itt-20240330false2024Q1000021622812-3100002162282024-01-012024-03-3000002162282024-04-30xbrli:sharesiso4217:USD00002162282023-01-012023-04-01iso4217:USDxbrli:shares00002162282024-03-3000002162282023-12-3100002162282022-12-3100002162282023-04-010000216228us-gaap:CommonStockMember2023-12-310000216228us-gaap:RetainedEarningsMember2023-12-310000216228us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000216228us-gaap:NoncontrollingInterestMember2023-12-310000216228us-gaap:RetainedEarningsMember2024-01-012024-03-300000216228us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-300000216228us-gaap:NoncontrollingInterestMember2024-01-012024-03-300000216228us-gaap:CommonStockMember2024-01-012024-03-300000216228us-gaap:CommonStockMember2024-03-300000216228us-gaap:RetainedEarningsMember2024-03-300000216228us-gaap:NoncontrollingInterestMember2024-03-300000216228us-gaap:CommonStockMember2022-12-310000216228us-gaap:RetainedEarningsMember2022-12-310000216228us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000216228us-gaap:NoncontrollingInterestMember2022-12-310000216228us-gaap:CommonStockMember2023-01-012023-04-010000216228us-gaap:RetainedEarningsMember2023-01-012023-04-010000216228us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-04-010000216228us-gaap:NoncontrollingInterestMember2023-01-012023-04-010000216228us-gaap:CommonStockMember2023-04-010000216228us-gaap:RetainedEarningsMember2023-04-010000216228us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-010000216228us-gaap:NoncontrollingInterestMember2023-04-010000216228itt:SvanehojMember2024-01-192024-01-19itt:Segment0000216228itt:MotionTechnologiesMember2024-01-012024-03-300000216228itt:MotionTechnologiesMember2023-01-012023-04-010000216228itt:IndustrialProcessMember2024-01-012024-03-300000216228itt:IndustrialProcessMember2023-01-012023-04-010000216228itt:ConnectControlTechnologiesMember2024-01-012024-03-300000216228itt:ConnectControlTechnologiesMember2023-01-012023-04-010000216228itt:SegmentResultsMember2024-01-012024-03-300000216228itt:SegmentResultsMember2023-01-012023-04-010000216228itt:SegmentEliminationsMember2024-01-012024-03-300000216228itt:SegmentEliminationsMember2023-01-012023-04-010000216228us-gaap:OperatingSegmentsMember2024-01-012024-03-300000216228us-gaap:OperatingSegmentsMember2023-01-012023-04-010000216228itt:AggregateEliminationsCorpAndOtherMember2024-01-012024-03-300000216228itt:AggregateEliminationsCorpAndOtherMember2023-01-012023-04-01xbrli:pure0000216228itt:MotionTechnologiesMember2024-03-300000216228itt:MotionTechnologiesMember2023-12-310000216228itt:IndustrialProcessMember2024-03-300000216228itt:IndustrialProcessMember2023-12-310000216228itt:ConnectControlTechnologiesMember2024-03-300000216228itt:ConnectControlTechnologiesMember2023-12-310000216228us-gaap:CorporateAndOtherMember2024-03-300000216228us-gaap:CorporateAndOtherMember2023-12-310000216228us-gaap:CorporateAndOtherMember2024-01-012024-03-300000216228us-gaap:CorporateAndOtherMember2023-01-012023-04-010000216228itt:MotionTechnologiesMemberitt:AutomotiveandrailMember2024-01-012024-03-300000216228itt:IndustrialProcessMemberitt:AutomotiveandrailMember2024-01-012024-03-300000216228itt:AutomotiveandrailMemberitt:ConnectControlTechnologiesMember2024-01-012024-03-300000216228itt:AutomotiveandrailMembersrt:ConsolidationEliminationsMember2024-01-012024-03-300000216228itt:AutomotiveandrailMember2024-01-012024-03-300000216228itt:MotionTechnologiesMemberitt:ChemicalandindustrialpumpsMember2024-01-012024-03-300000216228itt:IndustrialProcessMemberitt:ChemicalandindustrialpumpsMember2024-01-012024-03-300000216228itt:ChemicalandindustrialpumpsMemberitt:ConnectControlTechnologiesMember2024-01-012024-03-300000216228itt:ChemicalandindustrialpumpsMembersrt:ConsolidationEliminationsMember2024-01-012024-03-300000216228itt:ChemicalandindustrialpumpsMember2024-01-012024-03-300000216228us-gaap:OilAndGasMemberitt:MotionTechnologiesMember2024-01-012024-03-300000216228us-gaap:OilAndGasMemberitt:IndustrialProcessMember2024-01-012024-03-300000216228us-gaap:OilAndGasMemberitt:ConnectControlTechnologiesMember2024-01-012024-03-300000216228us-gaap:OilAndGasMembersrt:ConsolidationEliminationsMember2024-01-012024-03-300000216228us-gaap:OilAndGasMember2024-01-012024-03-300000216228itt:MotionTechnologiesMemberitt:AerospaceanddefenseMember2024-01-012024-03-300000216228itt:IndustrialProcessMemberitt:AerospaceanddefenseMember2024-01-012024-03-300000216228itt:ConnectControlTechnologiesMemberitt:AerospaceanddefenseMember2024-01-012024-03-300000216228srt:ConsolidationEliminationsMemberitt:AerospaceanddefenseMember2024-01-012024-03-300000216228itt:AerospaceanddefenseMember2024-01-012024-03-300000216228itt:MotionTechnologiesMemberitt:GeneralindustrialMember2024-01-012024-03-300000216228itt:GeneralindustrialMemberitt:IndustrialProcessMember2024-01-012024-03-300000216228itt:GeneralindustrialMemberitt:ConnectControlTechnologiesMember2024-01-012024-03-300000216228itt:GeneralindustrialMembersrt:ConsolidationEliminationsMember2024-01-012024-03-300000216228itt:GeneralindustrialMember2024-01-012024-03-300000216228srt:ConsolidationEliminationsMember2024-01-012024-03-300000216228itt:MotionTechnologiesMemberitt:AutomotiveandrailMember2023-01-012023-04-010000216228itt:IndustrialProcessMemberitt:AutomotiveandrailMember2023-01-012023-04-010000216228itt:AutomotiveandrailMemberitt:ConnectControlTechnologiesMember2023-01-012023-04-010000216228itt:AutomotiveandrailMembersrt:ConsolidationEliminationsMember2023-01-012023-04-010000216228itt:AutomotiveandrailMember2023-01-012023-04-010000216228itt:MotionTechnologiesMemberitt:ChemicalandindustrialpumpsMember2023-01-012023-04-010000216228itt:IndustrialProcessMemberitt:ChemicalandindustrialpumpsMember2023-01-012023-04-010000216228itt:ChemicalandindustrialpumpsMemberitt:ConnectControlTechnologiesMember2023-01-012023-04-010000216228itt:ChemicalandindustrialpumpsMembersrt:ConsolidationEliminationsMember2023-01-012023-04-010000216228itt:ChemicalandindustrialpumpsMember2023-01-012023-04-010000216228us-gaap:OilAndGasMemberitt:MotionTechnologiesMember2023-01-012023-04-010000216228us-gaap:OilAndGasMemberitt:IndustrialProcessMember2023-01-012023-04-010000216228us-gaap:OilAndGasMemberitt:ConnectControlTechnologiesMember2023-01-012023-04-010000216228us-gaap:OilAndGasMembersrt:ConsolidationEliminationsMember2023-01-012023-04-010000216228us-gaap:OilAndGasMember2023-01-012023-04-010000216228itt:MotionTechnologiesMemberitt:AerospaceanddefenseMember2023-01-012023-04-010000216228itt:IndustrialProcessMemberitt:AerospaceanddefenseMember2023-01-012023-04-010000216228itt:ConnectControlTechnologiesMemberitt:AerospaceanddefenseMember2023-01-012023-04-010000216228srt:ConsolidationEliminationsMemberitt:AerospaceanddefenseMember2023-01-012023-04-010000216228itt:AerospaceanddefenseMember2023-01-012023-04-010000216228itt:MotionTechnologiesMemberitt:GeneralindustrialMember2023-01-012023-04-010000216228itt:GeneralindustrialMemberitt:IndustrialProcessMember2023-01-012023-04-010000216228itt:GeneralindustrialMemberitt:ConnectControlTechnologiesMember2023-01-012023-04-010000216228itt:GeneralindustrialMembersrt:ConsolidationEliminationsMember2023-01-012023-04-010000216228itt:GeneralindustrialMember2023-01-012023-04-010000216228srt:ConsolidationEliminationsMember2023-01-012023-04-010000216228itt:RemainingCurrentFiscalYearMembersrt:MinimumMember2024-03-300000216228itt:RemainingCurrentFiscalYearMembersrt:MaximumMember2024-03-300000216228country:DE2023-01-012023-04-010000216228country:US2024-01-012024-03-300000216228country:IT2024-01-012024-03-300000216228us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2024-03-300000216228us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2024-03-300000216228us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2024-03-300000216228us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2024-03-300000216228us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2024-03-300000216228us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2024-03-300000216228us-gaap:CustomerRelationshipsMember2024-03-300000216228us-gaap:CustomerRelationshipsMember2023-12-310000216228us-gaap:TechnologyBasedIntangibleAssetsMember2024-03-300000216228us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310000216228itt:PatentsAndOtherMember2024-03-300000216228itt:PatentsAndOtherMember2023-12-310000216228itt:SvanehojMember2024-01-190000216228itt:SvanehojMemberus-gaap:CustomerRelationshipsMember2024-01-190000216228itt:SvanehojMemberus-gaap:CustomerRelationshipsMember2024-01-192024-01-190000216228itt:SvanehojMemberus-gaap:TechnologyBasedIntangibleAssetsMember2024-01-190000216228itt:SvanehojMemberus-gaap:TechnologyBasedIntangibleAssetsMember2024-01-192024-01-190000216228itt:SvanehojMemberus-gaap:TradeNamesMember2024-01-192024-01-190000216228itt:SvanehojMemberus-gaap:OrderOrProductionBacklogMember2024-01-190000216228itt:SvanehojMemberus-gaap:OrderOrProductionBacklogMember2024-01-192024-01-190000216228country:US2024-03-300000216228country:US2023-12-310000216228us-gaap:RevolvingCreditFacilityMember2024-03-300000216228itt:A2021RevolvingCreditFacilityMemberMember2024-03-300000216228itt:A2021RevolvingCreditFacilityMemberMember2024-01-012024-03-300000216228itt:TermLoanMember2024-01-012024-03-300000216228itt:TermLoanMember2024-03-300000216228itt:EquityBasedAwardsMember2024-01-012024-03-300000216228itt:EquityBasedAwardsMember2023-01-012023-04-010000216228itt:LiabilityBasedAwardsMember2024-01-012024-03-300000216228itt:LiabilityBasedAwardsMember2023-01-012023-04-010000216228itt:EquityBasedAwardsMember2024-03-300000216228itt:LiabilityBasedAwardsMember2024-03-300000216228us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-300000216228us-gaap:RestrictedStockUnitsRSUMember2024-03-300000216228us-gaap:PerformanceSharesMember2024-01-012024-03-300000216228us-gaap:PerformanceSharesMember2024-03-300000216228us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-04-010000216228us-gaap:PerformanceSharesMember2023-01-012023-04-010000216228itt:A2019ShareRepurchaseProgramMember2024-03-300000216228itt:A2019ShareRepurchaseProgramMember2023-01-012023-04-010000216228itt:A2023ShareRepurchaseProgramMember2024-03-300000216228itt:SettlementOfTaxWithholdingOnEmployeeEquityCompensationMember2024-01-012024-03-300000216228itt:SettlementOfTaxWithholdingOnEmployeeEquityCompensationMember2023-01-012023-04-010000216228us-gaap:SegmentContinuingOperationsMember2024-01-012024-03-300000216228us-gaap:SegmentContinuingOperationsMember2023-01-012023-04-010000216228itt:EnvironmentalRelatedMattersMembersrt:MaximumMember2024-03-300000216228itt:EnvironmentalRelatedMattersMembersrt:MaximumMember2023-04-010000216228itt:EnvironmentalRelatedMattersMember2024-03-30itt:site0000216228itt:EnvironmentalRelatedMattersMember2023-04-010000216228itt:SvanehojMember2024-01-012024-03-300000216228itt:MicroModeMember2023-05-02

