UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number: 1-1445

HAVERTY FURNITURE COMPANIES, INC.

|

Maryland

|

58-0281900

|

|

(State of Incorporation)

|

(IRS Employer Identification Number)

|

|

780 Johnson Ferry Road, Suite 800, Atlanta, Georgia 30342

|

|

|

(Address of principal executive offices)

|

|

|

(404) 443-2900

|

|

|

(Registrant’s telephone number, including area code)

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Name of each exchange on which registered

|

|

Common Stock ($1.00 Par Value)

|

New York Stock Exchange, Inc.

|

|

Class A Common Stock ($1.00 Par Value)

|

New York Stock Exchange, Inc.

|

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a

smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2018, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant

was $417,443,226 (based on the closing sale prices of the registrant’s two classes of common stock as reported by the New York Stock Exchange).

There were 18,813,551 shares of common stock and 1,757,157 shares of Class A common stock, each with a par value of $1.00

per share outstanding at February 28, 2019.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held May 13, 2019 are incorporated by

reference in Part III.

HAVERTY FURNITURE COMPANIES, INC.

Annual Report on Form 10-K for the year ended December 31, 2018

|

PART I

|

|||

|

Item 1.

|

Business

|

2

|

|

|

Item 1A.

|

Risk Factors

|

5

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

9

|

|

|

Item 2.

|

Properties

|

9

|

|

|

Item 3.

|

Legal Proceedings

|

9

|

|

|

Item 4.

|

Mine Safety Disclosures

|

9

|

|

|

PART II

|

|||

|

Item 5.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

11

|

|

|

Item 6.

|

Selected Financial Data

|

13

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

14

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

21

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

21

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

22

|

|

|

Item 9A.

|

Controls and Procedures

|

22

|

|

|

Item 9B.

|

Other Information

|

24

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

24

|

|

|

Item 11.

|

Executive Compensation

|

24

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

24

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

24

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

24

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

25

|

|

|

Item 16.

|

Form 10-K Summary

|

27

|

|

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking

statements often address our expected future business and financial performance and financial condition. These statements are within the meaning of Section 27A of the Securities Act of 1933 and Section 21F of the Securities Exchange Act of 1934.

Forward-looking statements include, but are not limited to:

|

·

|

projections of sales or comparable store sales, gross profit, SG&A expenses, capital expenditures or other financial measures;

|

|

·

|

descriptions of anticipated plans or objectives of our management for operations or products;

|

|

·

|

forecasts of performance; and

|

|

·

|

assumptions regarding any of the foregoing.

|

Because these statements involve anticipated events or conditions, forward-looking statements often include words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” or similar expressions.

These forward-looking statements are based upon assessments and assumptions of management in light of historical results and trends, current

conditions and potential future developments that often involve judgment, estimates, assumptions and projections. Forward-looking statements reflect current views about our plans, strategies and prospects, which are based on information currently

available.

Although we believe that our plans, intentions and expectations as reflected in or suggested by any forward-looking statements are reasonable,

they are not guarantees. Actual results may differ materially from our anticipated results described or implied in our forward-looking statements, and such differences may be due to a variety of factors. Our business could also be affected by

additional factors that are presently unknown to us or that we currently believe to be immaterial to our business.

Discussed elsewhere in further detail in this report are some important risks, uncertainties and

contingencies which could cause our actual results, performance or achievements to be materially different from any forward-looking statements

made or implied in this report.

Forward-looking statements are only as of the date they are made and they might not be updated to reflect changes as they occur after the

forward-looking statements are made. We assume no obligations to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. In evaluating forward-looking statements, you should consider these

risks and uncertainties, together with the other risks described from time to time in our other reports and documents filed with the Securities and Exchange Commission, or SEC, and you should not place undue reliance on those statements.

We intend for any forward-looking statements to be covered by, and we claim the protection under, the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995.

1

ITEM 1. BUSINESS

Unless otherwise indicated by the context, we use the terms “Havertys," "we," "our," or "us" when referring to the consolidated operations of

Haverty Furniture Companies, Inc.

Overview

Havertys is a specialty retailer of residential furniture and accessories. Our founder, J.J. Haverty began the business in 1885 in Atlanta,

Georgia with one store and made deliveries using horse-drawn wagons. The Company grew to 18 stores and was incorporated in September 1929. Anticipating further growth, the Company accessed additional capital through its initial public offering in

October 1929.

Havertys has grown to 120 stores in 16 states in the Southern and Midwest regions. All of our retail locations are operated using the Havertys

name and we do not franchise our stores. Our customers are generally college educated women in middle to upper-middle income households. Our brand recognition is very high in the markets we serve, and consumer surveys indicate Havertys is

associated with a high level of quality, fashion, value and service.

Merchandise and Revenues

We develop our merchandise selection with the tastes of the diverse “on trend” consumer in mind. A wide range of styles from traditional to

contemporary are in our core assortment and most of the furniture merchandise we carry bears the Havertys brand. We also tailor our product offerings to the needs and tastes of the local markets we serve emphasizing more “coastal,” “western” or

“urban” looks as appropriate. Our custom upholstery programs and eclectic looks are an important part of our product mix and allow the on-trend consumer more self-expression.

We have avoided offering lower quality, promotional price-driven merchandise favored by many regional and national chains, which we believe

would devalue the Havertys brand with the consumer. We carry nationally well-known mattress product lines such as Sealy®, Tempur-Pedic®, Serta®, Stearns & Foster®, and Beautyrest Black® in addition to our private label SkyeTM.

Our customers use varying methods to purchase or finance their sales. As an added convenience to our customers, we offer financing by

third-party finance companies or through an internal revolving charge credit plan. Sales financed by the third-party providers are not Havertys’ receivables; accordingly, we do not have any credit risk or servicing responsibility for these

accounts, and there is no credit or collection recourse to Havertys. The most popular programs offered through the third-party providers for 2018 were no interest offers requiring monthly payments over periods of 18 to 36 months. The fees we pay to

the third-party are included in SG&A as a selling expense. We also maintain a small in-house financing program for our customers with the offer most frequently chosen carrying no interest for 12 months and requiring equal monthly payments. This

program generates very minor credit revenue and is for credit worthy customers who prefer financing with the retailer directly or who are not able to quickly establish sufficient credit with other providers on comparable terms.

The following summarizes the different purchasing methods used as a percent of amount due from customers including sales tax:

|

|

Year Ended December 31,

|

|||||||||||

|

2018

|

2017

|

2016

|

||||||||||

|

Cash or check

|

8.1

|

%

|

8.8

|

%

|

8.5

|

%

|

||||||

|

Credit or debit cards

|

59.8

|

59.8

|

58.0

|

|||||||||

|

Third-party financed

|

31.6

|

30.8

|

32.5

|

|||||||||

|

Havertys financed

|

0.5

|

0.6

|

1.0

|

|||||||||

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

|||||||

2

Stores

As of December 31, 2018, we operated 120 stores serving 83 cities in 16 states with approximately 4.4 million retail square feet. Our stores

range in size from 19,000 to 66,000 selling square feet with the average being approximately 35,000 square feet. We strive to have our stores reflect the distinctive style and comfort consumers expect to find when purchasing their home furnishings.

The store’s curb appeal is important to the type of middle to upper-middle income consumer that we target and our use of classical facades and attractive landscaping complements the quality and style of our merchandise. Interior details are also

important for a pleasant and inviting shopping experience. We are very intentional in having open shopping spaces and our disciplined merchandise display ensures uniformity of presentations in-store, online and in our advertising.

