UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02735

ELFUN TAX-EXEMPT INCOME FUND

(Exact name of registrant as specified in charter)

One Iron Street

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

| (Name and Address of Agent for Service) | Copy to: | |

| Sean O’Malley, Esq. Senior Vice President and General Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 |

Adam M. Schlichtmann, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199-3600 | |

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Shareholder Report.

| (a) | The Report to Shareholders is attached herewith. |

| Elfun Funds |

| Elfun International Equity Fund |

| Elfun Trusts |

| Elfun Diversified Fund |

| Elfun Tax-Exempt Income Fund |

| Elfun Income Fund |

| Elfun Government Money Market Fund |

| Page | |

|

|

1 |

| Management’s

Discussion of Fund Performance, Understanding Your Fund’s Expenses, Performance Summary and Schedule of Investments |

|

|

|

2 |

|

|

10 |

|

|

17 |

|

|

55 |

|

|

68 |

|

|

92 |

| Financial Statements | |

|

|

100 |

|

|

106 |

|

|

108 |

|

|

110 |

|

|

113 |

|

|

124 |

|

|

125 |

| Notes to Performance | 1 |

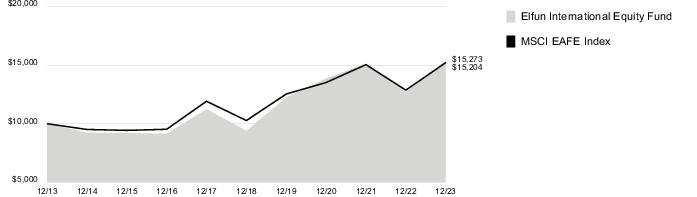

| 2 | Elfun International Equity Fund |

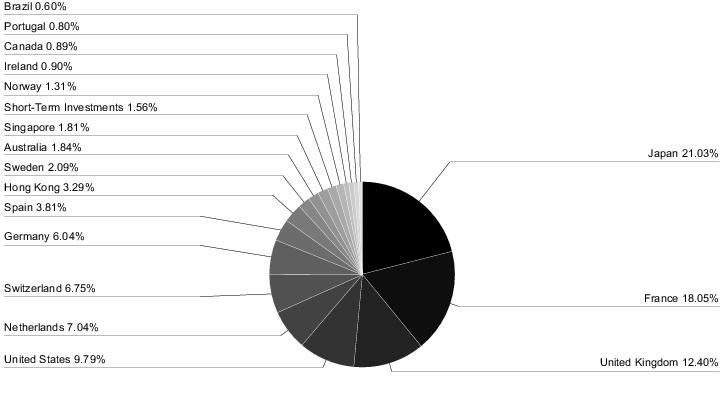

| Sector Allocation |

| Portfolio composition as a % of Fair Value of $173,625 (in thousands) as of December 31, 2023 (a)(b) |

| (a) | Fair Value basis is inclusive of short-term investments in State Street Institutional U.S. Government Money Market Fund - Class G Shares and State Street Institutional Treasury Money Market Fund - Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| Elfun International Equity Fund | 3 |

| 4 | Elfun International Equity Fund |

| Elfun International Equity Fund | 5 |

| 6 | Elfun International Equity Fund |

| Number

of Shares |

Fair

Value | |

| Schneider Electric SE | 24,485 | $ 4,916,669 |

| 16,996,368 | ||

| Total

Common Stock (Cost $118,105,299) |

170,915,269 | |

| Short-Term Investments - 1.5% | ||

| State Street Institutional Treasury Money Market Fund - Premier Class 5.28% (c)(d) | 1,533,237 | 1,533,237 |

| State Street Institutional U.S. Government Money Market Fund - Class G Shares 5.36% (c)(d)(e) | 1,176,046 | 1,176,046 |

| Total

Short-Term Investments (Cost $2,709,283) |

2,709,283 | |

| Total

Investments (Cost $120,814,582) |

173,624,552 | |

| Other Assets and Liabilities, net - 0.1% | 129,482 | |

| NET ASSETS - 100.0% | $ 173,754,034 | |

| The Fund had the following long futures contracts open at December 31, 2023: |

| Description | Expiration

Date |

Number

of Contracts |

Notional

Amount |

Value | Unrealized

Appreciation (Depreciation) |

| MSCI EAFE Mini Index Futures | March 2024 | 5 | $ 542,089 | $ 563,100 | $ 21,011 |

| Elfun International Equity Fund | 7 |

| Investments | Level 1 | Level 2 | Level 3 | Total | |||

| Investments in Securities | |||||||

| Common Stock | $ 170,915,269 | $ — | $ — | $ 170,915,269 | |||

| Short-Term Investments | 2,709,283 | — | — | 2,709,283 | |||

| Total Investments in Securities | $ 173,624,552 | $ — | $ — | $ 173,624,552 | |||

| Other Financial Instruments | |||||||

| Long Futures Contracts - Unrealized Appreciation | $ 21,011 | $ — | $ — | $ 21,011 | |||

| Total Other Financial Instruments | $ 21,011 | $ — | $ — | $ 21,011 |

| Sector | Percentage

(based on Fair Value) | ||

| Pharmaceuticals | 8.76% | ||

| Diversified Banks | 8.26% | ||

| Semiconductor Materials & Equipment | 5.90% | ||

| Building Products | 5.79% | ||

| Apparel, Accessories & Luxury Goods | 4.56% | ||

| Application Software | 4.53% | ||

| Packaged Foods & Meats | 3.99% | ||

| Healthcare Supplies | 3.80% | ||

| Specialty Chemicals | 3.58% | ||

| Life & Health Insurance | 3.29% | ||

| Electrical Components & Equipment | 2.83% | ||

| Consumer Electronics | 2.63% | ||

| Industrial Gases | 2.61% | ||

| Financial Exchanges & Data | 2.49% | ||

| Human Resource & Employment Services | 2.39% | ||

| Property & Casualty Insurance | 2.22% | ||

| Aerospace & Defense | 2.22% | ||

| Integrated Oil & Gas | 2.11% | ||

| Multi-Line Insurance | 1.99% | ||

| Industrial Machinery & Supplies & Components | 1.98% | ||

| Movies & Entertainment | 1.98% | ||

| Semiconductors | 1.97% | ||

| Apparel Retail | 1.94% | ||

| Personal Care Products | 1.87% | ||

| Integrated Telecommunication Services | 1.87% | ||

| Diversified Metals & Mining | 1.84% | ||

| Construction Machinery & Heavy Transportation Equipment | 1.79% | ||

| Trading Companies & Distributors | 1.64% | ||

| 8 | Elfun International Equity Fund |

| Sector | Percentage

(based on Fair Value) | ||

| Research & Consulting Services | 1.56% | ||

| Distillers & Vintners | 1.52% | ||

| Environmental & Facilities Services | 1.49% | ||

| Electronic Components | 1.25% | ||

| Asset Management & Custody Banks | 0.89% | ||

| Security & Alarm Services | 0.46% | ||

| Electronic Equipment & Instruments | 0.44% | ||

| 98.44% | |||

| Short-Term Investments | |||

| Short-Term Investments | 1.56% | ||

| 100.00% | |||

| Affiliate Table |

| Number

of Shares Held at 12/31/22 |

Value

at 12/31/22 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation (Depreciation) |

Number

of Shares Held at 12/31/23 |

Value

at 12/31/23 |

Dividend

Income | ||||||

| State Street Institutional Treasury Money Market Fund - Premier Class | 1,192,777 | $1,192,777 | $10,660,493 | $10,320,033 | $— | $— | 1,533,237 | $1,533,237 | $103,351 | |||||

| State Street Institutional U.S. Government Money Market Fund - Class G Shares | 935,166 | 935,166 | 10,560,913 | 10,320,033 | — | — | 1,176,046 | 1,176,046 | 89,770 | |||||

| TOTAL | $2,127,943 | $21,221,406 | $20,640,066 | $— | $— | $2,709,283 | $193,121 |

| Elfun International Equity Fund | 9 |

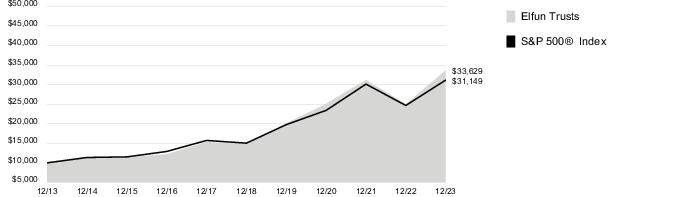

| 10 | Elfun Trusts |

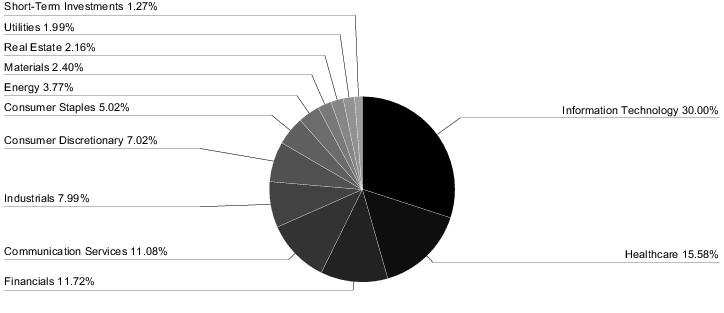

| Sector Allocation |

| Portfolio composition as a % of Fair Value of $3,635,069 (in thousands) as of December 31, 2023 (a)(b) |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund - Class G Shares and State Street Institutional Treasury Money Market Fund - Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| Elfun Trusts | 11 |

| 12 | Elfun Trusts |

| 14 | Elfun Trusts |

| Elfun Trusts | 15 |

| Investments | Level 1 | Level 2 | Level 3 | Total | |||

| Investments in Securities | |||||||

| Common Stock | $ 3,588,856,288 | $ — | $ — | $ 3,588,856,288 | |||

| Short-Term Investments | 46,213,083 | — | — | 46,213,083 | |||

| Total Investments in Securities | $ 3,635,069,371 | $ — | $ — | $ 3,635,069,371 |

| Affiliate Table |

| Number

of Shares Held at 12/31/22 |

Value

at 12/31/22 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation (Depreciation) |