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the transition period from to |

Commission File Number: 001-05672

ITT INC.

| | | | | | | | |

| Indiana | | 81-1197930 |

(State or Other Jurisdiction

of Incorporation or Organization) | | (I.R.S. Employer

Identification Number) |

100 Washington Boulevard, 6th Floor, Stamford, CT 06902

(Principal Executive Office)

Telephone Number: (914) 641-2000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | ITT | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | |

| ☑ | Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company |

☐ | Emerging growth company | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of April 30, 2024, there were 82.3 million shares of Common Stock (par value $1.00 per share) of the issuer outstanding.

TABLE OF CONTENTS

| | | | | | | | |

| ITEM | | PAGE |

| PART I – FINANCIAL INFORMATION |

| 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 2. | |

| | |

| | |

| | |

| | |

| | |

| | |

| 3. | | |

| 4. | | |

| PART II – OTHER INFORMATION |

| 1. | | |

| 1A. | | |

| 2. | | |

| 3. | | |

| 4. | | |

| 5. | | |

| 6. | | |

| | |

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the SEC). The SEC maintains a website at www.sec.gov on which you may access our SEC filings. In addition, we make available free of charge at www.investors.itt.com copies of materials we file with, or furnish to, the SEC as soon as reasonably practical after we electronically file or furnish these reports, as well as other important information that we disclose from time to time. Information contained on our website, or that can be accessed through our website, does not constitute a part of this Quarterly Report on Form 10-Q (this Report). We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Our corporate headquarters are located at 100 Washington Boulevard, 6th Floor, Stamford, CT 06902 and the telephone number of this location is (914) 641-2000.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

Some of the information included herein includes forward-looking statements within the meaning of the Securities Exchange Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are not historical facts, but rather represent only a belief regarding future events based on current expectations, estimates, assumptions and projections about our business, future financial results and the industry in which we operate, and other legal, regulatory and economic developments. These forward-looking statements include, but are not limited to, future strategic plans and other statements that describe the company’s business strategy, outlook, objectives, plans, intentions or goals, and any discussion of future events and future operating or financial performance.

We use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “guidance,” “project,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “target,” “will,” and other similar expressions to identify such forward-looking statements. Forward-looking statements are uncertain and, by their nature, many are inherently unpredictable and outside of ITT’s control, and involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed or implied in, or reasonably inferred from, such forward-looking statements.

Where in any forward-looking statement we express an expectation or belief as to future results or events, such expectation or belief is based on current plans and expectations of our management, expressed in good faith and believed to have a reasonable basis. However, we cannot provide any assurance that the expectation or belief will occur or that anticipated results will be achieved or accomplished.

Among the factors that could cause our results to differ materially from those indicated by forward-looking statements are risks and uncertainties inherent in our business including, without limitation:

•uncertain global economic and capital markets conditions, which have been influenced by heightened geopolitical tensions, inflation, changes in monetary policies, the threat of a possible regional or global economic recession, trade disputes between the U.S. and its trading partners, political and social unrest, and the availability and fluctuations in prices of energy and commodities, including steel, oil, copper and tin;

•fluctuations in interest rates and the impact of such fluctuations on customer behavior and on our cost of debt;

•fluctuations in foreign currency exchange rates and the impact of such fluctuations on our revenues, customer demand for our products and on our hedging arrangements;

•volatility in raw material prices and our suppliers’ ability to meet quality and delivery requirements;

•risk of liabilities from recent mergers, acquisitions, or venture investments, and past divestitures and spin-offs;

•our inability to hire or retain key personnel;

•failure to compete successfully and innovate in our markets;

•failure to manage the distribution of products and services effectively;

•failure to protect our intellectual property rights or violations of the intellectual property rights of others;

•the extent to which there are quality problems with respect to manufacturing processes or finished goods;

•the risk of cybersecurity breaches or failure of any information systems used by the Company, including any flaws in the implementation of any enterprise resource planning systems;

•loss of or decrease in sales from our most significant customers;

•risks due to our operations and sales outside the U.S. and in emerging markets, including the imposition of tariffs and trade sanctions;

•fluctuations in demand or customers’ levels of capital investment, maintenance expenditures, production, and market cyclicality;

•the risk of material business interruptions, particularly at our manufacturing facilities;

•risks related to government contracting, including changes in levels of government spending and regulatory and contractual requirements applicable to sales to the U.S. government;

•fluctuations in our effective tax rate, including as a result of changing tax laws and other possible tax reform legislation in the U.S. and other jurisdictions;

•changes in environmental laws or regulations, discovery of previously unknown or more extensive contamination, or the failure of a potentially responsible party to perform;

•failure to comply with the U.S. Foreign Corrupt Practices Act (or other applicable anti-corruption legislation), export controls and trade sanctions; and

•risk of product liability claims and litigation.