We currently have no plans to expand outside our distribution footprint and there are a limited number of markets that we do not currently serve

that are expansion candidates. We are evaluating certain existing stores for relocation. We expect a slight increase of approximately 2.0% in our retail square footage in 2019.

Internet

We consider our website an extension of our brick-and-mortar locations and not a separate segment of our business. Most customers will use the

internet for inspiration and as a start to their shopping process to view products and prices. Our website features a variety of helpful tools including a design center with 3D room planners, upholstery customization, and inspired accessories to

create shareable “Idea Boards.” A large number of product reviews written by our customers is also provided which some consumers find important in the decision-making process.

The next stop in the purchase journey for most consumers is a visit to a store to touch, sit, and see merchandise in person. Our sales

consultants also use havertys.com as a tool to further engage our customers while they are in the store. They may make their purchase in the store or opt to return home and finalize their decisions, place their orders online and set delivery. We

limit online sales of our furniture to within our delivery network, and accessories to the continental United States. Our online sales for 2018 were approximately 2% of our total sales and the level of online sales increased 10.9%.

We believe that a direct-to-customer business complements our retail store operations by building brand awareness.

Suppliers

We buy our merchandise from numerous foreign and domestic manufacturers and importers, the largest ten of which accounted for approximately 51%

of our product purchases during 2018. Most of our wood products, or “case goods,” are imported from Asia. Upholstered items are largely produced domestically, with the exception of our leather products which are primarily imported from Asia or

Mexico.

We purchase our furniture merchandise produced in Asia through sourcing companies and also buy direct from manufacturers. Our direct import team

works with industry designers and manufacturers in some of the best factories throughout Asia. We have dedicated quality control specialists on-site during production to ensure the items meet our specifications. Approximately 30% of our case goods

sales in 2018 were generated by our direct imports.

Supply Chain and Distribution

The longer lead times required for deliveries from overseas factories and the production of merchandise exclusively for Havertys makes it

imperative for us to have both warehousing capabilities and end-to-end supply chain visibility. Our merchandising team provides input to the automated procurement process in an effort to maintain overall inventory levels within an appropriate range

and reduce the amount of written sales awaiting product delivery. We use real-time information to closely follow our import orders from the manufacturing plant through each stage of transit and using this data can more accurately set customer

delivery dates prior to receipt of product.

3

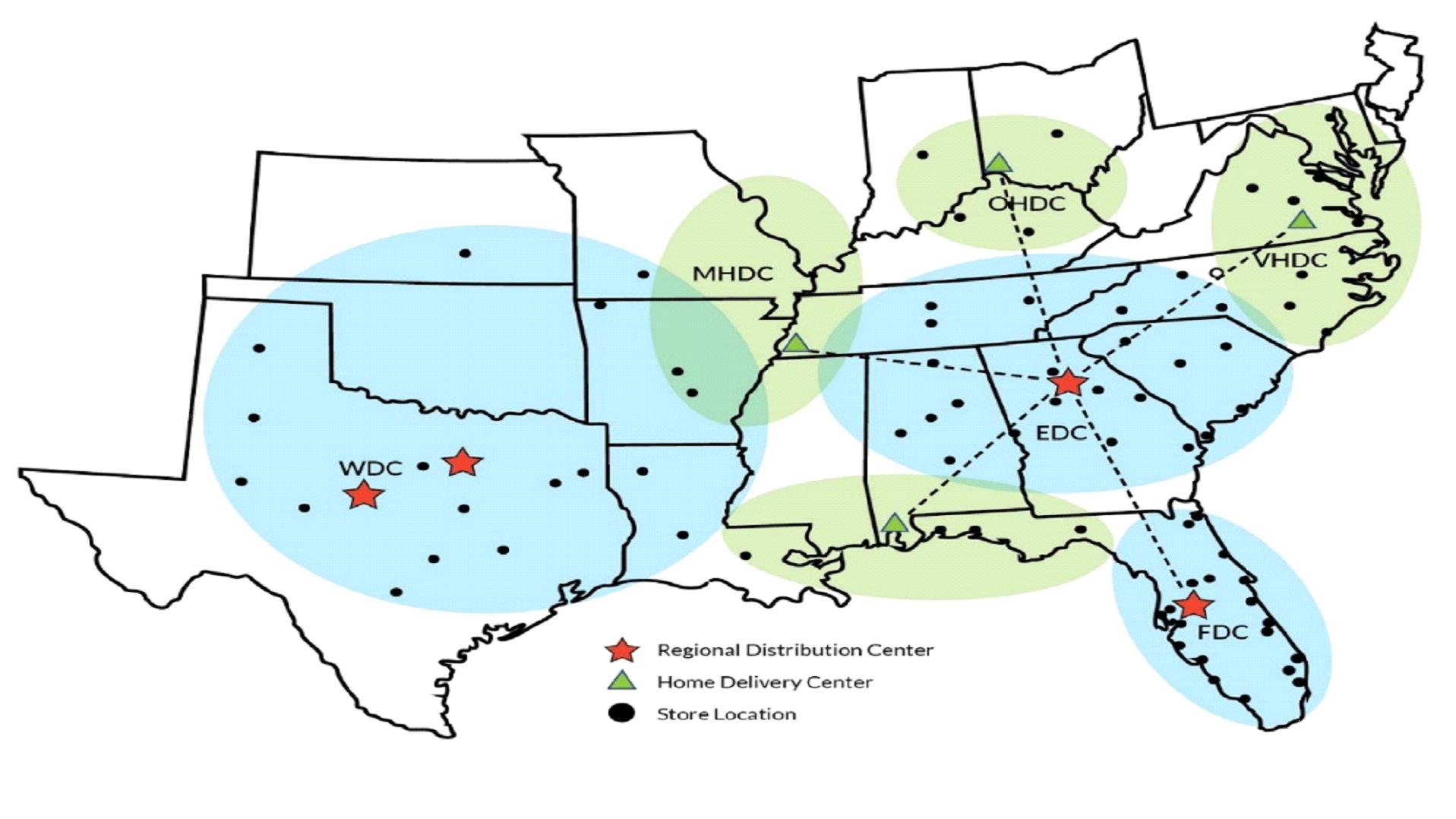

Our distribution system uses a combination of three distribution centers (DCs) and four home delivery centers (HDCs). The DCs receive both

domestic product and containers of imported merchandise. A warehousing management system using radio frequency scanners tracks each piece of inventory in real time and allows for random storage in the warehouse and efficient scheduling and changing

of the workflow. The DCs are also designed to shuttle prepped merchandise up to 250 miles for next day home deliveries and serve HDCs within a 500-mile radius. The HDCs provide service to markets within an additional 200 miles. We use a third-party

to handle over-the-road delivery of product from the DCs to the HDCs and market areas. We use Havertys employees for executing home delivery, and branded this service “Top Drawer Delivery,” an important function serving as the last contact with our

customers in the purchase process. Operating standards in our warehouse and delivery functions provide measurements for determining staffing needs and increasing productivity. We believe that our distribution and delivery system is one of the best

in the retail furniture industry and provides us with a significant competitive advantage.

Competition

The retail sale of home furnishings is a highly fragmented and competitive business. The degree and sources of competition vary by geographic

area. We compete with numerous individual retail furniture stores as well as chains. Retail stores opened by furniture manufacturers in an effort to control and protect the distribution prospects of their branded merchandise compete with us in

certain markets. Mass merchants, certain department stores, and some electronics and appliance retailers also have limited furniture product offerings. There has been growth in the e‑commerce channel both from internet only retailers and those

with a brick-and-mortar presence.

