Front Cover

| |

|

|

|

|

| Variable Funds Trust |

| |

|

| |

5.1.2024 |

Guggenheim Variable Funds Prospectus

| Series Name |

|

| Series A |

(StylePlus—Large Core Series) |

| Series B |

(Large Cap Value Series) |

| Series D |

(World Equity Income Series) |

| Series E |

(Total Return Bond Series) |

| Series F |

(Floating Rate Strategies Series) |

| Series J |

(StylePlus—Mid Growth Series) |

| Series N |

(Managed Asset Allocation Series) |

| Series O |

(All Cap Value Series) |

| Series P |

(High Yield Series) |

| Series Q |

(Small Cap Value Series) |

| Series V |

(SMid Cap Value Series) |

| Series X |

(StylePlus—Small Growth Series) |

| Series Y |

(StylePlus—Large Growth Series) |

| Series Z |

(Alpha Opportunity Series) |

Shares of the Funds are currently offered to insurance company separate accounts funding certain variable annuity contracts and variable life insurance policies and may also be offered to certain qualified pension and retirement plans. The availability of the Funds as investment options may vary by contract or policy and jurisdiction. Each contract and policy involves charges, fees and expenses not described in this Prospectus. This Prospectus should be read in conjunction with the applicable contract or policy prospectus. Please read both prospectuses and retain them for future reference.

The U.S. Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission have not approved or disapproved these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| GVFT-PRO-0524x0525 |

guggenheiminvestments.com |

Table of Contents

| 1 | |

| 10 | |

| 16 | |

| 23 | |

| 34 | |

| 44 | |

| 53 | |

| 62 | |

| 69 | |

| 78 | |

| 85 | |

| 92 | |

| 101 | |

| 110 | |

| 118 | |

| 119 | |

| 154 | |

| 154 | |

| 156 | |

| 160 | |

| 160 | |

| 161 | |

| 162 | |

| 162 | |

| 162 | |

| 163 | |

| 164 | |

| 164 | |

| 166 | |

| 167 | |

| Back Page |

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3,4 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

4

1 | PROSPECTUS

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 2

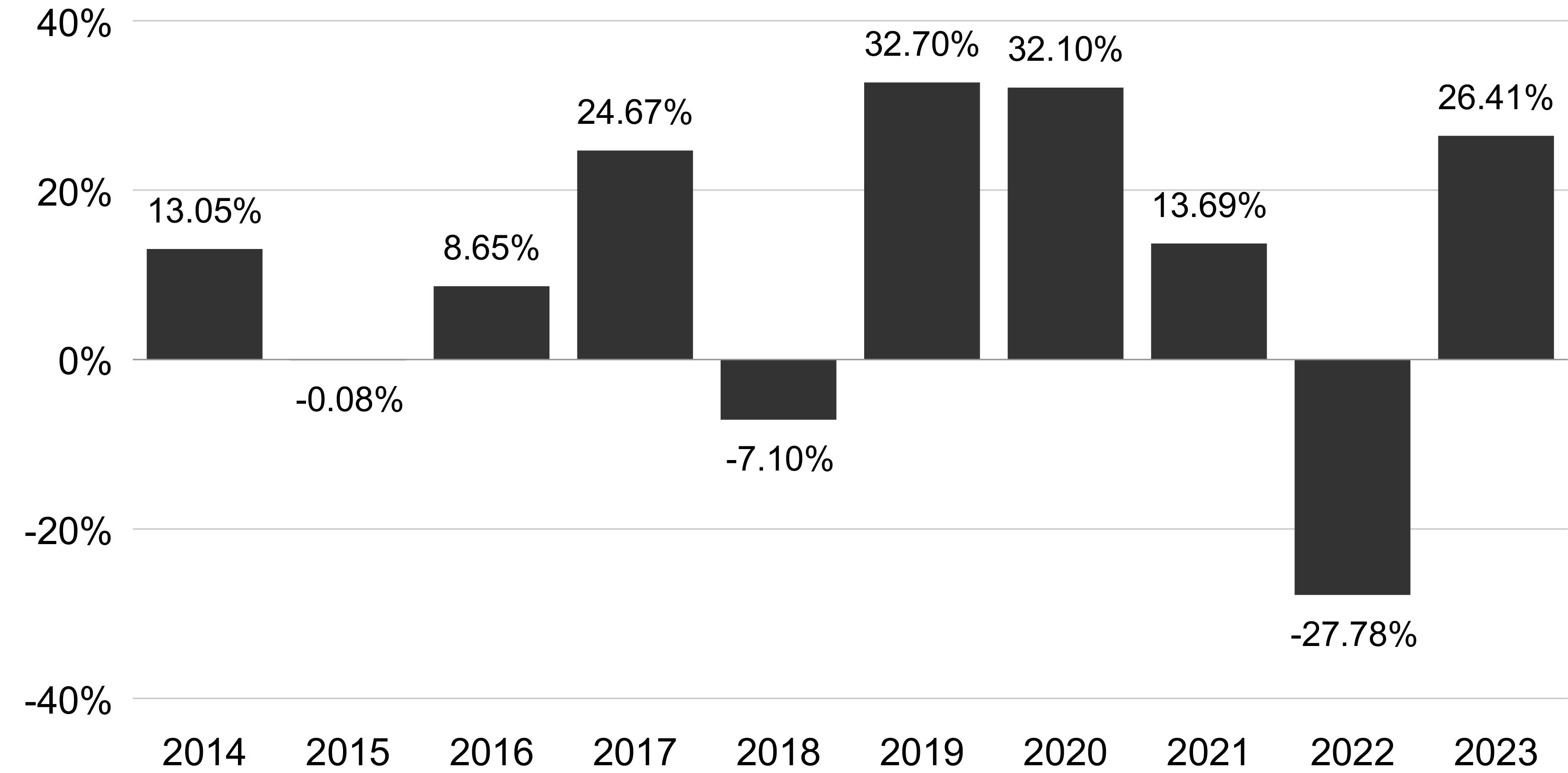

3 | PROSPECTUS

PROSPECTUS | 4

5 | PROSPECTUS

PROSPECTUS | 6

7 | PROSPECTUS

PROSPECTUS | 8

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series A |

|

|

|

| Index |

|

|

|

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Qi Yan |

Since 2016 |

Managing Director and Portfolio Manager |

| Adam J. Bloch |

Since 2018 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2013 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

