon Petroleum Corp. |

4,137 | 481,506 | ||||||

Valero Energy Corp. |

3,771 | 478,389 | ||||||

Occidental Petroleum Corp. |

7,011 | 441,623 | ||||||

Kinder Morgan, Inc. |

19,253 | 348,094 | ||||||

Phillips 66 |

2,730 | 284,138 | ||||||

Chevron Corp. |

1,581 | 283,774 | ||||||

Total Energy |

3,299,194 | |||||||

Communications - 1.6% |

||||||||

Alphabet, Inc. — Class C* |

13,814 | 1,225,716 | ||||||

Cisco Systems, Inc. |

13,380 | 637,423 | ||||||

Amazon.com, Inc.* |

7,483 | 628,572 | ||||||

VeriSign, Inc.* |

1,913 | 393,007 | ||||||

Meta Platforms, Inc. — Class A* |

2,523 | 303,618 | ||||||

Total Communications |

3,188,336 | |||||||

Financial - 1.3% |

||||||||

Visa, Inc. — Class A |

3,448 | 716,356 | ||||||

Mastercard, Inc. — Class A |

1,257 | 437,097 | ||||||

Goldman Sachs Group, Inc. |

1,094 | 375,658 | ||||||

Berkshire Hathaway, Inc. — Class B* |

1,152 | 355,853 | ||||||

JPMorgan Chase & Co. |

2,560 | 343,296 | ||||||

Bank of New York Mellon Corp. |

5,426 | 246,991 | ||||||

Prologis, Inc. REIT |

1,126 | 126,934 | ||||||

Total Financial |

2,602,185 | |||||||

12 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (continued) |

December 31, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

|

Shares |

Value |

||||||

Basic Materials - 0.6% |

||||||||

LyondellBasell Industries N.V. — Class A |

4,432 | $ | 367,989 | |||||

Dow, Inc. |

6,830 | 344,164 | ||||||

FMC Corp. |

1,013 | 126,422 | ||||||

Mosaic Co. |

2,527 | 110,859 | ||||||

CF Industries Holdings, Inc. |

1,194 | 101,729 | ||||||

Total Basic Materials |

1,051,163 | |||||||

Utilities - 0.2% |

||||||||

FirstEnergy Corp. |

10,472 | 439,196 | ||||||

Total Common Stocks |

||||||||

(Cost $39,118,525) |

38,786,664 | |||||||

MUTUAL FUNDS† - 79.1% |

||||||||

Guggenheim Strategy Fund III1 |

2,276,730 | 54,778,133 | ||||||

Guggenheim Variable Insurance Strategy Fund III1 |

2,219,814 | 53,430,927 | ||||||

Guggenheim Ultra Short Duration Fund — Institutional Class1 |

2,689,258 | 25,924,450 | ||||||

Guggenheim Strategy Fund II1 |

876,832 | 21,079,040 | ||||||

Total Mutual Funds |

||||||||

(Cost $160,401,178) |

155,212,550 | |||||||

MONEY MARKET FUND† - 0.6% |

||||||||

Dreyfus Treasury Securities Cash Management Fund — Institutional Shares, 3.90%2 |

1,137,805 | 1,137,805 | ||||||

Total Money Market Fund |

||||||||

(Cost $1,137,805) |

1,137,805 | |||||||

Total Investments - 99.5% |

||||||||

(Cost $200,657,508) |

$ | 195,137,019 | ||||||

Other Assets & Liabilities, net - 0.5% |

977,465 | |||||||

Total Net Assets - 100.0% |

$ | 196,114,484 | ||||||

Futures Contracts |

||||||||||||||||

Description |

Number of |

Expiration |

Notional |

Value and |

||||||||||||

Equity Futures Contracts Purchased† |

||||||||||||||||

S&P 500 Index Mini Futures Contracts |

50 | Mar 2023 | $ | 9,653,750 | $ | (92,880 | ) | |||||||||

Total Return Swap Agreements |

|||||||||||||||||||||||

Counterparty |

Index |

Type |

Financing |

Payment |

Maturity |

Units |

Notional |

Value and |

|||||||||||||||

OTC Equity Index Swap Agreements†† |

|||||||||||||||||||||||

Wells Fargo Bank, N.A. |

S&P 500 Total Return Index |

Pay |

4.56% (Federal Funds Rate + 0.23%) |

At Maturity | 06/28/23 | 18,159 | $ | 148,501,760 | $ | 2,201,633 | |||||||||||||

