Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| Coeur Mining, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

|

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid:

| |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

104 South Michigan Avenue

Suite 900

Chicago, Illinois 60603

Dear Stockholder:

2014 was a challenging year for the precious metals sector and for Coeur stockholders. Many global economic factors negatively impacted silver and gold prices, which led to a significant decline in the price of Coeur’s shares.

In last year’s proxy statement, we noted that our focus in 2014 would be to leverage the investment made in our organization to further achieve and sustain operating excellence, identify cost and process efficiencies, and to maximize margins to enhance the quality of our portfolio.

During 2014, as we said we would, we reduced costs, improved efficiencies and repositioned our existing mines to be able to generate strong cash flow in the coming years. Late in 2014 and early in 2015, we announced two important acquisitions to further bolster our portfolio of silver and gold mines. We look forward to executing our strategy and to delivering strong results for our stockholders.

We proactively embarked on this overhaul beginning in 2012, which we continue to implement, and we believe your company now has a strong foundation and a solid strategy in place.

At this year’s Annual Meeting of Stockholders, the Board of Directors recommends you vote promptly on the following proposals to move Coeur forward:

| • | Elect our Board; |

| • | Authorize an amendment to our certificate of incorporation to increase the number of authorized shares of common stock from 150 million to 300 million shares; |

| • | Approve the adoption of the Coeur Mining, Inc. 2015 Long-Term Incentive Plan and the reservation of 8,431,419 shares of common stock for issuance under the terms of the plan; |

| • | Vote on an advisory resolution to approve executive compensation; |

| • | Ratify the appointment of KPMG LLP as our independent registered public accounting firm; and |

| • | Transact such other business that properly comes before the Annual Meeting and any adjournment or postponement thereof. |

We hope you will attend this year’s Annual Meeting of Stockholders, to be held at 104 S. Michigan Avenue, 2nd Floor Auditorium, Chicago, Illinois 60603 at 9:30 a.m., local time, on May 12, 2015.

Only stockholders of record at the close of business on March 16, 2015 are entitled to notice of, and to vote at, the Annual Meeting.

Respectfully,

MITCHELL J. KREBS,

President, Chief Executive Officer and Director

Chicago, Illinois

March 31, 2015

Table of Contents

COEUR MINING, INC.

104 South Michigan Avenue

Suite 900

Chicago, Illinois 60603

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

Notice is hereby given that our Annual Meeting of Stockholders will be held at 104 S. Michigan Avenue, 2nd Floor Auditorium, Chicago, Illinois 60603, on Tuesday, May 12, 2015, at 9:30 a.m., local time, for the following purposes:

1. To elect as directors the eight nominees named in the Proxy Statement to serve for the ensuing year and until their respective successors are duly elected and qualified;

2. To authorize an amendment to our certificate of incorporation to increase the number of authorized shares of common stock from 150 million to 300 million shares;

3. To approve the adoption of the 2015 Long-Term Incentive Plan and the reservation of 8,431,419 shares of common stock for issuance under the terms of the plan;

4. To vote on an advisory resolution to approve executive compensation;

5. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2015; and

6. To transact such other business as properly may come before the Annual Meeting.

The director nominees to be elected at the Annual Meeting are set forth in the enclosed Proxy Statement.

Only stockholders of record at the close of business on March 16, 2015, the record date fixed by the Board, are entitled to notice of, and to vote at, the Annual Meeting.

YOUR VOTE IS IMPORTANT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 12, 2015. OUR PROXY STATEMENT IS ATTACHED. FINANCIAL AND OTHER INFORMATION CONCERNING COEUR MINING, INC. IS CONTAINED IN OUR 2014 ANNUAL REPORT TO STOCKHOLDERS. YOU MAY ACCESS THIS PROXY STATEMENT AND OUR 2014 ANNUAL REPORT TO STOCKHOLDERS AT www.edocumentview.com/cde.

Please vote and submit your proxy to ensure the presence of a quorum, even if you cannot attend the Annual Meeting of Stockholders.

Stockholders of record may vote:

1. By Internet: go to www.envisionreports.com/cde;

2. By toll-free telephone: call 1-800-652-8683; or

3. By mail (if you received a paper copy of the proxy materials by mail): mark, sign, date and promptly mail the enclosed proxy card in the postage-paid envelope.

Beneficial (“Street Name”) Stockholders. If your shares are held in the name of a broker, bank or other holder of record, follow the voting instructions you receive from the holder of record to vote your shares.

| By order of the Board of Directors,

|

|

|

|

CASEY M. NAULT |

| Senior Vice President, General Counsel and Secretary |

Chicago, Illinois

March 31, 2015

Table of Contents

| 1 | ||||

| 5 | ||||

| 7 | ||||

| 12 | ||||

| PROPOSAL NO. 3: ADOPTION OF THE 2015 LONG-TERM INCENTIVE PLAN |

14 | |||

| PROPOSAL NO. 4: ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION |

24 | |||

| PROPOSAL NO. 5: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

26 | |||

| 27 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 63 | ||||

| 64 | ||||

| 66 | ||||

| NARRATIVE DISCLOSURE TO SUMMARY COMPENSATION TABLE AND GRANTS OF PLAN-BASED AWARDS TABLE |

67 | |||

| 68 | ||||

| 69 | ||||

| 69 | ||||

| 70 | ||||

| 73 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 75 | ||||

| 75 | ||||

| APPENDIX A—AMENDMENT TO CERTIFICATE OF INCORPORATION |

A-1 | |||

| APPENDIX B— COEUR MINING, INC. 2015 LONG-TERM INCENTIVE PLAN |

B-1 | |||

| APPENDIX C—CERTAIN ADDITIONAL INFORMATION |

C-1 | |||

i

Table of Contents

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

| Time and Date: |

9:30 a.m., Chicago time, on Tuesday, May 12, 2015 | |

| Place: |

104 S. Michigan Avenue, 2nd Floor Auditorium, Chicago, Illinois 60603 | |

| Record Date: |

March 16, 2015 | |

| Voting: |

Holders of common stock as of the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. | |

| Entry: |

You are entitled to attend the Annual Meeting only if you were a Coeur stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. | |

| You should be prepared to present valid photo identification for admittance. If you do not provide photo identification, you will not be admitted to the Annual Meeting. Please let us know if you plan to attend the meeting by marking the appropriate box on the enclosed proxy card if you requested to receive printed proxy materials, or, if you vote by telephone or over the internet, by indicating your plans when prompted. | ||

Voting Matters

| Proposal |

Coeur Board Voting Recommendation |

Page Reference (for more detail) | ||||

| (1) |

Election of eight directors | FOR each nominee | 7 | |||

| (2) |

Authorize an amendment to certificate of incorporation to increase authorized shares of common stock | FOR | 12 | |||

| (3) |

Approve the adoption of the 2015 Long-Term Incentive Plan | FOR | 14 | |||

| (4) |

Vote on an advisory resolution to approve executive compensation | FOR | 24 | |||

| (5) |

Ratification of the appointment of KPMG LLP as Coeur’s independent registered public accounting firm for fiscal 2015 | FOR | 26 | |||

