| UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

FORM N-CSR | ||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES | ||

| Investment Company Act file number: | (811-02742) |

| Exact name of registrant as specified in charter: | Putnam Equity Income Fund |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| Name and address of agent for service: | Robert T. Burns, Vice President One Post Office Square Boston, Massachusetts 02109 |

| Copy to: | John W. Gerstmayr, Esq. Ropes & Gray LLP 800 Boylston Street Boston, Massachusetts 02199-3600 |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| Date of fiscal year end: | November 30, 2011 |

| Date of reporting period: | December 1, 2010 — November 30, 2011 |

Item 1. Report to Stockholders: |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |||

Putnam

Equity Income

Fund

Annual report

11 | 30 | 11

| Message from the Trustees | 1 | ||

|

|

|||

| About the fund | 2 | ||

|

|

|||

| Performance snapshot | 4 | ||

|

|

|||

| Interview with your fund’s portfolio manager | 5 | ||

|

|

|||

| Your fund’s performance | 10 | ||

|

|

|||

| Your fund’s expenses | 12 | ||

|

|

|||

| Terms and definitions | 14 | ||

|

|

|||

| Other information for shareholders | 15 | ||

|

|

|||

| Trustee approval of management contract | 16 | ||

|

|

|||

| Financial statements | 21 | ||

|

|

|||

| Federal tax information | 41 | ||

|

|

|||

| About the Trustees | 42 | ||

|

|

|||

| Officers | 44 | ||

|

|

|||

Consider these risks before investing: Value stocks may fail to rebound, and the market may not favor value-style investing. Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests.

Message from the Trustees

Dear Fellow Shareholder:

For all the volatility and economic uncertainty investors experienced in recent months, U.S. equity markets ended the year more or less where they started; some fixed-income sectors posted modest gains, while others struggled. This period of heightened volatility is likely to persist, given the unresolved European debt crisis and tepid growth here in the United States. However, not all the news is bad. Corporate earnings and balance sheets remain solid, unemployment has trended down, inflation pressures have eased globally, and state budgets show early signs of improvement.

The counsel of your financial advisor can be an invaluable resource during periods of market uncertainty, as can a long-term focus and a balanced investment approach. Moreover, Putnam’s portfolio managers and analysts are trained to uncover the opportunities that often emerge in this kind of environment, while also seeking to guard against downside risk.

We would like to thank John A. Hill, who has served as Chairman of the Trustees since 2000 and who continues on as a Trustee, for his service. We are pleased to announce that Jameson A. Baxter is the new Chair, having served as Vice Chair since 2005 and a Trustee since 1994.

Ms. Baxter is President of Baxter Associates, Inc., a private investment firm, and Chair of the Mutual Fund Directors Forum. In addition, she serves as Chair Emeritus of the Board of Trustees of Mount Holyoke College, Director of the Adirondack Land Trust, and Trustee of the Nature Conservancy’s Adirondack Chapter.

We would also like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

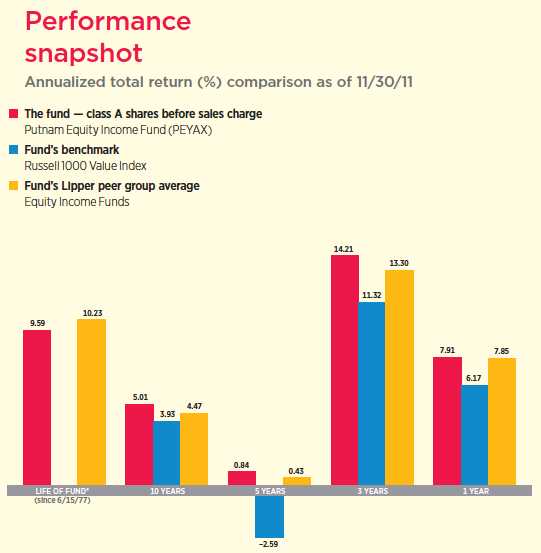

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 5.75%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Russell 1000 Value Index, was introduced on 12/31/78, which post-dates the inception of the fund’s class A shares.

4

Interview with your fund’s portfolio manager

Bart, in a volatile 12-month period for the stock market, the fund performed well relative to its benchmark and funds in its Lipper peer group. What contributed to these results?

We faced our share of challenges, including turbulent market conditions and a downturn in July that was particularly harmful to the performance of many holdings in the fund’s portfolio. However, I believed that the market had unfairly punished some fundamentally strong companies based largely on fears about the weakening economy and the potential for a double-dip recession. Recognizing that patience was in order, we maintained the fund’s positions in most of these holdings. In the subsequent months, as investors were able to distinguish company-specific issues from broader market fears, these stocks rebounded considerably.

July was not the only turbulent month. What can you tell us about financial market conditions throughout the fiscal year?

The period began on a strong note, but in early 2011, a number of events rattled investor nerves, including a devastating earthquake, tsunami, and nuclear crisis in Japan; unrest in the Middle East and North Africa; spiking oil prices; and political turmoil in Europe stemming from ongoing sovereign debt issues. We were impressed with the resilience of the financial markets as stocks overall weathered the turmoil and performed relatively well.

For the next several months, however, the markets were not as resilient. The S&P 500 Index, a common measure of broad stock market performance, saw its longest losing

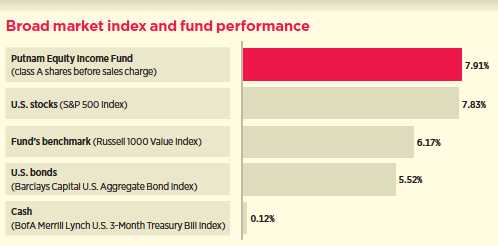

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 11/30/11. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on pages 14–15.

5

streak since 2008. Worsening sovereign credit woes in Europe and a generally dismal outlook for global economic growth led to sharp declines across world stock markets. Debt issues in the United States added to the pressure as lawmakers struggled to reach an agreement over the federal debt ceiling, and in August, the unprecedented downgrade of U.S. sovereign debt to AA+ from AAA by Standard & Poor’s sent stocks plunging again. Then, in October, the S&P 500 Index staged a dramatic recovery, delivering its best one-month gain since December 1991. The high levels of volatility that defined the period continued through the close of the fund’s fiscal year in November.