* |

Non-income producing security. |

** |

Includes cumulative appreciation (depreciation). Variation margin is reported within the Statement of Assets and Liabilities. |

† |

Value determined based on Level 1 inputs — See Note 4. |

†† |

Value determined based on Level 2 inputs — See Note 4. |

1 |

Affiliated issuer. |

2 |

Rate indicated is the 7-day yield as of December 31, 2022. |

plc — Public Limited Company |

|

REIT — Real Estate Investment Trust |

|

See Sector Classification in Other Information section. |

SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 13 |

SCHEDULE OF INVESTMENTS (concluded) |

December 31, 2022 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

The following table summarizes the inputs used to value the Fund’s investments at December 31, 2022 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Common Stocks |

$ | 38,786,664 | $ | — | $ | — | $ | 38,786,664 | ||||||||

Mutual Funds |

155,212,550 | — | — | 155,212,550 | ||||||||||||

Money Market Fund |

1,137,805 | — | — | 1,137,805 | ||||||||||||

Equity Index Swap Agreements** |

— | 2,201,633 | — | 2,201,633 | ||||||||||||

Total Assets |

$ | 195,137,019 | $ | 2,201,633 | $ | — | $ | 197,338,652 | ||||||||

Investments in Securities (Liabilities) |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Equity Futures Contracts** |

$ | 92,880 | $ | — | $ | — | $ | 92,880 | ||||||||

** |

This derivative is reported as unrealized appreciation/depreciation at period end. |

Affiliated Transactions

Investments representing 5% or more of the outstanding voting shares of a company, or control of or by, or common control under Guggenheim Investments (“GI”), result in that company being considered an affiliated issuer, as defined in the 1940 Act.

The Fund may invest in certain of the underlying series of Guggenheim Strategy Funds Trust, including Guggenheim Strategy Fund II, Guggenheim Strategy Fund III, and Guggenheim Variable Insurance Strategy Fund III, (collectively, the “Short Term Investment Vehicles”), each of which are open-end management investment companies managed by GI. The Short Term Investment Vehicles, which launched on March 11, 2014, are offered as short term investment options only to mutual funds, trusts, and other accounts managed by GI and/or its affiliates, and are not available to the public. The Short Term Investment Vehicles pay no investment management fees. The Short Term Investment Vehicles’ annual report on Form N-CSR dated September 30, 2022, is available publicly or upon request. This information is available from the EDGAR database on the SEC’s website at https://www.sec.gov/Archives/edgar/data/1601445/000182126822000340/gug84768.htm. The Fund may invest in certain of the underlying series of Guggenheim Funds Trust, which are open-end management investment companies managed by GI, are available to the public and whose most recent annual report on Form N-CSR is available publicly or upon request.

Transactions during the year ended December 31, 2022, in which the company is an affiliated issuer, were as follows:

Security Name |

Value |

Additions |

Reductions |

Realized |

Change in |

Value |

Shares |

Investment |

||||||||||||||||||||||||

Mutual Funds |

||||||||||||||||||||||||||||||||

Guggenheim Strategy Fund II |

$ | 16,780,495 | $ | 31,311,810 | $ | (26,500,000 | ) | $ | (390,779 | ) | $ | (122,486 | ) | $ | 21,079,040 | 876,832 | $ | 497,500 | ||||||||||||||

Guggenheim Strategy Fund III |

81,097,553 | 1,819,737 | (25,363,135 | ) | (449,343 | ) | (2,326,679 | ) | 54,778,133 | 2,276,730 | 1,811,531 | |||||||||||||||||||||

Guggenheim Ultra Short Duration Fund — Institutional Class |

54,253,430 | 653,311 | (28,084,987 | ) | 17,882 | (915,186 | ) | 25,924,450 | 2,689,258 | 649,369 | ||||||||||||||||||||||

Guggenheim Variable Insurance Strategy Fund III |

67,541,303 | 1,550,542 | (13,377,998 | ) | (365,472 | ) | (1,917,448 | ) | 53,430,927 | 2,219,814 | 1,541,894 | |||||||||||||||||||||

| $ | 219,672,781 | $ | 35,335,400 | $ | (93,326,120 | ) | $ | (1,187,712 | ) | $ | (5,281,799 | ) | $ | 155,212,550 | $ | 4,500,294 | ||||||||||||||||