We believe Havertys is uniquely positioned in the marketplace, with a targeted mix of merchandise that appeals to customers who are somewhat

more affluent than those of promotional price-oriented furniture stores. Our online presence provides most elements of a seamless omni-channel approach that many of our competitors do not have or cannot replicate. We consider the expansion of our

custom order capabilities, free in-home design service, the tailoring of merchandise on a local market basis, and the ability to make prompt delivery of orders through maintenance of inventory, significant competitive advantages.

Employees

Our employees are among our best investments and are critical for our success. As of December 31, 2018, we had 3,418 employees: 2,102 in

individual retail store operations, 196 in our corporate and credit operations, 70 in our customer-service call centers, and 1,050 in our warehouse and delivery points. None of our employees is a party to any union contract.

4

Seasonality

Our business is affected by traditional retail seasonality, advertising and promotion programs, and general economic trends. We typically

achieve our smallest quarter by revenues in the second quarter and the largest in the fourth quarter. In 2018, our fourth quarter sales did not match historical patterns as business surrounding the traditional holiday shopping periods around

Thanksgiving and Christmas was significantly lower than in the prior years.

Trademarks and Domain Names

We have registered our various logos, trademarks and service marks. We believe that our trademark position is adequately protected in all

markets in which we do business. In addition, we have registered and maintain numerous internet domain names including “havertys.com.” Collectively, the logos, trademarks, service marks and domain names that we hold are of material importance to

us.

Available Information

Filings with the SEC

As a public company, we regularly file proxy statements, reports and amendments thereto with the Securities and Exchange Commission (“SEC”).

These documents are available on our website as soon as reasonably practicable after they are filed with, or furnished to, the SEC. Our website is www.havertys.com and

contains, among other things, our annual report on Form 10-K, annual meeting proxy statement, quarterly reports on Form 10-Q and current reports on Form 8-K, which may be accessed free of charge. These reports are accessible by clicking on the

“Investors” tab on our home page and then click on “SEC filings.” This annual report on Form 10-K and other SEC filings made by Havertys are also accessible through the SEC’s website at www.sec.gov.

The information on our website listed above is not and should not be considered part of this annual report on Form 10-K and is not incorporated

by reference in this document.

ITEM 1A. RISK FACTORS

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding any statement

in this annual report on Form 10-K or elsewhere. The following information should be read in conjunction with Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A), and the consolidated

financial statements and related notes in Part II, Item 8. “Financial Statements and Supplementary Data” of this annual report on Form 10-K.

We routinely encounter and address risks, some of which may cause our future results to be different – sometimes materially different – than we

presently anticipate. The following factors, as well as others described elsewhere in this report or in our other filings with the SEC, that could materially affect our business, financial condition or operating results should be carefully

considered. Below, we describe certain important operational and strategic risks and uncertainties, but they are not the only risks we face. Our reactions to material future developments, as well as our competitors’ reactions to those developments,

may also impact our business operations or financial results. If any of the following risks actually occur, our business, financial condition or operating results may be adversely affected.

Changes in economic conditions could adversely

affect demand for our products.

A large portion of our sales represent discretionary spending by our customers. Demand for our products is generally affected by a number of

economic factors including, but not limited to: interest rates, housing starts, sales of new and existing homes, housing values, the level of mortgage refinancing, consumer confidence, debt levels and retail trends. Declining stock market values,

rising food and energy costs, and higher personal taxes adversely affect demand. A decline in economic activity and conditions in the markets in which we operate would adversely affect our financial condition and results of operations.

5

We face significant competition from national, regional and local retailers of home furnishings.

The retail market for home furnishings is highly fragmented and intensely competitive. We currently compete against a diverse group of

retailers, including regional or independent specialty stores, dedicated franchises of furniture manufacturers and national department stores. National mass merchants and electronics and appliance retailers also have limited product offerings. We

also compete with retailers that market products through store catalogs and the internet. In addition, there are few barriers to entry into our current and contemplated markets, and new competitors may enter our current or future markets at any

time. Our existing competitors or new entrants into our industry may use a number of different strategies to compete against us, including aggressive advertising, pricing and marketing, and extension of credit to customers on terms more favorable

than we offer.

Competition from any of these sources could cause us to lose market share, revenues and customers, increase expenditures or reduce prices, any

of which could have a material adverse effect on our results of operations.

If we fail to anticipate changes in consumer preferences, our sales may decline.

Our products must appeal to our target consumers whose preferences cannot be predicted with certainty and are subject to change. Our success

depends upon our ability to anticipate and respond in a timely manner to fashion trends relating to home furnishings. If we fail to identify and respond to these changes, our sales of these products may decline.

We import a substantial portion of our merchandise from foreign sources. This exposes us to certain risks that include

political and economic conditions. Recently, political discourse in the United States has increasingly focused on ways to discourage U.S. corporations from outsourcing manufacturing and production activities to foreign jurisdictions and curb what

are considered to be unfair trade practices. To address these concerns, tariffs were imposed on goods manufactured in China in an attempt to discourage these practices. The tariffs began in September 2018 at 10% of product costs and were scheduled

to increase to 25% on March 4, 2019. The increase to 25% has been postponed as part of ongoing discussions between the governments of the United States and China. If ultimately enacted, a 25% tariff could negatively impact our ability to source

products from foreign jurisdictions and could adversely affect our results of operations or profitability.

Based on product costs, approximately 70% of our total furniture purchases (which exclude mattresses) in 2018 were for goods not produced

domestically and approximately 35% were produced in China. All our purchases are denominated in U.S. dollars. As exchange rates between the U.S. dollar and certain other currencies become unfavorable, the likelihood of price increases from our

vendors increases. Some of the products we purchase are also subject to tariffs. If tariffs are imposed on additional products or the tariff rates are increased our vendors may increase their prices. Such changes, if they occur, could have one or

more of the following impacts:

|

·

|

we could be forced to raise retail prices so high that we are unable to sell the products at current unit volumes;

|

|

·

|

if we are unable to raise retail prices commensurately with the cost increases, gross profit as recognized under our LIFO inventory

accounting method could be negatively impacted; or

|

|

·

|

we may be forced to find alternative sources of comparable product, which may be more expensive than the current product, of lower

quality, or the vendor may be unable to meet our requirements for quality, quantities, delivery schedules or other key terms.

|

Significant fluctuations and volatility in the

cost of raw materials and components could adversely affect our profits.

The primary materials our vendors use to produce and manufacture our products are various woods and wood products, resin, steel, leather,

cotton, and certain oil-based products. On a global and regional basis, the sources and prices of those materials and components are susceptible to significant price fluctuations due to supply/demand trends, transportation costs, government

regulations and tariffs, changes in currency exchange rates, price controls, the economic and political climate, and other unforeseen circumstances. Significant increases in these and other costs in the future could materially affect our vendors’

costs and our profits as discussed above.

6

We are dependent upon the ability of our third-party producers, many of whom are located in foreign countries, to meet our

requirements; any failures by these producers to meet our requirements, or the unavailability of suitable producers at reasonable prices or limitations on our ability to source from certain third-party producers may negatively impact our ability to

deliver quality products to our customers on a timely basis or result in higher costs or reduced net sales.

We source substantially all of our products from non-exclusive, third-party producers, many of which are located in foreign countries. Although

we have long-term relationships with many of our suppliers, we must compete with other companies for the production capacity of these independent manufacturers. We regularly depend upon the ability of third-party producers to secure a sufficient

supply of raw materials, a skilled workforce, adequately finance the production of goods ordered and maintain sufficient manufacturing and shipping capacity. Although we monitor production and quality in many third-party manufacturing locations, we

cannot be certain that we will not experience operational difficulties with our manufacturers, such as the reduction of availability of production capacity, errors in complying with product specifications, insufficient quality control, failures to

meet production deadlines or increases in manufacturing costs. Such difficulties may negatively impact our ability to deliver quality products to our customers on a timely basis, which may, in turn, have a negative impact on our customer

relationships and result in lower net sales.

