10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period to

Commission File No. 1-6383

MEDIA GENERAL, INC.

(Exact name of registrant as specified in its charter)

|

| |

Commonwealth of Virginia | 46-5188184 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation or organization) | Identification No.) |

| |

333 E. Franklin St., Richmond, VA | 23219 |

(Address of principal executive offices) | (Zip Code) |

(804) 887-5000

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Voting Common Stock | New York Stock Exchange |

(Title of class) | (Name of exchange on |

| which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes X No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. (as defined in Rule 12b-2 of the Act).

Large accelerated filer X Accelerated filer Non-accelerated filer

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes No X

The aggregate market value of voting and non-voting stock held by nonaffiliates of the registrant, based upon the closing price of the Company’s Class A Common Stock as reported on the New York Stock Exchange, as of June 30, 2015, was $2.1 billion.

The number of shares of Voting Common Stock (no par value) outstanding on February 26, 2016, was 128,944,173.

Part III incorporates information by reference from the proxy statement for the Annual Meeting of Stockholders to be held on April 21, 2016.

Index to Media General, Inc.

Annual Report on Form 10-K for the Year Ended December 31, 2015

|

| | |

Item No. | Page |

Part I |

| | |

1. | | |

1A. | | |

1B. | | |

2. | | |

3. | | |

4. | | |

| | |

| | |

Part II |

| | |

5. | | |

6. | | |

7. | | |

7A. | | |

8. | | |

9. | | |

9A. | | |

9B. | | |

| | |

Part III |

| | |

10. | | |

11. | | |

12. | | |

13. | | |

14. | | |

|

Part IV |

| | |

15. | | |

| | |

| | |

Part I

Item 1. Business

General

In September 2015, Media General Inc. (the “Company” or “Media General”) announced a merger agreement under which the Company would have acquired all of the outstanding common stock of Meredith Corporation (“Meredith”) in a cash and stock transaction. Later in September of 2015 the Company received an unsolicited proposal from Nexstar Broadcasting Group, Inc. (“Nexstar”) to acquire all of the outstanding common stock of Media General. Following discussion between the various parties, in January 2016 Media General terminated its agreement with Meredith with Media General paying Meredith a $60 million termination fee and providing Meredith with an opportunity to negotiate for the purchase of certain broadcast and digital assets owned by Media General. Immediately thereafter, the Company entered into an agreement with Nexstar whereby Nexstar will acquire all outstanding shares of Media General for $10.55 per share in cash and 0.1249 shares of Nexstar Class A common stock for each Media General share. Upon the completion of the transaction, Nexstar will change its name to Nexstar Media Group. The agreement includes additional consideration in the form of a contingent value right entitling Media General shareholders to net cash proceeds, reduced to account for Media General shareholders' ongoing ownership in Nexstar following the transaction, to the extent received from the sale of Media General's spectrum in the Federal Communication Commission's upcoming Incentive Auction discussed further in Pending Matters. It is estimated that Media General shareholders will own approximately 34% and existing Nexstar shareholders will retain approximately 66% ownership of the combined company after closing. The closing of the transaction is subject to the satisfaction of a number of conditions including, but not limited to, the approval of various matters relating to the transaction by Media General and Nexstar shareholders, the approval of the Federal Communications Commission (“FCC”), clearance under the Hart-Scott-Rodino antitrust act and certain third party consents.

On December 19, 2014 (the “Closing Date”), Media General, Inc., now known as MGOC, Inc. (“Old Media General”), and LIN Media LLC, a Delaware limited liability company (“LIN Media” or “LIN”) were combined in a business combination transaction (the “LIN Merger”). As a result of this merger, Media General, Inc. formerly known as Mercury New Holdco, Inc. (“New Media General” or the “Company”) became the parent public-reporting company of the combined company; LIN Television Corporation (“LIN Television”) became a direct, wholly owned subsidiary of New Media General and Old Media General became a direct, wholly owned subsidiary of LIN Television and an indirect, wholly owned subsidiary of New Media General. The Company is headquartered in Richmond, Virginia.

Also on the Closing Date, the Company, through its wholly owned subsidiaries, completed the sale of the following television stations: (i) WJAR-TV in Providence, Rhode Island, (ii) WLUK-TV and WCWF-TV in Green Bay-Appleton, Wisconsin, (iii) certain assets of WTGS-TV in Savannah, Georgia, (iv) WVTM-TV in Birmingham, Alabama, (v) WJCL-TV in Savannah, Georgia, and (vi) WALA-TV in Mobile, Alabama. It also completed the purchase of the following television stations: (i) KXRM-TV and KXTU-LD in Colorado Springs, Colorado and (ii) WTTA-TV in Tampa, Florida.

References to Media General or the Company in this Annual Report on Form 10-K that include any period at and before the effectiveness of the LIN Merger shall be deemed to refer to Old Media General as the predecessor registrant to New Media General. References to Legacy Media General refer to Old Media General prior to the merger with New Young Broadcasting Holding Co., Inc. (“Young”) as further described below.

On November 12, 2013, Legacy Media General and Young were combined in a tax-free, all-stock merger transaction (the “Young Merger”). In the Young Merger, Media General issued to Young’s equity holders 60.2 million shares of Media General voting common stock. The merger with Young was accounted for as a reverse acquisition in accordance with FASB Accounting Standards Codification Topic 805, Business Combinations (“ASC 805”). For financial reporting purposes, Young was the acquirer and the continuing reporting entity. Accordingly, financial information presented for the Company in the consolidated financial statements for the year ended December 31, 2012 reflects the historical activity of Young.

The Company owns, operates or services 71 network-affiliated stations (23 with CBS, 13 with NBC, 12 with ABC, 8 with FOX, 8 with CW, and 7 with MyNetworkTV) and their associated digital media and mobile platforms, operating in 48 markets. These stations reach approximately 23% of U.S. TV households, and the Company reaches almost one half of the U.S. Internet audience. Fifty of the 71 stations are located in the top 100 designated market areas as grouped by Nielsen (“DMAs”), while 27 of the 71 stations are located in the top 50 markets.

Legacy Media General was incorporated in Virginia and became a public company in 1969. It grew through acquisition, mostly by purchasing high-quality, privately owned local media entities in the Southeast. Legacy Media General sold all of its newspapers in 2012. Young was incorporated in 2009 for purposes of acquiring the business of Young Broadcasting Inc. in connection with Young Broadcasting Inc.’s bankruptcy filing under Chapter 11 of Title 11 of the United States Bankruptcy Code.

In June of 2010, Young Broadcasting Inc. emerged from bankruptcy as a wholly owned subsidiary of Young pursuant to Young Broadcasting Inc.’s confirmed Chapter 11 plan of reorganization. Various LIN entities have owned and operated television stations since 1966.