More information on factors that could cause actual results or events to differ materially from those anticipated is included in Part II, Item 1A, “Risk Factors” herein, as well as in our reports filed with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2023 (particularly under the caption “Risk Factors”), our Quarterly Reports on Form 10-Q and in other documents we file from time to time with the SEC. The forward-looking statements included in this Report speak only as of the date of this Report. We undertake no obligation (and expressly disclaim any obligation) to update any forward-looking statements, whether written or oral or as a result of new information, future events or otherwise.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS (UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | |

| | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

| Revenue | $ | 910.6 | | | $ | 797.9 | | | | | |

| Cost of revenue | 609.8 | | | 536.0 | | | | | |

| Gross profit | 300.8 | | | 261.9 | | | | | |

| General and administrative expenses | 71.5 | | | 68.3 | | | | | |

| Sales and marketing expenses | 50.1 | | | 42.9 | | | | | |

| Research and development expenses | 30.0 | | | 26.4 | | | | | |

| | | | | | | |

| Operating income | 149.2 | | | 124.3 | | | | | |

| Interest and non-operating expense, net | 4.4 | | | 3.5 | | | | | |

Income before income tax expense | 144.8 | | | 120.8 | | | | | |

| Income tax expense | 32.8 | | | 20.1 | | | | | |

| | | | | | | |

| | | | | | | |

| Net income | 112.0 | | | 100.7 | | | | | |

| Less: Income attributable to noncontrolling interests | 1.0 | | | 0.7 | | | | | |

| Net income attributable to ITT Inc. | $ | 111.0 | | | $ | 100.0 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Earnings per share attributable to ITT Inc.: | | | | | | | |

Basic | $ | 1.35 | | | $ | 1.21 | | | | | |

| | | | | | | |

Diluted | $ | 1.34 | | | $ | 1.20 | | | | | |

| | | | | | | |

| Weighted average common shares – basic | 82.2 | | | 82.6 | | | | | |

| Weighted average common shares – diluted | 82.7 | | | 83.0 | | | | | |

The accompanying Notes to the Consolidated Condensed Financial Statements are an integral part of the Statements of Operations.

ITT Inc. | Q1 2024 Form 10-Q | 1

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(IN MILLIONS)

| | | | | | | | | | | | | | | |

| | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

| Net income | $ | 112.0 | | | $ | 100.7 | | | | | |

| Other comprehensive (loss) income: | | | | | | | |

| Net foreign currency translation adjustment | (32.1) | | | 6.0 | | | | | |

Net change in postretirement benefit plans, net of tax impacts of 0.3, 1.8, respectively | (1.0) | | | 0.4 | | | | | |

| | | | | | | |

| Other comprehensive (loss) income | (33.1) | | | 6.4 | | | | | |

| Comprehensive income | 78.9 | | | 107.1 | | | | | |

| Less: Comprehensive income attributable to noncontrolling interests | 1.0 | | | 0.7 | | | | | |

| Comprehensive income attributable to ITT Inc. | $ | 77.9 | | | $ | 106.4 | | | | | |

| | | | | | | |

| Disclosure of reclassification adjustments and other adjustments to postretirement benefit plans: | | | | | | | |

Amortization of prior service benefit, net of tax expense of $0.3, $0.3, respectively | $ | (1.1) | | | $ | (1.2) | | | | | |

Amortization of net actuarial loss, net of tax benefit of $0.0, $0.0, respectively | 0.1 | | | 0.1 | | | | | |

Other adjustments to postretirement benefit plans: | | | | | | | |

| | | | | | | |

| Deferred tax asset valuation allowance reversal | — | | | 1.5 | | | | | |

| | | | | | | |

| Net change in postretirement benefit plans, net of tax | $ | (1.0) | | | $ | 0.4 | | | | | |

The accompanying Notes to the Consolidated Condensed Financial Statements are an integral part of the Statements of Comprehensive Income.

ITT Inc. | Q1 2024 Form 10-Q | 2

CONSOLIDATED CONDENSED BALANCE SHEETS (UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 423.0 | | | $ | 489.2 | |

| Receivables, net | 752.0 | | | 675.2 | |

| Inventories | 609.4 | | | 575.4 | |

| Other current assets | 123.3 | | | 117.9 | |

| Total current assets | 1,907.7 | | | 1,857.7 | |

| Non-current assets: | | | |

| Plant, property and equipment, net | 568.1 | | | 561.0 | |

| Goodwill | 1,207.7 | | | 1,016.3 | |

| Other intangible assets, net | 332.2 | | | 116.6 | |

| Other non-current assets | 388.0 | | | 381.0 | |

| Total non-current assets | 2,496.0 | | | 2,074.9 | |

| Total assets | $ | 4,403.7 | | | $ | 3,932.6 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

Short-term borrowings | $ | 322.7 | | | $ | 187.7 | |

| Accounts payable | 459.2 | | | 437.0 | |

| Accrued and other current liabilities | 415.1 | | | 413.1 | |

| Total current liabilities | 1,197.0 | | | 1,037.8 | |

| Non-current liabilities: | | | |

Long-term debt | 230.5 | | | 5.7 | |

| Postretirement benefits | 135.9 | | | 138.7 | |

| Other non-current liabilities | 254.1 | | | 211.3 | |

| Total non-current liabilities | 620.5 | | | 355.7 | |

| Total liabilities | 1,817.5 | | | 1,393.5 | |

| Shareholders’ equity: | | | |

| Common stock: | | | |

Authorized – 250.0 shares, $1 par value per share | | | |

Issued and outstanding – 82.3 shares and 82.1 shares, respectively | 82.3 | | | 82.1 | |

| Retained earnings | 2,857.4 | | | 2,778.0 | |

Accumulated other comprehensive loss: | | | |

| Postretirement benefits | (2.6) | | | (1.6) | |

| Cumulative translation adjustments | (362.4) | | | (330.3) | |

| Total accumulated other comprehensive loss | (365.0) | | | (331.9) | |

| Total ITT Inc. shareholders’ equity | 2,574.7 | | | 2,528.2 | |

| Noncontrolling interests | 11.5 | | | 10.9 | |

| Total shareholders’ equity | 2,586.2 | | | 2,539.1 | |

| Total liabilities and shareholders’ equity | $ | 4,403.7 | | | $ | 3,932.6 | |

The accompanying Notes to the Consolidated Condensed Financial Statements are an integral part of the Balance Sheets.

ITT Inc. | Q1 2024 Form 10-Q | 3

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (UNAUDITED)

(IN MILLIONS)

| | | | | | | | | | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 |

| Operating Activities | | | |

| Income from continuing operations attributable to ITT Inc. | $ | 111.0 | | | $ | 100.0 | |

| Adjustments to income from continuing operations: | | | |

| Depreciation and amortization | 33.6 | | | 26.7 | |

| Equity-based compensation | 7.0 | | | 4.7 | |

| | | |

| | | |

| | | |

| | | |

| Other non-cash charges, net | 8.1 | | | 7.5 | |

| | | |

| Changes in assets and liabilities: | | | |

| Change in receivables | (67.7) | | | (34.7) | |

| Change in inventories | (1.0) | | | (29.1) | |

| Change in contract assets | (13.5) | | | (2.0) | |

| Change in contract liabilities | 3.3 | | | 2.9 | |

| Change in accounts payable | 15.0 | | | 1.8 | |

| Change in accrued expenses | (44.5) | | | (10.8) | |

| Change in income taxes | 10.1 | | | 3.7 | |

| Other, net | (3.6) | | | (12.6) | |

| Net Cash – Operating Activities | 57.8 | | | 58.1 | |

| Investing Activities | | | |

| Capital expenditures | (27.7) | | | (28.7) | |

| | | |

| | | |

| Acquisitions, net of cash acquired | (407.6) | | | — | |

| | | |

| | | |

| Other, net | — | | | 0.2 | |

| Net Cash – Investing Activities | (435.3) | | | (28.5) | |

| Financing Activities | | | |

| Commercial paper, net borrowings | 134.7 | | | (72.8) | |

| | | |

| | | |

Long-term debt issued, net of debt issuance costs | 299.1 | | | — | |

| Long-term debt, repayments | (70.5) | | | — | |

| Share repurchases under repurchase plan | — | | | (30.0) | |

| Payments for taxes related to net share settlement of stock incentive plans | (12.5) | | | (6.3) | |

| Dividends paid | (26.5) | | | (24.2) | |

| Other, net | (0.9) | | | 0.4 | |

| Net Cash – Financing Activities | 323.4 | | | (132.9) | |

| Exchange rate effects on cash and cash equivalents | (12.0) | | | 4.3 | |

| Net cash – operating activities of discontinued operations | (0.1) | | | (0.1) | |

| Net change in cash and cash equivalents | (66.2) | | | (99.1) | |

Cash and cash equivalents – beginning of year (includes restricted cash of $0.7 and $0.7, respectively) | 489.9 | | | 561.9 | |

Cash and Cash Equivalents – End of Period (includes restricted cash of $0.7 and $0.8, respectively) | $ | 423.7 | | | $ | 462.8 | |

Supplemental Disclosures of Cash Flow and Non-Cash Information: | | | |

| Cash paid during the year for: | | | |

Cash paid for interest | $ | 3.7 | | | $ | 4.2 | |

Cash paid for income taxes, net of refunds received | $ | 16.3 | | | $ | 13.2 | |

| Capital expenditures included in accounts payable | $ | 17.5 | | | $ | 10.3 | |

The accompanying Notes to the Consolidated Condensed Financial Statements are an integral part of the Statements of Cash Flows.