9 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Total Annual Operating Expenses |

% |

| Fee Waiver (and/or expense reimbursement)1,2 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 10

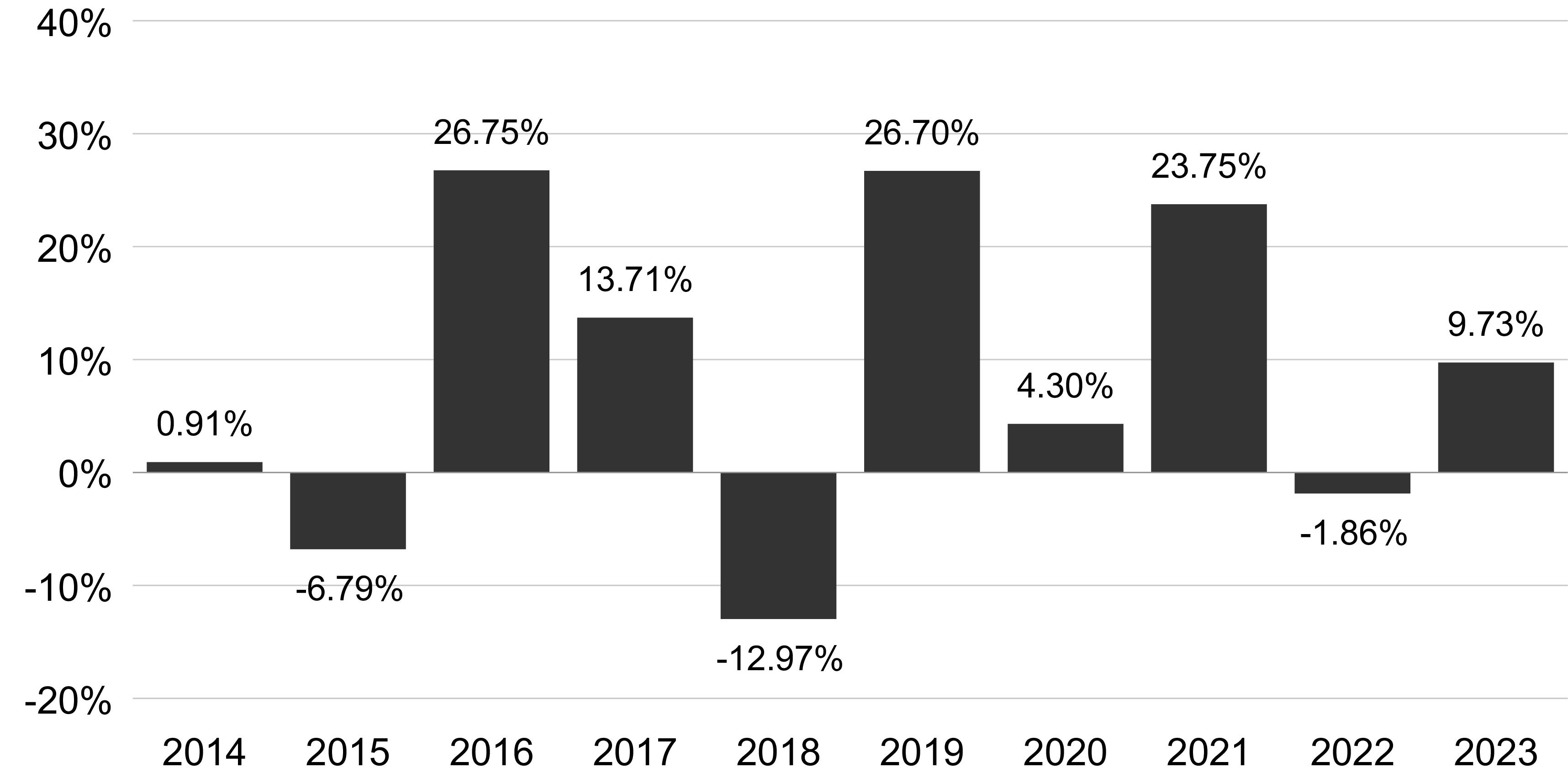

11 | PROSPECTUS

PROSPECTUS | 12

13 | PROSPECTUS

PROSPECTUS | 14

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series B |

|

|

|

| Index |

|

|

|

| Russell 1000® Value Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| James P. Schier |

Since 2015 |

Senior Managing Director and Portfolio Manager |

| David G. Toussaint |

Since 2017 |

Managing Director and Portfolio Manager |

| Chris Phalen |

Since June 2023 |

Managing Director and Portfolio Manager |

| Gregg Strohkorb |

Since 2015 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2015 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

| Burak Hurmeydan |

Since 2018 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

15 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Total Annual Operating Expenses |

% |

| Fee Waiver (and/or expense reimbursement)1,2 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 16