How did you position the fund in this environment?

Since we can’t prevent volatility, our strategy is to try to make it work to our advantage. This means buying into weakness with the goal of capturing gains when the market becomes optimistic, and continually assessing and repositioning the portfolio to prepare for pessimism and downturns. And, of course, we are stock-specific in our investing style — we focus on individual companies rather than broader sector trends or macroeconomic conditions. I am pleased to report that our stock selection was the greatest contributing factor to the fund’s outperformance for the fiscal year. Macroeconomic factors also play a role in our portfolio decisions, and in the slower growth environment, we made some shifts to companies with stronger balance sheets than we typically target. The strategy was to seek companies that may be more durable as demand and global GDP both slowed.

Which strategies or holdings helped fund performance for the period?

It is worth noting our decision to hold small positions, relative to the benchmark, in several large financial services companies that we believed were still vulnerable to declines. Our positioning in Bank of America, Citigroup, Goldman Sachs, and JPMorgan Chase was key to the

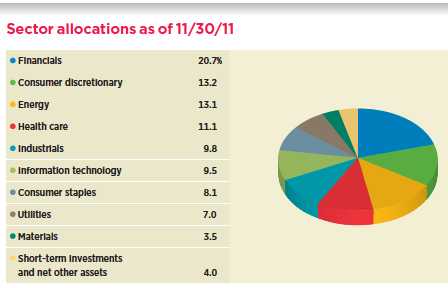

Allocations are represented as a percentage of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

6

fund’s ability to outperform its benchmark. We believed it was too soon to have significant exposure to these companies, most of which continue to face a number of regulatory, credit, and legal challenges. By the close of the period, we had sold the fund’s positions in Bank of America, Goldman Sachs, and JPMorgan Chase.

The financials sector had its share of strong-performing holdings as well. Fund performance benefited from our investments in Alliance Data Systems and Discover Financial Services, consumer finance companies that we believed were less affected by the costs of complying with regulatory changes such as the Consumer Protection Act of 2010. As earnings for these companies improved, they were among the fund’s top performers for the period.

Not surprisingly, fund performance was also boosted by consumer staples stocks such as tobacco giant Philip Morris International, pharmaceutical company Pfizer, and consumer products company Kimberly-Clark. Consumer staples are classic defensive investments that tend to hold up well in weak economic conditions. Similarly, in the oil and gas sector, we favored large, dividend-paying companies such as Chevron and Royal Dutch Shell over smaller energy firms. This strategy was effective as these stocks were also among our top contributors. By the close of the period, we had sold the fund’s position in Chevron.

What are some stocks that held back performance?

The performance of automobile-related stocks was disappointing for the period. The stock of Ford Motor was a top detractor, as was TRW Automotive Holdings. I believe this was the result of negative investor sentiment toward cyclical stocks in general, which typically struggle in an environment of slowing economic

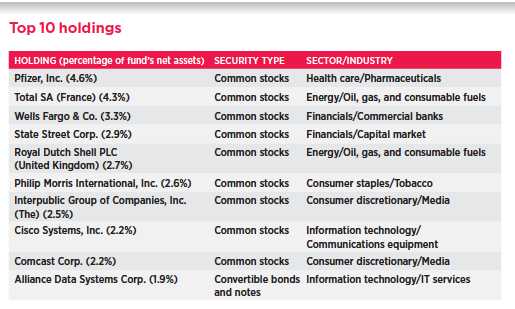

This table shows the fund’s top 10 individual holdings and the percentage of the fund’s net assets that each represented as of 11/30/11. Short-term holdings are excluded. Holdings will vary over time.

7

growth. Ford’s stock has suffered declines despite the company’s strengthening balance sheet, product improvements, and the recent reinstatement of its dividend. TRW designs, manufactures, and sells automotive systems and components such as air bags and safety electronics. At the close of the fiscal year, both of these stocks remained in the portfolio.

One significant detractor that was sold from the portfolio is OfficeMax. We initially believed this stock was attractively priced and that the company, an office supplies retailer, would benefit from a recovery in office employment. However, office employment remained weak and raw material costs led to greater-than-anticipated pricing pressures for the industry.

The stock of beauty products company Avon, a recent addition to the portfolio, also dampened fund performance. I began to build a position in this holding after declines in its share price made it an attractive long-term opportunity. As with most holdings in a value-oriented fund, this investment may take time and patience before we see its rewards. Earnings disappointments, restructurings, and a Securities and Exchange Commission [SEC] investigation have all weighed on the stock. Shortly after the close of the period, investors reacted positively to news that the company is seeking a new CEO. The stock remained in the portfolio at the close of the fiscal year.

Can you tell us about the fund’s recent dividend increases?

Effective in December 2010, the fund’s dividend rate increased by 20.83%, from $0.048 to $0.058 per class A share. And effective in June 2011, it increased again, by 15.52%, from $0.058 to $0.067 per class A share. These increases were due to our greater focus on dividend-paying stocks and the fact that several companies in the fund’s portfolio have continued to recover and have increased their dividend rates. Other share classes had similar increases.

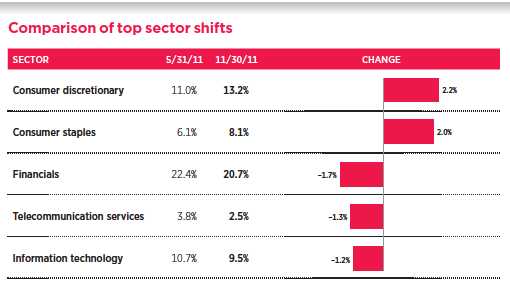

This chart shows the fund’s largest allocation shifts, by percentage, over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings will vary over time.

8

It is important to note that we continue to consider dividends as part of our criteria for selecting stocks, but we also look at a number of other characteristics. Companies that pay dividends can be attractive to investors for many reasons, particularly in today’s turbulent markets. They offer yields at a time when stock returns are volatile, and the payment of a dividend can be a sign of a company’s stability and financial health. However, in my view, it is important that we don’t pay too much for a stock simply because it offers a dividend. As we enter 2012, it appears that yields are historically quite expensive, and we will be cautious in our stock selection to ensure that dividend payments remain just one of many reasons for adding a stock to the portfolio.