Broadcast Stations and Markets

The Company’s operations as of December 31, 2015, include television stations (which cover 23% of the U.S.), websites and digital operations as shown on the following map:

The following table sets forth general information for the Company’s television stations as of December 31, 2015:

|

| | | | | | |

Market | DMA Rank (1) | Station | Network Affiliation | Status (2) | Expiration Date of Primary Network Agreement | Expiration of FCC License |

San Francisco, CA | 6 | KRON | MyTV | | 9/28/2016 | 12/1/2022 |

Tampa - St. Petersburg - Sarasota, FL | 11 | WFLA | NBC | | 12/31/2017 | 2/1/2021 |

Tampa - St. Petersburg - Sarasota, FL | 11 | WTTA | MyNet | | 9/28/2016 | 2/1/2021 |

Portland, OR | 24 | KOIN | CBS | | 12/31/2021 | 2/1/2023 |

Raleigh - Durham, NC | 25 | WNCN | NBC (3) | | 2/29/2016 | 12/1/2020 |

Indianapolis, IN | 27 | WISH | CW | | 9/1/2021 | 8/1/2021 |

Indianapolis, IN | 27 | WNDY | MyNet | | 9/28/2016 | 8/1/2021 |

Nashville, TN | 29 | WKRN | ABC | | 8/31/2021 | 8/1/2021 |

Hartford-New Haven, CT | 30 | WTNH | ABC | | 8/31/2021 | 4/1/2023 |

Hartford-New Haven, CT | 30 | WCTX | MyNet | | 9/28/2016 | 4/1/2023 |

Columbus, OH | 31 | WCMH | NBC | | 12/31/2017 | 10/1/2021 |

Greenville-Spartanburg, SC, Asheville, NC | 37 | WSPA | CBS | | 8/31/2019 | 12/1/2020 |

Greenville-Spartanburg, SC, Asheville, NC | 37 | WYCW | CW | | 9/1/2021 | 12/1/2020 |

Austin, TX | 39 | KXAN | NBC | | 12/31/2017 | 8/1/2022 |

Austin, TX | 39 | KNVA+ | CW | LMA | 9/1/2021 | 8/1/2022 |

Austin, TX | 39 | KBVO | MyNet | | 9/28/2016 | 8/1/2022 |

|

| | | | | | |

Market | DMA Rank (1) | Station | Network Affiliation | Status (2) | Expiration Date of Primary Network Agreement | Expiration of FCC License |

Grand Rapids-Kalamazoo-Battle Creek, MI | 41 | WOOD | NBC | | 12/31/2017 | 10/1/2021 |

Grand Rapids-Kalamazoo-Battle Creek, MI | 41 | WOTV | ABC | | 8/31/2021 | 10/1/2021 |

Grand Rapids-Kalamazoo-Battle Creek, MI | 41 | WXSP | MyNet | | 9/28/2016 | 10/1/2021 |

Norfolk-Portsmouth-Newport News, VA | 42 | WAVY | NBC | | 12/31/2017 | 10/1/2020 |

Norfolk-Portsmouth-Newport News, VA | 42 | WVBT | FOX | | 12/31/2017 | 10/1/2020 |

Harrisburg, PA | 44 | WHTM | ABC | | 8/31/2021 | 8/1/2023 |

Birmingham, AL | 45 | WIAT | CBS | | 8/31/2019 | 4/1/2021 |

Albuquerque-Santa Fe, NM | 48 | KRQE+ | CBS | | 8/31/2019 | 10/1/2022 |

Albuquerque-Santa Fe, NM | 48 | KASA | FOX | | 12/31/2017 | 10/1/2022 |

Albuquerque-Santa Fe, NM | 48 | KWBQ+ | CW | SSA | 9/1/2021 | 10/1/2022 |

Albuquerque-Santa Fe, NM | 48 | KASY | MyNet | SSA | 9/28/2016 | 10/1/2022 |

Providence, RI-New Bedford, MA | 52 | WPRI | CBS | | 8/31/2019 | 4/1/2023 |

Providence, RI-New Bedford, MA | 52 | WNAC | FOX | LMA | 12/31/2017 | 4/1/2023 |

Buffalo, NY | 53 | WIVB | CBS | | 8/31/2019 | 6/1/2023 |

Buffalo, NY | 53 | WNLO | CW | | 9/1/2021 | 6/1/2023 |

Richmond, VA | 56 | WRIC | ABC | | 8/31/2021 | 10/1/2020 |

Mobile, AL - Pensacola, FL | 58 | WKRG | CBS | | 8/31/2019 | 4/1/2021 |

Mobile, AL/Pensacola, FL | 58 | WFNA | CW | | 9/1/2021 | 4/1/2021 |

Albany, NY | 59 | WTEN+ | ABC | | 8/31/2021 | 6/1/2023 |

Albany, NY | 59 | WXXA | FOX | SSA/JSA | 12/31/2017 | 6/1/2023 |

Knoxville, TN | 62 | WATE | ABC | | 8/31/2021 | 8/1/2021 |

Dayton, OH | 64 | WDTN | NBC | | 12/31/2017 | 10/1/2021 |

Dayton, OH | 64 | WBDT | CW | SSA/JSA | 9/1/2021 | 10/1/2021 |

Wichita-Hutchinson, KS | 65 | KSNW+ | NBC | | 12/31/2017 | 6/1/2022 |

Honolulu, HI | 66 | KHON+ | FOX | | 12/31/2017 | 2/1/2023 |

Green Bay, WI | 68 | WBAY | ABC | | 8/31/2021 | 12/1/2021 |

Roanoke - Lynchburg, VA | 69 | WSLS | NBC | | 12/31/2017 | 10/1/2020 |

Colorado Springs-Pueblo, CO | 89 | KXRM | FOX | | 12/31/2017 | 4/1/2022 |

Colorado Springs-Pueblo, CO | 89 | KXTU | CW | | 9/1/2021 | 4/1/2022 |

Savannah, GA | 91 | WSAV | NBC | | 12/31/2017 | 4/1/2021 |

Charleston, SC | 94 | WCBD | NBC | | 12/31/2017 | 12/1/2020 |

Jackson, MS | 95 | WJTV | CBS | | 8/31/2019 | 6/1/2021 |

Tri-Cities, TN/VA | 97 | WJHL | CBS | | 12/31/2019 | 8/1/2021 |

Greenville - New Bern, NC | 99 | WNCT | CBS | | 8/31/2019 | 12/1/2020 |

Davenport, IA | 101 | KWQC | NBC | | 12/31/2017 | 2/1/2022 |

Myrtle Beach - Florence, SC | 102 | WBTW | CBS | | 8/31/2019 | 12/1/2020 |

Sioux Falls, SD | 110 | KELO+ | CBS | | 8/31/2019 | 4/1/2022 |

Fort Wayne, IN | 111 | WANE | CBS | | 8/31/2019 | 8/1/2021 |

|

| | | | | | |

Market | DMA Rank (1) | Station | Network Affiliation | Status (2) | Expiration Date of Primary Network Agreement | Expiration of FCC License |

Augusta, GA - Aiken, SC | 112 | WJBF (4) | ABC | | 8/31/2021 | 4/1/2021 |

Lansing, MI | 113 | WLNS | CBS | | 12/31/2021 | 10/1/2021 |

Lansing, MI | 113 | WLAJ | ABC | SSA/JSA | 8/31/2021 | 10/1/2021 |

Youngstown, OH | 114 | WKBN | CBS | | 12/31/2021 | 10/1/2021 |

Youngstown, OH | 114 | WYTV | ABC | SSA/JSA | 8/31/2021 | 10/1/2021 |

Youngstown, OH | 114 | WYFX+ | FOX | | 12/31/2017 | 10/1/2021 |

Springfield-Holyoke, MA | 116 | WWLP | NBC | | 12/31/2017 | 4/1/2023 |

Lafayette, LA | 121 | KLFY | CBS | | 12/31/2021 | 6/1/2021 |

Columbus, GA | 127 | WRBL | CBS | | 8/31/2019 | 4/1/2021 |

Topeka, KS | 135 | KSNT | NBC | | 12/31/2017 | 6/1/2022 |

Topeka, KS | 135 | KTKA | ABC | SSA/JSA | 8/31/2021 | 6/1/2022 |

Topeka, KS | 135 | KTMJ | FOX | | 12/31/2017 | 6/1/2022 |

Mason City, IA | 153 | KIMT | CBS | | 8/31/2019 | 2/1/2022 |

Terre Haute, IN | 155 | WTHI | CBS | | 8/31/2019 | 8/1/2021 |

Hattiesburg - Laurel, MS | 168 | WHLT | CBS | | 8/31/2019 | 6/1/2021 |

Rapid City, SD | 171 | KCLO | CBS | | 8/31/2019 | 4/1/2022 |

Lafayette, IN | 187 | WLFI | CBS | | 12/31/2021 | 8/1/2021 |

(1) Designated Market Area or “DMA” estimates and rankings are taken from Nielsen Local Universe Estimates for the 2015-2016 Broadcast Season, effective September 26, 2015. There are 210 DMAs in the United States. All Nielsen data included in this report represents Nielsen estimates, and Nielsen has neither reviewed nor approved the data included in this report.