14 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

STATEMENT OF ASSETS AND LIABILITIES |

December 31, 2022 |

Assets: |

||||

Investments in unaffiliated issuers, at value (cost $40,256,330) |

$ | 39,924,469 | ||

Investments in affiliated issuers, at value (cost $160,401,178) |

155,212,550 | |||

Cash |

8,777,117 | |||

Segregated cash with broker |

533,000 | |||

Unrealized appreciation on OTC swap agreements |

2,201,633 | |||

Prepaid expenses |

10,513 | |||

Receivables: |

||||

Dividends |

653,067 | |||

Interest |

7,734 | |||

Investment Adviser |

14 | |||

Total assets |

207,320,097 | |||

Liabilities: |

||||

Segregated cash due to broker |

9,910,000 | |||

Payable for: |

||||

Securities purchased |

645,819 | |||

Fund shares redeemed |

339,702 | |||

Management fees |

84,894 | |||

Distribution and service fees |

41,432 | |||

Swap settlement |

37,062 | |||

Variation margin on futures contracts |

25,625 | |||

Trustees’ fees* |

3,255 | |||

Fund accounting/administration fees |

3,086 | |||

Transfer agent/maintenance fees |

2,161 | |||

Miscellaneous |

112,577 | |||

Total liabilities |

11,205,613 | |||

Net assets |

$ | 196,114,484 | ||

Net assets consist of: |

||||

Paid in capital |

$ | 222,987,335 | ||

Total distributable earnings (loss) |

(26,872,851 | ) | ||

Net assets |

$ | 196,114,484 | ||

Capital shares outstanding |

6,013,841 | |||

Net asset value per share |

$ | 32.61 | ||

STATEMENT OF OPERATIONS |

Year Ended December 31, 2022 |

Investment Income: |

||||

Dividends from securities of unaffiliated issuers (net of foreign withholding tax of $767) |

$ | 803,477 | ||

Dividends from securities of affiliated issuers |

4,500,294 | |||

Interest |

98,241 | |||

Total investment income |

5,402,012 | |||

Expenses: |

||||

Management fees |

1,652,040 | |||

Distribution and service fees |

549,346 | |||

Transfer agent/maintenance fees |

25,387 | |||

Fund accounting/administration fees |

128,200 | |||

Interest expense |

101,058 | |||

Professional fees |

79,140 | |||

Custodian fees |

25,496 | |||

Line of credit fees |

7,000 | |||

Trustees’ fees* |

10,838 | |||

Miscellaneous |

22,413 | |||

Total expenses |

2,600,918 | |||

Less: |

||||

Expenses reimbursed by Adviser |

(7 | ) | ||

Expenses waived by Adviser |

(576,164 | ) | ||

Earnings credits applied |

(5,295 | ) | ||

Total waived/reimbursed expenses |

(581,466 | ) | ||

Net expenses |

2,019,452 | |||

Net investment income |

3,382,560 | |||

Net Realized and Unrealized Gain (Loss): |

||||

Net realized gain (loss) on: |

||||

Investments in unaffiliated issuers |

(824,783 | ) | ||

Investments in affiliated issuers |

(1,187,712 | ) | ||

Swap agreements |

(25,002,540 | ) | ||

Futures contracts |

382,826 | |||

Net realized loss |

(26,632,209 | ) | ||

Net change in unrealized appreciation (depreciation) on: |

||||

Investments in unaffiliated issuers |

(7,955,652 | ) | ||

Investments in affiliated issuers |

(5,281,799 | ) | ||

Swap agreements |

(17,777,522 | ) | ||

Futures contracts |

(193,155 | ) | ||

Net change in unrealized appreciation (depreciation) |

(31,208,128 | ) | ||

Net realized and unrealized loss |

(57,840,337 | ) | ||

Net decrease in net assets resulting from operations |

$ | (54,457,777 | ) | |

* |

Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 15 |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