ITT Inc. | Q1 2024 Form 10-Q | 4

CONSOLIDATED CONDENSED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (UNAUDITED)

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of and for the Three Months Ended March 30, 2024 | Common Stock | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Noncontrolling Interest | | Total Shareholders' Equity |

| (Shares) | | (Dollars) | | | | | | | | |

| December 31, 2023 | 82.1 | | $ | 82.1 | | | $ | 2,778.0 | | | $ | (331.9) | | | $ | 10.9 | | | $ | 2,539.1 | |

| Net income | — | | | — | | | 111.0 | | — | | | 1.0 | | | 112.0 | |

| Shares issued and activity from stock incentive plans | 0.3 | | | 0.3 | | | 7.0 | | | — | | | — | | | 7.3 | |

| | | | | | | | | | | |

| Shares withheld related to net share settlement of stock incentive plans | (0.1) | | | (0.1) | | | (12.4) | | | — | | | — | | | (12.5) | |

Dividends declared ($0.319 per share) | — | | | — | | | (26.3) | | | — | | | — | | | (26.3) | |

| Dividends to noncontrolling interest | — | | | — | | | — | | | — | | | (0.4) | | | (0.4) | |

| | | | | | | | | | | |

| Net change in postretirement benefit plans, net of tax | — | | | — | | | — | | | (1.0) | | | — | | | (1.0) | |

| Net foreign currency translation adjustment | — | | | — | | | — | | | (32.1) | | | — | | | (32.1) | |

| Other | — | | | — | | | 0.1 | | | — | | | — | | | 0.1 | |

March 30, 2024 | 82.3 | | | $ | 82.3 | | | $ | 2,857.4 | | | $ | (365.0) | | | $ | 11.5 | | | $ | 2,586.2 | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of and for the Three Months Ended April 1, 2023 | Common Stock | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Noncontrolling Interest | | Total Shareholders' Equity |

| December 31, 2022 | 82.7 | | | $ | 82.7 | | | $ | 2,509.7 | | | $ | (344.3) | | | $ | 9.3 | | | $ | 2,257.4 | |

| Net income | — | | | — | | | 100.0 | | | — | | | 0.7 | | | 100.7 | |

| Shares issued and activity from stock incentive plans | 0.2 | | | 0.2 | | | 4.9 | | | — | | | — | | | 5.1 | |

| Share repurchases under repurchase plan | (0.4) | | | (0.4) | | | (29.6) | | | — | | | — | | | (30.0) | |

| Shares withheld related to net share settlement of stock incentive plans | (0.1) | | | (0.1) | | | (6.2) | | | — | | | — | | | (6.3) | |

Dividends declared ($0.29 per share) | — | | | — | | | (24.1) | | | — | | | — | | | (24.1) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net change in postretirement benefit plans, net of tax | — | | | — | | | — | | | 0.4 | | | — | | | 0.4 | |

| Net foreign currency translation adjustment | — | | | — | | | — | | | 6.0 | | | — | | | 6.0 | |

| | | | | | | | | | | |

April 1, 2023 | 82.4 | | | $ | 82.4 | | | $ | 2,554.7 | | | $ | (337.9) | | | $ | 10.0 | | | $ | 2,309.2 | |

| | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The accompanying Notes to the Consolidated Condensed Financial Statements are an integral part of the Statements of Changes in Shareholders’ Equity.

ITT Inc. | Q1 2024 Form 10-Q | 5

NOTES TO THE CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

(DOLLARS AND SHARES (EXCEPT PER SHARE AMOUNTS) IN MILLIONS, UNLESS OTHERWISE STATED)

NOTE 1

DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Description of Business

ITT Inc. is a diversified manufacturer of highly engineered critical components and customized technology solutions for the transportation, industrial, and energy markets. Unless the context otherwise indicates, references herein to “ITT,” “the Company,” and such words as “we,” “us,” and “our” include ITT Inc. and its subsidiaries. ITT operates through three reportable segments: Motion Technologies (MT), consisting of friction and shock and vibration equipment; Industrial Process (IP), consisting of industrial flow equipment and services; and Connect & Control Technologies (CCT), consisting of electronic connectors, fluid handling, motion control, composite materials and noise and energy absorption products. Financial information for our segments is presented in Note 3, Segment Information. Business Combination

On January 19, 2024, we completed the acquisition of Svanehøj Group A/S (Svanehøj) for a purchase price of $407.6, net of cash acquired. Subsequent to the acquisition, Svanehøj’s results are reported within our IP segment. Refer to Note 18, Acquisitions, for more information. Basis of Presentation

The unaudited consolidated condensed financial statements have been prepared pursuant to the rules and regulations of the SEC and, in the opinion of management, reflect all known adjustments (which consist primarily of normal, recurring accruals, estimates and assumptions) necessary to state fairly the financial position, results of operations, and cash flows for the periods presented. The Consolidated Condensed Balance Sheet as of December 31, 2023, presented herein, has been derived from our audited balance sheet included in our Annual Report on Form 10-K (2023 Annual Report) for the year ended December 31, 2023, but does not include all disclosures required by accounting principles generally accepted in the United States (GAAP). We consistently applied the accounting policies described in the 2023 Annual Report in preparing these unaudited financial statements. These financial statements should be read in conjunction with the financial statements and notes thereto included in our 2023 Annual Report. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Estimates are revised as additional information becomes available. Estimates and assumptions are used for, but not limited to, revenue recognition, unrecognized tax benefits, deferred tax valuation allowances, projected benefit obligations for postretirement plans, accounting for business combinations, goodwill and other intangible asset impairment testing, environmental liabilities and assets, allowance for credit losses and inventory valuation. Actual results could differ from these estimates.

ITT’s quarterly financial periods end on the Saturday that is closest to the last day of the calendar quarter, except for the last quarterly period of the fiscal year, which ends on December 31st. ITT’s first quarter for 2024 and 2023 ended on March 30, 2024 and April 1, 2023, respectively.

Certain prior year amounts have been reclassified to conform to the current year presentation.

NOTE 2

RECENT ACCOUNTING PRONOUNCEMENTS

From time to time, the Financial Accounting Standards Board (“FASB”) or other standards setting bodies issue new accounting pronouncements. Updates to the FASB's accounting standards are communicated through issuance of an Accounting Standards Update (“ASU”). The Company considers the applicability and impact of all ASUs on our business and financial results.

ITT Inc. | Q1 2024 Form 10-Q | 6

Recently issued accounting pronouncements not yet adopted

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. This ASU updates reportable segment disclosure requirements by requiring disclosures of significant reportable segment expenses that are regularly provided to the Chief Operating Decision Maker (“CODM”) and included within each reported measure of a segment's profit or loss. This ASU also requires disclosure of the title and position of the individual identified as the CODM and an explanation of how the CODM uses the reported measures of a segment’s profit or loss in assessing segment performance and deciding how to allocate resources. This ASU is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Adoption of the ASU should be applied retrospectively to all prior periods presented in the financial statements. We are currently evaluating the impact that this guidance will have on the disclosures within our financial statements, and will adopt this ASU for the year ending December 31, 2024.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This ASU requires disclosure of specific categories in the rate reconciliation and additional information for reconciling items that meet a quantitative threshold. The amendment also includes other changes to improve the effectiveness of income tax disclosures, including further disaggregation of income taxes paid for individually significant jurisdictions. This ASU is effective for annual periods beginning after December 15, 2024. Adoption of this ASU should be applied on a prospective basis. Early adoption is permitted. We are currently evaluating the impact that this guidance will have on the disclosures within our financial statements, and expect to adopt this ASU for the year ending December 31, 2025.

During 2024, there were no other new accounting standards issued, or that are pending issuance, which are expected to have a material impact on our consolidated financial statements upon adoption.

NOTE 3

SEGMENT INFORMATION

The Company’s segments are reported on the same basis used by our Chief Executive Officer, who is also our CODM, for evaluating performance and for allocating resources. Our three reportable segments are referred to as Motion Technologies, Industrial Process, and Connect & Control Technologies.

Motion Technologies manufactures brake components and specialized sealing solutions, shock absorbers and damping technologies primarily for the global automotive, truck and trailer, public bus and rail transportation markets.

Industrial Process manufactures engineered fluid process equipment serving a diversified mix of customers in global industries such as chemical, energy, mining, and other industrial process markets and is a provider of plant optimization and efficiency solutions and aftermarket services and parts.

Connect & Control Technologies manufactures harsh-environment connector solutions, critical energy absorption, flow control components, and composite materials for the aerospace and defense, general industrial, medical, and energy markets.

Assets of our reportable segments exclude general corporate assets, which principally consist of cash, investments, deferred taxes, and certain property, plant and equipment. These assets are included within Corporate and Other, which is described further below.

Corporate and Other consists of corporate office expenses including compensation, benefits, occupancy, depreciation, and other administrative costs, as well as charges related to certain matters, including environmental liabilities, that are managed at a corporate level and are not included in segment results when evaluating performance or allocating resources. In addition, Corporate and Other includes research and development-related expenses associated with a subsidiary that does not constitute a reportable segment.