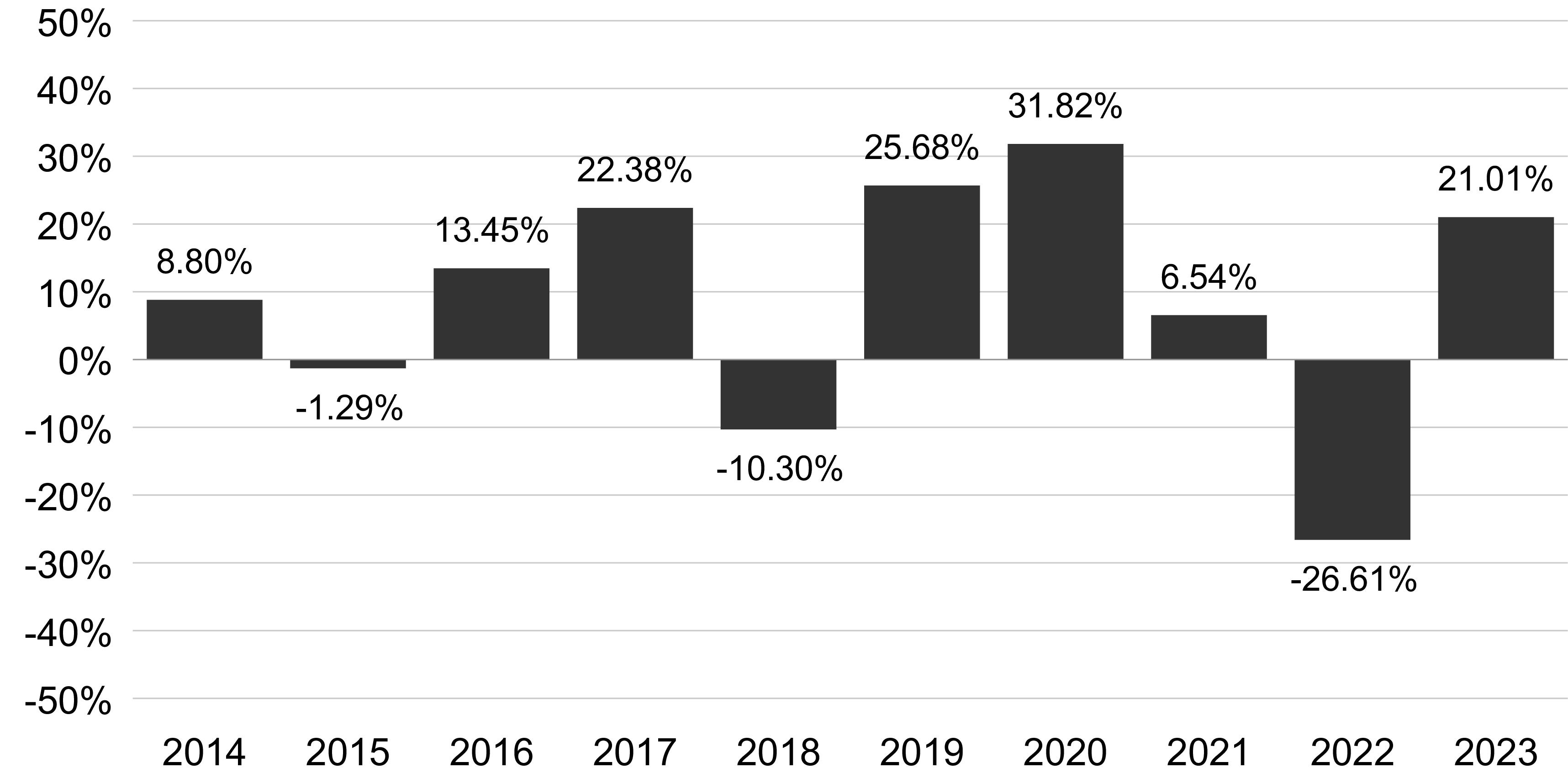

17 | PROSPECTUS

Fund will achieve its investment objective. The Fund is subject to certain risks and the principal risks of investing in the Fund are summarized below in alphabetical order, and not in the order of importance or potential exposure. Please see “Descriptions of Principal Risks” in the Fund’s prospectus for a more detailed description of the risks of investing in the Fund.

PROSPECTUS | 18

19 | PROSPECTUS

PROSPECTUS | 20

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series D |

|

|

|

| Index |

|

|

|

| MSCI World Index (Net)1 (reflects no deduction for fees, expenses or taxes, except foreign withholding taxes) |

|

|

|

1

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

21 | PROSPECTUS

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Farhan Sharaff |

Since 2013 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

| Evan Einstein |

Since 2017 |

Managing Director and Portfolio Manager |

| Douglas Makin |

Since 2020 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

PROSPECTUS | 22

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3,4 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