1

Table of Contents

2014 Performance and Compensation Summary

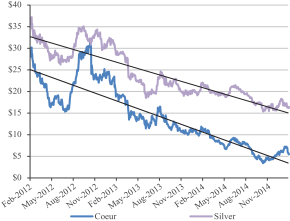

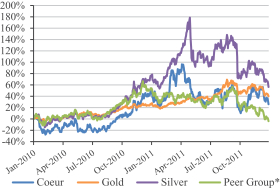

| • | The price of Coeur’s shares declined during 2014, primarily due to weak silver and gold prices. |

| • | We demonstrated the ability to execute our strategic plan during 2014. Although our 2014 objectives were largely achieved, many of our initiatives require more than one year to be fully implemented. |

| • | We anticipate that, with continued execution of our plan and initiatives, we will see further reductions in costs, higher operating margins, and strong cash flow from our portfolio of silver and gold mines. |

| • | As the benefits of our strategy are realized, we believe Coeur’s stock price will increase in value. |

| 2014 and Early 2015 Achievements |

||||

| 2014 production of 32.2 million AgEq* ounces, at high-end of guidance | ||||

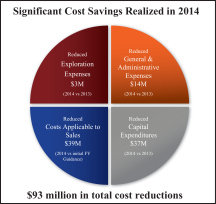

| Achieved significant cost savings YOY, including a 26% reduction in G&A, 36% lower capital expenditures, 10% decline in exploration spending, and costs applicable to sales 8% below initial 2014 guidance. | ||||

| 2014 Rochester production increased 50% and 45% for silver and gold, respectively, and costs per ton processed declined 31% from the prior year |

| |||

| New stream agreement with Franco-Nevada expected to significantly improve Palmarejo’s cash flow when current agreement ends | ||||

| Underground mining rates at Palmarejo’s Guadalupe deposit continue to increase, averaging ~500 ore tons per day YTD in 2015 and are expected to reach 1,500 ore tons per day by 3Q | ||||

| Significant mining cost reductions at Kensington during 2H 2014 as a result of strong throughput and robust grade; Kensington production and cost performance expected to continue in 2015 | ||||

| Announced acquisition of Paramount Gold and Silver; commenced tunnel to Independencia / Don Ese and expect to reach Don Ese by year-end assuming transaction closes | ||||

| Wharf acquisition closed February 20, 2015, six weeks earlier than expected |

| * | For purposes of silver equivalence, a 60:1 silver to gold ratio is used. |

2

Table of Contents

3

Table of Contents

Director Nominees

The following table provides summary information about each director nominee.

| Membership on Standing Committees | ||||||||||||||||||||||||

| Name | Age | Director Since |

Independent | AC | CC | NCGC | EHSSR | EC | ||||||||||||||||

| Robert E. Mellor (Chairman) |

71 | 1998 | YES | ü | C | C | ||||||||||||||||||

| Linda L. Adamany |

63 | 2013 | YES | C | ü | |||||||||||||||||||

| Kevin S. Crutchfield |

54 | 2013 | YES | ü | ü | |||||||||||||||||||

| Sebastian Edwards |

61 | 2007 | YES | ü | ü | |||||||||||||||||||

| Randolph E. Gress |

59 | 2013 | YES | ü | ü | |||||||||||||||||||

| Mitchell J. Krebs |

43 | 2011 | NO | ü | ||||||||||||||||||||

| John H. Robinson |

64 | 1998 | YES | ü | C | ü | ü | |||||||||||||||||

| J. Kenneth Thompson |

63 | 2002 | YES | ü | ü | C | ü | |||||||||||||||||

| AC |

Audit Committee | |||||||||||||||||

| C |

Committee Chairperson | |||||||||||||||||

| CC |

Compensation Committee | |||||||||||||||||

| EC |

Executive Committee | |||||||||||||||||

| EHSSR |

Environmental, Health, Safety and Social Responsibility Committee | |||||||||||||||||

| NCGC |

Nominating and Corporate Governance Committee | |||||||||||||||||

Each director nominee serves as a current director and attended at least 87% of all meetings of the board of directors and each committee on which she or he sat during 2014.

4

Table of Contents

COEUR MINING, INC.

PROXY STATEMENT

2015 ANNUAL MEETING OF STOCKHOLDERS

MAY 12, 2015

This proxy statement is furnished in connection with the solicitation by our Board of Directors of proxies of stockholders for shares to be voted at the Annual Meeting of Stockholders to be held at 104 S. Michigan Avenue, 2nd Floor Auditorium, Chicago, Illinois 60603, on Tuesday, May 12, 2015, at 9:30 a.m., and any and all adjournments or postponements thereof. This proxy statement and the accompanying proxy are first being made available to our stockholders on or about March 31, 2015.

Important Notice Regarding the Internet Availability of Proxy Materials — Our Proxy Statement and Annual Report to Stockholders are available at www.edocumentview.com/cde.

Stockholders entitled to vote

All stockholders of record as of the close of business on March 16, 2015 are entitled to vote at the Annual Meeting and any adjournment or postponement thereof upon the matters listed in the Notice of Annual Meeting. Each stockholder is entitled to one vote for each share held of record on that date. As of the close of business on March 16, 2015, a total of 103,338,910 shares of our common stock were outstanding.

Shares represented by a signed proxy will be voted according to the instructions, if any, given in the proxy. Unless otherwise instructed, the person or persons named in the proxy will vote as recommended by the Board of Directors:

| • | FOR the election as directors of the eight nominees listed herein (or their substitutes in the event any of the nominees is unavailable for election); |

| • | FOR the amendment to Coeur’s certificate of incorporation to increase the number of authorized shares of common stock; |

| • | FOR the adoption of the 2015 Long-Term Incentive Plan; |

| • | FOR the advisory resolution to approve executive compensation; |

| • | FOR the ratification of KPMG LLP as our independent registered public accounting firm for 2015; and |

| • | in their discretion with respect to such other business as properly may come before the Annual Meeting and any adjournment or postponement thereof. |

Voting your shares

If you received a paper copy of the proxy materials by mail and wish to vote your proxy by mail, mark your vote on the enclosed proxy card and then follow the directions on the card. To vote your proxy using the Internet or by telephone, see the instructions set forth on the Notice of Annual Meeting of Stockholders included with this proxy statement or the Notice of Internet Availability of Proxy Materials mailed to our stockholders on or about March 31, 2015.

Revoking or changing your proxy

Stockholders of record may revoke their proxies or change voting instructions by: (1) voting in person at the Annual Meeting, or (2) submitting a later-dated vote at any time before the polls close by the Internet, telephone or mail, or by delivering instructions to our Corporate Secretary. If you hold your shares in street name (that is, through a broker, bank, or other nominee), you should contact that nominee if you wish to revoke or change previous voting instructions.

5

Table of Contents

No dissenters’ rights

Pursuant to applicable Delaware law, there are no dissenters’ or appraisal rights relating to the matters to be acted upon at the Annual Meeting.

Votes required to approve the proposals:

| Proposal |

Required Vote | |

| Election of directors |

Majority of votes cast for the nominees | |

| Amendment to certificate of incorporation to increase the number of authorized shares of common stock |

Majority of outstanding stock entitled to vote | |

| Adoption of the 2015 Long-Term Incentive Plan |

Majority of votes cast for the action | |

| Approval of advisory resolution on executive compensation |

Non-binding advisory vote - majority of votes cast for the action | |

| Ratification of independent auditors for 2015 |

Majority of votes cast for the action | |

Tabulation

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspectors of election appointed by us for the meeting.

Quorum, Broker Non-Votes and Abstentions

A majority of the voting power of all issued and outstanding stock entitled to vote at the Annual Meeting, represented at the meeting in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. With respect to Proposals No. 1, 2, 4 and 5, the inspectors of election will treat abstentions and broker non-votes as shares that are present and entitled to vote for purposes of determining the presence of a quorum but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. Thus, abstentions and broker non-votes will have no impact on the outcome of the vote for these proposals. By contrast, with respect to Proposal No. 3, abstentions will be treated as votes against the proposal in accordance with New York Stock Exchange rules. A broker non-vote occurs when a broker or other nominee that holds shares on behalf of a street name stockholder does not vote on a particular matter because it does not have discretionary authority to vote on that particular matter and has not received voting instructions from the street name stockholder.