As the fund enters a new fiscal year, what is your outlook?

My view — which has actually been unchanged for a few years — is that the market in the coming years will be characterized by higher volatility and lower long-term rates of return than we experienced in the 1980s and 1990s. We will continue to try to capitalize on that volatility, maintaining our disciplined process, but also staying flexible enough to move in and out of holdings quickly as valuation characteristics change. From a macroeconomic standpoint, I believe that investors still have plenty to worry about, and we are keeping a careful eye on issues such as the ongoing European sovereign debt crisis and continued anxiety and uncertainty around U.S. deficit reductions.

Thank you, Bart, for your time and insight.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Bartlett R. Geer has an M.B.A. from the Tuck School of Business at Dartmouth College and a B.A. from Dartmouth College. A CFA charterholder, he joined Putnam in 2000 and has been in the investment industry since 1981.

IN THE NEWS

Despite persistent market volatility, corporate financials improved to near-peak levels in 2011. Economic growth may have slowed, but many U.S. companies that implemented cost-cutting measures since 2008 began to see the results of those efforts reflected in resilient profit margins. Companies in the S&P 500 Index are on track to generate record earnings per share in 2011. In lean economic times, companies have remained vigilant about controlling costs and managing inventories effectively. Even in the face of heightened market volatility and consequent investor risk aversion, strong earnings performance has supported both equities and high-yield bonds on a fundamental basis.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended November 30, 2011, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 11/30/11

| Class A | Class B | Class C | Class M | Class R | Class Y | |||||

| (inception dates) | (6/15/77) | (9/13/93) | (2/1/99) | (12/2/94) | (1/21/03) | (10/1/98) | ||||

|

| ||||||||||

| Before | After | Before | After | Net | Net | |||||

| sales | sales | Before | After | Before | After | sales | sales | asset | asset | |

| charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | |

|

| ||||||||||

| Annual average | ||||||||||

| (life of fund) | 9.59% | 9.40% | 8.67% | 8.67% | 8.77% | 8.77% | 8.94% | 8.82% | 9.32% | 9.70% |

|

| ||||||||||

| 10 years | 62.99 | 53.64 | 51.20 | 51.20 | 51.22 | 51.22 | 55.08 | 49.63 | 58.95 | 67.10 |

| Annual average | 5.01 | 4.39 | 4.22 | 4.22 | 4.22 | 4.22 | 4.49 | 4.11 | 4.74 | 5.27 |

|

| ||||||||||

| 5 years | 4.26 | –1.75 | 0.39 | –1.33 | 0.36 | 0.36 | 1.66 | –1.88 | 2.92 | 5.52 |

| Annual average | 0.84 | –0.35 | 0.08 | –0.27 | 0.07 | 0.07 | 0.33 | –0.38 | 0.58 | 1.08 |

|

| ||||||||||

| 3 years | 48.99 | 40.37 | 45.73 | 42.72 | 45.74 | 45.74 | 46.83 | 41.70 | 47.85 | 50.13 |

| Annual average | 14.21 | 11.97 | 13.37 | 12.59 | 13.38 | 13.38 | 13.66 | 12.32 | 13.92 | 14.50 |

|

| ||||||||||

| 1 year | 7.91 | 1.70 | 7.13 | 2.13 | 7.11 | 6.11 | 7.36 | 3.57 | 7.63 | 8.19 |

|

| ||||||||||

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

10

Comparative index returns For periods ended 11/30/11

| Lipper Equity Income Funds | ||

| Russell 1000 Value Index | category average* | |

|

| ||

| Annual average (life of fund) | —† | 10.23% |

|

| ||

| 10 years | 47.01% | 55.91 |

| Annual average | 3.93 | 4.47 |

|

| ||

| 5 years | –12.31 | 2.71 |

| Annual average | –2.59 | 0.43 |

|

| ||

| 3 years | 37.94 | 45.78 |

| Annual average | 11.32 | 13.30 |

|

| ||

| 1 year | 6.17 | 7.85 |

|

| ||

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 11/30/11, there were 288, 252, 205, 106, and 3 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Russell 1000 Value Index, was introduced on 12/31/78, which post-dates the inception of the fund’s class A shares.

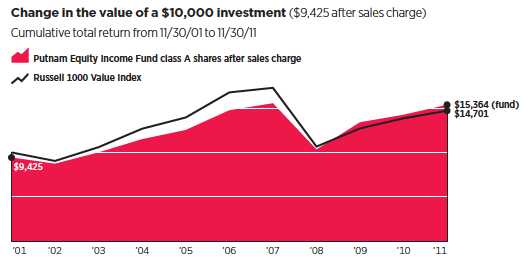

Past performance does not indicate future results. At the end of the same time period, a $10,000 investment in the fund’s class B and class C shares would have been valued at $15,120 and $15,122, respectively, and no contingent deferred sales charges would apply. A $10,000 investment in the fund’s class M shares ($9,650 after sales charge) would have been valued at $14,963. A $10,000 investment in the fund’s class R and class Y shares would have been valued at $15,895 and $16,710, respectively.

11

Fund price and distribution information For the 12-month period ended 11/30/11

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y | ||

|

| ||||||||

| Number | 4 | 4 | 4 | 4 | 4 | 4 | ||

|

| ||||||||

| Income | $0.263 | $0.144 | $0.154 | $0.187 | $0.229 | $0.302 | ||

|

| ||||||||

| Capital gains | — | — | — | — | — | — | ||

|

| ||||||||

| Total | $0.263 | $0.144 | $0.154 | $0.187 | $0.229 | $0.302 | ||

|

| ||||||||

| Before | After | Net | Net | Before | After | Net | Net | |

| sales | sales | asset | asset | sales | sales | asset | asset | |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| ||||||||

| 11/30/10 | $14.09 | $14.95 | $13.95 | $13.98 | $13.96 | $14.47 | $14.01 | $14.09 |

|

| ||||||||

| 11/30/11 | 14.94 | 15.85 | 14.80 | 14.82 | 14.80 | 15.34 | 14.85 | 14.94 |

|

| ||||||||

| Before | After | Net | Net | Before | After | Net | Net | |

| sales | sales | asset | asset | sales | sales | asset | asset | |

| Current yield (end of period) | charge | charge | value | value | charge | charge | value | value |