STATEMENTS OF CHANGES IN NET ASSETS |

|

Year Ended |

Year Ended |

||||||

Increase (Decrease) in Net Assets from Operations: |

||||||||

Net investment income |

$ | 3,382,560 | $ | 1,220,679 | ||||

Net realized gain (loss) on investments |

(26,632,209 | ) | 62,342,705 | |||||

Net change in unrealized appreciation (depreciation) on investments |

(31,208,128 | ) | (926,499 | ) | ||||

Net increase (decrease) in net assets resulting from operations |

(54,457,777 | ) | 62,636,885 | |||||

Distributions to shareholders |

(58,728,698 | ) | (26,897,830 | ) | ||||

Capital share transactions: |

||||||||

Proceeds from sale of shares |

3,989,714 | 2,897,714 | ||||||

Distributions reinvested |

58,728,698 | 26,897,830 | ||||||

Cost of shares redeemed |

(23,388,008 | ) | (25,651,784 | ) | ||||

Net increase from capital share transactions |

39,330,404 | 4,143,760 | ||||||

Net increase (decrease) in net assets |

(73,856,071 | ) | 39,882,815 | |||||

Net assets: |

||||||||

Beginning of year |

269,970,555 | 230,087,740 | ||||||

End of year |

$ | 196,114,484 | $ | 269,970,555 | ||||

Capital share activity: |

||||||||

Shares sold |

85,664 | 54,152 | ||||||

Shares issued from reinvestment of distributions |

1,731,388 | 518,662 | ||||||

Shares redeemed |

(556,929 | ) | (478,128 | ) | ||||

Net increase in shares |

1,260,123 | 94,686 | ||||||

16 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

SEE NOTES TO FINANCIAL STATEMENTS. |

SERIES A (STYLEPLUS—LARGE CORE SERIES) |

FINANCIAL HIGHLIGHTS |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

|

Year Ended |

Year Ended |

Year Ended |

Year Ended |

Year Ended |

|||||||||||||||

Per Share Data |

||||||||||||||||||||

Net asset value, beginning of period |

$ | 56.79 | $ | 49.39 | $ | 44.24 | $ | 36.80 | $ | 45.50 | ||||||||||

Income (loss) from investment operations: |

||||||||||||||||||||

Net investment income (loss)a |

.64 | .26 | .38 | .68 | .83 | |||||||||||||||

Net gain (loss) on investments (realized and unrealized) |

(11.88 | ) | 13.22 | 7.46 | 10.06 | (3.10 | ) | |||||||||||||

Total from investment operations |

(11.24 | ) | 13.48 | 7.84 | 10.74 | (2.27 | ) | |||||||||||||

Less distributions from: |

||||||||||||||||||||

Net investment income |

(.27 | ) | (.41 | ) | (.74 | ) | (.91 | ) | (.75 | ) | ||||||||||

Net realized gains |

(12.67 | ) | (5.67 | ) | (1.95 | ) | (2.39 | ) | (5.68 | ) | ||||||||||

Total distributions |

(12.94 | ) | (6.08 | ) | (2.69 | ) | (3.30 | ) | (6.43 | ) | ||||||||||

Net asset value, end of period |

$ | 32.61 | $ | 56.79 | $ | 49.39 | $ | 44.24 | $ | 36.80 | ||||||||||

|

||||||||||||||||||||

Total Returnb |

(20.67 | %) | 28.48 | % | 18.78 | % | 29.97 | % | (6.56 | %) | ||||||||||

Ratios/Supplemental Data |

||||||||||||||||||||

Net assets, end of period (in thousands) |

$ | 196,114 | $ | 269,971 | $ | 230,088 | $ | 218,082 | $ | 190,644 | ||||||||||

Ratios to average net assets: |

||||||||||||||||||||

Net investment income (loss) |

1.54 | % | 0.49 | % | 0.88 | % | 1.65 | % | 1.89 | % | ||||||||||

Total expensesc |

1.18 | % | 1.14 | % | 1.22 | % | 1.27 | % | 1.26 | % | ||||||||||

Net expensesd,e,f |

0.92 | % | 0.85 | % | 0.89 | % | 0.95 | % | 0.97 | % | ||||||||||

Portfolio turnover rate |

63 | % | 34 | % | 63 | % | 41 | % | 45 | % | ||||||||||

a |

Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

b |

Total return does not take into account any of the expenses associated with an investment in variable insurance products. If total return had taken into account these expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

c |

Does not include expenses of the underlying funds in which the Fund invests. |

d |

Net expense information reflects the expense ratios after expense waivers and reimbursements, as applicable. |

e |

The portion of the ratios of net expenses to average net assets attributable to recoupments of prior fee reductions or expense reimbursements for the years presented was as follows: |