4

23 | PROSPECTUS

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 24

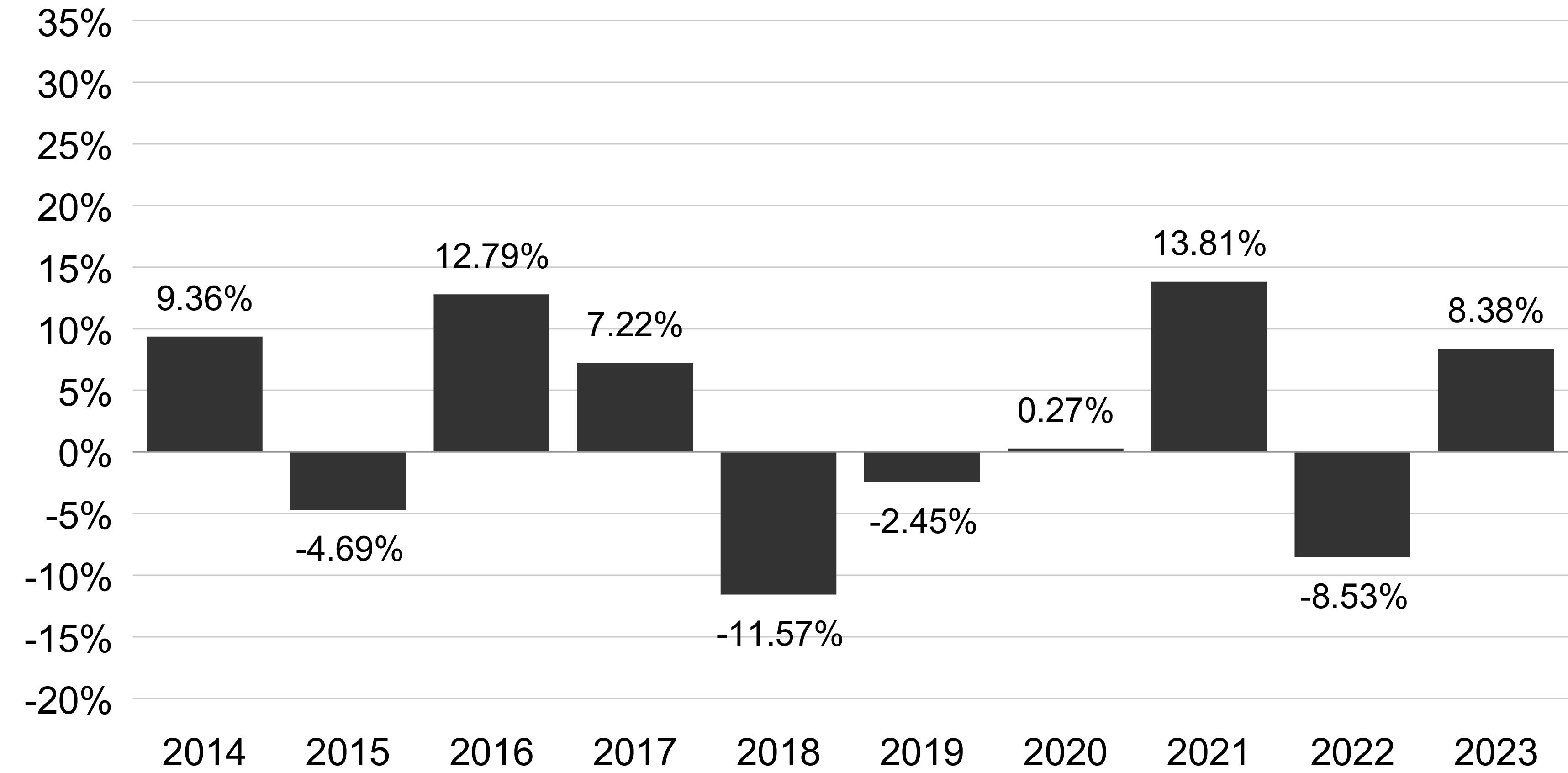

25 | PROSPECTUS

PROSPECTUS | 26

27 | PROSPECTUS

PROSPECTUS | 28

29 | PROSPECTUS

PROSPECTUS | 30

31 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series E |

|

|

|

| Index |

|

|

|

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Anne B. Walsh |

Since 2012 |

Managing Partner, Chief Investment Officer, and Portfolio Manager |

| Steven H. Brown |

Since 2016 |

Chief Investment Officer, Fixed Income, Senior Managing Director, and Portfolio Manager |

| Adam J. Bloch |

Since 2016 |

Managing Director and Portfolio Manager |

| Evan L. Serdensky |

Since 2023 |

Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

PROSPECTUS | 32

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

33 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 34

35 | PROSPECTUS

PROSPECTUS | 36

37 | PROSPECTUS

PROSPECTUS | 38

39 | PROSPECTUS

PROSPECTUS | 40

41 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

PROSPECTUS | 42

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series F |

|

|

|

| Index |

|

|

|

| Credit Suisse Leveraged Loan Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Guggenheim Partners Investment Management, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Anne B. Walsh |

Since 2013 |

Managing Partner, Chief Investment Officer, and Portfolio Manager |

| Steven H. Brown |

Since August 2023 |

Chief Investment Officer, Fixed Income, and Senior Managing Director and Portfolio Manager |

| Thomas J. Hauser |

Since 2014 |

Senior Managing Director and Portfolio Manager |

| Christopher Keywork |

Since August 2023 |

Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

43 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3,4 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

4

PROSPECTUS | 44

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

45 | PROSPECTUS

PROSPECTUS | 46

47 | PROSPECTUS

PROSPECTUS | 48

49 | PROSPECTUS

PROSPECTUS | 50

| |

|

|

| |

|

|

| |

|

|

51 | PROSPECTUS

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series J |

|

|

|

| Index |

|

|

|

| Russell Midcap® Growth Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Qi Yan |

Since 2016 |

Managing Director and Portfolio Manager |

| Adam J. Bloch |

Since 2018 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2013 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

PROSPECTUS | 52

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

1

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

53 | PROSPECTUS

PROSPECTUS | 54

the Fund (which include certain principal risks of the other investment vehicles in which the Fund invests) are summarized below in alphabetical order, and not in the order of importance or potential exposure. Please see “Descriptions of Principal Risks” in the Fund’s prospectus for a more detailed description of the risks of investing in the Fund.

55 | PROSPECTUS

PROSPECTUS | 56

57 | PROSPECTUS

PROSPECTUS | 58

59 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series N |

|

|

|

PROSPECTUS | 60

| |

1 Year |

5 Years |

10 Years |

| Index |

|

|

|

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Matthew Wu |

Since 2012 |

Director and Portfolio Manager |

| Michael P. Byrum |

Since 2012 |

Senior Managing Director and Portfolio Manager |

| Adrian Bachman |

Since September 2023 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

61 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Total Annual Operating Expenses |

% |

| Fee Waiver (and/or expense reimbursement)1,2 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 62

63 | PROSPECTUS

PROSPECTUS | 64

65 | PROSPECTUS

PROSPECTUS | 66

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series O |

|

|

|

| Index |

|

|

|

| Russell 3000® Value Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| James P. Schier |