|

| ||||||||

| Current dividend rate 1 | 1.79% | 1.69% | 1.03% | 1.08% | 1.30% | 1.25% | 1.59% | 2.03% |

|

| ||||||||

| Current 30-day SEC yield 2 | N/A | 1.58 | 0.94 | 0.94 | N/A | 1.15 | 1.43 | 1.92 |

|

| ||||||||

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/11

| Class A | Class B | Class C | Class M | Class R | Class Y | |||||

| (inception dates) | (6/15/77) | (9/13/93) | (2/1/99) | (12/2/94) | (1/21/03) | (10/1/98) | ||||

|

| ||||||||||

| Before | After | Before | After | Net | Net | |||||

| sales | sales | Before | After | Before | After | sales | sales | asset | asset | |

| charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | |

|

| ||||||||||

| Annual average | ||||||||||

| (life of fund) | 9.61% | 9.42% | 8.68% | 8.68% | 8.78% | 8.78% | 8.95% | 8.84% | 9.33% | 9.71% |

|

| ||||||||||

| 10 years | 61.29 | 51.99 | 49.60 | 49.60 | 49.62 | 49.62 | 53.43 | 48.06 | 57.31 | 65.35 |

| Annual average | 4.90 | 4.28 | 4.11 | 4.11 | 4.11 | 4.11 | 4.37 | 4.00 | 4.63 | 5.16 |

|

| ||||||||||

| 5 years | 3.39 | –2.57 | –0.43 | –2.14 | –0.40 | –0.40 | 0.82 | –2.68 | 2.06 | 4.72 |

| Annual average | 0.67 | –0.52 | –0.09 | –0.43 | –0.08 | –0.08 | 0.16 | –0.54 | 0.41 | 0.93 |

|

| ||||||||||

| 3 years | 45.46 | 37.15 | 42.16 | 39.16 | 42.20 | 42.20 | 43.28 | 38.30 | 44.28 | 46.57 |

| Annual average | 13.30 | 11.10 | 12.44 | 11.64 | 12.45 | 12.45 | 12.74 | 11.41 | 13.00 | 13.59 |

|

| ||||||||||

| 1 year | 1.77 | –4.09 | 1.04 | –3.95 | 0.97 | –0.03 | 1.27 | –2.27 | 1.48 | 2.03 |

|

| ||||||||||

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees,

12

which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| Class A | Class B | Class C | Class M | Class R | Class Y | |

|

| ||||||

| Total annual operating expenses for the fiscal year | ||||||

| ended 11/30/10* | 1.17% | 1.92% | 1.92% | 1.67% | 1.42% | 0.92% |

|

| ||||||

| Annualized expense ratio for the six-month period | ||||||

| ended 11/30/11† | 1.09% | 1.84% | 1.84% | 1.59% | 1.34% | 0.84% |

|

| ||||||

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Restated to reflect projected expenses under a management contract effective 1/1/10.

† For the fund’s most recent fiscal half year; may differ from expense ratios based on one-year data in the financial highlights.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from June 1, 2011, to November 30, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Class A | Class B | Class C | Class M | Class R | Class Y | |

|

| ||||||

| Expenses paid per $1,000*† | $5.23 | $8.82 | $8.82 | $7.62 | $6.43 | $4.04 |

|

| ||||||

| Ending value (after expenses) | $914.90 | $912.00 | $911.30 | $912.90 | $914.00 | $916.20 |

|

| ||||||

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 11/30/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended November 30, 2011, use the following calculation method. To find the value of your investment on June 1, 2011, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

13

| Class A | Class B | Class C | Class M | Class R | Class Y | |

|

| ||||||

| Expenses paid per $1,000*† | $5.52 | $9.30 | $9.30 | $8.04 | $6.78 | $4.26 |

|

| ||||||

| Ending value (after expenses) | $1,019.60 | $1,015.84 | $1,015.84 | $1,017.10 | $1,018.35 | $1,020.86 |

|

| ||||||

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 11/30/11. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a

14

fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2011, are available in the Individual Investors section at putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of November 30, 2011, Putnam employees had approximately $322,000,000 and the Trustees had approximately $70,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

15

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

The Board of Trustees, with the assistance of its Contract Committee, which consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (“Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. Over the course of several months ending in June 2011, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information that Putnam Management provided and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees on a number of occasions. At the Trustees’ June 17, 2011 meeting, the Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contracts, effective July 1, 2011. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the management arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that some aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in previous years.

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management or investment style, changes

16

in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

Most of the open-end Putnam funds have new management contracts, with new fee schedules reflecting the implementation of more competitive fee levels for many funds, complex-wide breakpoints for the open-end funds, and performance fees for some funds. These new management contracts have been in effect for a little over a year — since January or, for a few funds, February, 2010. The Trustees approved the new management contracts on July 10, 2009, and fund shareholders subsequently approved the contracts by overwhelming majorities of the shares voted.

Because these management contracts had been implemented only recently, the Contract Committee had limited practical experience with the operation of the new fee structures. Under its new management contract, your fund has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as assets under management in the Putnam family of funds increase. The Contract Committee observed that the complex-wide breakpoints of the open-end funds had only been in place for a short while, and the Trustees will examine the operation of this new breakpoint structure in future years in light of further experience.