Under the rules of the New York Stock Exchange, if you hold your shares in street name and do not provide voting instructions to the broker, bank or other nominee that holds your shares, the nominee has discretionary authority to vote on routine matters but not on non-routine matters. If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors (Proposal No. 1), the vote to approve the adoption of the 2015 Long-Term Incentive Plan and the reservation of 8,431,419 shares of common stock for issuance under the terms of the plan commencing in 2015 (Proposal No. 3), and the advisory resolution to approve executive compensation (Proposal No. 4), which are considered non-routine matters. The vote to authorize an amendment to our certificate of incorporation to increase the number of authorized shares of our common stock from 150 million to 300 million shares (Proposal No. 2) and the ratification of the appointment of the independent registered public accounting firm (Proposal No. 5) are considered routine matters.

Solicitation costs

We will bear the cost of soliciting proxies. Proxies may be solicited by directors, officers or regular employees in person or by telephone or electronic mail without special compensation. We have retained Morrow & Co. LLC, Stamford, Connecticut, to assist in the solicitation of proxies. Morrow & Co. LLC’s fee will be $8,000, plus out-of-pocket expenses.

6

Table of Contents

ELECTION OF DIRECTORS

Director and Nominee Experience and Qualifications

Our Board believes that the Board, as a whole, should possess a combination of skills, professional experience and diversity of viewpoints necessary to oversee our business. In addition, the Board believes that there are certain attributes that every director should possess, as reflected in the Board’s membership criteria summarized below. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and our current and future needs.

As set forth in our Corporate Governance Guidelines, the membership criteria include items relating to ethics, integrity and values, sound business judgment, strength of character, mature judgment, professional experience, industry knowledge, and diversity of viewpoints all in the context of an assessment of the perceived needs of the Board at that point in time. The Board, as a whole, should possess a variety of skills, occupational and personal backgrounds, experiences and perspectives necessary to oversee Coeur’s business. In addition, Board members generally should have relevant technical skills or financial acumen that demonstrates an understanding of the financial and operational aspects and associated risks of a large, complex organization like Coeur.

In evaluating director candidates and considering incumbent directors for renomination, the Board and the Nominating and Corporate Governance Committee have not formulated any specific minimum qualifications, but rather consider a variety of factors. These include each nominee’s independence, financial acumen, personal accomplishments, career specialization, and experience in light of the needs of Coeur. For incumbent directors, the factors also include past performance and term of service on the Board. Among other things, the Board has determined that it is important to have individuals with the following skills and experiences on the Board:

| Skill/Experience |

Relevance | |

| Leadership experience | Directors with experience in significant leadership positions possess strong abilities to motivate and manage others and identify and develop leadership qualities in others. | |

| Knowledge of our industry | Particularly as it relates to mining of silver and gold, provides better understanding of our business and strategy. | |

| Operations experience | Gives directors a practical understanding of developing, implementing and assessing our business strategy, operating plan and risk profile. | |

| Legal/ compliance experience | Facilitates assistance with the Board’s oversight of our legal and compliance matters. | |

| Financial/accounting experience | Specifically, knowledge of finance and financial reporting processes provides greater understanding in evaluating our capital structure and financial statements. | |

| Government/regulatory experience | We operate in a heavily regulated industry that is directly affected by governmental actions. | |

| Strategic planning experience | Facilitates review of our strategies and monitoring their implementation and results. | |

| Talent management experience | Valuable in helping us attract, motivate and retain top talent at Coeur. | |

| International experience | Relevant given our global presence, particularly in Latin America. | |

| Public company board service | Directors who have experience serving on other public company boards generally are well prepared to fulfill the Board’s responsibilities of overseeing and providing insight and guidance to management. | |

7

Table of Contents

Board Composition and Refreshment

The Board seeks to identify and retain directors with deep knowledge and experience in the mining and natural resources sectors while also including an appropriate number of directors with perspectives from other industries and experience. The mining sector, particularly precious metals mining, is cyclical, and stockholders and management benefit from the perspectives and experience of directors who have lead firms through several full business cycles. For instance, four of our seven independent directors have significant outside experience in the natural resources sector while others, such as our Chairman, bring significant business, risk management and financial experience.

Directors who have served on the Board for an extended period of time also provide important insight based on industry experience and a deep understanding of our long-term plans and strategic objectives. The Board believes that maintaining a balance between longer-serving directors with significant Coeur institutional knowledge and newer directors with complementary skills and expertise allows for natural turnover and an appropriate pace of Board refreshment. In 2013, four longstanding directors resigned or declined to seek re-election and three new independent directors — Messrs. Crutchfield and Gress and Ms. Adamany — were elected with Ms. Adamany also becoming Chair of the Audit Committee. If all of the nominees are elected to the Board, the average tenure of the directors will be approximately eight years.

Director Nomination Process

The Nominating and Corporate Governance Committee reviews and makes recommendations regarding the composition and size of the Board. The Nominating and Corporate Governance Committee is also responsible for developing and recommending Board membership criteria to the Board for approval. In identifying director candidates from time to time, the Nominating and Corporate Governance Committee may establish specific skills and experience that it believes we should seek in order to constitute a balanced and effective Board. The Nominating and Corporate Governance Committee assesses the effectiveness of its criteria when evaluating new director candidates and when assessing the composition of the Board. This assessment enables the Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as our needs evolve and change over time.

Majority Vote Standard for the Election of Directors

According to our Bylaws, in an uncontested election, each director will be elected by a vote of the majority of the votes cast, which means the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director.

If a nominee for director does not receive the vote of at least a majority of votes cast at the Annual Meeting, it is the policy of the Board that the Director must tender his or her resignation. The Nominating and Corporate Governance Committee will then make a recommendation to the Board whether to accept or reject the tendered resignation, or whether other action should be taken, taking into account all of the relevant facts and circumstances. The director who has tendered his or her resignation will not take part in the proceedings. For additional information, our Corporate Governance Guidelines are available on our website at www.coeur.com/company/corporate-governance/charters-and-policies, and to any stockholder who requests them.

Nominees

The eight persons named below have been nominated to be elected as directors at the Annual Meeting, each to serve for one year and until his or her successor is elected and qualified. All of the nominees were elected to the Board at the 2014 Annual Meeting. Proxies will be voted at the Annual Meeting, unless marked AGAINST, FOR the election of the eight persons named below. We do not contemplate that any of the persons named below will be unable, or will decline, to serve; however, if any such nominee is unable or declines to serve, the persons named in the accompanying proxy may vote for a substitute, or substitutes, in their discretion, or the Board may reduce its size.