(2) We own or operate all of our stations and digital channels except for those (i) noted as “LMA” which indicates stations to which we provide services under a local marketing agreement, (ii) noted as “SSA” which indicates stations to which we provide technical, engineering, promotional, administrative and other operational support services under a shared services agreement, and (iii) noted as JSA which indicates stations to which we provide advertising sales services under a joint sales agreement.

(3) WNCN-TV in the Raleigh-Durham, NC DMA will switch from an NBC affiliate to a CBS affiliate beginning February 29, 2016. The CBS Network Agreement will expire on February 29, 2020.

(4) The station is also party to joint sales and shared service agreements for WAGT, a NBC affiliate, which is licensed to an independent third party.

Revenues, Cyclicality and Seasonality

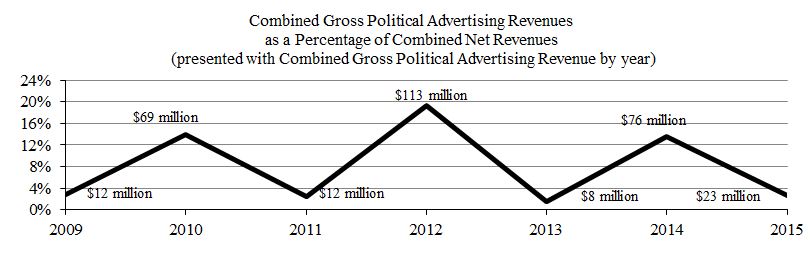

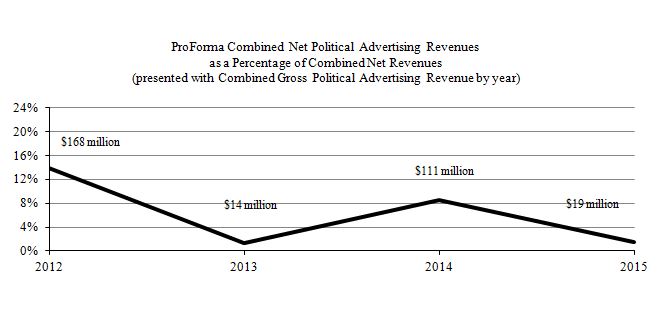

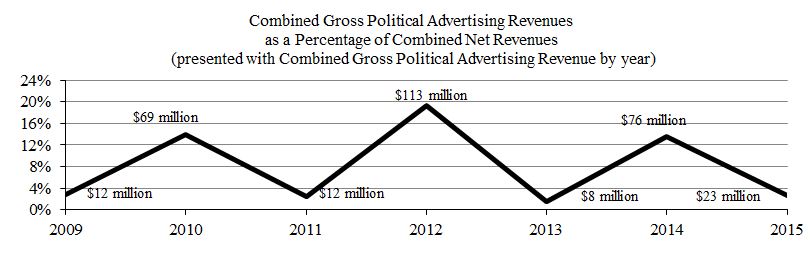

The Company’s primary source of revenue is the sale of advertising time on its television stations. Advertising revenue is recognized when advertisements are aired. Agency commissions related to advertising are recorded as a reduction of revenue. Advertising rates are influenced by a variety of factors including demand, the size of a station’s market, the station’s overall rating, economic conditions and the popularity of the station’s local, network and syndicated programming. Broadcast advertising revenue represented approximately 62%, 73% and 77% of gross operating revenues for the years ended December 31, 2015, 2014 and 2013, respectively.

Broadcast advertising revenue is generally higher in even-numbered years due to political election spending and advertising revenue generated from the Olympic Games on the Company’s thirteen NBC stations. Increased consumer advertising in the spring and for the holiday season generally generates higher advertising revenue in the second and fourth quarters of each year.

The Company receives consideration from certain satellite and cable providers in return for the Company’s consent to the retransmission of the signals of its television stations. Retransmission consent revenue is recognized on a per subscriber basis

in accordance with terms of each contract. Retransmission consent revenue represented approximately 25%, 19% and 16% of gross operating revenues for the years ended December 31, 2015, 2014 and 2013, respectively.

As part of the merger with LIN Media in 2014, the Company has an innovative digital media portfolio that helps agencies and brands effectively and efficiently reach their target audiences. Media General's digital media businesses include One Mobile, Federated Media, HYFN and Dedicated Media, all under the LIN Digital banner. With local-to-national reach and integrated marketing solutions, Media General is a one-stop-shop for agencies and brands that want to effectively and efficiently reach their target audiences across all screens. Digital advertising revenue is recognized when the advertisement is displayed on our websites and mobile applications, or the websites and mobile applications of the publishers and partners in our advertising network.

The Company generates revenue from other sources, which include commercial production and tower space rental income. The Company, in the ordinary course of business, also provides advertising airtime to certain customers in exchange for products or services.

Industry

All television stations in the country are grouped by Nielsen, a national audience measuring service, into approximately 210 Designated Market Areas (“DMA”) that are ranked in size according to various formulae based upon actual or potential audience. Each DMA is determined as an exclusive geographic area consisting of all counties in which the home-market commercial stations receive the greatest percentage of total viewing hours. Nielsen periodically publishes data on estimated audiences for the television stations in the various television markets throughout the country. The estimates are expressed in terms of the percentage of the total potential audience in the market viewing a station, which is referred to as the station’s “rating,” and of the percentage of the audience actually watching television, which is referred to as the station’s “share.” Nielsen provides such data on the basis of total television households and selected demographic groupings in the market using three methods of determining a station’s ability to attract viewers (diary markets, meter-diary adjusted markets and local people meter markets). Ratings in large DMAs are determined by meters connected directly to select television sets. In mid-sized DMAs, ratings are determined by a combination of meters connected directly to television sets and weekly diaries of television viewing, while in smaller markets only weekly diaries are used to determine viewing.

Whether a station is affiliated with one of the four major networks (ABC, CBS, NBC or FOX) has a significant impact on the composition of the station’s revenue, expenses and operations. A typical network affiliate receives a significant percentage of its programming each day from the network. This programming is provided to the affiliate by the network in exchange for a substantial majority of the advertising time during network programs. The network then sells this advertising time and retains the revenue. The affiliate retains the revenue from time sold during breaks in and between network programs and programs the affiliate produces or purchases from syndicators. In addition, stations generally pay a network program fee for the right to broadcast network programs. Traditional network programming typically achieves higher audience levels than syndicated programs aired by independent stations.

In acquiring syndicated programming to supplement network programming, network affiliates compete with the other stations in their markets. Local cable systems generally do not compete with local stations for programming, but various national cable and satellite networks from time to time have acquired programs that would have otherwise been offered to local television stations.

Competition

Competition in the television industry takes place on several levels: competition for audience, competition for programming (including news) and competition for advertisers. Additional factors that are material to a television station’s competitive position include signal coverage and assigned frequency.

Audience. Stations compete for audience on the basis of program popularity, which has a direct effect on advertising rates. A significant percentage of the daily programming on the Company’s stations is supplied by the network with which each station is affiliated. In those periods, the stations are totally dependent upon the performance of the network programs in attracting viewers. There can be no assurance that such programming will achieve or maintain satisfactory viewership levels in the future. Non-network time periods are programmed by the station with a combination of self-produced news, public affairs and other entertainment programming, including news and syndicated programs purchased for cash, cash and barter or barter only.