As in the past, the Trustees also focused on the competitiveness of each fund’s total expense ratio. In order to ensure that expenses of the Putnam funds continue to meet evolving competitive standards, the Trustees and Putnam Management agreed in 2009 to implement certain expense limitations. These expense limitations serve in particular to maintain competitive expense levels for funds with large numbers of small shareholder accounts and funds with relatively small net assets. Most funds, including your fund, had sufficiently low expenses that these expense limitations did not apply. The expense limitations were: (i) a contractual expense limitation applicable to all retail open-end funds of 37.5 basis points on investor servicing fees and expenses and (ii) a contractual expense limitation applicable to all open-end funds of 20 basis points on so-called “other expenses” (i.e., all expenses exclusive of management fees, investor servicing fees, distribution fees, investment-related expenses, interest, taxes, brokerage commissions and extraordinary expenses). Putnam Management’s support for these expense limitations was an important factor in the Trustees’ decision to approve the continuance of your fund’s management and sub-management contracts.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses (excluding any applicable 12b-1 fee), which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 1st quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 2nd quintile in total expenses (excluding any applicable 12b-1 fees) as of December 31, 2010 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The fee and expense data reported by Lipper as of December 31, 2010 reflected the most recent fiscal year-end data available in Lipper’s database at that time.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of

17

the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing of such economies of scale as may exist in the management of the funds at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of those fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these different types of clients. The Trustees observed that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients may reflect historical competitive forces operating in separate markets. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of several investment oversight committees of the Trustees, which met on a regular basis with the funds’ portfolio teams and with the Chief Investment Officer and other members of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Committee noted the substantial improvement in the performance of most Putnam funds during the 2009–2010 period and Putnam Management’s ongoing efforts to strengthen its investment personnel and processes. The Committee also noted the disappointing investment performance of some funds

18

for periods ended December 31, 2010 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional actions to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that its class A share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (Lipper Equity Income Funds) for the one-year, three-year and five-year periods ended December 31, 2010 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| One-year period | 4th | ||

|

|

|||

| Three-year period | 2nd | ||

|

|

|||

| Five-year period | 2nd | ||

|

|

|||

Over the one-year, three-year and five-year periods ended December 31, 2010, there were 281, 243 and 198 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

The Trustees, while noting that your fund’s investment performance in earlier periods had been favorable, expressed concern about your fund’s fourth quartile performance over the one-year period ended December 31, 2010 and considered the circumstances that may have contributed to this disappointing performance. The Trustees considered Putnam Management’s view that much of the fund’s underperformance over the one-year period was attributable to the fund’s investments in two companies linked to the Gulf of Mexico oil spill and to the impact of regulatory developments in the health care and financial sectors on the fund’s investments. They noted that the fund’s relative performance had improved over the second half of 2010, and that Putnam Management remained confident in the portfolio manager and his investment process based on the fund’s long-term performance. The Trustees also considered a number of other changes that Putnam Management had made in recent years in efforts to support and improve fund performance generally. These changes included Putnam Management’s efforts to increase accountability and to reduce complexity in the portfolio management process for the Putnam equity funds by moving generally from a portfolio management team structure to a decision-making process that vests full authority and responsibility with individual portfolio managers and by affirming its commitment to a fundamental-driven approach to investing. The Trustees noted that Putnam Management had also worked to strengthen its fundamental research capabilities by adding new investment personnel to the large-cap equity research team and by bringing U.S. and international research under common leadership. In addition, the Trustees recognized that Putnam Management has adjusted the compensation structure for portfolio managers and research analysts so that only those who achieve top-quartile returns over a rolling three-year basis are eligible for full bonuses.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees noted that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to performance issues, the Trustees concluded that it is preferable to seek change within Putnam Management to address

19

performance shortcomings. In the Trustees’ view, the alternative of engaging a new investment adviser for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. Subject to policies established by the Trustees, soft-dollar credits acquired through these means are used primarily to supplement Putnam Management’s internal research efforts. However, the Trustees noted that a portion of available soft-dollar credits continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor or distribution services. In conjunction with the annual review of your fund’s management contract, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”) and its distributor’s contracts and distribution plans with Putnam Retail Management Limited Partnership (“PRM”), both of which are affiliates of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV and PRM, as applicable, for such services are reasonable in relation to the nature and quality of such services.

20

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

21

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam Equity Income Fund:

We have audited the accompanying statement of assets and liabilities of Putnam Equity Income Fund (the fund), including the fund’s portfolio, as of November 30, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2011 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam Equity Income Fund as of November 30, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