8

Table of Contents

| Nominee |

Age | Director Since |

||||||

| Robert E. Mellor |

71 | 1998 | ||||||

| Chairman of the Board of Coeur Mining, Inc. since July 2011. Chairman, Chief Executive Officer and President of Building Materials Holding Corporation (distribution, manufacturing and sales of building materials and component products) from 1997 to January 2010, director from 1991 to January 2010; member of the board of directors of The Ryland Group, Inc. (national residential home builder) since 1999, lead director and member of the board of directors of Monro Muffler/Brake, Inc. (auto service provider) from 2002 to 2007 and re-appointed in 2010, and member of the board of directors of Stock Building Supply Holdings, Inc. (lumber and building materials distributor) since 2010. Mr. Mellor holds a Bachelor of Arts degree in Economics from Westminister College (Missouri) and a Juris Doctor from Southern Methodist University School of Law. As the former Chairman and Chief Executive Officer of Building Materials Holding Corporation, Mr. Mellor brings to the Board leadership, risk management, talent management, operations and strategic planning experience. Building Materials Holding Corporation filed a voluntary petition under the federal bankruptcy code in 2009 and emerged in 2010. Mr. Mellor also brings to the Board public company board experience through his service on the boards of The Ryland Group, Inc., Monro Muffler/Brake, Inc. and Stock Building Supply Holdings, Inc. | ||||||||

| Linda L. Adamany |

63 | 2013 | ||||||

| Non-executive director of Amec Foster Wheeler plc and its predecessor, AMEC plc (engineering, project management and consultancy company), since October 2012; member of the board of directors of Leucadia National Corporation since 2014 (diversified holding company engaged in a variety of businesses, including investment banking and capital markets, beef processing, manufacturing, energy projects, asset management and real estate) since March 2014; member of the board of directors of National Grid plc (electricity and gas generation, transmission and distribution company) from November 2006 to November 2012. Ms. Adamany served at BP plc in several capacities from July 1980 until her retirement in August 2007, most recently from April 2005 to August 2007 as a member of the five-person Refining & Marketing Executive Committee responsible for overseeing the day-to-day operations and human resource management of BP plc’s $45 billion Refining & Marketing business segment. Ms. Adamany also served BP plc as Executive Assistant to the Group Chief Executive from October 2002 to March 2005 and Chief Executive, BP Shipping from October 1999 to September 2002. Ms. Adamany is a CPA and holds a Bachelor of Science in Business Administration with a major in Accounting, awarded Magna cum Laude, from John Carroll University. With her over 35 years’ experience in global industries, including as an executive and a director, Ms. Adamany brings to the Board leadership, financial and accounting expertise, familiarity with both business line and functional support areas and experience in public company board leadership. | ||||||||

| Kevin S. Crutchfield |

54 | 2013 | ||||||

| Kevin S. Crutchfield is the Chairman (since May 2012) and Chief Executive Officer (since July 2009) of Alpha Natural Resources, Inc. (coal production). He has been with Alpha Natural Resources since its formation in 2003, serving as Executive Vice-President from November 2004 to January 2007, President from January 2007 to July 2009, Director since November 2007, Chief Executive Officer and most recently the additional responsibility of Chairman. Mr. Crutchfield is an over 25-year coal industry veteran with technical, operating and executive management experience. Mr. Crutchfield is currently the Vice Chairman of the National Mining Association and the Chairman of the American Coalition for Clean Coal Electricity. Prior to joining Alpha, he was President of Coastal Coal Co., LLC and Vice President of El Paso Corp. From 2000 to 2001, he served as President and CEO of AMVEST Minerals Corp. and President of the parent company, AMVEST Corp. Earlier in his career, he held senior management positions at Pittston Coal Co. and Cyprus Amax Coal Co, including a period in Australia as Chairman of Cyprus Australia Coal Corporation. Mr. Crutchfield also served on the board of directors at King | ||||||||

9

Table of Contents

| Nominee |

Age | Director Since |

||||||

| Pharmaceuticals, Inc. from February 2010 until the first quarter of 2011, when he resigned in connection with the acquisition of King Pharmaceuticals by Pfizer; and on the board of directors of Rice Energy, Inc. from January 2014 to November 2014, as a designated representative of Alpha Natural Resources, Inc. during the time period when Alpha Natural Resources, Inc. was entitled to board representation at Rice. Mr. Crutchfield brings to the board his experience in corporate leadership, financial and operational management, government and regulatory oversight, health and safety management, and industry expertise through his various executive roles in global natural resource businesses, in addition to experience in public company board leadership. | ||||||||

| Sebastian Edwards |

61 | 2007 | ||||||

| Henry Ford II Professor of International Business Economics at the University of California, Los Angeles (UCLA) from 1996 to present; Co-Director of the National Bureau of Economic Research’s Africa Project from 2009 to present; published twelve books, including two best-selling novels, and over 200 scholarly articles; taught at IAE Universidad Austral in Argentina and at the Kiel Institute from 2000 to 2004; Chief Economist for Latin America at the World Bank from 1993 to 1996. Mr. Edwards has been an advisor to numerous governments, financial institutions, and multinational companies and is a frequent commentator on economic matters in national and international media outlets and publications. Mr. Edwards was educated at the Universidad Católica de Chile where he became a Licenciado en Economía and earned an Ingeniero Comercial degree. He received an MA and PhD in economics from the University of Chicago. As a professor of International Business, as well as through various positions relating to Latin American economies, Mr. Edwards brings to the Board international, government, economics and financial experience. | ||||||||

| Randolph E. Gress |

59 | 2013 | ||||||

| Randolph E. Gress is the Chairman (since November 2006), President, Chief Executive Officer and Director (since August 2004) of Innophos, Inc. (specialty phosphates sales and manufacturing). He has been with Innophos, Inc. since its formation in 2004, when Bain Capital purchased Rhodia SA’s North American Specialty Phosphate Business. Prior to his time at Innophos, Inc., Mr. Gress was with Rhodia since 1997 and held various positions including Global President of Specialty Phosphates (with two years based in the U.K) and Vice-President and General Manager of the NA Sulfuric Acid and Regeneration businesses. From 1982 to 1997, Mr. Gress served in various roles at FMC Corporation including Corporate Strategy and various manufacturing, marketing, and supply chain positions. Mr. Gress began his career at the Ford Motor Company in 1977. Mr. Gress earned a B.S.E. in Chemical Engineering from Princeton University and an M.B.A. from Harvard Business School. He is a seasoned industrial CEO with a wide range of international and M&A experience. Mr. Gress brings to the board over 35 years of experience in manufacturing industries most of which has been in chemicals. He provides a unique background of corporate leadership, having guided his company through a spin off to private equity ownership and subsequent IPO and more recently achieving growth through acquisitions and geographic expansion. | ||||||||

| Mitchell J. Krebs |

43 | 2011 | ||||||

| President, Chief Executive Officer and member of the Board since July 2011; Senior Vice President and Chief Financial Officer from March 2008 to July 2011; Treasurer from July 2008 to March 2010; Senior Vice President, Corporate Development from May 2006 to March 2008; Vice President, Corporate Development from February 2003 to May 2006. Mr. Krebs first joined Coeur in August 1995 as Manager of Acquisitions after spending two years as an investment banking analyst for PaineWebber Inc. Mr. Krebs holds a BS in Economics from The Wharton School at the University of Pennsylvania and an MBA from Harvard University. Mr. Krebs is a member of the Board of Directors as well as the Executive Committee, the Audit and Finance Committee and the Nominating and | ||||||||