Although the commercial television broadcast industry historically has been dominated by the four major broadcast networks (ABC, CBS, NBC and FOX), stations affiliated with other national networks (e.g., The CW, MyNetworkTV and ION

Television), independent stations, and other video programming delivery methods, such as cable and satellite systems, are significant competitors for the television audience. In addition, certain cable operators have elected to compete for a share of the market revenue and audience with local cable news channels and regional sports networks.

Other sources of competition include home entertainment systems (including DVDs and video game devices), video-on-demand and pay-per-view, portable digital devices and the Internet. In particular, programmers, including networks and other program providers distribute programming directly to consumers via the Internet (referred to as “Over-The-Top”or OTT distribution), including portable digital devices such as smartphones.

Further advances in technology may increase competition for household audiences and advertisers. Video compression techniques, applicable to all video delivery systems, reduce the bandwidth required for television signal transmission and have the potential to provide vastly expanded programming to highly targeted audiences. This ability to reach very narrowly defined audiences is expected to alter the competitive dynamics for advertising expenditures. The same compression technology, however, enables local television broadcast stations to broadcast multiple digital channels of local television programming. This technology expands the capacity of local television broadcast stations to provide more programming and potentially develop new sources of revenue. The Company is unable to predict the effect that any of these or other technological changes in which programming may be delivered will have on the broadcast television industry or the future results of the Company’s operations.

Programming. Competition for programming involves negotiating with national program distributors or syndicators, which sell first-run and rerun packages of programming. The stations compete against in-market broadcast station competitors for exclusive local access to off-network reruns and first-run products in their respective markets. As noted, cable and satellite systems compete with local stations for programming to a lesser extent, and various national cable and satellite networks from time to time have acquired exclusive rights for programs that would have otherwise been offered to local television stations.

Advertising. Advertising rates are based upon the size of the market in which the station operates, the program’s popularity among the viewers that an advertiser wishes to attract, the number of advertisers competing for the available time, the demographic makeup of the market served by the station, the availability of alternative advertising media in the market area, aggressive and knowledgeable sales forces and development of projects, features and programs that tie advertiser messages to programming. Advertising revenue comprises the primary source of revenue for commercial television stations. The Company’s stations compete for such advertising revenue with other television stations in their respective markets, as well as with other advertising media, such as the Internet, cable and satellite systems, newspapers, radio stations, magazines, outdoor advertising, transit advertising, and direct mail serving the same market. Competition for advertising dollars in the broadcasting industry occurs primarily within individual markets. Generally, a television station in the market does not compete with stations in other market areas.

Broadcast Regulation

The ownership, operation and sale of television stations are subject to the jurisdiction of the Federal Communications Commission (the “FCC”), which acts under the authority granted by the Communications Act of 1934, as amended (the “Communications Act”). Among other things, the FCC assigns frequency bands for broadcasting; determines the particular frequencies, locations and operating power of stations; issues, renews, revokes and modifies station licenses; regulates equipment used by stations; adopts and implements regulations and policies that directly or indirectly affect the ownership, operation and employment practices of stations; and has the power to impose penalties for violations of the Communications Act and its related rules and regulations.

The following is a brief summary of certain provisions of the Communications Act and specific FCC regulations and policies. Reference should be made to the Communications Act, FCC rules and the public notices and rulings of the FCC for further information concerning the nature and extent of federal regulation of broadcast stations.

License Renewals

Continuation of operations requires that the Company retain and, from time to time, renew a variety of governmental approvals. FCC licenses to operate broadcast television stations generally have a term of eight years. Historically, the FCC has renewed the vast majority of broadcast licenses, but there can be no assurance that the Company’s licenses will be renewed at their expiration dates or, if renewed, that the renewal terms will be for the maximum permitted period. The non-renewal or revocation of one or more of the Company’s primary FCC licenses could have a material, adverse effect on its operations.

Ownership Matters

The Communications Act prohibits the assignment or transfer of control of a broadcast license without the prior approval of the FCC. In determining whether to permit the assignment or transfer of control of, or the grant or renewal of, a broadcast license, the FCC considers a number of factors pertaining to the licensee, including compliance with various rules limiting common ownership of media properties, the “character” of the licensee and its principals and compliance with the Communications Act’s limitations on ownership by non-U.S. citizens, non-U.S. entities or representatives of foreign persons or foreign governments (collectively, “aliens”). In general, aliens may not own or vote an aggregate interest of greater than 25% in an entity that controls a broadcast licensee.

FCC rules impose limits on the ownership and cross-ownership of interests in television broadcast stations and certain other media, including:

| |

• | the ownership of multiple television stations in the same market; |

| |

• | the cross-ownership of television stations and radio broadcast stations in the same market; |

| |

• | the ownership of television stations and daily newspapers of general circulation in the same market; and |

| |

• | the national ownership of television stations, which precludes a single entity from owning television stations reaching more than 39% of the entire population of the United States. |

In applying its media ownership limits, the FCC treats persons or entities holding “attributable” interests as station “owners.” Subject to some exceptions, attributable media interests include the following:

| |

• | 5% or more of voting shares, except in the case of insurance companies, investment companies and bank trust departments that are passive investors, where the attribution threshold is 20% of voting shares |

| |

• | a position as an officer or director; |

| |

• | a general partnership interest; |

| |

• | a limited partnership interest that is not “insulated” in accordance with FCC rules; |

| |

• | a time brokerage agreement for more than 15% of the airtime of another television station in the market; |

| |

• | a joint sales agreement (“JSA”) for more than 15% of the weekly advertising time of another television station in the market; and |

| |

• | any combination of debt and equity amounting to more than 33% of the total asset value (debt plus equity) of a media outlet if the holder either is a major program supplier (providing more than 15% of weekly programming) or holds another attributable media interest in the same market. |

The Communications Act requires the FCC to review its ownership rules every four years to determine whether those rules are necessary in the public interest. On April 15, 2014, the FCC released an order and a notice of proposed rulemaking to close its 2010 Quadrennial Review of its ownership rules and open its 2014 Quadrennial Review. The FCC determined to treat a JSA between two same-market television stations as attributable for purposes of its multiple ownership rules if the agreement applies to more than 15% of the weekly advertising time of the brokered station. The FCC gave broadcasters a two-year grace period to bring existing agreements into compliance with the new rule, a period that Congress subsequently extended so that existing JSAs may continue in effect until December 19, 2016. In December 2015, Congress enacted the Consolidated Appropriations Act, 2016, which provided that JSAs in effect as of March 31, 2014 have until September 30, 2025 to unwind or amend the agreements. This rule change affects the Company’s present agreements to sell advertising inventory for independently owned stations in Augusta, GA; Albany, NY; Lansing, MI; Springfield, OH; Youngstown, OH; Dayton, OH and Topeka, KS. In its 2014 Quadrennial Review, the FCC will continue to consider changes to the FCC’s rules regarding broadcast-newspaper cross ownership restrictions and the possible elimination of rules restricting the ownership of radio and TV stations in the same market. The FCC also is considering, among other things, whether to update the definitions of television service contours to take account of digital operations, require television broadcasters to disclose agreements with other broadcasters for shared services and to impose restrictions on these agreements, and regulate network affiliation swaps under the television duopoly rule.

In addition to the FCC, the Department of Justice and the Federal Trade Commission also may review matters related to the concentration of media ownership within markets.

Carriage of Television Broadcast Signals over Cable and Direct Broadcast Satellite Systems

Pursuant to FCC rules, local television stations may elect every three years to either (1) require cable and/or direct broadcast satellite operators to carry the stations’ signals or (2) enter into retransmission consent agreements for carriage. The Company has elected to enter into retransmission agreements with the cable and direct satellite broadcast companies serving its markets. There is no assurance, however, that the Company will be able to agree on acceptable terms for retransmission agreements when existing agreements expire.