Since 2008 |

Senior Managing Director and Portfolio Manager |

| David G. Toussaint |

Since 2017 |

Managing Director and Portfolio Manager |

| Chris Phalen |

Since June 2023 |

Managing Director and Portfolio Manager |

| Gregg Strohkorb |

Since 2015 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2015 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

| Burak Hurmeydan |

Since 2018 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

67 | PROSPECTUS

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

PROSPECTUS | 68

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Total Annual Operating Expenses |

% |

| Fee Waiver (and/or expense reimbursement)1,2 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

69 | PROSPECTUS

PROSPECTUS | 70

71 | PROSPECTUS

PROSPECTUS | 72

73 | PROSPECTUS

PROSPECTUS | 74

75 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

PROSPECTUS | 76

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series P |

|

|

|

| Index |

|

|

|

| Bloomberg U.S. Corporate High Yield Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund . Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Anne B. Walsh |

Since August 2023 |

Managing Partner, Chief Investment Officer, and Portfolio Manager |

| Steven H. Brown |

Since August 2023 |

Chief Investment Officer, Fixed Income, and Senior Managing Director and Portfolio Manager |

| Thomas J. Hauser |

Since 2017 |

Senior Managing Director and Portfolio Manager |

| John Walsh |

Since August 2023 |

Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

77 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 78

79 | PROSPECTUS

PROSPECTUS | 80

81 | PROSPECTUS

PROSPECTUS | 82

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series Q |

|

|

|

| Index |

|

|

|

| Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| James P. Schier |

Since 2009 |

Senior Managing Director and Portfolio Manager |

| David G. Toussaint |

Since 2017 |

Managing Director and Portfolio Manager |

| Chris Phalen |

Since June 2023 |

Managing Director and Portfolio Manager |

| Gregg Strohkorb |

Since 2015 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2015 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

| Burak Hurmeydan |

Since 2018 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

83 | PROSPECTUS

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

PROSPECTUS | 84

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Total Annual Operating Expenses |

% |

| Fee Waiver (and/or expense reimbursement)1,2 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

85 | PROSPECTUS

PROSPECTUS | 86

87 | PROSPECTUS

PROSPECTUS | 88

89 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series V |

|

|

|

| Index |

|

|

|

| Russell 2500® Value Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| James P. Schier |

Since 1997 |

Senior Managing Director and Portfolio Manager |

| David G. Toussaint |

Since 2017 |

Managing Director and Portfolio Manager |

| Chris Phalen |

Since June 2023 |

Managing Director and Portfolio Manager |

| Gregg Strohkorb |

Since 2015 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2015 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

| Burak Hurmeydan |

Since 2018 |

Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

PROSPECTUS | 90

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

91 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3,4 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

4

PROSPECTUS | 92

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

93 | PROSPECTUS

PROSPECTUS | 94

95 | PROSPECTUS

PROSPECTUS | 96

97 | PROSPECTUS

PROSPECTUS | 98

99 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series X |

|

|

|

| Index |

|

|

|

| Russell 2000® Growth Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Qi Yan |

Since 2016 |

Managing Director and Portfolio Manager |

| Adam J. Bloch |

Since 2018 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2013 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

PROSPECTUS | 100

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Interest and Other Related Expenses |

|

| Remaining Other Expenses |

|

| Acquired Fund Fees and Expenses |

% |

| Total Annual Operating Expenses1 |

% |

| Fee Waiver (and/or expense reimbursement)2,3,4 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

3

4

101 | PROSPECTUS

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 102

103 | PROSPECTUS

PROSPECTUS | 104

105 | PROSPECTUS

PROSPECTUS | 106

107 | PROSPECTUS

PROSPECTUS | 108

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series Y |

|

|

|

| Index |

|

|

|

| Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Qi Yan |

Since 2016 |

Managing Director and Portfolio Manager |

| Adam J. Bloch |

Since 2018 |

Managing Director and Portfolio Manager |

| Farhan Sharaff |

Since 2013 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

109 | PROSPECTUS

| Management Fees |

% |

| Distribution and/or Service (12b-1) Fees |

% |

| Other Expenses |

% |

| Total Annual Operating Expenses |

% |

| Fee Waiver (and/or expense reimbursement)1,2 |

- % |

| Total Annual Operating Expenses After Fee Waiver (and/or expense reimbursement) |

% |

1

2

| 1 Year |

3 Years |

5 Years |

10 Years |

| $ |

$ |

$ |

$ |

PROSPECTUS | 110

111 | PROSPECTUS

PROSPECTUS | 112

113 | PROSPECTUS

PROSPECTUS | 114

115 | PROSPECTUS

| |

|

|

| |

|

|

| |

|

|

(For the periods ended December 31, 2023)

| |

1 Year |

5 Years |

10 Years |

| Series Z |

|

|

|

| Index |

|

|

|

| ICE BofA 3-Month U.S. Treasury Bill Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Morningstar Long/Short Equity Category Average (reflects no deduction for fees, expenses or taxes) |

|

|

|

MANAGEMENT OF THE FUND

Security Investors, LLC, also known as Guggenheim Investments, serves as the investment manager of the Fund. Guggenheim Investments utilizes a team-based approach that follows a disciplined investment process. The portfolio managers for the Fund are:

| Name* |

Experience with the Fund |

Primary Title with Investment Manager |

| Samir Sanghani |

Since 2015 |

Managing Director and Portfolio Manager |

| Burak Hurmeydan |

Since 2015 |

Director and Portfolio Manager |

| Farhan Sharaff |

Since 2015 |

Assistant Chief Investment Officer, Equities, Senior Managing Director and Portfolio Manager |

*

Each portfolio manager is primarily responsible for the day-to-day management of the Fund.

PURCHASE AND SALE OF FUND SHARES

Shares of the Fund are purchased primarily by insurance companies for their separate accounts to fund variable life insurance policies and variable annuity contracts. Investors do not deal directly with the Fund to purchase and redeem shares. Please refer to the prospectus for the applicable variable annuity contract or variable life insurance policy for information on the allocation of premiums and transfers of accumulated value.