Number

of Shares Held at 12/31/23 |

Value

at 12/31/23 |

Dividend

Income | ||||||

| State Street Institutional Treasury Money Market Fund - Premier Class | 19,801,698 | $19,801,698 | $217,235,400 | $212,781,042 | $— | $— | 24,256,056 | $24,256,056 | $1,471,317 | |||||

| State Street Institutional U.S. Government Money Market Fund - Class G Shares | 18,975,185 | 18,975,185 | 215,762,883 | 212,781,041 | — | — | 21,957,027 | 21,957,027 | 1,419,174 | |||||

| TOTAL | $38,776,883 | $432,998,283 | $425,562,083 | $— | $— | $46,213,083 | $2,890,491 |

| 16 | Elfun Trusts |

| Elfun Diversified Fund | 17 |

| 18 | Elfun Diversified Fund |

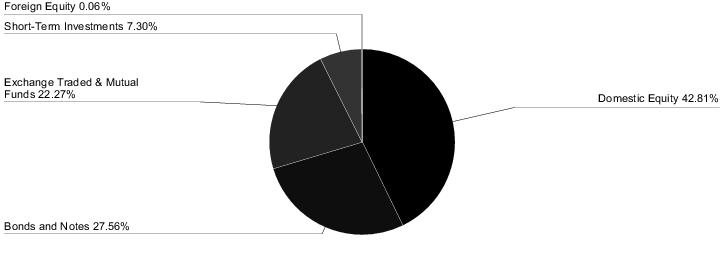

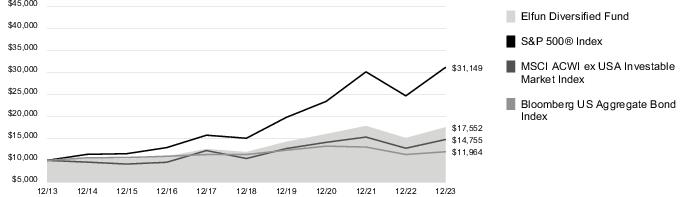

| Sector Allocation |

| Portfolio composition as a % of Fair Value of $182,327 (in thousands) as of December 31, 2023 (a)(b) |

| (a) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (b) | Fair Value basis is inclusive of short-term investment in affiliated money market funds. |

| Elfun Diversified Fund | 19 |

| 20 | Elfun Diversified Fund |

| Elfun Diversified Fund | 21 |

| 22 | Elfun Diversified Fund |

| Elfun Diversified Fund | 23 |

| 24 | Elfun Diversified Fund |

| Elfun Diversified Fund | 25 |

| 26 | Elfun Diversified Fund |

| Elfun Diversified Fund | 27 |

| 28 | Elfun Diversified Fund |

| Elfun Diversified Fund | 29 |

| 30 | Elfun Diversified Fund |

| Elfun Diversified Fund | 31 |

| 32 | Elfun Diversified Fund |

| Elfun Diversified Fund | 33 |

| 34 | Elfun Diversified Fund |

| Elfun Diversified Fund | 35 |

| 36 | Elfun Diversified Fund |

| Elfun Diversified Fund | 37 |

| 38 | Elfun Diversified Fund |

| Elfun Diversified Fund | 39 |

| 40 | Elfun Diversified Fund |

| Elfun Diversified Fund | 41 |

| 42 | Elfun Diversified Fund |

| Elfun Diversified Fund | 43 |

| 44 | Elfun Diversified Fund |

| Elfun Diversified Fund | 45 |

| 46 | Elfun Diversified Fund |

| Elfun Diversified Fund | 47 |

| 48 | Elfun Diversified Fund |

| Centrally Cleared Credit Default Swaps: |

| Reference Entity | Counterparty | Notional

Amount (000s omitted) |

Contract

Annual Fixed Rate/ Payment Frequency |

Termination

Date |

Market

Value |

Unamortized

Upfront Payments Received (Paid) |

Unrealized

Appreciation (Depreciation) |

| Sell Protection | |||||||

| Markit CDX North America High Yield Index | Intercontinental Exchange | $1,257 | 5.00%/

Quarterly |

12/20/28 | $73,304 | $151 | $73,153 |

| Elfun Diversified Fund | 49 |

| The Fund had the following long futures contracts open at December 31, 2023: |

| Description | Expiration

Date |

Number

of Contracts |

Notional

Amount |

Value | Unrealized

Appreciation (Depreciation) |

| U.S. Long Bond Futures | March 2024 | 7 | $ 812,712 | $ 874,762 | $ 62,050 |

| 10 Yr. U.S. Treasury Ultra Futures | March 2024 | 63 | 7,078,451 | 7,434,984 | 356,533 |

| 2 Yr. U.S. Treasury Notes Futures | March 2024 | 10 | 2,038,229 | 2,059,141 | 20,912 |

| Ultra Long-Term U.S. Treasury Bond Futures | March 2024 | 5 | 616,692 | 667,969 | 51,277 |

| 5 Yr. U.S. Treasury Notes Futures | March 2024 | 33 | 3,503,729 | 3,589,524 | 85,795 |

| S&P 500 E-mini Index Futures | March 2024 | 2 | 464,148 | 482,000 | 17,852 |

| $ 594,419 |

| The Fund had the following short futures contracts open at December 31, 2023: |

| Description | Expiration

date |

Number

of Contracts |

Notional

Amount |

Value | Unrealized

Appreciation (Depreciation) |

| 10 Yr. U.S. Treasury Notes Futures | March 2024 | 29 | $ (3,168,144) | $ (3,273,828) | $ (105,684) |

| During the year ended December 31, 2023, average notional values related to derivative contracts were as follows: | |||

| Long

Futures Contracts |

Short

Futures Contracts |

Credit

Default Swap Contracts | |

| Average Notional Value | $12,241,322 | $3,001,958 | $1,952,012 |

| 50 | Elfun Diversified Fund |

| Investments | Level 1 | Level 2 | Level 3 | Total | |||

| Investments in Securities | |||||||

| Domestic Equity | $ 78,056,939 | $ — | $ — | $ 78,056,939 | |||

| Foreign Equity | 113,232 | — | — | 113,232 | |||

| U.S. Treasuries | — | 15,046,240 | — | 15,046,240 | |||

| Agency Mortgage Backed | — | 13,473,839 | — | 13,473,839 | |||

| Agency Collateralized Mortgage Obligations | — | 334,548 | — | 334,548 | |||

| Corporate Notes | — | 17,968,520 | — | 17,968,520 | |||

| Non-Agency Collateralized Mortgage Obligations | — | 3,235,839 | — | 3,235,839 | |||

| Municipal Bonds and Notes | — | 183,872 | — | 183,872 | |||

| Exchange Traded & Mutual Funds | 40,606,701 | — | — | 40,606,701 | |||

| Short-Term Investments | 13,307,050 | — | — | 13,307,050 | |||

| Total Investments in Securities | $ 132,083,922 | $ 50,242,858 | $ — | $ 182,326,780 | |||

| Other Financial Instruments | |||||||

| Credit Default Swap Contracts - Unrealized Appreciation | $ — | $ 73,153 | $ — | $ 73,153 | |||

| Long Futures Contracts - Unrealized Appreciation | 594,419 | — | — | 594,419 | |||

| Short Futures Contracts - Unrealized Depreciation | (105,684) | — | — | (105,684) | |||

| Total Other Financial Instruments | $ 488,735 | $ 73,153 | $ — | $ 561,888 |

| Industry | Domestic | Foreign | Total |

| Exchange Traded Funds | 22.27% | 0.00% | 22.27% |

| Systems Software | 3.47% | 0.00% | 3.47% |

| Technology Hardware, Storage & Peripherals | 3.12% | 0.00% | 3.12% |

| Semiconductors | 3.03% | 0.06% | 3.09% |

| Interactive Media & Services | 2.48% | 0.00% | 2.48% |

| Pharmaceuticals | 1.60% | 0.00% | 1.60% |

| Broadline Retail | 1.51% | 0.00% | 1.51% |

| Diversified Banks | 1.26% | 0.00% | 1.26% |

| Application Software | 1.14% | 0.00% | 1.14% |

| Transaction & Payment Processing Services | 1.09% | 0.00% | 1.09% |

| Healthcare Equipment | 1.06% | 0.00% | 1.06% |

| Biotechnology | 0.87% | 0.00% | 0.87% |

| Automobile Manufacturers | 0.84% | 0.00% | 0.84% |

| Managed Healthcare | 0.76% | 0.00% | 0.76% |

| Elfun Diversified Fund | 51 |

| Industry | Domestic | Foreign | Total |

| Integrated Oil & Gas | 0.75% | 0.00% | 0.75% |

| Aerospace & Defense | 0.70% | 0.00% | 0.70% |

| Multi-Sector Holdings | 0.69% | 0.00% | 0.69% |

| Consumer Staples Merchandise Retail | 0.69% | 0.00% | 0.69% |

| Electric Utilities | 0.66% | 0.00% | 0.66% |

| Life Sciences Tools & Services | 0.62% | 0.00% | 0.62% |

| Soft Drinks & Non-alcoholic Beverages | 0.58% | 0.00% | 0.58% |

| Household Products | 0.53% | 0.00% | 0.53% |

| Home Improvement Retail | 0.51% | 0.00% | 0.51% |

| Financial Exchanges & Data | 0.49% | 0.00% | 0.49% |

| IT Consulting & Other Services | 0.49% | 0.00% | 0.49% |

| Restaurants | 0.49% | 0.00% | 0.49% |

| Oil & Gas Exploration & Production | 0.45% | 0.00% | 0.45% |

| Movies & Entertainment | 0.45% | 0.00% | 0.45% |

| Asset Management & Custody Banks | 0.39% | 0.00% | 0.39% |

| Investment Banking & Brokerage | 0.39% | 0.00% | 0.39% |

| Hotels, Resorts & Cruise Lines | 0.39% | 0.00% | 0.39% |

| Property & Casualty Insurance | 0.38% | 0.00% | 0.38% |

| Semiconductor Materials & Equipment | 0.38% | 0.00% | 0.38% |

| Industrial Machinery & Supplies & Components | 0.37% | 0.00% | 0.37% |

| Communications Equipment | 0.36% | 0.00% | 0.36% |

| Industrial Conglomerates | 0.36% | 0.00% | 0.36% |

| Packaged Foods & Meats | 0.32% | 0.00% | 0.32% |

| Integrated Telecommunication Services | 0.30% | 0.00% | 0.30% |

| Rail Transportation | 0.29% | 0.00% | 0.29% |

| Multi-Utilities | 0.29% | 0.00% | 0.29% |

| Construction Machinery & Heavy Transportation Equipment | 0.28% | 0.00% | 0.28% |

