How do I inspect the list of stockholders of record?

A list of the stockholders of record as of the Record Date entitled to vote at the Annual Meeting will be available for review on the virtual platform for the Annual Meeting. In addition, stockholders wishing to review the list of stockholders entitled to vote at the Annual Meeting can make arrangements to do so by contacting our Investor Relations department at investors@coeur.com.

Why did I receive a notice in the mail regarding the internet availability of proxy materials?

In accordance with the rules of the SEC, instead of mailing to stockholders a printed copy of our proxy statement, Annual Report and other materials (the “proxy materials”) relating to the Annual Meeting, Coeur may furnish proxy materials to stockholders on the Internet by providing a notice of internet availability of proxy materials (the “Notice of Internet Availability”) to inform stockholders when the proxy materials are available on the Internet. If you receive the Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials unless you specifically request a printed copy. Instead, the Notice of Internet Availability will instruct you on how to access and review all of Coeur’s proxy materials, as well as how to submit your proxy. The proxy materials are available at www.proxyvote.com.

Will I get more than one copy of the notice or proxy materials if multiple stockholders share my address?

When multiple stockholders have the same address, the SEC permits companies and intermediaries, such as brokers, to deliver a single copy of certain proxy materials and the Notice of Internet Availability to the stockholders. This process is commonly referred to as “householding.” We do not participate in householding, but some brokers may do so for stockholders who do not take electronic delivery of proxy materials. If your shares are held in a brokerage account and you have received notice from your broker that it will send one copy of the Notice of Internet Availability or proxy materials to your address, householding will continue until you are notified otherwise or you instruct your broker otherwise. If, at any time, you would prefer to receive a separate copy of the Notice of Internet Availability or proxy materials, or if you share an address with another stockholder and receive multiple copies but would prefer to receive a single copy, please notify your broker. We promptly will deliver to a stockholder who received one copy of the Notice of Internet Availability or proxy materials as the result of householding a separate copy upon the stockholder’s written or oral request directed to our investor relations department at (312) 489-5800, Coeur Mining, Inc., 200 South Wacker Drive, Suite 2100, Chicago, IL 60606. Please note, however, that if you wish to receive a paper proxy card or other proxy materials for purposes of this year’s Annual Meeting, you should follow the instructions provided in the Notice of Internet Availability.

What does it mean to give a proxy?

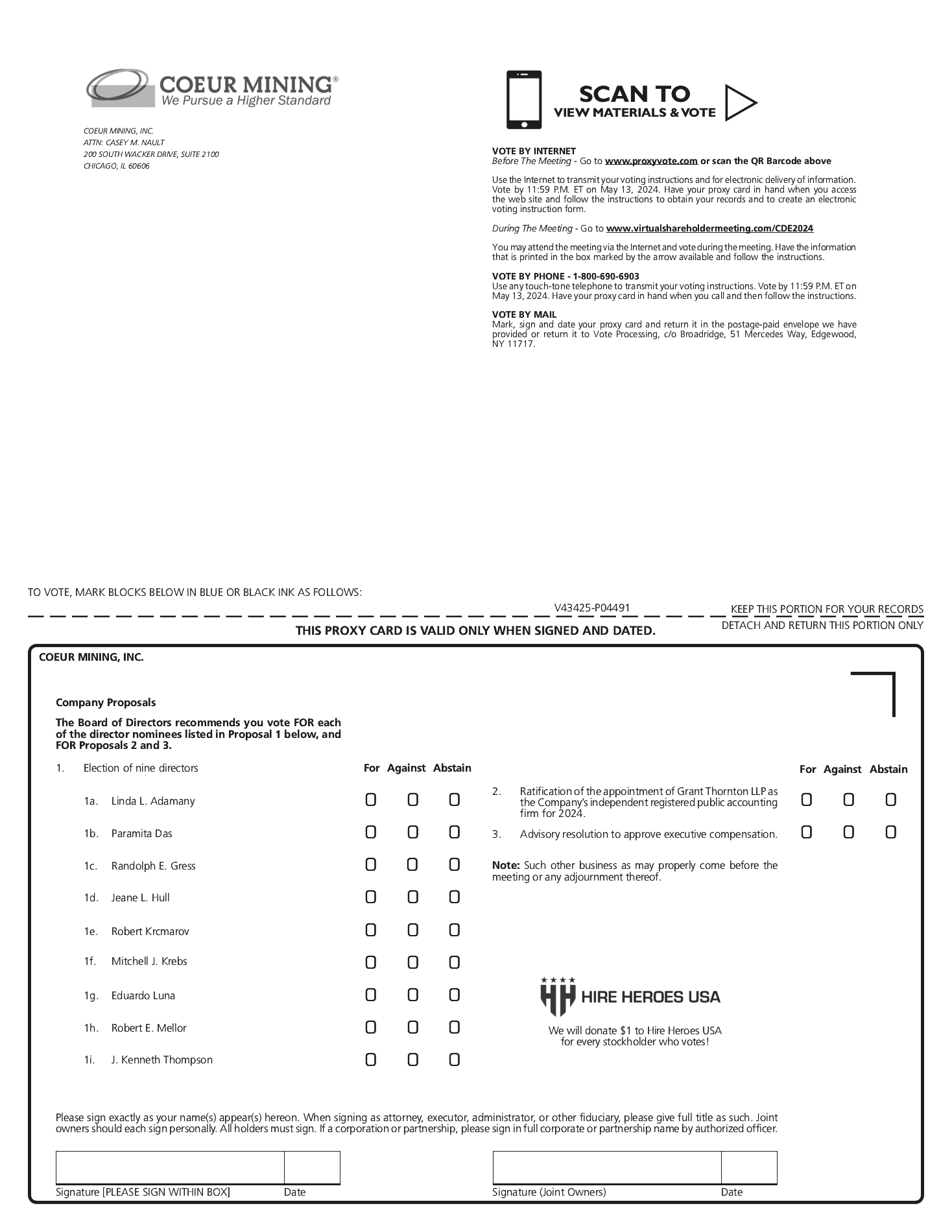

The persons named on the proxy card (the “proxy holders”) have been designated by the Board to vote the shares represented by proxy at the Annual Meeting. The proxy holders are officers of Coeur. They will vote the shares represented by each properly executed and timely received proxy in accordance with the stockholder’s instructions, or if no instructions are specified, the shares represented by each otherwise properly executed and timely received proxy will be voted “FOR” each nominee in Proposal No. 1 and “FOR” Proposals No. 2 and 3 in accordance with the recommendations of the Board as described in this proxy statement. If any other matter properly comes before the Annual Meeting or any adjournment or postponement thereof, the proxy holders will vote on that matter in their discretion.

How do I vote?

If you are a holder of shares of Coeur common stock, you can vote by telephone or on the internet 24 hours a day through 11:59 p.m. (Central Time) on the day before the Annual Meeting date using the telephone number or visiting the website listed on page

96. If you are submitting a proxy for your shares by telephone or internet, you should have the Notice of Internet Availability or the proxy card or voting instruction card (for those holders who have received, by request, a hard copy of the proxy card or voting instruction card) in hand when you call or access the website, as applicable.

If you have received, by request, a hard copy of the proxy card or voting instruction card, and wish to submit your proxy by mail, you must complete, sign and date the proxy card or voting instruction card and return it in the envelope provided in sufficient advance time so that it is received prior to the Annual Meeting.