10

Table of Contents

| Nominee |

Age | Director Since |

||||||

| Governance Committee of the Board of Directors of the National Mining Association and is the Vice President and a member of the Executive Committee of The Silver Institute. As our President and Chief Executive Officer, Mr. Krebs brings to the Board his leadership, industry, financial markets, merger and acquisition, and strategic planning experience, as well as his in-depth knowledge of Coeur through the high level management positions he has held over the years. | ||||||||

| John H. Robinson |

64 | 1998 | ||||||

| Chairman of Hamilton Ventures LLC (consulting and investment) since founding the firm in 2006; Chairman of EPC Global, Ltd. (engineering staffing company) from 2003 to 2004; Executive Director of Amey plc (British business process outsourcing company) from 2000 to 2002; Vice Chairman of Black & Veatch Inc. (engineering and construction) from 1998 to 2000. Mr. Robinson began his career at Black & Veatch in 1973 and was general partner and managing partner prior to becoming Vice Chairman. Member of the board of directors of Alliance Resource Management GP, LLC (coal mining); Federal Home Loan Bank of Des Moines (financial services) and Olsson Associates (engineering consulting). Mr. Robinson holds a Master of Science degree in Engineering from the University of Kansas and is a graduate of the Owner-President-Management Program at the Harvard Business School. As a senior corporate executive in the engineering and consulting industries, Mr. Robinson brings to the Board leadership, talent management, strategic planning, operations, and financial experience. Mr. Robinson also brings to the Board public company board experience. | ||||||||

| J. Kenneth Thompson |

63 | 2002 | ||||||

| President and Chief Executive Officer of Pacific Star Energy LLC (private energy investment firm in Alaska) from September 2000 to present, with a principal holding in Alaska Venture Capital Group LLC (private oil and gas exploration company) from December 2004 to present; Executive Vice President of ARCO’s Asia Pacific oil and gas operating companies in Alaska, California, Indonesia, China and Singapore from 1998 to 2000; President and Chief Executive Officer of ARCO Alaska, Inc., the oil and gas producing division of ARCO based in Anchorage from June 1994 to January 1998. Member of the board of directors of Alaska Air Group, Inc., the parent corporation of Alaska Airlines and Horizon Air. Mr. Thompson is also a member of the board of directors of Tetra Tech, Inc. (engineering consulting firm) and Pioneer Natural Resources (large independent oil and gas company). Mr. Thompson holds a Bachelor of Science degree and Honorary Professional Degree in Petroleum Engineering from the Missouri University of Science & Technology. Through Mr. Thompson’s various executive positions, including the role of Chief Executive Officer, he brings to the Board leadership, risk management, talent management, engineering, operations, strategic planning and industry experience. Mr. Thompson also has government and regulatory experience through his work in other highly regulated industries such as the oil and gas, energy and airline industries and possesses public company board experience. | ||||||||

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION

OF THE ABOVE NOMINEES AS DIRECTORS.

11

Table of Contents

AMENDMENT TO CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

The Board of Directors has unanimously approved and recommends to our stockholders this proposal to amend our Certificate of Incorporation to increase the authorized number of shares of our common stock from 150,000,000 to 300,000,000 shares.

Proposed Amendment Increasing the Number of Shares of Authorized Common Stock

We propose to implement this increase through amendments to Section 4.1 of Article IV of our Certificate of Incorporation, which is set forth in Appendix A. Including the 10,000,000 authorized shares designated as preferred stock, which will remain unchanged, this amendment would increase the total authorized shares of Coeur’s stock from 160,000,000 to 310,000,000 shares.

This proposed amendment also includes deleting the last sentence of Section 4.1, which was added to our Certificate of Incorporation in 2013 in connection with our reincorporation from the State of Idaho to the State of Delaware. This sentence is no longer necessary since our reincorporation occurred on May 16, 2013.

Reasons for Increasing the Number of Shares of Authorized Common Stock

As of March 16, 2015, after taking into account:

| • | shares of common stock issued and outstanding, plus |

| • | shares of common stock reserved for issuance under our equity incentive plans, plus |

| • | shares of common stock reserved for issuance pursuant to outstanding warrants, plus |

| • | shares of common stock anticipated to be issued in connection with the pending acquisition of Paramount Gold and Silver Corp, |

only approximately 9,872,111 shares of our common stock remain unissued and unreserved.

The Board believes that the availability of additional authorized shares of common stock is needed to provide us with additional flexibility to issue common stock for a variety of general corporate purposes as the Board may determine to be desirable, including but not limited to, using common stock as consideration for acquisitions, mergers, business combinations or other corporate transactions, raising equity capital, adopting additional employee benefit plans or reserving shares for issuance under such plans (including the 2015 LTIP described in this proxy statement), and implementing stock splits or stock dividends. Over the past several years, we have used authorized shares of common stock to pursue important acquisitions and other business opportunities. For example, we are obligated to issue shares in connection with our pending acquisition of Paramount Gold and Silver Corp. and issued shares in connection with our prior acquisitions of Orko Silver Corporation and Global Royalty Corporation in 2013 and the buyout of our joint venture partner for the Joaquin property in 2012. Unless our stockholders approve the proposed amendment to the Certificate of Incorporation, we may not have sufficient unissued and unreserved authorized shares to engage in similar transactions in the future.

Having additional authorized common stock available for future use will allow us to issue additional shares of common stock without the expense and delay of arranging a special meeting of stockholders. Except as described in “Proposal No. 3 — Adoption of the 2015 Long-Term Incentive Plan — New Plan Benefits”, the Board has not authorized Coeur to take any action with respect to the shares that would be authorized under this proposed amendment, and we currently do not have any definitive plans, arrangements or understandings with respect to the issuance of the additional shares of common stock authorized by this proposed amendment.

12

Table of Contents

Effect of Increasing the Number of Shares of Authorized Common Stock

The proposed increase in the number of authorized shares of our common stock will not change the number of shares of common stock outstanding, nor will it have any immediate dilutive effect or change the rights of current holders of Coeur’s common stock. However, the issuance of additional shares of common stock authorized by this amendment to the Certificate of Incorporation may occur at times or under circumstances as to have a dilutive effect on earnings per share, book value per share or the percentage voting or ownership interest of the present holders of our common stock, none of whom have preemptive rights under the Certificate of Incorporation to subscribe for additional securities that we may issue.

The proposed amendment has been prompted by business and financial considerations. The Board currently is not aware of any attempt by a third-party to accumulate shares of common stock or take control of Coeur by means of a merger, tender offer or solicitation in opposition to management or the Board. Moreover, we currently have no plans to issue newly authorized shares of common stock to discourage third parties from attempting to take over Coeur. However, the proposed amendment to increase the authorized number of shares of common stock could, under certain circumstances, have an anti-takeover effect or delay or prevent a change in control of Coeur by providing Coeur the capability to engage in actions that would be dilutive to a potential acquiror, to pursue alternative transactions, or to otherwise increase the potential cost to acquire control of Coeur. Thus, while we currently have no intent to use the additional unissued authorized shares as an anti-takeover device, the proposed amendment may have the effect of discouraging future unsolicited takeover attempts.

Once the proposed amendment is approved, no further action by the stockholders would be necessary prior to the issuance of additional shares of common stock unless required by law or the rules of any stock exchange or national securities association on which the common stock is then listed or quoted. Under the proposed amendment, each of the newly authorized shares of common stock will have the same rights and privileges as currently authorized shares of common stock. Adoption of the proposed amendment will not affect the rights of the holders of currently outstanding common stock of Coeur, nor will it change the par value of the common stock. The proposed amendment to increase the authorized number of shares of common stock does not change the number of shares of preferred stock that we are authorized to issue.

The general description of the proposed amendment set forth above is qualified in its entirety by reference to the amendment, which is attached as Appendix A.

Effectiveness and Required Vote

If the proposed amendment is adopted, it will become effective upon filing of the Certificate Amendment to our Certificate of Incorporation with the Secretary of State for the State of Delaware. However, even if our stockholders approve the proposed amendment to our Certificate of Incorporation, the Board retains the discretion under Delaware law not to implement the proposed amendment.

The affirmative vote of the holders of a majority of our outstanding stock entitled to vote on this proposal is necessary to approve this amendment to the Certificate of Incorporation.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 150 MILLION TO 300 MILLION.