January 17, 2012

22

The fund’s portfolio 11/30/11

| COMMON STOCKS (90.2%)* | Shares | Value |

|

| ||

| Aerospace and defense (2.5%) | ||

| Embraer SA ADR (Brazil) | 272,800 | $6,961,856 |

|

| ||

| Honeywell International, Inc. | 116,400 | 6,303,060 |

|

| ||

| L-3 Communications Holdings, Inc. | 150,040 | 9,947,652 |

|

| ||

| Northrop Grumman Corp. S | 979,390 | 55,893,787 |

|

| ||

| 79,106,355 | ||

| Auto components (1.2%) | ||

| Autoliv, Inc. (Sweden) S | 263,940 | 14,062,723 |

|

| ||

| TRW Automotive Holdings Corp. † | 722,880 | 23,609,261 |

|

| ||

| 37,671,984 | ||

| Automobiles (1.5%) | ||

| Ford Motor Co. † S | 3,299,340 | 34,973,004 |

|

| ||

| General Motors Co. † | 636,920 | 13,560,027 |

|

| ||

| 48,533,031 | ||

| Beverages (0.7%) | ||

| Coca-Cola Enterprises, Inc. | 813,700 | 21,253,844 |

|

| ||

| 21,253,844 | ||

| Biotechnology (0.2%) | ||

| Dendreon Corp. † S | 584,900 | 5,053,536 |

|

| ||

| 5,053,536 | ||

| Capital markets (2.9%) | ||

| State Street Corp. | 2,379,380 | 94,342,417 |

|

| ||

| 94,342,417 | ||

| Chemicals (1.4%) | ||

| Ashland, Inc. | 695,660 | 38,692,609 |

|

| ||

| LyondellBasell Industries NV Class A (Netherlands) | 192,600 | 6,292,242 |

|

| ||

| 44,984,851 | ||

| Commercial banks (4.6%) | ||

| Popular, Inc. (Puerto Rico) † | 3,189,905 | 4,752,958 |

|

| ||

| U.S. Bancorp S | 1,476,310 | 38,265,955 |

|

| ||

| Wells Fargo & Co. | 4,093,840 | 105,866,702 |

|

| ||

| 148,885,615 | ||

| Commercial services and supplies (1.0%) | ||

| Avery Dennison Corp. | 1,280,290 | 33,556,401 |

|

| ||

| 33,556,401 | ||

| Communications equipment (2.8%) | ||

| Cisco Systems, Inc. | 3,865,650 | 72,055,716 |

|

| ||

| Harris Corp. S | 271,280 | 9,657,568 |

|

| ||

| Tellabs, Inc. | 2,363,460 | 9,382,936 |

|

| ||

| 91,096,220 | ||

| Computers and peripherals (1.9%) | ||

| EMC Corp. † S | 354,458 | 8,156,079 |

|

| ||

| Hewlett-Packard Co. | 323,800 | 9,050,210 |

|

| ||

| SanDisk Corp. † | 895,490 | 44,156,612 |

|

| ||

| 61,362,901 | ||

| Consumer finance (0.6%) | ||

| Discover Financial Services | 848,564 | 20,212,794 |

|

| ||

| 20,212,794 | ||

| Containers and packaging (0.5%) | ||

| Sonoco Products Co. S | 494,720 | 16,068,506 |

|

| ||

| 16,068,506 | ||

| Diversified telecommunication services (1.2%) | ||

| Verizon Communications, Inc. | 1,016,070 | 38,336,321 |

|

| ||

| 38,336,321 | ||

23

| COMMON STOCKS (90.2%)* cont. | Shares | Value |

|

| ||

| Electric utilities (1.5%) | ||

| NV Energy, Inc. | 1,769,430 | $27,143,056 |

|

| ||

| Pepco Holdings, Inc. S | 1,041,550 | 20,601,859 |

|

| ||

| 47,744,915 | ||

| Electrical equipment (0.4%) | ||

| Hubbell, Inc. Class B | 188,430 | 12,327,091 |

|

| ||

| 12,327,091 | ||

| Food and staples retail (1.4%) | ||

| CVS Caremark Corp. | 1,188,700 | 46,169,108 |

|

| ||

| 46,169,108 | ||

| Health-care equipment and supplies (1.7%) | ||

| Baxter International, Inc. | 579,300 | 29,926,638 |

|

| ||

| Covidien PLC (Ireland) | 527,425 | 24,024,209 |

|

| ||

| 53,950,847 | ||

| Health-care providers and services (3.8%) | ||

| Aetna, Inc. | 994,110 | 41,573,680 |

|

| ||

| CIGNA Corp. | 1,042,500 | 46,109,775 |

|

| ||

| Lincare Holdings, Inc. S | 842,980 | 19,978,626 |

|

| ||

| Quest Diagnostics, Inc. S | 240,940 | 14,133,540 |

|

| ||

| 121,795,621 | ||

| Hotels, restaurants, and leisure (0.2%) | ||

| Wyndham Worldwide Corp. | 168,510 | 5,973,680 |

|

| ||

| 5,973,680 | ||

| Household durables (0.5%) | ||

| Jarden Corp. S | 520,360 | 16,204,010 |

|

| ||

| 16,204,010 | ||

| Household products (2.2%) | ||

| Energizer Holdings, Inc. † | 174,130 | 12,586,116 |

|

| ||

| Kimberly-Clark Corp. | 794,570 | 56,787,918 |

|

| ||

| 69,374,034 | ||

| Independent power producers and energy traders (1.7%) | ||

| AES Corp. (The) † | 4,341,870 | 52,449,790 |

|

| ||

| Calpine Corp. † | 63,900 | 961,056 |

|

| ||

| 53,410,846 | ||

| Industrial conglomerates (1.5%) | ||

| General Electric Co. | 293,500 | 4,669,585 |

|

| ||

| Tyco International, Ltd. | 883,030 | 42,350,119 |

|

| ||

| 47,019,704 | ||

| Insurance (9.5%) | ||

| Aflac, Inc. | 405,830 | 17,629,255 |

|

| ||

| Alterra Capital Holdings, Ltd. (Bermuda) S | 262,900 | 6,033,555 |

|

| ||

| Assurant, Inc. | 810,140 | 31,789,894 |

|

| ||

| Assured Guaranty, Ltd. (Bermuda) S | 548,471 | 5,320,169 |

|

| ||

| Everest Re Group, Ltd. | 135,160 | 11,857,587 |

|

| ||

| Hartford Financial Services Group, Inc. (The) | 1,557,230 | 27,656,405 |

|

| ||

| MetLife, Inc. | 908,970 | 28,614,376 |

|

| ||

| PartnerRe, Ltd. | 388,150 | 25,509,218 |

|

| ||

| Prudential Financial, Inc. | 695,760 | 35,233,286 |

|

| ||

| Transatlantic Holdings, Inc. | 663,450 | 36,250,908 |

|

| ||

| Validus Holdings, Ltd. | 1,867,590 | 56,195,783 |

|

| ||

| XL Group PLC | 1,046,511 | 21,579,057 |

|

| ||

| 303,669,493 | ||

24

| COMMON STOCKS (90.2%)* cont. | Shares | Value |

|

| ||

| Leisure equipment and products (1.7%) | ||

| Hasbro, Inc. S | 721,300 | $25,829,753 |

|

| ||

| Mattel, Inc. | 942,110 | 27,142,189 |

|

| ||

| 52,971,942 | ||

| Machinery (1.8%) | ||

| Eaton Corp. | 115,630 | 5,192,943 |

|

| ||

| Ingersoll-Rand PLC S | 498,070 | 16,496,078 |

|

| ||

| Parker Hannifin Corp. | 260,590 | 21,571,640 |

|

| ||

| Stanley Black & Decker, Inc. | 83,300 | 5,450,319 |

|

| ||

| Timken Co. | 202,600 | 8,511,226 |

|

| ||

| 57,222,206 | ||

| Media (7.7%) | ||

| Comcast Corp. Special Class A | 3,149,350 | 70,419,466 |

|

| ||

| Interpublic Group of Companies, Inc. (The) | 8,501,970 | 79,748,479 |

|

| ||

| McGraw-Hill Cos., Inc. (The) | 661,770 | 28,257,579 |

|

| ||

| News Corp. Class A | 615,000 | 10,725,600 |

|

| ||

| Time Warner, Inc. | 1,657,190 | 57,703,356 |

|

| ||

| 246,854,480 | ||

| Metals and mining (0.2%) | ||

| Freeport-McMoRan Copper & Gold, Inc. Class B (Indonesia) | 117,000 | 4,633,200 |