We also require third-party producers to meet certain standards in terms of working conditions, environmental protection and other matters

before placing business with them. As a result of costs relating to compliance with these standards, we may pay higher prices than some of our competitors for products. In addition, failure by our independent manufacturers to adhere to labor or

other laws or business practices accepted as ethical, and the potential litigation, negative publicity and political pressure relating to any of these events, could disrupt our operations or harm our reputation.

Our vendors might fail in meeting our quality control standards or reacting to changes to the legislative or regulatory

framework regarding product safety.

All of our vendors must comply with applicable product safety laws and regulations, and we are dependent on them to ensure that the products we

buy comply with all safety standards. Any actual, potential or perceived product safety concerns could expose us to government enforcement action or private litigation and result in recalls and other liabilities. These could harm our brand's image

and negatively affect our business and operating results.

Our revenue could be adversely affected by risks in our supply chain.

Optimal product flow is dependent on demand planning and forecasting, production to plan by suppliers, and timely transportation. We often make

commitments to purchase products from our vendors in advance of proposed production dates. Significant deviation from the projected demand for products that we sell may have an adverse effect on our results of operations and financial condition,

either from lost sales or lower margins due to the need to reduce prices to dispose of excess inventory. Disruptions to our supply chain could result in late arrivals of product. This could negatively affect sales due to increased levels of

out-of-stock merchandise and loss of confidence by customers in our ability to deliver goods as promised.

In addition, there is a risk that compliance lapses by our foreign manufacturers could occur which could lead to investigations by U.S.

government agencies responsible for international trade compliance. Resulting penalties or enforcement actions could delay future imports or otherwise negatively impact our business. There also remains a risk that one or more of our foreign

manufacturers will not adhere to applicable legal requirements or our compliance standards such as fair labor standards, the prohibition on child labor and other product safety or manufacturing safety standards. The violation of applicable legal

requirements, including labor, manufacturing and safety laws, by any of our manufacturers, the failure of any of our manufacturers to adhere to our global compliance standards or the divergence of the labor practices followed by any of our

manufacturers from those generally accepted in the U.S., could disrupt our supply of products from our manufacturers, result in potential liability to us and harm our reputation and brand, any of which could negatively affect our business and

operating results.

7

The rise of oil and gasoline prices could affect our profitability.

A significant increase in oil and gasoline prices could adversely affect our profitability. We deliver substantially all of our customers’

purchases to their homes. Our distribution system, which utilizes three DCs and multiple home delivery centers is very transportation dependent to reach the 21 states we deliver to from our stores across 16 Southern and Midwestern states.

If transportation costs exceed amounts we are able to effectively pass on to the consumer, either by higher prices and/or higher delivery

charges, then our profitability will suffer.

Because of our limited number of distribution centers, should one become damaged, our operating results could suffer.

We utilize three large distribution centers to flow our merchandise from the vendor to the consumer. This system is very efficient for reducing

inventory requirements but makes us operationally vulnerable should one of these facilities become damaged.

Our information technology infrastructure is vulnerable to damage that could harm our business.

Our ability to operate our business from day to day, in particular our ability to manage our point-of-sale, distribution system and credit

operations, largely depends on the efficient operation of our computer hardware and software systems. We use management information systems to communicate customer information, provide real-time inventory information, manage our credit portfolio

and to handle all facets of our distribution system from receipt of goods in the DCs to delivery to our customers’ homes.

The failure of these systems to operate effectively, problems with integrating various data sources, challenges in transitioning to upgraded or

replacement systems, difficulty in integrating new systems, or a breach in security of these systems could adversely impact the operations of our business.

Cyber threats are rapidly evolving and those threats and the means for obtaining access to information in digital and other storage media are

becoming increasingly sophisticated. Cyber threats and cyber-attackers can be sponsored by countries or sophisticated criminal organizations or be the work of single "hackers" or small groups of "hackers."

We invest in industry standard security technology to protect the Company’s data and business processes against risk of data security breach and

cyber-attack. Our data security management program includes identity, trust, vulnerability and threat management business processes as well as adoption of standard data protection policies. We measure our data security effectiveness through

industry accepted methods. We are continuously installing new and upgrading existing information technology systems. We use employee awareness training around phishing, malware, and other cyber risks to ensure that the Company is protected, to the

greatest extent possible, against cyber risks and security breaches. We are regularly the target of attempted cyber and other security threats and must continuously monitor and develop our information technology networks and infrastructure to

prevent, detect, address and mitigate the risk of unauthorized access, misuse, computer viruses and other events that could have a security impact. Insider or employee cyber and security threats are increasingly a concern for all companies,

including ours. Additionally, we certify our major technology suppliers and any outsourced services through accepted security certification standards.

8

Nevertheless, as cyber threats evolve, change and become more difficult to detect and successfully defend against, one or more cyber-attacks

might defeat our or a third-party service provider's security measures in the future and obtain the personal information of customers or employees. Employee error or other irregularities may also result in a failure of security measures and a

breach of information systems. Moreover, hardware, software or applications we use may have inherent defects of design, manufacture or operations or could be inadvertently or intentionally implemented or used in a manner that could compromise

information security. A security breach and loss of information may not be discovered for a significant period of time after it occurs. While we have no knowledge of a material security breach to date, any compromise of data security could result

in a violation of applicable privacy and other laws or standards, the loss of valuable business data, or a disruption of our business. A security breach involving the misappropriation, loss or other unauthorized disclosure of sensitive or

confidential information could give rise to unwanted media attention, materially damage our customer relationships and reputation, and result in fines, fees, or liabilities, which may not be covered by our insurance policies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. ROPERTIES

Stores

Our retail store space at December 31, 2018 totaled approximately 4.4 million square feet for 120 stores. The following table sets forth the

number of stores we operated at December 31, 2018 by state:

|

State

|

Number of Stores

|

State

|

Number of Stores

|

|

|

Florida

|

29

|

Maryland

|

4

|

|

|

Texas

|

22

|

Arkansas

|

3

|

|

|

Georgia

|

18

|

Louisiana

|

3

|

|

|

North Carolina

|

8

|

Kentucky

|

2

|

|

|

Virginia

|

8

|

Ohio

|

2

|

|

|

South Carolina

|

6

|

Indiana

|

1

|

|

|

Alabama

|

6

|

Kansas

|

1

|

|

|

Tennessee

|

6

|

Missouri

|

1

|

The 40 retail locations which we owned at December 31, 2018 had a net book value for land and buildings of $80.5 million. Additionally, we had

19 leased locations open whose properties have a net book value of $50.9 million which, due to financial accounting rules, are included on our balance sheets. The remaining 61 locations are leased by us with various termination dates through 2032

plus renewal options.

Distribution Facilities

We lease or own regional distribution facilities in the following locations:

|

Location

|

Owned or Leased

|

Approximate Square Footage

|

|

Braselton, Georgia

|

Leased

|

808,000

|

|

Coppell, Texas

|

Owned

|

394,000

|

|

Lakeland, Florida

|

Owned

|

335,000

|

|

Colonial Heights, Virginia

|

Owned

|

129,000

|

|

Fairfield, Ohio

|

Leased

|

50,000

|

|

Theodore, Alabama

|

Leased

|

42,000

|

|

Memphis, Tennessee

|

Leased

|

30,000

|

Corporate Facilities

We lease approximately 48,000 square feet on two floors of a suburban mid-rise office building located at 780 Johnson Ferry

Road, Suite 800, Atlanta, Georgia.