13

Table of Contents

ADOPTION OF THE 2015 LONG-TERM INCENTIVE PLAN

On March 2, 2015, our Board adopted the Coeur Mining, Inc. 2015 Long-Term Incentive Plan (the “2015 LTIP”) and recommended submitting the 2015 LTIP to stockholders for approval. As of December 31, 2014, there were 1,431,419 shares available for issue under our 2003 Long-Term Incentive Plan (the “2003 LTIP”), and we anticipate that our equity-based compensation needs will soon exceed the remaining shares available. Adoption of the 2015 LTIP is necessary to increase the available share pool and allow us to be able to continue delivering a majority of total direct compensation to executives in the form of equity incentives directly aligned with stockholders. The 2015 LTIP is an amendment and restatement of our 2003 LTIP, and its adoption by the Board is contingent upon approval by stockholders at the Annual Meeting. The Board believes our interests are best advanced by providing equity-based incentives to certain individuals responsible for our long-term success by encouraging such persons to remain in the service of Coeur and to align the financial objectives of such individuals with those of our stockholders.

We currently administer our equity-based compensation programs under the 2003 LTIP. We also have equity awards outstanding under the Coeur d’Alene Mines Corporation 2005 Non-employee Directors’ Equity Incentive Plan (the “Prior Plan” and together with the 2003 LTIP, the “Existing Plans”). As of December 31, 2014, 1,431,419 shares remained available for issuance under the 2003 LTIP (no new awards may currently be granted under the Prior Plan).

The 2015 LTIP, if approved, will provide for the issuance of up to 8,431,419 shares pursuant to awards granted on or after December 31, 2014, which as of the record date represents approximately 8.2% of Coeur’s outstanding common stock and represents an increase of 7,000,000 shares from the number of shares available for issuance pursuant to new awards under the 2003 LTIP as of December 31, 2014.

Key Changes from the 2003 LTIP

| • | Increase in Share Pool. As described above, if approved, the 2015 LTIP will increase the number of shares available for new awards by 7,000,000 shares. |

| • | Individual Award Limits for Employees. Under the 2015 LTIP, the aggregate number of shares that may be subject to share-based awards granted during any calendar year to any one employee is increased to 1,250,000, regardless of the type of award. The maximum cash amount payable pursuant to an incentive opportunity granted in any calendar year to any one employee under the 2015 LTIP is increased to $10,000,000, though an award at this level would, absent extraordinary circumstances, be unlikely under our current compensation structure, and LTIP awards will continue to be driven by stated market targets and our pay-for-performance philosophy. If the 2015 LTIP is approved by stockholders, these new individual award limits will apply to both awards granted after such approval and to awards outstanding as of the date of such approval. |

| • | Individual Award Limit for Directors. Under the 2015 LTIP, the aggregate number of shares that may be subject to awards granted during any calendar year to any one non-employee director cannot exceed that number of shares having a fair market value on the date of grant equal to $300,000; provided, however, that this limit will be increased to $600,000 for any non-employee director that is designated as Chairman of the Board or Lead Director. |

| • | Other. In addition to the above, the 2015 LTIP makes certain ministerial changes to the provisions of the 2003 LTIP. |

14

Table of Contents

Other Key Features of the 2015 LTIP

| • | Fungible Share Counting Formula. Shares issued pursuant to stock options and stock appreciation rights will count against the number of shares available for issuance under the 2015 LTIP on a one-for-one basis, whereas each share issued pursuant to all other awards will count against the number of shares available for issuance under the 2015 LTIP as 1.5 shares. |

| • | Limitation on Share Recycling. Shares surrendered for the payment of the exercise price or withholding taxes under stock options or stock appreciation rights, shares subject to stock appreciation rights not issued upon net settlement of such awards, and shares repurchased in the open market with the proceeds of an option exercise, may not again be made available for issuance under the 2015 LTIP. |

| • | No Automatic Single-Trigger Vesting Acceleration. The 2015 LTIP does not provide for automatic acceleration of the vesting of outstanding awards upon the occurrence of a change in control or other corporate transactions so long as such awards are assumed and continued in connection with such transaction. The 2015 LTIP does provide for double-trigger vesting acceleration in the event of a termination of employment without cause within two years following the occurrence of a change in control. |

| • | No Discounted Stock Options or SARs. All stock option and stock appreciation rights (“SAR”) awards under the 2015 LTIP must have an exercise or base price that is not less than the fair market value of the underlying common stock on the date of grant. |

| • | No Repricing. Other than in connection with a corporate transaction affecting Coeur, the 2015 LTIP prohibits any repricing of stock options or SARs without stockholder approval. |

| • | No Reload Stock Options. Stock options under the 2015 LTIP will not be granted in consideration for and will not be conditioned upon the delivery of shares to Coeur in payment of the exercise price or tax withholding obligation under any other stock option. |

| • | Performance Awards. Under the 2015 LTIP, the Compensation Committee may grant performance-based awards intended to qualify as exempt performance-based compensation under Section 162(m) of the Code as well as other performance-based awards. |

| • | Independent Committee. The 2015 LTIP will be administered by our Compensation Committee, which is composed entirely of independent directors. |

Why You Should Vote for the 2015 LTIP

The Board recommends that our stockholders approve the 2015 LTIP because it believes appropriate equity incentives are important to attract and retain the best employees and non-employee directors, to link incentive reward to company performance, to encourage employee and director ownership in Coeur, and to align the interests of participants with those of our stockholders. The approval of the 2015 LTIP will enable us to continue to provide such incentives; without approval we may be faced with the challenge of attracting and retaining the best talent needed to achieve our future business objectives. If the plan is not approved, we may need to increase our use of cash compensation, which may negatively impact our liquidity and desired alignment with stockholder interests that the 2015 LTIP has been designed to achieve.

Company Considerations

When approving the 2015 LTIP, the Board and the Compensation Committee considered various factors:

| 1. | Potential Dilution |

| 2. | Burn Rate |

| 3. | Overhang |

| 4. | Historical Grant Practices |

15

Table of Contents

The sections below explain these four considerations:

Potential Dilution. Coeur measures annual dilution as the total number of shares subject to equity awards granted less cancelations and other shares returned to the reserve, divided by total common shares outstanding at the end of the year. Our total annual dilution under our existing equity incentive plans for 2014 was 2.0% and our three-year average annual dilution for the three most recently completed years was 1.3%.

Burn Rate. We actively manage our long-term dilution by reviewing our burn rate at least annually. Burn rate is another measure of dilution that shows how rapidly a company is depleting its share reserve for equity compensation plans. Burn rate differs from annual dilution, because it does not take into account cancellations and other shares returned to the reserve. Please see the table below for our historic burn rate under the 2003 LTIP:

| Time Period |

Options Granted |

Full-Value Shares Granted |

Total Granted

= Options+ Full-Value Shares |

Weighted Average Number of CSO(a) |

Burn Rate | |||||||||||||||

| 2014 |

415,172 | 1,054,295 | 1,469,467 | 103,384,408 | 1.4 | % | ||||||||||||||

| 2013 |

190,452 | 747,240 | 937,692 | 102,843,003 | 0.9 | % | ||||||||||||||

| 2012 |

151,102 | 375,604 | 526,706 | 90,342,338 | 0.6 | % | ||||||||||||||

| (a) | “CSO” means “current shares outstanding”. |

The three-year average burn rate (calculated from 2012 to 2014) is 1.0%.

Overhang. An additional metric that we use to measure the cumulative impact of our equity program is overhang (number of shares subject to equity awards outstanding but not exercised or settled, plus number of shares available to be granted, divided by total common shares outstanding at the end of the year). Our overhang as of December 31, 2014 was 3.3%. If the 2015 LTIP is approved, our overhang as of that date would increase to 10.1%.