PROSPECTUS | 116

TAX INFORMATION

Shares of the Fund are owned by the insurance companies offering the variable annuity contracts or variable life insurance policies for which the Fund is an investment option. Please see the applicable prospectus for the variable annuity contract or variable life insurance policy for information regarding the federal income tax treatment of the annuity contract or insurance policy.

PAYMENTS TO INSURANCE COMPANIES AND OTHER FINANCIAL INTERMEDIARIES

If you invest in the Fund through an insurance company, broker/dealer, financial representative or other financial intermediary, the Fund and its related companies may pay the financial intermediary for the investment in the Fund and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a variable annuity contract or variable life insurance policy and the Fund over another available investment option. Ask your financial intermediary or visit your financial intermediary’s website for more information.

117 | PROSPECTUS

Additional Information Regarding Investment Objectives and Strategies

The Board of Trustees of the Funds may change a Fund’s investment objective and strategies at any time without shareholder approval. A Fund will provide written notice to shareholders prior to, or concurrent with, any such change as required by applicable law. Should a Fund with a name suggesting a specific type of investment or industry change its policy of investing at least 80% of its assets (net assets, plus the amount of any borrowings for investment purposes) in the type of investment or industry suggested by its name, the Fund will provide shareholders at least 60 days' notice prior to making the change. For purposes of this 80% policy, derivatives usually will be based on their notional value. For purposes of determining a Fund’s compliance with the Fund’s 80% investment policy under Rule 35d-1 under the Investment Company Act of 1940 ("1940 Act") (if applicable), the Fund may, to the extent permitted by its principal investment strategy, seek to obtain exposure to the securities in which it primarily invests through a variety of investment vehicles, principally closed-end funds, exchange-traded funds (“ETFs”) and other mutual funds where the identity of those underlying portfolio securities can be reasonably determined. As with any investment, there can be no guarantee a Fund will achieve its investment objective.

Each Fund may, from time to time and in the discretion of the Investment Manager, take temporary positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse or unstable market, economic, political, or other conditions or abnormal circumstances, such as large cash inflows or anticipated large redemptions. For example, each Fund may invest some or all of its assets in cash, derivatives, fixed-income instruments, government bonds, money market instruments, repurchase agreements or securities of other investment companies, including money market funds. The Fund may be unable to pursue or achieve its investment objective during that time and temporary investments could reduce the benefit to the Fund from any upswing in the market.

The Funds’ holdings of certain types of investments cannot exceed a maximum percentage of assets. Percentage limitations are set forth in this Prospectus and/or the Statement of Additional Information (“SAI”). While the percentage limitations provide a useful level of detail about the Funds’ investment program, they should not be viewed as an accurate gauge of the potential risk of the investment. For example, in a given period, a 5% investment in futures contracts could have significantly more of an impact on a Fund’s share price than its weighting in the portfolio. The net effect of a particular investment depends on its volatility and the size of its overall return or risk profile in relation to the performance of the Fund’s other investments. The Portfolio Managers of the Funds have considerable leeway in choosing investment strategies and selecting securities, investment vehicles and other types of instruments the Portfolio Managers believe will help a Fund achieve its objective. In seeking to meet its investment objective or to adapt to changing economic or market environments, a Fund may invest in any type of security or instrument whose investment characteristics are considered by the Portfolio Managers to be consistent with the Fund’s investment program, including some that may not be listed in this Prospectus. Series D will determine the country of an issuer of a security based on: (a) the issuer’s domicile or location of headquarters; (b) where the issuer derives a significant proportion (at least 50%) of its revenues or profits from goods produced or sold, investments made, or services performed or where it has at least 50% of its assets; (c) the principal trading market for the security; (d) the currency in which the security is denominated; or (e) the classification of the country of an issuer by a third-party index provider. Investments made by a Fund and the results achieved by a Fund at any given time are not expected to be the same as those made by other clients for which an Investment Manager acts as investment adviser, including mutual funds with names, investment objectives and policies similar to the Fund. Also, investment strategies and types of investments will evolve over time, sometimes without prior notice to shareholders.

The Funds’ investment policies, limitations and other guidelines typically apply at the time an investment is made. As a result, a Fund generally may continue to hold positions that met a particular investment policy or limitation at the time the investment was made but subsequently do not meet the investment policy or limitation.

The Funds are subject to certain investment policy limitations referred to as "fundamental policies." The full text of each Fund’s fundamental policies is included in the SAI.

In September 2023, the SEC adopted amendments to Rule 35d-1 regarding names of registered investment companies such as the Funds. The amendment could cause some Funds to change their name or investment policies and make other operational adjustments. Implementation of any such change, which would need to be made prior to December 2025, could adversely impact a Fund’s operations and investment strategies. To this point, the impact of the rule amendments is still uncertain and under assessment.

PROSPECTUS | 118

Descriptions of Principal Risks

An investment or type of security specifically identified in this Prospectus generally reflects a principal investment for a Fund. The Funds also may invest in or use certain other types of investments and investing techniques that are described in the SAI. An investment or type of security only identified in the SAI typically is treated as a non-principal investment. Additional information on the principal risks and certain non-principal risks of the Funds is set forth below. The risks are listed in alphabetical order, not in the order of importance or potential exposure, and not all of the risks are principal risks for each Fund. The fact that a particular risk is not indicated as a principal risk for a Fund does not mean that the Fund is prohibited from investing its assets in securities that give rise to that risk. It simply means that the risk is not a principal risk for that Fund. Although the Funds will not generally trade for short-term profits, circumstances may warrant a sale without regard to the length of time a security was held. Each Fund may engage in active and frequent trading of portfolio securities and other assets. A high turnover rate may increase transaction costs, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the assets and on reinvestment in other assets, which decreases the value of investments, and may adversely affect a Fund’s performance.