For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this report

under Item 7 of Part II.

ITEM 3. LEGAL PROCEEDINGS

There are no material pending legal proceedings to which we are a party or of which any of our properties is the subject.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

9

EXECUTIVE OFFICERS OF THE REGISTRANT

The following are the names, ages and current positions of our executive officers and, if they have not held those positions for the past five

years, their former positions during that period with Havertys or other companies.

|

Name, age and office (at December 31, 2018) and year elected to office

|

Principal occupation during last five years other than office of the Company currently held

|

||||

|

Clarence H. Smith

|

68

|

Chairman of the Board

President and Chief Executive

Officer

Director

|

2012

2002

1989

|

President and Chief Executive Officer

|

|

|

Steven G. Burdette

|

57

|

Executive Vice President,

Operations

|

2017

|

Executive Vice President, Stores, 2008-2017

|

|

|

J. Edward Clary

|

58

|

Executive Vice President,

and Chief Information Officer

|

2015

|

Senior Vice President, Distribution and Chief Information Officer

2008-2015

|

|

|

Kathleen M. Daly

|

56

|

Senior Vice President, Marketing

|

2014

|

Head of Industry, Retail/Vertical with Google, 2007-2014

|

|

|

Allan J. DeNiro

|

65

|

Senior Vice President, Chief

People Officer

|

2010

|

Has held this position for the last five years

|

|

|

John L. Gill

|

55

|

Senior Vice President, Merchandising

|

2018

|

Vice President, Merchandising 2017-2018; Eastern Regional Manager 2016-2018; Vice President, Operations 2015-2017;

Western Regional Manager 2005-2015

|

|

|

Richard B. Hare

|

52

|

Executive Vice President and Chief Financial Officer

|

2017

|

Senior Vice President,

Finance, Treasurer and Chief Financial Officer of Carmike Cinemas, Inc., 2006-2016

|

|

|

Rawson Haverty, Jr.

|

62

|

Senior Vice President, Real

Estate and Development

Director

|

1988

1992

|

Has held this position for the last five years

|

|

|

Jenny Hill Parker

|

60

|

Senior Vice President, Finance,

Secretary and Treasurer

|

2010

|

Has held this position for the last five years

|

|

|

Janet E. Taylor

|

57

|

Senior Vice President,

General Counsel

|

2010

|

Has held this position for the last five years

|

|

Rawson Haverty, Jr. and Clarence H. Smith are first cousins.

Our executive officers are elected or appointed annually by the Board of Directors for terms of one year or until their successors are elected

and qualified, subject to removal by the Board at any time.

10

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON

EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our two classes of common stock trade on The New York Stock Exchange (“NYSE”). The trading symbol for the common stock is HVT and for Class A

common stock is HVT.A.

Stockholders

Based on the number of individual participants represented by security position listings, there are approximately 3,940 holders of our common

stock and 160 holders of our Class A common stock as of February 26, 2019.

Dividends

We have historically paid and expect to continue to pay for the foreseeable future, quarterly cash dividends on our Common Stock and Class A

Common Stock. The payment of dividends and the amount are determined by the Board of Directors and depend upon, among other factors, our earnings, operations, financial condition, capital requirements and general business outlook at the time such

dividend is considered. We have paid a cash dividend in each year since 1935. Our credit agreement includes covenants that may restrict our ability to pay dividends. For more information, see Note 5, “Credit Arrangements,” and Note 9, “Stockholders

Equity,” in the Notes to Consolidated Financial Statements.

Equity Compensation Plans

For information regarding securities authorized for issuance under our equity compensation plans, see Part III, Item 12, “Security Ownership of

Certain Beneficial Owners and Management and Related Stockholder Matters.”

Stock Repurchase Program

The board of directors has authorized management, at its discretion, to purchase and retire limited amounts

of our common stock and Class A common stock. A program was initially approved by the board on November 3, 1986 with subsequent authorizations made as to the number of shares to be purchased or amount to be purchased in total dollars. On November

16, 2018, the board authorized the Company to purchase up to $15.0 million of its common and Class A common stock after the balance of approximately $1.3 million from a previous authorization is utilized. In addition to using cash flow for

profitable growth and the payment of dividends, opportunistic repurchases during periods of favorable market conditions is another way to enhance stockholder value.

The following table presents information with respect to our repurchase of Havertys’ common stock during

the fourth quarter of 2018.

|

(a)

Total Number of Shares Purchased

|

(b)

Average Price Paid Per Share

|

(c)

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

(d)