In February 2015, the FCC changed its rules implementing the statutory duty to negotiate retransmission consent agreements in good faith. With this change, a television broadcast station is prohibited from negotiating retransmission consent jointly with another station in the same market if the stations are not under common “dejure” control. Under the rule changes, stations may not delegate authority to negotiate or approve a retransmission consent agreement to another non-commonly owned station located in the same DMA or to a third party that negotiates on behalf of another television station in the same DMA; neither may stations in the same DMA facilitate or agree to facilitate coordinated negotiation of retransmission consent terms, including through the sharing of information. Retransmission consent agreements jointly negotiated prior to the effective date of the new rules remain enforceable until expiration of their terms, but contractual provisions related to separately owned stations consulting or jointly negotiating retransmission agreements are no longer enforceable. The Company cannot predict what effect, if any, the new rules may have on future negotiations for retransmission consent agreements.

The FCC’s syndicated exclusivity rules allow local broadcast television stations to demand that cable operators black out syndicated non-network programming carried on “distant signals” (i.e., signals of broadcast stations, including so-called “superstations,” which serve areas substantially removed from the cable system’s local community). The FCC’s network non-duplication rules allow local network-affiliated broadcast stations to require that cable operators black out duplicate network programming carried on distant signals. In a number of the Company's markets, the local cable networks may carry two or more stations that are affiliated with the same network. The carriage of two network stations on the same cable system could result in a decline of viewership, adversely affecting the revenues of the Company’s stations. In March 2014, the FCC issued a Report and Order and Further Notice of Proposed Rulemaking requesting comments on whether it has the authority to, and whether it should, modify or eliminate its network non-duplication and/or syndicated exclusivity rules. We cannot predict the outcome of this rulemaking, or what effect such rule changes might have.

By a notice of proposed rulemaking released on December 19, 2014, the FCC has sought comment on a proposed change to its rules to broaden the term “multichannel video programming distributor” (“MVPD”) so that it would include within its scope—and thus within the scope of FCC rules pertaining to MVPDs—certain online video distributors. The FCC has proposed to include those services that make multiple linear streams of video programming available for purchase by subscribers at a prescheduled time, regardless of the technology of the distribution platform (“Linear Programming Interpretation”). The FCC also asked for comment on an alternate interpretation of the MVPD definition that would add to the FCC’s classification entities that make available the transmission paths to the programmer (“Transmission Path Interpretation”). In addition, the FCC has proposed that its retransmission consent rules would apply to online MVPDs. The proceeding remains pending, and we cannot predict what changes the FCC may adopt in this proceeding or the effect that any such changes may have on the business and operations of the Company.

Restrictions on Broadcast Programming

As a broadcast licensee, the Company also must comply with a variety of FCC rules regulating its operations such as political broadcasting rules, children’s television rules and limitations on indecent or obscene programming. Violation of these and other FCC rules could subject the Company to significant fines or other sanctions.

Advertising of cigarettes and certain other tobacco products on broadcast stations has been banned for many years. Various states also restrict the advertising of alcoholic beverages and, from time to time, certain members of Congress have contemplated legislation to place restrictions on the advertisement of such alcoholic beverages. FCC rules also restrict the amount and type of advertising that can appear in a program broadcast primarily for an audience of children 12 years of age and younger.

Under the Communications Act and FCC rules, stations must provide “reasonable access” for the purchase of time by legally qualified candidates for federal office and “equal opportunities” for the purchase of equivalent amounts of comparable broadcast time by opposing candidates for the same elective office and must make favorable rates available to legally qualified

candidates during the 45 days preceding a primary or primary run-off election and during the 60 days preceding a general or special election.

It is a violation of federal law and FCC regulations to broadcast indecent programming outside of “safe harbor” periods or to broadcast obscene programming at any time. FCC licensees are, in general, responsible for the content of their broadcast programming, including that supplied by television networks. Accordingly, there is a risk of being fined because of the Company’s broadcast programming, including network programming. The maximum forfeiture amount for the broadcast of indecent material is $325,000 for each violation, with a cap of $3 million for any single act.

Programming and Operations

The Communications Act requires broadcasters to serve the “public interest.” The FCC has relaxed or eliminated many of the more formalized procedures it had developed in the past to promote the broadcast of certain types of programming responsive to the needs of a station’s community of license. FCC licensees continue to be required, however, to present programming responsive to the needs and interests of their communities and to maintain certain records demonstrating that responsiveness. Stations also must pay regulatory and application fees and follow various rules promulgated under the Communications Act that regulate, among other things, political advertising, sponsorship identification, obscene and indecent broadcasts and technical operations, including limits on radio frequency radiation. In addition, television licensees have obligations to create and follow employment outreach programs, provide a minimum amount of programming for children, maintain an online public inspection file and abide by regulations specifying requirements to provide closed captions for its programming.

Pending Matters

In April 2012, President Obama signed into law the American Jobs Act, which provides the FCC with the authority to conduct an “incentive auction” to auction and repurpose broadcast television spectrum for mobile broadband use. Pursuant to this authority and to encourage broadcasters to tender their licenses for auction, the FCC is permitted to share the proceeds of spectrum auction with incumbent television station licensees. In order to receive proceeds, licensees must agree to give up their licenses, share spectrum, or, in some cases, move to a different channel to facilitate an auction of their previous channel. The FCC would then “repack” non-tendering UHF broadcasters into the lower portions of the UHF band and auction new “flexible use” wireless licenses in the upper portion of the UHF band. By statute, television stations’ participation in the “incentive auction” is voluntary. The filing window for broadcasters’ applications to participate in the auction ran from December 8, 2015 to January 12, 2016. Initial bids for broadcasters submitting applications and wishing to participate in the auction are due March 29, 2016. The FCC stated that bidding in the reverse auction will begin after it announces the initial clearing target (3-4 weeks after the March 29, 2016 deadline) and holds mock auctions. The Company expects to participate in certain markets as discussed earlier. As part of the Nexstar agreement, the Company has a contingent value right entitling Media General shareholders to net cash proceeds as received from the sale of Media General’s spectrum. The Company anticipates that this right could be worth anywhere from $0 to $4 per share.

The FCC is considering in its ongoing 2014 Quadrennial Review of its ownership rules whether to require public disclosure of or otherwise restrict shared services, news sharing and other cooperative agreements among television stations. The Company has shared services agreements in the Albuquerque, NM market and in those markets where its stations sell advertising pursuant to joint sales agreements for independently owned stations (Augusta, GA; Albany, NY; Lansing, MI; Springfield, OH; Youngstown, OH; Dayton, OH and Topeka, KS).

In September 2015, the FCC released an Notice of Proposed Rulemaking (“NPRM”) in response to a Congressional directive in the STELA Reauthorization Act of 2014 to examine the “totality of the circumstances test” for good-faith negotiations of retransmission consent. The NPRM seeks comment on new factors and evidence to consider in its evaluation of claims of bad faith negotiation, including service interruptions prior to a “marquee sports or entertainment event,” restrictions on online access to broadcast programming during negotiation impasses, broadcasters’ ability to offer bundles of broadcast signals with other broadcast stations or cable networks, and broadcasters’ ability to invoke the FCC’s exclusivity rules during service interruptions.

Congress and the FCC currently have under consideration, and may in the future adopt new laws, regulations and policies regarding a wide variety of matters that, directly or indirectly, could affect the operation, ownership and profitability of the Company’s broadcast stations.

Environmental Regulation

The Company’s operations are subject to laws and regulations governing the environment and the health and safety of its workers. Under certain of these laws and regulations, an owner or operator of a facility can be liable for contamination even if the contamination is the result of activities of third parties. As a result, it is possible that the Company could have environmental liability with respect to the properties it owns or operates as a result of contamination caused by prior owners or operators or operations at neighboring properties. Although the Company believes it is in compliance with applicable environmental requirements, and it has not incurred significant costs or liabilities in the past, there can be no assurance that its environmental compliance costs or liabilities will not increase in the future or that it will not become subject to new governmental regulations, including those pertaining to climate change, that may impose additional restrictions or costs on the Company. The Company presently believes that none of its properties has any condition that is likely to have a material, adverse effect on its consolidated balance sheets, consolidated statements of comprehensive income or consolidated statements of cash flows.