Investors should note that each Fund reserves the right to discontinue offering shares at any time, to merge or reorganize itself or a class of shares, or to cease operations and liquidate at any time. In addition, portfolio managers can change at any time, the investment manager can be replaced, and an investment sub-adviser can be appointed to manage a Fund.

Investors should be aware that economies and financial markets have recently experienced increased uncertainty and volatility because of, among other factors, geopolitical tensions, labor and public health conditions around the world, inflation and changing interest rates. To the extent these or similar conditions continue or occur in the future, the risks below could be heightened significantly compared to normal conditions and therefore a Fund’s investments and a shareholder’s investment in a Fund may be particularly subject to reduced yield and/or income and sudden and substantial losses. The fact that a particular risk below is not specifically identified as being heightened under current conditions does not mean that the risk is not greater than under normal conditions.

Allocation Risk—The ability of a Fund to achieve its investment objective depends, in part, on the ability of the Investment Manager to allocate effectively the Fund’s assets among multiple investment strategies, underlying funds and asset classes. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or that an investment strategy will achieve its particular investment objective. Portfolio managers responsible for the investment strategies used by the Fund may make investment decisions independently and it is possible that the investment strategies may not complement one another. As a result, the Fund’s exposure to a given investment, industry, region or investment style could unintentionally be greater or smaller than it would have been if the Fund had a single investment strategy. In addition, underlying funds may not achieve their investment objectives, and their performance may be lower than that of the asset class the underlying funds were selected to represent.

Asset-Backed Securities Risk—The Funds may invest in asset-backed securities issued by legal entities that are sponsored by banks, investment banks, other financial institutions or companies, asset management firms or funds and are specifically created for the purpose of issuing such asset-backed securities. Investors in asset-backed securities receive payments that are part interest and part return of principal or certain asset-backed securities may be interest-only securities or principal-only securities. These payments typically depend upon the cash flows generated by an underlying pool of assets and vary based on the rate at which the underlying obligors pay off their liabilities under the underlying assets. The pooled assets provide cash flow to the issuer, which then makes interest and principal payments to investors. As a result, these investments involve the risk, among other risks, that the borrower may default on its obligations backing the asset-backed security and, thus, the value of and interest generated by such investment will decline.

Investments in asset-backed securities are subject to many of the same risks that are applicable to investments in certain other types of securities, including currency risk, geographic emphasis risk, high yield and unrated securities risk, leverage risk, prepayment and extension risk and regulatory risk. Asset-backed securities are particularly subject to interest rate, market and credit risks and the risk that non-payment on underlying assets will result in a decline in the value of the asset-backed-security. Compared to other fixed income investments with similar maturity and credit profile, asset-backed securities generally increase in value to a lesser extent when interest rates decline and generally decline in value to a similar or greater extent when interest rates rise. Asset-backed securities are also subject to liquidity and valuation risk and, therefore, may be difficult to value accurately or sell at an advantageous

119 | PROSPECTUS

time or price and involve greater transaction costs and wider bid/ask spreads than certain other instruments. In addition, the assets or collateral underlying an asset-backed security may be insufficient or unavailable in the event of a default and enforcing rights with respect to these assets or collateral may be difficult and costly.

With respect to a loan (such as a mortgage) backing asset-backed securities, when an underlying obligor (such as the homeowner) makes a prepayment, an investor in the securities receives a larger portion of its principal investment back, which means that there will be a decrease in interest payments and the investor may not be able to reinvest the principal it receives as a result of such prepayment in a security with a similar risk, return or liquidity profile. During periods of declining interest rates, asset-backed securities are more likely to be called or prepaid (or otherwise paid earlier than expected due to the sale of the underlying property, refinancing, or foreclosure), which may result in the Fund having to reinvest proceeds in other investments at a lower interest rate and the loss of any premium paid on the investment. In addition to prepayments, the underlying assets owned by an issuer of asset-backed securities are subject to the risk of defaults, and both defaults and prepayments may shorten the securities’ weighted average life and may lower their return, which may adversely affect a Fund’s investment in the asset-backed securities.

Loans made to lower quality borrowers, including those of sub-prime quality, may be underlying assets for an asset-backed security. Loans to such borrowers involve a higher risk of default. As a result, values of asset-backed securities backed by lower quality loans are more likely than others to suffer significant declines due to defaults, delays or the perceived risk of defaults or delays.

The value of asset-backed securities backed by sub-prime loans have in the past declined, and may in the future decline, significantly during market downturns. The value of asset-backed securities held by a Fund also may change because of actual or perceived changes in the reputation, creditworthiness or financial viability or solvency of the underlying asset obligors, the originators, the servicing agents, the financial institutions, if any, providing credit support, or swap counterparties in the case of synthetic asset-backed securities or the servicing practices of the servicing agent. Issuers of asset-backed securities may also have limited ability to enforce the security interest in the underlying assets and certain asset-backed securities do not have the benefit of a security interest in underlying collateral nor a government guarantee. In addition, the insurer or guarantor (if any) of an asset-backed security may fail to meet their obligations due to, for example, unanticipated legal or administrative challenges in enforcing contracts or because of damage to the collateral securing certain contracts.

Further, credit risk retention requirements for asset-backed securities may increase the costs to originators, securitizers and, in certain cases, asset managers of securitization vehicles in which a Fund may invest. Although the impact of these requirements is difficult to measure, certain additional costs may be passed to a Fund and the Fund’s investments in asset-backed securities may be adversely affected. Domestic or foreign regulatory developments could materially impact the value of a Fund’s investment in an asset-backed security, expose the Fund to additional costs and require changes to investment practices, thereby adversely affecting the Fund’s performance. Other regulatory, legislative or governmental actions may also adversely impact investments in asset-backed securities.