| Industrial Gases | 0.28% | 0.00% | 0.28% |

| Specialty Chemicals | 0.28% | 0.00% | 0.28% |

| Electrical Components & Equipment | 0.27% | 0.00% | 0.27% |

| Insurance Brokers | 0.26% | 0.00% | 0.26% |

| Healthcare Services | 0.24% | 0.00% | 0.24% |

| Tobacco | 0.23% | 0.00% | 0.23% |

| Cable & Satellite | 0.23% | 0.00% | 0.23% |

| Consumer Finance | 0.22% | 0.00% | 0.22% |

| Air Freight & Logistics | 0.22% | 0.00% | 0.22% |

| Building Products | 0.21% | 0.00% | 0.21% |

| Telecom Tower REITs | 0.19% | 0.00% | 0.19% |

| Human Resource & Employment Services | 0.18% | 0.00% | 0.18% |

| Oil & Gas Refining & Marketing | 0.17% | 0.00% | 0.17% |

| Apparel Retail | 0.16% | 0.00% | 0.16% |

| Life & Health Insurance | 0.16% | 0.00% | 0.16% |

| Oil & Gas Equipment & Services | 0.15% | 0.00% | 0.15% |

| Oil & Gas Storage & Transportation | 0.15% | 0.00% | 0.15% |

| Footwear | 0.14% | 0.00% | 0.14% |

| Environmental & Facilities Services | 0.14% | 0.00% | 0.14% |

| Healthcare Distributors | 0.14% | 0.00% | 0.14% |

| Regional Banks | 0.14% | 0.00% | 0.14% |

| Home Building | 0.14% | 0.00% | 0.14% |

| Passenger Ground Transportation | 0.14% | 0.00% | 0.14% |

| Industrial REITs | 0.13% | 0.00% | 0.13% |

| Retail REITs | 0.13% | 0.00% | 0.13% |

| Data Center REITs | 0.13% | 0.00% | 0.13% |

| Trading Companies & Distributors | 0.12% | 0.00% | 0.12% |

| 52 | Elfun Diversified Fund |

| Industry | Domestic | Foreign | Total |

| Automotive Retail | 0.12% | 0.00% | 0.12% |

| Agricultural & Farm Machinery | 0.11% | 0.00% | 0.11% |

| Multi-Family Residential REITs | 0.11% | 0.00% | 0.11% |

| Research & Consulting Services | 0.10% | 0.00% | 0.10% |

| Diversified Support Services | 0.10% | 0.00% | 0.10% |

| Electronic Components | 0.09% | 0.00% | 0.09% |

| Self Storage REITs | 0.09% | 0.00% | 0.09% |

| Wireless Telecommunication Services | 0.09% | 0.00% | 0.09% |

| Health Care REITs | 0.09% | 0.00% | 0.09% |

| Apparel, Accessories & Luxury Goods | 0.09% | 0.00% | 0.09% |

| Electronic Equipment & Instruments | 0.08% | 0.00% | 0.08% |

| Personal Care Products | 0.08% | 0.00% | 0.08% |

| Paper & Plastic Packaging Products & Materials | 0.07% | 0.00% | 0.07% |

| Passenger Airlines | 0.07% | 0.00% | 0.07% |

| Commodity Chemicals | 0.07% | 0.00% | 0.07% |

| Fertilizers & Agricultural Chemicals | 0.07% | 0.00% | 0.07% |

| Real Estate Services | 0.07% | 0.00% | 0.07% |

| Construction Materials | 0.07% | 0.00% | 0.07% |

| Healthcare Facilities | 0.07% | 0.00% | 0.07% |

| Interactive Home Entertainment | 0.07% | 0.00% | 0.07% |

| Other Specialty Retail | 0.06% | 0.00% | 0.06% |

| Copper | 0.06% | 0.00% | 0.06% |

| Steel | 0.06% | 0.00% | 0.06% |

| Electronic Manufacturing Services | 0.06% | 0.00% | 0.06% |

| Multi-Line Insurance | 0.06% | 0.00% | 0.06% |

| Agricultural Products & Services | 0.06% | 0.00% | 0.06% |

| Cargo Ground Transportation | 0.06% | 0.00% | 0.06% |

| Other Specialized REITs | 0.06% | 0.00% | 0.06% |

| Distillers & Vintners | 0.05% | 0.00% | 0.05% |

| Distributors | 0.05% | 0.00% | 0.05% |

| Gold | 0.05% | 0.00% | 0.05% |

| Casinos & Gaming | 0.05% | 0.00% | 0.05% |

| Healthcare Supplies | 0.05% | 0.00% | 0.05% |

| Internet Services & Infrastructure | 0.04% | 0.00% | 0.04% |

| Food Distributors | 0.04% | 0.00% | 0.04% |

| Automotive Parts & Equipment | 0.04% | 0.00% | 0.04% |

| Construction & Engineering | 0.04% | 0.00% | 0.04% |

| Technology Distributors | 0.03% | 0.00% | 0.03% |

| Food Retail | 0.03% | 0.00% | 0.03% |

| Advertising | 0.03% | 0.00% | 0.03% |

| Water Utilities | 0.03% | 0.00% | 0.03% |

| Timber REITs | 0.03% | 0.00% | 0.03% |

| Office REITs | 0.03% | 0.00% | 0.03% |

| Data Processing & Outsourced Services | 0.03% | 0.00% | 0.03% |

| Single-Family Residential REITs | 0.02% | 0.00% | 0.02% |

| Consumer Electronics | 0.02% | 0.00% | 0.02% |

| Drug Retail | 0.02% | 0.00% | 0.02% |

| Broadcasting | 0.02% | 0.00% | 0.02% |

| Metal, Glass & Plastic Containers | 0.02% | 0.00% | 0.02% |

| Computer & Electronics Retail | 0.02% | 0.00% | 0.02% |

| Gas Utilities | 0.02% | 0.00% | 0.02% |

| Reinsurance | 0.01% | 0.00% | 0.01% |

| Hotel & Resort REITs | 0.01% | 0.00% | 0.01% |

| Publishing | 0.01% | 0.00% | 0.01% |

| Elfun Diversified Fund | 53 |

| Industry | Domestic | Foreign | Total |

| Independent Power Producers & Energy Traders | 0.01% | 0.00% | 0.01% |

| Brewers | 0.01% | 0.00% | 0.01% |

| Household Appliances | 0.01% | 0.00% | 0.01% |

| Leisure Products | 0.01% | 0.00% | 0.01% |

| Home Furnishings | 0.01% | 0.00% | 0.01% |

| 65.14% |

| Affiliate Table |

| Number

of Shares Held at 12/31/22 |

Value

at 12/31/22 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation (Depreciation) |

Number

of Shares Held at 12/31/23 |

Value

at 12/31/23 |

Dividend

Income | ||||||

| State Street Corp. | 592 | $ 45,921 | $ 24,864 | $ 23,154 | $ (2,727) | $ 875 | 591 | $ 45,779 | $ 1,697 | |||||

| State Street Global All Cap Equity ex-U.S. Index Portfolio | 425,386 | 42,695,979 | 7,447,970 | 14,535,000 | (127,198) | 5,124,950 | 360,372 | 40,606,701 | 1,167,971 | |||||

| State Street Institutional Treasury Money Market Fund - Premier Class | 8,599,525 | 8,599,525 | 20,153,867 | 24,164,299 | — | — | 4,589,093 | 4,589,093 | 282,789 | |||||

| State Street Institutional Treasury Plus Fund - Premier Class | 116,548 | 116,548 | 12,369,729 | 10,584,763 | — | — | 1,901,514 | 1,901,514 | 89,281 | |||||

| State Street Institutional U.S. Government Money Market Fund - Class G Shares | 8,748,612 | 8,748,612 | 50,963,971 | 54,797,654 | — | — | 4,914,929 | 4,914,929 | 308,584 | |||||

| TOTAL | $60,206,585 | $90,960,401 | $104,104,870 | $(129,925) | $5,125,825 | $52,058,016 | $1,850,322 |

| 54 | Elfun Diversified Fund |

| Elfun Tax-Exempt Income Fund | 55 |

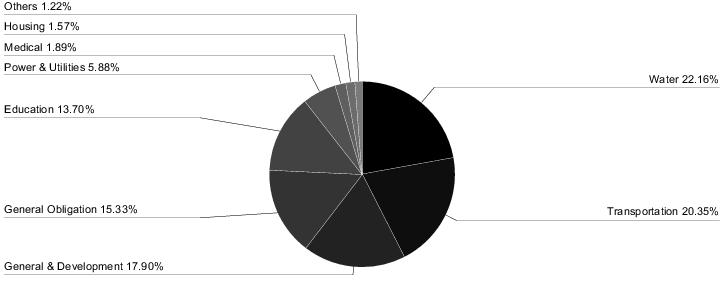

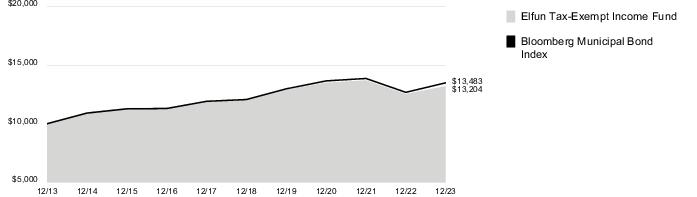

| Sector Allocation |

| Portfolio composition as a % of Fair Value of $1,014,376 (in thousands) as of December 31, 2023 (a)(b) |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional Treasury Plus Fund — Premier Class. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| * | Moody’s Investors Services, Inc. (“Moody’s”) and S&P Global Ratings (“S&P”) are nationally recognized statistical rating organizations. The quality ratings represent the lower of Moody’s or S&P credit ratings. When a rating from only one of the rating agencies is available, that rating is used. Securities not rated by Moody’s or S&P are categorized as not rated. Credit quality measures a bond issuer’s ability to repay interest and principal in a timely manner. Credit quality ratings assigned by a rating agency are subject to change periodically and are not absolute standard of quality. In formulating investment decisions for the Fund, SSGA Funds Management, Inc. (“SSGA FM”) develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agency ratings. |

| 56 | Elfun Tax-Exempt Income Fund |

| Elfun Tax-Exempt Income Fund | 57 |

| 58 | Elfun Tax-Exempt Income Fund |

| Elfun Tax-Exempt Income Fund | 59 |

| 60 | Elfun Tax-Exempt Income Fund |

| Elfun Tax-Exempt Income Fund | 61 |

| 62 | Elfun Tax-Exempt Income Fund |

| Elfun Tax-Exempt Income Fund | 63 |

| 64 | Elfun Tax-Exempt Income Fund |

| Elfun Tax-Exempt Income Fund | 65 |

| 66 | Elfun Tax-Exempt Income Fund |

| Investments | Level 1 | Level 2 | Level 3 | Total | |||

| Investments in Securities | |||||||

| Municipal Bonds and Notes | $ — | $ 1,009,798,273 | $ — | $ 1,009,798,273 | |||

| Short-Term Investments | 4,577,263 | — | — | 4,577,263 | |||

| Total Investments in Securities | $ 4,577,263 | $ 1,009,798,273 | $ — | $ 1,014,375,536 |

| Affiliate Table |

| Number

of Shares Held at 12/31/22 |

Value

at 12/31/22 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation (Depreciation) |