12/31/22 |

12/31/21 |

12/31/20 |

12/31/19 |

12/31/18 |

|

— |

— |

— |

— |

0.02% |

f |

Net expenses may include expenses that are excluded from the expense limitation agreement. Excluding these expenses, the net expense ratios for the years presented would be: |

12/31/22 |

12/31/21 |

12/31/20 |

12/31/19 |

12/31/18 |

|

0.87% |

0.84% |

0.87% |

0.89% |

0.91% |

SEE NOTES TO FINANCIAL STATEMENTS. |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 17 |

MANAGERS’ COMMENTARY (Unaudited) |

December 31, 2022 |

To Our Shareholders

The Series B (Large Cap Value Series, or the “Fund”) is managed by a team of seasoned professionals, led by David Toussaint, CFA, CPA, Managing Director and Portfolio Manager; James Schier, CFA, Senior Managing Director and Portfolio Manager; Farhan Sharaff, Senior Managing Director, Assistant Chief Investment Officer, Equities, and Portfolio Manager; Gregg Strohkorb, CFA, Director and Portfolio Manager; and Burak Hurmeydan, Ph.D., Director and Portfolio Manager. In the subsequent paragraphs, the investment team discusses the Fund’s performance for the 12-month period ended December 31, 2022 (the “Reporting Period”).

For the Reporting Period, the Fund provided a total return of -1.32%, outperforming the Russell 1000 Value Index (“Index”), the Fund’s benchmark, which returned -7.54% for the same period.

What factors contributed or detracted from the Fund’s performance during the Reporting Period?

After the market reached record highs at the end of 2021, it came under pressure as the Federal Reserve strove to contain inflation by raising rates and, at the same time, the market had to deal with the uncertainty over the Ukraine invasion. The Fund’s general focus towards quality companies (those with better balance sheets than peers) that meet our valuation parameters tended to position the Fund’s holdings well in most sectors. In fact, the Fund produced a very significant positive contribution from its security selection and produced a significant positive contribution from its sector allocation.

The Fund had an overweight relative to its benchmark to the Energy sector throughout the Reporting Period, which contributed the most to the Fund’s outperformance versus its benchmark. The Energy holdings returned over 60% during the Reporting Period, while the overall benchmark returned -7.54%. ConocoPhillips and Marathon Oil, both oil producers, performed extremely well and were up over 65% each, as oil prices improved due to uncertainty stemming from the Russian-Ukraine War and the companies exercised capital discipline throughout 2022. An oil and natural gas service company, Patterson-UTI Energy, was up over 100%, as the company’s oil and natural gas drilling rigs were put to work in the field. Another positive contributor to performance was the Fund’s overweight to the Utilities sector. Constellation Energy, a spin-off from Exelon Corp., fared well, as passage of the Inflation Reduction Act favored companies with nuclear power generation assets. One of the best performers in the Fund was McKesson Corp, within the Health Care sector, as it continued to grow revenue and earnings in its U.S. businesses and divested some of its European businesses.

The Fund’s largest detractor from performance was Micron Technology, one of the largest memory chips makers in the world. The oversupply of memory chips in the market caused prices to fall, hurting the company’s revenue and earnings. Another poor performer for the Fund was Tyson Foods, Inc., a producer and distributor of chicken, beef, and pork. The company has been faced with higher feed, labor, and freight costs that hurt margins and earnings.

How was the Fund positioned at the end of the Reporting Period?

The market outlook is unusually cloudy. In addition to the geopolitical uncertainty that appears to be potentially significant, the market must contend with a hawkish Federal Reserve. Together, this provides a challenging environment for economic growth. All of this, however, does not change our process, which is heavily bottoms up driven.

At the Fund’s year-end, the Fund held an overweight to the Utilities and a similar size underweight to the REITs sector. Both sectors are interest-rate-sensitive, but we favor utilities because of the valuations, profitability, and regulatory nature of their businesses. We are also overweight the Information Technology sector, as we are seeing more attractive opportunities after the sector has significantly underperformed during the past year. We continue to favor the Materials sector, as it trades at attractive valuations, generates free cash flow, and may provide growth opportunities as a result of the government programs and the onshoring of manufacturing. Two sectors the Fund is underweight are the Financials and Health Care sectors. Higher interest rates will benefit the Financials, but a possible looming recession could increase credit costs and depress earnings. Within Health Care, the Fund is primarily underweight Pharmaceuticals, a sector that has performed well but whose earnings and cash flow may disappoint post pandemic.