ITT Inc. | Q1 2024 Form 10-Q | 7

The following table presents our revenue for each segment and reconciles our total segment revenue to total consolidated revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | | | | | | | | | | | |

| Motion Technologies | $ | 392.4 | | | $ | 364.8 | | | | | | | | | | | | | | | |

| Industrial Process | 333.9 | | | 266.5 | | | | | | | | | | | | | | | |

| Connect & Control Technologies | 185.1 | | | 167.6 | | | | | | | | | | | | | | | |

Total segment revenue | 911.4 | | | 798.9 | | | | | | | | | | | | | | | |

| Eliminations | (0.8) | | | (1.0) | | | | | | | | | | | | | | | |

Total consolidated revenue | $ | 910.6 | | | $ | 797.9 | | | | | | | | | | | | | | | |

The following table presents our operating income for each segment and reconciles our total segment operating income to income from continuing operations before income tax.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| For the Three Months Ended | | | | | | | March 30,

2024 | | April 1,

2023 | | | | | | | | |

| Motion Technologies | | | | | | | $ | 70.6 | | | $ | 53.4 | | | | | | | | | |

| Industrial Process | | | | | | | 63.8 | | | 55.3 | | | | | | | | | |

| Connect & Control Technologies | | | | | | | 32.7 | | | 29.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Total segment operating income | | | | | | | 167.1 | | | 138.1 | | | | | | | | | |

Other corporate costs | | | | | | | (17.9) | | | (13.8) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Interest and non-operating expense, net | | | | | | | (4.4) | | | (3.5) | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Income from continuing operations before income tax | | | | | | | $ | 144.8 | | | $ | 120.8 | | | | | | | | | |

The following table presents our operating margin for each segment. Segment operating margin is calculated as segment operating income divided by segment revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| For the Three Months Ended | | | | | | | | | | | | | March 30,

2024 | | April 1,

2023 | | |

Motion Technologies | | | | | | | | | | | | | 18.0 | % | | 14.6 | % | | |

Industrial Process | | | | | | | | | | | | | 19.1 | % | | 20.8 | % | | |

Connect & Control Technologies | | | | | | | | | | | | | 17.7 | % | | 17.5 | % | | |

| | | | | | | | | | | | | | | | | |

The following table presents our total assets, capital expenditures, and depreciation & amortization expense for each segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of and for the Three Months Ended | Total Assets | | Capital

Expenditures | | Depreciation &

Amortization |

March 30,

2024 | | December 31,

2023 | | March 30,

2024 | | April 1,

2023 | | March 30,

2024 | | April 1,

2023 |

| Motion Technologies | $ | 1,368.9 | | | $ | 1,366.6 | | | $ | 18.0 | | | $ | 20.2 | | | $ | 15.8 | | | $ | 15.8 | |

| Industrial Process | 1,856.0 | | | 1,323.2 | | | 6.7 | | | 3.2 | | | 12.1 | | | 5.6 | |

| Connect & Control Technologies | 826.7 | | | 834.6 | | | 2.7 | | | 4.8 | | | 5.1 | | | 4.7 | |

| Corporate and Other | 352.1 | | | 408.2 | | | 0.3 | | | 0.5 | | | 0.6 | | | 0.6 | |

| Total | $ | 4,403.7 | | | $ | 3,932.6 | | | $ | 27.7 | | | $ | 28.7 | | | $ | 33.6 | | | $ | 26.7 | |

ITT Inc. | Q1 2024 Form 10-Q | 8

NOTE 4

REVENUE

The following tables present our revenue disaggregated by end market.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Three Months Ended March 30, 2024 | Motion Technologies | | Industrial Process | | Connect & Control Technologies | | Eliminations | | Total |

| Auto and rail | $ | 383.9 | | | $ | — | | | $ | — | | | $ | (0.1) | | | $ | 383.8 | |

| Chemical and industrial pumps | — | | | 218.9 | | | — | | | — | | | 218.9 | |

| Energy | — | | | 115.0 | | | 13.4 | | | — | | | 128.4 | |

| Aerospace and defense | 1.7 | | | — | | | 104.1 | | | — | | | 105.8 | |

| General industrial | 6.8 | | | — | | | 67.6 | | | (0.7) | | | 73.7 | |

| Total | $ | 392.4 | | | $ | 333.9 | | | $ | 185.1 | | | $ | (0.8) | | | $ | 910.6 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Three Months Ended April 1, 2023 | | | | | | | | | |

| Auto and rail | $ | 356.0 | | | $ | — | | | $ | — | | | $ | — | | | $ | 356.0 | |

| Chemical and industrial pumps | — | | | 218.0 | | | — | | | — | | | 218.0 | |

| Energy | — | | | 48.5 | | | 10.2 | | | — | | | 58.7 | |

| Aerospace and defense | 1.9 | | | — | | | 86.9 | | | — | | | 88.8 | |

| General industrial | 6.9 | | | — | | | 70.5 | | | (1.0) | | | 76.4 | |

| Total | $ | 364.8 | | | $ | 266.5 | | | $ | 167.6 | | | $ | (1.0) | | | $ | 797.9 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Contract Assets and Liabilities

Contract assets consist of unbilled amounts where revenue recognized exceeds customer billings, net of allowances for credit losses. Contract assets are included in other current assets and other non-current assets in our Consolidated Condensed Balance Sheets. Contract liabilities consist of advance customer payments and billings in excess of revenue recognized. Contract liabilities are included in accrued liabilities and other non-current liabilities in our Consolidated Condensed Balance Sheets.

The following table represents our net contract assets and liabilities.

| | | | | | | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 | | | |

Current contract assets | $ | 40.4 | | | $ | 25.8 | | | | | | |

Non-current contract assets | 1.6 | | | 1.6 | | | | | | |

Current contract liabilities(a) | (126.6) | | | (95.9) | | | | | | |

| Non-current contract liabilities | (4.5) | | | (4.5) | | | | | | |

| Net contract liabilities | $ | (89.1) | | | $ | (73.0) | | | | | | |

(a)The increase in current contract liabilities from December 31, 2023 to March 30, 2024 is driven by the acquisition of Svanehøj. Refer to Note 18, Acquisitions, for further information. During the three months ended March 30, 2024, we recognized revenue of $48.0 related to contract liabilities as of December 31, 2023. The aggregate amount of the transaction price allocated to unsatisfied or partially satisfied performance obligations as of March 30, 2024 was $1,450.1. Of this amount, we expect to recognize approximately $970 to $990 of revenue during the remainder of 2024.

ITT Inc. | Q1 2024 Form 10-Q | 9

NOTE 5

INCOME TAXES

The following table summarizes our income tax expense and effective tax rate.

| | | | | | | | | | | | | | | |

| | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

| Income tax expense | $ | 32.8 | | | $ | 20.1 | | | | | |

| Effective tax rate | 22.7 | % | | 16.6 | % | | | | |

The increase in the effective tax rate (ETR) for the three months ended March 30, 2024 was due to prior year benefits of $16.3 from valuation allowance reversals on deferred tax assets in Germany and $4.9 from filing an amended 2017 consolidated federal tax return. These benefits were partially offset by a prior year expense of $14.1 relating to an Italian tax audit settlement covering tax years 2016-2022.

In October 2021, more than 135 countries and jurisdictions agreed to participate in a “two-pillar” international tax approach developed by the Organisation for Economic Co-operation and Development (OECD), which includes establishing a global minimum corporate tax rate of 15 percent. The OECD published Tax Challenges Arising from the Digitalisation of the Economy — Global Anti-Base Erosion Model Rules (Pillar Two) in December 2021 and subsequently issued additional commentary and administrative guidance clarifying several aspects of the model rules. Since the model rules have been released, many countries have now enacted Pillar Two-related laws, some of which became effective January 1, 2024, and it is anticipated that many more will follow suit throughout 2024. As of March 31, 2024, the Company does not expect Pillar Two taxes to have a significant impact on its 2024 financial statements.

The Company operates in various tax jurisdictions and is subject to examination by tax authorities in these jurisdictions. The Company is currently under examination in several jurisdictions including China, Czechia, Germany, India, Italy, and the U.S. The estimated tax liability calculation for unrecognized tax benefits considers uncertainties in the application of complex tax laws and regulations in various tax jurisdictions. Due to the complexity of some of these uncertainties, the ultimate resolution may result in a payment that is materially different from the current estimate of the unrecognized tax benefit. Over the next 12 months, the net amount of the tax liability for unrecognized tax benefits in foreign and domestic jurisdictions could decrease by approximately $0.5 due to changes in audit status, expiration of statutes of limitations and other events.

NOTE 6

EARNINGS PER SHARE DATA

The following table provides a reconciliation of the data used in the calculation of basic and diluted earnings per share from continuing operations attributable to ITT.

| | | | | | | | | | | | | | | |

| | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

| Basic weighted average common shares outstanding | 82.2 | | | 82.6 | | | | | |

| Add: Dilutive impact of outstanding equity awards | 0.5 | | | 0.4 | | | | | |

| Diluted weighted average common shares outstanding | 82.7 | | | 83.0 | | | | | |

| | | | | | | |

Anti-dilutive shares(a) | 0.2 | | | 0.2 | | | | | |

(a) Anti-dilutive shares related to equity stock unit awards excluded from the computation of diluted earnings per share.