Employees

As of December 31, 2015, we employed approximately 5,400 full time employees, approximately 420 of which were represented by labor unions. We believe that our relations with our employees are satisfactory.

Available Information

We file annual, quarterly, and current reports, proxy statements, and other documents with the Securities and Exchange Commission (“SEC”) under the Exchange Act. The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including our filings, which we file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

We make available free-of-charge through our Internet website (at http://www.mediageneral.com) copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC.

We also make available on our website our Principles of Corporate Governance, the charters for our audit committee, compensation committee, and nominating and corporate governance committee and our code of business conduct and ethics. This information is available on our website to any stockholder who is interested in reviewing this information. In addition, we intend to disclose on our website any amendments to, or waivers from, our code of business conduct and ethics that are required to be publicly disclosed pursuant to rules of the SEC and the New York Stock Exchange (“NYSE”).

Item 1A. Risk Factors

Risks Related to the Company’s Business

The Company’s substantial indebtedness could impair its financial condition and its ability to fulfill its debt obligations.

As of December 31, 2015, the Company had total long-term debt of approximately $2.2 billion, with $147 million of available commitments under the Company’s Revolving Credit Facility after giving effect to $3 million of outstanding (but undrawn) letters of credit. This indebtedness could:

| |

• | make it more difficult for the Company to satisfy its debt obligations which could in turn result in an event of default on its indebtedness; |

| |

• | impair the Company’s ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions and other general corporate purposes; |

| |

• | require a substantial portion of the Company’s cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes; |

| |

• | expose the Company to the risk of increased rates as certain of its borrowings, excluding borrowings under the LIN Television’s 6.375% Senior Notes due 2021 and LIN Television’s 5.875% Senior Notes due 2022 (collectively the “Senior Secured Credit Facilities”), are at variable rates of interest; |

| |

• | diminish the Company’s ability to withstand a downturn in its business, the industry in which it operates or the economy generally; |

| |

• | limit flexibility in planning for, or reacting to, changes in the Company’s business and the industry in which it operates; and |

| |

• | place the Company at a competitive disadvantage compared to certain competitors that may have lower leverage. |

In addition, the Indentures governing LIN Television’s 6.375% Senior Notes due 2021 (the “2021 Notes”) and LIN Television’s 5.875% Senior Notes due 2022 (the “2022 Notes”) and the credit agreement governing the Senior Secured Credit Facilities contain restrictive covenants that limit the ability of the Company (in the case of the Senior Secured Credit Facilities) and LIN Television and its subsidiaries to engage in activities that may be in the Company’s long-term best interest. Failure to comply with those covenants could result in the acceleration of all of the Company’s debt.

Despite the Company’s level of indebtedness, the Company may still be able to incur substantial additional indebtedness in the future, which could increase the risks described above.

The Company may be able to incur substantial additional indebtedness in the future. The terms of the credit agreement governing the Senior Secured Credit Facilities and the Indentures governing the 2021 Notes and 2022 Notes limit, but do not prohibit, the Company or LIN Television and its subsidiaries from incurring additional indebtedness. In addition, as of December 31, 2015, the Company’s Revolving Credit Facility provided for unused commitments of $147 million (after giving effect to $3 million of outstanding (but undrawn) letters of credit). If the Company incurs additional indebtedness, the risks described in this report relating to having substantial debt could intensify.

The Company will require a significant amount of cash to service its indebtedness. This cash may not be readily available to the Company.

The Company’s ability to make payments on, or repay or refinance, its indebtedness and fund its ongoing operations and planned capital expenditures will depend largely upon the Company’s financial condition and operating performance. The Company’s and its subsidiaries’ future performance, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond its control. The Company cannot be certain that sufficient cash flow from operations will be generated or that future sources of capital will be available in amounts sufficient to enable the Company to pay the principal, premium, if any, interest on, and fees related to its indebtedness or to fund our other liquidity needs.

If the Company’s cash flows and capital resources are insufficient to fund its debt service obligations, the Company could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance its indebtedness. The Company may not be able to effect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, those alternative actions may not be sufficient to allow the Company to meet its scheduled debt service obligations. The Company’s ability to restructure or refinance its indebtedness will depend on the condition of the capital markets and the Company’s financial condition at that time. Any refinancing of the Company’s indebtedness could be at higher interest rates and may require the Company to comply with more onerous covenants, which could further restrict its business operations. The credit agreement governing the Senior Secured Credit Facilities and the Indentures governing the 2021 Notes and 2022 Notes restrict the ability of the Company (in the case of the Senior Secured Credit Facilities) and LIN Television and its subsidiaries to dispose of assets and use the proceeds from those dispositions and may also restrict the ability of the Company and LIN Television and its subsidiaries to raise debt or equity capital to be used to repay other indebtedness when it becomes due. The Company may not be able to consummate those dispositions or to obtain proceeds in an amount sufficient to meet any debt service obligations then due. The Company’s inability to generate sufficient cash flows to satisfy its debt obligations, or to refinance its indebtedness on commercially reasonable terms or at all, would materially adversely affect its financial position and results of operations and may restrict the Company’s current and future operations.

If the Company cannot make scheduled payments on its debt, it will be in default and holders of the 2021 Notes and 2022 Notes could declare all outstanding principal and interest to be due and payable, the lenders under the Senior Secured Credit Facilities could terminate their commitments to loan money and declare all outstanding principal, interest and other amounts owing

to be due and payable, require that certain obligations be cash collateralized and foreclose against the assets securing their borrowings and the Company could be forced into bankruptcy or liquidation.

Covenants in the Company’s debt agreements restrict our business in many ways.

The Indentures governing the 2021 Notes and 2022 Notes and the credit agreement governing the Senior Secured Credit Facilities contain a number of restrictive covenants that impose significant operating and financial restrictions on the Company (in the case of the Senior Secured Credit Facilities) and LIN Television and its subsidiaries and may limit the Company’s ability to engage in acts that may be in the Company’s long-term best interest, including restrictions on the Company’s and its subsidiaries’ ability to, among other things:

| |

• | incur or assume liens or additional debt or guarantee debt or other obligations; |

| |

• | issue certain preferred stock or similar equity securities; |

| |

• | pay dividends or distributions or redeem or repurchase capital stock; |

| |

• | prepay, redeem or repurchase debt; |

| |

• | make loans, investments and capital expenditures; |

| |

• | enter into agreements that restrict distributions from the Company’s subsidiaries; |

| |

• | sell assets and capital stock of the Company’s subsidiaries; |

| |

• | enter into certain transactions with affiliates; and |

| |

• | consolidate or merge with or into, or sell substantially all of the Company’s assets to, another person. |

A breach of any of the covenants or restrictions under the Indentures governing the 2021 Notes and 2022 Notes and the credit agreement governing the Senior Secured Credit Facilities could result in a default under the applicable indebtedness and could cross default to other indebtedness. Such a default may allow the creditors to accelerate the related debt and may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. Upon the occurrence of an event of default under the credit agreement governing the Senior Secured Credit Facilities, the lenders could elect to declare all amounts outstanding under the Senior Secured Credit Facilities to be immediately due and payable and terminate all commitments to extend further credit under those facilities. If the Company were unable to repay the amounts due and payable under the Senior Secured Credit Facilities, the lenders thereunder could proceed against the collateral granted to them to secure that indebtedness. The Company has pledged a significant portion of its assets as collateral under the Senior Secured Credit Facilities. If the lenders under the Senior Secured Credit Facilities or note holders under indentures accelerate the repayment of the Company’s borrowings, the Company may not have sufficient liquidity to repay its indebtedness and could be forced into bankruptcy or liquidation.