Performance displayed represents past performance which is no guarantee of future results.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

18 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) |

December 31, 2022 |

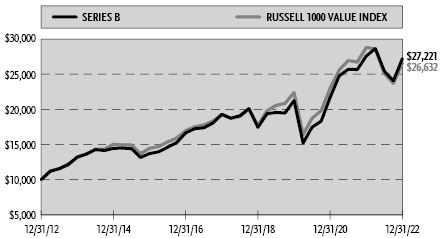

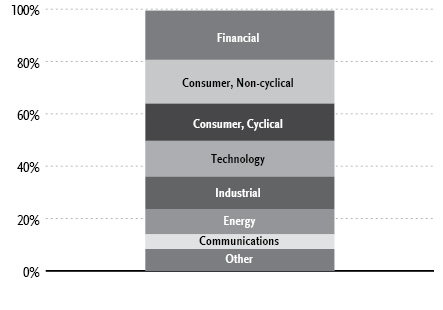

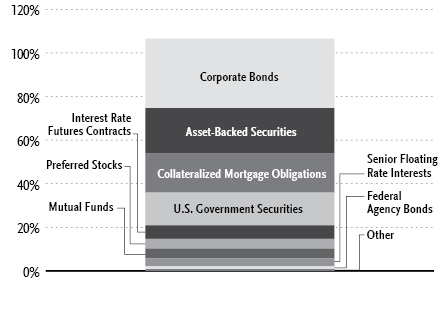

SERIES B (LARGE CAP VALUE SERIES)

OBJECTIVE: Seeks long-term growth of capital.

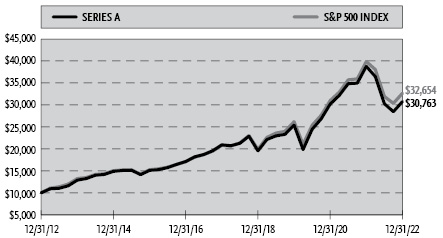

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Date: May 1, 1979 |

Ten Largest Holdings |

(% of Total Net Assets) |

JPMorgan Chase & Co. |

3.2% |

iShares Russell 1000 Value ETF |

3.0% |

Chevron Corp. |

2.9% |

Berkshire Hathaway, Inc. — Class B |

2.8% |

Johnson & Johnson |

2.5% |

Bank of America Corp. |

2.3% |

Humana, Inc. |

2.2% |

ConocoPhillips |

2.0% |

OGE Energy Corp. |

1.9% |

Verizon Communications, Inc. |

1.8% |

Top Ten Total |

24.6% |

“Ten Largest Holdings” excludes any temporary cash investments. |

|

THE GUGGENHEIM FUNDS ANNUAL REPORT | 19 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) |

December 31, 2022 |

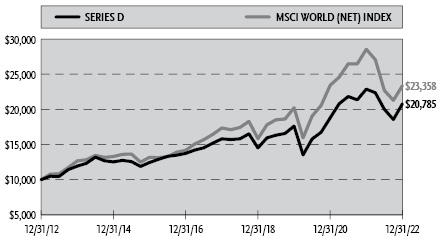

Cumulative Fund Performance*,†

Average Annual Returns*,†

Periods Ended December 31, 2022

|

1 Year |

5 Year |

10 Year |

Series B (Large Cap Value Series) |

(1.32%) |

7.14% |

10.53% |

Russell 1000 Value Index |

(7.54%) |

6.67% |

10.29% |

* |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The Russell 1000 Value Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

† |

Performance figures do not reflect fees and expenses associated with an investment in variable insurance products. If returns had taken into account these fees and expenses, performance would have been lower. Shares of a series of Guggenheim Variable Funds Trust are available only through the purchase of such products. |