|

| ||

| Nucor Corp. S | 44,000 | 1,734,920 |

|

| ||

| 6,368,120 | ||

| Multi-utilities (0.8%) | ||

| Ameren Corp. | 771,800 | 26,094,558 |

|

| ||

| 26,094,558 | ||

| Office electronics (1.0%) | ||

| Xerox Corp. | 4,107,160 | 33,473,354 |

|

| ||

| 33,473,354 | ||

| Oil, gas, and consumable fuels (13.1%) | ||

| Apache Corp. | 281,580 | 28,000,315 |

|

| ||

| Exxon Mobil Corp. | 314,300 | 25,282,292 |

|

| ||

| Hess Corp. | 649,200 | 39,094,824 |

|

| ||

| Marathon Oil Corp. | 449,200 | 12,559,632 |

|

| ||

| Marathon Petroleum Corp. | 1,240,700 | 41,426,973 |

|

| ||

| Newfield Exploration Co. † | 237,500 | 10,877,500 |

|

| ||

| Noble Energy, Inc. | 125,420 | 12,340,074 |

|

| ||

| Royal Dutch Shell PLC ADR (United Kingdom) | 1,222,410 | 85,568,700 |

|

| ||

| Sunoco, Inc. S | 191,100 | 7,416,591 |

|

| ||

| Total SA (France) | 2,643,060 | 136,523,989 |

|

| ||

| Valero Energy Corp. | 968,300 | 21,564,041 |

|

| ||

| 420,654,931 | ||

| Paper and forest products (1.4%) | ||

| International Paper Co. S | 1,553,410 | 44,116,844 |

|

| ||

| 44,116,844 | ||

| Personal products (1.2%) | ||

| Avon Products, Inc. | 2,338,410 | 39,752,970 |

|

| ||

| 39,752,970 | ||

| Pharmaceuticals (5.5%) | ||

| Johnson & Johnson | 177,370 | 11,479,386 |

|

| ||

| Merck & Co., Inc. | 231,600 | 8,279,700 |

|

| ||

| Pfizer, Inc. | 7,367,110 | 147,857,898 |

|

| ||

| Teva Pharmaceutical Industries, Ltd. ADR (Israel) | 231,300 | 9,161,793 |

|

| ||

| 176,778,777 | ||

25

| COMMON STOCKS (90.2%)* cont. | Shares | Value |

|

| ||

| Professional services (1.5%) | ||

| Dun & Bradstreet Corp. (The) S | 664,660 | $46,439,794 |

|

| ||

| 46,439,794 | ||

| Real estate investment trusts (REITs) (2.0%) | ||

| American Capital Agency Corp. | 466,900 | 13,395,361 |

|

| ||

| Chimera Investment Corp. S | 3,047,140 | 8,135,864 |

|

| ||

| CreXus Investment Corp. | 1,082,399 | 10,564,214 |

|

| ||

| MFA Financial, Inc. | 4,443,105 | 30,568,562 |

|

| ||

| 62,664,001 | ||

| Semiconductors and semiconductor equipment (0.9%) | ||

| Applied Materials, Inc. | 1,495,300 | 16,119,334 |

|

| ||

| Lam Research Corp. † | 295,810 | 12,060,174 |

|

| ||

| 28,179,508 | ||

| Software (0.1%) | ||

| Symantec Corp. † | 191,000 | 3,122,850 |

|

| ||

| 3,122,850 | ||

| Specialty retail (0.1%) | ||

| Staples, Inc. | 265,700 | 3,828,737 |

|

| ||

| 3,828,737 | ||

| Tobacco (2.6%) | ||

| Philip Morris International, Inc. | 1,096,150 | 83,570,476 |

|

| ||

| 83,570,476 | ||

| Wireless telecommunication services (1.2%) | ||

| Telephone and Data Systems, Inc. S | 71,670 | 1,934,373 |

|

| ||

| Vodafone Group PLC ADR (United Kingdom) | 1,355,200 | 36,793,680 |

|

| ||

| 38,728,053 | ||

| Total common stocks (cost $2,733,434,503) | $2,888,925,726 | |

| CONVERTIBLE PREFERRED STOCKS (5.4%)* | Shares | Value |

|

| ||

| Automobiles (0.3%) | ||

| General Motors Co. Ser. B, $2.375 cv. pfd. | 312,634 | $10,668,635 |

|

| ||

| 10,668,635 | ||

| Diversified financial services (0.4%) | ||

| Citigroup, Inc. $7.50 cv. pfd. | 155,592 | 13,138,188 |

|

| ||

| 13,138,188 | ||

| Electric utilities (3.0%) | ||

| Great Plains Energy, Inc. $6.00 cv. pfd. | 594,547 | 37,658,607 |

|

| ||

| PPL Corp. $4.375 cv. pfd. | 1,090,062 | 59,757,199 |

|

| ||

| 97,415,806 | ||

| Road and rail (0.8%) | ||

| Swift Mandatory Common Exchange Security Trust 144A | ||

| 6.00% cv. pfd. | 2,796,714 | 25,880,232 |

|

| ||

| 25,880,232 | ||

| IT services (0.9%) | ||

| Unisys Corp. Ser. A, 6.25% cv. pfd. | 391,215 | 27,336,148 |

|

| ||

| 27,336,148 | ||

| Total convertible preferred stocks (cost $185,121,441) | $174,439,009 | |

26

| CONVERTIBLE BONDS AND NOTES (2.6%)* | Principal amount | Value |

|

| ||

| Alliance Data Systems Corp. cv. sr. unsec. notes 4 3/4s, | ||

| 2014 | $26,850,000 | $59,808,375 |

|

| ||

| MGIC Investment Corp. cv. sr. notes 5s, 2017 | 18,271,000 | 9,683,630 |

|

| ||

| WESCO International, Inc. cv. company guaranty sr. unsec. | ||

| notes 6s, 2029 | 6,471,000 | 12,666,983 |

|

| ||

| Total convertible bonds and notes (cost $60,870,739) | $82,158,988 | |

| INVESTMENT COMPANIES (0.4%)* | Shares | Value |

|

| ||

| Ares Capital Corp. | 794,490 | $12,362,266 |

|

| ||

| Total investment companies (cost $12,305,720) | $12,362,266 | |

| SHORT-TERM INVESTMENTS (6.5%)* | Principal amount/shares | Value |

|

| ||

| Putnam Cash Collateral Pool, LLC 0.18% d | 165,312,573 | $165,312,573 |

|

| ||

| Putnam Money Market Liquidity Fund 0.10% e | 22,059,422 | 22,059,422 |

|

| ||

| Straight-A Funding LLC commercial paper with an effective | ||

| yield of 0.188%, January 18, 2012 | $16,173,000 | 16,168,903 |

|

| ||

| Straight-A Funding LLC commercial paper with an effective | ||

| yield of 0.188%, January 17, 2012 | 5,160,000 | 5,158,720 |

|

| ||

| Total short-term investments (cost $208,699,618) | $208,699,618 | |

| TOTAL INVESTMENTS | ||

|

| ||

| Total investments (cost $3,200,432,021) | $3,366,585,607 | |

Key to holding’s abbreviations

| ADR | American Depository Receipts |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from December 1, 2010 through November 30, 2011 (the reporting period).