Number

of Shares Held at 12/31/23 |

Value

at 12/31/23 |

Dividend

Income | |

| State Street Institutional Treasury Plus Fund - Premier Class | 15,874,392 | $15,874,392 | $285,432,118 | $296,729,247 | $— | $— | 4,577,263 | $4,577,263 | $568,445 |

| Elfun Tax-Exempt Income Fund | 67 |

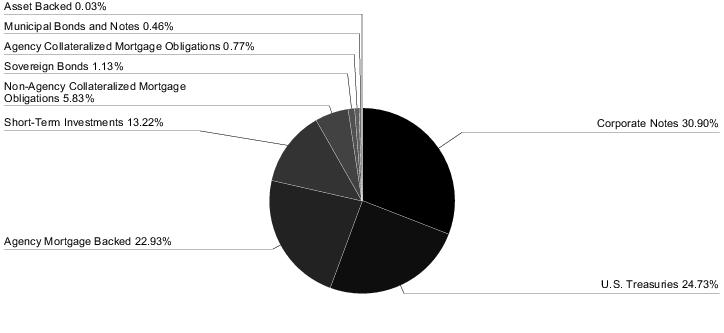

| 68 | Elfun Income Fund |

| Sector Allocation |

| Portfolio composition as a % of Fair Value of $156,647 (in thousands) as of December 31, 2023 (a)(b) |

| (a) | Fair Value basis is inclusive of a short-term investment in the State Street Institutional U.S. Government Money Market Fund - Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| * | Moody’s Investors Services, Inc. (“Moody’s”) and S&P Global Ratings (“S&P”) are nationally recognized statistical rating organizations. The quality ratings represent the lower of Moody’s or S&P credit ratings. When a rating from only one of the rating agencies is available, that rating is used. Securities not rated by Moody’s or S&P are categorized as not rated. Credit quality measures a bond issuer’s ability to repay interest and principal in a timely manner. Credit quality ratings assigned by a rating agency are subject to change periodically and are not absolute standard of quality. In formulating investment decisions for the Fund, SSGA Funds Management, Inc. (“SSGA FM”) develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agency ratings. |

| Elfun Income Fund | 69 |

| 70 | Elfun Income Fund |

| Elfun Income Fund | 71 |

| 72 | Elfun Income Fund |

| Elfun Income Fund | 73 |

| 74 | Elfun Income Fund |

| Elfun Income Fund | 75 |

| 76 | Elfun Income Fund |

| Elfun Income Fund | 77 |

| 78 | Elfun Income Fund |

| Elfun Income Fund | 79 |

| 80 | Elfun Income Fund |

| Elfun Income Fund | 81 |

| 82 | Elfun Income Fund |

| Elfun Income Fund | 83 |

| 84 | Elfun Income Fund |

| Elfun Income Fund | 85 |

| 86 | Elfun Income Fund |

| Elfun Income Fund | 87 |

| 88 | Elfun Income Fund |

| Centrally Cleared Credit Default Swaps: |

| Reference Entity | Counterparty | Notional

Amount (000s omitted) |

Contract

Annual Fixed Rate/ Payment Frequency |

Termination

Date |

Market

Value |

Unamortized

Upfront Payments Received (Paid) |

Unrealized

Appreciation (Depreciation) |

| Sell Protection | |||||||

| Markit CDX North America High Yield Index | Intercontinental Exchange | $3,472 | 5.00%/

Quarterly |

12/20/28 | $202,508 | $417 | $202,091 |

| Elfun Income Fund | 89 |

| The Fund had the following long futures contracts open at December 31, 2023: |

| Description | Expiration

Date |

Number

of Contracts |

Notional

Amount |

Value | Unrealized

Appreciation (Depreciation) |

| U.S. Long Bond Futures | March 2024 | 12 | $ 1,400,996 | $ 1,499,129 | $ 98,133 |

| 10 Yr. U.S. Treasury Ultra Futures | March 2024 | 176 | 19,773,218 | 20,770,750 | 997,532 |

| 2 Yr. U.S. Treasury Notes Futures | March 2024 | 25 | 5,095,572 | 5,147,851 | 52,279 |

| Ultra Long-Term U.S. Treasury Bond Futures | March 2024 | 16 | 1,933,387 | 2,137,500 | 204,113 |

| 5 Yr. U.S. Treasury Notes Futures | March 2024 | 91 | 9,655,310 | 9,898,383 | 243,073 |

| $ 1,595,130 |

| The Fund had the following short futures contracts open at December 31, 2023: |

| Description | Expiration

date |

Number

of Contracts |

Notional

Amount |

Value | Unrealized

Appreciation (Depreciation) |

| 10 Yr. U.S. Treasury Notes Futures | March 2024 | 57 | $ (6,228,627) | $ (6,434,766) | $ (206,139) |

| During the year ended December 31, 2023, average notional values related to derivative contracts were as follows: | |||

| Long

Futures Contracts |

Short

Futures Contracts |

Credit

Default Swap Contracts | |

| Average Notional Value | $34,158,859 | $8,580,187 | $5,002,508 |

| 90 | Elfun Income Fund |

| Investments | Level 1 | Level 2 | Level 3 | Total | |||

| Investments in Securities | |||||||

| U.S. Treasuries | $ — | $ 38,737,550 | $ — | $ 38,737,550 | |||

| Agency Mortgage Backed | — | 35,924,606 | — | 35,924,606 | |||

| Agency Collateralized Mortgage Obligations | — | 1,201,361 | — | 1,201,361 | |||

| Asset Backed | — | 48,305 | — | 48,305 | |||

| Corporate Notes | — | 48,406,978 | — | 48,406,978 | |||

| Non-Agency Collateralized Mortgage Obligations | — | 9,127,337 | — | 9,127,337 | |||

| Sovereign Bonds | — | 1,774,829 | — | 1,774,829 | |||

| Municipal Bonds and Notes | — | 714,930 | — | 714,930 | |||

| Short-Term Investments | 20,710,832 | — | — | 20,710,832 | |||

| Total Investments in Securities | $ 20,710,832 | $ 135,935,896 | $ — | $ 156,646,728 | |||

| Other Financial Instruments | |||||||

| Credit Default Swap Contracts - Unrealized Appreciation | $ — | $ 202,091 | $ — | $ 202,091 | |||

| Long Futures Contracts - Unrealized Appreciation | 1,595,130 | — | — | 1,595,130 | |||

| Short Futures Contracts - Unrealized Depreciation | (206,139) | — | — | (206,139) | |||

| Total Other Financial Instruments | $ 1,388,991 | $ 202,091 | $ — | $ 1,591,082 |

| Affiliate Table |

| Number

of Shares Held at 12/31/22 |

Value

at 12/31/22 |

Cost

of Purchases |

Proceeds

from Shares Sold |

Realized

Gain (Loss) |

Change

in Unrealized Appreciation (Depreciation) |

Number

of Shares Held at 12/31/23 |

Value

at 12/31/23 |

Dividend

Income | |

| State Street Institutional U.S. Government Money Market Fund - Class G Shares | 33,943,475 | $33,943,475 | $51,271,000 | $64,503,643 | $— | $— | 20,710,832 | $20,710,832 | $1,394,546 |

| Elfun Income Fund | 91 |

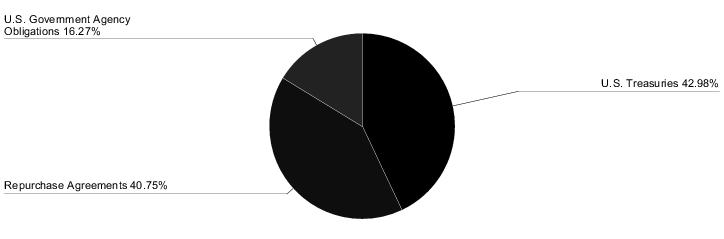

| 92 | Elfun Government Money Market Fund |

| Sector Allocation |

| Portfolio composition as a % of Fair Value of $149,980 (in thousands) as of December 31, 2023 (a) |

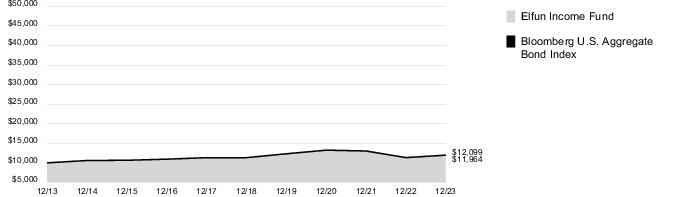

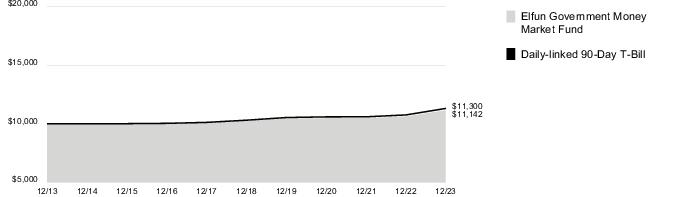

| Average Annual Total Return for the years ended December 31, 2023 | |||||||

| (Inception date: 6/13/90) | |||||||

| One Year | Five Year | Ten Year | Ending

Value of a $10,000 Investment | ||||

| Elfun Government Money Market Fund | 4.89% | 1.72% | 1.09% | $11,142 | |||

| Daily-linked 90-Day T-Bill | 5.01% | 1.79% | 1.23% | $11,300 | |||

| (a) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| Elfun Government Money Market Fund | 93 |

| 94 | Elfun Government Money Market Fund |

| Elfun Government Money Market Fund | 95 |

| 96 | Elfun Government Money Market Fund |

| Elfun Government Money Market Fund | 97 |

| 98 | Elfun Government Money Market Fund |

| Investments | Level 1 | Level 2 | Level 3 | Total | |||

| Investments in Securities | |||||||

| U.S. Treasuries | $ — | $ 64,453,622 | $ — | $ 64,453,622 | |||

| U.S. Government Agency Obligations | — | 24,402,110 | — | 24,402,110 | |||

| Repurchase Agreements | — | 61,124,000 | — | 61,124,000 | |||

| Total Investments in Securities | $ — | $ 149,979,732 | $ — | $ 149,979,732 |

| Elfun Government Money Market Fund | 99 |

| 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 | 12/31/19 | |||||

| Inception date | 1/1/88 | ||||||||

| Net asset value, beginning of period | $ 20.97 | $ 26.73 | $ 26.53 | $ 23.69 | $ 18.51 | ||||

| Income/(loss) from investment operations: | |||||||||

| Net investment income(a) | 0.46 | 0.56 | 0.83 | 0.29 | 0.43 | ||||

| Net realized and unrealized gains/(losses) on investments | 3.80 | (4.86) | 1.57 | 2.86 | 5.15 | ||||

| Total income/(loss) from investment operations | 4.26 | (4.30) | 2.40 | 3.15 | 5.58 | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.48) | (0.55) | (0.86) | (0.31) | (0.40) | ||||

| Net realized gains | — | (0.91) | (1.34) | — | — | ||||

| Total distributions | (0.48) | (1.46) | (2.20) | (0.31) | (0.40) | ||||

| Net asset value, end of period | $ 24.75 | $ 20.97 | $ 26.73 | $ 26.53 | $ 23.69 | ||||

| Total Return(b) | 20.35% | (16.11)% | 9.05% | 13.31% | 30.14% | ||||

| Ratios/Supplemental Data: | |||||||||

| Net assets, end of period (in thousands) | $173,754 | $153,897 | $204,799 | $201,200 | $199,123 | ||||