ITT Inc. | Q1 2024 Form 10-Q | 10

NOTE 7

RECEIVABLES

The following table summarizes our receivables and associated allowance for credit losses.

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| Trade accounts receivable | $ | 723.1 | | | $ | 641.3 | |

| Notes receivable | 18.1 | | | 25.5 | |

| Other | 25.7 | | | 22.6 | |

| Receivables, gross | 766.9 | | | 689.4 | |

Less: Allowance for credit losses | (14.9) | | | (14.2) | |

| Receivables, net | $ | 752.0 | | | $ | 675.2 | |

The following table displays a rollforward of our total allowance for credit losses.

| | | | | | | | | | | |

| March 30,

2024 | | April 1,

2023 |

| Total allowance for credit losses - January 1 | $ | 14.2 | | | $ | 12.2 | |

| | | |

Charges to income | 1.4 | | | 1.2 | |

| Write-offs | (0.6) | | | (0.3) | |

| Foreign currency and other | (0.1) | | | — | |

| Total allowance for credit losses - ending balance | $ | 14.9 | | | $ | 13.1 | |

NOTE 8

INVENTORY

The following table summarizes our inventories.

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| Raw materials | $ | 383.2 | | | $ | 366.6 | |

| Work in process | 124.0 | | | 111.8 | |

| Finished goods | 102.2 | | | 97.0 | |

| Inventories | $ | 609.4 | | | $ | 575.4 | |

Government Assistance (ASU 2021-10)

ASU 2021-10 requires entities to provide information about the nature of transactions, related policies and effect of government grants on an entity’s financial statements. In particular, in Italy, to qualify for an energy subsidy a company must apply for and receive a certificate attesting that the company is an "energy and gas consuming company" (high energy consumption connected to the production cycle). The amount of subsidies granted is calculated based on a percentage of actual consumption, ranging from 25% to 40%. One of our Italian subsidiaries within our MT segment obtained this certificate and was granted energy subsidies from the Italian government beginning in April 2022. This program concluded in the second quarter of 2023. Accordingly, no energy subsidies were granted for the three months ended March 30, 2024. For the three months ended April 1, 2023, we recognized a benefit of $3.9 related to energy subsidies, which we recorded within Costs of revenue in our Consolidated Condensed Statements of Operations. There was no other material government assistance received by the Company or any of our subsidiaries during the periods.

ITT Inc. | Q1 2024 Form 10-Q | 11

NOTE 9

OTHER CURRENT AND NON-CURRENT ASSETS

The following table summarizes our other current and non-current assets.

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| | | |

| Advance payments and other prepaid expenses | $ | 62.1 | | | $ | 55.3 | |

| Current contract assets, net | 40.4 | | | 25.8 | |

| Prepaid income taxes | 7.6 | | | 16.9 | |

| | | |

| Other | 13.2 | | | 19.9 | |

| Other current assets | $ | 123.3 | | | $ | 117.9 | |

| Other employee benefit-related assets | $ | 131.7 | | | $ | 128.6 | |

Operating lease right-of-use assets | 90.4 | | | 87.4 | |

| Deferred income taxes | 75.9 | | | 76.0 | |

| Equity-method and other investments | 47.8 | | | 46.6 | |

| Capitalized software costs | 7.1 | | | 7.9 | |

| Environmental-related assets | 7.8 | | | 6.0 | |

| Other | 27.3 | | | 28.5 | |

| Other non-current assets | $ | 388.0 | | | $ | 381.0 | |

NOTE 10

PLANT, PROPERTY AND EQUIPMENT, NET

The following table summarizes our property, plant, and equipment, net of accumulated depreciation.

| | | | | | | | | | | | | | | | | |

| Useful life

(in years) | | March 30,

2024 | | December 31,

2023 |

| Machinery and equipment | 2 - 10 | | $ | 1,325.3 | | | $ | 1,317.9 | |

| Buildings and improvements | 5 - 40 | | 318.4 | | | 298.4 | |

| Furniture, fixtures and office equipment | 3 - 7 | | 81.2 | | | 83.7 | |

| Construction work in progress | | | 74.4 | | | 78.1 | |

| Land and improvements | | | 29.9 | | | 29.5 | |

| Other | | | 1.9 | | | 1.7 | |

| Plant, property and equipment, gross | | | 1,831.1 | | | 1,809.3 | |

| Less: Accumulated depreciation | | | (1,263.0) | | | (1,248.3) | |

| Plant, property and equipment, net | | | $ | 568.1 | | | $ | 561.0 | |

The following table summarizes our depreciation expense.

| | | | | | | | | | | | | | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

| Depreciation expense | $ | 22.3 | | | $ | 20.7 | | | | | |

ITT Inc. | Q1 2024 Form 10-Q | 12

NOTE 11

GOODWILL AND OTHER INTANGIBLE ASSETS, NET

Goodwill

The following table provides a rollforward of the carrying amount of goodwill by segment.

| | | | | | | | | | | | | | | | | | | | | | | |

| Motion

Technologies | | Industrial

Process | | Connect & Control

Technologies | | Total |

Goodwill - December 31, 2023 | $ | 292.3 | | | $ | 403.0 | | | $ | 321.0 | | | $ | 1,016.3 | |

Acquired(a) | — | | | 201.9 | | | — | | | 201.9 | |

| | | | | | | |

| | | | | | | |

| Foreign exchange translation | (1.4) | | | (8.5) | | | (0.6) | | | (10.5) | |

Goodwill - March 30, 2024 | $ | 290.9 | | | $ | 596.4 | | | $ | 320.4 | | | $ | 1,207.7 | |

(a) Goodwill acquired is related to our acquisition of Svanehøj and represents the preliminary calculation of the excess purchase price over the net assets acquired. Refer to Note 18, Acquisitions, for further information. Other Intangible Assets, Net

The following table summarizes our other intangible assets, net of accumulated amortization.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 30, 2024 | | December 31, 2023 |

| Gross

Carrying

Amount | | Accumulated Amortization | | Net Intangibles | | Gross

Carrying

Amount | | Accumulated Amortization | | Net Intangibles |

| Customer relationships | $ | 320.5 | | | $ | (141.5) | | | $ | 179.0 | | | $ | 202.4 | | | $ | (138.4) | | | $ | 64.0 | |

| Proprietary technology | 121.2 | | | (34.3) | | | 86.9 | | | 61.5 | | | (32.5) | | | 29.0 | |

| Patents and other | 40.0 | | | (21.6) | | | 18.4 | | | 22.0 | | | (17.5) | | | 4.5 | |

| Finite-lived intangible total | 481.7 | | | (197.4) | | | 284.3 | | | 285.9 | | | (188.4) | | | 97.5 | |

| Indefinite-lived intangibles | 47.9 | | | — | | | 47.9 | | | 19.1 | | | — | | | 19.1 | |

| Other intangible assets | $ | 529.6 | | | $ | (197.4) | | | $ | 332.2 | | | $ | 305.0 | | | $ | (188.4) | | | $ | 116.6 | |

The preliminary fair values of intangible assets acquired in connection with the purchase of Svanehøj total $226.0 and consist of the following:

| | | | | | | | | | | |

| Useful life

(in years) | | Fair value |

| Customer relationships | 16 | | $ | 119.0 | |

| Developed technology | 17 | | 60.0 | |

| Trade name | Indefinite | | 29.0 | |

| Backlog | 1 | | 18.0 | |

| Total intangible assets acquired | | | $ | 226.0 | |

| | | |

ITT Inc. | Q1 2024 Form 10-Q | 13

Amortization expense related to finite-lived intangible assets was $9.6 and $4.7 for the three months ended March 30, 2024 and April 1, 2023, respectively. Estimated amortization expense for each of the five succeeding years and thereafter is as follows:

| | | | | |

| 2024 | $ | 32.3 | |

| 2025 | $ | 28.0 | |

| 2026 | $ | 23.3 | |

| 2027 | $ | 21.2 | |

| 2028 | $ | 21.2 | |

| Thereafter | $ | 158.3 | |

NOTE 12

ACCOUNTS PAYABLE, ACCRUED LIABILITIES AND OTHER NON-CURRENT LIABILITIES

The following table summarizes our accrued liabilities and other non-current liabilities.