As a result of these restrictions, the Company may be:

| |

• | limited in how it conducts its business; |

| |

• | unable to raise additional debt or equity financing to operate during general economic or business downturns; or |

| |

• | unable to compete effectively or to take advantage of new business opportunities. |

These restrictions may affect the Company’s ability to grow in accordance with its strategy. In addition, the Company’s financial results, substantial indebtedness and credit ratings could materially adversely affect the availability and terms of its financing.

Financial and economic conditions may have an adverse impact on the Company’s industry, business, financial condition and/or results of operations.

Financial and economic conditions could have an adverse effect on the fundamentals of the Company’s business, financial condition and/or results of operations. Poor economic and industry conditions could have a negative impact on the Company’s industry or the industry of those customers who advertise on the Company’s stations, including, among others, the automotive industry and service businesses, each of which is a significant source of its advertising revenue. Additionally, financial

institutions, capital providers or other consumers may be adversely affected. Potential consequences of any financial and economic decline include:

| |

• | the financial condition of those companies that advertise on the Company’s stations may be adversely affected, causing them to spend less on advertising, which could result in a significant decline in its advertising revenue; |

| |

• | the Company’s ability to pursue acquisitions or divestitures of certain television and non-television assets at attractive values may be limited; |

| |

• | the possibility that the Company’s business partners could be negatively impacted and the Company’s ability to maintain these business relationships could also be impaired; |

| |

• | the Company’s ability to refinance its existing debt on terms and at interest rates it finds attractive, if at all, may be impaired; and |

| |

• | the Company’s ability to make certain capital expenditures may be significantly impaired. |

If the Company is unable to secure or maintain carriage of its television stations’ signals over cable, telecommunication video and/or direct broadcast satellite systems, the Company’s television stations may not be able to compete effectively.

Pursuant to FCC rules, local television stations may elect every three years to either: (1) require cable and/or direct broadcast satellite operators to carry the stations’ signals or (2) enter into retransmission consent agreements for carriage. Failure to reach timely retransmission consent agreements with the relevant operators may harm the Company’s business. There is no assurance that the Company will be able to agree on acceptable terms, which could lead to a reduction in its revenue from cable and satellite retransmission consent agreements. If the Company is unable to reach retransmission consent agreements with cable companies, satellite providers and telecommunication providers for the carriage of its stations’ signals, the Company could lose revenues and audience share. The Company renegotiates retransmission agreements with cable and satellite providers as current contracts expire, and the Company may not be able to negotiate future agreements on terms comparable to or more favorable than its current agreements. This may cause revenues and revenue growth from its retransmission consent agreements to decrease under the renegotiated terms.

In February 2015, the FCC changed its rules implementing the statutory duty to negotiate retransmission consent agreements in good faith. With this change, a television broadcast station is prohibited from negotiating retransmission consent jointly with another station in the same market if the stations are under common “de jure” control. Under the rule changes, stations may not delegate authority to negotiate or approve a retransmission consent agreement to another non-commonly owned station located in the same DMA or to a third party that negotiates on behalf of another television station in the same DMA; neither may stations in the same DMA facilitate or agree to facilitate coordinated negotiation of retransmission consent terms, including through the sharing of information. Retransmission consent agreements jointly negotiated prior to the effective date of the new rules remain enforceable until expiration of their terms, but contractual provisions related to separately owned stations consulting or jointly negotiating retransmission agreements are no longer enforceable. The Company cannot predict what effect, if any, the new rules may have on future negotiations for retransmission consent agreements.

As a television broadcaster, the Company is highly regulated, and continuation of its operations requires that it retain or renew a variety of government approvals and comply with changing federal regulations.

The FCC extensively regulates the ownership, operation and sale of broadcast television stations, including those licensed to the Company. The Communications Act requires broadcasters to serve the public interest. Among other things, the FCC assigns frequency bands; determines stations’ locations and operating parameters; issues, renews, revokes and modifies station licenses; regulates and limits changes in ownership or control of station licenses; regulates equipment used by stations; regulates station employment practices; regulates certain program content and commercial matters in children’s programming; has the authority to impose penalties for violations of its rules or the Communications Act; and imposes annual fees on stations. Reference should be made to the Communications Act, as well as to the FCC’s rules, public notices and rulings for further information concerning the nature and extent of federal regulation of broadcast television stations.

Congress and the FCC have under consideration, and in the future may adopt, new laws, regulations and policies regarding a wide variety of matters that could affect, directly or indirectly, the operation, ownership transferability and profitability of the Company’s television stations and affect the ability of the Company to acquire additional stations. In addition to the matters noted above, these may include, for example, spectrum use fees; reallocation of portions of the television broadcast spectrum to other uses or reductions in the amount of spectrum allotted to television stations; further restrictions on the ability of same-market

television stations to engage in shared services, joint sales or other cooperative arrangements to reduce operating costs; political advertising rates; potential restrictions on the advertising of certain products (such as alcoholic beverages); program content; increased fines for rule violations; closed captioning requirements and ownership rule changes.

In addition, uncertainty about media ownership regulations and adverse economic conditions has dampened the acquisition market from time to time, and changes in the regulatory approval process may make it materially more expensive, or may materially delay, the Company’s ability to consummate further acquisitions or divestitures.

The Company requires licenses from the FCC for its operations, and a rejection or reconsideration of license renewals by the FCC could have a material, adverse effect on the Company’s business. Typically, the FCC begins processing renewal applications over the last month of the renewal term; however, for broadcasters to obtain license renewals (a necessary prerequisite to FCC consent for certain transactions), the FCC has required licensees to enter into tolling agreements extending the time that the FCC may prosecute indecency and other alleged violations beyond the date of the license renewals. Historically, the FCC renews the vast majority of broadcast licenses, but there can be no assurance that the Company’s licenses will be renewed at their expiration dates or, if renewed, that the renewal terms will be for the maximum permitted period. The non-renewal or revocation of one or more of the Company’s primary licenses could have an adverse effect on its operations.

The FCC is conducting a spectrum auction that could affect the spectrum for Media General’s stations and adversely impact its ability to compete.

The FCC has adopted rules to govern incentive auctions for television broadcast spectrum, the re-auction of any reclaimed spectrum to wireless broadband providers, and the repacking of broadcasters on the spectrum channels dedicated to television broadcasting after the auction. The FCC has announced that it intends to begin the auction on March 29, 2016, and the filing window for broadcasters’ applications to participate in the auction closed January 12, 2016. Changes in FCC and administration policies and legislative changes by Congress could still affect this schedule and the ultimate shape of the auctions in ways that cannot now be predicted.

The FCC is conducting a “reverse auction” at which television broadcast licensees would submit bids to receive compensation for relinquishing all or a portion of their rights in the spectrum licensed to their full-service and Class A stations. A licensee may bid to:

| |

1) | relinquish its channel entirely, |

| |

2) | relocate from a UHF(channels 14-51) to a VHF channel (channels 2-13), or |

| |

3) | relinquish its channel and share a different channel with another broadcaster. |

Broadcasters choosing to share a channel would remain licensees and retain must-carry rights on cable and satellite systems. Concurrently with the reverse auction, the FCC will conduct a forward auction of the relinquished spectrum. A successful auction likely will result in fewer local television stations in many markets and fewer spectrum channels available for local television stations nationwide. The Company has submitted applications to participate in the auction in certain of its markets. The Company is unable to predict whether it will be successful in the auction nor what proceeds, if any, it will receive as a result of its participation.