20 | THE GUGGENHEIM FUNDS ANNUAL REPORT |

SCHEDULE OF INVESTMENTS |

December 31, 2022 |

SERIES B (LARGE CAP VALUE SERIES) |

|

Shares |

Value |

||||||

COMMON STOCKS† - 94.3% |

||||||||

Consumer, Non-cyclical - 22.3% |

||||||||

Johnson & Johnson |

30,481 | $ | 5,384,469 | |||||

Humana, Inc. |

9,178 | 4,700,880 | ||||||

Quest Diagnostics, Inc. |

23,274 | 3,640,985 | ||||||

Tyson Foods, Inc. — Class A |

57,068 | 3,552,483 | ||||||

Merck & Company, Inc. |

29,200 | 3,239,740 | ||||||

Archer-Daniels-Midland Co. |

33,763 | 3,134,895 | ||||||

Ingredion, Inc. |

31,921 | 3,126,024 | ||||||

J M Smucker Co. |

17,762 | 2,814,566 | ||||||

Medtronic plc |

33,173 | 2,578,206 | ||||||

Bunge Ltd. |

24,190 | 2,413,436 | ||||||

Henry Schein, Inc.* |

29,932 | 2,390,669 | ||||||

Encompass Health Corp. |

31,362 | 1,875,761 | ||||||

HCA Healthcare, Inc. |

6,743 | 1,618,050 | ||||||

Moderna, Inc.* |

8,817 | 1,583,709 | ||||||

Pfizer, Inc. |

29,771 | 1,525,466 | ||||||

McKesson Corp. |

4,051 | 1,519,611 | ||||||

Bristol-Myers Squibb Co. |

16,678 | 1,199,982 | ||||||

Euronet Worldwide, Inc.* |

12,016 | 1,134,070 | ||||||

Total Consumer, Non-cyclical |

47,433,002 | |||||||

Financial - 15.4% |

||||||||

JPMorgan Chase & Co. |

50,992 | 6,838,027 | ||||||

Berkshire Hathaway, Inc. — Class B* |

18,930 | 5,847,477 | ||||||

Bank of America Corp. |

147,817 | 4,895,699 | ||||||

Charles Schwab Corp. |

34,239 | 2,850,739 | ||||||

Wells Fargo & Co. |

62,015 | 2,560,599 | ||||||

Mastercard, Inc. — Class A |

6,610 | 2,298,496 | ||||||

Goldman Sachs Group, Inc. |

5,570 | 1,912,627 | ||||||

Voya Financial, Inc. |

27,419 | 1,685,994 | ||||||

STAG Industrial, Inc. REIT |

34,679 | 1,120,479 | ||||||

American Tower Corp. — Class A REIT |

4,618 | 978,369 | ||||||

T. Rowe Price Group, Inc. |

8,571 | 934,753 | ||||||

Gaming and Leisure Properties, Inc. REIT |

12,532 | 652,792 | ||||||

Total Financial |

32,576,051 | |||||||

Energy - 9.9% |

||||||||

Chevron Corp. |

34,320 | 6,160,097 | ||||||

ConocoPhillips |

35,652 | 4,206,936 | ||||||

Coterra Energy, Inc. — Class A |

91,049 | 2,237,074 | ||||||

Pioneer Natural Resources Co. |

9,045 | 2,065,787 | ||||||

Marathon Oil Corp. |

69,368 | 1,877,792 | ||||||

Diamondback Energy, Inc. |

13,241 | 1,811,104 | ||||||

Kinder Morgan, Inc. |

95,042 | 1,718,360 | ||||||

Equities Corp. |

26,222 | 887,090 | ||||||

Total Energy |

20,964,240 | |||||||

Utilities - 8.8% |

||||||||

OGE Energy Corp. |

102,359 | 4,048,298 | ||||||

Edison International |

42,789 | 2,722,236 | ||||||

Exelon Corp. |

61,531 | 2,659,985 | ||||||

Pinnacle West Capital Corp. |

34,050 | 2,589,162 | ||||||

Duke Energy Corp. |

19,722 | 2,031,169 | ||||||

Black Hills Corp. |

26,749 | 1,881,525 | ||||||

NiSource, Inc. |

65,351 | 1,791,924 | ||||||

PPL Corp. |

33,862 | 989,448 | ||||||

Total Utilities |

18,713,747 | |||||||

Industrial - 8.4% |

||||||||

Curtiss-Wright Corp. |

20,865 | 3,484,246 | ||||||

Johnson Controls International plc |

46,562 | 2,979,968 | ||||||

Knight-Swift Transportation Holdings, Inc. |

46,371 | 2,430,304 | ||||||

Valmont Industries, Inc. |

6,927 | 2,290,551 | ||||||