* Percentages indicated are based on net assets of $3,202,573,897.

† Non-income-producing security.

d See Note 1 to the financial statements regarding securities lending. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

e See Note 6 to the financial statements regarding investments in Putnam Money Market Liquidity Fund. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

S Security on loan, in part or in entirety, at the close of the reporting period.

Debt obligations are considered secured unless otherwise indicated.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

ADR after the name of a foreign holding represents ownership of foreign securities on deposit with a custodian bank.

27

Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures (ASC 820) establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1 — Valuations based on quoted prices for identical securities in active markets.

Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 — Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| Valuation inputs | ||||

|

| ||||

| Investments in securities: | Level 1 | Level 2 | Level 3 | |

|

| ||||

| Common stocks: | ||||

|

| ||||

| Consumer discretionary | $412,037,864 | $— | $— | |

|

| ||||

| Consumer staples | 260,120,432 | — | — | |

|

| ||||

| Energy | 284,130,942 | 136,523,989 | — | |

|

| ||||

| Financials | 629,774,320 | — | — | |

|

| ||||

| Health care | 357,578,781 | — | — | |

|

| ||||

| Industrials | 275,671,551 | — | — | |

|

| ||||

| Information technology | 217,234,833 | — | — | |

|

| ||||

| Materials | 111,538,321 | — | — | |

|

| ||||

| Telecommunication services | 77,064,374 | — | — | |

|

| ||||

| Utilities | 127,250,319 | — | — | |

|

| ||||

| Total common stocks | 2,752,401,737 | 136,523,989 | — | |

| Convertible bonds and notes | — | 82,158,988 | — | |

|

| ||||

| Convertible preferred stocks | — | 174,439,009 | — | |

|

| ||||

| Investment companies | 12,362,266 | — | — | |

|

| ||||

| Short-term investments | 22,059,422 | 186,640,196 | — | |

|

| ||||

| Totals by level | $2,786,823,425 | $579,762,182 | $— | |

The accompanying notes are an integral part of these financial statements.

28

Statement of assets and liabilities 11/30/11

| ASSETS | |

|

| |

| Investment in securities, at value, including $168,574,454 of securities on loan (Note 1): | |

| Unaffiliated issuers (identified cost $3,013,060,026) | $3,179,213,612 |

| Affiliated issuers (identified cost $187,371,995) (Notes 1 and 6) | 187,371,995 |

|

| |

| Dividends, interest and other receivables | 14,690,372 |

|

| |

| Receivable for shares of the fund sold | 3,376,147 |

|

| |

| Receivable for investments sold | 13,300,982 |

|

| |

| Total assets | 3,397,953,108 |

| LIABILITIES | |

|

| |

| Payable for investments purchased | 7,018,660 |

|

| |

| Payable for shares of the fund repurchased | 18,882,017 |

|

| |

| Payable for compensation of Manager (Note 2) | 1,260,207 |

|

| |

| Payable for investor servicing fees (Note 2) | 836,802 |

|

| |

| Payable for custodian fees | 23,421 |

|

| |

| Payable for Trustee compensation and expenses (Note 2) | 539,706 |

|

| |

| Payable for administrative services (Note 2) | 15,241 |

|

| |

| Payable for distribution fees (Note 2) | 1,181,270 |

|

| |

| Collateral on securities loaned, at value (Note 1) | 165,312,573 |

|

| |

| Other accrued expenses | 309,314 |

|

| |

| Total liabilities | 195,379,211 |

| Net assets | $3,202,573,897 |

|

| |

| REPRESENTED BY | |

|

| |

| Paid-in capital (Unlimited shares authorized) (Notes 1, 4 and 7) | $3,480,732,608 |

|

| |

| Undistributed net investment income (Note 1) | 43,473,921 |

|

| |

| Accumulated net realized loss on investments and foreign currency transactions (Note 1) | (487,786,218) |

|

| |

| Net unrealized appreciation of investments | 166,153,586 |

|

| |

| Total — Representing net assets applicable to capital shares outstanding | $3,202,573,897 |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| |

| Net asset value and redemption price per class A share | |

| ($2,308,957,463 divided by 154,598,041 shares) | $14.94 |

|

| |

| Offering price per class A share (100/94.25 of $14.94)* | $15.85 |

|

| |

| Net asset value and offering price per class B share ($94,659,802 divided by 6,397,796 shares)** | $14.80 |

|

| |

| Net asset value and offering price per class C share ($109,413,680 divided by 7,383,992 shares)** | $14.82 |

|

| |

| Net asset value and redemption price per class M share ($31,868,001 divided by 2,153,955 shares) | $14.80 |

|

| |

| Offering price per class M share (100/96.50 of $14.80)* | $15.34 |

|

| |

| Net asset value, offering price and redemption price per class R share | |

| ($62,193,462 divided by 4,188,376 shares) | $14.85 |

|

| |

| Net asset value, offering price and redemption price per class Y share | |

| ($595,481,489 divided by 39,864,428 shares) | $14.94 |

|

| |

* On single retail sales of less than $50,000. On sales of $50,000 or more the offering price is reduced.

** Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

29