Even if a television licensee does not participate in the reverse auction, the FCC nevertheless may require it to relocate its station to another channel or make technical changes to facilitate repacking the post-auction local television stations on a smaller number of available spectrum channels. The FCC will have a $1.75 billion fund to compensate broadcasters and cable systems for the reasonable costs of repacking. If these funds prove insufficient to reimburse broadcasters and cable systems for their repack costs, it is not clear that further funds to defray those costs will be available from government agencies. The legislation limits the ability of broadcasters to challenge FCC repacking decisions by denying a licensee the right to a hearing before the FCC modifies its license, a right that the Communications Act otherwise would provide. Low power television stations and TV translator stations are ineligible to participate in the auction and are subject to displacement if they are located on spectrum channels recovered by the FCC through the reverse auction or if their facilities interfere with full-power or Class A stations following the repack on

those stations dedicated to broadcast TV following the auction. As a result, the availability of spectrum channels for low-power and TV translator stations following the auction cannot be predicted at this time.

The incentive auction legislation requires the FCC to make all reasonable efforts to protect the area and populations served by TV broadcast stations from interference by other television stations or wireless carriers following the auction. The FCC has adopted rules to carry out this mandate, but widespread disagreement exists regarding the likely effectiveness of these rules. As a result of the auction and the operation of the FCC’s rules, stations owned by Media General may suffer some diminution in

their service areas or populations served. The extent of this risk and the impact it may have on Media General stations are difficult to predict at this time.

The antitrust laws and the FCC’s rules prohibit certain communications between potential auction participants that disclose an auction applicant’s bids or bidding strategies both before and during the incentive auction. Under the FCC’s anti-collusion rule, following the date on which applications to participate in the auction are filed, broadcasters may not disclose their bids or bidding strategies to any other broadcaster or forward auction participant, and they may not covertly “signal” bidding information to other broadcasters by disclosing that information to third parties who may disclose that information to auction participants. Regardless of whether a broadcaster participates in the auction, compliance with these restrictions may place limitations on certain business activities between the date auction applications are filed and the completion of the auction. For example, discussions of station acquisitions or sales may be difficult to conduct during this period. In a related rule, the FCC prohibited consummation of transactions involving the sale of a station participating in the auction until after the auction has concluded. However, it granted a general waiver of this rule for parties that had an application seeking approval of such a transaction accepted for filing by the FCC on or prior to January 12, 2016.

The Company has taken steps to address these restrictions in its discussions with both Meredith and Nexstar. Under the terms of the negotiated agreement with Nexstar, the Company can participate in the auction with proceeds, if any, from that participation being remitted to the existing Media General shareholders (subject to certain netting arrangements) through a contingent value agreement that is also part of the agreement between the parties.

We cannot predict whether the auction and television spectrum reallocation, including the repacking of the band, the potential shortfall in funds available to cover broadcasters’ repack relocation expenses, compliance with auction-related communications restrictions, the impact that the auction and repack may have on the service area and population served by Media General stations, the prospective relocation of current television stations to different channels or other modified facilities, and the potential inability to find new channel positions for some displaced low power stations and translators will have any adverse effect upon Media General’s ability to compete. Additionally, we cannot predict whether the FCC or Congress might adopt even more stringent requirements or incentives to encourage broadcasters to abandon current spectrum if the initiatives now in progress are implemented but do not have the desired result of freeing what the agency deems to be sufficient spectrum for wireless broadband use.

Changes in FCC ownership rules through FCC action, judicial review or federal legislation may limit the Company’s ability to continue providing services to stations under sharing arrangements (such as LMAs, JSAs, SSAs and other similar agreements), may require the Company to amend or terminate certain agreements and/or may preclude the Company from obtaining the full economic value of one or more of its station combinations in a DMA upon a sale, merger or other similar transaction transferring ownership of such station or stations.

FCC ownership rules currently impose significant limitations on the ability of a person or entity to have attributable interests in multiple media properties. Federal law prohibits any person or entity from having an attributable interest in broadcast television stations located in markets which collectively include more than 39% of national television households. The FCC is currently considering elimination of the 50% TV household discount given to owners of UHF stations in determining compliance with this national cap. The proposed change, if adopted, could ultimately limit the company’s ability to acquire television stations in additional markets. While this rulemaking is pending, the FCC has indicated it will not grant applications that would put the applicant above the 39% cap without application of the UHF discount.

Ownership restrictions under FCC rules also include a variety of local limits on media ownership. The restrictions include an ownership limit of one television station in most medium and smaller television markets and two stations in most larger markets, known as the television duopoly rule. The regulations also include limits on the common ownership of a newspaper and television station in the same market (newspaper-television cross-ownership), and limits on common ownership of radio and television stations in the same market (radio-television station ownership).

If the FCC should loosen its media ownership rules, attractive opportunities may arise for additional television station and other media acquisitions, but these changes also would create additional competition for the Company from other entities, such as national broadcast networks, other large station groups, and newspaper chains, which may be better positioned to take advantage of such changes and benefit from the resulting operating synergies both nationally and in specific markets.

On March 12, 2014, the FCC issued a public notice with respect to the processing of broadcast television applications proposing sharing arrangements and contingent interests. The public notice indicated that the FCC will closely scrutinize any application that proposes that two or more stations in the same market that are not commonly owned (i) enter into an agreement to share facilities, employees and/or services or to jointly acquire programming or sell advertising including through joint sales

agreements, shared services agreements, or similar agreements, and (ii) enter into an option, right of first refusal, put/call arrangement or other similar contingent interest, or a loan guarantee. The Company cannot now predict what actions the FCC may require in connection with the processing of applications for FCC consent to acquire or divest stations. However, among other things, this may limit the Company’s ability to enter into and maintain contractual relationships with third-party licensees.

Under an FCC rule that became effective on June 19, 2014, a television licensee that agrees to sell more than 15% of the weekly advertising inventory of another television station in the same DMA will be deemed to have an attributable ownership interest in that station. The change will effectively ban joint sales agreements involving ad sales in excess of 15% between two stations in the same market unless the station selling the advertising time could own the other station under the FCC’s duopoly limitations or can obtain a waiver of the rule. According to the rule, stations with joint sales agreements that would put them in violation of the FCC’s new ownership limits will have until December 19, 2016, to amend or terminate those arrangements or to obtain waivers of the new rule. In December 2015, Congress enacted the Consolidated Appropriations Act, 2016, which provided that joint sales agreements in effect as of March 31, 2014 have until September 30, 2025 to unwind or amend the agreements. Although the FCC will consider waivers of the new joint sales agreement attribution rule, the FCC thus far has provided little guidance on what factors must be present for a waiver to be granted. Absent further developments of the grant of waivers, these changes will affect the Company’s present agreements to sell advertising inventory for independently owned stations in Augusta, GA, Albany, NY, Lansing, MI, Dayton, OH, Youngstown, OH and Topeka, KS, and will restrict its ability to enter such agreements in the future.

Concurrent with its adoption of the rule on TV joint sales agreements, the FCC issued a notice of proposed rulemaking in which it initiated its statutorily-required Quadrennial Review of its ownership rules. The rulemaking proposes, among other things, (i) eliminating the newspaper/radio cross ownership rule and the radio/television cross ownership rule, (ii) retaining the newspaper/television cross ownership rule but allowing for waivers on a case by case basis, (iii) retaining the local television rules, and (iv) prohibiting two television stations in the same market from swapping network affiliations if it would result in a single owner having two top-four network affiliations in a market where it could not otherwise own both affiliation-swapping stations. The proposed rulemaking also seeks comment on how to define a television shared services agreement and whether television stations should be required to disclose shared services agreements and how best to achieve disclosure. In addition, the FCC proposed to adopt the overlap of digital noise-limited service contours as the trigger for applying the local television ownership rules to commonly owned television stations in the same market and to grandfather existing ownership combinations that would exceed ownership limits under the revised approach.

The Company’s advertising revenue can vary substantially from period to period based on many factors beyond the Company’s control. This volatility may have an adverse impact on the Company’s business, financial condition or results of operations.