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| Compensation and other employee-related benefits | $ | 118.1 | | | $ | 165.5 | |

| Contract liabilities and other customer-related liabilities | 165.3 | | | 133.6 | |

| Accrued income taxes and other tax-related liabilities | 44.7 | | | 30.7 | |

| Operating lease liabilities | 19.5 | | | 19.5 | |

| Accrued warranty costs | 15.3 | | | 14.0 | |

| Environmental liabilities and other legal matters | 5.6 | | | 5.8 | |

| Accrued restructuring costs | 3.5 | | | 4.8 | |

| Other | 43.1 | | | 39.2 | |

| Accrued and other current liabilities | $ | 415.1 | | | $ | 413.1 | |

Operating lease liabilities | $ | 75.2 | | | $ | 72.3 | |

| Environmental liabilities | 50.2 | | | 52.0 | |

| Deferred income taxes and other tax-related liabilities | 62.8 | | | 25.0 | |

| Compensation and other employee-related benefits | 38.2 | | | 38.0 | |

| | | |

| Other | 27.7 | | | 24.0 | |

| Other non-current liabilities | $ | 254.1 | | | $ | 211.3 | |

Supply Chain Financing

The Company has supply chain financing ("SCF") programs in place under which participating suppliers may elect to obtain payment from an intermediary. The Company confirms the validity of invoices from participating suppliers and agrees to pay the intermediary an amount based on invoice totals. The majority of amounts payable under these programs are due within 90 to 180 days and are considered commercially reasonable. There are no assets pledged as security or other forms of guarantees provided for the committed payments. As of March 30, 2024 and December 31, 2023, there were $19.0 and $19.7, respectively, of outstanding amounts payable to suppliers who have elected to participate in these SCF programs. These amounts were recorded within Accounts payable in our Consolidated Condensed Balance Sheets.

ITT Inc. | Q1 2024 Form 10-Q | 14

NOTE 13

DEBT

The following table summarizes our outstanding debt obligations.

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

Commercial paper(a) | $ | 319.6 | | | $ | 184.9 | |

Current maturities of long-term debt | 2.3 | | | 2.3 | |

Short-term loans | 0.8 | | | 0.5 | |

Total short-term borrowings | 322.7 | | | 187.7 | |

Non-current maturities of long-term debt(b) | 230.5 | | | 5.7 | |

| Total debt and finance leases | $ | 553.2 | | | $ | 193.4 | |

(a) The associated weighted average interest rates as of March 30, 2024 and December 31, 2023 were 5.63% and 5.61% respectively. Outstanding commercial paper for both periods had maturity terms less than three months from the date of issuance.

(b) Our long-term debt is primarily related to a term loan that we entered into in January, 2024 in connection with the acquisition of Svanehøj. See additional details in section titled, “Term Loan”, below.

Revolving Credit Agreement

On August 5, 2021, we entered into a revolving credit facility agreement with a syndicate of third party lenders including Bank of America, N.A., as administrative agent (the 2021 Revolving Credit Agreement). Upon its effectiveness, this agreement replaced our existing $500 revolving credit facility due November 2022. The 2021 Revolving Credit Agreement matures in August 2026 and provides for an aggregate principal amount of up to $700. The 2021 Revolving Credit Agreement provides for a potential increase of commitments of up to $350 for a possible maximum of $1,050 in aggregate commitments at the request of the Company and with the consent of the institutions providing such increase of commitments.

On May 10, 2023, we entered into the First Amendment (the Amendment) to the Company’s 2021 Revolving Credit Agreement. In connection with the phase out of LIBOR as a reference interest rate, the Amendment replaced LIBOR as a benchmark for United States Dollar revolving borrowings with the term secured overnight financing rate (Term SOFR), and replaced LIBOR as a benchmark for Euro swing line borrowings with the euro overnight short-term rate (ESTR). The Amendment did not have a significant impact on the Company’s consolidated financial statements.

Since the Amendment, the interest rate per annum on the 2021 Revolving Credit Agreement is based on the term SOFR of the currency we borrow in, plus a margin of 1.1%. As of March 30, 2024 and December 31, 2023, we had no outstanding borrowings under the 2021 Revolving Credit Agreement. There is a 0.15% fee per annum applicable to the commitments under the 2021 Revolving Credit Agreement. The margin and fees are subject to adjustment should the Company’s credit ratings change.

As of March 30, 2024 and April 1, 2023, we had no outstanding obligations under the current or former revolving credit facility.

The 2021 Revolving Credit Agreement contains customary affirmative and negative covenants that, among other things, will limit or restrict our ability to: incur additional debt or issue guarantees; create certain liens; merge or consolidate with another person; sell, transfer, lease or otherwise dispose of assets; liquidate or dissolve; and enter into restrictive covenants. Additionally, the 2021 Revolving Credit Agreement requires us not to permit the ratio of consolidated total indebtedness to consolidated earnings before interest, taxes, depreciation, amortization, and other special, extraordinary, unusual, or non-recurring items (adjusted consolidated EBITDA) (leverage ratio) to exceed 3.50 to 1.00, with a qualified acquisition step up immediately following such qualified acquisition of 4.00 to 1.00 for four quarters, 3.75 to 1.00 for two quarters thereafter, and returning to 3.50 to 1.00 thereafter.

As of March 30, 2024, all financial covenants (e.g., leverage ratio) associated with the 2021 Revolving Credit Agreement were within the prescribed thresholds.

ITT Inc. | Q1 2024 Form 10-Q | 15

Term Loan

On January 12, 2024, ITT Italia S.r.l. (“ITT Italia”), an indirect wholly owned subsidiary of ITT, entered into a facility agreement (the “ITT Italia Credit Agreement”), among the Company, as a guarantor, ITT Italia, as borrower, and BNP Paribas, Italian Branch, as bookrunner, sole underwriter and global coordinator, mandated lead arranger and agent.

The ITT Italia Credit Agreement has an initial maturity of three years (January 2027) and provides for term loan borrowings in an aggregate principal amount of €300 (or $328.9), €275 (or $301.5) of which was used to finance the Company’s acquisition of Svanehøj Group A/S, which closed on January 19, 2024.

The interest rate per annum on the ITT Italia Credit Agreement is based on the EURIBOR rate for Euros, plus a margin of 1.00%. The margin and fees are subject to adjustment should the Company’s credit ratings change.

The ITT Italia Credit Agreement contains customary affirmative and negative covenants, as well as financial covenants (e.g., leverage ratio), that are similar to those contained in our 2021 Revolving Credit Agreement, as described above. As of March 30, 2024, the Company was in compliance with all covenants.

Total outstanding borrowings under the facility were €210, or $226.7, as of March 30, 2024. Debt issuance costs were $1.8 and will be amortized over the term of the debt. The following table provides the future maturities related to the outstanding balance as of March 30, 2024.

| | | | | | |

| 2024 | | $ | — | |

| 2025 | | — | |

| 2026 | | — | |

January 2027 | | 226.7 | |

Total maturities | | $ | 226.7 | |

| | |

| | |

| | |

| | |

NOTE 14

LONG-TERM INCENTIVE EMPLOYEE COMPENSATION

Our long-term incentive plan (LTIP) costs are primarily recorded within general and administrative expenses in our Consolidated Condensed Statements of Operations. The following table summarizes our LTIP costs.

| | | | | | | | | | | | | | | |

| | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

| Equity-based awards | $ | 7.0 | | | $ | 4.7 | | | | | |

| Liability-based awards | 0.7 | | | 0.8 | | | | | |

| Total share-based compensation expense | $ | 7.7 | | | $ | 5.5 | | | | | |

As of March 30, 2024, there was $45.3 of total unrecognized compensation cost related to non-vested equity awards. This cost is expected to be recognized ratably over a weighted-average period of 2.3 years. Additionally, unrecognized compensation cost related to liability-based awards was $4.9, which is expected to be recognized ratably over a weighted-average period of 2.3 years.

Year-to-Date 2024 LTIP Activity

The majority of our LTIP awards are granted during the first quarter of each year and have three-year service periods. These awards either vest equally each year or at the completion of the three-year service period. During the three months ended March 30, 2024, we granted the following LTIP awards as provided in the table below:

| | | | | | | | | | | |

| # of Awards Granted | | Weighted Average Grant Date Fair Value Per Share |

| | | |

| Restricted stock units (RSUs) | 0.1 | | $ | 127.91 | |

| Performance stock units (PSUs) | 0.1 | | $ | 145.42 | |

ITT Inc. | Q1 2024 Form 10-Q | 16

During the three months ended March 30, 2024 and April 1, 2023, a nominal amount of non-qualified stock options were exercised resulting in proceeds of $0.2 and $0.4, respectively. During the three months ended March 30, 2024 and April 1, 2023, RSUs of 0.1 and 0.1, respectively, vested and were issued. During the three months ended March 30, 2024 and April 1, 2023, PSUs of 0.1 and 0.1 that vested on December 31, 2023 and 2022, respectively, were issued.

NOTE 15

CAPITAL STOCK

On October 30, 2019, the Board of Directors approved an indefinite term $500 open-market share repurchase program (the 2019 Plan). There were no open-market share repurchases during the three months ended March 30, 2024. During three months ended April 1, 2023, the Company repurchased and retired 0.4 shares of common stock for $30.0. As of March 30, 2024, there was $78.8 of remaining authorization left under the 2019 Plan.

On October 4, 2023, the Board of Directors approved an indefinite term $1,000 open-market share repurchase program (the 2023 Plan). Repurchases under this authorization will begin upon the completion of the 2019 Plan.

Separate from the open-market share repurchase program, the Company withholds shares of common stock in settlement of employee tax withholding obligations due upon the vesting of equity-based compensation awards. During the three months ended March 30, 2024 and April 1, 2023, the Company withheld 0.1 and 0.1 shares of common stock for $12.5 and $6.3, respectively.