Approximate Dollar Value of Shares That

May Yet be Purchased Under the Plans or Programs

|

|||||||||||||

|

October 1 – October 31

|

—

|

—

|

—

|

$

|

5,555,961

|

|||||||||||

|

November 1 – November 30

|

202,663

|

$

|

21.10

|

202,663

|

$

|

16,279,813

|

||||||||||

|

December 1 – December 31

|

—

|

—

|

—

|

$

|

16,279,813

|

|||||||||||

11

Stock Performance Graph

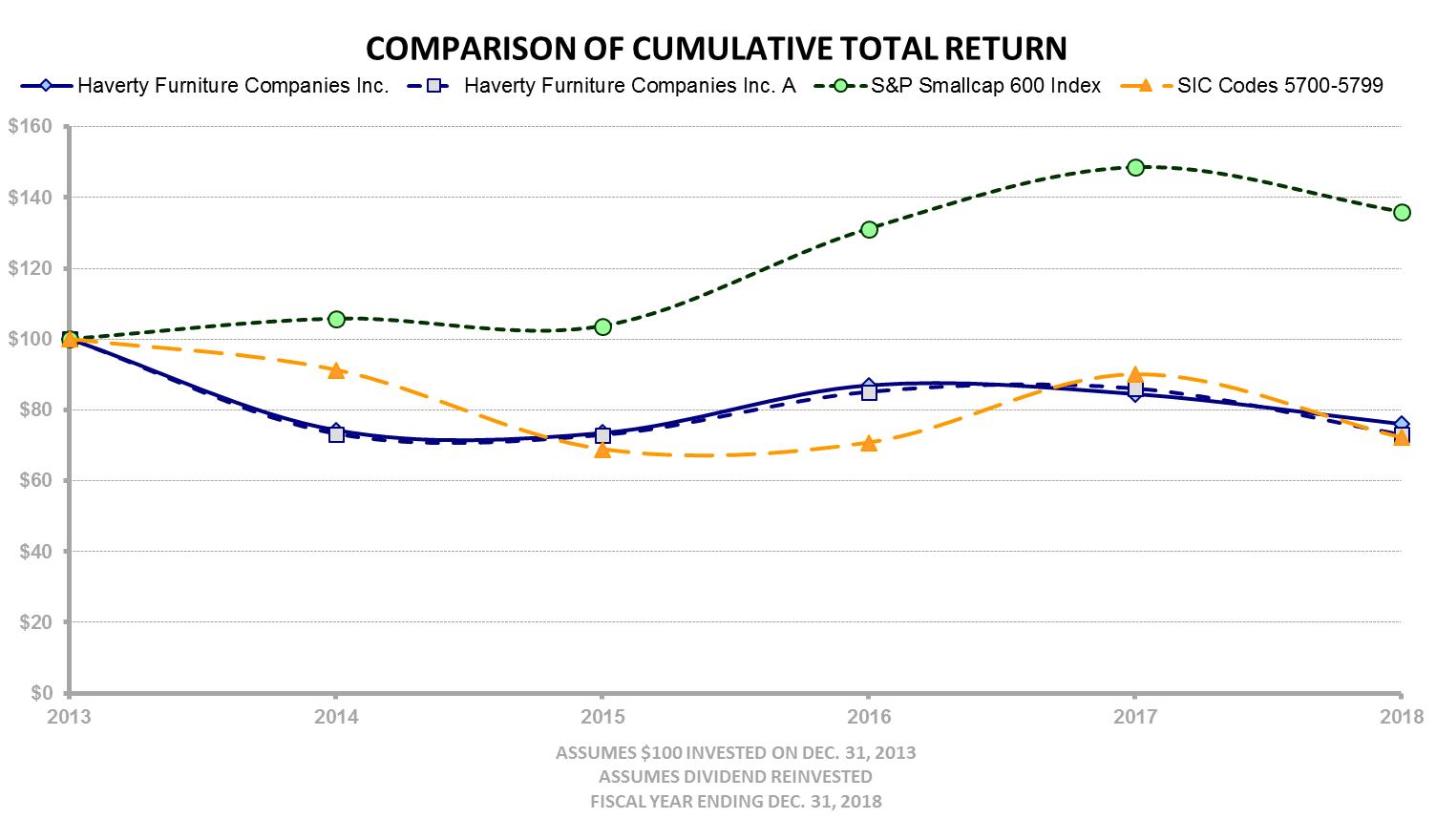

The following graph compares the performance of Havertys’ common stock and Class A common stock against the cumulative return of the

NYSE/AMEX/Nasdaq Home Furnishings & Equipment Stores Index (SIC Codes 5700 – 5799) and the S&P Smallcap 600 Index for the period of five years commencing December 31, 2013 and ended December 31, 2018. The graph assumes an initial

investment of $100 on January 1, 2013 and reinvestment of dividends.

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

|||||||||||||||||||

|

HVT

|

$

|

100.00

|

$

|

74.29

|

$

|

73.52

|

$

|

86.94

|

$

|

84.49

|

$

|

76.04

|

||||||||||||

|

HVT-A

|

$

|

100.00

|

$

|

73.21

|

$

|

72.89

|

$

|

85.07

|

$

|

86.01

|

$

|

72.98

|

||||||||||||

|

S&P Smallcap 600 Index

|

$

|

100.00

|

$

|

105.76

|

$

|

103.67

|

$

|

131.20

|

$

|

148.56

|

$

|

135.96

|

||||||||||||

|

SIC Codes 5700-5799

|

$

|

100.00

|

$

|

91.28

|

$

|

68.88

|

$

|

70.74

|

$

|

90.04

|

$

|

72.17

|

||||||||||||

12

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data and non-GAAP financial measures should be read in conjunction with “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” included in Item 7 below and the “Consolidated Financial Statements and the Notes to Consolidated Financial Statements” included in Item 8 below.

|

Year ended December 31,

|

||||||||||||||||||||

|

(Dollars in thousands, except per share data)

|

2018

|

2017

|

2016

|

2015

|

2014

|

|||||||||||||||

|

Results of Operations

|

||||||||||||||||||||

|

Net sales

|

$

|

817,733

|

$

|

819,866

|

$

|

821,571

|

$

|

804,870

|

$

|

768,409

|

||||||||||

|

Net sales change over prior year

|

(0.3

|

)%

|

(0.2

|

)%

|

2.1

|

%

|

4.7

|

%

|

3.0

|

% |

||||||||||

|

Comp-store sales change over prior year

|

0.3

|

%

|

(1.3

|

)%

|

2.1

|

%

|

2.5

|

%

|

3.6

|

% | ||||||||||

|

Gross profit

|

446,542

|

444,923

|

443,337

|

430,776

|

412,366

|

|||||||||||||||

|

Percent of net sales

|

54.6

|

%

|

54.3

|

%

|

54.0

|

%

|

53.5

|

%

|

53.7

|

% | ||||||||||

|

Selling, general and administrative expenses

|

404,856

|

402,884

|

399,236

|

384,801

|

364,654

|

|||||||||||||||

|

Percent of net sales

|

49.5

|

%

|

49.1

|

%

|

48.6

|

%

|

47.8

|

%

|

47.5

|

% | ||||||||||

|

Income before income taxes(1)

|

40,408

|

43,223

|

45,821

|

45,275

|

25,257

|

|||||||||||||||

|

Net income (1)

|

30,307

|

21,075

|

28,356

|

27,789

|

8,589

|

|||||||||||||||

|

Share Data

|

||||||||||||||||||||

|

Diluted earnings per share

|

||||||||||||||||||||

|

Common Stock

|

$

|

1.42

|

$

|

0.98

|

$

|

1.30

|

$

|

1.22

|

$

|

0.37

|

(1) | |||||||||

|

Class A Common Stock

|

1.39

|

0.94

|

1.27

|

1.17

|

0.33

|

|||||||||||||||

|

Cash dividends – amount per share:

|

||||||||||||||||||||

|

Common Stock(2)

|

$

|

1.720

|

$

|

0.540

|

$

|

1.440

|

$

|

0.360

|

$

|

1.320

|

||||||||||

|

Class A Common Stock(2)

|

$

|

1.630

|

$

|

0.510

|

$

|

1.365

|

$

|

0.340

|

$

|

1.250

|

||||||||||

|

Shares outstanding (in thousands):

|

||||||||||||||||||||

|

Common Stock

|

18,780

|

19,452

|

19,287

|

20,124

|

20,568

|

|||||||||||||||

|

Class A Common Stock

|

1,757

|

1,767

|

1,818

|

2,032

|

2,081

|

|||||||||||||||

|

Total shares

|

20,537

|

21,219

|

21,104

|

22,156

|

22,649

|

|||||||||||||||

|

Financial Position

|

||||||||||||||||||||

|

Inventories

|

$

|

105,840

|

$

|

103,437

|

$

|

102,020

|

$

|

108,896

|

$

|

107,139

|

||||||||||

|

Capital expenditures

|

$

|

21,473

|

$

|

24,465

|

$

|

29,838

|

$

|

27,143

|

$

|

30,882

|

||||||||||

|

Depreciation/amortization expense

|

29,806

|

30,516

|

29,045

|

25,756

|

22,613

|

|||||||||||||||

|

Total assets

|

$

|

440,179

|

$

|

461,329

|

$

|

454,505

|

$

|

471,251

|

$

|

460,987

|

||||||||||

|

Total debt(3)

|

50,803

|

54,591

|

55,474

|

53,125

|

49,065

|

|||||||||||||||

|

Stockholders’ equity

|

274,629

|

294,142

|

281,871

|

301,739

|

292,083

|

|||||||||||||||

|

Debt to total capital

|

15.6

|

%

|

15.7

|

%

|

16.4

|

%

|

15.0

|

%

|

14.4

|

% | ||||||||||

|

Net cash provided by operating activities

|

70,392

|

52,457

|

60,054

|

52,232

|

55,454

|

|||||||||||||||

|

Other Supplemental Data:

|

||||||||||||||||||||

|

Employees

|

3,418

|

3,551

|

3,656

|

3,596

|

3,388

|

|||||||||||||||

|

Retail sq. ft. (in thousands) at year end

|

4,417

|

4,517

|

4,494

|

4,380

|

4,283

|

|||||||||||||||

|

Annual retail net sales per weighted average sq. ft.

|

$

|

185

|

$

|

185

|

$

|

188

|

$

|

185

|

$

|

183

|

||||||||||

|

Average sale per written ticket

|

$

|

2,184

|

$

|

2,091

|

$

|

2,048

|

$

|

2,002

|

$

|

1,912

|

||||||||||

Due to rounding amounts may not add to totals.

|

(1)

|

Includes for 2014 the impact of the settlement of the pension plan of a $21.6 million increase in expense and

a tax benefit of $0.9 million, for a total impact of $20.7 million after tax or $0.90 per share.

|

|

(2)

|

Includes special dividends of $1.00 for Common Stock and $0.95 for Class A Common Stock paid in the third quarter of 2014 and

in the fourth quarter of 2016 and 2018.

|

|

(3)

|

Debt is comprised completely of lease obligations.

|

13

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Industry

The retail residential furniture industry's results are influenced by the overall strength of the economy, new and existing housing sales,

consumer confidence, spending on large ticket items, interest rates, and availability of credit. These factors remain tempered by rising consumer debt, home inventory constraints, and tight access to home mortgage credit, all of which provide

impediments to industry growth.