Historical Grant Practices. In 2012, 2013 and 2014, Coeur made equity award grants under the Existing Plans totaling approximately 526,706 shares, 937,692 shares and 1,469,467 shares, respectively. We estimate, based on historical grant dates, that the availability of 8,431,419 shares under the 2015 LTIP for awards granted after December 31, 2014 would provide a sufficient number of shares to enable us to continue to make awards at historical average annual rates for two to three years. In approving the share pool under the 2015 LTIP, the Compensation Committee determined that reserving shares sufficient for two to three years of new awards at historical grant rates is in line with the practice of our peer public companies.

The following are the factors that were material to the evaluation of the Board and Compensation Committee, in determining acceptable levels of dilution: competitive data from relevant peer companies, the current and future accounting expense associated with our equity award practices, and the influence of stockholder advisory firms like Institutional Stockholder Services (“ISS”). Our equity programs are revisited at least annually and assessed against these (and other) measures.

16

Table of Contents

Key Data

The following table includes information regarding all of our outstanding equity awards and shares available for future awards under our equity plans and equity award agreements as of December 31, 2014:

| Outstanding stock options |

598,346 | |||

| Outstanding restricted stock awards |

901,999 | |||

| Outstanding performance shares* |

516,830 | |||

| Total shares subject to outstanding awards as of December 31, 2014* |

2,017,175 | |||

| Proposed shares available for future awards under the 2015 LTIP |

8,431,419 |

| * | Based on then-current projections for payout under performance shares for which the performance period had not ended prior to December 31, 2014 |

Section 162(m) of the Code

The Board believes that it is in our best interests and the best interests of our stockholders to provide for an equity incentive plan under which compensation awards made to our named executive officers can qualify for company deductibility for federal income tax purposes. Accordingly, the 2015 LTIP has been structured so that awards granted can satisfy the requirements of “performance-based” compensation within the meaning of Section 162(m) of the Code. In general, under Section 162(m), to be able to deduct compensation in excess of $1,000,000 paid in any one year to our chief executive officer or any of our three other most highly compensated executive officers (other than our chief financial officer), such compensation must qualify as “performance-based.” One of the requirements of “performance-based” compensation for purposes of Section 162(m) is that material terms of the performance goals under which compensation may be paid be disclosed and approved by our stockholders. For purposes of Section 162(m), the material terms include (i) the employees eligible to receive compensation, (ii) a description of the business criteria on which the performance goal is based and (iii) the maximum amount of compensation that can be paid to an employee under the performance goal. With respect to the various types of awards under the 2015 LTIP, each of these aspects is discussed below, and stockholder approval of the 2015 LTIP will be deemed to constitute approval of each of these aspects of the 2015 LTIP for purposes of the approval requirements of Section 162(m). Although stockholder approval is one of the requirements for exemption under Section 162(m), even with stockholder approval there can be no guarantee that compensation will be treated as exempt performance-based compensation under Section 162(m). Furthermore, our Compensation Committee will continue to have authority to provide compensation that is not exempt from the limits on deductibility under Section 162(m).

Summary of the 2015 Long-Term Incentive Plan

The following is a description of the material features of the 2015 LTIP. The complete text of the 2015 LTIP is attached hereto as Appendix B to this proxy statement. The following discussion is qualified in all respects by reference to Appendix B.

Purpose. The purpose of the 2015 LTIP is to advance our interests by providing for the grant to participants of stock-based and other incentive awards.

Eligibility. The Compensation Committee selects participants from among key employees, directors, consultants and advisors of Coeur and its affiliates. Eligibility for options intended to be incentive stock options (“ISOs”) is limited to employees of Coeur or certain affiliates. As of December 31, 2014, approximately seventy-eight employees and seven non-employee directors would be eligible to participate in the 2015 LTIP.

Share Reserve. Subject to stockholder approval, the maximum number of shares of common stock that may be issued pursuant to awards granted under the 2015 LTIP after December 31, 2014 is 8,431,419, plus any shares of common stock subject to awards made under the Existing Plans as of the date of approval by

17

Table of Contents

stockholders that subsequently cease to be subject to such awards (other than by reason of exercise or settlement of the awards to the extent they are exercised for or settled in nonforfeitable shares of common stock). Any shares of common stock issued pursuant to options or stock appreciation rights under the 2015 LTIP will be counted against this limit on a one-for-one basis and any shares of common stock issued pursuant to awards under the 2015 LTIP other than options or stock appreciation rights will be counted against the above limit as 1.5 shares for every one share issued pursuant to such award. The share reserve is subject to adjustments to reflect stock dividend, stock split or combination of shares, recapitalization or other change in our capital structure and certain transactions as provided in the 2015 LTIP.

Shares of common stock issued under the 2015 LTIP may be authorized but unissued shares of common stock or previously issued common stock acquired by Coeur. Shares of common stock underlying awards which expire or otherwise terminate, or become unexercisable without having been exercised or which are forfeited to or repurchased by us due to failure to vest will again become available for grant under the 2015 LTIP. Additionally, shares that are withheld by Coeur in satisfaction of tax withholding with respect to an award other than stock options or SARs, and any shares of common stock underlying awards settled in cash will also become available for grant under the 2015 LTIP. Any shares of common stock that again become available for grant shall be added back as one share if such shares were subject to options or stock appreciation rights, and as 1.5 shares if such shares were subject to awards other than options or stock appreciation rights.

Notwithstanding the foregoing, shares of common stock subject to an award may not again become available for grant under the 2015 LTIP (and will not be added to the 2015 LTIP in respect of awards under the Existing Plans) if such shares are: (i) shares that were subject to a stock-settled stock appreciation right and were not issued upon the net settlement or net exercise of such stock appreciation right, (ii) shares delivered to or withheld by Coeur to pay the exercise price of an option, (iii) shares delivered to or withheld by Coeur to pay the withholding taxes related an option or stock appreciation right, or (iv) shares repurchased on the open market with the proceeds of an option exercise.

Administration. The 2015 LTIP is administered by the Compensation Committee, who has the authority to, among other things, interpret the 2015 LTIP, determine eligibility for, grant and determine the terms of awards under the 2015 LTIP, and to do all things necessary or appropriate to carry out the purposes of the 2015 LTIP. The Compensation Committee’s determinations under the 2015 LTIP are conclusive and binding.

Individual Limits. The maximum number of shares for which awards may be granted under the 2015 LTIP to any person in any calendar year is 1,250,000 shares. The maximum cash amount payable pursuant to an incentive opportunity granted in any calendar year to any person under the 2015 LTIP is $10,000,000. If the 2015 LTIP is approved by stockholders, these new individual award limits will apply to both awards granted after such approval and to awards outstanding as of the date of such approval.

Under the 2015 LTIP, the aggregate number of shares that may be subject to awards granted during any calendar year to any one non-employee director (other than the Chairman of the Board or Lead Director cannot exceed that number of shares having a fair market value on the date of grant equal to $300,000. Under the 2015 LTIP, the aggregate number of shares that may be subject to awards granted during any calendar year to the Chairman of the Board or Lead Director cannot exceed that number of shares having a fair market value on the date of grant equal to $600,000.

The maximum number of shares of common stock that may be issued in satisfaction of the exercise or surrender of ISOs granted under the 2015 LTIP after the date of stockholder approval is 8,431,419 shares.