| Ratios to average net assets: | |||||||||

| Net expenses | 0.44% | 0.44% | 0.37% | 0.40% | 0.38% | ||||

| Gross expenses | 0.44% | 0.44% | 0.37% | 0.40% | 0.38% | ||||

| Net investment income | 1.99% | 2.46% | 2.93% | 1.31% | 2.02% | ||||

| Portfolio turnover rate | 9% | 16% | 17% | 20% | 15% | ||||

| Notes to Financial Highlights | |

| (a) | Per share values have been calculated using the average shares method. |

| (b) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| 100 | Financial Highlights |

| 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 | 12/31/19 | |||||

| Inception date | 5/27/35 | ||||||||

| Net asset value, beginning of period | $ 58.58 | $ 79.73 | $ 71.55 | $ 62.16 | $ 50.14 | ||||

| Income/(loss) from investment operations: | |||||||||

| Net investment income(a) | 0.80 | 0.72 | 0.72 | 0.64 | 0.71 | ||||

| Net realized and unrealized gains/(losses) on investments | 19.40 | (16.59) | 16.72 | 14.90 | 17.15 | ||||

| Total income/(loss) from investment operations | 20.20 | (15.87) | 17.44 | 15.54 | 17.86 | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.82) | (0.75) | (0.74) | (0.69) | (0.67) | ||||

| Net realized gains | (1.40) | (4.53) | (8.52) | (5.46) | (5.17) | ||||

| Total distributions | (2.22) | (5.28) | (9.26) | (6.15) | (5.84) | ||||

| Net asset value, end of period | $ 76.56 | $ 58.58 | $ 79.73 | $ 71.55 | $ 62.16 | ||||

| Total Return(b) | 34.49% | (19.87)% | 24.28% | 25.07% | 35.57% | ||||

| Ratios/Supplemental Data: | |||||||||

| Net assets, end of period (in thousands) | $3,636,415 | $2,912,901 | $3,965,156 | $3,419,765 | $2,979,222 | ||||

| Ratios to average net assets: | |||||||||

| Net expenses | 0.18% | 0.18% | 0.18% | 0.18% | 0.18% | ||||

| Gross expenses | 0.18% | 0.18% | 0.18% | 0.18% | 0.18% | ||||

| Net investment income | 1.18% | 1.03% | 0.89% | 0.99% | 1.20% | ||||

| Portfolio turnover rate | 22% | 29% | 26% | 25% | 17% | ||||

| Notes to Financial Highlights | |

| (a) | Per share values have been calculated using the average shares method. |

| (b) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and do not include the effect of insurance contract charges. Past performance does not guarantee future results. |

| Financial Highlights | 101 |

| 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 | 12/31/19 | |||||

| Inception date | 1/1/88 | ||||||||

| Net asset value, beginning of period | $ 17.02 | $ 21.68 | $ 20.97 | $ 19.54 | $ 17.02 | ||||

| Income/(loss) from investment operations: | |||||||||

| Net investment income(a) | 0.45 | 0.35 | 0.34 | 0.37 | 0.41 | ||||

| Net realized and unrealized gains/(losses) on investments | 2.29 | (3.67) | 2.08 | 2.02 | 2.93 | ||||

| Total income/(loss) from investment operations | 2.74 | (3.32) | 2.42 | 2.39 | 3.34 | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.41) | (0.42) | (0.42) | (0.38) | (0.42) | ||||

| Net realized gains | (0.08) | (0.92) | (1.29) | (0.58) | (0.40) | ||||

| Total distributions | (0.49) | (1.34) | (1.71) | (0.96) | (0.82) | ||||

| Net asset value, end of period | $ 19.27 | $ 17.02 | $ 21.68 | $ 20.97 | $ 19.54 | ||||

| Total Return(b) | 16.13% | (15.31)% | 11.56% | 12.23% | 19.58% | ||||

| Ratios/Supplemental Data: | |||||||||

| Net assets, end of period (in thousands) | $176,538 | $166,006 | $211,716 | $205,144 | $199,011 | ||||

| Ratios to average net assets: | |||||||||

| Net expenses | 0.32% | 0.33% | 0.30% | 0.31% | 0.30% | ||||

| Gross expenses | 0.34% | 0.34% | 0.30% | 0.31% | 0.30% | ||||

| Net investment income | 2.47% | 1.83% | 1.53% | 1.88% | 2.20% | ||||

| Portfolio turnover rate | 45% (c) | 49% (c) | 41% (c) | 56% (c) | 162% | ||||

| Notes to Financial Highlights | |

| (a) | Per share values have been calculated using the average shares method. |

| (b) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| (c) | The portfolio turnover calculated for the fiscal years ended 12/31/23, 12/31/22, 12/31/21 and 12/31/20 did not include To-Be-Announced transactions and, if it had, the portfolio turnover would have been 125%, 116%, 90% and 136%, respectively. |

| 102 | Financial Highlights |

| 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 | 12/31/19 | ||||||

| Inception date | 1/1/80 | |||||||||

| Net asset value, beginning of period | $ 10.13 | $ 11.47 | $ 11.67 | $ 11.54 | $ 11.19 | |||||

| Income/(loss) from investment operations: | ||||||||||

| Net investment income(a) | 0.34 | 0.31 | 0.31 | 0.37 | 0.38 | |||||

| Net realized and unrealized gains/(losses) on investments | 0.18 | (1.28) | (0.14) | 0.17 | 0.41 | |||||

| Total income/(loss) from investment operations | 0.52 | (0.97) | 0.17 | 0.54 | 0.79 | |||||

| Contribution from affiliate (Note 5) | 0.00 (b) | — | — | — | — | |||||

| Less distributions from: | ||||||||||

| Net investment income | (0.39) | (0.37) | (0.37) | (0.41) | (0.44) | |||||

| Total distributions | (0.39) | (0.37) | (0.37) | (0.41) | (0.44) | |||||

| Net asset value, end of period | $ 10.26 | $ 10.13 | $ 11.47 | $ 11.67 | $ 11.54 | |||||

| Total Return(c) | 5.31% | (8.44)% | 1.44% | 4.77% | 7.13% | |||||

| Ratios/Supplemental Data: | ||||||||||

| Net assets, end of period (in thousands) | $1,009,908 | $1,047,236 | $1,250,501 | $1,341,617 | $1,377,821 | |||||

| Ratios to average net assets: | ||||||||||

| Net expenses | 0.21% | 0.21% | 0.21% | 0.21% | 0.20% | |||||

| Gross expenses | 0.21% | 0.21% | 0.21% | 0.21% | 0.20% | |||||

| Net investment income | 3.37% | 2.96% | 2.65% | 3.24% | 3.35% | |||||

| Portfolio turnover rate | 79% | 43% | 42% | 41% | 25% | |||||

| Notes to Financial Highlights | |

| (a) | Per share values have been calculated using the average shares method. |

| (b) | Rounds to less than $0.005. |

| (c) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| Financial Highlights | 103 |

| 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 | 12/31/19 | |||||

| Inception date | 12/31/84 | ||||||||

| Net asset value, beginning of period | $ 9.68 | $ 11.67 | $ 12.25 | $ 11.74 | $ 11.02 | ||||

| Income/(loss) from investment operations: | |||||||||

| Net investment income(a) | 0.34 | 0.25 | 0.24 | 0.29 | 0.32 | ||||

| Net realized and unrealized gains/(losses) on investments | 0.19 | (1.80) | (0.38) | 0.63 | 0.73 | ||||

| Total income/(loss) from investment operations | 0.53 | (1.55) | (0.14) | 0.92 | 1.05 | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.36) | (0.27) | (0.27) | (0.34) | (0.33) | ||||

| Net realized gains | — | (0.17) | (0.17) | (0.07) | — | ||||

| Total distributions | (0.36) | (0.44) | (0.44) | (0.41) | (0.33) | ||||

| Net asset value, end of period | $ 9.85 | $ 9.68 | $ 11.67 | $ 12.25 | $ 11.74 | ||||

| Total Return(b) | 5.78% | (13.47)% | (1.19)% | 8.03% | 9.50% | ||||

| Ratios/Supplemental Data: | |||||||||

| Net assets, end of period (in thousands) | $146,043 | $160,286 | $218,824 | $244,329 | $233,663 | ||||

| Ratios to average net assets: | |||||||||

| Net expenses | 0.33% | 0.32% | 0.29% | 0.27% | 0.29% | ||||

| Gross expenses | 0.34% | 0.32% | 0.29% | 0.27% | 0.29% | ||||

| Net investment income | 3.51% | 2.41% | 2.03% | 2.44% | 2.77% | ||||

| Portfolio turnover rate | 53% (c) | 40% (c) | 71% (c) | 108% (c) | 107% | ||||

| Notes to Financial Highlights | |

| (a) | Per share values have been calculated using the average shares method. |

| (b) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and do not include the effect of insurance contract charges. Past performance does not guarantee future results. |

| (c) | The portfolio turnover calculated for the fiscal years ended 12/31/23, 12/31/22 and 12/31/21 did not include To-Be-Announced transactions and, if it had, the portfolio turnover would have been 268%, 187%, and 184%, respectively. |

| 104 | Financial Highlights |

| 12/31/23 | 12/31/22 | 12/31/21 | 12/31/20 | 12/31/19 | |||||

| Inception date | 6/13/90 | ||||||||

| Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | ||||

| Income/(loss) from investment operations: | |||||||||

| Net investment income(a) | 0.05 | 0.01 | — | 0.00 (b) | 0.02 | ||||

| Total income from investment operations | 0.05 | 0.01 | — | 0.00 (b) | 0.02 | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.05) | (0.01) | — | (0.00) (b) | (0.02) | ||||

| Total distributions | (0.05) | (0.01) | — | (0.00) (b) | (0.02) | ||||

| Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | ||||

| Total Return(c) | 4.89% | 1.45% | —% | 0.32% | 1.99% | ||||

| Ratios/Supplemental Data: | |||||||||

| Net assets, end of period (in thousands) | $147,062 | $159,127 | $142,430 | $153,251 | $128,561 | ||||

| Ratios to average net assets: | |||||||||

| Net expenses | 0.26% | 0.24% | 0.09% | 0.19% | 0.26% | ||||

| Gross expenses | 0.26% | 0.27% | 0.26% | 0.25% | 0.26% | ||||

| Net investment income | 4.77% | 1.50% | —% | 0.30% | 1.96% | ||||

| Notes to Financial Highlights | |

| (a) | Per share values have been calculated using the average shares method. |

| (b) | Rounds to less than $0.005. |

| (c) | Total returns are historical and assume changes in share price, reinvestment of dividends and capital gains distributions and assume no sales charge. Past performance does not guarantee future results. |

| Financial Highlights | 105 |

| Elfun

International Equity Fund |

Elfun

Trusts | ||

| Assets | |||

| Investments in unaffiliated securities, at fair value (cost $118,105,299; $1,608,899,978; $108,506,252; $986,086,424; $144,162,041 and $0, respectively) | $ 170,915,269 | $ 3,588,856,288 | |

| Short-term investments, at fair value (cost $0; $0; $0; $0; $0 and $88,855,732, respectively) | — | — | |