Our Business

We sell home furnishings in our retail stores and via our website and record revenue when the products are delivered to our customer. Our

products are selected to appeal to a middle to upper-middle income consumer across a variety of styles. Our commissioned sales associates receive a high level of product training and are provided a number of tools with which to serve our customers.

We also have over 120 in‑home designers serving most of our stores. These individuals work with our sales associates to provide customers additional confidence and inspiration in their furniture purchase journey. We do not outsource the delivery

function, something common in the industry, but instead ensure that the “last contact” is handled by a customer-oriented Havertys delivery team. We are recognized as a provider of high-quality fashionable products and exceptional service in the

markets we serve.

2018

Sales were slightly lower in 2018 than in 2017, falling 0.3%

or $2.2 million. Our average ticket increased 4.4% but store traffic was down mid-single digits. Gross profit as a percent of net sales increased 30 basis points. SG&A costs increased less than 1% but with less leverage increased 40 basis

points as a percent of sales. Our pre-tax income was $40.4 million, a decrease of 6.5% or $2.8 million. Our fourth quarter results were pre-tax income of $12.3 million,

down from $14.1 million in the prior year period. We made $21.5 million in important capital expenditure investments in our business and returned $54.2 million to shareholders with $15.0 million in dividends, $20.5 million in special cash

dividends, and $18.7 million in purchases of common stock.

Management Objectives

Management is focused on capturing more market share and increasing sales per square foot of showroom space. This organic growth will be driven

by concentrating our efforts on our customers with improved interactions highlighted by new products, services, enhanced stores and better technology. The Company’s strategies for profitability include targeted marketing initiatives, productivity

and process improvements, and efficiency and cost-saving measures. Our focus is to serve our customers better and distinguish ourselves in the marketplace.

Key Performance Indicators

We evaluate our performance based on several key metrics which include net sales, comparable store sales, sales per square foot, gross profit,

operating costs as a percentage of sales, EBITDA, cash flow, total debt to total capital, and earnings per share. The goal of utilizing these measurements is to provide tools in economic decision-making such as store growth, capital allocation and

product pricing. We also employ metrics that are customer focused (customer satisfaction score, on-time-delivery and quality), and internal effectiveness and efficiency metrics (sales per employee, average sale per ticket, closing ratios per

customer store visit, inventory out-of-stock, exceptions per deliveries, and lost time incident rate). These measurements aid us in determining areas of our operations that are in need of additional attention but are not evaluated in isolation

from others, so as not to conflict with our company goals.

Net Sales

Comparable-store or “comp-store” sales is a measure which indicates the performance of our existing stores and website by comparing the growth

in sales in store and online for a particular period over the corresponding period in the prior year. Stores are considered non-comparable if open for less than 12 full calendar months or if the selling square footage has been changed significantly

during the past 12 full calendar months. Large clearance sales events from warehouses or temporary locations are also excluded from comparable store sales, as are periods when stores are closed or being remodeled. As a retailer, comp‑store sales is

an indicator of relative customer spending and store performance.

14

Total sales decreased $2.2 million or 0.3% in 2018 and $1.7 million or 0.2% in 2017. Comparable store sales, which includes online sales,

increased 0.3% or $2.2 million in 2018 and decreased 1.3% or $10.9 million in 2017. The remaining $4.4 million in 2018 and $9.2 million in 2017 of the changes were from closed, new and otherwise non-comparable stores.

The following outlines our sales and comp-store sales increases and decreases for the periods indicated. (Amounts and

percentages may not always add to totals due to rounding.)

|

December 31,

|

|||||||||||||||||||||||||||||||||||||

|

2018

|

2017

|

2016

|

|||||||||||||||||||||||||||||||||||

|

Net Sales

|

Comp-Store Sales

|

Net Sales

|

Comp-Store Sales

|

Net Sales

|

Comp-Store Sales

|

||||||||||||||||||||||||||||||||

|

Period

Ended |

Dollars

in millions |

%

Increase

(decrease) over prior period |

% Increase

(decrease) over prior period |

Dollars

in millions |

% Increase

(decrease) over prior period |

% Increase

(decrease) over prior period |

Dollars

in millions |

% Increase

(decrease) over prior period |

%

Increase

(decrease) over prior period |

||||||||||||||||||||||||||||

|

Q1

|

$

|

199.4

|

(0.5)%

|

(1.1)%

|

$

|

200.4

|

3.0%

|

1.6%

|

$

|

194.5

|

1.7%

|

0.9%

|

|||||||||||||||||||||||||

|

Q2

|

198.8

|

1.0

|

1.3

|

196.8

|

1.1

|

(0.2)

|

194.8

|

3.8

|

3.8

|

||||||||||||||||||||||||||||

|

Q3

|

210.5

|

1.4

|

2.6

|

207.6

|

(1.9)

|

(2.9)

|

211.7

|

0.8

|

1.2

|

||||||||||||||||||||||||||||

|

Q4

|

209.0

|

(2.8)

|

(1.6)

|

215.0

|

(2.6)

|

(3.5)

|

220.6

|

2.2

|

2.5

|

||||||||||||||||||||||||||||

|

Year

|

$

|

817.7

|

(0.3)%

|

0.3%

|

$

|

819.9

|

(0.2)%

|

(1.3)%

|

$

|

821.6

|

2.1%

|

2.1%

|

|||||||||||||||||||||||||

Sales in 2018 declined for the year as business slowed markedly in the last half of the fourth quarter. Our revenues by category remained

relatively consistent with prior years with increases in our accessories sales and delivery revenue. Our average ticket increased 4.4% to $2,184 which helped offset the decline in the number of transactions. Our in-home designers were part of 21.5%

of our sales and their average ticket was $4,466.

Sales in 2017 declined slightly as the level of our store traffic weakened throughout the year. Our average ticket increased 2.1% allowing our

sales results to not moderate at the same pace as traffic. Our in-home designers were part of 20.6% of our sales, with their average ticket twice the overall average.

Sales in 2016 began slowly as first quarter consumer spending remained at its sluggish end of 2015 pace. Throughout 2016 our business became

more concentrated around holidays and we adjusted our advertising cadence accordingly. Our average ticket increased 2.3% and our in-home designers were part of 19.7% of our sales.

2019 Outlook

We believe as the general economic outlook stabilizes, and consumer spending and the housing market strengthens, our business will benefit. We

have an appealing online presence and upgraded stores, and we offer on-trend merchandise, knowledgeable salespeople, and expanded special order capabilities which will be important drivers for our 2019 sales results. We expect our retail square

footage to increase 2.0% in the second half of 2019.

Gross Profit

Our cost of goods sold consists primarily of the purchase price of the merchandise together with inbound freight, handling within our

distribution centers and transportation costs to the local markets we serve. Our gross profit is primarily dependent upon vendor pricing, the mix of products sold and promotional pricing activity. Substantially all of our occupancy and home

delivery costs are included in selling, general and administrative expenses as is a portion of our warehousing expenses. Accordingly, our gross profit may not be comparable to those entities that include some of these expenses in cost of goods

sold.