Types of Awards. The 2015 LTIP provides for grants of options, SARs, restricted stock, restricted stock units, performance shares, and incentive opportunities. Dividend equivalents may also be provided in connection with awards under the 2015 LTIP, other than an award of options or SARs, for which dividend equivalents will not be provided.

18

Table of Contents

Stock Options and SARs: The 2015 LTIP provides for the grant of ISOs, non-qualified stock options (“NSOs”), and SARs. The exercise price of an option, and the base price against which a SAR is to be measured, may not be less than the fair market value (or, in the case of an ISO granted to a ten percent stockholder, 110% of the fair market value) of a share of common stock on the date of grant. Our Compensation Committee determines when stock options or SARs become exercisable and the terms on which such awards remain exercisable. Stock options and SARs will generally have a maximum term of ten years.

Restricted Stock: A restricted stock award is an award of common stock subject to forfeiture restrictions.

Restricted Stock Units: A restricted stock unit award is denominated in shares of common stock and entitles the participant to receive stock or cash measured by the value of the shares in the future.

Performance Shares: A performance share is an award of restricted stock or restricted stock units that are subject during specified periods of time to such performance conditions and terms.

Incentive Opportunities: An incentive opportunity is an award denominated in cash pursuant to which the participant may become entitled to receive an amount based on satisfaction of such performance criteria established for a specified performance period.

Repricing Prohibited. The Compensation Committee may not authorize the amendment of any outstanding stock option or SAR to reduce the exercise or base price, and no outstanding stock option or SAR may be cancelled in exchange for other awards, or cancelled in exchange for stock options or SARs having a lower exercise or base price, or cancelled in exchange for cash, without the approval of our stockholders. However, this prohibition does not apply in connection with an adjustment involving a corporate transaction or event as provided in the 2015 LTIP.

Vesting. The vesting of any award granted under the 2015 LTIP will occur when and in such installments and/or pursuant to the achievement of such performance criteria, in each case, as the Compensation Committee, in its sole and absolute discretion, shall determine.

Termination of Service. The Compensation Committee determines the effect of termination of employment or service on an award. Unless otherwise provided by the Compensation Committee, upon a termination of employment or service, all unvested options and other awards requiring exercise will terminate and all other unvested awards will be forfeited.

Qualifying Performance Criteria. The 2015 LTIP provides that grants of performance shares may be made based upon, and subject to achieving, “performance objectives” over a specified performance period. Performance objectives with respect to those awards that are intended to qualify as “performance-based compensation” for purposes of Section 162(m) are limited to one or more of the following performance criteria, or derivations of such criteria, either individually, alternatively or in any combination, applied to either Coeur as a whole or to a business unit or subsidiary, either individually, alternatively or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, either based upon United States Generally Accepted Accounting Principles (“GAAP”) or non-GAAP financial results, in each case as specified by the Compensation Committee: (i) earnings per share (actual or targeted growth); (ii) economic valued added (EVA); (iii) net income after capital costs; (iv) net income (before or after taxes); (v) return measures (including return on average assets, return on capital, return on equity, or cash flow return measures); (vi) stock price (including growth measures and total stockholder return); (vii) expense targets; (viii) margins; (ix) production levels; (x) cost performance measures, including but not limited to cash and/or all-in sustaining costs of production, and/or costs applicable to sales (in each case on a per ounce, per ton, aggregate or other basis); (xi) earnings before interest, tax, depreciation, and amortization; (xii) capital budget targets; (xiii) budget target measures; (xiv) earnings before interest and taxes (EBIT); (xv) revenue; (xvi) cash flow (including operating cash flow);

19

Table of Contents

(xvii) reserve replacement; (xviii) resource levels, including but not limited to growth in reserves and resources either on an aggregate or per share basis; (xix) statistical health, safety and/or environmental performance; (xx) growth in gross investments (GGI); and (xxi) net asset value (or growth therein).

To the extent consistent with the requirements for satisfying the performance-based compensation exception under Section 162(m), our Compensation Committee may provide in the case of any award intended to qualify for such exception that one or more of the performance objectives applicable to an award will be adjusted in an objectively determinable manner to reflect events (for example, acquisitions and divestitures) occurring during the performance period of such award that affect the applicable performance objectives.

Prior to grant, vesting or payment of a performance award that is intended to qualify as “performance-based compensation” under Section 162(m), the Compensation Committee will certify whether the applicable performance criteria have been attained and such determinations will be final and conclusive.

Transferability. Awards under the 2015 LTIP may not be transferred except by will or by the laws of descent and distribution, unless (for awards other than ISOs) otherwise provided by the Compensation Committee.

Change in Control. Unless otherwise expressly provided for in an award agreement or another contract, including an employment agreement, in the event of an involuntary termination without cause (as defined in the 2015 LTIP) within twenty-four months following a Change in Control (as defined in the 2015 LTIP), the following shall occur: (i) outstanding stock options and stock appreciation rights shall become fully vested and may be exercised for a period of twelve months following such termination; (ii) outstanding awards subject to qualifying performance criteria, as described above, shall be converted into the right to receive a payment based on performance through a date of the Change in Control, and (iii) outstanding restricted stock and/or restricted stock units (other than those described in clause (ii)) shall become fully vested. In the event of a Change in Control in which the acquiring or surviving company in the transaction does not assume or continue outstanding awards upon the Change in Control, immediately prior to the Change in Control, all awards that are not assumed or continued shall be treated as follows effective immediately prior to the Change in Control: (i) outstanding options or stock appreciation rights shall become fully vested and exercisable; (ii) outstanding awards subject to qualifying performance criteria, as described above, shall be converted into the right to receive a payment based on performance through a date of the Change in Control (unless such performance cannot be determined, in which case the grantee shall have the right to receive a payment equal to the target amount payable); and (iii) outstanding restricted stock and/or restricted stock units (other than those described in clause (ii)) shall become fully vested.

Adjustment. In the event of certain corporate transactions (including, but not limited to, a stock dividend, stock split or combination of shares, recapitalization or other change in our capital structure), the Compensation Committee will make appropriate adjustments to the maximum number of shares that may be delivered under and the individual limits included in the 2015 LTIP, and will also make appropriate adjustments to the number and kind of shares of stock or securities subject to awards, the exercise prices of such awards or any other terms of awards affected by such change. The Compensation Committee may also make the types of adjustments described above to take into account distributions to stockholders and events other than those listed above if it determines that such adjustments are appropriate to avoid distortion in the operation of the 2015 LTIP.

Term. No awards will be made after the tenth anniversary of the 2015 LTIP’s adoption by our Board, but previously granted awards may continue beyond that date in accordance with their terms.

Amendment and Termination. The Compensation Committee may amend the 2015 LTIP or outstanding awards, or terminate the 2015 LTIP as to future grants of awards, except that the Compensation Committee will not be able alter the terms of an award if it would affect materially and adversely a participant’s rights under the award without the participant’s consent (unless expressly provided in the 2015 LTIP or reserved by the Compensation Committee at the time of grant). Stockholder approval will be required for any amendment to the extent such approval is required by law, including the Code or applicable stock exchange requirements.

20

Table of Contents

U.S. Tax Consequences

The following is a brief description of the anticipated federal income tax treatment that generally will apply to awards granted under the 2015 LTIP, based on federal income tax laws in effect on the date of this proxy statement. The exact federal income tax treatment of awards will depend on the specific circumstances of the grantee. No information is provided herein with respect to estate, inheritance, gift, state, or local tax laws, although there may be certain tax consequences upon the receipt or exercise of an award or the disposition of any acquired shares under those laws. Grantees are advised to consult their personal tax advisors with regard to all consequences arising from the grant or exercise of awards, and the disposition of any acquired shares.