| Investments in affiliated securities, at fair value (cost $2,709,283; $46,213,083; $46,484,469; $4,577,263; $20,710,832 and $0, respectively) | 2,709,283 | 46,213,083 | |

| Repurchase agreements | — | — | |

| Cash | — | — | |

| Net cash collateral on deposit with broker for future contracts | 2,372 | — | |

| Foreign currency (cost $2,306, $0, $32,020, $0, $0 and $0, respectively) | 2,306 | — | |

| Receivable for investments sold | — | — | |

| Income receivables | 484,406 | 3,797,921 | |

| Receivable for fund shares sold | 1,239 | 387,698 | |

| Income receivable from affiliated investments | 19,300 | 164,266 | |

| Receivable for accumulated variation margin on swap contracts | — | — | |

| Receivable for accumulated variation margin on futures contracts | 21,025 | — | |

| Prepaid expenses and other assets | 464 | 9,162 | |

| Total assets | 174,155,664 | 3,639,428,418 | |

| Liabilities | |||

| Distribution payable to shareholders | — | — | |

| Net cash collateral on futures contracts due to broker | — | — | |

| Net cash collateral on swap contracts due to broker | — | — | |

| Payable for investments purchased | — | — | |

| Payable for fund shares redeemed | 220,273 | 2,328,472 | |

| Payable to the Adviser | 24,489 | 407,857 | |

| Payable for custody, fund accounting and sub-administration fees | 9,493 | 72,781 | |

| Accrued other expenses | 147,375 | 204,715 | |

| Total liabilities | 401,630 | 3,013,825 | |

| Net Assets | $ 173,754,034 | $ 3,636,414,593 | |

| Net Assets Consist of: | |||

| Capital paid in | $ 123,137,919 | $ 1,628,813,590 | |

| Total distributable earnings (loss) | 50,616,115 | 2,007,601,003 | |

| Net Assets | $ 173,754,034 | $ 3,636,414,593 | |

| Shares outstanding (Par value $10; $10; $10; $10; $10; and $1, respectively; unlimited shares authorized) | 7,021,303 | 47,497,079 | |

| Net asset value, offering and redemption price per share | $ 24.75 | $ 76.56 | |

| 106 | Statements of Assets and Liabilities |

| Elfun

Diversified Fund |

Elfun

Tax-Exempt Income Fund |

Elfun

Income Fund |

Elfun

Government Money Market Fund | |||

| $ 130,268,764 | $ 1,009,798,273 | $ 135,935,896 | $ — | |||

| — | — | — | 88,855,732 | |||

| 52,058,016 | 4,577,263 | 20,710,832 | — | |||

| — | — | — | 61,124,000 | |||

| — | — | — | 328 | |||

| — | — | — | — | |||

| 37,171 | — | — | — | |||

| 3,143,406 | — | 10,476,430 | — | |||

| 434,125 | 13,335,526 | 1,045,165 | — | |||

| 1,135 | 58,764 | 24,589 | 242,493 | |||

| 62,550 | 54,797 | 101,358 | 280,821 | |||

| 75,398 | — | 208,293 | — | |||

| 488,656 | — | 1,389,405 | — | |||

| 481 | 2,827 | 416 | 407 | |||

| 186,569,702 | 1,027,827,450 | 169,892,384 | 150,503,781 | |||

| — | 920,947 | 108,930 | 48,266 | |||

| 469,721 | — | 1,674,526 | — | |||

| 75,946 | — | 169,302 | — | |||

| 9,277,237 | 16,064,739 | 21,742,316 | 2,948,300 | |||

| 80,748 | 648,445 | 43,279 | 351,630 | |||

| 23,358 | 136,448 | 19,494 | 12,688 | |||

| 10,256 | 21,095 | 4,040 | 12,519 | |||

| 94,315 | 128,185 | 87,394 | 68,796 | |||

| 10,031,581 | 17,919,859 | 23,849,281 | 3,442,199 | |||

| $ 176,538,121 | $ 1,009,907,591 | $ 146,043,103 | $ 147,061,582 | |||

| $ 151,622,592 | $ 1,103,546,200 | $ 174,759,902 | $ 147,061,550 | |||

| 24,915,529 | (93,638,609) | (28,716,799) | 32 | |||

| $ 176,538,121 | $ 1,009,907,591 | $ 146,043,103 | $ 147,061,582 | |||

| 9,162,431 | 98,429,229 | 14,829,968 | 147,061,530 | |||

| $ 19.27 | $ 10.26 | $ 9.85 | $ 1.00 | |||

| Statements of Assets and Liabilities | 107 |

| Elfun

International Equity Fund |

Elfun

Trusts | ||

| Investment Income | |||

| Income | |||

| Dividend | $ 3,930,153 | $ 41,436,234 | |

| Interest | — | — | |

| Income from affiliated investments | 193,121 | 2,890,491 | |

| Less: Foreign taxes withheld | (120,979) | (38,256) | |

| Total income | 4,002,295 | 44,288,469 | |

| Expenses | |||

| Advisory and administration fees | 346,858 | 4,574,863 | |

| Blue Sky fees | 33,186 | 36,970 | |

| Transfer agent fees | 121,110 | 550,928 | |

| Trustees' fees | 22,405 | 48,221 | |

| Custody, fund accounting and sub-administration fees | 56,622 | 426,037 | |

| Professional fees | 102,910 | 50,317 | |

| Printing and shareholder reports | 3,528 | 19,539 | |

| Registration fees | — | 2,567 | |

| Other expenses | 35,021 | 58,704 | |

| Total expenses before waivers | 721,640 | 5,768,146 | |

| Fees waived and/or reimbursed by the adviser | — | — | |

| Net expenses | 721,640 | 5,768,146 | |

| Net investment income (loss) | $ 3,280,655 | $ 38,520,323 | |

| Net Realized and Unrealized Gain (Loss) on Investments | |||

| Realized gain (loss) on: | |||

| Unaffiliated investments | $ 608,838 | $ 66,873,485 | |

| Affiliated investments | — | — | |

| Futures | 166,377 | — | |

| Swap contracts | — | — | |

| Foreign currency transactions | (80,969) | — | |

| Increase (decrease) in unrealized appreciation/depreciation on: | |||

| Unaffiliated investments | 26,298,605 | 864,081,688 | |

| Affiliated investments | — | — | |

| Futures | 27,002 | — | |

| Swap contracts | — | — | |

| Foreign currency translations | 76,855 | — | |

| Net realized and unrealized gain (loss) on investments | 27,096,708 | 930,955,173 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ 30,377,363 | $ 969,475,496 |

| 108 | Statements of Operations |

| Elfun

Diversified Fund |

Elfun

Tax-Exempt Income Fund |

Elfun

Income Fund |

Elfun

Government Money Market Fund | |||

| $ 1,273,905 | $ — | $ 8,544 | $ — | |||

| 1,696,750 | 36,040,105 | 4,432,765 | 7,539,874 | |||

| 1,850,322 | 568,445 | 1,394,546 | — | |||

| (349) | — | (114) | — | |||

| 4,820,628 | 36,608,550 | 5,835,741 | 7,539,874 | |||

| 293,012 | 1,636,828 | 258,174 | 149,600 | |||

| 32,555 | 31,672 | 31,386 | 27,093 | |||

| 102,803 | 226,745 | 111,610 | 78,946 | |||

| 22,486 | 29,971 | 22,366 | 22,245 | |||

| 78,513 | 152,026 | 51,550 | 67,439 | |||

| 46,238 | 44,447 | 39,031 | 26,566 | |||

| 460 | 5,214 | 368 | 14,277 | |||

| — | 730 | — | — | |||

| 8,576 | 20,643 | 9,434 | 2,540 | |||

| 584,643 | 2,148,276 | 523,919 | 388,706 | |||

| (27,233) | — | (20,958) | — | |||

| 557,410 | 2,148,276 | 502,961 | 388,706 | |||

| $ 4,263,218 | $ 34,460,274 | $ 5,332,780 | $ 7,151,168 | |||

| $ 487,194 | $ (22,004,512) | $ (7,135,536) | $ 28 | |||

| (129,925) | — | — | — | |||

| (583,911) | — | (1,701,442) | — | |||

| 210,019 | — | 509,179 | — | |||

| — | — | — | — | |||

| 15,765,563 | 39,230,213 | 9,922,410 | — | |||

| 5,125,825 | — | — | — | |||

| 505,446 | — | 1,342,451 | — | |||

| (41,324) | — | (79,001) | — | |||

| 3,356 | — | — | — | |||

| 21,342,243 | 17,225,701 | 2,858,061 | 28 | |||

| $ 25,605,461 | $ 51,685,975 | $ 8,190,841 | $ 7,151,196 |

| Statements of Operations | 109 |

| Elfun International Equity Fund | Elfun Trusts | ||||||

| Year

Ended December 31, 2023 |

Year

Ended December 31, 2022 |

Year

Ended December 31, 2023 |

Year

Ended December 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations: | |||||||

| Net investment income (loss) | $ 3,280,655 | $ 4,093,389 | $ 38,520,323 | $ 34,301,058 | |||

| Net realized gain (loss) on investments, futures, swap contracts and foreign currency transactions | 694,246 | 1,012,444 | 66,873,485 | 29,082,241 | |||

| Net increase (decrease) in unrealized appreciation/depreciation on investments, futures, swap contracts and foreign currency translations | 26,402,462 | (38,191,968) | 864,081,688 | (838,339,517) | |||

| Net increase (decrease) from operations | 30,377,363 | (33,086,135) | 969,475,496 | (774,956,218) | |||

| Distributions to shareholders: | |||||||

| Total distributions | (3,335,403) | (10,109,923) | (103,313,728) | (244,921,749) | |||

| Increase (decrease) in assets from operations and distributions | 27,041,960 | (43,196,058) | 866,161,768 | (1,019,877,967) | |||

| Share transactions: | |||||||

| Proceeds from sale of shares | 1,123,363 | 1,319,728 | 29,812,242 | 46,867,193 | |||

| Value of distributions reinvested | 2,845,714 | 8,739,289 | 83,869,293 | 199,361,109 | |||

| Cost of shares redeemed | (11,153,754) | (17,765,665) | (256,330,188) | (278,604,671) | |||

| Net increase (decrease) from share transactions | (7,184,677) | (7,706,648) | (142,648,653) | (32,376,369) | |||

| Contribution from affiliate (Note 5) | — | — | — | — | |||

| Total increase (decrease) in net assets | 19,857,283 | (50,902,706) | 723,513,115 | (1,052,254,336) | |||

| Net Assets | |||||||

| Beginning of year | 153,896,751 | 204,799,457 | 2,912,901,478 | 3,965,155,814 | |||

| End of year | $ 173,754,034 | $ 153,896,751 | $ 3,636,414,593 | $ 2,912,901,478 | |||

| Changes in Fund Shares | |||||||

| Shares sold | 48,534 | 57,624 | 431,748 | 682,298 | |||

| Issued for distributions reinvested | 116,342 | 414,965 | 1,095,731 | 3,419,573 | |||