In addition, investments in asset-backed securities entail additional risks relating to the underlying pools of assets, including credit risk, default risk (such as a borrower’s default on its obligation and the default, failure or inadequacy or unavailability of a guarantee, if any, underlying the asset-backed security intended to protect investors in the event of default) and prepayment and extension risk with respect to the underlying pool or individual assets represented in the pool. The underlying assets of an asset-backed security may include, without limitation, residential or commercial mortgages, motor vehicle installment sales or installment loan contracts, leases of various types of real, personal and other property, receivable from credit card agreements and automobile finance agreements, student loans, consumer loans, and income from other income streams, such as income from business loans. Moreover, additional risks relating to investments in asset-backed securities may arise principally because of the type of asset-backed securities in which a Fund invests, with such risks primarily associated with the particular assets collateralizing the asset-backed securities (such as their type or nature), the structure of such asset-backed securities, or the tranche or priority of the asset-backed security held by the Fund (with junior or equity tranches generally carrying higher levels of risk).

For example, collateralized mortgage obligations (“CMOs”), which are mortgage-backed securities (“MBS”) that are typically collateralized by mortgage loans or mortgage pass-through securities and multi-class pass-through securities, are commonly structured as equity interests in a trust composed of mortgage loans or other MBS. CMOs are usually issued in multiple classes, often referred to as “tranches,” with each tranche having a specific fixed or

PROSPECTUS | 120

floating coupon rate and stated maturity or final distribution date. Under the traditional CMO structure, the cash flows generated by the mortgages or mortgage pass-through securities in the collateral pool are used to first pay interest and then pay principal to the holders of the CMOs. Subject to the provisions of individual CMO issues, the cash flow generated by the underlying collateral (to the extent it exceeds the amount required to pay the stated interest) is used to retire the bonds. As a result of these and other structural characteristics of CMOs, CMOs may have complex or highly variable prepayment terms, such as companion classes, interest only or principal only payments, inverse floaters and residuals. These investments generally exhibit similar risks to those of MBS but entail greater market, prepayment and liquidity risks than other MBS, and may be more volatile or less liquid than other MBS. CMOs are further subject to certain risks specific to these securities. For example, the average life of CMOs is typically determined using mathematical models that incorporate prepayment and other assumptions that involve estimates of future economic and market conditions, which may prove to be incorrect, particularly in periods of heightened market volatility. Further, the average weighted life of certain CMOs may not accurately reflect the price volatility of such securities, resulting in price fluctuations greater than what would be expected from interest rate movements alone. In addition, asset-backed securities backed by aircraft loans and leases may provide a Fund with a less effective security interest in the related underlying collateral than do mortgage-related securities and, thus, it is possible that recovery on repossessed collateral might be unavailable or inadequate to support payments on these asset-backed securities. In addition to the risks inherent in asset-backed securities generally, risks associated with aircraft securitizations include but are not limited to risks related to commercial aircraft, the leasing of aircraft by commercial airlines and the commercial aviation industry generally. With respect to any one aircraft, the value of such aircraft can be affected by the particular maintenance and operating history for the aircraft or its components, the model and type of aircraft, the jurisdiction of registration (including legal risks, costs and delays in attempting to repossess and export such aircraft following any default under the related loan or lease) and regulatory risk. With respect to the airline industry generally, economic and public health situations may at times result in widespread travel restrictions and reduced travel demand, which adversely affects the value and liquidity of aircraft securitizations. A Fund may invest in these and other types of asset-backed securities that may be developed in the future.

The general effects of inflation on the United States economy can be wide ranging, as evidenced by rising interest rates, wages, and costs of consumer goods and necessities. The long-term effects of inflation on the general economy and on any individual obligor are unclear, and in certain cases, rising inflation may affect an obligor’s ability to repay its related loan or obligation, thereby reducing the amount received by the holders of asset-backed securities with respect to such loan. Additionally, increased rates of inflation may negatively affect the value of certain asset-backed securities in the secondary market. In addition, during periods of declining economic conditions, losses on obligations underlying asset-backed securities generally increase.

Mortgage-backed securities generally are classified as either commercial mortgage-backed securities (“CMBS”) or residential mortgage-backed securities (“RMBS”), each of which are subject to certain specific risks. CMBS and RMBS are also subject to risks similar to those associated with investing in real estate, such as the possible decline in the value of (or income generated by) the real estate, variations in rental income, fluctuations in occupancy levels and demand for properties or real estate-related services, changes in interest rates and changes in the availability or terms of mortgages and other financing that may render the sale or refinancing of properties difficult or unattractive.

Commercial Mortgage-Backed Securities—CMBS are collateralized by one or more commercial mortgage loans. Banks and other lending institutions typically group the loans into pools and interests in these pools are then sold to investors, allowing the lender to have more money available to loan to other commercial real estate owners. Commercial mortgage loans may be secured by office properties, retail properties, hotels, mixed use properties or multi-family apartment buildings. The value of, and income generated by, investments in CMBS are subject to the risks of asset-backed securities generally and the commercial real estate markets and the real estate securing the underlying mortgage loans. Economic downturns, rises in unemployment, tightening lending standards, increased interest and lending rates, developments adverse to the commercial real estate markets, and other developments that limit or reduce the activities of and demand for commercial retail and office spaces (including continued or expanded remote working arrangements) as well as increased maintenance or tenant improvement costs and costs to convert properties for other uses adversely impact these investments. For example, economic decline in the businesses operated by the tenants of office or retail properties may increase the likelihood that the tenants may be unable to pay their rent or that properties may be unable to attract or retain tenants at all or on favorable terms for the commercial real estate owners, resulting in vacancies (potentially for extended periods) and losses. These developments could also result from, among other things, population shifts and other demographic changes, changing tastes and preferences as well as cultural, technological, working or economic and market developments. In addition, changing interest rate environments and associated changes in lending standards and higher refinancing rates may adversely

121 | PROSPECTUS