Year-to-Year Comparisons

Gross profit as a percentage of net sales was 54.6% in 2018 compared to 54.3% in 2017. This improvement was predominately driven by our

execution on product mix and pricing. Our Havertys branded merchandise provides a strong value and fashion statement to consumers. The increasing sales generated by our in‑home designers have boosted higher margin mix opportunities through custom

upholstery and accessories sales. The imposition of tariffs of 10% on products imported in China began in late September. We raised the selling prices on some impacted products and worked with our suppliers to minimize cost increases.

15

Gross profit as a percentage of net sales was 54.3% in 2017 compared to 54.0% in 2016. The use of the LIFO method generated a $2.7 million or 33

basis points positive impact in 2017 over 2016.

2019 Outlook

Our expectations for 2019 are for annual gross profit margins of approximately 54.6%. This assumes no additional increases in tariffs for goods

imported from China. We are shifting some product to other countries and have factored this into our 2019 gross profit margin expectations. The impact of a further increase in tariffs is difficult to quantify given the variables of product cost,

replacement merchandise, and changing retail prices. We do not plan to increase the level of our promotional pricing.

Selling, General and Administrative Expenses

SG&A expenses are comprised of five categories: selling, occupancy, delivery and certain warehousing costs, advertising, and administrative.

Selling expenses primarily are comprised of compensation of sales associates and sales support staff, and fees paid to credit card and third-party finance companies. Occupancy costs include rents, depreciation charges, insurance and property

taxes, repairs and maintenance expense and utility costs. Delivery costs include personnel, fuel costs, and depreciation and rental charges for rolling stock. Warehouse costs include supplies, depreciation, and rental charges for equipment.

Advertising expenses are primarily media production and space, direct mail costs, market research expenses and agency fees. Administrative expenses are comprised of compensation costs for store personnel exclusive of sales associates, information

systems, executive, accounting, merchandising, advertising, supply chain, real estate and human resource departments.

We classify our SG&A expenses as either variable or fixed and discretionary. Our variable expenses include the costs in the selling and

delivery categories and certain warehouse expenses as these amounts will generally move in tandem with our level of sales. The remaining categories and expenses are classified as fixed and discretionary because these costs do not fluctuate with

sales. The following table outlines our SG&A expenses by classification:

|

2018

|

2017

|

2016

|

||||||||||||||||||||||

|

(In thousands)

|

% of

Net Sales

|

% of

Net Sales

|

% of

Net Sales

|

|||||||||||||||||||||

|

Variable

|

$

|

149,973

|

18.3%

|

$

|

149,694

|

18.2%

|

$

|

149,299

|

18.2%

|

|||||||||||||||

|

Fixed and discretionary

|

254,883

|

31.2

|

253,190

|

30.9

|

249,937

|

30.4

|

||||||||||||||||||

|

$

|

404,856

|

49.5%

|

$

|

402,884

|

49.1%

|

$

|

399,236

|

48.6%

|

||||||||||||||||

Year-to-Year Comparisons

Our SG&A as a percent of sales increased 40 basis points to 49.5% in 2018 from 49.1% in 2017. Our fixed and discretionary expenses increased

$1.7 million or 0.7% in 2018 over 2017. This change was primarily due to increases in administrative costs of $1.5 million which included a $2.0 million increase in group medical expenses. We also had increases in our advertising and marketing

expenses, warehouse costs and other occupancy costs totaling $1.4 million. These increases were partly offset by $0.7 million in lower depreciation expense and rent expense. Our variable expenses increased slightly due to higher transportation and

delivery costs.

Our SG&A costs as a percent of sales increased 50 basis points to 49.1% in 2017 from 48.6% in 2016. Our fixed and discretionary expenses

increased $3.3 million or 1.3% in 2017 over 2016. This change was primarily due to increases in advertising and marketing expenses of $2.9 million and higher depreciation, rent, and other occupancy costs totaling $3.7 million. These increases were

partly offset by $3.0 million in lower administrative costs driven by lower medical costs. Our variable expenses increased slightly due to continued growth generated by our in-home designers and increases in delivery costs.

16

2019 Outlook

Fixed and discretionary type expenses within SG&A are expected to be in the $260.0 to $262.0 million range for 2019. Approximately $2.0

million of the increase is due to amounts previously charged to interest expense that will be classified as lease expense. This change is the result of the implementation on January 1, 2019 of the lease accounting standard update ASU 2016-02

(“ASU”). We also anticipate in 2019 higher occupancy costs from new and relocated stores, increases in employee group medical costs and increases from inflation. Fixed and discretionary type expenses in total should average approximately $66.0

million per quarter excluding the second quarter which is expected to be $3.0 million lower. For 2018 these expenses averaged $64.5 million per quarter in all but the second quarter which was $61.5 million.

Variable costs within SG&A for 2019 are expected to be 18.2% as a percent of sales.

Interest Expense

Our interest expense for the years 2016 to 2018 is primarily driven by amounts related to our lease obligations. For leases accounted for as

capital and financing lease obligations, we record straight-line rent expense for the land portion in occupancy costs in SG&A along with amortization on the additional asset recorded. Rental payments are recognized as a reduction of the

obligations and as interest expense.

Provision for Income Taxes

The Tax Cuts and Jobs Act (the “Tax Act”) was signed into law on December 22, 2017. The Tax Act significantly revised the U.S. corporate income

tax by lowering the statutory corporate tax rate from 35% to 21%. It also eliminated certain deductions and enhanced and extended through 2026 the option to claim accelerated depreciation deductions on qualified property. We estimated the effects

of the Tax Act and recorded in our financial statements as of December 31, 2017 approximately $5.9 million in additional tax expense for the remeasurement of net deferred tax assets and liabilities. We completed our analysis in 2018 and no

additional adjustments were made for the impact of the Tax Act.

Our effective tax rate was 25.0% in 2018, 51.2% in 2017 and 38.1% in 2016. The 2018 and 2016 rate varies from the U.S. federal statutory rate

primarily due to state income taxes. The 2017 rate is impacted by the negative effect of $5.9 million for the Tax Act.

Liquidity and Capital Resources

Overview of Liquidity

Our primary cash requirements include working capital needs, contractual obligations, benefit plan contributions, income tax obligations and

capital expenditures. We have funded these requirements exclusively through cash generated from operations and have not used our credit facility since 2008. We believe funds generated from our expected results of operations and available cash and

cash equivalents will be sufficient to fund our primary obligations and complete projects that we have underway or currently contemplate for the next fiscal and foreseeable future years.

At December 31, 2018, our cash, cash equivalents and restricted cash equivalents balance was $79.8 million, a decrease of $7.8 million compared

to December 31, 2017. This change primarily resulted from strong operating results offset by purchases of property and equipment and dividends paid to stockholders, including a special dividend, and repurchases of common stock. Additional

discussion of our cash flow results, including the comparison of 2018 activity to 2017, is set forth in the Analysis of Cash Flows section.

At December 31, 2018, our outstanding indebtedness was $50.8 million in lease obligations required to be recorded on our balance sheet. We had

no amounts outstanding and $51.5 million available under our revolving credit facility.

Capital Expenditures

Our primary capital requirements have been focused on our stores, distribution centers, and the development of both proprietary and purchased

information systems. We have successfully concluded our store remodeling program and in 2018 we completed the expansion of our Western Distribution Center. Our capital expenditures were $21.5 million in 2018, $3.0 million less than 2017.

17

Our future capital requirements will depend in large part on the number of and timing for new stores we open within a given year, the