NOTE 16

COMMITMENTS AND CONTINGENCIES

From time to time, we are involved in litigation, claims, government inquiries, investigations and proceedings, including but not limited to those relating to environmental exposures, intellectual property matters, personal injury claims, product liabilities, regulatory matters, commercial and government contract issues, employment and employee benefit matters, commercial or contractual disputes, and securities matters.

Although the ultimate outcome of any legal matter cannot be predicted with certainty, based on present information, including our assessment of the merits of the particular claim, as well as our current reserves and insurance coverage, we do not expect that such legal proceedings will have any material adverse impact on our financial statements, unless otherwise noted below. However, there can be no assurance that an adverse outcome in any of the proceedings described below will not result in material fines, penalties or damages, changes to the Company's business practices, loss of (or litigation with) customers or a material adverse effect on our financial statements.

Environmental Matters

In the ordinary course of business, we are subject to federal, state, local, and foreign environmental laws and regulations. We are responsible, or are alleged to be responsible, for ongoing environmental investigation and site remediation. These sites are in various stages of investigation or remediation and in many of these proceedings our liability is considered de minimis. We have received notification from the U.S. Environmental Protection Agency, and from similar state and foreign environmental agencies, that a number of sites formerly or currently owned or operated by ITT, and other properties or water supplies that may be or have been impacted from those operations, contain disposed or recycled materials or wastes and require environmental investigation or remediation. These sites include instances where we have been identified as a potentially responsible party under federal and state environmental laws and regulations.

ITT Inc. | Q1 2024 Form 10-Q | 17

The following table provides a rollforward of our estimated environmental liability.

| | | | | | | | | | | |

For the Three Months Ended | March 30,

2024 | | April 1,

2023 |

| Environmental liability - beginning balance | $ | 56.0 | | | $ | 57.1 | |

Change in estimates for pre-existing accruals | 0.1 | | | 0.4 | |

| | | |

| | | |

| | | |

| Payments | (1.9) | | | (2.0) | |

| Foreign currency | — | | | 0.1 | |

| Environmental liability - ending balance | $ | 54.2 | | | $ | 55.6 | |

Environmental-related assets, including estimated recoveries from insurance providers and other third parties, were $8.3 and $13.3 as of March 30, 2024 and April 1, 2023, respectively.

The following table illustrates the reasonably possible high range of estimated liability and number of active sites.

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| High-end estimate of environmental liability | $ | 95.3 | | | $ | 98.2 | |

| Number of open environmental sites | 26 | | | 26 | |

As actual costs incurred at identified sites in future periods may vary from our current estimates given the inherent uncertainties in evaluating environmental exposures, management believes it is possible that the outcome of these uncertainties may have a material adverse effect on our financial statements.

NOTE 17

DERIVATIVE FINANCIAL INSTRUMENTS

The Company is exposed to various market risks relating to its ongoing business operations. From time to time, we use derivative financial instruments to mitigate our exposure to certain of these risks, including foreign exchange rate fluctuations. By using derivatives, the Company is further exposed to credit risk. Our exposure to credit risk includes the counterparty’s failure to fulfill its financial obligations under the terms of the derivative contract. The Company attempts to minimize its exposure by avoiding concentration risk among its counterparties and by entering into transactions with creditworthy counterparties.

Foreign Currency Derivative Contracts

The Company enters into foreign currency forward or option contracts to mitigate foreign currency risk associated with transacting with international customers, suppliers, and subsidiaries. The notional amounts and fair values of our outstanding foreign currency derivative contracts, which are recorded within Other current assets in our Consolidated Condensed Balance Sheets, were as follows:

| | | | | | | | | | | |

| As of the Period Ended | March 30,

2024 | | December 31,

2023 |

| Notional amount (U.S. dollar equivalent) | $ | 94.4 | | | $ | 258.4 | |

Fair value of foreign currency derivative contracts(a) | $ | 2.5 | | | $ | 3.8 | |

(a) Our foreign currency derivative contracts are classified within Level 2 of the fair value hierarchy because these contracts are not actively traded and the valuation inputs are based on market observable data of similar instruments.

ITT Inc. | Q1 2024 Form 10-Q | 18

Gains or losses arising from changes in fair value of our foreign currency derivative contracts are recorded within General and administrative expenses in our Consolidated Condensed Statements of Operations, and were as follows:

| | | | | | | | | | | | | | | |

| | | |

| For the Three Months Ended | March 30,

2024 | | April 1,

2023 | | | | |

Loss on foreign currency derivative contracts(b) | $ | (2.2) | | | $ | (1.1) | | | | | |

(b) None of our derivative contracts were designated as hedging instruments under ASC 815 - Derivatives & Hedging.

The cash flow impact upon settlement of our foreign currency derivative contracts is included in operating activities in our Consolidated Condensed Statements of Cash Flows. During the three months ended March 30, 2024 and April 1, 2023, net cash inflows from foreign currency derivative contracts were $1.3 and $5.5, respectively.

ITT Inc. | Q1 2024 Form 10-Q | 19

NOTE 18

ACQUISITIONS

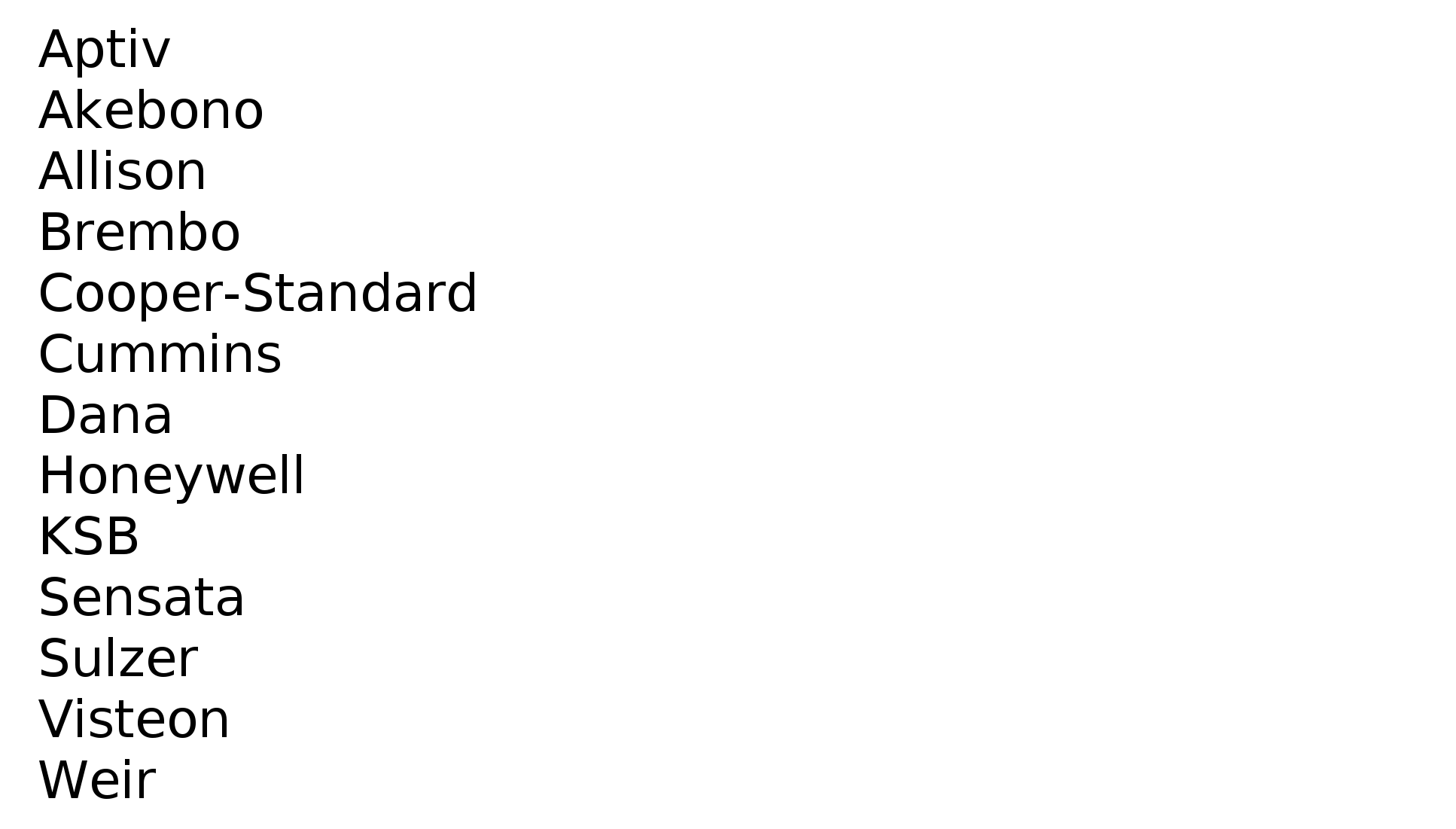

Acquisition of Svanehøj Group A/S (Svanehøj)