| Shares redeemed | (481,778) | (796,024) | (3,752,164) | (4,109,858) | |||

| Net increase (decrease) in fund shares | (316,902) | (323,435) | (2,224,685) | (7,987) | |||

| 110 | Statements of Changes in Net Assets |

| Elfun Diversified Fund | Elfun Tax-Exempt Income Fund | |||||

| Year

Ended December 31, 2023 |

Year

Ended December 31, 2022 |

Year

Ended December 31, 2023 |

Year

Ended December 31, 2022 | |||

| $ 4,263,218 | $ 3,341,934 | $ 34,460,274 | $ 32,745,446 | |||

| (16,623) | 2,862,030 | (22,004,512) | (38,399,737) | |||

| 21,358,866 | (38,242,543) | 39,230,213 | (97,949,642) | |||

| 25,605,461 | (32,038,579) | 51,685,975 | (103,603,933) | |||

| (4,450,469) | (12,253,898) | (39,868,126) | (39,613,148) | |||

| 21,154,992 | (44,292,477) | 11,817,849 | (143,217,081) | |||

| 3,675,600 | 4,806,152 | 17,516,652 | 27,813,701 | |||

| 3,924,811 | 10,857,841 | 28,676,526 | 28,329,020 | |||

| (18,223,226) | (17,081,582) | (95,357,812) | (116,189,891) | |||

| (10,622,815) | (1,417,589) | (49,164,634) | (60,047,170) | |||

| — | — | 17,942 | — | |||

| 10,532,177 | (45,710,066) | (37,328,843) | (203,264,251) | |||

| 166,005,944 | 211,716,010 | 1,047,236,434 | 1,250,500,685 | |||

| $ 176,538,121 | $ 166,005,944 | $ 1,009,907,591 | $ 1,047,236,434 | |||

| 200,733 | 245,078 | 1,723,651 | 2,667,177 | |||

| 204,524 | 637,197 | 2,844,784 | 2,728,399 | |||

| (993,874) | (896,699) | (9,471,668) | (11,098,604) | |||

| (588,617) | (14,424) | (4,903,233) | (5,703,028) | |||

| Statements of Changes in Net Assets | 111 |

| Elfun Income Fund | Elfun

Government Money Market Fund | ||||||

| Year

Ended December 31, 2023 |

Year

Ended December 31, 2022 |

Year

Ended December 31, 2023 |

Year

Ended December 31, 2022 | ||||

| Increase (Decrease) in Net Assets | |||||||

| Operations: | |||||||

| Net investment income (loss) | $ 5,332,780 | $ 4,480,057 | $ 7,151,168 | $ 2,245,052 | |||

| Net realized gain (loss) on investments, futures and swap contracts | (8,327,799) | (10,985,019) | 28 | 211 | |||

| Net increase (decrease) in unrealized appreciation/depreciation on investments, futures and swap contracts | 11,185,860 | (22,359,867) | — | — | |||

| Net increase (decrease) from operations | 8,190,841 | (28,864,829) | 7,151,196 | 2,245,263 | |||

| Distributions to shareholders: | |||||||

| Total distributions | (5,736,339) | (7,501,246) | (7,151,430) | (2,245,052) | |||

| Increase (decrease) in assets from operations and distributions | 2,454,502 | (36,366,075) | (234) | 211 | |||

| Share transactions: | |||||||

| Proceeds from sale of shares | 3,850,491 | 10,181,575 | 49,228,579 | 76,139,491 | |||

| Value of distributions reinvested | 4,551,271 | 6,014,489 | 6,813,329 | 2,101,565 | |||

| Cost of shares redeemed | (25,099,421) | (38,368,027) | (68,107,558) | (61,544,131) | |||

| Net increase (decrease) from share transactions | (16,697,659) | (22,171,963) | (12,065,650) | 16,696,925 | |||

| Total increase (decrease) in net assets | (14,243,157) | (58,538,038) | (12,065,884) | 16,697,136 | |||

| Net Assets | |||||||

| Beginning of year | 160,286,260 | 218,824,298 | 159,127,466 | 142,430,330 | |||

| End of year | $ 146,043,103 | $ 160,286,260 | $ 147,061,582 | $ 159,127,466 | |||

| Changes in Fund Shares | |||||||

| Shares sold | 402,137 | 943,220 | 49,228,578 | 76,139,492 | |||

| Issued for distributions reinvested | 472,181 | 598,767 | 6,813,329 | 2,101,565 | |||

| Shares redeemed | (2,610,193) | (3,722,118) | (68,107,558) | (61,544,131) | |||

| Net increase (decrease) in fund shares | (1,735,875) | (2,180,131) | (12,065,651) | 16,696,926 | |||

| 112 | Statements of Changes in Net Assets |

| • | Equity investments (including preferred stocks and registered investment companies that are exchange-traded funds) traded on a recognized securities exchange for which market quotations are readily available are valued at the last sale price or official closing price, as applicable, on the primary market or exchange on which they trade. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last published sale price or at fair value. |

| • | Investments in registered investment companies (including money market funds) or other unitized pooled investment vehicles that are not traded on an exchange are valued at that day’s published net asset value (“NAV”) per share or unit. |

| • | Government and municipal fixed income securities are generally valued using quotations from independent pricing services or brokers. Certain government inflation-indexed securities may require a calculated fair valuation as the cumulative inflation is contained within the price provided by the pricing service or broker. For these securities, the inflation component of the price is “cleaned” from the pricing service or broker price utilizing the published inflation factors in order to ensure proper accrual of income. |

| • | Debt obligations (including short term investments and convertible debt securities) are valued using quotations from independent pricing services or brokers or are generally valued at the last reported evaluated prices. |

| Notes to Financial Statements | 113 |

| • | Exchange-traded futures contracts are valued at the closing settlement price on the primary market on which they are traded most extensively. Exchange-traded futures contracts traded on a recognized exchange for which there were no sales on that day are valued at the last reported sale price obtained from independent pricing services or brokers or at fair value. |

| • | Options on futures are priced at their last sale price on the principal market on which they are traded on the valuation date. If there were no sales on that day, options on futures are valued at either the last reported sale or official closing price on their primary exchange determined in accordance with the valuation policy and procedures approved by the Board. |

| • | Swap agreements are valued daily based upon prices supplied by Board approved pricing vendors or through brokers. Depending on the product and terms of the transaction, the value of agreements is determined using a series of techniques including valuation models that incorporate a number of market data factors, such as discounted cash flows, yields, curves, trades and values of the underlying reference instruments. In the event SSGA Funds Management, Inc. (the “Adviser” or “SSGA FM”) is unable to obtain an independent, third-party valuation the agreements will be fair valued. |

| • | Level 1 — Unadjusted quoted prices in active markets for an identical asset or liability; |

| • | Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability (such as exchange rates, financing terms, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs; and |

| • | Level 3 — Unobservable inputs for the asset or liability, including the Committee’s assumptions used in determining the fair value of investments. |

| 114 | Notes to Financial Statements |

| Notes to Financial Statements | 115 |

| 116 | Notes to Financial Statements |

| Fund | Strategies |

| Elfun International Equity Fund | Equitization of Cash |

| Elfun Diversified Fund | Management of Interest Rate Risk and Equitization of Cash |

| Elfun Income Fund | Management of Interest Rate Risk |

| Notes to Financial Statements | 117 |

| Asset Derivatives | ||||||

| Interest

Rate Risk |

Foreign

Exchange Risk |

Credit

Risk |

Equity

Risk |

Commodity

Risk |

Total | |

| Elfun International Equity Fund | ||||||

| Futures Contracts | $ — | $ — | $ — | $ 21,025 | $ — | $ 21,025 |

| Elfun Diversified Fund | ||||||

| Futures Contracts | $ 470,804 | $ — | $ — | $ 17,852 | $ — | $ 488,656 |

| Swap Contracts | — | — | 75,398 | — | — | 75,398 |

| Elfun Income Fund | ||||||

| Futures Contracts | $ 1,389,405 | $ — | $ — | $ — | $ — | $ 1,389,405 |

| Swap Contracts | — | — | 208,293 | — | — | 208,293 |

| Realized Gain (Loss) | ||||||

| Interest

Rate Risk |

Foreign

Exchange Risk |

Credit

Risk |

Equity

Risk |

Commodity

Risk |

Total | |

| Elfun International Equity Fund | ||||||

| Futures Contracts | $ — | $ — | $ — | $ 166,377 | $ — | $ 166,377 |

| Elfun Diversified Fund | ||||||

| Futures Contracts | $ (630,155) | $ — | $ — | $ 46,244 | $ — | $ (583,911) |

| Swap Contracts | — | — | 210,019 | — | — | 210,019 |

| Elfun Income Fund | ||||||

| Futures Contracts | $ (1,701,442) | $ — | $ — | $ — | $ — | $ (1,701,442) |

| Swap Contracts | — | — | 509,179 | — | — | 509,179 |

| Net Change in Unrealized Appreciation/Depreciation | ||||||

| Interest

Rate Risk |

Foreign

Exchange Risk |

Credit

Risk |

Equity

Risk |

Commodity

Risk |

Total | |

| Elfun International Equity Fund | ||||||

| Futures Contracts | $ — | $ — | $ — | $ 27,002 | $ — | $ 27,002 |

| Elfun Diversified Fund | ||||||

| Futures Contracts | $ 474,011 | $ — | $ — | $ 31,435 | $ — | $ 505,446 |

| Swap Contracts | — | — | (41,324) | — | — | (41,324) |

| Elfun Income Fund | ||||||

| Futures Contracts | $ 1,342,451 | $ — | $ — | $ — | $ — | $ 1,342,451 |

| Swap Contracts | — | — | (79,001) | — | — | (79,001) |

| 118 | Notes to Financial Statements |

| Fund | Management Fee |

| Elfun International Equity Fund | 0.21% |

| Elfun Trusts | 0.14% |

| Elfun Diversified Fund | 0.17% |

| Elfun Tax-Exempt Income Fund | 0.16% |

| Elfun Income Fund | 0.17% |

| Elfun Government Money Market Fund | 0.10% |

| Expiration Date | Amount |

| 12/31/2024 | $233,832 |

| 12/31/2025 | $ 43,973 |

| Notes to Financial Statements | 119 |

| U.S.

Government Obligations |

Other

Securities | ||||

| Fund | Purchases | Sales | Purchases | Sales | |

| Elfun International Equity Fund | $ — | $ — | $ 14,023,758 | $ 21,421,076 | |

| Elfun Trusts | — | — | 714,721,437 | 928,974,544 | |

| Elfun Diversified Fund | 17,464,780 | 21,732,111 | 52,598,136 | 57,554,857 | |

| Elfun Tax-Exempt Income Fund | — | — | 793,508,338 | 817,171,032 | |

| Elfun Income Fund | 381,073,547 | 395,504,055 | 19,091,609 | 27,550,764 | |

| Fund | Exempt

Income |

Ordinary

Income |

Long-Term

Capital Gains |

Total |

| Elfun International Equity Fund | $ — | $ 3,335,403 | $ — | $ 3,335,403 |

| Elfun Trusts | — | 56,486,542 | 46,827,186 | 103,313,728 |

| Elfun Diversified Fund | — | 3,740,490 | 709,979 | 4,450,469 |

| Elfun Tax-Exempt Income Fund | 39,197,233 | 670,893 | — | 39,868,126 |

| Elfun Income Fund | — | 5,736,339 | — | 5,736,339 |

| Elfun Government Money Market Fund | — | 7,151,430 | — | 7,151,430 |

| 120 | Notes to Financial Statements |

| Fund | Exempt

Income |

Ordinary

Income |

Long-Term

Capital Gains |

Total |

| Elfun International Equity Fund | $ — | $ 4,234,360 | $ 5,875,563 | $ 10,109,923 |

| Elfun Trusts | — | 41,029,943 | 203,891,806 | 244,921,749 |

| Elfun Diversified Fund | — | 4,049,986 | 8,203,912 | 12,253,898 |

| Elfun Tax-Exempt Income Fund | 39,349,026 | 264,122 | — | 39,613,148 |

| Elfun Income Fund | — | 5,213,578 | 2,287,668 | 7,501,246 |

| Elfun Government Money Market Fund | — | 2,245,052 | — | 2,245,052 |

| Fund | Undistributed

Ordinary Income |

Tax

Exempt Income |

Capital

Loss Carryforwards |

Undistributed

long term gain |

Net

Unrealized Gains (Losses) |

Qualified

Late-Year Losses |

Total |

| Elfun International Equity Fund | $ 58,234 | $ — | $ (1,127,928) | $ — | $ 51,685,809 | $— | $ 50,616,115 |

| Elfun Trusts | 4,563,844 | — | — | 28,663,863 | 1,974,373,296 | — | 2,007,601,003 |

| Elfun Diversified Fund | 652,785 | — | — | 1,193,506 | 23,069,238 | — | 24,915,529 |

| Elfun Tax-Exempt Income Fund | — | 60,437 | (103,997,585) | — | 10,298,539 | — | (93,638,609) |

| Elfun Income Fund | 16,758 | — | (19,805,726) | — | (8,927,831) | — | (28,716,799) |

| Elfun Government Money Market Fund | 32 | — | — | — | — | — | 32 |

| Fund | Non-Expiring

Short Term |

Non-Expiring

Long Term |

| Elfun International Equity Fund | $ — | $ 1,127,928 |

| Elfun Tax-Exempt Income Fund | 47,192,459 | 56,805,126 |

| Elfun Income Fund | 7,189,579 | 12,616,147 |

| Fund | Tax

Cost |

Gross

Unrealized Appreciation |

Gross

Unrealized Depreciation |

Net

Unrealized Appreciation (Depreciation) |

| Elfun International Equity Fund | $ 121,983,542 | $ 56,013,765 | $ 4,351,744 | $ 51,662,021 |

| Elfun Trusts | 1,660,696,076 | 1,987,000,244 | 12,626,949 | 1,974,373,295 |

| Elfun Diversified Fund | 159,824,579 | 27,137,917 | 4,073,828 | 23,064,089 |

| Elfun Tax-Exempt Income Fund | 1,004,076,997 | 22,949,226 | 12,650,687 | 10,298,539 |

| Elfun Income Fund | 167,165,641 | 1,991,793 | 10,919,624 | (8,927,831) |

| Elfun Government Money Market Fund | 149,979,732 | — | — | — |

| Notes to Financial Statements | 121 |

| 122 | Notes to Financial Statements |

| Notes to Financial Statements | 123 |

| 124 | Report of Independent Registered Public Accounting Firm |

| Amount | |

| Elfun Trusts | $46,827,186 |

| Elfun Diversified Fund | 709,979 |

| Amount | |

| Elfun International Equity Fund | $107,789 |

| Amount | |

| Elfun International Equity Fund | $3,939,298 |

| Amount | |

| Elfun Tax-Exempt Income Fund | $39,197,233 |

| Other Information | 125 |

| 126 | Other Information |

| Name,

Address, and Year of Birth |

Position(s)

Held with Funds |

Term

of Office and Length of Time Served |

Principal

Occupation During Past Five Years and Relevant Experience |

Number

of Funds in Fund Complex Overseen by Trustee† |

Other

Directorships Held by Trustee During Past Five Years |

| INDEPENDENT TRUSTEES | |||||

| Patrick

J. Riley c/o SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1948 |

Trustee

and Chairperson of the Board |

Term:

Indefinite Appointed: 4/16 Elected: 6/16 |

Associate

Justice of the Superior Court, Commonwealth of Massachusetts (2002 – May 2010); Partner, Riley, Burke & Donahue, L.L.P. (law firm) (1985 – 2002); Independent Director, State Street Global Advisors Europe (investment company) (1998 – 2023); Independent Director, SSGA Liquidity plc (formerly, SSGA Cash Management Fund plc) (1998 – 2023); Independent Director, SSGA Fixed Income plc (January 2009 – present); and Independent Director, SSGA Qualified Funds plc (January 2009 – 2019). |

54 | Board

Director and Chairman, SSGA SPDR ETFs Europe I, plc Board (2011 – March 2023); Board Director and Chairman, SPDR Europe II, plc (2013 – March 2023). Board Director, State Street Liquidity plc (1998 – March 2023). |

| John

R. Costantino c/o SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1946 |

Trustee

and Chairperson of the Qualified Legal Compliance Committee |

Term:

Indefinite Elected: 12/18 |

Executive,

Kleinfeld Bridal Corp. (January 2023 – present); Senior Advisor to NGN Capital LLC (January 2020 – present); Managing General Partner, NGN Capital LLC (2006 – December 2019). |

54 | Director

of Kleinfeld Bridal Corp. (January 2016 – present); Trustee of Neuroscience Research Institute (1986 – 2017); Trustee of Fordham University (1989 – 1995 and 2001 – 2007) and Trustee Emeritus (2007 – present); Trustee and Independent Chairperson of GE Funds (1993 – February 2011); Director, Muscular Dystrophy Association (2019-present); Trustee of Gregorian University Foundation (1992 – 2007); Chairman of the Board of Directors, Vivaldi Biosciences Inc. (May 2017 – present); Chairman of the Supervisory Board, Vivaldi Biosciences AG. (May 2017 – present); Trustee, Gallim Dance (December 2021 – present). |

| Other Information | 127 |

| Name,

Address, and Year of Birth |

Position(s)

Held with Funds |

Term

of Office and Length of Time Served |

Principal

Occupation During Past Five Years and Relevant Experience |

Number

of Funds in Fund Complex Overseen by Trustee† |

Other

Directorships Held by Trustee During Past Five Years |

| INDEPENDENT TRUSTEES (continued) | |||||

| Donna

M. Rapaccioli c/o SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1962 |

Trustee,

Chairperson of the Audit Committee, Vice-Chairperson of the Nominating Committee and Vice-Chairperson of the Governance Committee |

Term:

Indefinite Elected: 12/18 |

Dean

of the Gabelli School of Business (2007 – present) and Accounting Professor (1987 – present) at Fordham University. |

54 | Director-

Graduate Management Admissions Council (2015 – present); Trustee of Emmanuel College (2010 – 2019). |

| Michael

A. Jessee c/o SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1946 |

Trustee

and Chairperson of the Valuation Committee |

Term:

Indefinite Appointed: 7/16 Elected: 12/18 |

Retired;

formerly, President and Chief Executive Officer of the Federal Home Loan Bank of Boston (1989 – 2009); Trustee, Randolph-Macon College (2004 – 2016). |

54 | None. |

| Margaret

McLaughlin c/o SSGA Funds Management,Inc. One Iron Street Boston,MA 02210 YOB: 1967 |

Trustee,

Vice-Chairperson of the Audit Committee and Vice-Chairperson of the Qualified Legal Compliance Committee |

Term:

Indefinite Appointed: 9/22 |

Consultant,Bates

Group(consultants)(September 2020 – January 2023) consultant,Madison Dearborn Partners (private equity)(2019 – 2020) General Counsel/CCO, kramer Van Krik Credit strategies L.P./Mariana Systems LLC (Investment Adviser/SaaS Technology)(2011 – 2019) |

54 | Director,Manning

& Naiper Fund Inc(2021 – 2022) |

| George

M. Pereira c/o SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1964 |

Trustee,

Chairperson of the Nominating Committee and Chairperson of the Governance Committee |

Term:

Indefinite Appointed: 9/22 |

Chief

Operating Officer (January 2011 – September 2020) and Chief Financial Officer (November 2004 – September 2020), Charles Schwab Investment Management. |

54 | Director,

Pave Finance Inc. (May 2023 – present); Director, Pacific Premier Bancorp,Pacific Premier Bank(2021 – present) Director, Charles Schwab Asset Management (Ireland) Ltd., & Charles Schwab Worldwide Funds plc. (2005 – 2020); Director, Rotaplast International, Inc. . (non-profit providing free medical services to children worldwide) (2012 – 2018). |

| 128 | Other Information |

| Name,

Address, and Year of Birth |

Position(s)

Held with Funds |

Term

of Office and Length of Time Served |

Principal

Occupation During Past Five Years and Relevant Experience |

Number

of Funds in Fund Complex Overseen by Trustee† |

Other

Directorships Held by Trustee During Past Five Years |

| INDEPENDENT TRUSTEES (continued) | |||||

| Mark

E. Swanson c/o SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1963 |

Trustee

and Vice-Chairperson of the Valuation Committee |

Term:

Indefinite Appointed: 3/23 |

Treasurer, Chief Accounting Officer and Chief Financial Officer, Russell Investment Funds (“RIF”) (1998 – 2022); Global Head of Fund Services, Russell Investments (2013 – 2022); Treasurer, Chief Accounting Officer and Chief Financial Officer, Russell Investment Company (“RIC”) (1998 – 2022); President and Chief Executive Officer, RIF (2016 – 2017 and 2020 – 2022); President and Chief Executive Officer, RIC (2016 – 2017 and 2020 – 2022). | 54 | Director and President, Russell Investments Fund Services, LLC (2010 – 2023); Director, Russell Investment Management, LLC, Russell Investments Trust Company and Russell Investments Financial Services, LLC (2010 – 2023). |

| † | For the purpose of determining the number of portfolios overseen by the Trustees, “Fund Complex” comprises registered investment companies for which SSGA FM serves as investment adviser. |

| Other Information | 129 |

| Name,

Address, and Year of Birth |

Position(s)

Held with Funds |

Term

of Office and Length of Time Served |

Principal

Occupation During Past Five Years |

| OFFICERS | |||

| Ann

M. Carpenter SSGA Funds Management, Inc. One Iron Street Boston, MA 02210 YOB: 1966 |

President

and Principal Executive Officer; Deputy Treasurer |

Term:

Indefinite Served: since 10/12 Term: Indefinite Served: since 5/23 |

Chief